The AI pricing and monetization playbook

An early primer on how founders and AI product leaders capture value in a world where every token has a cost, and every customer expects exponential outcomes.

Every new AI product typically aims to achieve three goals: reach new audiences, deepen engagement through new capabilities, and expand the total addressable market. But at the foundation of AI pricing lies a hard truth that changes everything: unlike traditional software, delivering AI isn't free.

Cost of goods sold (COGS)—specifically, compute and inference costs, plus customer support such as "humans in the loop"—weighs heavily on monetization strategy. Unlike classic SaaS, where serving one more customer costs virtually nothing, every AI query incurs a non-trivial expense. Your pricing must account for these material unit costs while capturing the value you create.

Here lies the challenge for founders and product leaders: AI is in its early innings, and reliable pricing benchmarks are scarce. Comparing AI companies is often apples-to-oranges, given how differently each model and industry operates. Yet through our work with dozens of AI teams across verticals, we've observed patterns and pitfalls that transcend any single niche.

Key AI pricing takeaways

- Your charge metric is a strategic statement, not just a billing decision: Tokens work for technical buyers but confuse everyone else. Outcomes maximize value alignment but require absorbing cost variability. Choose based on what customers will pay for, then build operational discipline to make it profitable. Hint: Hybrid models (base subscription + usage/outcome tiers) win when you're uncertain. They provide customer predictability while capturing upside as they scale—the effective middle ground for early-stage startups.

- AI economics are fundamentally different from SaaS—COGS matter again: Every AI query incurs real compute costs. Companies see 50-60% gross margins vs. 80-90% for SaaS. If the math doesn't work at 10 customers, it won't at 1,000. Track true costs from day one (including founder time) and design pricing that covers compute while capturing customer value.

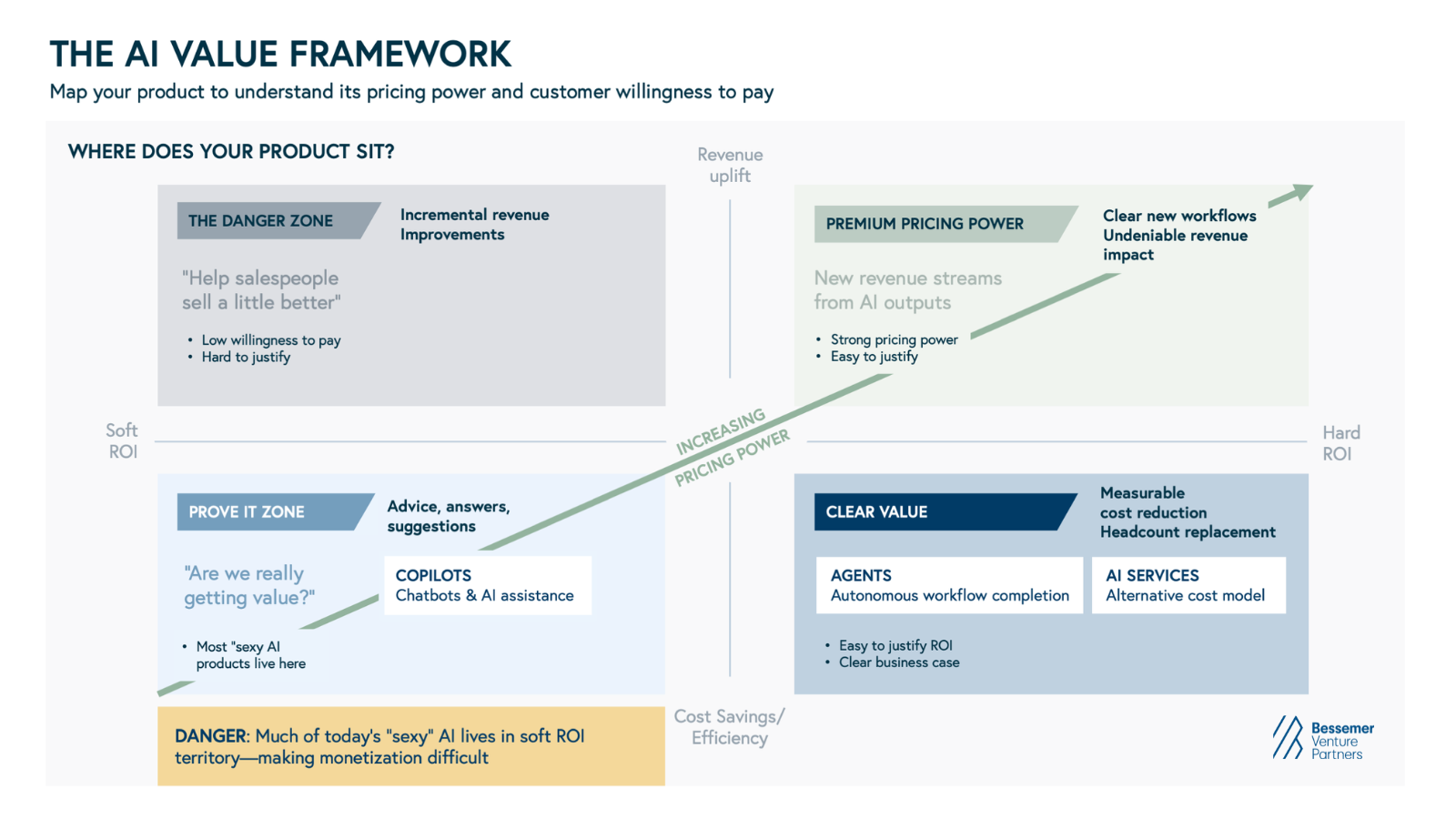

- Soft ROI positioning kills willingness-to-pay: Copilots offering advice without closing the loop live in dangerous soft ROI territory—customers question "are we really getting value?" As 2025 pilots hit 2026 renewals, pricing must reflect actual value, not promise.

- Find your pricing sweet spot through friction, not spreadsheets: Start with a price. If customers say "sold" immediately, you're too cheap. Raise incrementally until you hear "we have to think about that." Stop before it becomes a blocker. This is how multi-billion dollar companies found their sweet spot. Most founders default to cost-plus (calculate costs, double it) because asking for more feels awkward. Lead with value.Pricing shapes your entire GTM motion and org structure

- Pricing determines how sales, customer success, and product teams operate. Intercom's $0.99 per resolution aligns every team around one outcome: resolved tickets. Outcome-based contracts create new questions: How do AEs size scalable deals? How much upside should CS capture? Avoid the complexity trap—identify one model that works at both 10 and 1,000 customers.

How should I price my AI product?

As investors, we can't offer a one-size-fits-all formula. Business models are still emerging and vary dramatically across horizontal and vertical AI categories. But we can provide a framework—one built on a fundamental principle that's especially true in vertical AI: companies are no longer just selling access; they're selling outcomes.

That's why your pricing strategy must be bespoke: tailored to your industry, your customer's workflows, the concrete outcomes your product delivers, and the cost structure required to ensure profitable growth. Put simply, you must align the value your product creates with the value you capture through pricing to drive enduring revenue streams.

The first step? Convene a cross-functional team across product, sales, finance, and GTM operations to explore four critical questions:

- What's our go-to-market motion?

- What's the unit of value our pricing can scale with?

- How do we determine a customer's willingness to pay?

- How do we design a pricing model that's flexible and scalable—delivering value at each stage of customer growth without causing sticker shock?

This primer offers seven guiding principles and five founder best practices for determining willingness to pay and setting the right strategy. It's not a plug-and-play formula—it's a framework to equip you with the right considerations and questions as you design a pricing strategy that scales value for your customers and your company alike.

Three emerging AI business models shaping AI pricing today

Across our portfolio, we've observed three AI business models signaling a fundamental shift in software economics. Copilots, Agents, and AI-enabled Services are poised to define how AI businesses grow and monetize in the coming decade—and each comes with distinct "charge metrics."

| AI business model | What is it? | How is it priced? | Examples |

| Copilots | AI sidekicks that sit beside human users, enhancing productivity without replacing the person in the loop. | Copilots are typically priced per seat or consumption (much like SaaS) and are already driving major revenue expansions at companies like Microsoft, Google, and Salesforce. | From GitHub Copilot’s developer acceleration to Abridge’s clinical documentation assistant, copilots are proving that AI can double – even triple – employee productivity across text, code, image, and voice workflows. |

| Agents | Autonomous AI actors that represent the next leap in productivity. Rather than merely assisting a human, an Agent can execute entire workflows on its own, decoupling output from human headcount. | Pricing models for Agents are still evolving, but they’re often tied to tangible ROI (e.g. workflow-based, outcome-based, cost savings or output equivalent to a human’s work) instead of per-seat fees. | Early examples are cropping up in sales, recruiting, and customer support – such as Intercom’s Fin agent for customer service — functions where automation can substitute for incremental hires. |

| AI-enabled Services | Companies that blend automation with human oversight to deliver a service faster, cheaper, and more consistently than traditional providers. | This model shows how an AI-driven service can pass savings to customers while capturing more value for itself, also allowing for customers to scale spend up and down far more flexibly. Charge metrics could range from consumption- workflow- or outcome-based pricing, including cost of hiring an equivalent FTE or market rate for the service provider. | EvenUp combines AI and legal experts to generate personal injury demand letters; by charging per output (per completed letter) rather than by the hour and benefit from higher margins. |

1. Consumption-based pricing (per API call, per LLM token)

2. Workflow-based pricing (per completed task)

3. Outcome-based pricing (per successful outcome)

| A clear pattern emerges: As you move from consumption to workflow to outcome-based pricing, you're making a deliberate trade. You're accepting more cost risk in exchange for tighter alignment with customer value. The best founders don't choose based on what's easier to implement—they choose based on what their customers will pay for, and they build the operational discipline to make that model profitable. |

The seven guiding principles for AI pricing

1. Pricing in the AI era ties directly to value delivered—not access granted

- Usage-based pricing: Customers pay per token, API call, or inference.

- Workflow- or outcome-based pricing: Customers pay when the AI completes a defined task (e.g., ticket resolved, document drafted, lead generated).

- Hybrid pricing: A base subscription ensures predictability, while usage tiers capture upside as customer value grows.

2. Hybrid and tiered models create predictability with upside

Many vertical AI companies are adopting hybrid models that blend a base subscription with usage or outcome-based tiers. This approach provides:

- Predictability for revenue forecasting and customer budgeting.

- Elasticity for expansion as usage scales or AI results improve.

3. Pricing must account for inference costs

- Usage-based monetization that scales naturally with inference costs.

- Bundled or embedded AI features inside seat-based products for predictability.

- Workflow- or outcome-based pricing that charges for completed business processes.

4. AI tools reimagine traditional budgets

5. New success metrics redefine "value"

- % of work completed autonomously

- AI resolution rate or accuracy

- Developer acceptance rate (e.g., % of AI-generated code accepted in Cursor)

- Turnaround time: Faster processing than human-powered services

- Task completion rate: Higher throughput versus standard service providers

- Accuracy of output: Measurable quality improvements

6. Pricing strategy shapes GTM and customer success

7. AI is more akin to adding co-workers, not just tools

The biggest evolution in pricing strategy isn't structural—it's philosophical. AI is no longer just a tool that extends human capacity; it's a productive teammate that completes work autonomously.

When your AI resolves a ticket, drafts a brief, or ships a line of code—it's doing real work. Products should get paid for outcomes, not access.

This shift reframes pricing as a partnership model between human and machine productivity. Founders who internalize that will define how AI monetization—and value—evolves. Common threads among AI pricing leaders show that solutions are priced on delivering measurable work:

| Company | Model type | Pricing mechanism | Value focus |

| DeepL | Hybrid | Per user + per editable file | Accuracy & customization |

| EvenUp | Outcome-based | Per AI-generated demand package | Legal time saved |

| Graph AI | Outcome-based | Per case processed | Regulatory compliance & efficiency |

| Intercom (Fin) | Outcome-based | $0.99 per AI resolution | Support efficiency |

| Leena AI | Outcome-based | Prices using ROI basis number of tickets automatically closed by agents, often offering a minimum threshold of tickets to be closed | Back office automation and outcomes delivered for teams |

| Pepper Content | Outcome-based | Charges per word - graphic - content piece delivered | Assets created |

| Resolve AI | Outcome-based | Pay when AI ensures uptime | Reliability & engineering outcomes |

| Sett.ai | Hybrid | Per generative module, plus share of ad spend on winning campaigns | Assets and campaign created |

| Zenskar | Hybrid | Annual subscription (tiered plans) with flexible fees that scale by usage and complexity | Flexible billing automation and reduced engineering/finance effort |

Five founder best practices to hone the right AI pricing strategy

1. Lead with a value-first pricing test

- $12K annual platform fee covers your infrastructure costs

- Includes 100 ticket resolutions

- Additional resolutions: $5K per 100 tickets

2. Find your sweet spot through friction

- Start with a price (say, $12K/year)

- If customers immediately say "sold," you're probably too cheap

- Raise prices incrementally until you hear "we have to think about that"

- Stop just before pricing becomes a real blocker

3. Map your product to the value framework: Revenue vs. efficiency, hard vs. soft ROI

- Revenue uplift: Are you creating clear new workflows with undeniable revenue impact? Or just helping salespeople perform "a little better next month"?

- Cost savings/efficiency: Including potential headcount reduction

- Hard ROI: Measurable, undeniable, clear metrics

- Soft ROI: Incremental improvements that are harder to quantify

4. Build “unit economics discipline” from day one

It can feel premature to do full product-line profitability studies on day one when everyone's rowing in the same direction. But you should do it anyway. Have brutal self-awareness as early as practical:

- If your CEO spends half their time selling, allocate that to sales & marketing costs

- If your CTO answers support tickets half-time, account for that drag

- Track variable costs to support revenue and investment costs to grow revenue

5. Steer away from the “pricing complexity trap” at scale

Next steps: Setting your pricing exercise up for success

Ten crucial questions to explore during your AI pricing journey

As you convene your cross-functional team, use these questions as a structured framework to pressure-test your assumptions:

| Question | Consideration | |

| 1 | How do AI economics differ from SaaS—and why do margins matter so much more? | Unlike traditional software, where serving one more customer costs virtually nothing, every AI query incurs real compute costs. Understanding this fundamental shift is critical to avoiding the trap of subsidized growth that never reaches profitability. |

| 2 | What are the dominant AI pricing models emerging in 2025—and which one best fits my product? | From consumption-based to outcome-based to hybrid models, each approach carries different trade-offs around predictability, adoption friction, and value alignment. Your choice should reflect both your product category (Copilot, Agent, or AI-enabled Service) and your customers' buying behavior. |

| 3 | How can I tie pricing to customer outcomes without confusing or overwhelming users? | The most powerful pricing models make the value equation instantly clear—but clarity shouldn't come at the cost of complexity. Test whether a first-time buyer can understand what they're paying for and why it's worth it. |

| 4 | How do I manage variable compute costs while maintaining predictable revenue? | This is the central tension in AI pricing. Hybrid models, usage caps, prepaid credits, and tiered subscriptions are all tools to balance this—but the right answer depends on your customer segment and their appetite for variability. |

| 5 | When should I shift from free usage to paid tiers in an AI product? | Consumption-based pricing lowers barriers to adoption, but free pilots can obscure true willingness to pay. The transition from free to paid is a critical inflection point that requires careful timing and clear communication about the value threshold. |

| 6 | How should I measure success—what replaces SaaS metrics like CAC, LTV, and the Rule of 40 in an AI business? | Traditional metrics still matter, but AI introduces new success indicators: AI resolution rate, developer acceptance rate, time from idea to prototype, and percentage of work completed autonomously. These "magical experience" metrics capture what truly differentiates AI products. |

| 7 | What early data do I need to model my AI unit economics accurately? | From day one, track the full cost stack—not just model inference costs, but also the human-in-the-loop expenses, customer success overhead, and sales allocation. Companies that don't build this discipline early scale to negative margins without realizing it. |

| 8 | How can pricing itself become a moat—differentiating my business model from competitors using similar AI models? | When everyone has access to the same foundation models, your pricing strategy can be a source of competitive advantage. Outcome-based pricing that deeply aligns with customer workflows is harder to replicate than feature sets. |

| 9 | What signals show I've found a sustainable, value-based pricing model (versus one propped up by hype and subsidies)? | Look for customers who renew without hesitation, expand usage naturally, and refer others based on clear ROI. Sustainable pricing feels like a no-brainer to customers while maintaining healthy margins for you. |

| 10 | What mistakes are leading AI startups making right now with pricing and monetization—and how can we avoid them? | The most common pitfalls include: pricing complexity that spirals out of control, pure consumption models that commoditize the product, cost-plus pricing that leaves money on the table, and soft ROI positioning that fails to justify premium pricing. |

AI product leaders will monetize outcomes

|

As AI pricing models mature, we’re tracking and researching several open questions:

|