Fiverr

From: Adam Fisher, Jeremy Levine, Ophir Reshef

Date: January 10, 2011

Re: Fiverr Investment Recommendation

Overview

We recommend BVP invest $3.5m in Fiverr, an Israel-based company that has created a new global marketplace for buying and selling five-dollar “micro-services.” BVP will invest $2.9m in a $4m round alongside the existing angel investors at a pre-money valuation of $14m. Additionally, BVP will purchase $600k of shares directly from the two founders (such shares will have the same rights as those acquired in the primary purchase). Following both transactions, the resulting ownership for BVP will be 19.4%. The company does not yet have an ESOP, so we expect to end up at ~17.5% ownership after the creation of a 10 percent option pool. The shares in both transactions are ostensibly “common” shares but bear most of the preferred economic rights we typically seek, including a straight preferred liquidation preference along with first refusal, co-sale and pre-emptive rights.

Last Monday, the CEO and co-founder of Fiverr, Micha Kaufman, presented to the partnership from Herzliya. The group was generally enthusiastic about the potential to build a new marketplace for services and impressed with the traction the business has generated thus far. However, many in the group expressed reservations based on the impracticality and eccentricity of many of the micro-services currently offered in the marketplace. Some also expressed concern about the danger of being consigned to a “micro-revenue” model should the company fail to grow beyond $5 transactions. While we acknowledge and share these concerns, we believe the tremendous upside from circumventing these early stage risks justifies an investment.

In summary, we are recommending an investment because Fiverr exhibits most of the attributes we seek in early stage consumer Internet deals including strong momentum, organic growth, capital efficiency and impressive customer satisfaction. We are also attracted to the low burn rate, which will allow the company to experiment with a lot of new ideas without additional capital from BVP.

The Fiverr Service

Fiverr is a marketplace for a category that the company defines as micro-services. These services (referred to as “gigs”) are smaller than the projects sourced through marketplaces such as eLance and ODesk, but require more skill and creativity than the tasks performed at Mechanical Turk/CrowdFlower. It is also akin to the myriad service offerings found on Craig’s List (note Jeremy’s “picking apart Craig’s List” thesis), but unique in several respects which we will detail below. Since its launch in late February 2010 Fiverr has grown rapidly to 60K transactions / month (all for $5) in December without any marketing spend and an 8-person team. Fiverr appears to be in a unique position to go after a large untapped opportunity and has many of the favorable characteristics that marketplaces exhibit, including quasi recurring revenue, a strong community of users who promote the site, a scalable model and a natural barrier to entry that grows over time.

The idea for Fiverr started when one of the founders tried to set up a customized Wordpress blog, and had some minor technical issues he couldn’t solve. It was obvious that there were many people who knew the solution to his problem, but there was no way he could find them easily and get them to help him for a reasonable fee. The founders realized that there is considerable demand for a wide variety of services, which require some knowledge, experience or skill to provide them, yet which still don’t require a true professional or business engagement. Conversely, with a wide enough definition of “services” they realized that everyone knows something or has the talent to do something that is of benefit to someone else. Hence, the founders decided on the first of two key principles of Fiverr marketplace, namely, that any legitimate service can be offered by anyone regardless of their qualifications or background. The idea was to appeal to the supply side of the market place by asking with the question of “what would you do for $5.” The aim was to populate the site with gigs, but more importantly to allow and encourage each individual to decide for themselves what they are able to offer, regardless of how silly, mundane, creative or esoteric it may initially seem.

The second key principle of the marketplace is that every service is priced at $5. While this decision may seem odd and limiting, it has proven very clever. Removing pricing from the equation forces sellers to differentiate based on the quality of the service they want to provide and not based on price. Such rigidity also forces sellers to be creative and efficient if they are to make any profit at $5. More importantly, the fixed price component has been a major reason that buyers have been quick to purchase gigs and to do so repeatedly (which is essential for a service that should only take minutes to perform). A “one-price” offering eliminates the negotiation and removes any hesitation on the part of the buyer once there is interest in the gig. Furthermore, the low price point is a “no-brainer” for most buyers, which explains the relatively high conversion and satisfaction metrics. Finally, it is worth noting that $5 is not zero. Even a minor payment such as this facilitates a degree of seriousness from both sides to raise the transaction success rate.

The downside, of course, is that the market is limited to services that can be priced at $5, and Fivver’s revenue is always a fraction of that. Surprisingly, this hasn't been as much of a deterrent for quality sellers as one would expect, as many sellers offer services that are clearly worth more than $5 (e.g., produce video or audio), presumably aiming to promote themselves and get fully-priced follow-on jobs outside of the Fiverr marketplace. Interestingly, there are many repeat buyers, including bulk buyers who distribute the same task to multiple sellers to take advantage of the low price. The average buyer made 5 purchases so far, with over 1% of buyers making 50 purchases or more. Also intriguing is the fact that 7% of sellers are also buyers, often using their income from selling to make purchases. From the sellers side, while they don’t make a living off of Fiverr, 40% of those who post gigs to the system are able to sell, with an average of 14 gigs. A few sellers were even able to make thousands of Dollars, and the most successful one sold 3,300 gigs.

The variety of services offered and purchased in the system is impressive, and illustrates the size of the micro-services market potential. The most common popular categories are online marketing, graphics / creative ("I'll produce a logo / product video"), content ("I will write a search engine optimized 500 words assay"), tutoring of various kinds ("I will show you how to put new strings on a guitar"), and fun ("I'll make a funny caricature from your photo"). The company has a small moderation team that approves only the legitimate gigs (about 40% of gigs suggested).

Traction

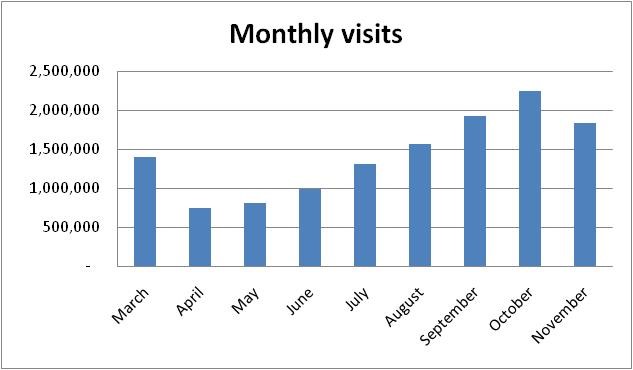

Shortly after launch, the company was featured on the front page of Yahoo, leading to a huge spike in traffic. Since then traffic has stabilized, and has grown consistently as shown in the chart below:

November and December traffic was said to be weaker than October due to seasonality, which seems a reasonable explanation.

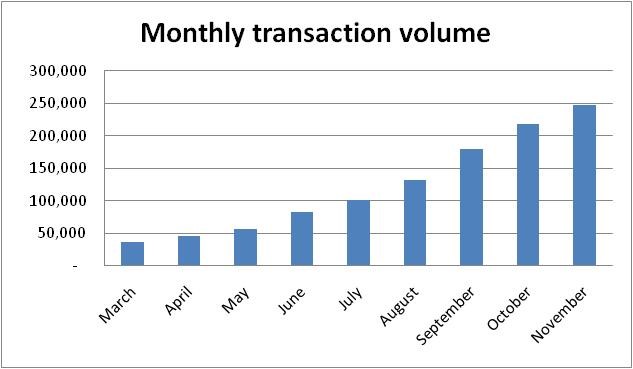

Transaction volume has been growing faster than traffic, mostly due to repeat purchases.

Fiverr charges 20% of the transaction value, so net revenue is directly proportionate to the transactions. At $250K gross revenue / month, Fiverr gets $50K. All payments must be done through PayPal, which costs Fiverr 15% of its net revenue. With only 8 employees, Fiverr is a lean operation and unlikely to burn a lot of cash unless the company discovers a profitable way to acquire traffic.

As typically marketplaces take a long time to build, we think the growth rate is quite exceptional so far, especially since 100% of the traffic is organic. A small part (10-15%) is originated with search engines, but most of the growth is driven by strong word of mouth, social media, media coverage, and an ecosystem that has developed around the service. This eco-system includes how-to-sell-on-fiverr guides and videos, fiverr clones (none of which with real traction so far), and even software platforms to create fiverr clones.

We think that Fiverr’s retention and satisfaction metrics are also encouraging, especially given the challenge of managing a wide variety of gigs with a short period of seller history to rely on. Out of the gigs ordered in November, 82% were successfully completed, 15% were replaced with another (successful) gig, only 2% were abandoned (not fulfilled or rejected by the buyer without replacing it), and 0.16% were refunded. The buyer cohorts are rather consistent, with about 50% repeat purchase on the month following the first month of purchase, 40% on the 3rd month, and 30% on the 5th. Both satisfaction and retention data are improving over time.

Where Do They Go From Here?

A key component in the company's plans going forward is to leverage the reputation and trust created in the system with the $5 gigs to support higher priced gigs within the system. Micha envisions multiple tiers of services, where each seller has to perform enough gigs in the lower priced tiers to earn the right to sell the higher priced gigs, which may be a way to establish seller reputation in the system with less friction than other marketplaces. This vision is not fully baked yet, but seems essential in order to realize the marketplace's potential. Another important dimension for the company is what they call “geo” services. On the one hand, their geo plans include the localization (language and currency) of the site for traffic from countries other than the US. This is meant to capture the universal interest in Fiverr, but also to stem off the Fiverr clones, which are multiplying by the day. They also plan to provide buyers with a local filtering option, which will encourage more off-line service offerings. Lastly, we think it will be very important to improve the buyer experience by improving discovery of relevant gigs and by expanding the buyer initiated section of the website.

Team

Micha Kaufman (co-founder, CEO): Micha is a serial entrepreneur, though none of his previous companies was a breakthrough success. His last venture, Spotback (content recommendation platform for websites), started when Micha was an EIR at Benchmark, but wound down when unable to raise financing. Prior to that Micha founded Keynesis, a security software company for portable storage devices, that became profitable though not at large scale. Micha is a lawyer with LLB from Haifa University.

Shai Wininger (co-founder, CTO): Shai is also a serial entrepreneur, who started off by founding a web development company in the early 90s. Shai founded 3 more companies: a 3D browser, mobile gaming infrastructure that replaces Flash on feature phones, and a workflow software for the aerospace industry. Two of these were VC backed, but none became a big success. Shai is a designer who graduated from the Neri Bloomfield Academy of Design and Education.

The company has currently 8 employees, who are largely junior hires. Micha acknowledges the need to accelerate hiring and build the management team of the company, but has been careful with hiring so far.

Deal

We have been tracking the company closely since we made the first contact in May. The company had raised $1MM from angels in March, and wasn't open to discuss financing (including a rejection of our seed investment top-off offer). We were intending to make a preemptive offer given the company’s continued progress only to find out that the company had received exactly such an offer from another US-based fund at a $14m pre-money valuation. At this point, Micha and his angel group prefer to work with us, but the board has been only marginally flexible on the terms.

We believe we have reached an agreement to lead a $4MM round, with BVP investing $2.9MM and the angels investing the remainder. Additionally, BVP would purchase 4% of the company pre-investment directly from the founders to help BVP reach its target shareholding. Post the transaction, BVP will have invested a total of $3.5M for 19.4% (prior to any ESOP). The shares we would buy are technically "common", but carry most of the typical preferred economic rights, such as liquidation preference (straight preferred), right of first refusal, co-sale and pre-emptive. And though BVP will not have any of the approval rights typically secured in our deals, neither will any single party control the board or the shareholder base. Post investment, Adam will join the board, together with the two founders, an angel representative and a yet-to-be appointed independent, industry expert.

Risks

The site feels gimmicky, and may be just a fad: We characterize this as the biggest risk and acknowledge that a consumer-driven marketplace like Fiverr can devolve to become utterly absurd and inconsequential. This risk stems from a concern that some of the services offered on Fiverr do not provide genuine value to the buyers and are unlikely to be sustainable over the long-term (e.g. some of the social marketing offerings). A related concern is that by fixing the gig price to $5, Fiverr is able to pique buyer and seller curiosity, but that price may be insufficient to allow any seller to build a significant, legitimate business. While these concerns are real (though unsubstantiated), we find comfort in the available data, which suggests that buyers are largely happy with the service so far: completion rates are high, refund rates are very low, and the repeat purchase rate is significant, with the average user buying five times. We believe sellers will use Fiverr to generate supplemental income, to gain exposure and to generate leads, rather than to make a living – at least in the short term.

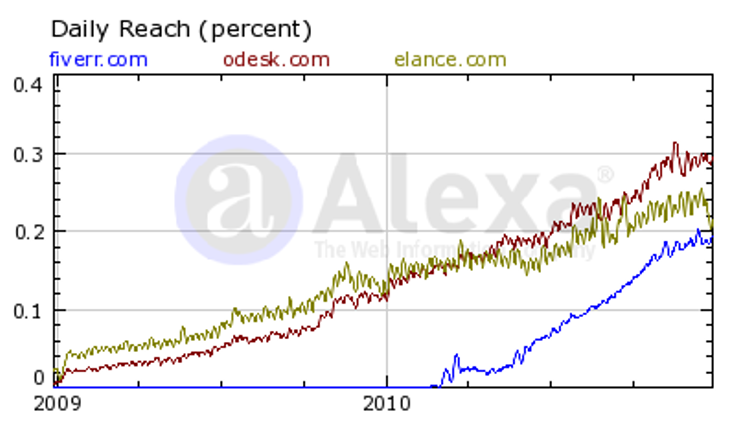

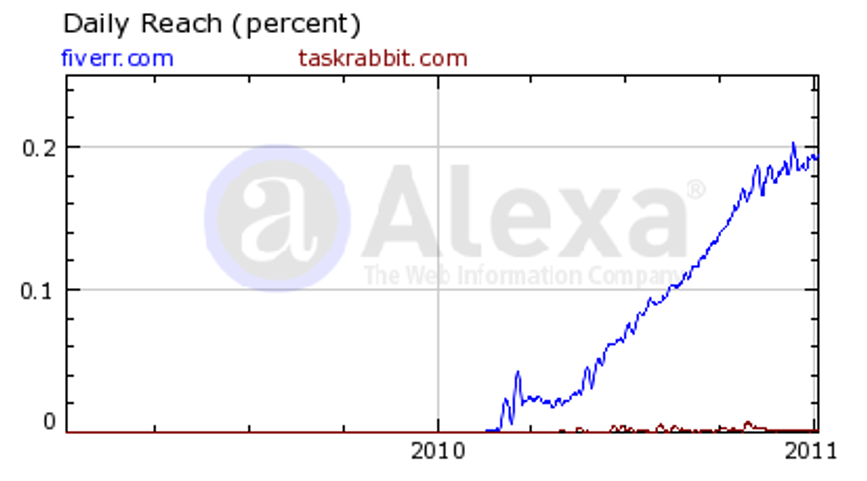

Nonetheless, it is likely that in order to succeed the marketplace will have to evolve from a novelty to a platform for mainstream offerings. The company and its founders are well aware of this challenge and have plans to realize a vision with more gravitas. It also weighs heavily on us that several highly successful Internet platforms such as eBay and YouTube stemmed from primitive beginnings based on pez dispensers and cheesy home videos. In addition, other service companies realized significant success without ever relinquishing their gimmicky nature; notable examples include Zynga and mobile ring-tone companies. With its early traction and buyer/seller community, we believe Fiverr is better positioned to evolve into a more mainstream offering relative to other marketplaces such as TaskRabbit, which have focused service offerings, but minimal traction (see Alexa chart below).

Can the traffic sustainably grow? Growth has been driven by PR and word of mouth, which are hard to control and predict. It is unclear whether the company will find effective traffic acquisition channels, especially due to the company's low revenue per transaction. When Fiverr starts allowing higher-priced services, there is a risk it loses its quirky character, which has driven its word-of-mouth growth. There was also concern that flat November and December traffic may suggest Fiverr has already begun to stagnate. While we can't credibly project the growth rate, there are several reasons why we believe traffic and order volume won’t suddenly stagnate or fall. Almost 60 percent of traffic is direct, and it is rather consistent on a daily basis, which suggests it does not rely on any particular mention in the media, but rather mostly on word of mouth. Additionally, as in any marketplace, sellers have an incentive to promote their own profile and services, which, combined with strong recurring visits and high buyer-seller overlap, creates a virtuous growth cycle. Etsy, for example, relies primarily on such organic growth and has been showing strong growth for 5 years. Finally, we are encouraged by the growth of an ecosystem forming around the service (1,480,000 results for "fiverr" in Google, out of which 1,270,000 are *not* on fiverr.com). The plethora of guides on how to make money on Fiverr, the host of Fiverr clones, and the broad range of related user-generated content, will likely sustain interest around the marketplace for a while.

Team building: Micha and Shai have yet to demonstrate an ability to recruit strong people around them at Fiverr, and may not have what it takes to bring in relevant experience. At this stage we feel comfortable with the team’s execution capabilities, its scrappiness and its vision. Micha and Shai are both experienced entrepreneurs, and our impression from several meetings with them is that they have a good feel for product and community, and that they are consistently and thoughtfully taking steps to improve the service.

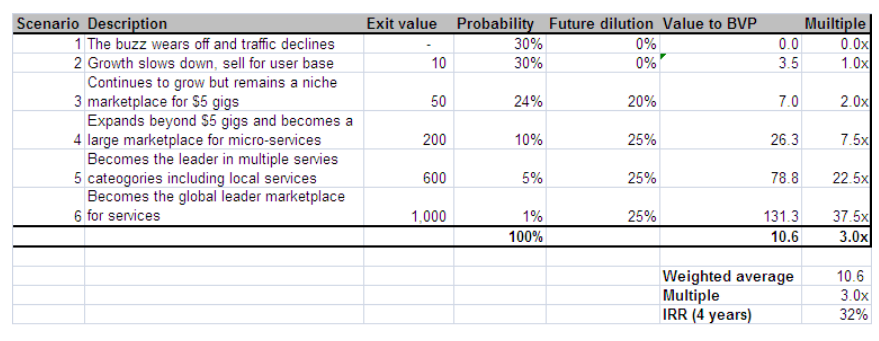

Outcomes Table

Conclusion

Fiverr is peculiar, but fascinating. This is a high-risk, early stage investment, but we believe that the opportunity to build a global marketplace for services is compelling and that the company is in a uniquely strong position to succeed given its rapid organic growth with meaningful transaction volume. We think this deal offers a compelling risk-reward ratio driven by the small check size and the opportunity to invest more in the future should the company continue to perform well. We are excited to recommend this investment.