Roadmap: European resilience

An overview on our emerging investments aimed to protect democratic values and sovereignty in Europe through technology and innovation.

Europe faces an unprecedented geopolitical moment. Russia's invasion of Ukraine has fundamentally shifted the security landscape, forcing European nations to confront hard truths about military independence. Simultaneously, China's growing alignment with authoritarian regimes and America's increasingly unpredictable foreign policy stance have made European strategic autonomy not just desirable, but essential.

The harsh reality is that Europe has lagged behind the United States in economic growth, productivity growth, and defence capabilities for the past two decades. European NATO members have consistently under-invested in defence, falling short of the 2% GDP target that is now racing toward 3.5% by 2030—representing a €970 billion annual commitment by European nations.

Defence technology represents the single largest growth opportunity in Europe today—and is on track to become Europe’s largest sector, fueled by an estimated 3.4x increase in spending over the next six years.

This shift isn’t just about bigger budgets—it’s about a fundamental re-architecture of defence: moving from hardware-heavy arsenals to software and AI-defined autonomy. Just as cloud computing transformed enterprise technology by abstracting complexity and enabling scale, AI-enabled software is transforming defence by changing the economic equation on the battlefield.

In our latest roadmap, we outline the forces shaping our European defence technology investment strategy and the five domains where new category leaders will emerge: autonomous systems across air, land, and sea; next-generation aerial defence; space sovereignty; advanced command-and-control; and the industrial backbone required to build at scale. The companies founded and scaling today will define Europe’s security and sovereignty for decades to come.

Key insights on Bessemer’s emerging investments in European resilience

- Europe is at a critical geopolitical juncture, facing security, productivity, and defence gaps compared to the US, which is being amplified by global threats and new alliances.

- Defence technology—which is primarily AI-enabled autonomy across air, land, sea, and space—is emerging as Europe’s fastest-growing sector, driving a major re-architecture from hardware-heavy arsenals to software-defined capabilities.

- Startups are increasingly shaping defence outcomes, leveraging dual-use commercial technologies (like drones and robotics) for military operations at lower cost and greater agility than legacy contractors.

- European governments are accelerating defence procurement from mission-oriented founders, validating companies that combine deep military expertise with scalable AI- and software-driven solutions.

- Five core investment domains will define future resilience: physical autonomy, aerial defence, command and control, space sovereignty, and advanced industrial manufacturing, including additive and autonomous production and critical materials independence.

- As Bessemer invests in technologies that strengthen Europe’s strategic autonomy, the opportunities that will be prioritized will include: high defence IQ, dual use and expansive TAM, sticky contracts as revenue anchors, non-dilutive funding leverage and early traction with democratic governments.

The accelerating technology curve

What we've witnessed in Ukraine has proven that the nature of warfare has changed. AI, robotics, and space surveillance technologies have revolutionized both the economics and effectiveness of defence capabilities. Each of these technologies will also require new forms of advanced manufacturing to be produced at the speed and scale required to protect Europe’s national sovereignty. Companies are successfully repurposing commercial technologies for military applications—from drone delivery systems becoming tactical swarms to advanced satellite imaging technologies that increase the effectiveness of military operations.

The software-defined battlefield is here. Traditional defence primes are being both challenged and assisted by agile startups that can deliver previously impossible autonomous capabilities at dramatically lower costs thanks to AI. European governments are increasingly procuring from innovative companies in addition to legacy contractors, recognizing that startups are often best suited to deliver the most advanced and cost-effective AI and robotics capabilities needed to to determine battlefield outcomes.

Our commitment to European resilience

Just as artificial intelligence is reshaping how we live, work, and organize societies, we believe nations are undergoing a historic shift in how they approach defence. Emerging technologies are already redefining security for today’s and future generations. Guided by the values of supporting democracy and innovation, Bessemer is committed to backing mission-oriented founders in Europe who are building the technological capabilities required to secure European sovereignty. This is not a passing trend—it is a generational commitment to ensuring sovereignty is protected through technological superiority.

Jump here to see the chart of standout companies.

Five core areas of investment for European defence technologies

Based on our analysis and a decade’s worth of experience investing in this category in the United States, Bessemer is now committing to invest in European companies that enable 'European Resilience' across five critical domains: (1) physical autonomy, (2) aerial defence, (3) command & control systems, (4) space technology, and (5) industrial manufacturing.

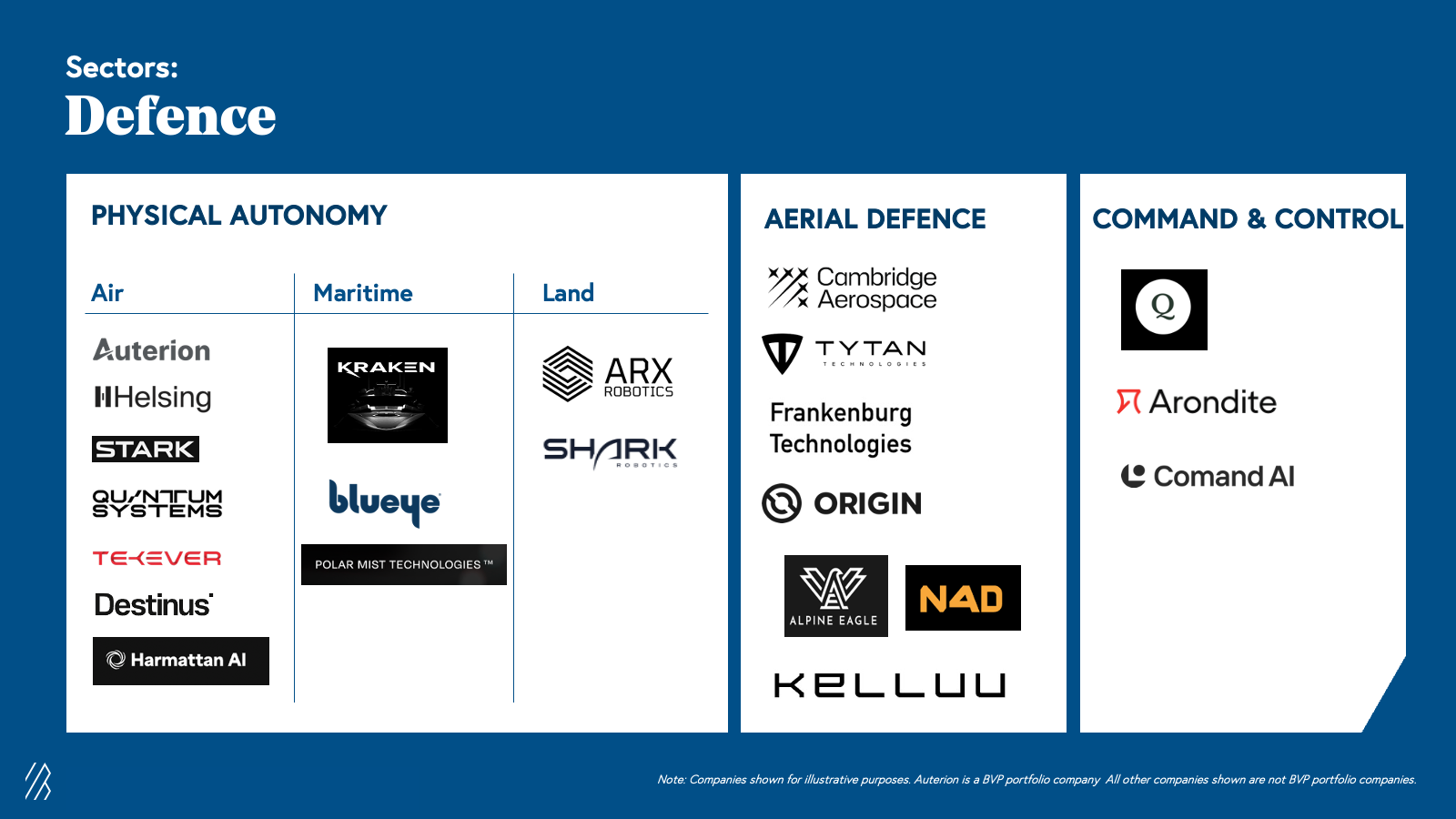

1. Physical autonomy

Across air, maritime, and land domains, the future of military operations will be autonomous. We see investment opportunities in companies developing the following technologies:

Autonomous aerial systems and drone swarms

The nature of warfare has fundamentally changed. Ground-based troops and traditional land systems are no longer the decisive force; aerial platforms operating with full autonomy increasingly shape battlefield outcomes. Modern conflicts now demand more than individual drones—they require coordinated swarms that can adapt in real time, operate in GPS- or comms-denied environments, and execute multi-platform attacks that overwhelm adversary defences.

For Europe, this represents both a vulnerability and an opportunity. The capability gap is clear: nations need autonomous systems that can detect, surveil, and neutralize hostile targets without constant human control. They need adaptive electronic warfare platforms that can disrupt enemy communications while protecting friendly forces. And they need autonomous logistics aircraft capable of delivering supplies and sustaining operations deep in contested zones.

We see enormous potential for European founders to lead in this domain—by building systems that combine the cost-effectiveness of commercial hardware with the sophistication of AI-driven autonomy. The companies that succeed will not only strengthen Europe’s defence resilience but also redefine what air dominance means in the 21st century.

Maritime autonomous systems

Europe’s defence and economic resilience rests heavily on the sea. Its vast coastlines, critical shipping lanes, and underwater infrastructure—including the subsea cables carrying 99% of intercontinental data traffic and pipelines transporting energy—represent both strategic assets and points of vulnerability. Traditional naval fleets, however, are too costly and too limited to provide the persistent surveillance and rapid response these waters demand.

This is where autonomy becomes transformative. Maritime defence increasingly requires unmanned surface and underwater systems that can patrol continuously, inspect and protect undersea infrastructure, and operate in environments where human crews cannot. Coordinated swarms of USVs and AUVs can secure chokepoints, conduct electronic warfare, or deploy barriers to deny hostile forces access.

For European founders, the opportunity is twofold: build systems that strengthen defence while serving dual-use commercial markets—from offshore energy to undersea cable maintenance. The most valuable platforms will combine rugged design for harsh maritime conditions, advanced communications that overcome the signal challenges of water, and power systems that enable months of autonomous operation.

The companies that succeed here won’t just protect Europe’s maritime sovereignty—they’ll reshape how the world thinks about securing and sustaining critical infrastructure in the global commons.

Ground-based robotics

While aerial dominance increasingly shapes the outcomes of modern conflicts, ground-based autonomy remains indispensable. These systems take soldiers out of the most dangerous missions, preserving lives by operating in environments too hazardous or unpredictable for humans. For Europe—with its diverse terrain, long borders, and dense critical infrastructure—the need for resilient ground autonomy is especially acute.

The opportunity lies in platforms that address Europe’s most pressing terrestrial challenges. Autonomous border surveillance systems can provide persistent monitoring across vast frontiers while also serving dual-use roles in disaster response—from wildfire detection to flood monitoring to search-and-rescue. Perimeter security platforms can protect critical infrastructure, military bases, and sensitive facilities. Mine detection and clearance robots can safely navigate contaminated areas, reducing one of the deadliest risks of post-conflict zones. And modular logistics robots can resupply ammunition, evacuate casualties, and transport equipment in contested or GPS-denied environments.

The companies that succeed will combine modularity, resilience, and cost-effectiveness—offering solutions that not only strengthen Europe’s defence capabilities but also deliver life-saving impact in civilian contexts. In doing so, they will help ensure that ground autonomy becomes as essential to sovereignty as air and maritime dominance.

The frontier of physical autonomy spans air, land, and sea, and Europe is producing breakout leaders across each domain.

- In the air, Auterion has evolved from open-platform autopilots into the operating system for autonomous mass operations. Already deployed in Ukraine and scaling globally through partnerships with major defence contractors, it is setting the standard for coordinated autonomy at scale. Germany continues to be a hub of innovation with Helsing, STARK, and Quantum Systems, while Portugal’s Tekever is building battle-ready UAVs for aerial surveillance.

- On land, Germany’s ARX Robotics is pioneering modular, multi-connectivity ground robots - autonomous, cost-effective, and designed to operate in the most demanding environments.

- At sea, the UK’s Kraken Technology is delivering versatile, dual-use autonomous vessels with speed and operational impact, while Norway’s blueye provides “eyes below the surface” through professional-grade underwater ROVs for defence and commercial use.

Together, these companies demonstrate how Europe is not just participating in the autonomy revolution—it is leading it, across every domain of the modern battlefield.

2. Aerial defence

Europe’s skies face escalating threats—from hypersonic missiles to swarming drones—that demand a fundamental rethinking of aerial defence. Recent conflicts have exposed a dangerous asymmetry: militant groups can launch rockets costing only hundreds or thousands of dollars, while defending nations are forced to respond with interceptors priced in the hundreds of thousands or even millions. This cost imbalance is unsustainable, and it undermines deterrence itself.

The opportunity for European founders lies in reshaping the economics of aerial warfare. Low-cost interceptor technologies can neutralize threats at or below the price of incoming attacks. Equally critical are AI-powered integrated detection networks that fuse data from multiple sensor platforms, instantly classify threats, calculate trajectories, and autonomously deploy the most effective response.

Together, these innovations don’t just promise better defence—they reset the cost curve of conflict, ensuring that democratic nations can defend themselves affordably, sustainably, and at scale.

Defence companies leading in aerial defence include the UK’s Cambridge Aerospace with their Starhammer and Skyhammer defence interceptors and Germany’s TYTAN Technologies with their AI-powered, cost-effective counter-drone solutions to protect people and critical infrastructure.

3. Command & control systems

Modern warfare increasingly demands rapid decision-making across vast streams of data. Yet traditional military command structures—shaped by decades of hardware-first procurement—often emphasize siloed platforms that struggle to share information. This leaves human operators forced to manually stitch together intelligence across sensors, networks, and assets. In today’s threat environment, where adversaries can launch multiple, simultaneous attack vectors, that model is no longer tenable.

The opportunity lies in AI-powered command & control systems that unify the battlespace. By automatically correlating data from diverse sources, applying historical threat patterns and geographic context, and generating real-time risk assessments, these systems can present commanders with intelligent, prioritized recommendations—whether deploying reconnaissance drones, repositioning defensive assets, or initiating countermeasures.

For European founders, the challenge is clear: build platforms that not only integrate seamlessly with military assets but also elevate human judgment, enabling commanders to make faster, more effective decisions.

For example, in the UK, Arondite is advancing a vision of human–machine teams for the autonomous age. In Germany, Lateration is setting the standard in high-precision localization technologies. And in France, Comand AI is developing AI-powered platforms to orchestrate defence and security operations in real time.

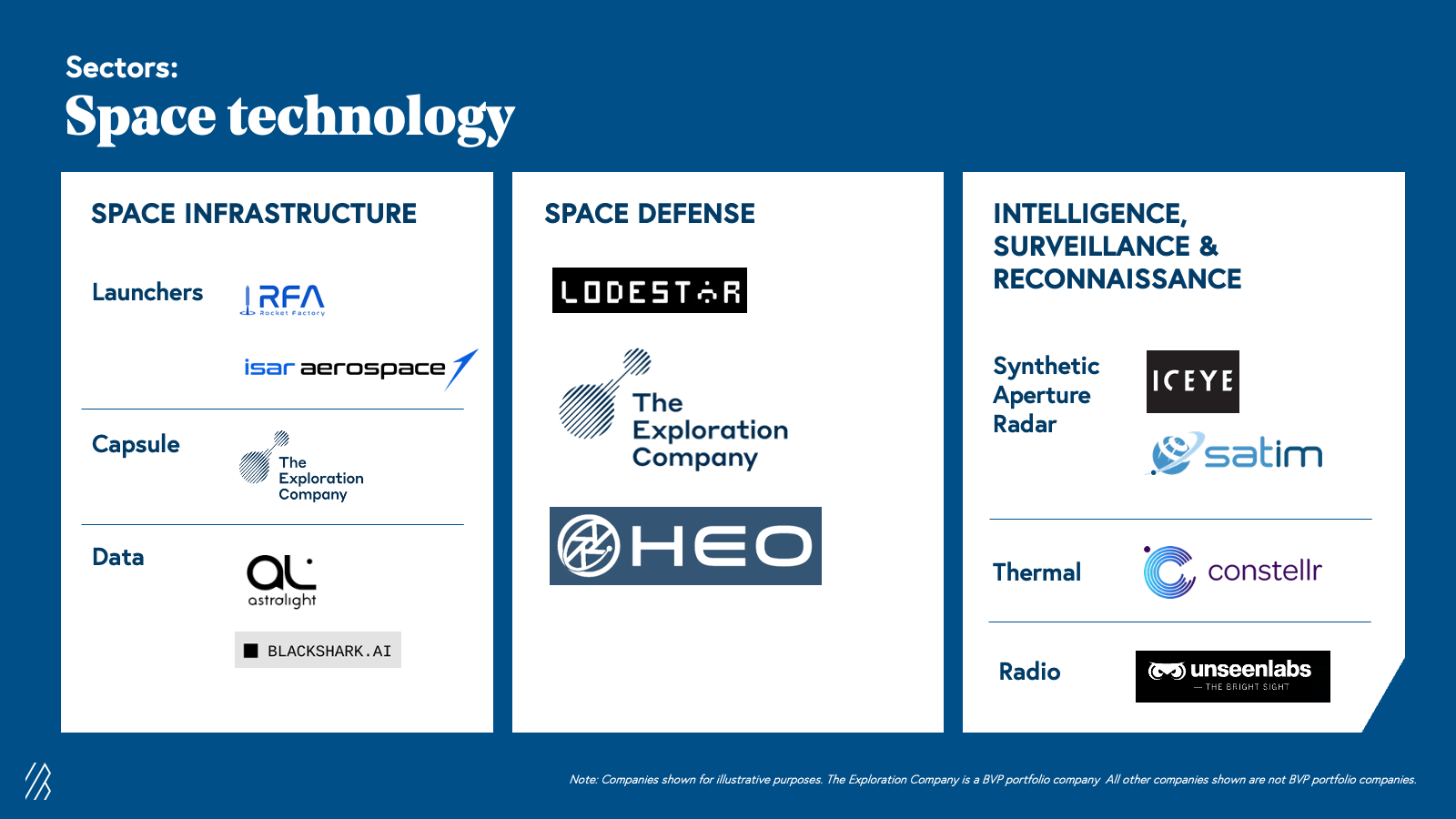

4. Space sovereignty as a national security imperative

Space has moved from a frontier of exploration to a critical battleground for national security and economic competitiveness. Modern military operations depend on space-based assets for communications, navigation, intelligence, and precision targeting. That dependency has elevated space sovereignty—the ability to independently access, operate, and defend space assets—into an existential requirement for nations.

We see multiple investable opportunities across this domain, including these example areas and companies:

- Synthetic Aperture Radar (SAR) satellites have become indispensable for all-weather, day–night surveillance. Unlike optical systems, SAR penetrates cloud cover and darkness to provide continuous monitoring of adversary activity, ship movements, and infrastructure changes. Leaders include Finland’s ICEYE, with its reliable SAR imaging and NatCat insights, and Poland’s SATIM, specializing in object detection and classification.

- Multi-spectral imaging satellites capture data across visible, infrared, and other bands, giving militaries unprecedented insight into ground activity. Germany’s Constellr is advancing thermal intelligence to eliminate blind spots in low-light or camouflaged conditions.

- Satellite fleet bandwidth is expanding rapidly through laser inter-satellite links and phased-array antennas, enabling real-time streaming of high-resolution imagery and supporting AI workloads that demand massive throughput. Companies like Commcrete provide critical communications solutions, while Lithuania’s Astrolight connects Earth and space with high-speed laser links.

- “Satellite bodyguards” are defensive spacecraft designed to protect high-value assets against anti-satellite weapons, electronic warfare, and cyber attacks. For example, the UK’s Lodestar is building autonomous AI “fighter pilots” for orbital defence-as-a-service.

Together, these innovations signal the next chapter of defence: a software and AI-driven race for space sovereignty, where control of orbital infrastructure defines both military advantage and economic resilience.

5. Advanced industrial manufacturing, from factory floors to battlefields

Modern conflicts demand responsive, distributed manufacturing that can operate even in contested environments. Ukraine has shown us that wars are no longer won by stockpiles alone—they are won by the ability to rapidly produce, adapt, and deploy systems at scale. For Europe, this means a manufacturing renaissance that prioritizes mobile combat-zone production and independence from critical materials controlled abroad.

The need to innovate in Europe’s advanced industrial manufacturing could not be more urgent. The ramp-up in Russia’s military supply chains and manufacturing output has been staggering with defence outlays between 2022 and 2024 of at least $263 billion.

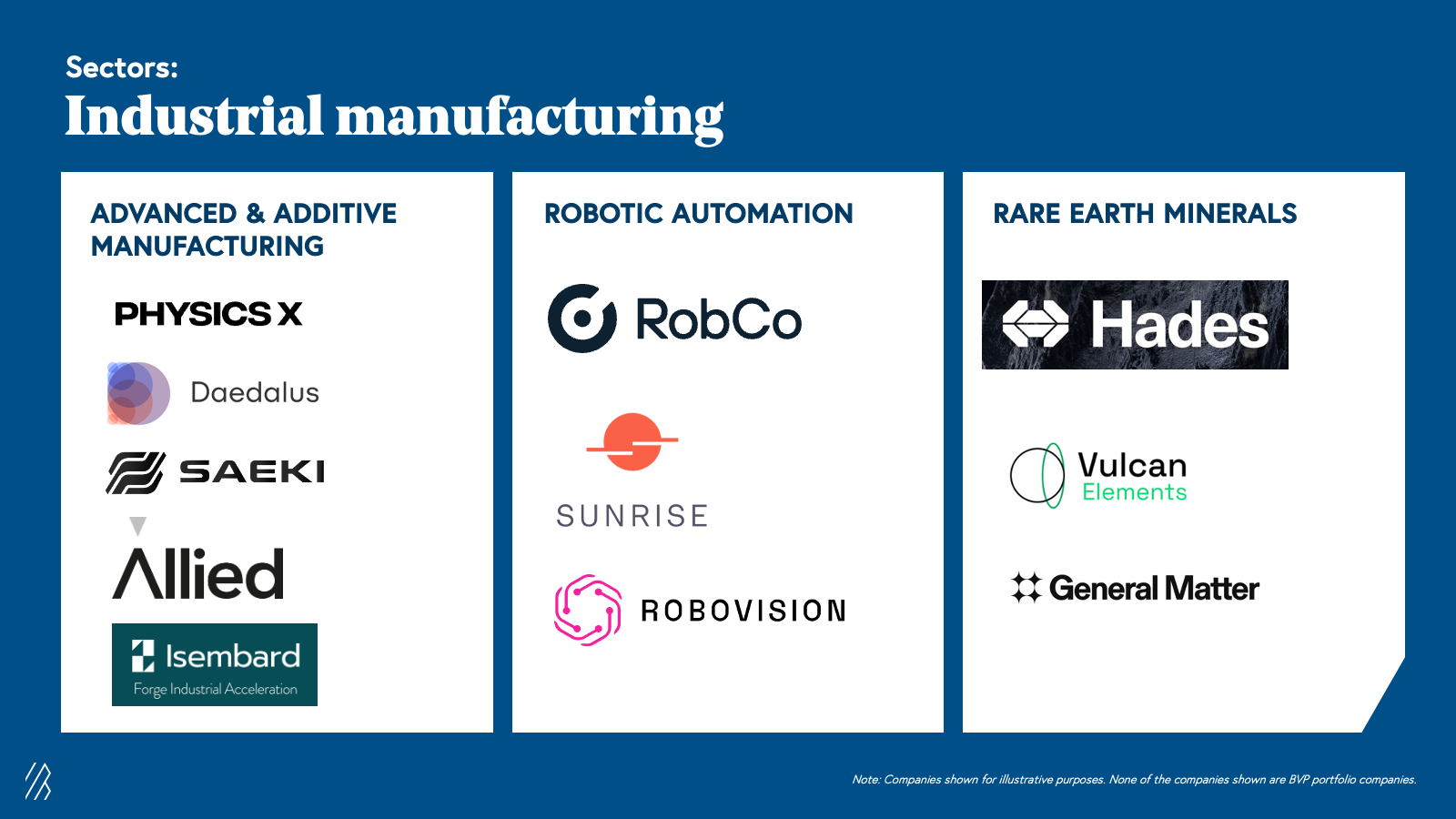

With that in mind, we’re investing in three core areas shaping this future and resulting in the following outcomes:

a. Additive manufacturing for forward deployment

3D printing now enables battlefield manufacturing that was previously impossible: mobile fabrication units producing spare parts within kilometers of the front line, or rapid prototyping of countermeasures to evolving enemy tactics. Design a drone jammer in the morning, print and deploy it by evening. Ukrainian forces already operate containerized 3D printing facilities, producing everything from UAV airframes to mission-critical components. This isn’t a future capability—it’s today’s battlefield reality.

- Switzerland’s SAEKI delivers on-demand additive manufacturing for large, complex parts.

- France’s Cognitive Design Systems is cutting aerospace development cycles with AI-powered concurrent engineering.

b. Autonomous manufacturing at scale

AI-driven robotics make it possible to surge production 24/7 with “lights-out” factories, retool commercial lines for defence in days instead of months and distribute manufacturing across hardened micro-factories rather than relying on single vulnerable plants. Resilience comes from distribution: destroy one node, and hundreds more continue operating.

- Germany’s Daedalus is pioneering scalable AI-driven precision manufacturing.

- Germany’s RobCo provides modular robotic systems that can instantly upgrade any factory.

- Slovenia’s Sunrise Robotics advances intelligent automation for European manufacturers.

- Belgium’s Robovision applies visual AI to detect flaws in real time, boosting quality control in defence production.

- The UK’s PhysicsX is a London-based AI-native engineering platform that aims to transform how physical systems are engineered, embedding intelligence across the entire product lifecycle.

c. Breaking dependence on critical materials

Today, China controls 90% of global rare earth magnet production - vital for EV motors, wind turbines, precision munitions, fighter jets, and electronic warfare systems. This dominance gives Beijing effective veto power over European defence production. The vulnerability is acute: a Chinese export ban could halt European defence output within months. Sovereignty requires materials independence.

We are seeking founders working on:

- Advanced extraction from Europe’s lower-grade deposits.

- Industrial-scale recycling to recover 90%+ of magnets from end-of-life systems.

- Rare-earth-free alternatives (iron-nitride, manganese compounds) for next-generation systems.

- Strategic reserves sized not for peacetime, but for sustained conflict production.

The bottom line? Europe’s security will not be determined solely by battlefield tactics, but by the speed, resilience, and independence of its industrial base. The companies that master distributed, autonomous, and sovereign manufacturing will anchor Europe’s defence for decades to come.

Principles for building Europe’s defence future

Our commitment is clear: we stand alongside mission-driven founders building enduring companies that will safeguard Europe’s sovereignty and shape the future of defence for generations to come.

As we invest in technologies that strengthen Europe’s strategic autonomy, we prioritize opportunities that embody five critical qualities:

- High defence IQ: Founders with deep knowledge of military requirements, procurement processes, and operational realities — whether as veterans, industry leaders, or technologists embedded with defence customers.

- Dual use and expansive TAM: With European defence spending projected to grow from €285B in 2021 to €970B by 2030, we back companies addressing large, fast-growing markets—with the added advantage of dual-use applications beyond defence.

- Sticky contracts as revenue anchors: Long-term defence contracts with high switching costs provide predictable, recurring revenue and enduring customer relationships.

- Non-dilutive funding leverage: Smart defence companies use R&D programs—SBIR, Horizon Europe, national initiatives—to advance technology readiness while preserving equity.

- Early traction with democratic governments: While the U.S. DoD remains the gold standard, accelerating adoption by European allies validates technology and go-to-market strategy.

Alongside capital, Bessemer brings unmatched scale and experience. With more than a decade’s worth of U.S. defence and deep technology investments, we connect founders to the world’s largest defence market and provide playbooks for navigating procurement. Our global platform links European innovators to DoD opportunities, allied governments, and fellow entrepreneurs already selling to these buyers.

We also surround founders with expertise through our defence Tech Advisory Board—renowned leaders including:

- Dr. Ray Johnson (Lockheed Martin)

- Major General Kim Crider (U.S. Space Force)

- Lt. Gen. Clint Hinote (U.S. Air Force)

- Forrest Underwood (Space Force Reservist)

- Vice Admiral Matt Kohler (U.S. Navy)

- Joshua Marcuse (Google Public Sector)

- Susanna Blume (former CAPE Director)

Their collective knowledge helps portfolio companies anticipate the future, avoid pitfalls, and accelerate scale.

If you are building and scaling a defence technology business in Europe or abroad, we want to hear from you. Together, we can help your team evolve, grow, and serve democracy at every stage. Please email defence@bvp.com.

Standout defence technologies

| Company | Country | Domain | Innovation |

|

Auterion

|

Switzerland | Aerial autonomy | Operating system for autonomous drones, deployed in Ukraine |

| Helsing | Germany | Defence AI | Next-generation battlefield AI |

| STARK | Germany | Aerial autonomy | Advanced drone platforms |

| Quantum Systems | Germany | Aerial autonomy | Scalable UAVs for military use |

| Tekever | Portugal | Aerial autonomy | Battle-ready UAVs for surveillance |

| ARX Robotics | Germany | Ground autonomy | Modular, multi-connectivity robots |

| Kraken Technology | UK | Maritime autonomy | Dual-use autonomous vessels |

| Blueye Robotics | Norway | Maritime autonomy | Underwater ROVs for defence / construction |

| Cambridge Aerospace | UK | Aerial defence | Low-cost missile/drone interceptors |

| TYTAN Technologies | Germany | Aerial defence | AI-powered, cost-effective counter-drone solutions |

| Arondite | UK | Command & control | Human-machine teamed command platforms |

| Lateration | Germany | Command & control | High-precision localization tech |

| Comand AI | France | Command & control | AI-powered operations orchestration |

| ICEYE | Finland | Space/satellite tech | Reliable SAR imaging for military intelligence |

| SATIM | Poland | Space/satellite tech | Object detection and classification via satellites |

| Constellr | Germany | Space/satellite tech | Thermal and multispectral imaging |

| Commcrete | Germany | Space/satellite tech | Critical satellite communication |

| Astrolight | Lithuania | Space/satellite tech | High-speed laser satellite links |

| Lodestar | UK | Space defence | Autonomous AI satellite “bodyguards” |

| SAEKI | UK | Space defence | Autonomous AI satellite “bodyguards” |

| Cognitive Design Systems | France | AI manufacturing engineering | Concurrent AI-powered design and prototyping |

| Daedalus | Germany | AI-driven manufacturing | Scalable precision manufacturing with AI |

| RobCo | Germany | Modular robotics | Factory-upgrade robotics |

| Sunrise Robotics | Slovenia | Industrial automation | Intelligent automation for manufacturing |

| Robovision | Belgium | Visual AI | Real-time detection and quality control |

| PhysicsX | UK | AI engineering platform | AI-native engineering for physical systems |