Toast

From: Kent Bennett, Eric Ahlgren

Date: 12/14/15

Re: Toast Series B IR

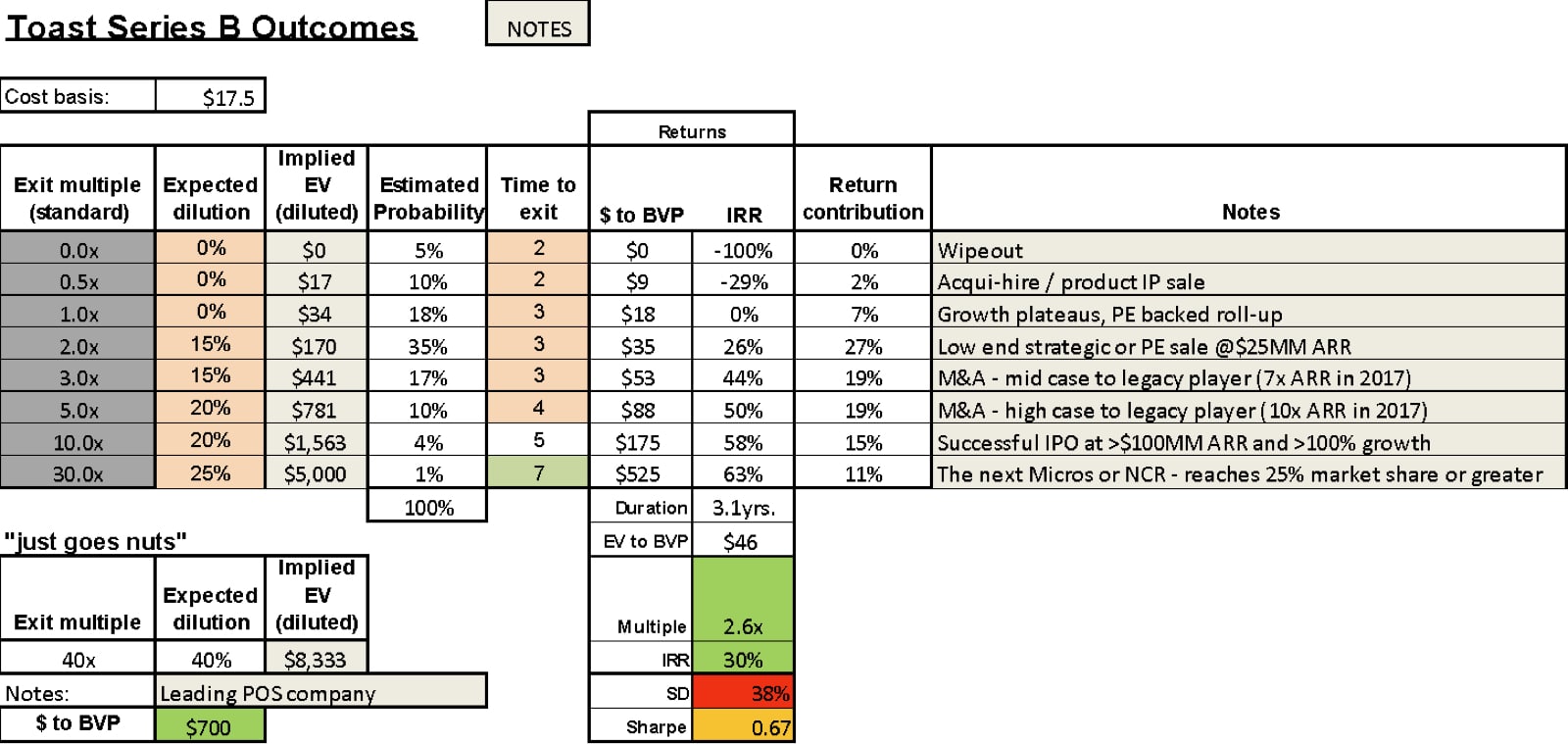

We recommend a $17.5M investment in the $24M first institutional round of Toast, a Boston based company selling restaurant point of sale (POS) software. Our $17.5M will purchase 14.3% FD ownership and will see a 2X return at a $150M exit and a 2.5X return at a $210M exit. Our hope, of course, is that Toast will use what we believe is a meaningful product advantage to grab a large share of the 1M restaurants who will transition to cloud based POS in the coming decade. The benefit of a massive market is that with a little more than 1% market penetration Toast could be a $100M revenue company. The company momentum since signing our term sheet has us eager to close ASAP and we hope that an impressive product, a huge market, and potential for continued capital efficient hyper-growth will make up for an admittedly premium price on entry.

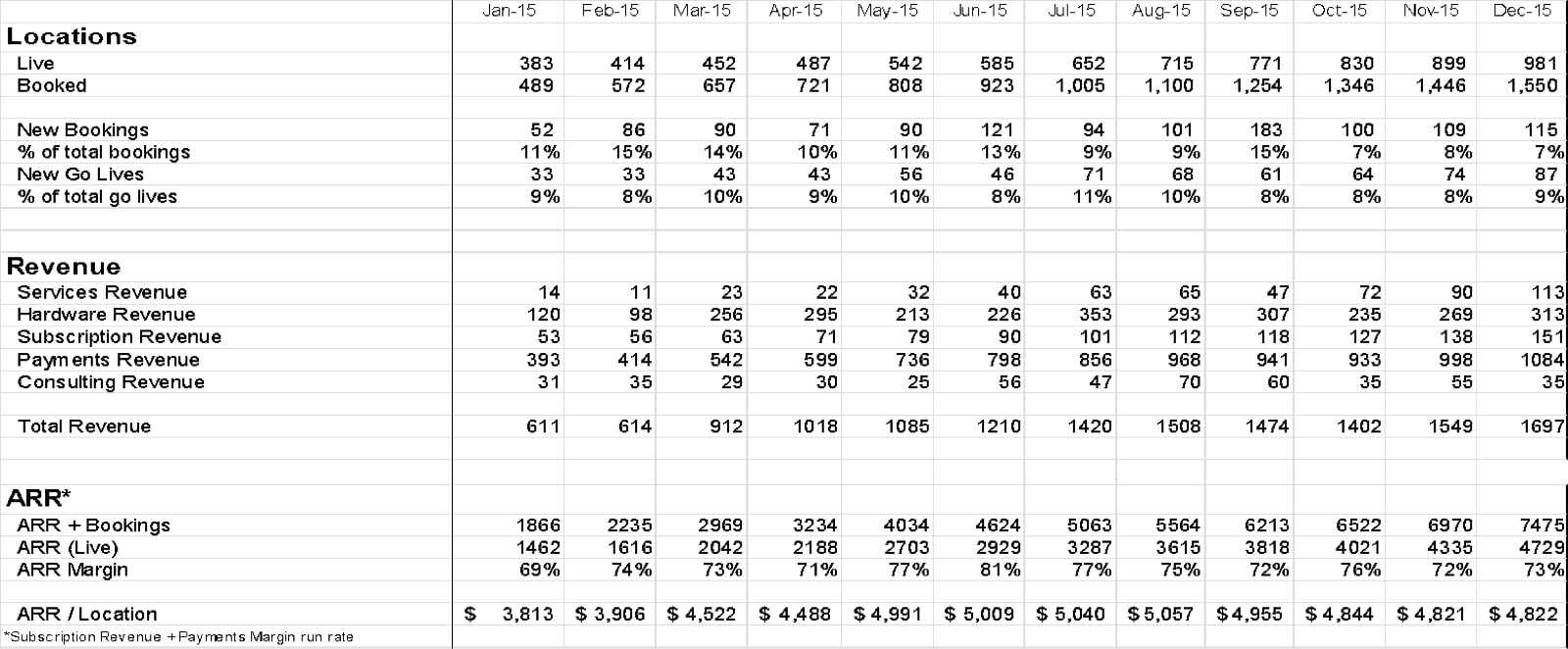

By the Numbers

- At the effective pre-money we’re paying 12x CARR / 17x ARR (the company has a ~3 month backlog of booked sites) – this is 3.8X YE2016 forecasted CARR although the company is ahead of that plan at the moment.

- November was a record month with $800K of new ARR, a 7% increase in ASP, 0.3% gross churn, and most ramped reps above quota. Across the board things appear to be humming.

- $24MM CARR / $17MM ARR forecast exiting 2016 - ~300% YOY growth.

- 75% blended Gross Margins on ARR (subscription + payment processing)

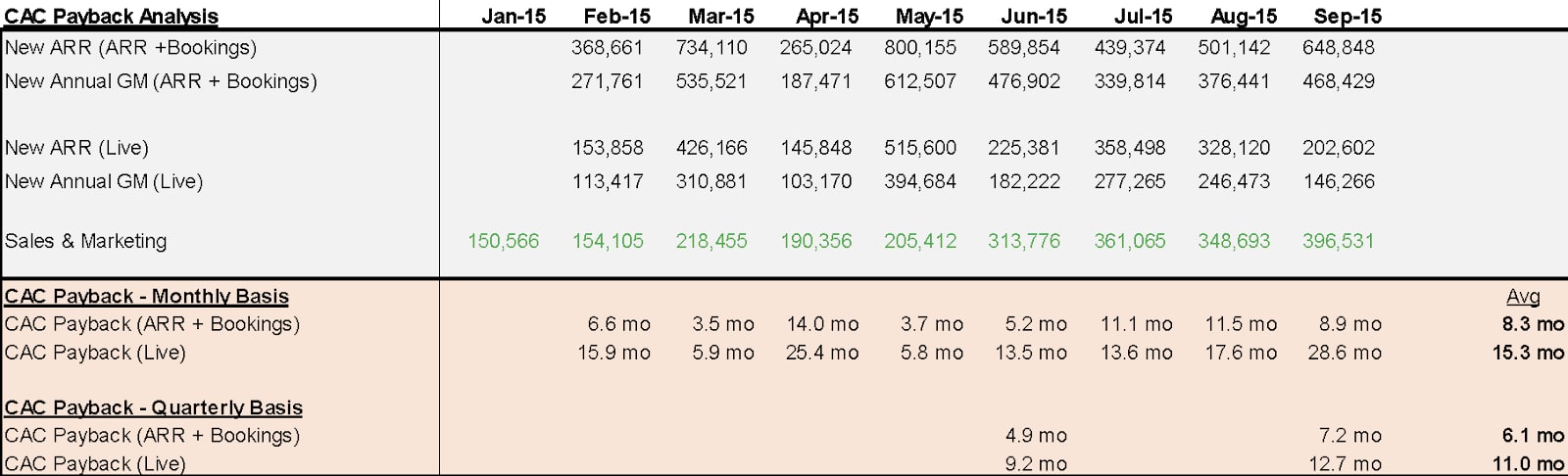

- 8-month CAC payback on live ARR (although inefficient implementation has stretched the cash on cash payback closer to a year – this is already headed back down in November)

- <1% gross quarterly churn

- >150% net retention, including upsell and account expansion

- $5300 ARR / location (November bookings averaging $6200)

- Market size: ~1M restaurants and bars (US only) = $6B for Toast at current monetization level with potential for expansion (product modules, international)

- $14.5MM capital invested to date

- $3.4MM cash remaining

- $1MM monthly burn

Product:

Toast offers a cloud-based system to quick serve (QSRs) and full service restaurants (FSRs), with a modular all-in-one restaurant management platform encompassing POS, payments, operations management, online ordering, self-serve kiosk ordering and checkout, inventory management, loyalty program management, gifting and myriad other restaurant needs (much of this is live today, although there may be a >5 year roadmap with endless product features ahead). Toast’s Android tablet-based cloud solution is beating out other new systems head to head and more impressively attacking on prem proprietary hardware incumbents Micros and NCR, who together make up 50% of the market.

While there are a handful of “next gen” players attacking this market, we believe that Toast has a significant early advantage. First off, the sheer amount of software the team has built in a short span is impressive – feature for feature they are already much more in the class of the >20 year old enterprise systems than the next gen “Bistro” players, and so for restaurants with any level of sophisticated feature requirements they win easily. But beyond just being very good at building good product quickly, the company also made two smart choices that sets them apart from the other players.

First, while competitors have almost all built on iPads/iOS, Toast’s Android-based architecture allows restaurants to be much more flexible in their hardware choices (iPads are simply not enterprise grade and come in far fewer form factors than Android), has fewer software versioning issues than iOS and the upfront hardware costs are cheaper.

Second, Toast also did real work to build out transaction processing capability, which lets them subsidize their fees by operating as a transaction processor (they simply match current restaurant rates and almost always win the transaction business without objection.) This allows Toast to price competitively and earn a much higher margin than competitors head-to-head.Despite what we think is an early lead, Toast’s product is still very immature, and every day they roll out new features like online ordering and inventory management (a $75 / mo upsell they introduced in October to 10% immediate adoption.)

There are countless ways they can expand the product offering over time, and with a modern software stack and open API they will continue to improve their product and integrate with partners who can offer great functionality on top of Toast.

We attended a company hackathon, where in two days employees had built applications to do among other things kiosk ordering, rapid backroom inventory, order ahead on mobile, vendor purchasing management – basically several other startups we’ve seen in the restaurant space are simply modules on Toast. We think an app store model over time (a la Shopify) is possible and could contribute to Toast’s defensibility along with integration into several ecosystem players.

We spent significant time with Toast customers, prospects, and industry experts and continue to feel confident that Toast has a best in class product. Despite a VERY noisy space we think they’ve emerged as a product leader fueled by the quality of the team and great decisions, namely Android as an OS and the decision to do the hard work of building out processor capability which supports a differentiated value proposition.

We’ve collected some data to back up this product assessment, namely:

- Toast beats every major competitor head-to-head in sales scenarios by a significant margin and has never lost head to head on product criticism (other than for a feature that they have not built yet). Combing through all of their loss explanations it seems to us they only lose based on either an owner who has already selected another system, or on price, and there just at the low-end of the market (where they have a plan to simplify their pricing as most losses are to snake oil competitors who manipulate their pricing with sleazy hardware leases)

- Toast churn is driven almost entirely by restaurants going out of business, and they have never lost a customer to another cloud-based POS, whereas they have stolen several customers from their competitors. Occasionally they will lose a customer in a complex location where wifi issues make handheld tablets (part of the Toast value prop for some buyers) difficult and in those cases the owners tend to revert to legacy systems but remain big fans of the Toast product.

- Toast net retention and upsell across multi-unit locations has been a big growth driver – many times a one unit pilot has turned into a multi-unit adoption

Beyond combing through their salesforce data, we have also spoken to 30 Toast customers – in addition to the 12 references provided by the company we did another ~20 “secret shopper” in-person visits – representing about 7% of Toast’s booked restaurant locations, and the feedback has been overwhelmingly positive, producing an informal NPS of over 80 with only one mild detractor (we think a WiFi issue). Encouragingly, when we ask users for their favorite features of Toast, the range of answers has common themes but is also impressively long including:

-

It’s intuitive and really easy to use.

- Much more efficient than legacy systems on key workflow activities. Occasionally an owner will mention something that could be improved and are always amazed when the software improves the next week...

- Really easy for a new employee which means reduced time training

-

Cloud solution – multiple users cited benefits of the cloud including

- Make updates or review analytics from anywhere. An owner can set alerts giving them visibility throughout the day on performance at any location, or in a particular server area

- Feature improvements – impressed at the rapid deployment of new features to make the product even better

- No more server crashes. If anything stalls it’s only just for a minute and the devices can operate in offline mode so no outages

- Integration with third party software – several users favor another third-party restaurant solution (like a loyalty program or inventory tool) and Toast has been able to easily integrate into these solutions.

- Table-side hardware drives throughput efficiency:

- Allows servers to send orders immediately to the kitchen

- Guests can run credit cards at the table – and give dynamic feedback on service

- Many customers have seen significant increase in table turns and service speed

- CRM:

- Guests receive receipts by email (this also speeds up line throughput in QSRs/cafes), and restaurant has entire order history easily accessible which allows for analysis on best guests, quick retrieval of a past receipt, etc. We think the potential to improve CRM functionality over time is one of the most exciting aspects of the Toast roadmap.

- Other advanced features such as online ordering, website menu integration, integration with other third-party software, etc.

- Only points of criticism are around non-Toast specific issues like wifi connectivity and hardware sensitivity and some mild critique that their service has degraded (which the team admits has been true at times in this period of hyper-growth.)

The bottom line is that we think this is a stand-out product which is driving the company’s early success, and there is a ton of potential for the product to improve with modules for mobile checkout, scheduling, inventory management, CRM, and others just getting started.

As for the tech under the hood we spoke to both Adam Ferrari as well as Keith Johnson who were the former CTO and VPE at Endeca and have been working with the Toast team. Both are convinced that the company currently has a solid engineering team with a code base ready to support the product roadmap although one that will require continued investment to support the growth in 2016/17.

Market:

There are approximately 1 million addressable restaurants in the US, and with current ARR / location around $5,000 and upside with additional product features potentially approaching $10,000, we estimate the market size at $5 – 10 billion. This is large, but maybe not surprising relative to the $600B Americans spend at restaurants every year. Approximately seven in ten of these million restaurants are “independent” often single location operations, as opposed to chain stores, although a significant fraction of these “independents” have shared ownership or multiple locations. Toast’s core demographic today is independent operators but they have begun to move into “mid-market” 10-200 location chains as well. The likely sweet spot for Toast in 2016/17 is the combination of larger independent restaurants and “mid-market” chains – approximately 300-400K of the 1M restaurants fall into this sweet spot. Over time we think any restaurant that uses meaningful software should be a Toast customer. As an example Toast is engaged with the CIO of Chipotle (1400 locations), and inspired by positive market buzz the CIO of Burger King (14K locations) called Toast two weeks ago and has already scheduled a second meeting. While we don’t expect any national chain to move quickly we do believe Toast could be in position to take down national chains in the next 24-36 months which could drive a step-function of growth.

Competition:

In addition to being massive, the POS market is extremely fragmented, with two large incumbents, Micros and NCR, each accounting for roughly 25% market share. Beyond these two big players there is a growing list of cloud challengers, including:

- Revel: Early leader in the iOS tablet market and has raised >$100MM. iPad based.

- Breadcrumb: Feature-light POS acquired by Groupon.

- POS Lavu: iOS.

- Clover: extensive distribution, low upfront cost and proprietary hardware.

- Square: For basic single countertop and cash register restaurants only - no true restaurant operating system.

- TouchBistro: targeting smaller restaurants.

- HarborTouch: Catering to the 1-2 terminal restaurant.

- Aldelo: built around an on prem solution.

- Positouch

The market is incredibly noisy, but we have reviewed Toast’s win/loss rates against all of the above competitors and Toast consistently wins based on the quality of product and reasonable pricing relative to such a full-suite product.

Go-to-market/sales strategy:

Toast is primarily selling direct to SMBs today via an inside sales force, but the company is also in the early stages of building out a channel strategy. The company claims that the Micros acquisition has been painful for their VAR channel and is freeing up many VARs in search of new solutions to sell. Toast’s most notable channel partner to date is Gordon Food Service, a distributor to >100K locations who are pushing Toast and an integration to their food costing/ordering service – GFS accounted for about 25% of Toast bookings this year.

The sales effort to date has been effective, but we believe highly under-optimized. Both SMB and enterprise sales are being run by co-founder Aman Narang, an ex-star product leader at Endeca who had previously never sold anything in his life. Room for improvement is also clearly evident on the marketing side; a search for “best restaurant POS” will show Toast only several pages deep. Despite this “bootstrapped” approach, Toast is seeing >4x YoY growth and 6-8 month payback on sales efforts.

Most exciting for us is Toast’s ability now that the product has matured to push into the mid-market chains which have much more volume per location and thus monetize at a much higher rate, and have sophisticated needs that drop away all of the competitive noise as no cloud POS other than Revel (which we think is an inferior product with a bit of a head start) can compete at this level.

Over the course of 2016 Toast plans to hire 3 enterprise reps to tackle this end of the market and are already engaged with senior sales leaders from Aloha and Micros who tellingly have been approaching Toast.

Marketing for Toast has been largely organic with trade shows driving some leads, but many leads coming in from restaurants researching solutions or hearing about or seeing Toast out in the market. This year we think Toast has an opportunity to build out their SEO and lead gen capability although leads are not the problem at the moment as Toast reps are able to cold generate many of their own leads.

A quote from a sales rep we introduced to Toast (from Intigua) who after a month is already ramped: “It's remarkable to me. Typical days here include 2+ demos per rep (I did 4 today)! You were definitely right about Toast. They are onto something big here.”

Financials:

Toast makes money in five ways: subscriptions, a rake on payment processing, hardware sales, services and consulting fees. When we talk about CARR and ARR here, we are talking about only subscription revenue and Toast’s margin on payment processing. Together, subscription fees and payment processing margin have blended gross margins of ~75% due to Toast’s US-based support services (another differentiator from competitors like Revel, who rely on cheaper offshore support that many customers hate).

Note also that installations are struggling to keep up with rapid sales growth so there exists a backlog, which accounts for most of the difference between October’s $7.1MM “CARR” and $4.25MM of live “ARR.” Since the last Flash, we also received news of an outstanding November, which saw a 10% increase in CARR to $7.8MM and a 20% increase in live ARR to $5.1MM, putting the business ahead of the forecast laid out below.

The way to think about the business is about a core recurring engine of high margin subscription software and payment processing, served by an implementation arm working to get these customers live. Today Toast makes a slight margin on hardware, breaks even on consulting (which ends up being a way for Toast to subsidize some product development) and loses money on implementation services which is a big area for improvement in 2016 with pricing and process upgrades.

Toast has built a highly performing SaaS sales engine, achieving >3x YoY growth, 75% gross margins, <3% annual gross churn, >150% net retention including upsell and account expansion and a 14-month CAC payback that should be <8 months if Toast’s implementation teams were able to keep go-lives on pace with bookings. Overall, we are comfortable that the machine is working, but believe there is room for significant improvement. For example, the company has been undercharging for implementation and is currently losing ~$2000 per install, but has been steadily increasing pricing and projects to break even on installs by YE2016. The company makes a slight margin on hardware today that offsets part of this install cost, and we also expect those margins to improve as Toast scales. We also expect an increase in sales efficiency as 2/3 of ISRs are already achieving quotas of 4.5 locations / month with several significantly overachieving. We expect that quota will increase to 6 locations / month by YE2016. And this is not to mention mid-market sales which we think have a chance to significantly increase sales efficiency as those reps come online.

Below is a snapshot of 2015 revenue growth:

This is the plan they handed us mid-October, but they are already $830K ARR ahead on bookings as of November month end, and are $765K ARR ahead on go-lives.

CAC payback is somewhat lumpy month to month, in particular as larger restaurant groups come online, but the overall picture shows a payback of 8 months assuming no backlog. While there will always be some delay in getting sites online, we believe this will significantly improve after this round of financing, and look at CAC payback from booking as an accurate indicator of the efficiency of the sales model. Below is an analysis of CAC payback in 2015.

Deal:

We are investing $16M in an up to $22.5M fresh primary round at a post money valuation (inclusive of an outstanding $8M convertible note) of $125M. Google Ventures will be investing $5MM of the round which we see as a positive given their Android association and the halo of their brand. The board will be BVP, Steve Papa, CEO, founder, and one independent seat.

Team:

We believe this is the best product team in the POS space. CEO Chris Comparato and co-founders Steve Fredette, Aman Narang, and Jon Grimm were A players at Endeca, and the team is extremely hungry working all hours obsessed with building out the best product the restaurant industry has ever seen.

Chris Comparato, CEO: Chris joined Toast in 2015 from Acquia, where he was SVP of Customer Success. Prior to Acquia Chris was SVP Worldwide Solutions at Endeca and was Steve Papa’s best operator. We have been impressed so far with Chris although this is his first full CEO role.

Steve Fredette, Co-Founder: Steve is a world-class product/engineering unicorn, and previously led pre-sales and product at Endeca. He focuses more on product and engineering at Toast.

Aman Narang, Co-Founder: Aman currently helps run Product as well as Toast’s inside and field sales efforts, and has performed impressively in the role given a background otherwise totally devoid of sales experience. Previously, Aman was a member of the product leadership team at Endeca. We’re not sure where Aman’s focus will settle in the long run, but he’s extremely talented and has a ton of upside potential.

Jon Grimm, Co-Founder: Jon is currently focused on technology—making sure the product works at all times including payments. Tech is a massive challenge here as restaurant customers don’t tolerate a minute of product downtime and Jon has performed admirably although has a big challenge on his hands to keep the tech performing as the company scales.

The team will hire other senior engineering leadership, a VP of customer success, and in 2016 the company will likely need to add a head of HR as headcount is expected to double from 150 to 300.

Key Risks/Ways This Can Fail:

- Competition is noisy and Toast fails to emerge as one of the few next gen winners

- Toast’s growth overwhelms them – backlog swells, financing market gets more challenging, and the team is forced to adjust the growth path.

- Financing markets seize up and companies are forced to halt growth and run off of cash flow.

Summary:

We’re very excited about this investment – for the past 18 months we’ve stood by anxiously as the team hit obvious product market fit but punted on raising more equity. Finally they’ve seen an opportunity to step on the gas, and frankly have seen the capital markets “rationalize” (okay, slightly) which has given us an opportunity to invest in a deal we can stomach.

Our deep look over the past two months has validated this is a best in class product, that the commercial engine, while still under optimized, is impressively efficient, and we believe they’re only getting started and have significant opportunity to build a real moat in this market and be one of a few, and perhaps the dominant next gen restaurant POS player. We strongly recommend this investment.