Click, watch, shop: The consumer opportunity in India

India is poised for a trillion-dollar digital opportunity, driven by a decade of digital transformation, rising incomes, and technology-first progressive policies.

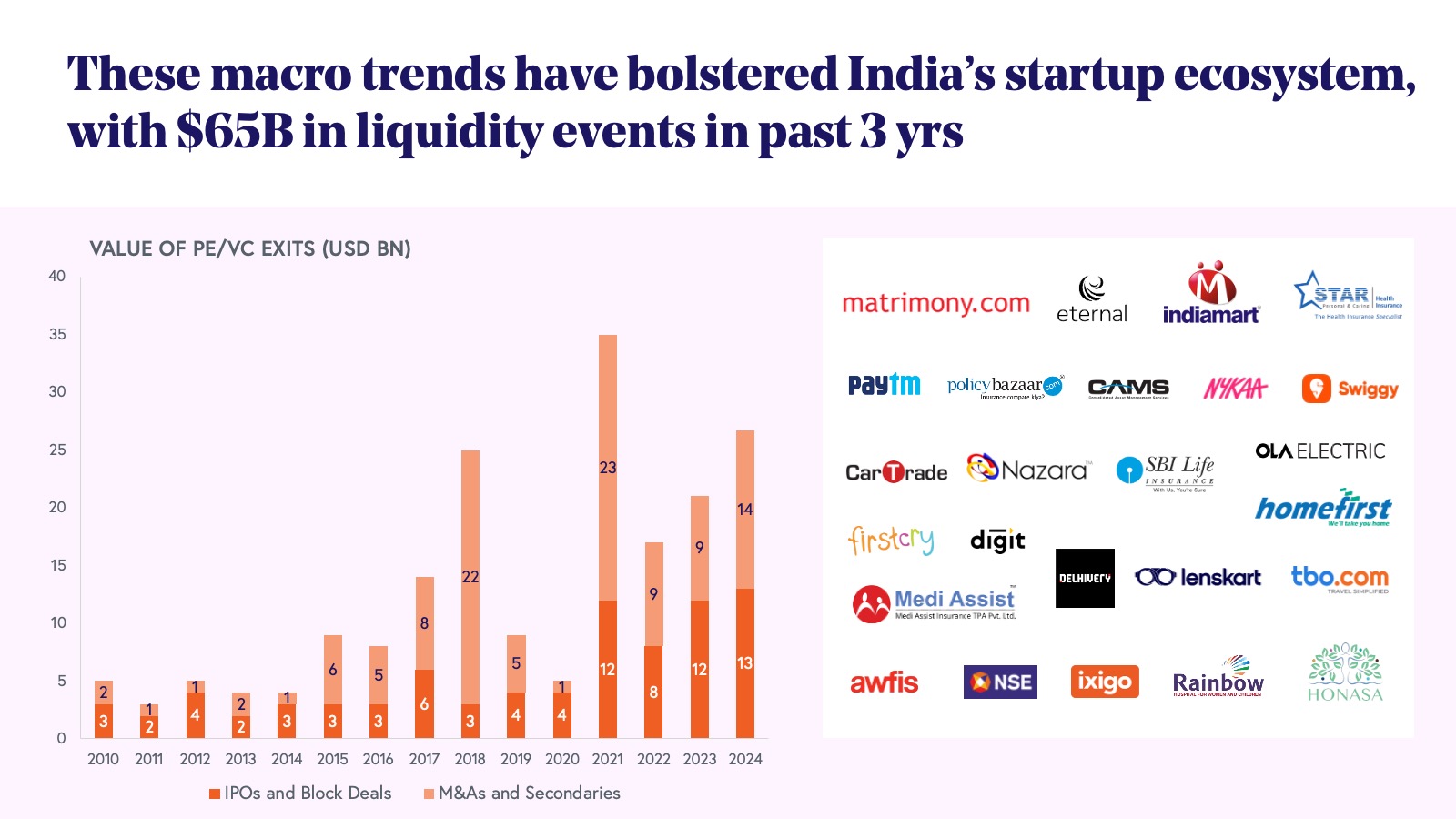

India is poised for a new era of consumer innovation. Over the last decade, several technology disruptions have led to an almost $200 billion digital economy, on the back of smartphones, e-commerce, UPI, and a rising disposable income, including companies such as Swiggy, Flipkart, and UrbanCompany.

We believe that the coming decade is poised for an even bigger growth spurt, leading to a trillion-dollar digital opportunity. This era of entrepreneurship is almost five times the value creation that happened in the last decade. And given that more than 60% of India’s economy is consumer-led, we expect a large share of this value to accrue to consumer startups. India is about to witness its digital economy take off like a rocket, with a triple engine of commerce, content, and consumer discernment fueled by AI.

There has never been a better time to be a consumer entrepreneur in India; in this report, we dive into this new era's growth engines, AI’s impact so far, and the key metrics entrepreneurs should prioritize.

Full slide deck

Key trends in India's consumer landscape for entrepreneurs to leverage

1. India's digital economy is on the verge of a trillion-dollar boom.

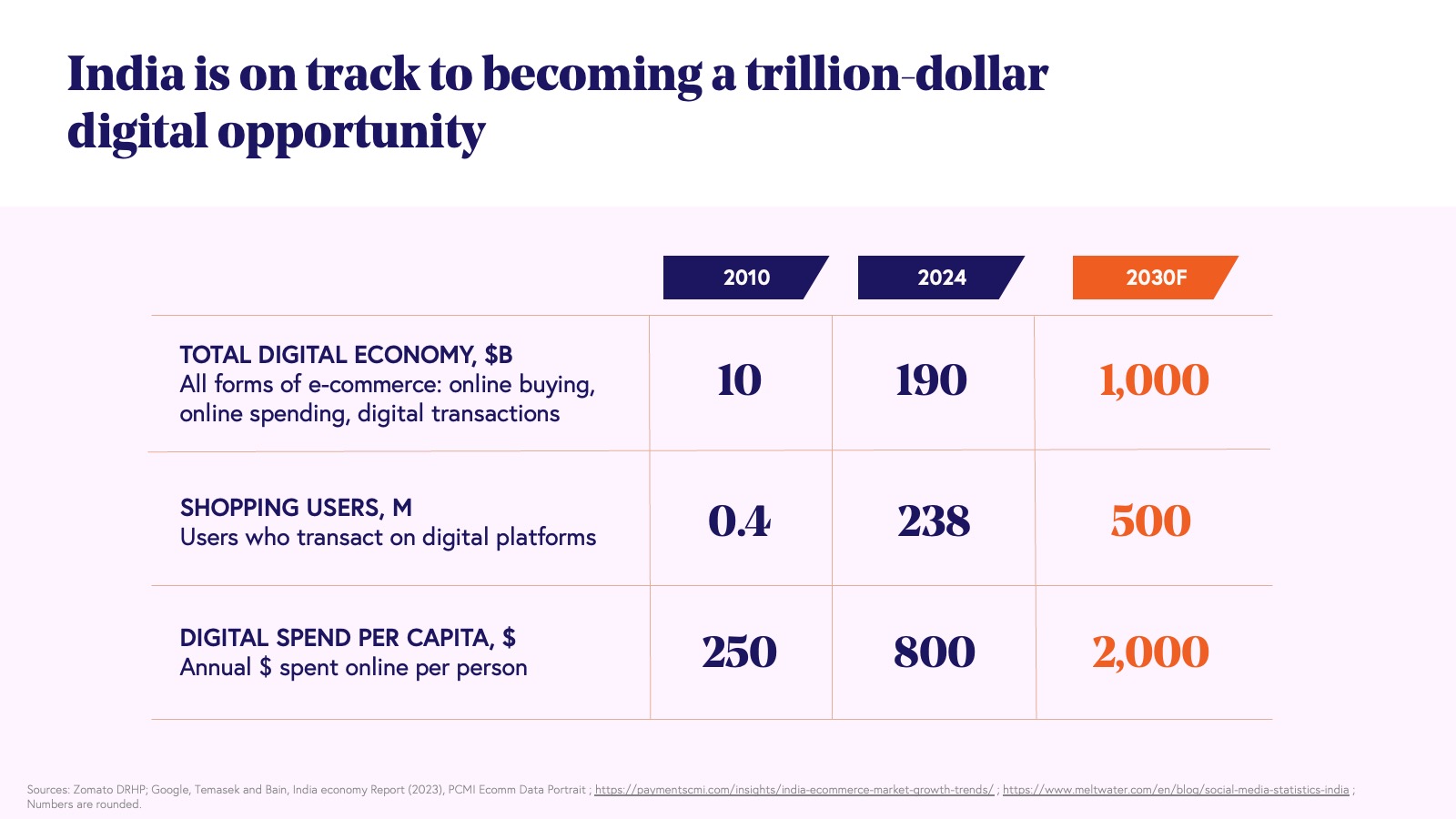

India’s digital economy is projected to quintuple in the next decade, driven by widespread internet access (800+ million users), affordable data, and progressive digital policies. E-commerce users are expected to double from 238 million in 2024 to 500 million by 2030, making India the world’s second-largest e-commerce market by user base, only behind China.

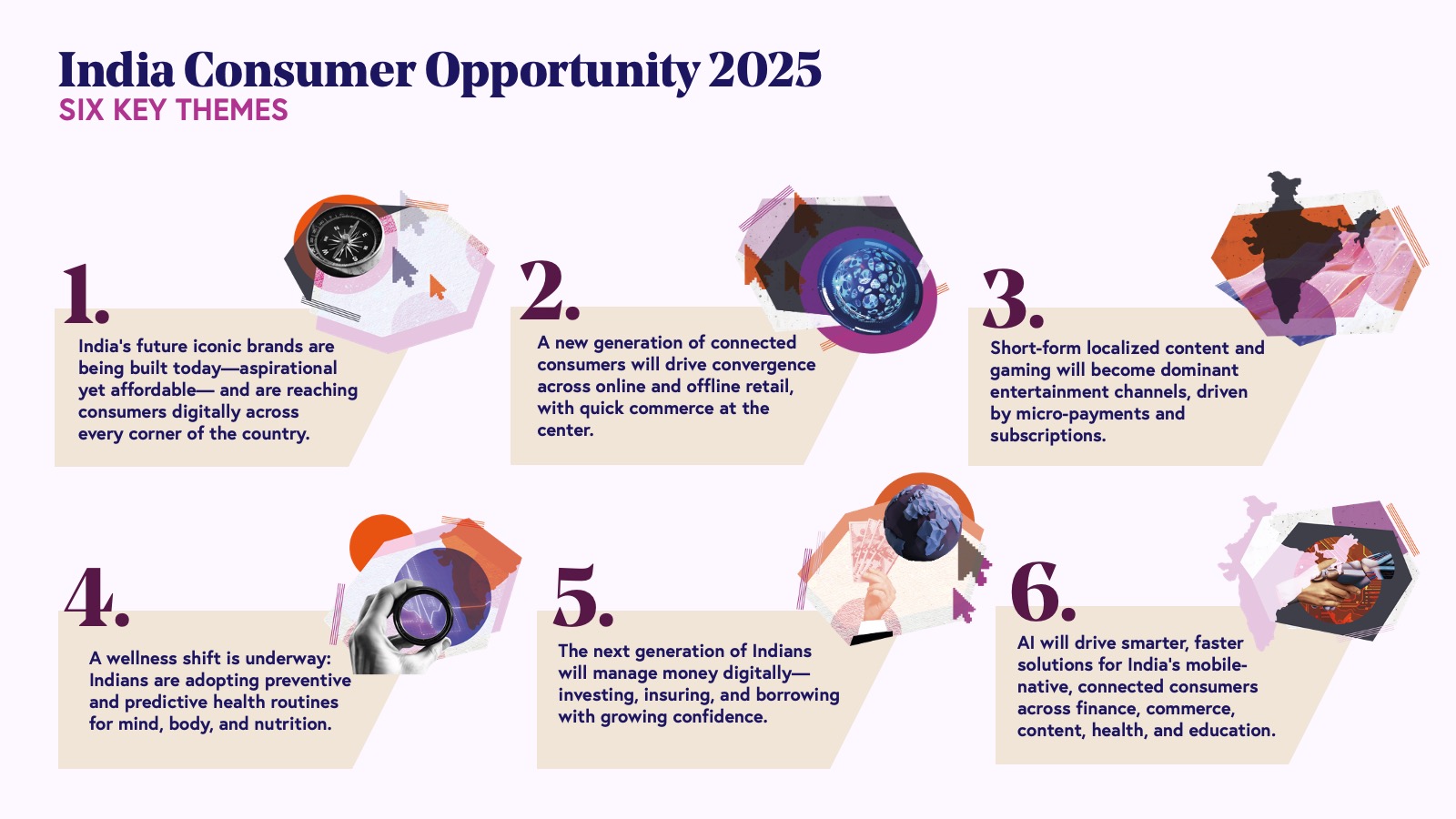

2. The next wave of digital growth will be powered by commerce, content, and consumer discernment.

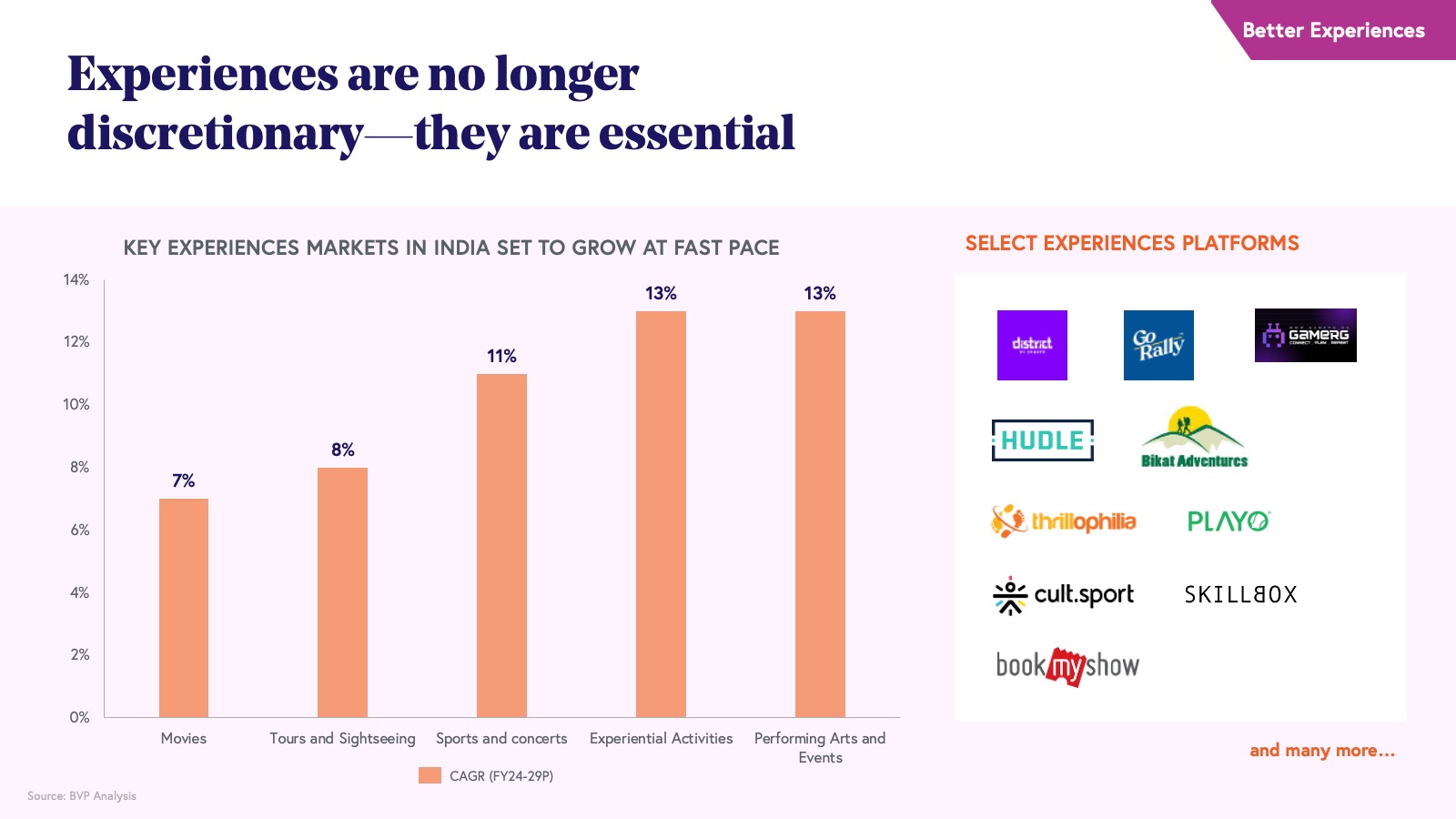

The next wave of digital growth will be powered by rapidly expanding online commerce (both e-commerce and ultra-fast "q-commerce"), a content revolution with explosive growth in short-form video, regional language platforms, and gaming, and increasingly discerning consumers, especially among India's younger population who demand aspirational, high-quality, and mass premium brands across every category.

3. Lifestyle and financial habits are rapidly evolving.

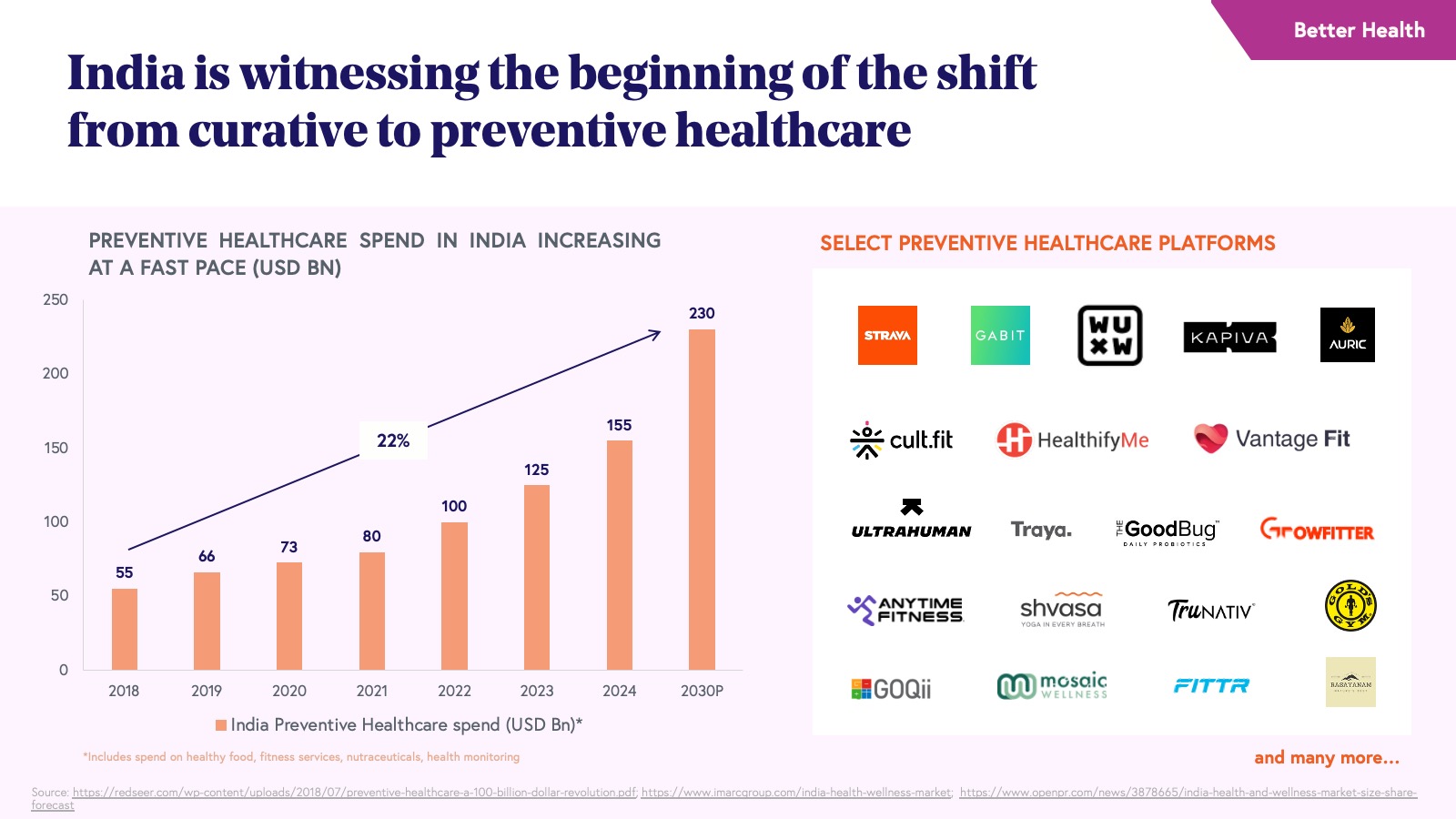

Indian consumers are spending more on health, wellness, and lifestyle categories that were previously considered nonessential, such as organic food, fitness, mental health, and pet care. Digital public infrastructure like UPI and Account Aggregator networks are democratizing access to financial services, investments, and wealth creation, especially for younger and non-metro consumers.

4. AI is the new growth catalyst across sectors.

AI is transforming every aspect of the Indian consumer landscape — personalizing commerce, scaling content creation, enabling better healthcare and education, and powering smarter financial services. Businesses not leveraging AI risk missing out on significant growth and efficiency gains.

5. Building sustainable consumer businesses will depend on four core metrics: TAM, CAC, CM, and flatline retention.

Enduring success in India’s consumer market depends on mastering Total Addressable Market (TAM), Customer Acquisition Cost (CAC), Contribution Margin (CM), and flatline retention, achieving high long-term retention, which accelerates profitability and revenue predictability.

A tailwind trifecta: Internet penetration, evolving demographics, and policy changes

India's trillion-dollar digital economy opportunity has been driven by three key elements:

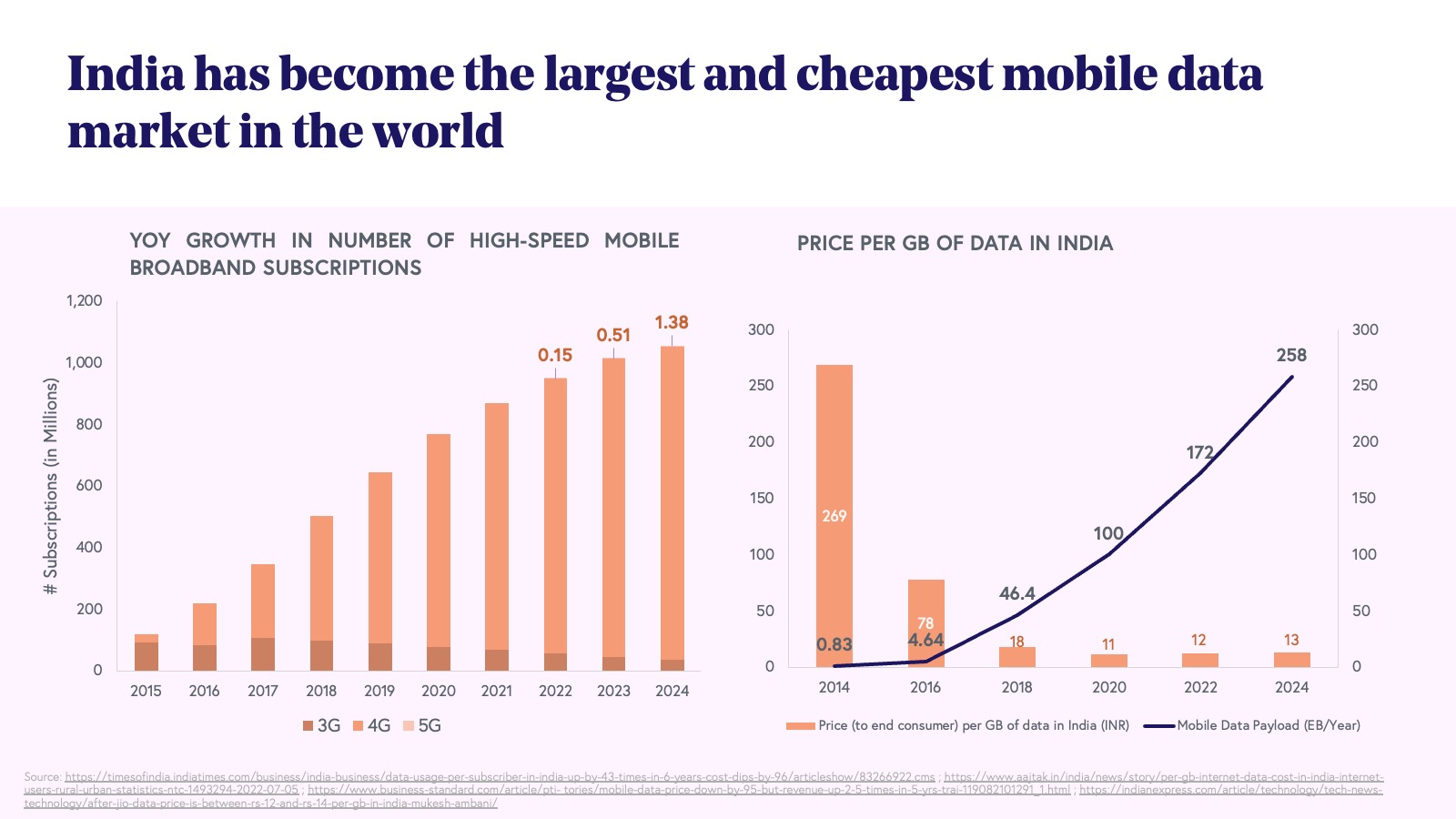

First, affordable mobile data (around $0.15 per GB) has enabled widespread internet access for over 800 million Indians, dramatically increasing online shoppers from almost none in 2010 to 238 million in 2024. This makes India the second-largest e-commerce market by users, behind China, with projections reaching half a billion by 2030.

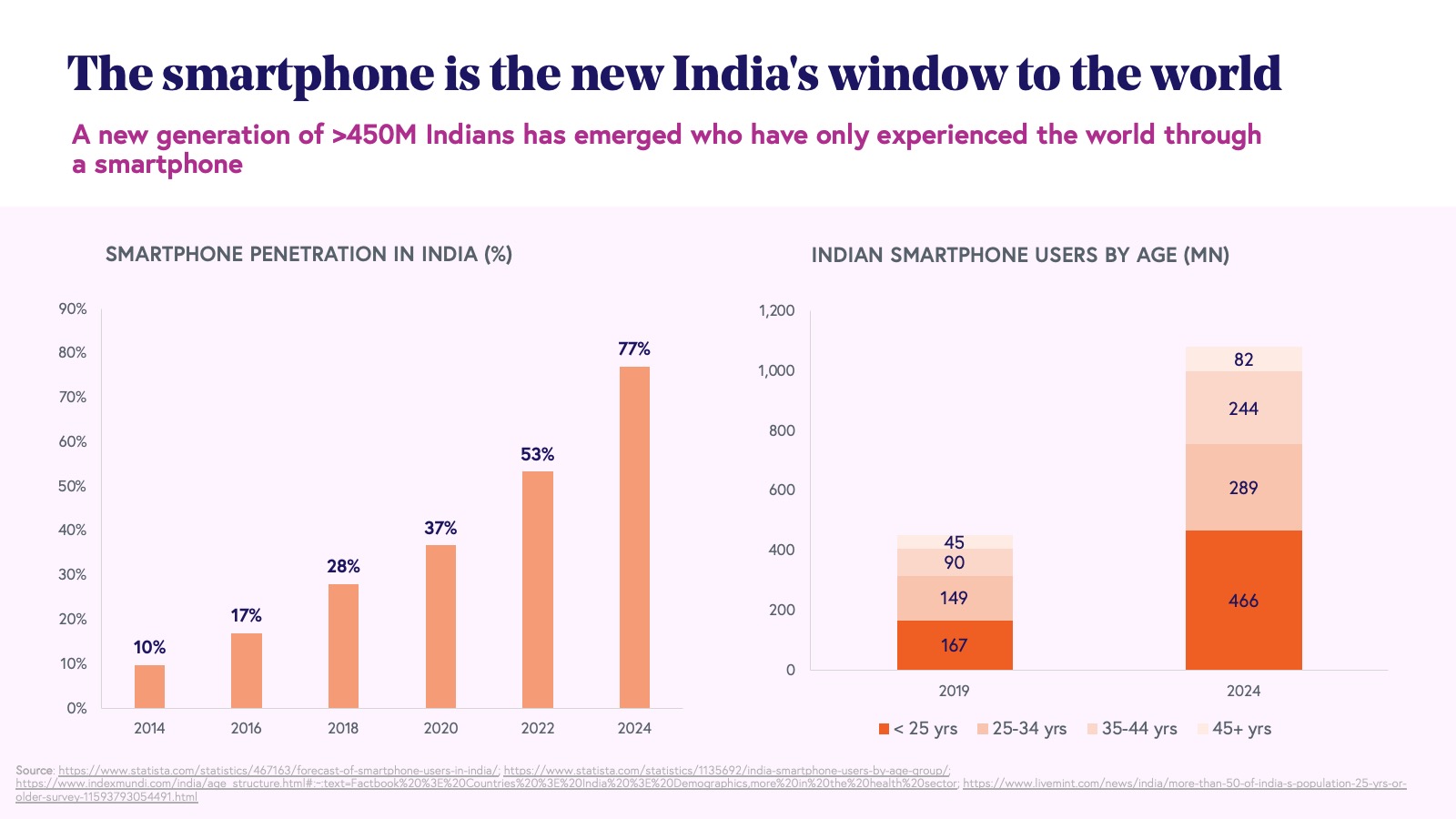

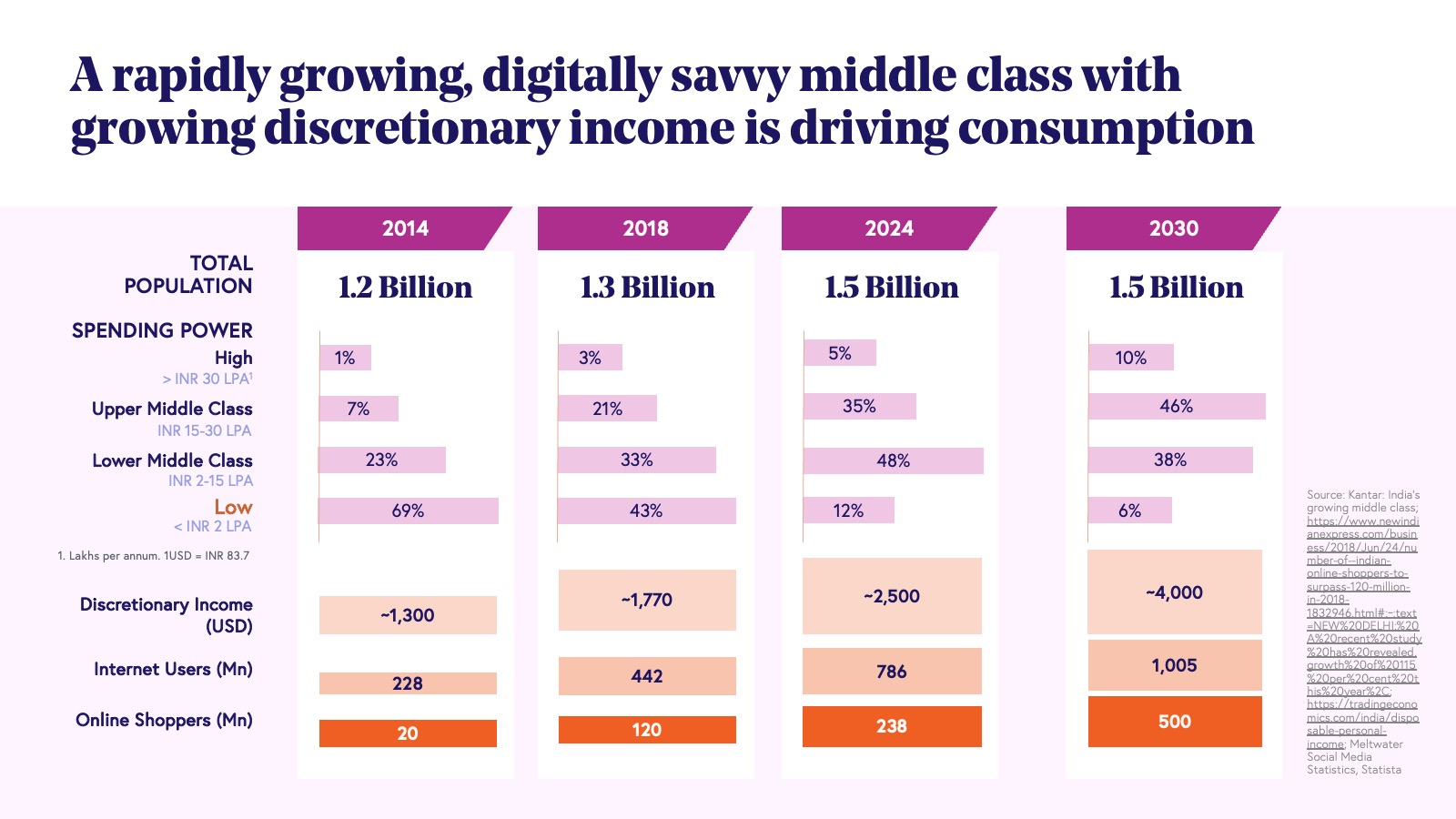

Second, India's demographic shifts are significant. As the world's most populous nation in 2023 (1.48 billion) with a young median age (28.8 years), its per capita discretionary income has doubled to roughly $2,500 in 2024 and is expected to hit $4,000 by 2030, fueling retail growth. It is also interesting to note that a large proportion of India’s young consumer base was born with a smartphone in their hand, with no knowledge of an offline world.

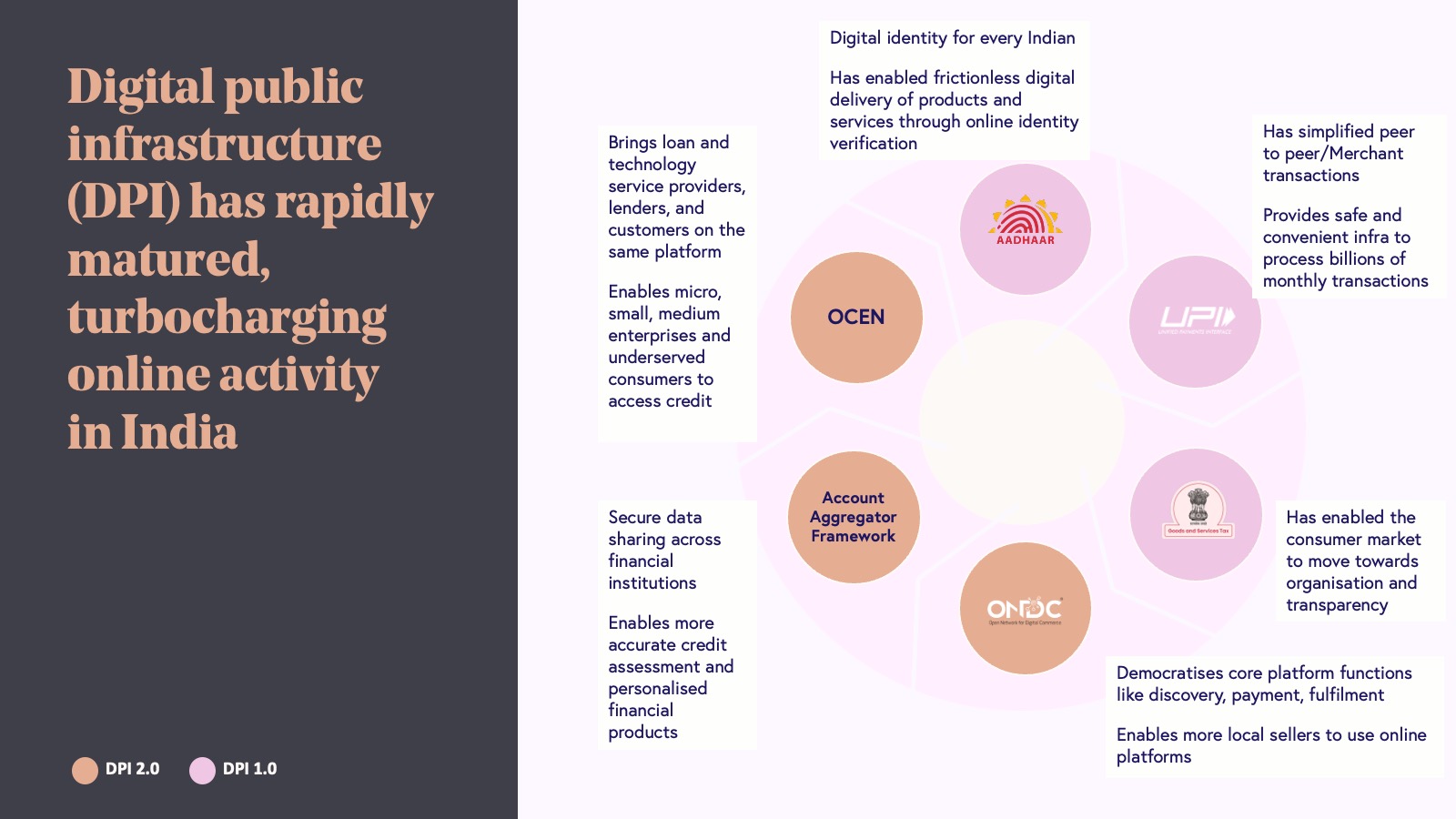

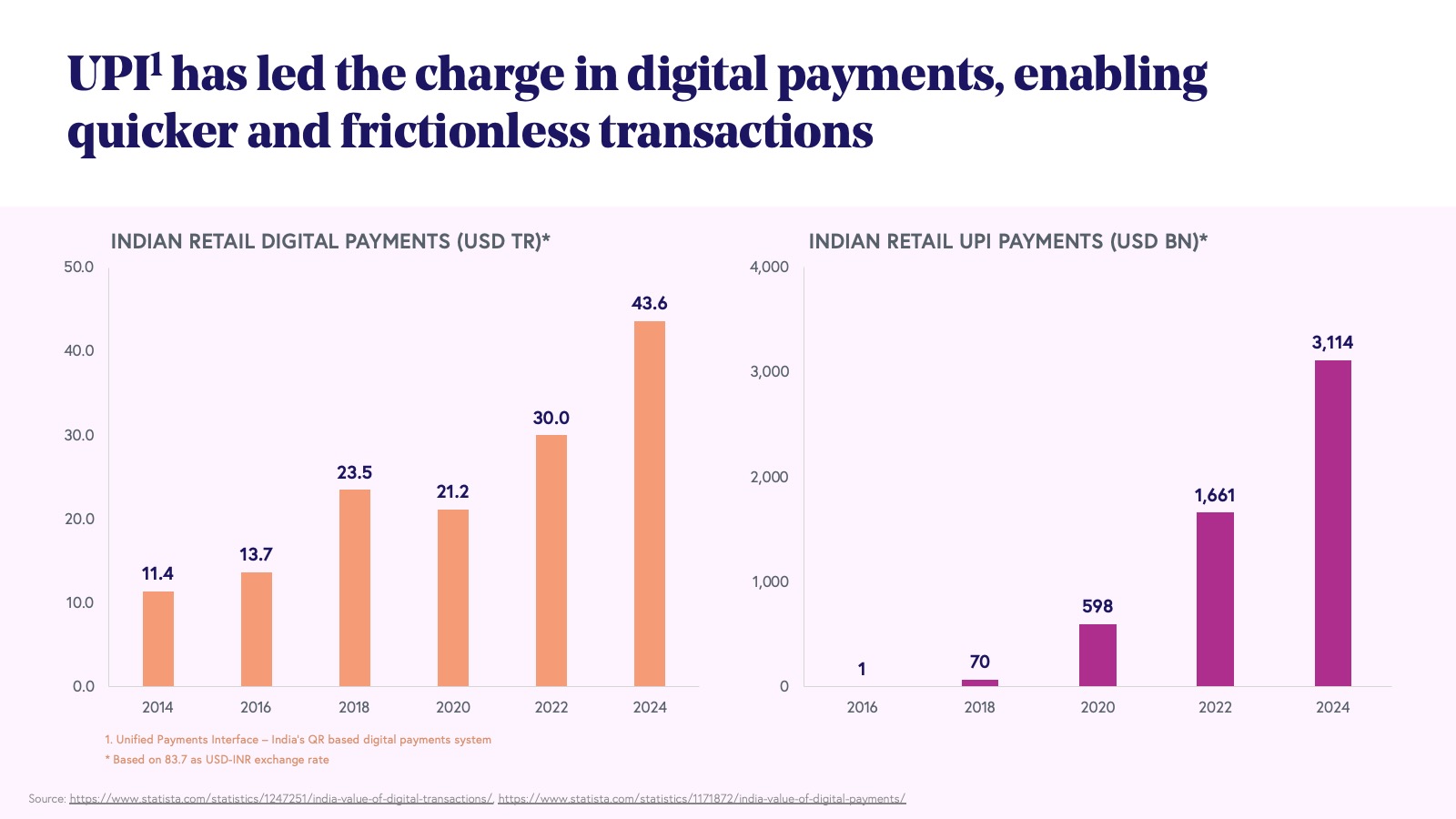

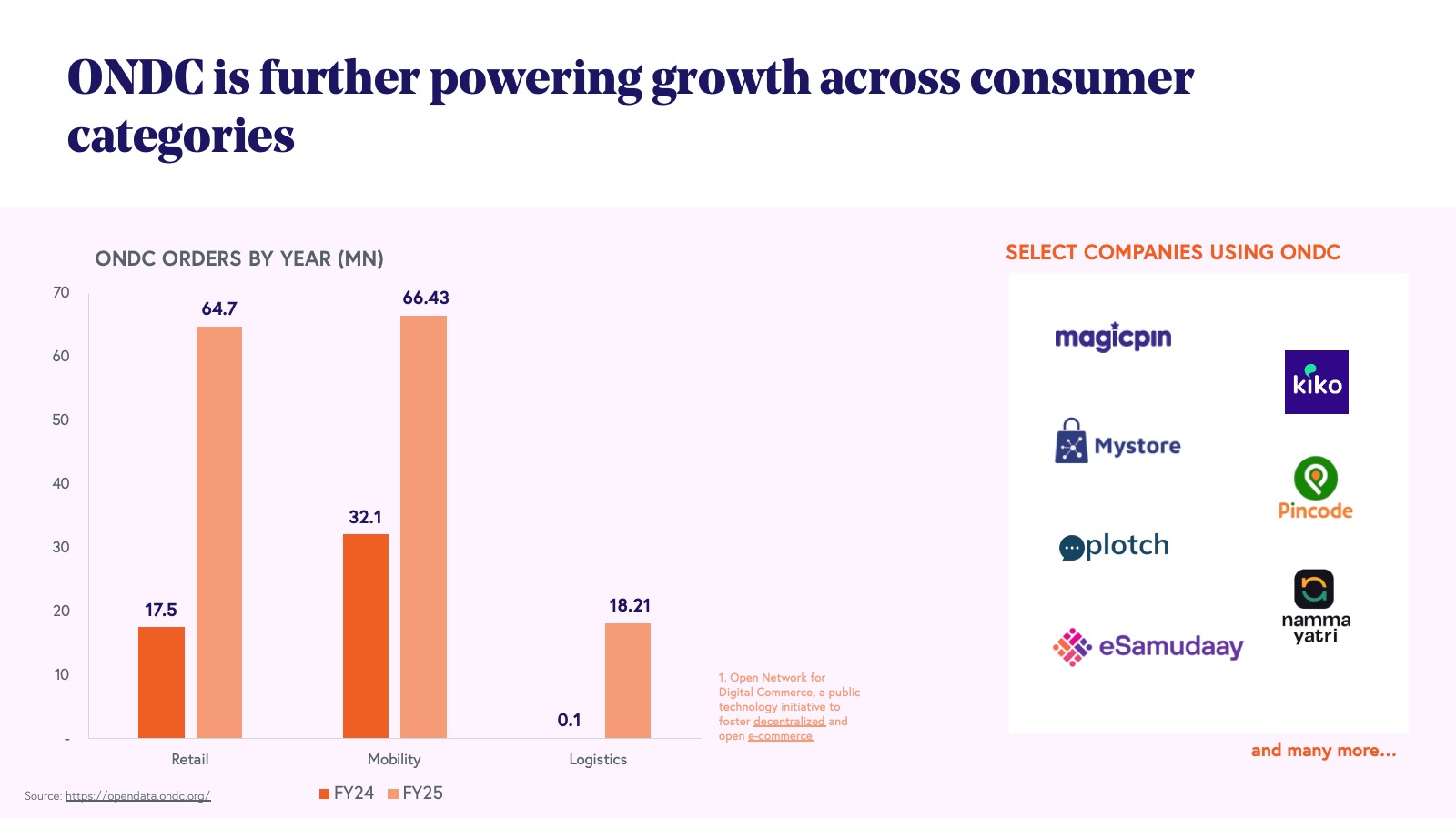

Third, policy reforms and a strong digital public infrastructure (DPI) built over the last decade (e.g., the goods and services tax and Aadhaar identification system) have facilitated smooth online transactions. The Unified Payments Interface (UPI) has been particularly impactful, making peer-to-peer and merchant transactions almost seamless. UPI transaction volumes have exploded from 93,000 in August 2016 to 18.3 billion in March 2025. We believe that the next wave of DPI will see the growth of platforms like the open network for digital commerce (ONDC), which is expected to democratize e-commerce, and the open credit enablement network (OCEN), which is expected to do the same for lending.

The growth engines of the future

I. Commerce: Quicker, better, and more aspirational across channels

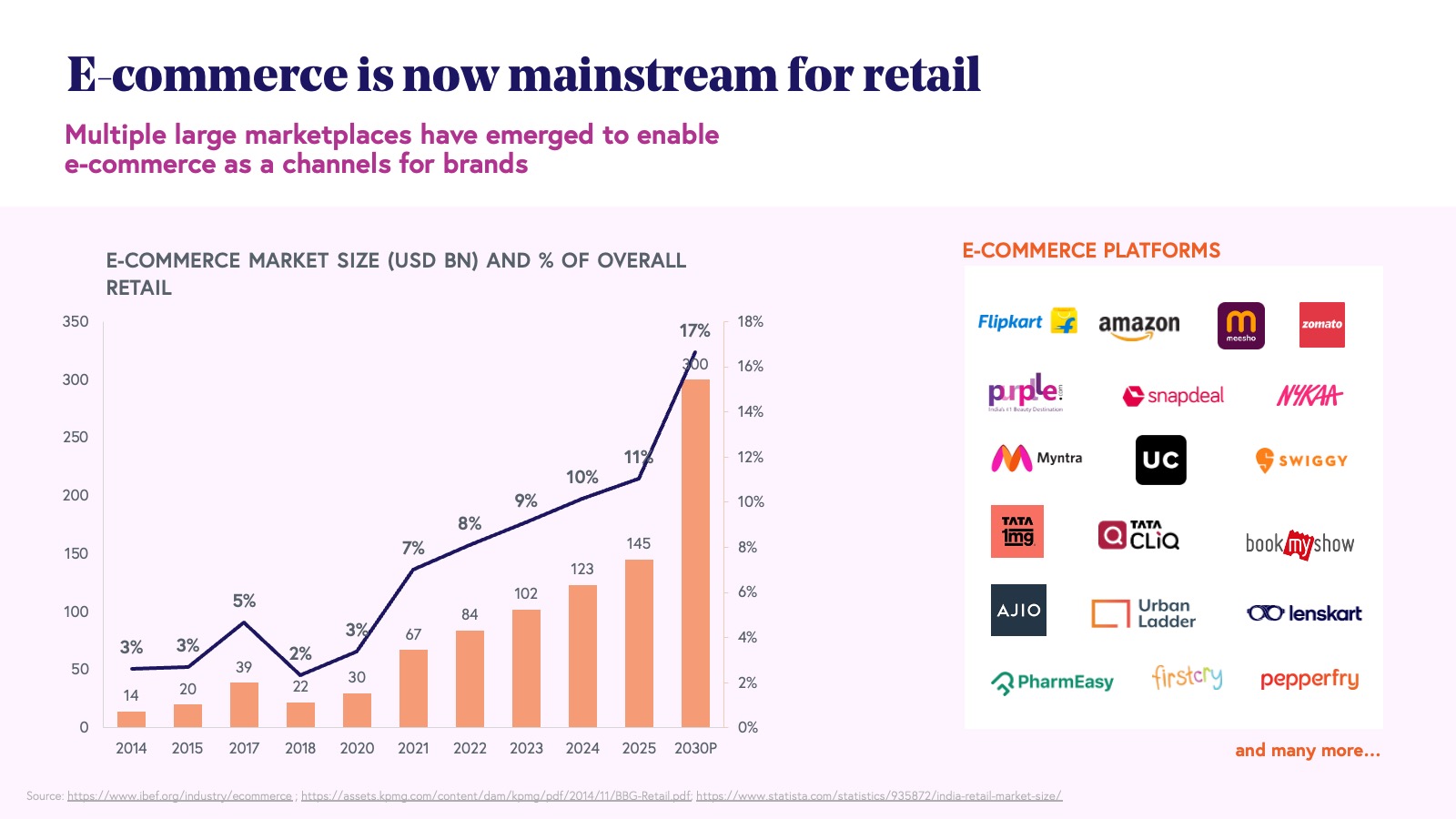

India's burgeoning online commerce sector has witnessed an extraordinary expansion in recent years, demonstrating it is no longer a niche phenomenon catering to a small segment. It has firmly established itself as a dominant force within the Indian retail landscape for a significant and growing share of the population. This growth has occurred across a diverse set of product categories, ranging from electronics and fashion to groceries and household goods. Starting from a base of $30 billion in 2020, the market has more than quadrupled, reaching $123 billion in 2024, and is expected to get to $300 billion by 2030. This remarkable trajectory underscores a fundamental shift in how Indian consumers engage with retail, with online channels becoming increasingly preferred for a wide array of goods and services.

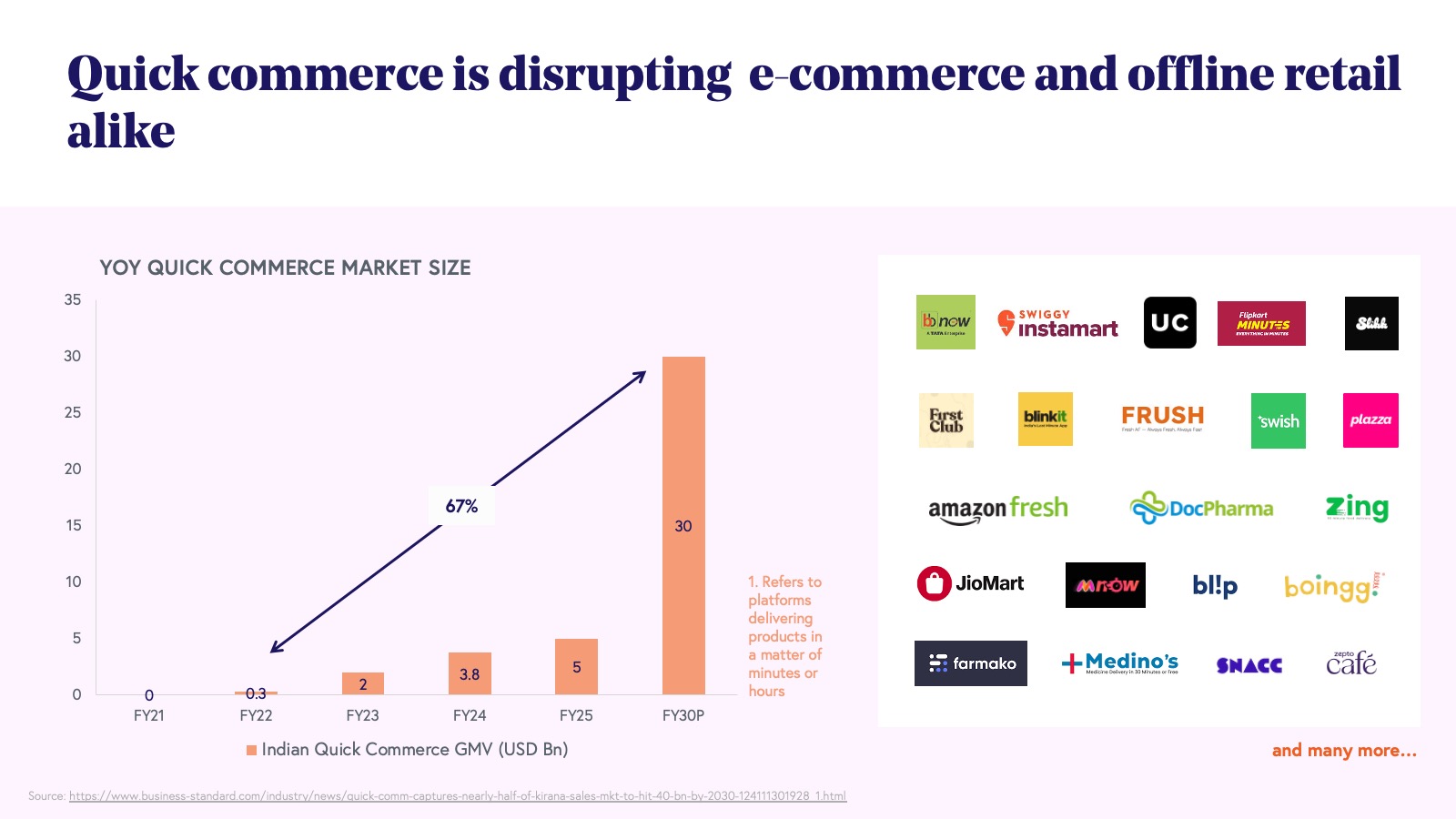

The recent rise of quick commerce (or q-commerce, ultra fast e-commerce) has introduced a new dimension to the online retail ecosystem, further revolutionizing the way consumers access goods. Platforms such as BigBasket, Blinkit, Swiggy Instamart, and Zepto have spearheaded this movement, demonstrating the viability and consumer appeal of rapid delivery services. Their success has not gone unnoticed by established e-commerce giants like Amazon and Flipkart, which are now actively adapting their strategies and infrastructure to participate in and capitalize on the burgeoning q-commerce market. This competitive landscape is driving innovation in logistics, warehousing, and delivery mechanisms, ultimately benefiting consumers with more choices and faster service.

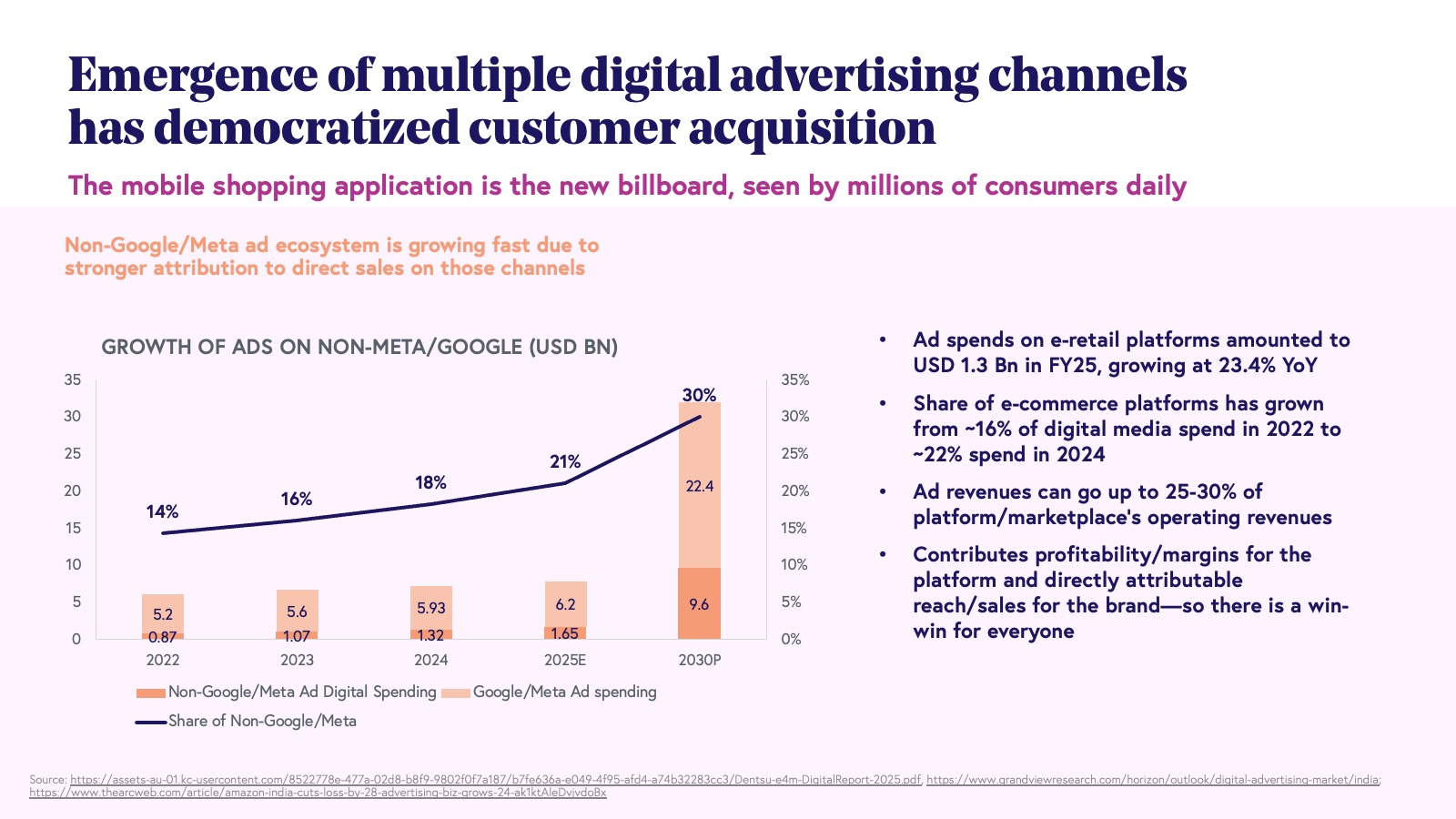

To add to the mix, similar to what we saw with e-commerce, verticalized q-commerce is emerging as a challenger to horizontal q-commerce with startups like Snabbit, Swish, and Slikk. While questions remain over the eventual profitability of this channel, consumer behavior has definitely evolved and when that happens, profits often follow, albeit with a lag. We believe ad spends could be a key factor in determining when and in what quantity these profits arrive. Digital advertising spend - long considered a duopoly between Google and Meta - has seen the emergence of retail media as a key third player. This not only allows e-commerce and q-commerce platforms to get a high margin source of revenue (brands may end up spending as much as 25-30% of sales as ads), but it also creates a more level playing field for new brands to get visibility in an otherwise crowded market landscape.

The seamless nature of online shopping, coupled with readily available visibility, has transformed the internet into a primary channel for brands aiming to connect with Indian consumers. A multitude of online platforms, encompassing both traditional e-commerce and rapid delivery services, are intensely competing for consumer attention. This competition manifests in continuous offers and discounts offered to customers, as well as a race to acquire unique or best-selling brands to fill their shelves. E-commerce platforms and marketplaces looking for an edge are also actively searching for startups, more favorable commercial agreements, and broader distribution opportunities for even nascent brands.

Furthermore, a brand's success on a single online platform triggers a domino effect. Other online marketplaces start to pursue popular brands, and established offline retail giants such as D-Mart, Shoppers Stop, and general trade retailers also follow - a novel development within the Indian retail landscape. The current environment presents an unprecedented opportunity for establishing and scaling a direct-to-consumer (D2C) brand in India, benefiting from both the dynamic online marketplace and the evolving interest of traditional offline channels.

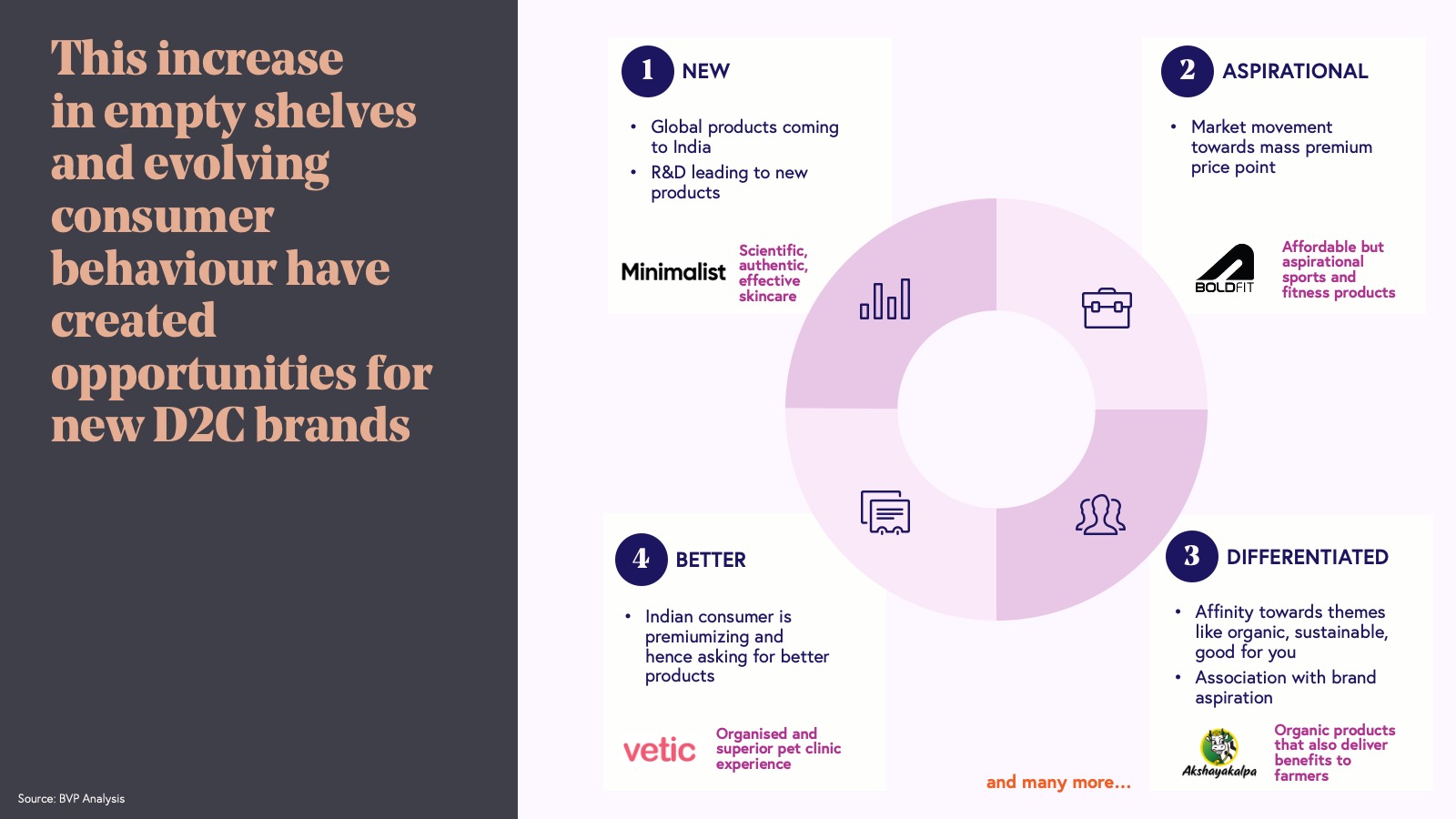

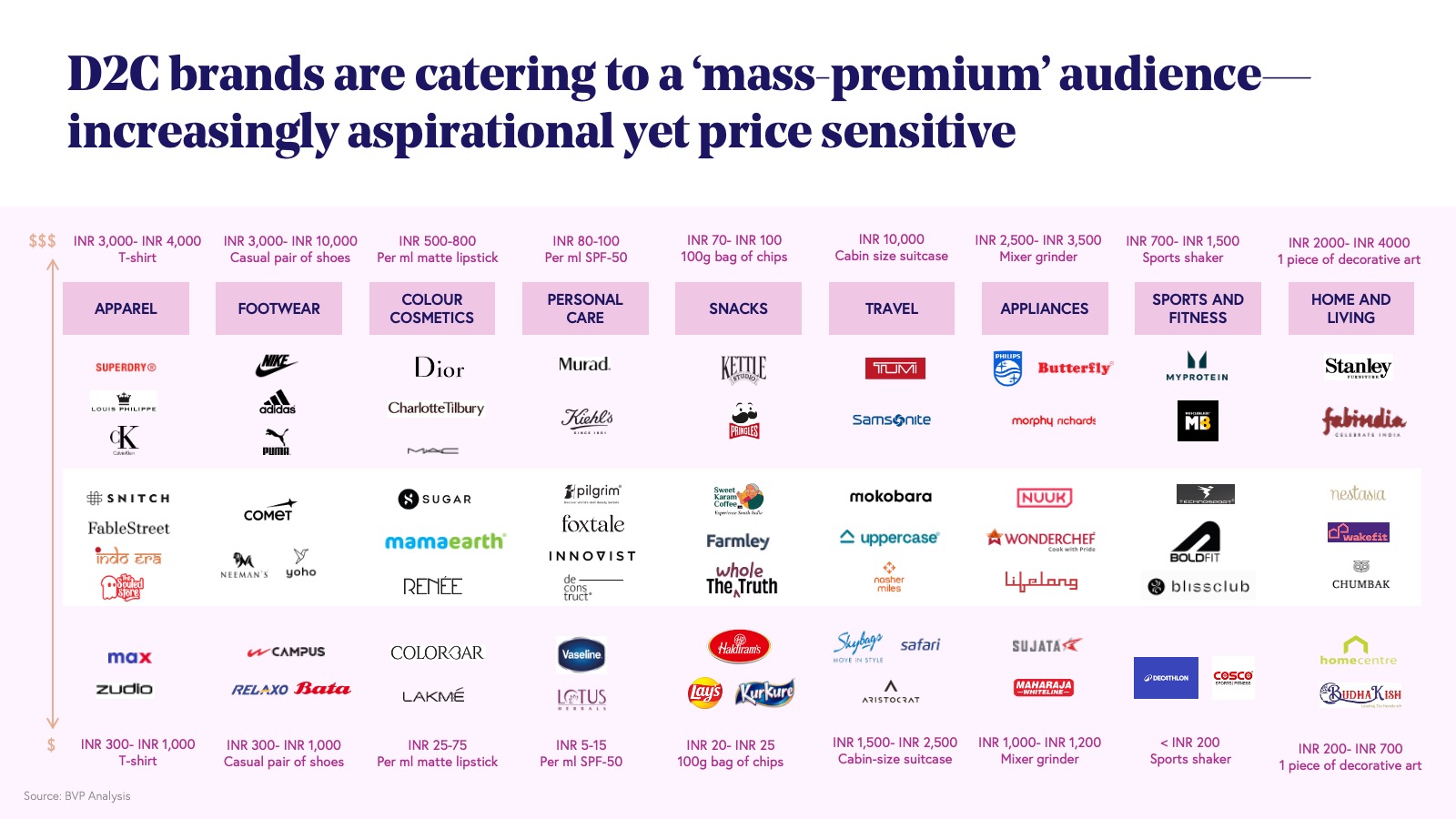

This democratization of distribution has been accompanied by a marked change in consumer preferences with a demand for newer, better priced, more aspirational, and higher quality products. Entrepreneurs have grabbed this opportunity with a proliferation of brands across virtually every category. Be it Boldfit or Blissclub in sports and fitness, Mokobara or Uppercase in travel, Snitch or NEWME in fast fashion, Lifelong or Nuuk in appliances, Minimalist, Innovist, or Deconstruct in beauty, Nestasia or Indus Valley in home and living, Comet, Neeman’s or Yoho in footwear—the list is endless.

Today, the Indian consumer has an aspirational, mass premium brand to choose in virtually every category. This brings us to believe in two key opportunities that emerge for the next decade: the rise of q-commerce and the emergence of new-age D2C brands.

II. Content: Entertainment comes home

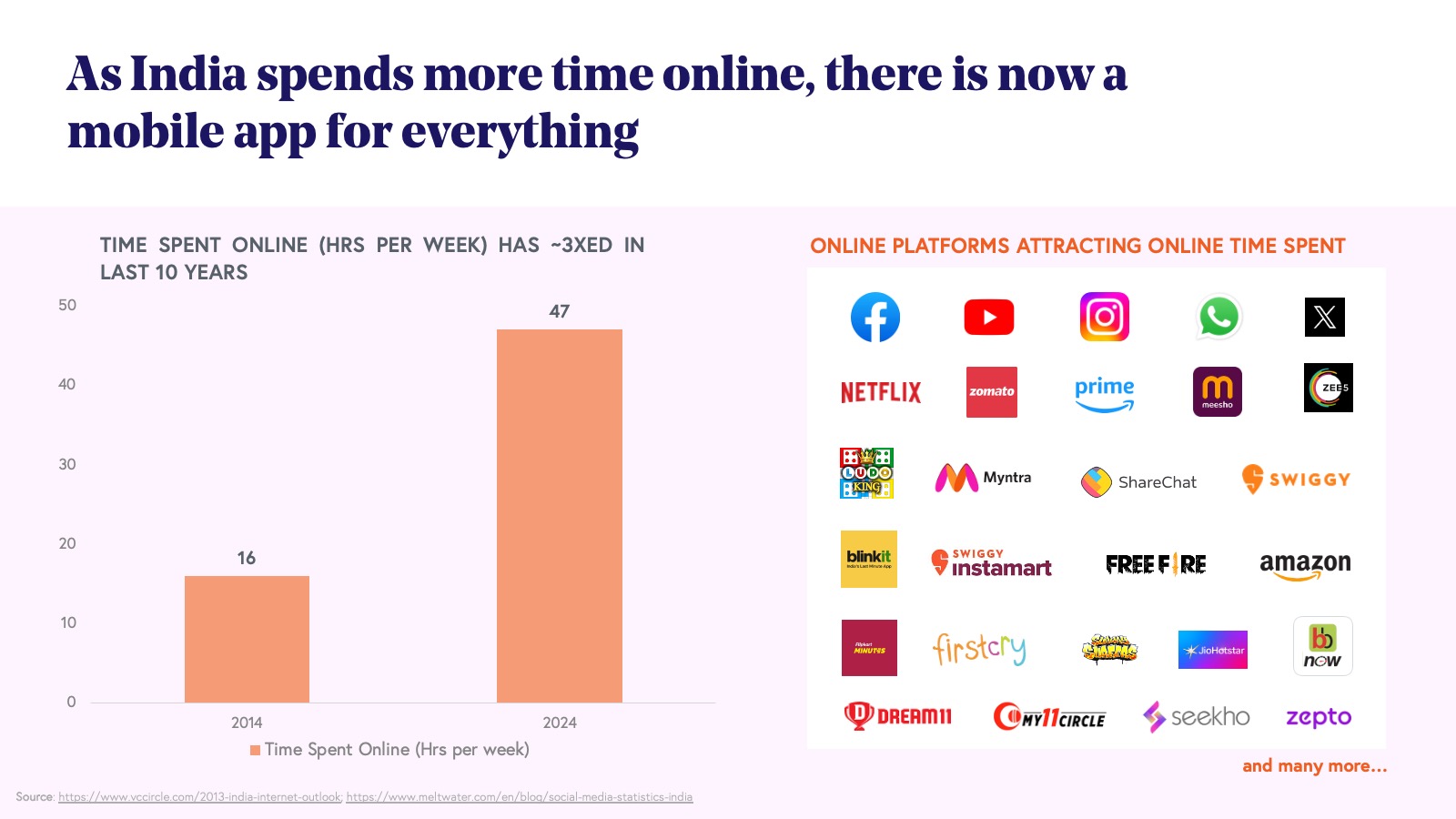

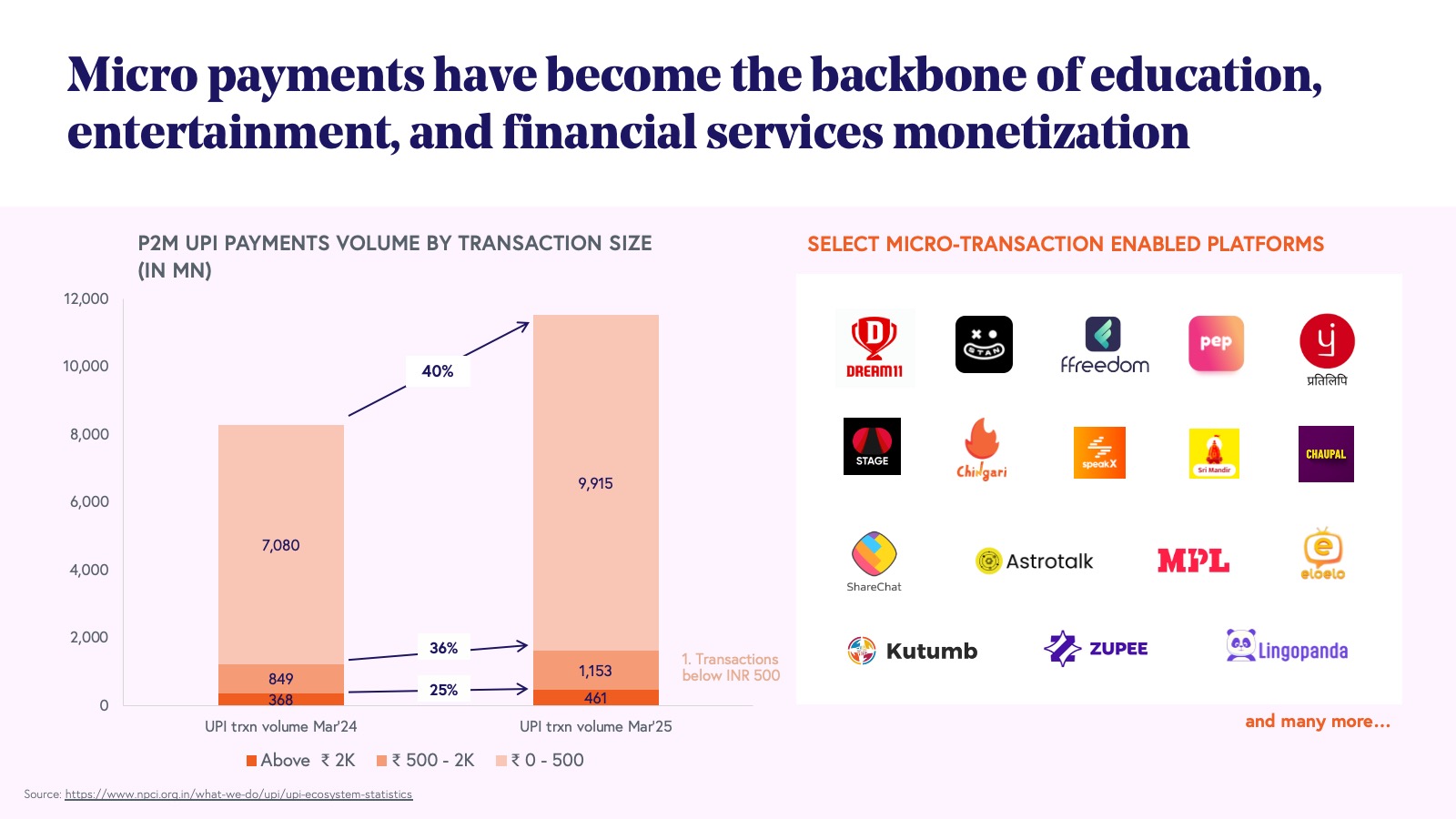

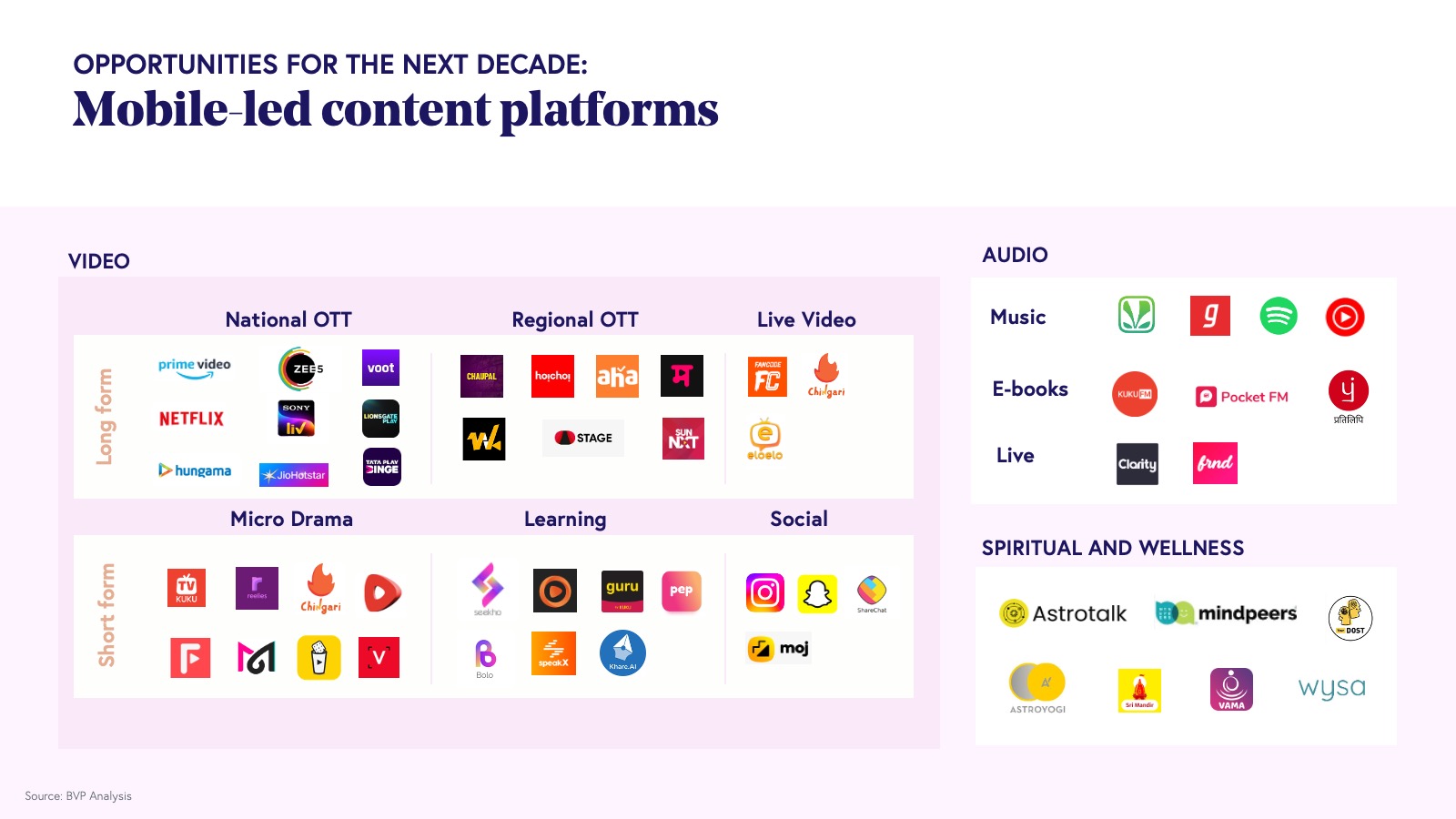

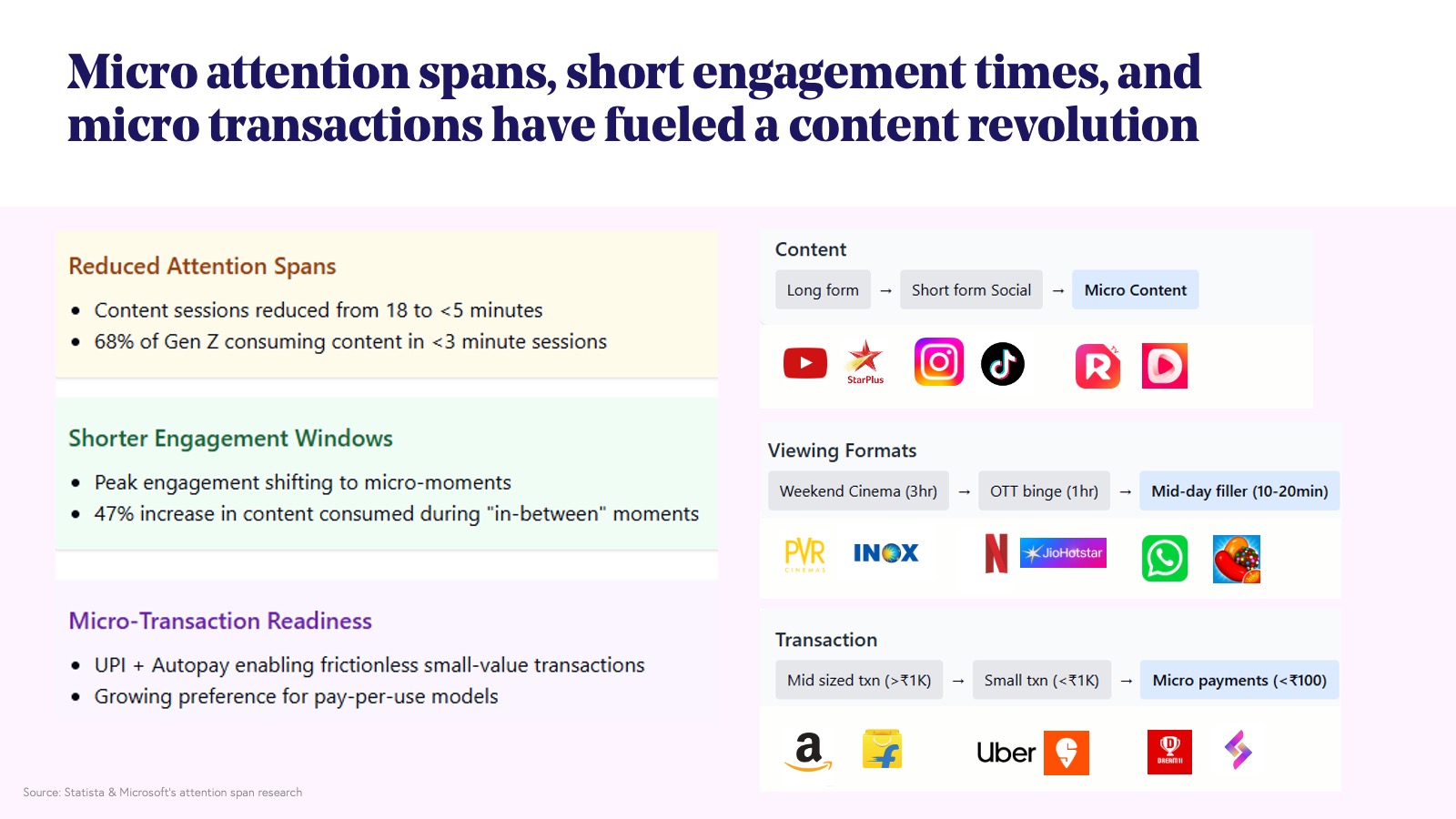

India is experiencing a content revolution driven by consumers' diverse appetites for entertainment, education, and gaming. Characterized by short attention spans and a multitude of accessible platforms across interests, languages, and budgets, user engagement is rapid, facilitated by frictionless microtransactions or subscriptions on autopay.

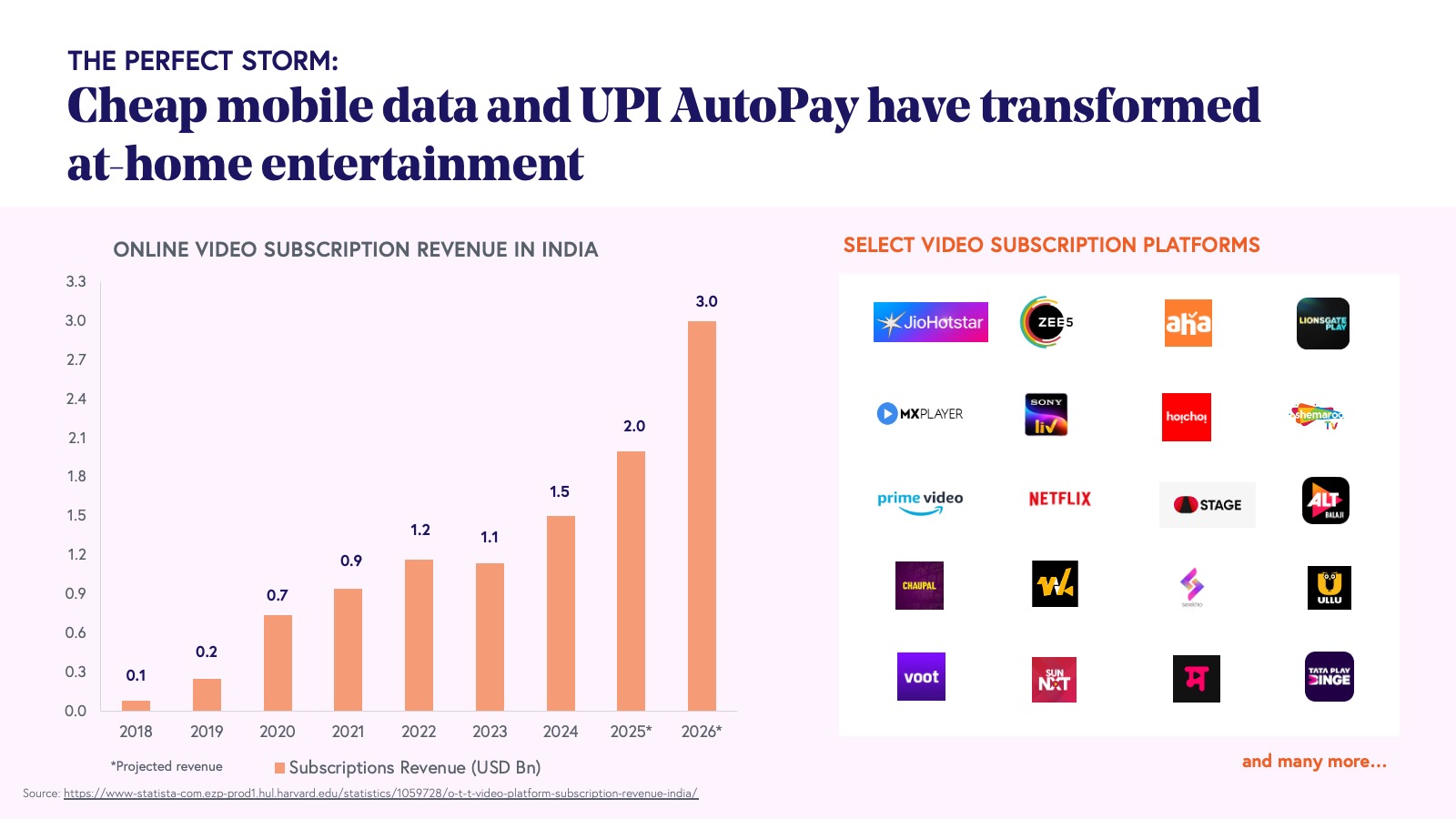

Platforms are adapting to these shorter attention spans with quick and engaging content. Over the past five years, short-form video platforms in India have witnessed 3.6X growth in daily active users, competing with mainstream digital platforms. Projections indicate the online video subscription market in India is anticipated to grow from $700 million in 2020 to $3 billion by 2026. The rise of “virtual tipping, tipping for services through a digital payment platform, is expected to reach $700-800 million by 2029 and exemplifies the growth of UPI-enabled microtransactions.

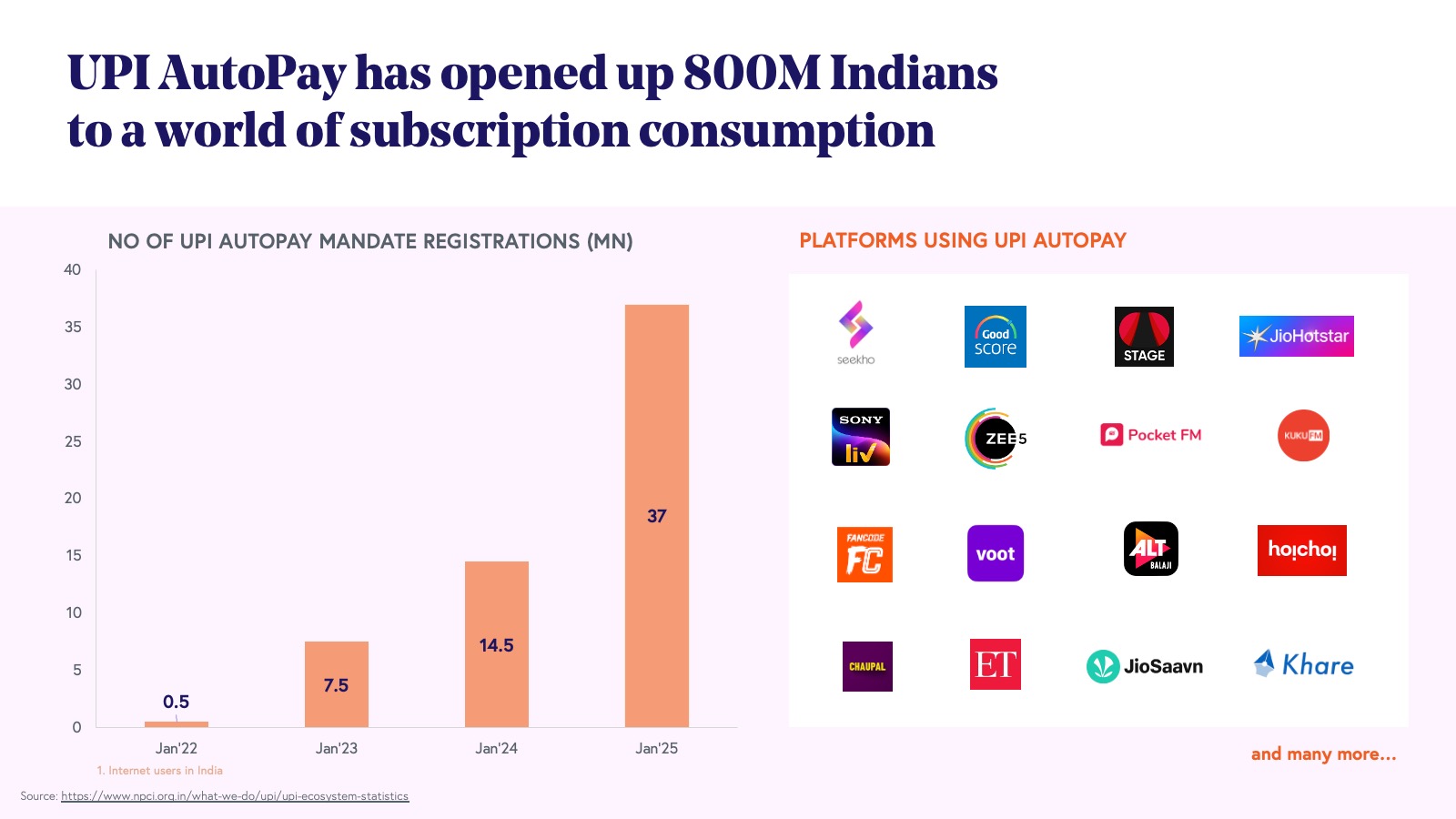

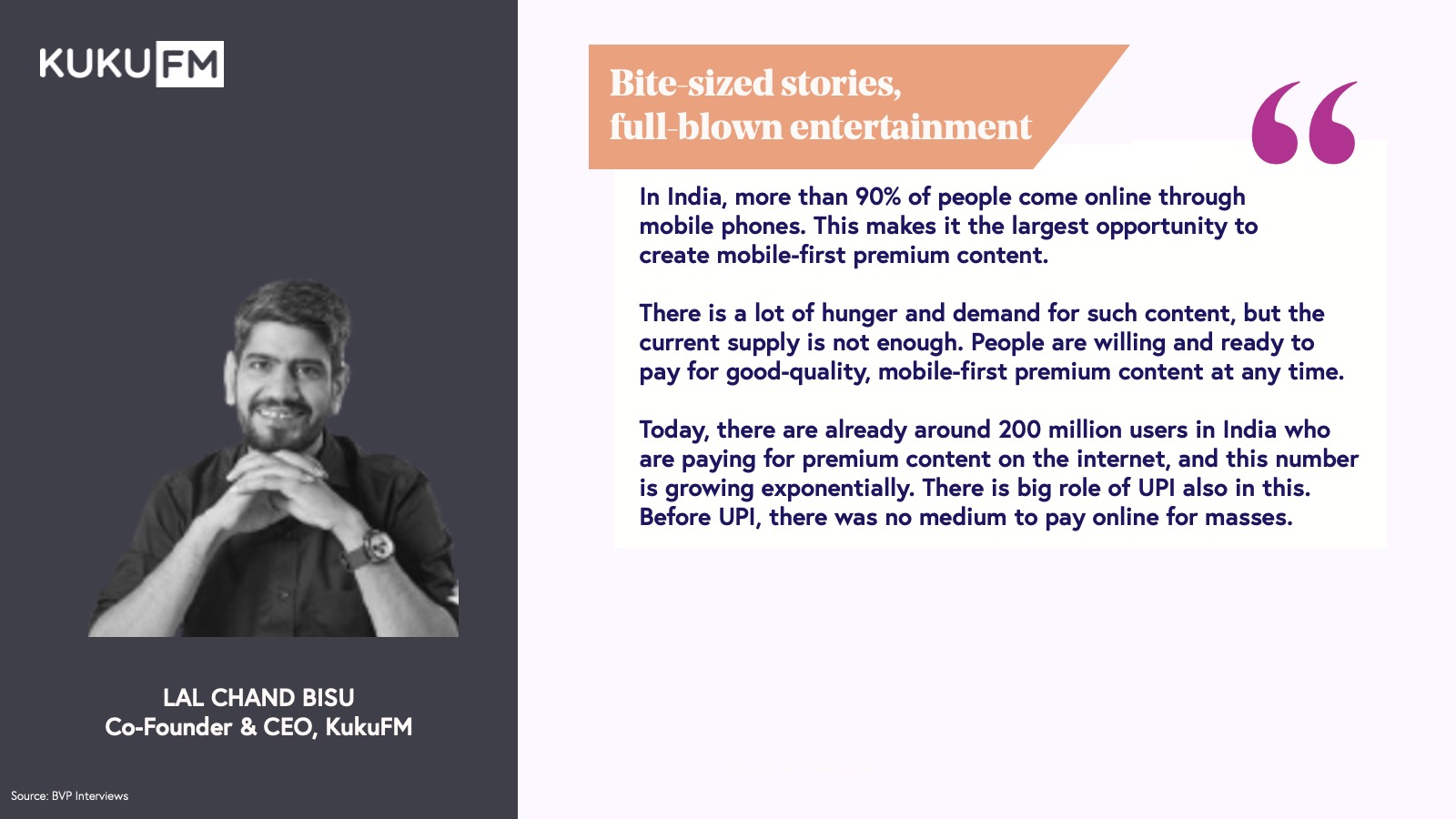

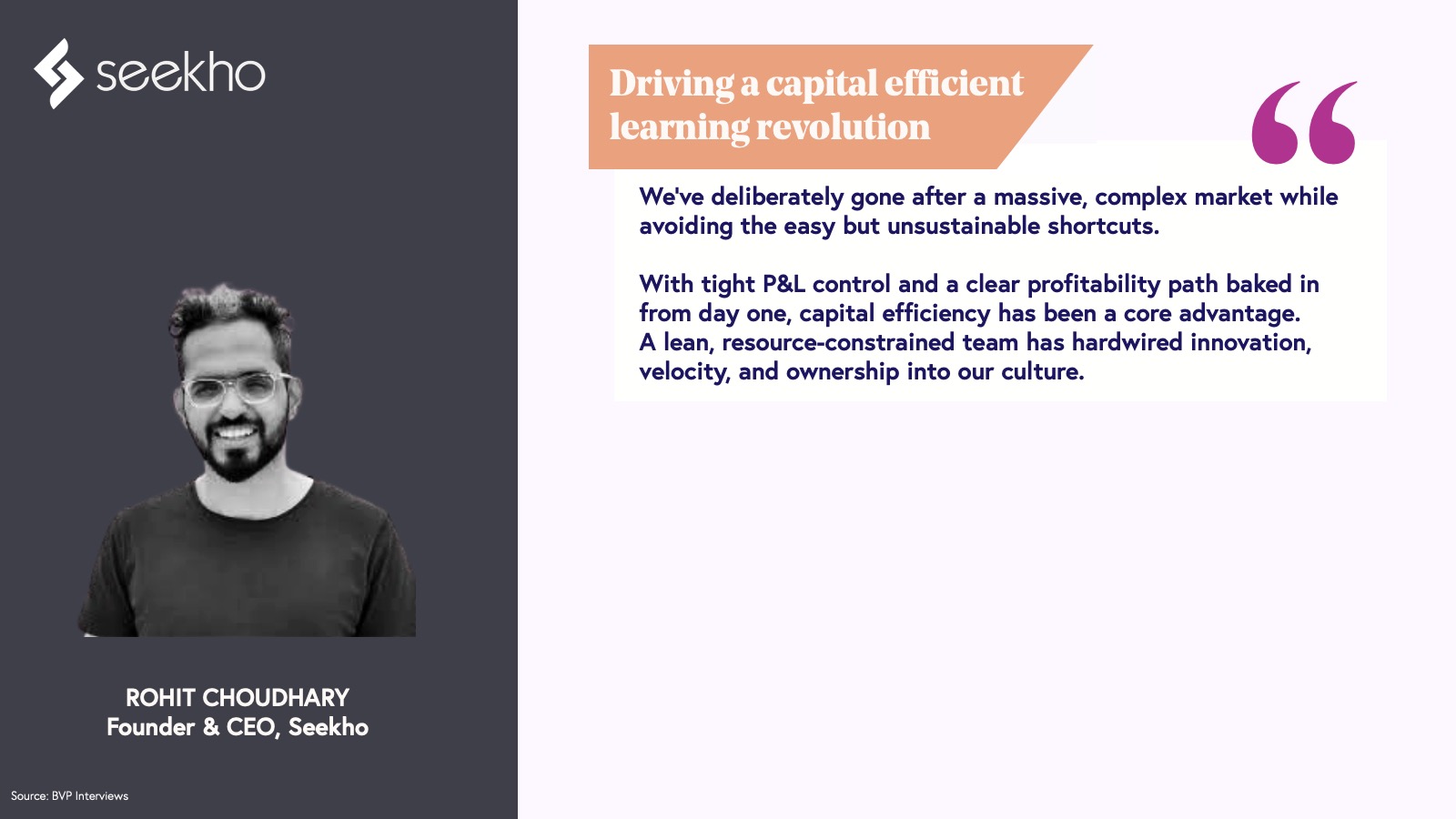

UPI autopay has also significantly boosted the content value proposition by enabling the 800 million internet users in India to participate in subscription or pay-as-you-go models. This surge has led to the emergence of content platforms in various formats and regional languages, spanning entertainment and education. Companies like KukuFM in audio, Seekho in education, Clarity in mental health, SpeakX in education, and Stage in dialect-based entertainment are capitalizing on this trend, with further expansion expected in areas like micro-drama, digital wellness, and gaming.

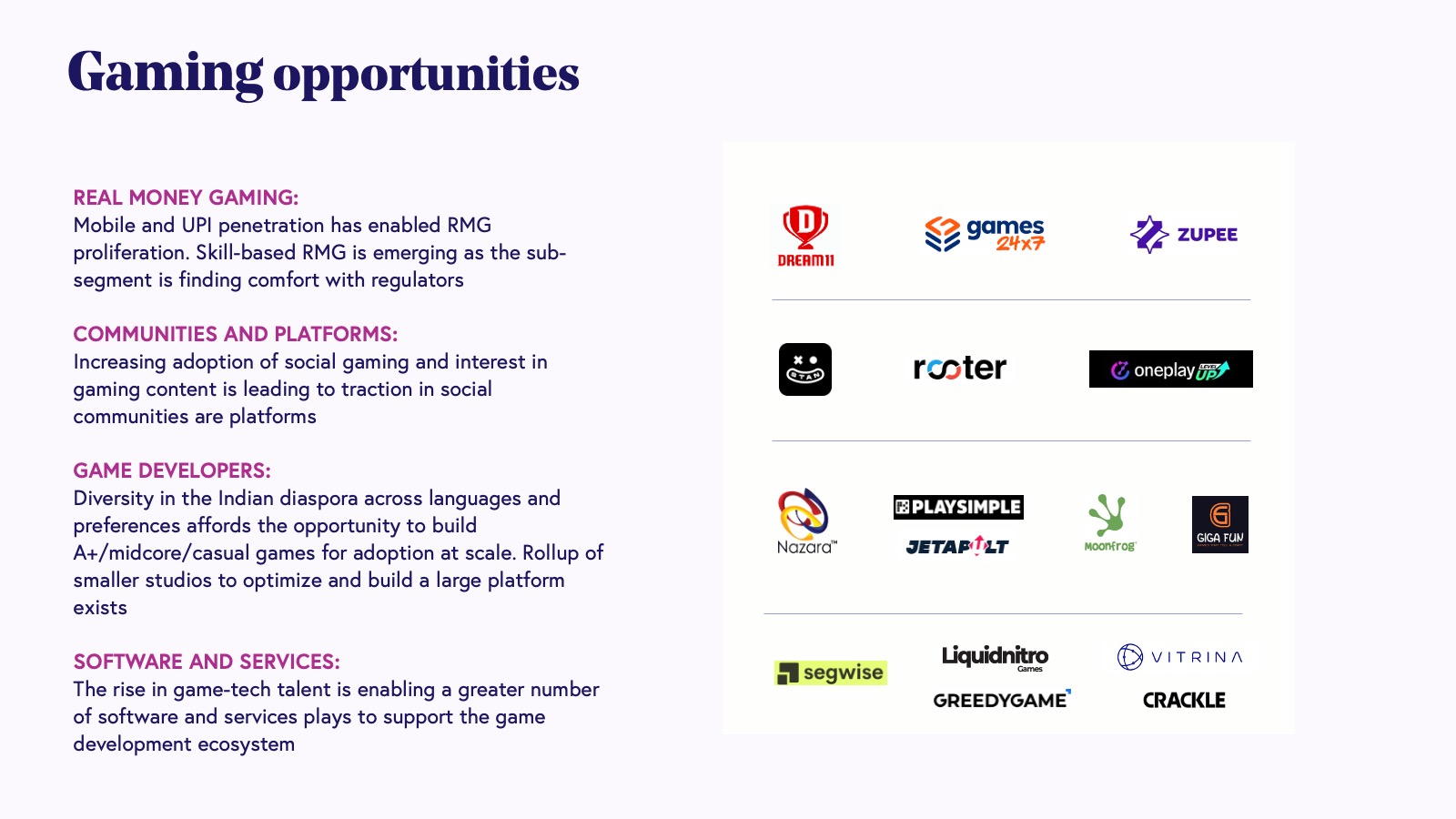

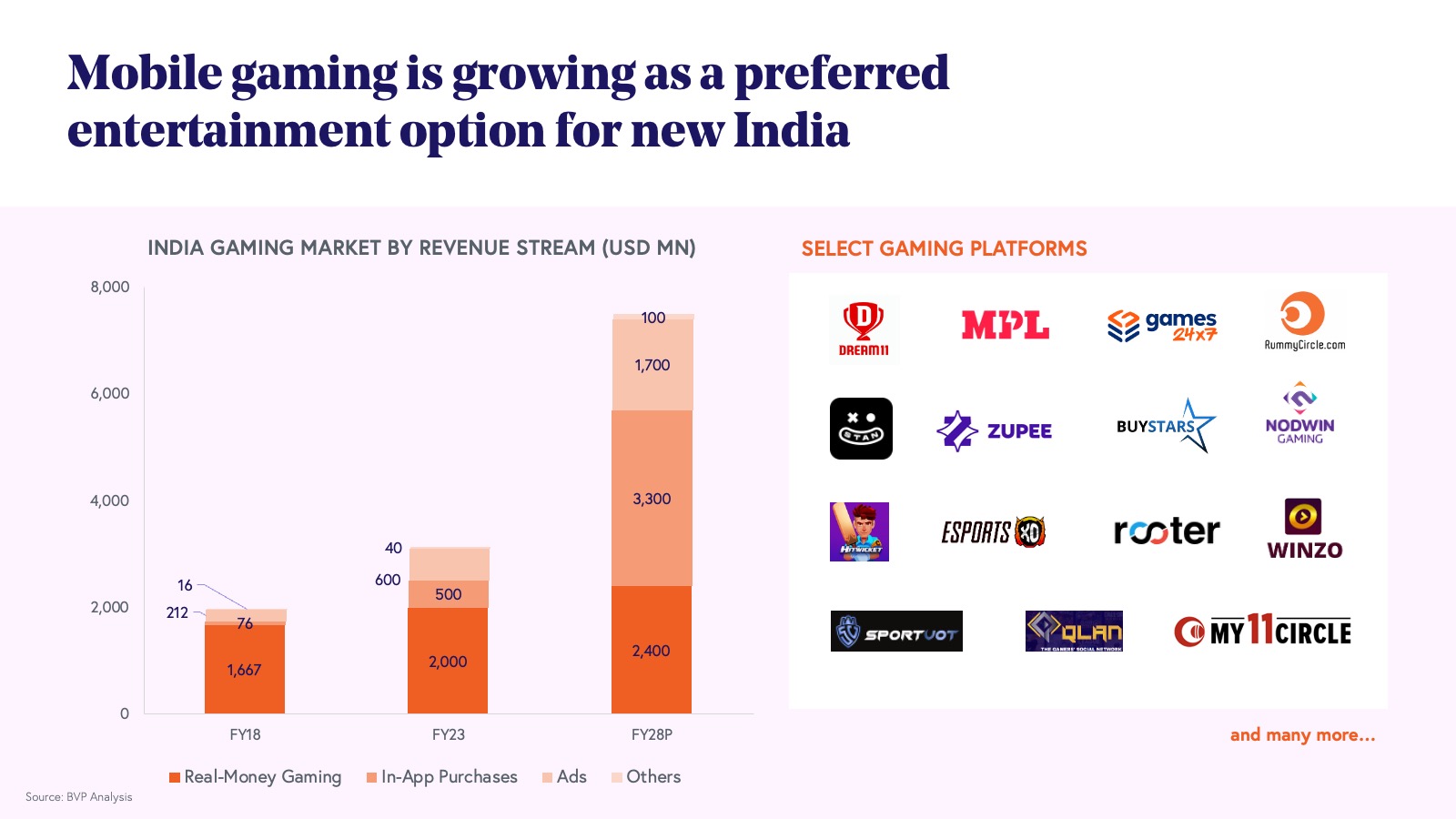

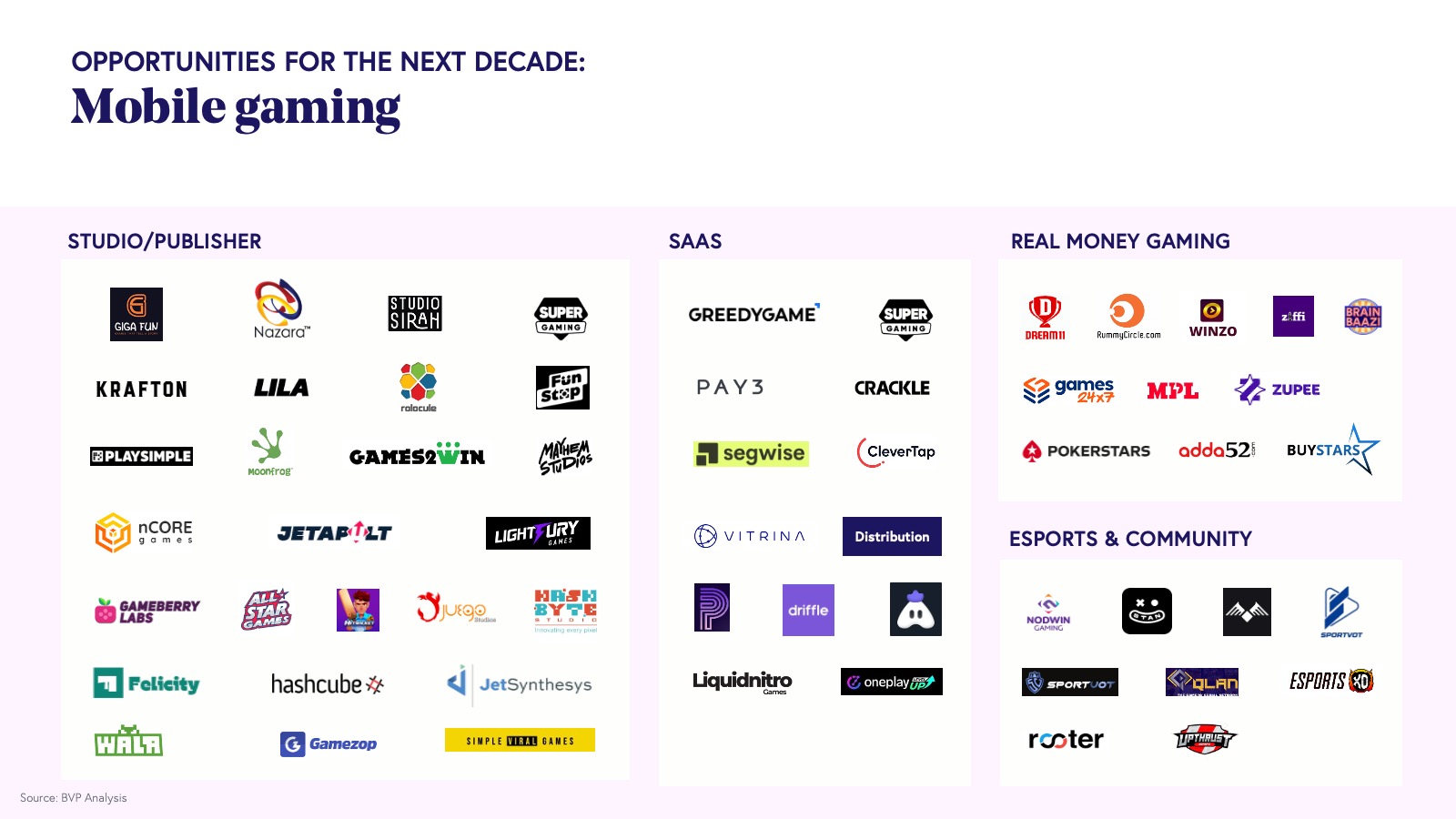

In addition to content, as India’s middle class has prioritized entertainment with their disposable income (and time), gaming has been a beneficiary, with the country’s total gaming market growing from $1.9 billion in 2018 to $3.1 billion in 2023 and projected to reach $7.5 billion by 2028. This is largely due to in-app purchases, with local and global companies alike growing the ecosystem. Ease of micropayments has helped fast-track this adoption as well. From real-money games, social games, and e-sports to software and services, the entire segment is gaining traction.

This again brings us to two more new opportunities for the next decade: mobile-led content and gaming platforms.

III. The rise of new lifestyle and consumption habits

The modern Indian consumer’s choices increasingly prioritize what were previously seen as lifestyle spending. These include previously thought “nonessential” spending in areas such as physical and mental health, financial wellness, and pet care. This expenditure has moved from being a good-to-have to a must-have for Indian consumers.

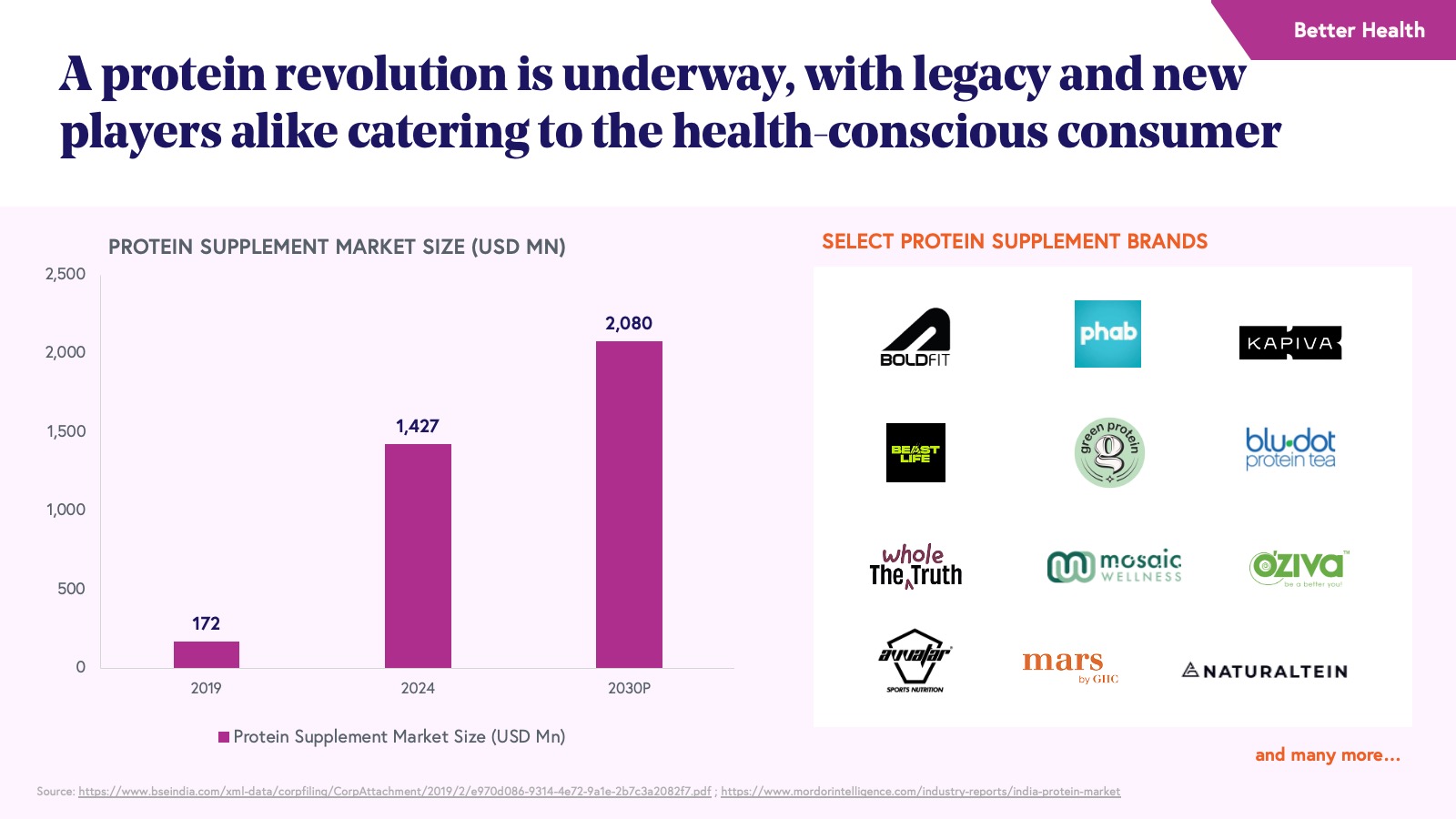

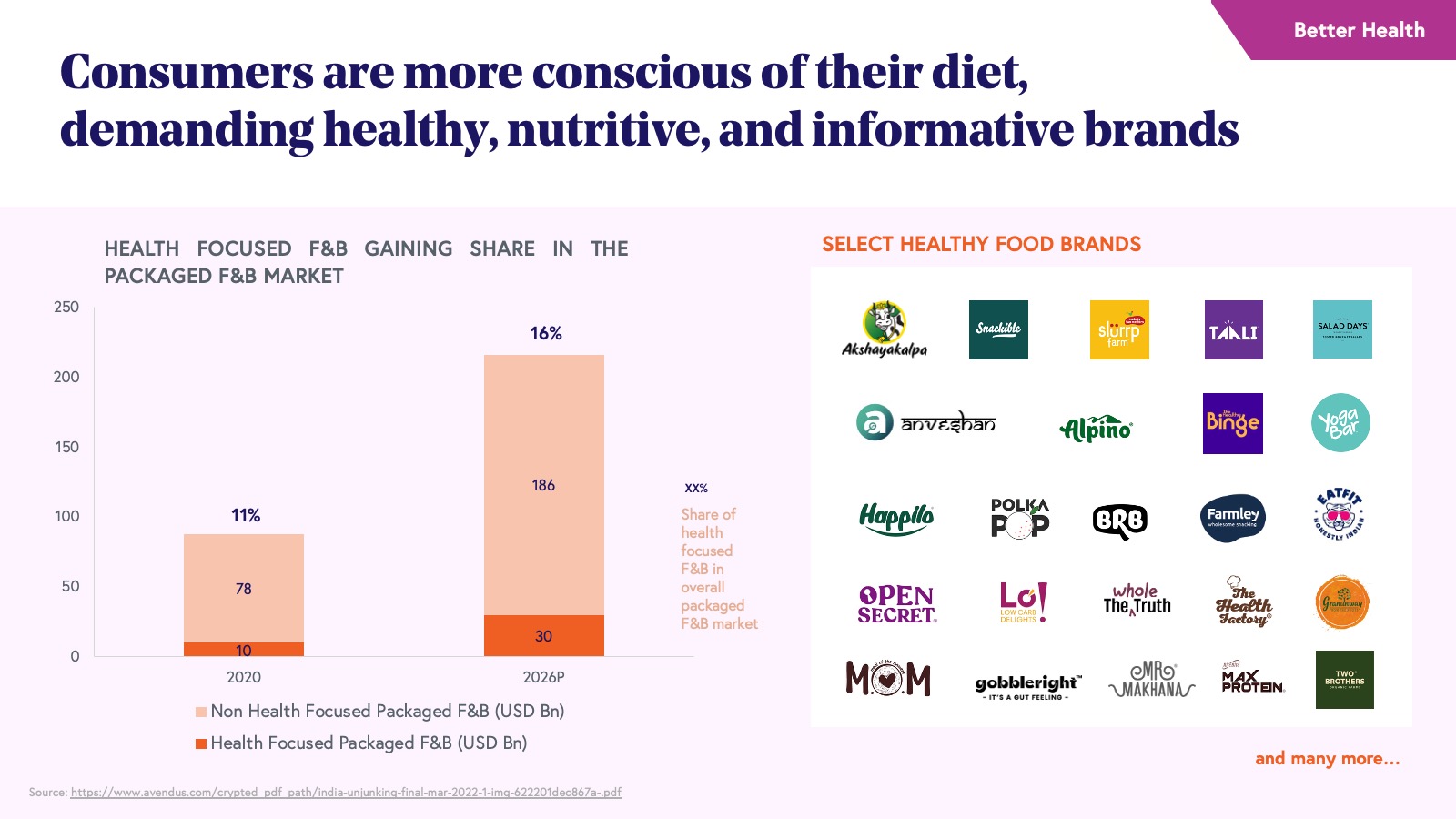

There is increased spending on organic food, protein, fitness gadgets, preventive healthcare, and wellness services. Health-focused food and beverage (F&B) has expanded from ~11% to ~16% of F&B spend and is expected to continue to increase, as brands have been quick to adapt to this trend. Protein-rich foods, for example, have quickly become a fast-growing consumption category, with nearly every F&B brand - from legacy brands like Amul to newer ones like Boldfit, The Whole Truth Foods, Yoga Bars, and Kapiva - have launched protein and protein-related products.

Another beneficiary of this wellness trend has been science-backed personal care products with brands like Minimalist, Innovist, Wishcare, and Deconstruct rapidly emerging. A similar movement is being seen in gut health with brands like The Good Bug and TruNativ emerging into mainstream retail. We expect to see many more such health and wellness-focused brands and platforms to emerge in the coming decade.

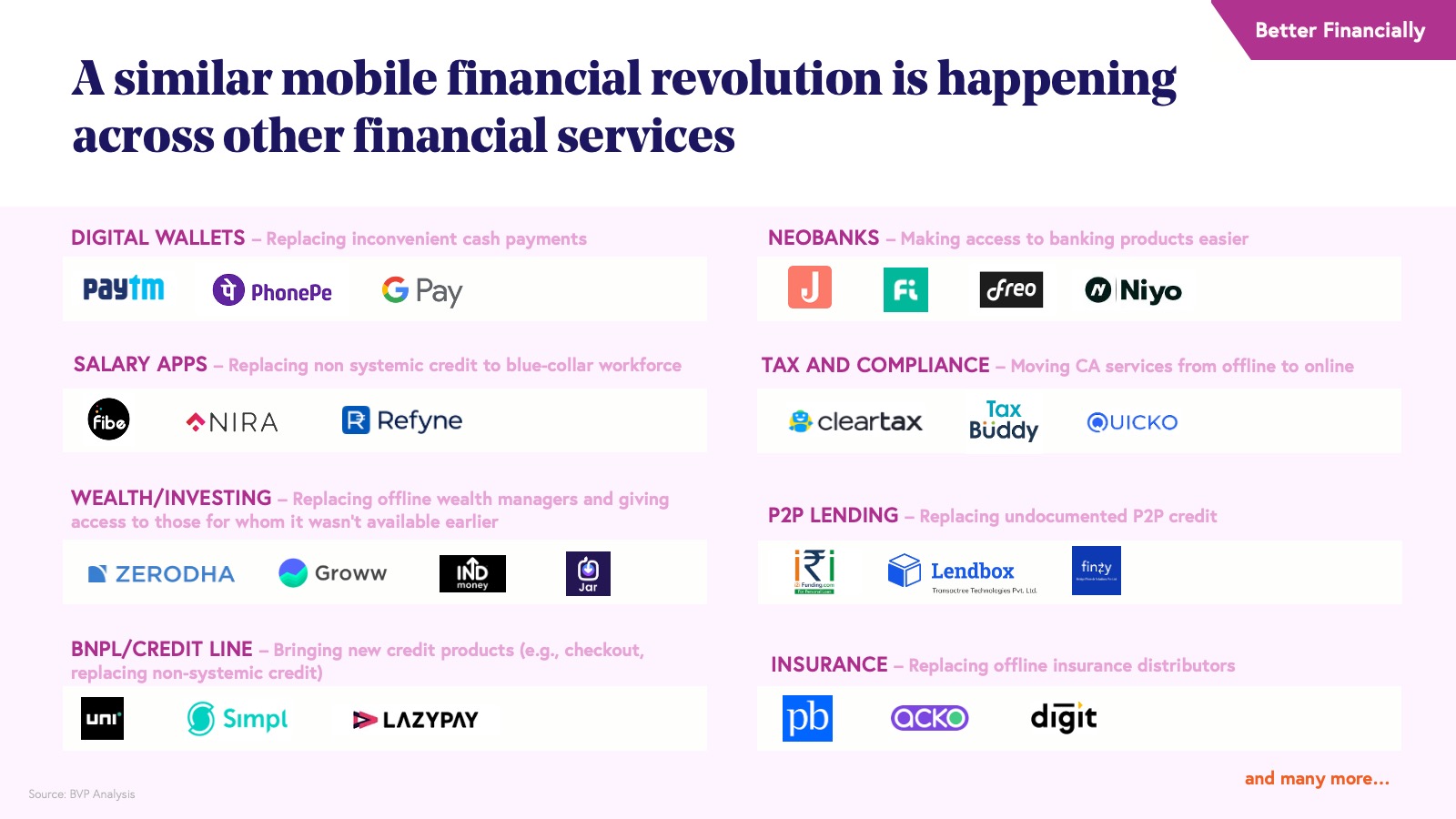

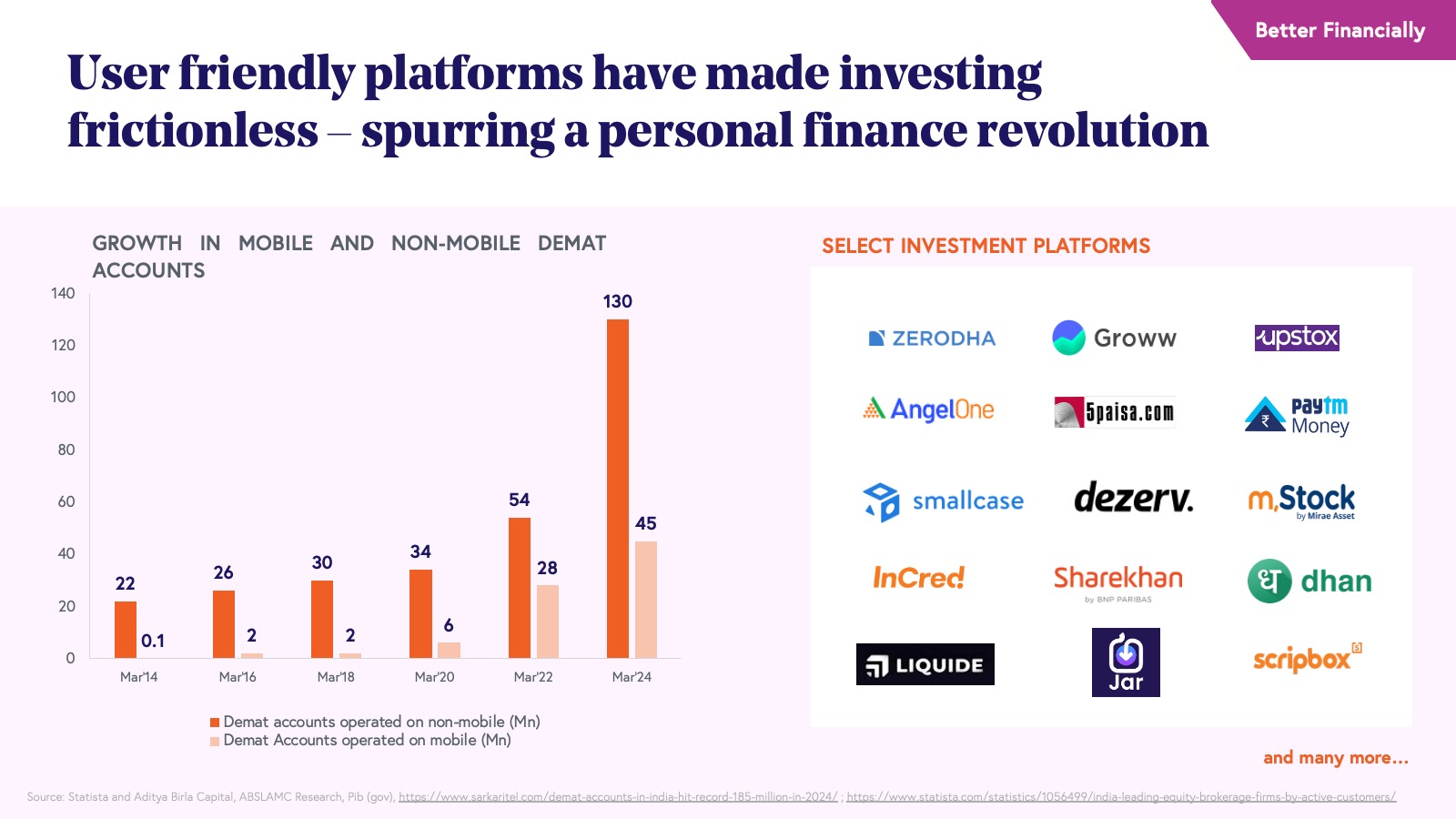

Increased ownership of smartphones, combined with vernacular content (i.e., tailored to regional dialects) and digital literacy efforts has also opened the doors to better financial awareness. India’s financial landscape is in the midst of a tectonic shift, propelled by the confluence of robust digital infrastructure, progressive regulation, and a mobile-first, hyper-personalized approach to consumer finance.

At the heart of this transformation is the Unified Payments Interface (UPI), which processed a staggering 18.3 billion transactions in March 2025 alone. Every 10% increase in UPI usage has correlated with a 7% rise in credit availability without a corresponding spike in defaults, underscoring its role in responsible credit expansion.

Meanwhile, the Account Aggregator (AA) network is reshaping personal finance by enabling consent-driven data sharing across banks, non-banking financial companies (NBFCs), and fintechs. This empowers consumers with holistic, real-time access to credit, investment, and insurance products tailored to their financial lives.

A young, aspirational India is now demanding intuitive, personalized financial services. This revolution extends naturally into wealth creation. Almost 8 million new consumers are expected to enter the wealth industry on the back of digital and mobile-led financial distribution between 2022 and 2025. The surge in demat accounts (“dematerialized;” i.e., digital accounts holding financial securities), driven by seamless digital onboarding and user-friendly trading apps, signals a new wave of retail investor participation. Platforms like Zerodha, Groww, Dezerv, and Angel One have led the charge, onboarding millions of new investors from smaller towns and cities - underscoring the demand for low-cost, mobile-first investment experiences.

Mutual fund investing has also been profoundly democratized. Systematic investment plan (SIP) contributions grew 45% in FY25 to nearly $35 billion, supported by over 81 million active SIP accounts. Digital platforms now enable instant smartphone-led SIP setup (also powered by UPI Autopay), frictionless daily savings via digital gold, real-time portfolio tracking, and AI-led personalized recommendations, bringing disciplined investing within reach for a broader base of retail investors. The rise of neobrokers and robo-advisors, now powered by these digital rails, has fueled a fundamental behavioral shift. Indians are no longer just trading more, they are embracing long-term, goal-based investing through digital channels.

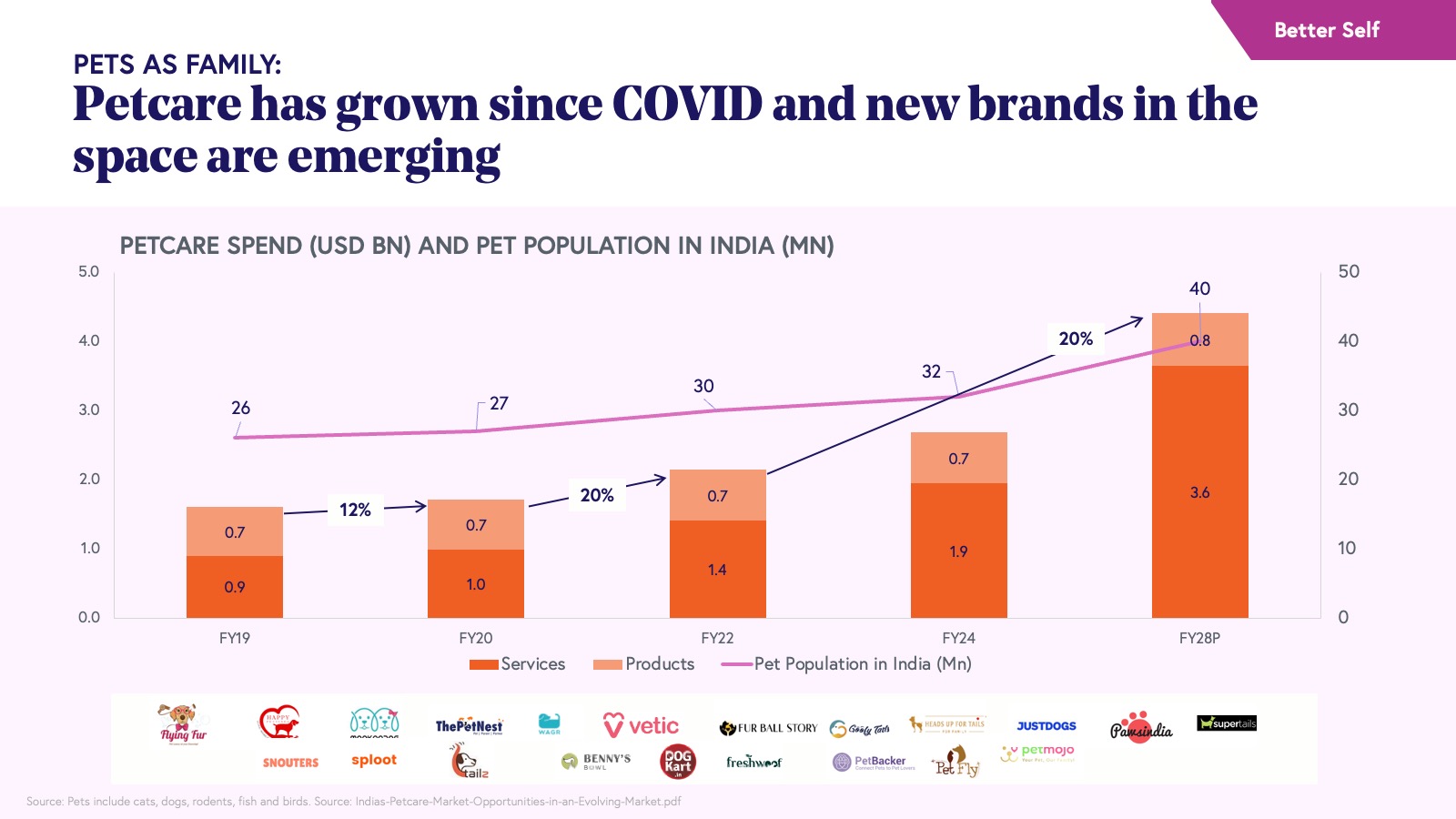

Another major area that has seen an entire new category being created is petcare. In India today, investing in petcare has gone from a niche luxury to family care, with Millennials and Gen Z increasingly identifying themselves as “pet parents.” Brands are on the rise to offer pet food, grooming, healthcare, and accessories as owners prioritize their pets’ comfort and wellness. Spending in this category has doubled since FY 2019-20, reaching $3.6 billion in FY 2020-24, and it’s projected to hit $7–7.5 billion by FY 2027-28.

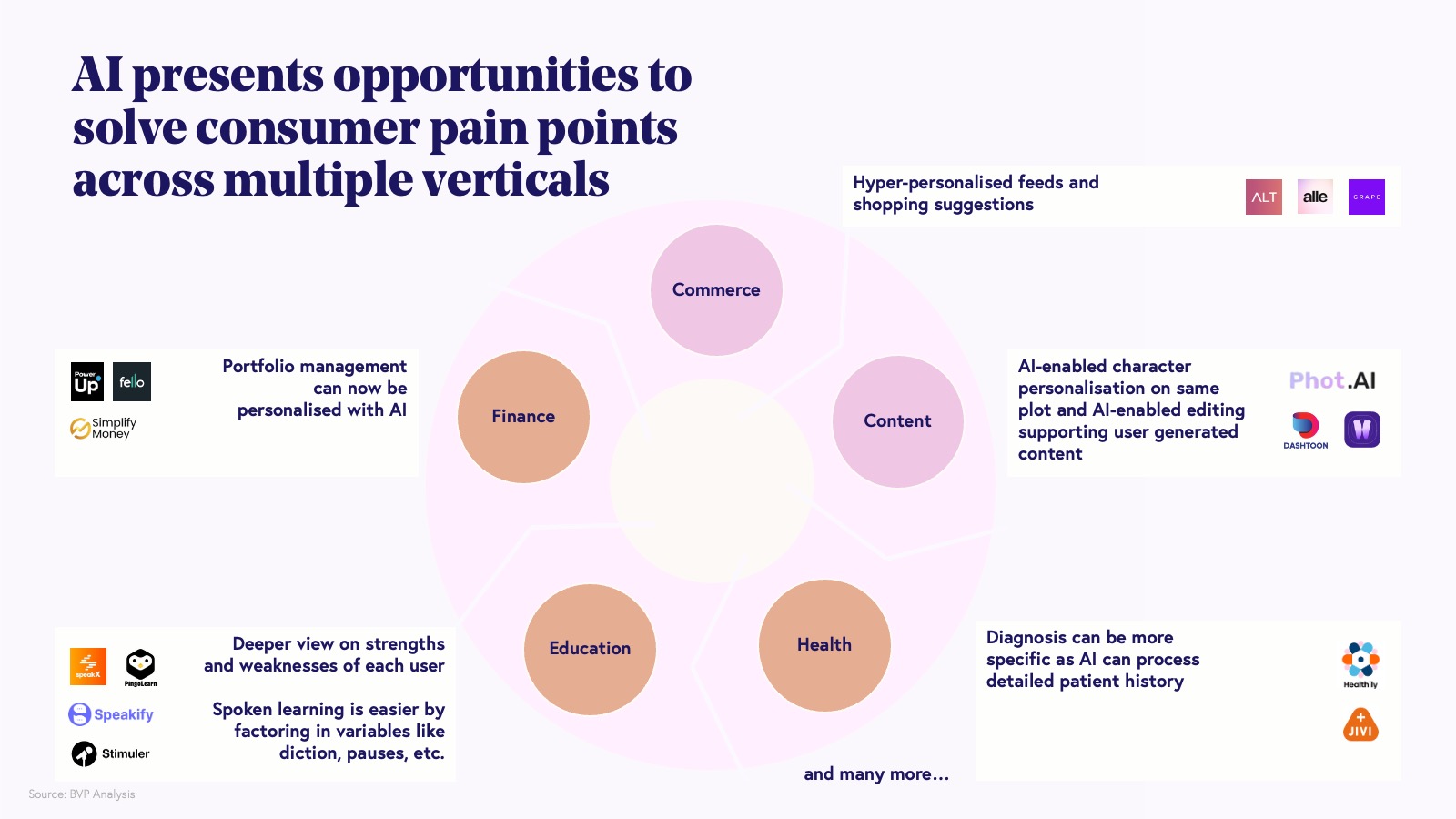

The promise of AI in India’s consumer landscape

AI may be the single most important technological innovation for India that has emerged since UPI, or even the internet itself. Not surprisingly, it has led to a boost for Indian consumer businesses across commerce, content, health, finance, education, and other domains. The benefits of AI are different for different businesses. For instance, AI allows commerce catalogues to be more personalized, content can be created more cheaply at scale, education can be delivered with higher accuracy and lower cost, healthcare and financial services can be more easily accessible, and so on. While we’d need a whole another report to cover all the impacts of AI on Indian consumer internet, it seems safe to say if you’re an Indian consumer internet business not leveraging AI, then you may be missing out.

How to build an enduring consumer business

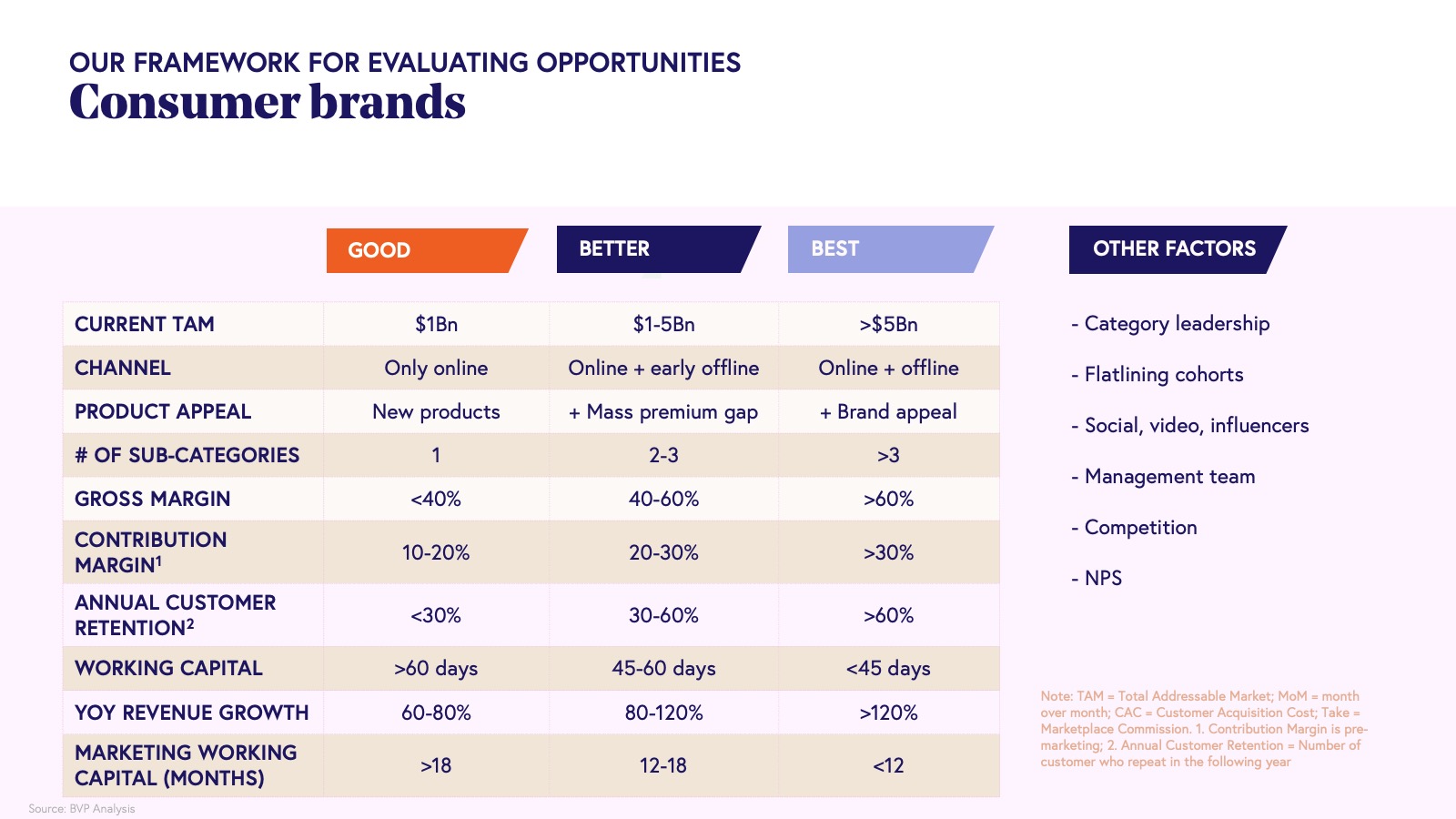

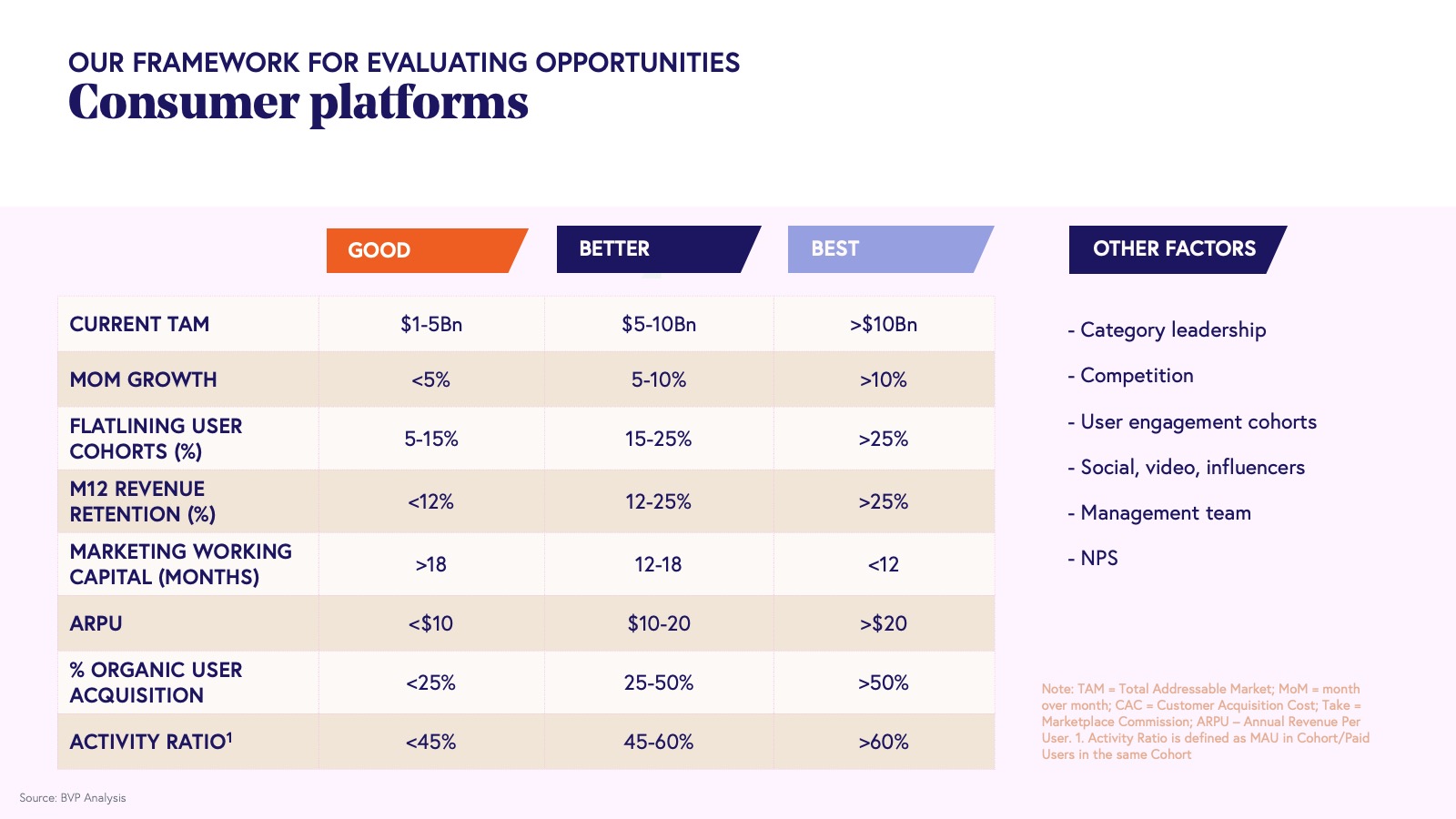

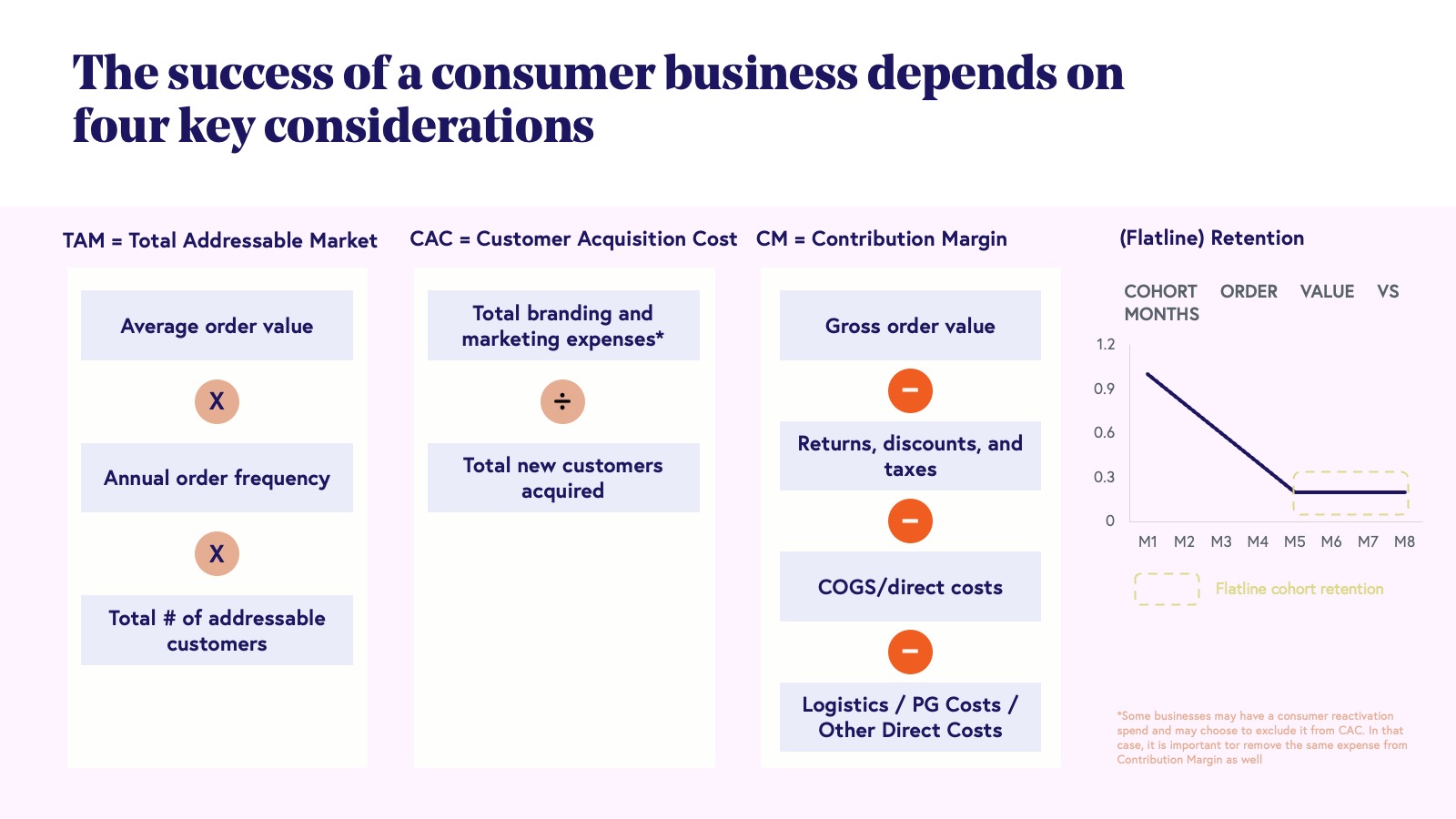

As entrepreneurs build businesses to tap into this consumer revolution, a fundamental question arises: What are the markers of a healthy and enduring business? We believe that building a robust consumer business in India depends on an interplay of four forces: total addressable market (TAM), consumer acquisition cost (CAC), contribution margin (CM), and flatline retention.

Total addressable market (TAM)

With 1.48 billion people, it is easy (and often correct!) to assume that most markets in India are large. However, there are many Indias within India and the true opportunity size for a business is shaped by the utility of its offering, its pricing, positioning, and its choice of channel. More simply put, a business’ TAM depends on a specific Indian persona, how many such people exist, how much they will pay, and how many times in a year they will pay.

We see the Indian market as a mosaic of distinct user personas, each with well-defined needs and unique engagement and transaction behaviors. Unlocking meaningful and sustainable growth in India’s consumer landscape requires a nuanced understanding of these personas and a relentless focus on maximizing both order value and frequency.

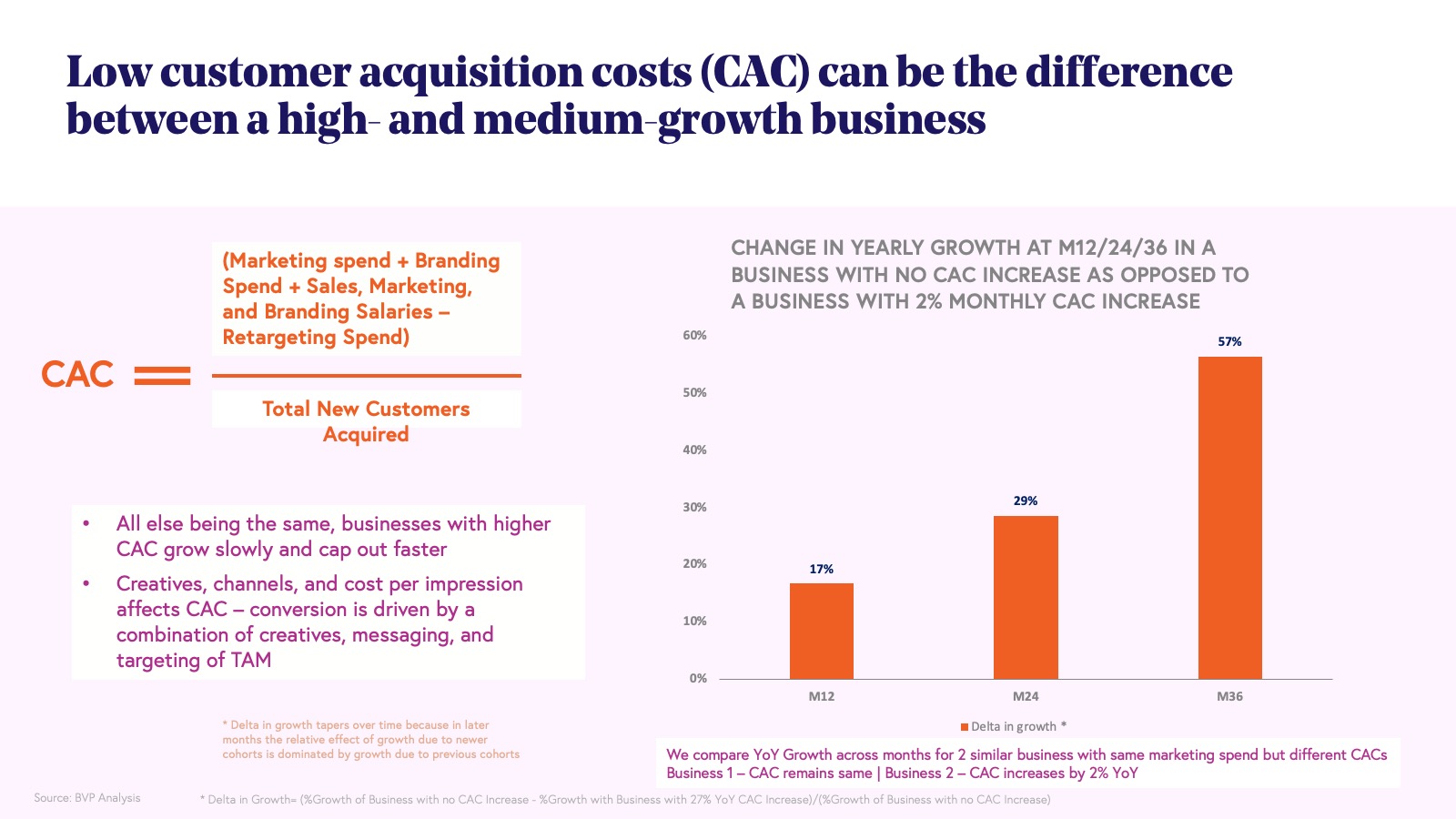

Customer acquisition cost (CAC)

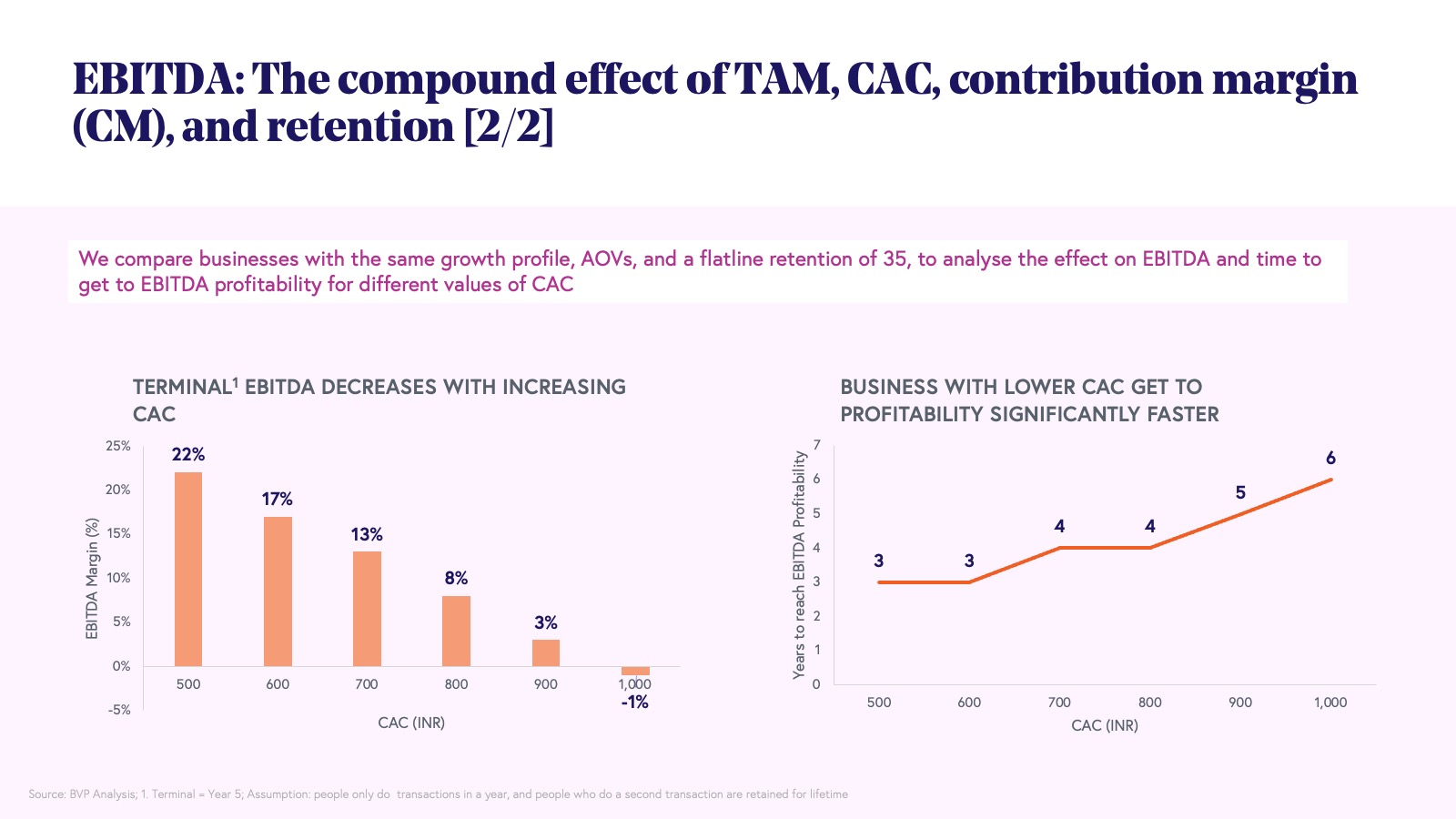

The biggest cost in any consumer business in India over the long term is often its CAC. A disciplined approach to calculating it involves considering the full branding and marketing outlay, while netting out any spend allocated toward engaging previously acquired customers.

Our sample analysis demonstrates that even a modest 2% month-over-month increase in CAC can materially impact a business’s growth trajectory. This underscores the importance of maintaining a sharp focus on acquisition efficiency, as incremental changes in CAC can compound over time and significantly influence the scalability and long-term success of a consumer business. More importantly, as a business grows and increases market share, the number of new customers available often reduces, thereby giving rise to the adage that CAC only increases with time. We think this adage, while not always correct, does have some truth in it - that is, as you cycle through the set of customers available for your business, unless you keep upgrading your product or introducing new offerings (expanding your TAM), CAC is likely to take a hit.

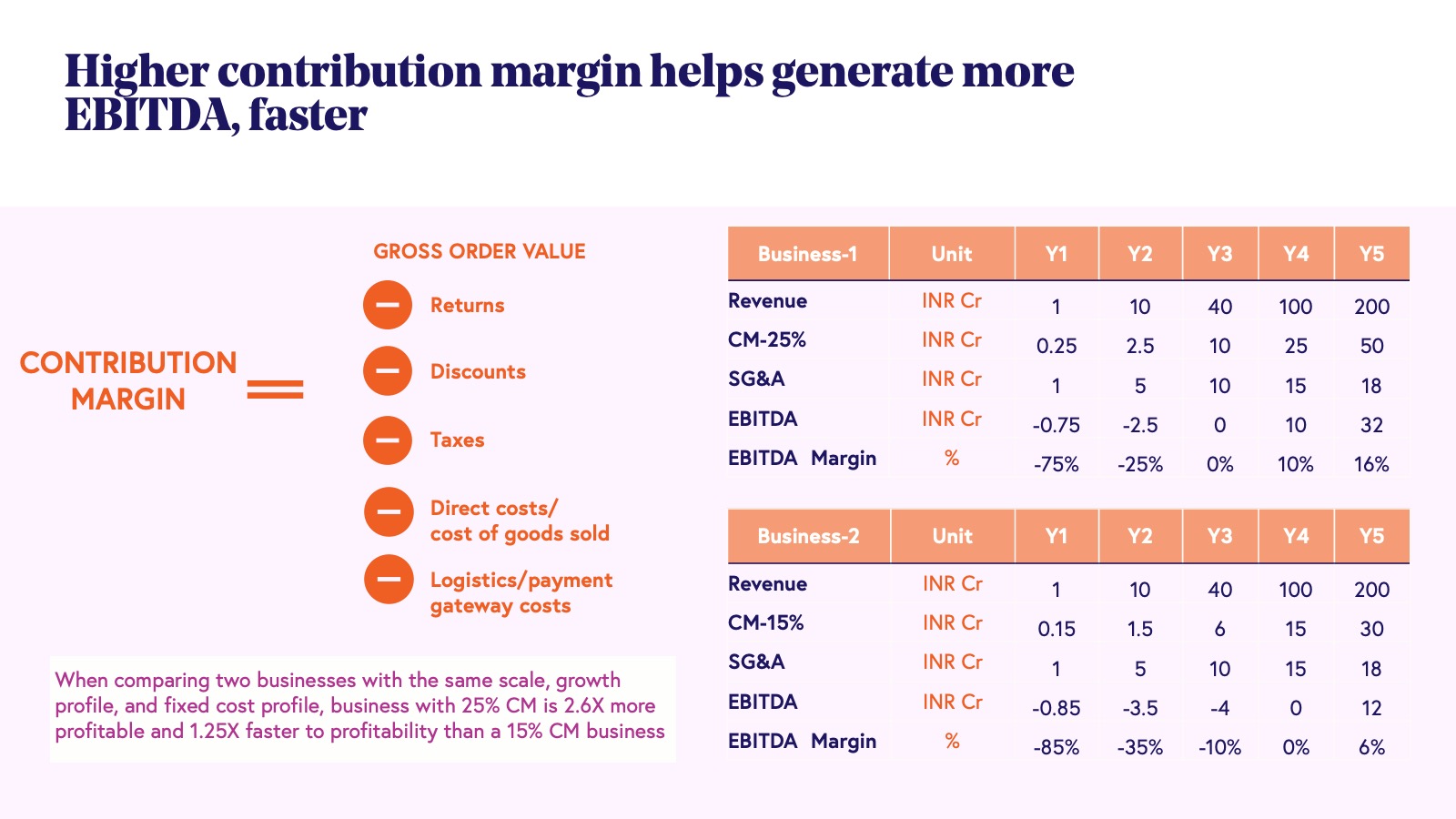

Contribution margin

Once we have clarity on which customers are being acquired and at what cost, the next step is to analyze the value a business can capture by removing the cost of servicing these customers. Specifically, it is necessary to determine the dollar contribution from each order after accounting for all the variable costs associated with fulfilling that order. This contribution margin, calculated as net sales revenue minus variable costs, is a critical metric for understanding the unit economics of a business. Contribution margin serves as a foundational driver of earnings before interest, taxes, depreciation, and amortization (EBITDA) at scale, as it reflects the portion of revenue available to cover fixed costs and ultimately contribute to profitability.

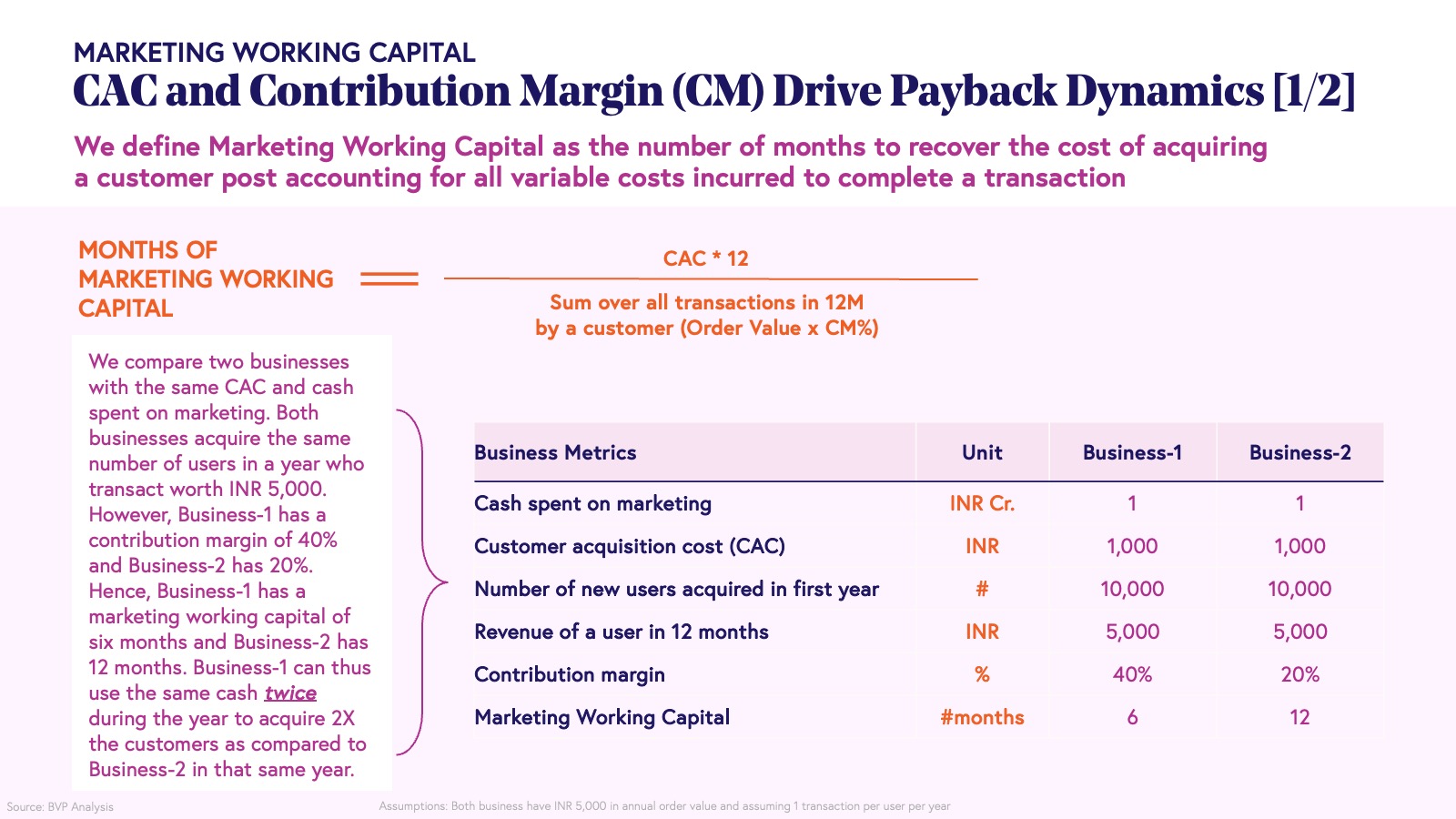

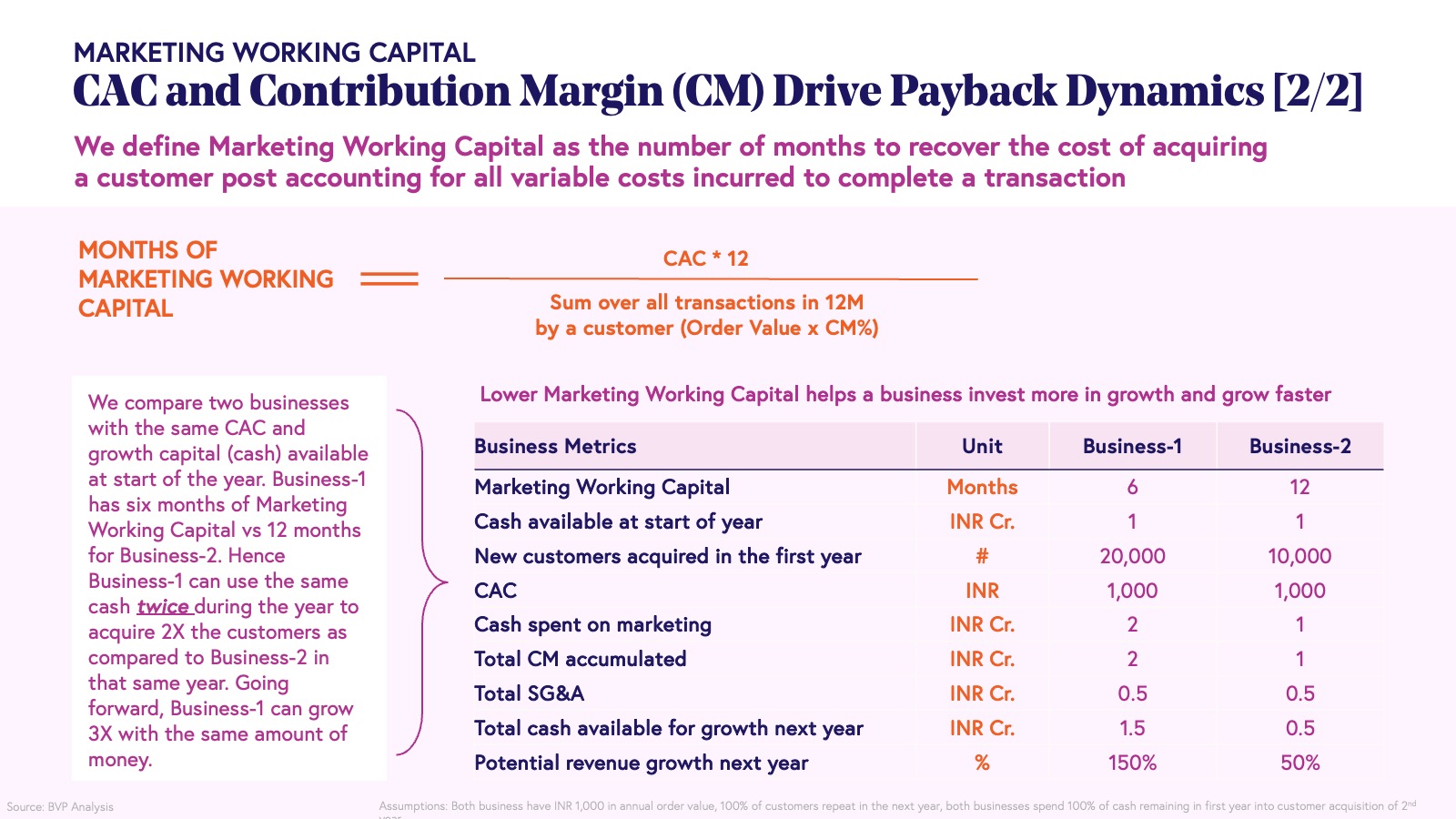

One adjacent concept to understand here is what we refer to as “Marketing Working Capital,” which is an interplay between CAC and CM. While traditional businesses have capital expenditures or upfront costs to recover, digital consumer businesses have a similar upfront expenditure in customer acquisition and brand building. Marketing Working Capital refers to the time it takes for a business to recover the contribution margin from all orders, sufficient to offset the acquisition cost incurred to bring a customer onboard. The speed at which a company can recoup its marketing spend from customer-generated cash flows directly impacts its ability to reinvest in growth and pursue other strategic initiatives.

Flatline retention

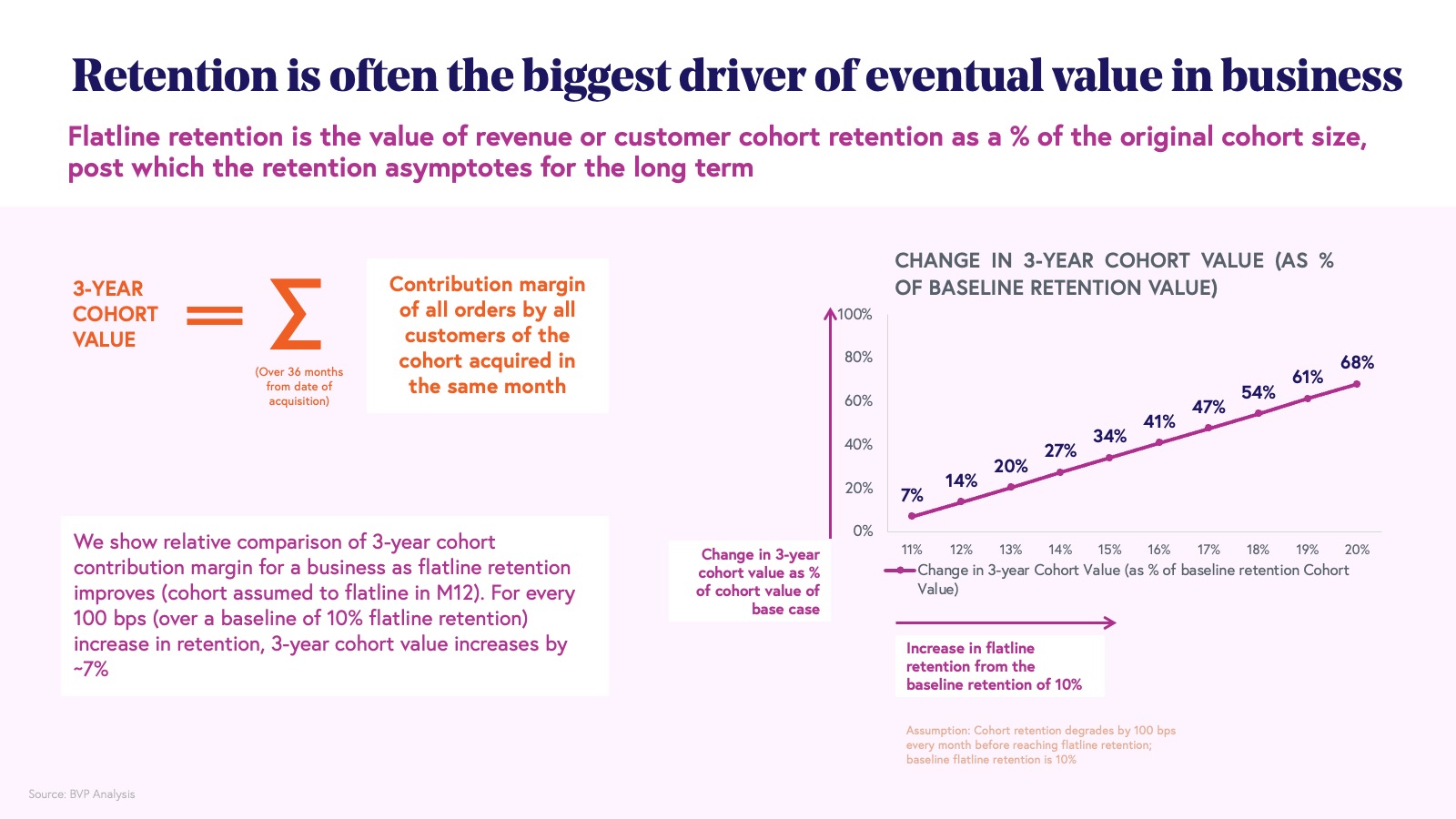

While any business may have a large TAM, customer preferences even within the TAM can vary and hence only a subset of customers will remain engaged over the long term — those who experience a strong and consistent product-need fit. Within every user cohort, the proportion of users who continue to engage with the product over time is referred to as flatline retention. This metric is fundamental to assessing the long-term outlook and profitability of a business, as these retained users tend to contribute disproportionately to the contribution margin over their lifetime. All else being equal, a business with 20% flatline cohort retention will realize a significantly higher three-year cohort value compared to one with just 10% cohort retention.

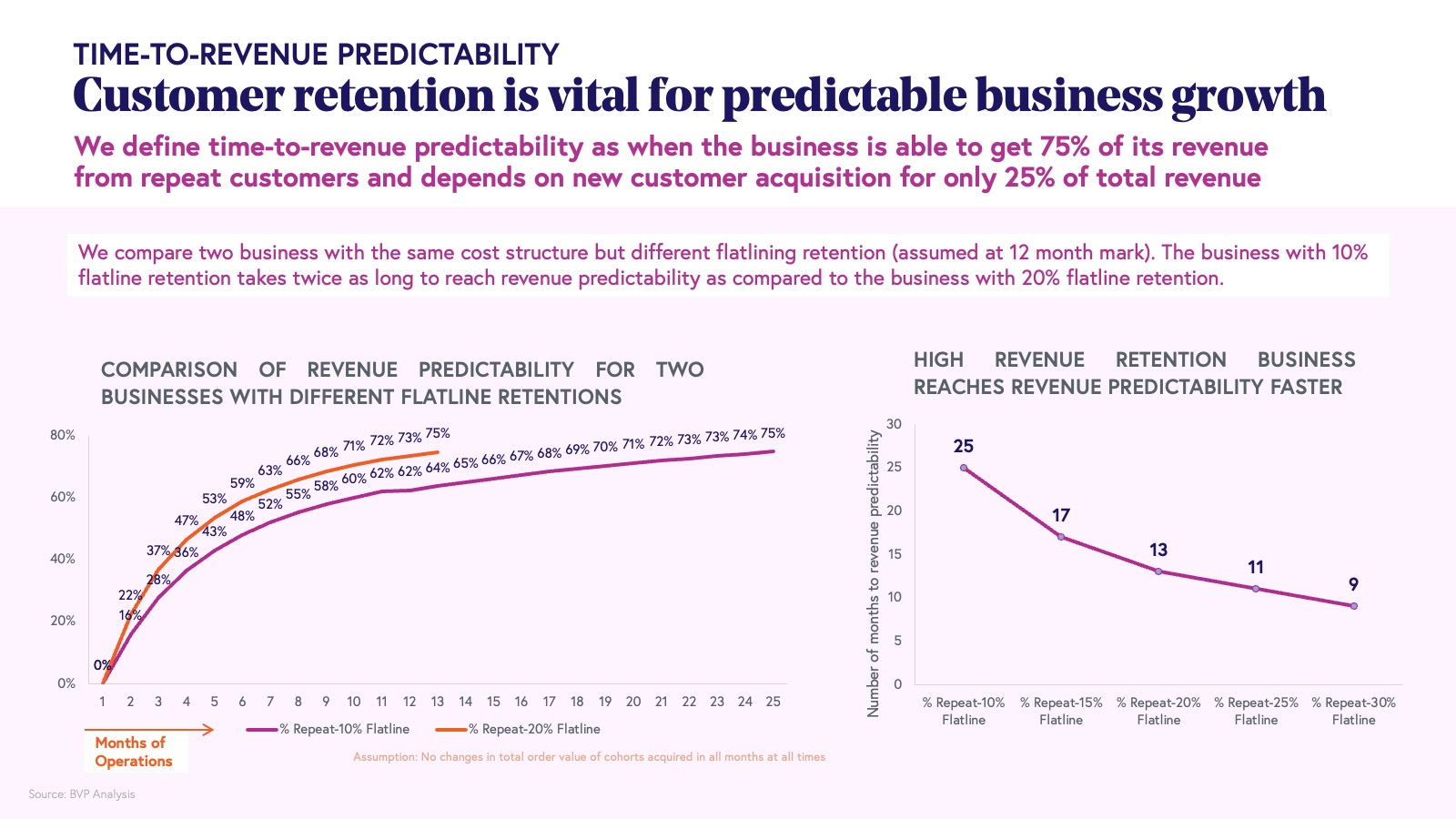

Last, but definitely not least, the ultimate tests of an enduring and sustainable business are its revenue and time to EBITDA profitability. Revenue predictability is a critical focus for any consumer business, particularly given the reality that a significant portion of customers from one period may not transact again in the next. Achieving a high degree of confidence in forecasting future revenue becomes possible when a business reaches a stage where 75% of its revenue is generated by existing users, relying on new user acquisition for only the remaining 25%. Flatline retention is a key driver in reaching this level of predictability, as it reflects the proportion of customers who consistently return and transact over time.

To illustrate the impact, consider two businesses with identical marketing spends, average order values, and customer acquisition costs. If one business improves its retention rate from 10% to 20%, it can reach revenue predictability as much as 12 months sooner than the other. This demonstrates how even incremental gains in retention can materially accelerate the path to stable, predictable revenue and, ultimately, sustainable growth.

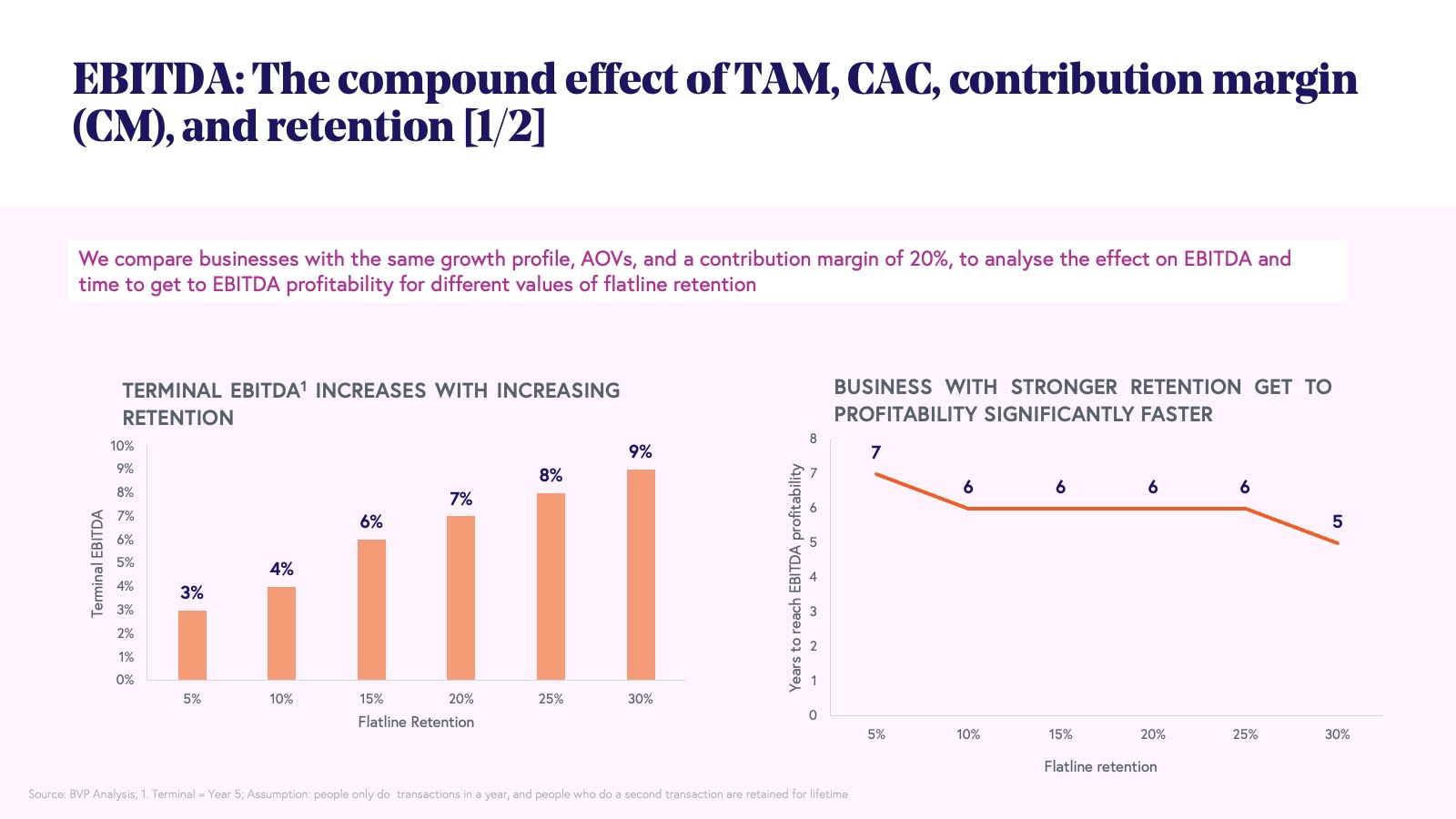

Similarly, time to EBITDA profitability is a critical milestone for consumer businesses, marking the point at which a company becomes self-sustaining and able to generate EBITDA for ongoing operations and future growth. Flatline retention emerges as a key driver in accelerating the path to EBITDA profitability, as retained customers require minimal incremental marketing spend, yet continue to generate contribution margin for the business. In our sample analysis, increasing flatline retention from 5% to 30% can reduce the time to profitability by as much as 24 months, underscoring the outsized impact that strong customer retention has on a business’ journey to sustainable profitability.

Moving forward with India 2.0

To summarize, we are big believers in the Indian consumer story. While the past decade was a key inflection in terms of technology disruptions, the coming decade will be even brighter, as all these disruptions come together with macro tailwinds to create a perfect storm for entrepreneurs building in the Indian consumer internet space.

Q-commerce, brands, and digital consumer platforms like content and gaming are all exciting segments where the next $100 million net revenue businesses could emerge.

—

We're excited to back many more such companies, so if you’re building in these spaces, get in touch with us at indiaconsumerinternet@bvp.com.