The Cloud 100 Benchmarks Report 2025

This year’s Cloud 100 cohort marks a historic milestone, surpassing $1 trillion in value for the first time in 10 years, as the race for AI talent and growth defines cloud leadership amid record-breaking 2025 valuations.

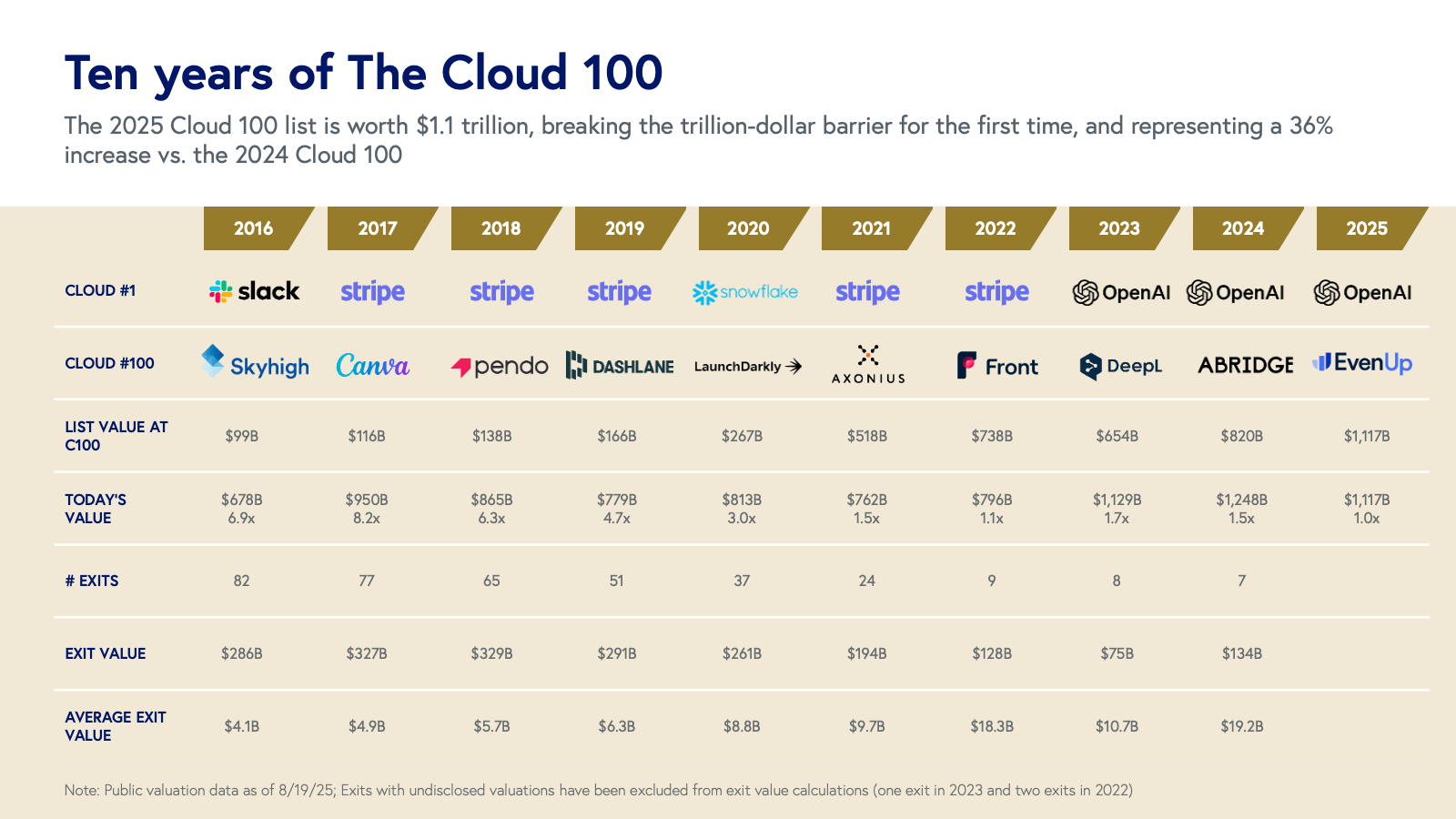

2025 marks the tenth anniversary of the Cloud 100 — the definitive ranking of the world’s top private cloud and AI companies. This year, the list not only celebrates a decade of chronicling the industry’s innovation, but also crosses a historic threshold: Cloud 100 honorees now collectively exceed $1 trillion in value for the first time, surpassing $1.1 trillion, a remarkable +36% increase from last year. Over the past decade, the cloud industry has undergone multiple inflection points, and this surge occurs during a period of rapid, AI-driven transformation that continues to rewrite the rules of technology.

While a handful of companies exited the list in the past year through headline-making acquisitions (such as Scale AI and Wiz) or public market debuts (including ServiceTitan, CoreWeave, and Figma), overall list value climbed due to two powerful and consistent trends:

- Private companies are staying private longer

- AI leaders are commanding ever-higher valuations, now representing 42% of the Cloud100 (doubled from 21% in 2024)

The growth in the cloud and AI sector is reverberating far beyond private markets. In July 2025, Nvidia became the world’s most valuable company, surpassing Apple and Microsoft and crossing a $4 trillion market cap. This milestone underscores a new era, one in which those building the foundational “picks and shovels” of AI — chips, infrastructure, and models — are capturing unprecedented value at an extraordinary pace. This macro trend is also mirrored at the top of this year’s Cloud 100, with OpenAI and Anthropic leading the list. Yet the cloud-to-AI evolution is far from complete.

A new arms race is underway for AI: not just for breakthroughs, but for the minds who power them. The competition for elite AI talent has escalated to new heights, with companies deploying billions in “acquihires” to scoop up entire firms, such as Scale AI and Windsurf. From Silicon Valley and beyond, top researchers now command nine-figure salaries, as tech giants and ambitious startups alike deploy every tool at their disposal to win this zero-sum battle. In this climate, talent is both the ultimate prize and bottleneck — and the defining constraint on how fast the next chapter of AI innovation will unfold.

Without question, AI is fundamentally reshaping how the best cloud companies grow, scale, and compete. In this tenth edition of the Cloud 100 Benchmarks report, we reveal the critical data points behind this shift, from record valuations and growth rates to compressed time-to-scale milestones and category-defining multiples. You’ll find benchmarks across all ten categories of this year’s list, plus insights on how AI is bending the curve on the journey to $100M+ ARR and beyond. For founders and investors alike, this report serves as a roadmap for what it now takes to lead and win in the cloud AI age.

Ten years of The Cloud 100

Top highlights from 2025 Cloud 100 benchmarks:

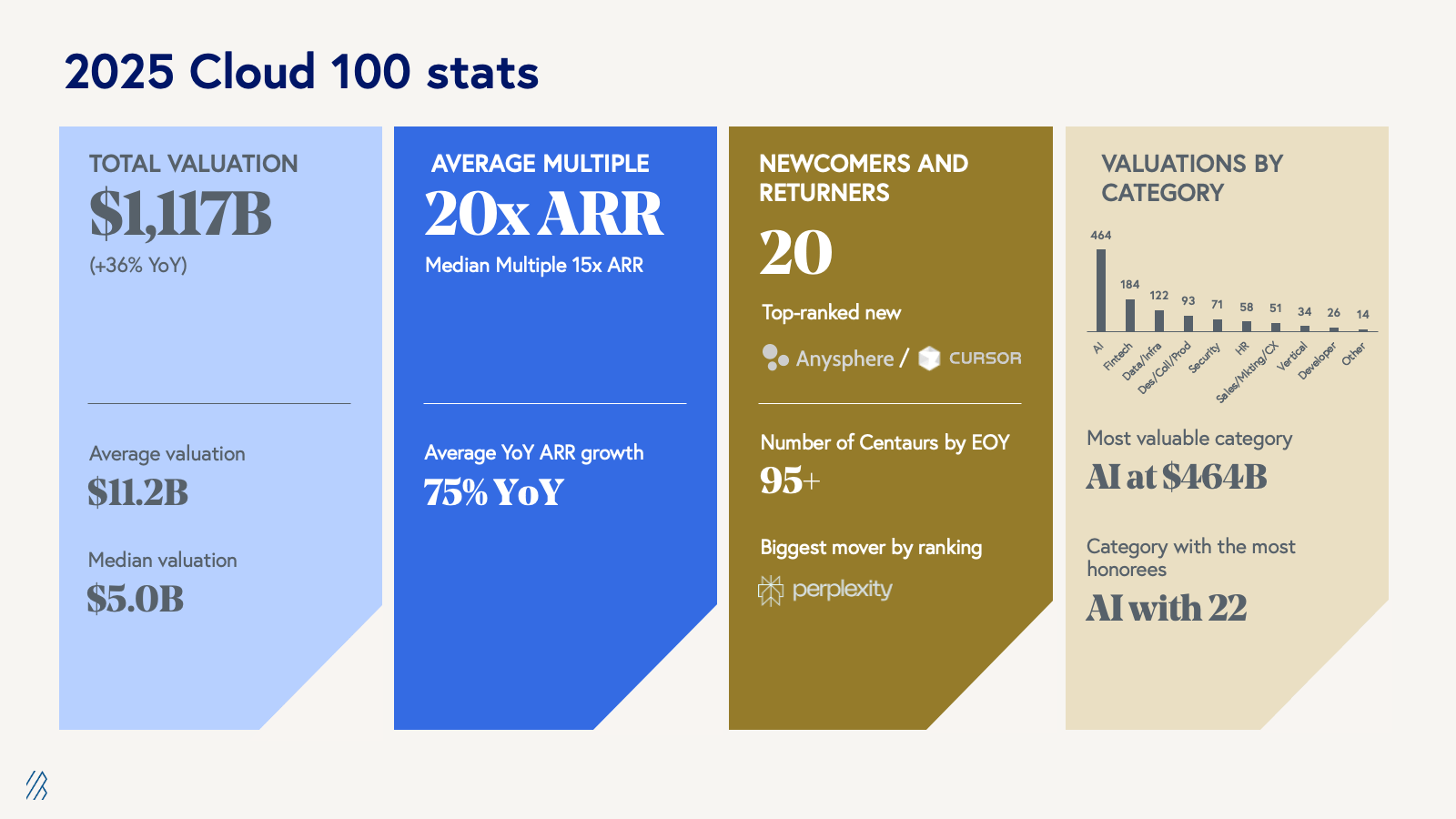

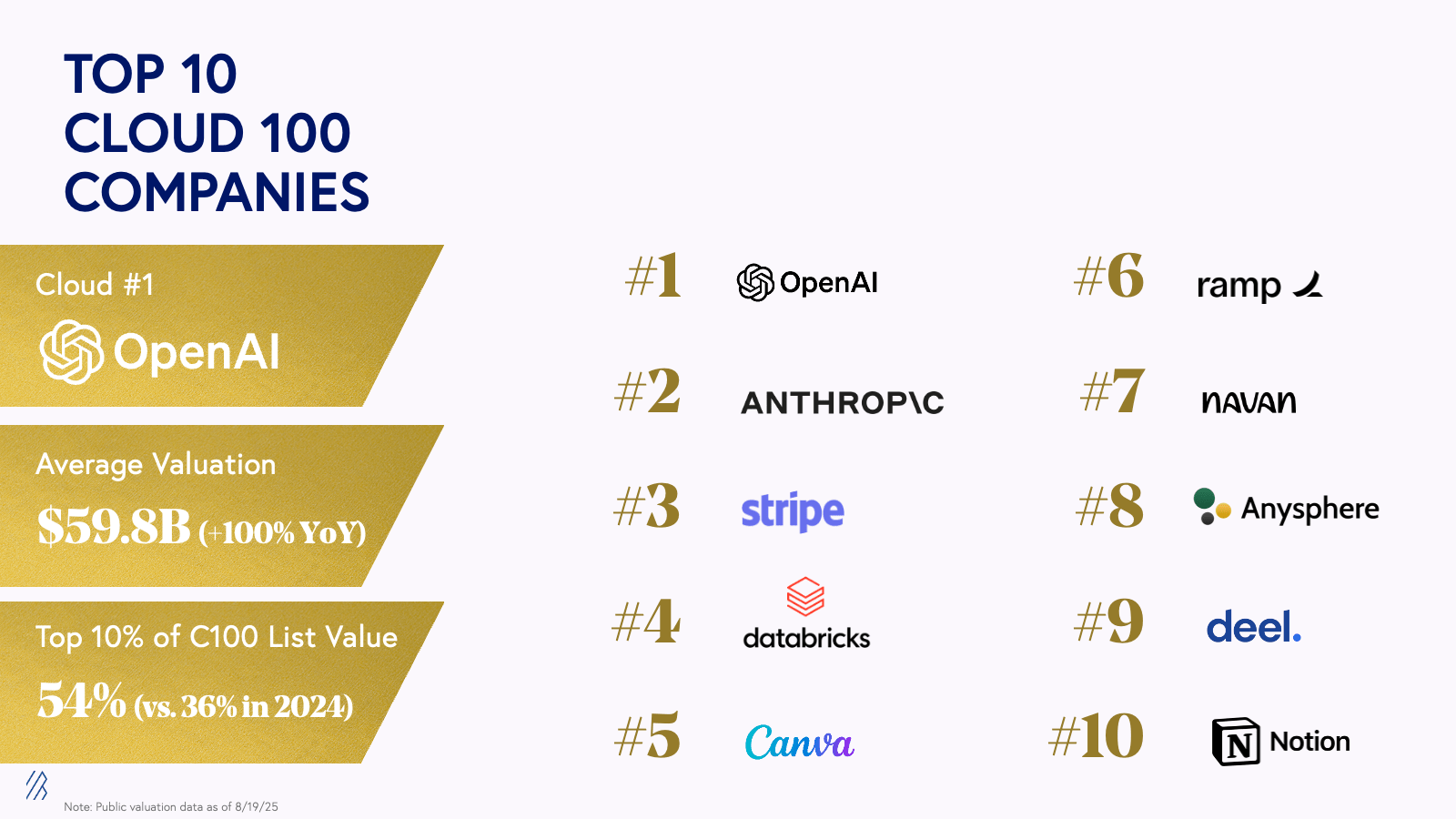

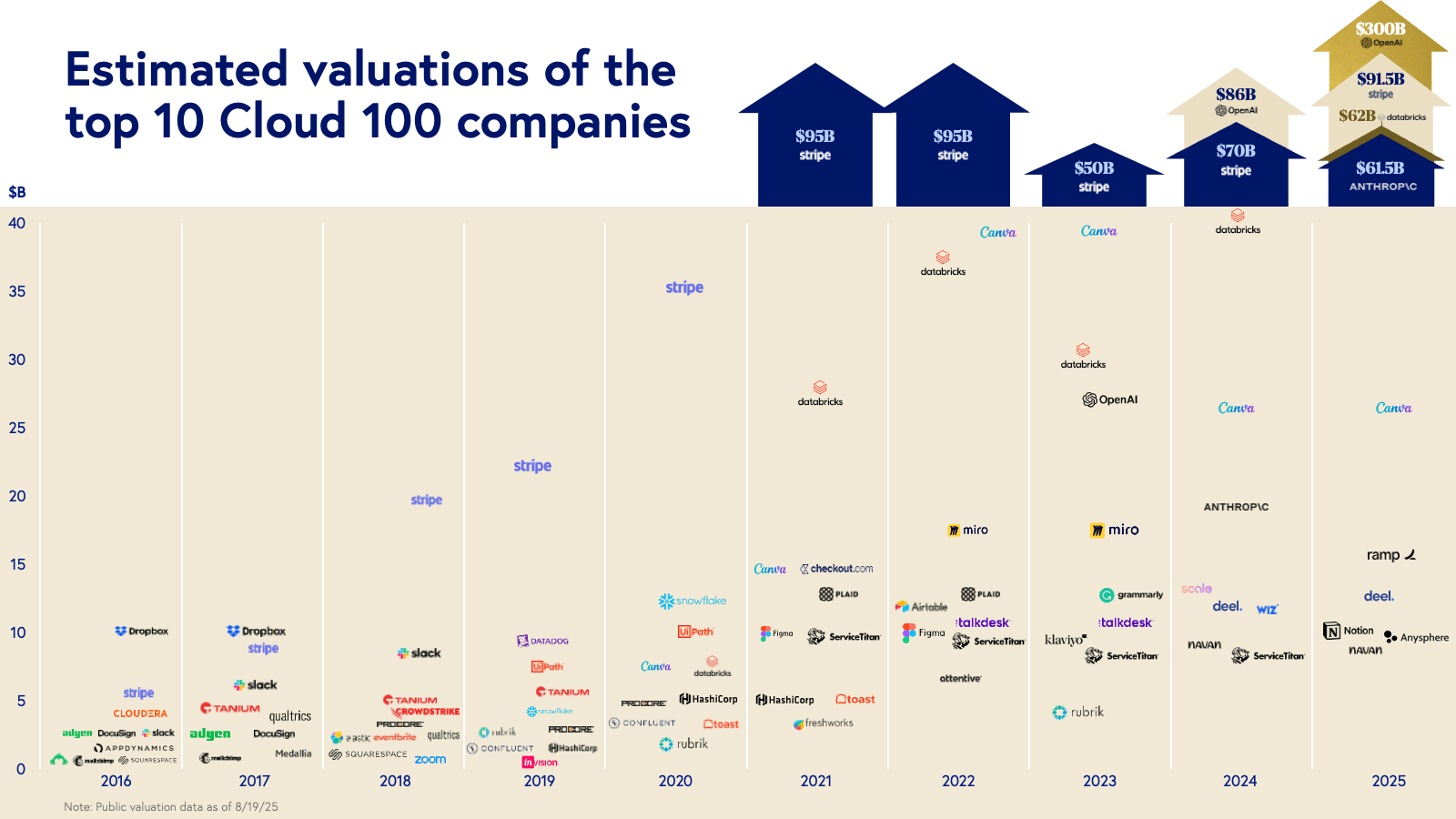

- The 2025 Cloud 100 achieved a record $1,117 billion in aggregate value, representing a 36% increase from $820 billion in 2024. The top 10 companies now account for $598 billion — 54% of list value, versus 36% last year — with OpenAI valued at $300 billion and exceeding the combined value of last year’s top 10 alone. These valuations continue to climb. Note: OpenAI was recently valued at $500 billion based on a recent secondary share sale transaction, Anthropic was recently valued at $183 billion after completing a $13 billion Series F, and Databricks is reportedly being valued at >$100 billion in a new, announced Series K financing.

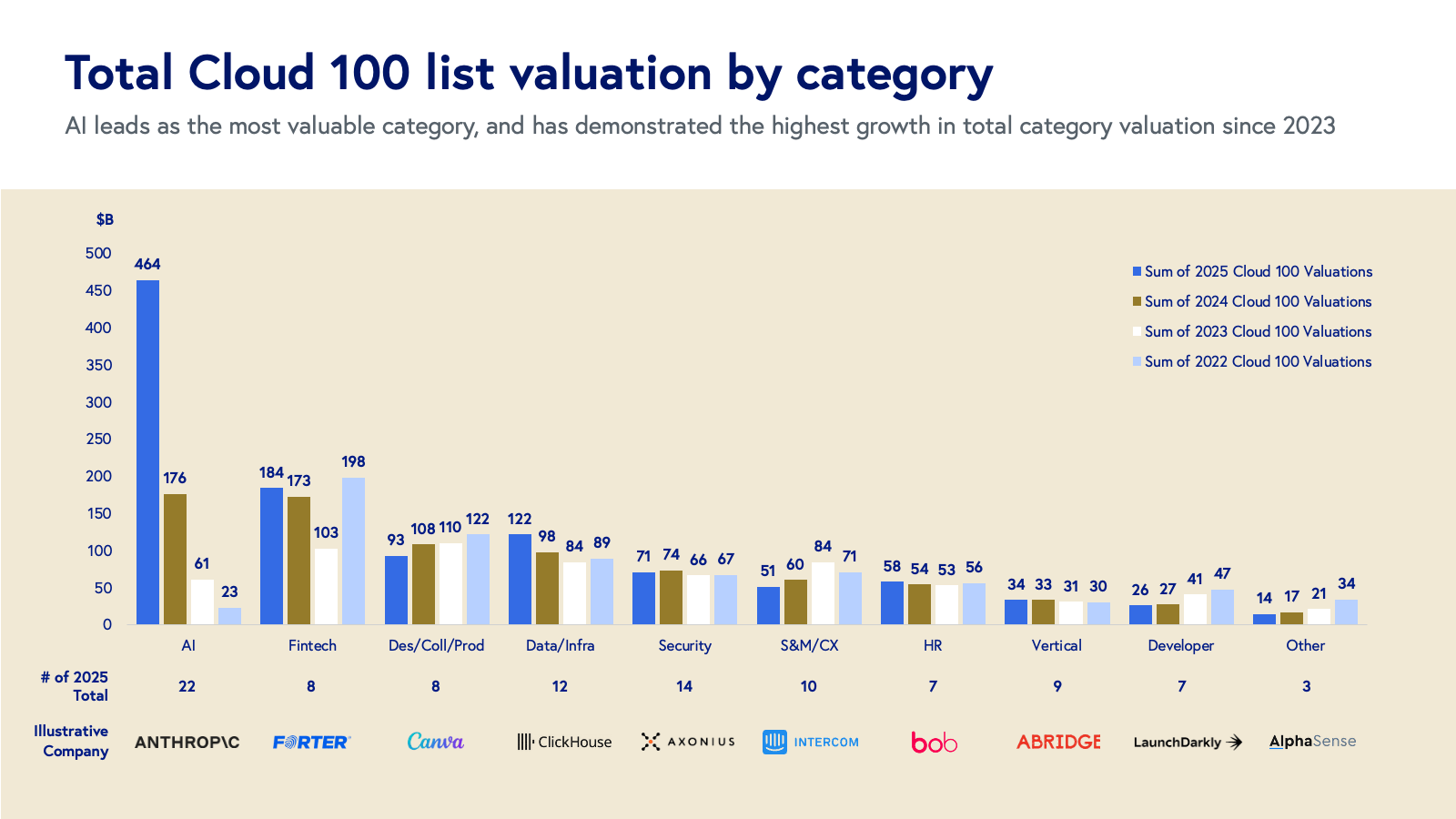

- AI dominates this year’s list, comprising $464 billion (42% of total value, doubling its list value percentage from last year) despite making up its category with just 22 companies. Fintech is a close second at $184 billion. The Cloud 100 spans ten sectors, including AI, infrastructure, fintech, design/productivity, sales/marketing/CX, security, HR, developer, vertical software, and others.

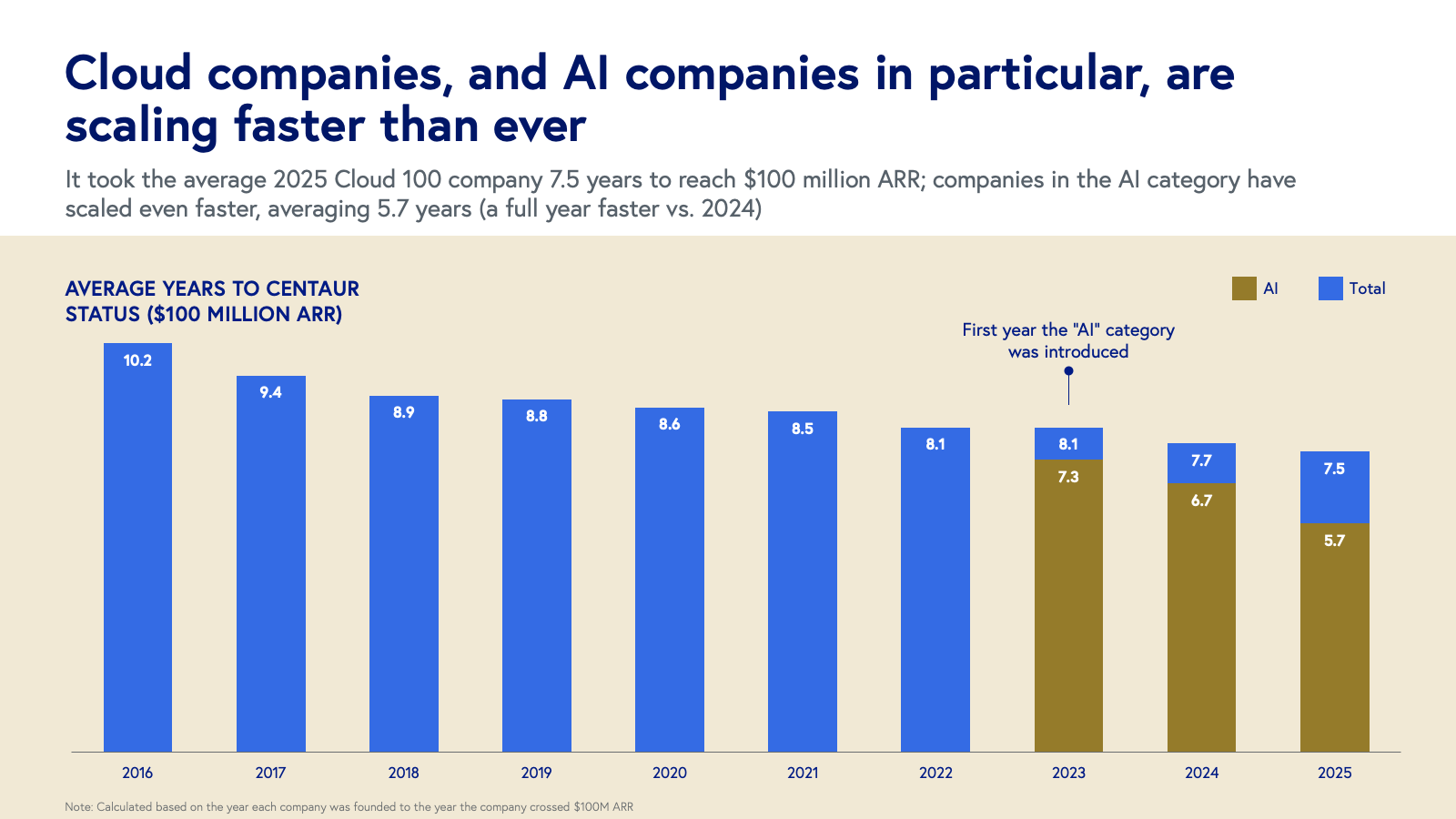

- The pace to “Centaur” status ($100 million ARR) has accelerated: the average Cloud 100 company reached the milestone in just 7.5 years. AI companies are scaling faster than ever, averaging only 5.7 years — a whole year faster than last year. By the end of the year, 95%+ of honorees are projected to surpass $100M ARR.

- Valuations are at all-time highs, with the average company valued at $11.2 billion — more than 10x the inaugural 2016 Cloud 100 cohort’s average valuation. Despite this, the average Cloud 100 revenue multiple fell for the third year to 20x (from 23x in 2024 and 26x in 2023), down 41% from the 2021 peak. AI companies, on the other hand, outperform with a 24x average multiple, compared to 19x for their non-AI peers.

The 2025 Cloud 100 at a glance

With a record-breaking $1.1 trillion in equity value, the 2025 Cloud 100 list has shattered previous benchmarks, placing the average honoree at a double-digit valuation of $11.2 billion. Several factors contributed to this growth acceleration, including companies growing larger while staying private longer, AI companies being valued at eyepopping multiples, and companies reaching Centaur status faster than ever before, with more than 95% of honorees expected to be at Centaur status by EOY. AI stalwarts like OpenAI and Anthropic are redefining what private valuations can look like, and high-flying new AI companies like Anysphere (Cursor) are breaking the assumptions around how quickly companies can reach Centaur status. It comes as no surprise that we’re seeing AI as the most valuable category for a second year in a row.

We welcomed 19 newcomers and one returner to the 2025 Cloud 100 list. While AI already represents 10 of these companies, you would be hard-pressed to find any companies not referencing AI in their product offerings, even if they primarily belong to another category like data and infrastructure or security. The highest ranking new company is Anysphere (#8), followed by other newcomers including AlphaSense (#25), NinjaOne (#47), ClickHouse (#72), MaintainX (#79), ElevenLabs (#80), Cyera (#82), Fireworks AI (#84), Odoo (#85), Together (#86), dbt Labs as a returner (#87), Fal (#88), Mercor (#89), Harvey (#91), Sierra (#92), GlossGenius (#95), Chainguard (#97), Synthesia (#98), Clay (#99), and EvenUp (#100).

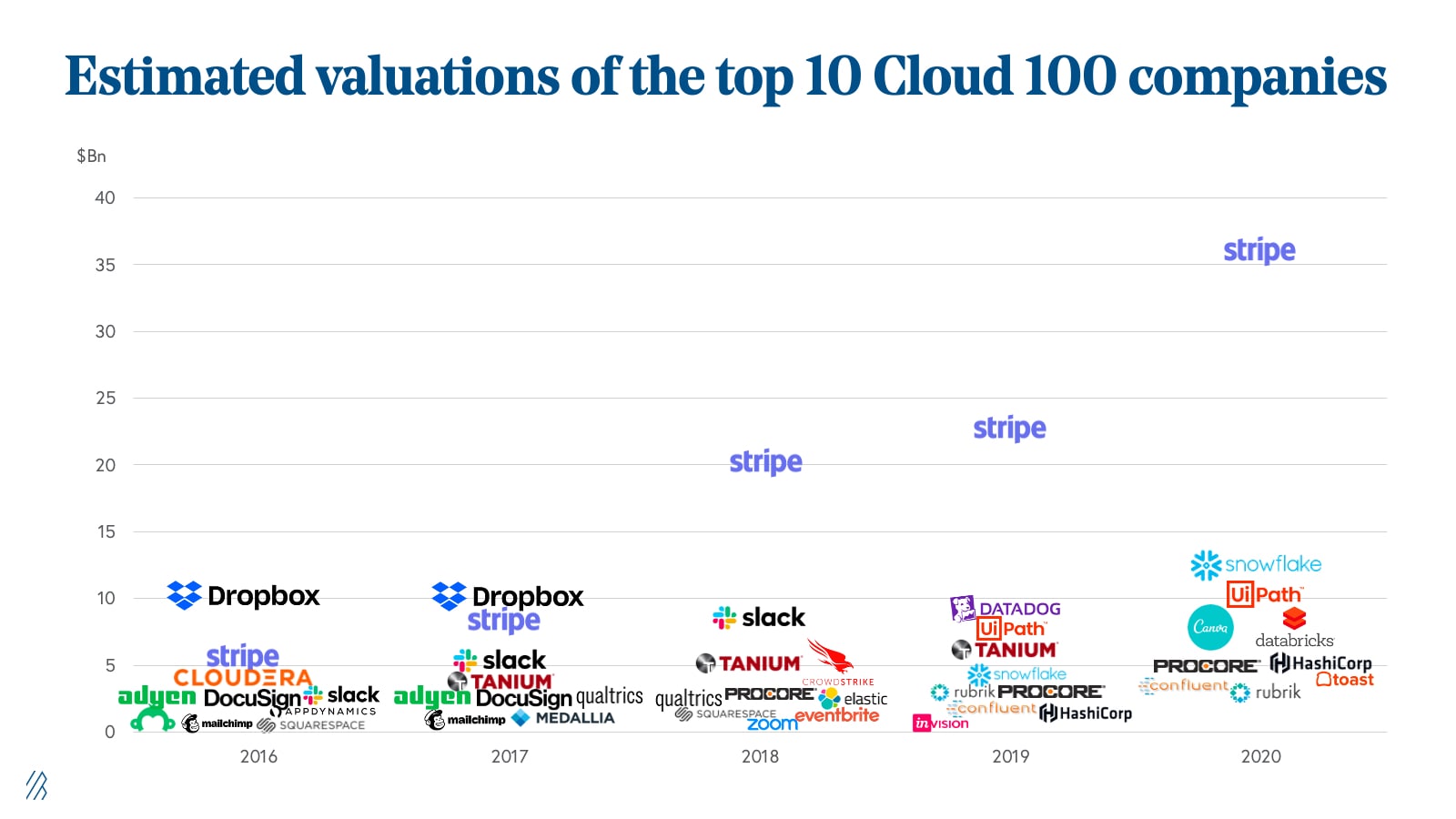

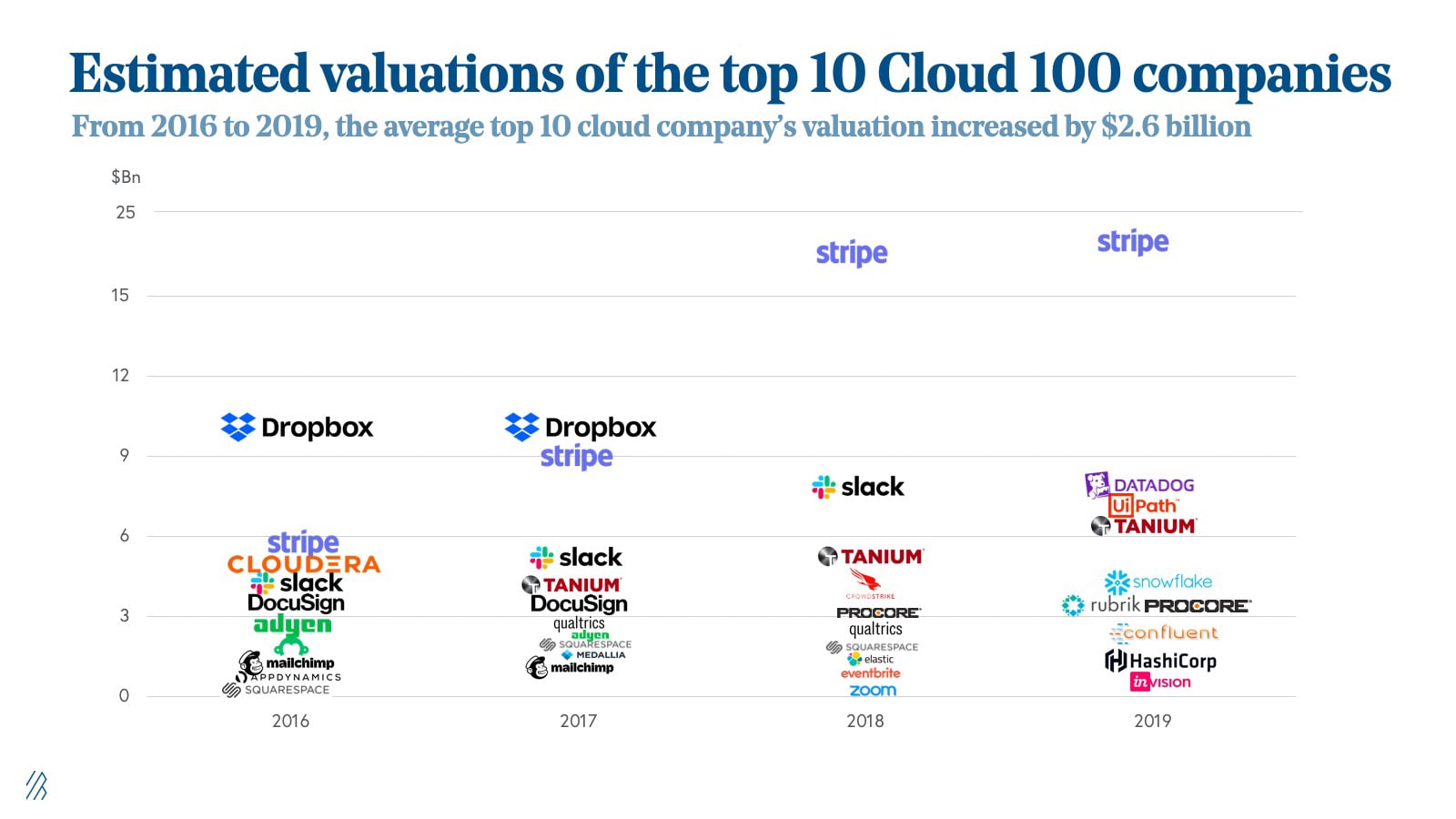

This year’s Cloud 100 leaderboard is more concentrated than ever, with just 10 companies now commanding over half of the list’s total value — a striking jump from around a third last year. Representing $598 billion, these top 10 giants have seen their average valuation soar to nearly $60 billion, highlighting a dramatic compound effect at the top. To put it in perspective, this year’s elite are nearly 20 times the size of their predecessors from a decade ago (with the average top 10 company on the 2016 list valued at $3.4 billion), illustrating how outlier scale — and AI-fueled momentum — have redrawn the boundaries of what’s possible in private cloud.

AI’s influence on the top 10 continues to be front and center, with Anthropic joining just below OpenAI to claim the top two positions. Anysphere has entered the Cloud 100 at #7, the highest new debut since OpenAI’s entrance at #1 in 2023. Data infrastructure leaders also continue to thrive on the AI boom, with Databricks at #4 raising a Series K at a $>$100 billion valuation, up from a $62 billion just 8 months ago in December 2024. Note: our report still reflects OpenAI’s last round price of $300 billion and Databricks’ last round price of $62 billion, given these transactions have not yet closed, and our data cutoff was July 2025.

Meanwhile, existing cloud giants continue to maintain ground: Stripe at #3 recently completed a tender offer for their employees at a valuation of $91.5 billion, approaching its 2021 high of $95 billion. Ramp jumped 31 places to #6 with a recent Series F at a $22.5 billion valuation, more than doubling the company’s ~$7 billion round just a year prior. This highlights how cloud solutions with an AI edge are rapidly ascending the leaderboard — rounding out the top 10 are Canva, Navan, Deel, and Notion.

2025 also marks a pivotal reopening of the exit environment, following several muted years. Notably, the M&A landscape was punctuated by two mega-deals, with Wiz acquired by Google for $32 billion and Scale AI acquihired by Meta for $14 billion, alongside sizable acquisitions of Melio by Xero for $2.5 billion and Own Company by Salesforce for $1.9 billion. The IPO pipeline churned back to life, too, with ServiceTitan opening at $9.0 billion, CoreWeave pricing at $18.6 billion (but trading as high as $90 billion), and Figma pricing at $16.3 billion (but trading as high as $60 billion on the day of the IPO), while Navan has filed for an upcoming debut.

Throughout this active period, one theme remains consistent: even as companies hold out for public market windows, they continue to create value at unprecedented scale in the private markets. The top 10 Cloud 100 companies, more than ever, reflect a decade of transformation — where AI’s ascent and the interplay between exits and private growth have permanently changed what it means to be a leader in cloud.

At $464 billion of aggregate value, AI has not only remained the most valuable Cloud 100 category, but added $288 billion of value from the 2024 cohort, when AI was the highest valued category at “just” $176 billion (21% of the list value). The AI category’s 22 players now represent 42% of the Cloud 100’s total value, which doubles its list value percentage from last year.

Fintech has stayed the runner-up at $184 billion of aggregate value. The category was propelled by fintech giants like Ramp that raised again at a $22.5 billion valuation and stalwarts like Navan, Brex, and Plaid. While both Ramp and Brex historically focused on the corporate card businesses, the launch of their software offerings — like accounting automation, expense reporting, and vendor management — now positions them squarely in the cloud arena. Throughout the cloud era, we've seen SaaS platforms, such as Shopify, Toast, and ServiceTitan, expand from software offerings into payments as inventive ways to monetize and drive new sources of revenue. And now, these emergent "neo" corporate card companies are following a similar Second Act strategy, but in reverse, illustrating how software and payment models are increasingly the go-to combined monetization strategies that drive market dominance within certain vertical industries.

Cloud 100 companies are scaling at unprecedented speed — and AI is the accelerant

After a remarkable 25% jump in value from 2023 to 2024, this year’s Cloud 100 list accelerated even further with a jump of +36%, reaching its new record height of $1.1 trillion. AI’s contribution to this growth is meaningful, as the AI category continues to cement its presence on the Cloud 100 list, while other Cloud 100 companies — such as Canva and Intercom — are also reimagining their products with AI, enabling their ability to sustain (or even accelerate growth) at scale.

Companies like OpenAI and Anthropic are not only setting the industry’s pace, but others, such as Perplexity — this year’s biggest mover, catapulting 59 spots to #26 — highlight how AI-native businesses are sprinting up the ranks. Unlike prior rounds of valuation surges driven more heavily by expectation, today’s massive valuations are oftentimes matched by unprecedented revenue trajectories and market traction. Investors are responding to this new reality with mega funding rounds at multibillion-dollar marks, rewarding hard revenue growth and transformational technologies over hype alone.

The result: Cloud 100 is now a showcase for how fast, scalable execution in AI can translate into real enterprise value, with dozens of companies reaching $100 million, $1 billion, and even $100 billion, faster than previously thought possible. The age of AI isn’t just reshaping the landscape; it’s determining the very speed at which the world’s best cloud companies achieve breakout success.

Case study: Canva’s natural evolution with AI

Since its founding in 2013, Canva has made it a mission to be more than just another design tool. Unlike traditional, complex design software, Canva allows design to be more accessible for users regardless of their technical background. This democratization strategy drove explosive growth: from one million users in 2014 to over 240 million monthly users today, while expanding internationally, growing to a global team of thousands, and launching offerings like Canva for Work and Education. Its freemium model and focus on user feedback sparked viral bottom-up adoption and eventually penetrated large enterprises, with over 95% of Fortune 500 companies now using the platform.

As an early adopter of AI (launching some of its first tools back in 2017), Canva’s more recent advancements are a natural evolution of the team’s accessibility mission. This acceleration is powered by a deep embrace of generative tools with the launch of its Magic Studio in 2023, Canva AI in Q1 2025, and acquisition of MagicBrief (an AI creative intelligence platform for marketers) in Q2 2025 — tools that address enterprise pain points like brand consistency, content scale, and cross-functional collaboration. Canva AI is a voice-enabled creative partner that can generate designs and documents, build interactive tools, and transform business data into branded visuals.

Features like Magic Design and Canva Code allow users to move seamlessly from ideation to execution, shifting creative power from technical designers to the average user. Together, Magic Studio and Canva AI tools have been used more than 18 billion times since their launch. Canva continues to deploy new AI integrations and functionality at a rapid pace, launching a Text to Video feature with Google’s Veo 3, a new Deep Research plugin with ChatGPT, and its own MCP server so that AI agents of the future can work with Canva.

With over 16 billion instances of AI usage, Canva exemplifies successful platform evolution and the power of bottom-up enterprise adoption. By using AI as a competitive moat and deeply embedding it into its offerings, Canva has expanded its reach across the organization, increased seat growth and retention, and cemented its role as an indispensable engine within the modern design workflow.

Case study: Intercom’s AI-native transformation

Intercom's transformation from traditional SaaS provider to an AI-native leader in customer service is a playbook for incumbents successfully navigating the generative AI revolution. Founded in 2011, the company's journey began well before the ChatGPT boom, with AI-driven support experiments dating back to 2018 that laid crucial groundwork for their recent breakthrough AI agent product, Fin.

When ChatGPT launched in late 2022, Intercom's response exemplified organizational agility at its best. Within hours of the release, teams were experimenting. Within one week, leadership overhauled the company's strategy and product roadmap to prioritize AI-first customer service, anticipating that the sector would be among the first to be disrupted by AI. Four months later, Fin went live, and today it’s a growing eight-figure business on track to reach $100M ARR. With the industry’s highest average resolution rate at 65%, Fin now resolves a million customer queries weekly and delivers instant, conversational customer service for more than 6,000 customers, including established SaaS businesses and leading AI companies.

The transformation required far more than adding AI features to existing products. Intercom recognized that AI couldn't be layered onto legacy systems and instead rebuilt its entire technology stack for AI-native development, including conducting a front-end migration and redesigning backend systems. Product development focused on building ahead of the curve while rigorously validating readiness. Before launch, Fin underwent extensive internal testing: backtesting on historical data, simulating user behavior, and running large-scale A/B tests. A “build in public” approach then brought in early adopters to refine the product before scaled deployment. Intercom also reimagined its commercial model, moving away from traditional seat-based pricing to outcomes-based billing: customers pay only when Fin successfully resolves a conversation. This pricing model has since set a new industry standard — one that competitors like Salesforce and Zendesk have emulated.

Intercom’s transformation is so comprehensive 76% of Intercom’s own customer support requests are now handled by Fin, demonstrating the team’s commitment and conviction in their product. By rebuilding infrastructure, realigning business models, and investing early, Intercom didn’t just survive the AI revolution; it became a category leader for what’s possible.

The trajectory to Centaur status has been reimagined for Cloud 100

The rise of AI-native companies has also fundamentally changed the trajectory to Centaur status, a term we debuted in 2022 for businesses reaching $100 million ARR. In this year’s cohort, it took the average Cloud 100 company 7.5 years to reach Centaur status, the fastest timeline in the list’s history. AI companies are accelerating at an even faster pace, averaging 5.7 years to reach Centaur status (a whole year shorter than AI companies in the 2024 cohort).

Our research on AI-native companies in this year’s State of AI 2025 report builds on this observation and outlines the dramatic acceleration we’ve seen in growth trajectories of breakout AI companies (with the highest performing startups reaching $100 million ARR anywhere from 18 months to 4 years on average). We expect that the average years it takes Cloud 100 companies to reach Centaur status will continue to decline over time.

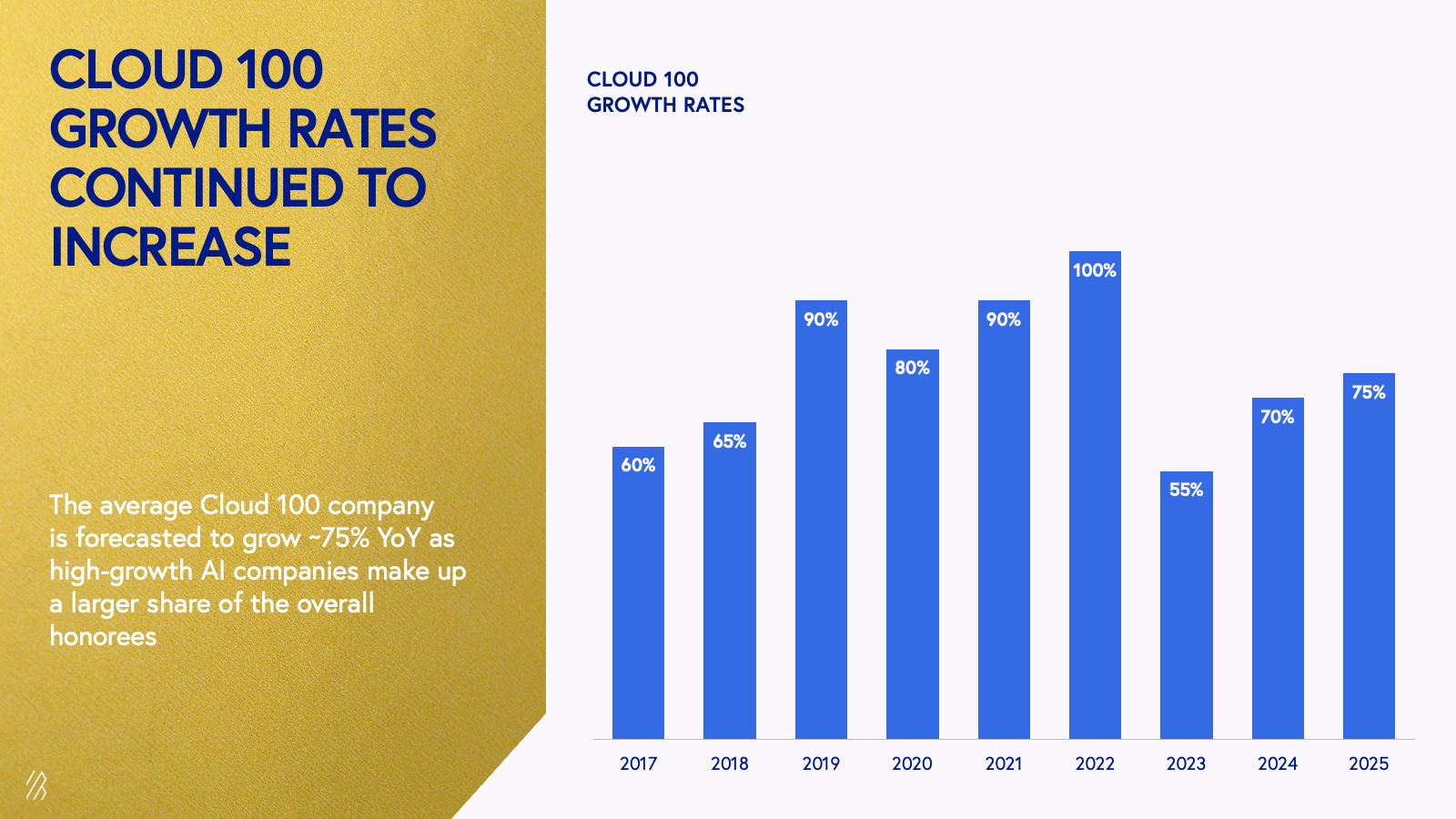

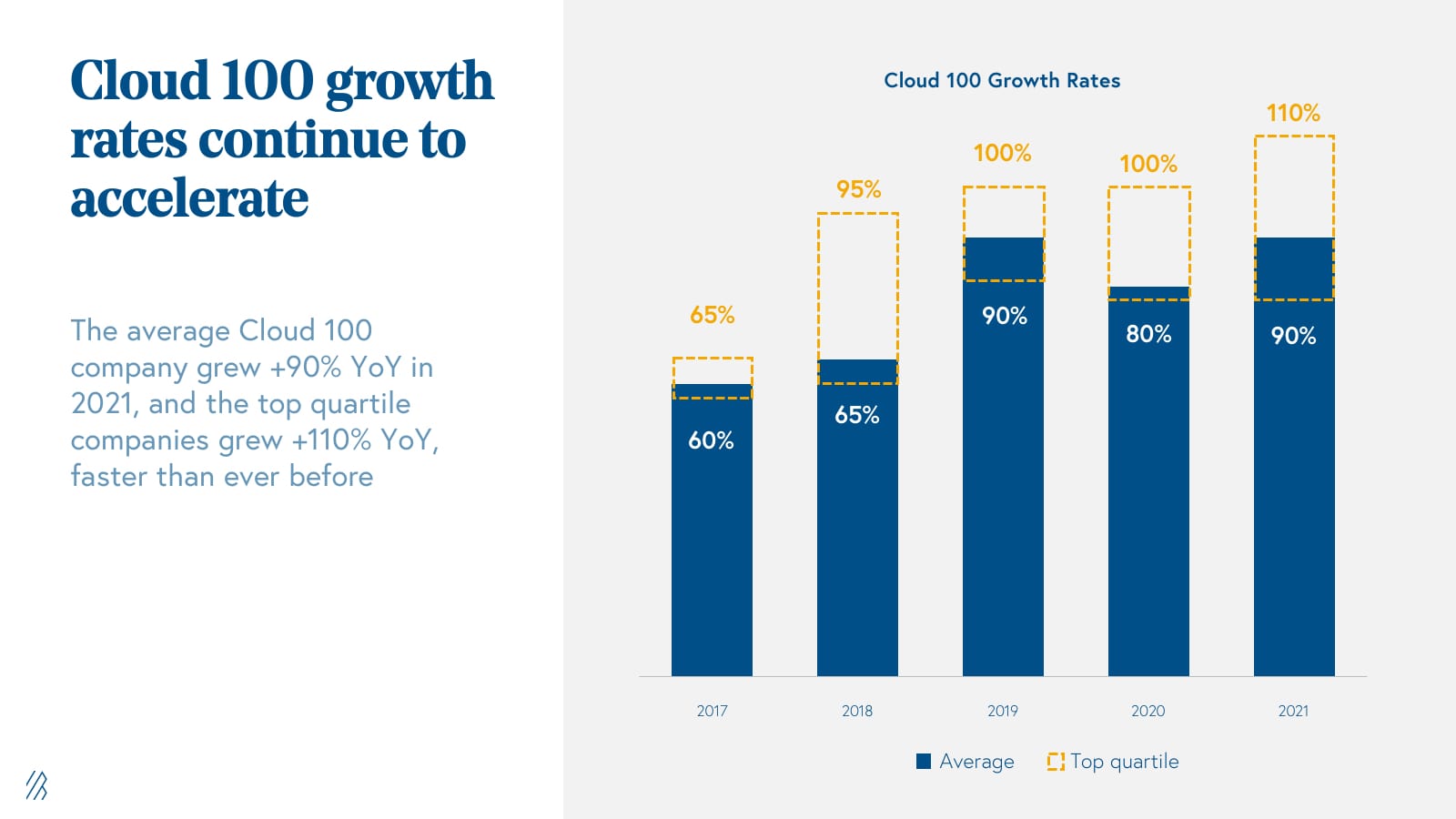

In 2023, the average Cloud 100 revenue growth rate fell to a record low of 55% YoY. However, this year’s cohort continued to see an uptick at 75%. The growth rates at which AI companies can compound, paired with the sheer size of the prize and the sky-high valuations investors have been willing to pay, have all played a factor in the recent talent wars between foundation model companies.

A decreasing valuation divergence between AI and traditional cloud

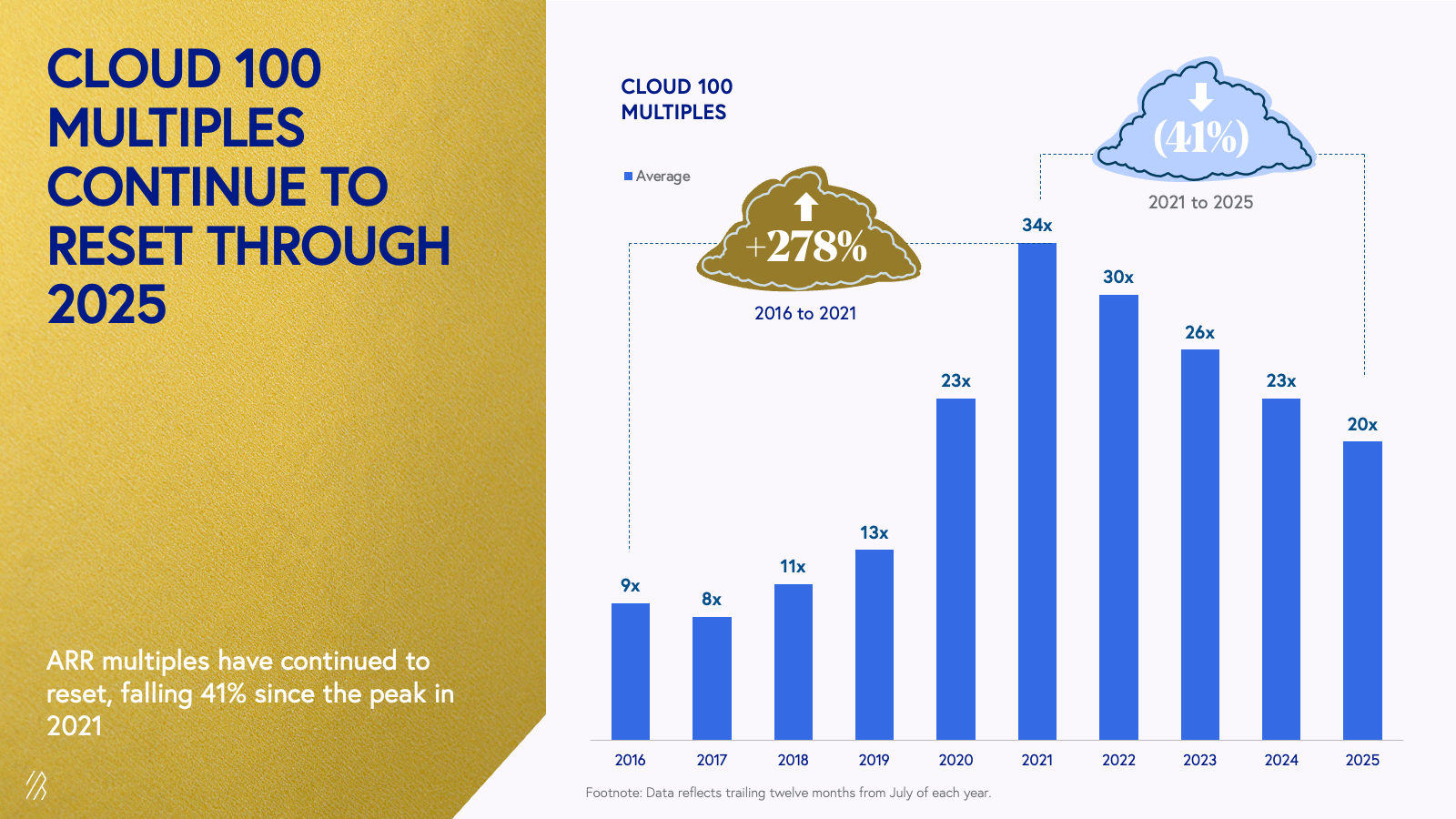

We saw ARR multiples continue to compress in 2025, with the average Cloud 100 multiple of 20x representing a 41% decline versus the peak in 2023. However, we note that Cloud 100 honorees still trade meaningfully above public market benchmarks, with the average public BVP Cloud Index company trading at ~8x ARR.

AI companies also continue to shine among our benchmarks, as AI companies on average command a 24x multiple, compared to 19x for their non-AI peers. Outside of a few outlier cases, we note that the gap in multiples between AI companies and the rest of our honorees has compressed over time; as AI becomes table stakes across software categories, this valuation gap may prove temporary.

Talent and leadership will determine the trajectory of AI companies

Big tech companies have been offering pro sports-level bounties to entice talent away, leading to the recent musical chairs of researchers and engineers moving between OpenAI, Anthropic, Meta, Alphabet, Apple, and others at pace. Talent has been won and lost within weeks (see recent changes at Anthropic), acquihires are occurring at unprecedented prices (as we mentioned with Scale AI earlier), while foundational labs dig their heels in to retain talent through alignment on vision — and large compensation packages by their own right. However, with Anysphere’s AI code editor Cursor exploding onto the scene and the recent focus around agentic tools in the enterprise, there’s never been a sharper dichotomy between the exuberance at the top and the uncertainty around entry-level hiring.

Celebrating the tenth anniversary of the Cloud 100 benchmarks

As we celebrate 10 years of the Cloud 100, this report documents nothing less than a generational handoff. 2025 captures a fundamental inflection point where AI has permanently altered the rules of building a cloud company. The data is unambiguous: AI is producing the highest valuations we’ve seen, AI firms averaging 5.7 years to Centaur status, entire business models being rebuilt around AI-first principles, and a talent war unlike anything the cloud has experienced.

So, $1.1 trillion in aggregate value is more than a record-breaking number — it’s evidence that we’re in the early innings of the largest platform shift since the internet itself. And this isn’t just growth; it’s the compound effects of market maturation and now AI acceleration converging into a perfect storm of value creation. As we enter the next decade, one thing is certain: companies mastering AI today will be the category definers of tomorrow. The question isn’t whether these trends will continue – but how much further they’ll exceed our already ambitious projections.

Note: This report relies on valuation data available as of July 2025.

Benchmarks archive

2024 Cloud 100 Benchmarks

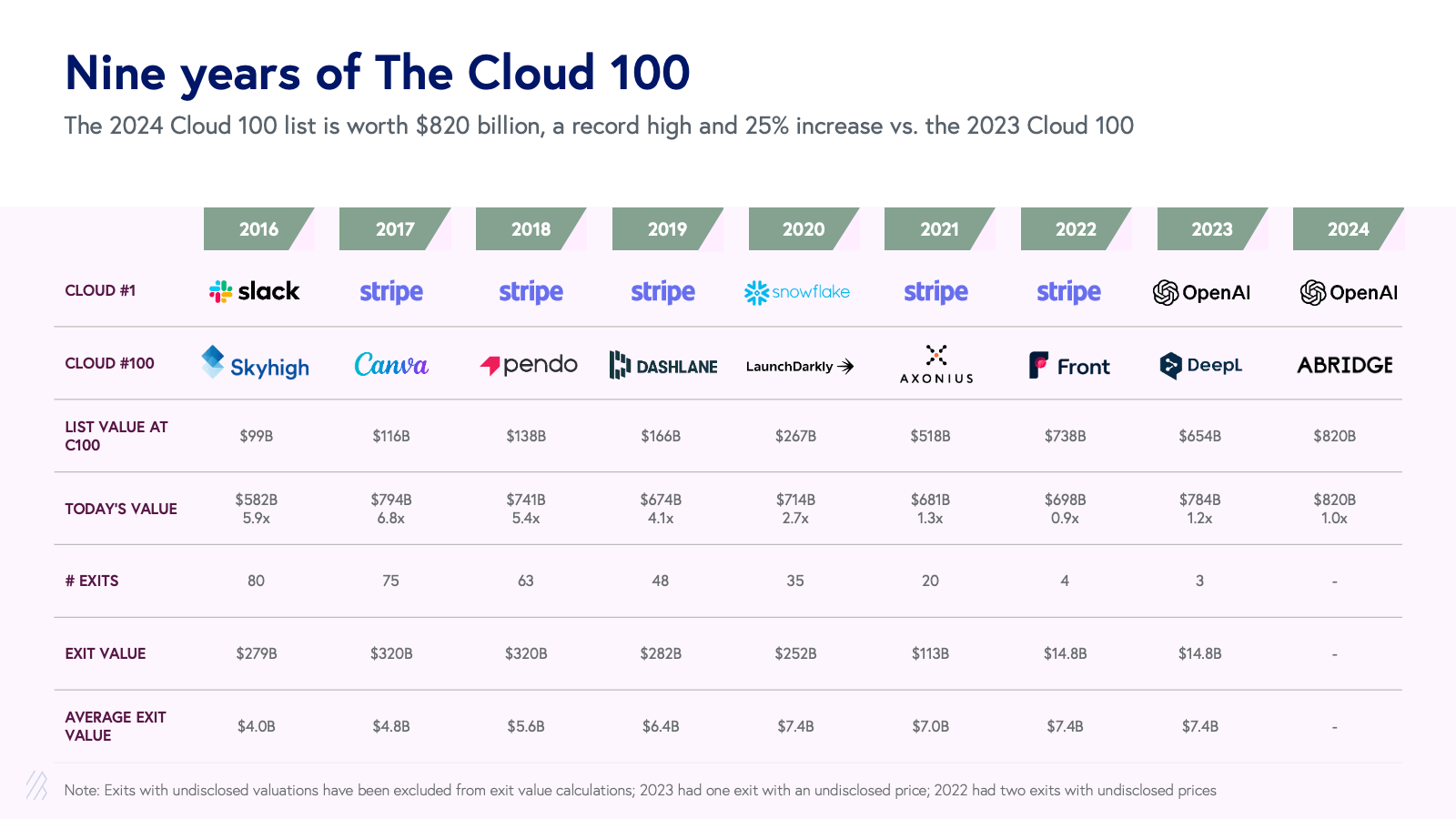

Back for its ninth edition, Bessemer Venture Partners, Forbes, and Salesforce Ventures have released the 2024 Cloud 100 List, the definitive ranking of the world’s top 100 private cloud companies. After a dynamic 2023 in which we saw the Cloud 100 list value contract for the first time year-over-year, this year’s 2024 Cloud 100 cohort sets multiple records, demonstrating the resiliency of cloud companies in navigating these uncertain times.

First, the Cloud 100 list value reached $820 billion this year, a +25% year-over-year increase and the highest list value ever in Cloud 100 history (compared with the previous record of $738 billion set by the 2022 Cloud 100 cohort). Several factors drove this impressive rebound. For one, AI companies drove a massive jump in market cap of over +$100 billion. Also, even though we saw the exciting IPO graduations of Klaviyo and Rubrik off of the 2023 Cloud 100, macroeconomic uncertainties continue to hold many private software companies back from entering the public markets. Nonetheless, these companies have spent the last couple of years adjusting their balance sheets and optimizing their business models for sustainable growth. They have largely emerged from the market turbulence more resilient than ever—and their valuations reflect that.

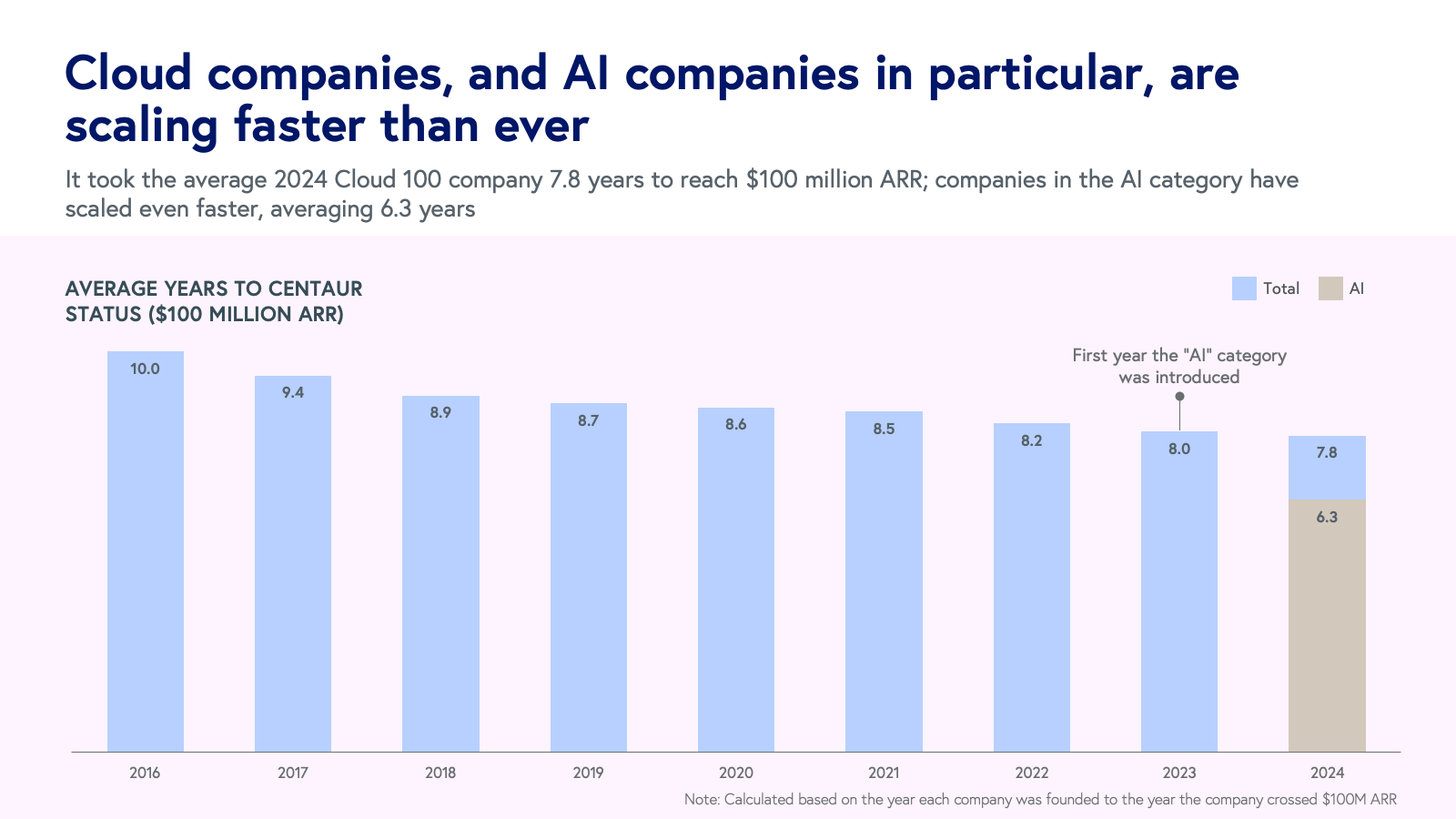

Second, even as companies have faced a challenging macroeconomic environment in the past few years, the time it took the average Cloud 100 company to reach Centaur status—crossing $100 million annual recurring revenue (ARR)—has decreased consistently since the list’s inception. It took the average 2024 Cloud 100 company under eight years to reach Centaur status, down from ten years for the inaugural 2016 Cloud 100 cohort. AI companies in particular have shown their ability to scale faster than others, averaging just over six years for this year’s cohort. Value is accruing to these companies faster than ever.

Across nine years of the Cloud 100, we have yet to see as competitive of a cohort as the 2024 list. In this year’s Benchmarks Report, we reveal Bessemer’s analysis of the 2024 Cloud 100 and lessons learned from the leading private cloud companies in the market.

Top highlights:

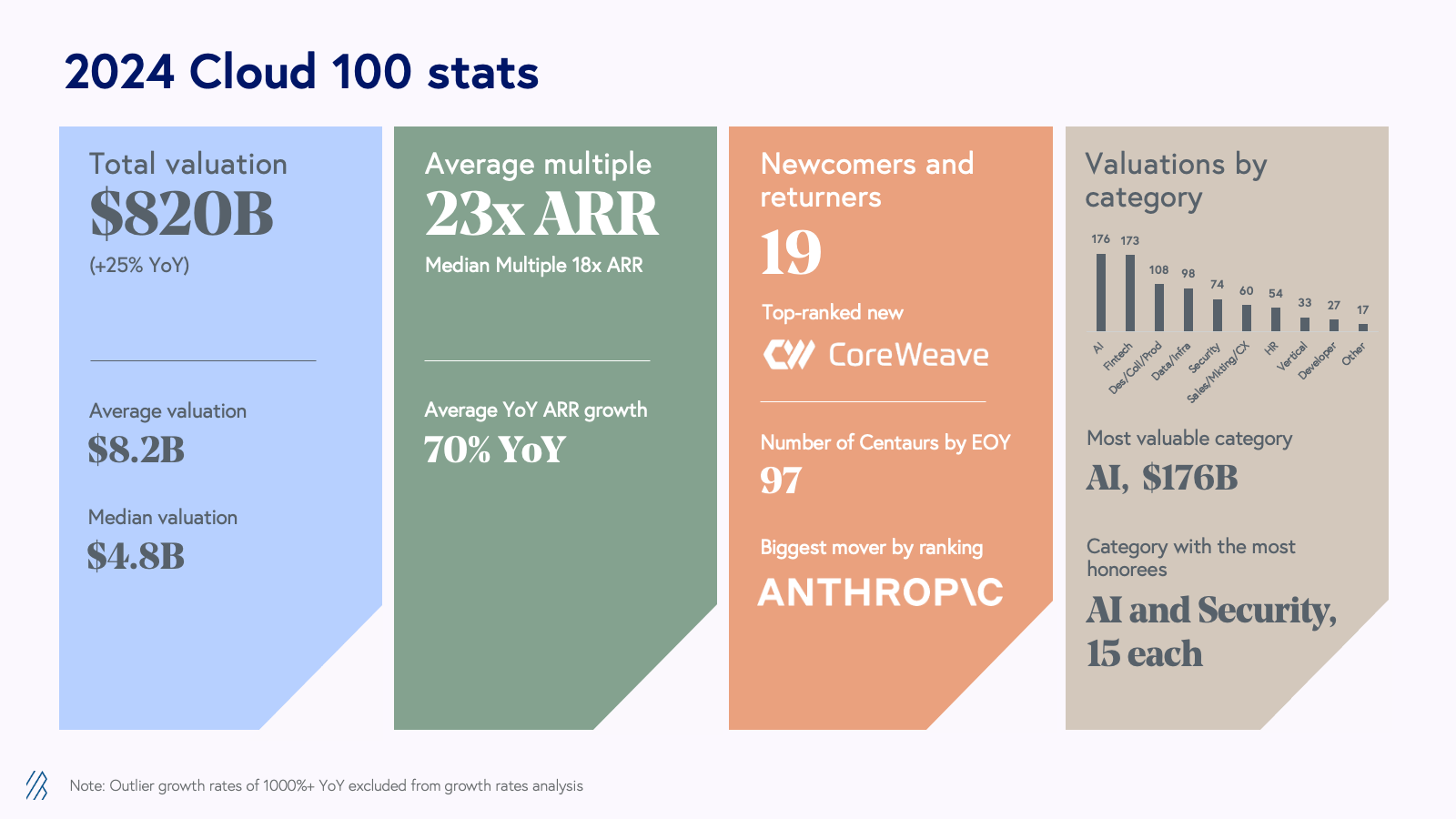

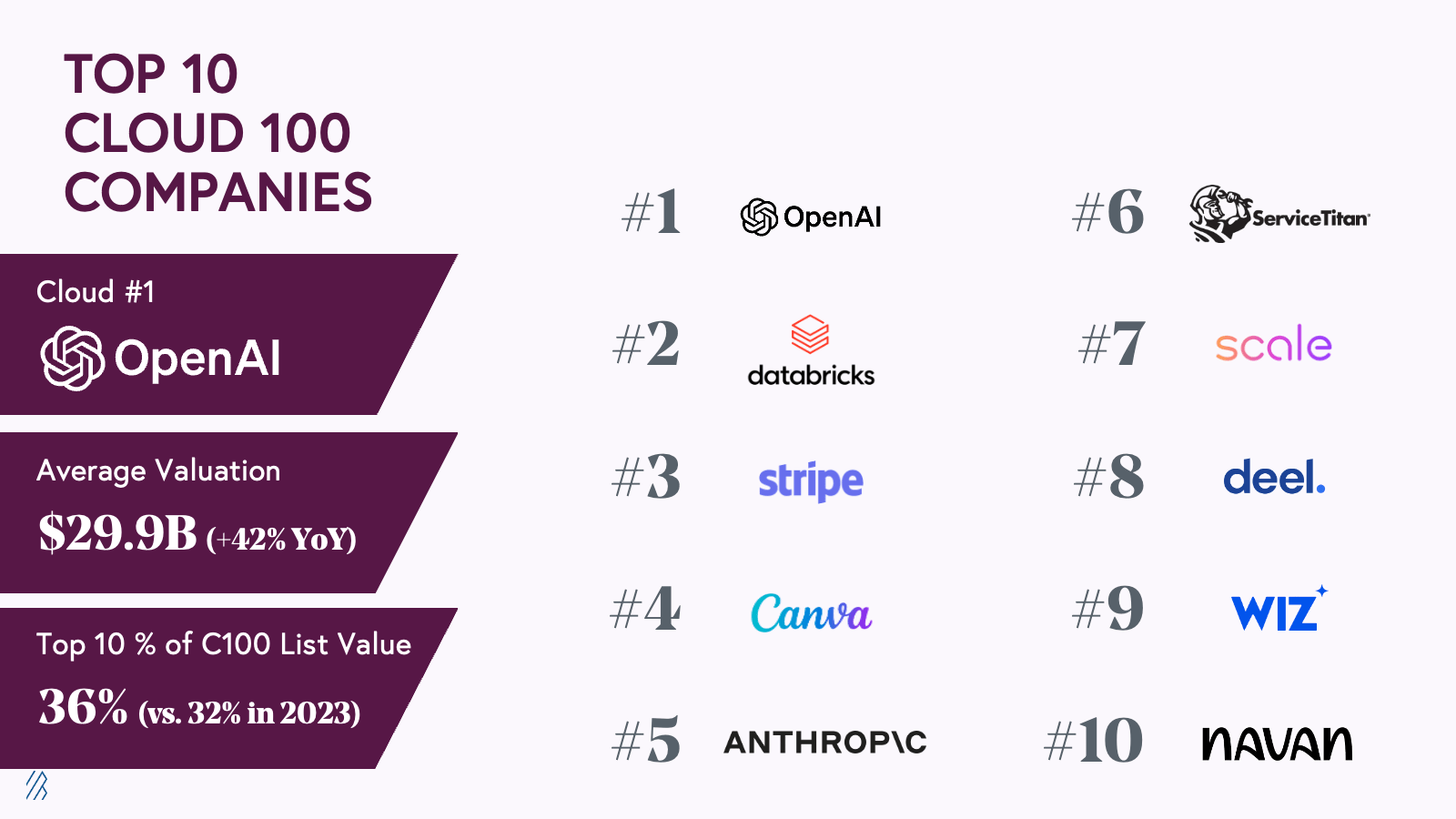

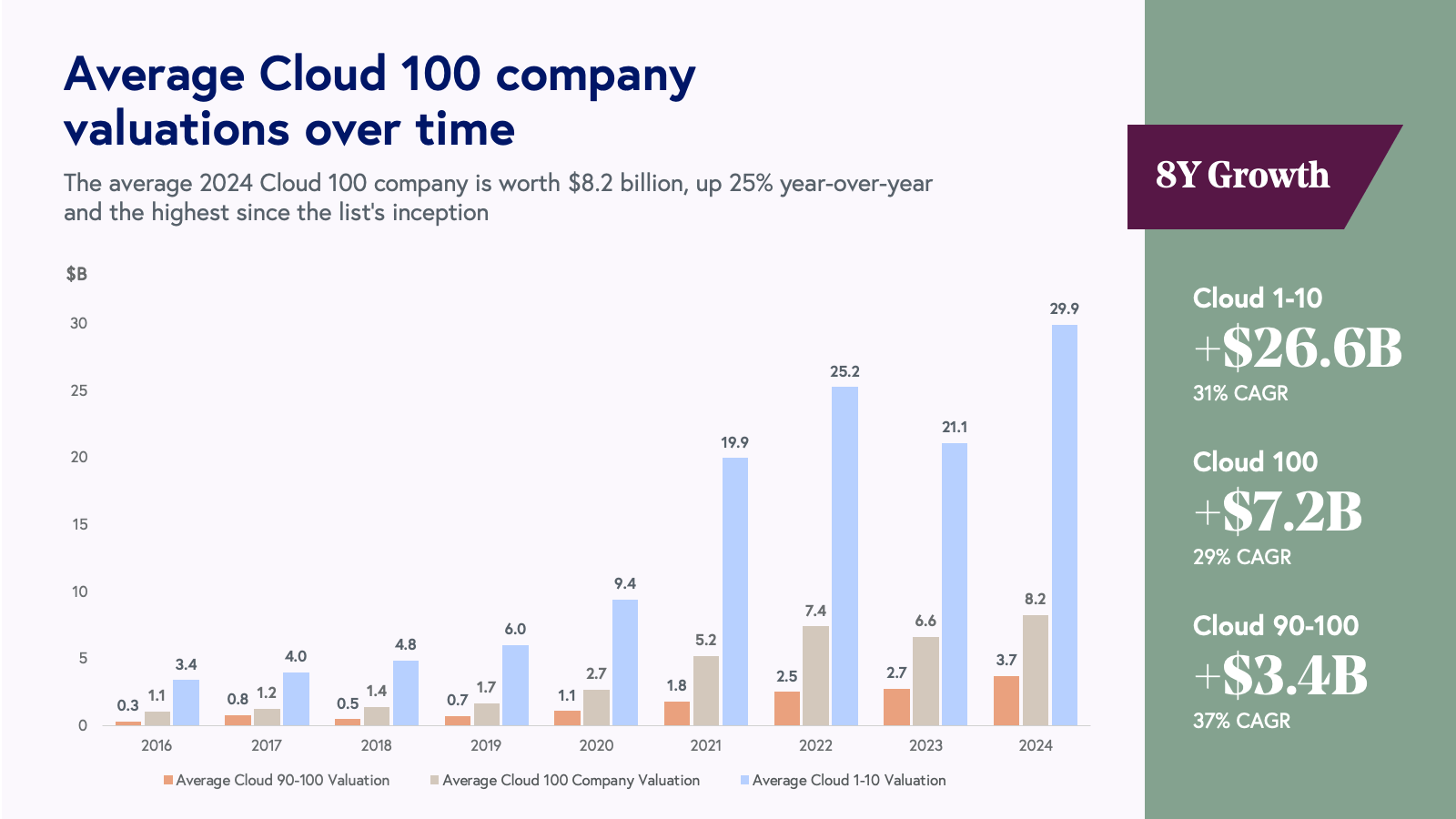

- The 2024 Cloud 100 is worth an aggregate $820 billion vs. $654 billion in 2023, representing a 25% increase year-over-year. The top 10 Cloud 100 companies have grown in influence on the list, representing $299 billion of equity value and comprising 36% of total list value (vs. 32% in 2023). The average Cloud 100 company is now worth $8.2 billion.

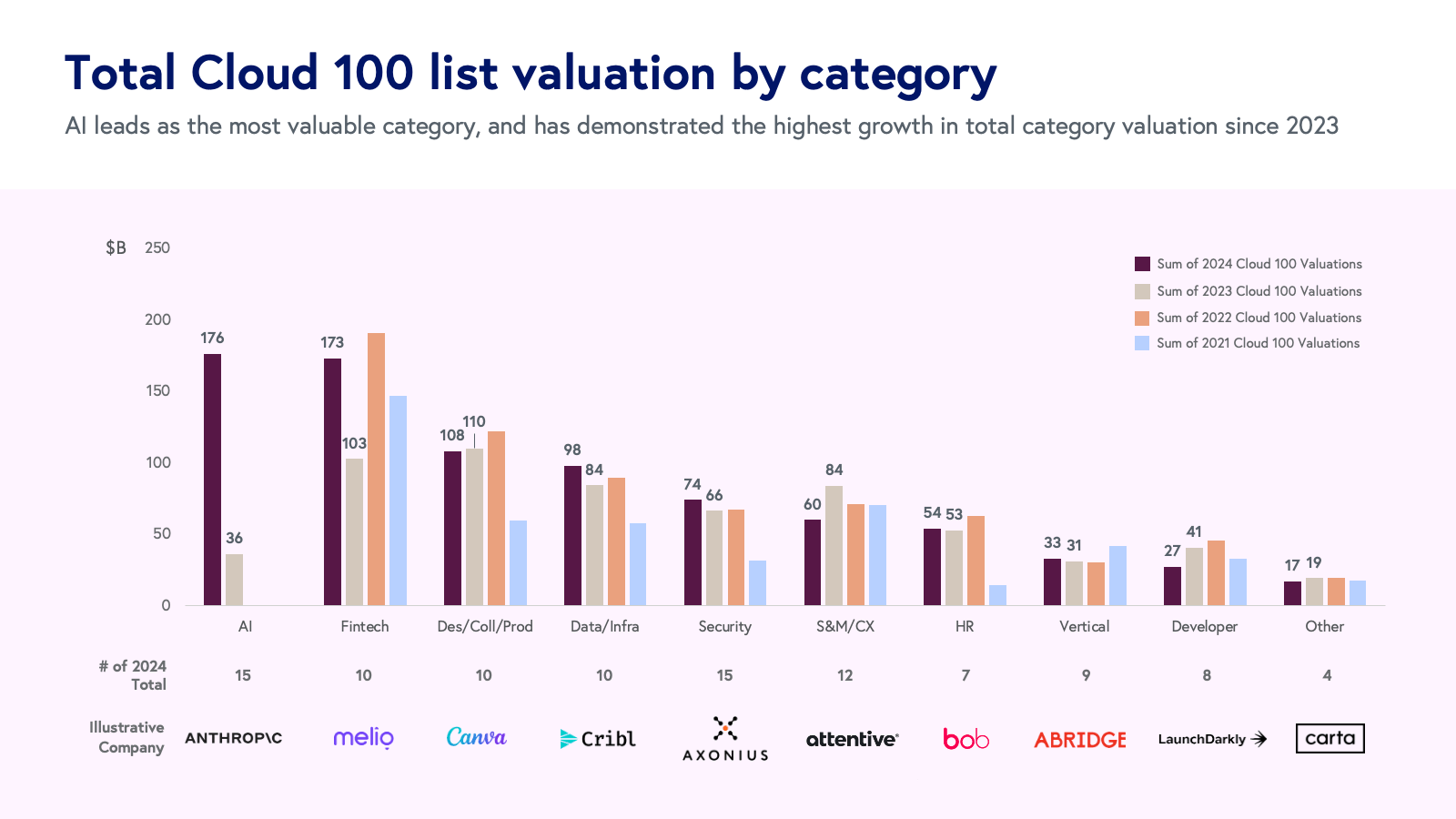

- Unsurprisingly, this year, AI is now the highest valued category at $176 billion (21% of list value), followed closely by Fintech at $173 billion. As a refresher, we evaluate Cloud 100 entrants in 10 different categories of cloud computing: AI; Data and Infrastructure; Fintech; Design, Collaboration, and Productivity; Sales, Marketing, and CX; Security; HR; Developer; Vertical Software; and Other.

- In 2022, we introduced the “Centaur,” a $100 million+ ARR business. In the history of the Cloud 100, we’ve yet to see a cohort scale to Centaur status as quickly: it took the average 2024 Cloud 100 company 7.8 years to reach Centaur status, with the average for AI companies even lower at 6.3 years. 97% of honorees are forecasted to reach or surpass $100 million of ARR by the end of the year (vs. 95% in 2023).

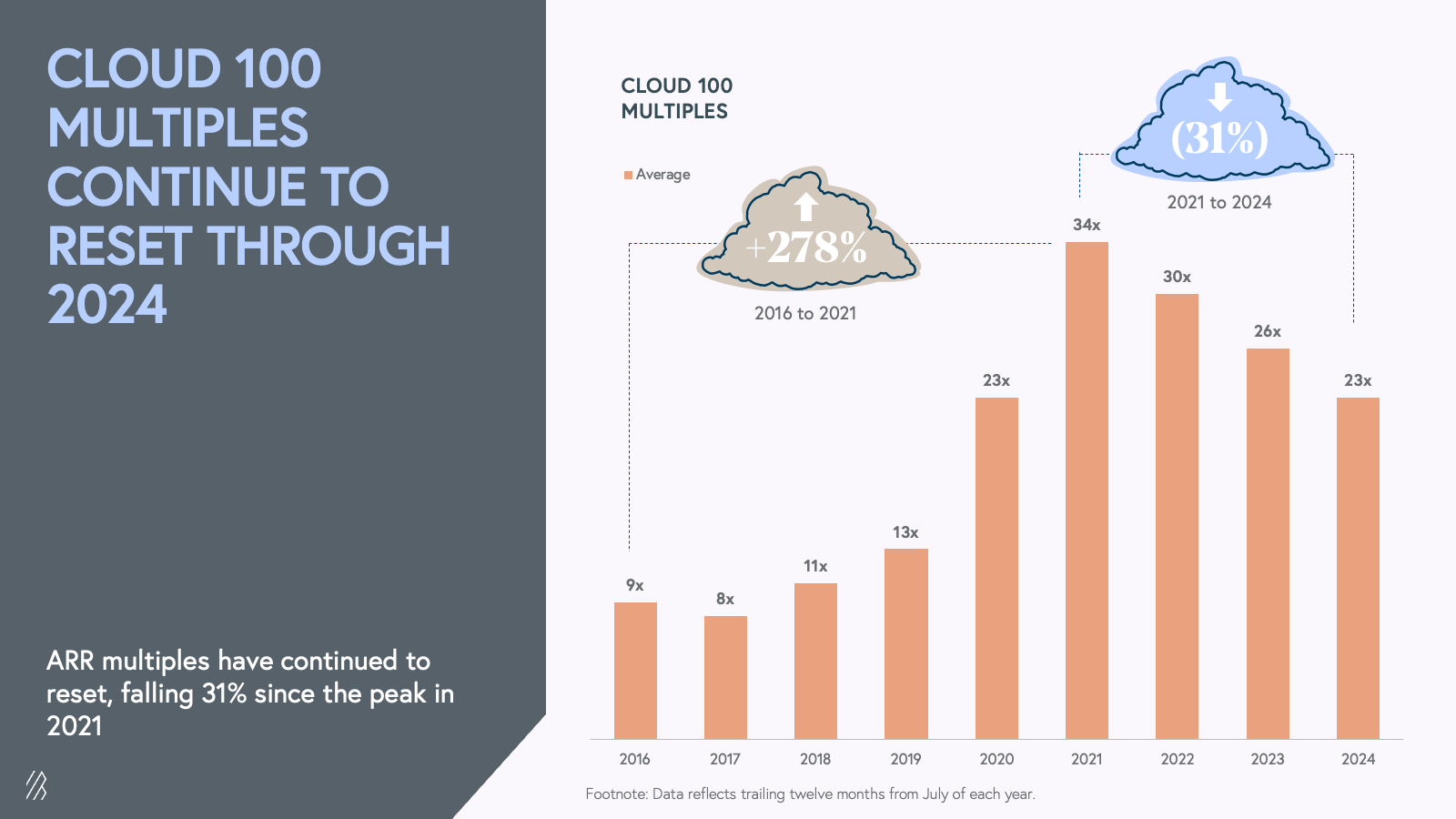

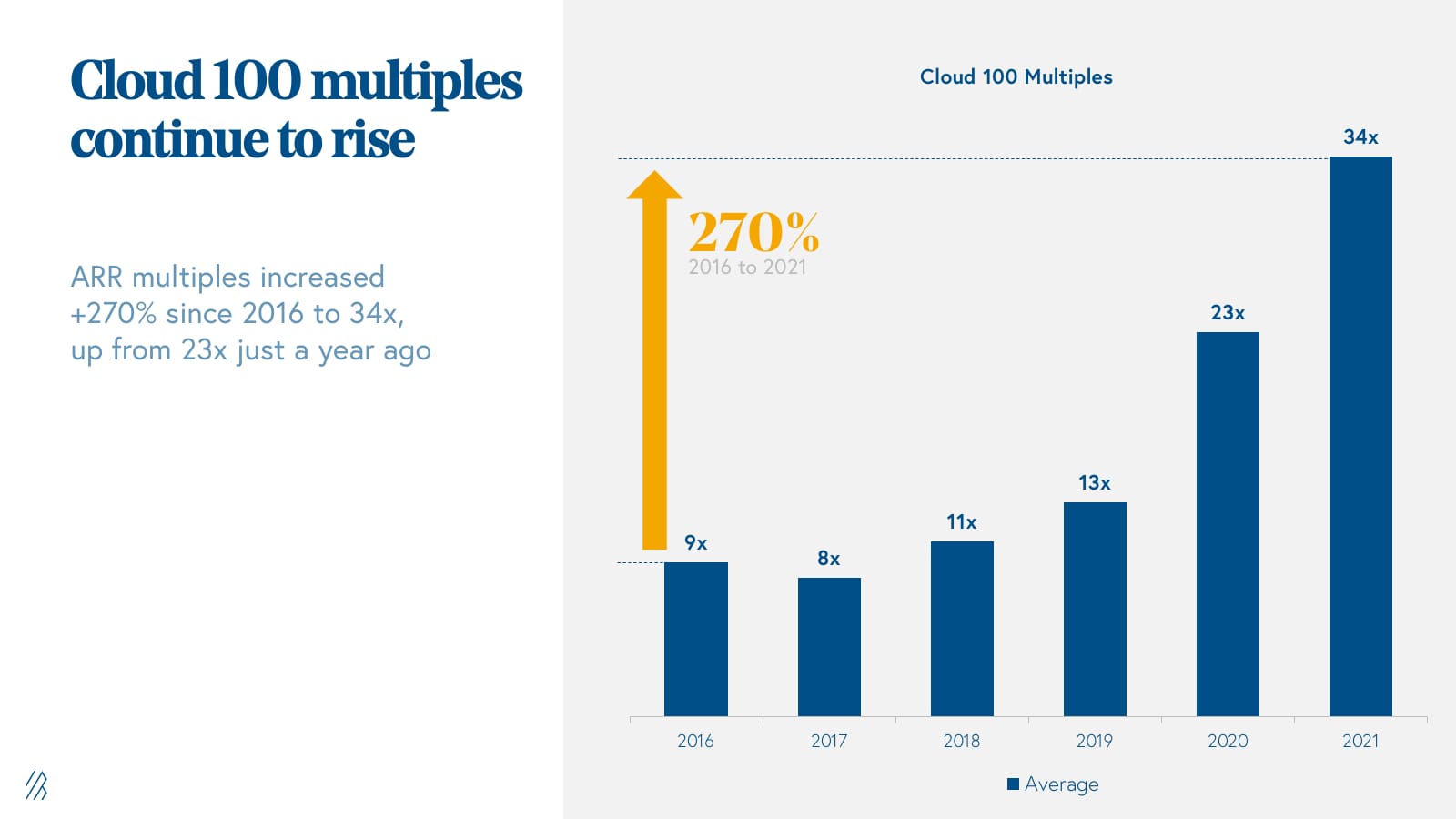

- Valuations are record-high, yet private cloud multiples continue to reflect the impact of the public market reset that began in early 2022. The average 2024 Cloud 100 company valuation is $8.2 billion, up 25% year-over-year, a stark increase from the inaugural 2016 Cloud 100 cohort’s $1.1 billion average valuation. At the same time, the average Cloud 100 multiple decreased for the third year in a row, down to 23x from 26x last year, representing a 31% decline since the 2021 peak of 34x.

The 2024 Cloud 100 at a glance

The 2024 Cloud 100 list represents a record-high $820 billion of equity value, with an average company valuation of $8.2 billion, 25% higher than last year’s average valuation. Several factors contributed to this growth acceleration (after the 2023 decline in YoY list value), including that companies are growing larger while staying private longer; annual average growth rates have rebounded since last year’s low of 55%; and companies are reaching Centaur status faster than ever before. High-growth AI upstarts have particularly contributed to the rebound in average growth rates this year.

We are welcoming 19 newcomers and returners on the 2024 Cloud 100 list, with the majority of them in AI (seven companies) and fintech (four companies). The highest ranking new company is CoreWeave (#29), followed by other newcomers and returners including Ramp (#37), Brex (#42), VAST Data (#47), Flock Safety (#49), Airwallex (#54), Clio (#56), Lambda (#84), Perplexity (#85), Cato Networks (#86), Glean (#87), Vercel (#90), Mistral (#92), Island (#93), Runway (#94), Melio (#98), Cohere (#99), and Abridge (#100). (Note that Figma has also returned to the list at #12 after Adobe’s acquisition attempt did not close.)

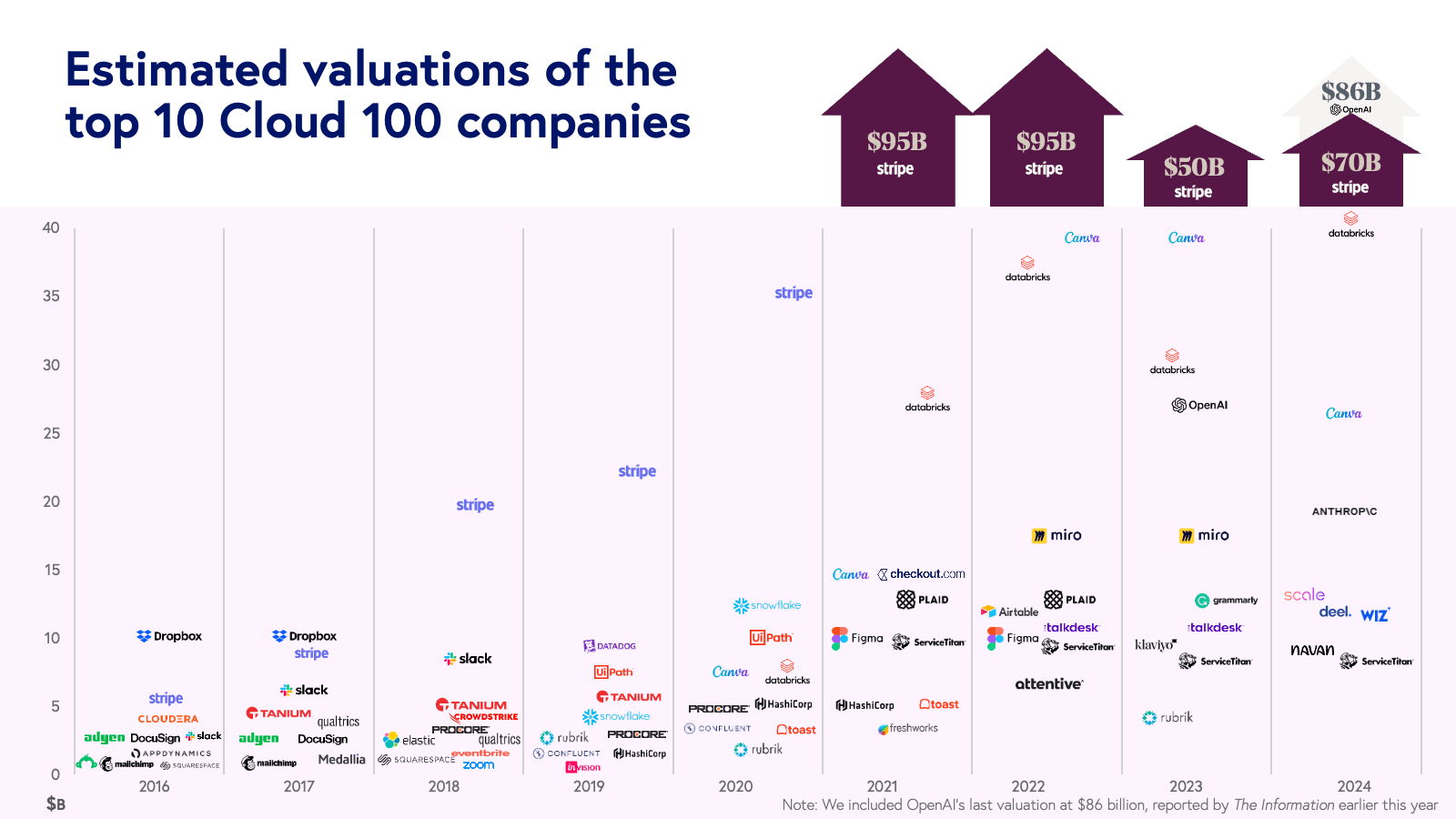

The top 10 Cloud 100 companies represent $299 billion of equity value alone, accounting for 36% of the list’s aggregate value (vs. 32% last year). The average valuation of the top 10 is larger than ever before at $29.9 billion, representing a 42% YoY increase, and $27 billion greater than that of the inaugural 2016 list. AI’s influence on the top 10 list cannot be ignored—not only are there two foundation model companies that rose to the top 10 within the past two years (Open AI and Anthropic), but also there are two data infrastructure companies that have experienced significant AI-fueled growth in their own businesses, which also resulted in notable financing rounds in the past year (Databricks raised at a $43 billion valuation in September 2023, and Scale AI raised at $13.8 billion in May 2024, nearly doubling its valuation).

While the top four companies remain the same as last year (OpenAI, Databricks, Stripe, Canva), Anthropic rose to claim the #5 spot, the largest mover on the list this year (+68 spots). Founded in 2021, the company was last valued at $19.4 billion as of January 2024 per PitchBook data. Since launching a year ago, Anthropic’s AI assistant Claude is now used by millions worldwide, while the company’s API powers tens of thousands of businesses, including Fortune 500 giants Pfizer and SAP, enterprise tools like Asana and Slack, and AI startups like Perplexity. Rounding out the top ten are ServiceTitan, Scale, Deel, Wiz, and Navan.

While the IPO environment is still far less active than in prior years—Klaviyo and Rubrik were the only two to IPO from 2023’s Cloud 100 list—the IPO window opened slightly in the first half of 2024. There were 11 technology IPOs that priced this year (vs. five total in 2023), totaling over $6.5 billion of issuance YTD (count is based on US IPOs over $50 million). Most recently, OneStream went public on July 23 and reached a market cap of $5 billion at IPO.

We do not think that the Cloud 100 cohort is far behind. Of the 2024 Cloud 100 companies, Coreweave, Cato Networks, and VAST Data are reportedly in the midst of IPO preparation, and we think that we will see more issuance in 2025.

Even as companies wait for the IPO window to open, they are building value privately. This has resulted in this year’s record-high valuations across the Cloud 100 and across the top 10 Cloud 100 companies in particular.

At $176 billion of aggregate value, AI overtook Design, Collaboration, and Productivity this year as the most valuable Cloud 100 category. The AI category has experienced meteoric growth in equity value over the last 24 months (up more than $100 billion in equity value from 2023’s Cloud 100!), as more foundation model companies (e.g., Mistral, Cohere), full-stack AI companies (e.g., Perplexity, Glean, Runway), and compute companies (e.g., CoreWeave, Lambda) all made it onto the list.

Fintech is the runner-up at $173 billion of aggregate value. The category was propelled by fintech giants like Ramp that raised $150 million this year at a $7.7 billion valuation, in addition to other needlemovers in the category like Brex, which was last valued at a $12.3 billion valuation. While both Ramp and Brex historically focused on the corporate card businesses, the launch of their software offerings like accounting automation, expense management, and vendor management now position them squarely in the cloud arena.

Cloud 100 companies are scaling faster than ever

The 2023 list valuation was down for the first time year-over-year, as private companies suffered from down rounds in a tough macro environment. But this year, the list value surged by +25% and reached a record height of $820 billion. By far the largest contributor to the rebound in Cloud 100 valuations is the AI category.

AI is a high-growth segment across both public and private markets, driving an influx of investor dollars at eye-popping valuations—yet they are largely pairing the high prices with revenue results. Companies like OpenAI, Anthropic, Perplexity, and more are ramping revenue at rates never seen before in historical cloud software companies, and investors are rewarding this meteoric growth with mega rounds at multibillion-dollar valuations.

In our 2022 Cloud 100 report, we debuted the concept of a Centaur, which is a $100 million ARR business. Over the years we’ve seen the length of time from company founding to Centaur status decrease steadily, from 10 years for the inaugural 2016 cohort down to 7.8 years for the 2024 cohort. Cloud 100 honorees in the AI category this year are scaling faster than others, averaging 6.3 years—and from what we’ve seen, not only are these AI giants eclipsing $100 million faster than ever, several are bending the curve on the ramp to $1 billion of ARR.

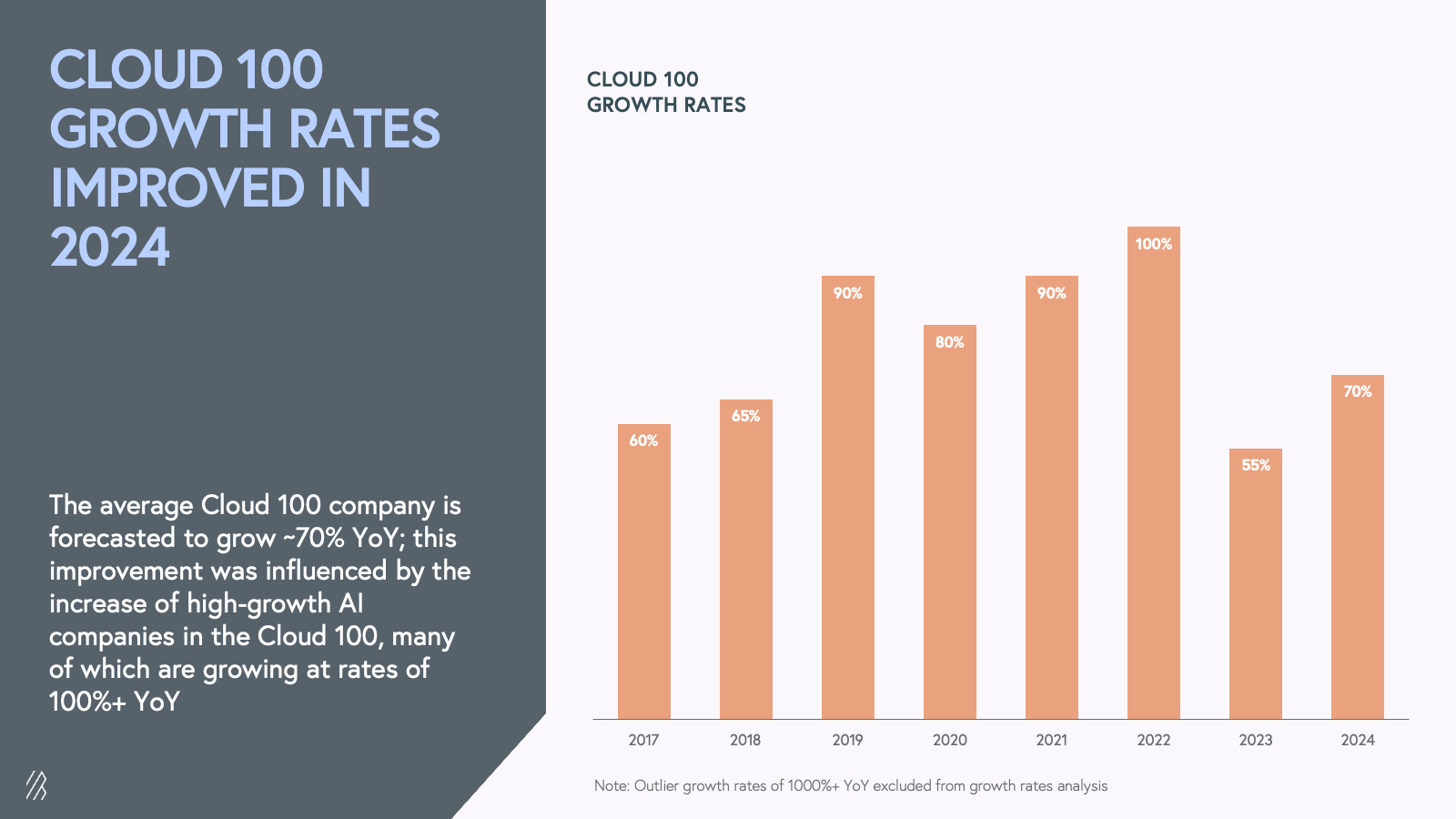

So, what’s enabling this hypergrowth? Beyond broad-based consumer demand for AI products and services, enterprises are increasingly demanding AI solutions to enhance efficiency, drive innovation, and maintain a competitive edge. AI companies are leveraging strategic partnerships with cloud providers to accelerate their reach, providing access to vast computational resources and cloud infrastructure. This hypergrowth is occurring at all layers of the new AI technology stack, from infrastructure to applications, across both B2B and B2C segments, as they redefine how we interact with software. The success of AI companies in bending the scaling curve has also influenced average Cloud 100 growth rates. The average Cloud 100 revenue growth rate fell to a record low of 55% year-over-year in 2023; however, this has rebounded incredibly to 70% for the 2024 cohort.

The enduring growth of Cloud 100 companies also helps explain why in a period when cloud ARR multiples have continued to reset, we’ve still seen the overall total valuation of the Cloud 100 cohort increase to record highs. For the third year in a row, the average Cloud 100 multiple has decreased, from 26x in 2023 to 23x (down 31% vs. the high in 2021). We expect that private multiples will continue to compress and revert close to long-term software averages, adjusted for their growth rates—for reference, the average public BVP Cloud Index company is currently trading ~6x ARR.

Celebrating Cloud’s rebound from a period of macroeconomic uncertainty

While we are in no way fully out of the proverbial "woods" of today's thorny macroeconomic environment, as the relatively tepid IPO market and still-correcting ARR multiples suggest, this year’s Cloud 100 list celebrates the impressive achievements of cloud companies who astutely navigated the challenges that faced them. The result is a Cloud 100 cohort that has generated record-high valuations and record-fast timelines to reaching Centaur status.

Looking ahead, we are enthusiastic for all the innovation yet to come in this dynamic market—whether it be in AI continuing to augment the trajectory of cloud incumbents and newcomers across the list, or more companies graduating as the chilled exit environment thaws. See you for next year’s Cloud 100, when this definitive ranking of the world’s top cloud companies will be celebrating its 10th edition!

Note: This report relies on valuation data available as of July 31, 2024, and the total 2024 Cloud 100 list value excludes Midjourney’s valuation, as it has not held a publicly reported financing.

2023 Cloud 100 Benchmarks

Today Bessemer Venture Partners, Forbes, and Salesforce Ventures announced the 2023 Cloud 100 List, the definitive ranking of the top 100 private cloud companies. And this year’s list feels different – is different – for two core reasons.

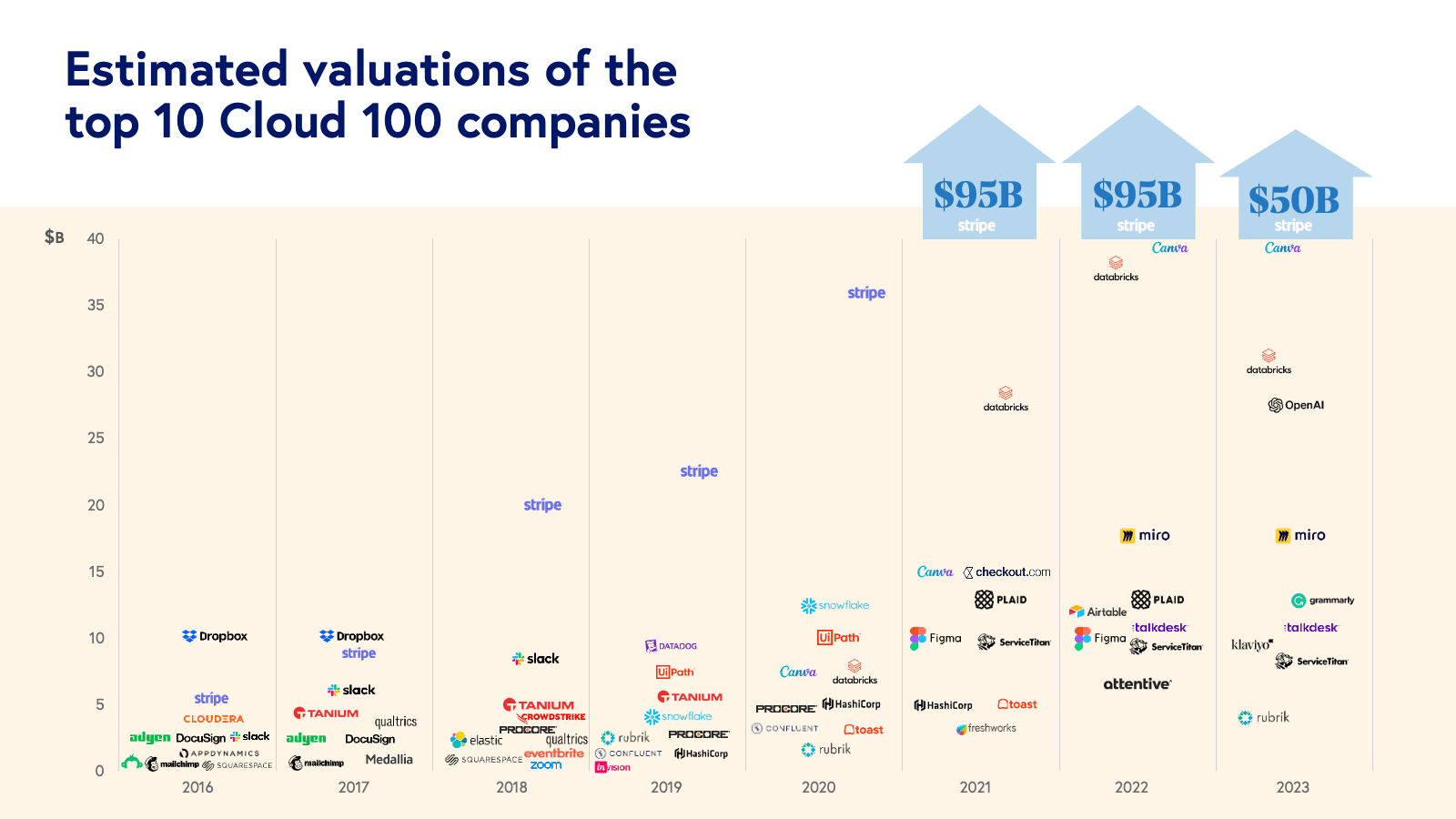

First, for the first time ever, the aggregate Cloud 100 list value actually contracted in value year-over-year. Last year, the bar for inclusion in the Cloud 100 was incredibly high: not only did all the 2022 Cloud 100 honorees reach the $1 billion valuation milestone, but also the average Cloud 100 valuation skyrocketed to $7.4 billion. However, 2022 was one of the most challenging years in recent history for the cloud economy as companies dealt with macroeconomic uncertainty, tightened IT budgets, elongated sales cycles, layoffs, and valuation multiple compression. These headwinds combined and made 2023 the first year in which the aggregate value of the Cloud 100 contracted year-over-year to $654 billion, down 11% versus the 2022 list value.

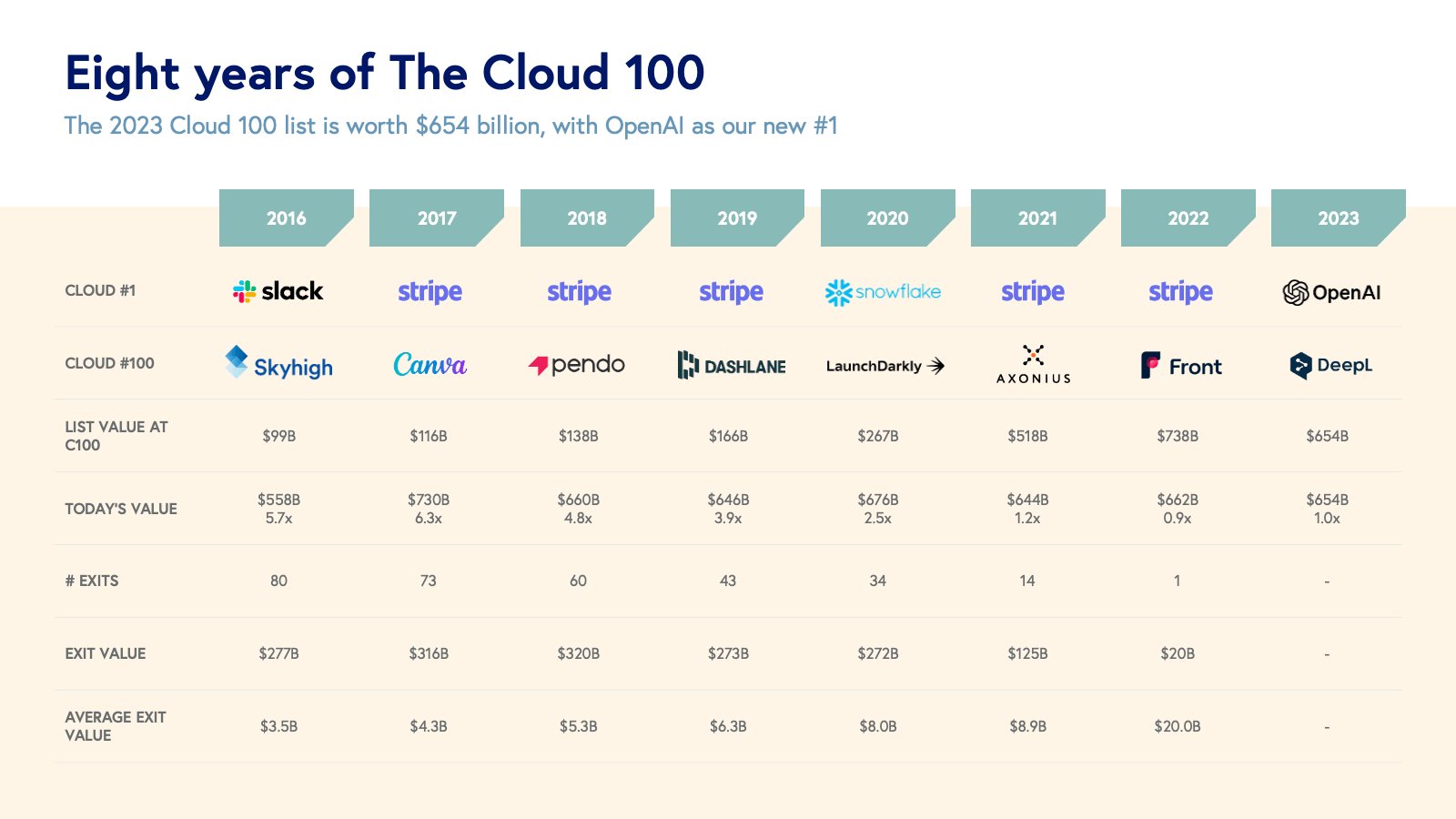

Second, despite this bleak backdrop, AI emerged as a shining light for the cloud ecosystem. The AI revolution propelled many of the movers and shakers on the 2023 Cloud 100 list. OpenAI not only made the list for the first time, but it also replaced Stripe in earning the top spot as #1 on the list. Databricks, another company making big investments into AI, also moved to the #2 spot. Embedded AI catalyzed growth in the highest-valued cloud category, “Design, Collaboration, and Productivity”, and AI-Native was by far the most highly valued category of new entrants to the list. These shake-ups make this year’s Cloud 100 list one of the most dynamic in history, and we believe the cloud economy will continue evolving as we enter the Age of AI.

With eight years of Cloud 100 data behind us, in this year’s Benchmarks Report we reveal Bessemer’s analysis and insights into the 2023 Cloud 100 cohort and what it tells us about the exciting future ahead for the cloud economy.

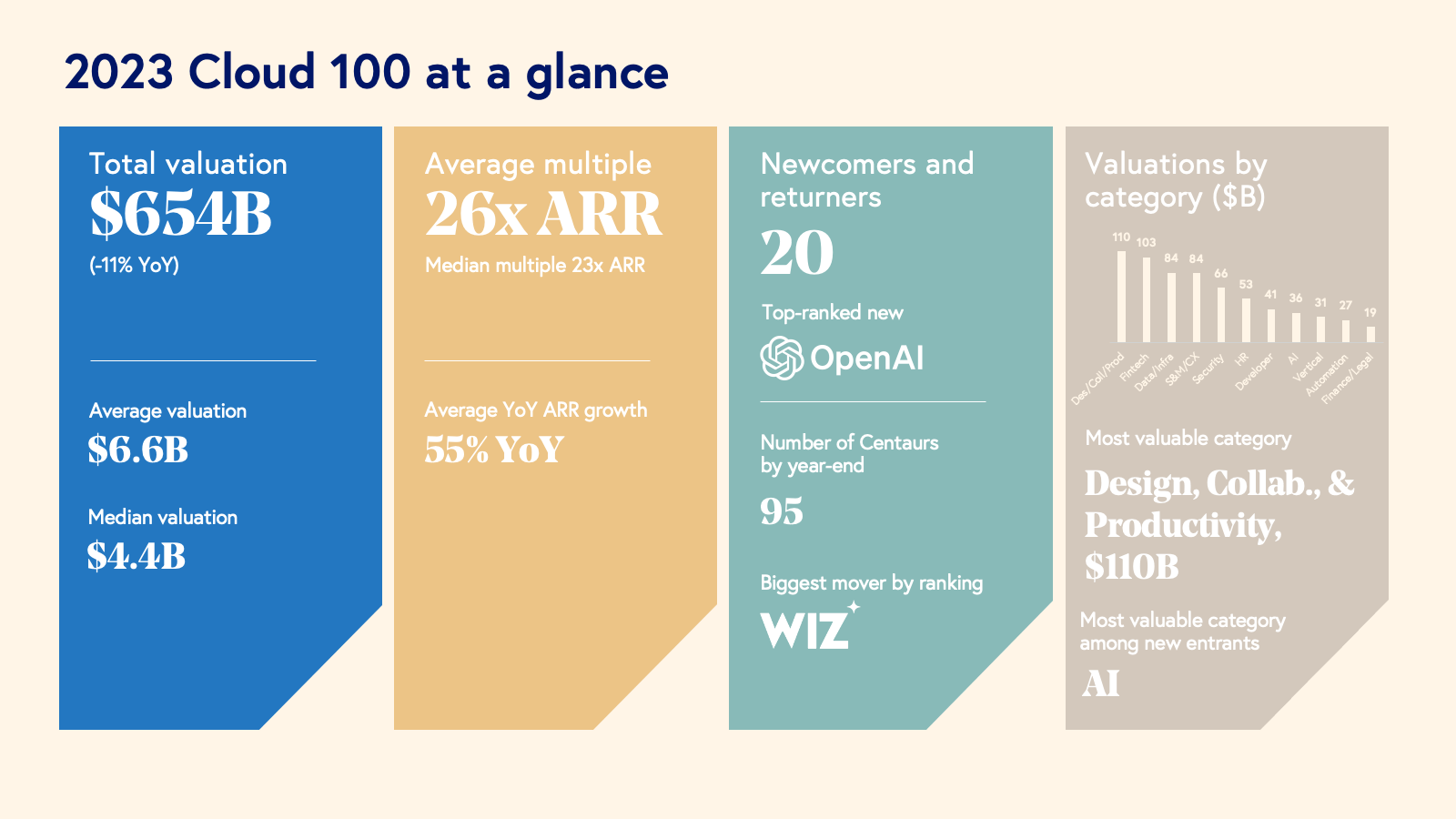

Top highlights:

- The 2023 Cloud 100 is worth an aggregate $654 billion vs. $738 billion in 2022, representing an 11% decrease year-over-year. Nonetheless, the top 10 Cloud 100 companies still represent an astounding $211 billion of equity value (32% of list value) and the average Cloud 100 company is worth $6.6 billion.

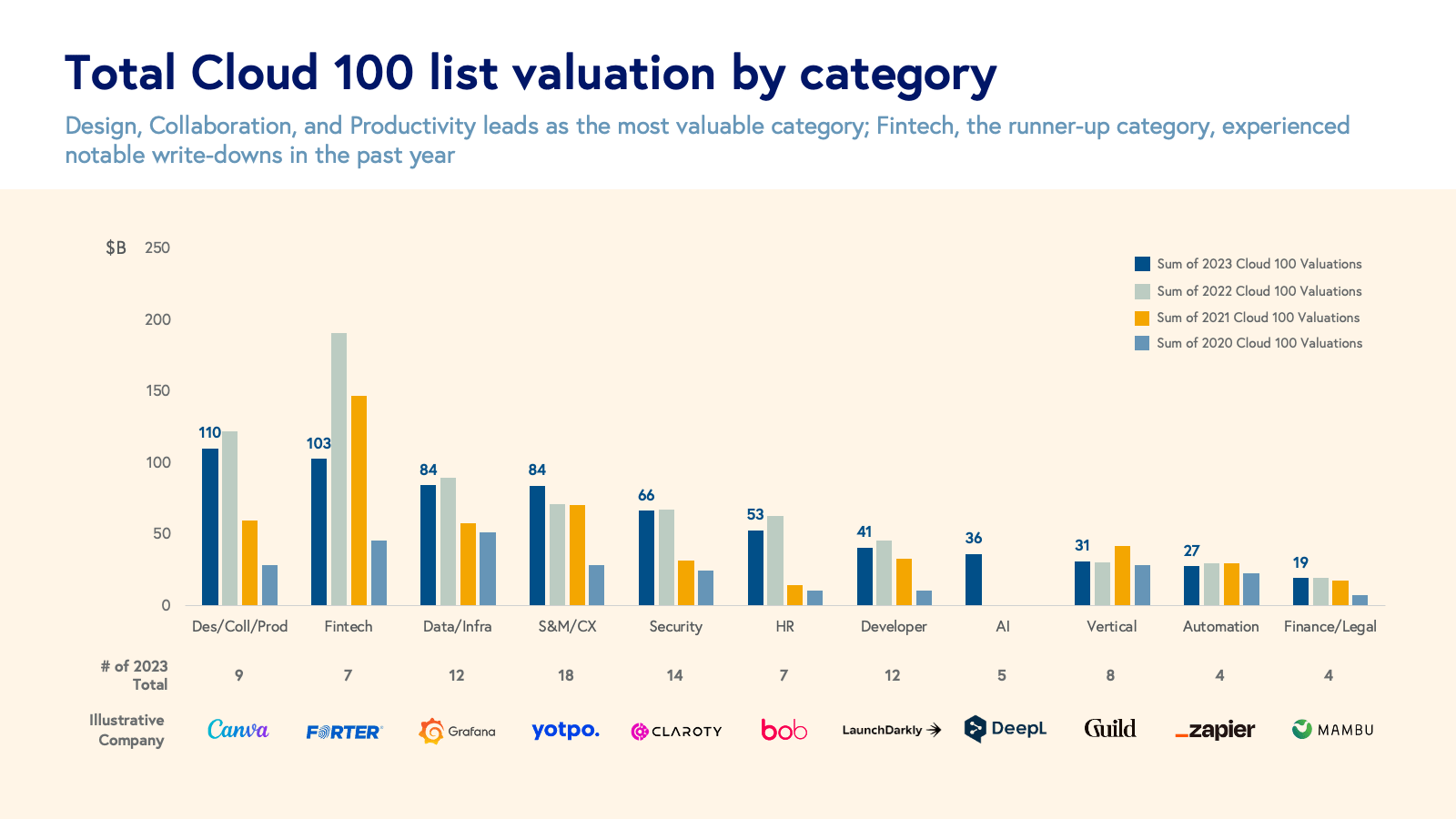

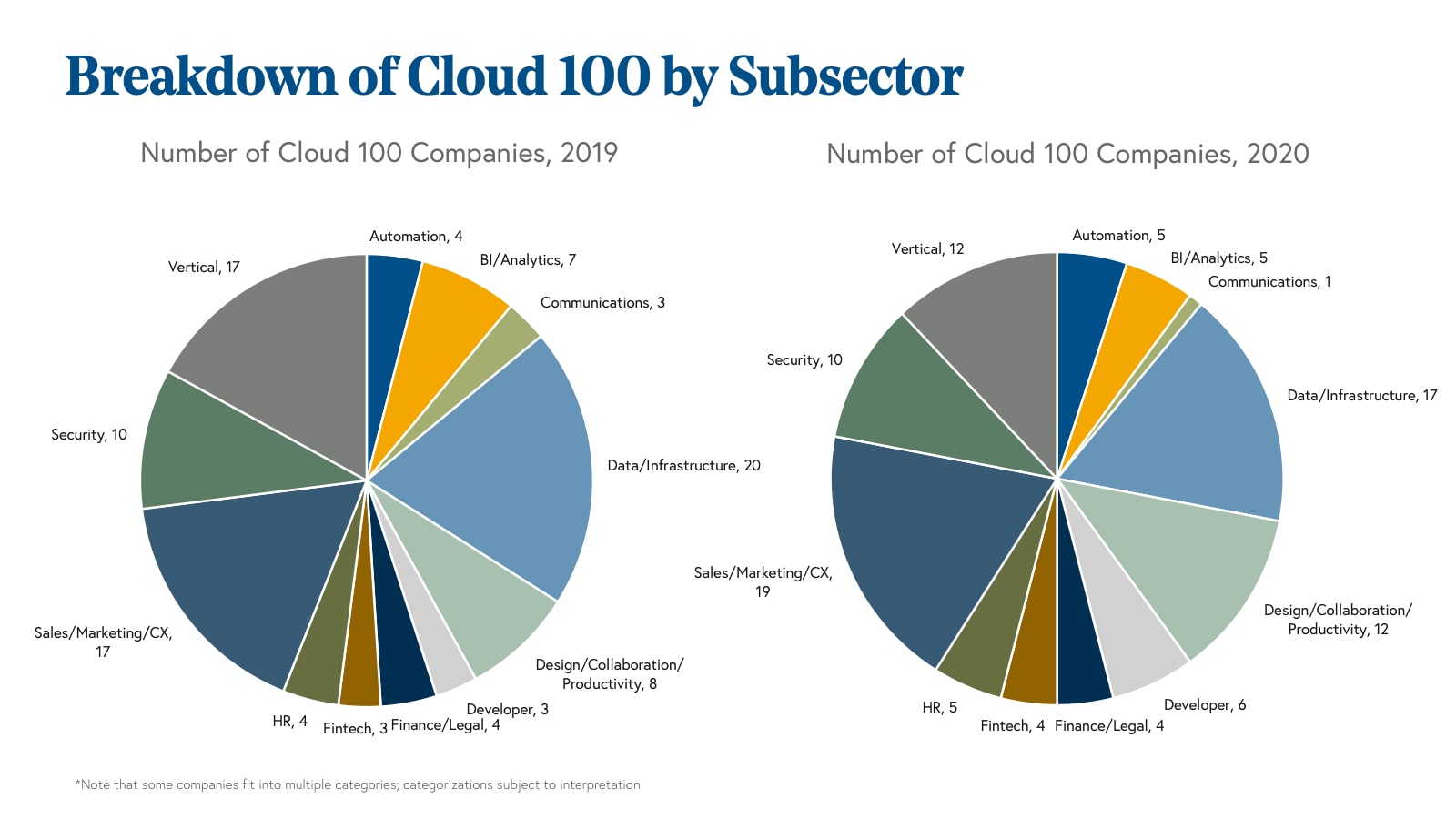

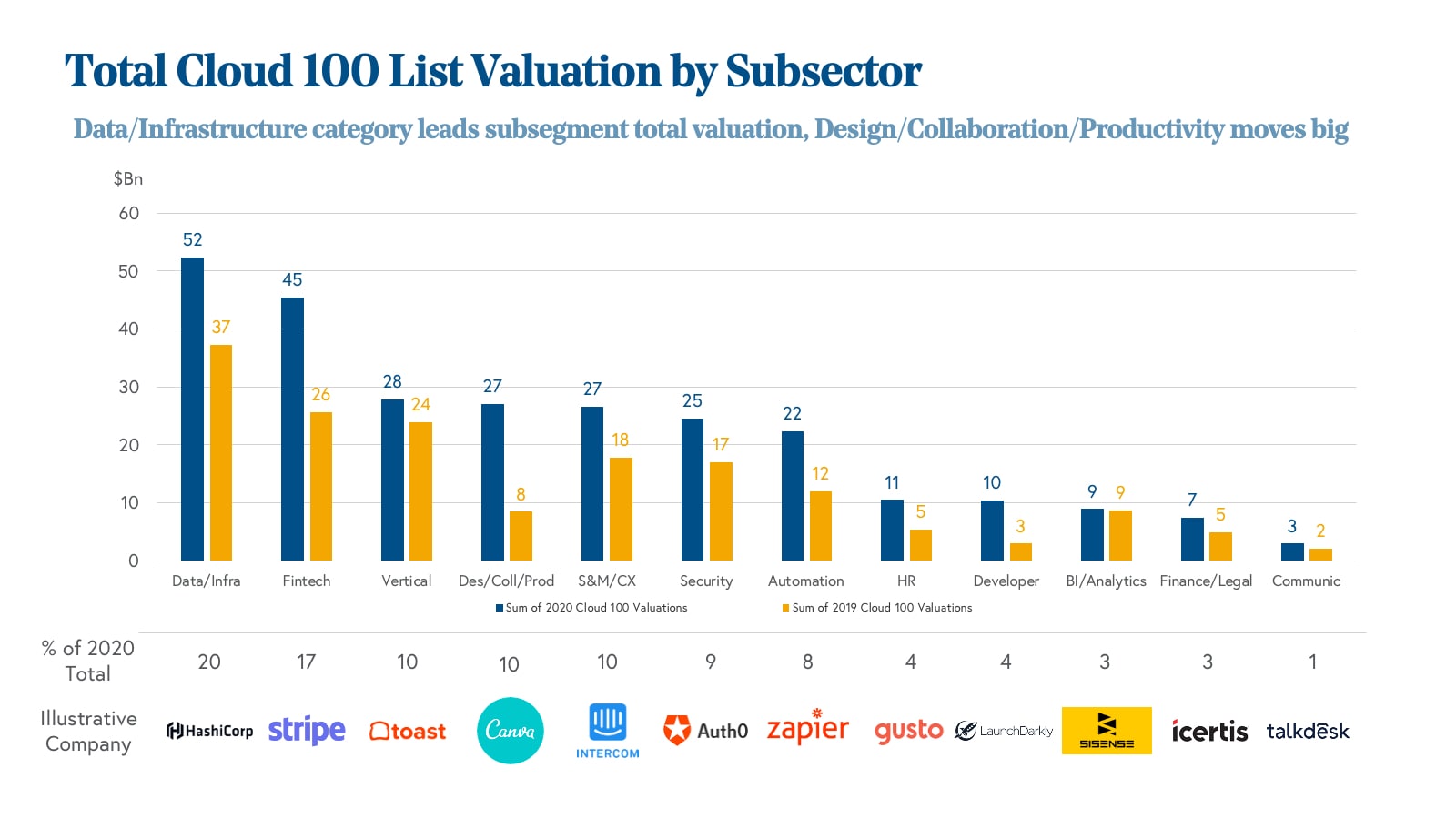

- This year, Design, Collaboration, and Productivity is the highest valued category at $110 billion (17% of list value), followed by Fintech at $103 billion (16% of list value), the highest category last year. (We evaluate Cloud 100 entrants in 12 different categories of cloud computing: AI; Data and Infrastructure; Fintech; Design, Collaboration, and Productivity; Sales, Marketing, and CX; Security; Finance and Legal; Automation; HR; Developer; and Vertical Software.)

- We introduced AI as a new standalone category this year, with all 5 AI-native companies in the category making their debut on the Cloud 100 list this year. While the core AI category represents $36 billion in total equity value, we’ve seen the impacts of AI across almost every category; in particular, nearly every company in this year’s leading Design, Collaboration, and Productivity category has openly embraced integrating AI into their product capabilities.

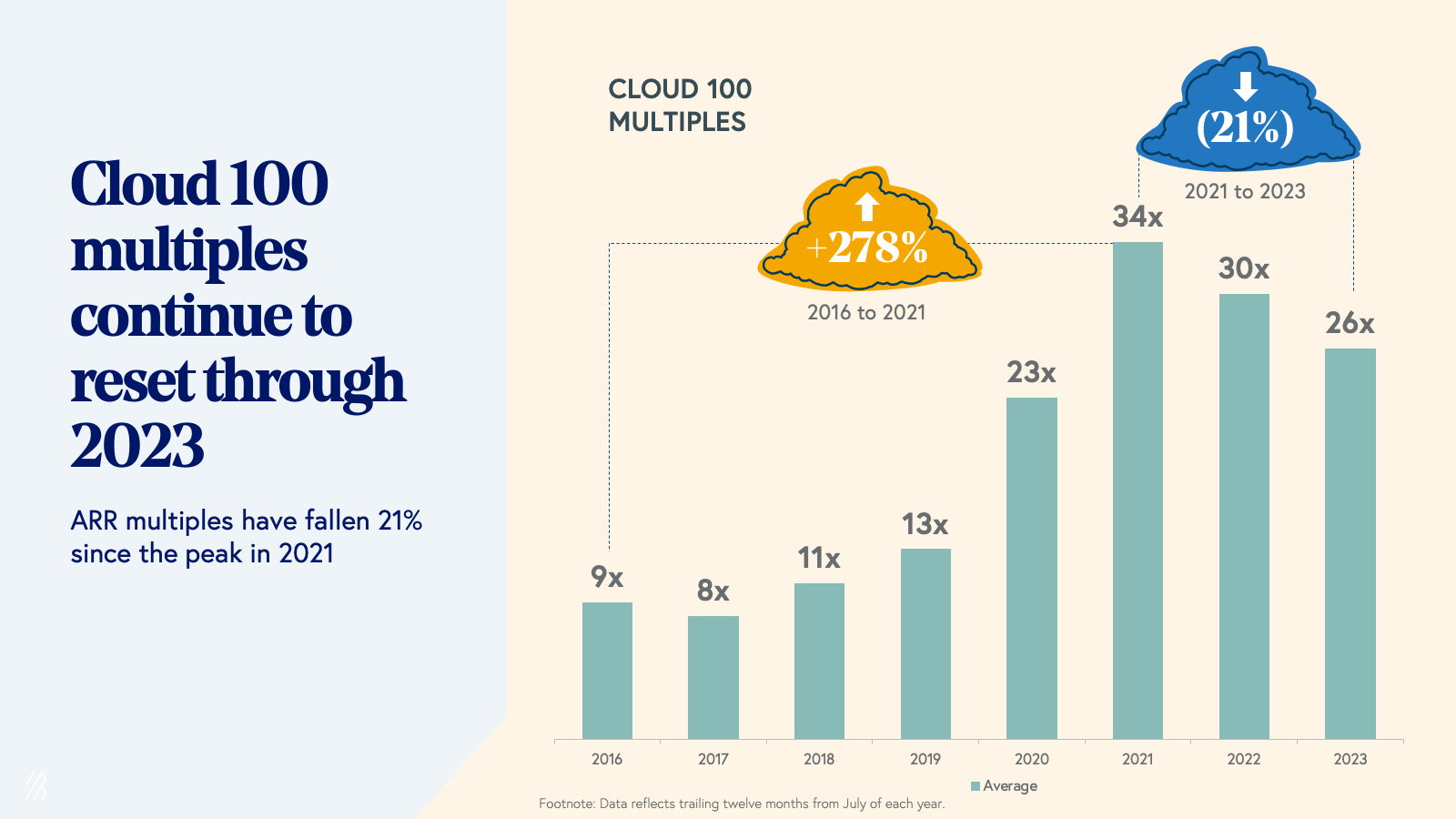

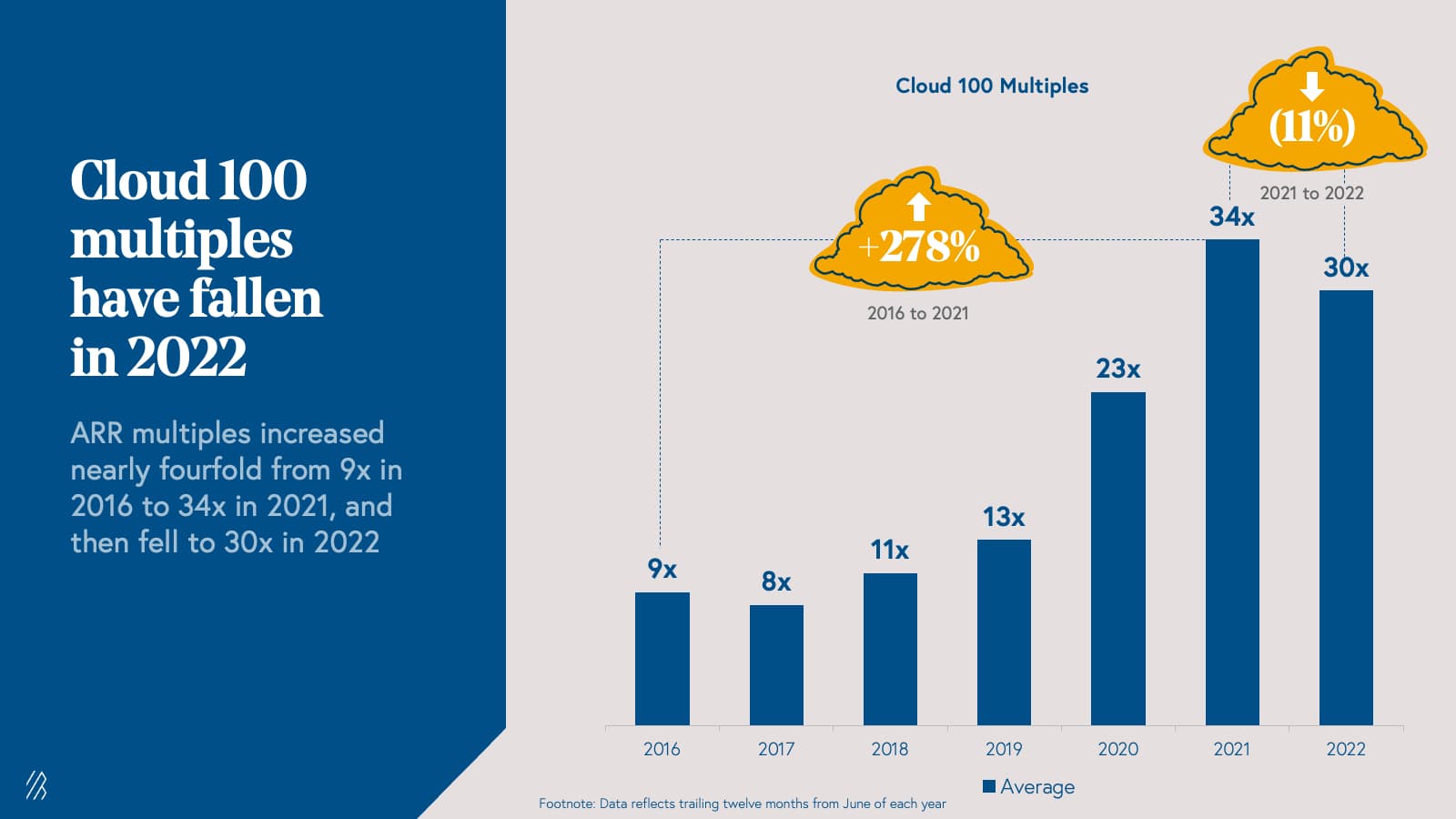

- Private cloud multiples are now reflecting the impact of the public market reset that began at the start of 2022. The average Cloud 100 multiple decreased for the second year in a row, down to 26x from 30x last year, representing a 21% decline since the 2021 peak of 34x.

- Last year, we introduced the “Centaur,” a $100 million+ ARR business. In 2022, ~80% of companies on the Cloud 100 list were forecasted to become Centaurs by the end of the year; this year’s list of honorees has raised the bar, with ~95% of honorees forecasted to reach $100 million of ARR by the end of the year.

The 2023 Cloud 100 at a glance: a year with major changes and shake-ups

The 2023 Cloud 100 list represents an astonishing $654 billion of equity value, with an average company valuation of $6.6 billion. Still, this is the first year in which the cumulative Cloud 100 list value contracted year-over-year, largely due to down rounds. (Note that the total list value of The Cloud 100 excludes Midjourney's valuation, as it has not conducted a publicly reported financing.)

Despite this backdrop, 2023 was one of the most competitive years in history for honorees to make the Cloud 100 list, since there was only one graduate off of the 2022 list, design software company Figma. Adobe announced its $20 billion acquisition of Figma in September 2022, though the acquisition is still in process. Adobe’s proposed price valued the company at 50x current ARR, representing one of the highest acquisition multiples in history. While the deal has not yet closed, it exemplifies that best-in-class cloud companies can command a valuation premium even in tough economic conditions.

20 newcomers and returners nonetheless earned their spots on the 2023 Cloud 100 list, largely fueled by the AI revolution. In a testament to the rise of AI, the highest-ranked new entrant was OpenAI, which earned the #1 spot on this year’s list. Stripe has had a stronghold on the top spot for four of the last five years, having briefly been replaced by Snowflake until its IPO in 2020. Alongside OpenAI, other newcomers and returners include Dialpad (#25), Appsflyer (#27), Zoho (#41), Druva (#49), Komodo Health (#56), Browserstack (#58), Retool (#64), ContentSquare (#66), Anthropic (#73), Abnormal (#80), Vanta (#82), Midjourney (#85), Brightwheel (#86), Tekion (#87), Moveworks (#92), Orca Security (#95), Cribl (#96), Hugging Face (#98), and DeepL (#100).

The biggest mover title for 2023 went to cloud security company Wiz, which moved up +67 spots to #15 on the Cloud 100 list. Wiz closed its latest $300 million financing in February 2023, valuing the company at $10 billion. The strength of this financing is notable given the overall decline in list value as well as the backdrop of muted VC fundraising activity, especially at the growth stage. Months before that, Wiz announced that it had reached Centaur status—$100 million of ARR—in a record-breaking speed of just 18 months!

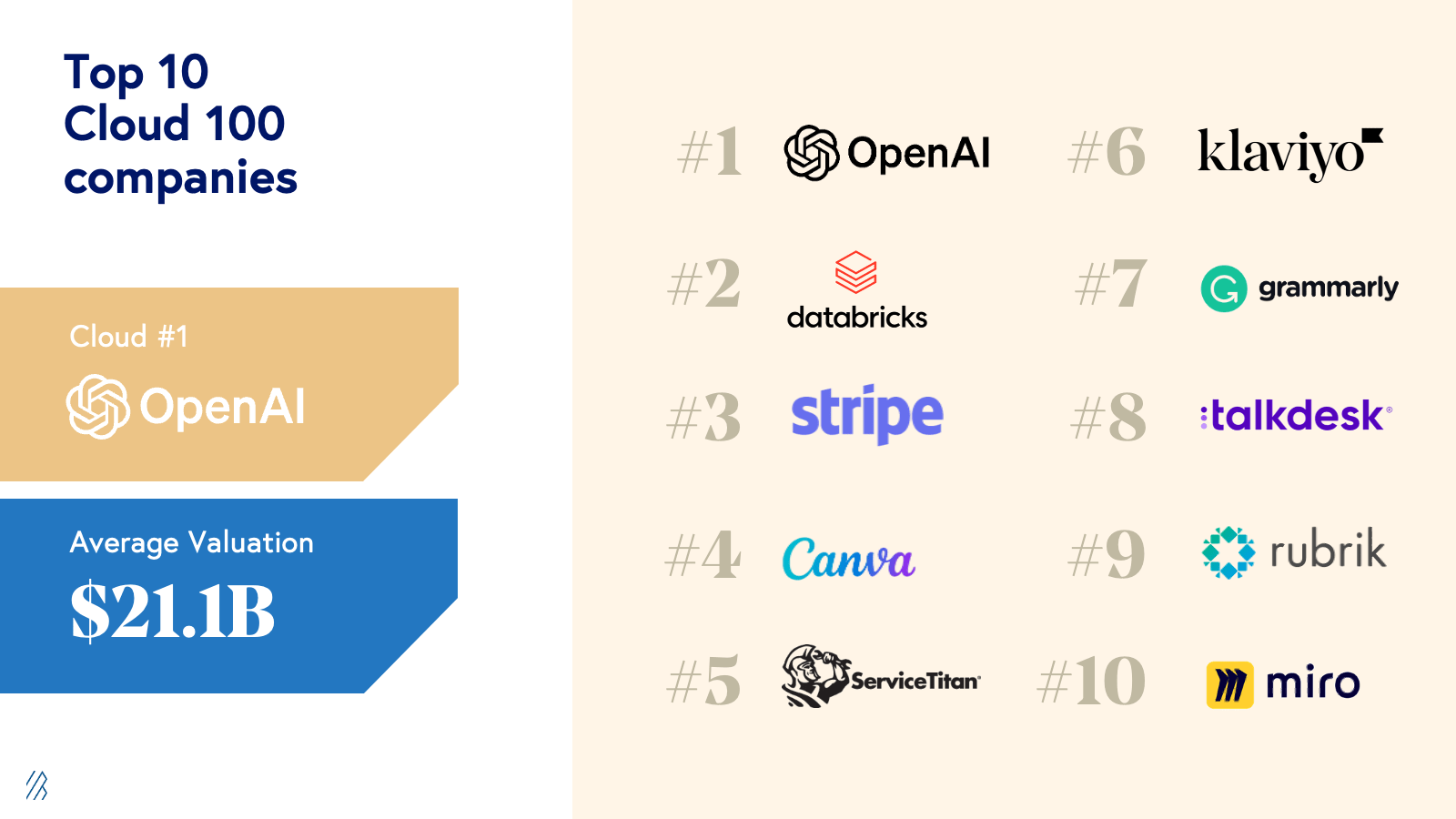

The top 10 Cloud 100 companies represent $211 billion of equity value alone, accounting for 32% of the list’s aggregate value. New entrant OpenAI earned the #1 spot with its multi-billion megaround led by Microsoft earlier this year at a $29 billion valuation. Another big move within the Top 10 was Databricks, which moved ahead of Stripe, last year’s #1. Databricks is another company that has embraced AI over the last year, having recently announced its acquisition of MosaicML, its launch of its own large language model (Dolly 2.0), and its launch of the Lakehouse AI platform. Last year’s #1, Stripe, rounds out the Top 3. Joining them in the top ten are Canva, ServiceTitan, Klaviyo, Grammarly, Talkdesk, Rubrik, and Miro. The top 10 average a $21 billion valuation individually, up +$18 billion from the inaugural 2016 list.

While the IPO window has been frozen over the last year-and-a-half, there are signs of life. Companies are beginning to test the waters—non-cloud companies like restaurant chain Cava have gone public over the last two months, and there are indications that shoemaker Birkenstock and chip maker Arm will go public as early as September. Combined with slowing inflation and the market’s indication that it has priced in the impact of recent interest rate hikes, the capital markets have become more predictable. We anticipate that this will lead to many Top 10 Cloud 100 companies soon making public exits and paving the way for others. It has been reported that companies such as Stripe, Klaviyo, Talkdesk, and Rubrik, have been ramping up IPO discussions and preparations.

At $110 billion of aggregate value, the Design, Collaboration, and Productivity category has now overtaken Fintech as the most valuable Cloud 100 category, largely because these companies have recently supercharged their business models and revenues by leveraging AI. As brief examples, Canva released a suite of AI-powered image design and text capabilities, Grammarly launched GrammarlyGO, its enterprise-grade AI text generator and editor, and ClickUp released an AI-powered productivity assistant. Fintech, last year’s leading category, was the second most valuable category this year at $103 billion. It felt downwards pressure from high-profile write-downs from companies—for instance, Stripe’s March 2023 Series I funding round valued the company at $50 billion (down from its prior Series H valuation of $95 billion), and Checkout.com reportedly lowered its internal valuation from $40 billion to $11 billion in December 2022.

Sales, Marketing, and Customer Experience software continues to be the category with the most Cloud 100 companies, at an impressive 18. This category includes the likes of Yotpo, Attentive, and Intercom. The most represented category for newcomers to the Cloud 100 was AI, including OpenAI, Anthropic, Midjourney, Hugging Face, and DeepL, with an estimated combined valuation of $36 billion.

AI takes center stage

The impact of AI on the 2023 Cloud 100 list cannot be understated: 55 Cloud 100 honorees have announced a generative AI product or feature in the last eight months, and 70 are using AI or ML (generative and otherwise) in their products today. Of the 70 companies using AI or ML, 65 honorees have embedded AI, meaning they have added AI tooling and capabilities to enhance their core applications, while five are AI-native, meaning they were designed from the ground up to incorporate generative AI as a core component of their product architecture.

Many of this year’s honorees have embedded generative AI to enhance and streamline workflows in their flagship applications, improving both user productivity and experience. Some have taken the “AI assistant” product approach, using large language models (LLMs) to auto-generate everything from email and SMS content to marketing copy to code suggestions. Others are launching entirely new product lines built from generative AI, like Intercom’s Fin, a GPT-4 powered chatbot, and Zapier’s AI-powered natural language actions API, which allows customers to use natural language prompts to link information and build workflows between applications.

Embedding AI isn’t the only way to capture value—companies are also acquiring these capabilities via M&A, and others are building AI-native apps from the ground up. Cloud 100 honorees like OpenAI, Anthropic, Midjourney, Hugging Face, and DeepL have built their products with a generative AI-first architecture and rely on AI-driven products and research to drive their business strategy.

In this deep dive section, we look at how Cloud 100 honorees Cloudinary, Databricks, and DeepL have taken embedded AI, acquired AI, and AI-native approaches, respectively, to enhance their product offerings and deliver more value to their customers.

Case Study: How Cloudinary is embedding generative AI

Founded in 2012, Cloudinary (#81 on the 2023 Cloud 100) is a cloud solution for managing digital media assets — whether a furniture brand wants to offer a 360° view of its latest sofa, or a large corporation wants to optimize its high-quality images for faster website load speeds on smartphones, the Cloudinary platform helps businesses improve their visual media experiences and workflows.

With the help of generative AI and LLMs, Cloudinary recently introduced new generative AI features that enhance the capabilities of its Programmable Media image and video APIs. Generative Fill, for instance, makes it possible for users to expand images with matching content, and Generative Remove and Replace features enable users to remove and replace unwanted objects from images without the need for reshooting. New natural language features, like AI-Powered Image Captioning and Conversational Transformation Builder, help technical and non-technical users quickly caption images and make transformations via ChatGPT—for example, instead of coding, users can type conversational language commands, like “remove the dog using AI,” to prompt Cloudinary to remove a dog from an image without disturbing the existing background.

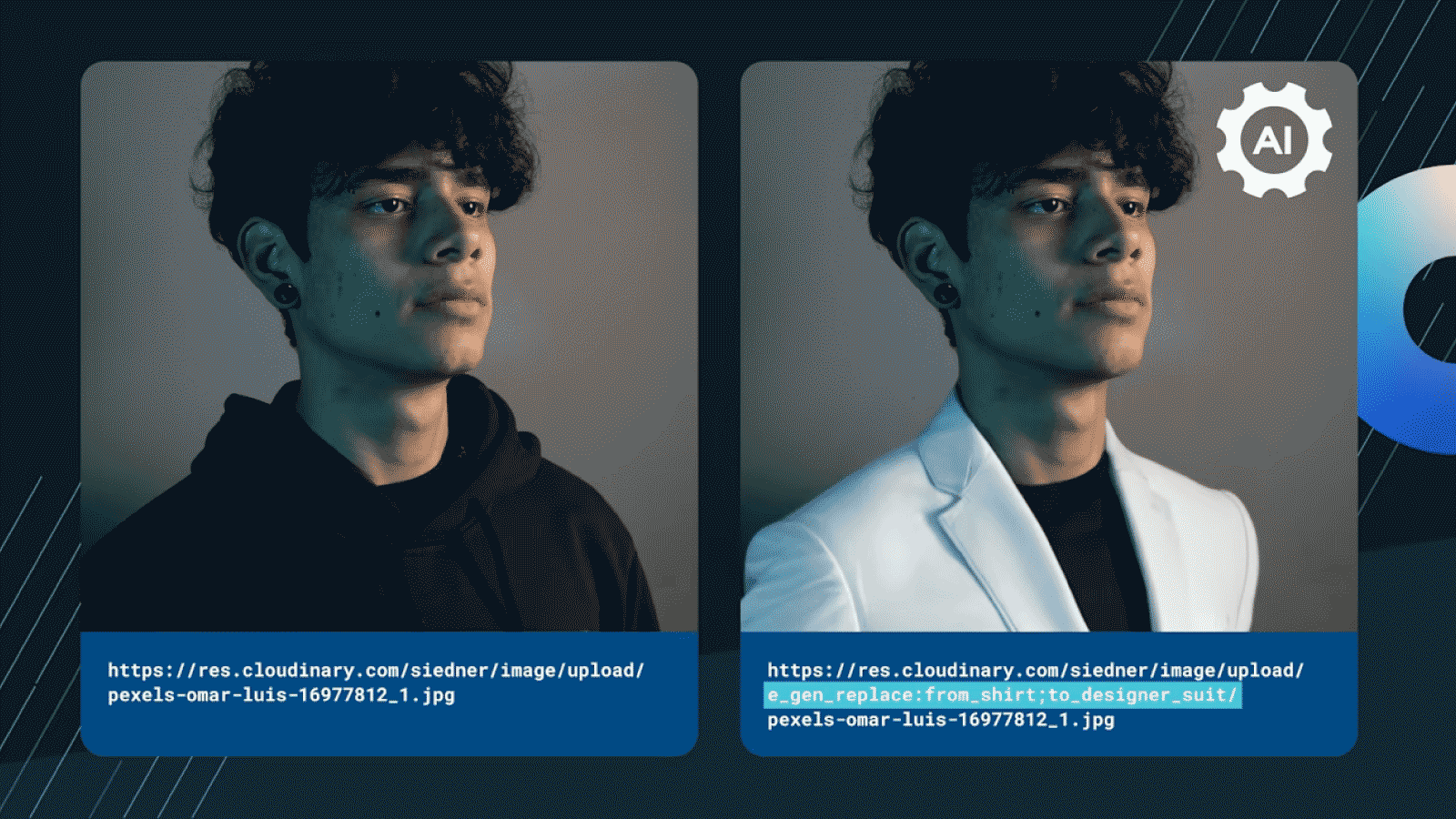

The above image depicts Cloudinary’s new Generative Replace feature, which uses natural language prompts to detect and replace objects in photos. In this case, AI identifies and transforms the subject’s black sweatshirt to a white designer suit using the following prompt: “gen_replace:from-shirt;to_designer_suit.”

These AI-embedded features not only facilitate productivity gains for users, but also expand Cloudinary’s total addressable market (TAM) and drive customer growth. By making it possible for non-technical professionals to make what used to be developer-grade media modifications, and by hastening the creative process, Cloudinary’s AI strategy will help the company reach new user personas, like marketers. And selling additional seats to adjacent customers will enable Cloudinary to increase the account value of its customers, a move that increases net dollar retention and revenue growth over time.

Case Study: How Databricks is cementing its AI leadership through acquisitions

In the AI era when moving fast is rewarded, acquiring capabilities is another way that Cloud 100 winners are maintaining an edge. Databricks (#2 on the 2023 Cloud 100) acquired MosaicML, a pioneer in large language model operations (LLMOps), for $1.3 billion, adding to its strong, internally-developed AI capabilities.

Founded in 2013, Databricks makes software that helps organizations store and transform massive datasets, while MosaicML enables companies to train and deploy their own generative AI models. Concurrent with the MosaicML acquisition, Databricks unveiled Lakehouse AI, a suite of tools for building and governing generative AI models, including LLMs within the Databricks platform. Earlier in the year, Databricks had released Dolly, an LLM trained for less than $30 to exhibit ChatGPT-like human interactivity (aka instruction-following), as well as Dolly 2.0 which it touted as “the World's First Truly Open Instruction-Tuned LLM. ”

Now with MosaicML onboard, Databricks customers have access to a cost-effective, unified platform to manage and analyze their data at scale. By making it simpler than ever for companies to deploy proprietary machine learning models—helping them with everything from fraud detection and drug discovery to modernizing their business intelligence processes—Databricks’ acquisition of MosaicML expands the capabilities of their infrastructure offers, enhancing current customers and bringing on new businesses that are hindered by their existing data architecture setup and costs.

Case Study: How AI-native DeepL is breaking language barriers

Lastly, DeepL (#100 on the 2023 Cloud 100) is transforming the $60 billion language services provider market with its AI-native architecture. DeepL generates real-time language translations that capture cultural context and resonate with native speakers. Unlike traditional translation options that often fall short in providing accurate and culturally aware results, DeepL uses neural machine translation (NMT) and deep learning to provide high-quality translations. By utilizing NMT models, DeepL captures context and nuances of language more accurately, making it the platform of choice particularly for business users who are seeking to translate contracts, corporate communications, and other key business documents in which translation errors might be deleterious.

Deep learning is a way to train computers to process new information just like the human brain does. At DeepL, this approach ensures that the company’s models learn complex language patterns, making them adaptable to linguistic nuances and continuously improving over time. Deep learning with NMT is helping DeepL sell to different markets and use cases, ranging from consumers and small teams to full API access plans. DeepL’s Translator product helps enterprise customers sharpen their customer support chatbots, communicate internally across geographies, and securely translate sensitive information. And translation is only the beginning for DeepL— the team recently introduced DeepL Write, a generative AI writing assistant that’s built on neural network technology, just like DeepL Translator. Now with a multi-product suite of solutions, DeepL serves a broader customer base of creators, professionals, and teams with writing-heavy workloads. With each new solution, DeepL is set up to cross-sell to a new segment or team, deepening engagement and retention with customers and driving more value for the business.

Cloudinary, Databricks, and DeepL exemplify AI’s transformative capacity to increase productivity, expand product use cases, and strengthen cloud software business models. Whether embedded, acquired, or built natively, AI has expanded the product capabilities and improved user experience for customers in a way we’ve never seen before. It enabled our spotlight companies to democratize creative content generation for non-technical users through embedded AI (Cloudinary), empower customers to develop their own proprietary models through acquisitions like MosaicML (Databricks), and deliver higher fidelity translations via AI-native architecture (DeepL). The impact of generative AI on our Cloud 100 honorees list is undeniable, and we expect that it will continue to drive innovation and enhance user experience across software more broadly.

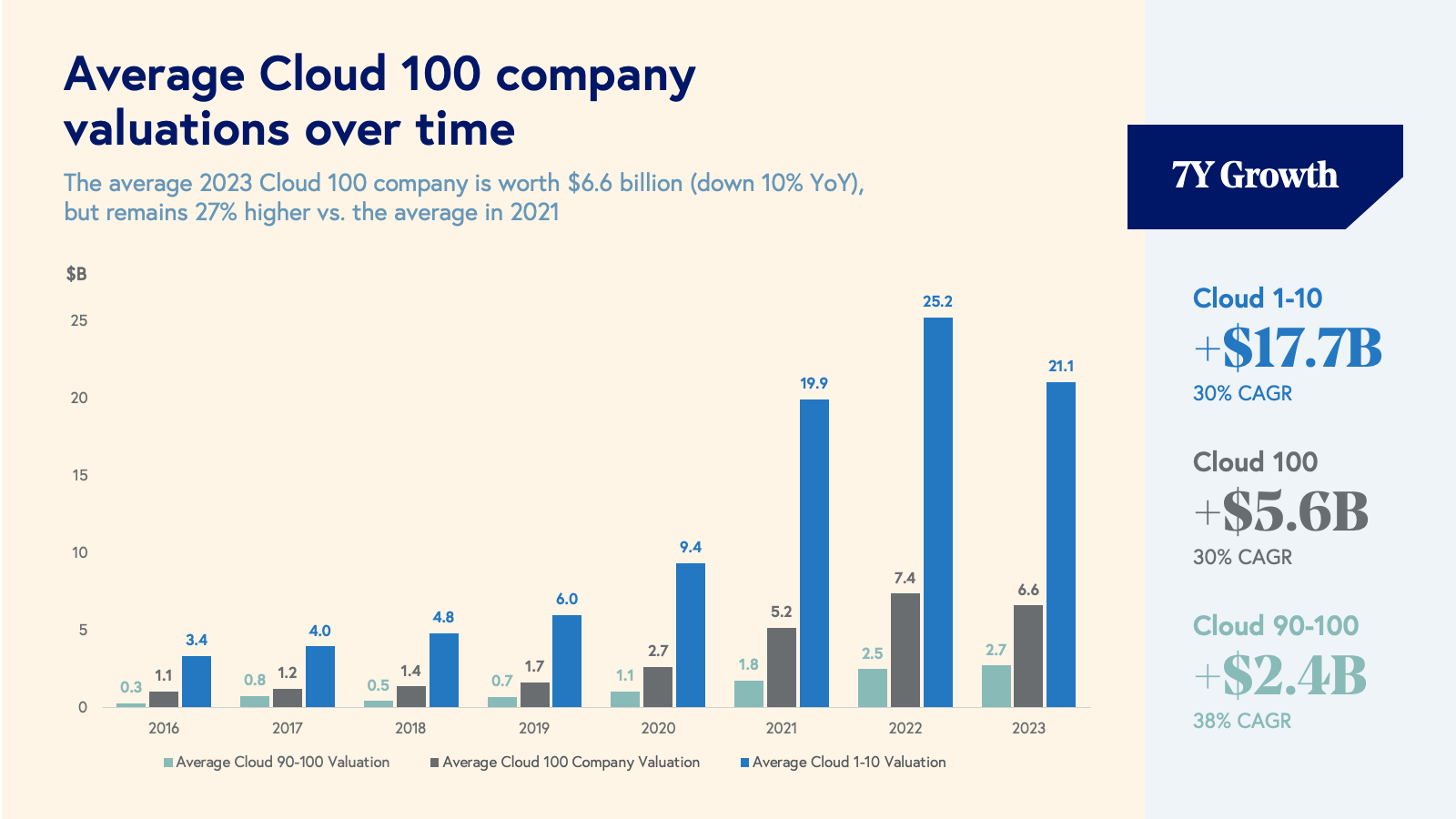

Cloud fundamentals check in: Centaurs, multiples, and efficiency

The average 2023 Cloud 100 company valuation is $6.6 billion—down 10% year-over-year, but still 27% higher than the 2021 average valuation, even as the macro environment has deteriorated over the last 18 months. As we noted last year, however, valuations are not always reflective of a company’s fundamental value, especially when capital is easily accessible and markets are frothy. This golden truth is even more pertinent in today’s challenging environment where the already significant gap between fundamentals and valuations is growing even wider.

This is why we introduced the concept of the Centaur, a $100 million ARR business as a more reflective milestone of performance. Last year, we expected 80% of the 2022 Cloud 100 honorees to reach the Centaur milestone by the end of the year. For the 2023 Cloud 100 cohort, we expect to reach ~95% by the end of the year, strengthening our conviction that the cloud market has a bright future ahead despite all the doom and gloom of the last year. That’s right – ~95% of the Cloud 100 will have $100 million or more of ARR by the end of 2023. This includes companies like Zapier, Canva, Cohesity, and Wiz, which has announced reaching $100 million ARR faster than ever.

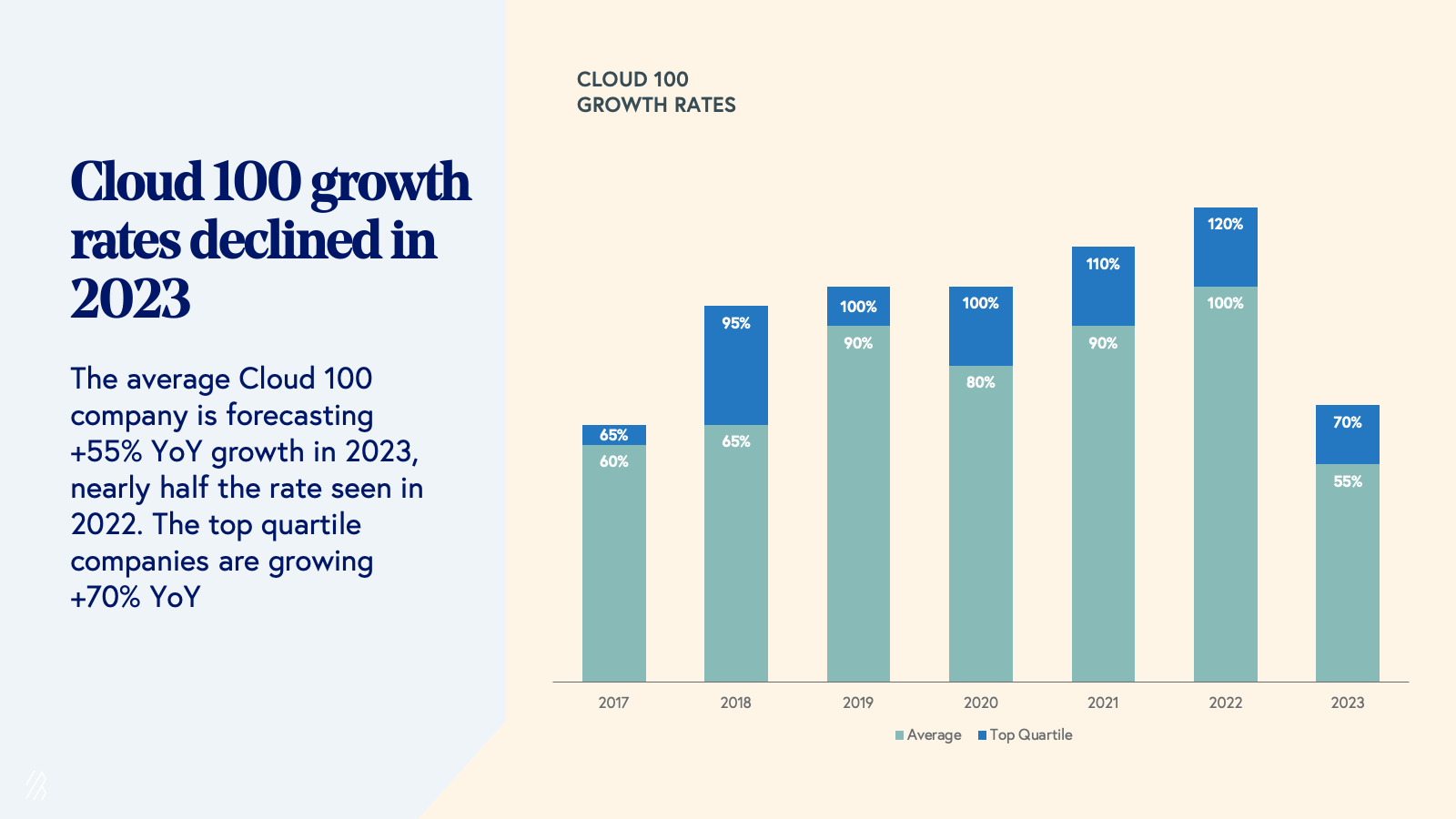

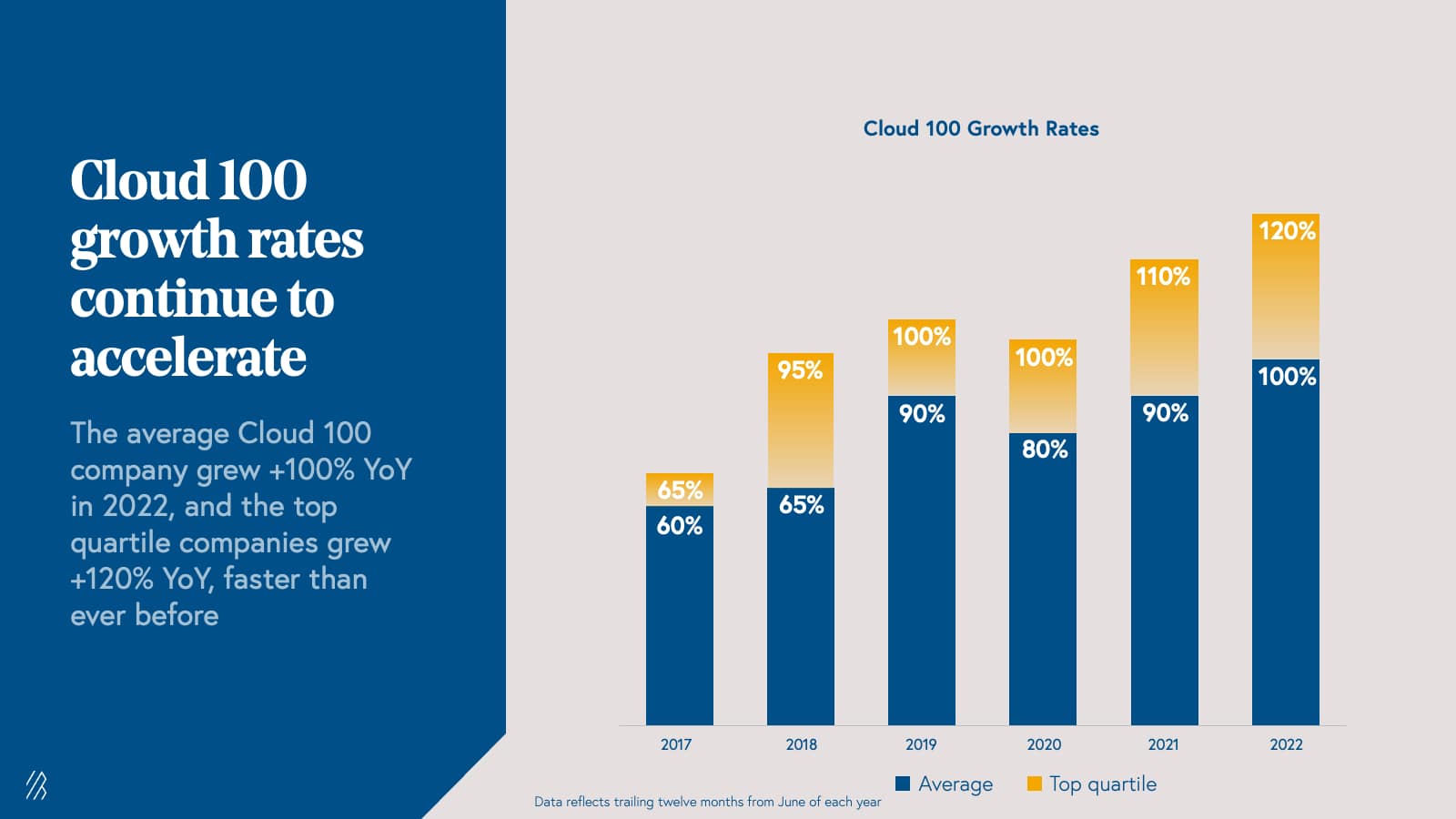

The macro background has nonetheless hurt the average Cloud 100 company. For years we saw growth rates increase, but in 2023, the average growth rate for a Cloud 100 company – the 100 best private companies in the world – has been nearly halved. After years of defying gravity and reaching record highs, headwinds eventually caught up with Cloud 100 fundamentals. The average Cloud 100 revenue growth rate fell significantly to 55% within the year, with the growth rate of the top quartile companies falling to 70%, once again reinforcing the extremely challenging year that the world’s best cloud companies had to deal with.

The private financing markets have responded in turn. For the second year in a row, the average Cloud 100 multiple has decreased, from 30x in 2022 to 26x. Considering that the average public BVP Cloud Index company is trading under 10x, we expect that reported private multiples will continue to compress.

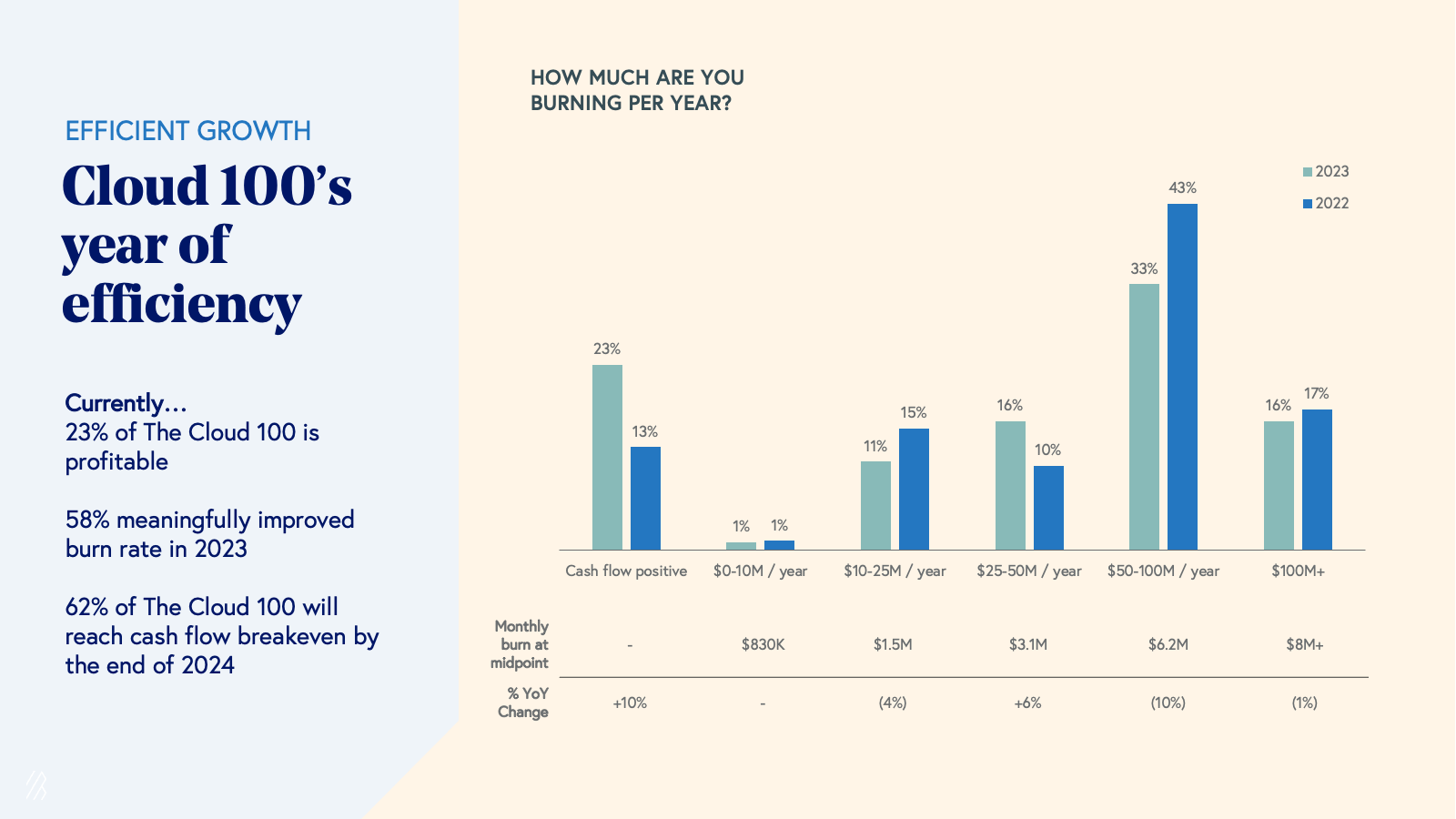

Cloud 100’s year of efficiency

As 2022 saw more tightening in capital markets, IT budgets, and consumer spend, founders faced new challenges in reducing burn and driving efficient growth. 2023 became the year of efficiency in cloud, and profitable growth became more valuable than growth-at-all-costs. At Bessemer, we’ve always been big advocates of growth at optimal costs as a core guiding principle, and this is Law #2 in our 10 Laws of Cloud.

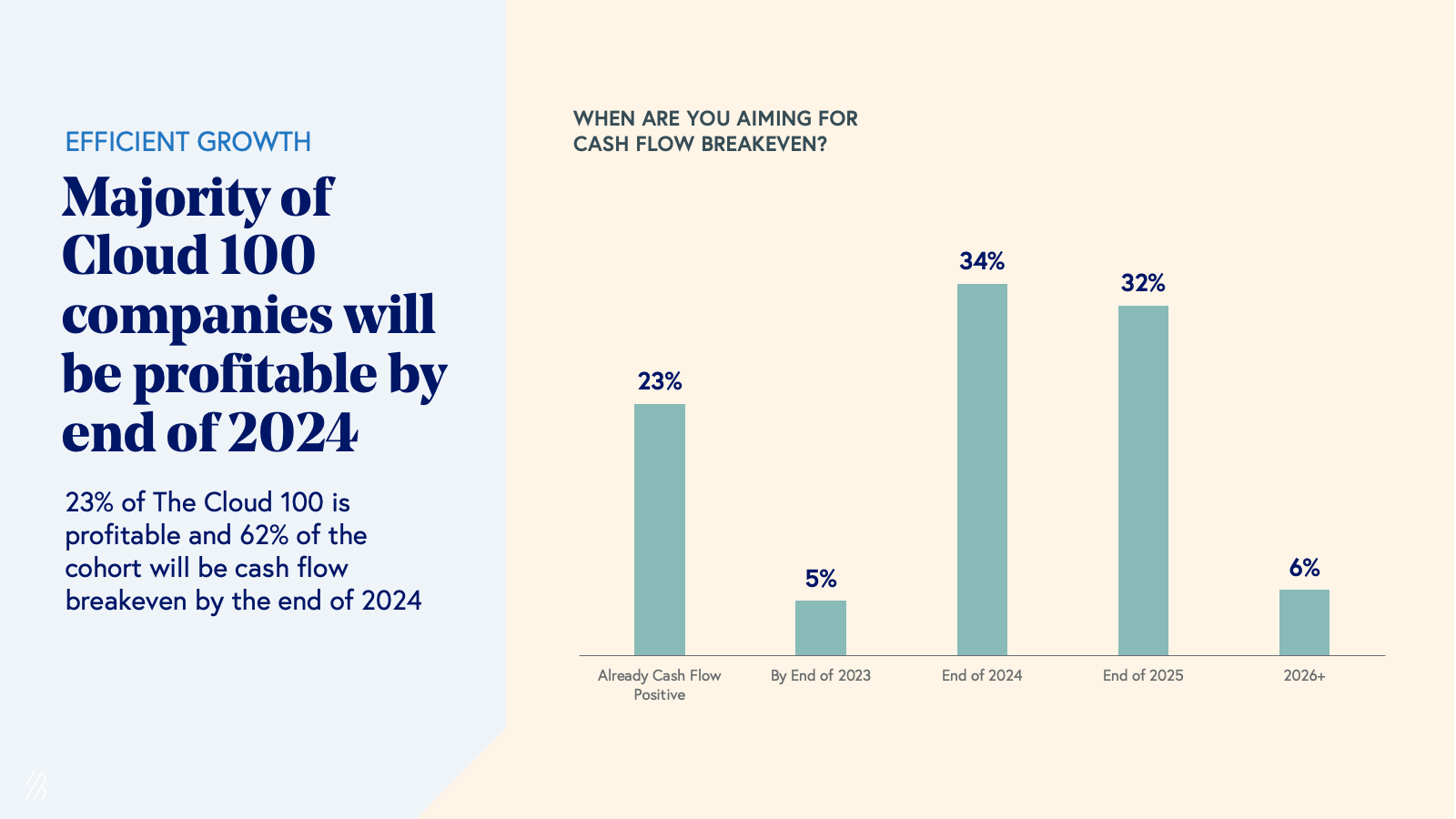

Internalizing this mantra of efficient growth, this year’s Cloud 100 honorees displayed remarkable resilience and adaptability proving the power of the cloud business model. Nearly 25% of Cloud 100 members are already cash flow positive today, and nearly two-thirds of the 2023 Cloud 100 will be cash flow breakeven or profitable by the end of 2024. 94% of Cloud 100 companies will be profitable by the end of 2025.

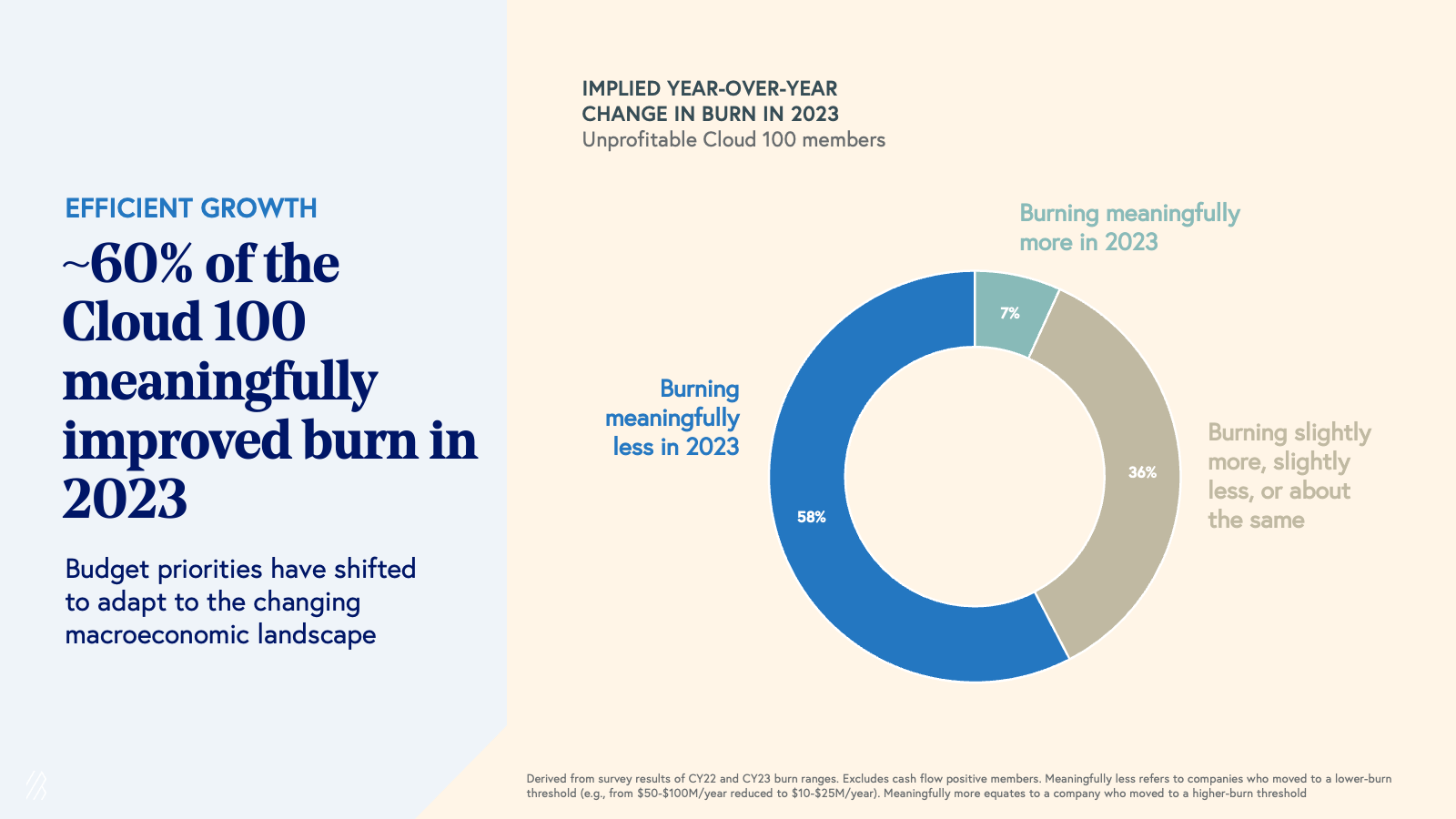

Further improving on this strong trajectory of efficient growth, over half of 2023’s currently unprofitable Cloud 100 honorees (58%) are meaningfully reducing their burn rate this year. Only a very small portion (7%) of the Cloud 100 intends to accelerate burn in 2023.

Observing the trends in absolute burn numbers also validates the commitment of the Cloud 100 cohort towards cash flow positivity and how these companies took swift action within a short period of time. On an absolute basis, 2023’s Cloud 100 cohort showed meaningful improvement in total burn when comparing their burn numbers from 2022 to 2023.

As the Cloud 100 cohort has shown, efficiency is a core imperative for cloud companies in 2023, especially since balancing the trade offs between growth and profitability not only has a tangible impact on business performance, but also on valuations. At Bessemer, we have seen the tactical steps great cloud companies have taken across our portfolio and compiled them here as a guide for SaaS leaders to drive profitable growth.

The future of the cloud economy will be efficient, and will be AI-driven

In the midst of a highly uncertain and volatile year, we commend all of the 2023 Cloud 100 honorees for demonstrating resilience and executing on efficient growth despite the doom-and-gloom that has impacted cloud fundamentals and valuations. We applaud that ~95% of the Cloud 100 will reach Centaur status by the end of 2023—the highest percentage ever in Cloud 100’s history—with companies hitting this milestone at record-breaking speed and strong efficiency despite the bleak backdrop.

Looking ahead to a brighter future, we recognize that we are in the midst of a defining paradigm shift as AI advancements will no doubt shape our lives and work for generations. We are excited to see so many Cloud 100 honorees at the forefront of this movement and look forward to seeing how the AI revolution will continue to define and transform the cloud industry in the years to come.

See you for the 2024 Cloud 100!

2022 Cloud 100 Benchmarks

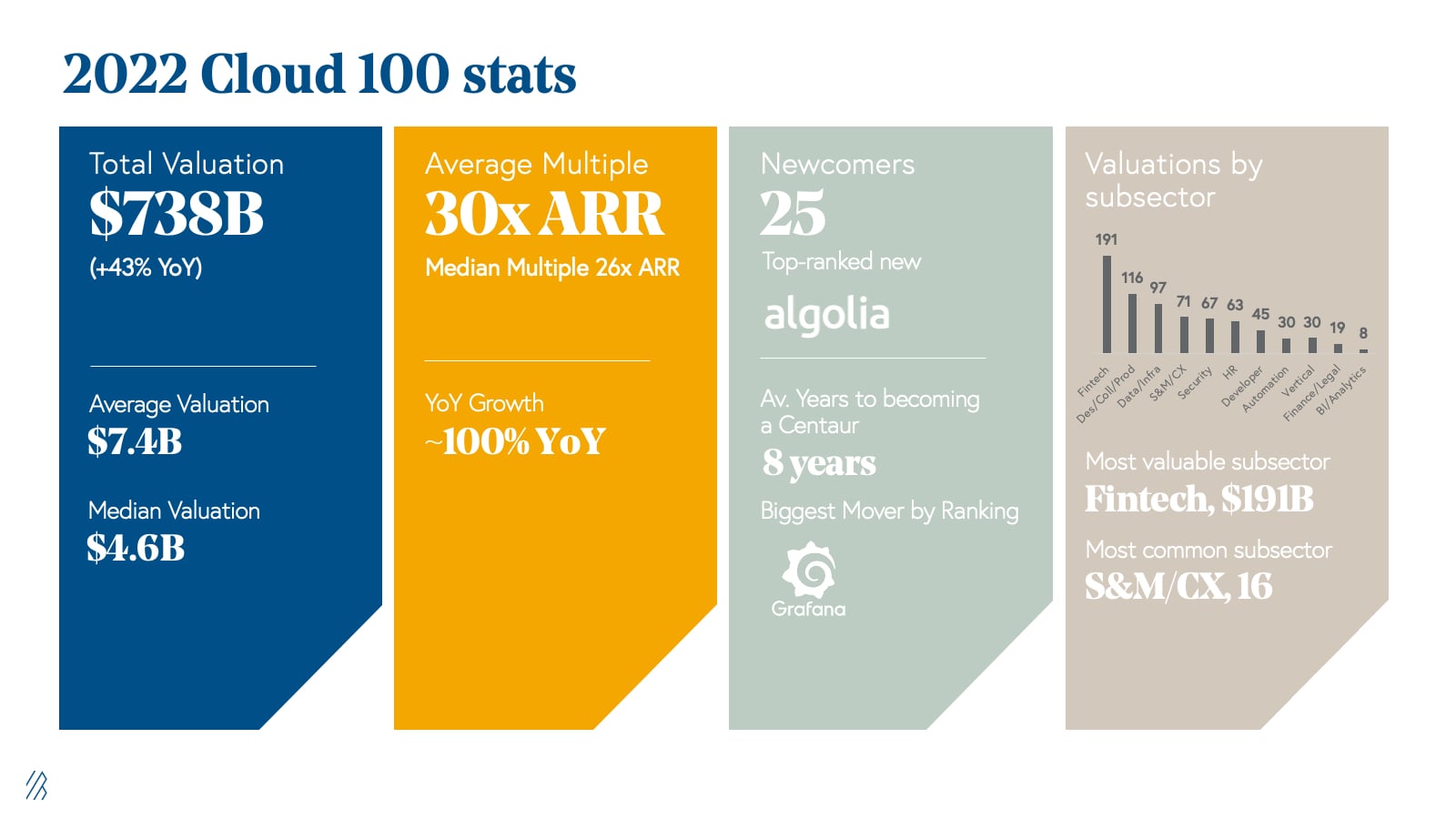

Today Bessemer Venture Partners, Forbes, and Salesforce Ventures announced the 2022 Cloud 100 List, the definitive ranking of the top 100 private cloud companies. Last year, the estimated valuation required to make the Cloud 100 list was over $1 billion, and the median was $3 billion. This was a record-high threshold for which—for the first time in history—each honoree had to achieve the unicorn milestone to be on the list.

This year, the bar has been set even higher. Not only have all of the 2022 Cloud 100 honorees again reached at least the $1 billion valuation milestone, but also the average Cloud 100 valuation has skyrocketed to $7.4 billion. The median is an impressive $4.6 billion.

But wait, aren’t the public markets in turmoil? With rising inflation, decreased stock prices, and the fears of recession looming, why did private cloud valuations continue to get bigger? We note that all of the 2022 Cloud 100 honorees raised their last private round between 2020 to early 2022, when the cloud market was far more exuberant than it is today. All of the companies on this years’ list raised before the downturn and are still holding on to these high private marks.

Given the ebullient market backdrop of 2020 and 2021, we recently wrote about the need to return to business metrics outside of valuation that cannot be so easily gamed, and we looked for a milestone rooted in business fundamentals. And the milestone that we celebrate now is reaching $100 million of ARR, which we call becoming a Centaur.

Based on this year’s data, over 70% of 2022 Cloud 100 companies are currently Centaurs, with an additional about 10% expected to hit this milestone by the end of the year—marking over 80% of 2022 Cloud 100 honorees as Centaurs! This is a primary reason why we have conviction that this year's honorees truly represent the best cloud companies globally.

To learn more about the strategies that help cloud leaders gain Centaur status, read the full report.

With seven years of Cloud 100 data behind us, in this year’s Benchmarks Report we reveal Bessemer’s analysis and insights into the 2022 Cloud 100 cohort and what it tells us about the Cloud Centaurs in the private cloud market today.

Top highlights:

- Private cloud valuations continue to get bigger. The Cloud 100 2022 is worth an aggregate of $738 billion in 2022 vs. $518 billion in 2021, which is a 43% increase year-over-year and 7.5x increase since 2016. The top 10 Cloud 100 companies alone contribute $252 billion of equity value (34% of list value).

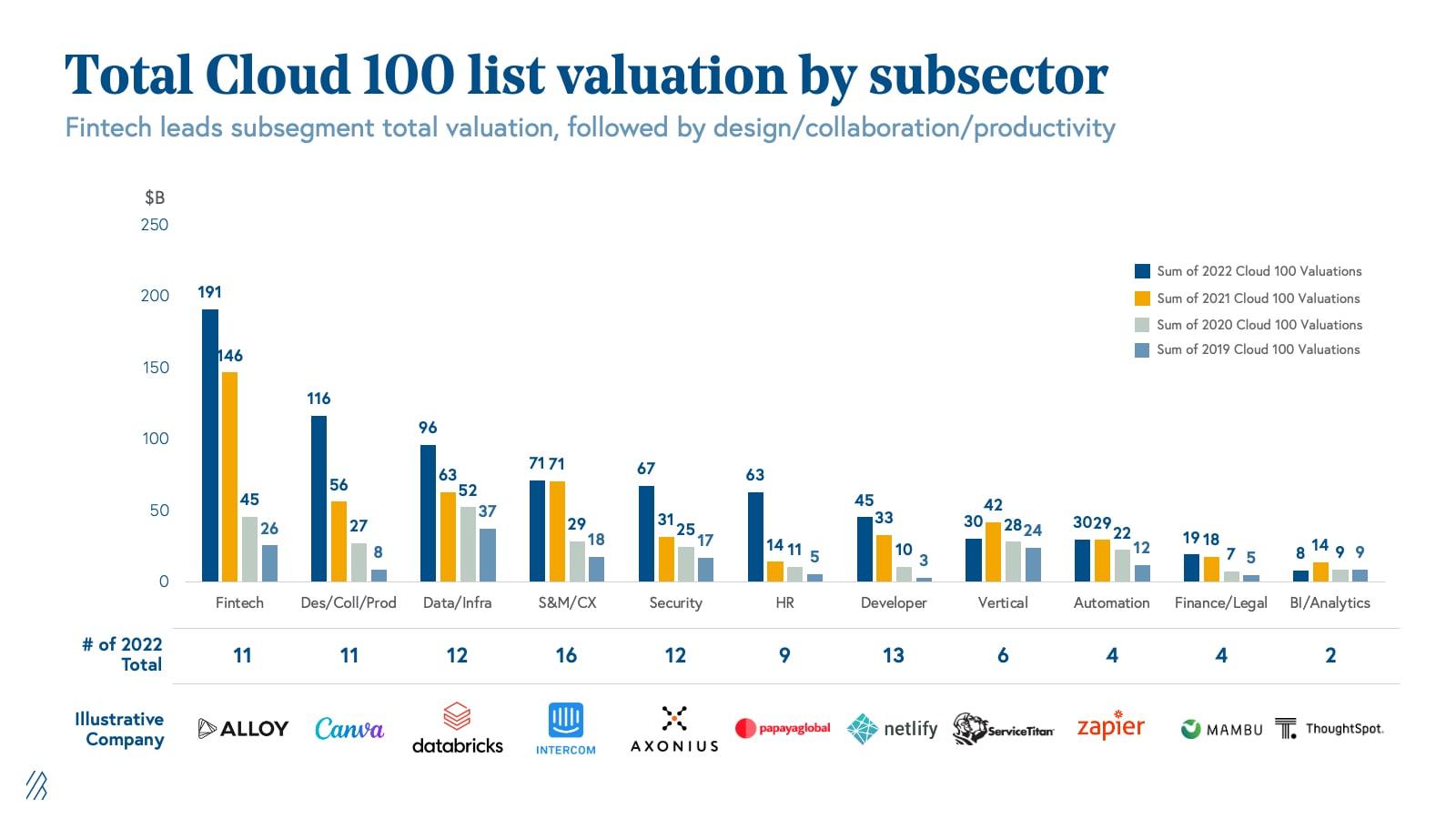

- Similar to last year’s trend, Fintech represents the highest value subsector at $191 billion (26% of list value), anchored by Stripe that contributes $95 billion of market cap alone per its last private financing. This is followed by Design/Collaboration/Productivity at $116 billion (16% of list value), and data/infrastructure at $96 billion (13% of list value).

- The threshold to make the Cloud 100 continues to get higher: similar to last year, every company on the list has at least hit the $1 billion+ valuation milestone. In addition, the average cloud company valuation was $7.4 billion, an increase of $2.2 billion year-over-year. Note, however, that all 2022 Cloud 100 companies raised prior to early 2022, keeping their high marks they earned pre-downturn.

- Something notable this year is that as the public markets began to cool, the average Cloud 100 multiple has decreased slightly from 34x in 2021 to 30x ARR, though the average growth rate actually increased to 100% year-over-year.

- Given the fact that valuation can be an illusion, at Bessemer we choose to use a more reflective metric: the Centaur milestone of achieving $100 million of ARR. We are proud to observe that over 70% of 2022 Cloud 100 Honorees are currently Centaurs, with an additional about 10% expected to hit this milestone by the end of the year—marking over 80% of 2022 Cloud 100 honorees being Centaurs. Impressively, it took an average of eight years from their founding for Cloud 100 Centaurs to hit this milestone.

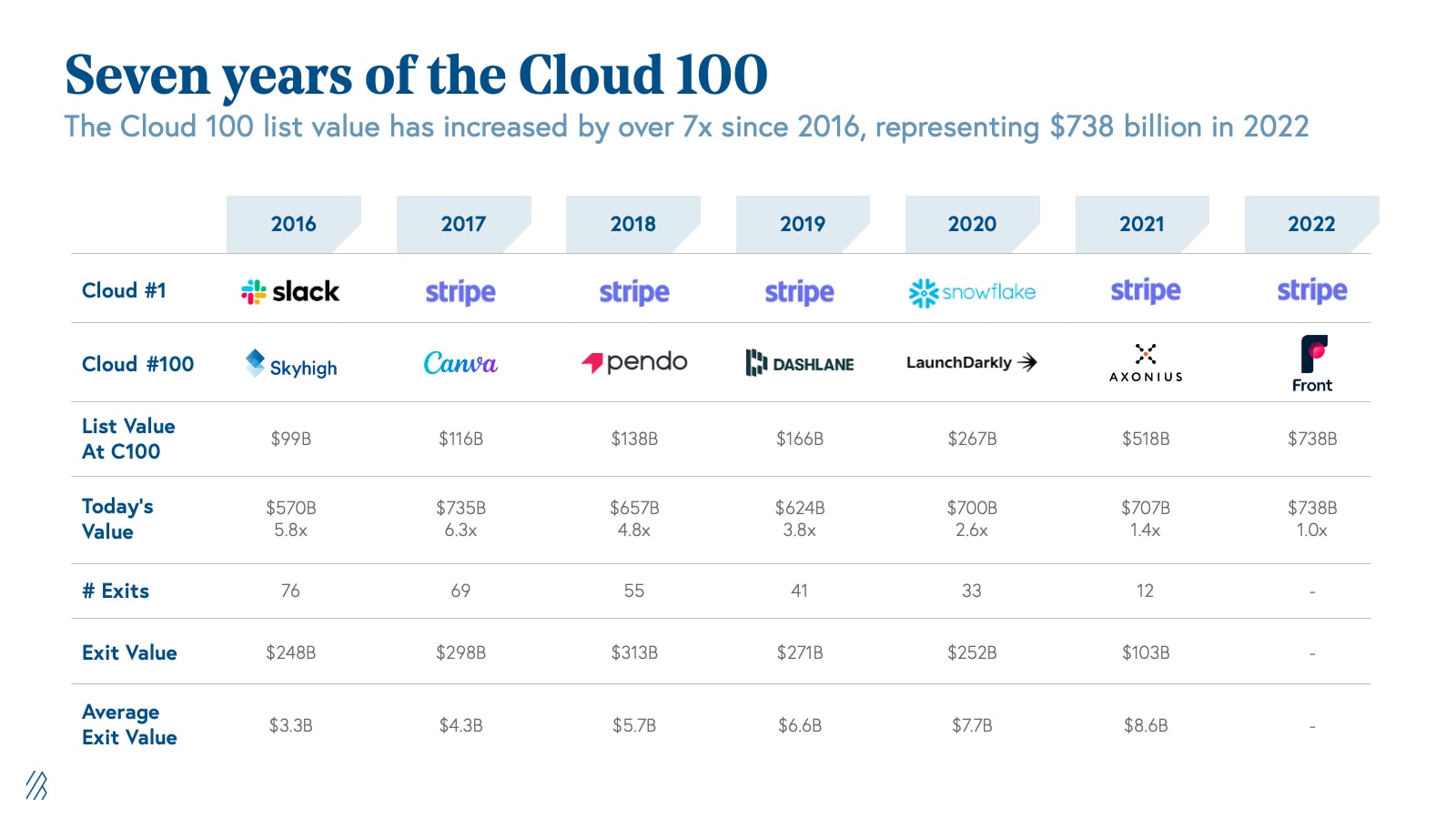

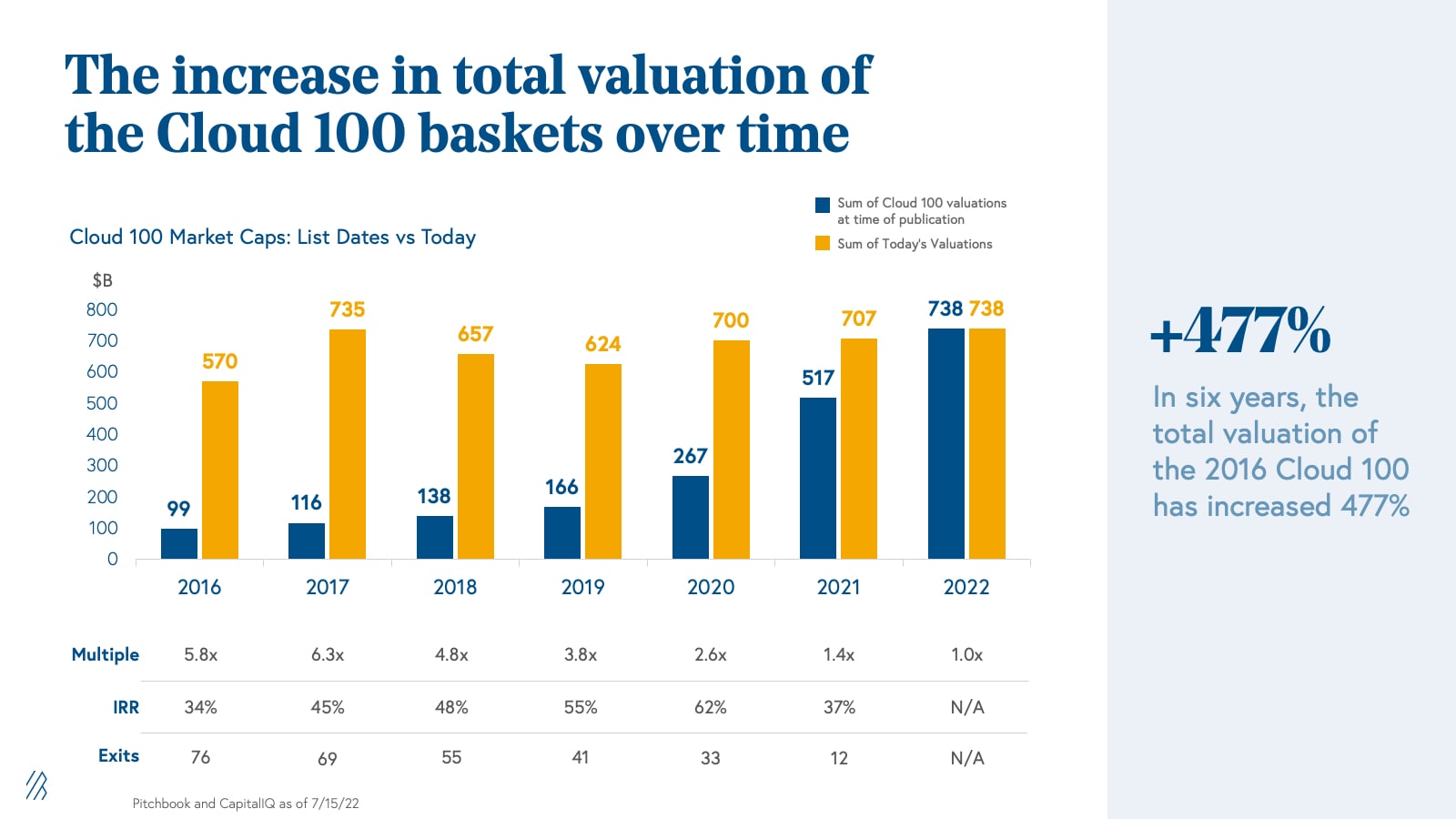

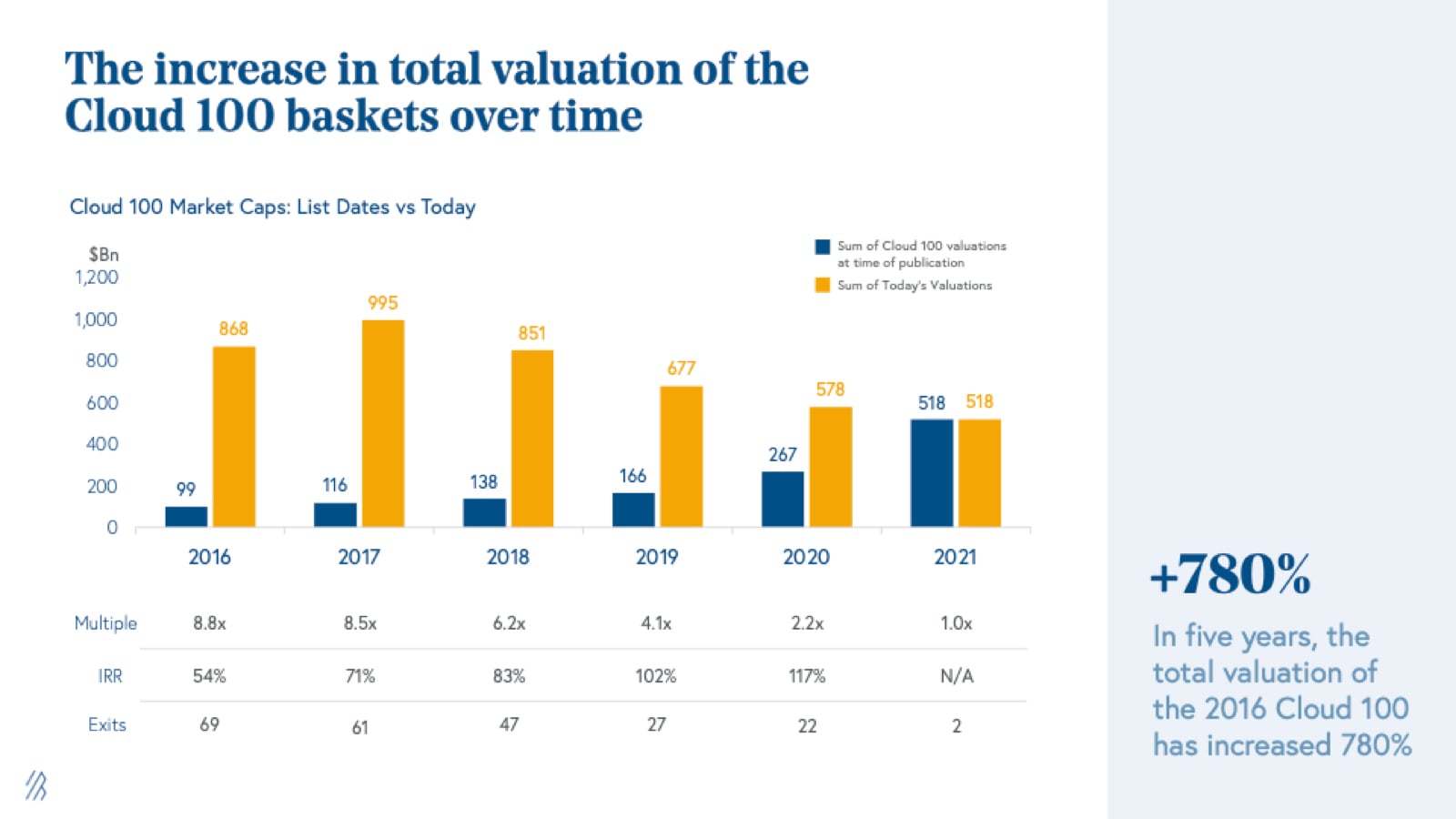

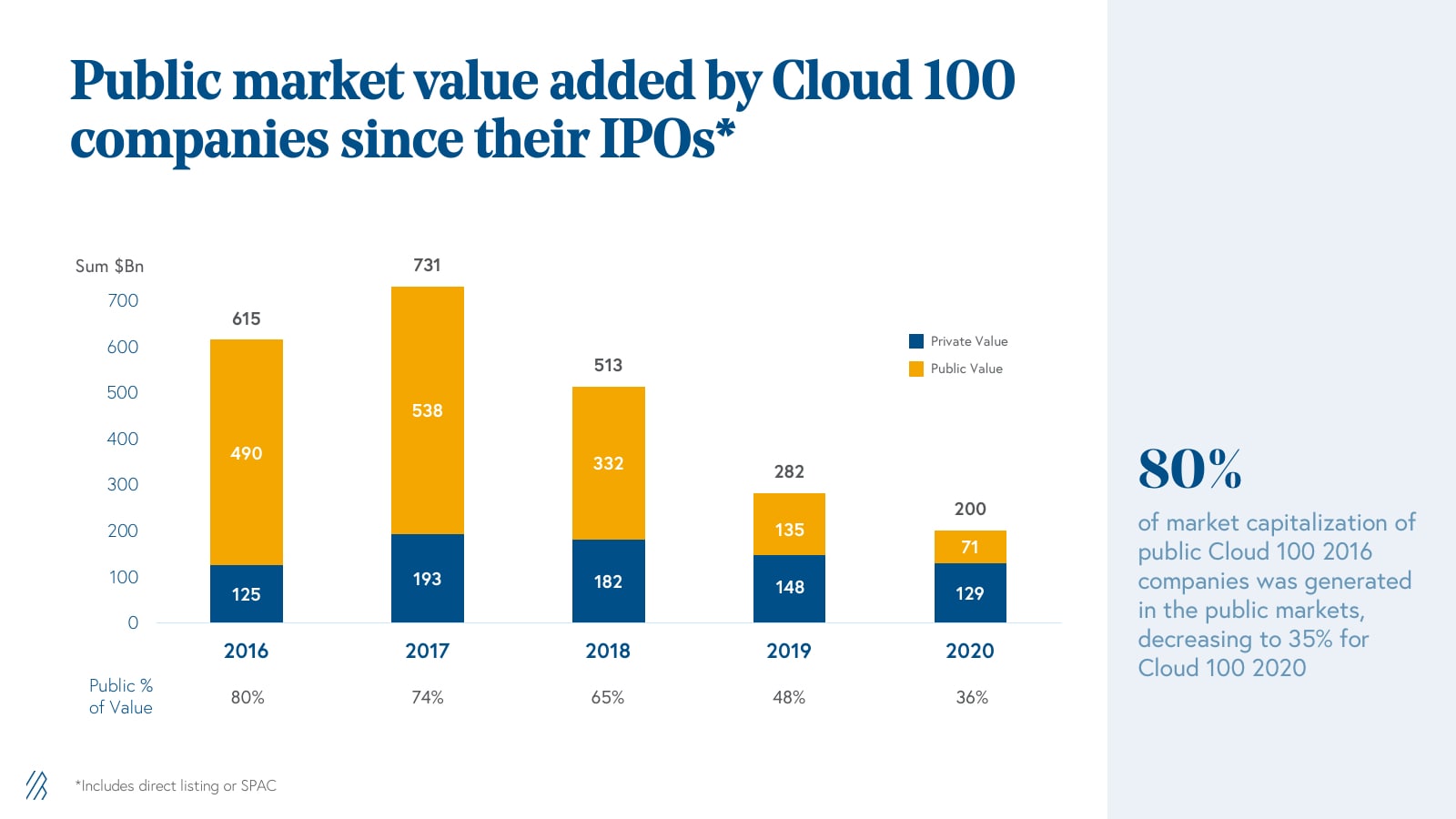

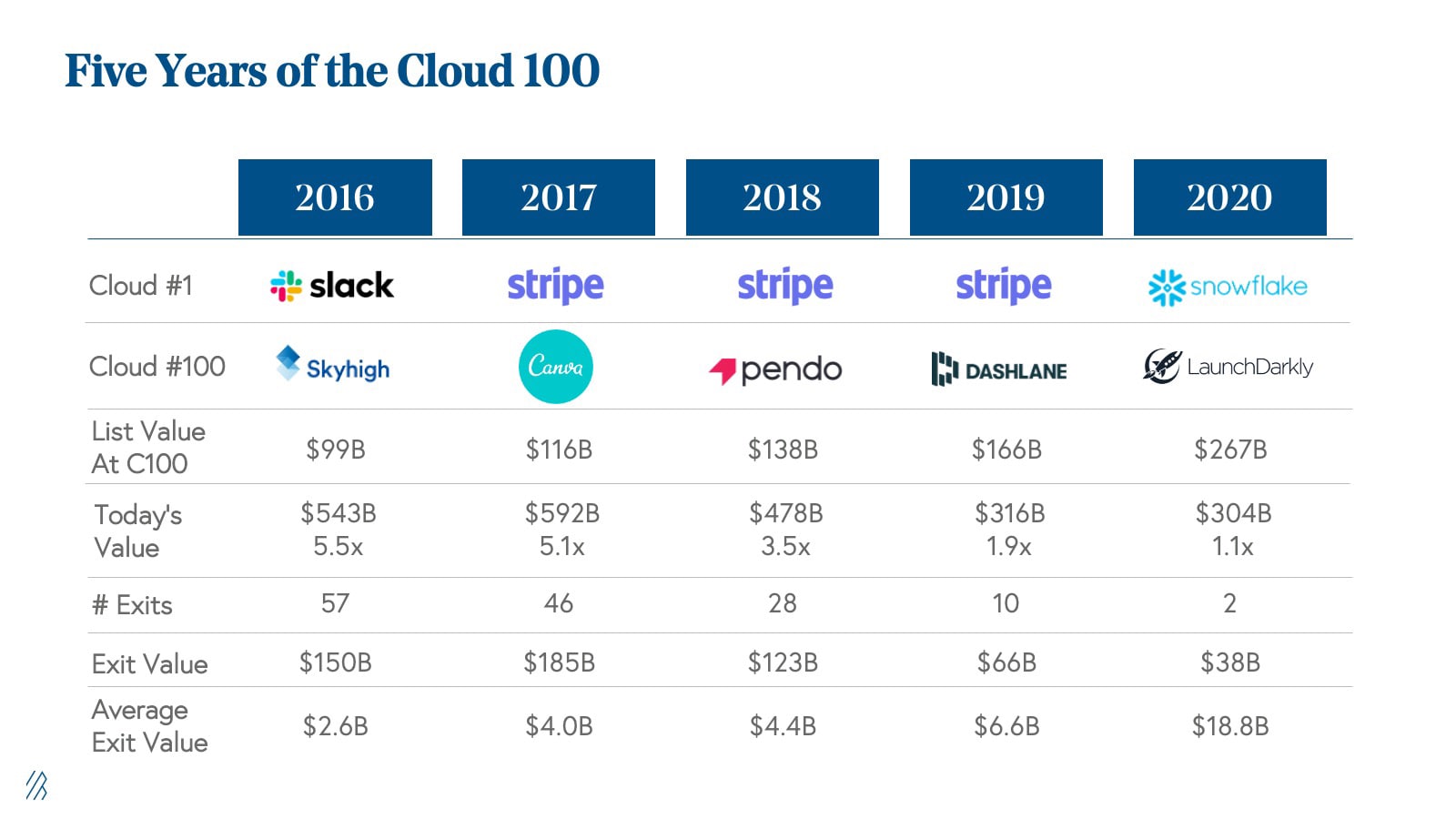

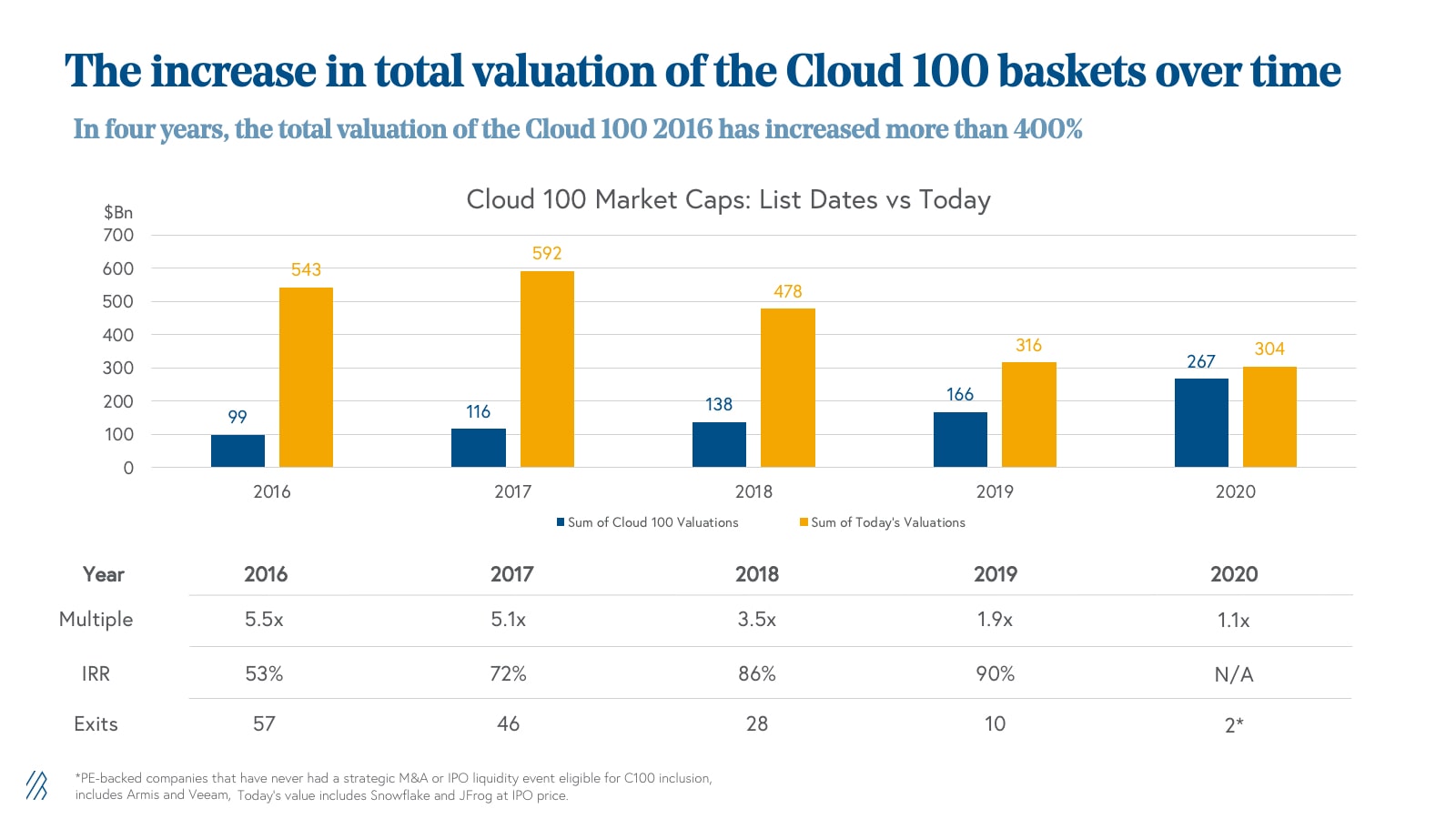

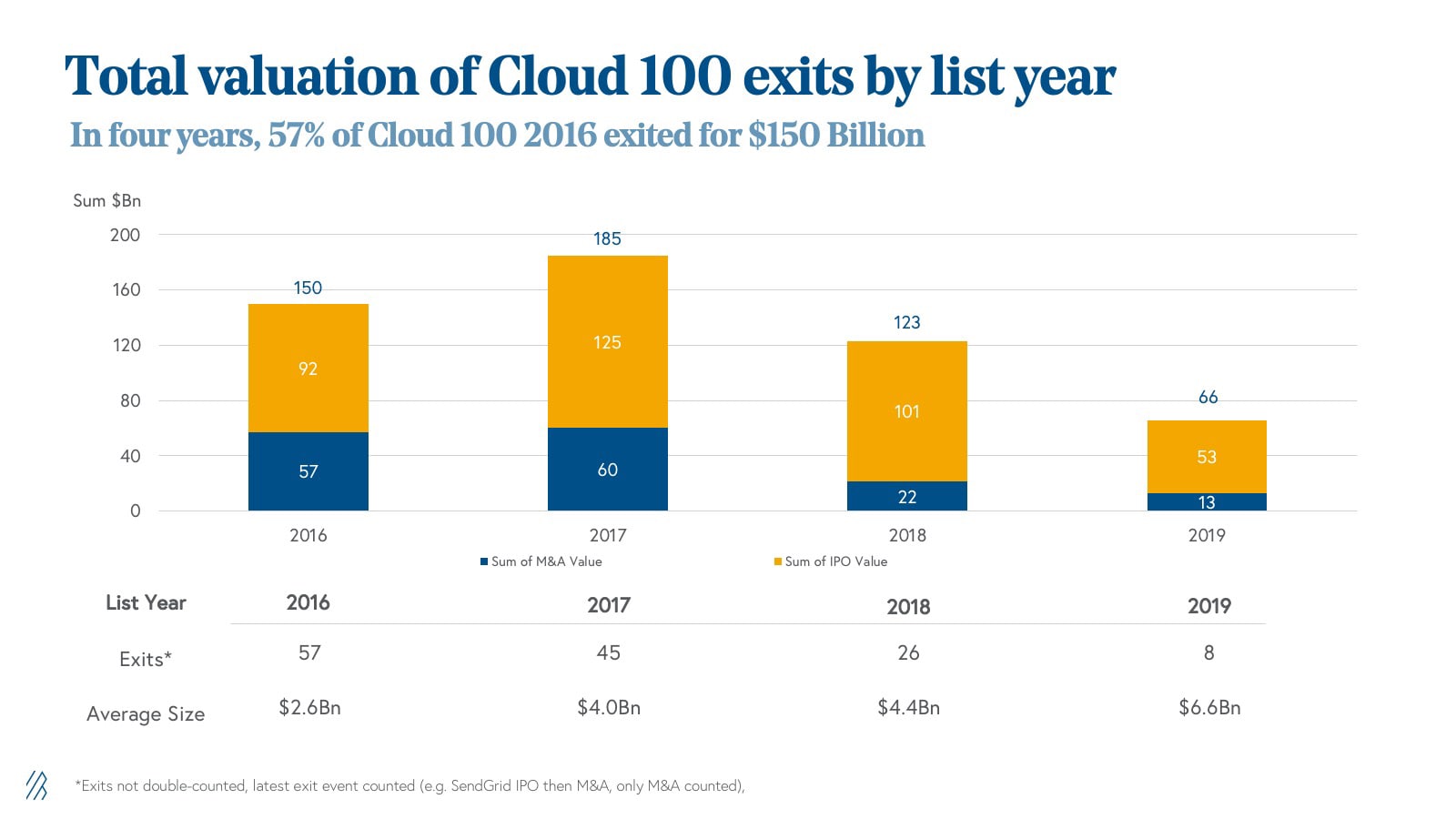

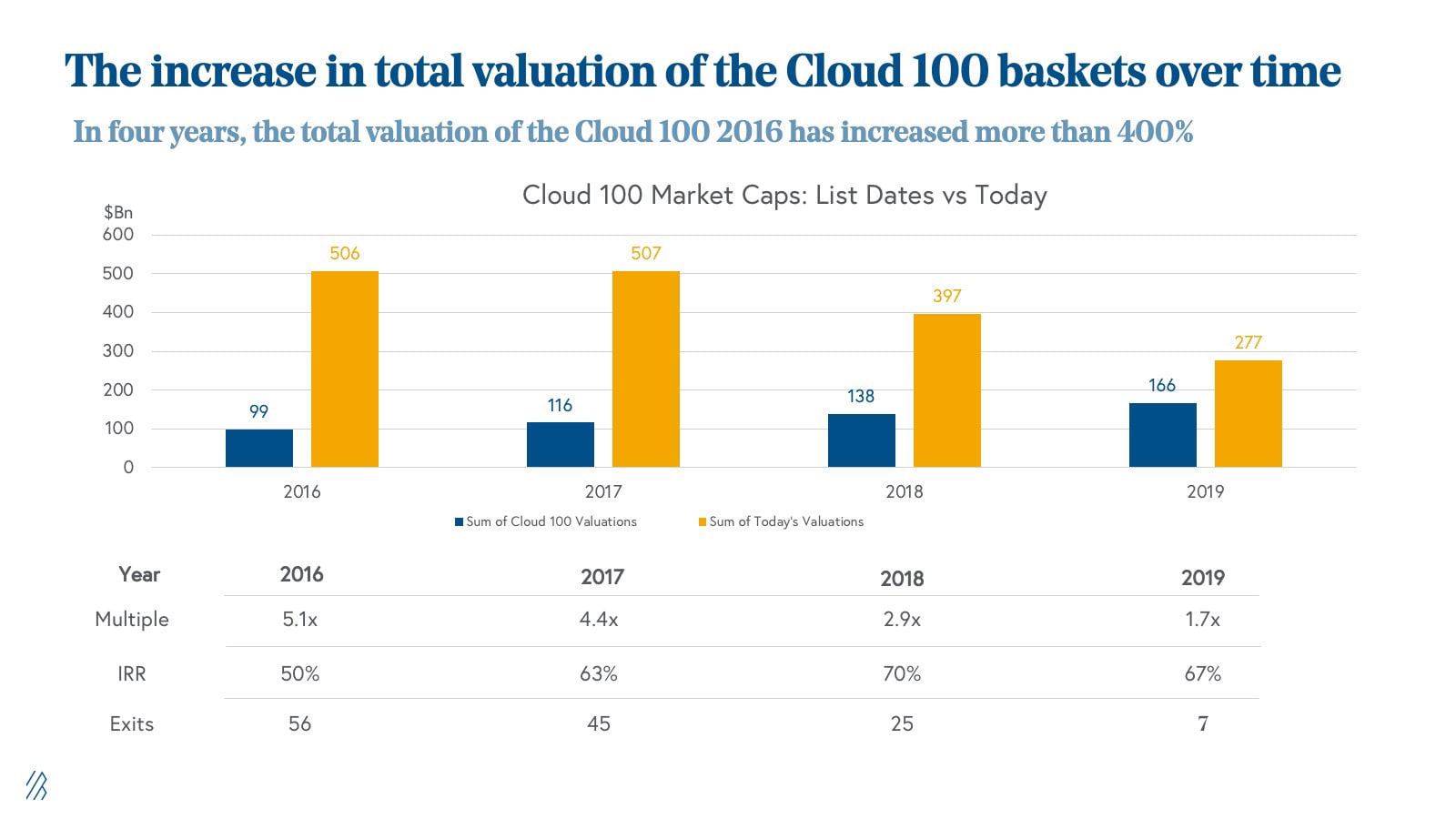

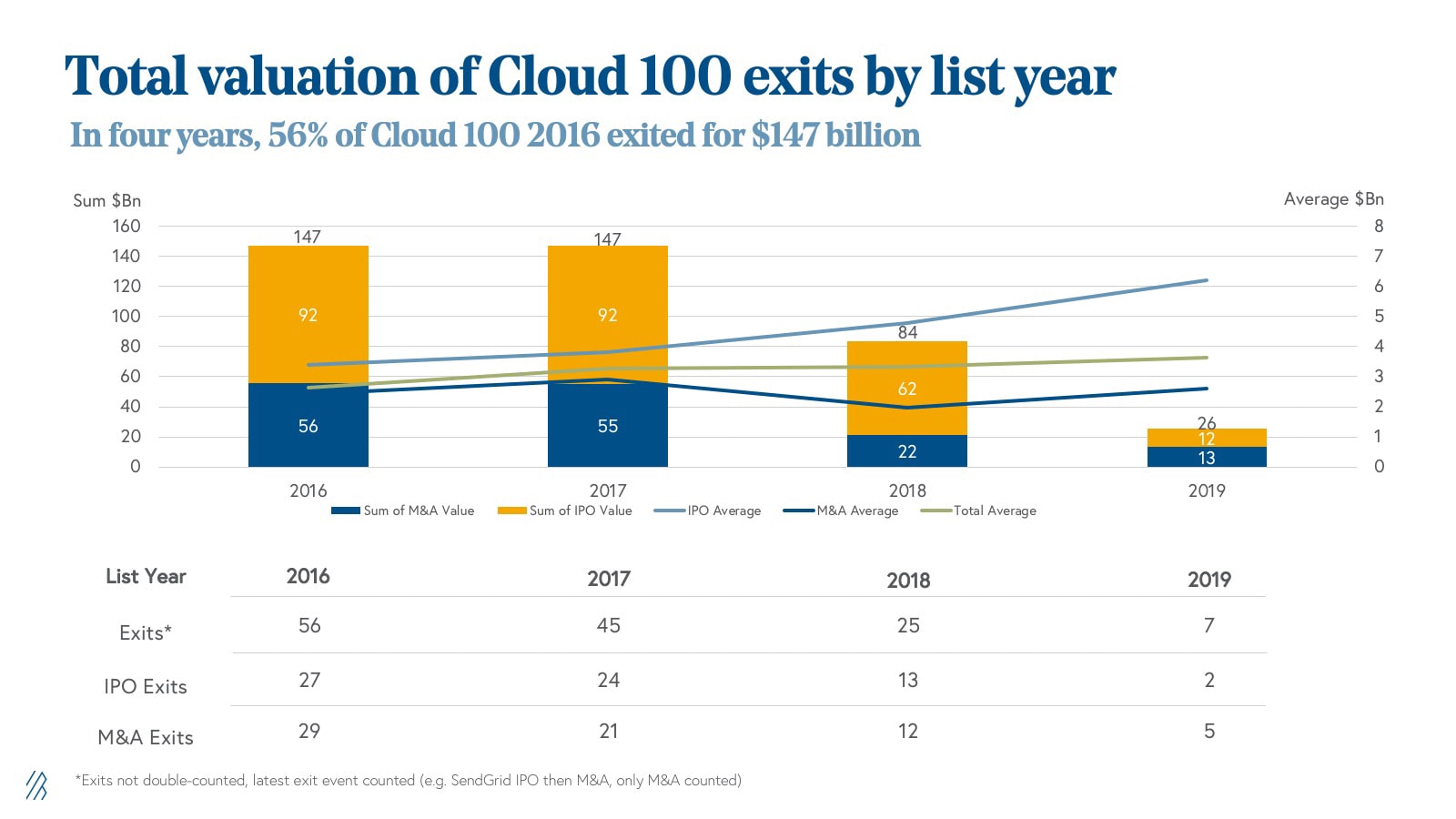

- It is no surprise that since these are the best-in-class companies as defined by fundamental performance rather than arbitrary valuation marks, the Cloud 100 list continues to produce strong returns. In seven years, the total valuation of the 2016 Cloud 100 list has increased by more than $469 billion, delivering a 5.8x and 34% IRR in that time. The 2017 Cloud 100 basket has delivered an 6.3x and 45% IRR as its aggregate value nears $735 billion; the 2018 basket a 4.8x and 48% IRR; the 2019 basket a 3.8x and 55% IRR; the 2020 basket a 2.6x and 62% IRR, and the 2021 basket a 1.4x and 37% IRR in just one year alone.

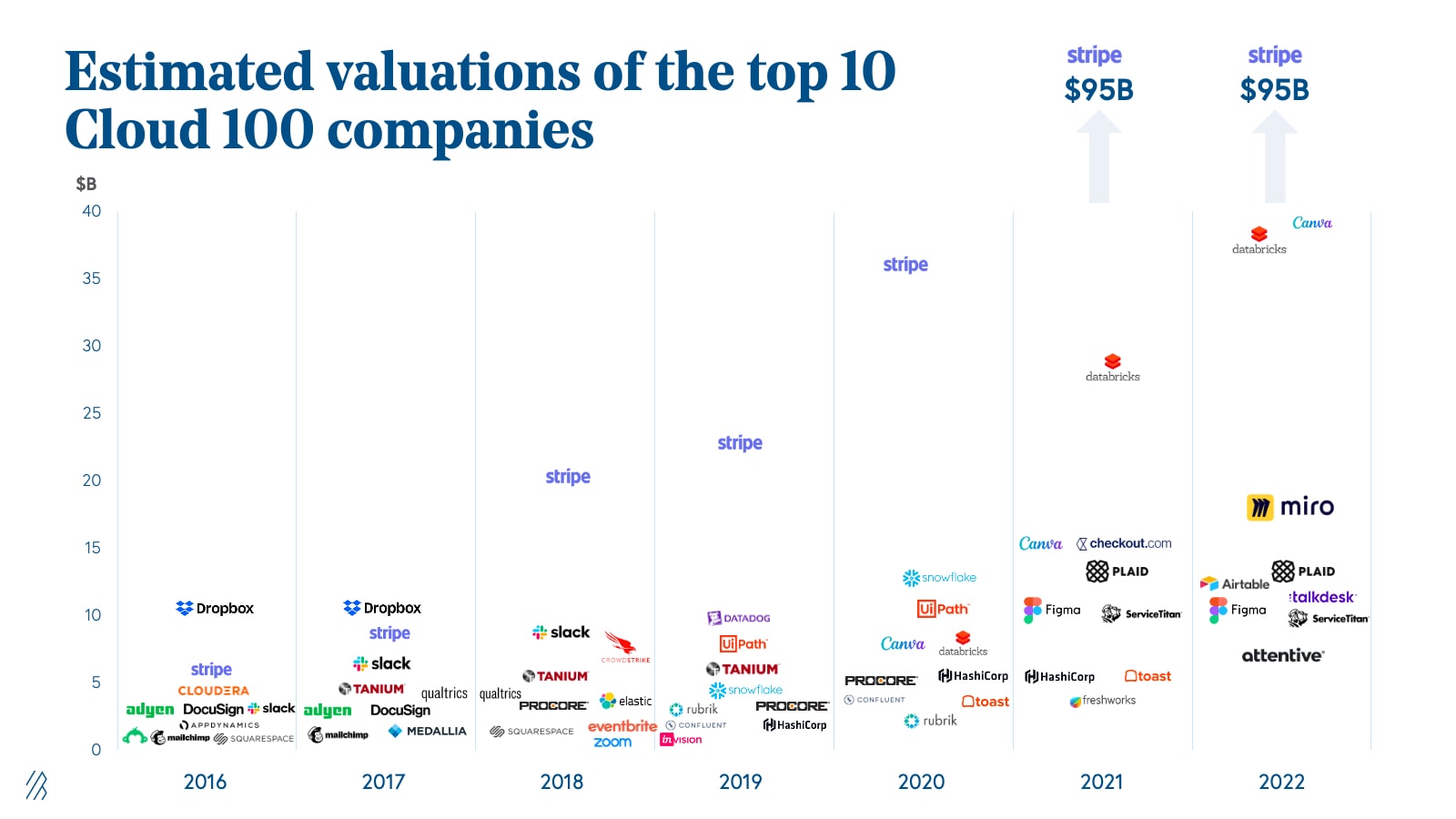

The 2022 Cloud 100 at a glance: $738 billion of equity value

The 2022 Cloud 100 list represents an astonishing $738 billion of equity value, with an average $7.4 billion valuation per company. The cumulative value of the Cloud 100 list is up a staggering +43% from the 2021 list’s aggregate value of $518 billion, in just one year.

This valuation growth was catalyzed in part by both a high-priced multiple environment and the sheer volume of capital that went into cloud businesses: $129 billion in 2021 per Pitchbook. In many ways, it may have been wise of these companies to take advantage of market conditions to reduce dilution and buffer their cash runway in anticipation of more challenging times ahead.

This year we welcomed 25 new companies to the Cloud 100 list. The highest-ranked new entrant was Algolia, which graced the Cloud 100 list in 2018 and returns in 2022. Other newcomers include Clickup and Dataiku, alongside Bessemer portfolio companies HiBob, the modern HR platform; Alloy, the identity decisioning engine for financial services; and Netlify, the web development and deployment platform.

This year’s biggest mover title goes to Grafana Labs, the performance monitoring platform, which moved up +43 spots to #37 on the Cloud 100 list and announced its Series D raise at a $6 billion valuation in April.

The Top 10 Cloud Companies represent over $252 billion of equity value alone. Stripe retains the #1 spot on the Cloud 100 for the second year in a row (and fifth year overall) with its last private financing at a $95 billion valuation. Joining Stripe in the top ten are Databricks (#2), Canva (#3), Miro (#4), Figma (#5), Airtable (#6), ServiceTitan (#7), TalkDesk (#8), Plaid (#9), and Attentive (#10). At #4, Miro had the largest jump of any Top 10 company, increasing +32 spots from its #36 position on the 2021 list.

Representing $252 billion as a group, the Top 10 Cloud 100 companies individually average a valuation of $25.2 billion, which is up +$5 billion from 2021 and +$22 billion from the inaugural 2016 list. Some notable financings in this group include Canva’s September 2021 round at $40 billion and Miro’s December 2021 round at $17.5 billion. The strength of the Top 10 companies cannot be overstated; from the 2021 list Toast, HashiCorp, and Freshworks all successfully went public in the second half of 2021. We anticipate that the most anticipated cloud IPOs in the future (when the IPO window opens!) will be from this Top 10 list.

Digging into sub-sectors, Fintech continues to represent the most valuable Cloud 100 category at $191 billion (and 26% of total list value), though that market cap is anchored by Stripe’s $95 billion valuation in the last round. The next most valuable category is Design/Collaboration/Productivity, which contributes 16% of list value with $116 billion of market cap. Cloud 100 winners from this category include Figma, Airtable, and Notion. Data/Infrastructure rounds out the top three with $96 billion of market cap and 13% of list value, inclusive of companies like Databricks, Scale AI, and Fivetran.

While Fintech is the most valuable category by market cap, the highest number Cloud 100 honorees come from the Sales, Marketing, and Customer Success category. With 16 companies represented including Attentive, Klaviyo, Yotpo, and Intercom, it retains its top spot on having the most number of Cloud 100 honorees year-over-year.

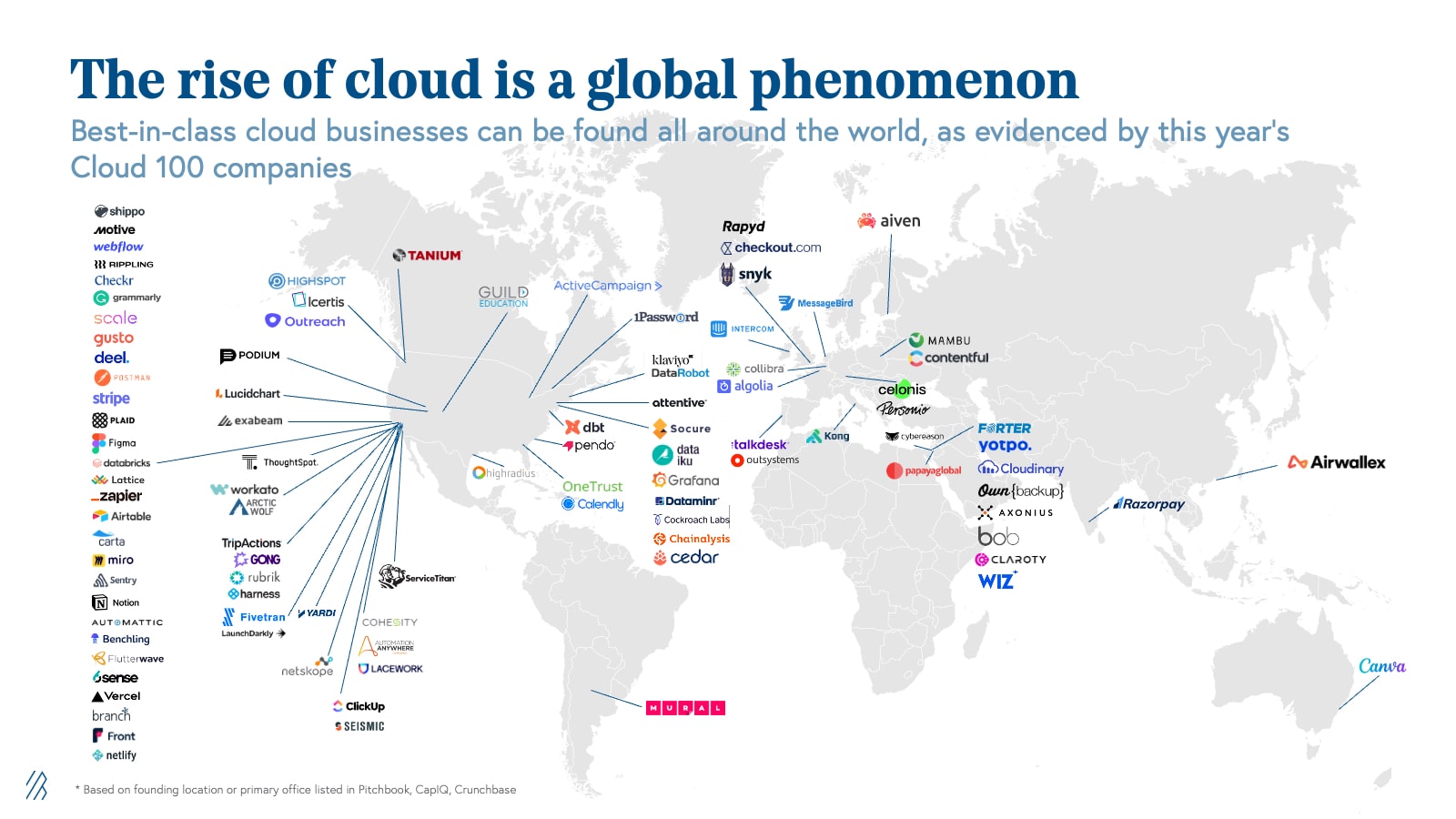

We noted last year that as entrepreneurs, operators, and investors all around the world increasingly recognize the power of the cloud, we’re seeing cloud startups bloom in technology hubs globally. Building on our prediction from last year, international representation on the 2022 Cloud 100 list has now surpassed 30%. In State of the Cloud 2022, we noted that public cloud spend is only 10% of the total $4 trillion total IT spend across the globe, with lots of untapped potential in regions such as Europe, Latin America, and Asia-Pacific. Using public cloud spend as a leading indicator of spend on all SaaS, we expect the Cloud 100 to become more and more geographically diverse in the coming years, as the globalization of cloud continues.

Valuations can be misleading, but Centaur status is a clear measure of traction

As we discussed above, the 2022 Cloud 100 list is worth an aggregate of $738 billion, an impressive +43% year-over-year growth over the $518 billion value of the 2021 list, increasing the average Cloud 100 winner’s valuation up to a massive $7.4 billion year-over-year ($6.5 billion if you remove Stripe). This must be surprising given the backdrop of deteriorating public markets, but as we noted, all of the 2022 Cloud 100 honorees raised their latest round in peak conditions before the downturn, and are still holding on to these high private marks.

However, we observe this year that as the market begins to cool, the average Cloud 100 multiple has decreased slightly from 34x in 2021 to 30x, reinforcing the frenzy of 2021 in the private cloud markets. Considering that the average public BVP Cloud Index company is trading under 10x, we expect that private multiples will continue to compress, though it may take several more quarters.

But while fears of recession, decreased purchasing power, and forecasted longer sales cycles are being often talked about in cloud company board rooms, thus far the performance of Cloud 100 companies continues to defy gravity. Even with these widespread macro concerns, the average Cloud 100 revenue growth rate actually increased to 100% year-over-year, with some companies forecasting even 200% or 300% growth for 2022. Taken in combination with the decreased multiples, growth-adjusted multiples improved year-over-year and returned to 2020 levels.

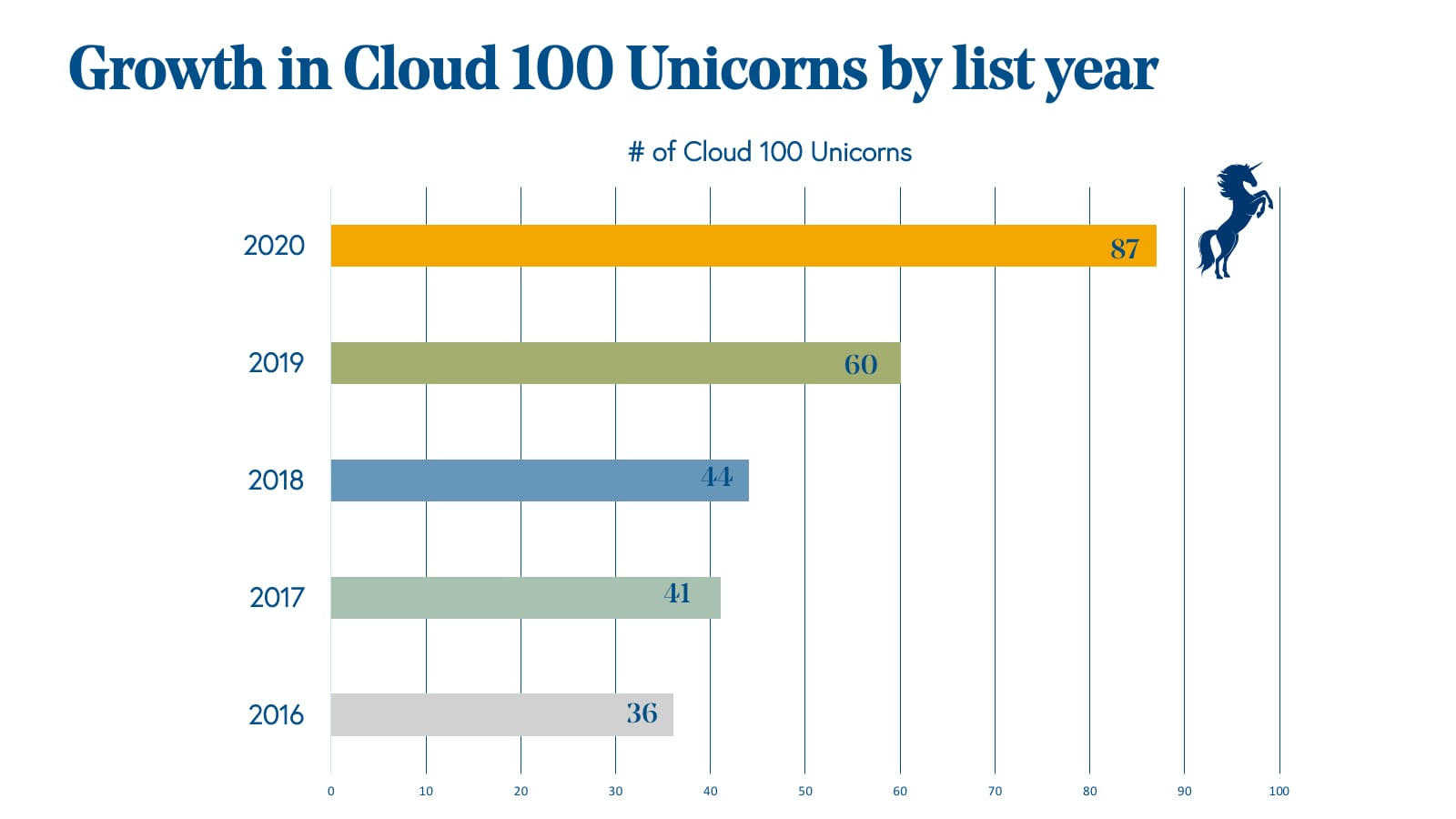

While we continue to celebrate the fundraising milestones of Cloud 100 companies, and the minimum threshold for this year’s list was $1 billion, we note that valuations are not always reflective of a company’s fundamental value when capital is easily accessible and markets are frothy. A decade ago, reaching the $1 billion valuation milestone was an exceptional accomplishment and a genuine proxy for success that signaled to customers, partners, employees and the media that a company should be taken seriously because it would likely endure. At that time, only 14 private startups were valued at $1 billion or more at the time, and only four unicorns were added to the herd yearly. However, as multiples increased and many cloud companies saw successful IPOs in a strong macro backdrop, capital flooded the cloud software startup ecosystem, driving the number of cloud unicorns to over 400+.

At Bessemer, this is why we choose to orient our companies, the broader VC community, and even ourselves, towards the more reflective company milestone of becoming a Centaur, a $100 million ARR business.

We are exceptionally proud to observe that over 70% of 2022 Cloud 100 Honorees are currently Centaurs, with an additional about 10% expected to hit this milestone by the end of the year—marking over 80% of 2022 Cloud 100 honorees as Centaurs! This year’s honorees possess an incredible ability to grow quickly at $100 million+ ARR scale, strengthening our conviction that this list truly represents the best cloud companies globally.

Impressively, it only took an average of eight years from the founding for Cloud 100 Centaurs to hit this milestone. On a category basis, the Sales/Marketing/CX category has the most Centaurs.

We congratulate every Cloud 100 company that has reached this exceptional milestone, including a very special Bessemer portfolio company that is proud to announce its Centaur status today—LaunchDarkly!

Cloud 100 returns: +477% increase in valuation since 2016

As highlighted by the high representation of Cloud Centaurs in the Cloud 100, these are best-in-class cloud companies as defined by fundamental performance rather than arbitrary valuation marks. It is thus no surprise that the Cloud 100 list continues to produce strong returns. In seven years, the total valuation of the 2016 Cloud 100 list has increased by more than $469 billion, delivering a 5.8x and 34% IRR in that time. The 2017 Cloud 100 basket has delivered an 6.3x and 45% IRR as its aggregate value nears $735 billion; the 2018 basket a 4.8x and 48% IRR; the 2019 basket a 3.8x and 55% IRR; the 2020 basket a 2.6x and 62% IRR, and the 2021 basket a 1.4x and 37% IRR in just one year alone.

While there were 11 IPOs/direct listings from the 2021 Cloud 100 members, the IPO window remained shut in 2022 given the market turning for the worse. In fact, several honorees had to postpone IPO plans for this year. Despite this, we still have conviction that Cloud 100 honorees are going to be the strongest IPO candidates when the window opens and perhaps targets of strategic M&A.

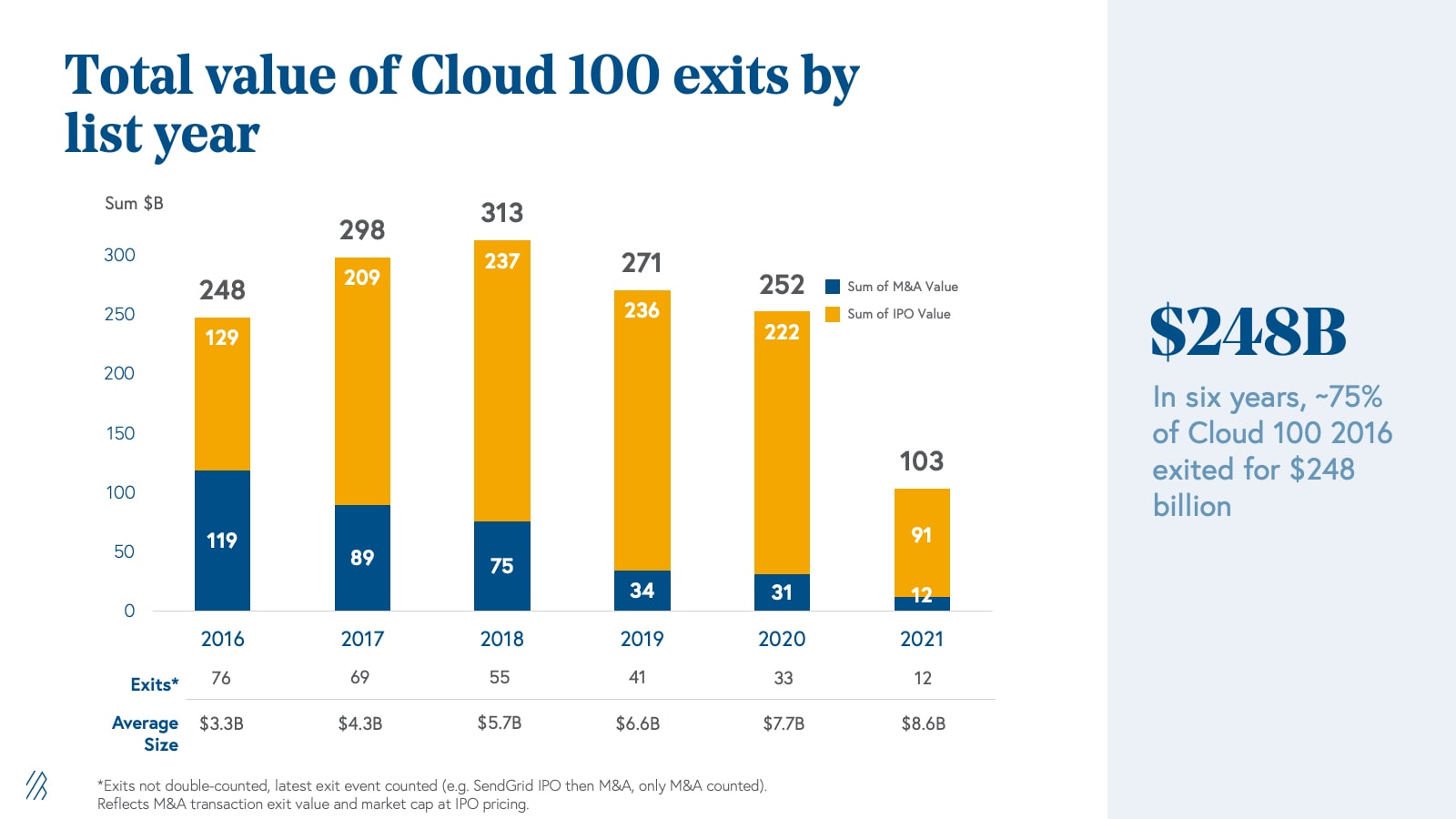

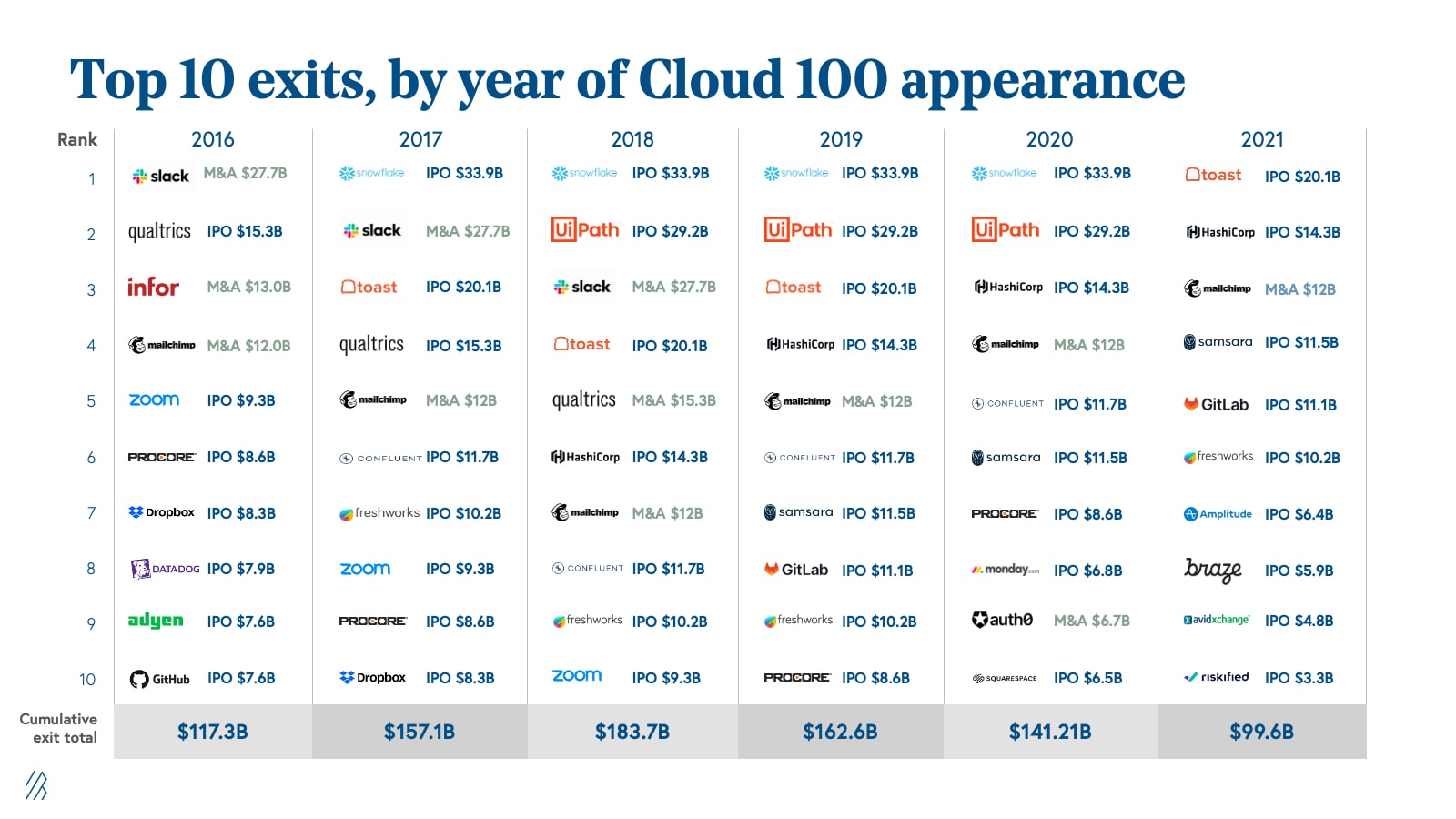

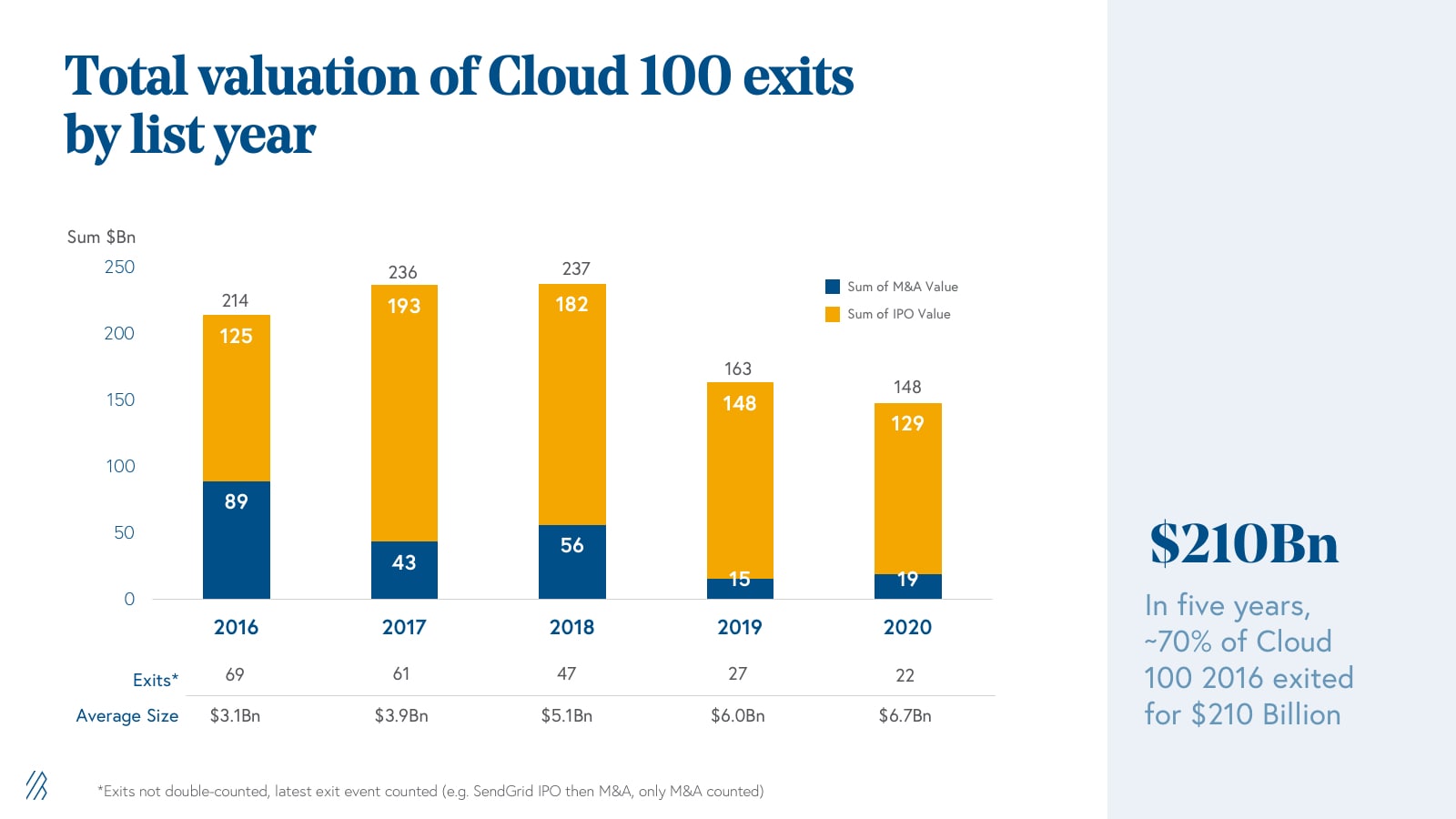

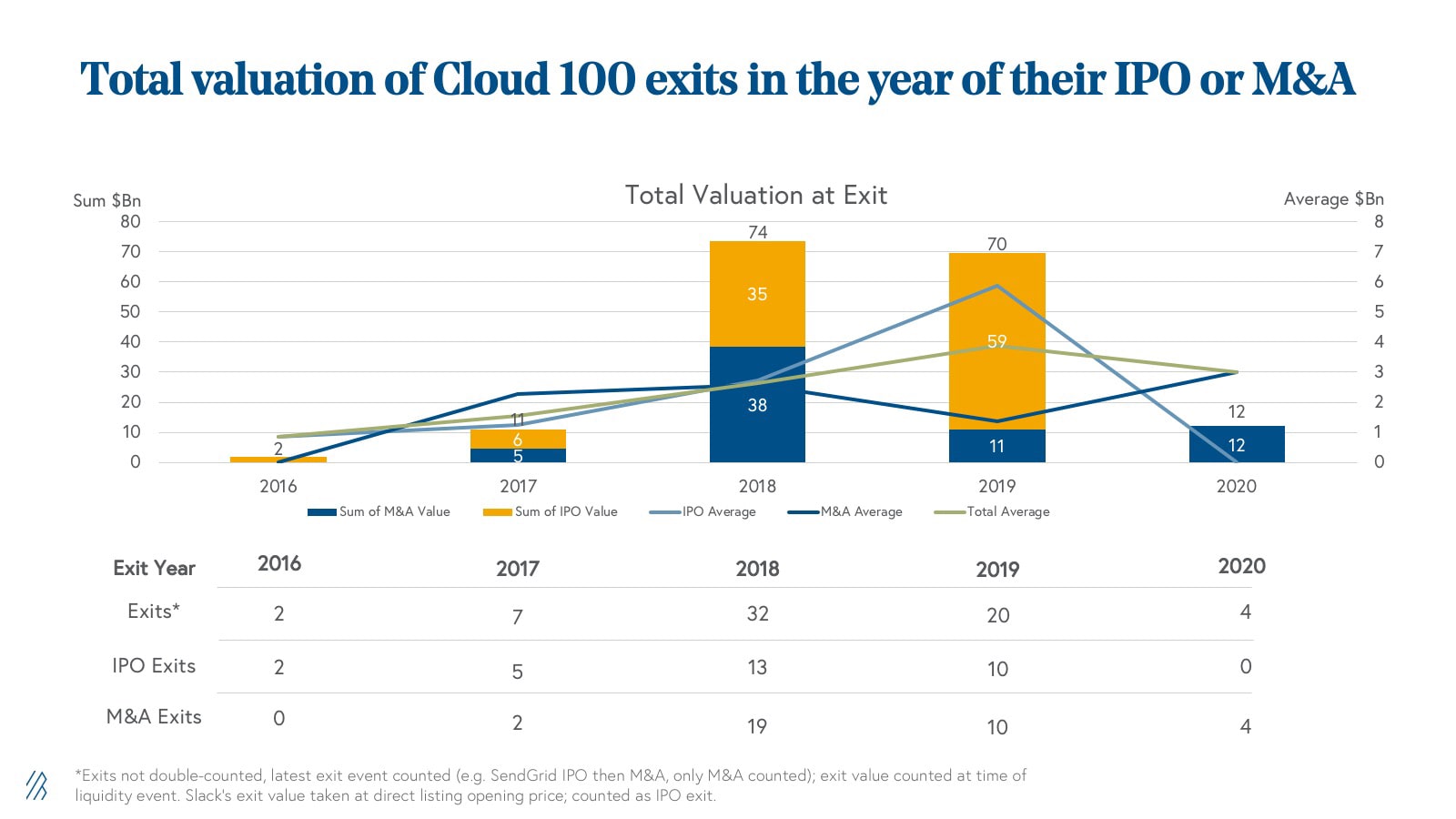

To highlight this potential, we reviewed exits per list year and found that the average exit size of Cloud 100 companies has been increasing over time, from an average of $3.3 billion in 2016 to $8.6 billion from realized exits in 2021. Historically, a majority of the exit value has been generated from IPOs, signaling how Cloud 100 members can grow into strong, standalone companies.

To illustrate this point, we note that iconic companies have IPOed from the Cloud 100 list, including the likes of Snowflake, UiPath, and Toast with their mega IPOs.

Focusing on strong business fundamentals

As we celebrate the 2022 Cloud 100 season, we want to remind entrepreneurs and investors that despite compressing multiples and what feels like doom-and-gloom in the markets, cloud businesses today are still displaying strong fundamentals.

As previous Cloud 100 graduates have demonstrated, the best cloud leaders are not only able to survive, but also thrive, through challenging times. These businesses are riding multi-decade tailwinds, and here at Bessemer we’re long-term oriented and long-term bullish on these companies. From the high percentage of Centaur representation in the 2022 Cloud 100 cohort, these honorees have already proven that they are companies with strong, durable fundamentals which gives us great conviction that the world’s best cloud companies will be able to weather the storm.

See you for the 2023 Cloud 100!

Read more Centaur Studies from ServiceTitan, Calendly, and LaunchDarkly in The Centaur Report.

2021 Cloud 100 Benchmarks

Today Bessemer Venture Partners, Forbes, and Salesforce Ventures announced the [2021 Cloud 100 List](https://forbes.com/cloud100), the definitive ranking of the top 100 private cloud companies. And — keeping consistent with previous years’ trends — the 2021 list was even stronger than the last. This year features bigger companies, higher valuations, and more market tailwinds than ever before — so much so, in fact, that the estimated valuation required to make the list was over $1 billion*. That’s right. The bar for this year’s list was so high that each honoree achieved the unicorn milestone. Between Stripe at $95 billion, Databricks at $28 billion, and Checkout at $15 billion, to get on the 2021 Cloud 100 list was a fight among giants. These honorees truly represent the best cloud companies globally.

With six years of Cloud 100 data behind us, in this year’s Benchmarks Report we reveal Bessemer’s analysis and insights into the 2021 Cloud 100 cohort and what it tells us about the state of the private cloud market today.

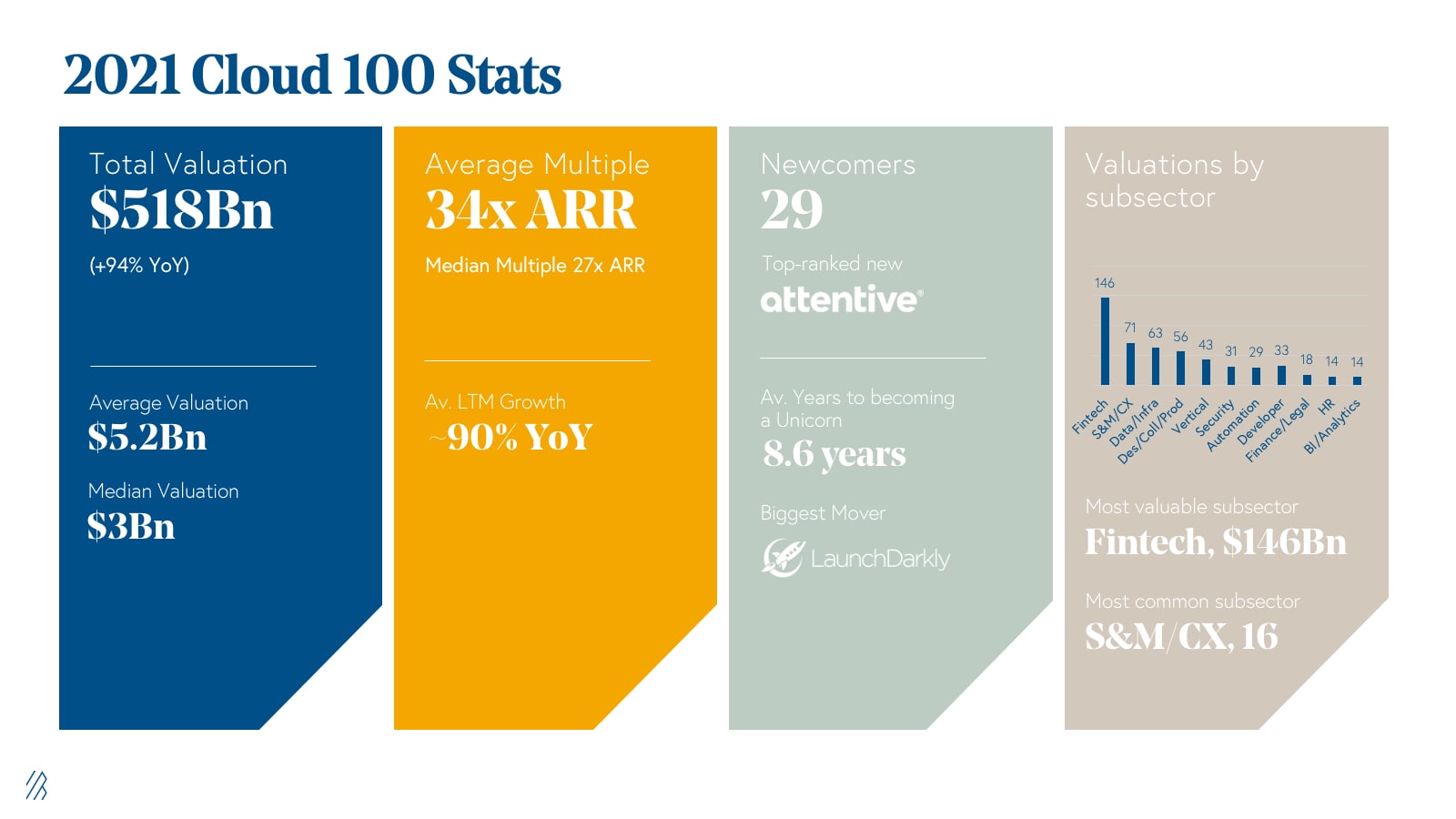

Top highlights:

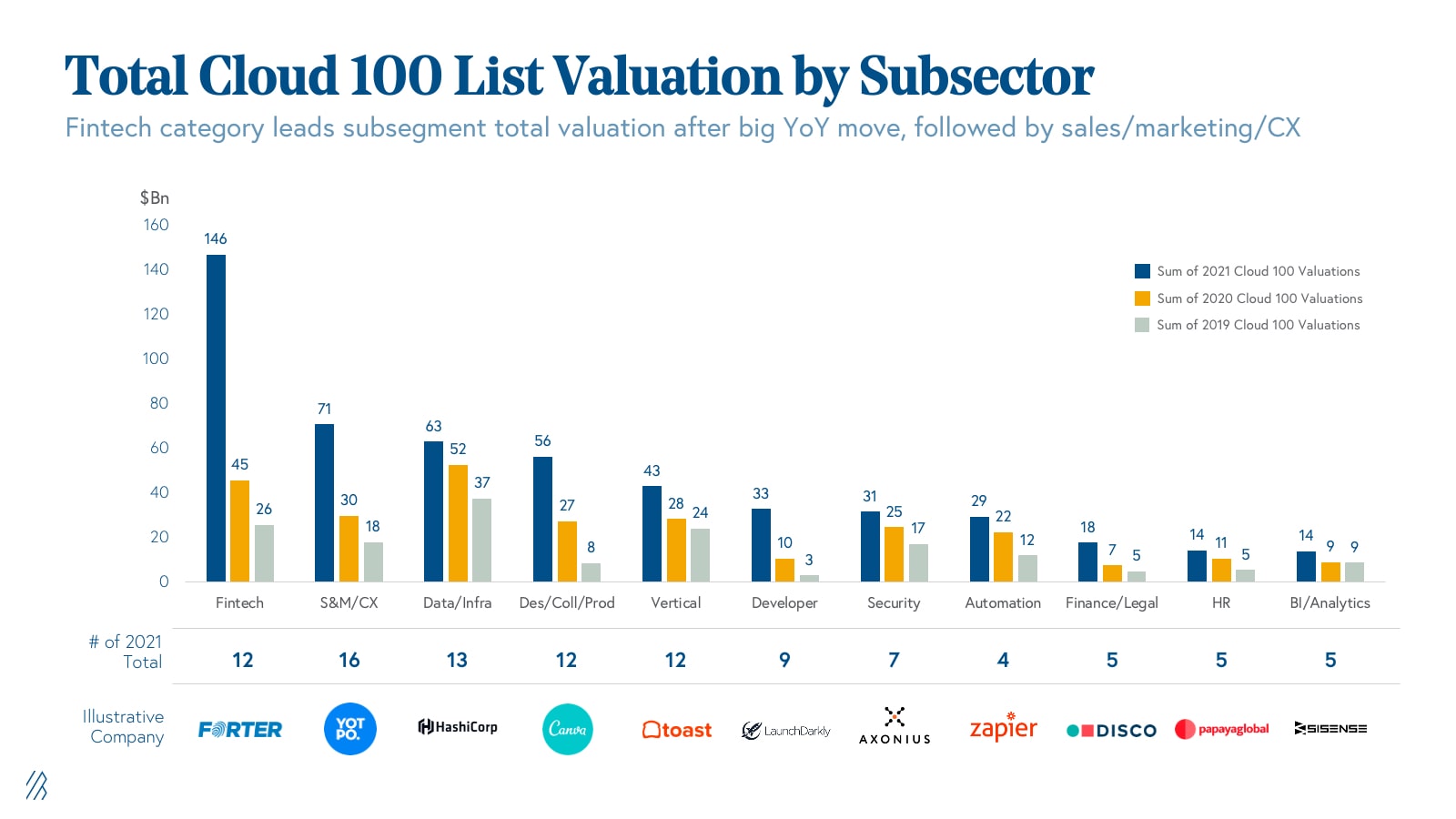

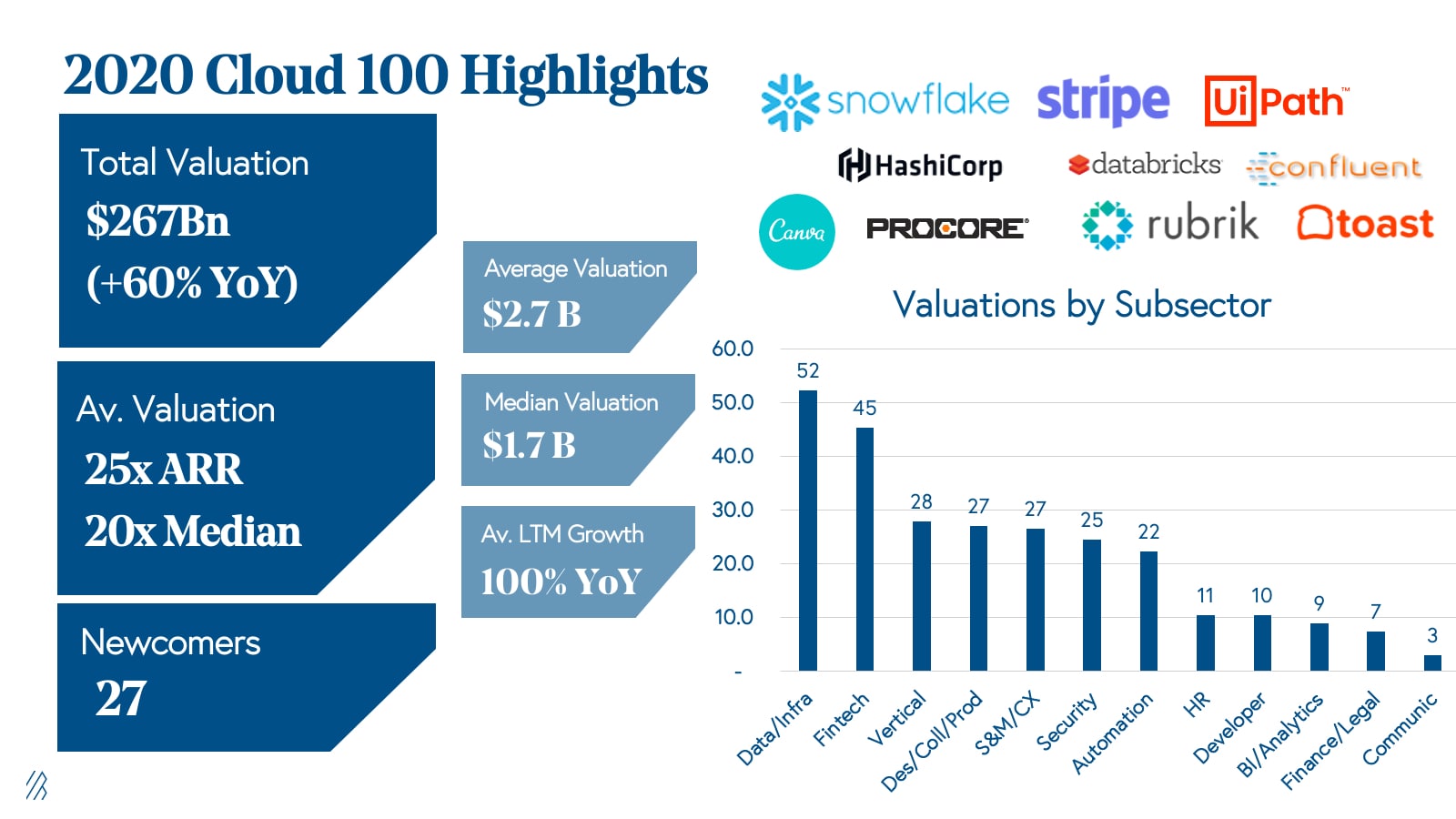

- Private cloud valuations continue to get bigger. The Cloud 100 2021 is worth an aggregate of $518 billion in 2021 vs. $267 billion in 2020, which is a 94% increase year-over-year (YoY). The top 10 Cloud 100 companies alone contribute $200 billion of equity value (38% of list value), and fintech represents the highest value subsector at $146 billion (28% of list value).

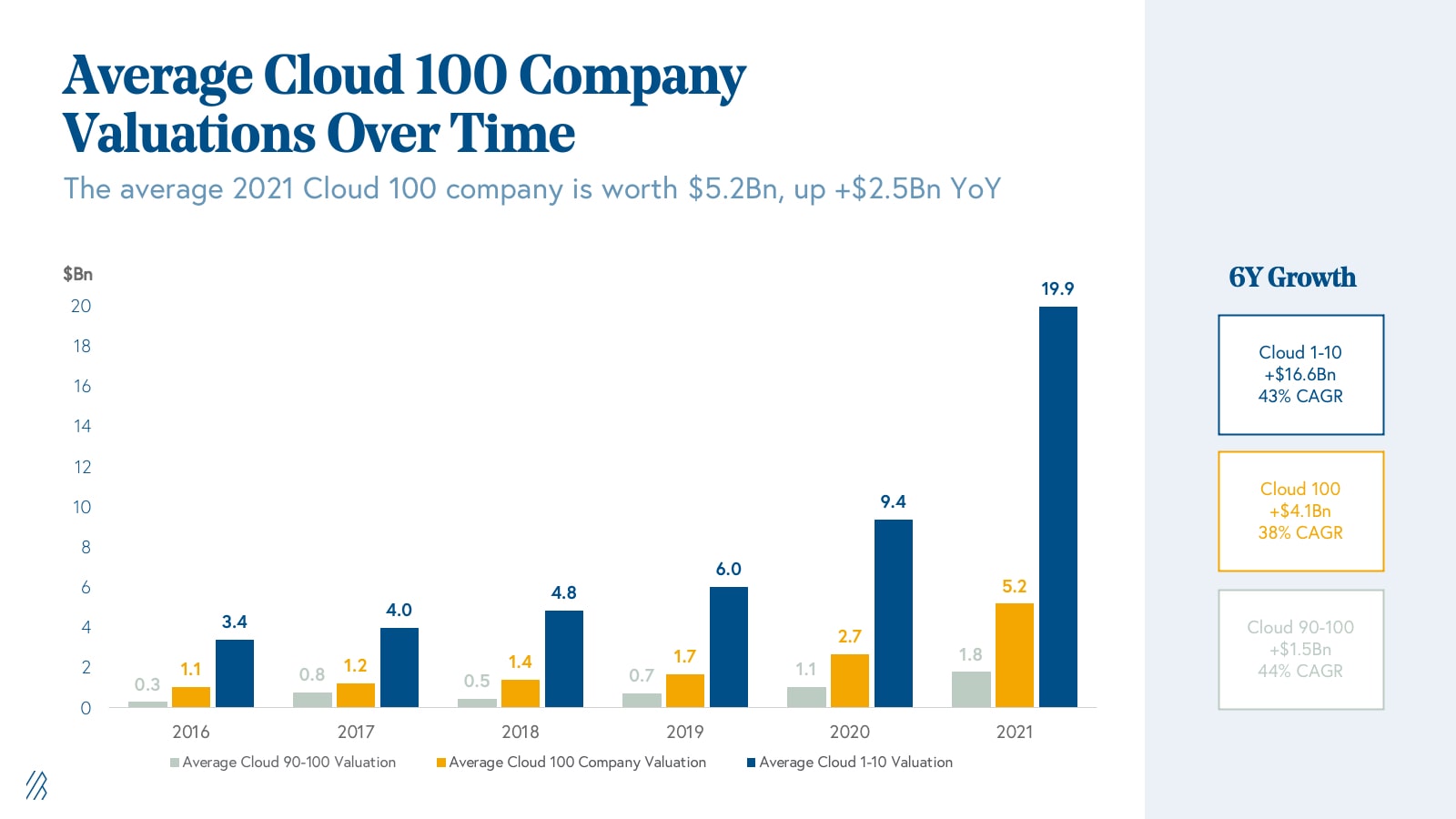

- The threshold to make the Cloud 100 continues to get higher: this year, every company on the list has at least hit the unicorn milestone. In addition, the average cloud company valuation was $5.2 billion, an increase of $2.5 billion YoY.

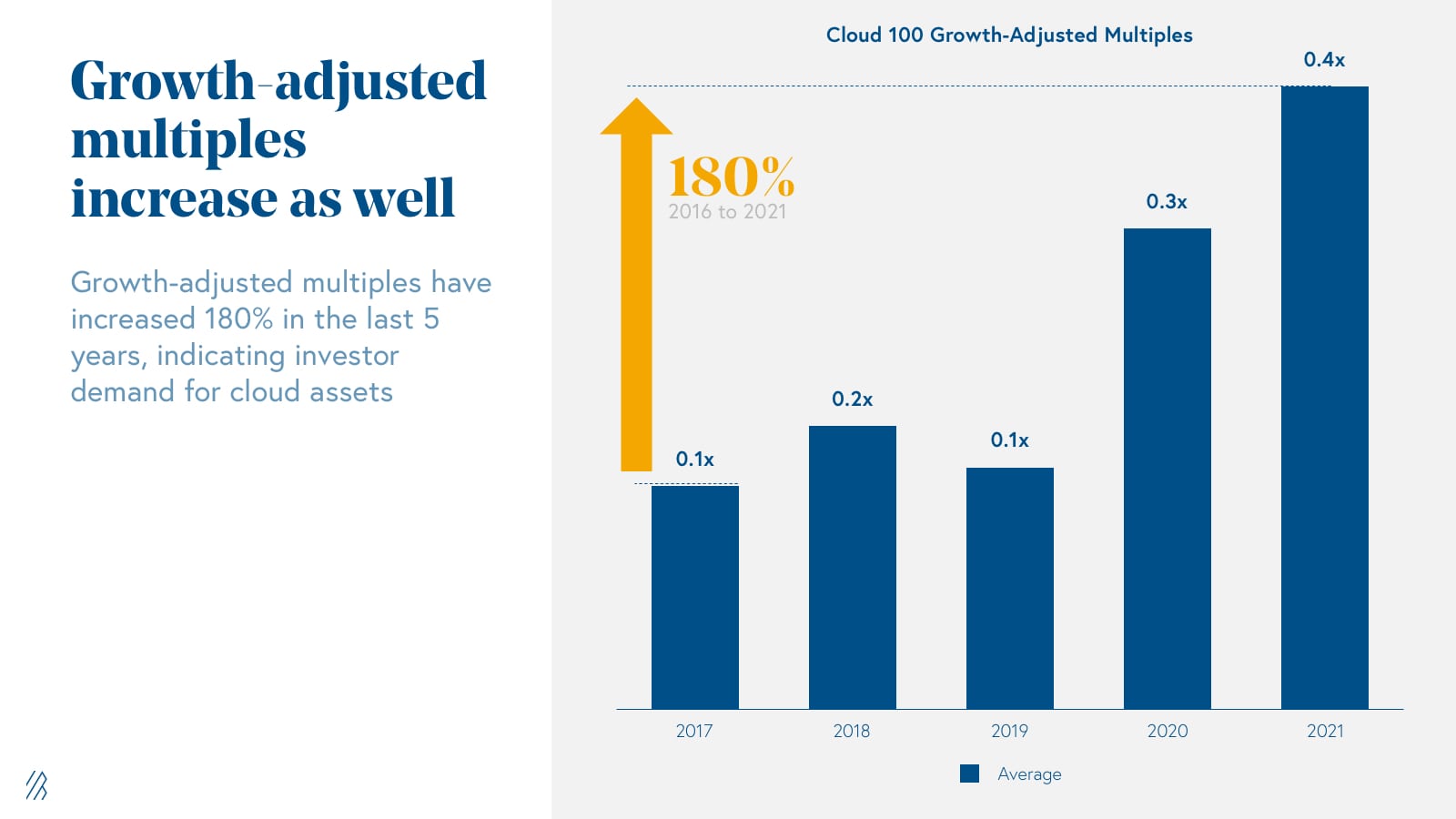

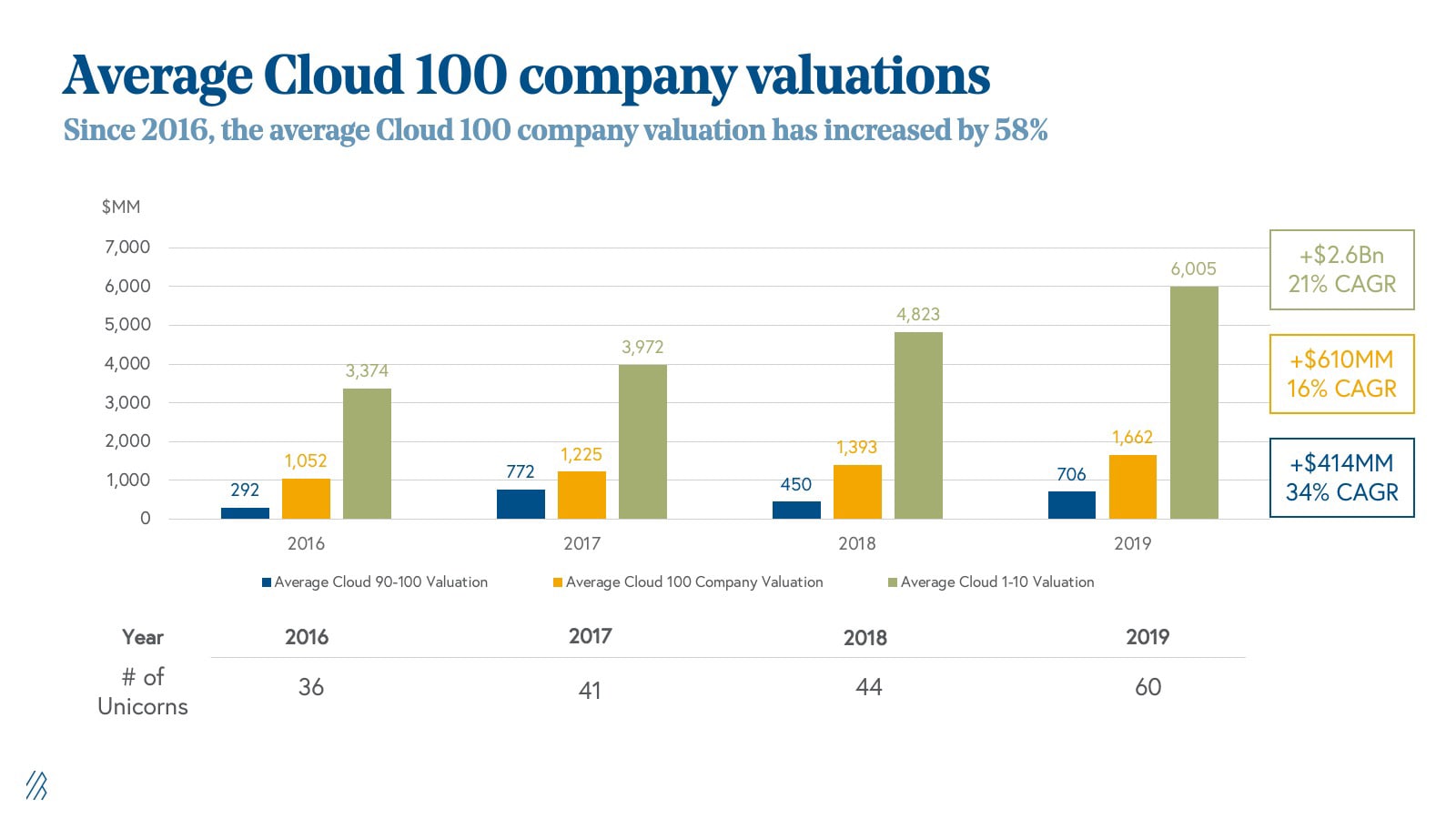

- The growth in valuations comes from both increased growth rates for Cloud 100 businesses and higher multiples being paid. The average Cloud 100 valuation multiple increased by approximately 270% in the last six years, from 9x ARR in 2016 to 34x in 2021, while the average Cloud 100 company revenue growth rate increased to 90% YoY.

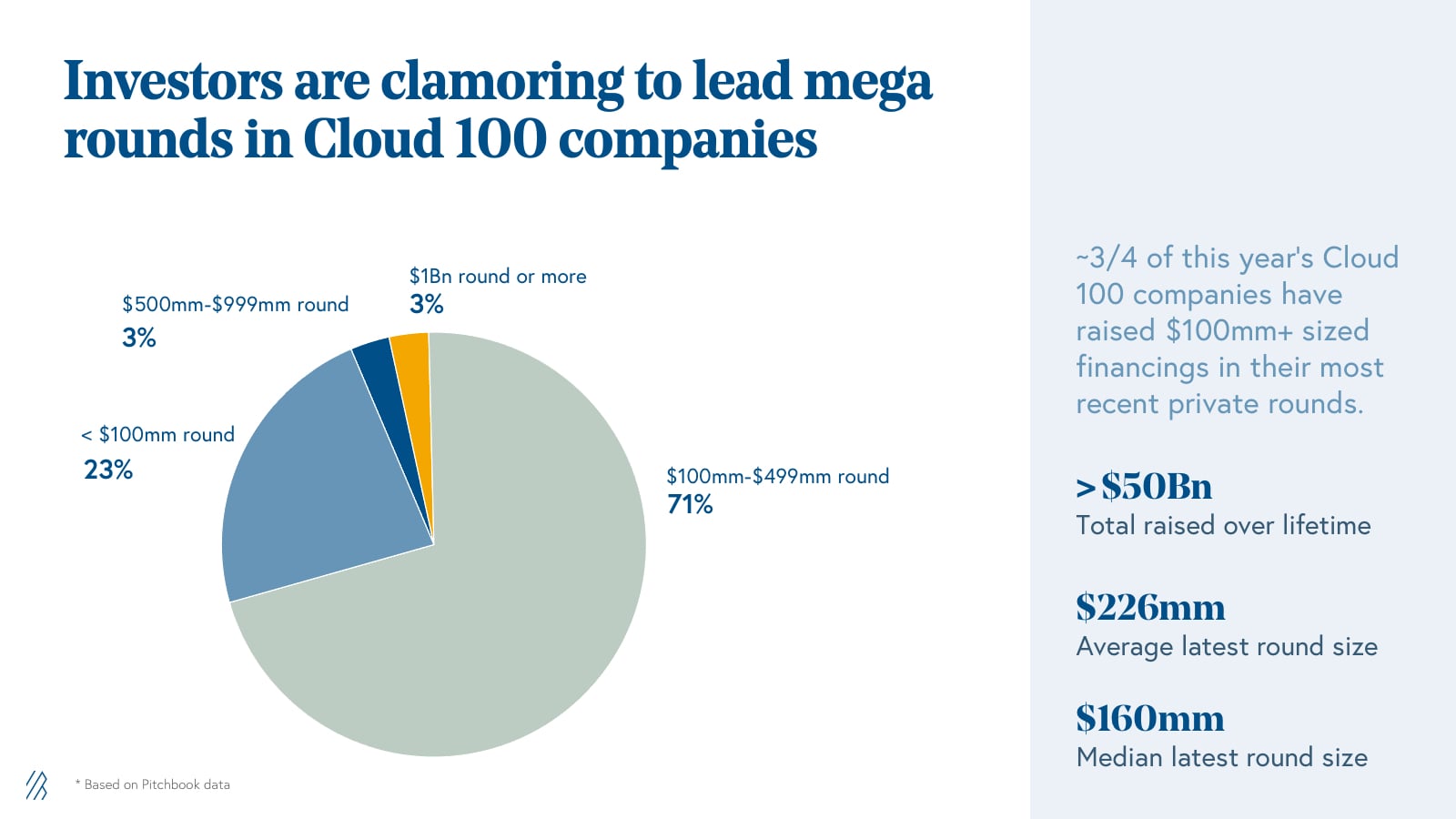

- Cloud 100 companies are reaching the unicorn milestone faster than ever before. When we look at the 2021 basket, it took the average Cloud 100 honoree 8.6 years from founding to grow into a unicorn, as compared to 12.1 years in 2016. Cumulatively, the Cloud 100 2021 basket has raised more than $50 billion over its lifetime.

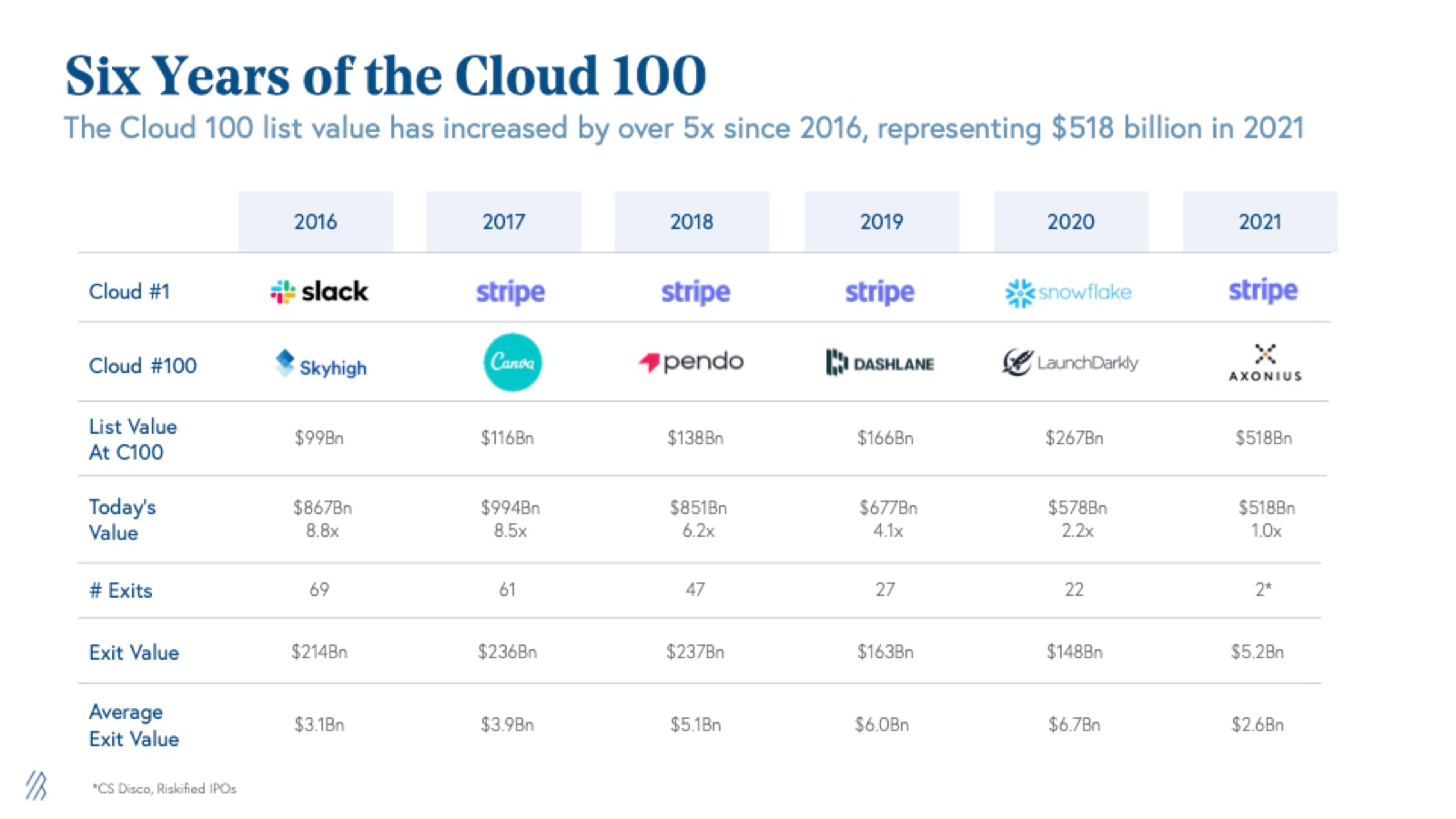

- The Cloud 100 list continues to produce strong returns. In five years, the total valuation of the 2016 Cloud 100 list has increased by more than 780%, delivering an 8.8x and 54% IRR in that time. The 2017 Cloud 100 basket has delivered an 8.5x and 71% IRR as its aggregate value nears $1 trillion; the 2018 basket a 6.2x and 83% IRR; the 2019 basket a 4.1x and 102% IRR; and the 2020 basket a 2.2x and 117% IRR in just one year alone.

Let’s dig in!

The Cloud 100 2021 at a glance: $518 billion of equity value

The 2021 Cloud 100 list represents an astonishing $518 billion of equity value, with an average $5.2 billion valuation per company. The cumulative value of the Cloud 100 list is up a staggering +94% from the 2020 list’s aggregate value of $267 billion, in just one year.

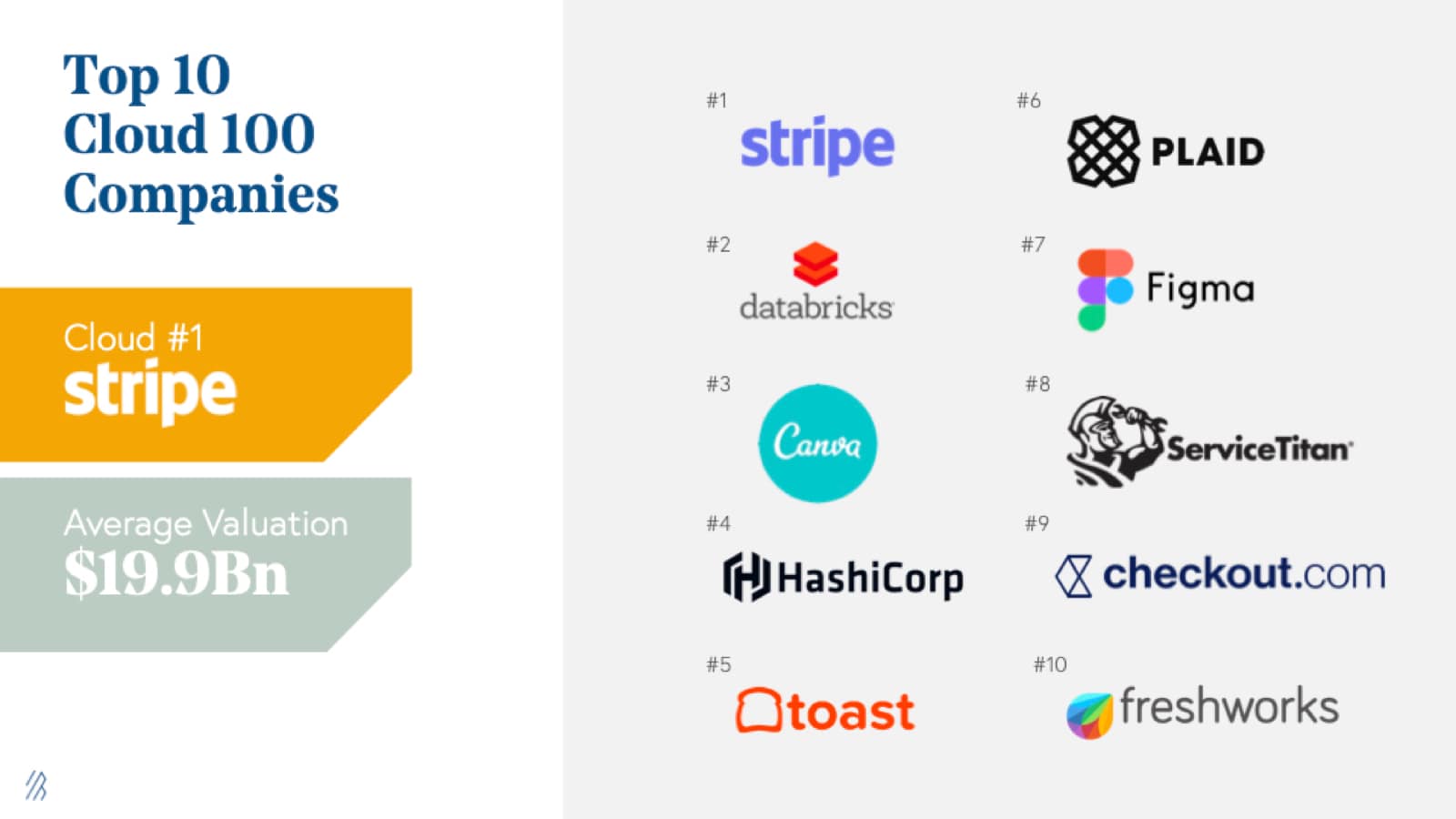

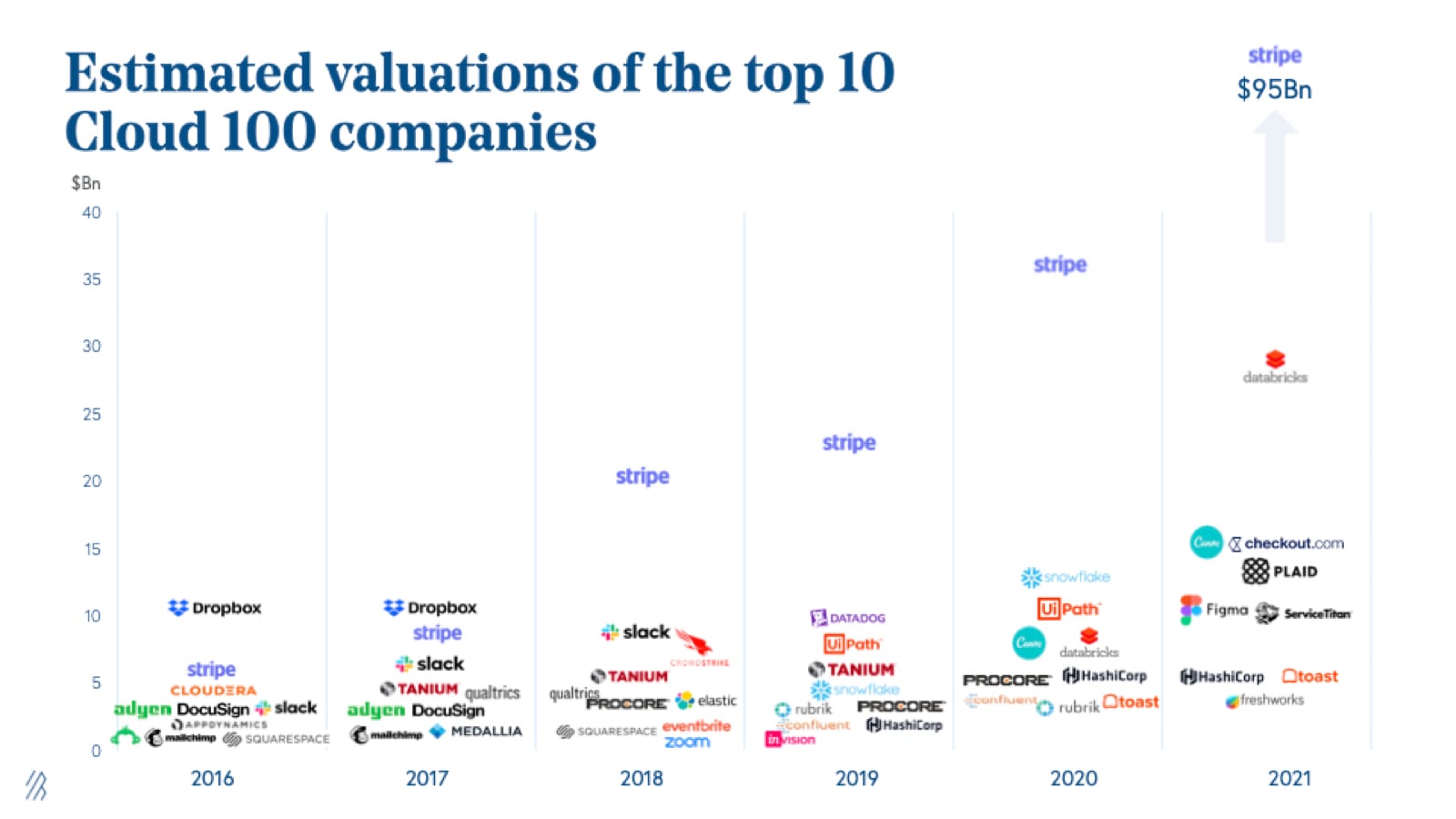

The Top 10 Cloud Companies represent almost $200 billion of equity value alone. Stripe, which was unseated by Snowflake in 2020, secured its number one spot once again and is the top-ranked cloud company, valued at $95 billion. Joining Stripe on the top ten list includes Databricks (#2), Canva (#3), HashiCorp (#4), Toast (#5), Plaid (#6), Figma (#7), ServiceTitan (#8), Checkout.com (#9), and Freshworks (#10). Representing $200 billion of equity value as a group, these companies individually average a valuation of almost $20 billion, $10.5 billion more than in 2020 and an incredible $16.6 billion more than in the 2016 iteration of the Cloud 100. Some notable financings in this group include [ServiceTitan’s $500 million round](https://www.servicetitan.com/press/500-million-investment) in March 2021, which put its valuation at $8.3 billion and [Canva’s April 2021 round at $15 billion](https://www.forbes.com/sites/alexkonrad/2021/04/06/canva-reaches-15-billion-valuation-making-cofounders-melanie-perkins-and-cliff-obrecht-billionaires/?sh=2c4a3dfc63c1).

Fintech surpassed data infrastructure as the most valuable Cloud 100 category, though sales, marketing, and customer success software continues to have the plurality of companies on the list. With 16 companies, the Sales/Marketing/CX category was the largest category represented on the 2021 Cloud 100 list by company count, including such notable names as Attentive, Yotpo, and Intercom, and it was the second most valuable subsector with $71 billion of value. However, the data changes when looking at aggregate valuation by subsector. With only 12 fintech companies on the list, this subsector holds 28% of the list’s equity value at $146 billion and is the highest valued subsector, anchored by Stripe (18% of the list’s value alone).

There were 29 newcomers to this year’s Cloud 100 list. The highest-ranked new entrant was Attentive, appearing on the list as #12. Other newcomers include Loom and Calendly alongside Bessemer portfolio companies Forter, the leader in fraud prevention software, and PapayaGlobal, an international payroll solution. The biggest mover title goes to world’s leading feature management platform, LaunchDarkly, which announced its Series D today at over a $3 billion valuation.

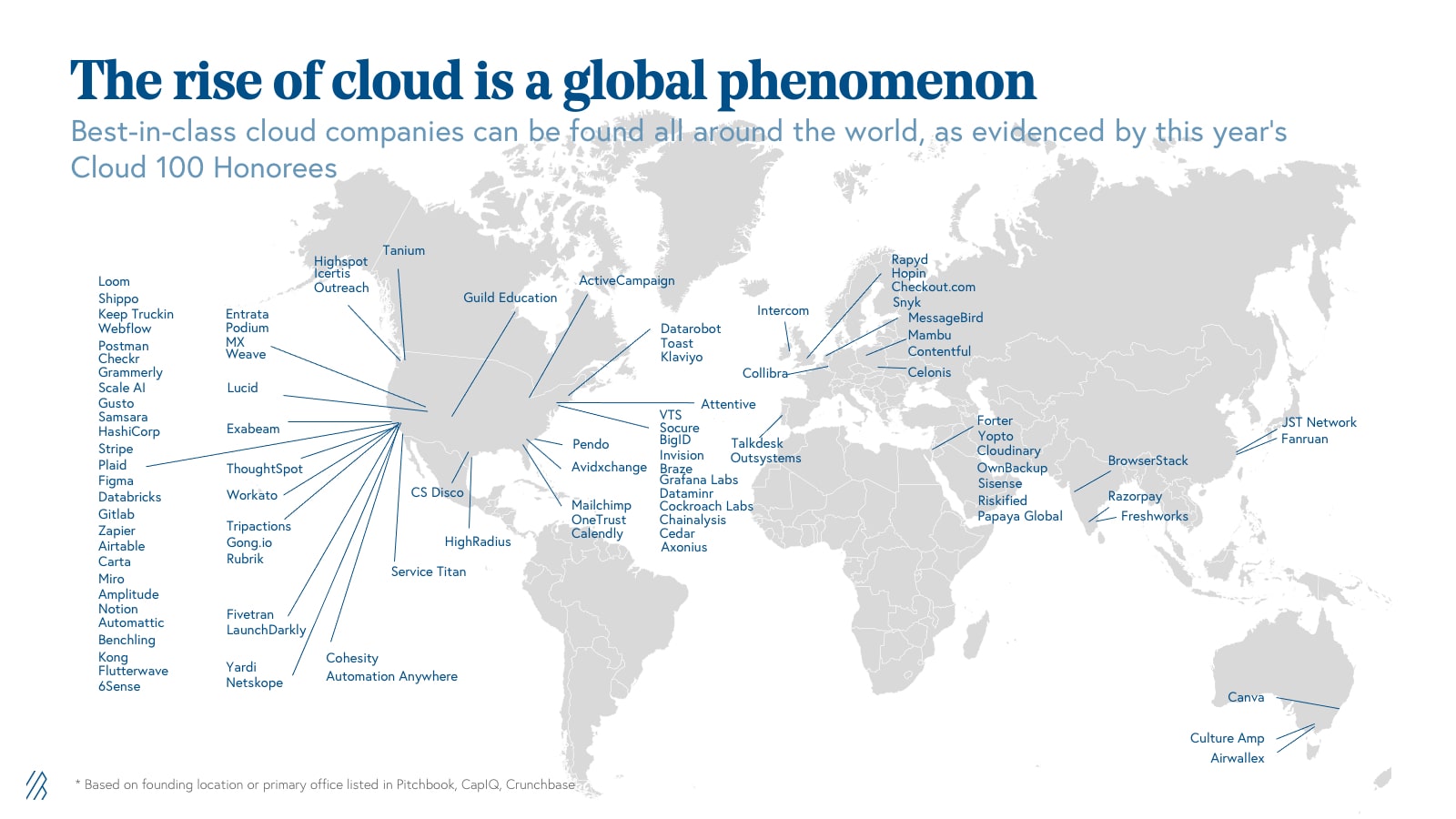

The globalization of cloud continues. As entrepreneurs, operators, and investors all around the world increasingly recognize the power of the cloud, we’re seeing cloud startups bloom in technology hubs globally. The Cloud serves as the backbone for emerging tech communities across the globe as startup teams have more flexibility and agency than ever before. In the Work from Anywhere movement, we’ve found that remote-first and distributed cloud teams across North and South America, EMEA, and APAC experienced more efficiency, increased scalability, and higher access to diverse pools of talent from all around the world. International representation on the Cloud 100 list reached almost 30% this year, and we expect this trend to continue for many more years to come, making the Cloud 100 more and more geographically diverse. We believe entrepreneurship is borderless, and we’re excited to continue to back cloud entrepreneurs around the world, from Canva in Australia to Mambu in Germany!

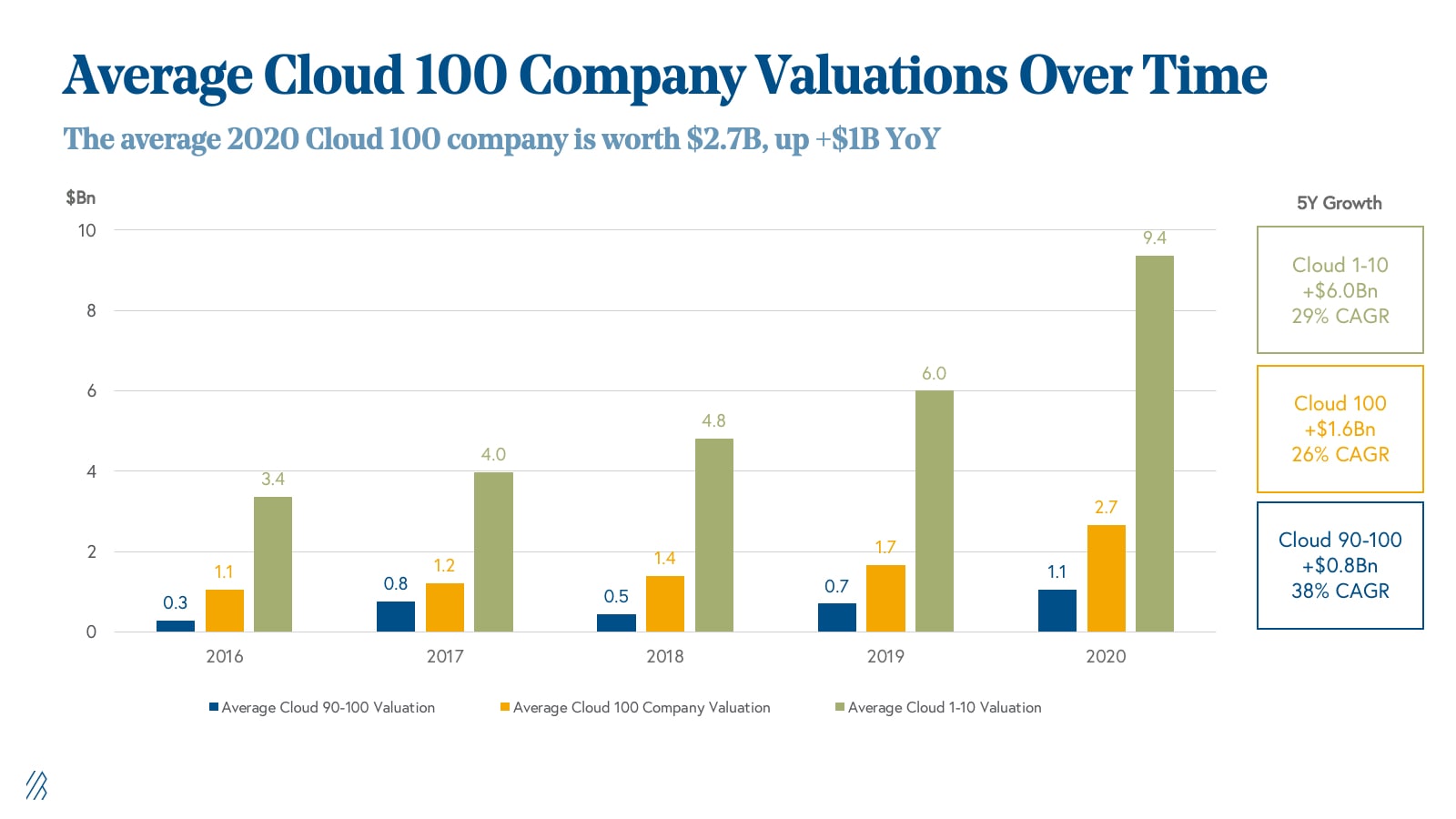

Cloud 100 new norms: 34x+ ARR multiples and +90% YoY growth

As we discussed above, the Cloud 100 2021 list is worth an aggregate of $518 billion, an impressive +94% YoY growth over the $267 billion value of the 2020 list, increasing the average Cloud 100 winner’s valuation up a massive $2.5 billion YoY ($1.6 billion if you remove Stripe). Combining all years of the Cloud 100, the growth is even more phenomenal. In six years, the average Cloud 100 valuation has grown by $4.1 billion and a +38% CAGR, from $1.1 billion in 2016 to $5.2 billion today.