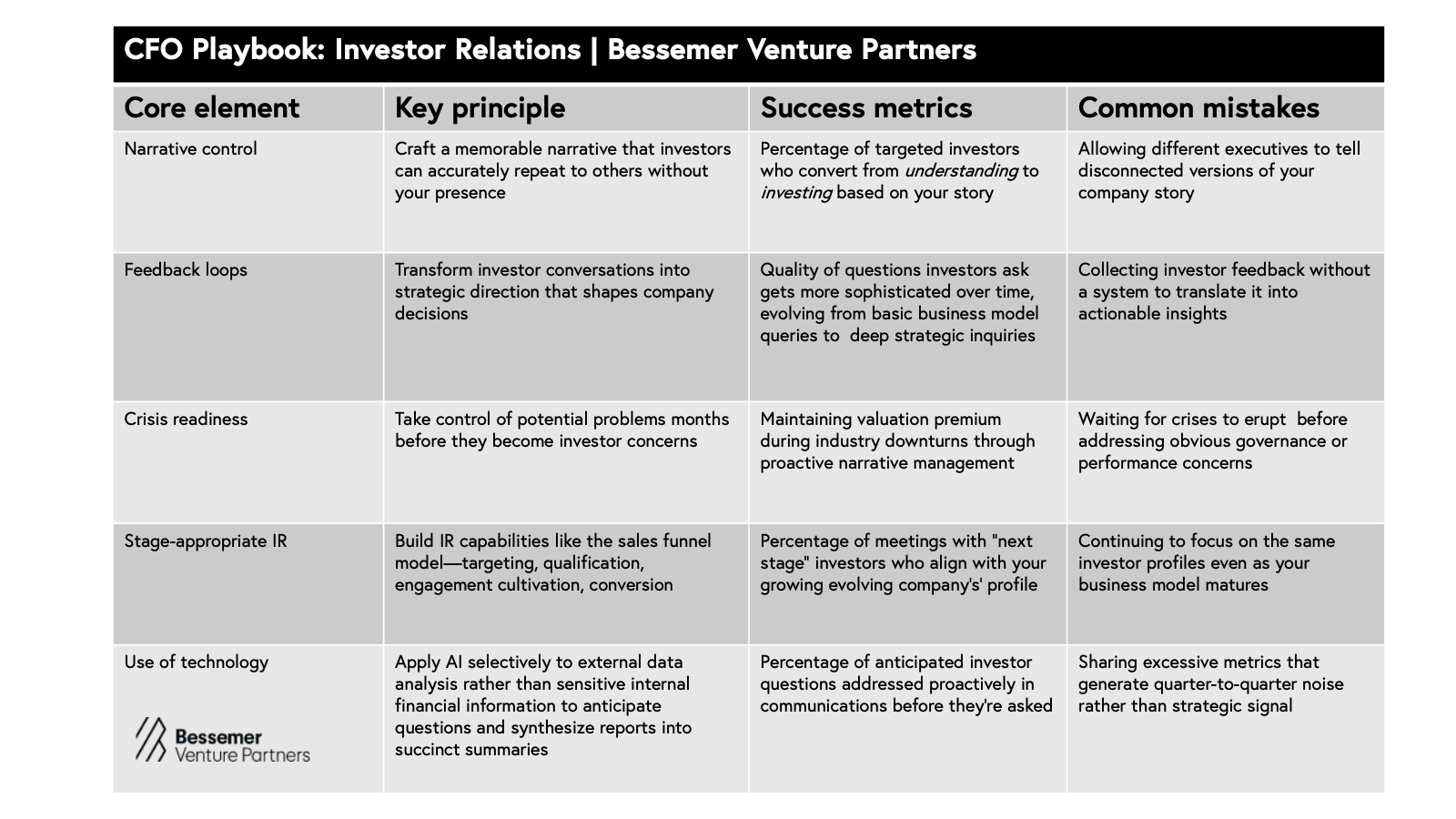

CFO playbook: Five elements of building world-class investor relations

Investor Relations has advanced beyond just reactive reporting. Top experts share how to elevate the function to a strategic advantage at your company.

CFO Playbook: Investor relations overview

Core roles & responsibilities

Crafting your strategic market narrative

Creating a narrative that investors can repeat with conviction

How do you know if your story is landing effectively? One powerful technique is to directly test comprehension during investor meetings. After presenting your story, ask the investor to articulate it back to you in their own words. This exercise immediately reveals whether your key messages are being understood and internalized.

Practical test: After your next investor meeting, ask yourself: "If I asked this investor to pitch our company thesis back to me, would they be just as convincing as our team?" If not, your narrative needs refinement.

Building your amplification network

Your direct investor communications are only one piece of the narrative puzzle. The real firepower comes from building relationships with influencers who amplify your story.

- Analysts as educators: Identify key analysts within your sector, build relationships with them, and ensure they deeply understand your narrative. These analysts educate other market participants about your company, creating a multiplier effect for your messaging.

- Strategic investors as advocates: Build relationships with long-term investors who really get your business so they will become powerful advocates. These investors speak to other investors, reinforce your narrative in their networks, and provide stability during volatile periods.

Treating investor relations like strategic sales

One of the most transformative approaches to IR is treating the function with the same discipline and rigor as you do with sales. Bryan of Twilio shares how this shift created measurable results:

"We've been much more programmatic each quarter about targeting folks who could be our next cohort of long-term investors," he explains. "We’re treating it like a sales job where you have to build a pipeline."

This approach transforms investor relations from a reactive function to a proactive strategy with clear metrics:

- Target identification: Identify potential investors whose investment thesis aligns with your evolving business model and growth stage.

- Proactive outreach: Regularly communicate with targeted investors rather than relying solely on inbound interest.

- Long-term relationship building: Invest time in developing relationships, recognizing that investor education and building trust are prerequisites to eventually securing funding.

- Conversion tracking: Monitor which investor meetings convert into actual investments, creating accountability metrics that speak to the effectiveness of your targeting and narrative.

How success is measured

Creating metrics that drive valuation

Effective IR isn't just about pushing information outward—it's about creating feedback loops that bring valuable market intelligence back into your company. In other words, external awareness drives internal insight. When done right, your IR function becomes a competitive advantage by helping you understand how the market perceives your strategy, your competition, and your industry.

Specific metrics for measuring IR effectiveness

Based on insights from experienced IR leaders, these metrics separate world-class programs from merely adequate ones:

Quantitative success metrics:

- Target engagement rate: Establish specific numerical targets for engaging your top investors each quarter (e.g., your goal could be to engage with 80% of your top 10 ideal investors in a given quarter)

- Investor conversion tracking: Move beyond activity metrics to measure how many targeted meetings convert to actual investment decisions (e.g., your goal could be to convert 5% of your meetings into investments.)

- Predictive accuracy: Track what percentage of investor questions were anticipated versus coming as surprises during earnings calls or meetings. (e.g., your goal could be to have less than 10% of questions come as a surprise.)

- New investor acquisition: Measure the success of proactive outreach by tracking new investors gained through targeted versus inbound channels. (E.g., your goal could be to gain 50% of investors through outbound channels.)

Qualitative success metrics:

- Narrative penetration: Assess whether investors can accurately repeat your company’s market thesis without prompting or misinterpretation.

- Question evolution: Monitor the progression from basic business model questions toward sophisticated strategic discussions.

- Feedback loop effectiveness: Evaluate how effectively investor insights are translated into actionable intelligence for executive decisions.

- Crisis resilience: Measure investor retention and valuation premium during challenging periods.

- Executive narrative alignment: Audit the consistency of messaging across different executives using mock interviews.

Discerning which feedback matters most

Gaining value from investor interactions requires you to distinguish between valuable feedback and market noise.

"A big part of the role is ensuring you’re effective at creating a feedback loop. Are you taking all the insights and comments and feedback from investors and relaying that back to both the executive team and the board? Are you making active decisions and changes based on feedback you’re getting?" — Bryan Vaniman

- Misconceptions that require better education: When investors misunderstand your business model or strategy, the solution lies in improving education, not making strategic changes.

- Valid concerns that deserve attention: When multiple sophisticated investors raise similar concerns about strategic direction or execution, taking this feedback seriously can be invaluable.

Case study: How Twilio turned investor concerns into a display of the business’s strength

When Twilio’s blended gross margin slipped from the high-50s to the low-50 percent range, investor concerns mounted—fearing that it could signal anything from eroding pricing power to increasing costs to serve. Instead of offering vague assurances, the company used its Investor Day to tell the full story.

First, it disentangled the numbers—showing that the mix was tilting toward SMS and WhatsApp messaging, a product line that naturally carries lower percentage margins than pure-software subscriptions but drives far more absolute contribution dollars. Second, it unpacked geography: international traffic incurs higher carrier pass-through fees than U.S. traffic, which drags the reported percentage down even though per-message pricing was rising year over year. By laying out unit economics product-by-product and region-by-region, management reframed the “margin decline” as evidence that lucrative messaging volume and global expansion were accelerating exactly as planned — using this as an opportunity to turn investor skepticism into confidence.

Common failure modes

Preserving credibility when challenges arise

How you handle challenges often determines investor confidence more than how you deliver good news. That’s why it’s critical to approach these conversations transparently yet skillfully—and with the appropriate depth of understanding.

"Investors can smell the difference between someone who truly understands the business versus someone who's just relaying talking points." —Sameer Dholakia, former CEO of SendGrid and current Partner at Bessemer

- Inconsistent messaging: When your CTO paints one picture at a conference and the CFO presents different information to investors, this creates confusion and suspicion. Udi of Claroty notes, "Confidence gets shaken when there is inconsistency between different parts in the organization."

- Reactive rather than proactive communication: Waiting until problems are unavoidable before acknowledging them makes you appear either unaware or dishonest. Bryan of Twilio advises, "Don't wait until you miss your quarterly earnings guidance. Don't wait until an upset investor shows up at the door. Anticipate the situations that could happen and make sure you've got a plan of action."

- Surface-level understanding: Sameer emphasizes that IR professionals often fail when they "are not super embedded into the business." When tough questions arise, this lack of depth becomes obvious and damages credibility.

Balancing transparency with narrative control

How do you provide sufficient transparency while maintaining narrative control? The secret lies in providing metrics at the right altitude—giving investors enough visibility to track your execution without drowning them in detail:

- Core quarterly metrics: Select a focused set of indicators that directly validate your strategic narrative. These metrics should provide the right vantage point to answer the question: "Are we executing against our stated strategy?" Review this set of metrics annually to ensure they still align with your evolving priorities.

- Annual deep dives: Provide context through periodic analysis that connects operational details to strategic outcomes. This cadence offers deeper visibility into specific areas like product performance without the effort of quarterly reporting cycles.

- Investor day strategic engagements: Use investor days to present comprehensive frameworks that reinforce your narrative with supporting data. These events allow you to share deeper insights without committing to ongoing detailed disclosures that could create quarter-to-quarter noise and unnecessary scrutiny.

This layered approach to disclosure ensures investors have enough visibility to know if you're executing against the narrative you sold them on, without creating information overload. Finding this balance is crucial—too little information undermines credibility, but too much detail obscures the strategic storyline and creates unnecessary volatility from quarter-to-quarter.

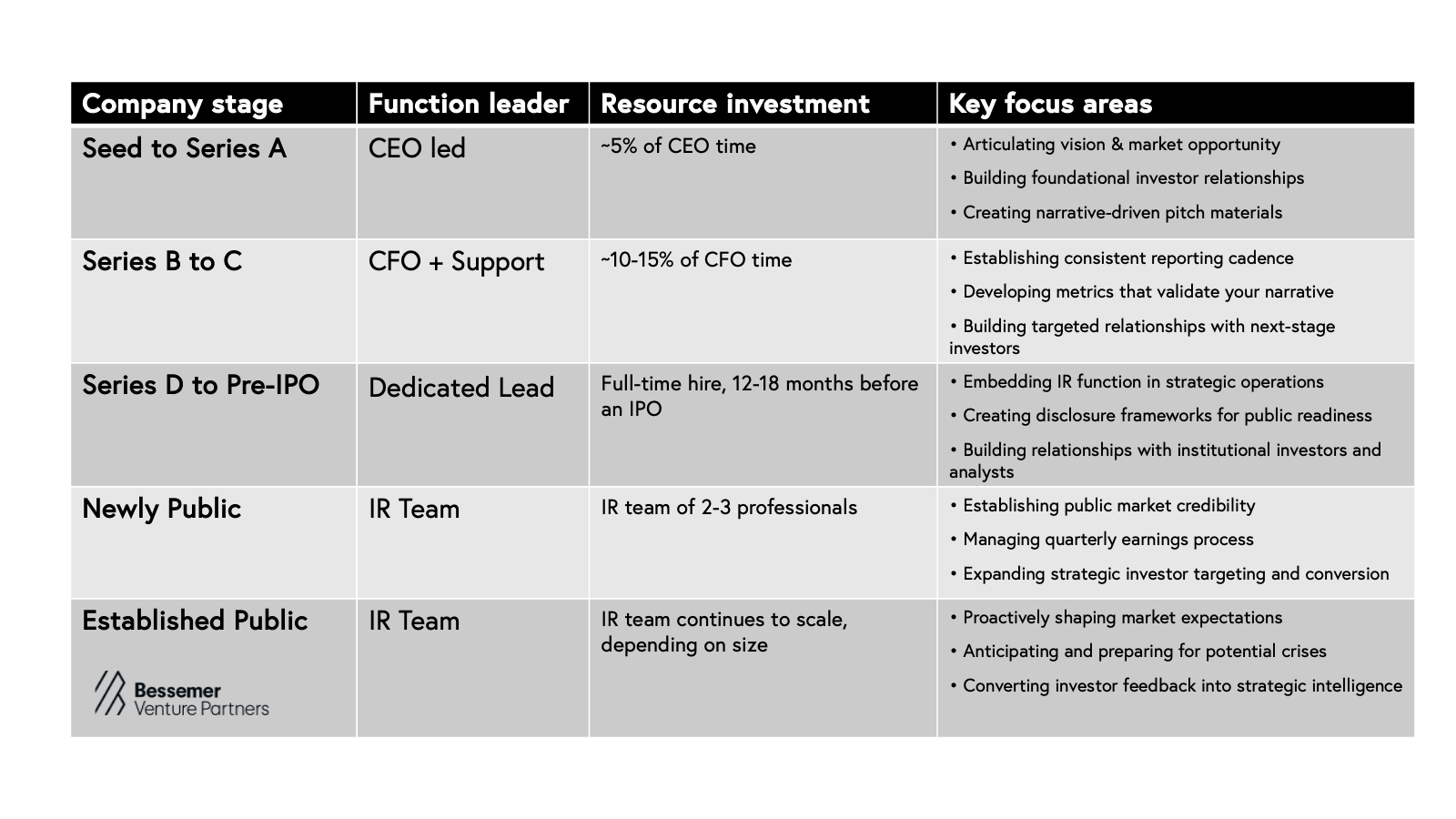

How the role evolves across growth stages

Evolving from founder-led to independent strategic function

The founder as the first IR professional

Growth stage to post-IPO: the critical transition

As fundraising becomes more complex and company operations more sophisticated, IR requirements grow. This transition point often determines whether companies build sustainable capital market advantages or struggle with misaligned investor expectations. "We hired our IR person as a full-time employee a year before we went public,” shares Sameer when reflecting on his time as CEO of Sendgrid. “I wanted him to sit in our operating meetings every Monday for a year, attend our quarterly business reviews, and hear from every product leader and sales leader to really understand the business."

The investor relations function evolution: A strategic roadmap

Impact of technology & AI

Using AI to enhance intelligence while managing risk

Technology is transforming investor relations, but it requires strategic implementation. "The key is identifying where technology truly enhances the human relationship aspects of IR versus where it creates risk," explains Sameer, who has guided multiple companies through technology transformations.

High-impact, low-risk applications

"The human element remains irreplaceable in investor relations. Technology should enhance relationship-building and insight gathering, not replace the trust that comes from personal connection." - Sameer Dholakia