Shopify

From: Alex Ferrara, Trevor Oelschig

Date: October 12, 2010

Re: Shopify

We seek approval for BVP to invest up to $7mm in the Series A financing of Shopify, a provider of e-commerce software to SMBs. Shopify sells a simple SaaS solution that enables a business to quickly setup and run an online retail store. A typical customer signs up using their credit card and is up and running in a few hours with no long-term contract. Shopify targets SMBs and at-home capitalists (e.g., eBay and Etsy sellers) who pay an average of $45 per month, with the goal of servicing these customers as they scale to become larger customers with more sophisticated needs. Shopify has also managed to sign-up a number of large businesses like Pixar, Amnesty International and Tesla Motors (selling Tesla accessories, not the cars) at higher price points.

Shopify was my first lead investment as a partner, so I was incredibly nervous. It took me three roundtrip flights to Ottawa before I finally decided to present Tobi a term sheet. Why? Very few VCs believed that software businesses targeting SMBs were good investments, let alone ones that could deliver venture returns.

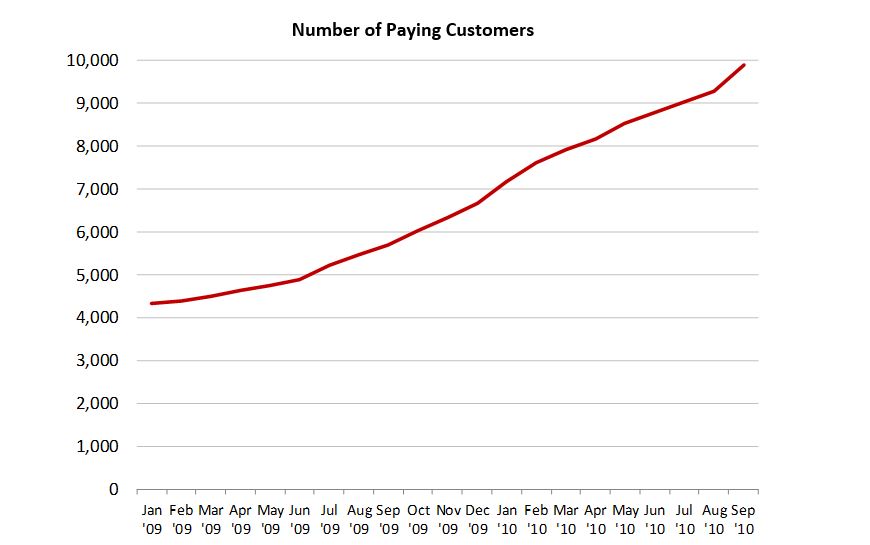

Shopify has grown at an impressive rate. With limited marketing, customers have increased from 5,500 a year ago to nearly 10,000 today (+81% Y/Y). Over the same period, monthly recurring revenue has grown from $164K to $438K (+151% Y/Y). Across all Shopify-powered stores, the annualized gross merchandise value transacted is roughly $132mm. The business is profitable and largely bootstrapped, having raised just $1mm to date and having $1.3m of cash on its balance sheet with no debt.

Shopify’s target focus on SMBs and the potential market size of online retail were seen as key risks, but their organic growth and profitable business was hard to ignore. In 2010, $132mm in GMV would have put Shopify in the top 50 online retailers. That’s how small the online retail market was at that time!

Shopify was founded in 2007 by two Ruby on Rails core developers. One of the co-founders left soon after starting the business. The other, Tobi Lütke, stayed on and is serving as CEO. We have been impressed by Tobi. He is a young, first-time CEO who is thoughtful, has good product and management instincts. Shopify’s 24 employees are located in Ottawa, Canada. Based on Shopify’s reputation in Ottawa as a local internet startup success story, and based upon Tobi’s reputation among the developer community, the company has been able to recruit some of the best development and design talent in Ottawa at 60%-70% of the cost of similar talent in Silicon Valley or New York.

When Tobi came out to Silicon Valley, many VCs told him they’d invest only if he moved to the Bay Area or merged his startup with one of their Bay Area investments. While I admittedly was not a big fan of Ottawa’s bone-chilling winters, Shopify’s office was located in an energetic area downtown and they didn’t seem to have any issues recruiting great talent in the region or from the nearby schools. I was excited to back what was clearly the best cloud startup in Canada’s capital.

We are excited by what we see as a great product that has struck a chord with customers. The product is simple enough so that anyone can set up a fully functioning online store in a matter of hours.

There’s so much to love about the simplicity of the Shopify and the way it enabled small merchants to easily sell online. One of our colleagues described it as “minutes to learn, a lifetime to master” because it was both so simple to set up but the app store made ecommerce powerful and robust.

Yet sophisticated features are also available without complicating the overall user experience. Shopify accomplishes this by making available an “App Store”. A customer can click and install an “App” that extends the functionality of their online store beyond what Shopify provides. To make the “App Store” possible, Shopify exposes an open API that allows third party software developers to integrate into its platform. This approach is a big competitive differentiator for Shopify. The API’s breadth and ease of use has resonated with the development community. For Shopify this is great—it can offer capabilities necessary to support larger customers without having to invest in building out these features itself. Roughly two-thirds of Shopify’s customers utilize at least one app from their “App Store”.

The round is priced at a $20mm pre-money valuation ($18.7mm EV). We plan to invest $5mm and thereby own 20% on a fully-diluted basis. Shopify is on a ~$5.5mm annualized run rate and has demonstrated strong organic growth. Further, we think that there is an enormous opportunity to accelerate growth by investing in: i) marketing, ii) international expansion and product localization and iii) business development to expand the applications available in the Shopify App Store. In particular, we see marketing as a huge opportunity as the company’s growth to date has been largely organic and marketing thus far has been rudimentary. In fact, Shopify employs one paid search marketer and has no VP of Marketing.

Market Opportunity

Shopify plays into two themes:

The consumerization of enterprise software. The ability to offer cheap, consumer-like software opens a whole new market of customers (SMBs), who otherwise would find traditional enterprise software too complex and certainly too expensive. This is a roadmap in which we have been actively pursuing for 18 months across a number of categories of enterprise software—from invoicing (Freshbooks) to remote support (TeamViewer) to help desk (Zendesk) to website creation (Wix).

At Bessemer, Adam Fisher invested in Tel Aviv-based Wix in 2007 based on the platform and community they provided for creative self-expression, a novel idea during the Web 2.0 era. Bob Goodman and I invested in TeamViewer in 2009, a German provider of remote access software and desktop support software.

The continued growth of e-commerce and its reach into SMBs. Just as those smaller businesses have realized the power of the Internet as a channel for marketing (ala Yelp and Yodle), so too are they seeing it as a channel for selling their product. The widespread availability of product that can be drop shipped directly from manufacturers or via wholesale suppliers makes it even easier for the small guy to sell online.

Customers & Pricing

Shopify has grown its customers at an impressive clip.

Typical customers are small online-only or brick-and-mortar retail businesses as well as “stay-at-home capitalists” who are looking to supplement the family income with a side business. On average, a Shopify customer is selling $13K of online merchandise a year. This average is very much skewed by customers who are selling just a handful of items a day. Shopify’s largest customer is selling $10mm of merchandise annually.

In 2019, the number of merchants on the Shopify platform achieving over $1 million in GMV grew by 44%. Shopify continues to add 10,000 paying customers a week, with over 1,000,000 total customers and growing.

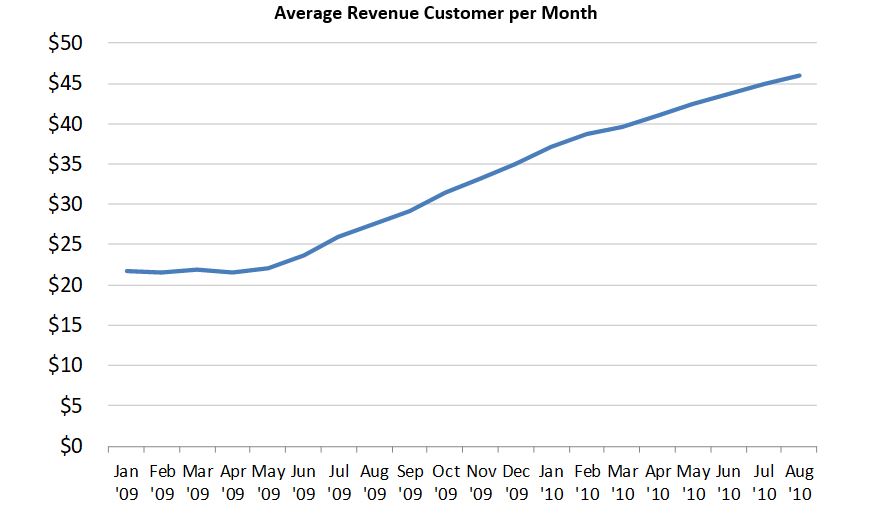

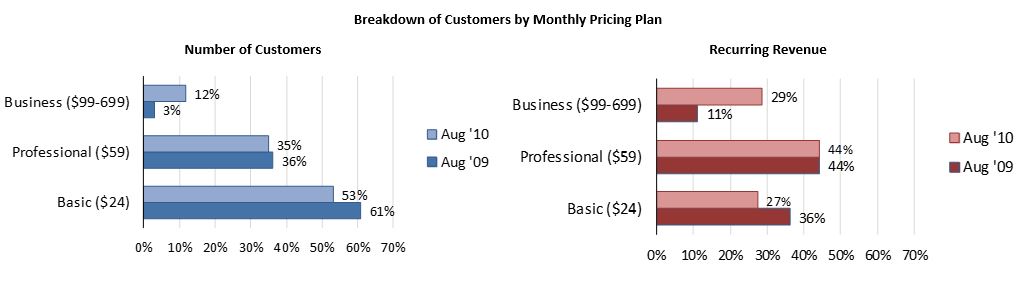

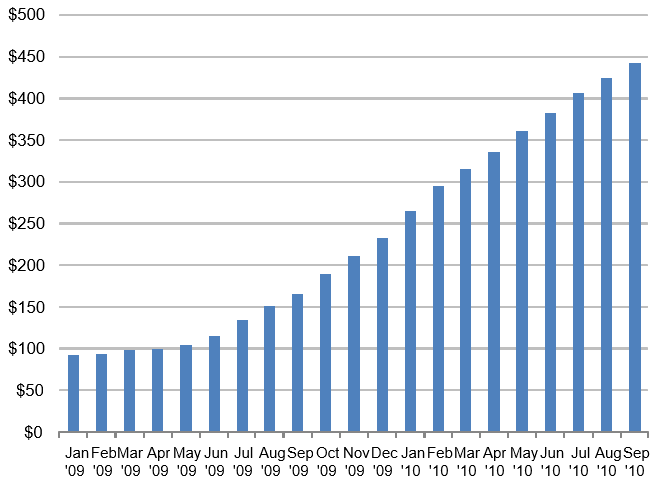

Pricing plans are tiered, starting at $24 per month and goes as high as $700 per month with a transaction fee of 0.5–2% of sales. The distribution of customers is skewed towards to low-end. On average, customers are paying $45 per month. Over time, the average revenue per customer has increased.

The increase in ARPU has been driven by increasing transaction fee revenue as Shopify’s customers grow their own businesses and the related increase in number of customers opting for higher-priced plans.

Product

Shopify is a SaaS application for setting up and running an online store. In many ways, its strength lies in its simplicity, which is ideally suited to small businesses. A non-techie can start taking orders from a professional-looking online store in a few hours after sign-up.

- Customize storefront’s look & feel. Select a design template from their “Theme Store”, which includes templates created by their community of 500 web designers. Those who want more flexibility can edit make direct edits to HTML or CSS. A customer can switch out a template and have their site dynamically updated.

- Organize and manage products. Add, list, edit and organize products using a streamlined interface. Drag-and-drop to order product images and descriptions.

- Perform basic inventory management.

- Accept credit card payments through payment gateways.

- Track and respond to orders. Track payment and shipping status on orders with detailed reports. Email customers from within Shopify.

The Shopify philosophy is to build only those features into that most customers need most of the time.

They were one of the first cloud companies to successfully create a third party app ecosystem that enabled customers to get access to functionality without having to rely on Shopify to develop it. However in the early days they didn't have many customers so it was difficult to attract third party developers. They resorted to running contests for the best third party app, taking a page from our portfolio company Twilio which has also had success building an ecosystem of third party apps.

For capabilities that a high-volume retailer might need, Shopify has made available an open API that enables third party software to integrate into its platform. This means that Shopify can keep its product simple, while adding niche or sophisticated features to its platform without needing to build it themselves. From a customer’s perspective, they can add a feature by accessing Shopify’s “App Store”. Customer take-up has been impressive, with roughly two-thirds (66%) of customers using at least one third-party app.

The App Store was launched a year ago and now has over 54 applications.

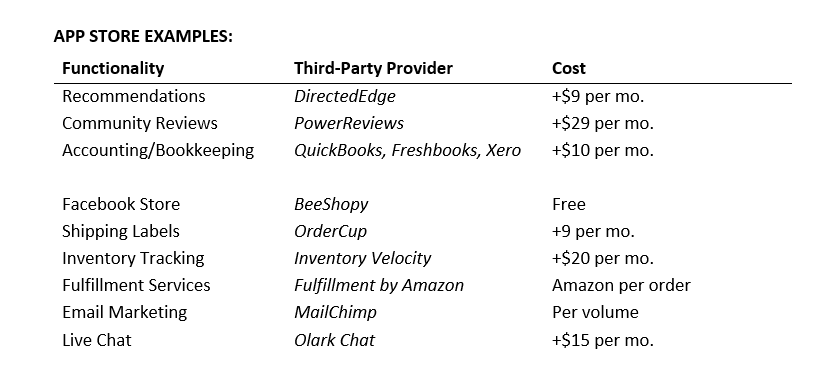

Apps range from those developed specifically for Shopify and those of vendors like PowerReviews that are integrated into a number of different platforms. Growth has been almost entirely organic. Until just two months ago Shopify had not talked to a single company in the app ecosystem. Some examples:

Competing vendors like Volusion, BigCommerce and Magento have also made available an API that enables third party software to integrate into its platform. These have seen limited uptake. Our diligence of customers has validated that the APIs made available by these vendors are extremely difficult to develop against.

Customer Acquisition & Retention

Roughly 65–70% of customers sign-up via word-of-mouth. Roughly 20% of customers sign-up via referrals from web design firms. Until Shopify had setup a data warehouse, they didn’t know how crucial their web design firm channel could be for growth (as it has been for Wix and HubSpot). And just recently, the company hired a full-time person to cultivate this channel. Finally, roughly 10–15% of customers sign-up via paid channels, which is largely keyword marketing and the occasional contest program. It is spending $25–70K per month and, as they would admit, the team’s marketing sophistication is rudimentary, at best. Despite this, they are able to acquire a customer for between $175–225 and can pay back that spend in 7–9 months on a churn-adjusted basis. We believe that Shopify has under-invested in marketing in a big way and that with a VP of Marketing and a few experienced people in place, the company can accelerate growth.

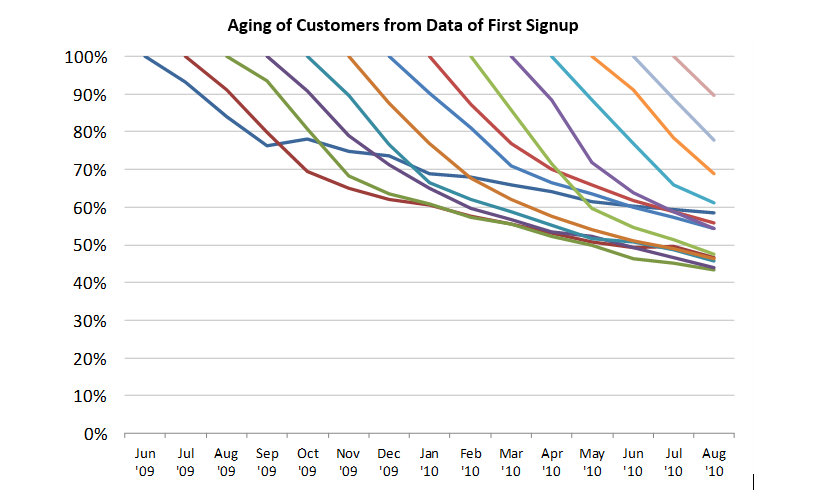

Like most businesses selling to SMBs, there is a sharp drop-off in the first few months following sign-up. For Shopify, this is no different. By month 3, Shopify retains roughly 75% of its customers. By month 12, 50–60% of customers remain. Once stabilized, monthly churn ranges from 3–5%. Overall, Shopify’s retention curve looks quite similar to that of Wix.

A 5% monthly logo churn likely scared off other investors. We got comfortable investing in SMB companies that have high logo churn so long as 1) the company doesn’t have to pay a lot to acquire those customers, and 2) the customers that do stick around end up making up for the ones that churn. We look at cohort retention to figure out the latter. Shopify was strong in both cases.

Market Opportunity

Shopify targets small and mid-sized brick & mortar retailers as well as people looking to start an online-only store to sell physical goods. Estimating the size of this market is difficult. However, the size of similar, but much more legacy and US/Canada-only businesses provide a proxy: Homestead (~85K customers), Yahoo Stores (~55K) and eBay ProStores (~30K). At the lowest end, Shopify targets at-home capitalists—the same audience as Etsy, which has roughly 80,000 active sellers generating $300mm in annualized gross merchandise value.

We are also excited by the potential to expand more aggressively beyond online retail and into brick & mortar businesses which desire an integrated online presence. It is in this area that Shopify is dedicating a large portion of its resources. Based on a flood of requests from existing customers, Shopify is developing a simple retail point-of-sale and inventory management system for use with an iPad/iPhone/smartphone that ties into Shopify’s online storefront platform. Shopify will enable its merchants to offer their brick and mortar customers a point-of-sale experience similar to that found in physical Apple Stores at a fraction of the cost of more traditional point-of-sale offerings.

Another capability on the company’s product roadmap is support for recurring billing. Shopify is currently designed to meet the needs of customers seeking to sell physical goods online. However there is growing marketplace demand for shopping carts that enable the sale of digital goods and software on a recurring basis. Shopify plans to offer recurring billing capabilities at some point in the next year and the compounding nature of those customer accounts provides the potential for substantial economic upside to this investment.

Competition

The market for traditional ecommerce software is crowded, but the needs of SMBs are growing rapidly to include mobile commerce, web-based inventory management, and innovations around point of sale systems. We believe that Shopify’s technology solution is better positioned than competitors to provide these solutions to the growing number of “Main Street” retailers who are coming online.

- SMB Ecommerce Platforms & Shopping Cart Software (eBay ProStores, WebStore by Amazon, BigCommerce & Volusion)—Volusion is perhaps the most formidable competitor. In 2009, it generated $23mm in revenue. It is priced in the same range as Shopify and has a similar feature set, but is less drag-and-drop than Shopify (customization requires some programming).

- Domain Name Registrars (GoDaddy, Yahoo)—The large registrars are marketing machines which have millions of customers that they can up-sell at the time of registration or at a later period. Most offer only basic shopping cart capabilities. However, it is certainly conceivable that they can expand with a more full-featured offering.

- Mid-Tier Ecommerce Products (Magento Commerce)—Magento is the leading open source ecommerce product and is sold on a perpetual licenses basis. The product has a reputation for being powerful but complicated to implement and scale, typically requiring an engineering team for implementation, operation and performance optimization. Magento is growing nicely and plans to compete with Shopify by offering a SaaS version of its product.

While the large, full-feature e-commerce packages (Escalate, IBM, ATG, Demandware), offer a superset of Shopify’s features, we do not see them as competition. As with players in other categories of enterprise software, we think it will be hard for these companies to compete on the low-end.

A few months after we invested, Oracle acquired ATG for $500m. I remember emailing with Tobi about how great it would be to someday top that outcome because it seemed aspirational and far-reaching to say the least. At that time, none of the large acquirors and very few public market investors cared much about SMB-focused businesses. Few could have imagined an SMB-focused like Shopify ever going public. But the long-term trend of ecommerce growth ultimately dominated any concerns around selling to SMBs.

Team

Shopify was founded in 2007 by two young Ruby on Rails core developers. One co-founder is no-longer active. The other, Tobi Lütke, is their CEO. Tobi is a relatively young programmer who was part of the Ruby on Rails core development team. Tobi has largely bootstrapped the business and has done a good job at that. He has a clear vision for building the business and recognizes his own shortcomings. We don’t feel like there is any immediate need to replace him as CEO, but will need to ensure that he has more senior talent around him. The business desperately needs a VP of Marketing and to more generally hire marketing talent. We will likely look beyond Ottawa to find marketing talent. Having met other members of the senior team in Ottawa, it is clear that their strength lies in product design and user experience.

Is this first-time founder capable of recruiting top talent and growing a team that scales with the company? Carrying out their vision while running a business? Tobi has not only done a fantastic job as CEO, but he recruited and built an outstanding team who are still there today. Throughout our due diligence process, Harley Finklestein did all the heavy lifting to our requests and was incredibly responsive. He’s still the Chief Operating Officer. And shortly after we invested, Tobi hired Craig Miller, who is now Chief Product Officer at Shopify but played the VPM role for many years.

Summary Financials

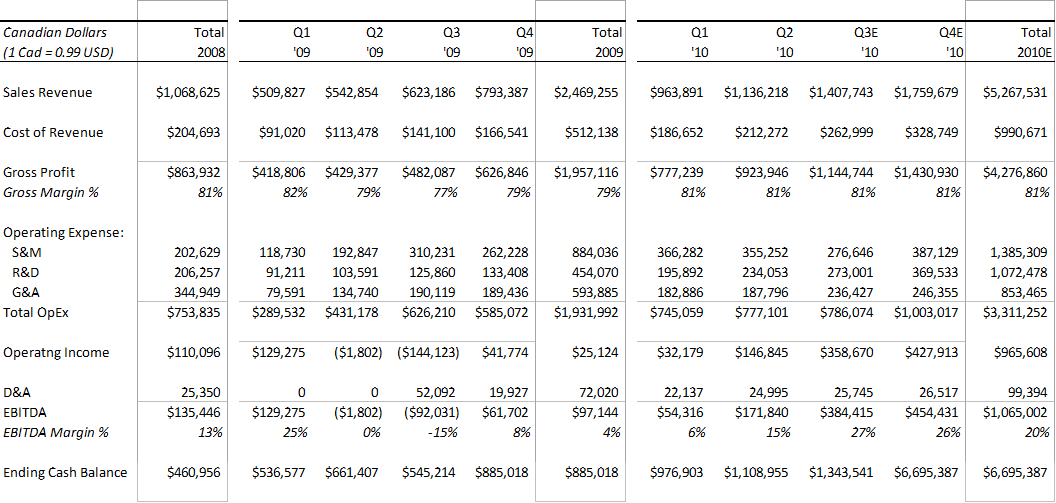

Shopify generates an overwhelming majority of its revenue from recurring monthly fees that it charges customers and a small percentage from a transaction fee of 0.5–2% on its customers’ merchandise sales.

Unfortunately, the company has not forecasted 2011. Historically, there wasn't much need to do forecasting as a cash-in-the-bank based bootstrapped business. We don’t think it unreasonable for Shopify to double revenue next year. At close, Shopify will have roughly $6.3mm in cash ($.3mm existing and $5mm additional).

Summary P&L

Deal

This is a deal for BVP to invest $5mm at $25mm pre-money, with a 13.5% option pool built into the pre-money valuation, 4% of which will be re-granted to existing employees. This Series A security is a 1x straight preferred. BVP will receive two of five board seats and will have the right to force a sale after 6 years.

In addition, we anticipate an opportunity to purchase $2mm worth of common shares at a 25% discount from a co-founder who left the company several years ago. The additional $2mm would increase our exposure to $7mm, but also increase our ownership to 31% at an attractive price. We would likely share a portion of the $2m investment with Felicis.

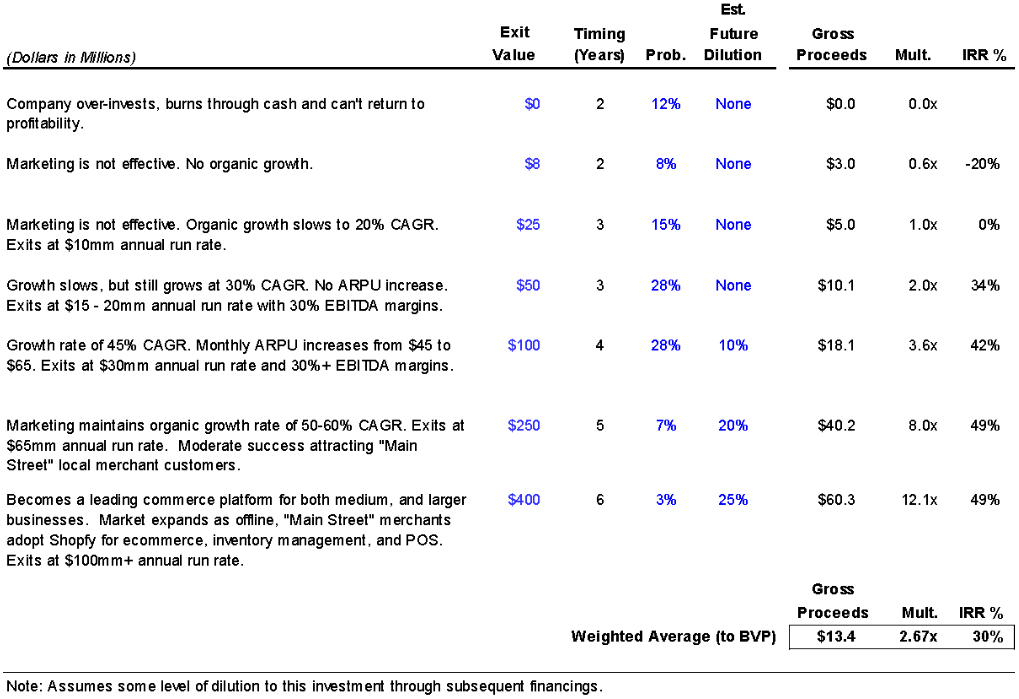

Outcomes Analysis

There weren't any big internet exits in Canada in 2010 and some of Shopify's existing shareholders and advisors thought the biggest possible outcome for the company was ~$50m. In our term sheet negotiations, I initially asked for some structure in the deal (remember, I was nervous as this was my first solo deal as a partner) so that if Tobi decided to sell for $50m we'd make money. Tobi, to his credit, resisted and instead held out for a "clean" deal. We agreed to keep it clean, but before we signed I asked for his word and a handshake agreement that he wouldn’t sell Shopify if he got an offer for $50 or $75m. Lucky for us, we were completely wrong in our outcomes analysis; the upside case was off by more than two orders of magnitude!

Conclusion

We are enthusiastic about the potential for Shopify to disrupt existing solutions with a consumer-like product that has resonated with customers and enabled the company to demonstrate strong organic growth. Further, uptake of the App Store—by both third-party developers and customers—provides differentiation and a path to break away from the pack. We recommend this investment.

Appendix

Consumerization of Enterprise Software Roadmap

There are emerging SMB versions for almost all categories of enterprise software—from invoicing to accounting to CRM to IT management. The Internet as a medium for reaching and transacting with customers is also creating whole new software categories—from collaboration to online advertising. Historically installed software has been too complex for SMBs to setup and use. And more often than not, SMBs couldn’t afford it anyway. In turn, vendors have struggled with making direct or even channel sales profitable. This is now possible; thanks to Web 2.0 and the SaaS delivery model and the ability to use online marketing to profitably acquire and provision SMB customers.

Incumbent enterprise software vendors have proven themselves unable to compete as they are fundamentally not oriented to sell to or serve SMBs. They would love to move down market. But doing so would disrupt their business models and cannibalize cash cows. Fundamentally, they know how to sell direct and by channel, but don’t know how to market online. Just as important, the incumbents aren’t strong at building consumer software or creating great Web experiences.

Because barriers-to-entry are low and customer churn can be high, we believe that breakout companies will have the following characteristics:

- Product categories with well-known and well-defined pain points and a natural stickiness

- Companies achieving strong growth with limited marketing spend

- Companies with good customer acquisition economics, even if still early

- Companies beginning to build a brand and scale relative to competitors

- Teams with a strong product design sense and consumer Internet DNA

We believe that Shopify meet these characteristics. And over time, like leaders in other categories, we feel that Shopify and its App Store strategy gives it a path to ultimately disrupt enterprise vendors with a “come from below” offering and move up market.