Defense tech roadmap: Five frontiers for 2026

Defense tech has advanced more in the past twenty-four months than in the previous three decades, with startups leading the charge on key pillars of innovation.

We first published our Defense Tech Roadmap in early 2024. The velocity of change across the landscape since then has been astonishing with defense technology advancing more in the past twenty-four months than in the previous three decades. The convergence of AI breakthroughs, procurement reform, and intensifying geopolitical tensions has created a compounding effect, accelerating defense innovation at unprecedented speed.

Transformational catalysts are converging in defense technology today

Here are key transformational catalysts we’ve observed just in the past year:

- Procurement modernization has accelerated dramatically. The Executive Order on Modernizing Defense Acquisitions and sweeping Department of War (DoW) reforms are prioritizing speed and outcomes over process. Initiatives like rebuilding the defense industrial base, empowering acquisition teams to more rapidly deliver capability, and slashing regulatory red tape signal that the Pentagon is serious about working at startup speed.

- Silicon Valley's relationship with defense has fundamentally shifted. The valley is now recognizing that AI leadership and national security are inseparable. As new budgets are unlocked, AI leaders are prioritizing national security as a target vertical. For instance, companies such as OpenAI and Anthropic secured major defense contracts in 2025 and now have dedicated offerings for federal stakeholders to harden AI for national security use cases.

- New programs are spurring rapid innovation and coordination. Initiatives announced in 2025 such as the Executive Order on Unleashing American Drone Dominance and Golden Dome for America are creating opportunities for startups and primes alike.

- Geopolitical tensions have increased interest in defense innovation worldwide. European defense spending is projected to grow 3.4x over the next six years, making defense Europe's fastest-growing sector. Additionally, geopolitical flashpoints continue to multiply across the Middle East, Taiwan Strait, Venezuela, and even the Arctic.

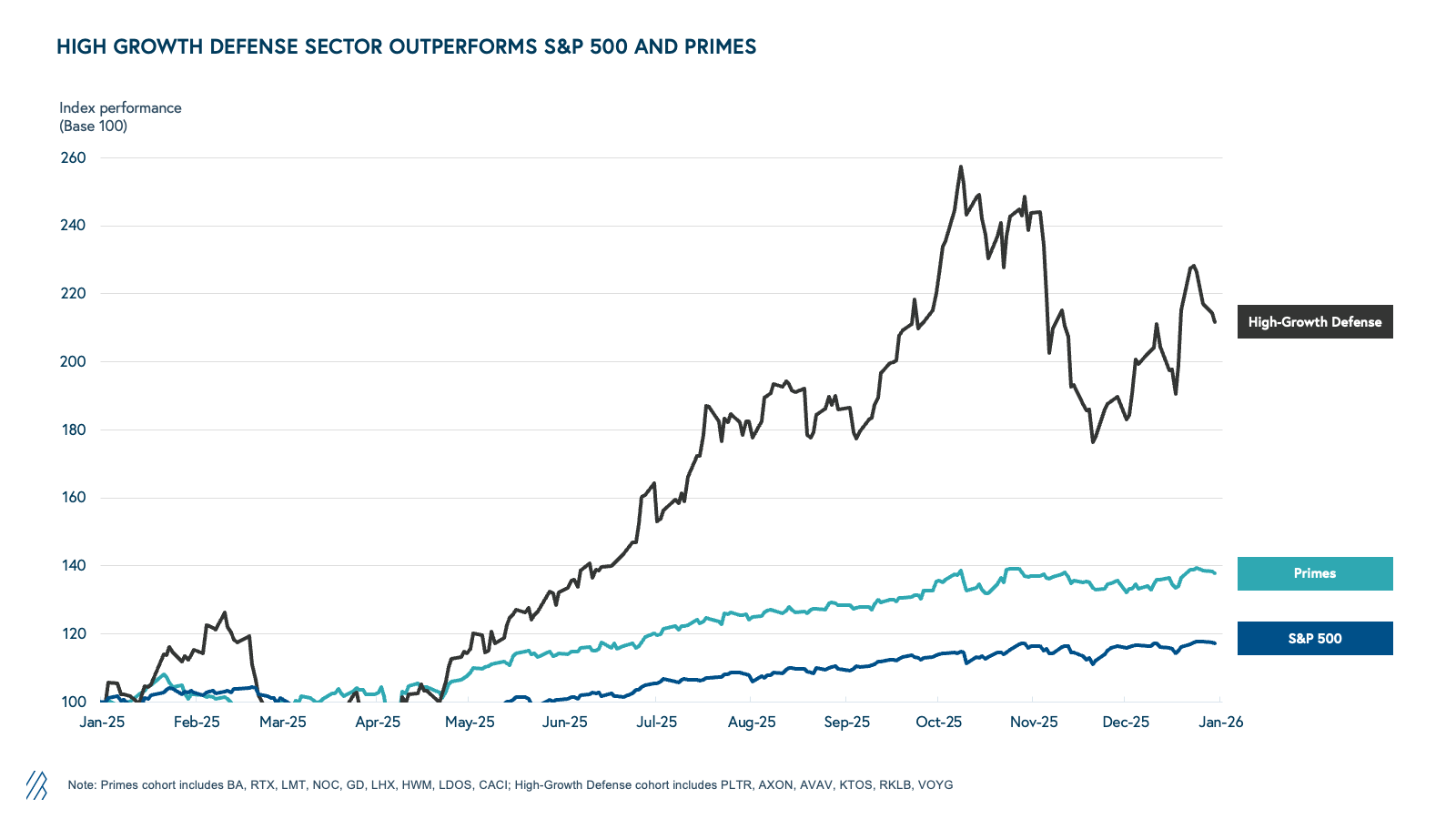

- Capital markets are validating defense innovation at unprecedented multiples. 2025 was a notable year for defense tech momentum in the public markets. Not only did defense as a sector pull ahead of the broader markets, high-growth defense names were responsible for a big portion of this outperformance. Several IPOs from companies such as Karman Holdings, AIRO Group Holdings, Firefly Aerospace, and Voyager underscored rising investor demand for new names in the sector. Palantir, trading at close to 65x NTM revenue, still commands the highest revenue multiple in the software cohort, a shocking ~10x higher than the EMCLOUD median. These companies have validated that it is possible for defense innovators and Neoprimes to build scalable businesses alongside legacy primes.

Multiple transformational forces aren’t just converging, they are amplifying each other. Procurement reform enables faster deployment of cutting-edge technologies. Early successes attract AI talent previously hesitant to work in defense. Geopolitical threats drive budget increases. Rising budgets validate public market interest, attracting more capital and entrepreneurs to the sector.

As these forces compound, the result is a fundamental reshaping of the defense technology landscape, in a generational change from the consolidated structure that has shaped the sector for decades since the “Last Supper” of the 1990s. We anticipate momentum for defense tech to continue into the new year, particularly as defense spending is expected to rise significantly leading into 2027.

Five critical frontiers for defense technology in 2026

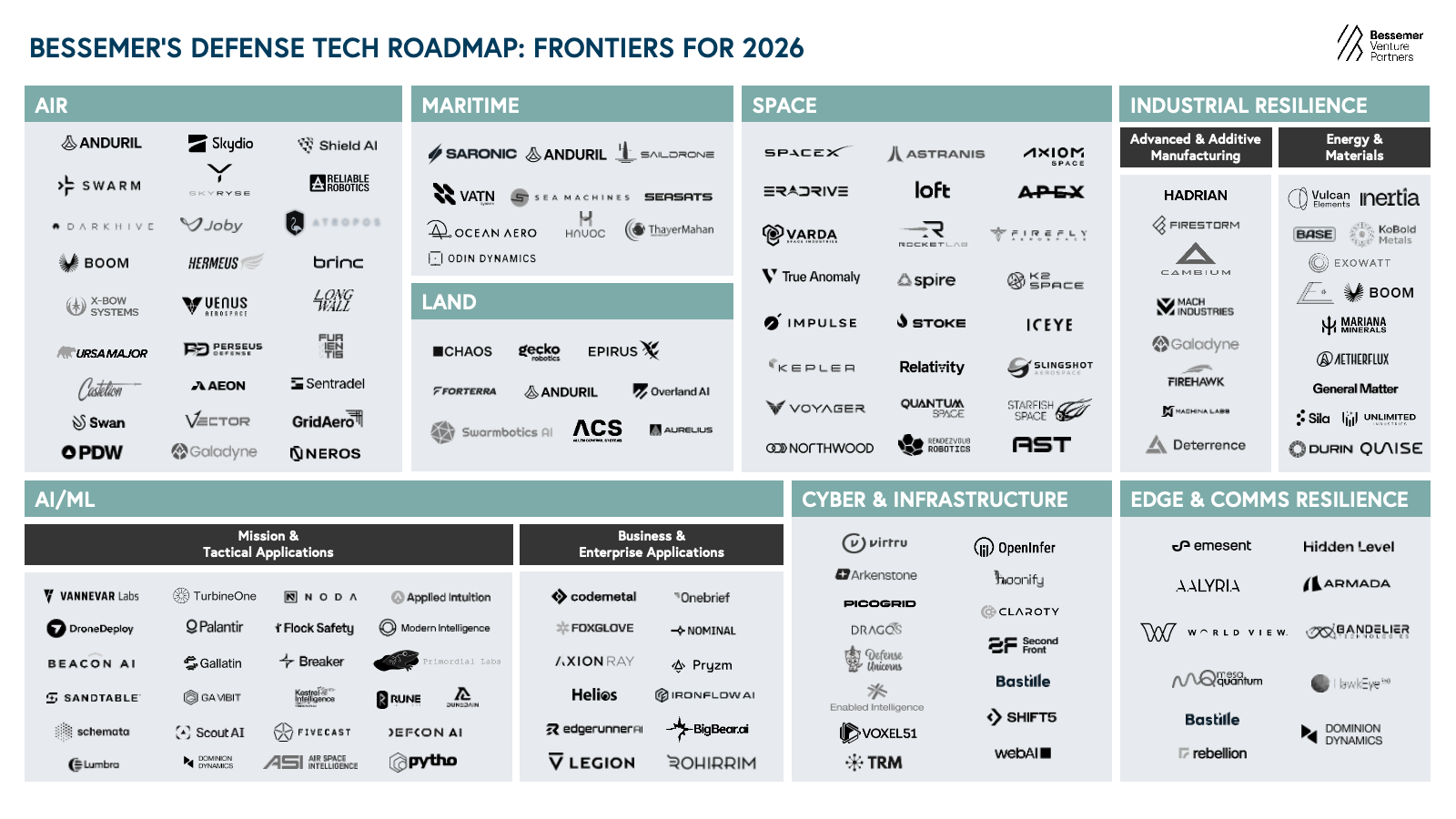

On top of the opportunity areas highlighted in our 2024 Defense Tech roadmap and 2025 European Resilience roadmap, here are additional critical domains that we believe will define the next generation of national security in 2026:

Market map

Please refer to Bessemer’s European Resilience roadmap for additional companies based outside of North America.

1. Autonomy moves from concept to combat

Autonomous systems featured prominently as its own category and as a unifying thread across themes in our 2024 roadmap. At the time, such systems were still largely experimental. Fast forward to today and they're rapidly moving from concept to combat, helping to define battlefield outcomes around the globe. Demand for such technologies has given rise to a new generation of autonomous systems trailblazers and Neoprimes, from Anduril to Saronic, across all domains.

The progress has been rapid, accelerated by the changing nature of warfare and geopolitical conflicts. Yet, we strongly believe that we’re still in the early days of autonomy reaching its full potential as there are many more waves of innovation to come. The rise of autonomous platforms has just been one chapter of the story. As autonomy proliferates at scale, new challenges, particularly around command and control, have emerged in orchestrating mission objectives and tactics across numerous heterogeneous autonomous ecosystems, and also between manned and unmanned systems.

In some ways, this is not new news. The DoW has pursued vendor-agnostic orchestration for nearly two decades through various agencies and initiatives. What has changed in today’s paradigm though is both the urgency and the art of the possible: the rise of mass autonomy in the battlefield has made the need for such solutions even more dire, and the current wave of AI technology has accelerated innovation to unlock autonomous collaborative teaming solutions that weren’t viable previously.

Startups like NODA AI converge decades of deterministic models with frontier AI technologies to provide a reasoning engine capable of near-real time task optimization and delegation, representative of yesteryear's strike cells, operations centers, and battle staffs. Others like Breaker allow operators to command and query autonomous systems through natural language over standard push-to-talk radios, eliminating dependency on bulky laptops or vulnerable networks.

2. AI permeates DoW workflows— both mission critical and enterprise back-end

In our 2024 roadmap, we noted that cutting-edge AI/ML solutions would become the next frontier of national security, as the DoW mapped and released its formal AI adoption strategy in 2023. This movement has only accelerated over the past 24 months, with the convergence of two trends bringing agentic AI to DoW application-level workflows. The first is deployment: the software “plumbing” and underlying data infrastructure has continued to mature (APIs, containerized stacks, and credible on-prem/air-gapped options), so these models can be integrated into existing workflows without forcing sensitive data into brittle or disconnected point solutions. The second is improving AI capability: modern LLMs have crossed a practical usability threshold where they can ingest messy inputs that dominate staff work—notes, chats, PDFs, slides—and reliably output the kinds of artifacts that drive various workflows.

As the underlying infrastructure continues to improve, we’re excited to see how AI continues to permeate the application layer for complex DoW workflows. The messier the data, the more moving pieces, the better! From TurbineOne in edge-first targeting and threat detection, to OneBrief in mission planning, to Schemata in simulation and war-gaming, to Defcon, Gallatin, and Rune in logistics, AI-native companies transforming the accuracy, speed, and efficacy of DoW workflows across all parts of the stack.

3. New performance and innovation vectors for advanced manufacturing

Advanced manufacturing was a foundational pillar in our 2024 roadmap, with breakthroughs in automation and AI-driven process control sweeping through the next-generation of industrial modernization technologies. Over the past twenty-four months, advanced manufacturing has been elevated further into a defining strategic imperative for national security and economic resilience. Recent events highlighting the changing nature of warfare, as witnessed in the Ukraine conflict and combatting Houthi attacks in the Red Sea, have exposed a deeper structural weakness: Western capacity to manufacture munitions and energetic compounds is simply not built to scale rapidly.

While primes have traditionally excelled in large, intricate systems, this is no longer enough. Legacy production methods, many dating back to WWII-era processes, rely on slow, hazardous techniques and concentrated supply chains that cannot surge to meet demand. It costs millions of dollars to counteract adversaries’ low cost, small system strikes. Furthermore, there is a lack of inventory for highly depletable resources. Supply chain fragility for certain materials and critical components further compounds the situation.

This is where foundational innovation becomes critical. Startups are increasingly stepping up to innovate in this area and fill the increasing need for low-cost, scalable manufacturing. For instance, Furientis is building shipside interceptors with “design for manufacturing” in mind to confer cost and production advantages, with the aim of conferring the most efficient cost-range and cost-shot offerings in the industry.

Additionally, additive manufacturing has risen as an important strategic imperative. Firestorm is leading the charge on radically affordable, mission-adaptable unmanned aerial systems using modular designs and distributed, additive manufacturing to slash costs and build drones in hours rather than weeks. In another example, Firehawk Aerospace is using 3D printing to fundamentally reimagine how rocket propellant is manufactured. The company's additive approach cuts production times and improves performance. Deterrence is attacking the problem from an adjacent angle, deploying intelligent automation with computer vision and robotics to build ultra-scalable, ultra-flexible manufacturing capacity for critical energetics.

Lastly, emerging conflict zones are creating demand for novel systems and rapid manufacturing that only startups can deliver at scale. Dominion Dynamics is building interoperable, attritable systems for the most extreme operating environments in the Arctic.

These startups are operating at the very foundations of the complex infrastructure and weapons systems that will depend on them. Their success in scaling production and in proving that cost, speed, and volume is critical for the West to close its manufacturing gap.

4. Edge and network resilience

Resilient networking is emerging as a critical priority as adversaries demonstrate increasingly sophisticated capabilities to jam, spoof, and intercept traditional signals.

AI-enhanced mesh networks now enable dynamic spectrum management and self-healing architectures that maintain battlefield connectivity even as individual nodes are degraded or destroyed. Companies like Bastille deploy networks of software defined radios in the field to detect and thwart wireless espionage. Meanwhile, the vulnerability of GPS has accelerated investment in alternative positioning, navigation, and timing solutions, which include inertial navigation systems enhanced by AI sensor fusion, signals of opportunity that leverage ambient RF and cellular infrastructure, and quantum sensors that detect variations in Earth's magnetic and gravitational fields to enable navigation without any external signal dependency.

The convergence of these technologies points toward a future where contested and denied environments no longer mean communications blackout, but rather trigger automated fallback to resilient, redundant systems that adversaries cannot easily disrupt.

5. Energy and materials independence

Recent tariffs and export restrictions between the United States and China have laid bare an uncomfortable truth: America's industrial future rests on a foundation of critical materials it does not control. China controls approximately 70% of the world's rare earth production and 90% of its processing, with leading refining positions in 19 of 20 strategic minerals at an average market share of 70%. In April 2025, China introduced export controls on heavy rare earth elements with immediate effect, later expanding these controls to include internationally-made products containing Chinese-sourced materials. Supply chain concentration has become a strategic weapon.

The stakes are amplified by unprecedented energy demands. Global electricity demand from data centers is projected to more than double by 2030 to approximately 945 terawatt-hours. In the United States alone, data centers are expected to account for nearly half of all electricity demand growth between now and 2030. The nation that secures reliable access to both energy and the materials that enable its generation and storage will define the next era of technological leadership.

Nuclear energy is a foundational pillar of future energy infrastructure, and companies like Base Power are building a distributed battery network to stabilize the grid and enable affordable, reliable electricity. Off-grid AI data centers need modern natural gas turbines to generate power, which is why we backed Boom. We also backed Sila Nanotechnologies in 2018, a battery materials company developing silicon anodes that deliver significantly higher energy density than conventional graphite cells. Just last year, Sila began operations at Moses Lake, Washington, the nation's first automotive-scale silicon anode plant.

In addition to nuclear plants, batteries and gas turbines, the world needs to build hundreds of new mines and refineries to meet rising demand for copper, lithium, nickel, cobalt, rare earths, and uranium. Yet Western mining companies have lost the ability to efficiently transform mineral discoveries into operating mines, while Chinese competitors build faster, commission faster, and compound learnings from project to project. The result is a widening execution gap at precisely the moment when demand for these materials is accelerating.

A new generation of startups is working to close that gap. Mariana Minerals is building a vertically integrated, software-first minerals company that designs, permits, finances, commissions, and operates mines, with a target of bringing 10 mineral projects into production in 10 years in an industry where a single project typically takes twelve. Durin is tackling the exploration bottleneck, building semi-autonomous drill rigs that reduce costs and send real-time data directly to geologists to accelerate mineral discovery. These companies represent a broader thesis: the United States cannot maintain technological leadership in AI, defense, or clean energy without first securing the materials that make it possible. Energy and materials independence is no longer a supply chain optimization problem. It is a prerequisite for sovereignty.

National security now runs on startup innovation

Macro shifts, technological innovation, and structural reform are converging to create the most dynamic period in modern defense history, and the way we build, buy, and deploy defense solutions is being rewritten in real time. Unlike previous transformations, startups now play a defining role—and we believe many generational defense tech companies will emerge from this wave.

Bessemer has a long track record partnering with defense-tech pioneers including Auterion, Rocket Lab, Skybox Imaging, Vannevar Labs, Claroty, and Spire Global. We're eager to support mission-driven founders innovating in national security. Check out our resources here and don’t hesitate to reach out to Janelle Teng, Christopher Wan, Jason Scheller, and David Cowan by emailing us at defense@bvp.com.