Roadmap: Transforming Indian healthcare, one specialty at a time

The shift towards single-speciality hospitals and clinics is becoming the preferred model in Indian healthcare, as insurance coverage has doubled in the past decade.

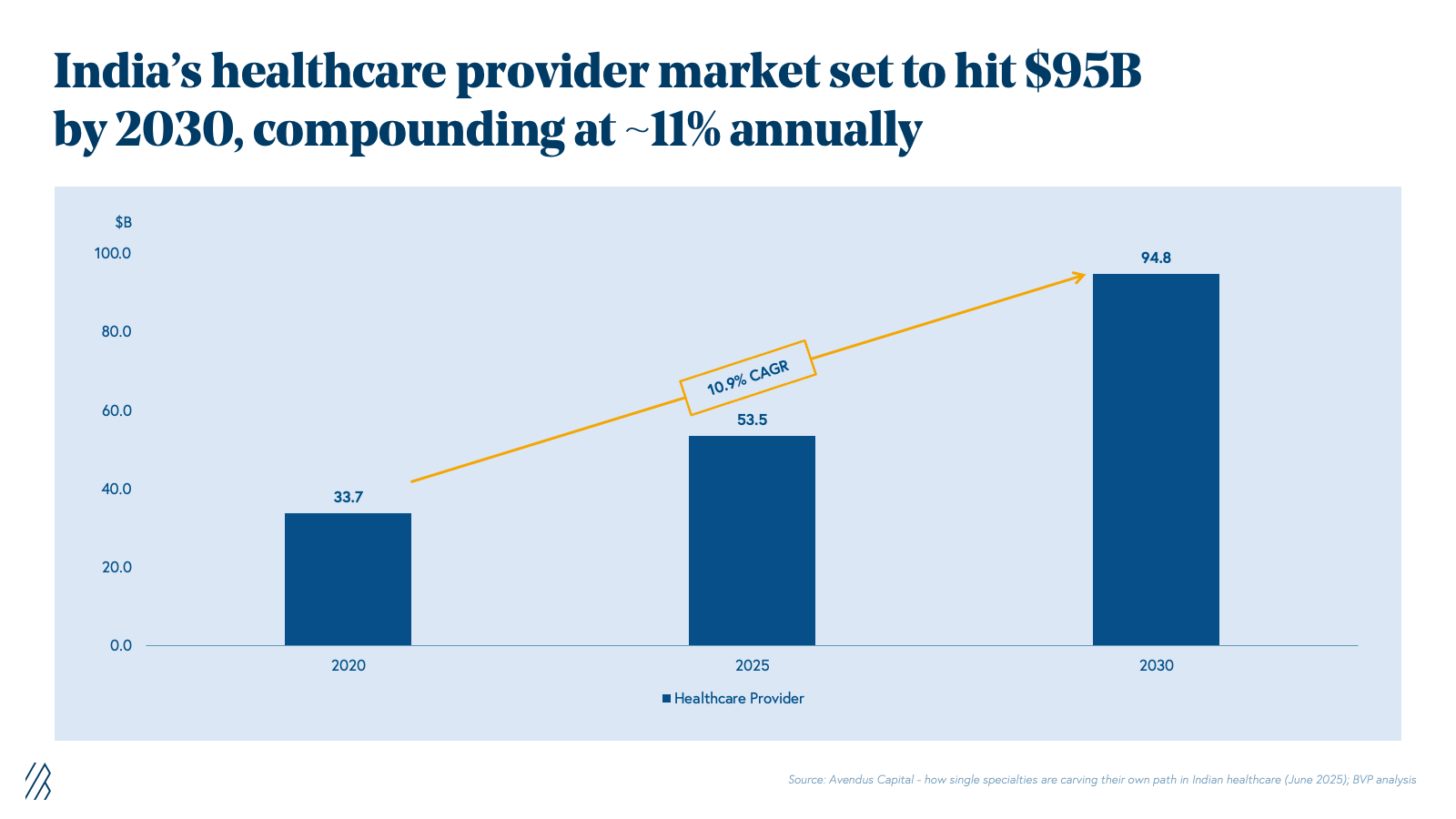

India has taken significant strides in the past decade in delivering healthcare to its 1.4 billion people. Insurance coverage has doubled from 2013 to 2023, now reaching 40% of the population. This rate is likely to reach 55-60% by 2030 as the healthcare provider market is expected to grow 10%+, growing into a $95 billion market by 2030.

While health coverage has expanded rapidly, the delivery of medical care is undergoing an equally significant transformation. Single-specialty hospitals and clinics, designed around specific conditions rather than all-purpose care, are increasingly emerging as the preferred model.

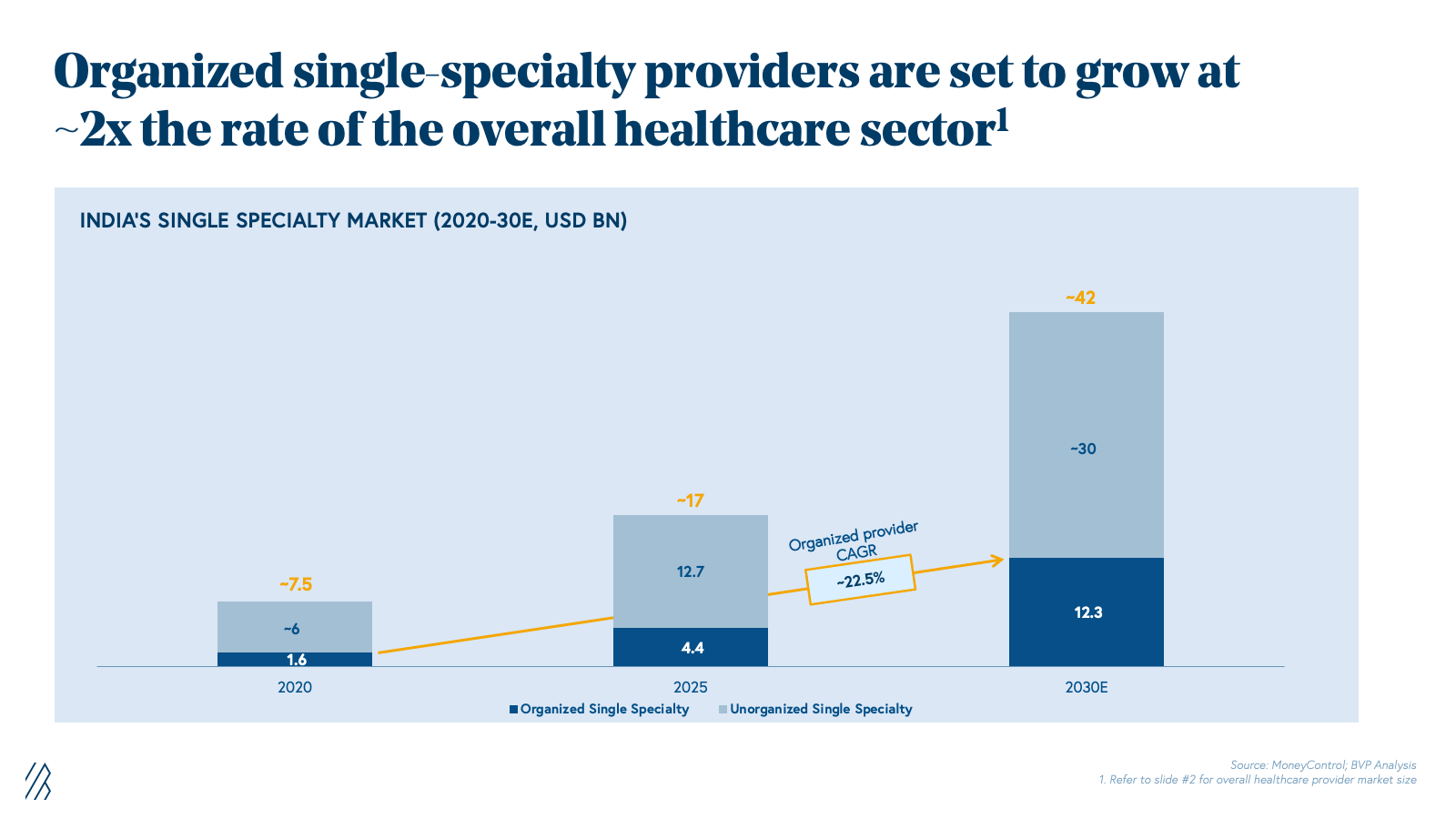

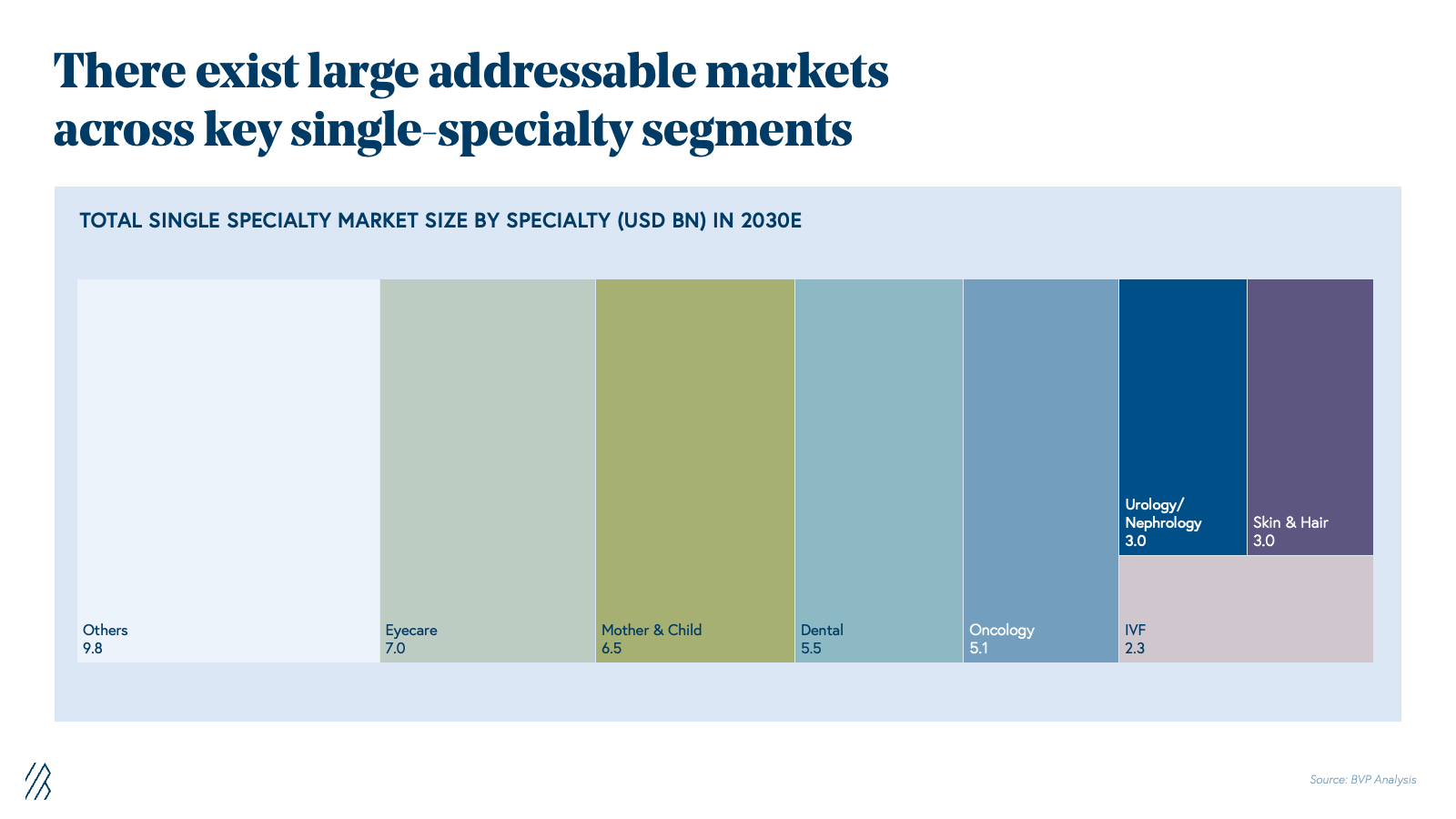

An industry-wide shift toward single specialty reflects a structural re-orientation of healthcare delivery. The traditional multi-specialty, jack-of-all-trades hospital model is giving way to focused, standardized, and patient-centric systems. In its place, a new class of specialty-native providers is emerging: agile chains built to deliver superior clinical outcomes, better patient experiences, and inherently more scalable economics. The segment is projected to grow from $4.4 billion in 2025 to ~$12.3 billion by 2030, compounding at ~22% annually, twice the growth rate of the broader healthcare provider sector.

Our roadmap explores how specialization is reshaping India's healthcare industry, and breaks down why this is a winning business model, what it takes for healthcare founders building in India to succeed, and why this transformation could redefine healthcare access and quality for the decade ahead.

Key insights from India’s single speciality healthcare transformation

- India’s healthcare market is expanding and rapidly verticalizing: The healthcare provider sector will grow from ~$54B in 2025 to ~$95B by 2030, but the real shift is the rise of single-specialty care, growing ~22% CAGR, which is over 2× faster than multi-specialty hospitals, as patients increasingly prefer focused expertise.

- Specialization expands the healthcare opportunity: Demographics (a 3.4% annual growth in the population aged 60+), rising insurance penetration, and sustained investor interest are accelerating the growth of single-speciality providers. By 2030, India’s single-specialty market (organized and unorganized) is poised to exceed $40B, led by operators achieving superior outcomes, differentiated patient experience, and attractive unit economics - with 12–18 month payback and sustainable 20%+ EBITDA margins.

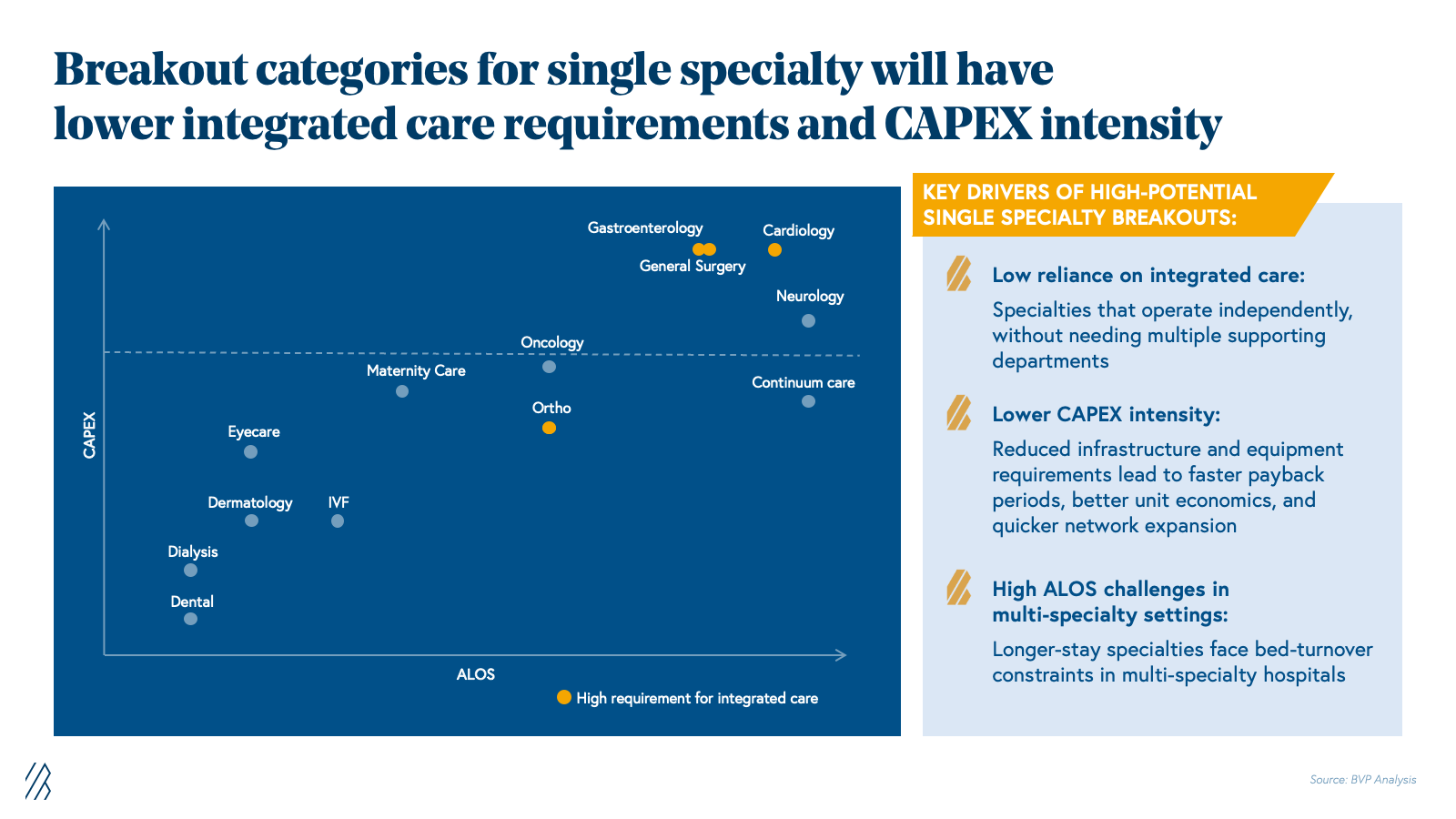

- Specialization is reimagining delivery of care: Multi-specialty hospitals remain central to complex, multi-disciplinary procedures, while purpose-built centers are capturing focused, repeatable care with better outcomes and lower costs. The system is shifting from solely broad, capex-intensive hospital models to also accommodating providers designed to excel in a single clinical domain.

- From metro-centric care to scalable specialty networks: Specialty care remains metro-centric. Tier 2/3 cities remain reliant on inconsistent local providers, creating an opportunity for single-specialty brands to scale with standardized care protocols and repeatable, hub-and-spoke operations.

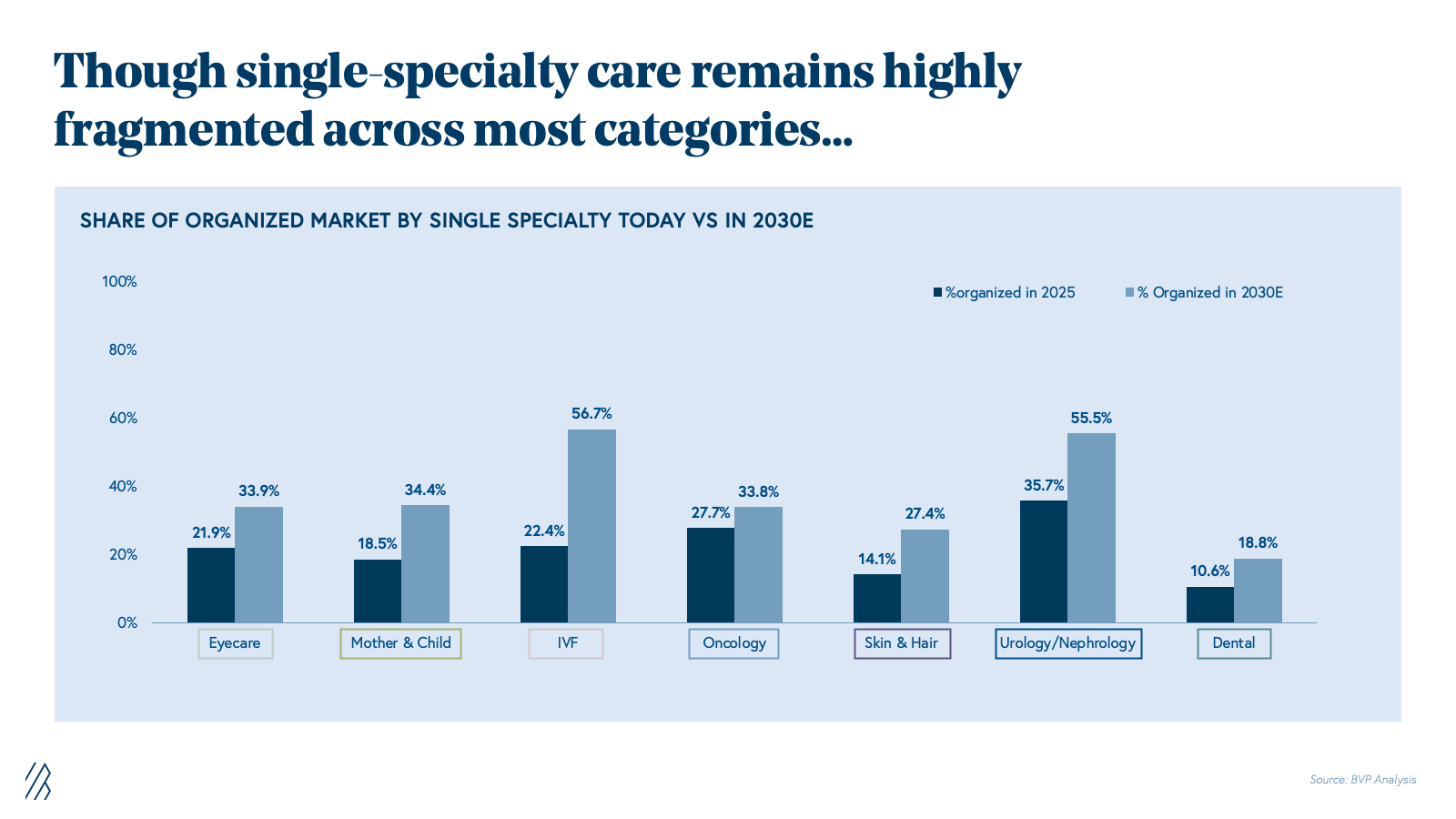

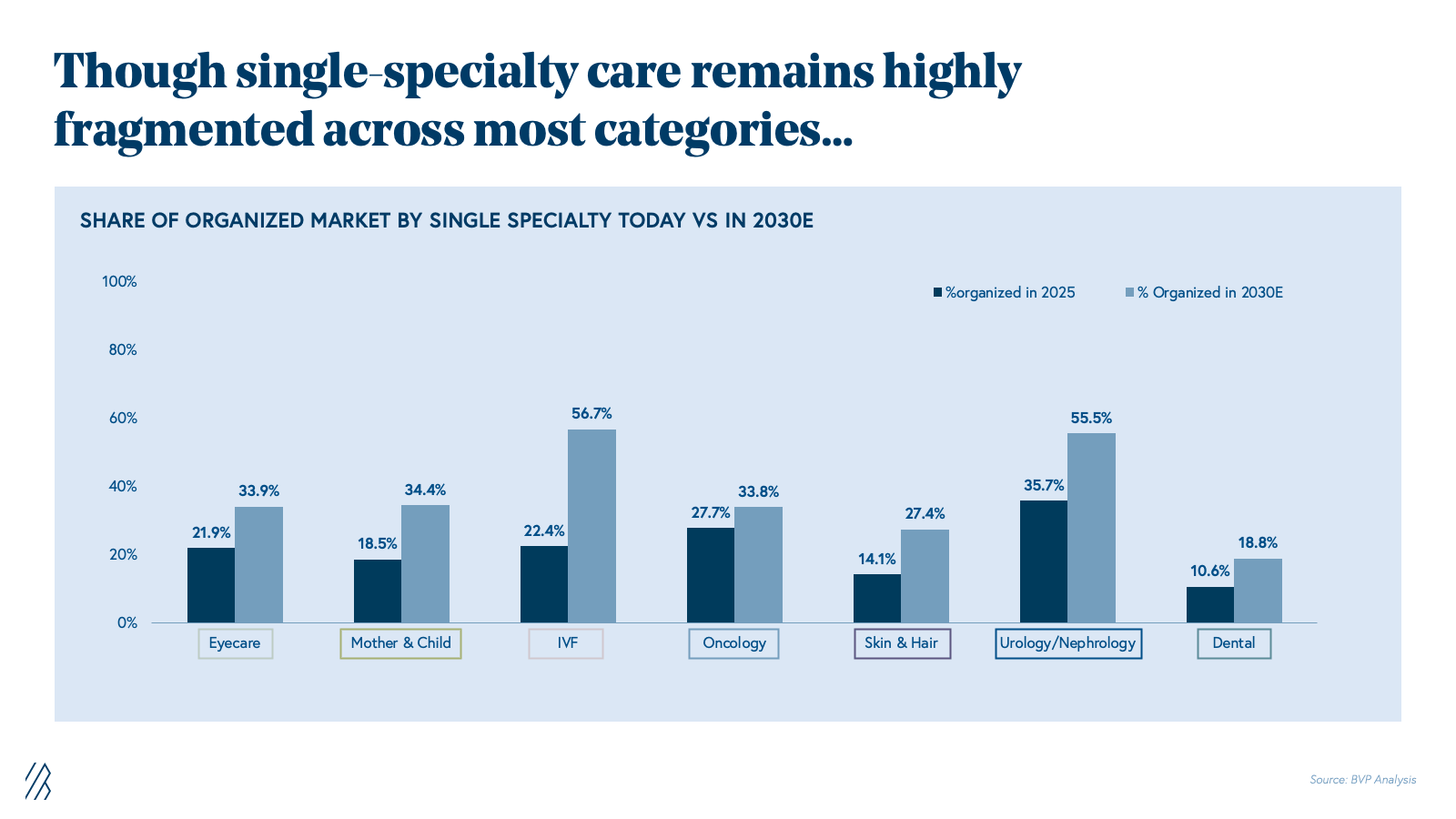

- The current landscape presents a compelling opportunity for entrepreneurial founders, as most single-specialty verticals remain highly fragmented. Even by 2030, most categories, such as eyecare, oncology, and dental, are unlikely to be even 60% organized. This fragmentation creates a significant opening for visionary founders to establish credible brands, set industry standards, and effectively become category creators in their chosen vertical.

Full slide deck

What’s driving the demand for expansive healthcare in India?

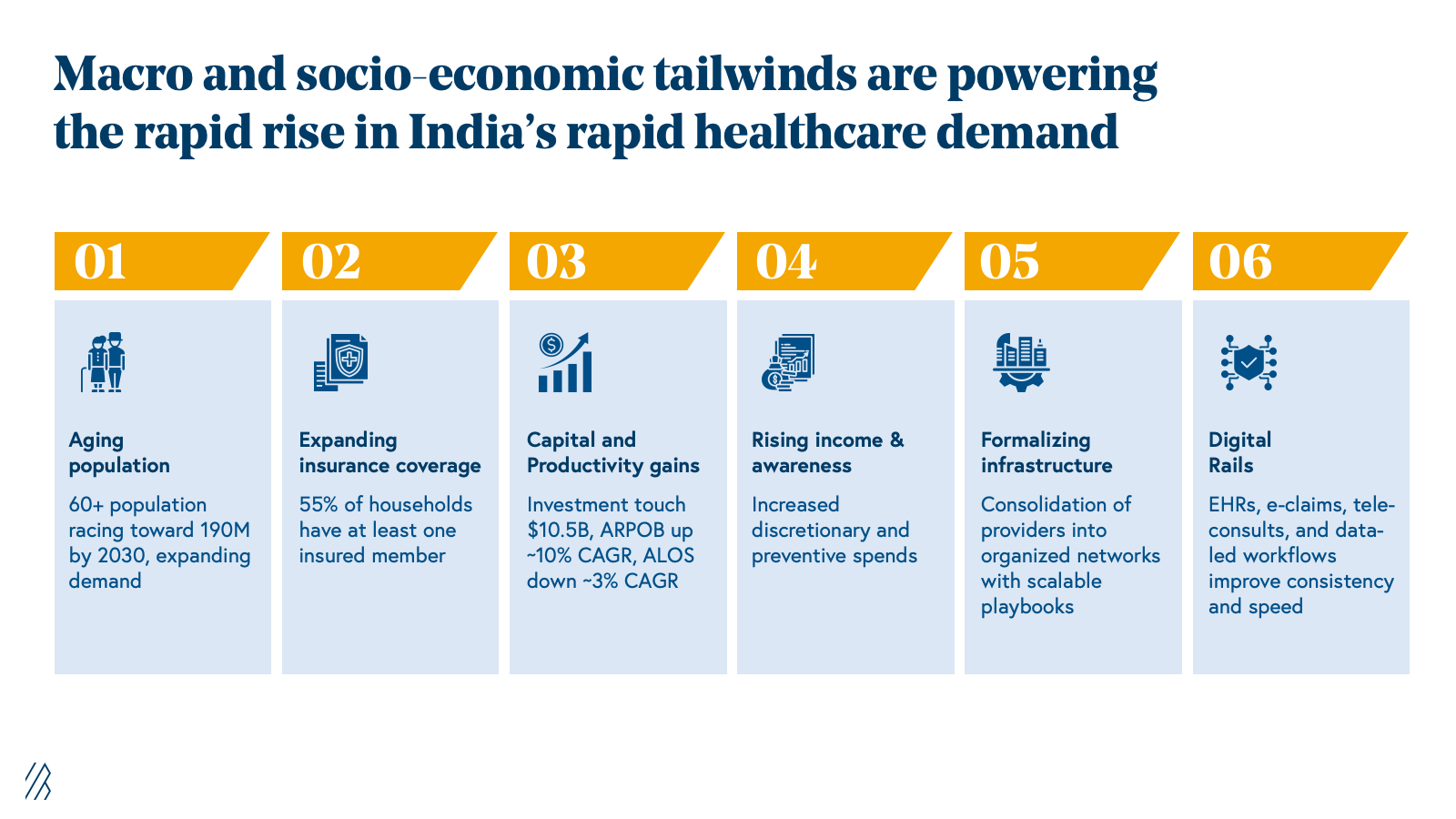

India’s provider market is expected to grow from roughly $54 billion in 2025 to about $95 billion by 2030, growing at approximately 11% CAGR. Powerful demographic, financial, and structural shifts underpin this expansion:

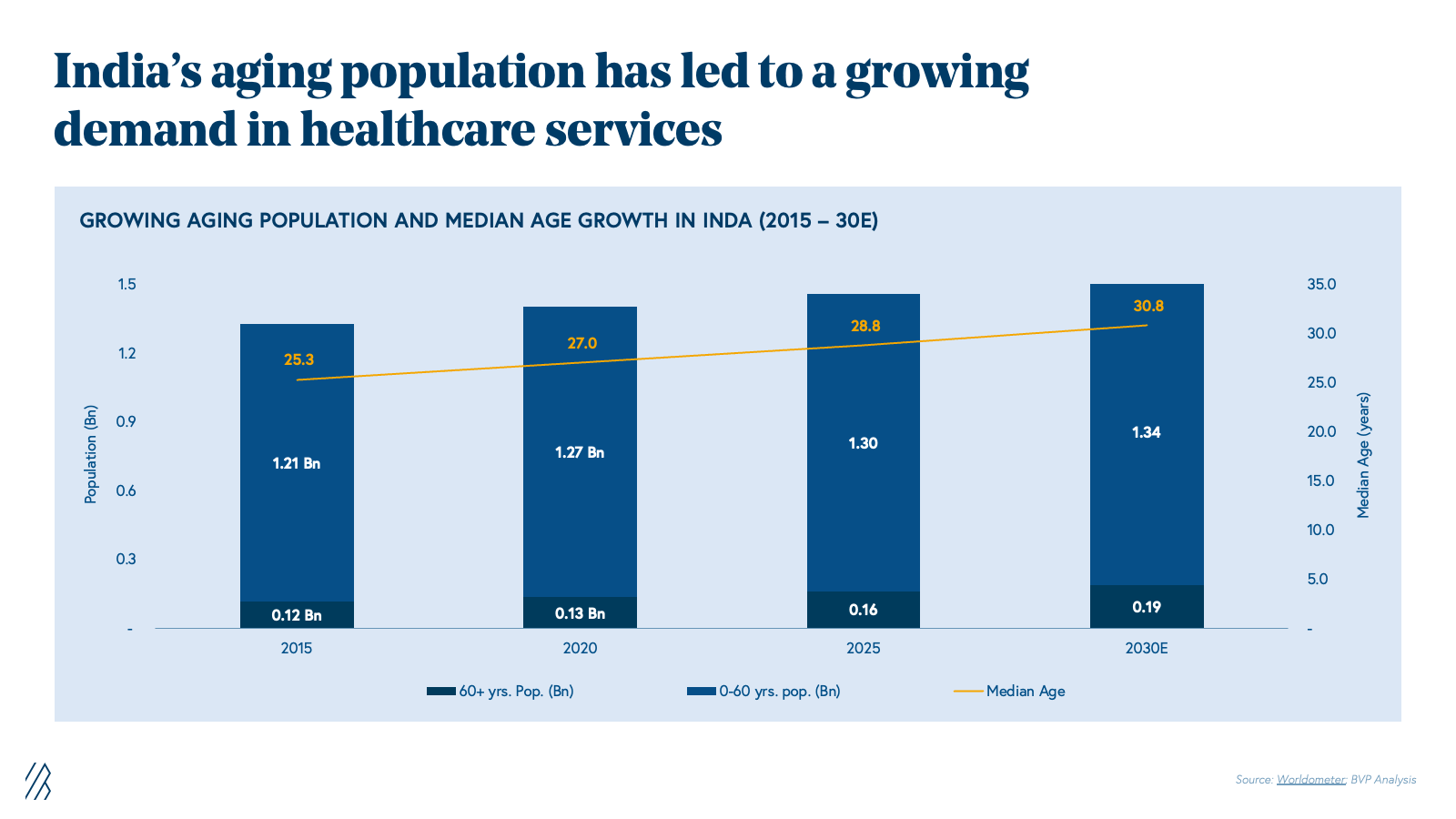

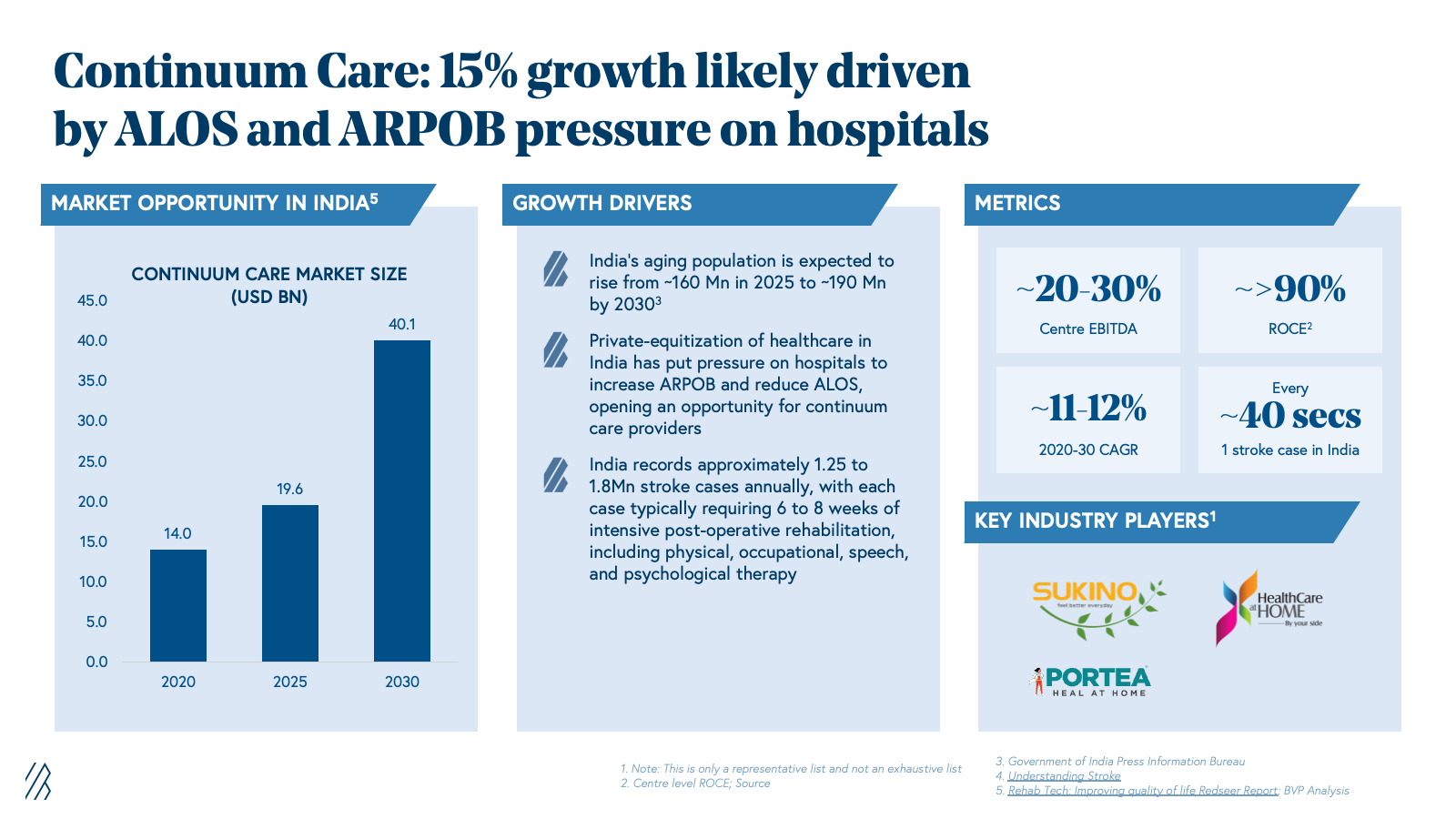

- Demographic tailwinds: The 60+ population is projected to rise from about 160 million in 2025 to nearly 190 million by 2030, sharply increasing demand for chronic and age-related care services. This aging cohort is driving sustained utilization of both acute and long-term care infrastructure.

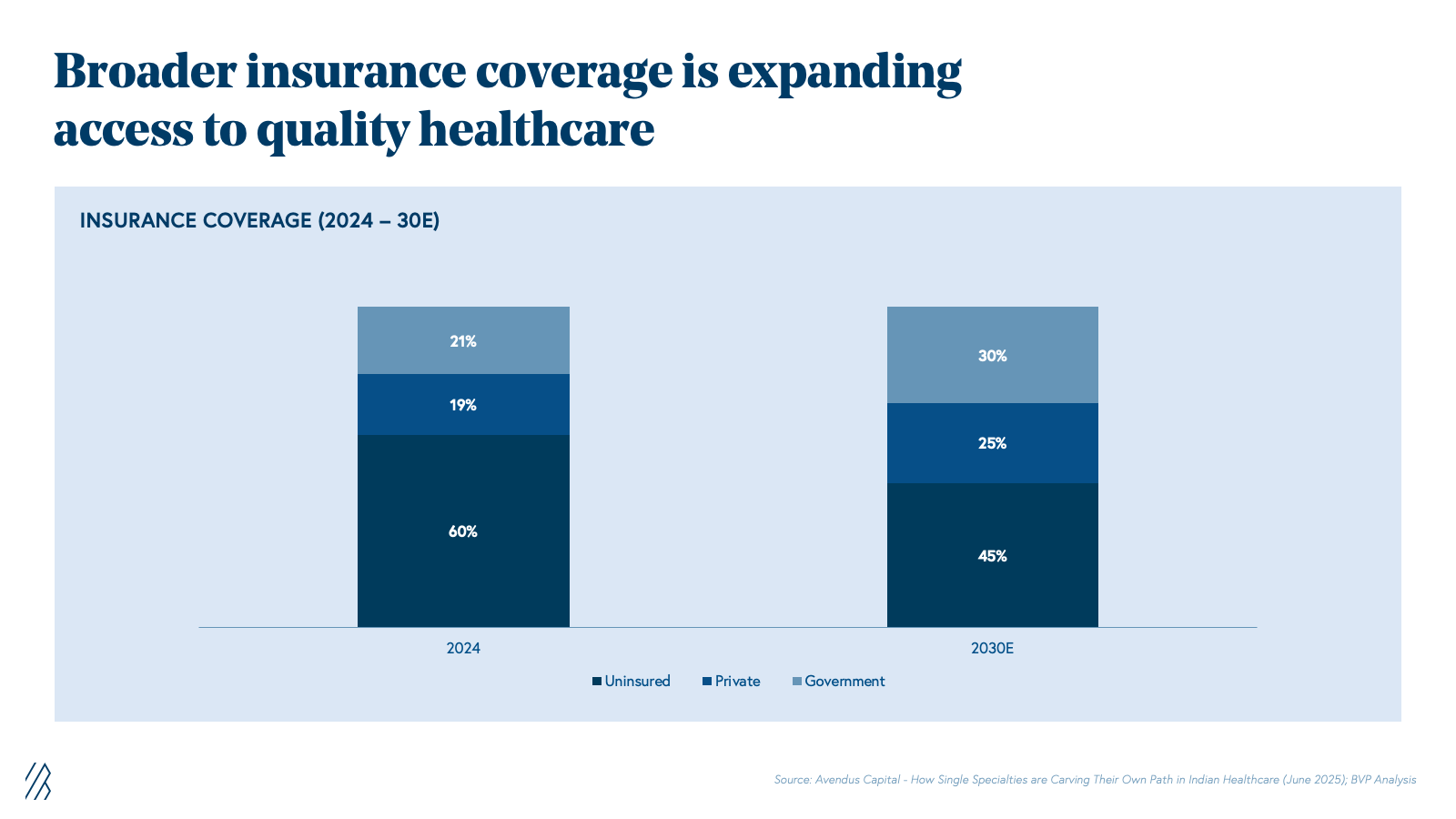

- Expanding insurance coverage: As of 2025, an estimated 40% of Indians are covered under a public or private health insurance plan, supported by large government schemes such as Ayushman Bharat (PM-JAY) and various state programs. Private health insurance penetration has also accelerated, with overall coverage at roughly 40–42% in 2023 and projected to approach 50% by 2025. Premiums in the health insurance industry are forecasted to exceed $23 billion by 2028, reflecting rising awareness, employer-sponsored benefits, and product innovation.

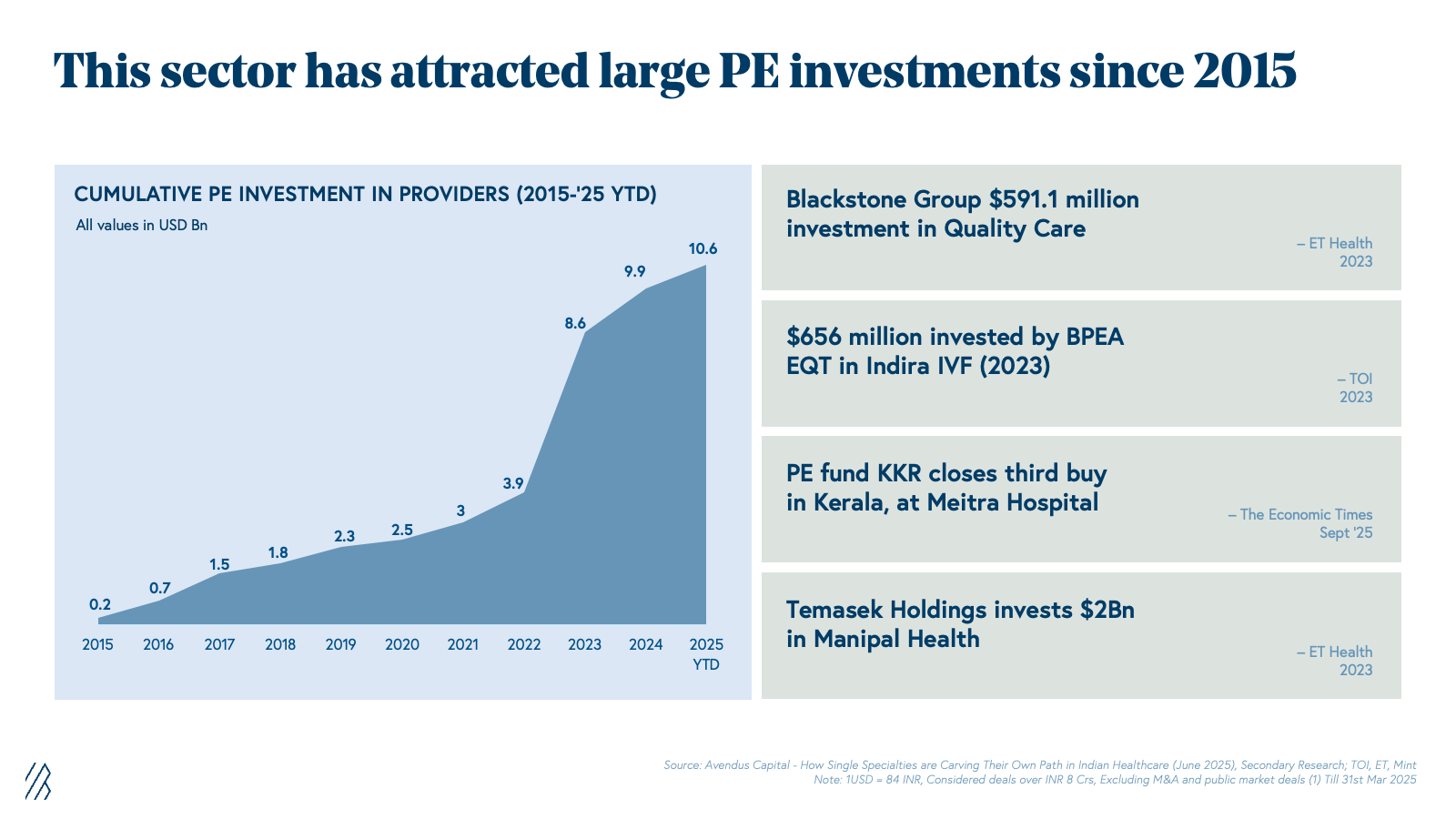

- Capital, productivity, and consolidation: Cumulative private equity investments in healthcare providers reached about $10.5 billion between 2020 and 2025, with nearly half of this deployed between 2022 and 2024. This capital has funded network expansion, technology adoption, and tighter operating discipline, lifting productivity across leading platforms.

- Rising spend and health awareness: Growth in household incomes, coupled with greater health literacy, is increasing willingness to spend on discretionary and preventive healthcare services. This shift is expanding demand beyond episodic acute care into wellness, diagnostics, and early-intervention offerings.

- Formalizing infrastructure: Previously fragmented provider capacity is consolidating into organized hospital and clinic networks that operate to clearer accreditation norms and standardized playbooks. This formalization is improving clinical consistency, brand trust, and the scalability of multi-city provider platforms.

- Strengthening digital rails: Digital infrastructure such as centralized claims, teleconsultation platforms, and data-driven procurement and quality systems is now embedded across many large providers and insurers. These “digital rails” enable multi-site consistency, faster decision cycles, and richer performance benchmarking across the ecosystem.

Single-specialty healthcare is growing nearly 2x the multi-specialty healthcare market

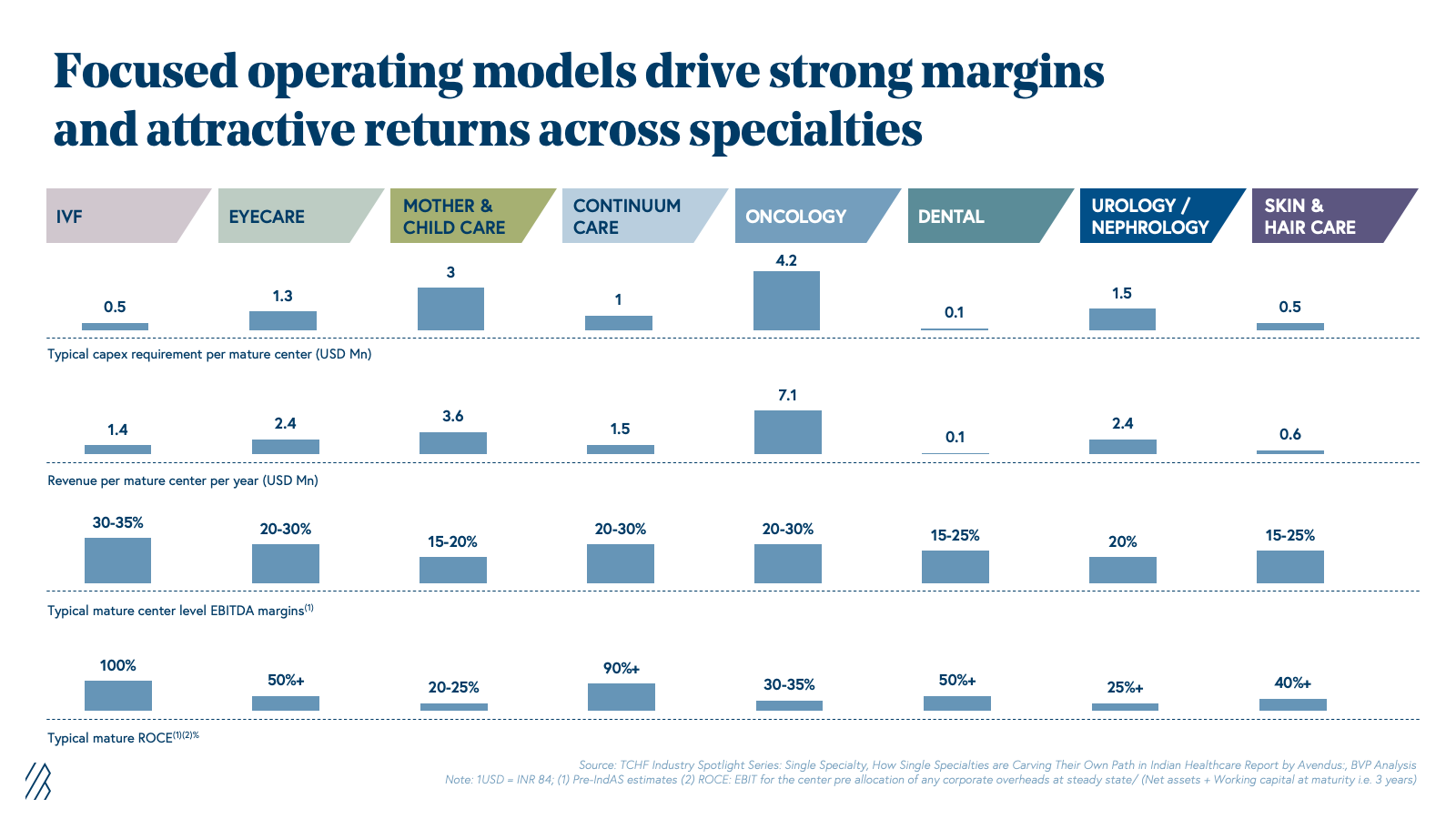

We expect single-specialty healthcare providers to expand at nearly 2x the pace of multi-specialty hospitals1. Several structural advantages, including purpose-built specialization, explain this outperformance. While multi-specialty hospitals spread capital across equipment usable in multiple departments, single-specialty centers invest in highly specialized tools tailored to one area of care, whether ophthalmic lasers, IVF labs, or dialysis stations, enabling superior precision and outcomes.

Brand clarity that drives patient flow

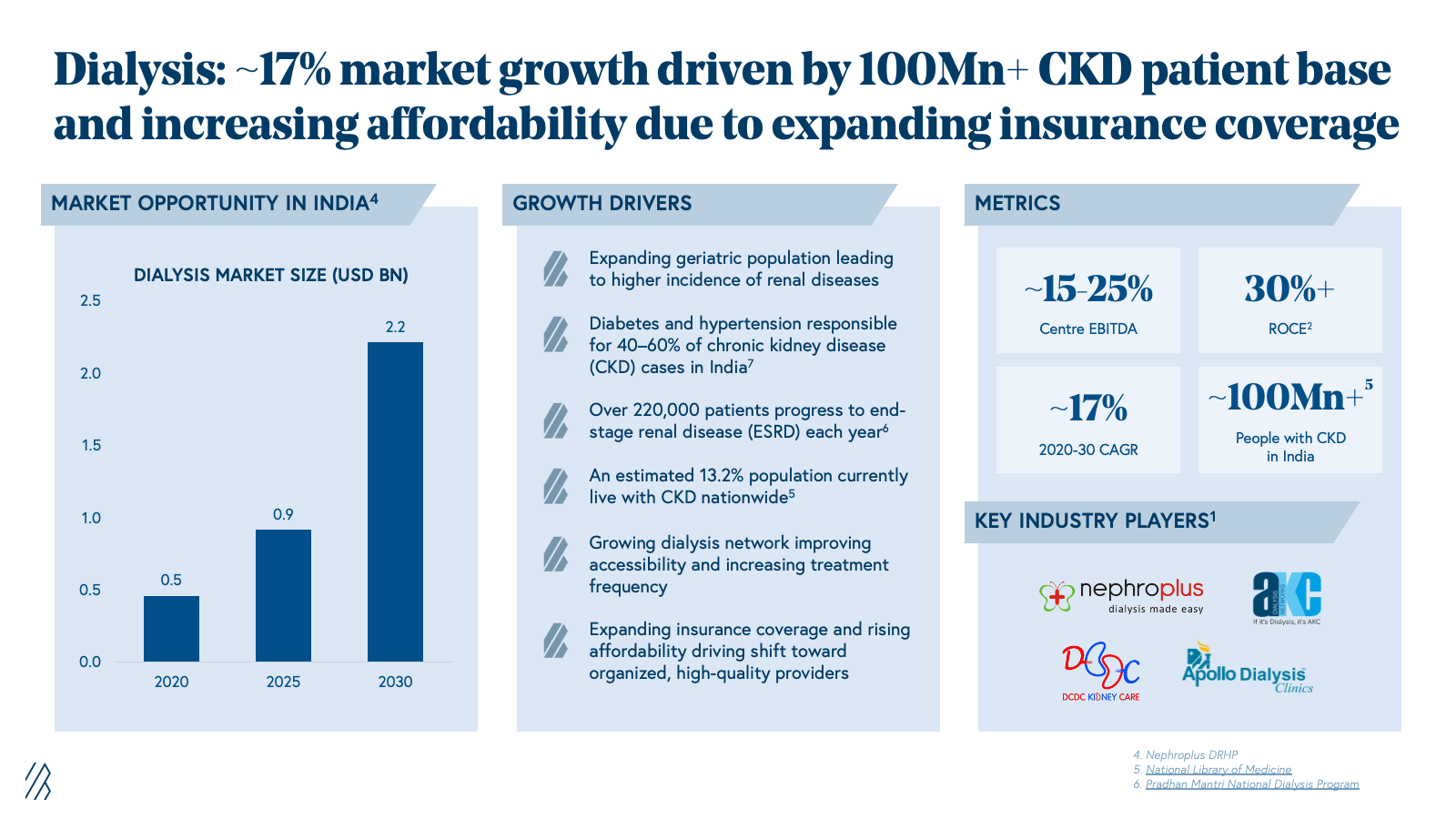

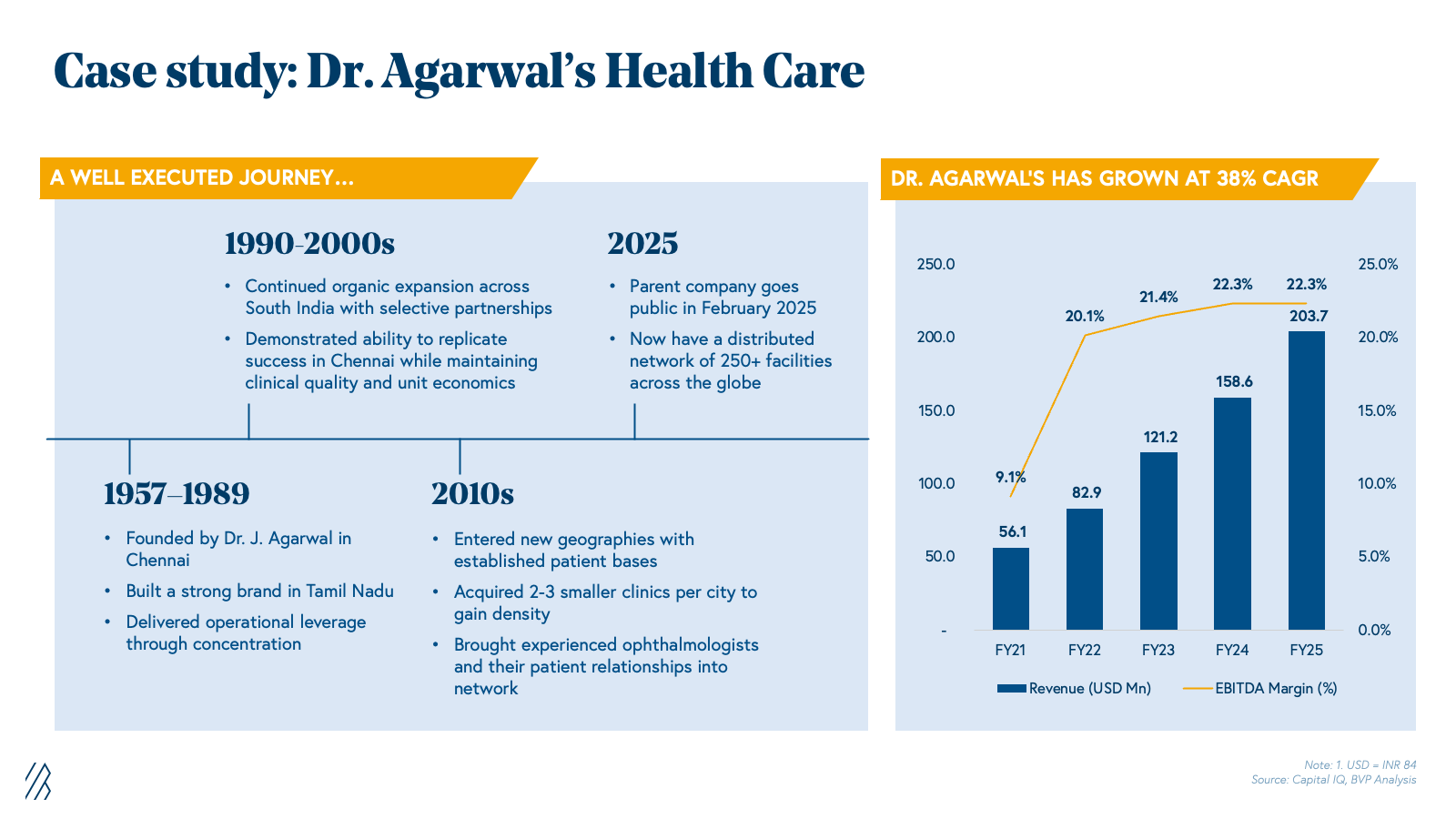

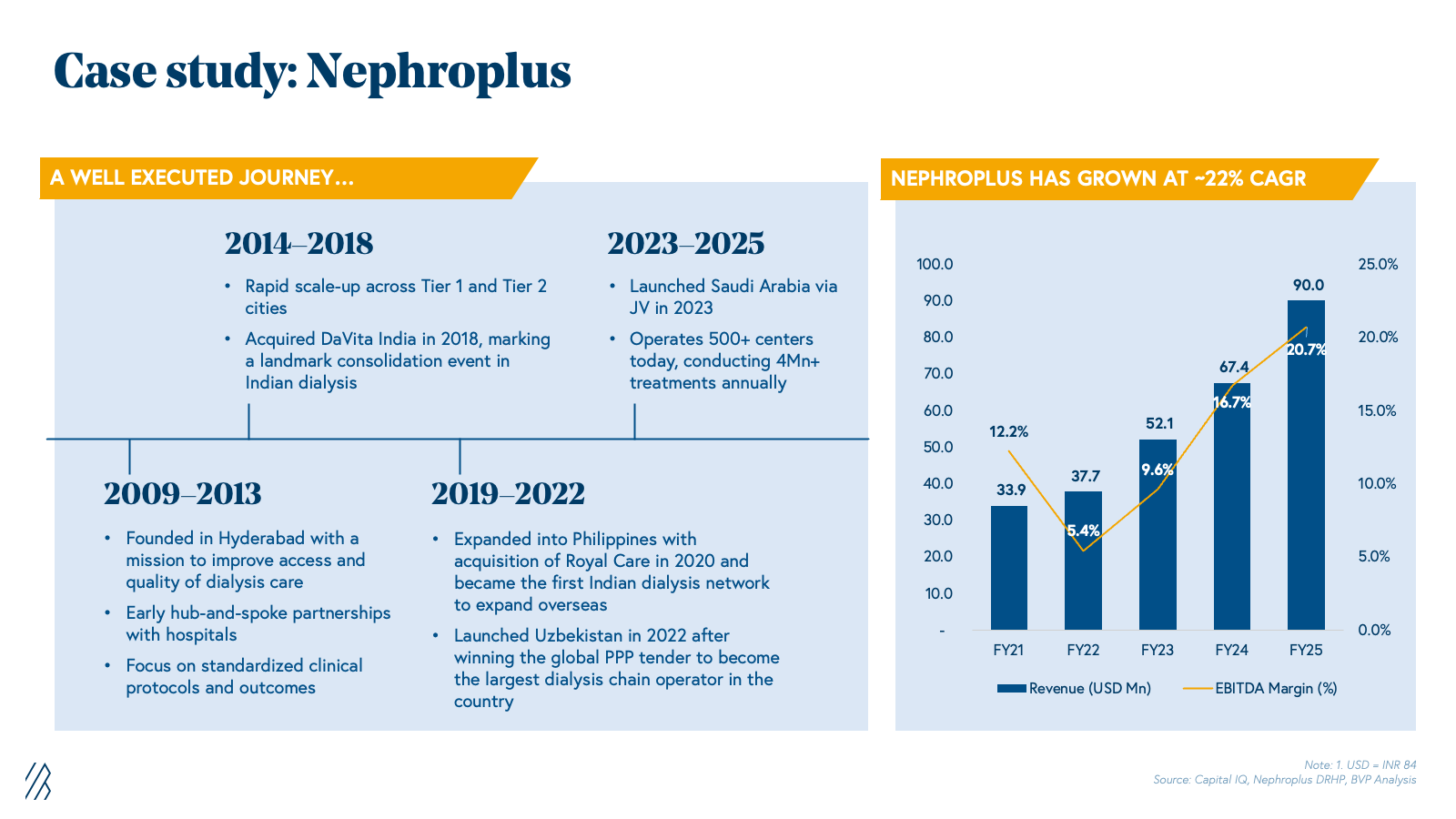

Patients also increasingly associate single-specialty brands with trusted expertise in specific ailments, an “eye hospital” for cataracts, a “fertility center” for IVF, whereas multi-specialty brands compete mainly for complex, cross-disciplinary cases. For instance, Nephroplus illustrates the power of this focused positioning as a dedicated dialysis network operating 500+ centers across five countries. This singular focus has enabled the company to build deep referral relationships with nephrologists who trust the brand to deliver consistent, high-quality treatment. Patients benefit from scheduling flexibility and seamless movement across network centers, reinforcing brand loyalty. In a category where patients need treatment multiple times per week for life, being the default "dialysis destination" creates a powerful, self-reinforcing patient acquisition flywheel that generalist hospital brands struggle to replicate.

Lean capex and opex structure

Focusing on a defined set of procedures keeps infrastructure requirements tight. Standardized layouts, centralized procurement of specialty consumables, and repeatable workflows lower both upfront investment and operating costs while improving scalability. Sukino, one of India's leading post-acute rehabilitation providers, demonstrates this principle well. Each new center follows a standardized blueprint that includes consistent facility layouts, templated equipment lists, and protocol-driven care workflows across physical, occupational, speech, and psychological therapy. This uniformity enables centralized procurement of consumables and equipment, while a structured staffing model with clearly defined roles allows new centers to become operational quickly and reach breakeven within months. The result is a care model that delivers outcomes comparable to hospital-based rehabilitation at a fraction of the cost, making quality post-stroke and post-surgical recovery accessible to a much broader population.

Operational scalability by design

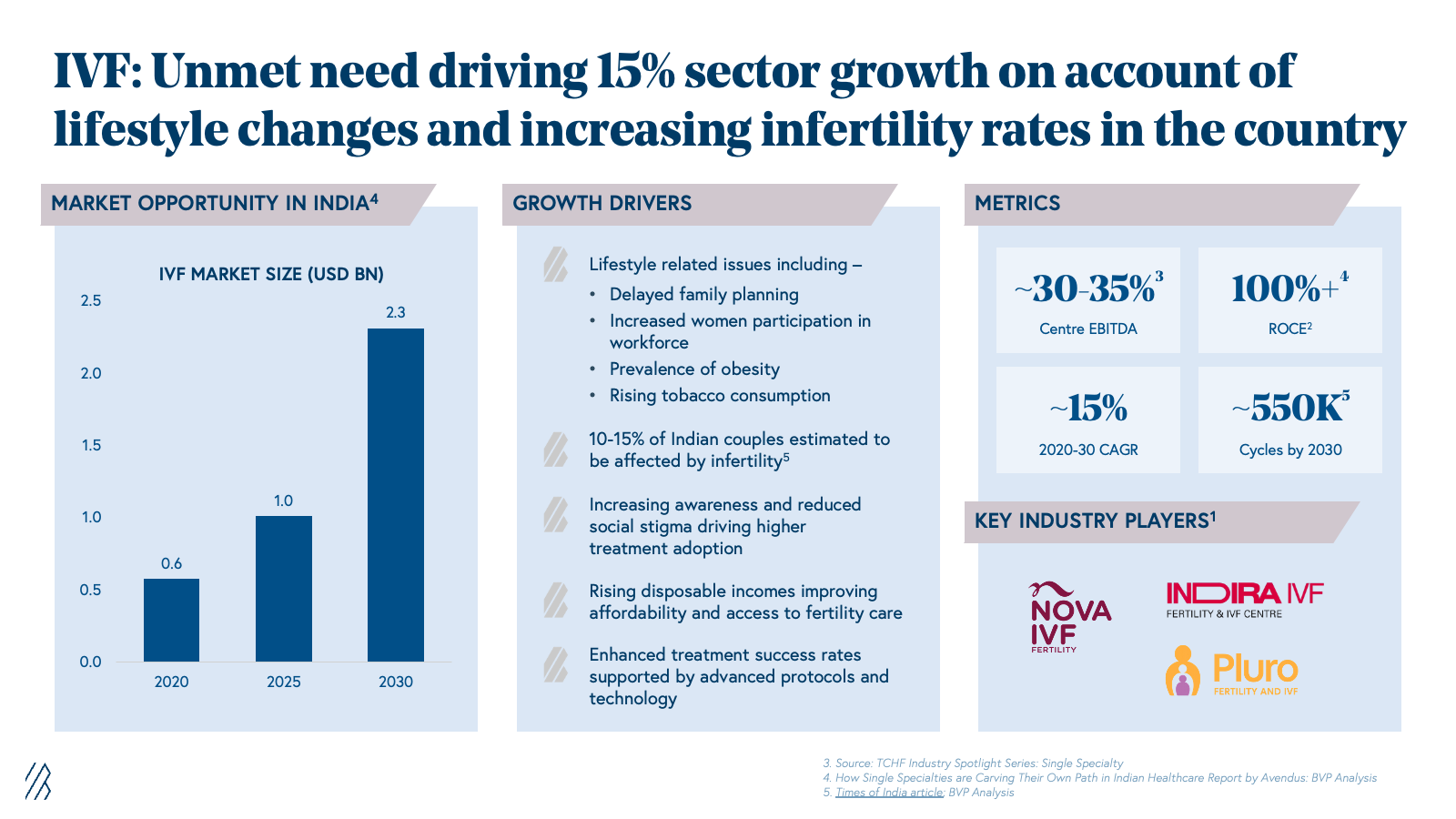

Streamlined SOPs, predictable patient volumes, and customizable capacity planning make replication across cities or clusters faster and capital-light, ideal for Tier 2 and Tier 3 market expansion. For instance, Pluro Fertility and IVF is an M&A roll-up platform consolidating single doctor-led fertility clinics across India. The company has built a comprehensive post-merger integration playbook covering standardized clinical SOPs, centralized IT and financial systems, unified branding, and procurement efficiencies that are being deployed rapidly at each acquired clinic. By retaining founder-doctors as clinical leads while layering in operational infrastructure, Pluro demonstrates how templated integration processes and regional density can enable efficient scaling across underserved markets. Single-specialty operations are well-positioned to scale thanks to their ability to deliver more focused and intentional care. For example:

- Specialist-led, distraction-free care: Doctors and staff in single-specialty setups hone deeper expertise in one domain and spend less time on administrative coordination, resulting in a sharper focus on patient outcomes and quality of care.

- Cleaner, safer environments: Limited exposure to communicable diseases and optimized patient segregation improve infection control and facility hygiene, particularly important for elective or high-sensitivity treatments.

- Superior experience at comparable pricing: With process-driven flow and shorter turnaround times, patients enjoy higher-quality experiences without paying more than at multi-specialty hospitals.

- Closer, more consistent access: The hub-and-spoke expansion model improves geographic accessibility, placing branded, high-quality care within shorter travel distances, critical in a market where convenience increasingly shapes provider choice.

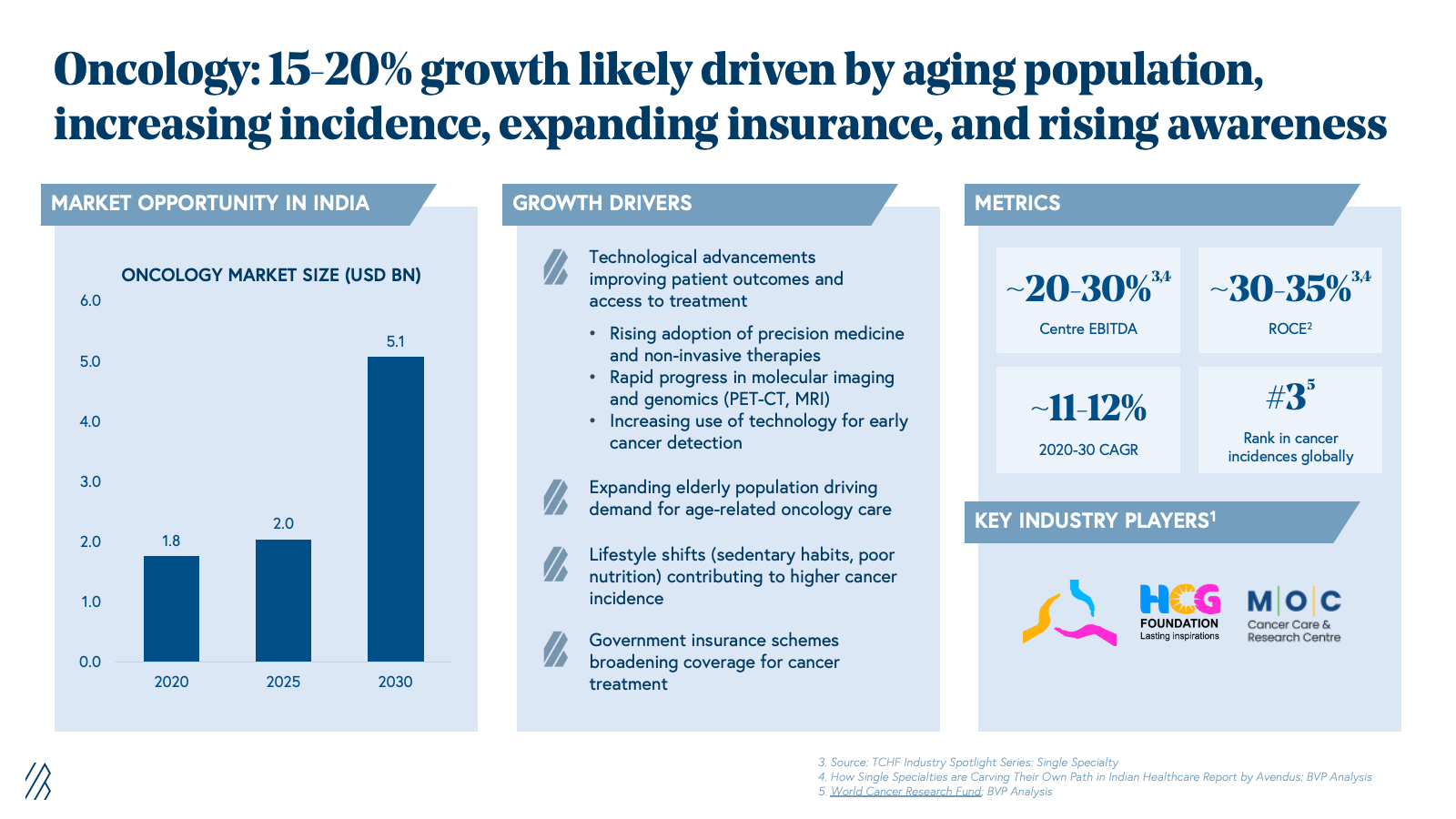

These advantages are reshaping how care is allocated across the healthcare system. Multi-specialty hospitals are increasingly prioritizing complex, high-acuity procedures such as cardiac surgery, neurosurgery, and organ transplants, where multi-disciplinary depth and premium pricing justify large-scale infrastructure and specialized teams. These procedures deliver significantly higher revenue per bed-day than standardized interventions.

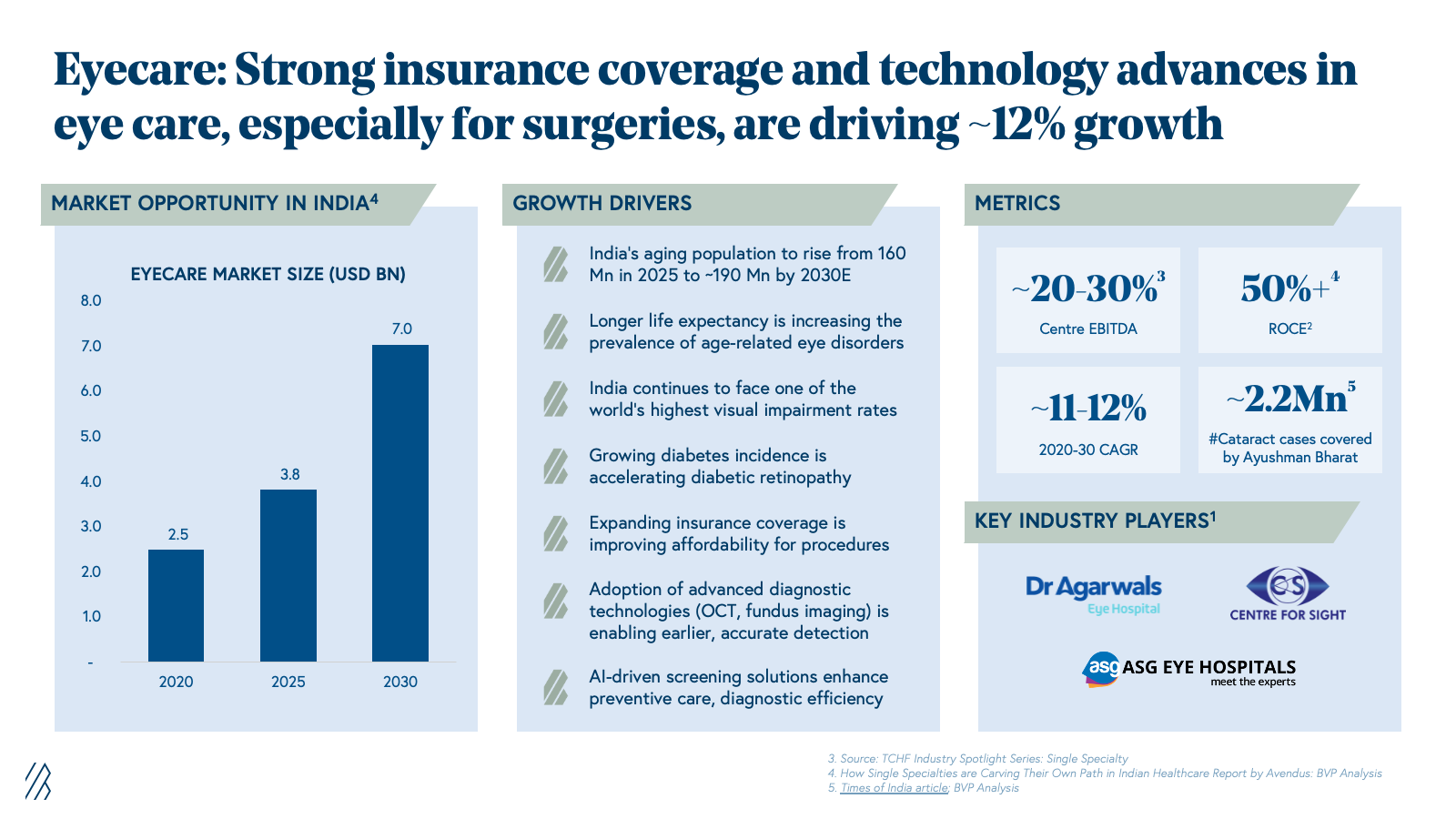

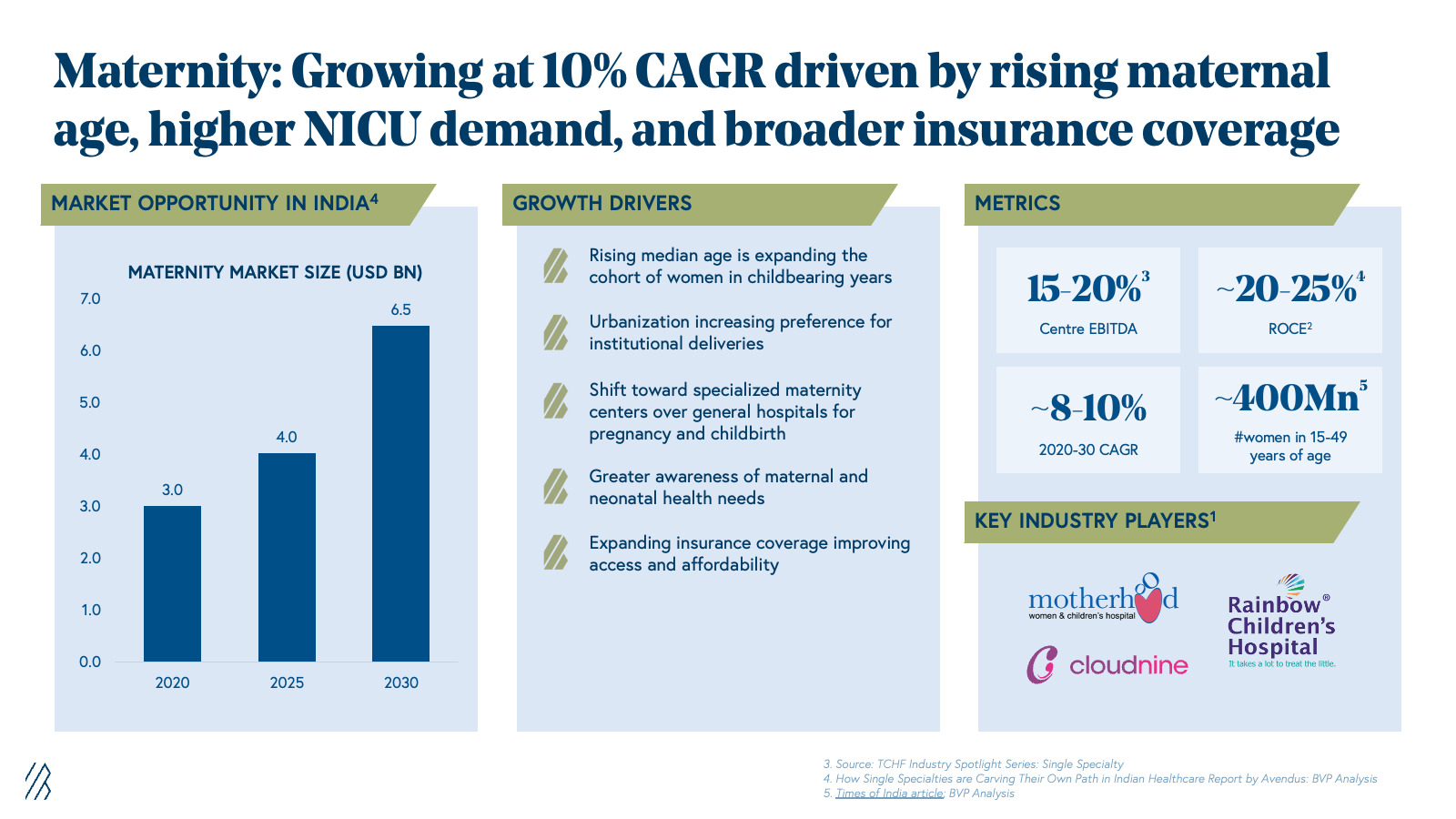

As a result, standardized and protocol-driven treatments, including cataract surgeries, normal deliveries, IVF, dialysis, and oncology day care, are increasingly shifting toward focused single-specialty providers. Purpose-built for repeatability and scale, these platforms deliver consistent outcomes, better patient experiences, and stronger unit economics. This structural segmentation is enabling single-specialty chains across key clinical domains to grow faster than the broader provider market and capture a rising share of organized healthcare demand over time.

1. Data in this report has been generated through BVP research based on figures from company and industry reports

Risks and challenges of building a single-speciality business

While the single specialty opportunity in India is compelling, scaling these businesses presents significant operational challenges. Success requires navigating strategic, operational, and market-building risks that separate category winners from the many players who fail to achieve sustainable scale.

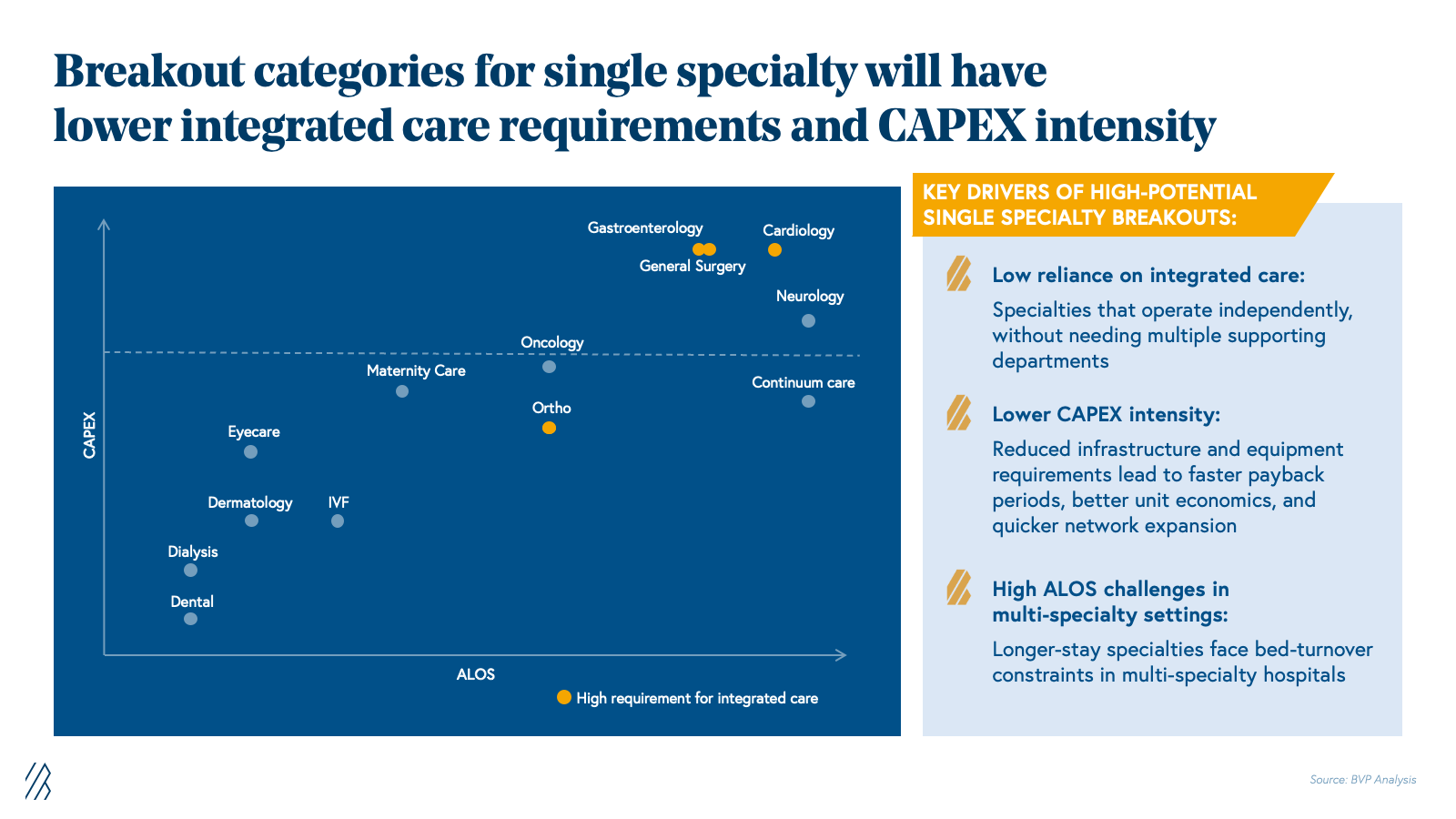

Founders evaluating single-specialty models must build their business around high procedure volumes, standardized protocols, limited dependence on other specialties, and a clear patient value proposition. Specialties such as eye care, IVF, dialysis, and mother and child care are well-suited for verticalization, while high-complexity, multi-disciplinary areas like orthopaedics and neurology are better integrated into broader hospital settings.

Outcomes are also shaped by the complexity of operations and doctor dependencies. Highly physician-dependent areas, such as complex oncology, lend themselves to slower, expertise-led, M&A-driven expansion. On the other hand, protocol-driven areas such as dialysis can scale rapidly via standardized training, systems, and multi-center rollouts.

Sustainable growth in single-specialty healthcare also requires prioritizing steady organization building over aggressive build-out. Building a strong brand is critical in fragmented markets, demanding sustained investment in patient education, thought leadership, referral networks, and consistently superior clinical outcomes and experiences across every touchpoint - supported by structured feedback systems and technology that enhances, rather than replaces, human interaction. Over time, this brand strength drives lower acquisition costs, stronger clinician attraction, better partnerships, and pricing power, allowing the provider to become synonymous with its specialty.

|

What this means for founders: Build on a single-specialty model comprehensively, not aggressively, while having the foresight to know whether your business is more suited to scale through rapid integration or endure M&A expansion. Find your wedge by defining a clear value proposition that addresses every touchpoint throughout the patient experience. |

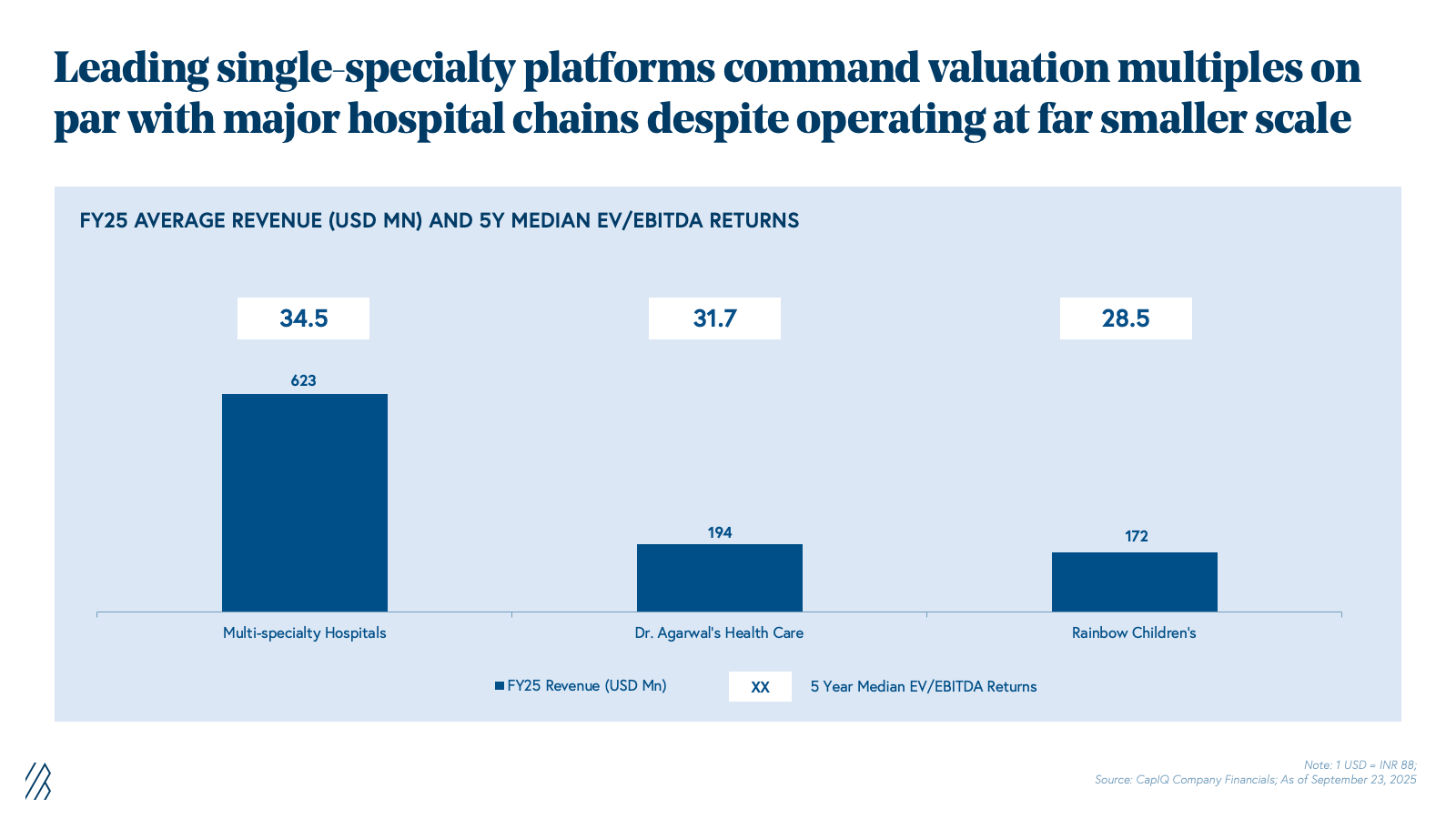

Market validation: Public performance of healthcare validates opportunities for single specialty providers

The public markets have rewarded well-managed providers consistently over the past decade. Indian healthcare companies have traded at an average 10-year enterprise value/EBITDA multiple of approximately ~33x for LTM and ~26x for NTM, reflecting strong investor appetite for the sector.

Single specialty providers are positioned to command even more attractive valuations given their superior unit economics. For instance, Dr. Agarwal's Eye Hospital, despite being significantly smaller (FY25 revenue of ~$194M) in scale compared to leading hospital chains like Apollo Hospitals (FY25 revenue of ~$2.5B) or Max Healthcare (FY25 revenue of ~$799M)1, trades at comparable multiples. This valuation parity, despite the relatively smaller scale, validates that investors value the quality of earnings and business model characteristics — high margins, capital efficiency, predictable growth, and category leadership — over absolute revenue size.

Mapping the opportunity landscape: specialty by specialty

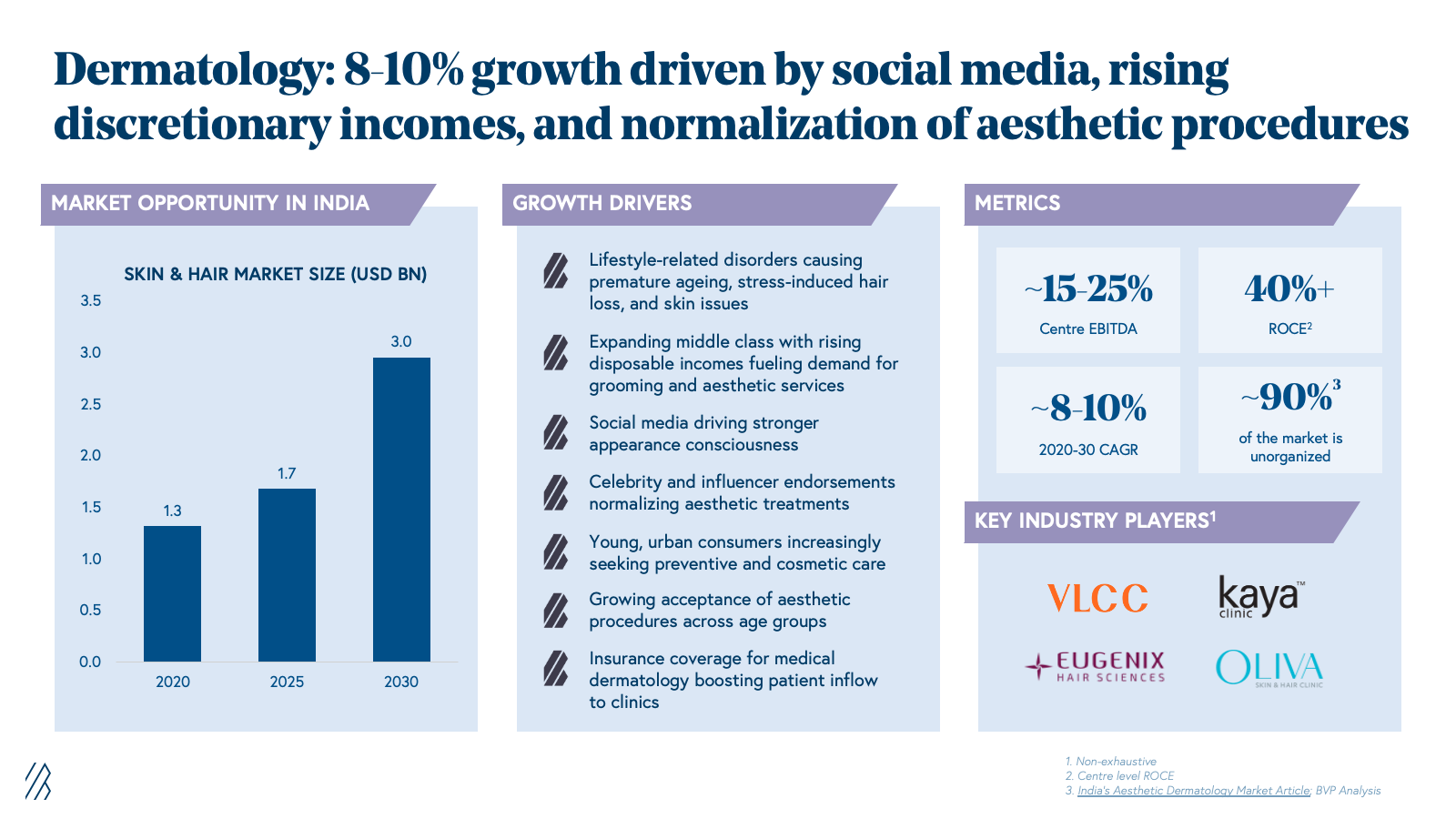

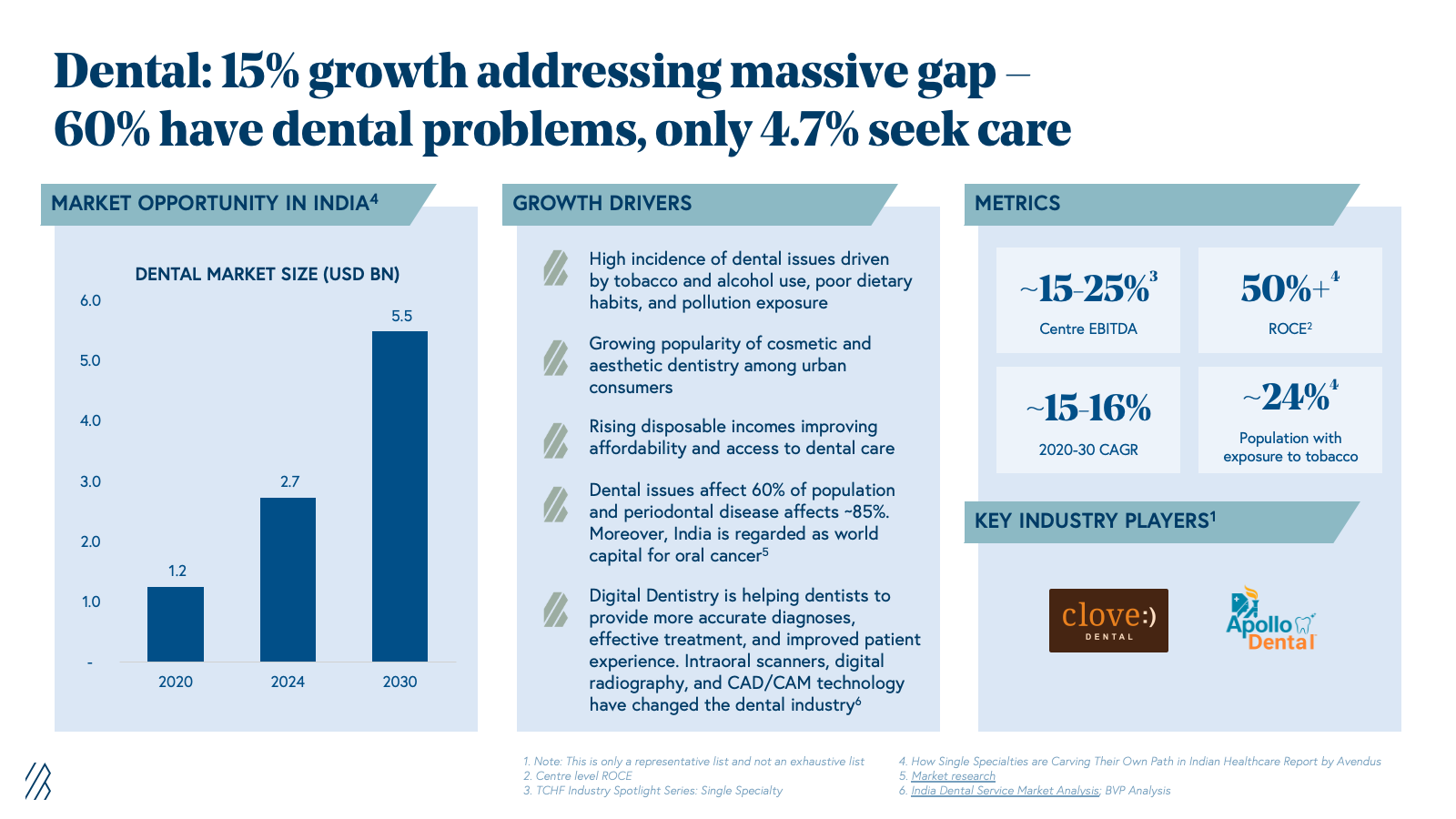

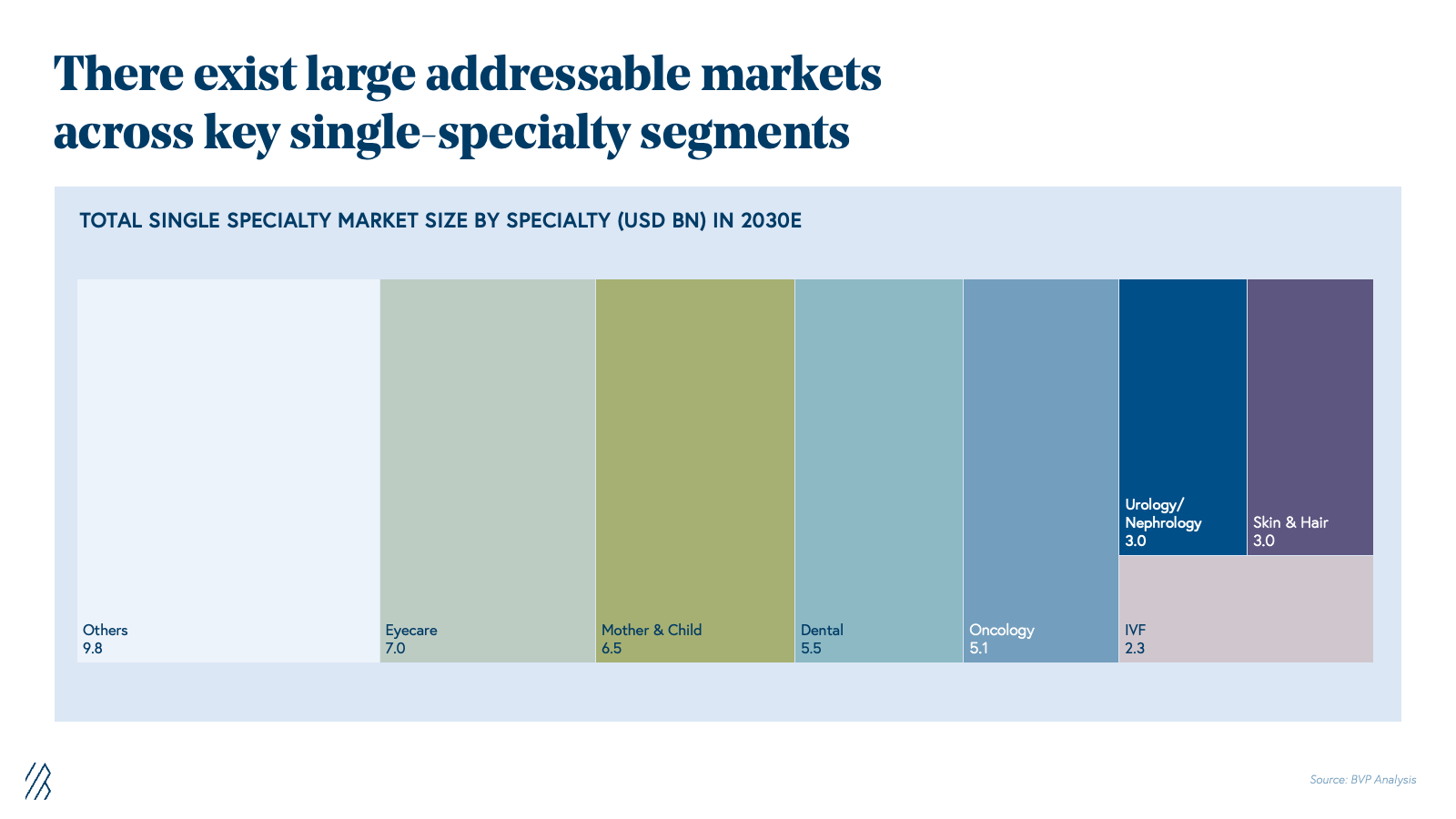

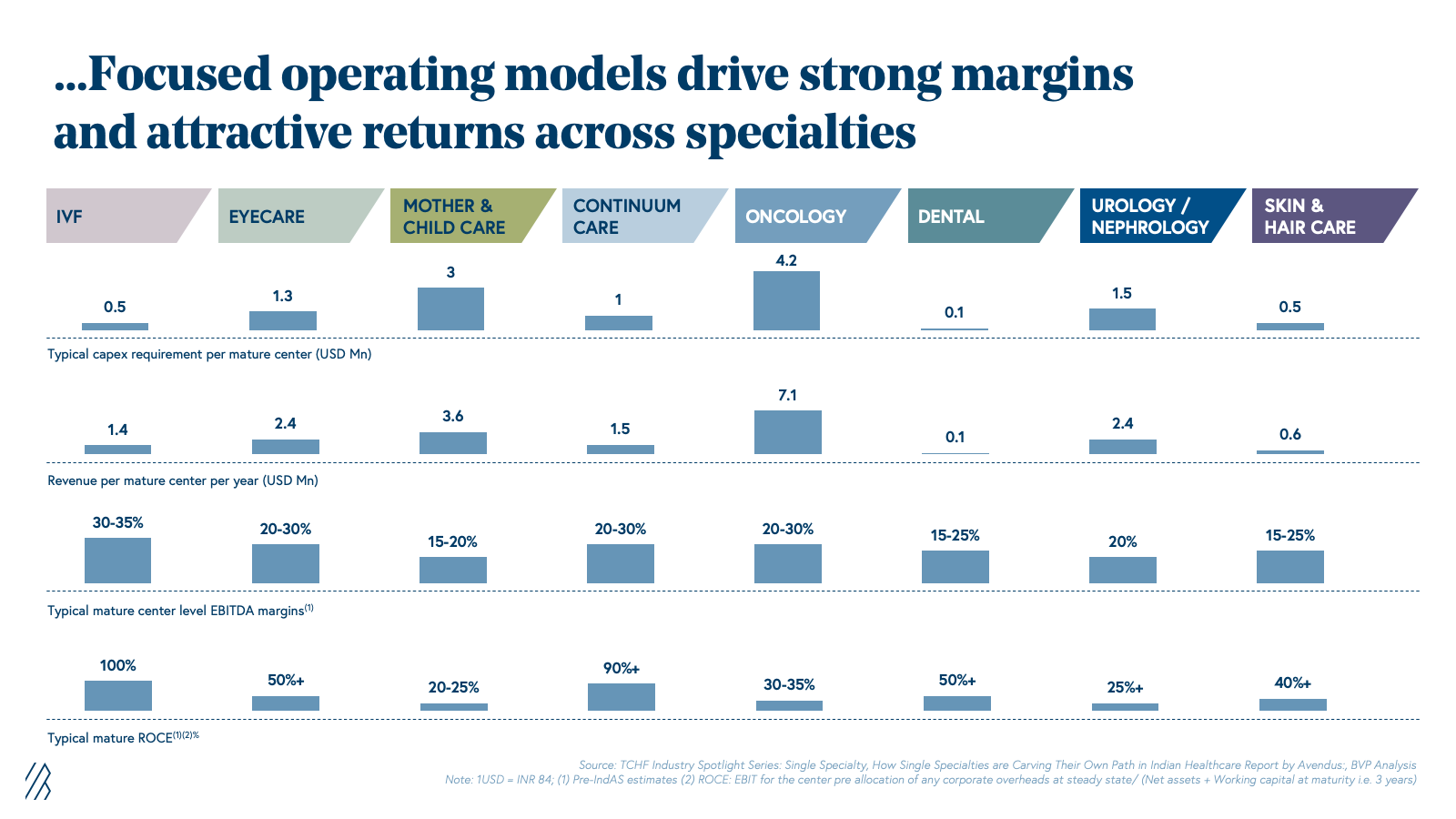

In exploring vertical industry opportunities, we recognize that not all single-specialty opportunities are created equal. Each specialty presents distinct characteristics, market dynamics, and investment considerations, stemming from the total addressable market and fragmentation, including the efficiency of unit economics of that specialty.

For instance, a dental surgeon would be well-suited to start their entrepreneurial journey given the large TAM in this space ($7.8B), the continued fragmentation expected in this specialty (less than 19% organization even by 2030), and the minimal capex needed per center. They’ll have the opportunity to standardize protocols and create a category-defining brand that patients can trust.

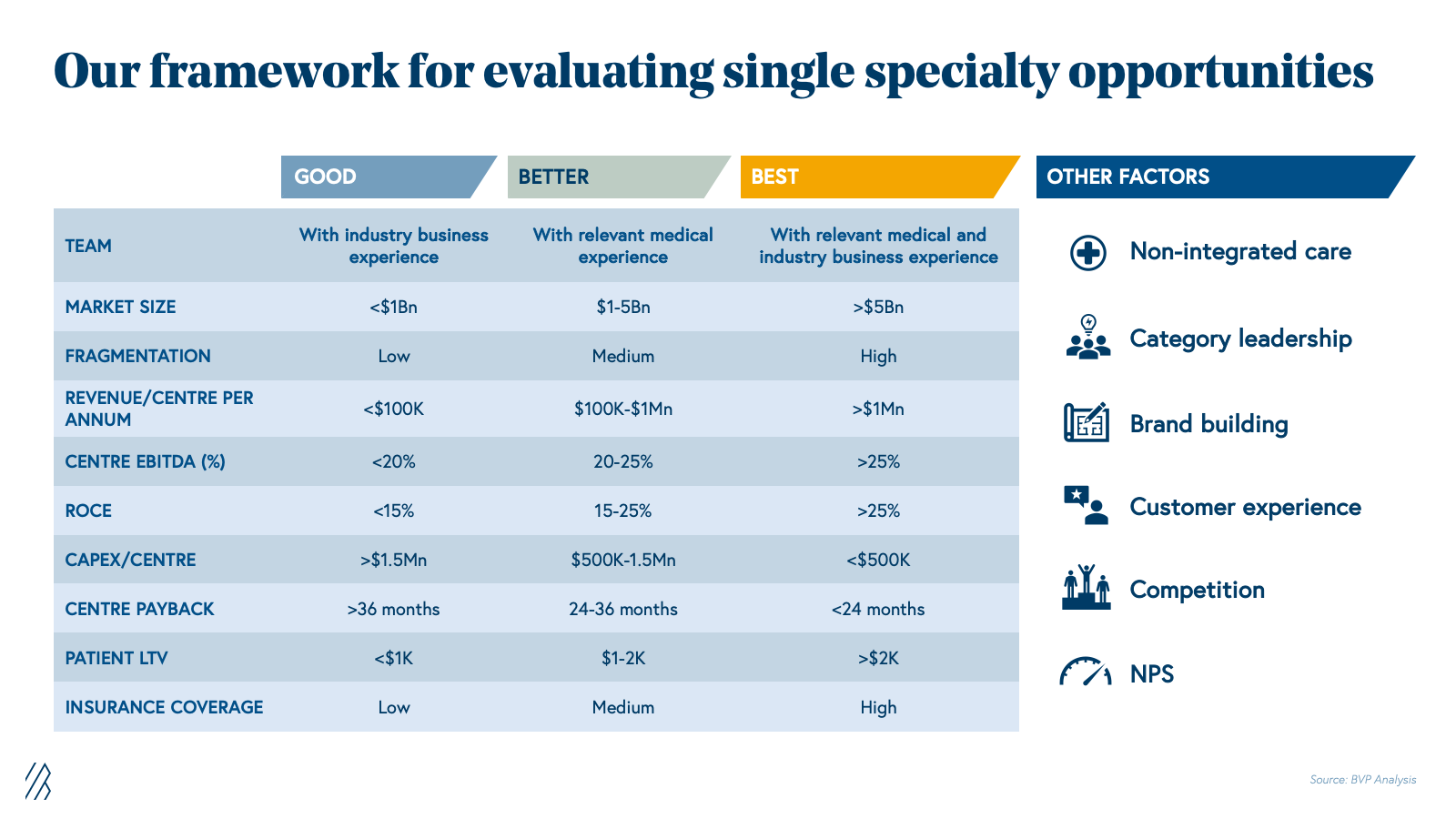

Our investment criteria when assessing the single-specialty opportunity for founders

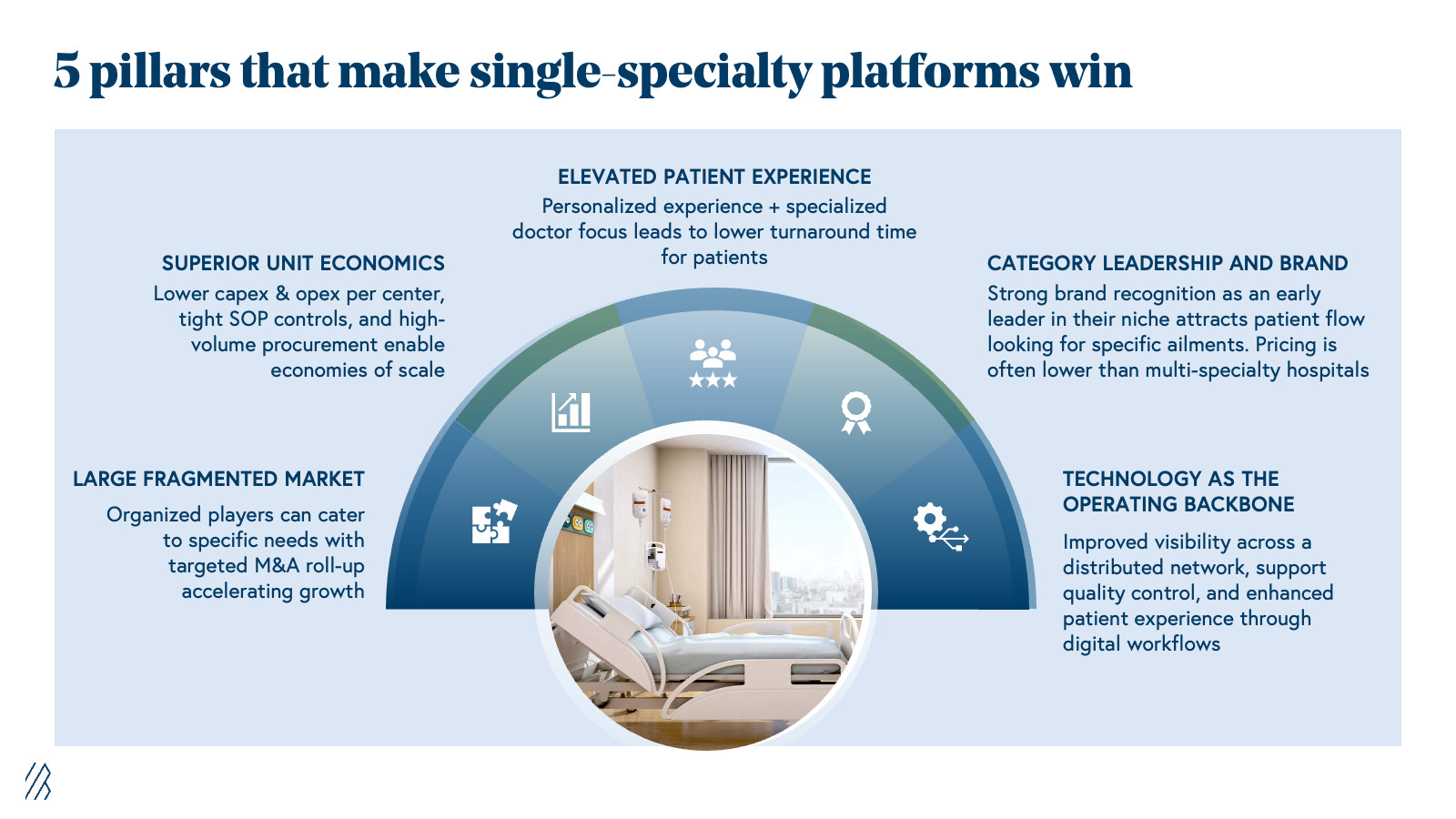

At Bessemer, our framework for assessing single-specialty companies focuses on factors that ultimately determine exceptional patient experiences. Single-specialty healthcare in India represents more than a discrete investment theme; it reflects a structural rethink of how medical care can be delivered at scale while remaining deeply patient-centric.

Verticalization works because it aligns incentives across the ecosystem. Patients benefit from specialized expertise, faster access, transparent pricing, and better outcomes. Doctors gain the ability to deepen their domain expertise within well-designed clinical environments. Investors accrue returns from businesses with strong unit economics, clear scaling playbooks, and multiple expansion opportunities, including consolidation. The broader system benefits from better access to quality care across geographies.

| What this means for founders: For entrepreneurs building in this space, the opportunity is substantial, but the execution challenge is real. Building a healthcare company requires balancing clinical excellence, operational efficiency, financial discipline, and patient-centricity — often under competing constraints. |

We believe the most successful founders will be those who can:

- Recruit strong medical and operational teams

- Maintain patient-first cultures as they scale

- Navigate complex regulatory environments

- Deploy capital efficiently

- Maintain long-term focus while consistently delivering near-term results

Good, Better, Best framework for single specialty companies

| Good | Better | Best | |

| Team |

With industry business experience |

With relevant medical experience |

With relevant medical and industry business experience |

| Market size |

<$1B |

$1-5B |

>$5B |

| Fragmentation |

Low |

Medium |

High |

| Revenue |

<$100K |

$100K-$1M |

>$1M |

| Center EBITDA (%) |

<20% |

20-25% |

>25% |

| ROCE |

<15% |

15-25% |

>25% |

| Capex per center |

>$1.5M |

$500K-1.5M |

<$500K |

| Center payback |

>36 months |

24-36 months |

<24 months |

| Patient LTV |

<$1K |

$1-2K |

>$2K |

| Insurance coverage |

Low |

Medium |

High |

We’re actively looking to partner with exceptional teams building single-specialty healthcare operations in India. Beyond capital, we offer global healthcare expertise, operational support, and a long-term partnership mindset aligned with building enduring institutions. The most successful companies in this space will combine meaningful patient impact with strong economic outcomes, a combination that underpins the enduring attractiveness of this opportunity.

If you’re a founder building a single-specialty healthcare business in India, please contact us at indiahealthcare@bvp.com