Data trends: Visualizing the global cloud industry in 2023

In our largest survey yet, encompassing 405 companies, we uncover and analyze the latest geographic, leadership, and financial trends in the global cloud industry.

At Bessemer, we surveyed 405 cloud companies as a status check for the private cloud computing industry, tracking their financial performance, artificial intelligence (AI) adoption, leadership priorities, and biggest challenges.

We aimed to answer the question: Where does the cloud industry stand in 2023, the year where pressures to drive profitable growth intensified and AI eclipsed every business conversation and captivated the world?

According to Bessemer Partner Byron Deeter, the global cloud industry is stronger than ever. “How do you think AI is delivered? Tens of thousands of GPUs working together in the cloud,” said Byron. “Our 2023 Cloud 100 applicants have never been stronger — proof that AI is the next horizon of cloud.”

While our Cloud 100 Benchmarks act as an industry yardstick for best-in-class private cloud performance, this survey widens the aperture by more than 4x to assess performance of private cloud companies of every stage and scale.

In 35 charts, we visualize the quantitative and qualitative trends moving the private cloud industry across 23 countries and 114 cities.

Five cloud industry insights for 2023

-

The top five cloud companies voted most likely to IPO next are Stripe, Databricks, Canva, Klavyio, and Snyk.

-

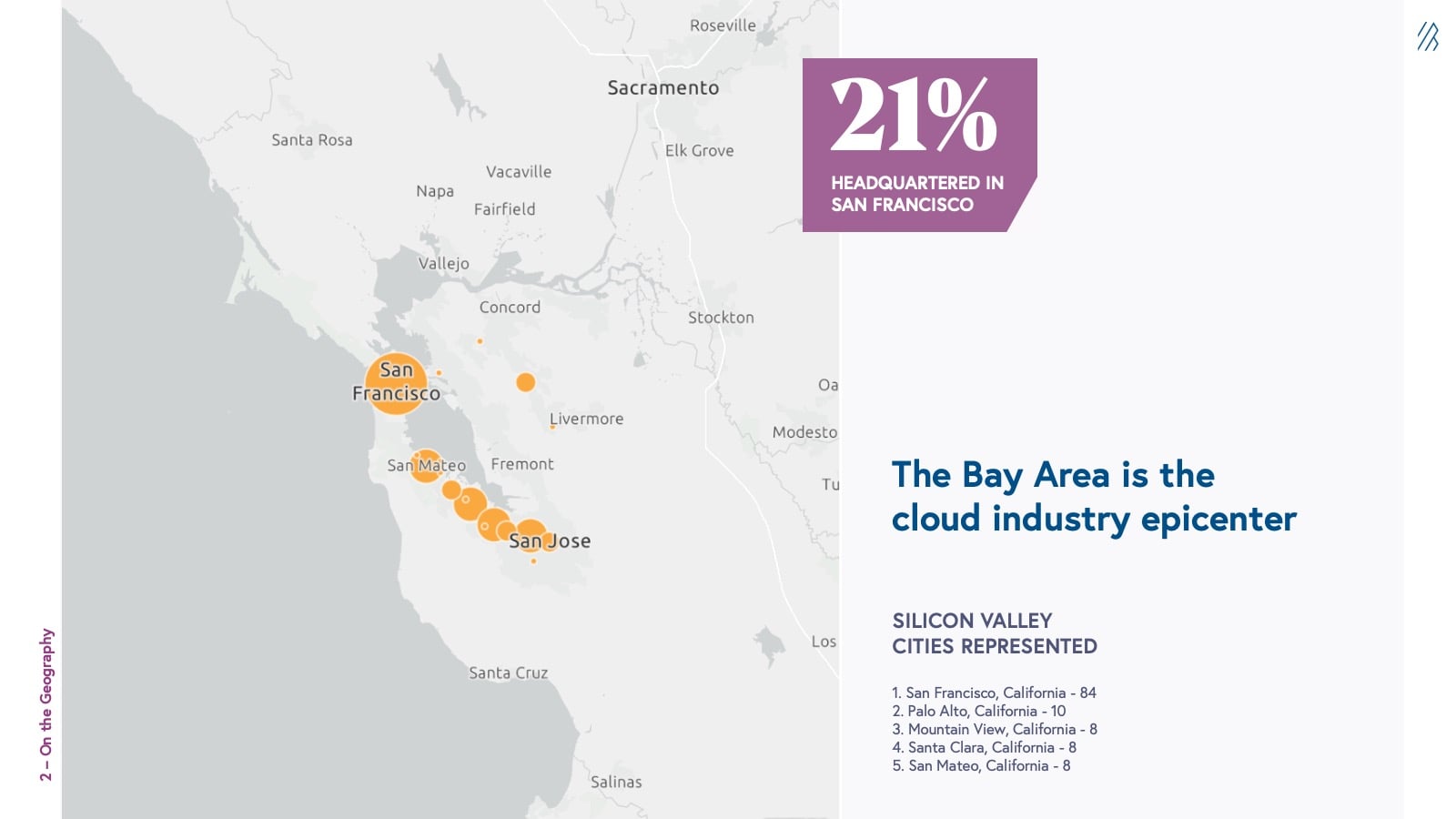

San Francisco is the cloud industry epicenter in terms of headquarters and hiring: 52% of cloud companies reside in California, with 21% of companies headquartered in San Francisco.

-

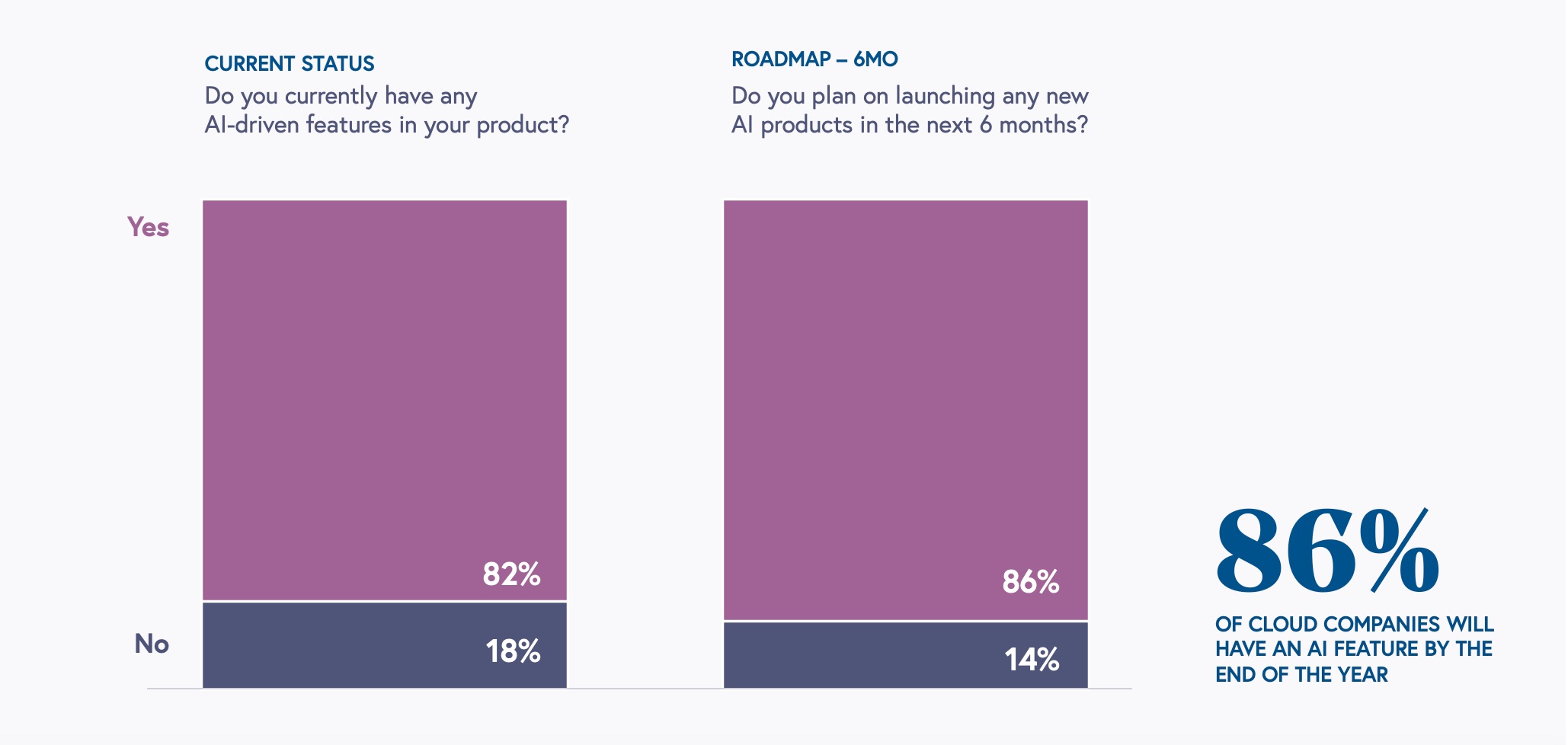

AI has already taken over SaaS: By the end of the year, 86% of cloud companies surveyed will have an AI-driven feature.

-

Cloud leaders ranked setting competitive differentiation in the product and go-to-market strategy as the biggest challenge facing their companies. Driving profitable growth was ranked as the leading objective whereas fundraising was ranked one of the lowest priorities for 2023.

-

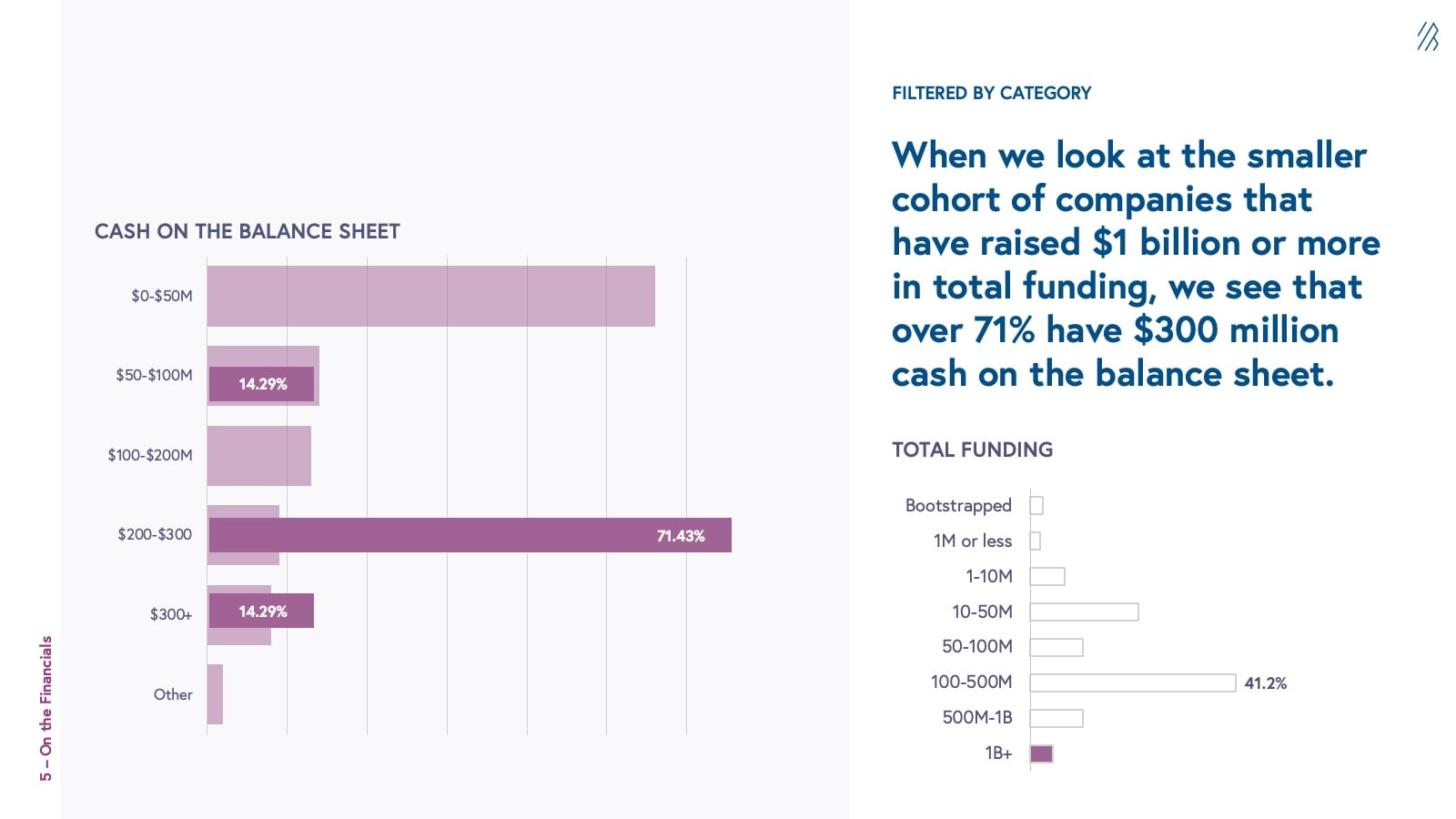

Cloud companies are still well funded: A majority of surveyed cloud companies have raised over $100 million or more in total funding. More than half of the surveyed companies have less than $50 million on the balance sheet, whereas almost a third have $100 million or more. Of the cloud companies that have raised $1 billion or more, over 70% have more than $300 million on the balance sheet.

Dive into the details and explore the trends and visualizations.

On the category

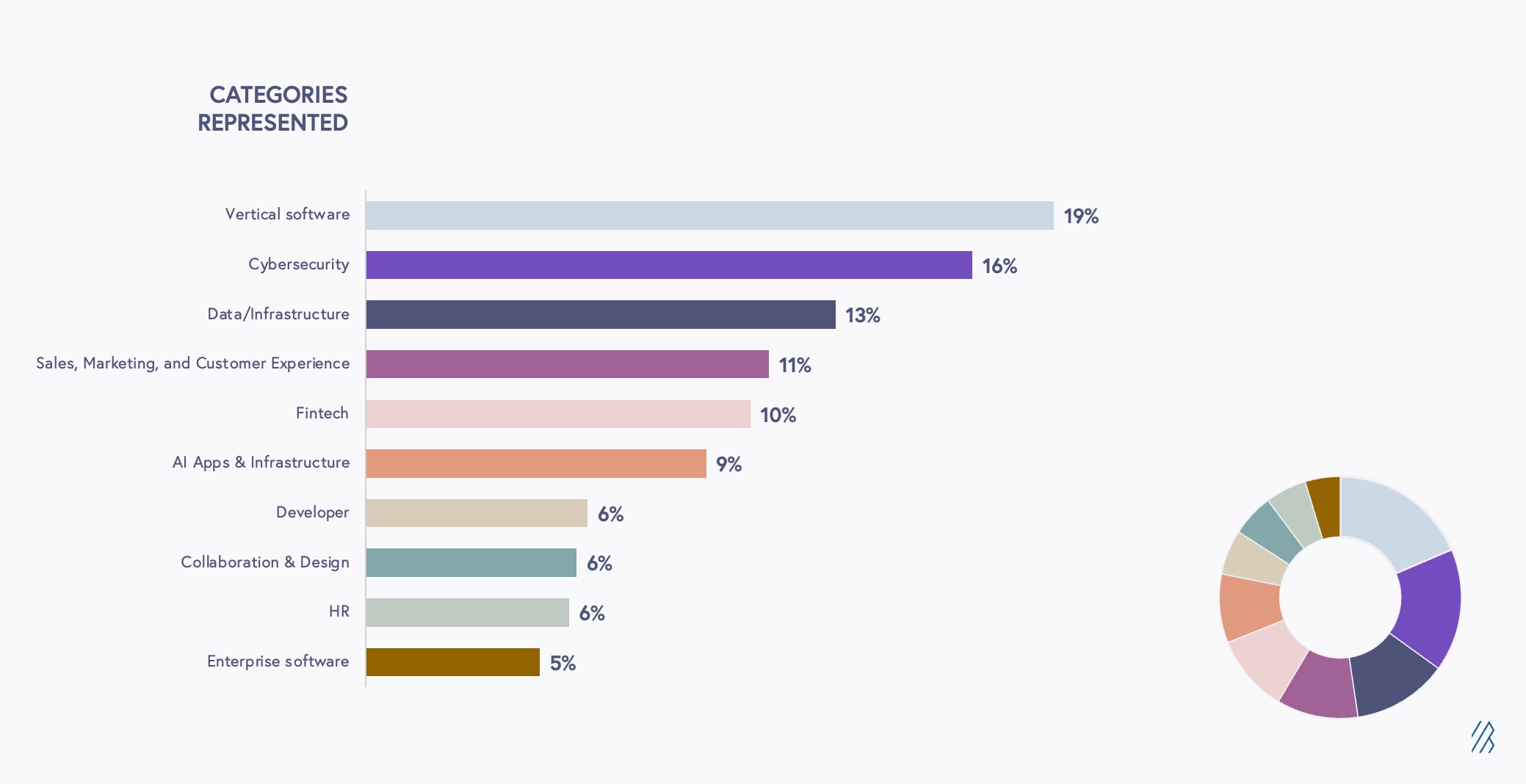

Vertical Software is the top ranking cloud category with Cybersecurity on its heels

- 19% - Vertical Software (75)

- 16% - Cybersecurity (66)

- 13% - Data Infrastructure (51)

- 11% - Sales, Marketing, and Customer Experience (44)

- 10% - Fintech (42)

- 9% - AI Apps & Infrastructure (37)

- 6% - Developer (24)

- 6% - Collaboration & Design (23)

- 5.4% - HR (22)

- 4.7% - Enterprise software (19)

Among surveyed Vertical Software companies, we see broad geographic representation across the United States, Western and Central Europe, and India.

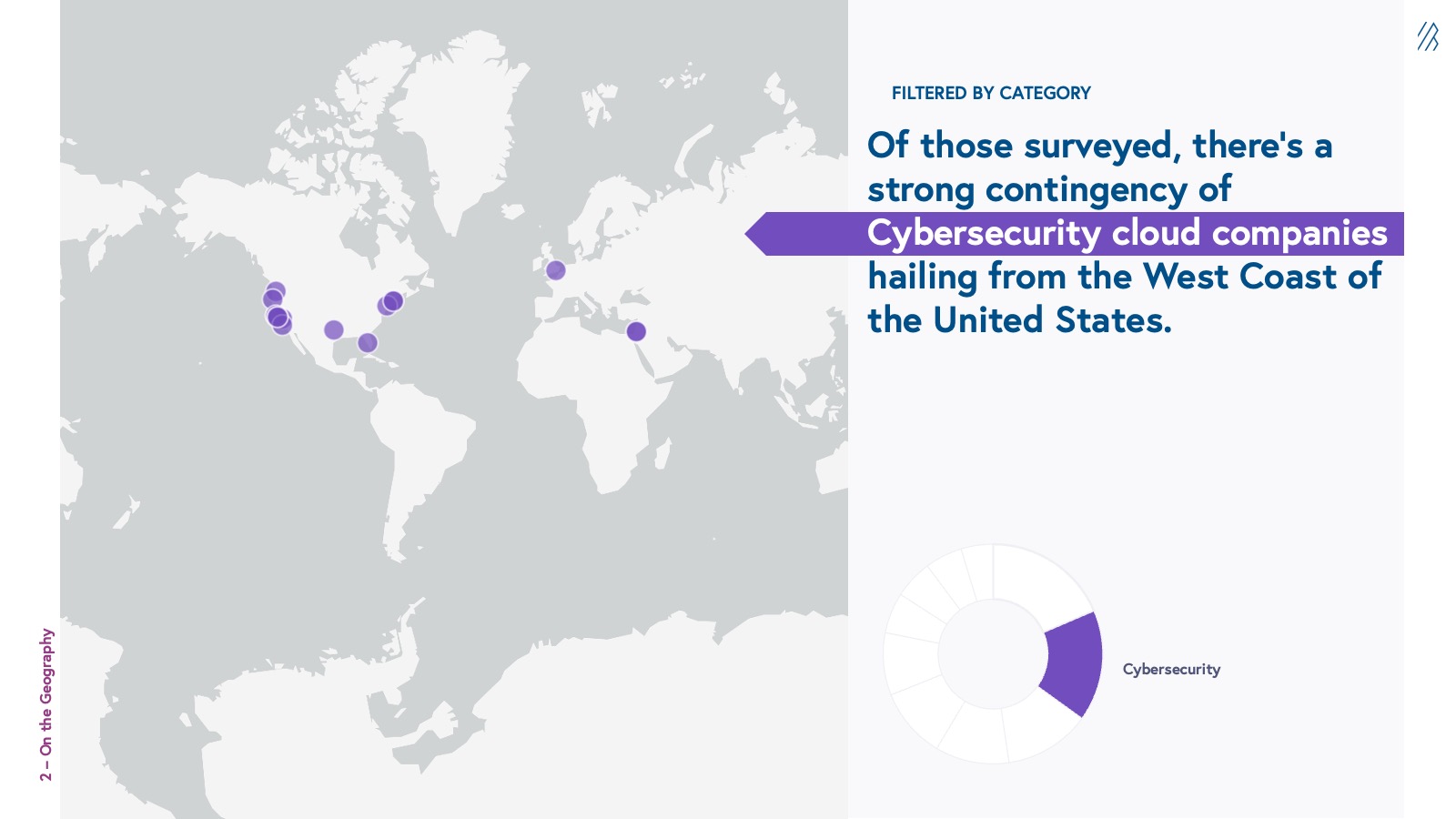

Of those surveyed, there’s a strong contingent of Cybersecurity cloud companies hailing from the West Coast of the United States.

On the geography

San Francisco is the cloud industry epicenter

Top 10 global cities represented

- San Francisco, California - 84

- New York, New York - 44

- Tel Aviv, Israel - 18

- Boston, MA - 13

- London, UK - 12

- Palo Alto, California - 10

- Paris, France - 8

- Mountain View, California - 8

- Santa Clara, California - 8

- San Mateo, California - 8

While innovation is global, the Bay Area still has a strong gravitational pull for the cloud industry. Of the top 10 cities represented, San Francisco is the top headquartered city for cloud companies, with 84 names within city limits. New York (44) ranks second and serves as the East Coast epicenter for emerging tech startups. The remaining top cities are clear representatives of SaaS ecosystems around the world — Tel Aviv, Israel, comes in third place (18), back to Boston, Massachusetts, for fourth (13), and then across The Pond to Europe with London, England, in fifth (12), and Paris, France, in eighth (8).

52% of all surveyed cloud companies are headquartered in California, with over 34 companies based specifically in the Silicon Valley cities of Palo Alto (10), Mountain View (8), Santa Clara (8), or San Mateo (8).

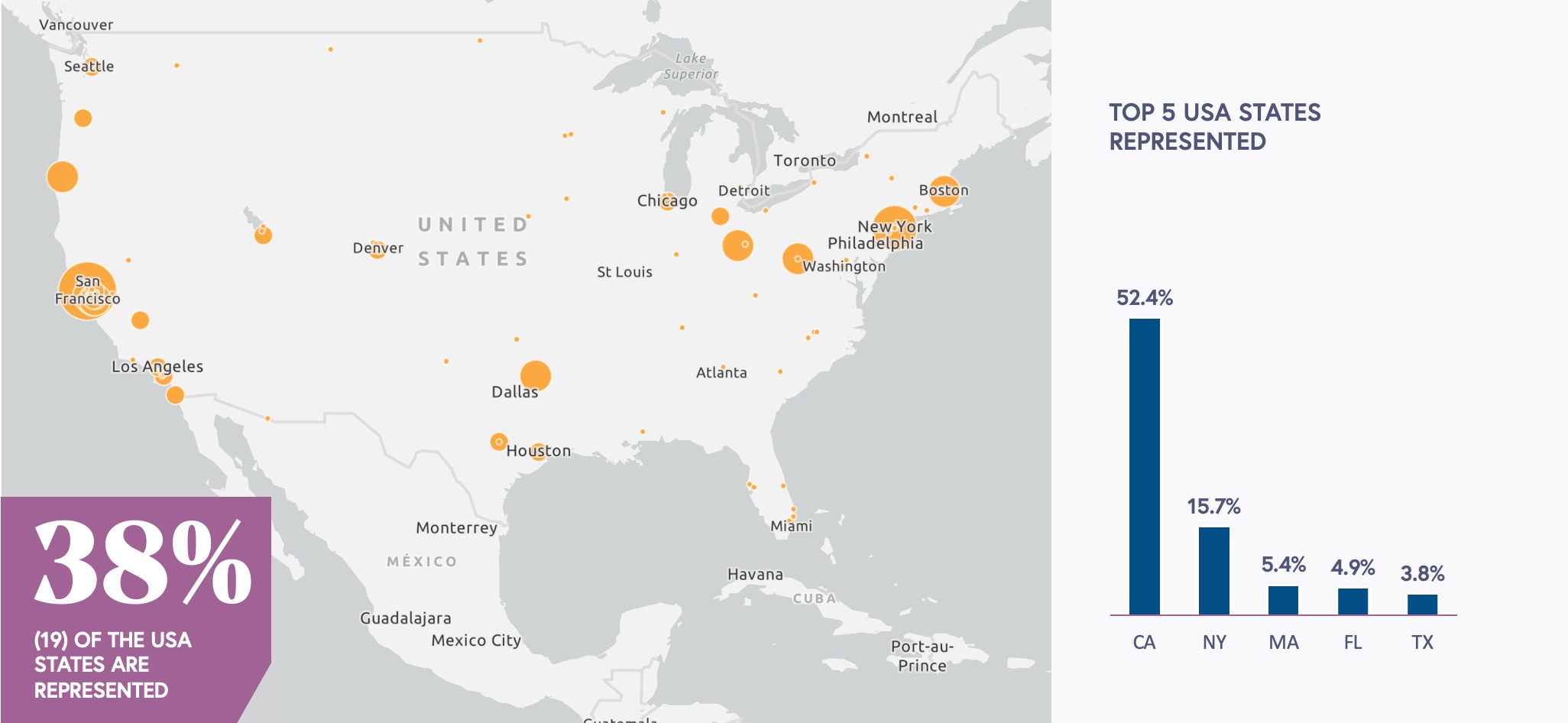

Since 2020, Austin, Texas, and Miami, Florida, have dominated the newscycle as anticipated new tech capitals in North America, yet from this survey, it doesn’t appear this has come to fruition — at least for the cloud industry. Austin only had three companies represented and Miami had two. However, when we look at the top five USA states, Florida and Texas both reached the top five, each with 4%.

52% of cloud companies reside in California

Of the businesses surveyed, 38% (19) of the USA states are represented.

Top 5 USA states represented

- 52% - California

- 16% - New York

- 5% - Massachusetts

- 4% - Florida

- 4% - Texas

On the size

The typical (median) cloud company has 478 full-time employees (FTEs), whereas the average cloud company has 230

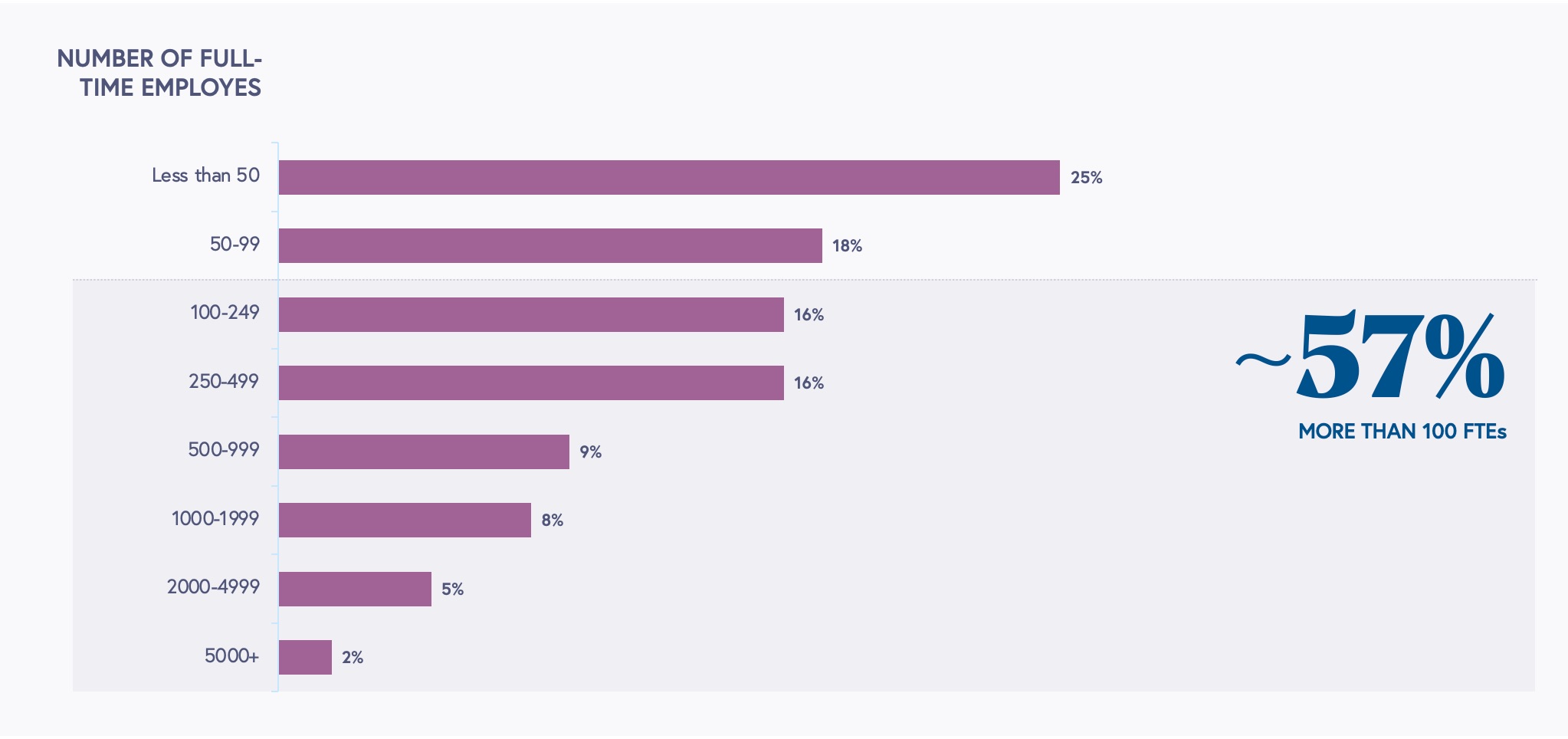

A quarter of cloud companies surveyed have teams with less than 50 people, and 65% have teams with more than 100 people. There was one company that reported 14,000 full-time employees.

The breakdown of the total number of FTEs

- 25.3% have less than 50 employees.

- 17.6% have 50 to 99 employees.

- 16.3% have 100 to 249 employees.

- 16.3% have 250 to 499 employees.

- 9.4% have 500 to 999 employees.

- 8.2% have 1,000 to 1,999 employees.

- 5.0% have 2,000 to 4,999 employees.

- 1.7% have 5,000+ employees.

On the leadership

AI is already reshaping the majority of SaaS products

By the end of the year, 86% of cloud companies will have an AI feature

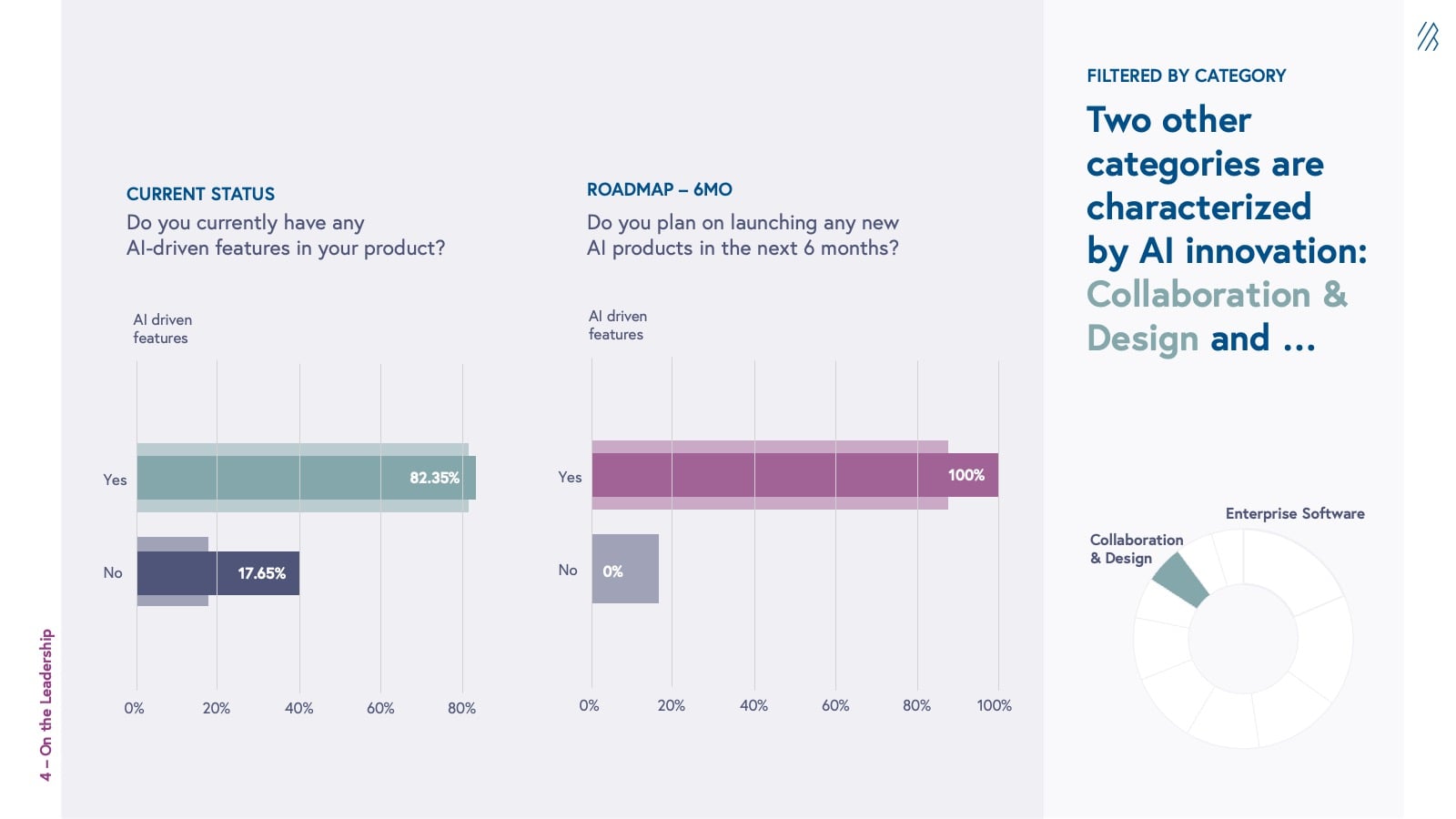

When we surveyed cloud companies in June 2023, we asked “Do you currently have any AI-driven features in your product?” 82% replied with “Yes” and 18% replied with “No.”

When we asked them if they’d have AI features in the next six months (by the end of 2023), the rate of change was only 4%+ to “Yes,” supporting our view that much of the AI innovation in SaaS is already in motion.

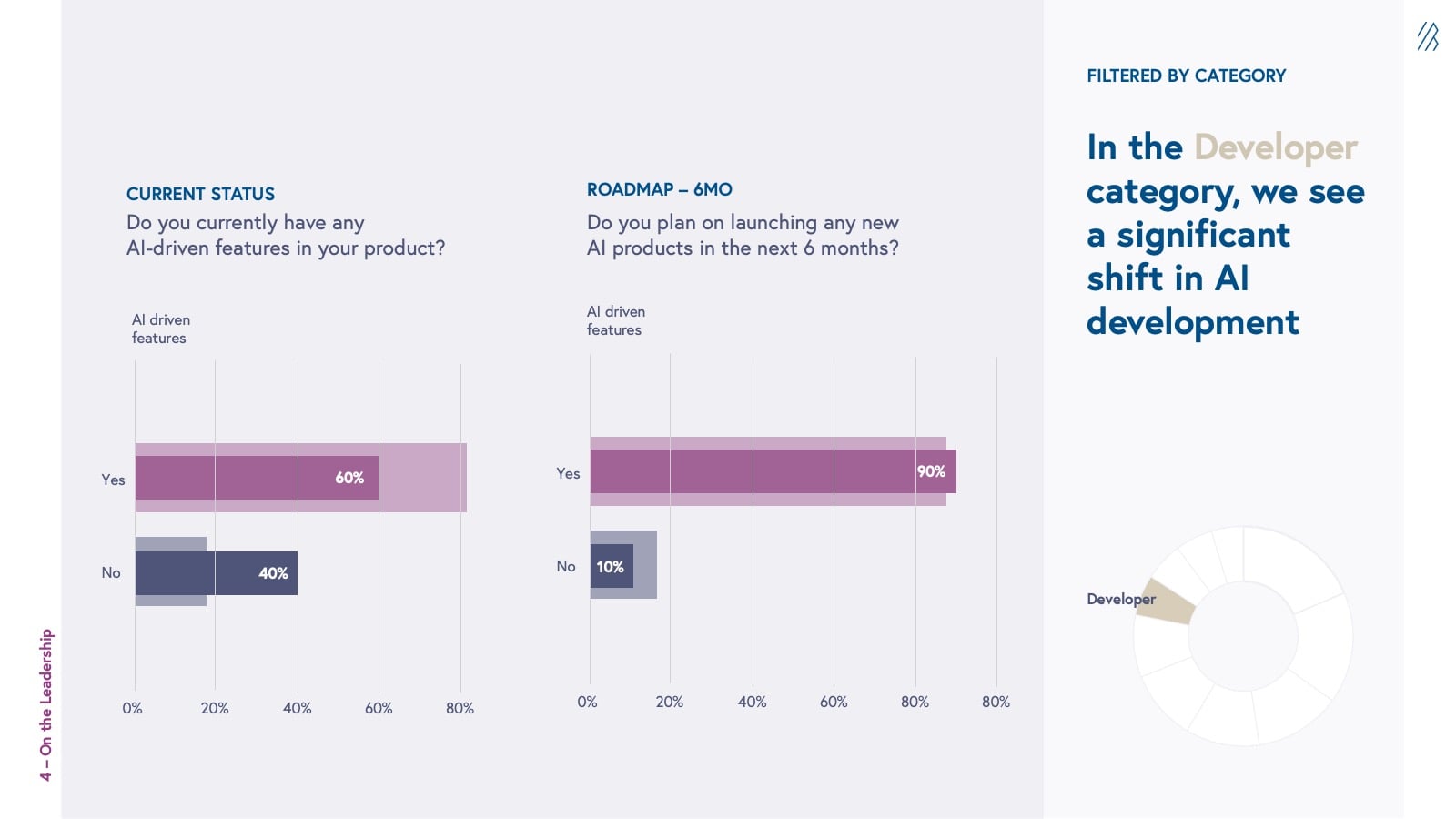

The Developer category was an exception. In June 2023, 60% of Developer companies reported having an AI feature, and by the end of the year, 90% expect to have an AI feature — a 30%+ jump.

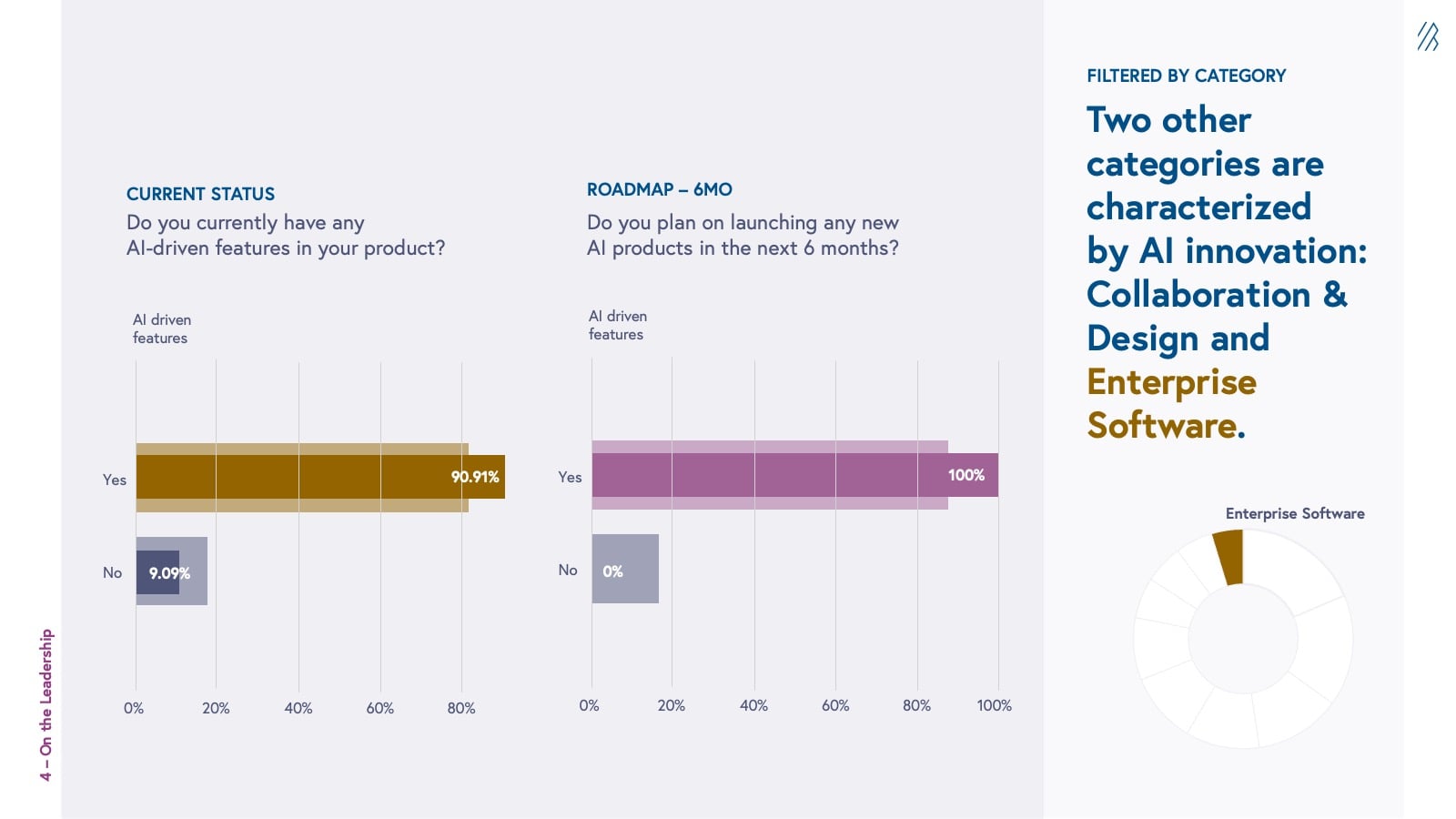

Two other categories are characterized by additional investment in AI: Collaboration & Design and Enterprise Software. Companies in both of these categories reported that by the end of the year, 100% will have at least one AI feature, marking a 10%+ change for Enterprise Software and 18%+ change for Collaboration & Design.

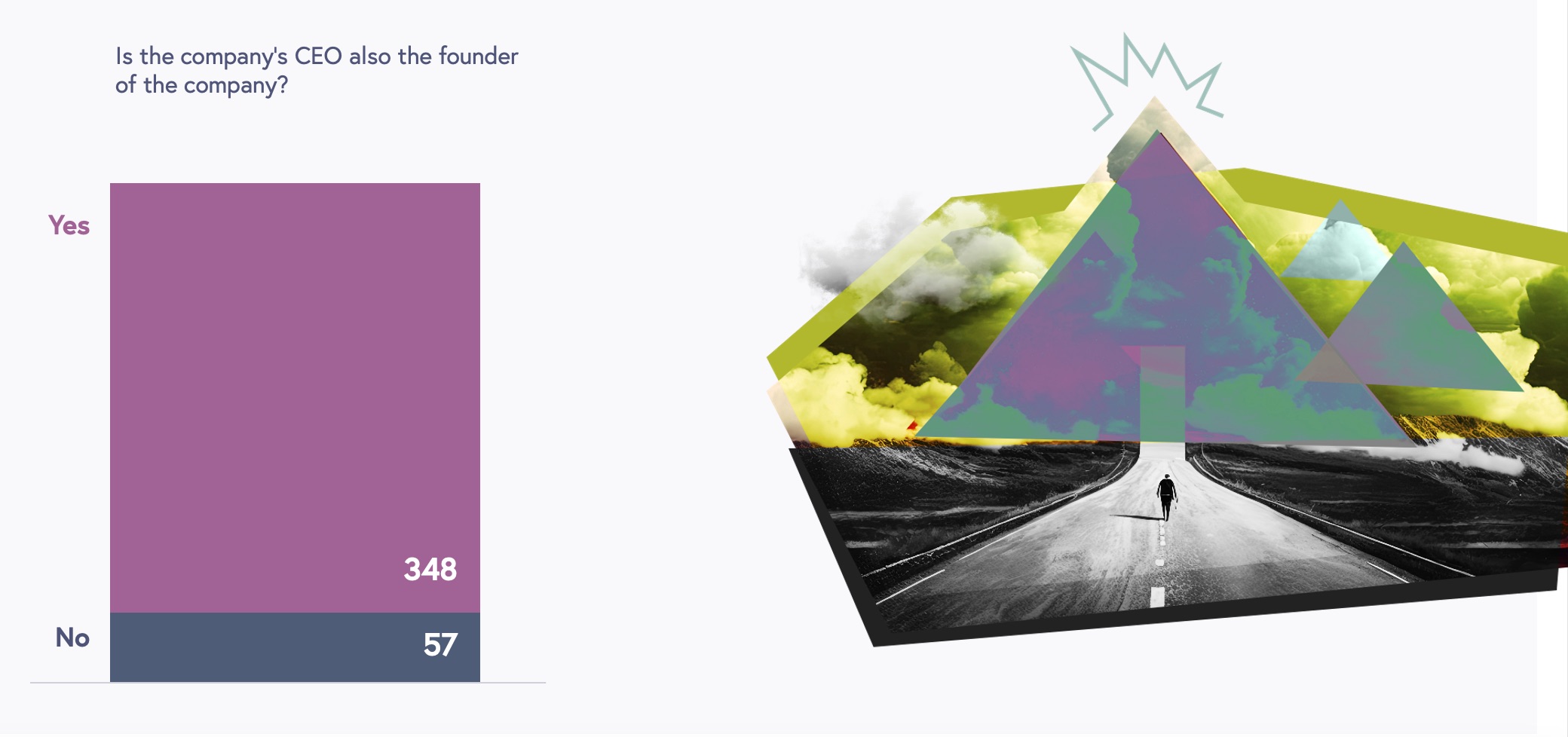

Breakdown of companies with a founder CEO vs. non-founder CEO

86% of the companies have a CEO that is also a founder of the business, whereas 14% of these cloud companies have a non-founder CEO.

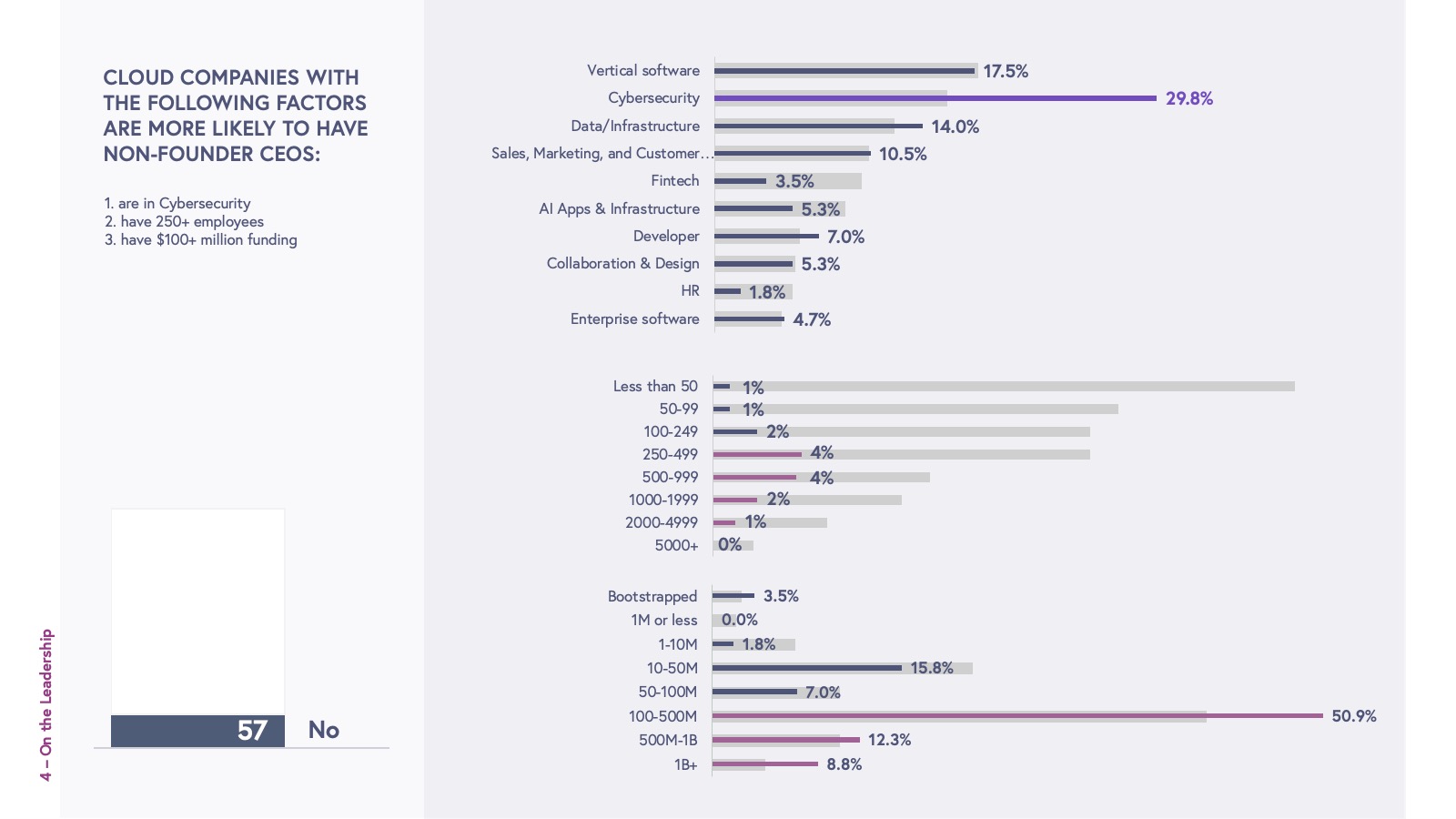

Cloud companies with the following factors are more likely to have non-founder CEOs: are in Cybersecurity, have 250+ employees, or have $100+ million funding.

Three key insights arise when we look at the non-founder CEO cohort:

- Cybersecurity cloud companies have the highest rate of CEOs who were not founding members of the business.

- Companies with more than 250 employees have higher rates of non-founder CEOs, indicating that those companies have a higher likelihood of leadership transition than companies with fewer than 250 employees.

- Of the cloud companies surveyed with non-founder CEOs, 51% have raised a total of $100 to $500 million in total funding. This trend indicates that after reaching $100 million in total funding, there’s a higher likelihood of leadership transition.

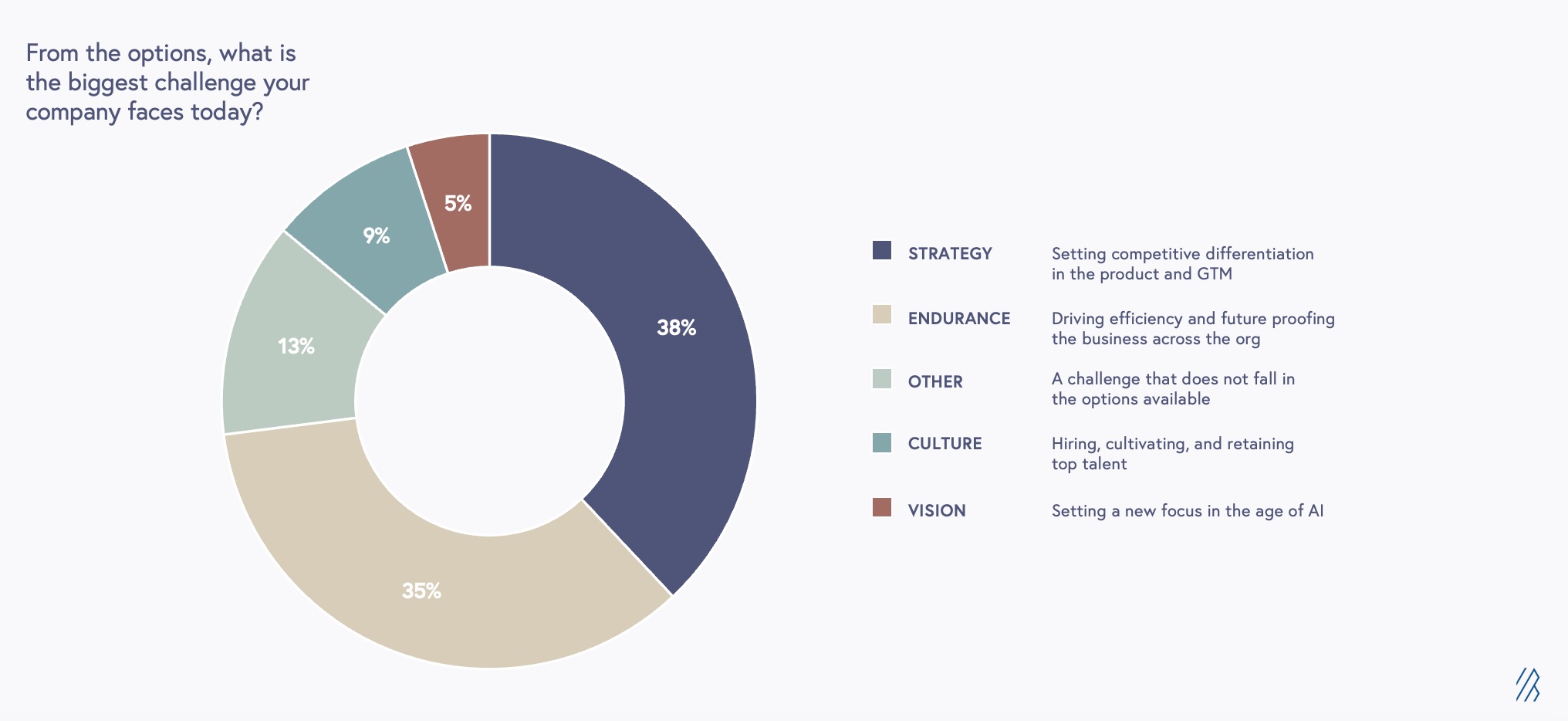

Setting competitive differentiation in the product and go-to-market strategy is the top ranking challenge among cloud companies.

Every business has its unique challenges. To gauge which headwinds are strongest for cloud companies in 2023, we defined four key themes: (1) Vision: setting a new focus in the age of AI (2) Strategy: setting competitive differentiation in the product and GTM, (3) Endurance: driving efficiency and future proofing the business across the organization, and (4) Culture: hiring, developing, and retaining top talent.

Top cloud company challenges

- 38% - Strategy

- 35% - Endurance

- 13% - Other

- 9% - Culture

- 5% - Vision

With 2023 being a year of AI innovation and driving efficiency and profitable growth, it’s no surprise that “Strategy” and “Endurance” were the top challenges facing cloud companies. Ranking in third place was “Other,” where a significant proportion of respondents (13%) shared a wide array of challenges, including:

- Macroeconomic challenges

- Maintaining an agile and experimental nature as the organization grows

- Meeting the expectations of hyper growth benchmarks

- New geography expansion

- Packaging and pricing

- PR and marketing

- Product adoption in an emerging category

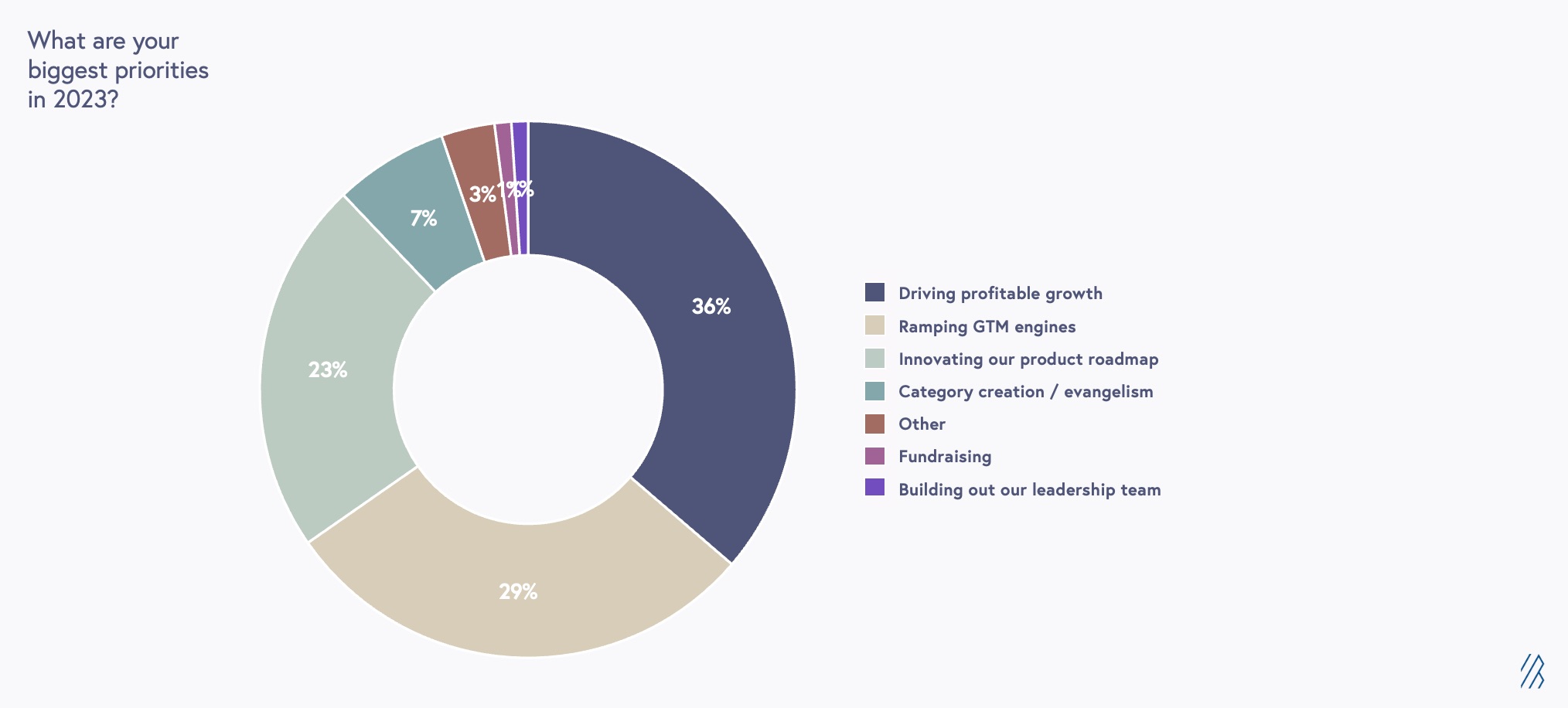

In 2023, cloud companies rank driving profitable growth as the leading business objective with fundraising as one of their lowest priorities

We went on to ask cloud companies what their biggest business priorities are for 2023. We created six themes: (1) driving profitable growth, (2) ramping GTM engines, (3) innovating the product roadmap, (4) category creation, (5) fundraising, and (6) building out the leadership team.

Top cloud company priorities

- 36.0% - Driving profitable growth

- 28.8% - Ramping GTM engines

- 22.4% - Innovating product roadmap

- 6.8% - Category creation / evangelism

- 3.2% - Other

- 1.6% - Fundraising

- 1.2% - Building out the leadership team

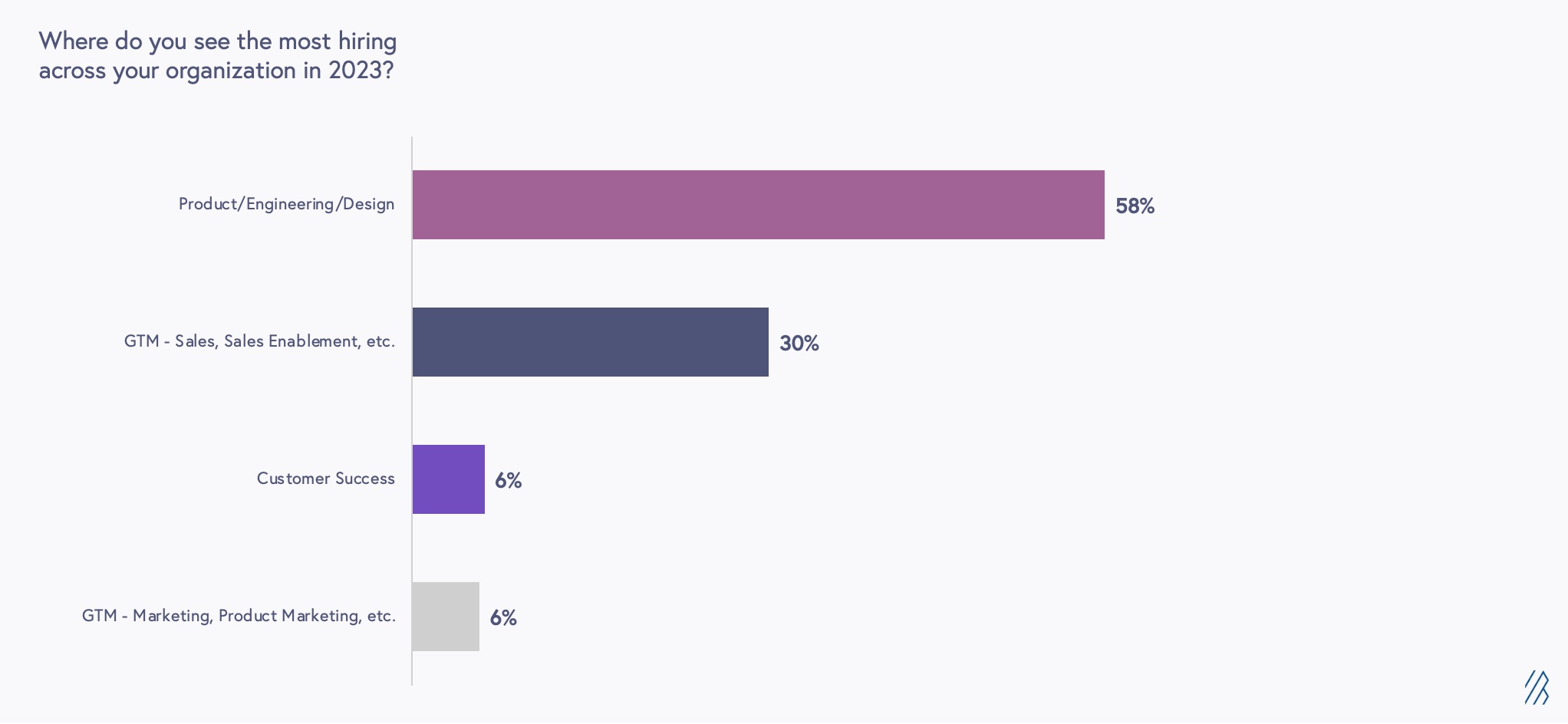

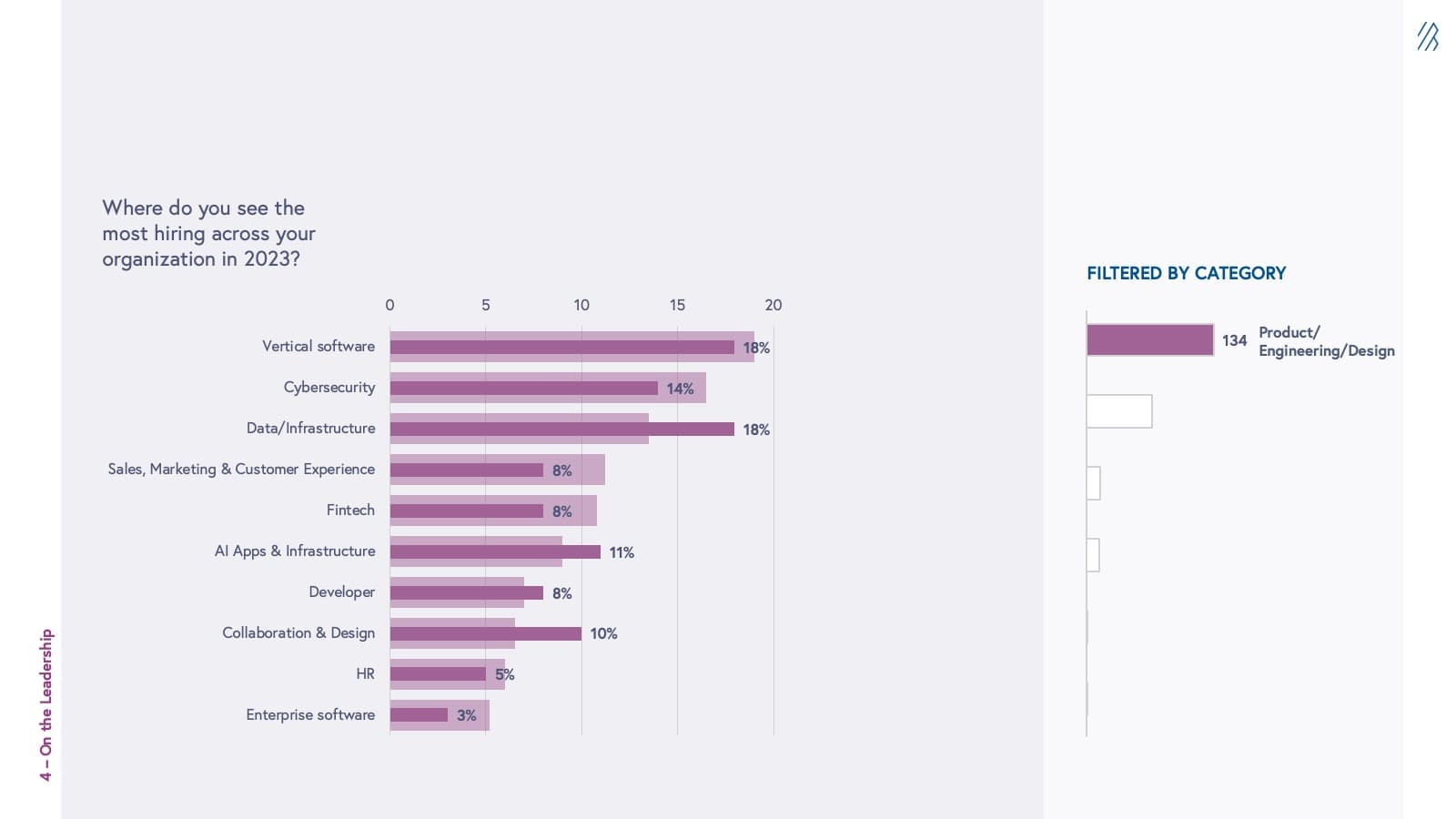

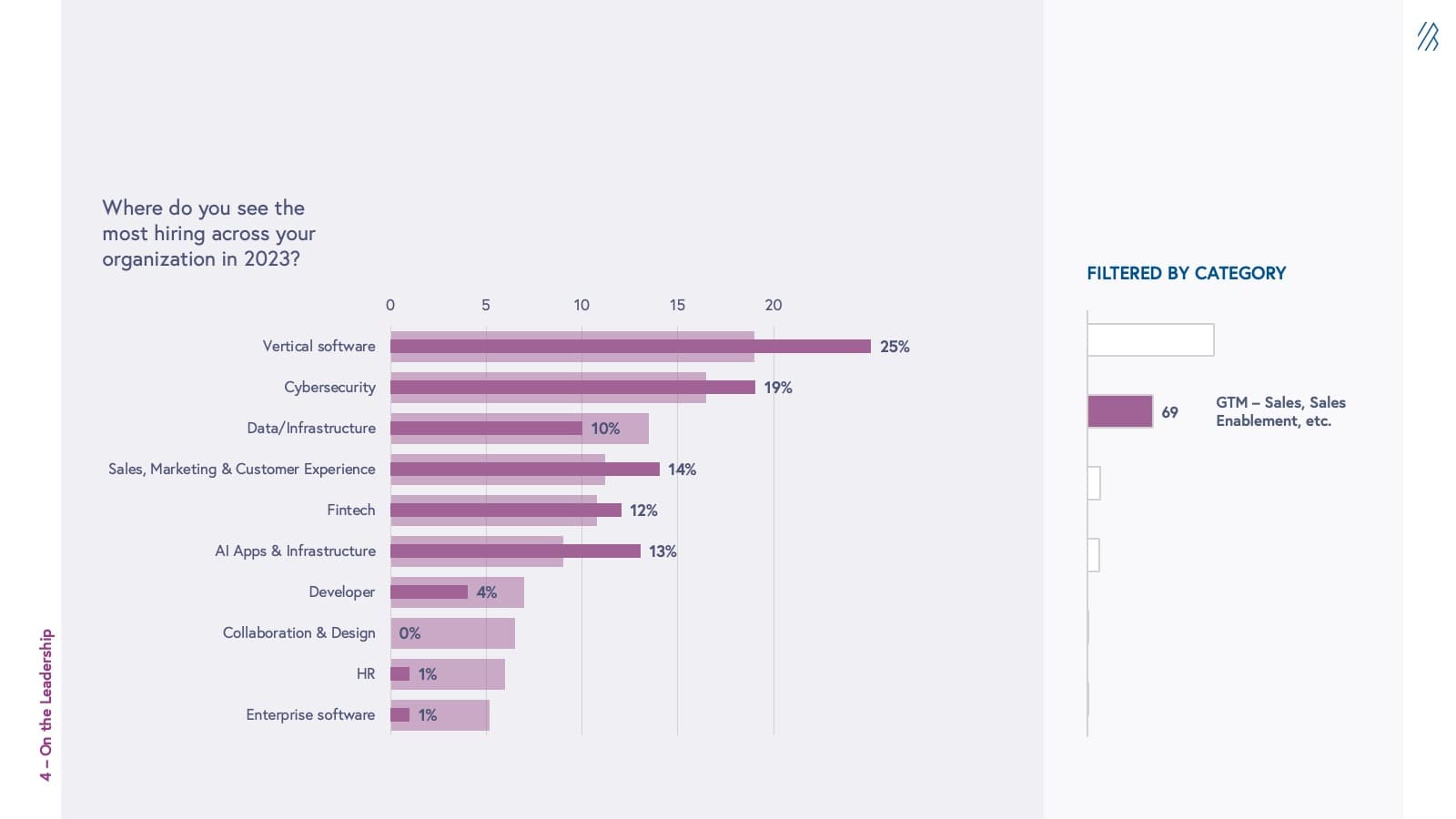

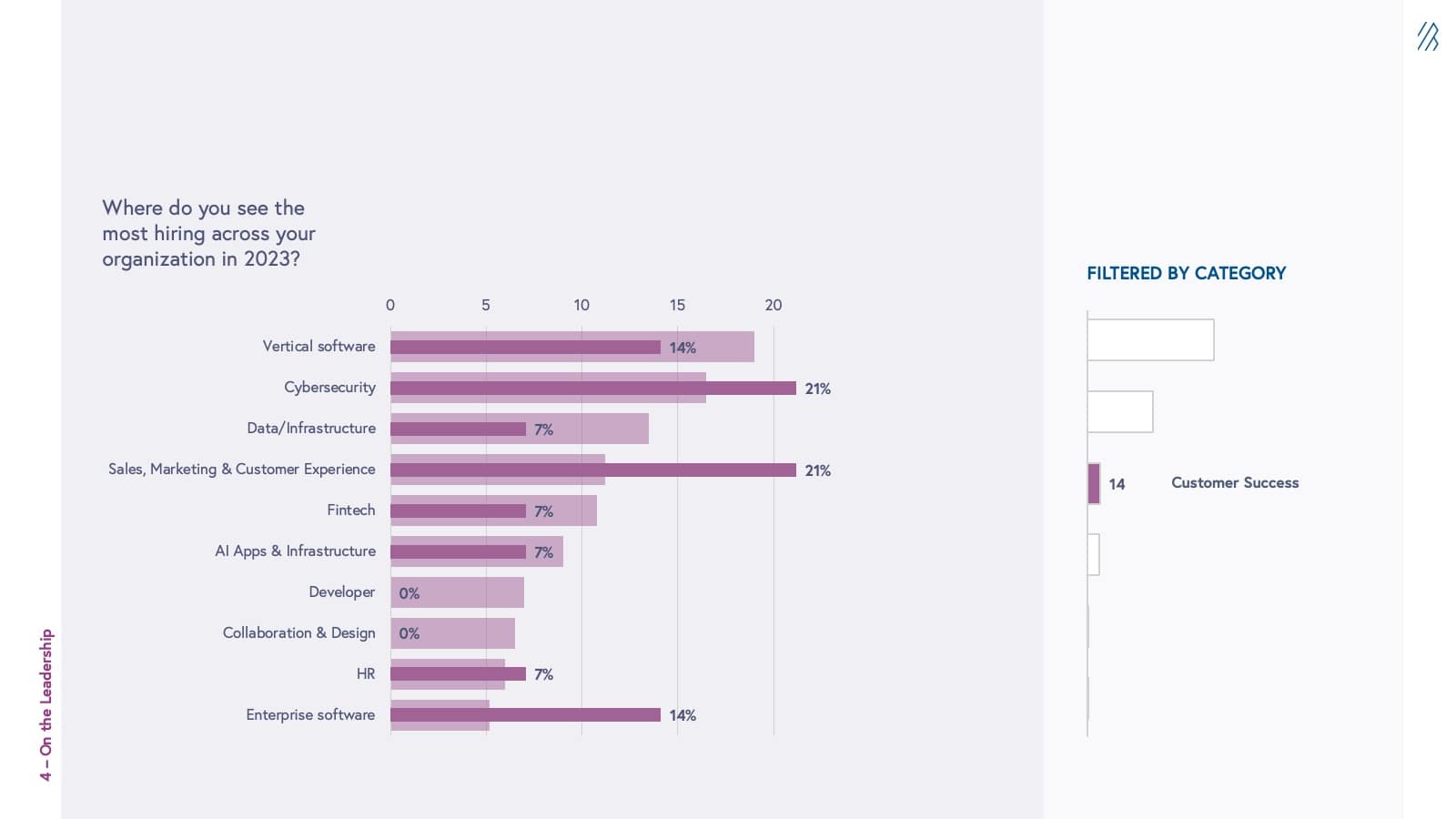

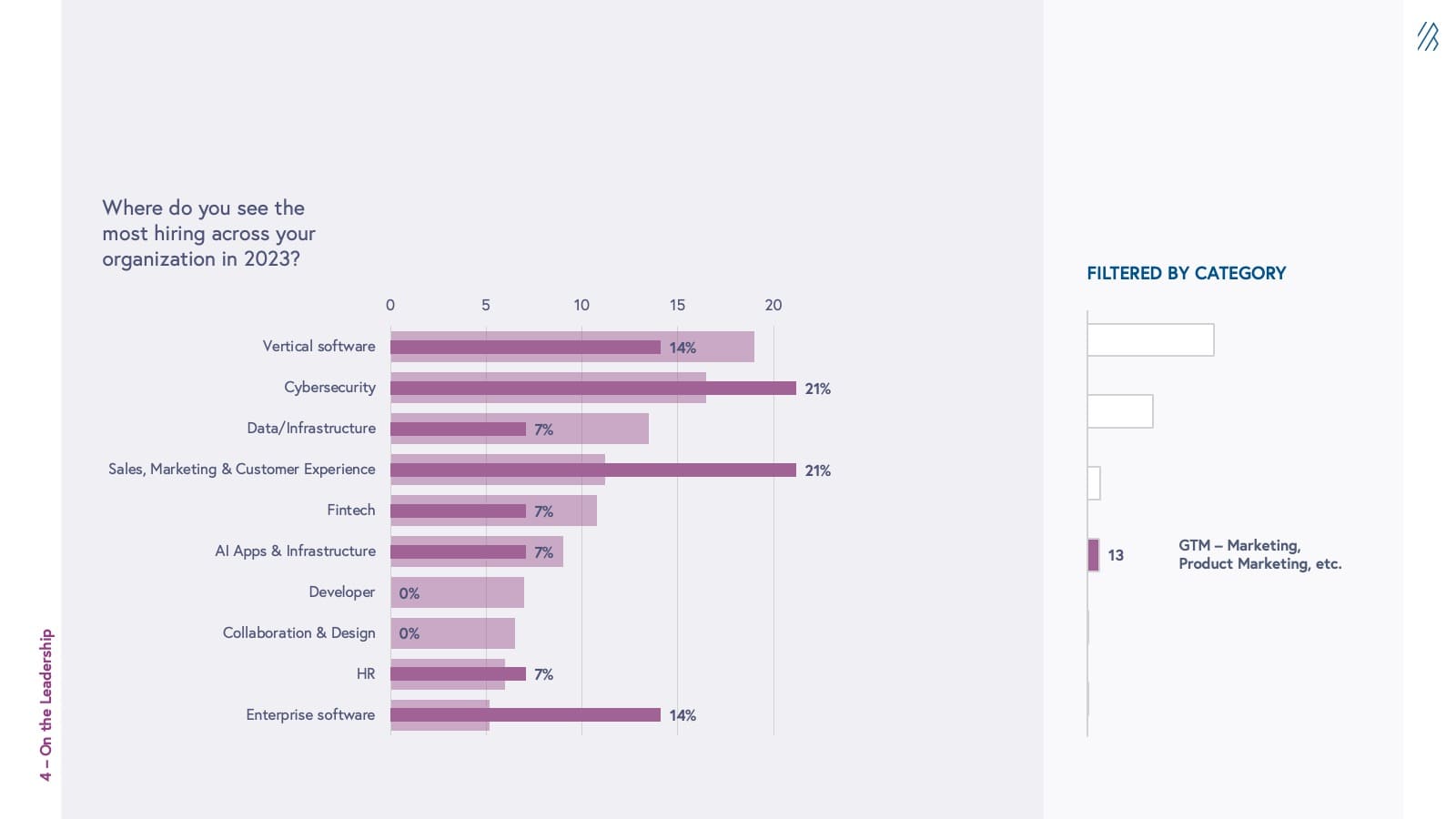

The majority of cloud companies report seeing the most hiring in product, engineering, and design

The past two years have seen significant volatility in the job market — from The Great Resignation to tech hiring freezes and rounds of layoffs, and finally, to a slightly warmer market.

In light of these changes, we wanted to determine where cloud companies are still investing in headcount. In the survey, we asked where cloud companies see the most hiring across the organization in 2023. (Keep in mind that these responses are anecdotal and not measured by the number of open positions.)

From the survey results we see that across all categories, a majority of cloud companies are prioritizing hiring in product, engineering, and design (58%) with the least prioritization in customer success and marketing (6%). (Note: This question received a 57% response rate.)

Top areas of the organization for hiring

- 58% - Product, Engineering, Design

- 30% - GTM - Sales, Sales Enablement

- 6% - Customer Success

- 6% - GTM - Marketing, Product Marketing

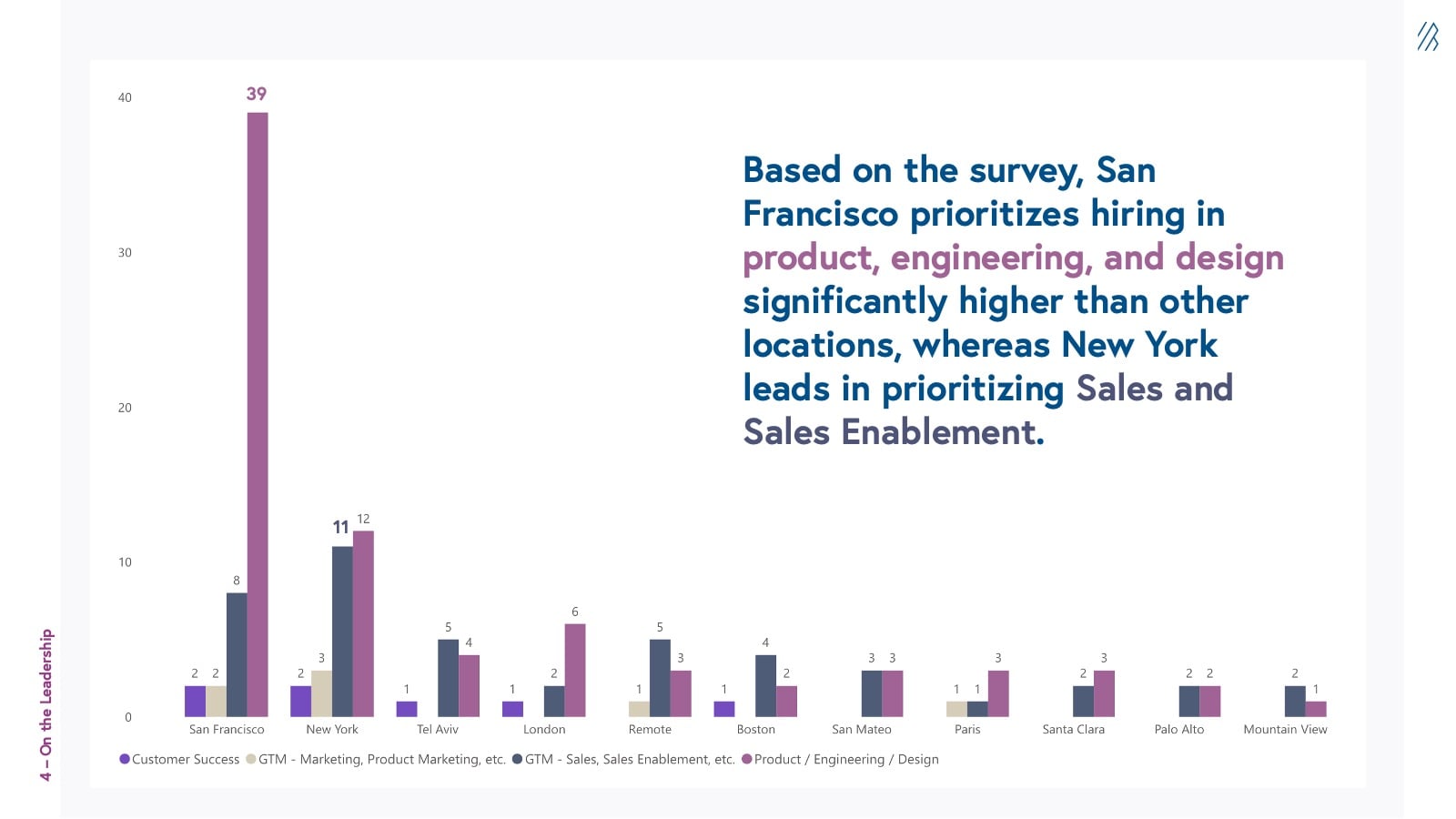

Based on the survey, San Francisco prioritizes hiring in product, engineering, and design significantly higher than other locations, whereas New York leads in prioritizing Sales and Sales Enablement.

By job type and category, there are some interesting directional trends. For example:

Product, engineering, and design roles have a higher likelihood of opportunity in Data Infrastructure, Vertical Software, and Cybersecurity categories.

Sales and sales enablement roles have a higher likelihood of opportunity in Vertical Software, Security, and GTM categories.

Customer success roles have a higher likelihood of opportunity in Security, GTM, Enterprise Software, and Vertical Software categories.

Marketing roles have a higher likelihood of opportunity in Vertical Software, GTM, and HR categories.

On the financials

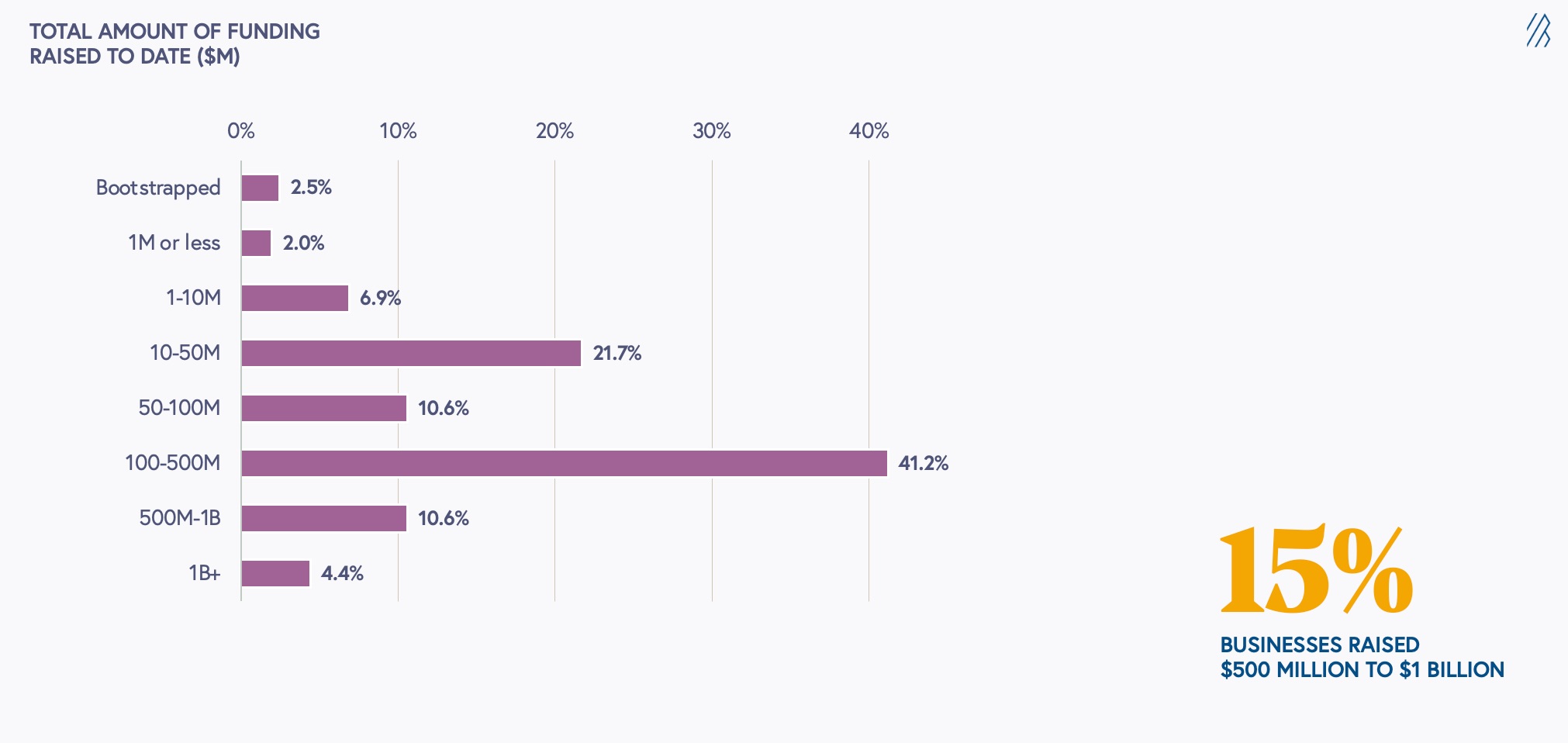

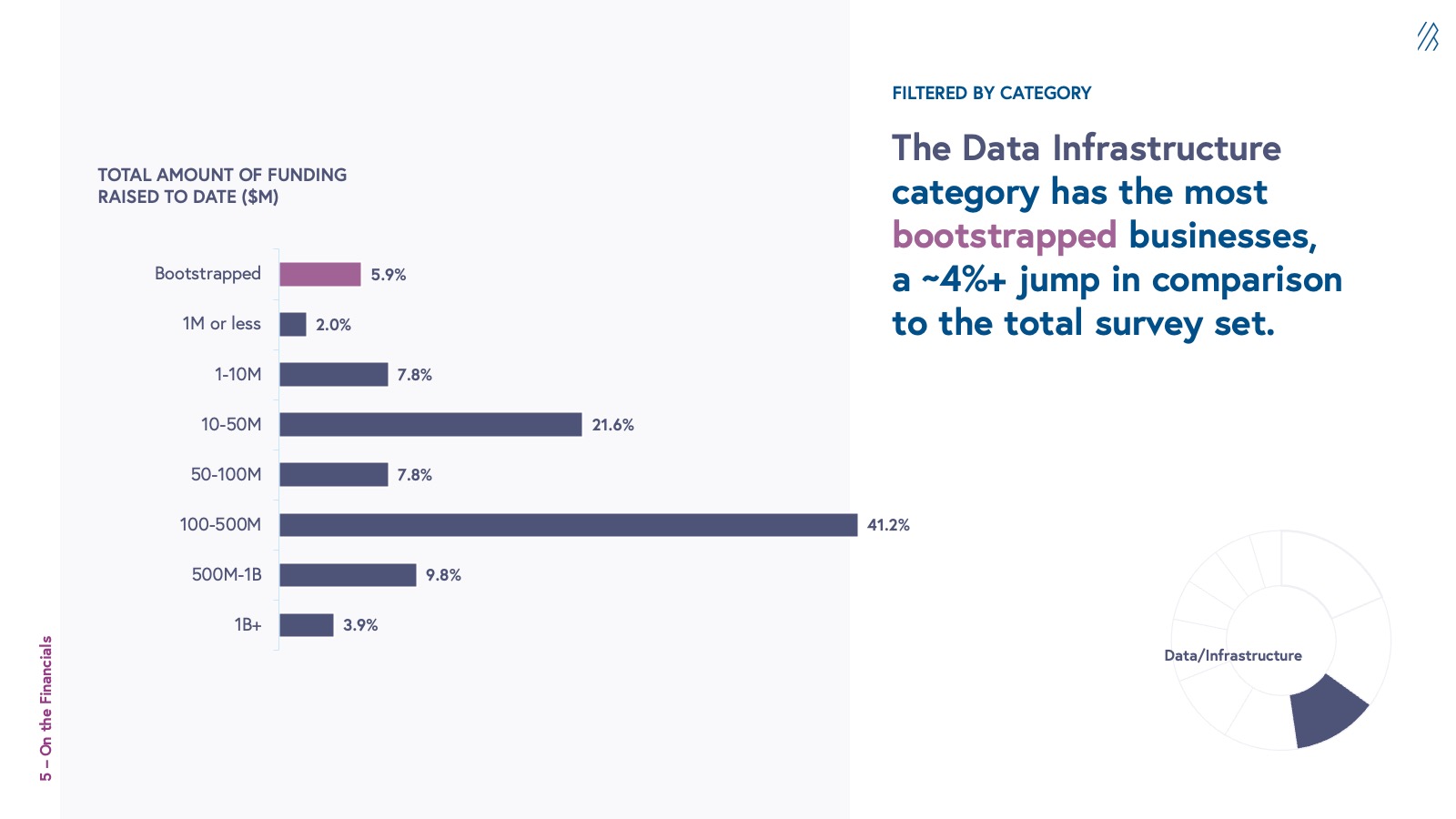

A majority of surveyed cloud companies have raised over $100 million+ in total funding

Total amount of funding raised to date

- 2.5% - Bootstrapped

- 2.0% - $1M or less

- 6.9% - $1M -10M

- 21.7% - $10M-50M

- 10.6% - $50M-100M

- 41.2% - $100-500M

- 10.6% - $500M-1B

- 4.4% - $1 billion +

When we look at external reports as benchmarks, we see that the average Series A round is anywhere between $10 to $20 million, and the average Series B round is approximately $45 million. With this in mind, for the sake of this survey, we use the total funding amount to date to roughly approximate the stage of the businesses.

Based on this assumption, a majority of the cloud companies surveyed are in their Growth stages.

Early stage:

- 2.0% have raised 1 million or less in total funding.

- 6.9% have raised $1 to $10 million in total funding.

- 21.7% have raised $10 to $50 million in total funding.

Mid stage:

- 10.6% have raised between $50 to $100 million in total funding.

Growth stage:

- 41.2% have raised anywhere from $100 million to $500 million.

- 36% (146) have raised more than $250 million in total funding.

- 10.6% have raised between $500 million to $1 billion in total funding.

Notable outliers:

- 4.4% (18) have raised $1 billion or more.

- 2.5% are “bootstrapped” and haven’t raised any funding.

Interestingly, the Data Infrastructure category has the most bootstrapped businesses, a ~4%+ jump in comparison to the total survey set.

Based on reported funding data, we can assume the following categories are more mature given the total amount they’ve raised.

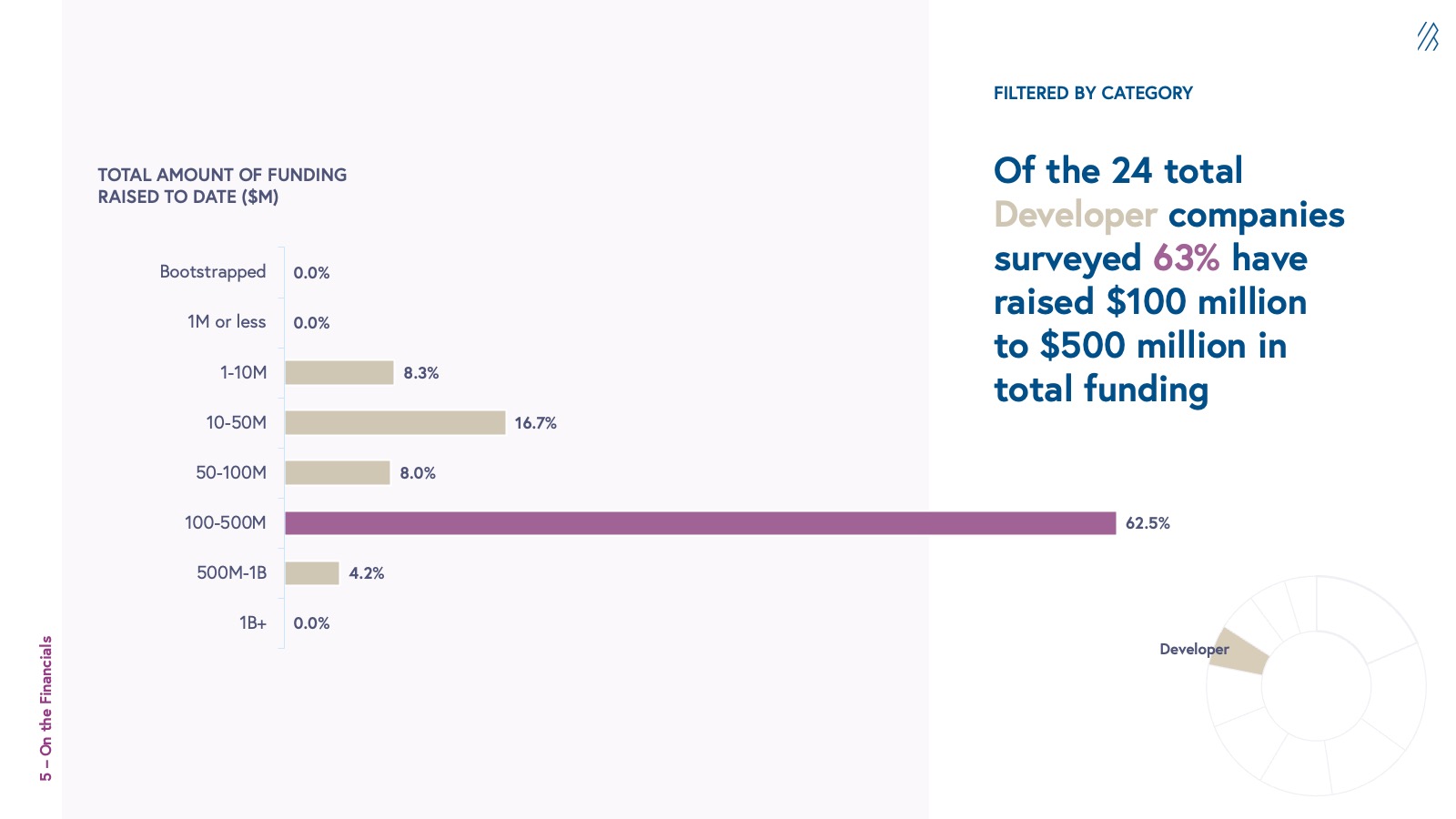

Of the 24 total Developer companies surveyed, 63% of those businesses have raised $100 million to $500 million in total funding.

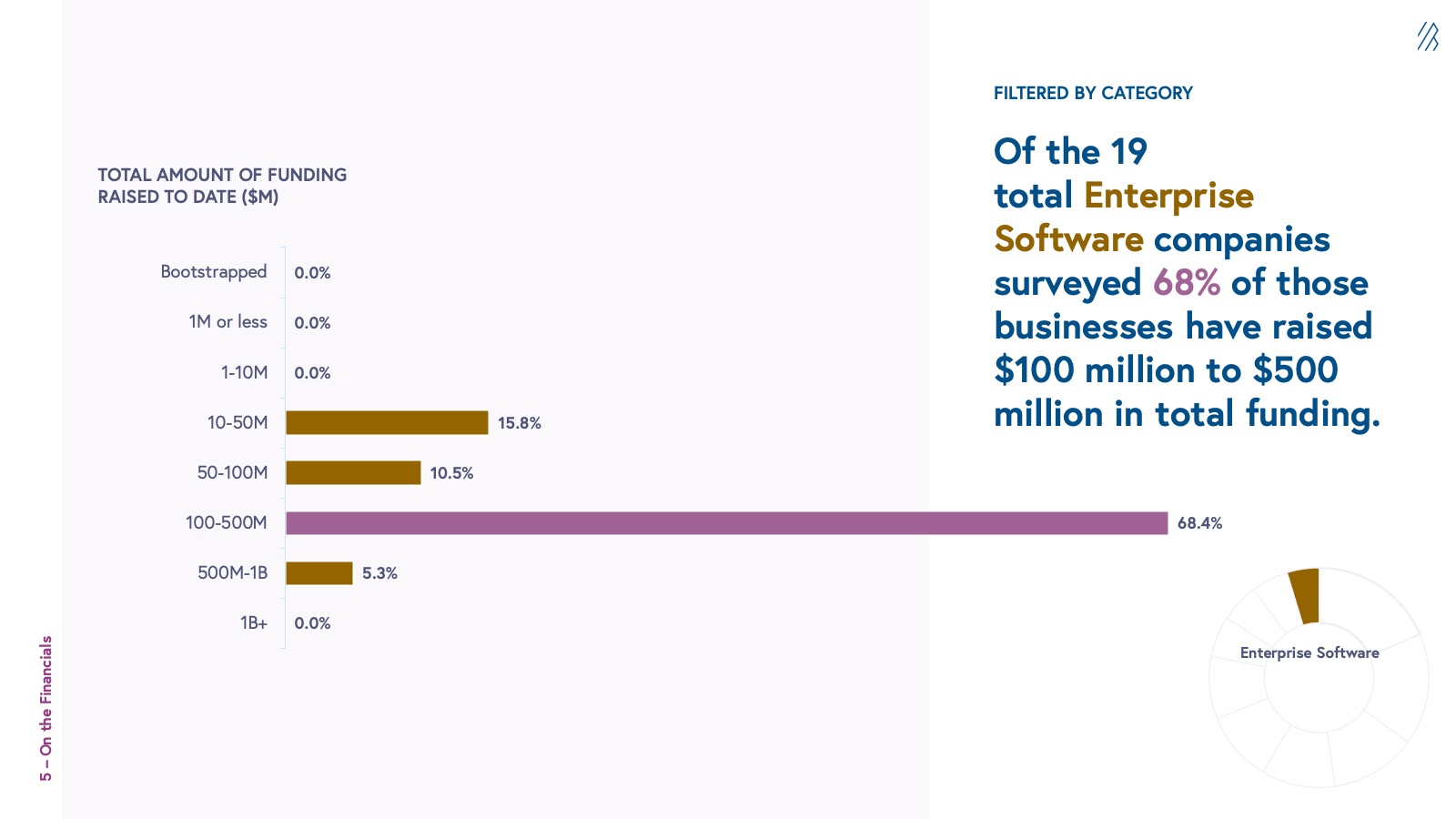

Of the 19 total Enterprise Software companies surveyed 68% of those businesses have raised $100 million to $500 million in total funding.

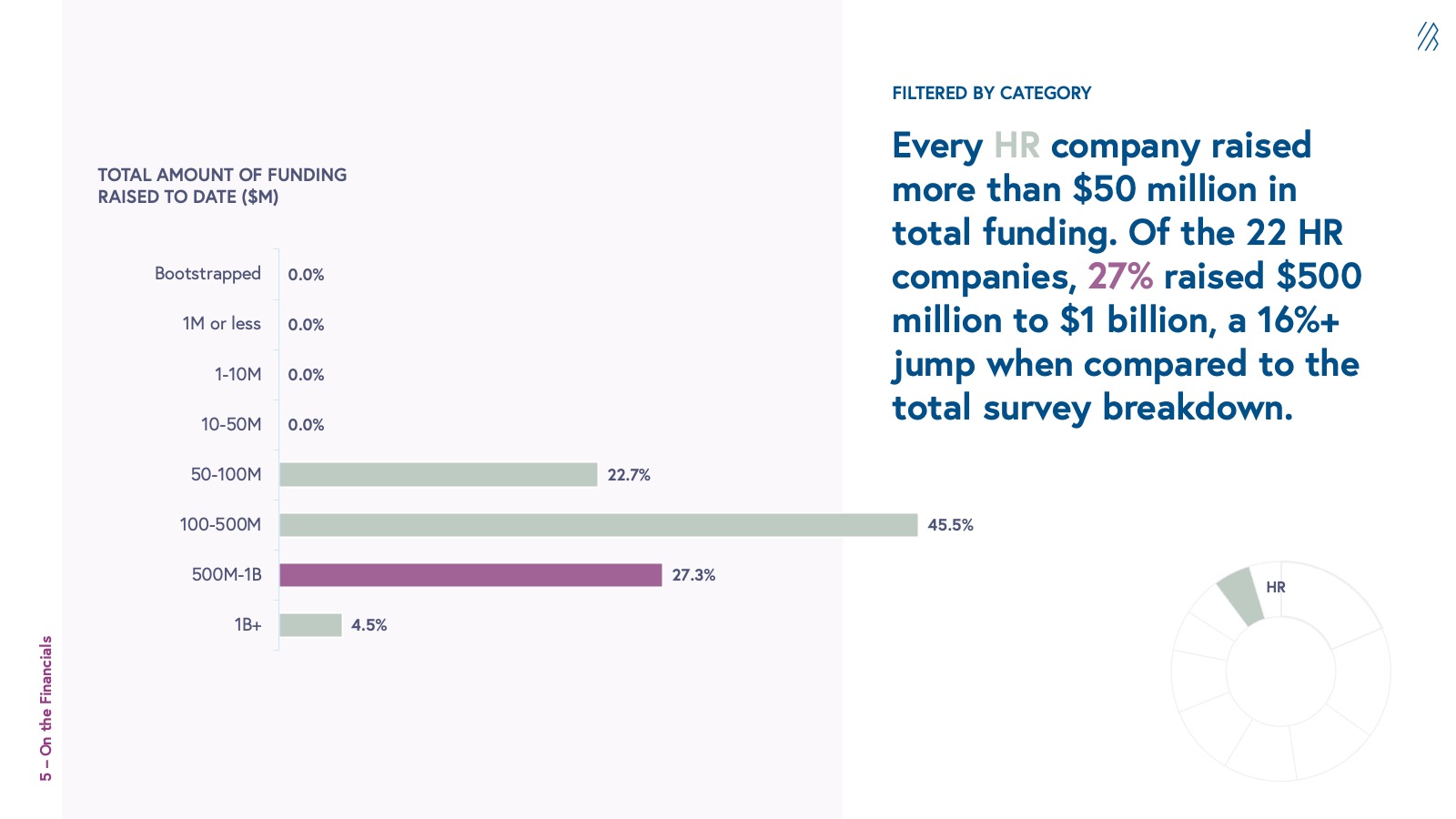

Every HR company surveyed raised more than $50 million in total funding. Notably, of the 22 HR companies, 27% of those businesses raised $500 million to $1 billion, which is 16% higher than the aggregate data set.

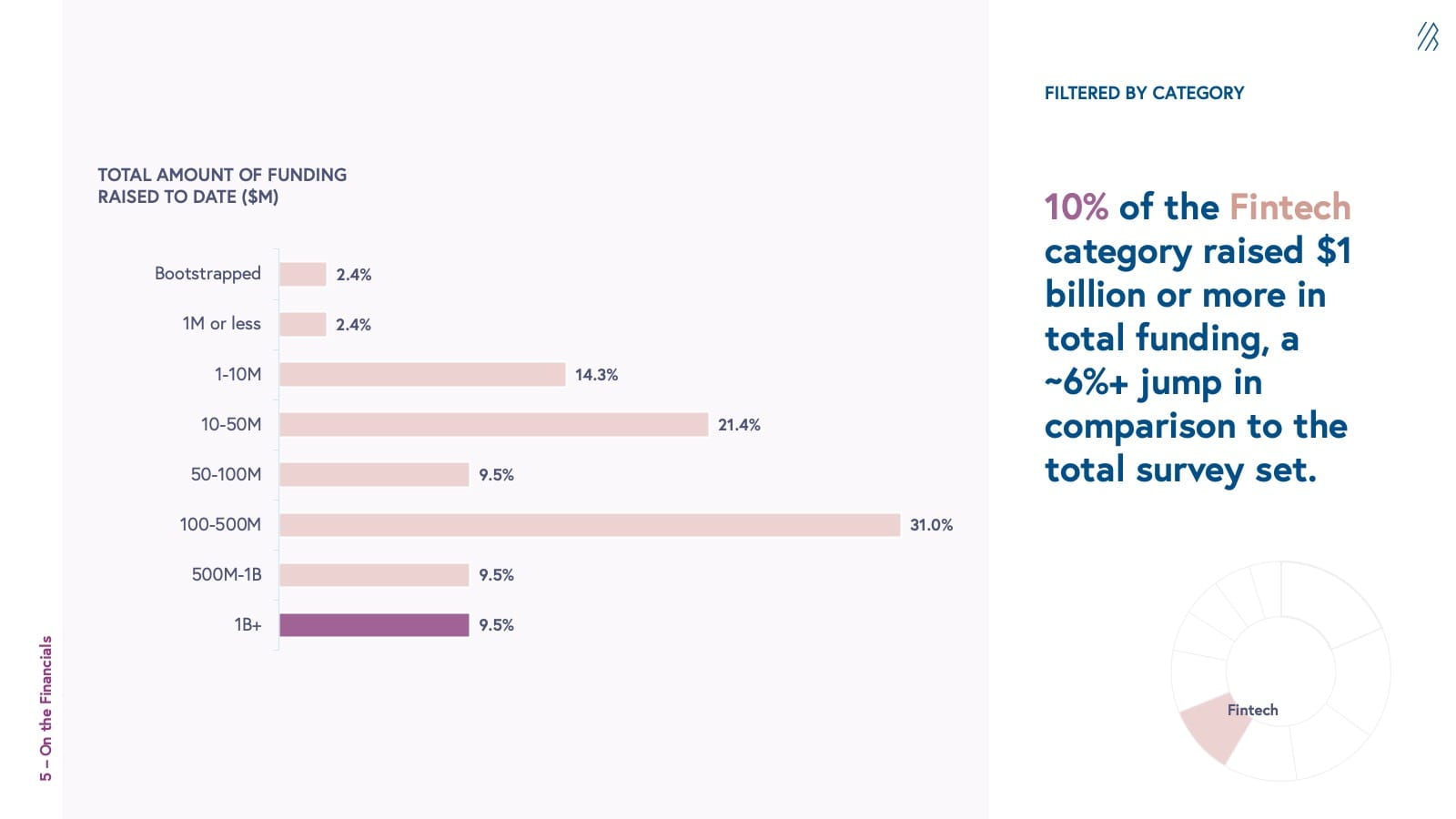

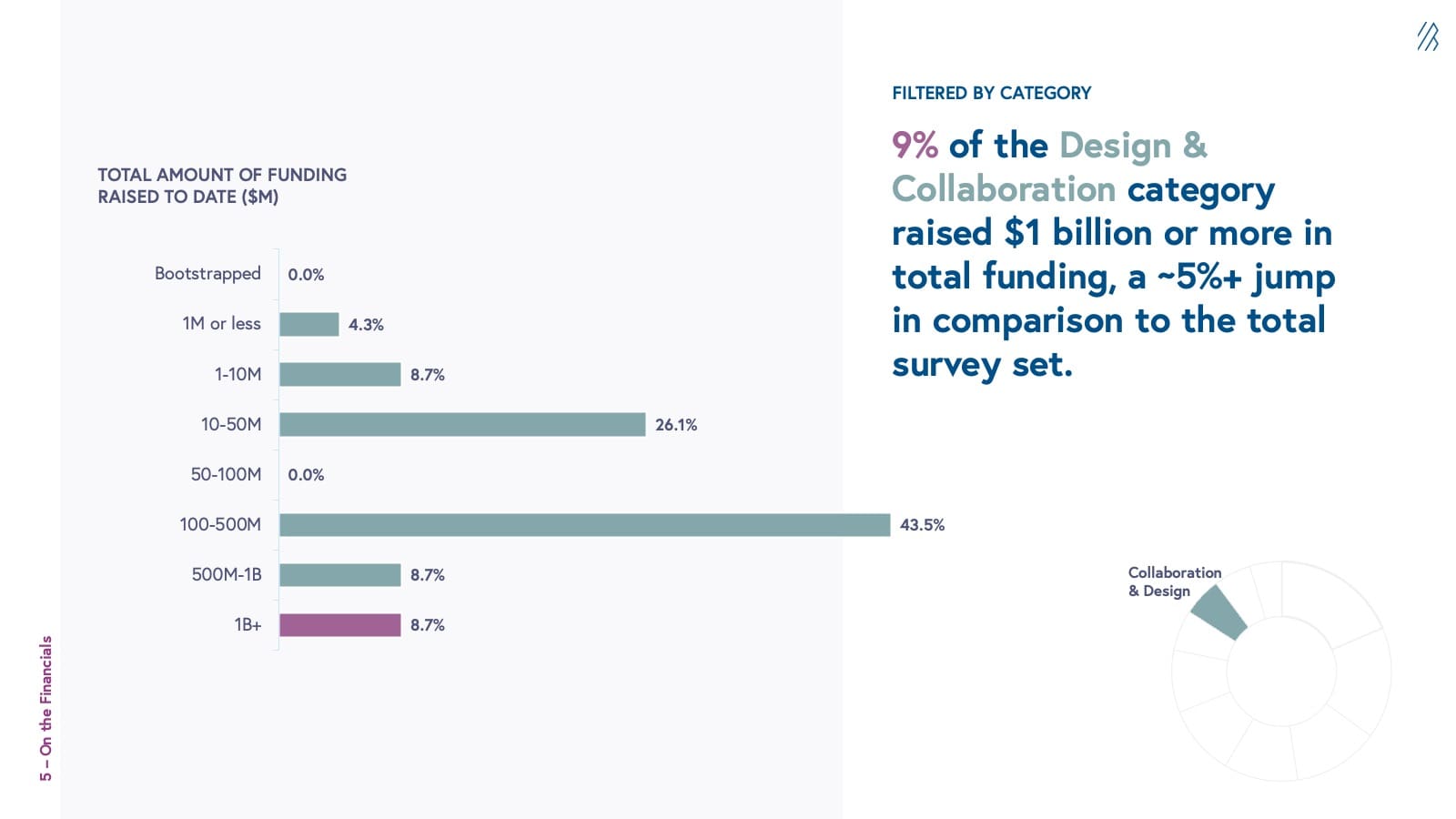

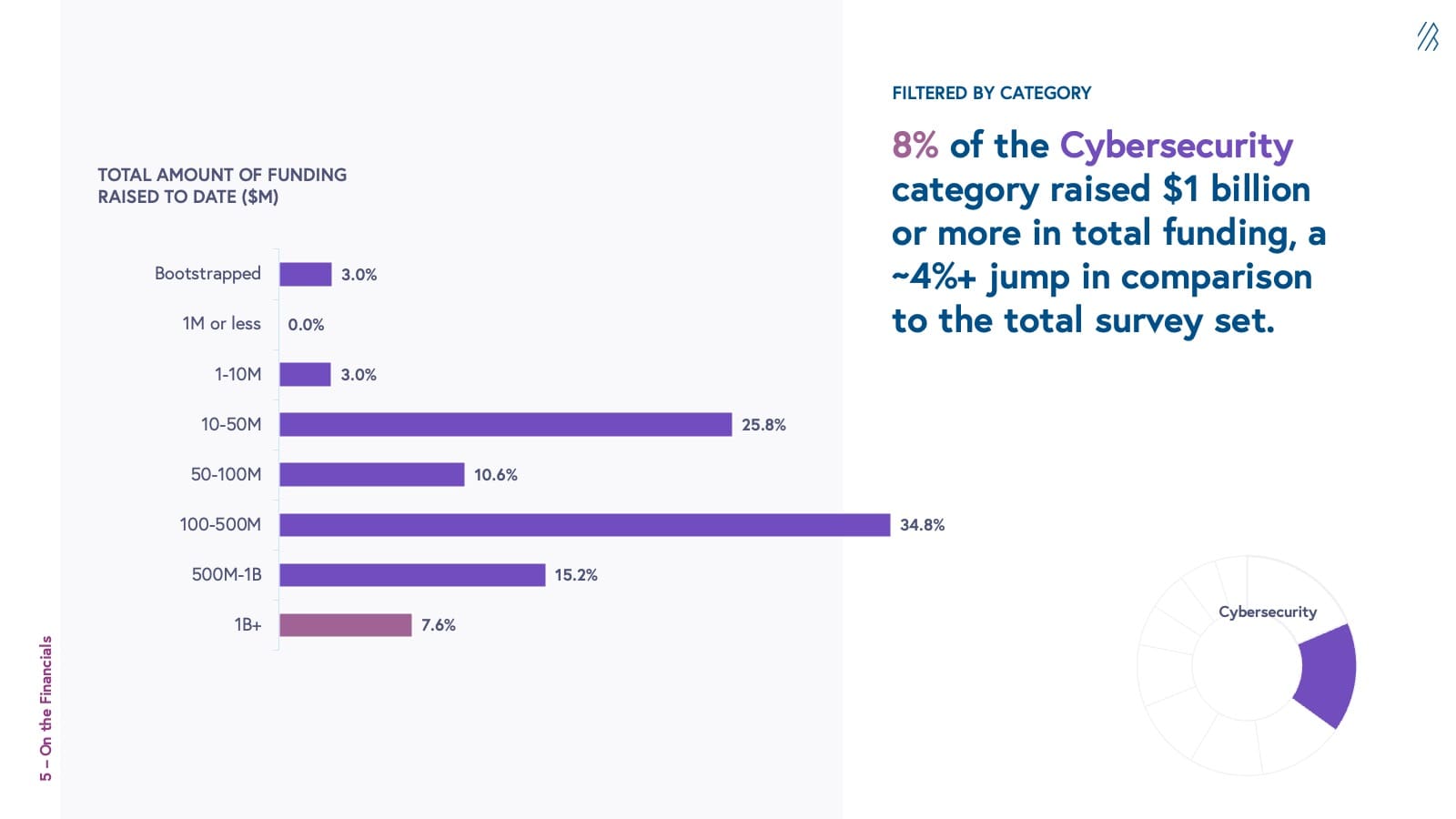

Among the total 18 cloud companies that have raised $1 billion or more in total funding, we see the top three categories: Fintech, Collaboration & Design, and Cybersecurity.

10% of the Fintech category raised $1 billion or more, 6% higher than the percentage of the total survey set.

9% of the Collaboration & Design category raised $1 billion or more, 5% higher than the percentage of the total survey set.

8% of the Cybersecurity category raised $1 billion or more, 4% higher than the percentage of the total survey set.

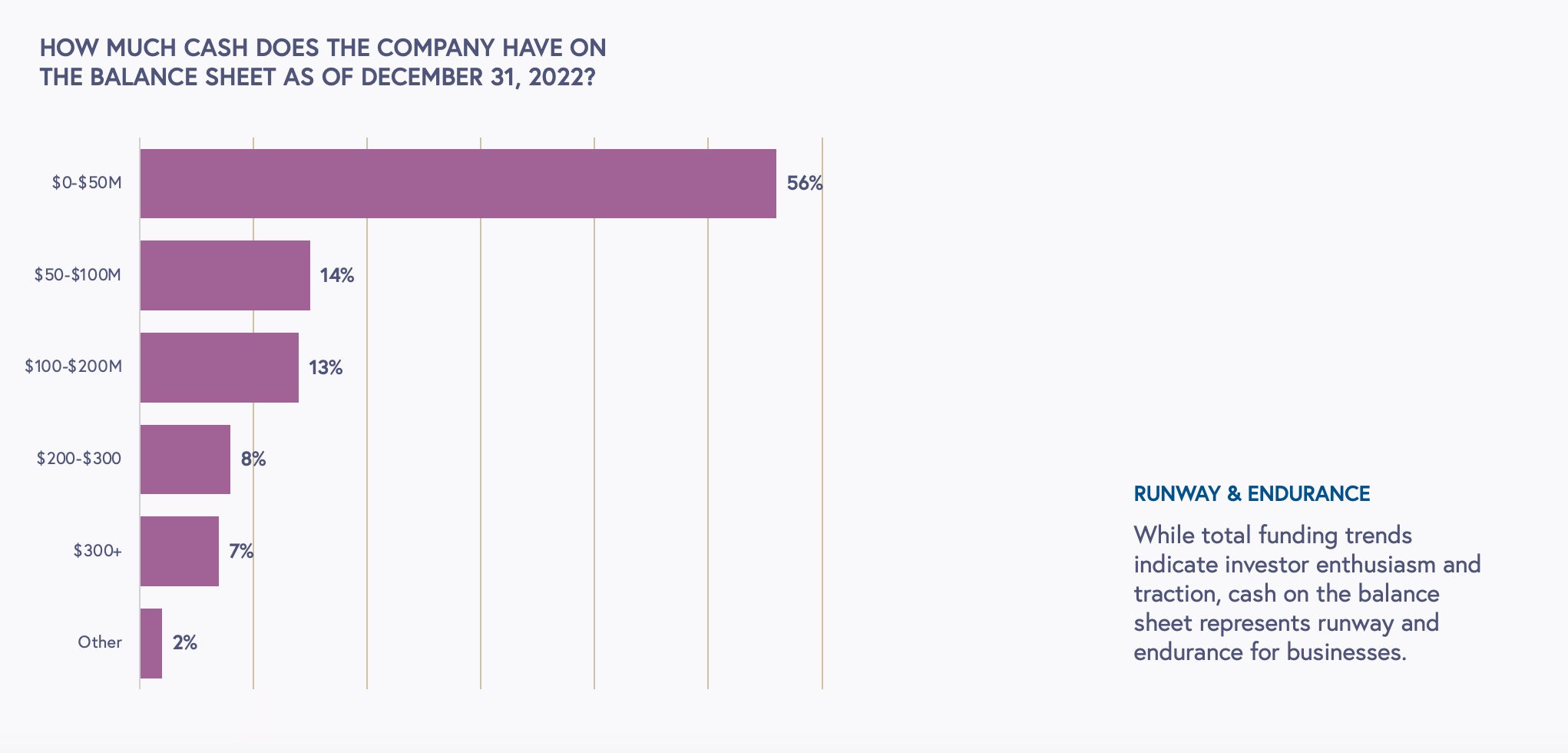

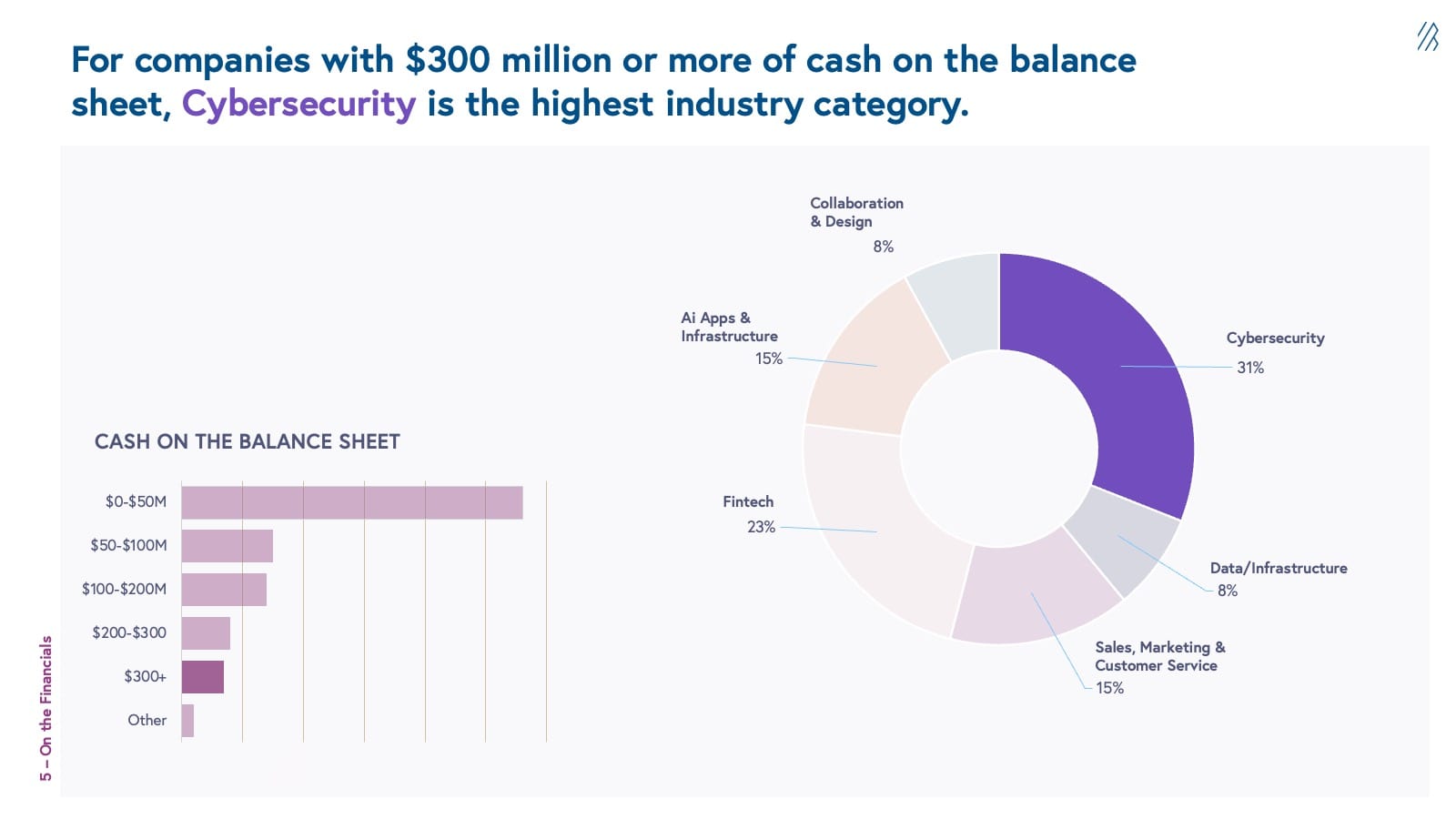

More than half of cloud companies have less than $50 million on the balance sheet, whereas almost a third have $100 million+

While total funding trends indicate investor enthusiasm and traction, cash on the balance sheet represents runway and endurance for businesses.

Cash on the balance sheet

As of December 31, 2022, the surveyed cloud companies (a total of 190 responses) had the total amount of cash on the balance sheet:

- 55.79% have $0 to $50M.

- 14.21% have $50M to $100M.

- 13.16% have $100M to $200M.

- 7.37% have $200M to $300M.

- 6.84% have $300M+.

55% of the cloud companies reported having less than $50 million on the balance sheet, whereas 27% of cloud companies have $100 million or more cash on the balance sheet. The Cybersecurity cloud category had the highest number of companies with $300 million or more of cash on the balance sheet.

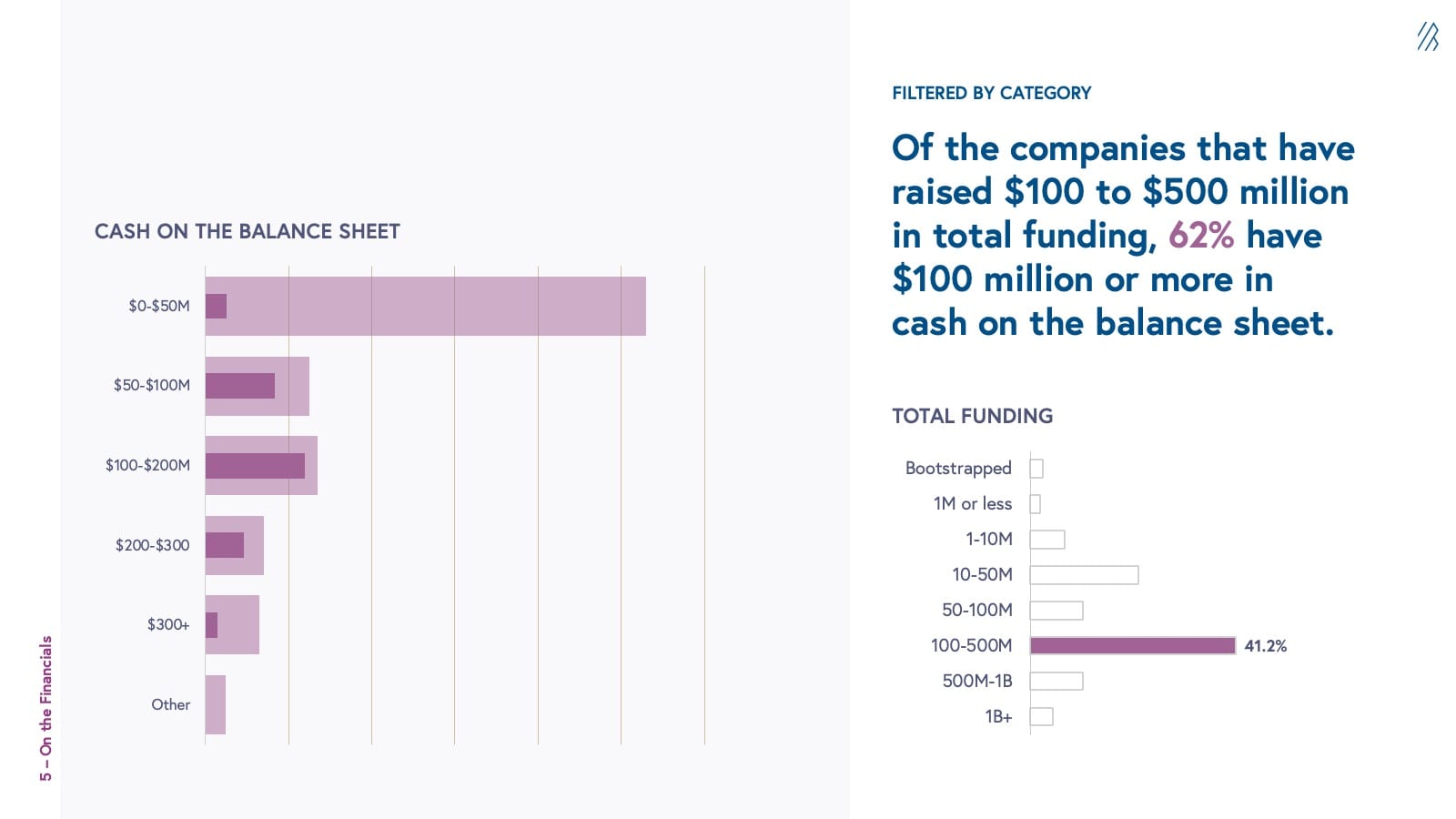

Funding to cash correlation

Of the companies that have raised $100 to $500 million in total funding, we see the following breakdown in terms of total cash on the balance sheet as of of December 31, 2022:

- 9% have $0 to $50 million on the balance sheet.

- 29% have $50 to $100 million on the balance sheet.

- 41% have $100 to $200 million on the balance sheet.

- 16% have $200 to $300 million on the balance sheet.

- 5% have $300 million on the balance sheet.

For the 41% of cloud companies that have raised $100 to $500 million in total funding, 62% of that cohort have $100 million or more in cash on the balance sheet.

Of the cloud companies that have raised $1 billion or more, over 70% have more than $300 million on the balance sheet

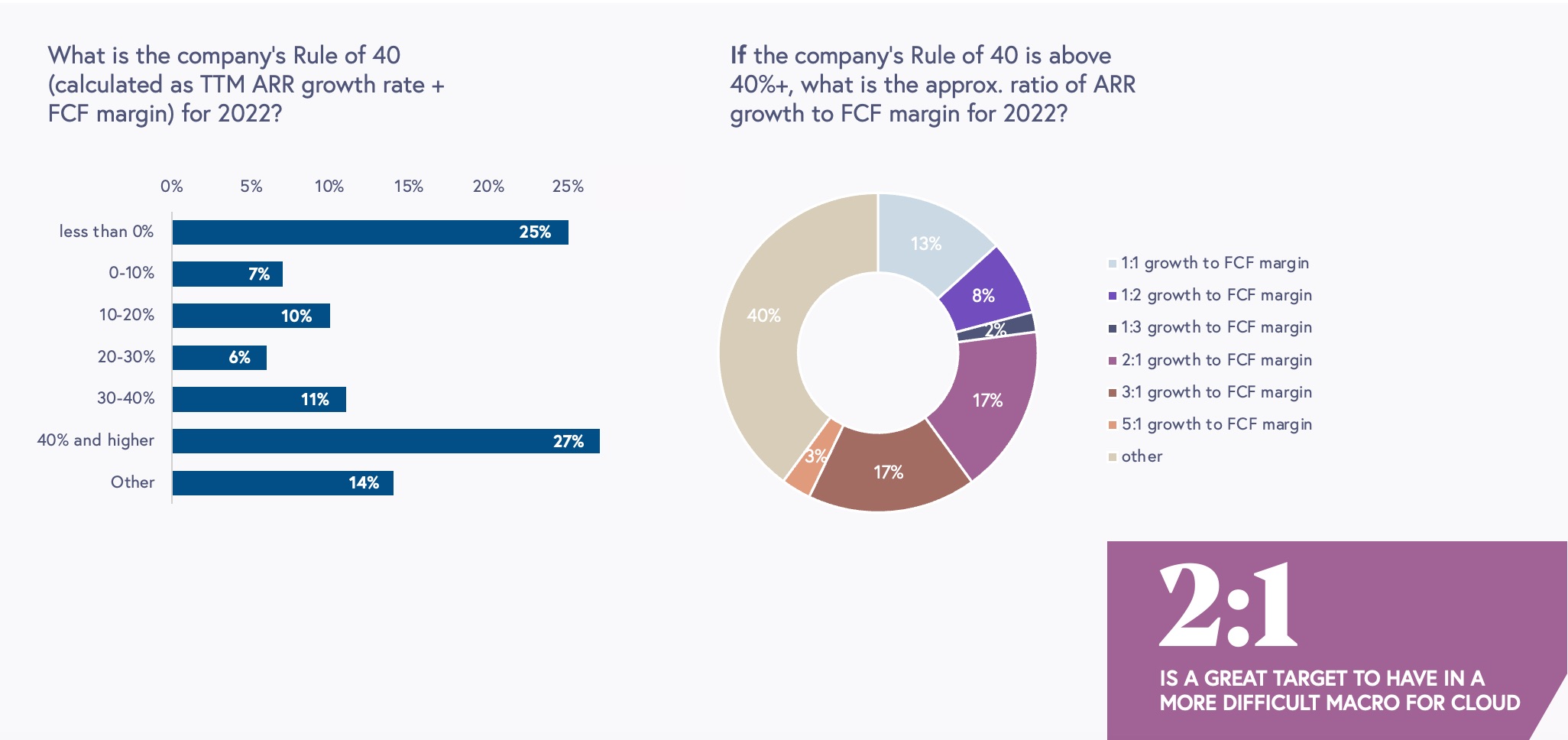

More than 70% of cloud companies have not met the Rule of 40

When we asked cloud companies what their Rule of 40 is for the calendar year of 2022, more than 70% of the respondents are sub Rule of 40. According to Bessemer investors, this trend isn’t surprising given today’s macro environment, and it ties very closely to The BVP Nasdaq Emerging Cloud Index where about a third of public companies are Rule of 40+.

Rule of 40 cloud trends for the calendar year of 2022

Note: this question had 40% response rate

- 25% of cloud companies said "Less than 0%."

- 7% of cloud companies said "0-10%."

- 10% of cloud companies said "10-20%."

- 6% of cloud companies said "20-30%."

- 11% of cloud companies said "30-40%."

- 27% of cloud companies said "40% and higher."

- 14% of cloud companies said "Other" (Freeform responses included "over 90%+," “120%,” “261%,” and "company did not meet the rule of 40 in 2022 however we're at 1:3 for 2023.).

We asked cloud companies that if their Rule of 40 was above 40% for the calendar year of 2022, what was the approximate ratio of ARR growth to FCF margin? The results are as follows:

Note: this question had a 25% response rate

- 13.2% had a 1:1 growth to FCF margin.

- 7.55% had a 1:2 growth to FCF margin.

- 1.89% had a 1:3 growth to FCF margin.

- 16.98% had a 2:1 growth to FCF margin.

- 16.98% had a 3:1 growth to FCF margin.

- 3.77% had a 5:1 growth to FCF margin.

- 39.67% - Other (Freeform responses included "N/A," “not tracking,” and "742% ARR Growth (2021 to 2023), and a 4.6% FCF margin in 2022."

When we look at the above trends we see that 100% of the companies with a 1:3 growth to FCF margin and 5:1 growth to FCF margin also had 40% and higher Rule of 40.

Bessemer investors say that the fact one-third of the companies are 2:1 or higher suggests that cloud companies have done really well to pull back on expenses (i.e., shrink their FCF margin) while sustaining higher growth multiples. While there’s no clear majority, we still think 2:1 is a great target for cloud companies in a more difficult macro environment.

On the market

And finally, with the IPO SaaS market being closed, we asked the cloud ecosystem who they predict will be the next big IPO. The following companies ranked highest.

Top-5 cloud companies voted most likely to IPO next

- Stripe

- Databricks

- Canva

- Klaviyo

- Snyk

All of the businesses above are among the Cloud 100 Top 10, except for Snyk, the Boston-based cloud cybersecurity company at #20.

While this survey visualizes the trends of over 400 private cloud companies, the Bessemer team has also analyzed what best-in-class cloud companies look like in our Cloud 100 Benchmarks for 2023.

Curious to learn more about this cloud survey? Email the Atlas Editors at content@bvp.com with your question and we’d be happy to see if we can share more insight.