Why I’m cryptophobic

Adam Fisher’s exegesis on why he believes that despite the recent crash, crypto will rise again to the detriment of society.

At Bessemer, we value intellectual honesty and diversity of opinions. Dive into the other side of the crypto debate here.

Contrary to popular belief the crypto market did not collapse. At least not any more than the tech market collapsed. Bitcoin and Ethereum are up 3x and 5x, respectfully, since the beginning of the pandemic which makes them some of the best performing assets. While both "currencies” exhibit the volatility of tech stocks, they are remarkably stable for what most crypto skeptics derisively call a Ponzi scheme. Those eulogizing the demise of crypto do so prematurely. I agree with the crypto advocates that crypto will rebound and rise in the years to come, but not because it is beneficial, worthy, or inevitable. Most critics ignore the potent ideological undercurrent that propels crypto investing and that will lead to its rise again. A rise that concerns me and makes me not just cryptoskeptic, but cryptophobic due to fear that crypto frameworks will replace an imperfect economic system with something far more opaque, concentrated and unaccountable. Only strict regulation can extinguish the crypto fire that burns bright in the hearts and minds of millions of its followers and prevent a far bigger catastrophe down the road.

The future I fear is one with a new anarcho-libertarian power structure that lacks transparency, accountability, and is the antithesis of democracy.

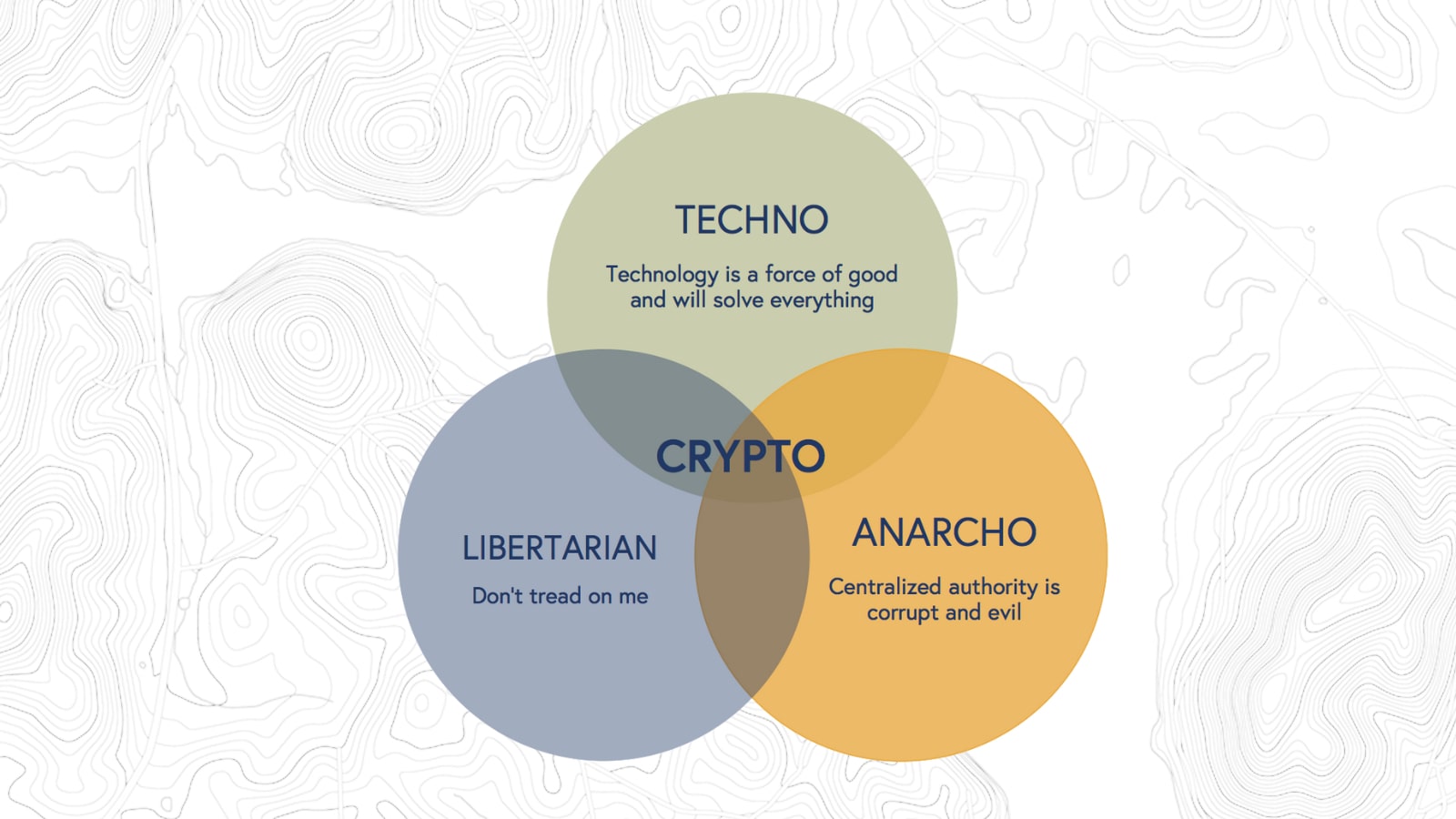

The world has never seen an economic phenomenon like crypto. There is no historical analogous technology trend or investment craze that comes close to capturing the sustained and frenzied momentum of crypto that has engulfed so many and that will continue to do. There are however analogous socio-political movements in history such as anarchism and communism that help to understand the durable appeal and obsession that characterizes the crypto world at present, and that foreshadow the profound effects crypto will likely have on state and society even if it doesn’t come close to fulfilling the goals of its biggest advocates. While speculation is fundamental to the launch and success of any crypto project, there is an anti-establishment, techno-anarcho-libertarian message that keeps crypto followers faithful and will sustain the market for years to come.

The world has never seen an economic phenomenon like crypto.

Crypto is too volatile to be a currency like the dollar, too high maintenance to be a store of value like gold, and unlike a stock, crypto is also not a financial asset with intrinsic value. It is rather a naïve notion that anything can be an asset or currency if enough people believe it to be and is cynically likened to fiat currency issued by the state even though the state’s fiat powers come from its credibility, transparency and the power of taxation. Unlike most innovations, crypto doesn’t so much offer an improvement to an existing system, as an opportunity to supplant it. This is surprising because much in the crypto world was created and developed by idealistic, open-source developers, and entrepreneurs with a desire to do good with their talents. They are drawn to the innovation, the strong sense of community and the allure of personal wealth creation, but tend to overlook its harmful and destructive characteristics, including its anarcho-libertarian roots. With so little to show after so much innovation and investment, crypto enthusiasts continue to point to the potential and want to be judged not so much on what it is today as on what it will be in the future.

A powerful idea more than a decade in the making, the broad attraction to crypto reflects the concerns and possibilities of the current technological age. Crypto is an outgrowth of the realization that while technology may have liberated and enlightened us, technology has also demonstrated its potential to restrict people through tighter regulation, censorship, and surveillance, all of which has fueled fears of tyrannical government and corporate overreach. Today crypto has a massive following whose individual financial fortunes are wholly entwined with the success of the movement itself. Crypto deftly melds speculation and frustration to widen its base, push up the price and cushion any price falls, with most followers too materially and emotionally invested to reason. To paraphrase Upton Sinclair, “It’s difficult to get a man to understand something when his investment portfolio depends on him not understanding it.”

Although most crypto startups don’t directly involve mainstream crypto “currencies” like Bitcoin or Ethereum, it is the continued success of these crypto currencies that underpins the broader crypto market including so-called stable coins, tokens, NFTs and DeFi (decentralized finance). As the recent collapse of several stablecoin and DeFi related companies demonstrates, crypto markets are not just correlated with one another, but often highly interdependent. Should Bitcoin or Ethereum ever completely collapse in the same manner, it could create a catastrophic cascade effect across the entire sector crushing millions of investors already disenchanted with the economic system dating back to the 2008, which not coincidentally is when the original Bitcoin white paper was written by the pseudonymous Satoshi Nakamoto.

Many investors and policy makers may have considered a scenario of a crypto bubble bursting and accepted these risks as reasonable given their own economic security and the principle of caveat emptor, but nearly not enough attention has been drawn to the more worrying consequences of crypto’s potential triumph. In this scenario, crypto continues to draw millions of people in the years to come with help from politicians, taking the price of Bitcoin and others far beyond their historic highs and reinforcing a parallel virtual economy that is largely predicated on speculation. More ominous with the success of crypto is the gradual realization of its founding anarcho-libertarian principles, whether its followers believe in them or not.

As I explain, crypto is also the ultimate realization of anarcho-libertarians with outspoken subversive intent regarding central banks, commercial banks, and sovereign currencies. They and their followers represent a millenarian movement that sees the modern economy as corrupt and harmful, and in need of sweeping transformation. Like anarchists and communists in the early 20th century who advocated for a stateless system, the most fervent followers of crypto similarly envision a stateless economic system.

The irony of crypto is that while it brandishes freedom and decentralization as its core philosophy, in practice it bends towards centralization and authoritarianism, much like mass political movements of the past.

Whether it's Bitcoin or Binance Coin or Solana, the creators and their early backers of these currencies and tokens are “whales;” large crypto assets holders whose individual holdings can move markets like a whale makes waves. In a crypto-dominated economic order, society would effectively be consenting to the replacement of big banks, big tech and big government with something far more opaque, unpredictable and concentrated. For the unaware, new research indicates that .01% of Bitcoin accounts own 27% of the Bitcoin (10K accounts) in circulation, while the top 100 accounts of Ethereum own almost 52% of Ethereum and 10 accounts own 88% of Binance Coin. The same level of concentration applies to every token or currency issued in crypto.

Of course, most crypto enthusiasts do not harbor extremist views, nor do they have nefarious intentions. They are more aptly described as “techno-optimists” who believe technology is inherently a force of good, whose imperfections will be worked out with time and code updates. Nevertheless, the anarcho-libertarian ethos of Bitcoin permeates much of the broader crypto market using blockchain models that rely on speculation, the constant recruitment of new followers and profiteering. Whether the originators of crypto projects realize it or not, many of their most active users do in fact subscribe to anarcho-libertarian viewpoints. And because most crypto projects directly or indirectly bolster the need for Bitcoin and Ethereum, they also reinforce everything those primary crypto currencies represent.

Crypto currencies and tokens should be regulated like any financial security, but regulation will confirm the fundamental anarcho-libertarian claim that government officials colluding with big banks and big tech are only looking out for their own interests, stifling innovation and freedom in the process. In the meantime, the prospect of government regulation is likely to awaken the ideological leanings of those already bought into the crypto messages without fully realizing they are now part of a movement. Regardless of whether crypto is a colossal failure or a screaming success in the long term, in the coming years crypto will become highly politicized and used as a political cudgel to ensure its success and prevent its needed regulation, creating ideal conditions for economic unrest and political instability. As I explain below, I’m cryptoskeptic because everything crypto relies on speculation with a disregard for the negative externalities, but I’m also cryptophobic because crypto unintentionally advances a political ideology that is destabilizing and has the hallmarks of a mass movement ideology.

To learn more about why many of my partners are optimistic, read Ethan Kurzweil and Lindsey Li’s article, “The antidote to cryptophobia."

Crypto is predicated on speculation

The blockchain technology that facilitates crypto has been heralded as the solution to address the lack of trust in traditional institutions and intermediaries. It uses cryptographic math to support a trustless decentralized system, thereby overcoming human inspired failings found in centralized systems. But at its core, the only way to motivate actors to facilitate and validate the math that underpins blockchain is to create an incentive in the form of a tradeable digital currency or token. And the only way to convince someone that these digital currencies have value is to simultaneously restrict the supply and promote its potential for uncapped appreciation. It’s ingenious in many ways leveraging human greed to remove the need for a centralized authority to act as the arbiter of truth. Speculation may be an unintentional byproduct of some crypto projects, it’s also the irresistible fuel that propels them and they cannot function without it.

Critics appropriately equate crypto investments with bubbles and pyramid schemes, but the truth is that the long-term success of any powerful idea, be it a religion or mass movement, is dependent on consistently attracting new followers who subscribe to the movement’s core tenets. No powerful idea ever succeeded without the explicit promise of rectifying the wrongs of the current economic system and its ruling class, and the anticipation of greater prosperity through some redistribution or realignment of wealth. Historically, most utopian, ideological movements enriched their earliest and most fervent followers through plunder and expropriation, not by the promise of an “expanded pie.” And similarly, crypto rewards its early followers and doesn’t promise an expanded pie, but a changing of the guard. The crypto movement stands out in how it fuses financial speculation with its anarcho-techno-libertarian ideology to create a uniquely potent message, the likes of which we’ve never seen.

Anyone can be swept up in speculation, but in the case of crypto there is an ideological undercurrent that provides speculators with the ultimate pretext to deny they are speculating.

Despite the noble aims of some crypto creators and entrepreneurs, no technology can relieve humanity of its greed and lust for power. As an example, there is a lot of innovation and consideration that goes into crafting the rules and protocols to curb bad actors in crypto. Part of the innovation lies in the use of Decentralized Autonomous Organizations (DAO) which are created as part of the Ethereum code to allow members of the community to control and direct a given crypto project in a decentralized, trustless manner. While DAOs sound fair and democratic, they are often regressive, functioning much like a shareholder vote, not on a “one person/one vote” principle. This is entirely consistent with libertarian ideology, because with centralization as the bugaboo, the wealthy can now purchase their power and influence legally even if it means commandeering the vote for someone’s personal benefit. The difference is that those consolidating ownership using DAOs can hide behind pseudonyms.

There is a growing feeling of losing control in the core of the movement itself. Vitalik Buterin, the creator of Ethereum, realizes the “dystopian potential if implemented wrong” and I expect more to speak out in the coming years as important philosophical differences expose deeper fissures with regards to what they are trying to achieve. The constant hacks and graft (colloquially known as “rug pulls”) are a warning of what’s to come, not a sign of immaturity and what must be fixed. The stronger and more widespread crypto becomes, the more criminal and nation-state hacking, theft, and manipulation can be expected.

The “dystopian potential” Buterin alluded to lies not only in the potential for speculation and manipulation by bad actors, but also in the immutability of anything that happens on blockchain-based systems and the implications that has for privacy and safety of those who come to rely on it. Blockchain’s ability to irreversibly record every transaction or exchange of information is frightening if you’ve ever made a mistake and desperately needed something to be changed, deleted, or undone. Science fiction writers warned us of the dangers of AI and tampering with DNA, but never foresaw the potential dystopian path that awaits with crypto. Historian Yuval Noah Harari warned repeatedly how a lot in technology favors centralization and tyranny, but surprisingly remains undecided regarding blockchain and crypto.

The movement’s ability to shrug off the impracticality of crypto and deny what common sense says is clearly speculation only proves the effectiveness of crypto doctrine. One may fairly argue that lots of capitalist pursuits rely on some level of speculation, but crypto is unique in that it is unable to detach itself from speculation. The second difference with crypto is that it’s aided by a political ideology that sustains and intensifies the speculation making it that much harder to stamp out. As I describe below, crypto is not so much an investment idea that aligns with the libertarian political ideology, as it is a virulent strain of libertarian political ideology leveraging human greed through the blockchain.

Crypto is political

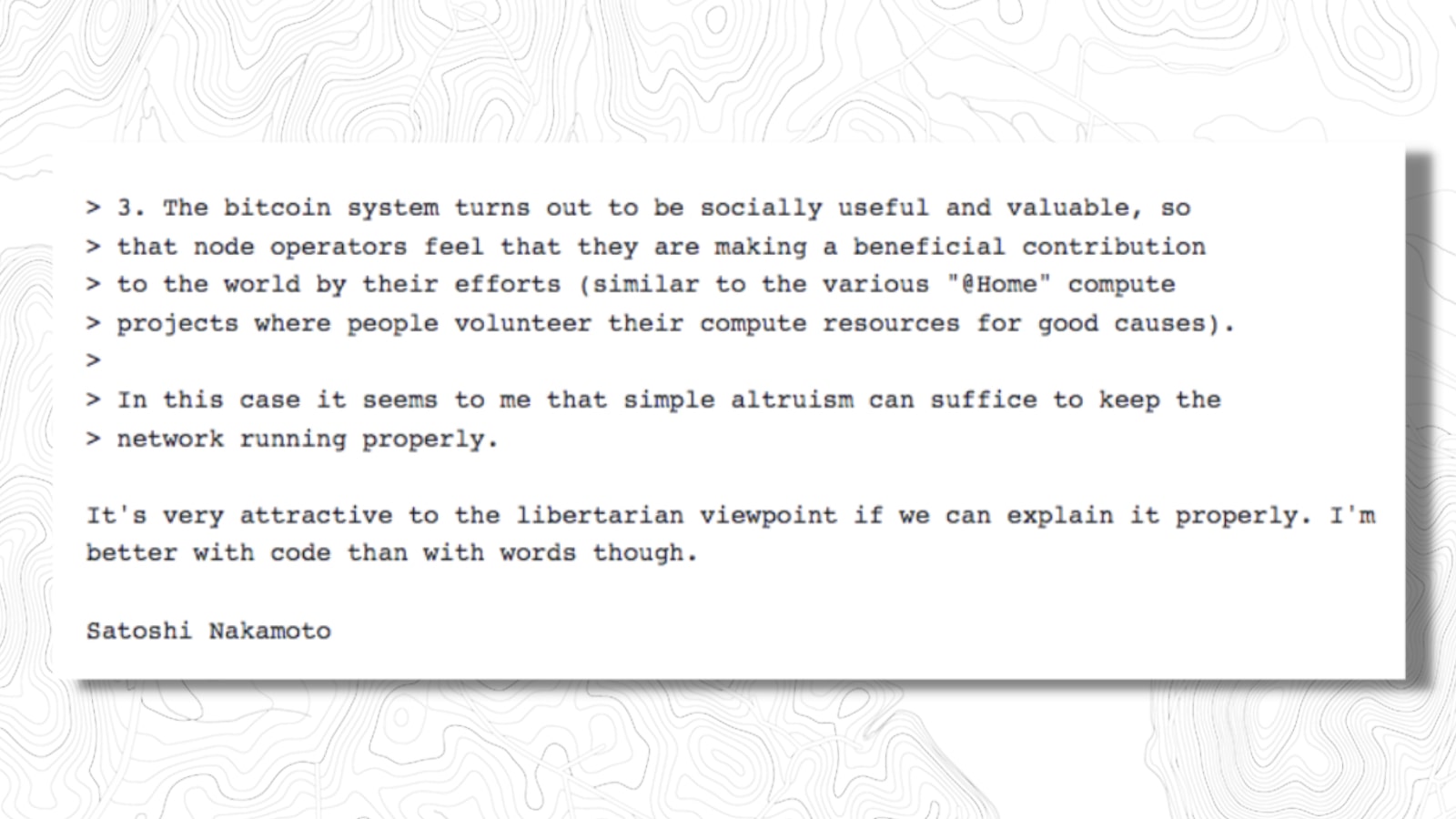

In case it isn’t clear yet, crypto has all the markings of a utopian, ideological movement replete with a prophet (Satoshi Nakamoto), a manifesto, its own rhetoric and jargon, factions and enemy lists, widespread use of icons and pseudonyms, a new capital city (Miami), disdain for non-adherents, hostility to criticism, and of course, a heavy reliance on evangelism to attract new followers. It’s too decentralized and accessible to be a cult and doesn’t require relinquishing your existing beliefs like a religion. It is disorganized but it has heroes and “whales” who have become its de facto spokespersons. Like communism which initially aimed to help the poor and underprivileged, crypto has rapidly evolved to become highly regressive, favoring the originators and early movers, the connected and the influential, and anyone with market making sums at their disposal.

In his address at the Bitcoin2022 conference in Miami, Peter Thiel said, “When they choose not to allocate to Bitcoin, that is a deeply political choice, and we need to be pushing back against them...It’s a political question whether this movement is going to succeed or whether the enemies of the movement are going to succeed in stopping us.” He then shared his enemies list which includes prominent crypto-skeptic investors, such as Warren Buffet, and made sure to include the “nameless, faceless bureaucrats” many on the right derisively refer to as the “deep state.” Those who’ve followed Thiel know this isn’t hyperbole and should be alarmed that he is also one of the largest donors to 16 pro-crypto Senate and House candidates.

It’s no surprise that a right-wing libertarian like Theil supports Bitcoin. Crypto presents anarcho-libertarians with an escape hatch that seemingly puts one’s no wealth, data, and resources beyond the reach of the state or a corporation. It helps circumvent KYC, anti-money laundering, sanctions and taxation, although not nearly as well as its users believe. A non-sovereign currency provides the missing link for those anarcho-libertarians who seek to be stateless like “seasteaders” (also supported by Theil). While crypto markets itself as the embodiment of hope and freedom, it is inherently reactionary, thriving on anger and fear of government, multinational institutions and large corporations that have used technology to monitor and occasionally deny one access to their financial resources.

As of now crypto claims no political agenda except the part about weakening the local currency for the benefit of a digital currency they already own in vast quantities. I predict that will change given a confluence of vested interests. In response to calls for the regulation of crypto, the immense financial clout of its early devotees is being used to acquire socio-political clout by converting unsuspecting politicians, celebrities, and influencers to the cause in the name of innovation and freedom. Senators and representatives from both sides of the aisles are being recruited to support “financial freedom” and “financial innovation” and to block crypto regulation. What’s more, several former SEC commissioners, including former Chairman Jay Clayton and former SEC counsel Elad Roisman, have taken senior roles at Fireblocks and Coinbase, respectively. The revolving door mimics the revolving door of big finance. The foxes are guarding the henhouse.

So far there are only pro-crypto political donors, which means there are also only pro-crypto lobbyists (320 according to the Financial Times), advocacy groups and PACs working their way into the minds of politicians. This includes a super PAC funded by the billionaire founder of FTX and the Financial Freedom PAC devoted to supporting Bitcoin champions in Congress. The support has largely been bipartisan so far. There is an Innovation Caucus in the Senate, which includes the “crypto-queen” of the Senate (Sen. Lummis), and a Blockchain Caucus in the House with over three dozen members. Many centrist Democrats, including Senators Cory Booker, Ron Wyden and Christine Gillibrand, have fallen under the spell, attending digital currency conferences and repeating the mantra that crypto is good for minorities and underprivileged people. NYC Mayor Eric Adams famously accepted his first three paychecks in Bitcoin to show his support (same as Miami Mayor Suarez). And Democrat congressman from Silicon Valley, Ro Khanna, is promoting a bill that among other things would state cryptocurrencies are not a security, and therefore not eligible for regulation by the SEC.

More recently it has been Republicans who have embraced crypto the most, largely due to the messages of freedom and anti-regulation. While former President Trump has previously expressed doubts about crypto, surely no one doubts that he, or Florida Governor De Santis, would embrace it wholeheartedly if he thought it could help him win the nomination in 2024. Interestingly, it has been the most progressive Democrats (e.g. Sen Warren and Rep. Ocasio-Cortez) who have expressed strong reservations with regards to crypto, but this is something that has the potential to make the regulation topic even more polarizing.

If crypto is ultimately regulated, it will be kept light allowing the crypto movement to swell with a semblance of legitimacy until it’s too late to contend with as a mere investment craze. As much as I am concerned about people being duped into speculative bets, I am even more concerned with how crypto speculation will enrich a new class of pseudonymous, anarcho-oligarchs while drawing millions more into its mass movement.

Hallmarks of a mass movement ideology

The sustained conviction in crypto following the hype and disappointment suggests an ideological attachment, and I see disturbing parallels with other attempts at a sweeping reorganization of our imperfect and, at times, very unfair economic system. All-encompassing narratives that purport to provide a solution for all that ails our society are the key characteristic of mass movements according to Eric Hoffer in his 1951 classic True Believer. The others include an anti-establishment ethos, the corralling of the people and a zero-sum approach to those they are trying to convert (i.e. “with us or against us”).

When considering crypto as a mass movement, there are many worrying parallels to point to. To begin with, there are the lofty, inspiring goals espoused by adherents to lift people out of poverty, bring about peace and protect individual rights and freedom.

Armed with rhetoric catechisms, crypto adherents often appeal to moral rights that are not easily contested, such as “the user should own their data,” “the freedom to transact,” and “the community should be able to profit from its activity.” These are compelling slogans not easily contested at face value, but familiar to anyone who has studied mass political movements of the 20th century.

Similar to other ideological movements crypto presents an engrossing theory that explains our economic past and future, giving it the veneer of being “progressive” and on the “right side of history.” Specifically, it presents itself as being the natural evolution of human economic development like a crypto version of Marxist historical materialism. Crypto advocates carefully delineate between Web1 and Web2, employing terms most of us in the tech world ceased to use 15 years ago, in order to introduce “web3”...a more wholesome and welcoming term for crypto. As web3, crypto becomes something belonging to the future, which helps it weather the inevitable setbacks and volatility. It is essential because in order to convince people of the future, one must first be able to coherently explain the past. This includes the prominent Silicon Valley investor Naval Ravikant, who presents crypto as an inevitable step in the progress of our species. As recently as May, Naval referred to Bitcoin as “Galt’s Gulch” referencing a secret location where the brightest and wealthiest find shelter in Ayn Rand’s novel Atlas Shrugged. “Balaji Srinivasan, another prominent Silicon Valley thinker, presents a similar approach on his blog, going so far as to envision a sovereign, virtual country governed by crypto principles.

As with other compelling ideologies, theory always precedes implementation in crypto. Using the original Bitcoin white paper as an example, crypto entrepreneurs prepare elaborately detailed business plans that explain the intricacies of the eventual working system but tend to overlook the utility for the end user other than wealth creation. Unless you are already a believer, the weight given to crypto theory makes some entrepreneurs sound incomprehensible. As Eric Hoffer wrote “....[w]e can only be absolutely certain about things which we do not understand... [i]f a doctrine is not unintelligible, it has to be vague; and if neither unintelligible nor vague, it has to be unverifiable.” Unsurprisingly, when a crypto project doesn’t go according to plan or there is a ruinous hack, the familiar slogan “it wasn’t implemented properly” surfaces followed by an explanation for why they must continue with some modifications. The recent Bitcoin crash resulted in familiar calls from the community saying the drop was actually “good.” Take for example the consummate real estate investor and the best-selling author of Rich Dad, Poor Dad who recites the crypto catechisms following the recent price drops. He too is under the spell.

Crypto enthusiasts often announce that they’ve gone down the "crypto rabbit hole" as a sign of their full and complete conversion. A rabbit hole is an apt description for crypto, where everything is interconnected and where the deeper you go the darker it gets and more disconnected you become from the world above. Regardless of the terminology, once admitted crypto adherents find answers to all their burning questions and then everything suddenly makes sense.

“By the time I had finished [reading], something had clicked in my brain which shook me like a mental explosion. To say that one had “Seen the light” is a poor description of the mental rapture which only the convert knows (regardless of what he has been converted to). The new light seems to pour from all directions across the skull; the whole universe falls into pattern like the stray pieces of a jigsaw puzzle assembled by magic at one stroke. There is now an answer to every question, doubts and conflicts are a matter of the tortured past- a past already remote, when one had lived in dismal ignorance in the tasteless, colorless world of those who don’t know."

Arthur Koestler on his conversion to communism in 1930 from “The God that Failed.”

If crypto were merely a technology trend or investment opportunity it would be hard to explain the disdain and impatience so many crypto adherents have for nonbelievers (recall the zero-sum approach to converts). This too is reminiscent of mass political movements of the past. There is an army of online crypto trolls ready to extol minor successes and price jumps, but equally ready to leap at detractors and naysayers. Perhaps the most revealing retort of crypto adherents to non-believers is “have fun being poor.” This intolerance is pervasive in crypto going back to Satoshi Nakamoto himself. Disregard for questions or critique is typical of mass ideological movements, not investment strategies or the latest technology trend. For the same reasons, those wrapped up in crypto have a hard time criticizing anything but the most extreme examples of abuse and negligence. The cost of being branded a traitor or heretic is indeed great, and it makes sense that they choose to stay silent. There is another reason that crypto adherents don’t speak out and that is because the strength of faith in mass movements is measured not so much by a belief in the impossible, but a refusal to see reality that confronts them.

There is one major fissure in the crypto community that has caught the headlines and put people like Elon Musk and Jack Dorsey at odds with many in the venture community and some of the most successful startups. A simple truth is that a lot of the success crypto has had is based on centralization or at least concentration, despite the core crypto tenet of decentralization. This includes concentration in mining (10 miners account for 50% of mining capacity), concentration in exchanges (e.g. Coinbase, Binance, OpenSea), concentration in staking and concentration in the “off-ramps” to the existing financial system (unregulated financial intermediaries). Such concentration makes crypto subject to manipulation and interference much like the current financial system it wants to replace. The parallel to mass movements continues because original communist theory posited that decentralized popular collectives would function democratically and there was no need for centralization. Vladimir Lenin thought otherwise and found that centralization uniquely suited his goals. As Will and Ann Durant wrote in “The Lessons of History”: “Nothing is clearer in history than the adoption by successful rebels of the methods they were accustomed to condemn in the forces they deposed.”

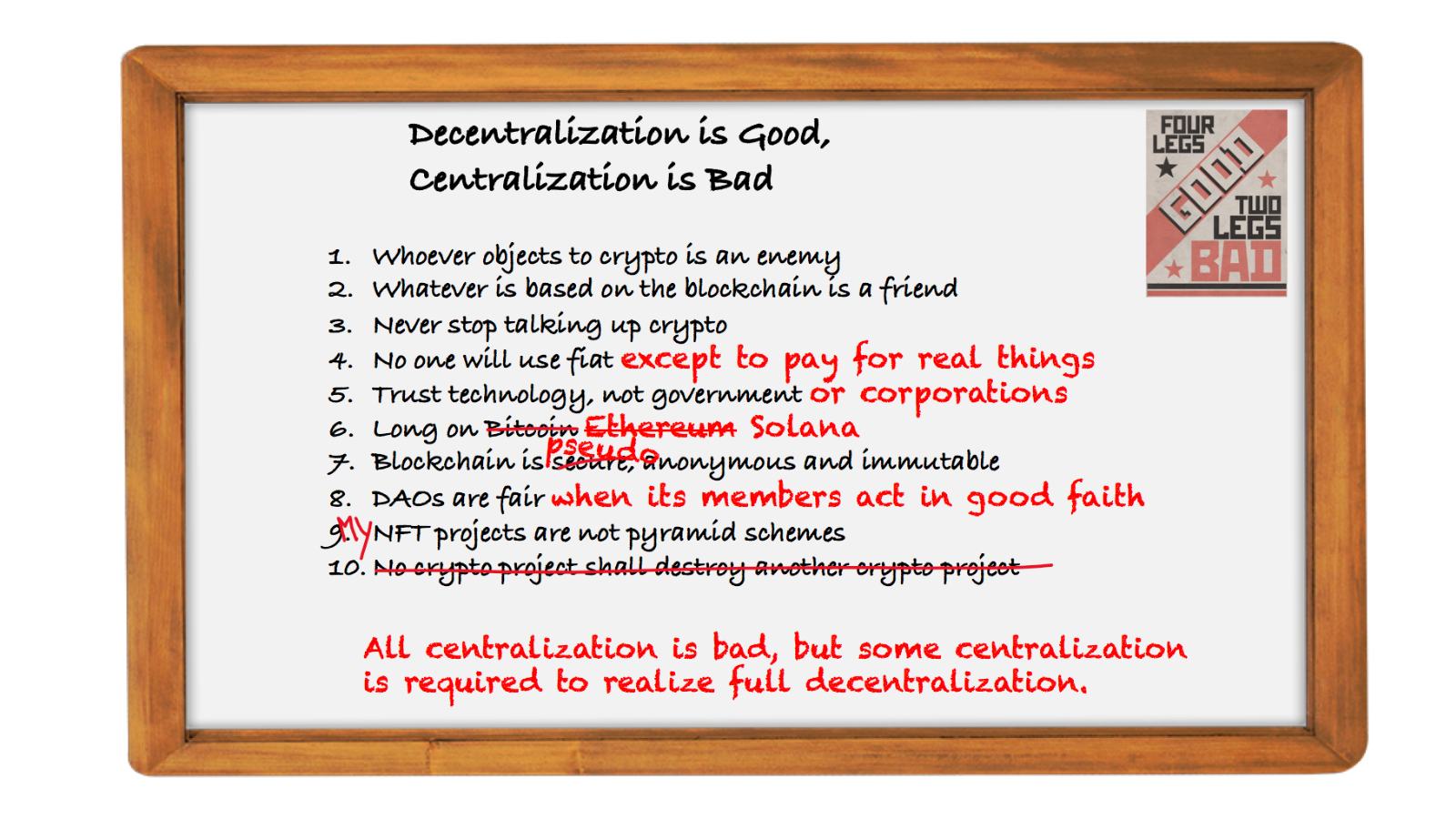

And finally, like other mass movements, the messages of cryptoism are malleable and evolving, allowing it to evade critique while broadening its appeal. The result is an increasingly arcane and inconsistent set of messages that is difficult to follow, resembling the changing “seven laws” from George Orwell’s Animal Farm.

In case it isn’t clear, the analogy to communism has nothing to do with leftist thought or a welfare state, and I don’t predict gulags or secret police any more than I foresee an actual revolution. Similar to communism, crypto bends towards centralization and consolidation due to human greed and capitalist impulse, which is why the tone of the crypto adherents often sounds authoritarian. Both communists and crypto advocates present utopian ideas of a stateless economic system and need to recruit a mass following to realize their vision. Both view the future as inevitable, which perversely allows them to evade moral culpability of any negative externalities that occur, which in the case of crypto includes speculative losses, environmental harm and ransomware payment terms. And in both I see a casual disregard for the new power structure and disparities that will emerge if their visions are ever realized. If anarcho-libertarians get their way, it will be they who are set free, not the poor, underprivileged masses.

An uncertain future

Unlike other critics, I expect the crypto movement to swell in followers as regulation lags, inflation persists, ETFs are launched and employees add it to their 401K, growing like the roots of a tree until it cannot be uprooted. It will gain steam because Wall Street can make money off it, social media revenues increasingly rely on it, and prominent politicians will seize on it as a winning issue. Crypto dollars will also find their way ever deeper into our media channels ensuring it receives “fair and balanced” coverage and further into mainstream advertising venues, whether they’re online or offline. By the time regulators and politicians recognize the urgency of action, it will have become too mainstream to regulate without creating political tension and the crypto-oligarchs will have the upper hand and perhaps a friend in the White House.

A feudal system in which the masses are duped into farming the lands of their crypto overlords. A world that makes a mockery of advanced societies that are supposed to prevent the weak from becoming too weak and the powerful from becoming too powerful. Our current system is far from perfect, but a crypto-dominated world would be an anarcho-libertarian’s dream. As French philosopher Raymond Aron said, "[e]very advance in liberation carries the seed of a new form of enslavement." This applies equally to technology advancements like crypto. Is crypto liberating as they claim or another stage of “digital serfdom”? To be clear, I do not believe crypto will come close to realizing its dream of replacing the dollar, but that doesn’t mean it won’t wreak havoc on the current economic and political order as it grows and becomes politicized.

I truly hope there is a middle path, where crypto is regulated and tamed, becoming a source of financial innovation and experimentation, the benefits of which could then seep into the mainstream economy. A path where NFTs assume their rightful place among other real-world collectibles, where modest speculation intersects with legitimate status seeking goals. A path where startups can use the blockchain in innovative ways without relying on speculation and embracing concentration, but I’m skeptical.

I’m certainly not the first to speak out and I know I won’t be the last. Most venture capitalists don’t speak out because it feels like the “next thing,” but also due to a fear of missing out. Being neutral may be more prudent and lucrative for me, but we all have a responsibility to speak our minds. Some will say I’m a sore loser who missed the boat, but I say you are becoming the elitists you want to replace. Some will say I’m too old to understand, but I say I'm just old enough to call it as I see it.

I'm seeing this through a slightly different lens in comparison to most, with the simultaneous views from being a student of history and political philosophy and as a VC at Bessemer. It’s possible I’m being alarmist, that the technology forces of good will not only solve crypto's negative externalities but prevail over the human penchant to speculate and exploit their own financial interests. I hope I'm wrong. But if my essay will have given a crypto entrepreneur, investor or regulator pause as they ply their trade, I will have made the impact I wanted to make.

Postscript: In the essay above, I reserve most of my concern and criticism for crypto currencies such as Bitcoin, but at the risk of overgeneralizing I effectively take aim at all tokenized protocols and any crypto project that relies on appreciated virtual currencies or that attempts to exploit human greed with the implicit promise of a new appreciating digital asset, including NFTs. I know crypto has been helpful for remittances, refugees, dissidents and even non-profits, but that has very little to do with the trillion-dollar crypto economy that has emerged. I expect some interesting projects to emerge from the crypto movement using blockchain and NFTs, but not until it has found a way to provide true value to users and customers without relying on speculation.