Roadmap: Built World AI

The built world drives nearly a quarter of U.S. GDP and yet remains one of the least digitized sectors. Multimodal AI is enabling the next wave of innovation in how we design, build, and operate it.

The built world is one of humanity’s greatest collective achievements. Every skyline, neighborhood, and building is the result of extraordinary coordination of people, materials, and capital, all executed with precision. It takes imagination to design a building, discipline, and resources to construct it into reality, and resilience to maintain it for generations.

Building infrastructure represents one of the largest sectors of the US economy. Construction’s nominal value alone is $1.3 trillion, representing 4.4 percent of the U.S. GDP, while real estate, rental, and leasing contribute $4.2 trillion to the U.S. GDP. Yet despite their physical and economic scale, Construction and Real Estate have benefited only selectively from the SaaS revolution. Our hypothesis: both verticals are fundamentally language-intensive, where success depends on coordination between multiple stakeholders across multiple sites and modalities (text, image, video), making complex, high-stakes decisions. The last two decades of technological advancements have only partially addressed these dynamics.

Few sectors touch our daily lives as directly as construction and real estate. Physical infrastructure carries immense responsibility, from cost and quality to safety and compliance. We believe multi-modal AI will transform how the built world delivers on each of these dimensions.

Imagine a handful of key workflows in 2030: architects sketch ideas that can be used to generate full building models; estimators fine tune takeoffs and bids that are generated automatically from drawings; safety reports are dictated through voice and image on the job site; home buyers benefit from more intuitive search and guidance through their journey; and building managers are no longer bogged down by outdated tools. The result is a built environment that rewards creativity, efficiency, transparency, and safety and not one trapped in endless, opaque paperwork and clicks.

At Bessemer, we’ve already backed the evolution of the built world, including category-defining companies such as Procore and ServiceTitan. Jump here to explore select examples of our current construction and real estate related portfolio.

We believe construction and real estate are at an inflection point, one as transformative as the advent of CAD in the 1960s–70s or SaaS in the 2000s; driven by multimodal LLM-powered workflows and new forms of human–machine collaboration. In our latest roadmap, we explore (1) Construction and (2) Real Estate as two key sectors with promising Vertical AI investment opportunities, including the emerging principles driving our decisions on the founders we’re looking to back.

Key insights on Built World AI

The built world’s AI moment

- Construction and real estate represent nearly a quarter of US GDP, yet remain one of the least digitized sectors.

- Multimodal AI tech is poised to fundamentally change how we design, build, and operate the built world.

Construction AI: Five areas of opportunity

- Design generation: Generating code-compliant, cost-optimized layouts and 2D/3D models, turning computer-aided design into computer-generated design.

- Takeoff & estimation: Automating assemblies and material takeoffs from evolving plans, enabling estimators to focus on pricing and margin optimization.

- On-site coordination: Turning voice, image, video, and text inputs into faster coordination and proactive safety management.

- Knowledge management: Unifying fragmented project data including contracts, drawings, RFIs, change orders into a single, query-driven source of truth.

- Construction robotics: Enabling crews to control autonomous and semi-autonomous equipment through natural language interfaces.

Real Estate AI: Four areas of opportunity

- Broker & agent automation: Automating repetitive, language-based workflows such as lead nurturing, scheduling, and compliance, to allow agents to focus on client relationships rather than administrative work.

- Property search & discovery: Transforming static listings into intuitive, query-driven search that help buyers / renters find, evaluate, and transact on properties cheaper and faster.

- Property management: Building LLM-powered automation on top of legacy systems to orchestrate leasing, renewals, maintenance, and tenant operations.

- Design & visualization: Generating high-quality visualizations of spaces to reimagine how properties are marketed, staged, designed, and experienced.

Sector-wide outlook

- Construction and real estate are entering an inflection point that we believe will surpass past transformations like CAD and SaaS.

- This roadmap outlines our evolving perspective on where the next generation of builders can create lasting impact.

I. Construction AI

Why now: The state of productivity in the construction industry

Over the past six decades, aggregate labor productivity across the U.S. economy has surged more than 290%. In contrast, construction labor productivity has been shrinking nearly one percentage point per year between 1970 and 2020.

For an industry that employs over seven million people and underpins $1.3 trillion in economic value annually, this productivity gap represents a drag on growth. The problem isn’t a lack of effort or expertise; it’s the sheer complexity of coordination.

The construction ecosystem spans four major sub-sectors; residential, commercial, industrial, and infrastructure. Software providers such as Procore, Autodesk, DroneDeploy serve as connective tissue across these sub-sectors. Despite technological advancements, the sector remains challenged by multiple headwinds: a persistent labor shortage (the U.S. will need to attract roughly 500,000 workers in 2026 just to meet demand), rising interest rates, volatile input costs, and the ripple effects of policy and supply chain disruption.

The technology gap is equally stark. According to Deloitte, construction firms allocate just 2.7% of annual revenue to technology, which is the lowest share of any industry surveyed. Compare that to financial services or manufacturing, where technology spend often exceeds 5-10%. For an industry so dependent on precision, this underinvestment in digital infrastructure has left a massive opportunity on the table.

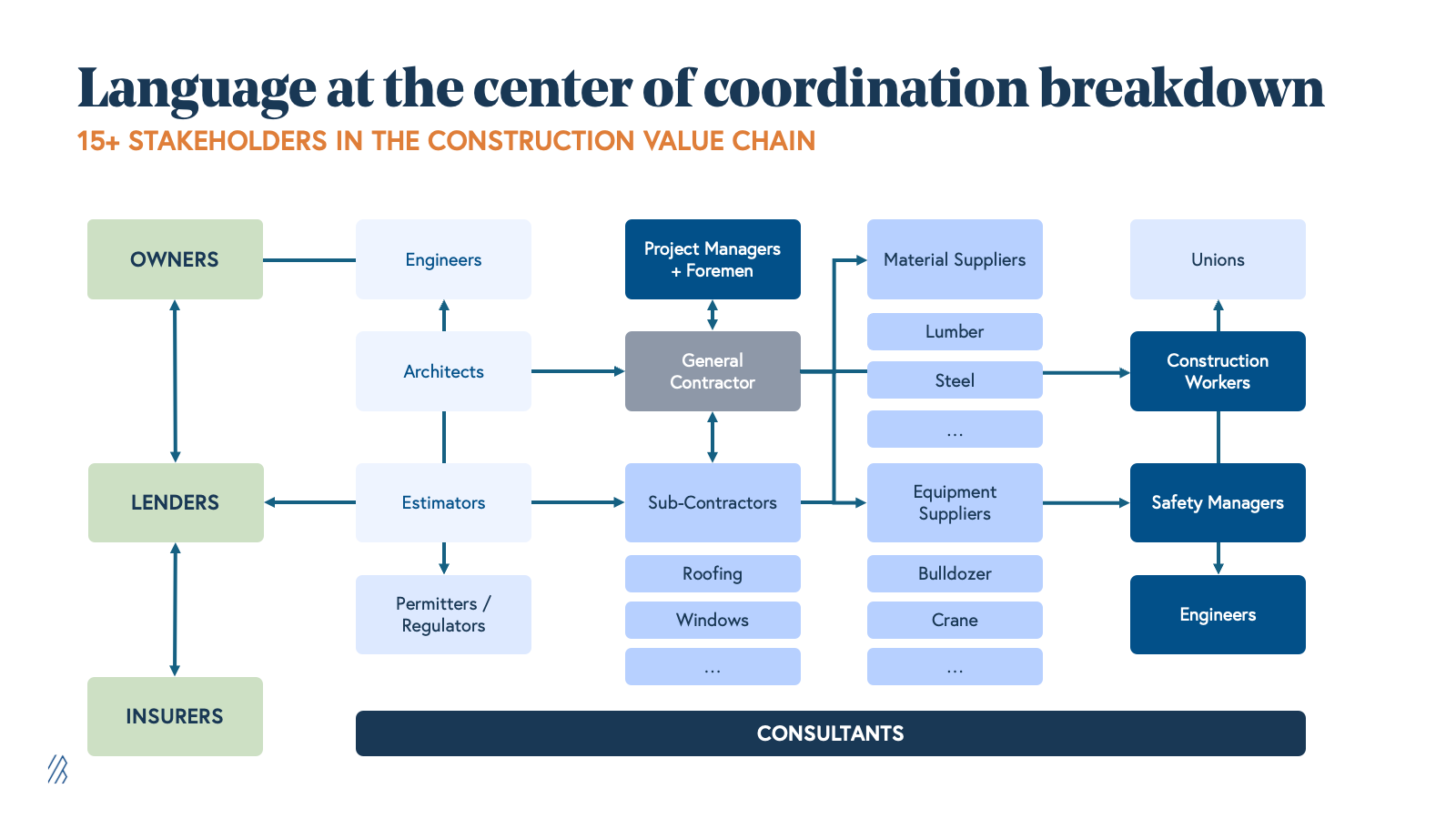

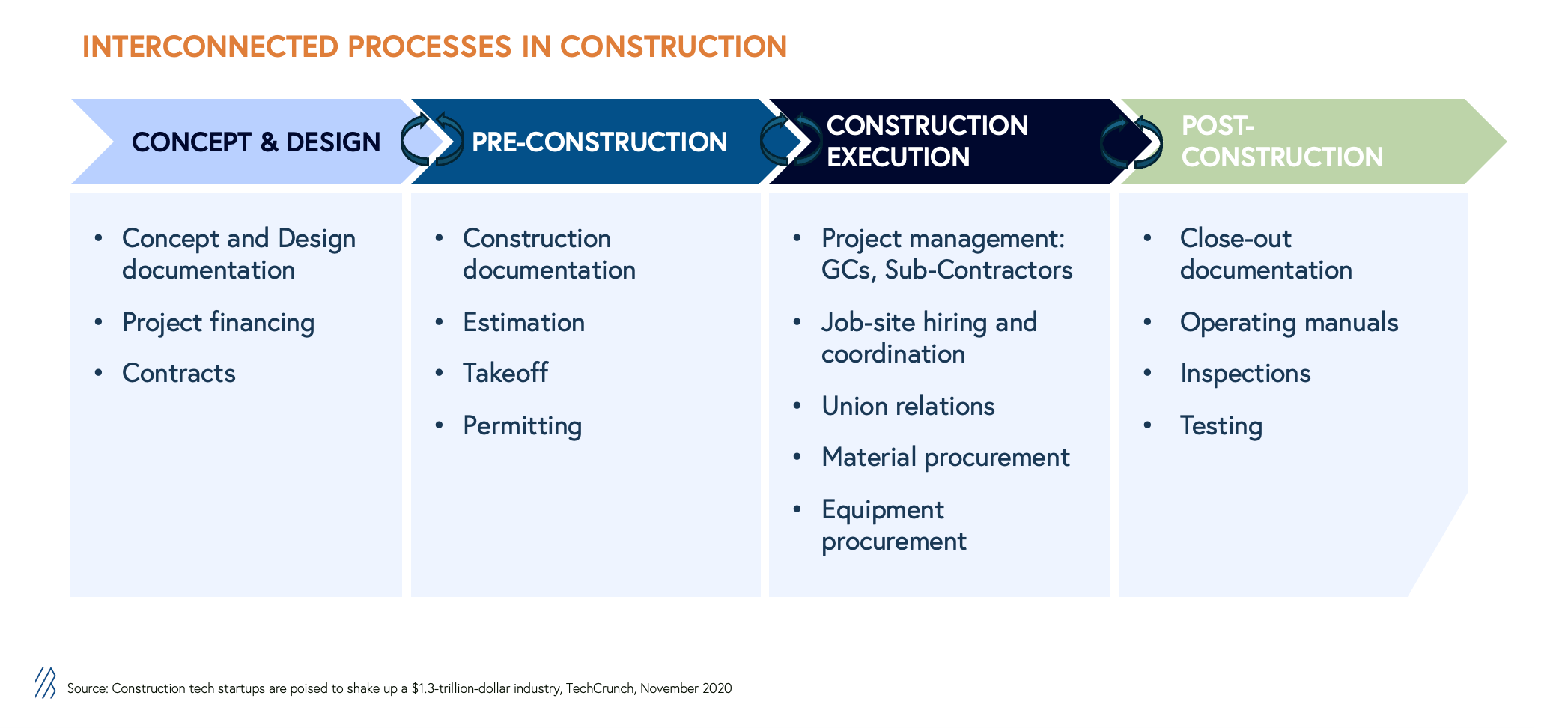

Every construction project is, at its core, an exercise in multi-modal language: contracts, blueprints, construction documentation, project plans, safety reports, purchase orders, change orders, and inspection reports. And it is deeply human and inherently in-person, involving constant communication between 15 or more stakeholder groups, from general contractors, subcontractors, and engineers to regulators, lenders, insurers, and owners. Each stage of the project lifecycle (e.g., design, pre-construction, construction, and close-out) introduces friction in accountability and information flow.

The “why now” is clear. Multimodal LLM-powered applications focused on construction can finally address the sector’s greatest bottleneck: its coordination problem.

Nonetheless, applying AI to construction remains a deeply technical challenge; one rooted in multimodal coordination, including parametric design and geometry. These are still active areas to be researched, but the academic community is taking notice. Construction-focused AI/ML publications have surged in recent years, alongside new institutes and conferences dedicated to the field. This momentum is now translating into company formation: startups across Construction AI are emerging at a faster pace, and accelerator cohorts increasingly include founders focused on transforming built world technology.

Five Construction AI categories we are watching closely

The potential for Construction AI is vast, and the workflow implications of LLMs and language-based automation are still evolving. Based on our conversations with customers and industry experts, we believe these five categories represent some of the most compelling opportunities within the Construction AI ecosystem.

1. Architecture & design: Design generation

Today, the building design generation process still revolves around modeling tools like AutoCAD and Revit; platforms that brought a foundational shift to digital design but demand expertise and offer limited true automation. Every design iteration, code update, or specification change triggers time-consuming manual revisions across 2D drawings and 3D models. These tools were built for precision, not iteration, leaving architects, structural engineers, and MEP designers to translate every change by hand, slowing changes and stifling creativity.

Imagine if architects, structural engineers, and MEP designers could instantly generate code-compliant, cost-optimized schematic, detailed, and construction-ready designs and documents tailored to client needs. This shift could 10× the speed of the building design process.

Companies such as Higharc, Finch, Augmenta, Motif, and others are building toward the future of generative design. We see enormous potential in this category and view it as one of the most technically demanding challenges in Construction AI, one that will require real breakthroughs in parametric generation and reasoning. Because construction is fundamentally a discipline of geometry, we believe enduring differentiation will come from companies that can truly master its underlying complexity.

2. Pre-construction: Takeoff and estimation

Today, more than 200,000 estimators underpin the financial backbone of construction in the U.S. alone. Yet their workflows remain largely manual, repetitive, and error-prone. The term “takeoff” itself dates back to when estimators would literally take off quantities from paper blueprints by hand, counting fixtures, tracing dimensions, and tallying materials line by line. Even with established software, the process of takeoff and estimation still demands painstaking labor: defining assemblies for every wall, window, or floor; measuring blueprints; and reconciling materials, quantities, and labor inputs to arrive at a bid.

Every design change or pricing update triggers another round of recalculations. What should be a data-driven process often becomes an exercise in educated guessing. As the CFO of one NYC subcontractor put it: “If we do 365 projects a year, we gamble 365 times a year. It’s an educated gamble but a gamble nonetheless.”

Imagine if estimators could instantly generate detailed assemblies and material takeoffs from evolving designs, freeing them to focus on strategic pricing and margin optimization instead of manual measurement and reconciliation.

Companies such as Bild AI, Drawer AI, and SketchDeck AI are building toward a future that reduces the guesswork in one of construction’s most critical workflows. We’re particularly excited about the evolution of multi-modal language models across image and video, which will further accelerate this transformation by allowing systems to interpret plans, specs, and site data with advanced fluency.

3. On-site Communication and coordination

Today, on-site communication and safety management remain fragmented and reactive. Crews rely on a patchwork of emails, calls, texts, paper logs, and spreadsheet trackers, while safety programs still depend on periodic walk-throughs and checklists that surface hazards only after they appear. Even leading platforms require manual data entry and lack real-time translation, contextual understanding, or insight.

Imagine if every on-site superintendent and crew member could use voice to instantly generate timestamped, multilingual RFIs, field reports, or safety observations, each automatically linked to the right drawing, schedule, and location. Spoken instructions, progress notes, and on-the-fly questions would become structured, searchable project records, making information instantly accessible to everyone, regardless of language, shift, or trade.

We see significant potential for multimodal applications of LLMs to redefine how field teams capture and act on information. By combining voice, image, video, and text models, these next-generation tools could facilitate faster coordination, proactive safety interventions, and a more connected, risk-aware worksite.

4. Knowledge management

Today, project managers are forced to navigate a maze of tools, including project management software, emails, and texts, just to find the right information or resolve conflicts. Critical data is often siloed across teams or buried in long communication threads, leading to delays, errors, and slower project delivery.

Imagine if project managers could orchestrate knowledge management through a single platform that instantly surfaces the right document, answers complex technical questions, and resolves coordination issues before they impact costs and timelines.

Companies such as Trunk Tools and TwinKnowledge are reimagining how information flows through construction projects. We see opportunity in reimagining information flow across construction projects. Those who can connect the fragmented data within contracts, drawings, RFIs, and change orders will enable a new paradigm of natural-language, query-driven project management.

5. Construction robotics

Today, labor shortages, safety risks, and rising material costs make on-site construction workflows increasingly expensive and difficult to scale. Despite major advances in automation elsewhere, most construction processes remain manual even as demand for critical infrastructure, such as data centers continues to surge.

Imagine if autonomous and semi-autonomous robotic systems could work alongside crews, allowing operators to control multiple machines through natural language, improving both crew and machine utilization. Companies such as Terrafirma and Bedrock Robotics are already building for this future by retrofitting existing machinery to enable it to operate autonomously or semi-autonomously. The next frontier of construction productivity will be defined by human–machine collaboration, allowing crews to control multiple machines through point and click and eventually natural language.

Five emerging principles for Construction AI founders

| Value creation | Focus on delivering measurable margin impact, not incremental efficiency, through clear cost savings or topline growth. |

| Pain points | Address critical, cross-stakeholder bottlenecks that materially affect project delivery rather than isolated workflow challenges. |

| Data advantage | Build enduring moats through proprietary, domain-specific construction data such as cost libraries, annotated plans, or project histories that compound over time. |

| Integration depth | Fit seamlessly into existing processes, workflows, or tools to lower adoption friction; require minimal behavioral change to spread organically across crews, projects, and teams. |

| User empathy | Build with empathy for the architect, estimator, superintendent, project engineer, or field worker; their context, constraints, and motivations are unique to the realities of construction and should shape every feature you build. |

II. Real Estate AI

Why now: Language model technology in real estate as an enabler of a relationship-centric industry

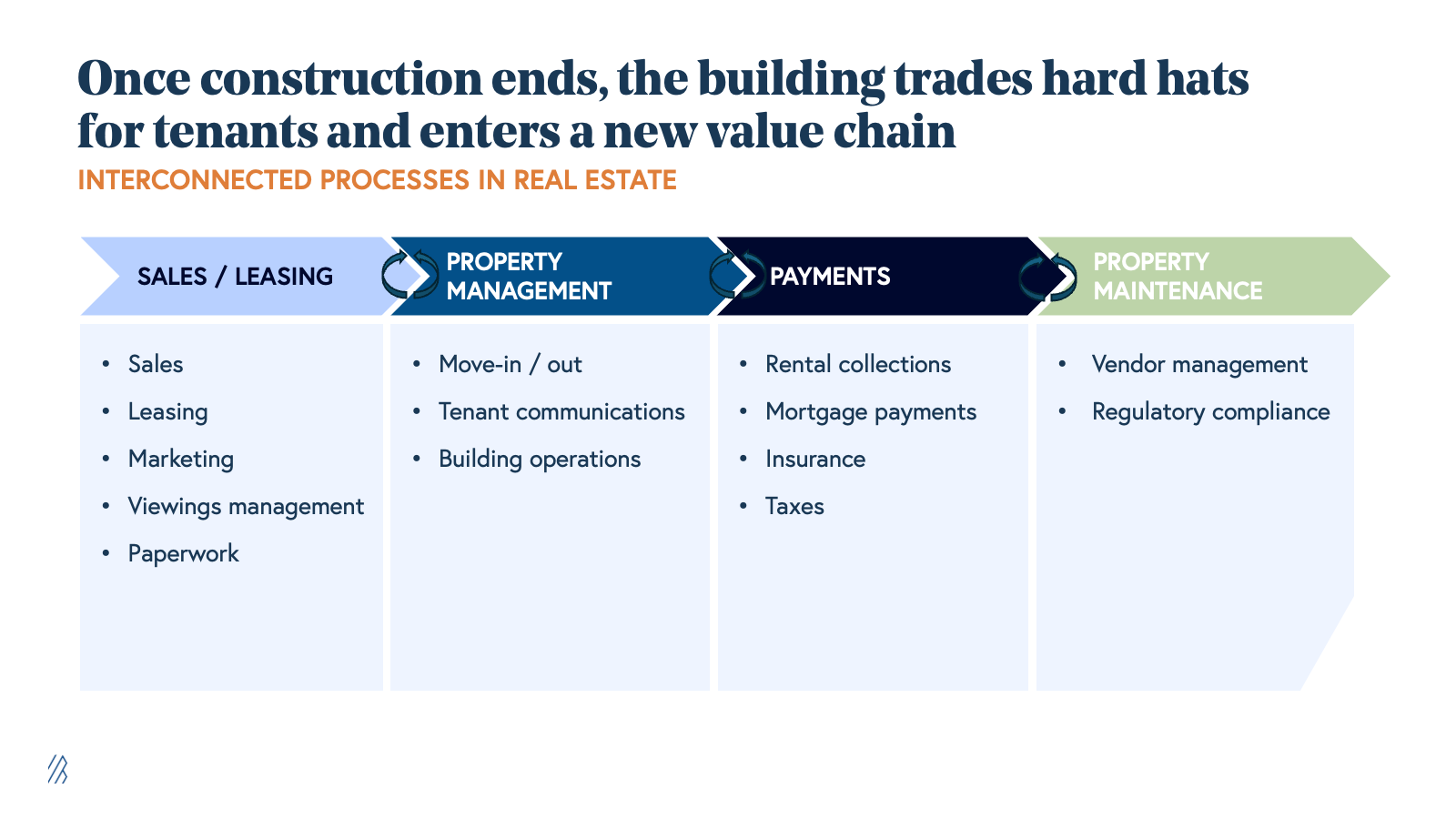

Once construction ends, the building trades hard hats for tenants and enters a new value chain, which spans sales, leasing, payments, property management, and maintenance. While this value chain varies across asset types (residential, commercial, industrial, and special-purpose), all share one foundation: real estate is a trust-driven business where local knowledge, networks, and relationships define success.

Four Real Estate AI categories we are watching closely

1. Automation of broker and agent workflows

2. Property search and discovery

3. Property management

4. Design

Five emerging principles for Real Estate AI founders

| Value creation | Focus on measurable topline growth or cost savings (e.g., through reduced outsourcing and admin work, higher lead conversion, or faster deal cycles). |

| Workflow density | Go deep to build trust. The most valuable products manage complex, relationship-driven (and often emotional) journeys end-to-end (such as sales or leasing) rather than solving narrow, one-off tasks. |

| Proprietary, localized data | Build a defensible data advantage by creating self-reinforcing data flywheels powered by hyper-local data that capture market behavior, zoning nuances, and relationship networks to sharpen accuracy. |

| Incentive alignment | Design for full incentive recognition across stakeholders. When owners, managers, tenants, and agents all benefit in some way, friction declines and adoption accelerates. |

| Account for relationships | Real estate is relationship-driven. Prioritize the agent, owner, manager, or buyer/renter experience alongside automation, acknowledging the unique dynamics of high-trust, emotional workflows. |

Our inboxes are open for Built World AI

Bessemer’s construction and real estate-related portfolio (select examples)

| Company | What they do |

| Procore* | Cloud-based construction management platform that connects key stakeholders on one unified system to manage documents, budgets, and timelines |

| ServiceTitan* | End-to-end software suite for trades businesses (HVAC, plumbing, electrical, and more) covering scheduling, dispatch, invoicing, and payments |

| Capmo | Smart project assistant for construction managers to give them a full overview of construction projects |

| Curri | Platform for tech-enabled delivery of construction and industrial supplies to enable customers to move faster and deliver without limits |

| DroneDeploy | Construction management software that monitors sites via drones, 360 cameras, and robots to capture data and conditions throughout the project lifecycle. |

| EliseAI | Automation and conversational AI that helps housing and healthcare organizations streamline communications and improve operational efficiency |

| Hatch | AI-powered customer service team for home services, home improvement, and beyond, designed to elevate customer experience and drive revenue growth |

| LuxuryPresence | AI-powered marketing platform for real estate agents to attract more clients, work more efficiently, and deliver better service |

| MaintainX | Computerized Maintenance Management System (CMMS) that streamlines maintenance operations, improves asset management, and empowers frontline teams across verticals, including property and facilities management |

| Miter | Suite of apps that simplify HR, finance, and operations for contractors, enabling them to build with confidence |

| Ownwell | Helping property owners reduce the costs of owning real estate through proprietary software that manages the end-to-end process of tax appeals, exemptions, and corrections |

| Rilla | Sales coaching for the AI era for auto services, home services, and home building |

| Rundoo |

All-in-one software for independent supply stores to win customers and streamline operations

|

| SurfaceAI | AI agent platform that helps multifamily operators uncover revenue, automate workflows,and run smarter operations |

| VTS | Unified platform for commercial real estate owners and operators to manage their buildings, including workflows for leasing, market intelligence and tenant experience |

| Unlimited Industries | Unlimited is an AI-native engineering and construction company, working with industry leading companies to design and build large-scale industrial projects in mining, energy, advanced manufacturing, and data centers. |

| WiredScore | Setting the global benchmark for building technology through WiredScore and SmartScore certifications, the world’s leading standards for digital connectivity and smart real estate |

*Indicates IPO or M&A exit