Tackling product-market fit: Tactics and frameworks for new and future founders

Use smaller deals to prove scale and other great ideas for early-stage growth from the founders of Box, Atlassian, and Shippo.

This is Lesson 3 from Bessemer's How to Lead: Founders Fundamentals Course. Sign up today for mentorship from 30+ leaders.

Hearing the story of a startup's rise can make it seem like it was always destined to succeed. But what these stories tend to leave out are the seemingly intractable problems that nearly every founder faces, and the long periods where solving them feels far from guaranteed.

Often, the biggest (and most existential) of these challenges is attaining the elusive goal of product/market fit. In this installment of the Leadership Course, you’ll read about the tactics that helped Atlassian, Box, and Shippo founders drive early-stage growth, plus two helpful frameworks from a seasoned VC.

1. Know the four quadrants of product/market fit

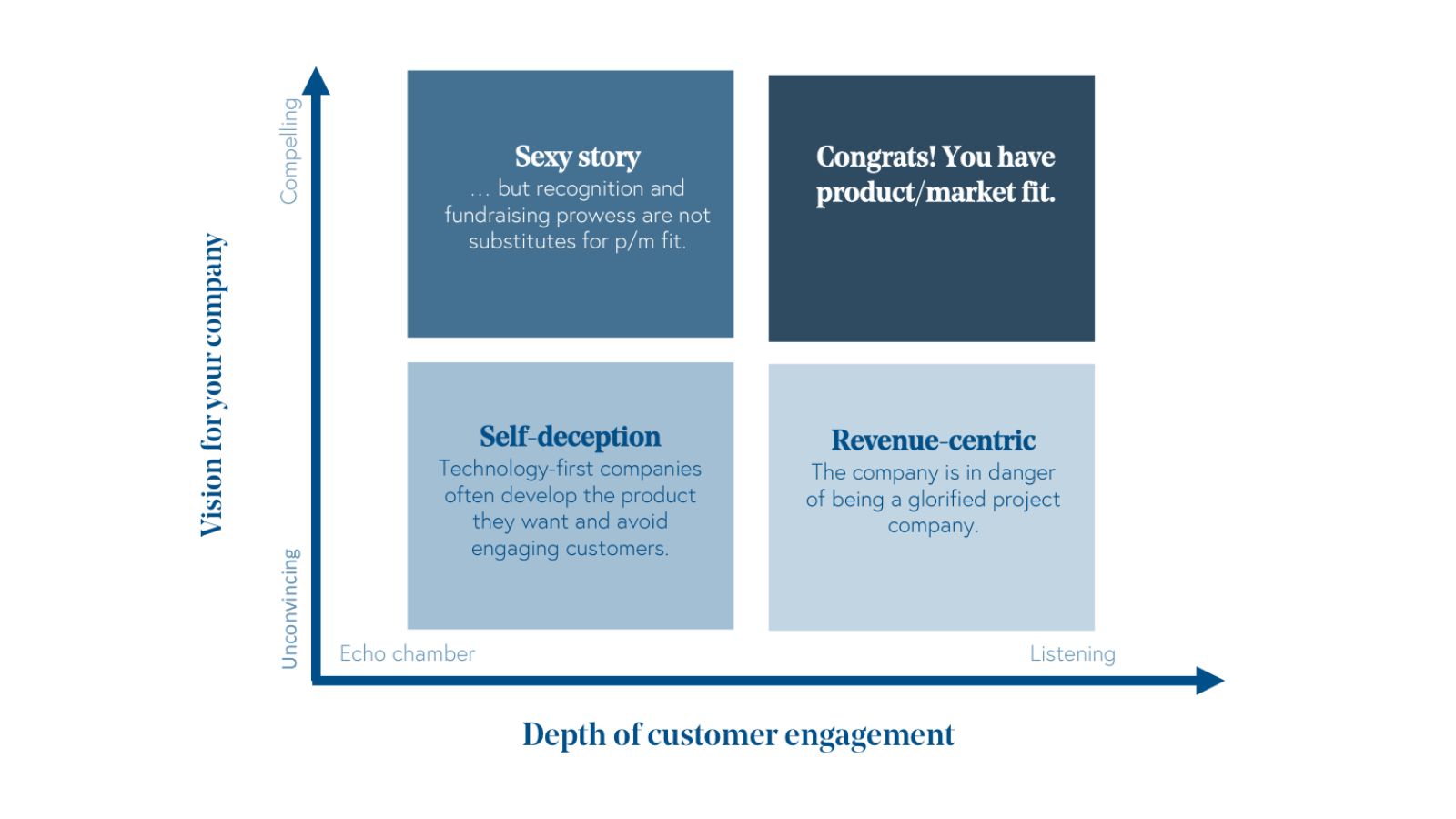

“Product/market fit” is not a one-dimensional continuum measured by growth, but rather a two-dimensional matrix. To give founders a mental model, Bessemer Partner Adam Fisher developed a diagram showing three detours on the way to product-market fit.

The x-axis of the chart above measures the depth of customer engagement. One end is characterized by careful listening to target customers and an understanding of their priorities, needs, alternatives, concerns, and levels of usage and engagement.

The other end is the proverbial echo chamber. Startups are talking to themselves and other startups, and are overconfident in their beliefs about the target customer. When they do speak with customers, it’s only the ones who are too compliant to express a conflicting point of view.

The y-axis measures the strength of your product and business vision. A compelling product vision will be clever and innovative, with a pitch that generates a buzz among customers, partners, and investors alike. It often challenges conventional views and solutions.

The lower end of the y-axis can best be described as unconvincing. This doesn’t mean the startup can’t sell its product, but they typically don’t appreciate the broader strategic trends in their particular market and fail to offer a vision that really resonates with their audience.

Getting to the upper right-hand quadrant requires trade offs. Some paying customers won’t embrace your vision, while others will buy in without giving you any of the insightful feedback that’s vital for development. Customer listening or vision alone won’t get you there — you need both.

In this article, Adam provides a deeper analysis of each of the quadrants, including warning signs, common culprits, and advice for moving to the upper-right. Keep reading →

2. Overdeliver in a narrow market

Box founder and CEO Aaron Levie was a sophomore at USC when he started the company. “Like in all great entrepreneur stories, we had very few friends and weren't invited to any parties in college, so we had an abundance of time to spend on computers.”

The first two years, the early Box team was stretched thin trying to serve diametrically opposed use cases: average people who wanted a place to back up personal computers and store mp3s, and business users looking to upgrade existing platforms that no longer met their needs.

Through conversations with an investor, Aaron realized that trying to cater to two customer segments could just end up diluting the experience for both of them. So the team made the decision to focus exclusively on enterprise — by far the largest revenue opportunity for Box.

“The hardest part for me personally was cutting off half of the market after we’d worked so hard to build both arms of the business. But, ultimately, cutting off the consumer half of the business was the best decision we ever made.”

Choosing to overdeliver in a narrower market isn't an uncommon scenario — founders often reach a juncture where they need to make this type of choice given market dynamics and the competitor landscape. (For another more contemporary example, read up on Jasper’s decision to focus on building the AI marketing copilot for enterprise teams.)

In our interview, Aaron also discusses leading Box through the 2008 recession, why founders should pay more attention to cash flow, and what you can learn when you let go of ego. Keep reading →

3. Experiment with lowball pricing strategies

Atlassian co-founder Scott Farquhar may have accidentally invented the freemium model out of necessity. Being able to sell in every time zone required making Atlassian available through self-service. Self-service required a product that was easy to evaluate, download, and install. And with no salespeople to sell it, it also needed to be cheap.

To this day, Scott continues advising founders in competitive markets to consider lower pricing. From his vantage point, it gives you the mindshare of users who refuse to use a competitor’s more expensive product, and gives you infinite time to upsell free users to paid products.

“Today’s highest grossing [mobile] games are now free-to-play, but feature in-store upgrades or in-app upgrades. They get started for free, then once you have their attention, you have a monopoly on whatever that person needs to buy.”

Scott developed this practice a decade ago when he tested a program that offered subscriptions for five users for only $5. The experience fundamentally reshaped how Atlassian does business, and today Atlassian offers free trials to nearly every one of their products. In fact, Atlassian is often cited as the very first product led growth business.

In our interview, Scott also discusses the ways constraints fueled Atlassian’s success, why engineering is often a better investment than GTM, and the importance of corporate philanthropy. Keep reading →

4. Use smaller deals to prove scale

Long before e-commerce shipping platform Shippo won the trust of 100,000 customers, CEO Laura Behrens Wu faced a catch-22 familiar to most founders: you can’t sell without social proof, but you can’t get social proof until you sell.

“When we started pitching larger companies, they’d ask, ‘How many packages are you shipping?’ When we couldn't pull out an impressive number, they were reluctant to try an API that was unproven — especially for something as important as shipping operations.”

Instead of trying new enterprise sales tactics, Laura’s team decided to go after more small and mid-sized businesses. Her strategy was two-fold: build a dashboard so customers could buy shipping labels without API integrations, and sell to startups who had resources to integrate the API.

Focusing exclusively on SMBs is what ultimately allowed Shippo to go upmarket. “We were able to amass enough customers on the platform over time to be able to successfully pitch larger customers. Finally we could tell them we're actually shipping millions of packages every month.”

In our interview, Laura also discusses her journey from intern to successful founder, the importance of choosing the right investors, and other lessons that fueled Shippo’s growth. Keep reading →

5. Choose the right pace of growth

Cloudinary belongs to an extremely small group of cloud startups that hit the $100 million ARR milestone without raising a dollar of equity. They demonstrate how cloud businesses can choose a middle path between the anti-investor bootstrappers and the classic VC-backed founders.

Because bootstrapped companies have to live within their means, they must operate based on sustainable SaaS KPIs including high gross margins, a fast payback on CAC, and healthy cohorts. This often puts them in a disadvantage to startups that use venture capital.

Despite startup culture being prescriptive about how to build a SaaS company, founders not only get to choose their product and GTM strategy, but also the pace of growth that will allow them to realize their goals and build shareholder value without assuming an uncomfortable level of risk.

Bootstrapped companies enjoy more latitude in this regard, but the same applies for venture-backed companies that can easily adjust their spending level without stunting growth. To say there is no downside to pushing the limits of growth is incorrect — and Cloudinary is a shining example of what can happen when you challenge that convention.

In this article, Bessemer Partner Adam Fisher tells the story of Cloudinary’s rise, shares the fundamentals to bootstrapped success, and gives key takeaways for venture-backed founders. Keep reading →

Bonus exercise

Read Adam Fisher’s complete article on navigating product/market fit. If you’ve already started your company, use his four quadrant’s framework to assess the current risks and opportunities for your business. If you’re a future founder, use a startup you currently worked for or have worked for in the past and complete the same exercise.

This is Lesson 3 from Bessemer's How to Lead: Founders Fundamentals Course. Sign up today for mentorship from 30+ leaders.