The Rise of SaaS in India 2023

As the Indian SaaS ecosystem continues to mature, AI and efficiency are emerging as key themes for cloud growth in India.

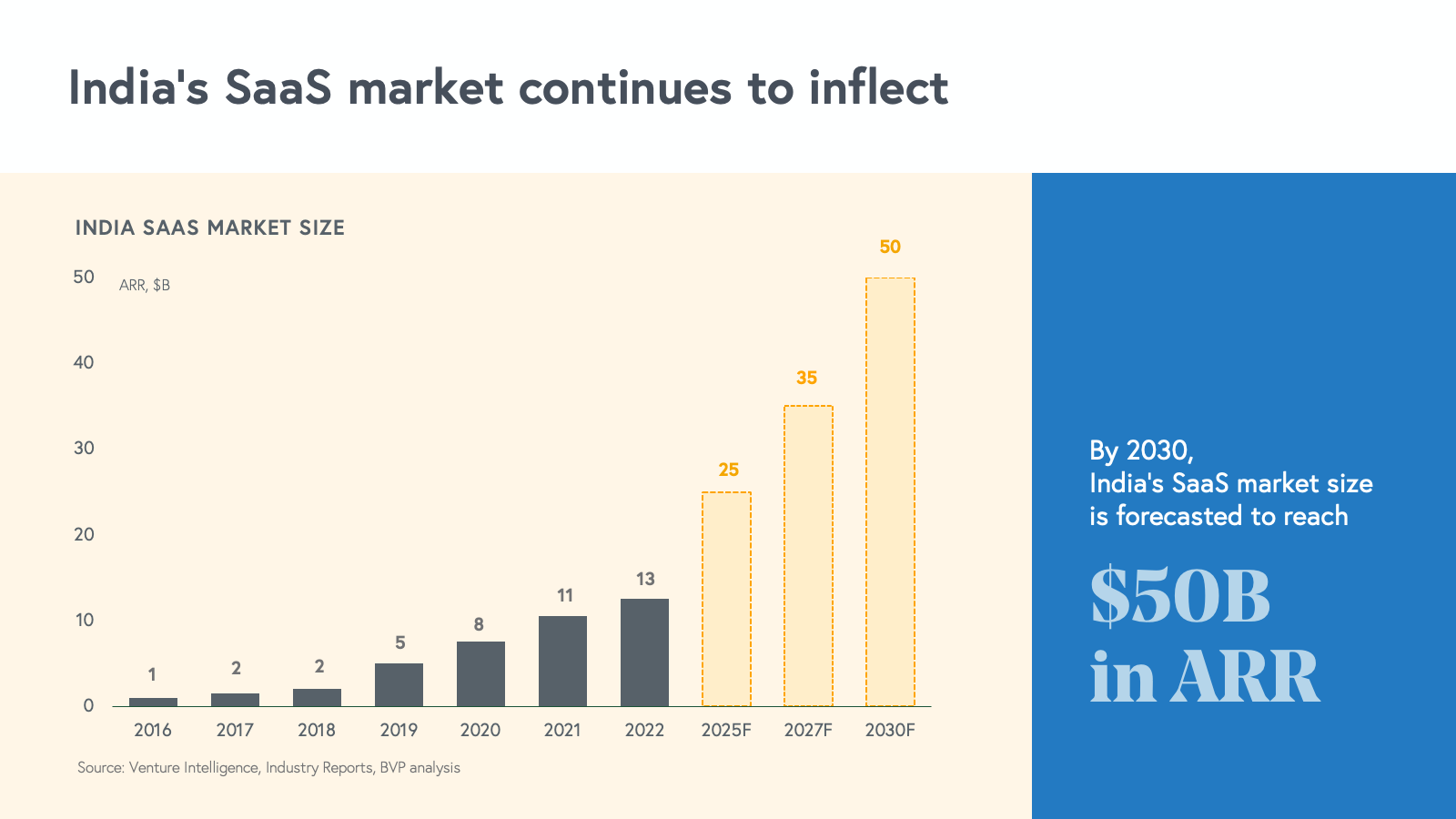

India's software-as-a-service (SaaS) market continues to go from strength to strength—it’s projected to reach $50 billion of annual recurring revenue (ARR) by 2030, nearly quadrupling its size today. Cloud builders in the country serve domestic and international customers alike: “India-first” companies, such as Perfios, Lentra, M2P, and Zopper, sell software that reaches the country’s population of 1.4 billion, while “global-first” companies, like Zoho, Freshworks, Gainsight, Icertis, Zenoti, Leena, and Entropik primarily sell to customers around the world.

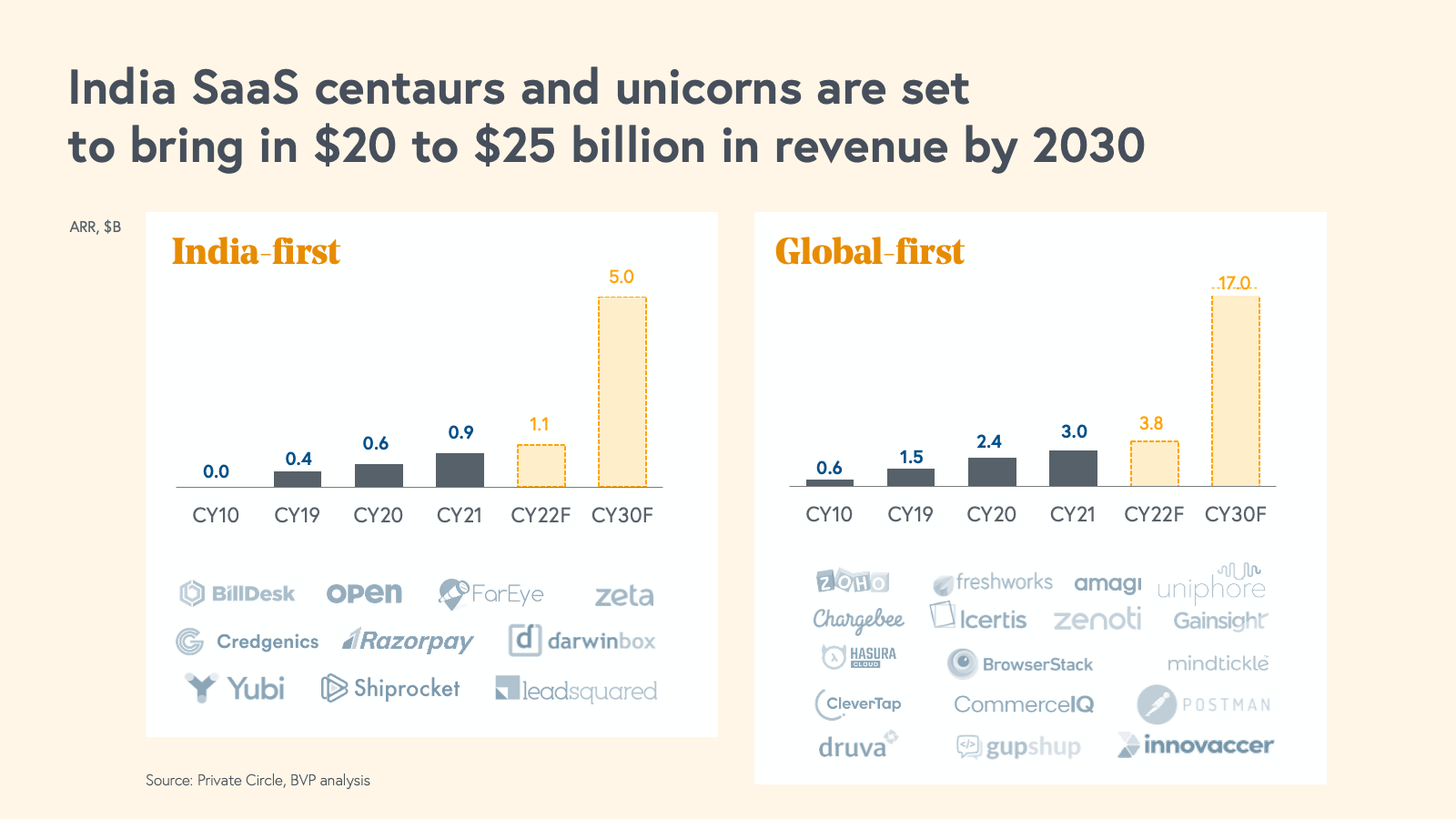

Many global-first India SaaS businesses, like Zoho, Freshworks, and Icertis started selling globally on day one, while others, like Entropik and Leena, started by selling to the India market first, eventually expanding into global markets Today, tens of companies generating $50 million or more in revenue fall into both categories. Having been investors in India’s entrepreneurial ecosystem for 15 years, we know that there’s no better time to invest in the region. We believe Indian SaaS centaurs and unicorns will bring in between $20 and $25 billion in revenues by 2030.

<p

In our previous report, we shared our perspective on the fundamental drivers of cloud innovation in India—including the rise of digital rails, mobile ubiquity, and the digitalization across all industries—as well as our predictions for the India SaaS market. For 2023, we present an update on the state of India’s cloud ecosystem, highlighting the current valuation environment, the importance of efficiency, the artificial intelligence (AI) landscape, and our predictions for the next year.

India’s SaaS market in 2023

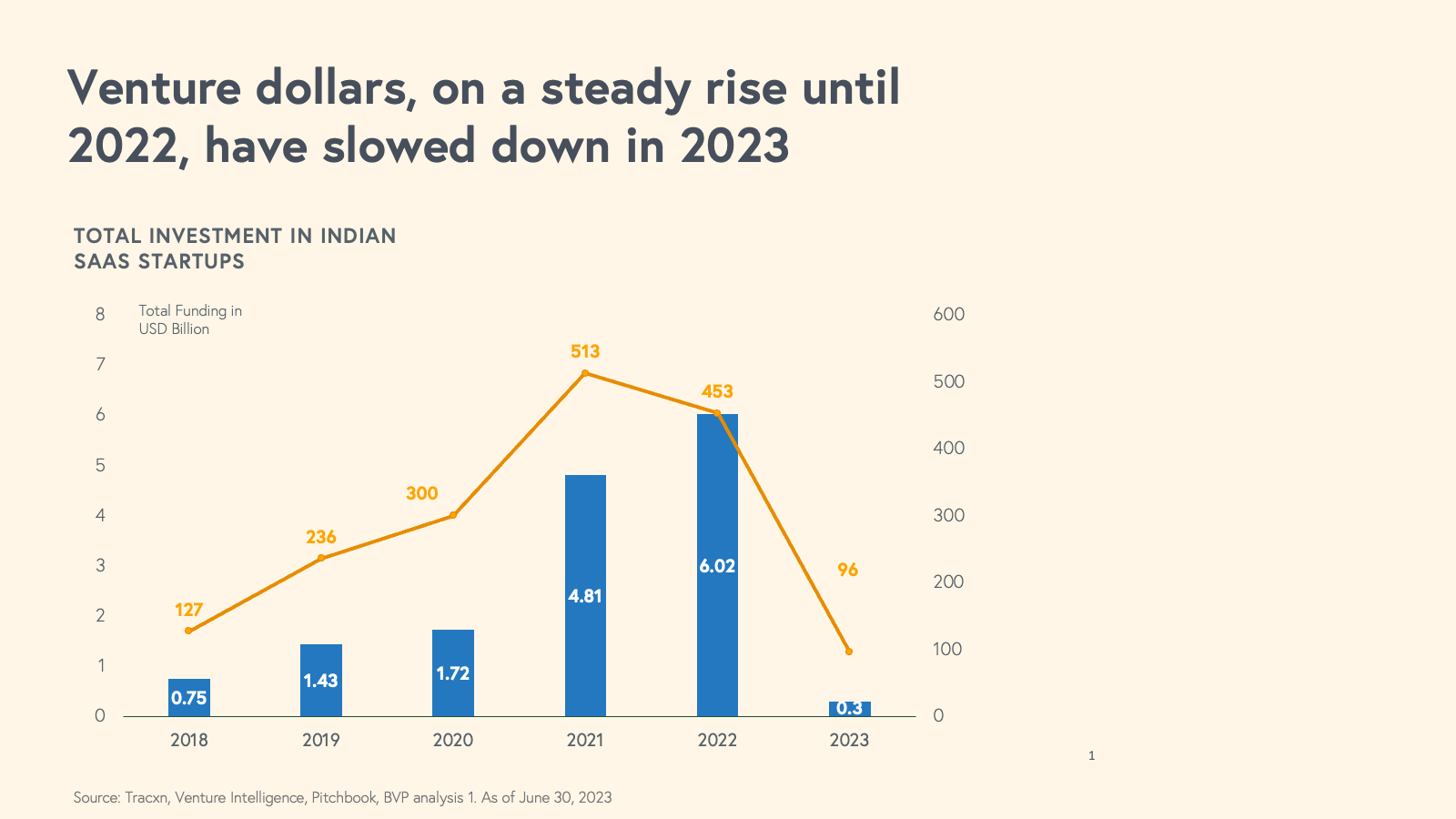

In 2022, investors deployed almost $6 billion into Indian SaaS companies, up nearly 3.5x from 2020 and a staggering 8x from 2018. However, new venture funding has sharply declined this year-to-date: amid geopolitical conflicts and interest rate hikes aimed to curb inflation, tech sector growth has slowed in the public markets, prompting investors to be more judicious about which software businesses to back.

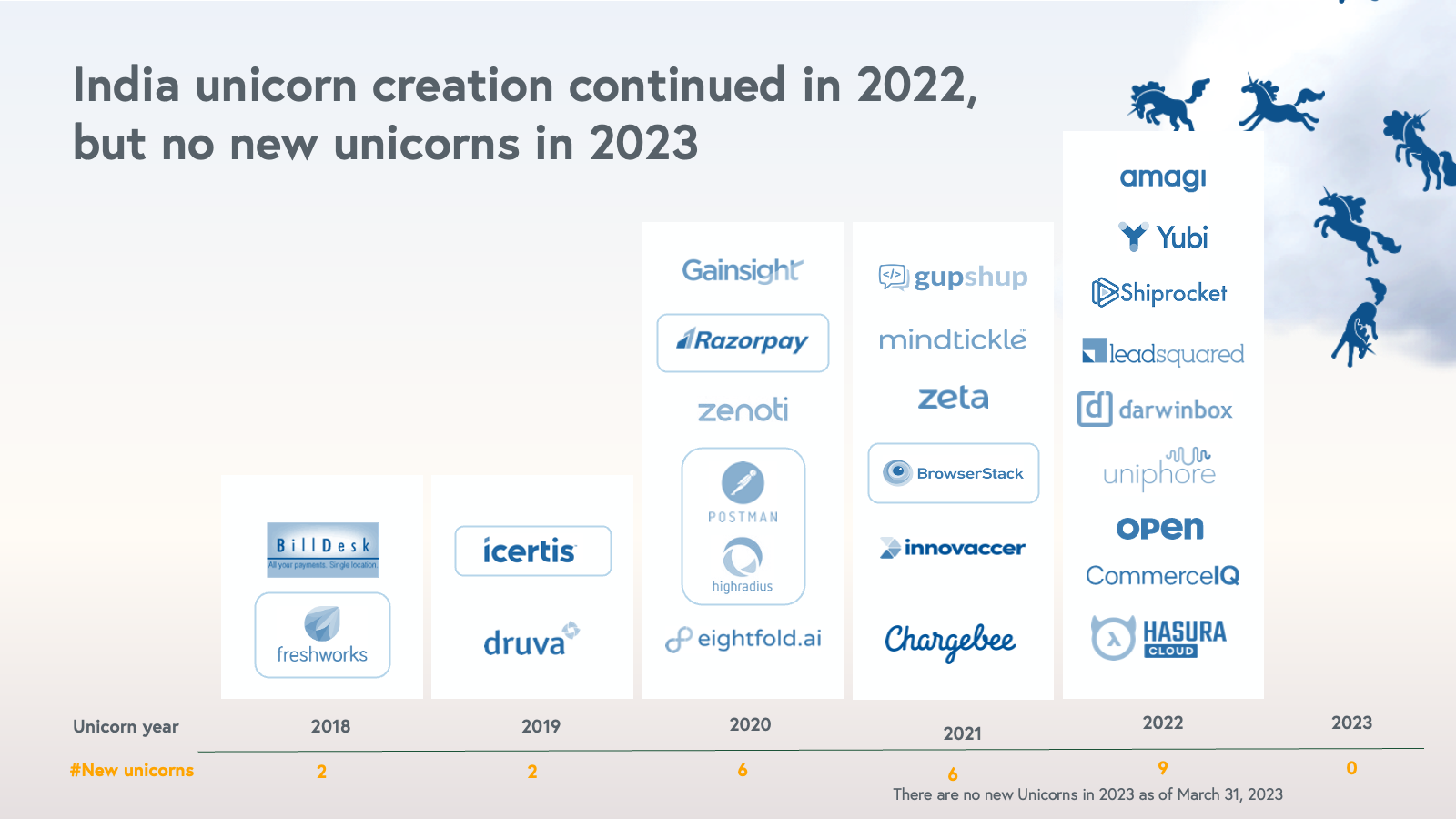

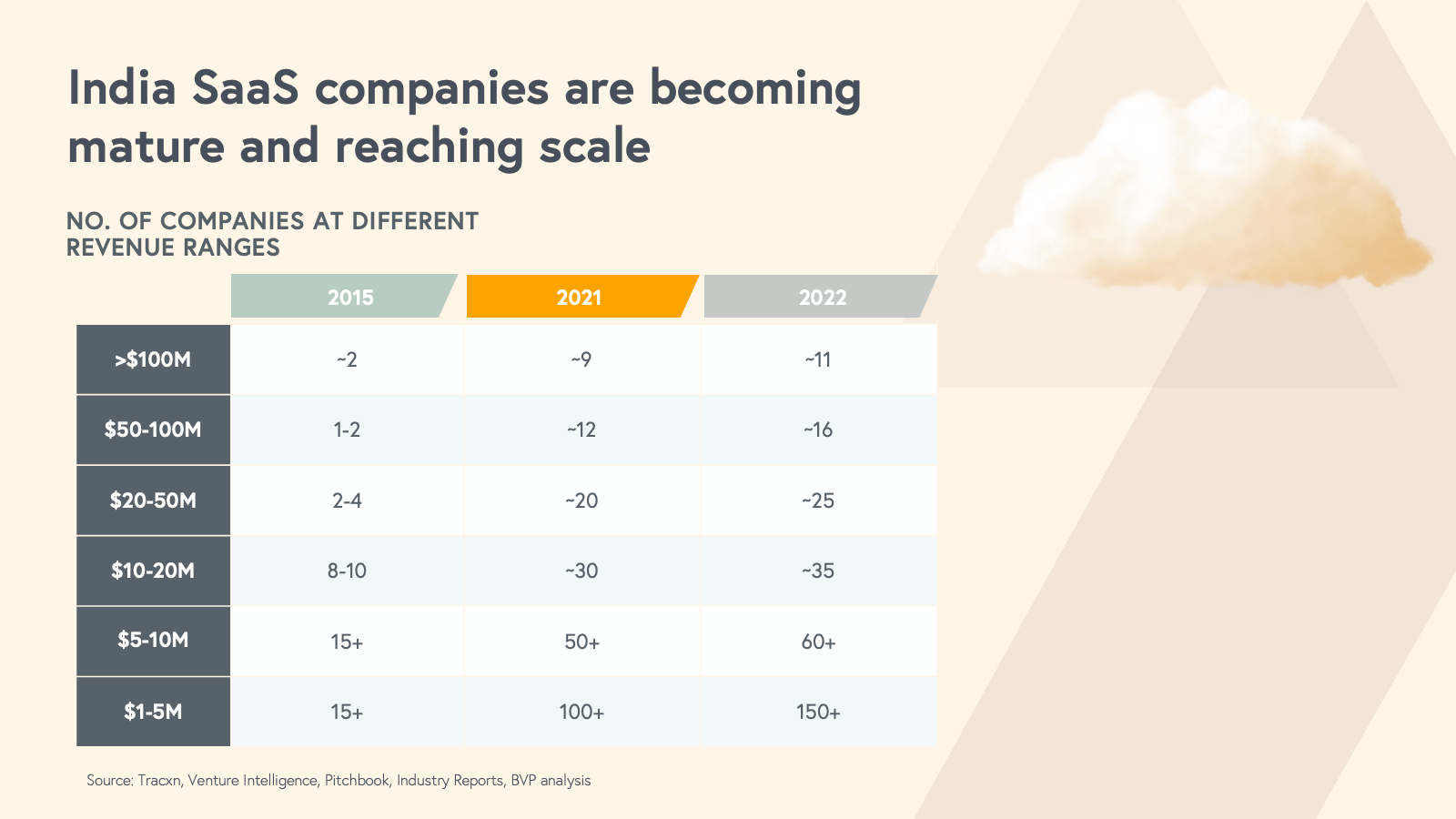

At the same time, the ecosystem continues to mature. As we explored in last year’s State of the Cloud 2022, centaurs—private SaaS businesses that have crossed the $100 million ARR mark—represent a new milestone of success in the cloud world. This year, the number of Indian centaurs has grown to 11, now including Postman and GupShup, signaling resilience and growth in the Indian SaaS ecosystem, even in the current market environment.

While India’s SaaS ecosystem is still in its early innings, we’re already seeing promising signs of growth and durability. In particular, we’ve seen significant growth in the number of early-stage companies that surpass $10 million in revenue. Six years ago, we identified approximately 30 businesses with revenue over $10 million, and today that figure is over 85 companies, an almost threefold increase.

Cloud multiples and interest rates

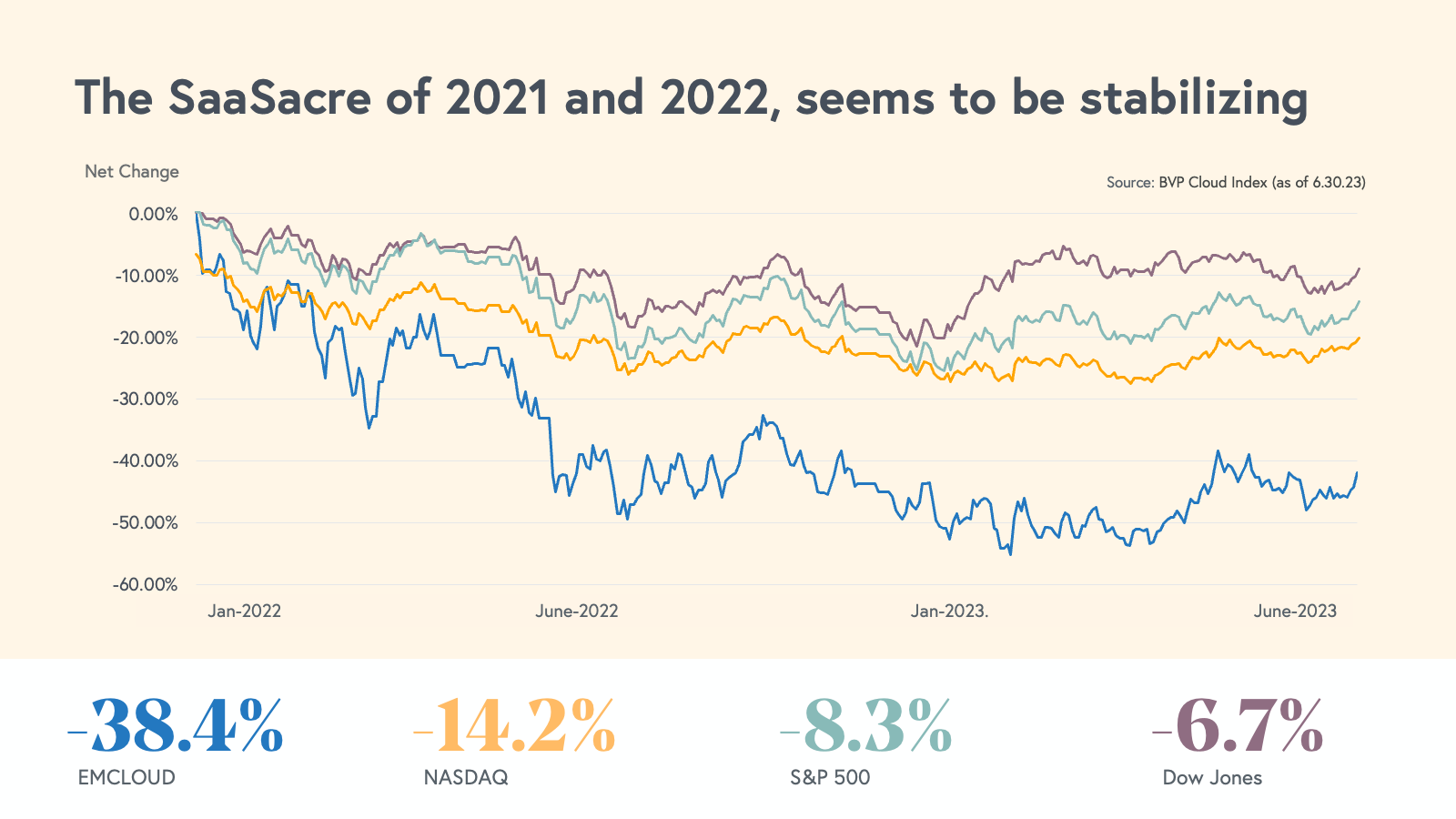

It is well known that cloud multiples have compressed from their all-time highs in the last ~18 months. The average EV/NTM revenue multiple for The BVP Nasdaq Emerging Cloud Index declined from its high of ~25X to ~6X as of the first half of this year. Interest rates are a major driver of SaaS multiple compression—they rose from almost zero to almost 6.5% in the same time period. And it’s not just cloud stocks that were affected: the broader S&P 500 and Nasdaq also declined by 8.3% and 14.2%, respectively, in the same time period. So, what do rising interest rates actually mean for growing SaaS businesses in India?

When it's cheaper to borrow, company valuations tend to be higher––interest rates and asset valuations have an inverse relationship. And when the cost of borrowing is higher, company valuations tend to be lower. That's because company valuations depend on an estimate of what future cash flows would be worth today––and interest rates are a key part of the mathematical model that is used (Discounted Cash Flow model). Without going into too much detail, it is important to understand that the value of future cash flows of a business is calculated by discounting those cash flows to cost of capital and the cost of capital goes up when interest rates go up. Hence valuation multiples tend to be lower than they would be in a less challenging macroeconomic environment.

So what should Indian SaaS founders do? At the end of the day, what’s most important for founders to focus on is building a sustainable business––one that grows in any market environment. The cloud model remains strong for this reason. Founders and entrepreneurs should focus on metrics and KPIs they can control, e.g. revenue and customer satisfaction, while building sustainable businesses, and not trouble themselves with externalities that they can’t really control.

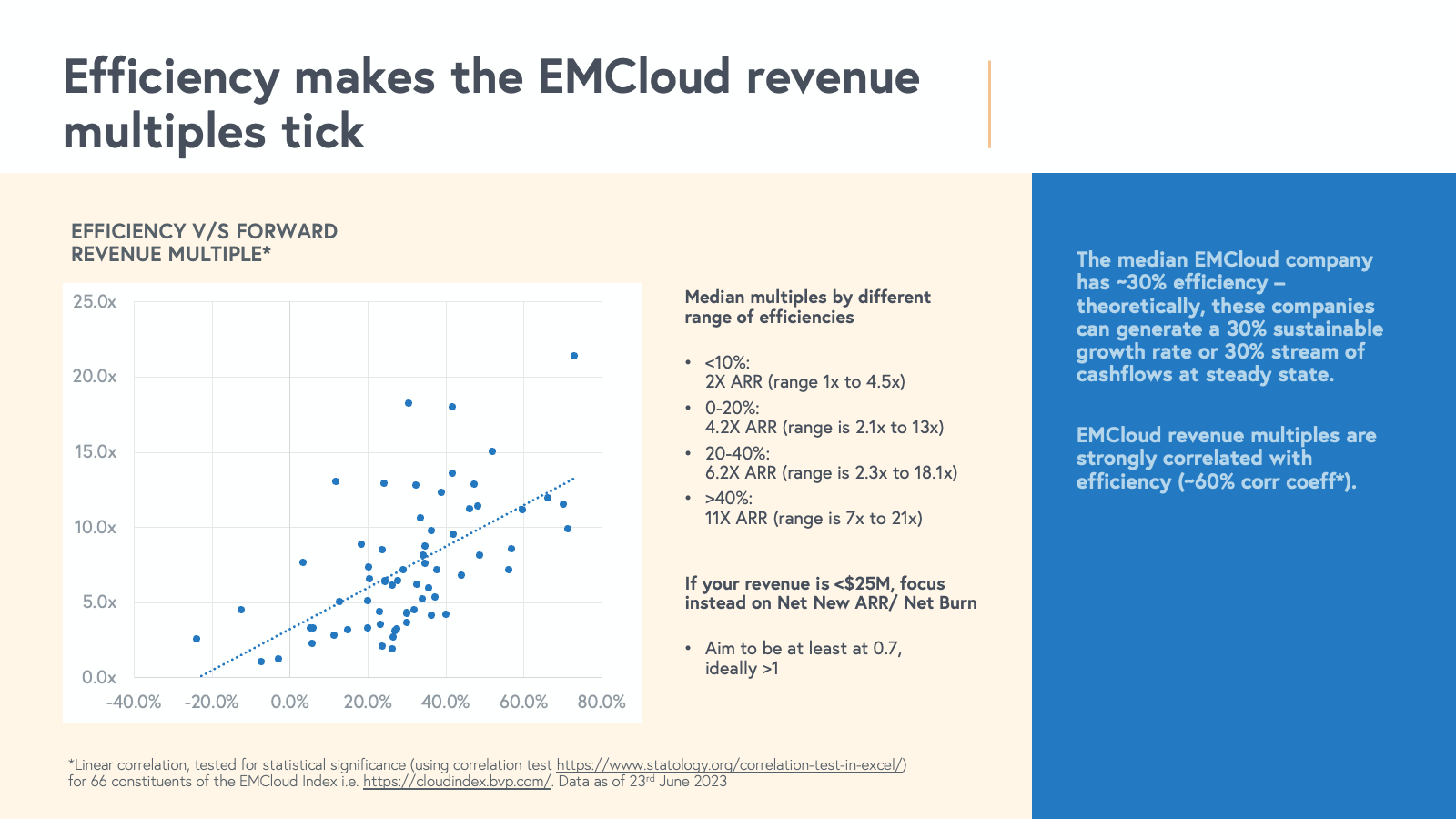

Building an efficient business won’t just pay off in the future––more efficient companies are valued more highly in high interest rate environments. This is apparent in The BVP Nasdaq Emerging Cloud Index: there is a strong correlation between revenue multiples and capital efficiency at leading cloud companies.

The India advantage

In today’s high-interest rate environment, India’s SaaS businesses have a leg up. Capital markets around the world are placing a valuation premium on efficient businesses, and India’s SaaS market is poised to benefit—as we highlighted in last year’s report, Indian software companies tend to have higher efficiency metrics than their global counterparts. Across revenue ranges and levels of business scale, we observed that Indian SaaS companies have higher efficiency scores (defined as FCF% + Growth for mature companies, and as Net New ARR/ Net Burn for early stage companies) than their U.S. counterparts.

There are two key drivers behind India’s efficiency advantage: (1) SaaS businesses in India already value efficiency on a cultural level; they can upstart and scale with less capital than startups in other countries; (2) India’s SaaS companies tend to build additional products faster and earlier in their lifecycle.

Indian companies like Zoho and Freshworks have used a multi-product strategy to their advantage—every subsequent product is a way to add more revenue from the same customer. Zoho in particular has shown that it is possible to cross $1 billion in ARR without needing outside capital. Similarly, companies like Perfios, Lentra, and Zopper have shown that by going to market with a fully baked product (As opposed to a minimum viable product) and by continuously iterating based on customer feedback to add more product features, creates the ability to capture more spend buckets from the same customer.

In the next section, we share five predictions for India’s distinctive SaaS market, beginning with one that’s rooted in efficiency.

Five predictions for India’s SaaS market

Prediction 1: Indian companies’ efficiency advantage will aid them on their path to global leadership

By having an efficient operational foundation, in today’s macroeconomic environment, Indian SaaS businesses will have an easier time expanding into international markets than software companies with higher overhead costs that are based in other countries. In addition, as investors across the world try to find efficient businesses with higher growth and cash flows, we believe Indian companies could provide them with compelling investment opportunities leading to increased availability of growth capital for Indian SaaS companies. This availability of capital could be a key factor in the path to global leadership for many Indian SaaS companies.

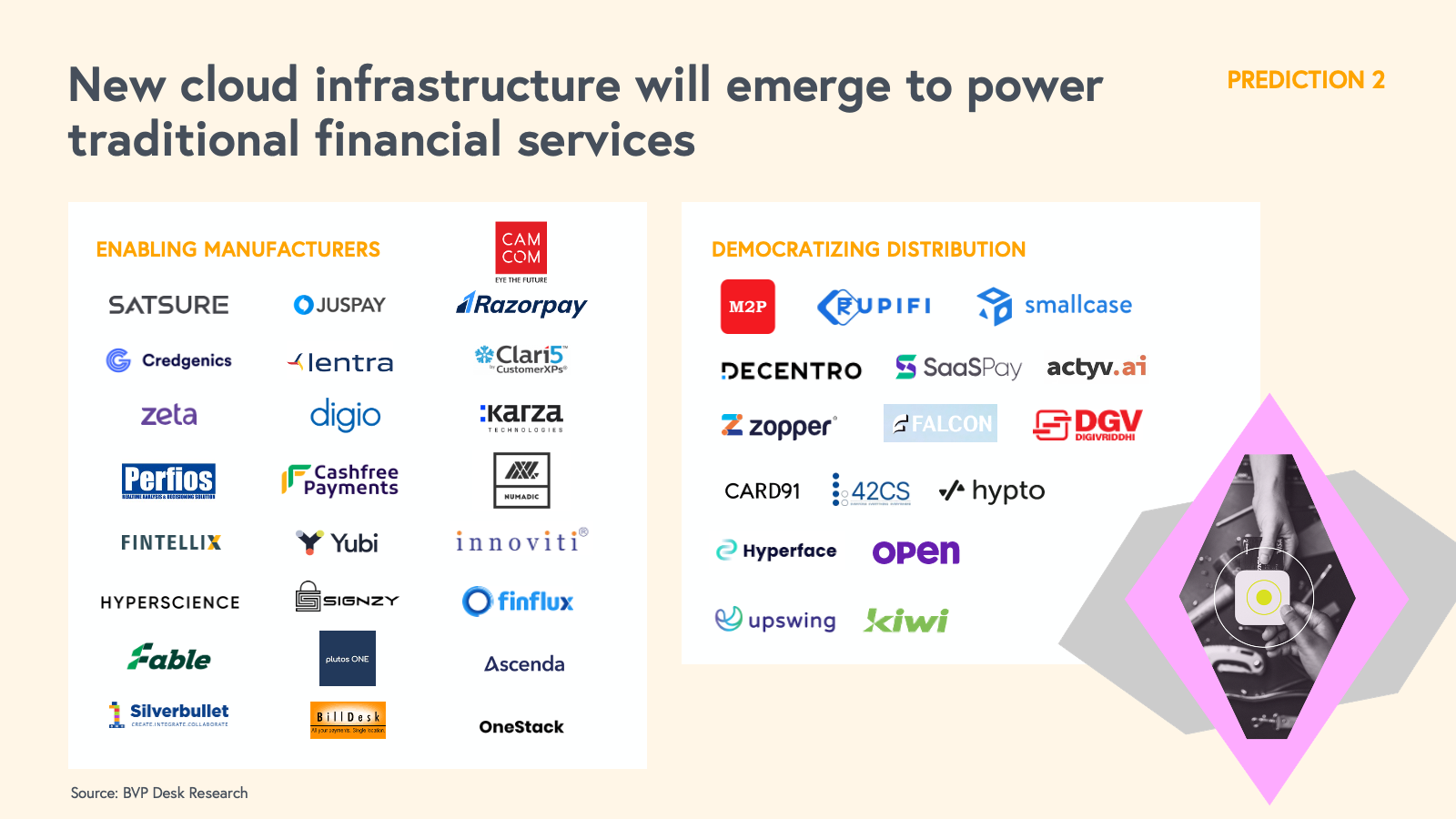

Prediction 2: New cloud infrastructure will emerge to power traditional financial services

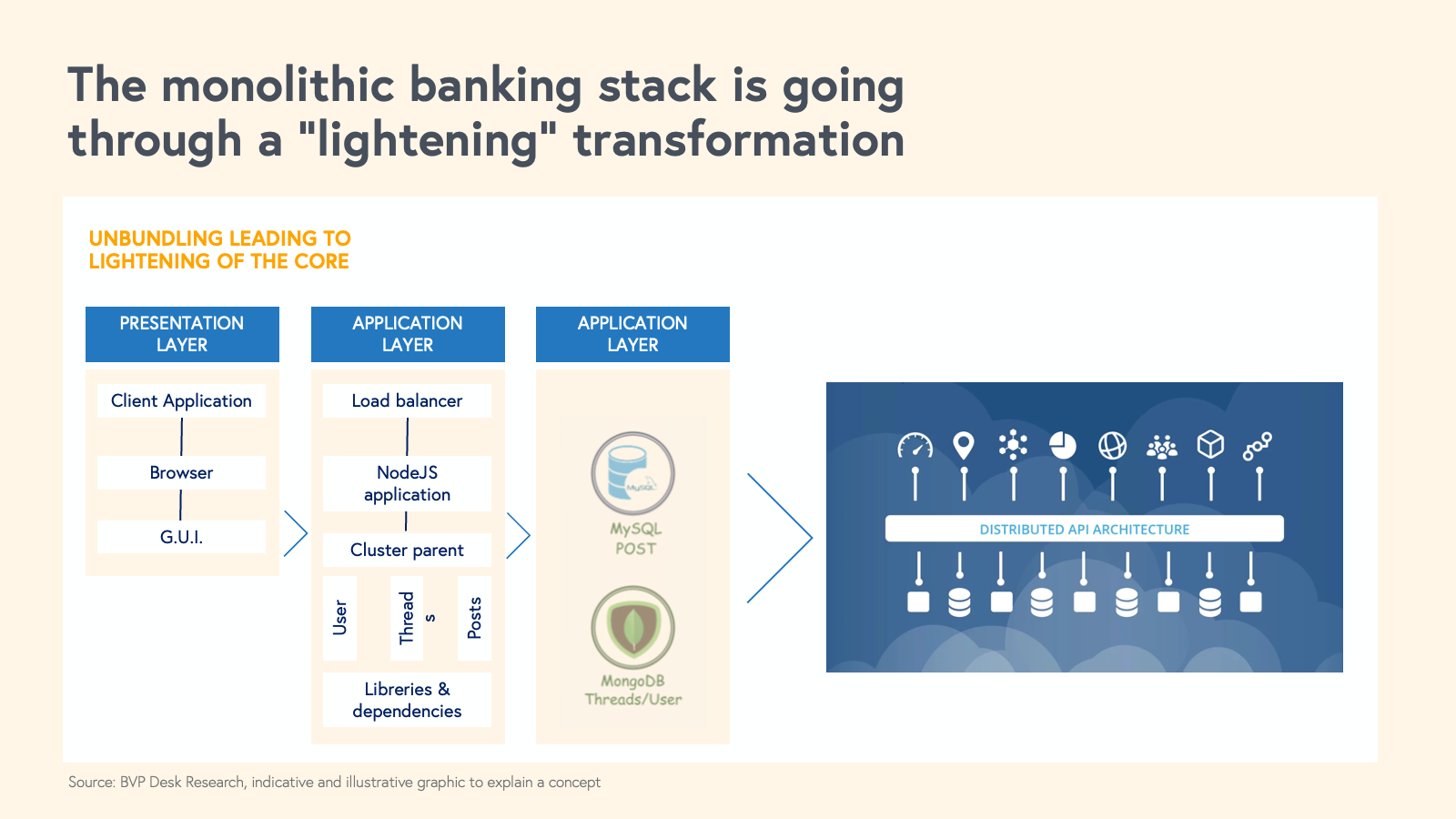

Investing in fintech infrastructure in India today is a once-in-a-lifetime opportunity due to a unique confluence of events: wider cloud adoption; new players are offering more flexible and customer-friendly products; banks are unable to launch new products on the go; legacy software is hampering flexibility; and COVID-19 has accelerated the process of digital lending.

Pressure from new players, the accelerated adoption of digital lending, and widespread cloud usage have required banks and non-bank lenders to start embracing cloud-based SaaS platforms across different use cases: underwriting, fraud, collection, KYC, wealth management, loan origination systems (LOS), loan management systems (LMS), customer engagement, among others.

We predict that three main trends will unfold:

- The emergence of software products designed to support incumbent financial institutions—e.g. banks, insurance companies, and asset managers (financial services manufacturers)—aiming to provide better services at lower costs across the country. We believe every step of financial service delivery will be reimagined by cloud software companies built on top of the digital financial rails of Aadhar, which in practice might look like products for easier KYC, authentication, underwriting, loan or insurance processing, credit monitoring, loan collections, insurance claims processing, and more.

- The rise of fintech solutions that allow every company to be a fintech company by providing banking-as-a-service (BaaS). One of the biggest hindrances to large-scale financial services adoption has been the high cost of distribution. With the rise of the internet, more distribution platforms that can reach every pin-code of India are emerging. We believe that all these platforms will eventually offer financial services, e.g. credit, payments, and more to their consumers, something which will be enabled by new embedded finance products on the cloud.

-

Banks and insurance companies are also expected to witness a significant uptick in the adoption of software solutions both in their product offerings and marketing strategies. In response to the growing competition from fintech companies and major tech players, banks and insurance companies in India have shifted their focus towards customer-centricity. This involves the creation or development of super-app platforms to consolidate various services. To accomplish this, these organizations are actively collaborating with cutting-edge technology solutions across key areas like product management, streamlining loan processes through digitization, campaign analytics, content strategy, branding, trust-building, and hyper-personalization. The ultimate goal is to provide customers with a seamless and highly personalized experience, ensuring their needs are met efficiently and conveniently within a single integrated platform.

At the helm of this digital transformation, Chief Marketing Officers and Digital Transformation Heads in these established institutions are forging partnerships with companies like Pepper Content, Entropik, and Single Interface. By harnessing the power of software to scale these initiatives, they are likely to reap substantial ROI and staying ahead in the competitive market.

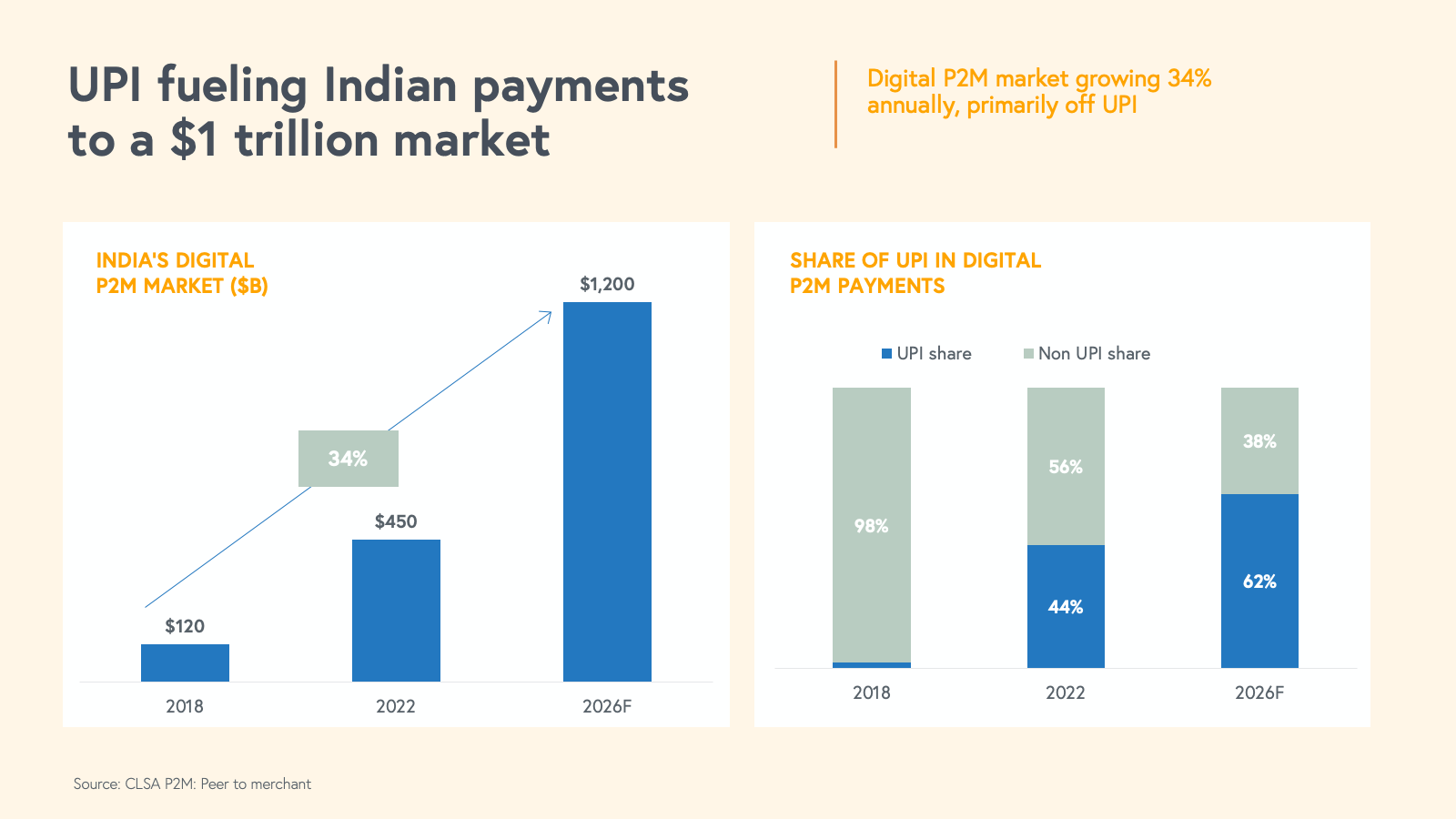

Prediction 3: UPI will create SaaS and infrastructure opportunities across a wide spectrum

India is spearheading the global shift to digital payments, with people-to-merchant (P2M) payments expected to grow by 3X, creating a $1.2 trillion market by 2026. While there are several drivers behind this significant growth—government initiatives such as Aadhaar, fintech innovations, and even the unprecedented COVID-19 pandemic—the introduction of the Unified Payments Interface (UPI) has been the most pivotal development. UPI has single-handedly transformed the way consumers make payments and merchants accept them. We anticipate that by 2026, two out of three digital merchant payments will be done via UPI.

While payments distribution has limited monetization potential, we believe the next wave of disruption in the payments industry will occur in two key areas: credit on UPI and UPI infrastructure.

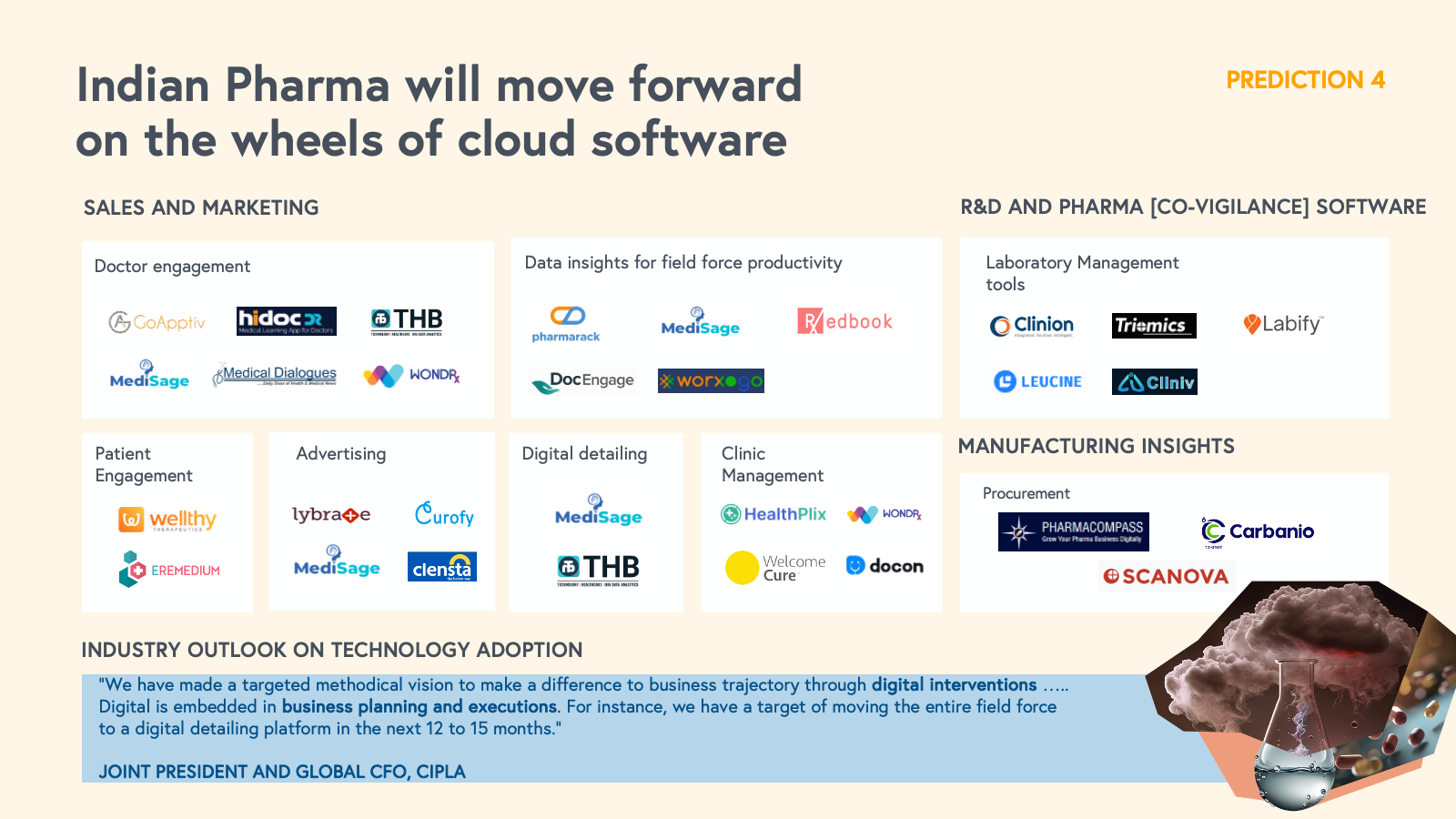

Prediction 4: Indian Pharma will move forward on the wheels of cloud software

As of now, the Indian pharmaceutical industry follows a traditional approach where medical representatives physically visit doctors to promote drugs and provide various benefits such as samples, goodies, events, and magazine subscriptions. However, recent regulatory changes, including the implementation of Section 194R that imposes taxes on benefits offered to doctors, have led to increased monitoring and scrutiny of these benefits beyond the permissible limits. Moreover, certain pharmaceutical companies in India have faced scrutiny and investigation related to unofficial benefits provided to doctors. This shift in regulations is expected to encourage doctors to be more open to digital interactions with pharmaceutical companies.

Looking ahead, we anticipate that the pharmaceutical industry will embrace innovative and cost-effective methods to engage with doctors over the next three to five years. While the scope for growth in pharmaceutical manufacturing and research and development (R&D) may be limited in India, there are multiple Software-as-a-Service (SaaS) categories available for sales and marketing purposes, including doctor engagement, field force productivity, and digital detailing. Our portfolio company Medisage already operates in these areas, offering services such as doctor engagement, field force productivity, digital detailing, and advertising to doctors.

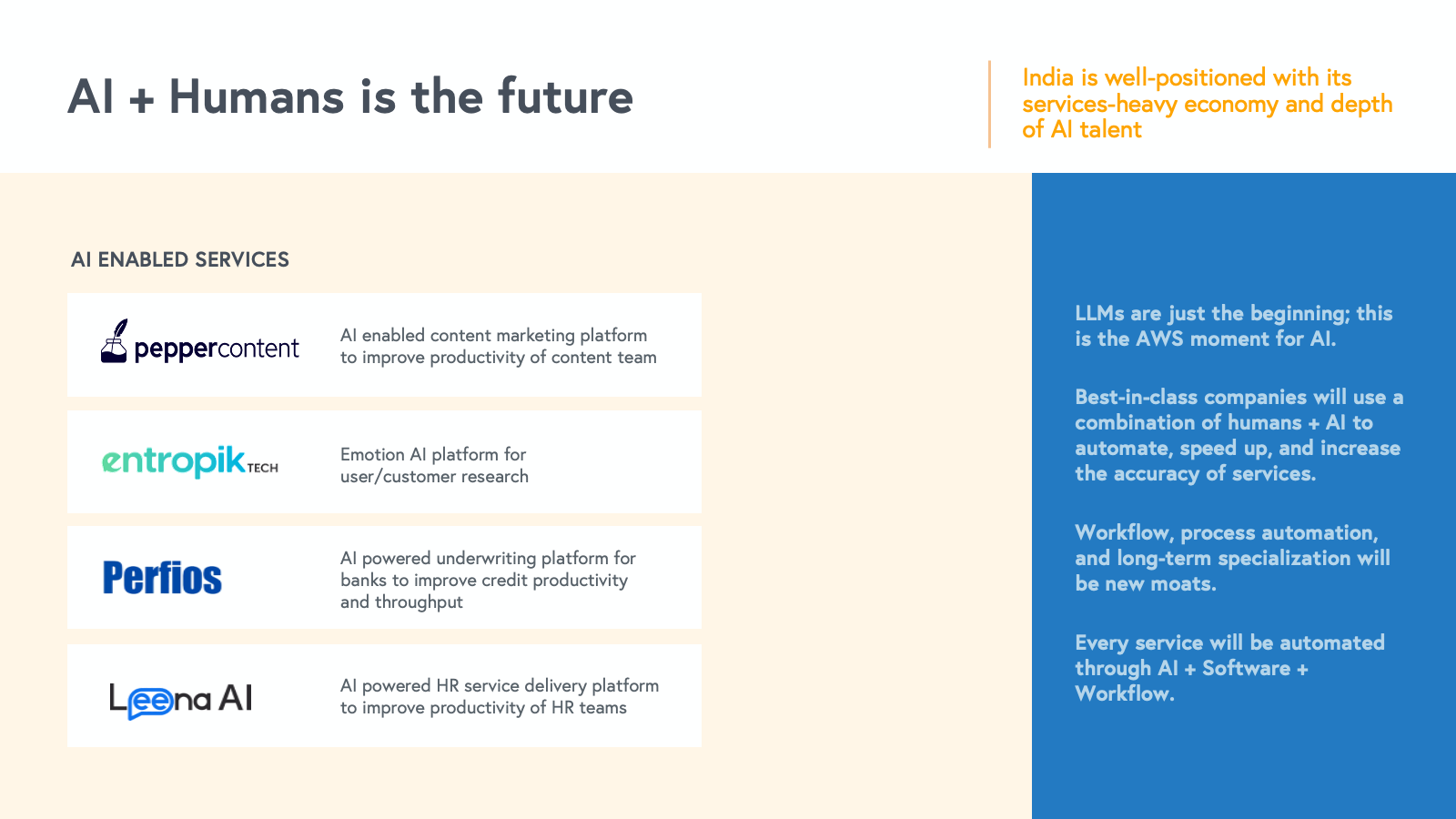

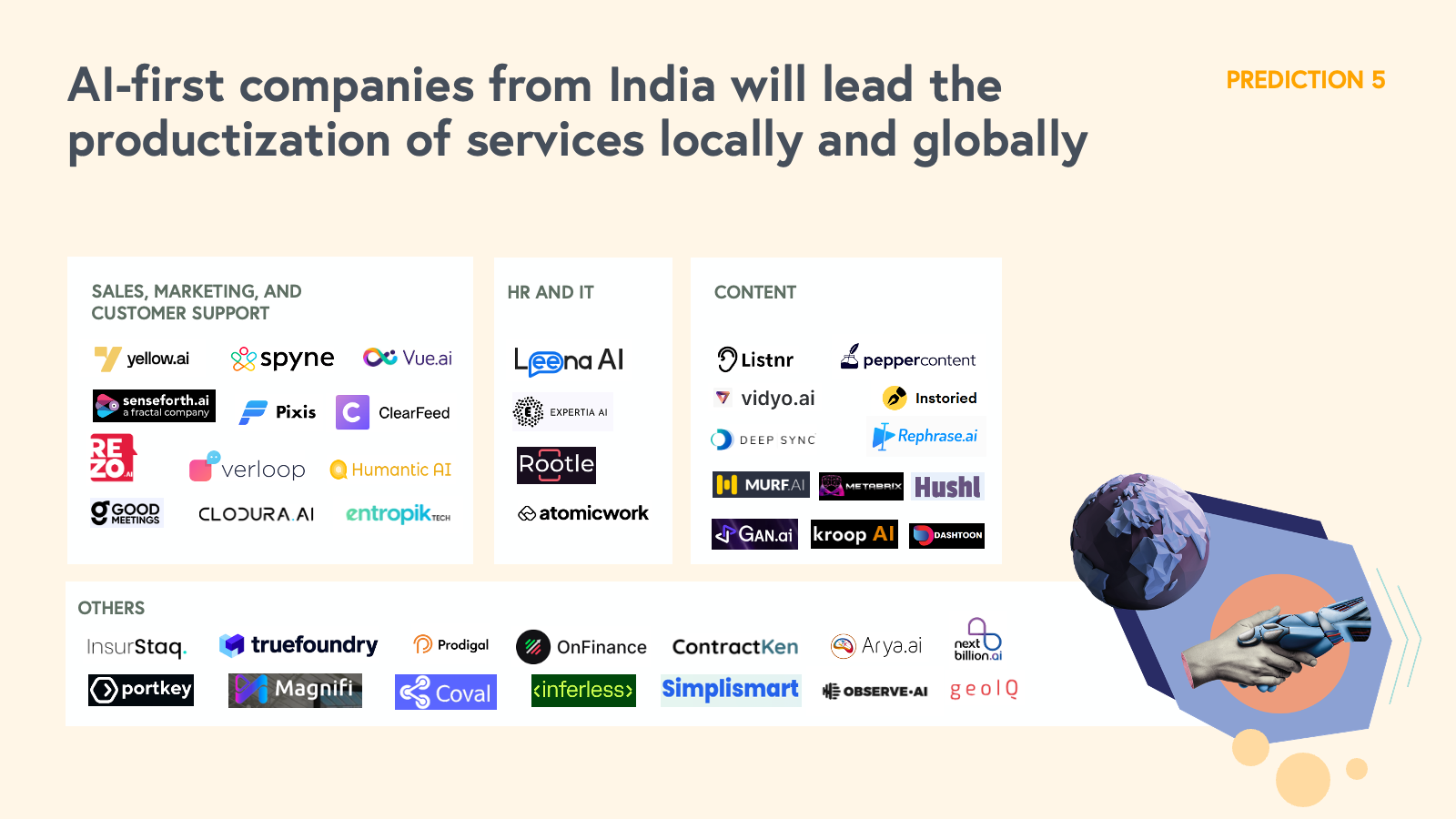

Prediction 5: AI-first companies from India will lead the productization of services locally and globally

Artificial intelligence (AI) adoption is surging among Indian software developers—46% of Indian developers already incorporate AI into their tools, positioning India as the second-highest country worldwide in terms of AI utilization.

Moreover, 84% of Indian developers have plans to integrate AI into their development process, claiming the top spot globally. This speaks volumes about their recognition of the immense potential and benefits that AI offers. Furthermore, 55% of Indian developers express trust in AI-generated output. With a strong emphasis on collaboration, 58% of Indian developers express their eagerness to utilize AI as a means to enhance collaboration within their teams.

In fact, India has emerged as a leading hub for open-source AI projects on GitHub. Indian software developers are realizing the value of AI across various dimensions, including enhanced efficiency, coding improvements, collaborative enhancements, increased productivity, accelerated learning, and more. Their widespread adoption of AI reflects a forward-thinking mindset and a commitment to leverage cutting-edge technologies for innovation and growth.

We believe India presents a significant opportunity for the "productization of services"—meaning that cloud software developers will leverage AI to improve B2B service delivery, likely in the form of new tools or software-enabled marketplaces. This transformative moment is similar to the AWS revolution in the cloud computing realm, with large language models (LLMs) serving as just the beginning for the AI revolution. The companies best poised to benefit from this moment will combine human expertise with AI capabilities to automate processes, accelerate operations, and enhance service accuracy.

Several Indian SaaS businesses, such as Leena.ai, Perfios, Entropik, Murf.ai, Plobal Apps and Pepper Content, are already driving innovation in this space, delivering AI-powered solutions for HR service delivery, underwriting in banks, emotion AI for user research, AI for voice creation, editing and dubbing, AI for mobile application building and AI-enabled content marketing. These examples highlight the immense potential in India for leveraging AI-embedded cloud software to productize services, leading to enhanced productivity and transformative outcomes across different industries. We at Bessemer are committed to the cause of AI and have set aside $1B to invest in AI and we continue to look for high potential opportunities in this domain in India.

On the horizon

India’s SaaS market continues to differentiate itself among global innovation hubs. As entrepreneurs around the world navigate a higher-interest rate environment, capital efficiency stands out to investors, making India’s already efficient software market poised to benefit in aggregate. Favorable regulatory and infrastructure developments continue to lay a strong foundation for product development, and high rates of AI adoption will enhance delivery and transform industries. We look forward to seeing India’s SaaS founders build the next generation of cloud software.

If you’re an entrepreneur building the next great SaaS business in the region, we want to hear from you. Reach out to our team at IndiaSaaS@bvp.com.