Roadmap: Fintech for the aging

Technology holds the potential to help solve systemic issues in our wealth management system and allow people to age with fewer financial worries.

(Warning: Some or all of this content is mildly depressing!)

In the United States, retirement is a complicated, sometimes scary, and often aspirational concept that many of us are working towards. However, as we prepare for the future, it’s important to recognize that Americans today are living longer with rising healthcare costs and an ever-expanding debt burden while many people have little saved for retirement.

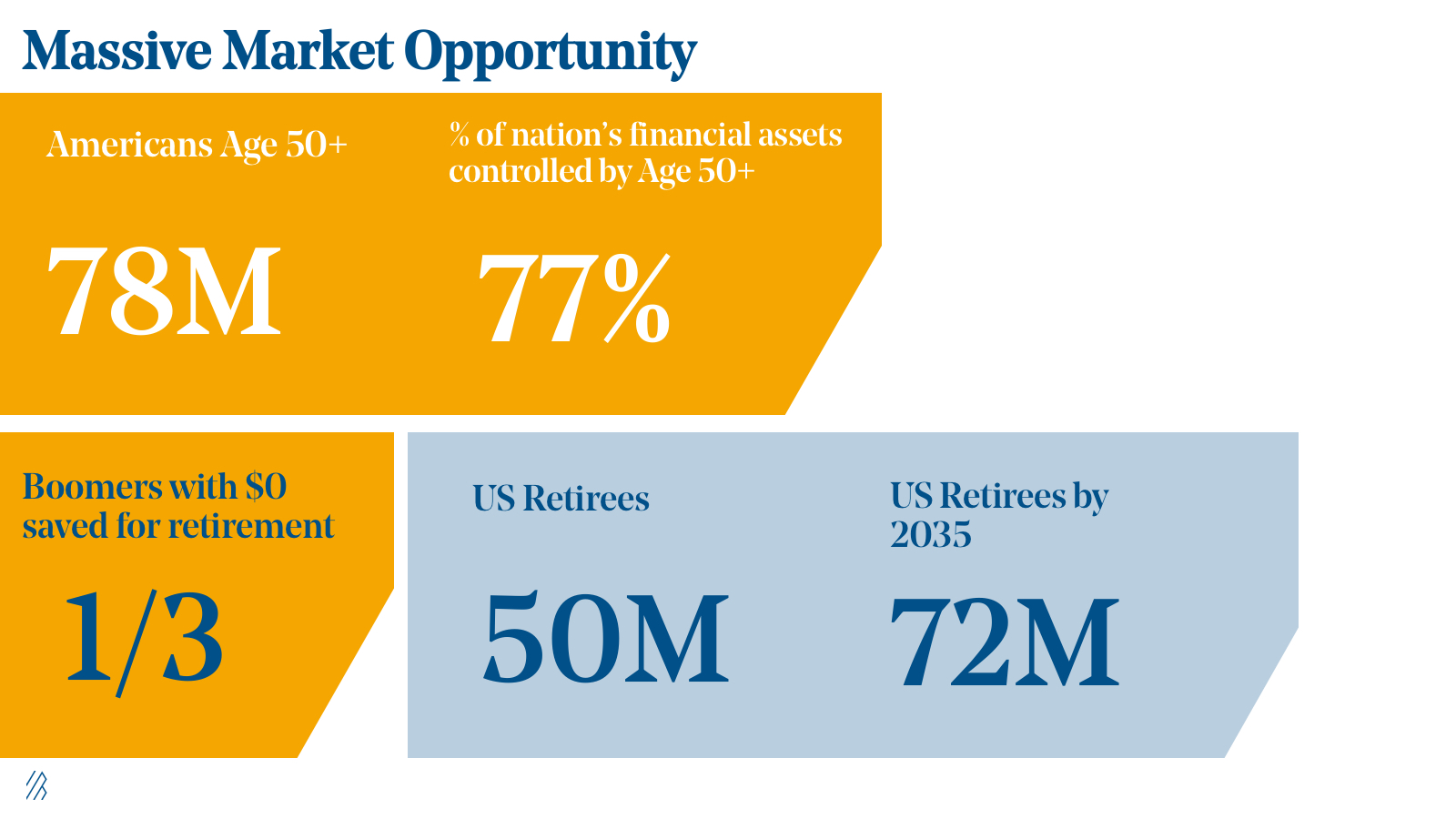

To put this in perspective, nearly one-third of Baby Boomers have nothing saved in retirement plans; for those with positive balances, the median amount saved is approximately $200,000, in contrast to the estimated $1 million to $1.5 million nest egg needed to afford daily living and healthcare expenses throughout a thirty-year retirement.

Nearly one-third of Baby Boomers have nothing saved in retirement plans.

Fortunately, we are starting to see many of today’s entrepreneurs focus on solving Baby Boomers’ challenges. Developing new and innovative financial solutions for the aging population presents one of the greatest frustrations and areas of opportunity in consumer financial services. At Bessemer, we are starting to see this burgeoning problem motivate some of the brightest entrepreneurs and these product leaders are creating modern solutions for aging individuals facing life's financial inevitabilities.

Life can indeed get better with age, but technology’s role in helping people prepare for retirement is only beginning to scratch the surface. Within our Fintech Roadmap at Bessemer we have been mapping out and exploring the macro trends that are impacting the aging population's financial well-being while also trying to identify potential solutions.

It is undeniable that massive demographic shifts are changing financial realities for the aging population:

America’s aging population is vast and growing as ten to eleven thousand Boomers continue to retire every day. According to LIMRA, there are over 50 million retirees in the United States and, by 2035, there will be 72 million retirees.

This age demographic also disproportionately impacts our economy relative to its size. BBVA research reveals that Boomers control $2.4 trillion in buying power and account for half of all consumer spending in the U.S.

Retirees and Boomers yet to retire own 83 percent of all investable assets or nearly $35 trillion. Nevertheless, as one would expect these numbers are skewed to the wealthy; the majority of Boomers are headed for a desperate need for financial assistance.

We have highlighted four major shifts driving the urgent need for product innovation in financial services:

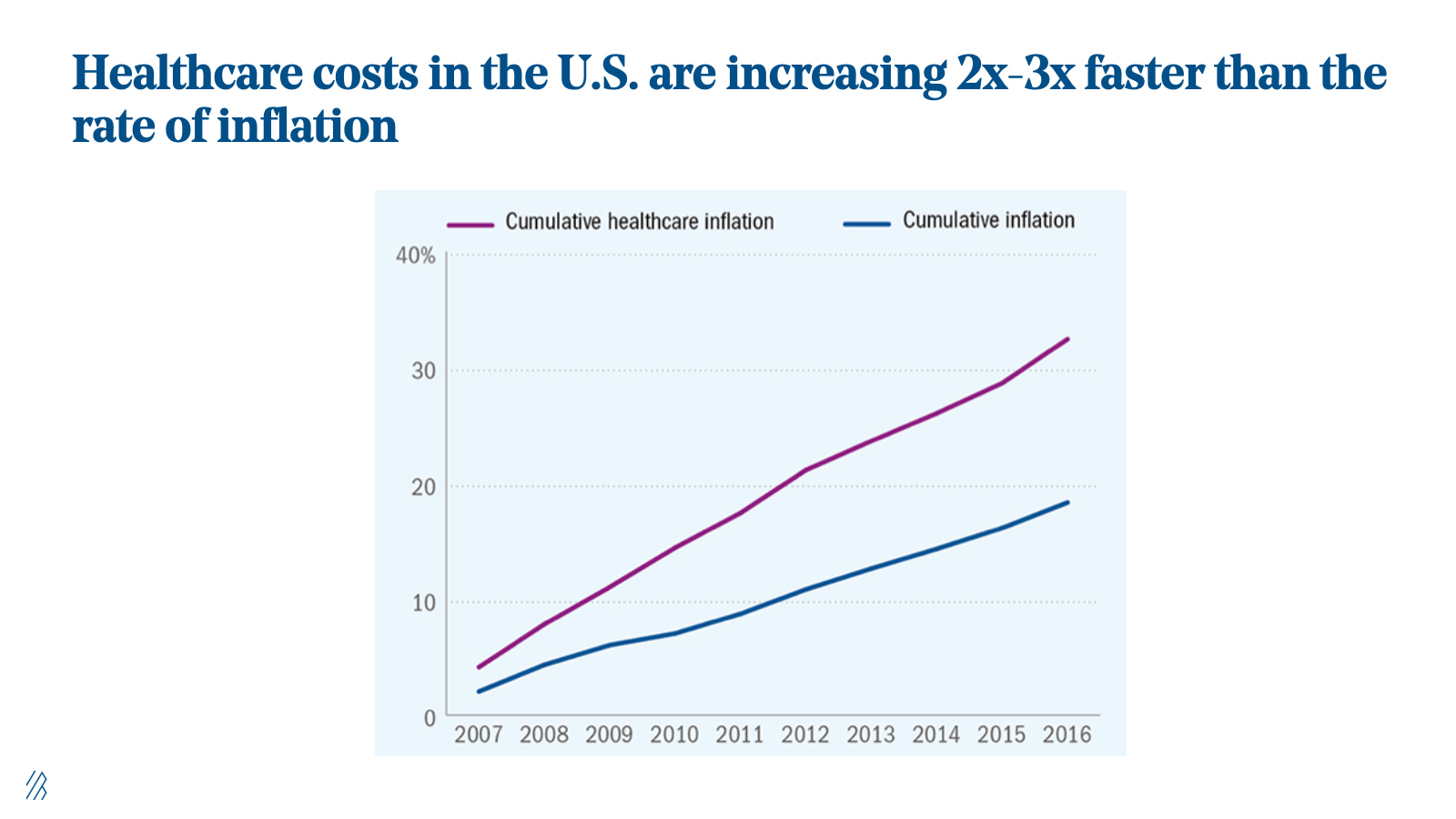

1. Healthcare costs continue to rise.

Boomers are living longer and will continue to need more healthcare services than any other prior generation of Americans. At the same time, the cost of healthcare in the U.S. is increasing at a rate 2X to 3X faster than the rate of inflation.

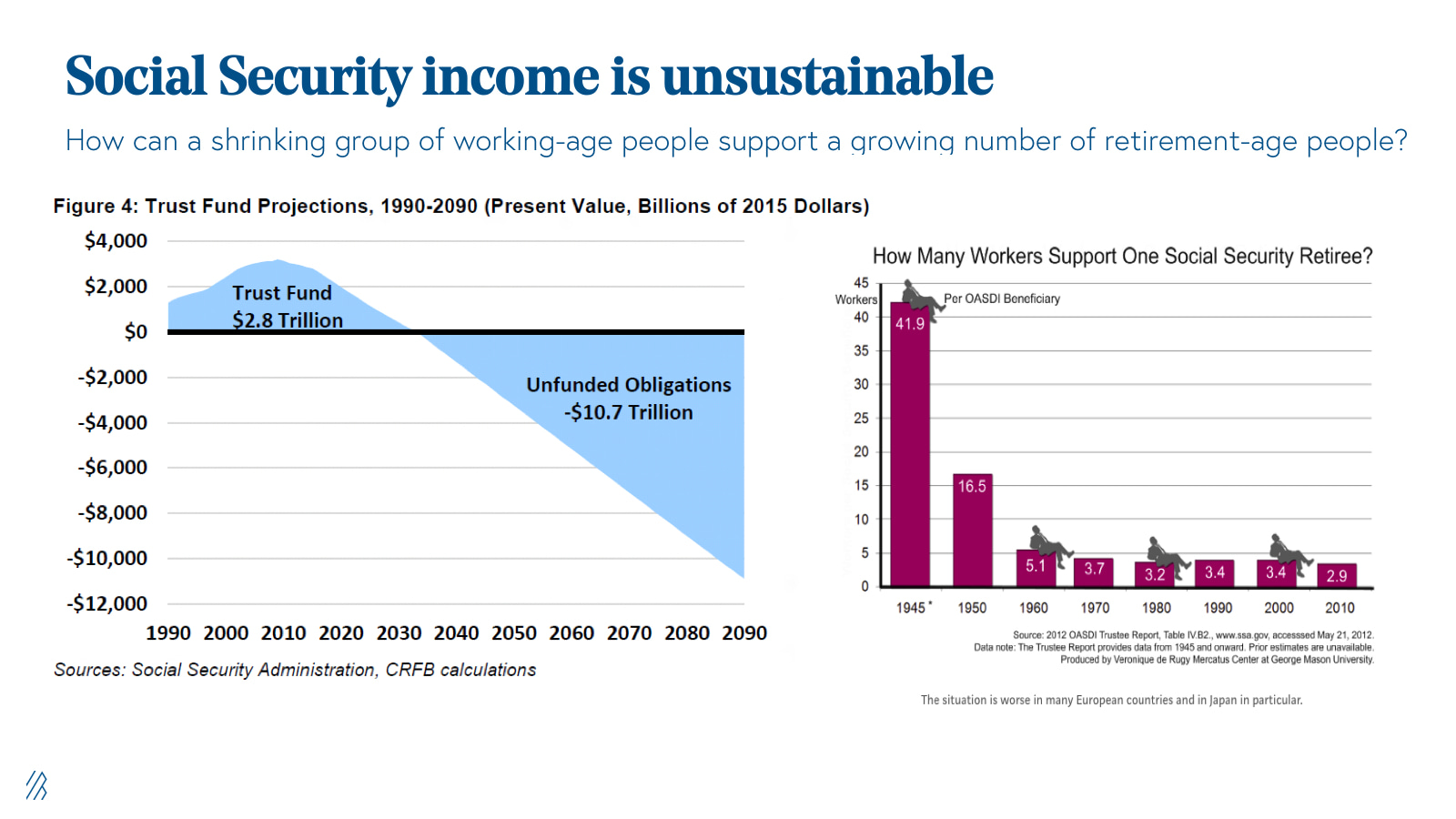

2. Social Security income is unsustainable.

In 1940, 160 workers were supporting each retiree. By 1950, the number of workers supporting one retiree shrank to approximately 16, and now is between two and three. As the number of potential beneficiaries (Americans ages 65+) will rise from 49 million to 79 million by 2035, the number of workers supporting each Social Security recipient will continue to decline.

At current rates of in and outflows, Social Security's $2.8 trillion in cash will be exhausted by 2034, and unfunded obligations will pile up to become trillions in additional national debt.

Reports from the Social Security Administration state that the payroll tax would need to rise 21 percent today to keep Social Security solvent beyond that date. If lawmakers were to wait until 2034 to act, the payroll tax would need to increase by 32 percent at that point in time. As 61 percent of retirees rely on these benefits to account for at least half of their monthly income, Social Security solvency is an issue for most retirees.

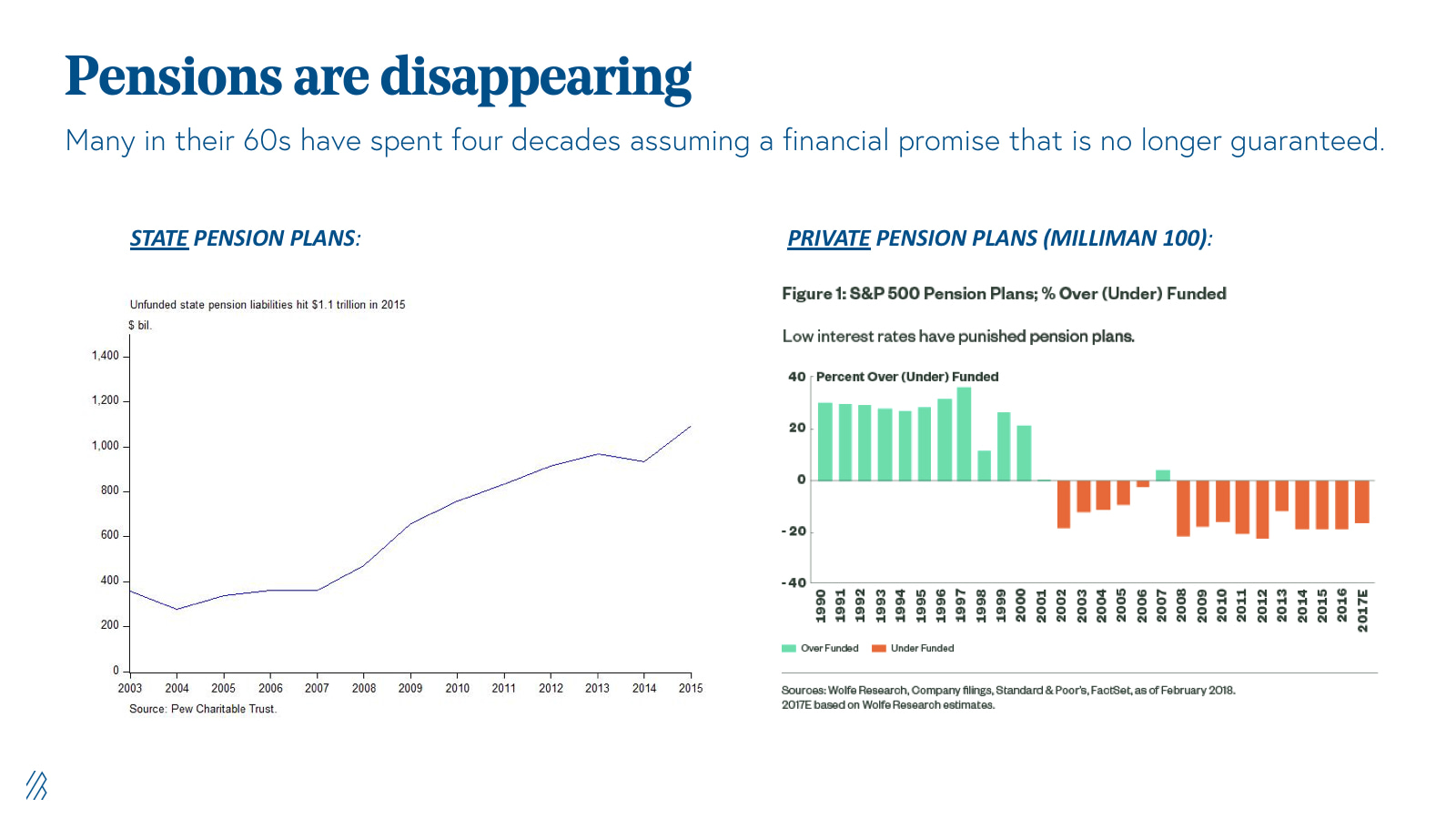

3. Pensions are moving from defined benefit to defined contribution and/or going away.

Many people in their sixties have spent four decades assuming a financial promise that is no longer guaranteed, according to reports. Only eleven percent of those ages 50 to 64 and 46 percent of those ages 65+ have a pension.

State and local pension plans in the U.S. are at their lowest level since 2001, with less than three-quarters of the money they need to meet their promised payouts. In dollar terms, the hole for state and local pensions has reached $5 trillion.

As pensions continue to move from defined benefit to defined contribution, individuals who rely on pensions need tools and new wealth management solutions that help them manage their pension risk now that professionals no longer handle this on their behalves.

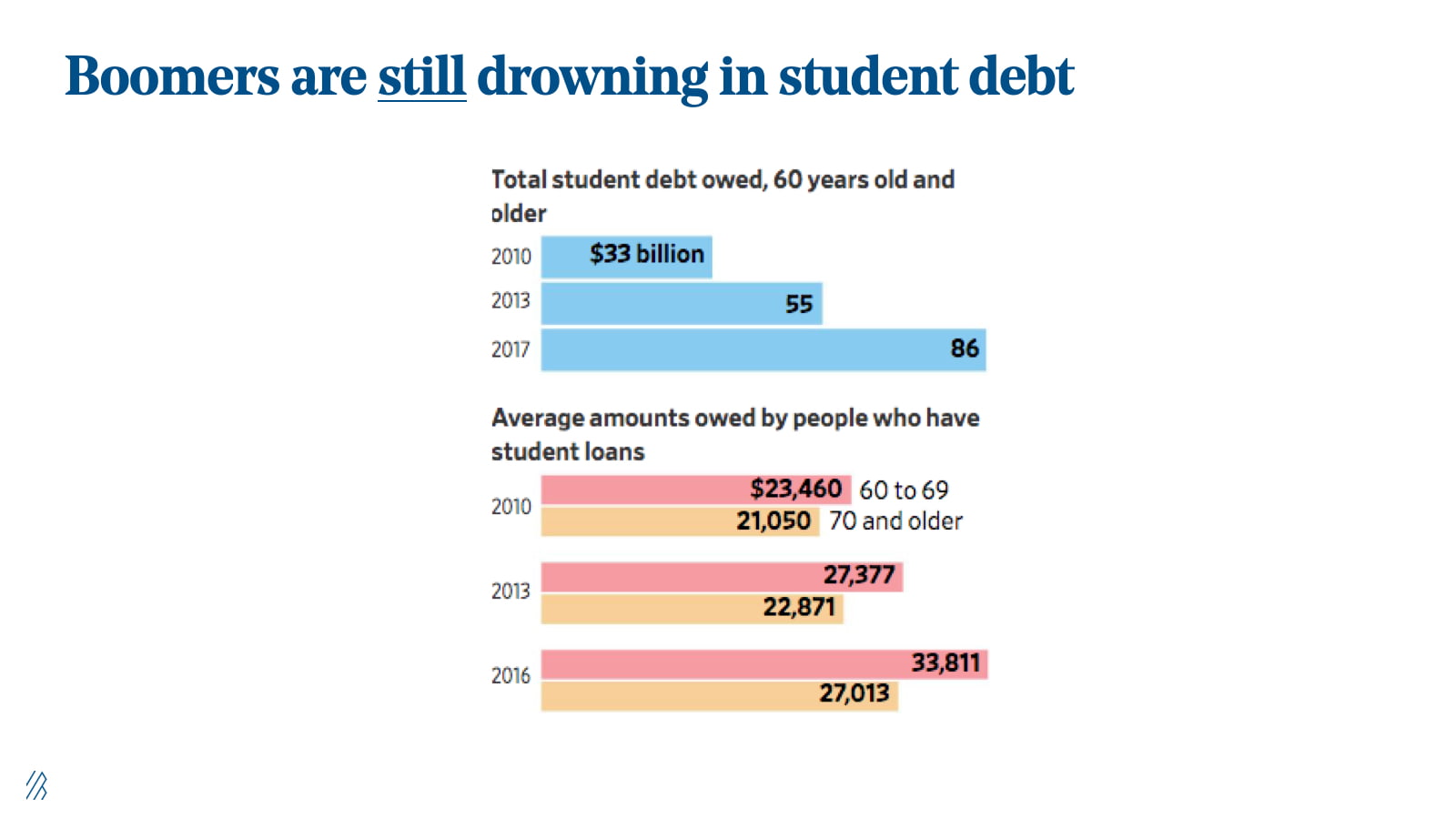

4. Boomers are still drowning in student loan debt.

Sadly, you read that correctly! Older Americans are the fastest growing group of student loan borrowers, often taking on debt to help finance college for themselves, but mostly for their children and grandchildren (¼ for themselves, ¾ for their progeny).

Nearly 7 million Americans over age 50 have student loan debt.

Nearly 7 million Americans over age 50 have student loan debt, and borrowers ages 50+ now owe more than $260 billion in student loan debt. Student loan debt will lead to a $1.3 trillion retirement savings gap by 2021, as it prevents 31 percent of Boomers from contributing to their retirement funds. Making matters worse, those who default on federal education loans can have a portion of their Social Security benefits and other assets withdrawn to repay their student loans.

To respond to today’s socio-economic and political climate, fintech entrepreneurs and their teams will be forced to either reinvent or retrofit financial services. We believe these companies must offer highly targeted and tailored solutions for this unique demographic and period in our financial history to find product/market fit and cultivate trust between the aging population and tech-enabled solutions.

Entrepreneurial opportunities in the wealth decumulation market

As we’ve been meeting with entrepreneurs who are building promising companies that serve the aging population’s retirement and economic gap needs, we have become intrigued by a few areas where we see significant near-term opportunity.

1. Creating opportunities for supplemental income.

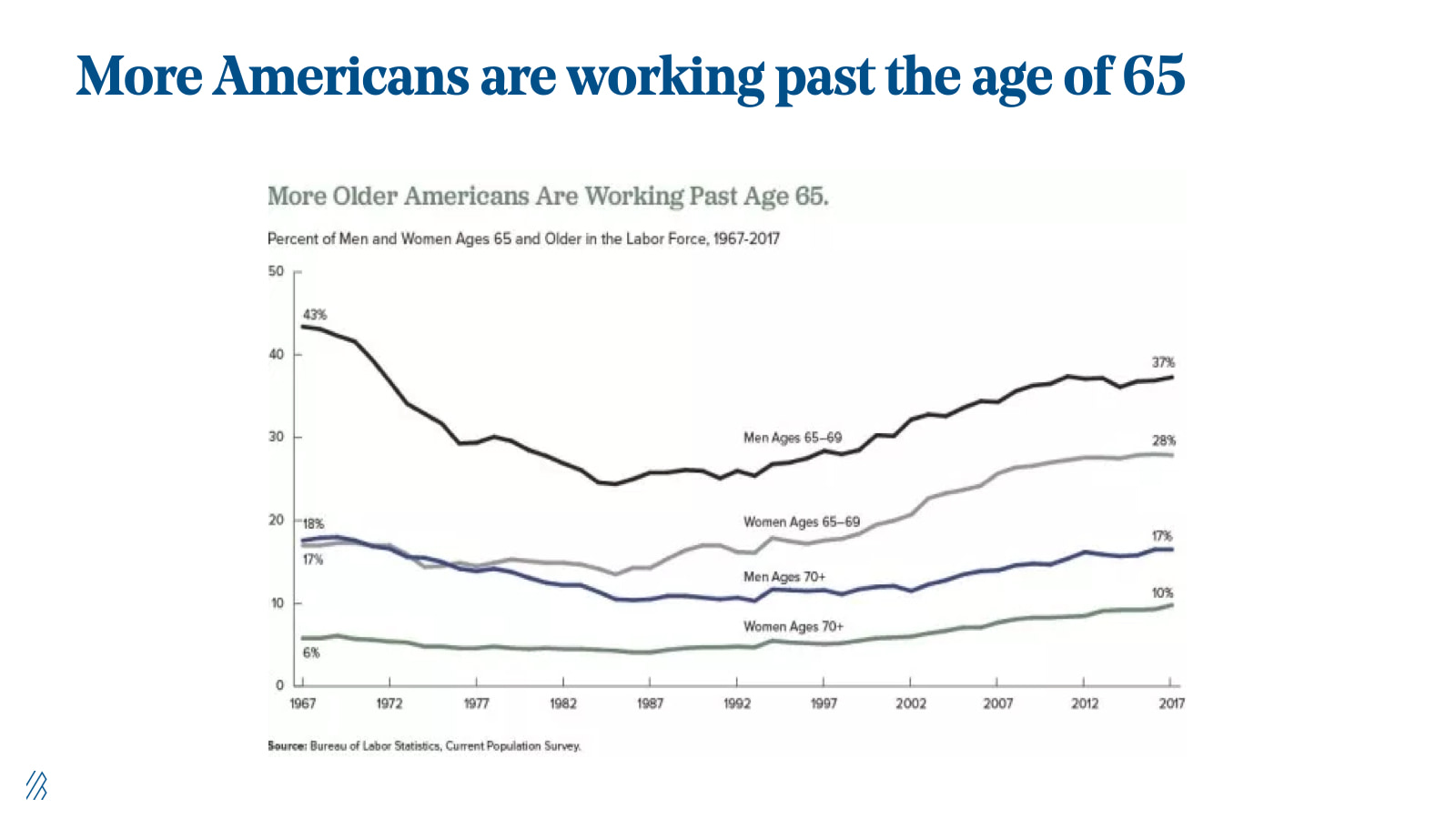

Boomers are expected to live longer than previous generations. Given the alarmingly low balances Boomers have in their retirement accounts (including workplace retirement plans and IRAs), most will simply have to work longer.

We expect to see companies help retirees monetize their hobbies or take on more part-time work. Just as people pick up new hobbies or volunteerism during retirement, online communities can help retirees or soon-to-be retirees earn supplemental income. Income-building platform Steady, for example, is a fast-growing example that connects flexible opportunities to underemployed groups, although it is not exclusively focused on the aging population.

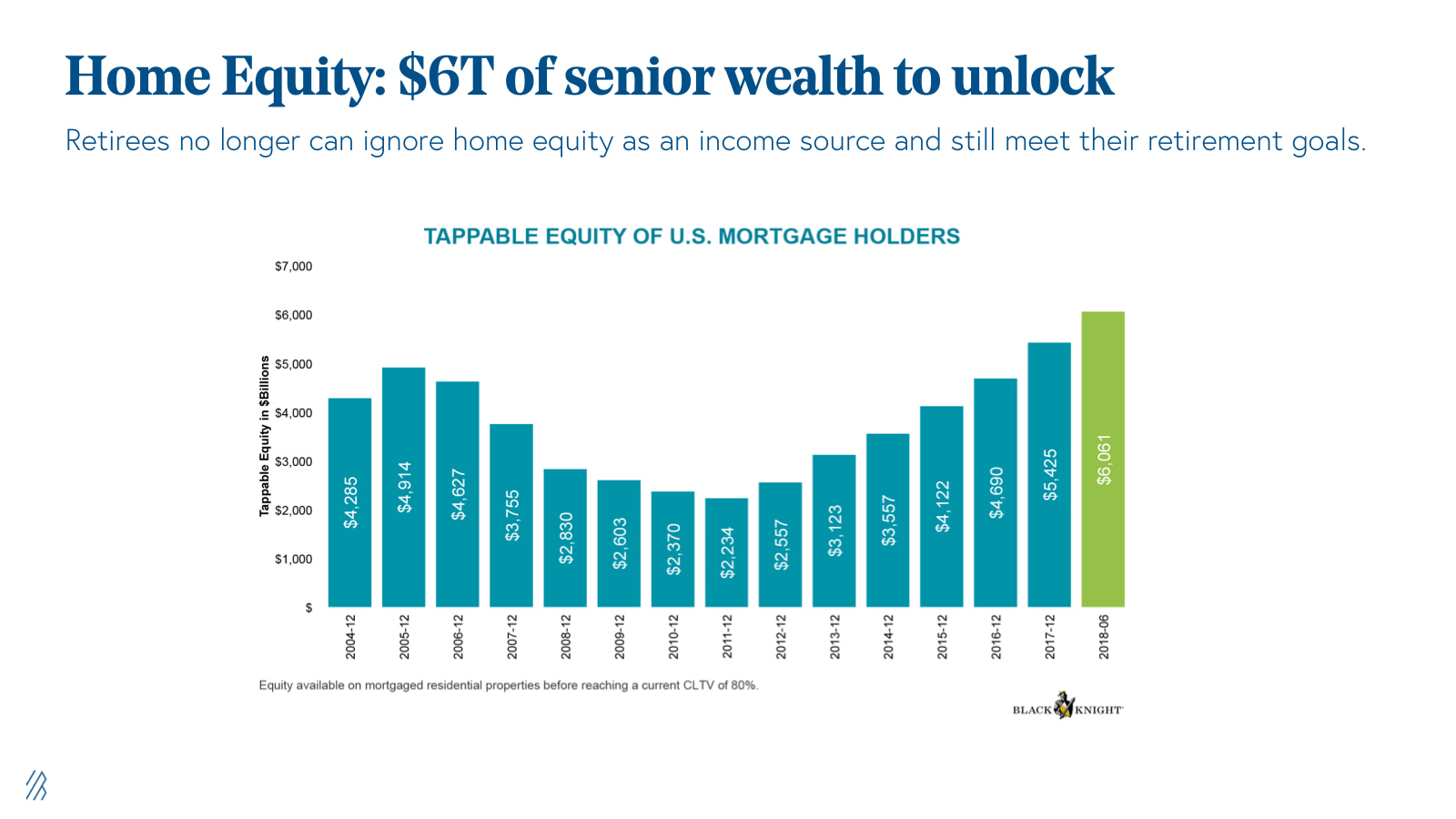

2. Tapping into $6+ trillion senior home equity.

For most aging Americans, home equity is the most significant asset. In 2018, senior home equity reached $6.9 trillion, an all-time high. Housing experts had predicted a “great senior sell-off,” expecting seniors to move into senior living homes, move in with family, or move into smaller homes, but they were wrong. Research from Harvard’s Joint Center for Housing Studies reveals that two-thirds of senior homeowners wish to “age in place.”

However, with rising debt and healthcare costs, no salaried income, and often no pension or social security income, seniors may be forced to tap into their home equity as they become more desperate for liquidity.

Home-sharing, home equity lines of credit (HELOC), reverse mortgages, and sales leasebacks are options that allow retirees to leverage their home equity while staying in their homes. While these options are extremely helpful for certain individuals wanting to age in place, they are difficult to understand and not right for everyone.

Companies such as Unison, Patch, Point, and Figure, have created straightforward solutions that make it easy for older adults to tap into their home equity without needing to accept unfair terms or downgrades.

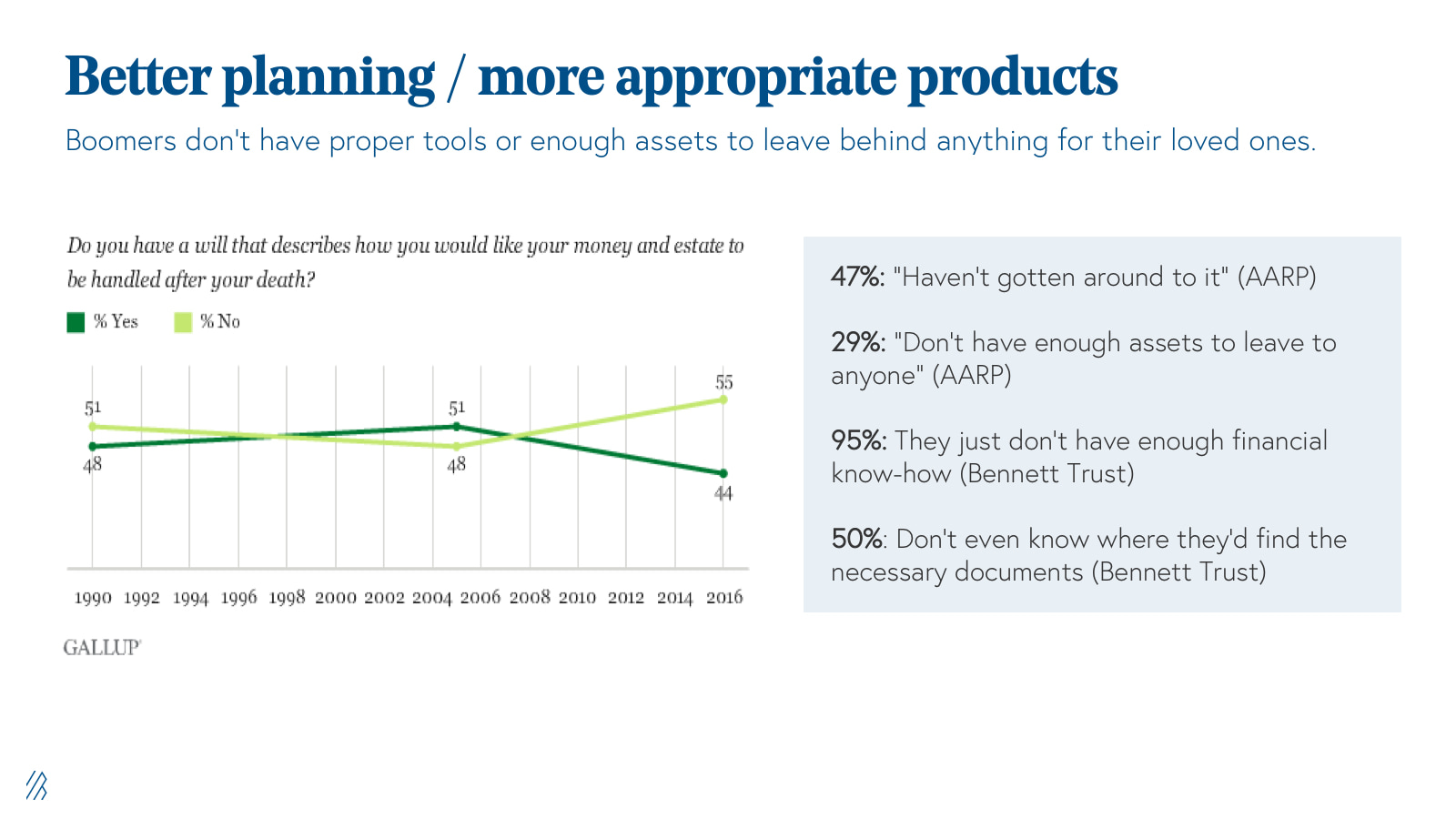

3. Investing in estate planning tools.

According to research from Bennett Trust and AARP, sixty percent of Americans lack a will or any estate planning. Moreover, ninety-five percent of people lack the financial know-how to create succession plans on their own, leaving many people and their families vulnerable to exploitation.

Today, there’s low hanging fruit in the estate planning market to build mobile-first and senior-friendly solutions that simplify the process of estate planning, breaking down barriers and increasing participation while providing a platform that acts as a single source of truth. Kindur and recently acquired United Income are emerging players in this space.

4. Protecting people against elder exploitation, fraud, and trust abuse.

One in five seniors has been the victim of financial exploitation, and total annual losses are greater than $37 billion annually, according to estimates. Just as Credit Karma and NerdWallet helped to educate the online masses on financial basics for millennials, we expect to see a new crop of companies, such as EverSafe and TrueLink Financial, continue to address financial concerns for the aging population through education and novel solutions that can predict and prevent financial vulnerabilities and even salvage funds for those who have been victimized.

What’s next?

Over the past decade we have seen a wave of consumer fintech innovation unbundle the traditional bank and financial services platforms as younger customers have poured in to those emerging leaders. This most recent wave of fintech entrepreneurs has reoriented how traditional financial institutions can serve customers in a world of digital and mobile ubiquity.

Fintech founders have prioritized earning the trust of younger, more digital native customers and have largely overlooked older generations. No recent consumer-focused fintech player has built a new, large financial services platform specifically focused on America’s aging population as these major shifts described above have created huge economic gaps that still need to be filled. Given the number of Boomers reaching retirement age, their unique spending patterns, the wealth they control, and their need for different financial solutions, we believe it is only a matter of time until several of these new platforms emerge.

If you’re building the next great company striving to help seniors work, age, and retire more comfortably, we want to talk to you!