From: Jeremy Levine

Date: December 11, 2006

Re: Investment Recommendation: LinkedIn

Summary

LinkedIn’s business networking Internet site is a frequent pit stop for many of us at BVP, and we have been tracking the company’s progress for many months now. More than 8 million white collar professionals have registered on the site since its launch in 2003, and the pace of growth has increased substantially driven by the network effects inherent in the model. On just over $10 million of invested capital, the company has reached breakeven on about $1.5 million of monthly revenues. We have an opportunity to lead a Series C round in which BVP would invest $12.5 million to purchase 5% of the fully diluted equity ($237.5 million pre-money valuation) inclusive of a new 10% unallocated option pool. While this is a fully-priced deal, I believe its risk/reward attributes are quite attractive. The potential upside associated with becoming the global namespace for business people coupled with limited downside given the nearly profitable existing business model and minimal invested capital make this a compelling opportunity.

Core Product

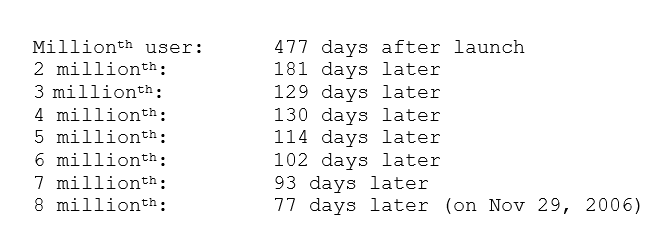

LinkedIn’s core product offering is free. Anyone can sign up online and enter his business profile, which is effectively one’s resume. Users are then encouraged to invite their business contacts to the network. Much like most social networking sites, LinkedIn derives all of its new user sign ups through referrals from its members. As a result, growth of the user base increases with its size:

LinkedIn is far and away the most popular business networking site on the Internet and could be described as Facebook or MySpace for business users. The primary difference between LinkedIn and other social networks is its focus on business people, and so the site is currently devoid of photos and other personalization elements that typically blanket social networks. A second important difference is that few users truly “live on the site” the way college students live on Facebook or teenagers live on MySpace.

For many users, LinkedIn is primarily an online resume. There are a few segments of users, however, which are, in fact, starting to “live” on the site. The primary group is executive recruiters. Because of the breadth and quality of LinkedIn’s member base, recruiters are using it to identify, contact and check references on passive job seekers – i.e., individuals who are happily employed but potentially willing to entertain a new career opportunity. Secondary groups of heavy users include sales people (who use LinkedIn to find contacts at companies they are targeting for a sale) and those in networking-oriented professions like business development or venture capital.

As of last week, 58% of LinkedIn’s 8.15M users had been on the site within the last 6 months. When excluding users who signed up within the last 6 months, 42% of LinkedIn’s 6M users who are at least 6 months old have been on the site within the last 6 months. Clearly, there is room for improvement with regard to site usage. Most of the repeat visitors fall into the categories described above.

Although the mainstream business professional does not yet have a compelling reason to spend time on LinkedIn daily, a big focus of the company is to add features to motivate broader regular usage. Recent new feature examples include finding and endorsing service providers such as lawyers and accountants, re-connecting with former colleagues and classmates, and searching among available job postings. While none of these features has driven a step-function increase in usage, each has contributed to improvements. The fundamental idea underlying LinkedIn’s strategy is to continue adding more functionality until there are several useful features for virtually every white collar professional.

Market and Paying Customers

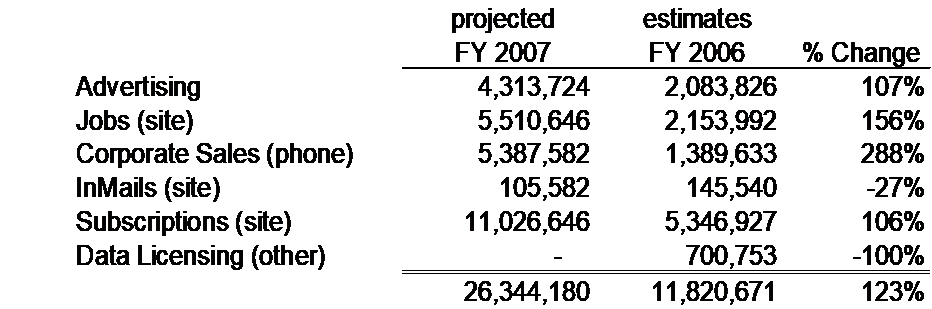

LinkedIn generates revenues in a few large existing markets. The following is an overview of LinkedIn’s 2006 (almost actual) and projected 2007 revenue breakdown, and below is a brief description of each product and market.

Advertising ($2.1M, 18% 0f 06 revenues) – According to Alexa, LinkedIn is the ~150th most popular site on the Internet. More important to advertisers, the site skews toward affluent professionals, which comprise an attractive demographic. Through a traditional ad sales force, the company has signed deals with about 25 advertisers including the likes of E*Trade, Microsoft, Vonage, Jeep, and VmWare. The ad deals tend to last 2 to 4 months and cover about $20,000 of inventory. The most notable deal is an $800,000 deal with Google to place a video ad on all user profile pages. In addition to the ads it sells directly, LinkedIn also monetizes pages with third party, self-service ad networks like Google AdSense and AdBrite.

Jobs on the site ($2.1M, 18% of 06 revenues) – Any LinkedIn member can post a job listing on the site for promotion to the user base at a cost of $100 to $150 per job (depending on posting volume). This revenue stream is particularly attractive because it’s entirely a self-serve process, and therefore the associated gross profit falls straight to the bottom line.

Corporate sales ($1.4M, 12% of 06 revenues) – The internal telesales team sells packages of job listings and subscription accounts (see below) to companies such as Expedia, Google, Dell and Lockheed Martin. These are annual deals ranging from $10,000 to $150,000 each. The telesales effort is brand new but growing quite quickly, and the sales reps I spoke with were ecstatic with the ease of the sale driven by the strength of LinkedIn’s brand, particularly in the technology industry, where recruiters are clamoring for better ways to recruit engineers.

With regard to market size, the jobs and corporate sales products fit into the $2 billion annual online jobs market currently led by Monster (50% share) with Yahoo Hotjobs and Career Builder filling in the top three. There are dozens of smaller private companies experimenting with the online jobs model, so this is a dynamic market. The market is also influenced heavily by macro economic conditions, though given LinkedIn’s tiny current share, it will likely grow through any near-term recession.

InMails ($0.1M, 1% of 06 revenues) – Any member can buy an a la carte package of InMails which enable a user to send an email to another LinkedIn member with whom he is not connected. InMails cost $10 each. This product makes economic sense to only a few users because most prefer the subscription packages described below.

Subscriptions ($5.4M, 45.8% of revenues) – Members can buy monthly subscription packages to access three premium features on the site:

- Intros – these let you find a network path of more than one step to someone you want to contact and then let you pass a message through the path to request an introduction.

- InMails – described above

- Search results – at no charge, you can search your ‘extended network’ which is defined as everyone within 3 degrees. At no charge, you can also see 20 search results from outside your extended network. With paid searching capabilities, you can increase the number of results you see from outside your 3-degree network. To put these numbers in context, on LinkedIn I have 165 direct connections, 34,600 second degree connections and 1,126,000 third degree connections. To access more than 20 of the remaining 7 million LinkedIn members, I would need to pay for additional search results.

The subscriptions come in three flavors:

- Business level = $19.95/month for 15 Intros, 3 InMails, and 100 search results

- Business + level = $50/month for 25 Intros, 10 InMails, and 150 search results

- Pro level = $200/month for 40 Intros, 50 InMails, and 200 search results

Subscriptions can be purchased monthly or annually. The company was selling about $50k of subscriptions per week in January and sales grew steadily to about $200k during the last week of November. As with jobs sold on the site, there are no incremental costs associated with each dollar of subscription revenues, which makes for a very attractive business model.

Though there is no well defined existing market relevant to subscriptions, there are a few large target customer segments: headhunters are the most important and faithful customers, job seekers tend to subscribe for a period of time (until they find a job), and business development professionals often represent low-end, but steady customers.

Data licensing ($0.7M, 6% of revenues) – This year, LinkedIn sold aggregate data to a hedge fund attempting to identify attractive short opportunities. The idea was to monitor when a sudden influx of employees from a public company signed up at LinkedIn or updated profiles. This influx was thought to represent brewing fear about layoffs or negative events at a company. The initial mock trading results looked quite promising, but after three quarters of less favorable results, the company no longer believes this is likely to be a viable offering. Nonetheless, it is a useful demonstration of the team’s creativity and of the potential option value in the business.

Future products

In addition to the existing revenue sources, the company has a broad range of future opportunities to tap. The following are examples:

- A tailored InMail or Intro product for sales people to generate warm leads (i.e., compete with D&B or Hoovers)

- The ability to promote one’s services or capabilities within the LinkedIn network for professional service providers like lawyers, accountants, web designers, etc.

- Functionality similar to Yahoo Answers to help professionals ask questions of people within or beyond their extended network

Intellectual Property

There are dozens of social networks on the internet, and they may all be infringing on a 1996 “six degrees” patent. When Reid Hoffman started thinking about launching LinkedIn, he and Mark Pincus did enough IP research to uncover this broad social networking patent and purchased it for about $500,000. Today, Reid personally owns half the company that holds the patent, and Tribe, Mark Pincus’ startup, owns the other half. LinkedIn has a perpetual royalty-free license to the patent and an option to buy Reid’s interest in the holding company at cost.

With LinkedIn (or, more likely, an affiliated holding company) owning the patent, there may be some offensive upside given the popularity and profitability of potential infringers like MySpace and Facebook, but I do not consider this a core element to our investment rationale.

Competition

The only true competitor is Xing (formerly known as Open Business Club). Xing dominates the German and Austrian markets but has little traction elsewhere despite joint ventures in China and India. Xing announced 1.5 million members at the end of September, which means LinkedIn has more members in Europe than Xing has globally despite the fact that LinkedIn is available only in English while Xing operates in 16 languages. In fact, only half of LinkedIn’s eight million members are based in the US.

Nonetheless, Xing is a serious competitor and recently raised 35 million euros through an IPO in Germany. Existing shareholders and management also sold just under 30 million euros of stock in the offering. Xing’s market cap is now 167 million euros ($225 million), and the stock has traded up about 8% since the IPO 10 days ago.

It’s also important to note that Xing offers a slightly different business model from LinkedIn. On Xing, free functionality is extremely limited, and the site is geared to compel users to sign up for the 6 euros per month premium access to get any real benefits. About 13% of its members are paying, and so its monthly revenue run-rate is about equal to LinkedIn’s at just under $1.5M. Xing posted 2.8 million euros of revenues for the quarter ended September.

Beyond Xing, the only other comparable business of note is Viaduc, which is a French language copycat. The company has 650,000 members in France and operates at breakeven with 40 employees. It raised 5 million euros in June from two French VC investors. By comparison, LinkedIn’s member base includes 287,000 users in France.

In the recruiting / job posting segment, competitors include Zoominfo (Venrock-backed), Jobster (Ignition-backed) and Doostang (not yet backed)

In the sales lead segment, the leading competitor is Hoovers. Hoovers announced a joint venture with Visible Path to create a LinkedIn copycat called Hoovers Connect, but it has not yet launched.

Management

Reid Hoffman – Founder/CEO

Reid is a brilliant strategist and product visionary. He’s not a strong, detail-oriented manager. He is self-aware and amenable to bringing on a CEO, and a search process is currently underway. The initial set of candidates is quite attractive, though of course this type of change poses risk for the business. Before LinkedIn, Reid was a senior executive at Paypal. He spent his early career in product roles at Apple and Fujitsu. He is currently involved with about half a dozen startups as an active angel investor including our portfolio company Wikia. He is a Stanford grad with a masters from Oxford.

Sarah Imbach – Chief of Staff

Sarah is a talented nuts and bolts general manager. At Paypal, she ran Customer Service and Fraud, by far its largest division as measured by headcount. She seems like a strong general manager and everyone effectively reports to her at LinkedIn. She spent her early career in project management roles for large non-profit healthcare companies. She is a Penn/Wharton grad.

Keith Rabois – VP Business Development

Keith is a strong business development executive and spends a lot of time on product as well. He played a similar role at Paypal. He is a Harvard Law graduate and has a B.S. from Stanford.

Jean-Luc Vailant – VP Engineering, co-founder

On the management team, Jean-Luc is thought of as a perfectionist, which means the product back end is solid, but feature development and the pace of hiring are not as rapid as they could be. He has done an adequate job by all measures, and given that he has been in the role since day one of the company, there is a lot of important technical information about the service in his head.

There are capable director-level employees running sales and product (both reporting to Sarah) who are also talented but relatively inexperienced. One of the most important challenges in 2007 will be filling out the team.

Board

The current board consists of Mark Kvamme (Sequoia), David Sze (Greylock) and Reid. Bessemer will have typical observation rights, and the company will add one or two independent outside directors as interesting candidates emerge.

Financials

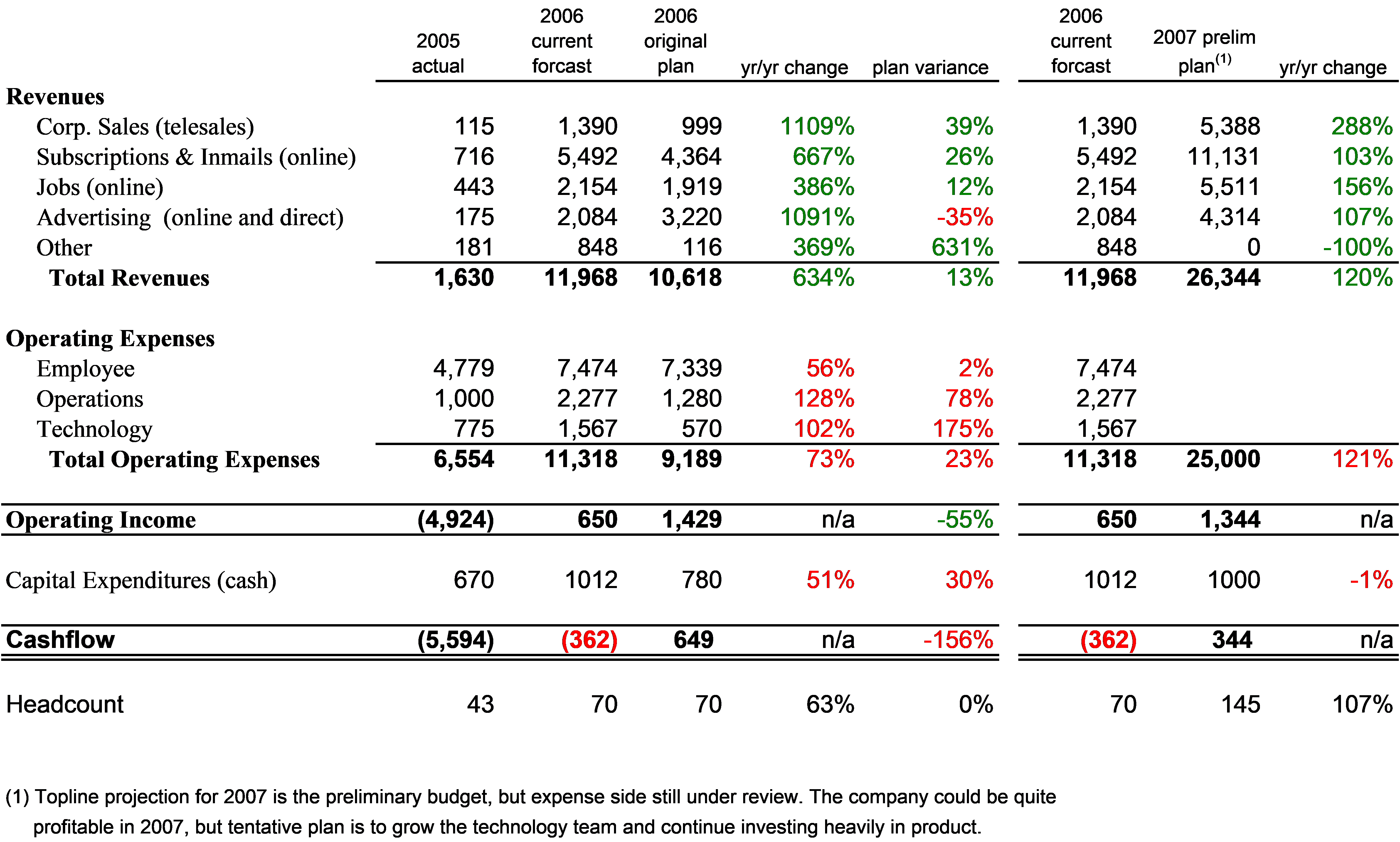

Below are the complete 2006 financials based on estimates from late November. The company is on a $17M run-rate ($1.4M per month) and operates at about breakeven. The 2007 projection is very preliminary, and there is some current debate about how aggressively to add staff next year. Reid’s initial proposal is to be very aggressive and focus a lot of resources on product improvement by operating at break-even on $26M of revenues.

Deal

At $237.5M pre, it feels fully-priced. We will be the only Series C investor as the existing investors are refusing to participate, so for $12.5 million we will own 5% of the fully diluted equity including a new 10% unallocated option pool. I expect the entire pool will get issued over the next couple of years to recruit a CEO a few new VPs.

Although other investors also own a healthy chunk of the company, we have sufficient voting provisions and downside protections to be confident in at least getting our capital back in all but the rarest of disaster scenarios given that the company is already breakeven and there will be less than $30 million of preferences on the balance sheet. For example, in any IPO, we have the right to sell enough shares to get all of our capital back at the greater of cost or the IPO price. The upside-related provisions are clean and simple (i.e., no participation).

Risks

Most of the typical early stage risks have been mitigated as the company is already nearing cash flow profitability, but here are the important things to worry about:

- Team – the team is full of very talented Silicon Valley entrepreneurs, but the senior management team is still thin. As we recruit a CEO and a couple of new VPs, the goal would be to have a positive influence on the culture and dynamics of the company, but these transitions go poorly almost as often as they go well.

- Usage – for LinkedIn to become a very large business, repeat usage by the average white collar professional must increase substantially. Though the company has an enviably long list of features in queue, if most fall flat and fail to motivate more usage, LinkedIn may get trapped in the jobs and executive search categories, which would limit the upside of our investment to very moderate returns.

- Industry expansion – though there are VPs from all but one Fortune 500 company on LinkedIn, there is a heavy concentration of technology professionals on the site. (In excess of 80% of Google’s entire workforce, for example, has a LinkedIn account!) To become the truly dominant business network, LinkedIn has to achieve much more significant penetration outside the technology industry especially in areas where it is presently weak such as healthcare.

Though some of the key risks could lead to potential disaster scenarios, most relate to tapping upside potential, which drives my thinking in the scenario analysis in the next section.

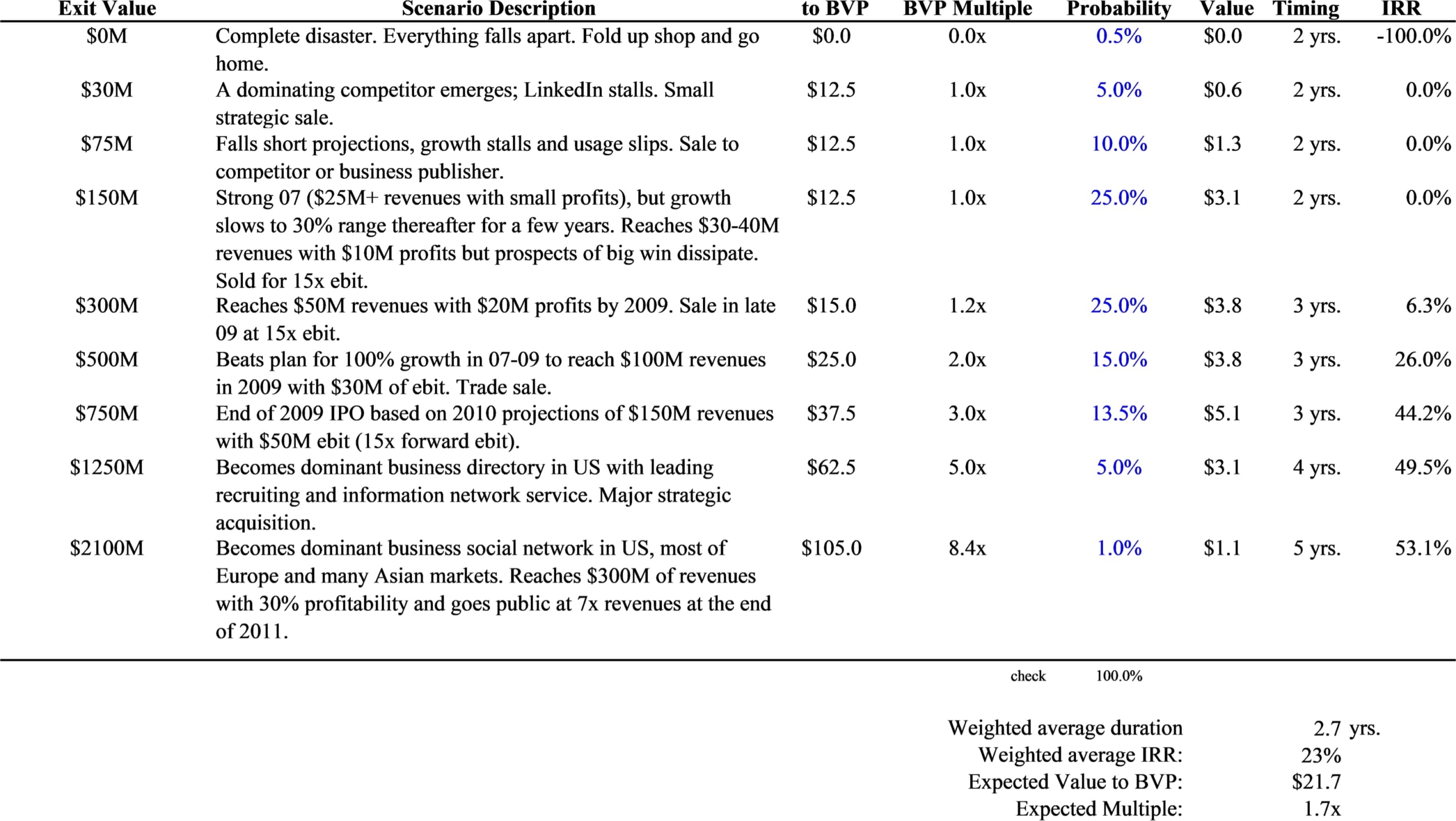

Scenario Analysis

Given the deal pricing, the expected multiple is lower than what we see in many of the investments we evaluate. The limited downside risk helps to compensate by constraining the volatility. Therefore, on a risk adjusted basis it feels compelling. Put another way, I estimate the chance of capital loss is less than 1%, but the chance of at least a 2x gain is 35%. Here’s the full outcomes table:

Conclusion

LinkedIn is one of few consumer internet companies with the momentum and market potential to be a billion-dollar business. Though I’d certainly prefer to recommend this deal at a lower price, given the relatively attractive risk/reward profile of the opportunity available to BVP, I strongly support the investment.