State of Deep Tech

Investments in the commercialization of scientific research have propelled humanity forward—here are the businesses defining the deep technology category.

Over the past half millennium, investments in scientific research have given rise to a parade of “deep technologies” that defy imagination and re-shape the human experience. One of the clearest examples came in 1969, when Apollo 11 landed Man on the Moon, untethering humanity from this Pale Blue Dot and opening a window of possibility into the next physical frontier. Exiting the Earth’s atmosphere, surviving the most extreme environment imaginable, and landing on a rock a quarter million miles away were feats once dismissed as mere science fiction. But the commercialization of scientific research has transformed aspiration into reality, driving the future of humanity. Other notable examples include the telescope in 1608, the steam engine in 1774, anesthesia in 1844, steel smelting in 1857, the lightbulb in 1879, the airplane in 1903, the computer in 1945, the Internet in 1969, and clinical genomic sequencing in 2014. We call this category of advancements deep tech.

In the State of Deep Tech, we explore what innovators are building today and celebrate the XB100, the definitive ranking of 100 of the most promising deep tech startups. XPRIZE and Bessemer partnered to create the list, and a panel of scientists helped rank the companies. From quantum computing to rocket technology to next-generation biotherapeutics, the companies in this report are tackling problems on a planetary scale. Their speed and success will ultimately determine the plot for our next chapter of humanity.

What is deep tech?

Our favorite definition of deep tech is technology that was science fiction in the past but is reality today; it pushes the boundaries of human capability through novel research and directed commercialization. Although this definition encompasses an umbrella of technologies, it’s important to note additional commonalities and distinctions that all deep tech companies share:

- The risks facing deep tech companies are different from those facing software investments. Market and customer risks dominate in software startups— Is the market big enough for this software? Does the software product have product-market fit with customers? —whereas technical and financing risks dominate risks in deep tech. For instance, if a deep tech company actually manages to build a commercial quantum computer, it’s a no-brainer that the market is more than big enough and that customers will clamor to use it. (We describe these risks in more detail in the Challenges section below.)

- It’s hard to establish growth and go-to-market metrics with deep tech. While different software verticals face similar product development and marketing processes, the engineering challenges across deep tech categories, such as drones and hydrogen production, are too different to make them easily comparable.

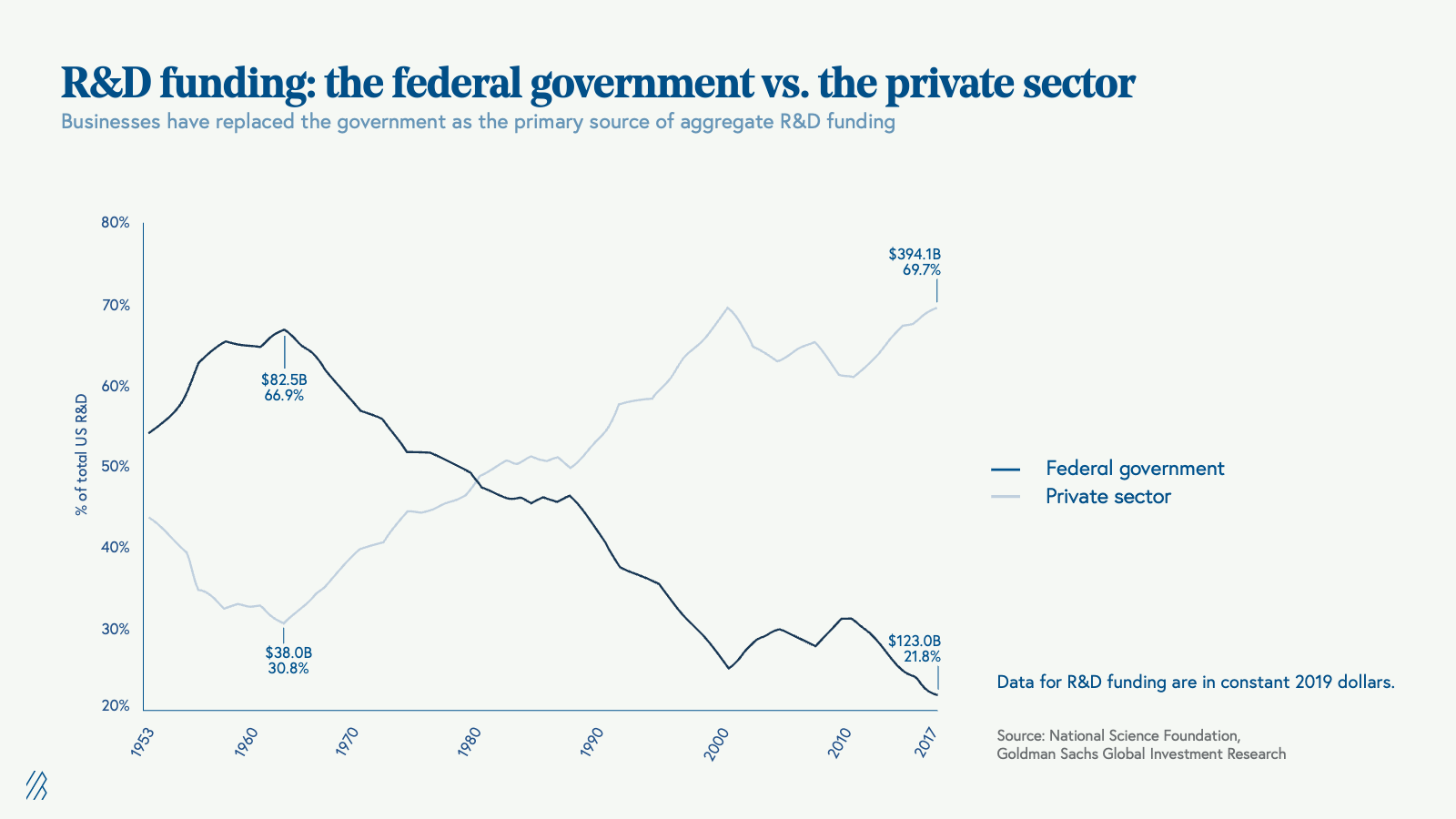

- Deep tech is more than just government research. Though governments have historically played an important role in building deep technologies—take rockets and the Internet as examples—they have functioned more as a funder and regulator of deep tech than its progenitor. Over the past 50 years, more and more R&D has been migrating to the private sector as opposed to the public sector (see graph below). Today, the government can still catalyze deep tech with non-dilutive funding, but it also does so through other policy means (e.g., tax credits).

- Deep tech commercializes scientific research. Science pushes the boundaries of human knowledge, adding to our understanding of the world. Meanwhile, deep tech occurs downstream of science experiments, applying cutting-edge science to solve concrete problems.

Introducing The XB100

The XB100 is the definitive ranking of the world’s top private deep technology companies. XPRIZE Foundation and Bessemer Venture Partners have set out to identify and study this promising cohort of businesses shaping the future.

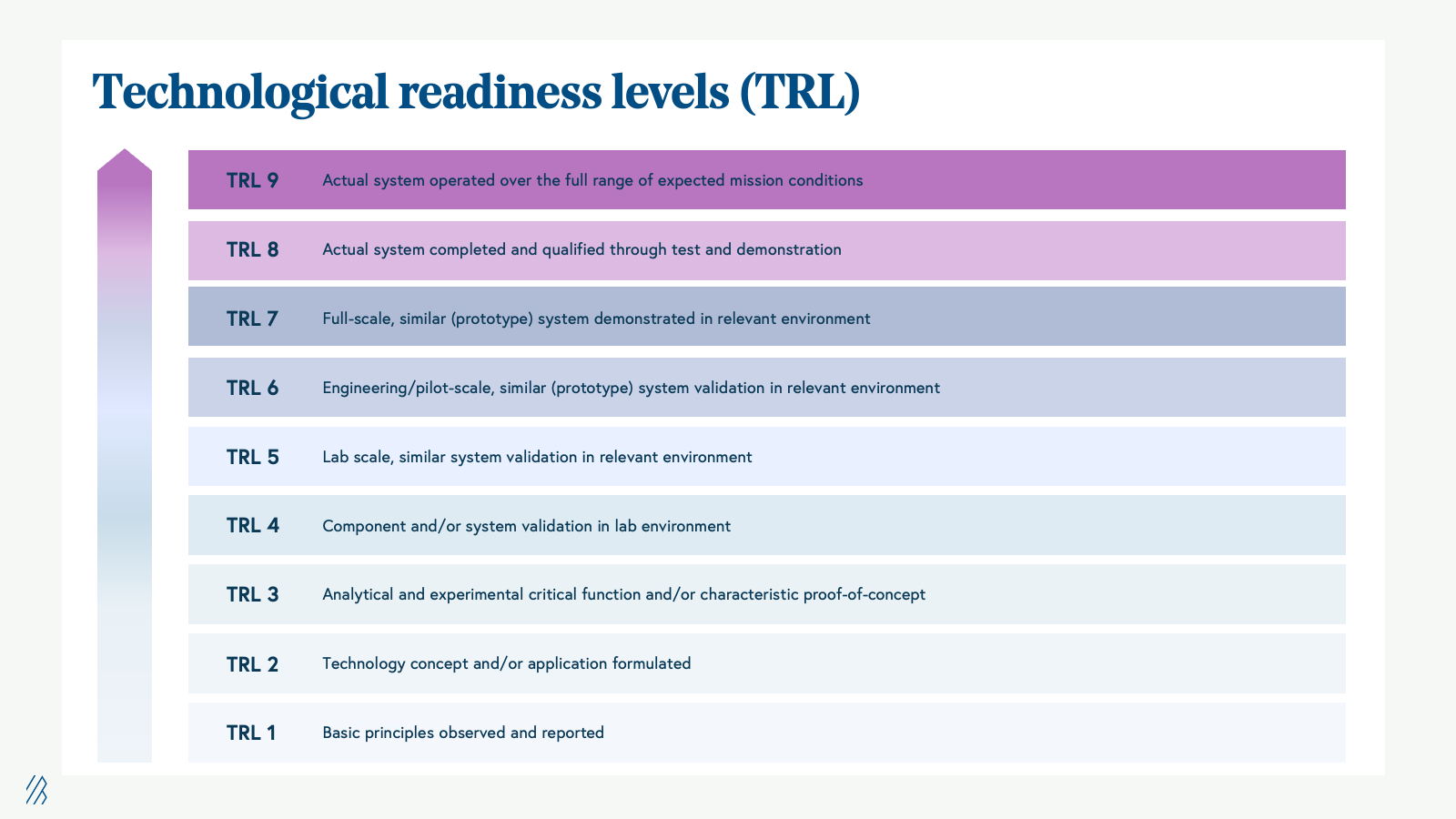

We evaluated these businesses based on four criteria: impact on humanity; valuation; scientific difficulty (evaluated using number of PhDs and patents); and commercial traction [evaluated using NASA’s Technological Readiness Level (TRL) framework].

The XB100 encompasses nine categories of deep tech:

- Agriculture: As the global population approaches 10 billion people by 2050, we'll need new ways to feed people and support improved living standards. Agricultural deep tech companies are developing new, sustainable methods to produce or grow food, such as vertical farming, offshore aquaculture, and alternative meat.

- Artificial intelligence (AI): Thanks to advancements in chips, AI models, training methods, and ways to collect, label, and analyze data, AI is transforming from a rules-based machine to a human-like creator. In the long-run, these AI developments will become personal assistants that augment our productivity and the way we work.

- Aviation: From drone-based disaster response deliveries to autonomous flying taxis and supersonic aircraft, people and goods are going to travel in the air in ways they never have before.

- Climate: Climate change poses an existential risk to humanity, and we need to deploy a number of different solutions to tackle it. With climate headwinds picking up globally, many entities, from universities to governments to corporations, are deploying capital to develop, produce, scale and market a deep technologies ranging from energy storage to carbon capture.

- Mobility: Deep tech mobility companies, like those building autonomous vehicles, are changing the way we move on the ground, which will inevitably impact the way we design cities, infrastructure, and buildings.

- Next-gen biotech: New biotech companies use advancements in AI, genomics, and other novel modalities (e.g., CRISPR, single particle tracking) to prolong life through cheaper, more rapid diagnostics and the treatment of diseases like cancer.

- Quantum: When quantum computers reach "quantum advantage," the point where they're powerful and stable enough to outperform classical computers in solving commercially valuable problems, they will revolutionize pharmaceuticals, logistics, financial services, automotive, and other industries.

- Robotics: In combination with AI, machines that operate autonomously (e.g., robotic arm, humanoid robots) can perform physical tasks with greater precision, accuracy, and speed than humans can.

- Space: Humans haven’t been to the Moon since 1972, but we expect to return before the end of the decade. In addition to launch and travel, a number of other space technologies—like remote sensing and in-space manufacturing— are changing our lives here on Earth.

We worked in conjunction with seven judges to evaluate the impact of each category on humanity: Anousheh Ansari, astronaut and CEO of XPRIZE Foundation; Emily Calandrelli, science communicator, author, and Emmy-nominated TV host; Lori Garver, co-founder of the Brooke Owens Fellowship and former Deputy Administrator at NASA; Ray Johnson, CEO of Technology Innovation Institute and former CTO of Lockheed Martin; Stacy Kauk, Sustainability Expert; Ray Kurzweil, author, inventor, and futurist; and Tina Seelig, Executive Director of Knight-Hennessy Scholars at Stanford University.

Across the nine sectors using a formulaic ranking, we have produced a ranked list of the 100 most valuable, impactful, scientifically difficult, and technologically advanced deep tech companies:

Deep tech benchmarks and trends

The XB100 companies are all distinctive: each emerging industry has its own dynamics and technological readiness levels. We surfaced the following trends and data points from our analysis.

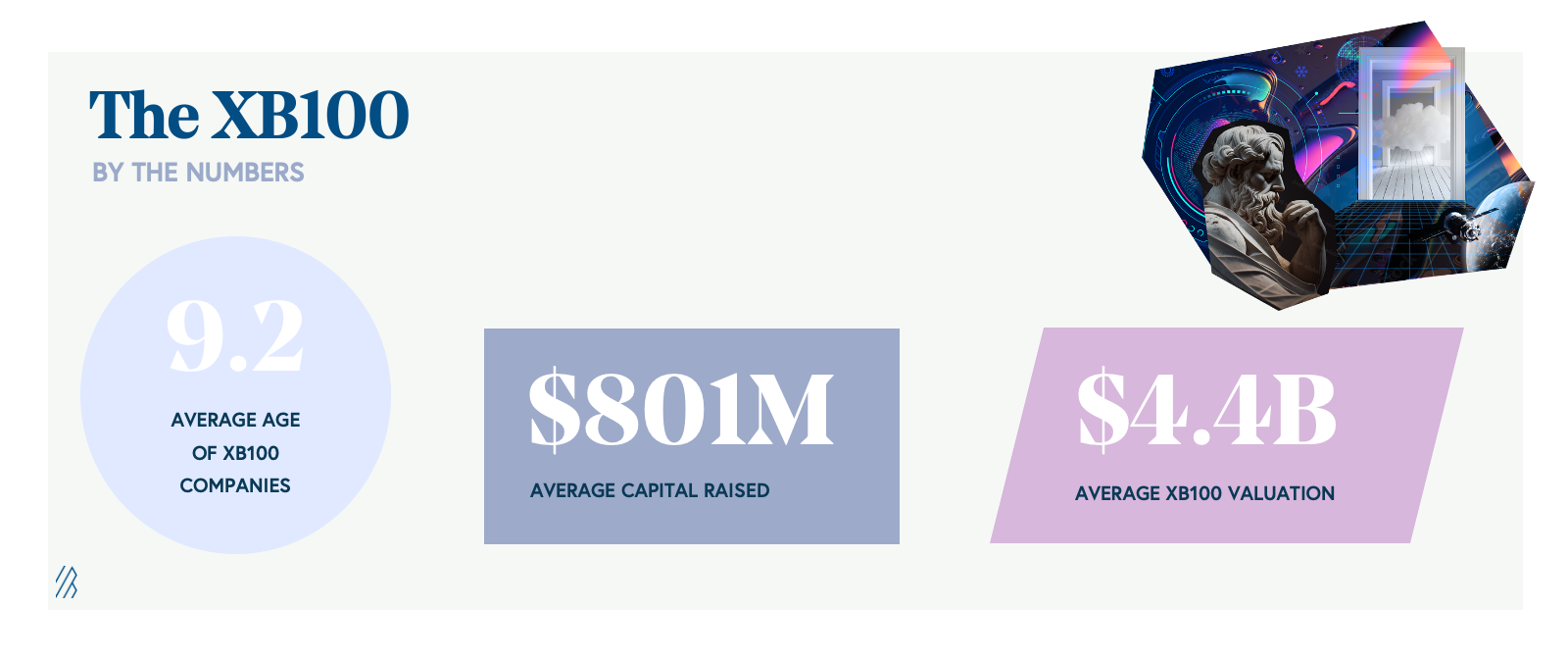

1. Deep tech businesses are capital-intensive and have long timelines for exit, so the opportunity cost of capital is relatively high when deciding whether to invest in deep tech. Across the XB100, the average company age is 9.2 years, the average amount of capital raised is $801 million, and the average valuation is $4.4 billion, and 84 are unicorns, or valued over $1 billion. (Software companies, by comparison, tend to be quicker to mature and rise in valuation: in 2022, the average Cloud 100 company took eight years to reach Centaur status—$100 million ARR—and had an average valuation of $7.4 billion. Deep tech companies have a slower early ramp because they need to spend the first few years tackling tech risk, but when they ultimately go to market, their valuation potential is higher.)

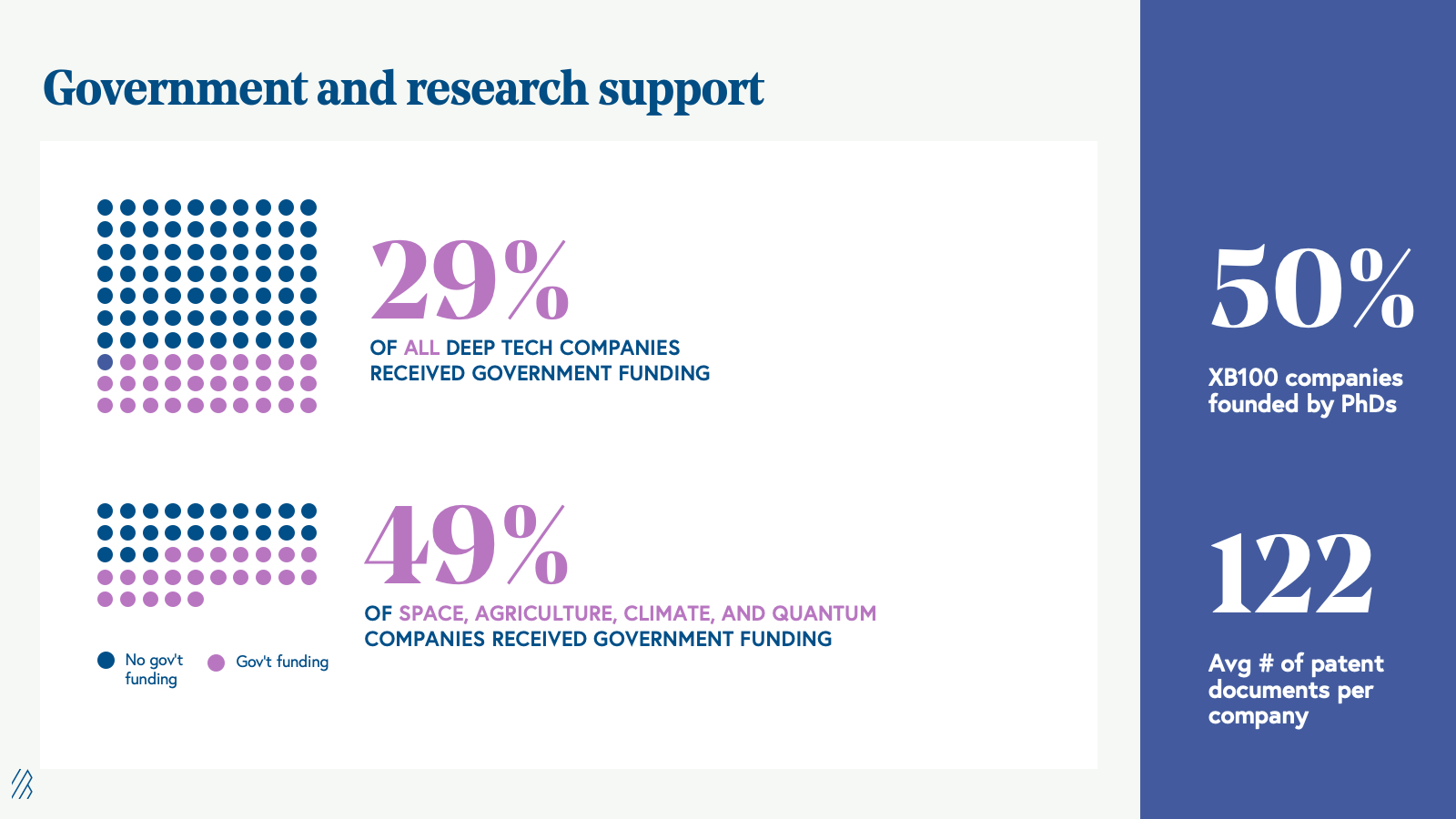

2. Deep tech investments can still provide strong returns on a risk-adjusted basis. One reason is that governments provide non-dilutive capital to mitigate future financing risk. Across the XB100, 29% of companies have received funding from the government. This percentage rises to ~49% when isolating companies in space, agriculture, climate, and quantum. We expect climate companies, especially, to receive a large amount of non-dilutive government funding in the years to come thanks to federal agencies like the Loan Programs Office (LPO), which was given $100 billion in loan authority under the landmark 2022 Inflation Reduction Act (IRA) to fund climate technology deployments.

3. Many deep tech companies also have technological moats. PhDs founded 50% of XB100 companies, and companies on the list have an average of 122 patent documents. These moats not only protect companies, but also provide downside protection to company value. Companies that might be years away from commercial viability might already have significant independent value thanks to a high-value patent portfolio.

4. Deep tech innovation is highly concentrated in the United States, highly comprised of PhD-founders, and taken together, strongly tied to U.S. academia: 74% of the XB100 features U.S. startups, with most of the remainder coming from Europe, China, and Canada. Furthermore, of the 50 PhD-founded startups on the XB100 list, 45 of those companies had PhDs conferred from American universities. Admittedly, the scarcity of data on deep tech and companies in other markets in part explains the list's heavy concentration of U.S.-based startups. It’s important to recognize deep tech as a global category, since the commercialization of scientific research not only happens around the world but also impacts all of humanity. That said, as geopolitical tensions continue to rise, we expect further opacity of deep tech development in other geographies, and additional restrictions on tech transfer may lead to increasing balkanization of deep tech.

5. There are no AR/VR companies on the XB100—yet. One of the most prominent and recent startup headlines in this space was Magic Leap, which Saudi Arabia’s Public Investment Fund acquired in late 2022 at a $450 million valuation. At the time of acquisition, Magic Leap had thousands of patents, raised billions of dollars, and stayed private for nearly 14 years. This suggests that even among deep tech investors in the private markets, the required capital expenditures and time to exit is too far into the future. Instead, AR/VR has attracted attention from public tech companies with balance sheets large enough to invest in what they believe is the next computing platform. Indeed, over the last two years, most of the AR/VR news has centered around Apple’s new Vision Pro headset and Meta’s push to the metaverse. That said, AR/VR is certainly a category of deep technology that could make its way onto the XB100 in the years to come.

6. As shown with SpaceX and OpenAI, the top two companies on the XB100, deep tech companies reach a tipping point, where they suddenly become household names after years of under-the-radar tech development. In 2021, millions of people watched live as SpaceX launched its first all-civilian crew to orbit. In 2022 and 2023, OpenAI released its DALL-E 2 and GPT-4 models, which showed that AI can perform basic reasoning tasks and generate complex works that we had traditionally thought were uniquely human—things like art and essays. But SpaceX and OpenAI represent only the beginning. Deep tech companies and industries across the board have the potential to continue along this trend, hitting inflection points in societal awareness upon reaching different ground-breaking milestones.

7. The average TRL of companies on the XB100 is ~7. At this stage, companies have demonstrated a fully-functioning prototype of their technology in a close-to-real-world environment. The company category with the lowest TRL was quantum computing, with a TRL of 4, while the company categories with the highest TRL were robotics and mobility, each with a TRL of ~8.5.

8. The average value-capital-multiple (VCM), the ratio of the latest valuation to the total amount of capital raised, on the XB100 is 5.5. While latest valuations may not be entirely current nor reflective of today’s macroeconomic environment, this multiple is still directionally useful in capturing how efficiently deep tech companies convert invested capital into value. This is especially important in an era where capital efficiency is king. The category with the highest VCM is aerospace at 11.9, while the category with the lowest is agriculture at 2.6.

Common deep tech challenges

While deep tech has the potential to transform society in many different ways, deep tech companies often encounter a common set of three challenges, which we’ll examine in turn—technology, talent, and tons of cash.

1. Technology

Deep tech companies must overcome the challenge of making their technology work and scaling it economically. Sometimes the technology will require many more years before commercialization is feasible. Nuclear engineers have often joked that nuclear fusion is perpetually 20 years away, no matter what year it is. But the recent development of high-temperature, superconducting magnets that can contain multimillion-degree nuclear plasma has made nuclear fusion seem closer to reality.

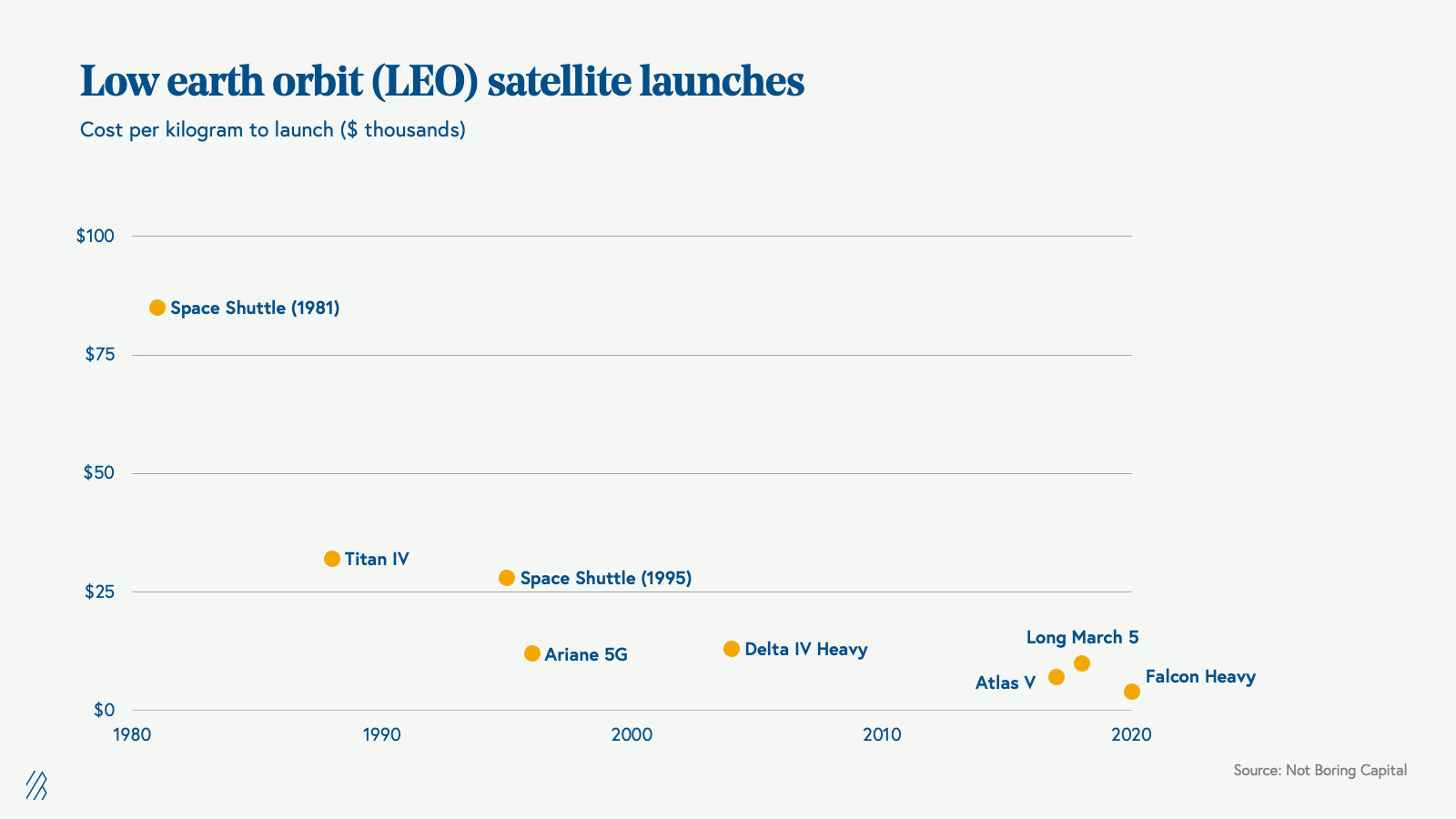

Or consider space launch and satellites, which took 40 years to reach technical and economic feasibility. From the 1960s to the early 2000s, the price of launching payloads (like satellites) to space was approximately $50,000/kilogram. Because costs were so high, companies launched fewer satellites and needed to maximize each satellite’s geographic coverage. Companies therefore sent satellites far away to geostationary orbit (GEO), 40,000 km away. But in the mid-2000s, SpaceX rewrote the playbook: the cost to launch a rocket into space went down dramatically, to the order of $5,000/kilogram, and enabled us to launch more satellites to low-earth orbit (LEO), less than 2,000 km away. Today, we’ve launched ~5,000 satellites to LEO while the number of satellites in GEO remains in the low hundreds.

In order to assess the technological readiness of deep tech companies, founders and investors need to answer to the following questions:

- Why now?

- What does the techno-economic analysis (TEA) look like? TEAs are crucial in evaluating the unit economics of a technology at its current and future technological readiness levels.

- What are the assumptions?

- What needs to be true in order for this to work at scale?

- What has been demonstrated so far? What will it take to go from prototype to production?

2. Talent

While deep tech is not pure scientific research, deep tech companies must still hire the best scientists in order to succeed. Contrast this to the world of B2B and B2C software, where software developers can produce and deploy web and mobile apps without advanced (or indeed any) degrees. Software architectures are relatively well-understood, and once a team decides on an architecture, the next step is rapid execution. In deep tech, we have no pre-existing architectures. For instance, how do we build a nuclear fusion reactor that produces net energy? Deep tech companies need to find and hire the best scientists to lead tech development and ultimately expand the boundaries of engineering.

But the growth rate of U.S. science doctorates is slowing, and a majority of PhD students still prefer to enter academia after graduation. Just under 30% prefer to work in industry, although this percentage appears to be growing (see statistics from MIT, Stanford, Harvard).

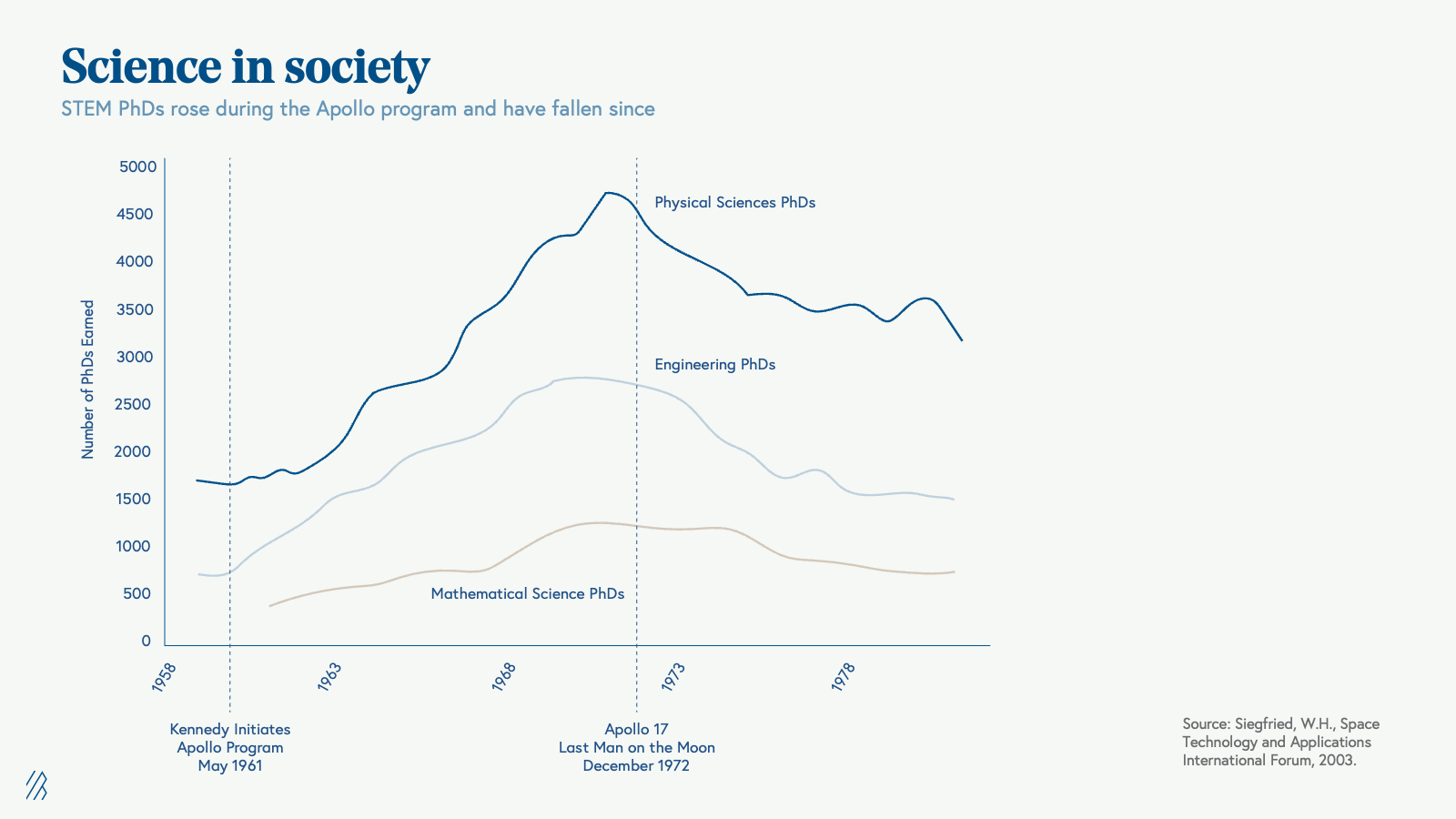

That said, the amount of talent may be correlated with the social milieu. During the space race of the 1960s, the number of math, engineering, and physics PhDs steadily grew year over year until peaking in the early 1970s (see below). Similarly, today, Gen Z increasingly hopes to tackle climate change as an integral part of their careers, suggesting that we may see more climate-related science talent in the years to come. We hope that the State of Deep Tech report, in combination with the efforts of deep tech companies, philanthropists, and governments, can inspire a new generation of young scientists to pursue deep tech as a vocation.

3. Tons of cash

Deep tech companies suffer from financing risk: Where will future sources of capital come from in order to commercialize the technology at scale? For example, during the “CleanTech 1.0 bust” of the early 2000s, later-stage capital for deep climate technologies such as biofuels, batteries, and solar power dried up, dooming many previously well-funded startups.

Deep tech companies face high capital expenditures (CapEx) for a number of reasons:

- Deep tech companies deal in the world of atoms (not bits) and therefore need to spend significant amounts of their budgets purchasing physical equipment and lab space.

- Unlike software companies, where engineers can push bug fixes and iterative product improvements to servers instantaneously, deep tech companies must get the product perfect before any customer use.

- Deep tech companies need to comply with regulations before going to market, and regulatory approval takes time and money.

- Each new stage of development (research → prototype → deployment → commercial scale) presents new technical development challenges.

That said, in recent years, we’ve seen a number of vectors for deep tech startups to mitigate financing risk.

- New venture capital funds. Certain new venture funds have extended their return lifetimes—beyond the typical ~7-10 years of a traditional VC fund—in order to fund deep technology that has a longer path to commercialization. Breakthrough Energy Ventures, for instance, has an investment return horizon of 20 years. Similarly, we’ve recently seen the emergence of crossover funds and large public institutional investors (e.g., Tiger, SoftBank, Fidelity) that mitigate financing risk by deploying large sums of capital into mid-late stage startups.

- SPACs. In 2021, many deep tech companies went public via SPAC (special-purpose acquisition company) mergers. Investment banks typically like to see stable cash flows before agreeing to underwrite traditional IPOs, a preference that poses a challenge to early deep tech companies. The SPAC vehicle, on the other hand, enabled deep tech companies that hadn’t yet reached commercial scale to raise large amounts of cash and get access to the public markets. This immense amount of cash would theoretically provide several years of runway and serve as a bridge to profitability, thereby mitigating future financing risk. While the SPAC market effectively dried up in 2022, time will tell how companies that went public via SPAC perform, how SPACs eventually get regulated, and whether they re-emerge—even if only in a limited capacity—as an alternative late-stage funding mechanism for deep tech companies.

- Non-dilutive funding. Non-dilutive funding mechanisms have been around for a while but remain important for deep tech companies, especially given the sheer amount of capital that needs to be raised in order to reach commercialization at scale. For example, the U.S. government provides about $2.5 billion per year for early-stage R&D through its Small Business Innovation Research (SBIR) program, and Australia and Canada both provide tax grants for R&D. In deep climate technologies, the Advanced Research Projects Agency–Energy (ARPA-E) provides companies hundreds of millions of dollars per year to overcome technical risk. Later-stage companies should also explore debt or project finance, although investors often want to see the technical risk retired and will assess products more on market and operational conditions.

Deep tech: A key to solving humanity’s toughest challenges

As we celebrate the deep tech companies building at the frontiers of science, we want to reiterate that deep tech holds a key to solving many of humanity’s toughest challenges. That said, companies can’t tackle these challenges without the proper technology, talent, and tons of cash.

There are many things we can do to create this primordial soup for emerging deep tech companies to thrive: we can shine light on more deep tech companies and play a larger role in judiciously yet ambitiously supporting these companies throughout their lifecycle. The XB100 List aims to do just that.

Academic institutions can cultivate more scientists. Governments can catalyze more research. In general, we can all take a renewed interest in things like nuclear energy and space. Indeed, the Moon landing in the 1960s catalyzed an entire generation of deep technologies, but humans haven’t been back to the Moon since 1972. As we peer into the future of deep tech, we’re excited to return to the Moon, landing the first woman and person of color before the end of the decade and pushing humanity further into the stars in the decades beyond.

The XB100 companies are transformational and inspirational. They tackle profound problems facing our species and planet, ultimately propelling humanity forward, as deep tech has done in the past and will continue to do for centuries to come.