State of the Cloud 2022

Bessemer uncovers the year’s top trends and insights in the global cloud economy, including how the model is only getting better, and why being a Centaur is the new milestone to celebrate.

When we compare the cloud economy in 2021 to 2022, we see two drastically different pictures. 2021 was one for the record books: the total public cloud market capitalization reached a peak of $2.7 trillion in November, blockbuster tech IPOs in the U.S. yielded $142.4 billion in proceeds, and global tech M&A topped over $1.24 trillion. But in 2022, things began to change.

With inflation on the rise, interest rates climbing, and geopolitical uncertainty, 2022 was met by stormy conditions in the form of a dramatic market correction. The BVP Nasdaq Emerging Cloud Index slipped back to 2020 levels, dropping over 40% in value. (As of May 2022, the cumulative market capitalization of the public cloud is approximately $1.4 trillion). However, despite this drop—or what we’ve called “The SaaSacre” at Bessemer—this cohort of cloud companies still exhibits strong fundamentals (e.g., 41% average growth rate, 71% average gross margin, 45% average efficiency score.)

So what is the true state of the cloud? Public stock performance never impacts how we, as venture capitalists, invest into early stage businesses, but we recognize that for private cloud founders, this is a tenuous time. Despite this, we still believe that the cloud model is the most important paradigm shift since the invention of the internet. The promise and potential of the cloud economy still persists—and will only continue to grow.

Slides

In State of the Cloud 2022, we share seven crucial insights cloud founders need to know:

- Why the cloud model is so promising

- How SaaS is improving as an industry

- Why the onramp to the cloud is getting smoother

- Which macro factors are driving cloud adoption

- Which geographies and industries still see low cloud penetration

- What’s notable about the SaaS ecosystems across different regions

- Why valuations may not be the best way to measure startup success (and why revenue is a better alternative.)

In addition to these seven insights, we’ll also share our five top predictions for the coming year throughout the report.

The power of the cloud model

Let’s go back to basics: SaaS allows businesses to deliver software through the internet, making it available everywhere, with products that continuously improve. The subscription business model drives companies to focus obsessively on customer needs, and strive to earn their trust every day.

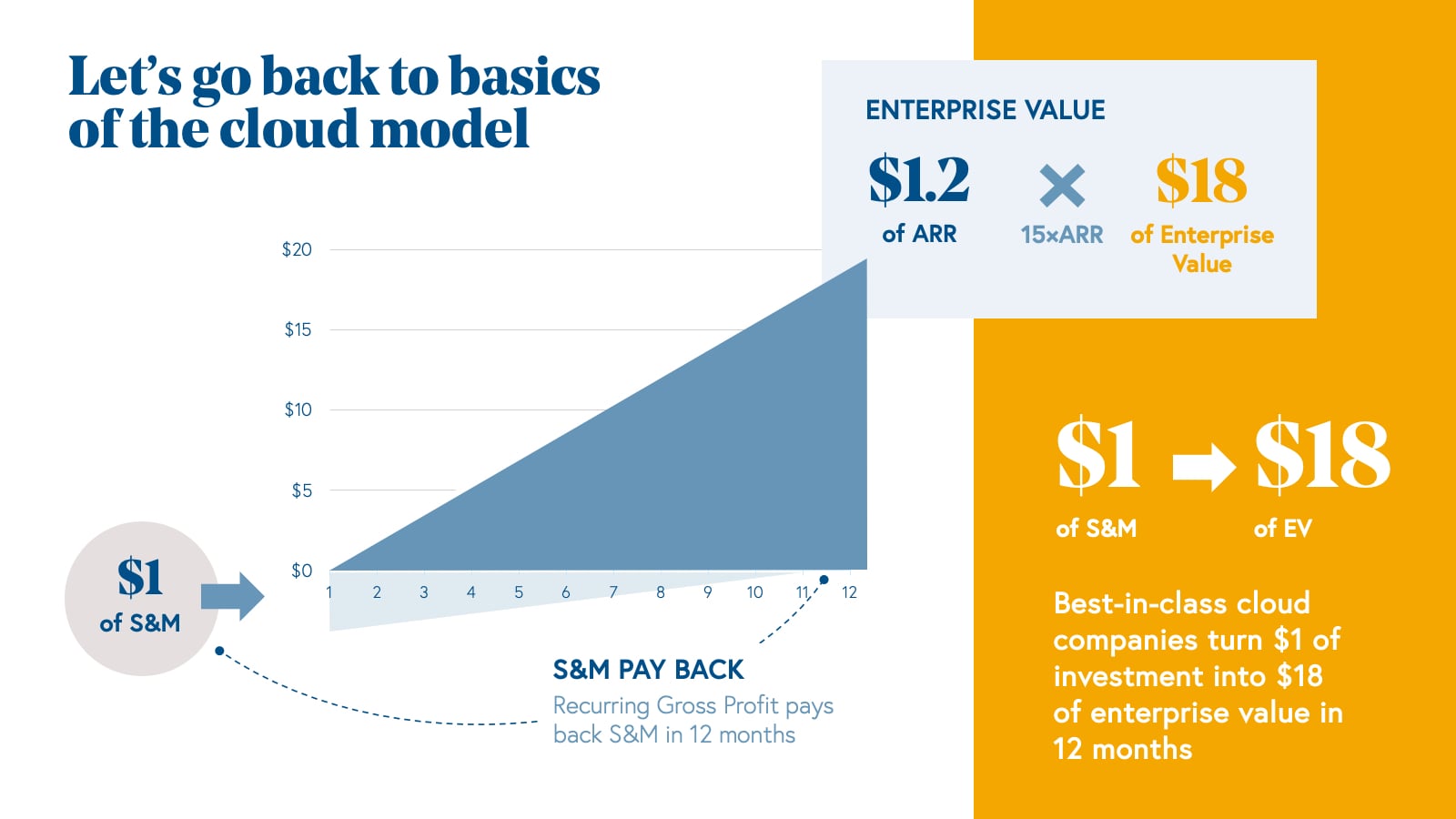

When a SaaS business achieves best-in-class sales efficiency and net retention metrics, they can generate net new recurring revenue with unprecedented efficiency. As a result, we believe this business model may be the best on the planet.

For every dollar a SaaS business spends on its sales team, the company will see a dollar of recurring revenue materialize in less than a year and grow nearly in perpetuity. The power of the cloud model is why these businesses are often valued at 10 to 20 times their annual revenue, even in today’s market. At these multiples, each dollar invested in growth can create tens of dollars of enterprise value every year. (In fact, the leading cloud companies turn $1 of investment into $18 of enterprise value in 12 months.)

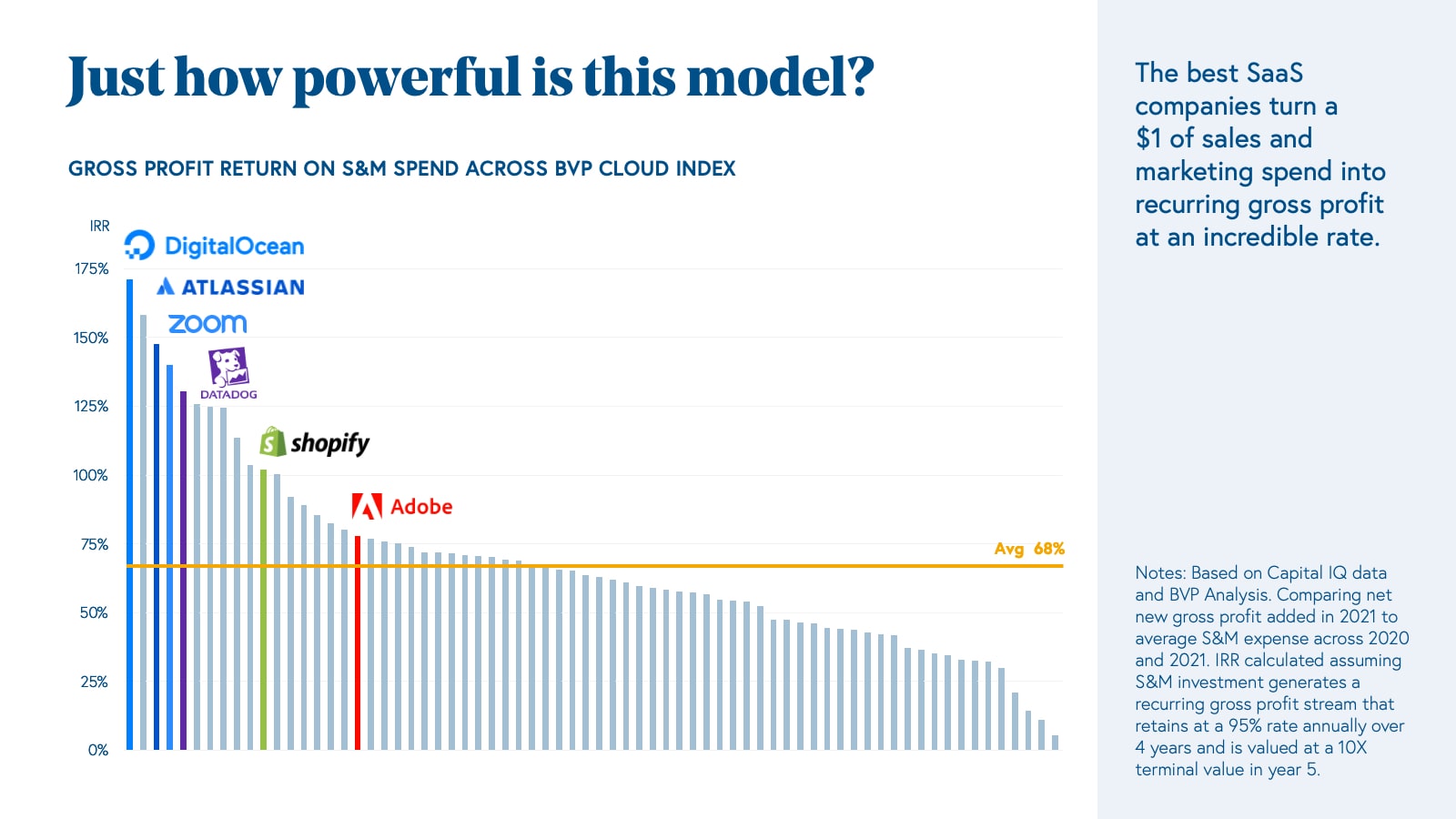

We calculated the annual return that BVP Nasdaq Emerging Cloud Index companies generated on a gross margin basis, relative to their sales and marketing investments last year. Based on our conservative assumptions, the average BVP Cloud Index company generated a 68% internal rate of return (IRR) for every dollar poured into sales and marketing. (In comparison with the average S&P 500 company that strives to reach a 20% return on capital, it’s clear how much of an advantage cloud businesses have when it comes to efficiently recycling capital.)

Top-performing cloud companies saw returns well north of 100% IRR, and not just fast-growing product-led companies like Digital Ocean, Datadog, or Zoom. More mature companies like Atlassian and Shopify still returned over 100% last year simply by investing sales and marketing dollars behind a stellar product.

The SaaS model and products are getting better

Every day, technology improves with more bandwidth, more data, new APIs, and advancements in AI, powering everything from image recognition to language generation. This means that every day, the SaaS products we build on this fabric grow more powerful.

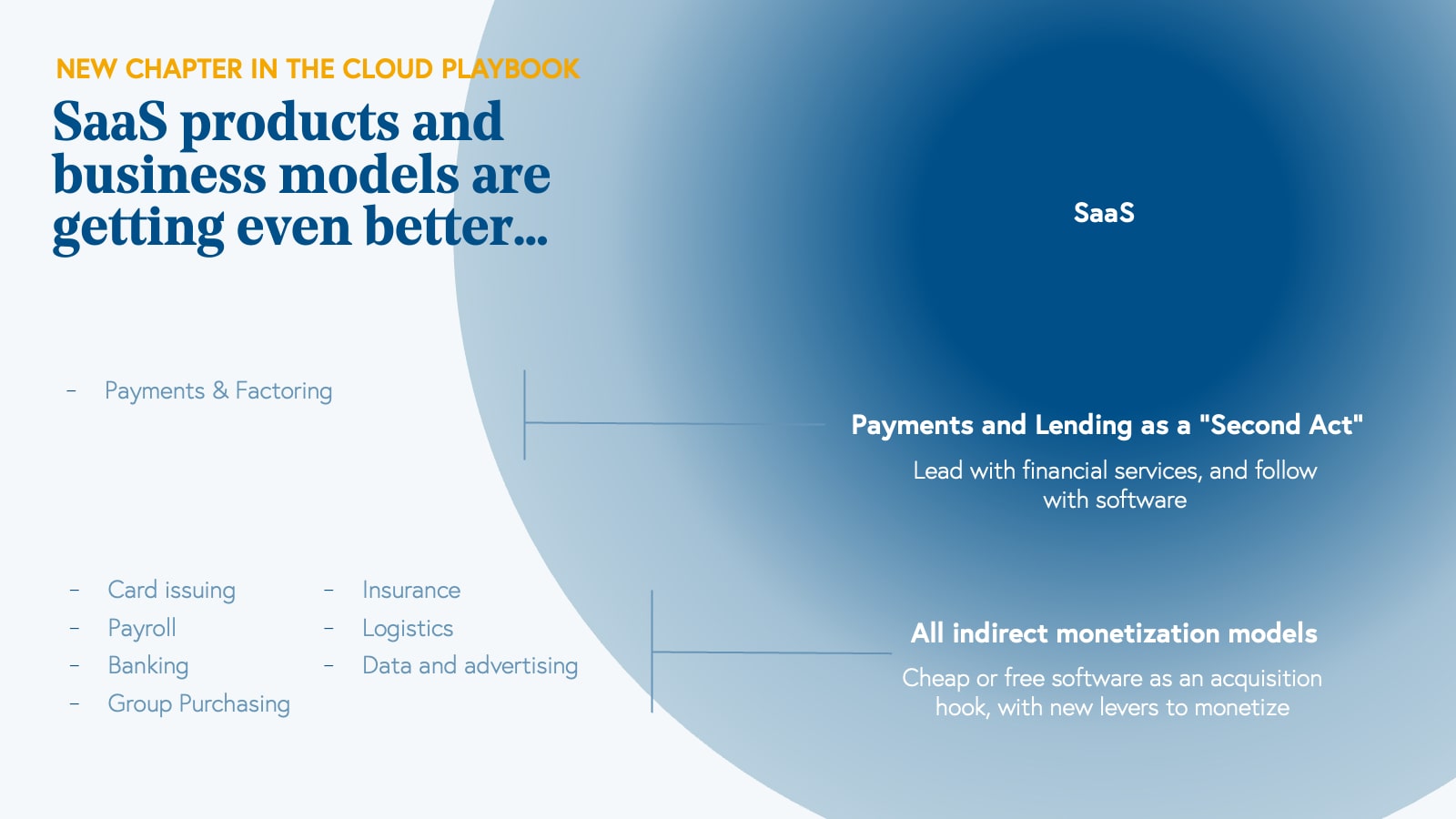

Historically, the “First Act” of product innovation was software-as-a-service, and with time, pioneering SaaS companies layered on embedded fintech solutions—such as payments and factoring—as meaningful “Second Acts.” This layered cake strategy broadens a business’ addressable market, improves retention, and increases average contract values. For example, when Shopify launched payments in 2015, they grew their annual recurring revenue from $50 million to $150 million within a year and a half.

Today, companies are embedding a much broader suite of services into their products, including card issuing, banking, group purchasing, insurance, logistics, and usage based pricing—which are driving new business models. What were once Second Acts are now becoming First Acts, and helping SaaS companies differentiate themselves as SaaS markets become increasingly competitive.

Prediction 1: Leaning into indirect monetization from day one is becoming table stakes for SaaS businesses

Thanks to the proliferation of APIs, it is easier than ever to build products that monetize indirectly on a range of ancillary services. In some rare cases, companies are even jumping to completely free software as a lead generation tactic to capture more lucrative indirect monetization streams. Either way, indirect monetization is an extremely effective way to build a business, and given the increasingly competitive SaaS markets, this strategy is becoming table stakes.

Businesses that we’ve seen successfully lean into indirect monetization so far include Ambrook, Basicblock, Brex, Built, Cents, Coast, Fresha, Gloss Genius, Lasso, Miter, MVMNT, Mycarrier, Ramp, Wrapbook, among others. These businesses are powered by a wave of API building blocks (such as Stripe and Melio in payments; Lithic and Marqueta in card issuing; Gusto and Check in payroll; Cover Genius and Sure in insurance; Modern Treasury, Unit, and Alloy in banking; and Parafin and Lendflow in lending.)

The evolving cloud adoption onramp

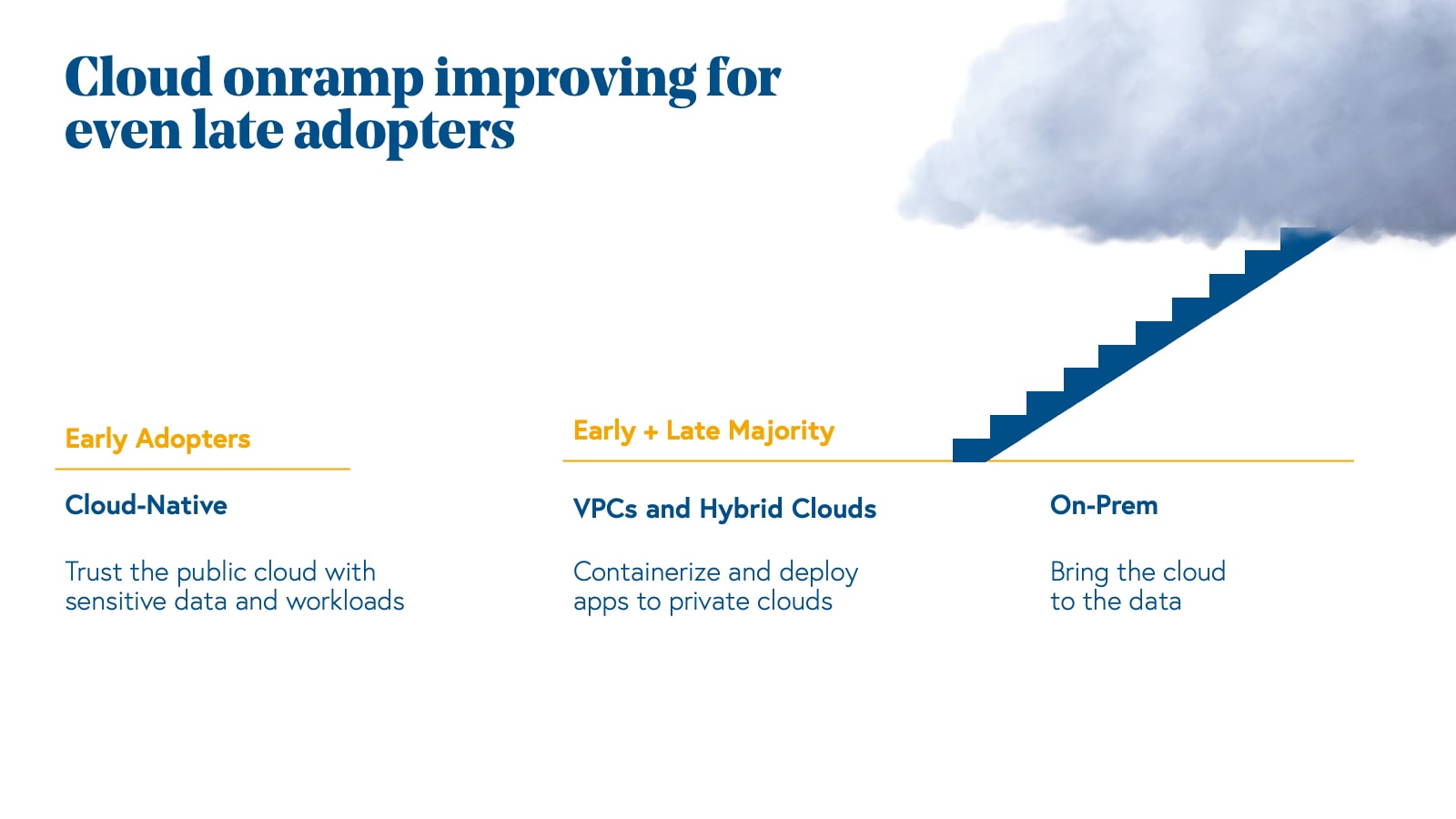

In addition to advancements in APIs that make SaaS products better, the onramp to the cloud is also getting increasingly easier for customers, regardless of a customer’s sophistication or cloud readiness.

Three key trends are reducing the friction in accessing cloud services:

- Sensitive data on the cloud. Cloud early adopters continue moving increasingly sensitive data like security logs and financial records to the cloud, which would have been nearly unthinkable a decade ago.

- Virtual private clouds. It is becoming easier to package SaaS products and deploy them inside a customer’s virtual private cloud (VPC). This is due in part to the standardization around Kubernetes as the operating system of the cloud. This makes it easier for SaaS companies to serve a wider range of customers that may prefer to keep certain sensitive data or applications in a VPC.

- Middleware building bridges. Emerging middleware platforms are making it easier to bring the power of the cloud to the data, wherever it may be. This has played out in industries like financial services, where a wave of modern fintech infrastructure helped build bridges between the cloud and legacy banking systems. We are seeing similar bridges being built in other large industries like supply chain, logistics, and healthcare to bring the power of the cloud to these on-premise data sources.

Ultimately, these trends help to further break down barriers to the industries and use cases that the cloud can impact, as the cloud continues to consume all of enterprise IT.

From every facet of SaaS—the business model, the product, the onramp—we’re seeing improvements. And now, the cloud is becoming increasingly critical as a sales and fulfillment channel for software.

Prediction 2: The cloud goes to market(places)

Cloud marketplaces have emerged as one of the most natural places for SaaS buyers and sellers to transact, regardless of whether it is a bottoms-up purchase or a large enterprise deal. These platforms provide value to both buyers who want to consolidate spend with their cloud providers and gain economies of scale, and SaaS sellers, who want to streamline the procurement process and access larger budgets. Cloud marketplaces can serve as powerful sales and fulfillment channels for any SaaS companies that sell into enterprises with substantial cloud spend. We are seeing a broad range of SaaS players flock to marketplaces, including sales, marketing, and communications SaaS companies, not just infrastructure SaaS providers.

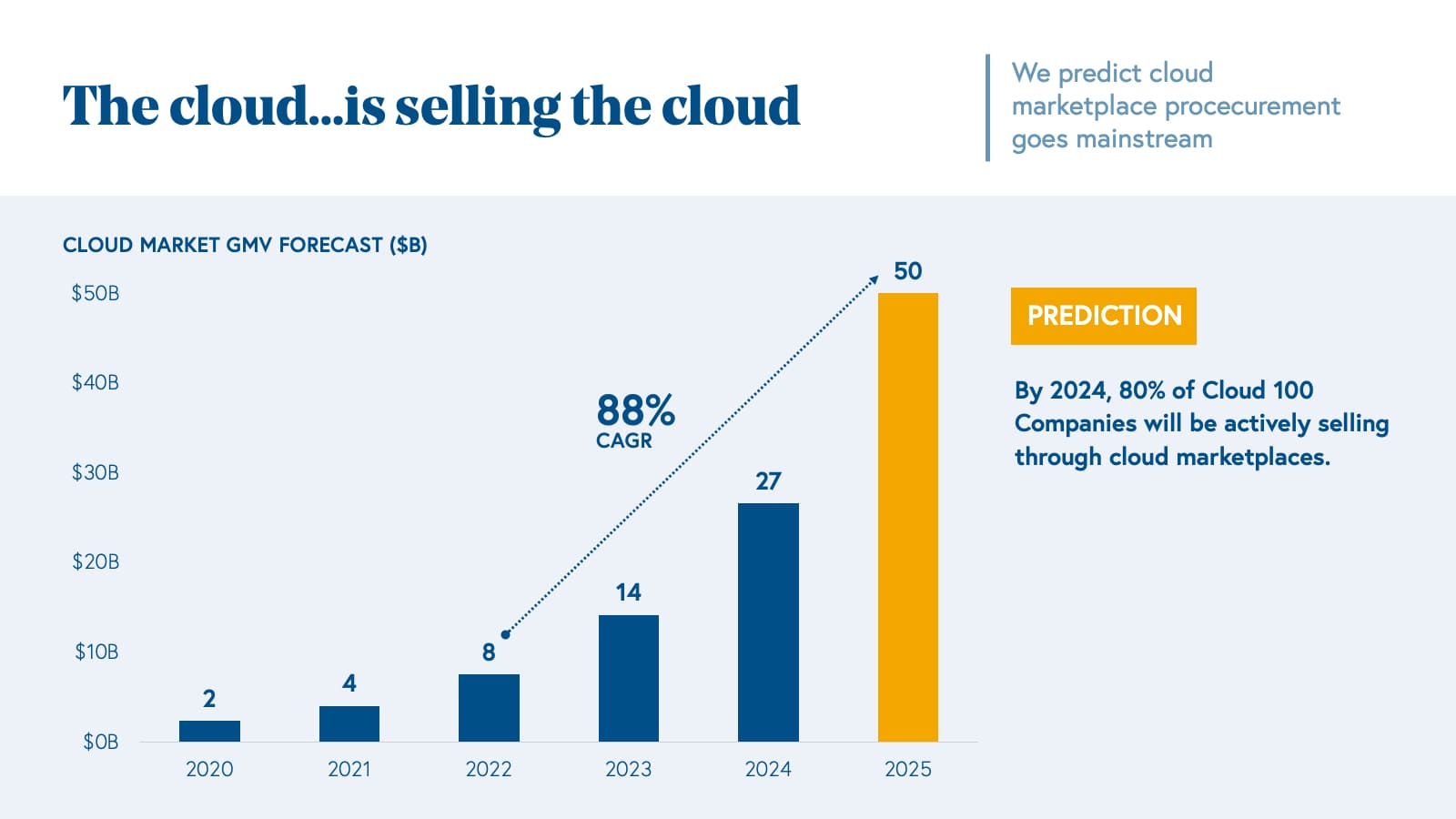

Cloud marketplaces are still nascent, but in 2021, we saw marketplace transactions grow an estimated 70% to $4 billion, which is 3x faster growth than the public cloud at large. And according to cloud marketplace platform Tackle.io, we will continue to see these marketplaces explode, growing to $50 billion of gross merchandise value (GMV) by 2025.

Going forward, we predict that cloud marketplace procurement will go fully mainstream, and become a standard component of the SaaS go-to-market playbook. Last year, 45% of our Cloud 100 companies were actively selling on at least one cloud marketplace. We predict this will nearly double to 80% over the next two years.

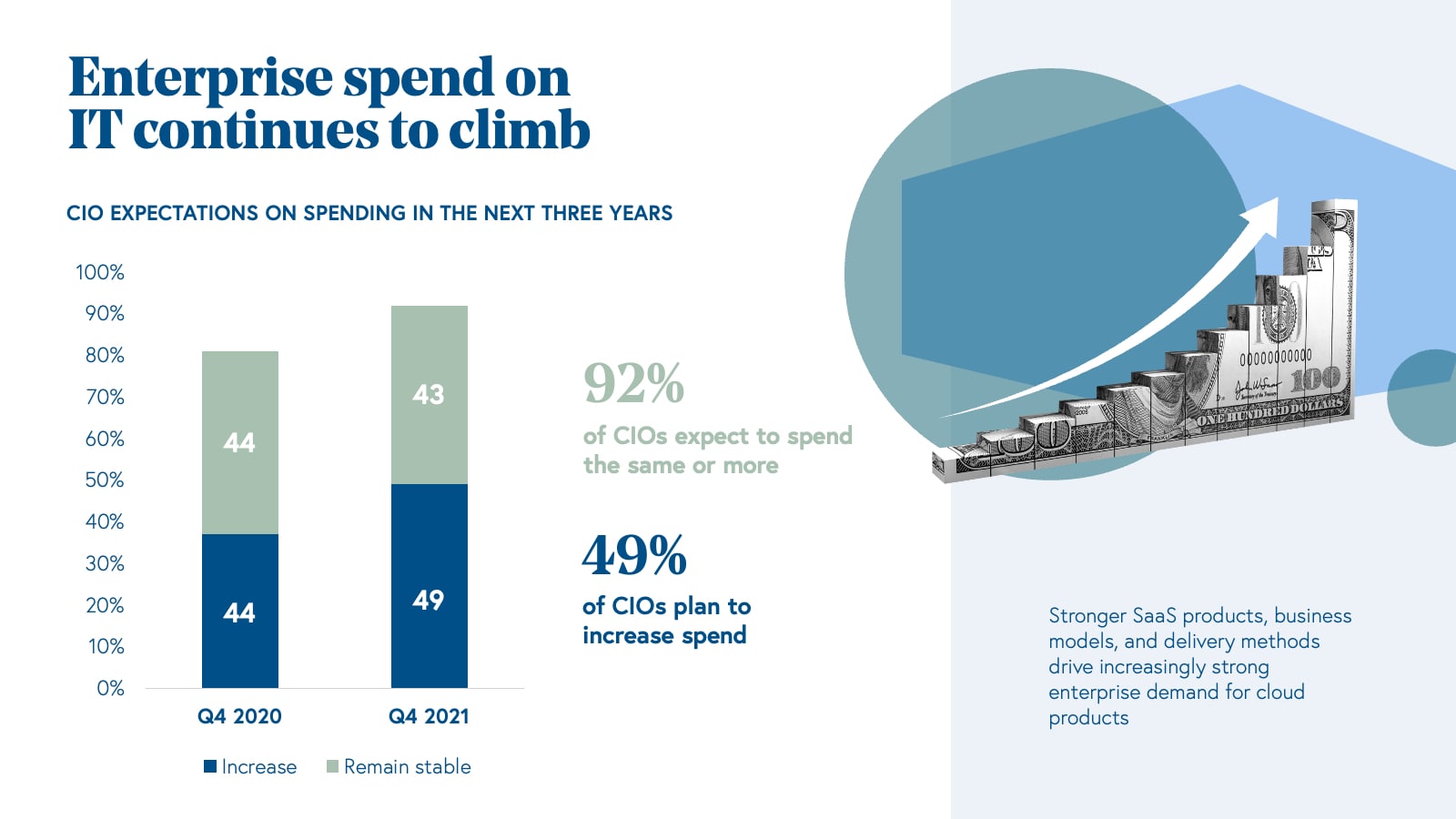

So cloud products, monetization models, delivery methods, and sales channels are all improving, and providing even better customer experiences in the process. Thus, it’s not surprising to see enterprise demand for IT continue to rise, with the cloud still clearly on track to become the largest spend category within all of IT.

Macro drivers of cloud adoption

The cloud model is becoming more efficient than ever before. But what are the global macro drivers that signal we’re still in the early days of cloud adoption?

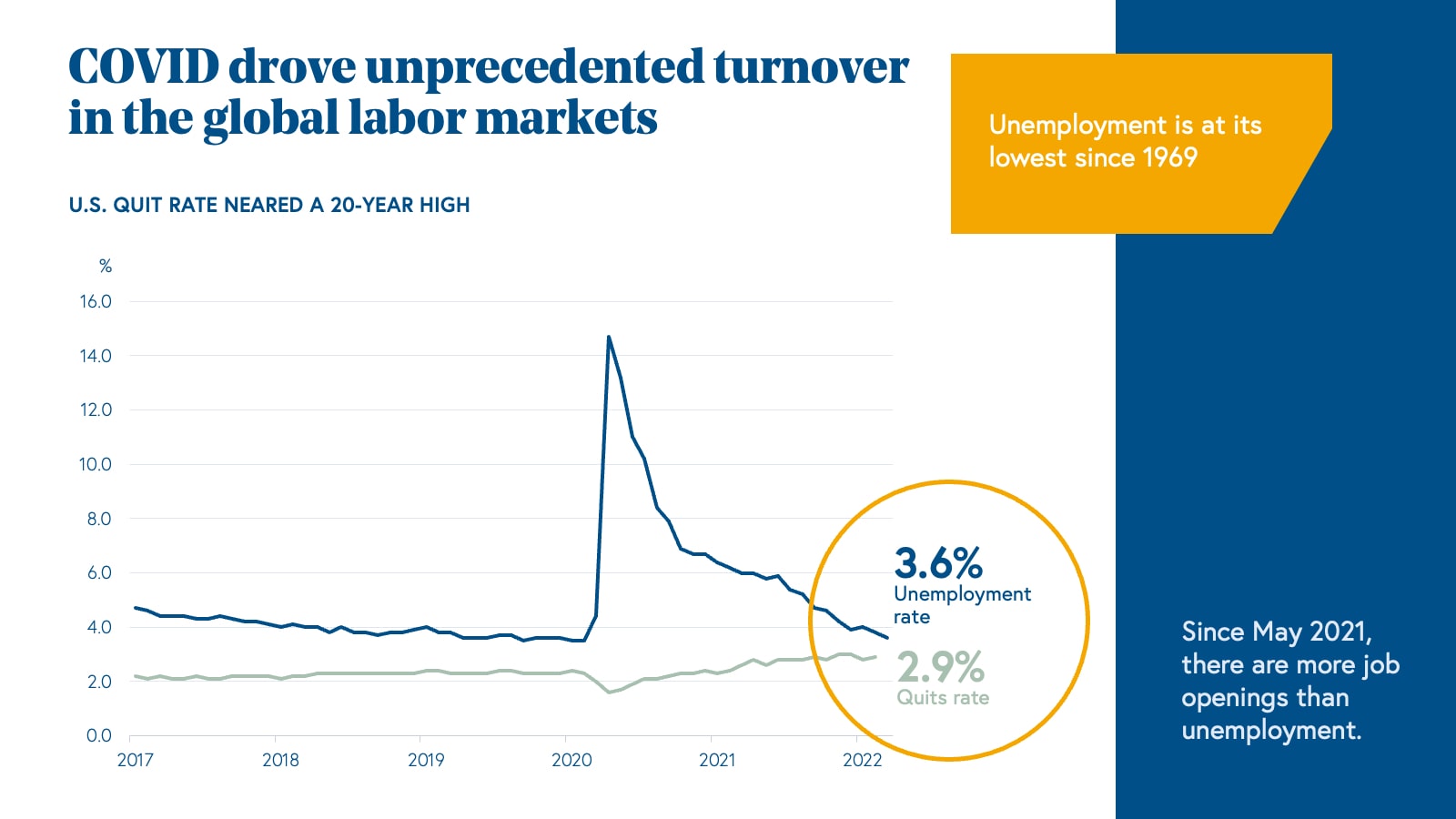

Software has become integral to the way businesses and people operate, especially as hybrid and distributed working models dominate. With this in mind, we look to the global jobs market to reveal drivers of the cloud. The COVID-19 pandemic set off unprecedented turnover in the U.S. labor market. Widespread initial job losses were followed by the Great Resignation and incredible labor shortages. Just last month the U.S. “quit rate” neared a 20-year high at 2.9%, while the “unemployment rate” dropped to its lowest level since 1969, hitting 3.6%.

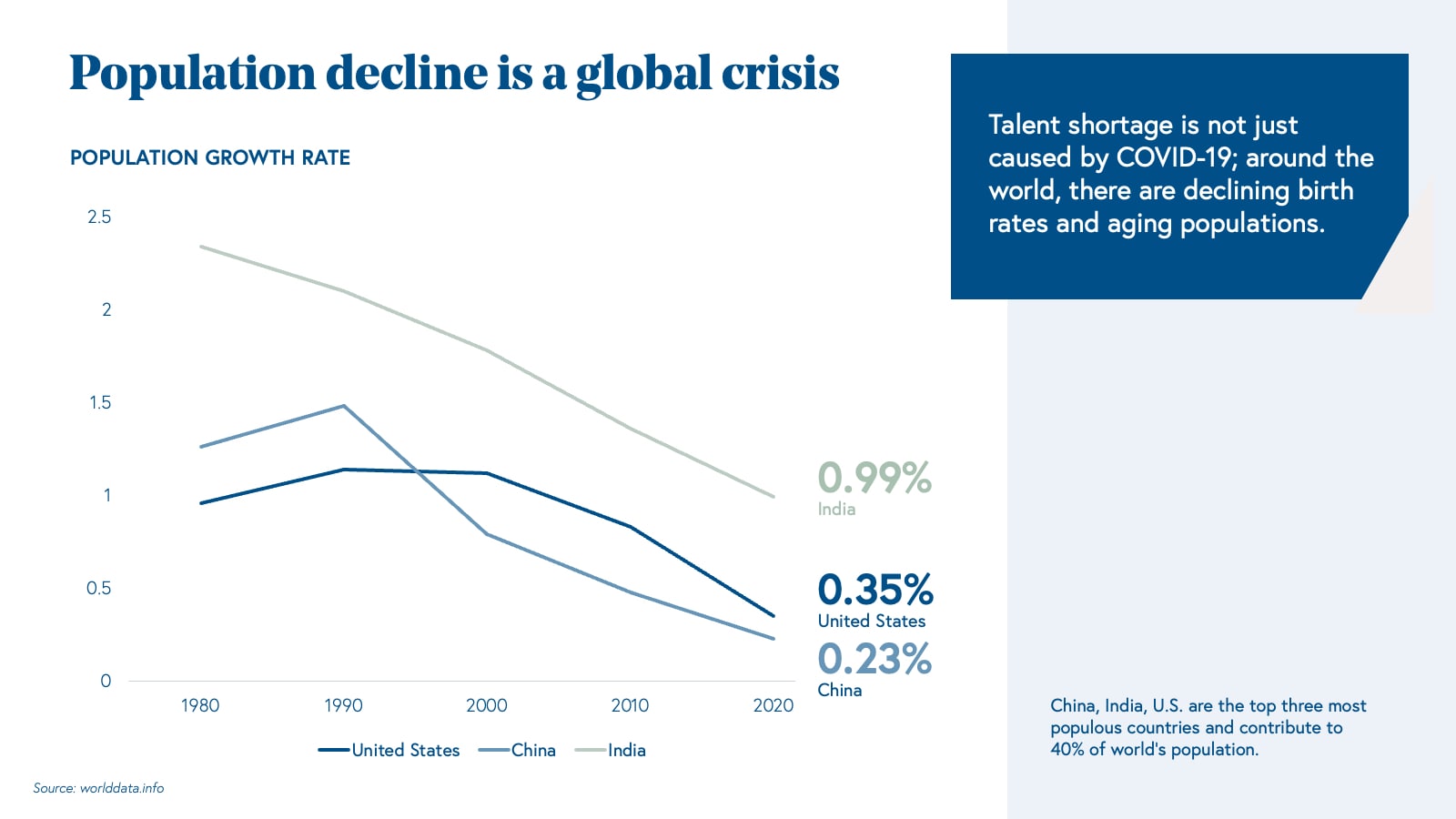

Today there are more job openings than unemployed individuals. This talent shortage also rides on the back of a long-term trend of declining birth rates and an aging population.

And it’s not just the supply of labor that is in question. The supply of pretty much everything else, from microchips to imported goods, to oil and even wheat is in question at the moment.

The cloud certainly can’t solve all the world’s problems, but we can predict that cloud software will play a pivotal role in closing the gap of global productivity.

We see three obvious opportunities for the cloud to have an impact on the macro picture:

- The global supply chain is in peril. And yet 50% of U.S. importers still use spreadsheets to manage their business. Meanwhile over 90% of Fortune 500 C-suites report having plans to increase resilience in their supply chain this year. This environment is ripe for adoption of SaaS products to help manage the global supply chain and increase efficiency.

- With labor markets as competitive as ever, remote and hybrid work—once thought to be a temporary COVID response—are here to stay. And cloud software is a critical ingredient in this new workplace. This includes businesses leveraging API-layers and platforms to shift and automate transactions online. They will also use new tools to maximize individual productivity in today’s hybrid working environment.

- And finally, on the individual level, we’re seeing the 1.1 billion freelancers around the world leverage creator and builder tools to monetize their talents. Over 50% of younger generations suggest that they are likely to freelance in the future. SaaS solutions are helping “arm the rebels,” as Shopify’s Founder and CEO Tobi Lutke once said.

Prediction 3: Cloud software will help close the global productivity gap

We believe The Great Resignation isn’t just a phase—it’s a signal for what’s to come. Labor is on the brink of massive transformation—how we work, how we define productivity, and the systems supporting both sides of the talent market will depend on software to thrive.

We predict that cloud software will play a pivotal role in closing the global productivity gap.

- In labor shortage and wellness, we see horizontal platforms such as Hibob and Papaya Global support businesses in HR management, payroll. In productivity and collaboration, tools such as Productboard and Demostack, optimize product and go-to-market teams, respectively.

- As for freelancers and creators, platforms such as Canva, Patreon, Substack, and beyond support entrepreneurial pursuits.

- In healthcare, platforms like Aspen RxHealth provide pharmacists with the tools to connect with patients looking for more affordable and personalized care.

- In work automation, we see market leaders such as Zapier, Leena AI, Salto, Jasper automate business operations, HR functions, DevOps, and even content creation.

- As for supply chain and logistics, vertical solutions are shifting B2B commerce online and optimizing logistics with software, as we see with Provi in alcohol and beverages, Torch in dental supply, Choco in food ordering for restaurants, and Shippo in e-commerce shipping. Other cloud players, such as Flexport, Cargo.One, and Optimal Dynamics are making global trade and commerce trackable and efficient across land, air, and sea.

Cloud penetration is still low in certain US industries and across the globe

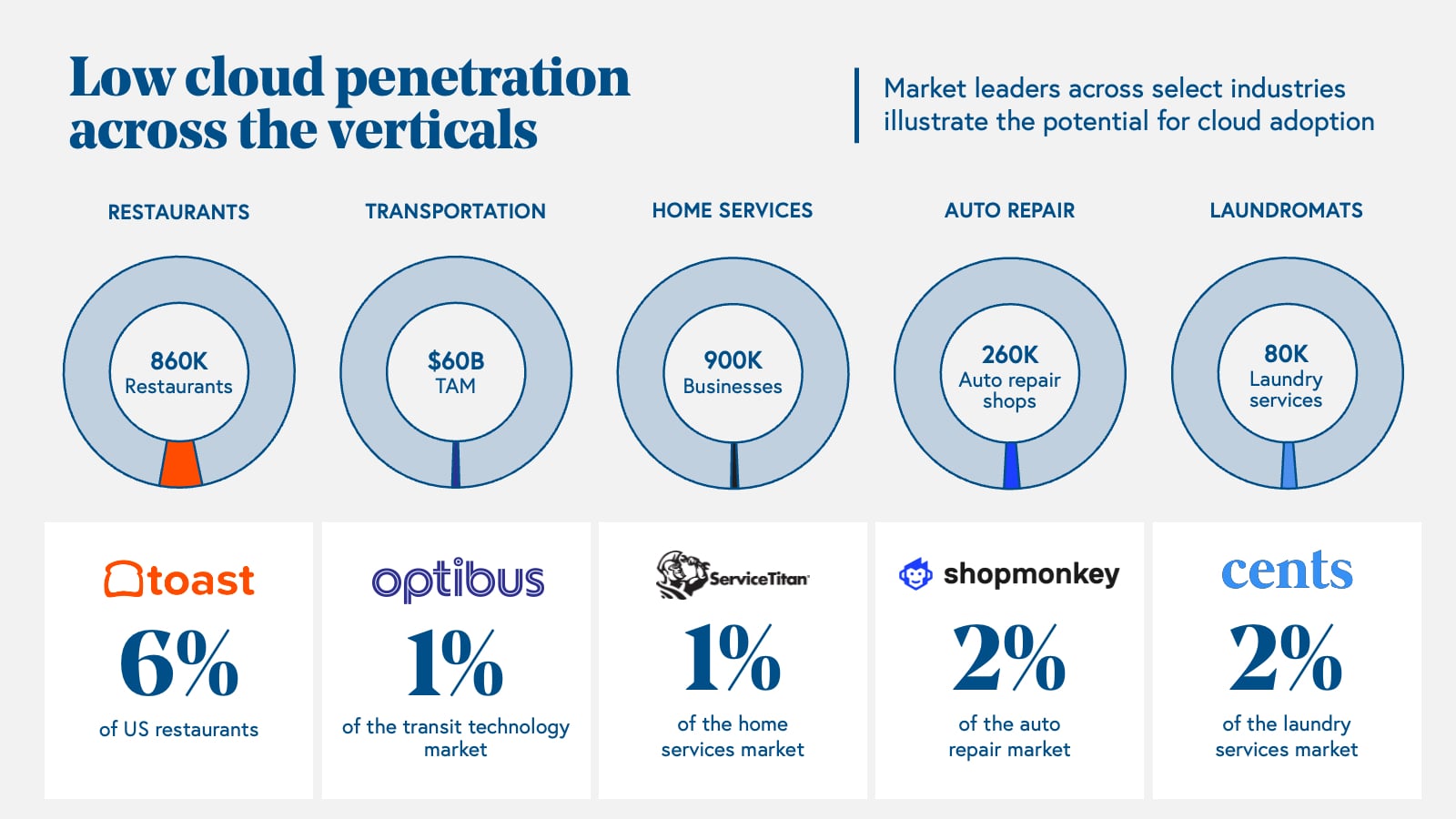

Low cloud penetration rates across different industries within the United States alone illustrate just how far the cloud economy has left to go. Leading vertical cloud players act as a proxy for their industry’s adoption—for example, as of 2021, Toast, the restaurant management SaaS, is only in 6% of U.S. restaurant locations. Optibus, the cloud-native AI platform that makes public transportation smarter, better, and more efficient, has reached less than 1% of the total public transit software market. ServiceTitan, a leading vertical SaaS for home services, penetrated 1% of its core TAM of 900,000 home services businesses. Across other verticals such as in auto repair with Shopmonkey and laundry services with Cents we see 2% penetration. And when we look beyond North America, global cloud maturity rates vary widely, too.

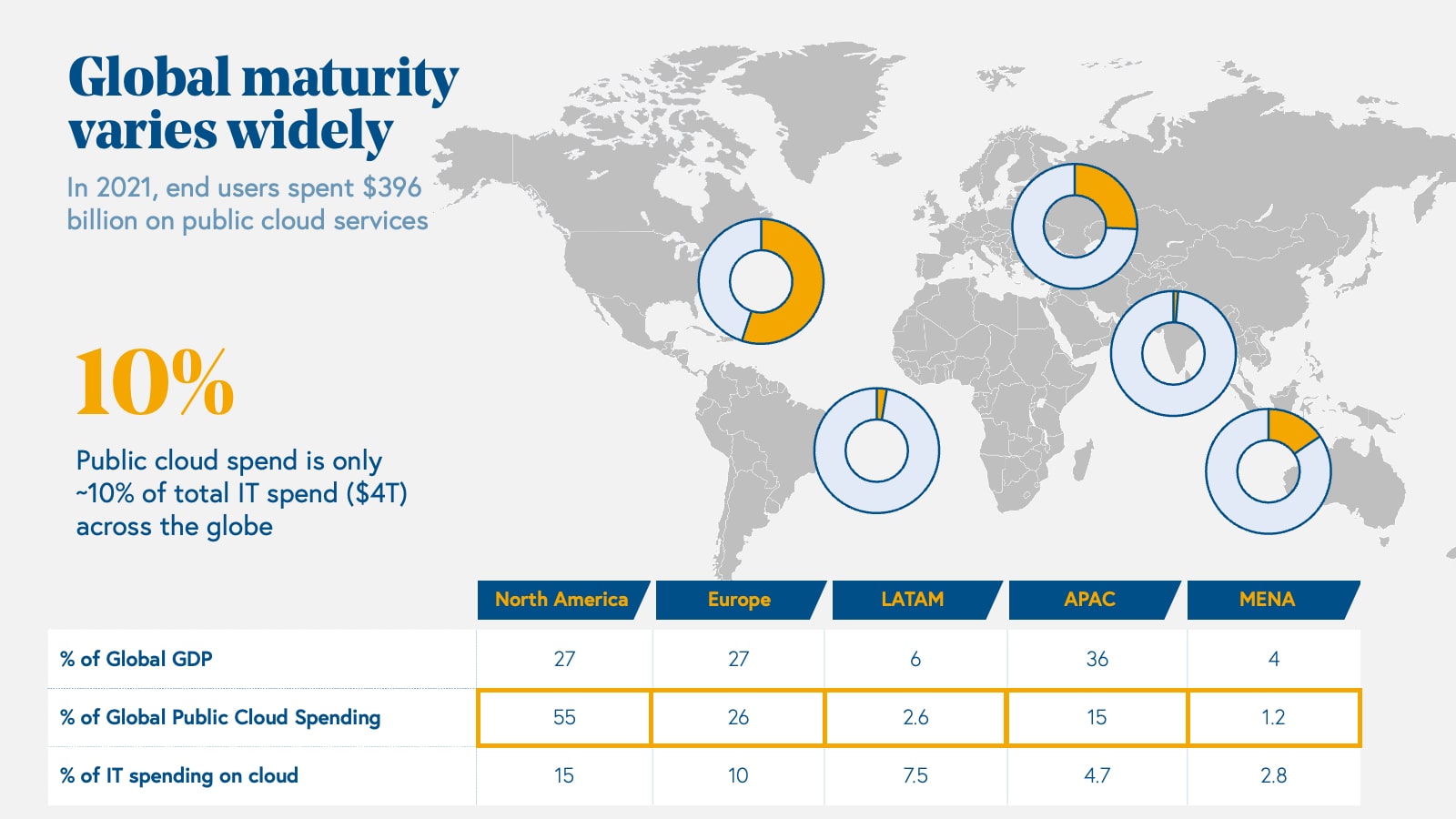

Public cloud spend is only 10% of the total $4 trillion total IT spend across the globe.

North America has the highest rate of IT spending on public cloud with 15%, which represents 55% of the global public cloud spending. Europe represents approximately 26% of the global cloud market and spends 10% of its IT budget on cloud. Latin America contributes 6% of global GDP and 2.6% of global public cloud spending. In comparison, Asia-Pacific contributes to one third of global GDP, but is just over 15% of global public cloud spend and 4.7% of local IT expenses. Finally, in the Middle East & North Africa, cloud spend is even less at 1.2% on public cloud which is 2.8% of the region’s total IT spend.

Prediction 4: Cloud will go local to go global

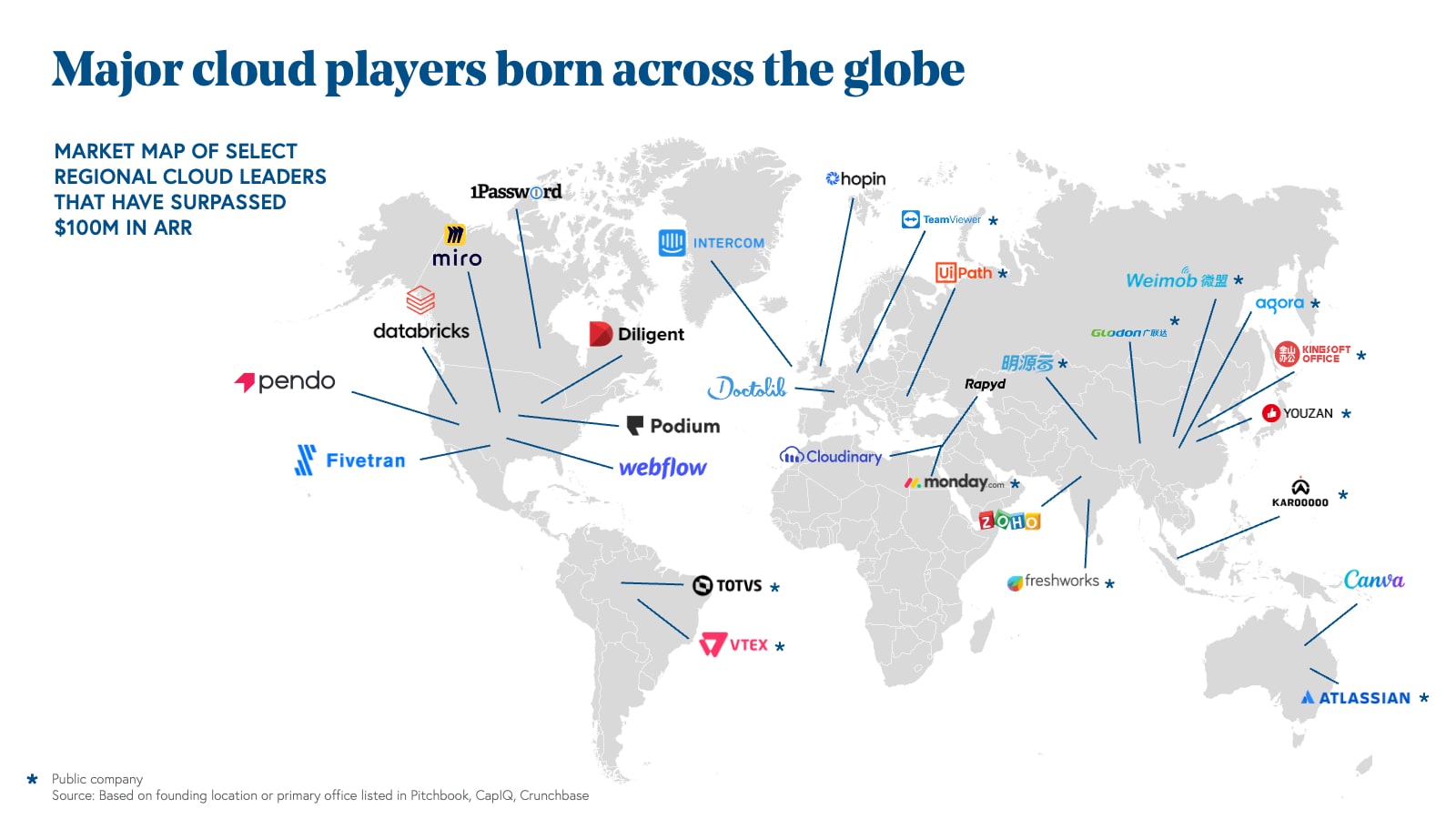

For years, we’ve been saying that cloud innovation will proliferate around the globe. Innovation is indeed a borderless endeavor, but we’re seeing a nuanced shift in the way cloud players expand and scale into new regions.

Not every cloud provider is built to sweep the globe. This is why localization, especially within vertical software, is a critical aspect to serving any industry. For the horizontal or vertical players that do expand into new markets, they pay especially close attention to adapting their product, go-to-market strategy, and customer needs to the new region.

It’s clear that the world needs better software to strengthen the economy, and that the global cloud is only getting started. Cloud adoption and maturity rates across different geographies indicate one thing—there’s so much room left for the cloud economy to grow. Witnessing how many regional players surpass the $100 million ARR mark gives us a great deal of confidence in the trajectory of the global cloud economy.

Seeing so many cloud leaders pass this significant revenue milestone leaves us wondering—is there a better way to measure the promise and potential of cloud businesses, especially in the private markets, other than valuation? (Go here to learn more.)

Regional SaaS ecosystem deep dives

With cloud adoption reaching different states of maturity across different regions, our global investment teams in China, Europe, India, and Israel share the top venture insights and novel cloud trends unique to their region.

China SaaS

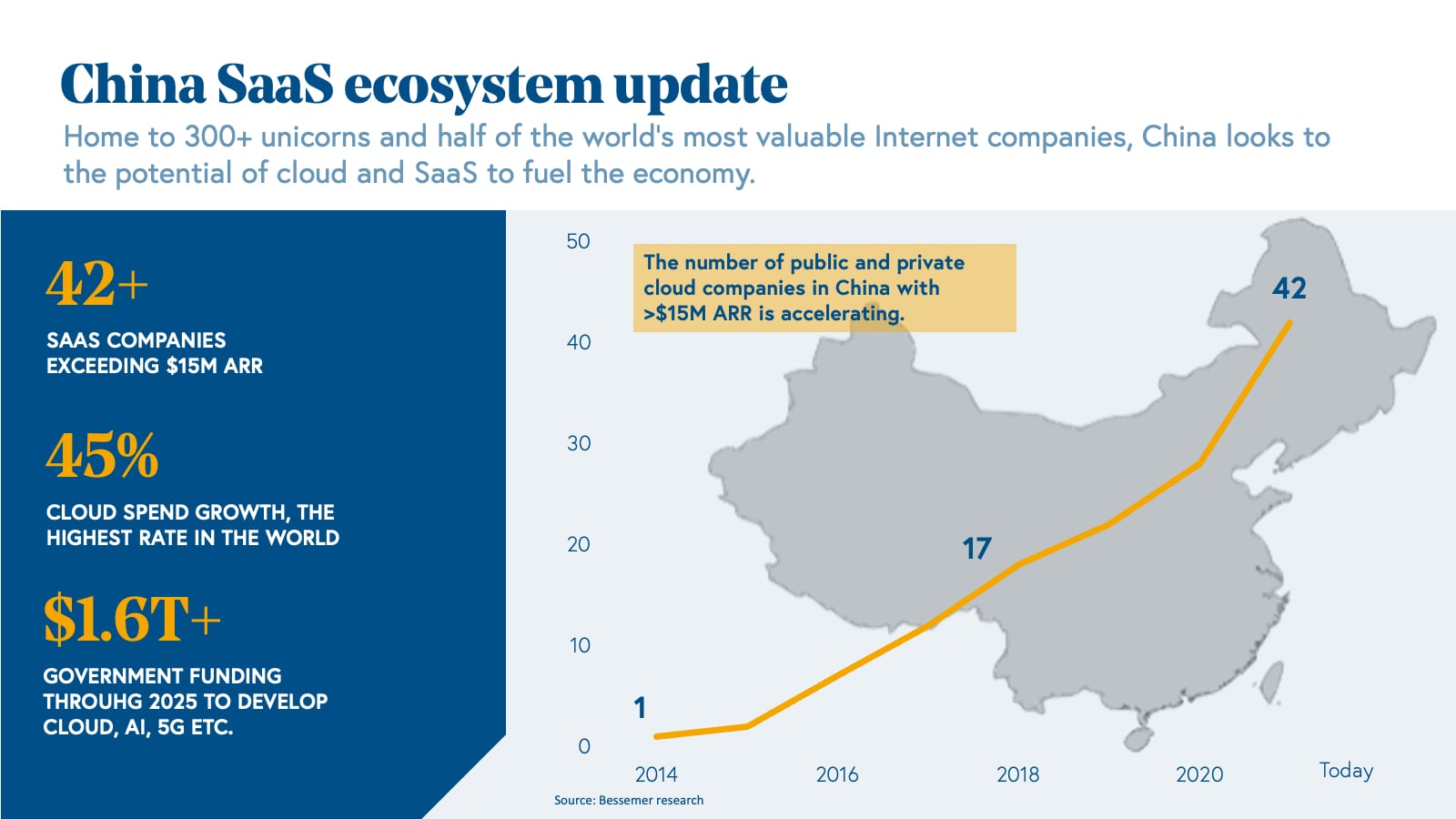

Home to over 300 unicorns and half of the world’s most valuable internet companies, China is eyeing cloud and SaaS to fuel the future of the economy.

Today, cloud penetration is still low in China compared to the U.S and Europe, but the cloud ecosystem is quickly maturing. It benefits from secular tailwinds including rising labor costs, higher willingness to pay for cloud and SaaS solutions, advances in AI and 5G, and a vibrant ecosystem of entrepreneurs and engineers that are moving away from consumer internet to capitalize on the opportunity of enterprise automation. Notably, China’s public and private sectors are set to spend $1.6 trillion through 2025 to further develop next-generation infrastructure including 5G, artificial intelligence, and other emerging technologies. 2021 was also the third year in a row that annual venture deployment in cloud exceeded $9 billion.

The number of private and public cloud companies in China with over $15 million ARR (100 million RMB) is accelerating. Based on the analysis from Bessemer’s investment team in China, in 2014, only one company had reached $15 million of SaaS ARR in the domestic market. Today, over 42 companies have exceeded this threshold. China also has the highest growth rate in cloud spending in 2021 at 45%. China spent $27 billion on cloud in 2021 and is projected to grow to $85 billion by 2026.

The best Chinese SaaS startups are innovators that are adapting the cloud playbook to capitalize on local market advantages. We see this in two key areas: product and go-to-market.

Product innovation: With over half of the world’s clothes and over 90% of electronics produced in China, up-and-coming SaaS vendors are developing novel products that leverage China’s extensive supply chain advantage to better serve manufacturers, retailers, and merchants. These vendors include cross-border ERP systems, B2B payments providers, and supply chain consolidators.

Go-to-market innovation: In addition to capitalizing on local supply chain advantages, many Chinese SaaS companies are efficiently scaling go-to-market and distribution by leveraging the existing consumer internet platforms and infrastructure. For example, China is home to the world’s super apps, including WeChat (>1.2B MAU), TikTok (>600M China only DAU), DingTalk (>220M MAU), among others. These applications are fertile B2B2C distribution channels enabling businesses to reach and engage customers directly. For example, the WeChat Enterprise version has already connected 10 million businesses with over 500 million end users to drive retention and upsell. A number of notable social CRM and omni-channel management SaaS businesses have risen from these platforms, and we expect to see this trend continue in the years ahead.

Europe SaaS

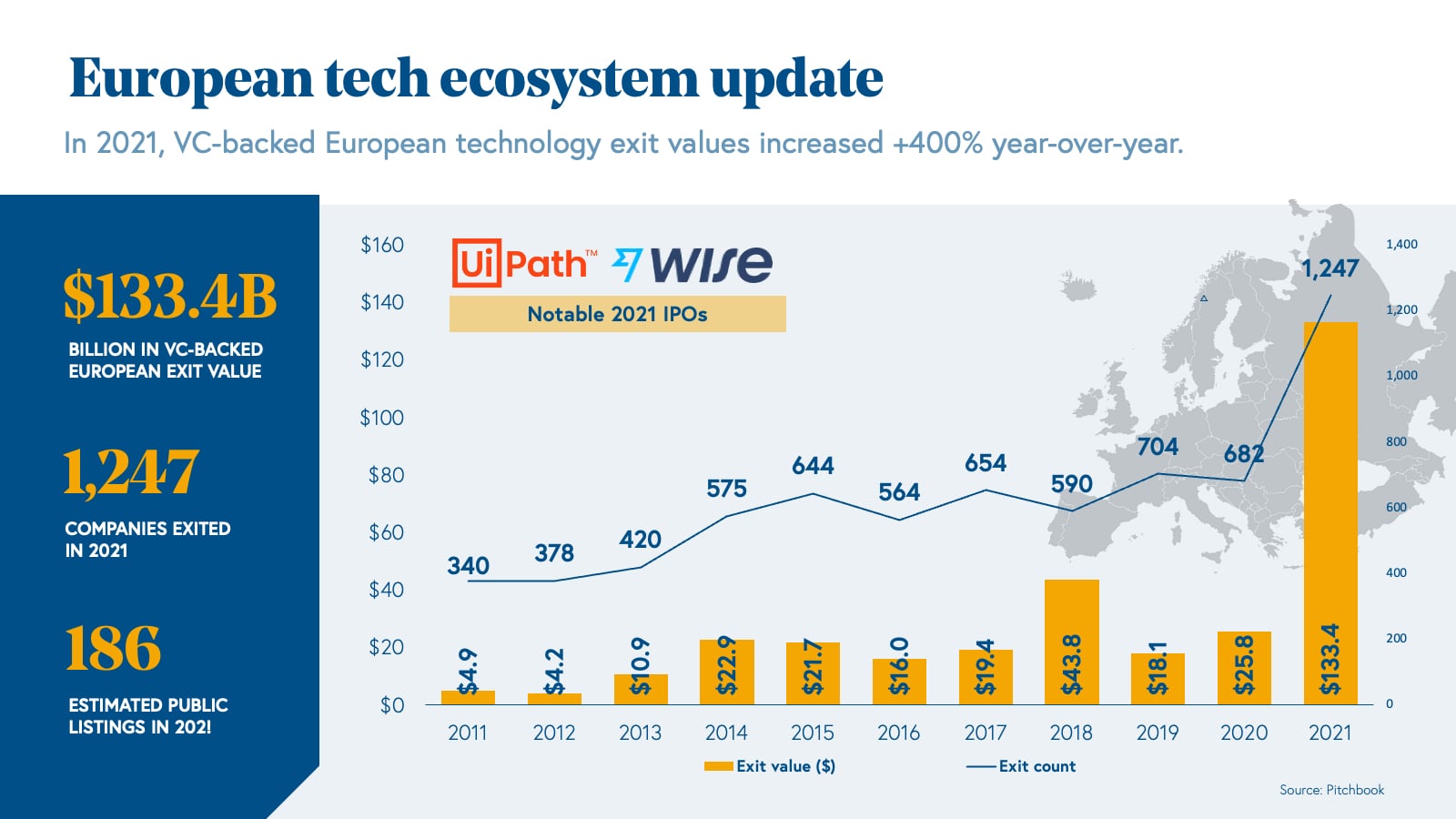

European technology exit values and counts have skyrocketed in the past year, reaching $133.4 billion in value (+400% year-over-year increase) across 1,247 exits. In 2021, there were approximately 186 public listings, including names such as UiPath, Wise, GitLab, OVH, and SUSE. In addition, M&As reached an all-time high with 687 European companies being acquired.

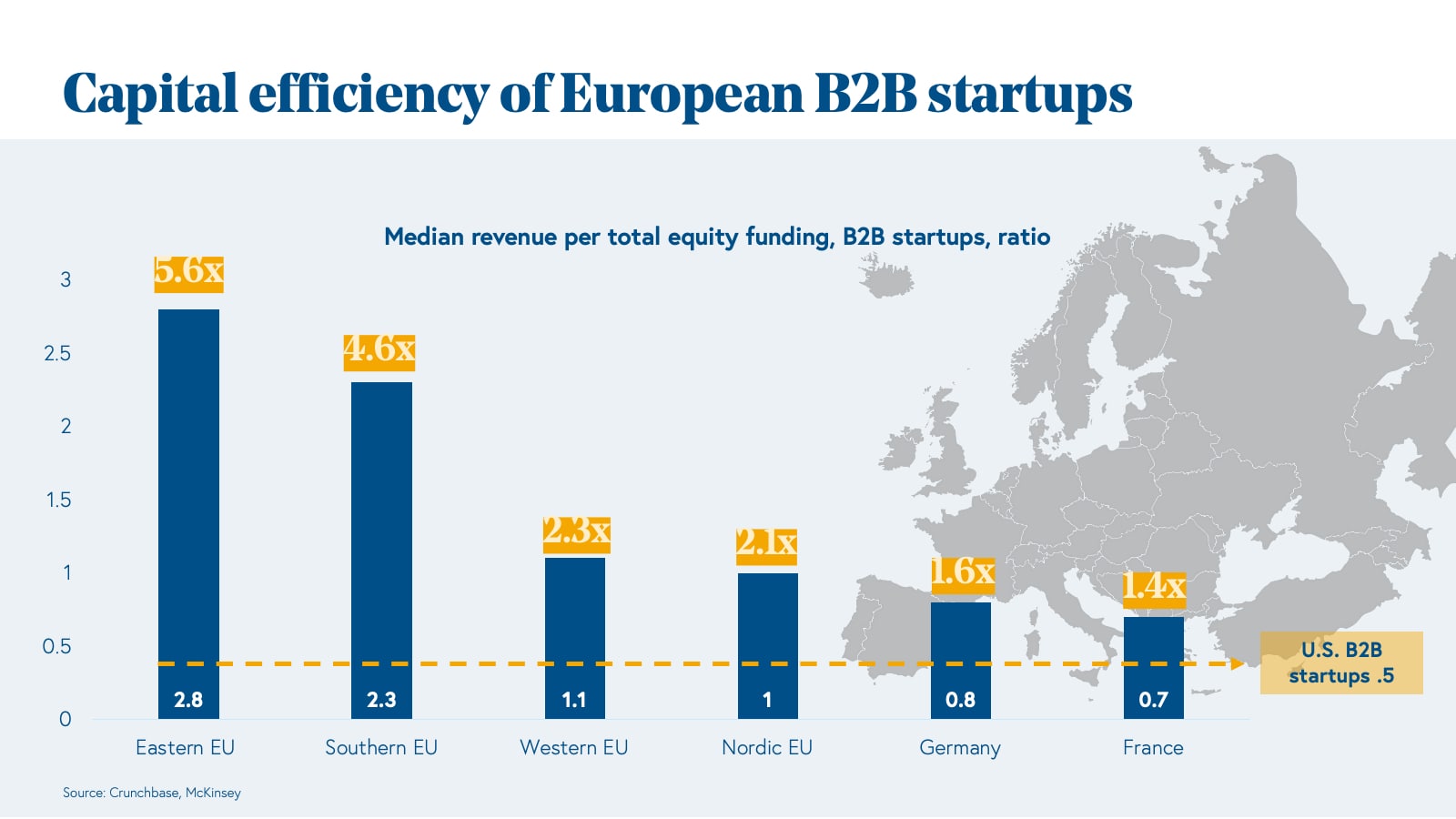

Europe's deep pool of technical talent, strong seed fund development, and employees of the first wave of successful tech companies starting new ventures have all contributed to this cloud ecosystem acceleration. European B2B startups often outperform other regional peers based on capital efficiency, due to a shared mindset of keeping operating costs low and focusing on revenue acceleration early in a company’s growth, according to McKinsey.

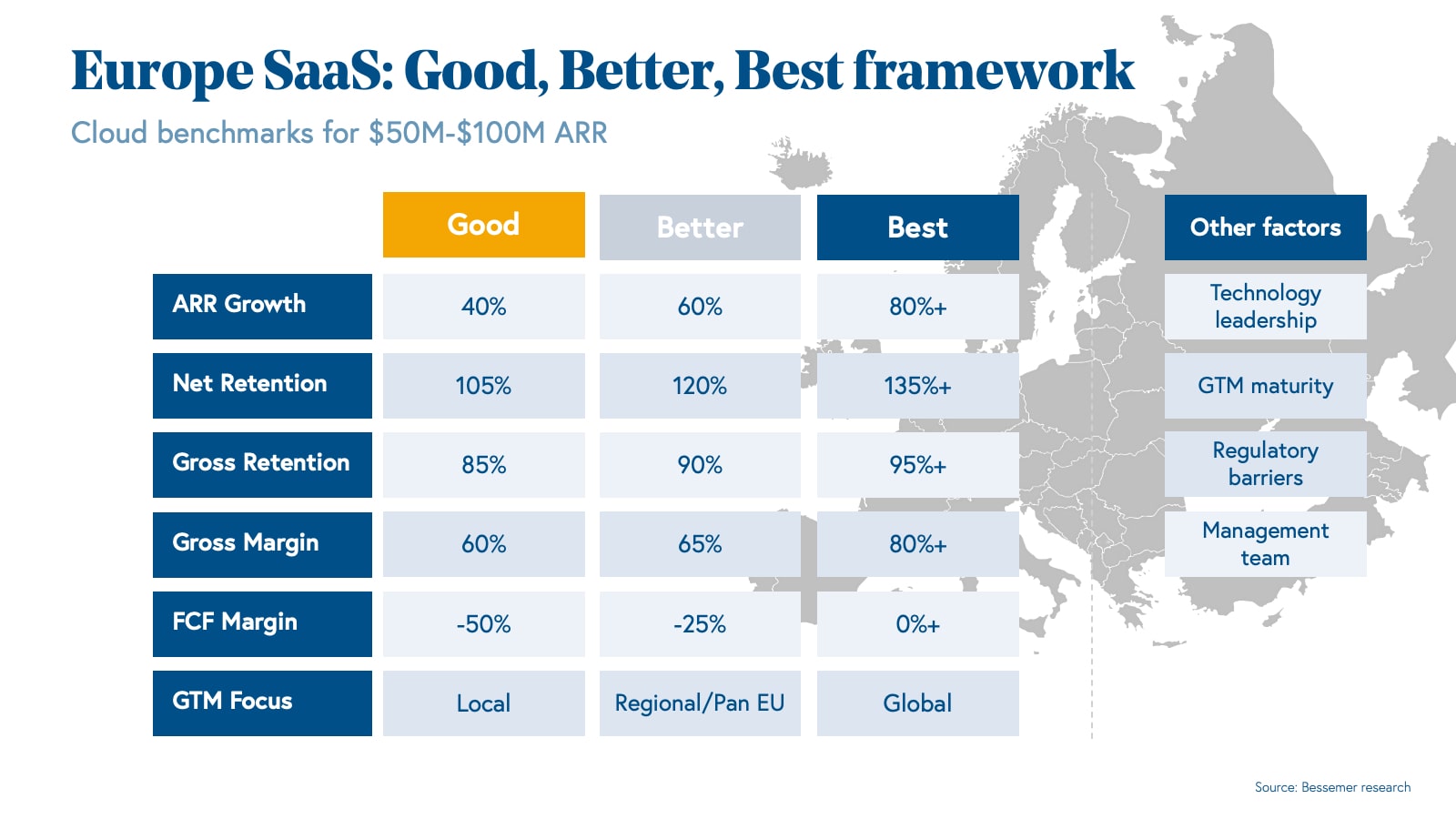

For B2B startups, companies from all EU regions demonstrate increased efficiency when compared to SaaS businesses in the United States. Eastern EU companies boast a 5.6x capital efficiency, Western EU 2.3x, Germany 1.6x, and France 1.4x compared to American companies. As the next wave of successful European exits gears up, we'll be looking to key growth-stage benchmarks to identify the cloud leaders of tomorrow. And much like pioneers such as Skype and TeamViewer before them, we think the best new European cloud companies will approach their go-to-market from a pan-Europe and global perspective.

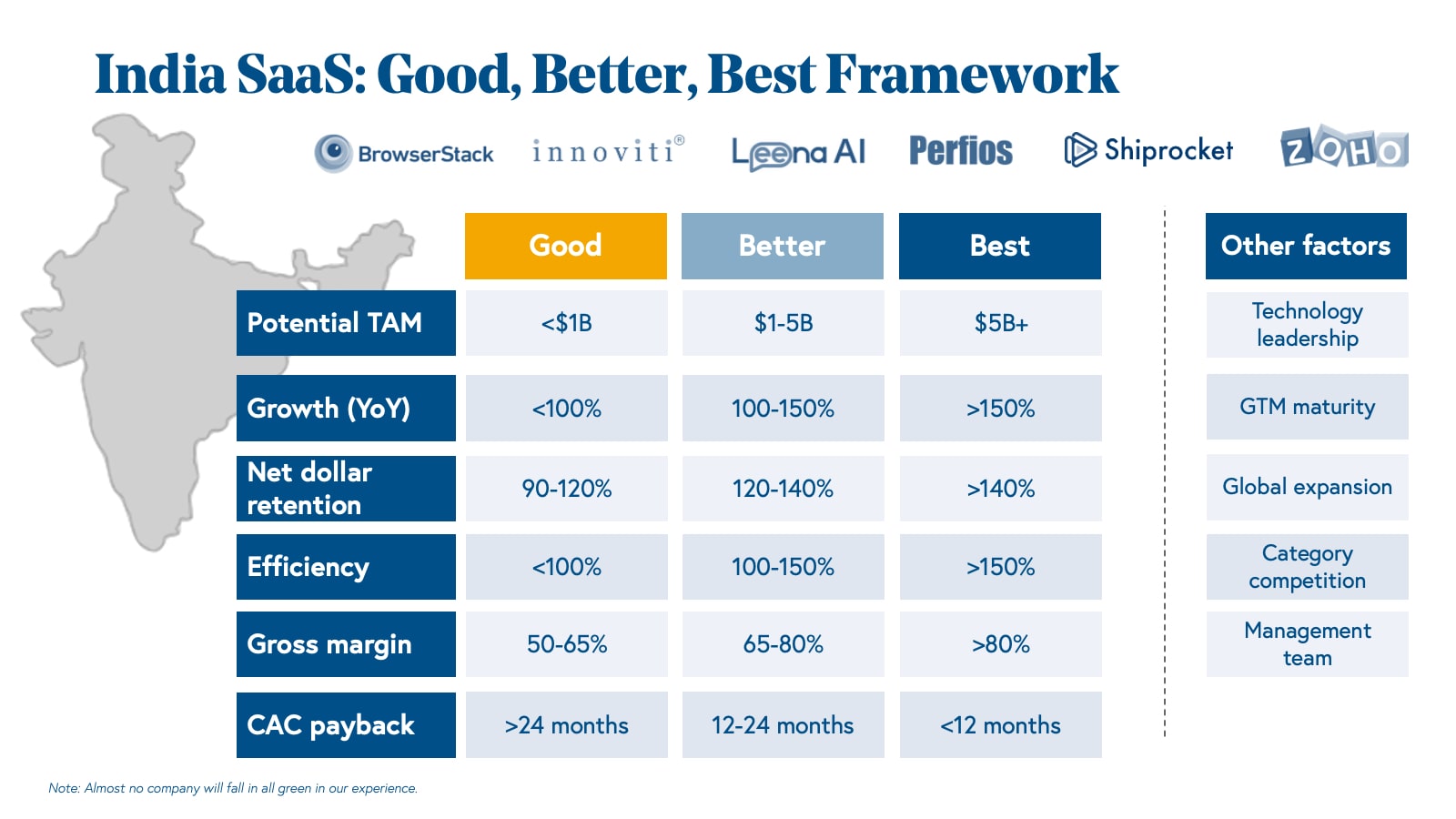

For more insight into how we evaluate SaaS investments in Europe, check out our Good, Better, Best Framework.

India SaaS

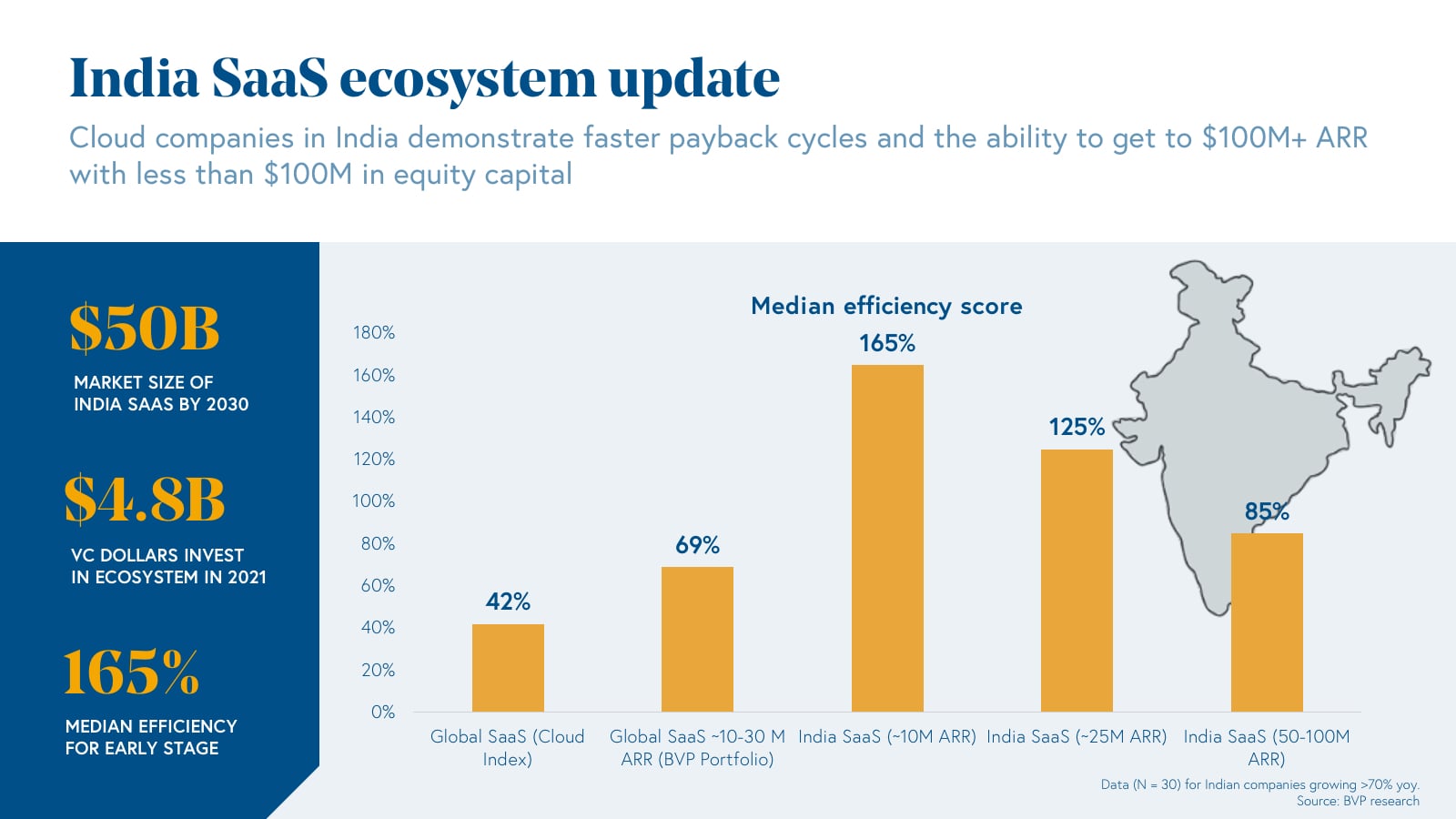

Projected to be valued at $50 billion by 2030, India’s SaaS market has reached a critical inflection point as venture dollars deployed in the region reached $4.8 billion in 2021.

The evolution of the entrepreneurial ecosystem in this SaaS market is due to three driving factors, according to Bessemer’s investment team in India.

- Digital rails. The emergence of digital rails for large industries has spurred development across a number of large industries, such as financial services. What this means is that over 1 billion people in India have unique digital identities and all banks and financial institutions are connected through a common transactional back end which is also linked to the same identity. Software companies are now building products and solutions for banking and financial services on top of these commonly accepted rails and standards. (A similar trend is also happening across other industries such as healthcare and beyond.)

- Smartphones. With the rise of mobile internet, over 700 million people have smartphones in India, and similar to other regions, they use them for work as much as for their personal lives.

- Digitization. The rapid acceleration of digitization across all industries due to the global pandemic, has furthered digital sales in both goods, services, and software. This also means that Indian SaaS companies can now target global customers which has led to the emergence of many global SaaS leaders from India including Zoho, Freshworks, Browserstack, iCertis, among others.

While our data set is somewhat limited, early indicators show us that Indian SaaS businesses demonstrate faster payback cycles and are more efficient in their ability to get to $100 million ARR with less than $100 million in equity capital.

Most best-in-class SaaS companies have approximately 60-70% sales efficiency at $10 million-$30 million ARR. As these companies grow, efficiency trends down to 30-40% by the time they reach scale (e.g., Rule of 40). However, when we look at most Indian SaaS companies, they run at 80-100% or more sales efficiency, even up to $100 million in ARR. With these numbers, most Indian SaaS companies will have the ability to break even at around $10 million of ARR and will only need capital for achieving hyper growth.

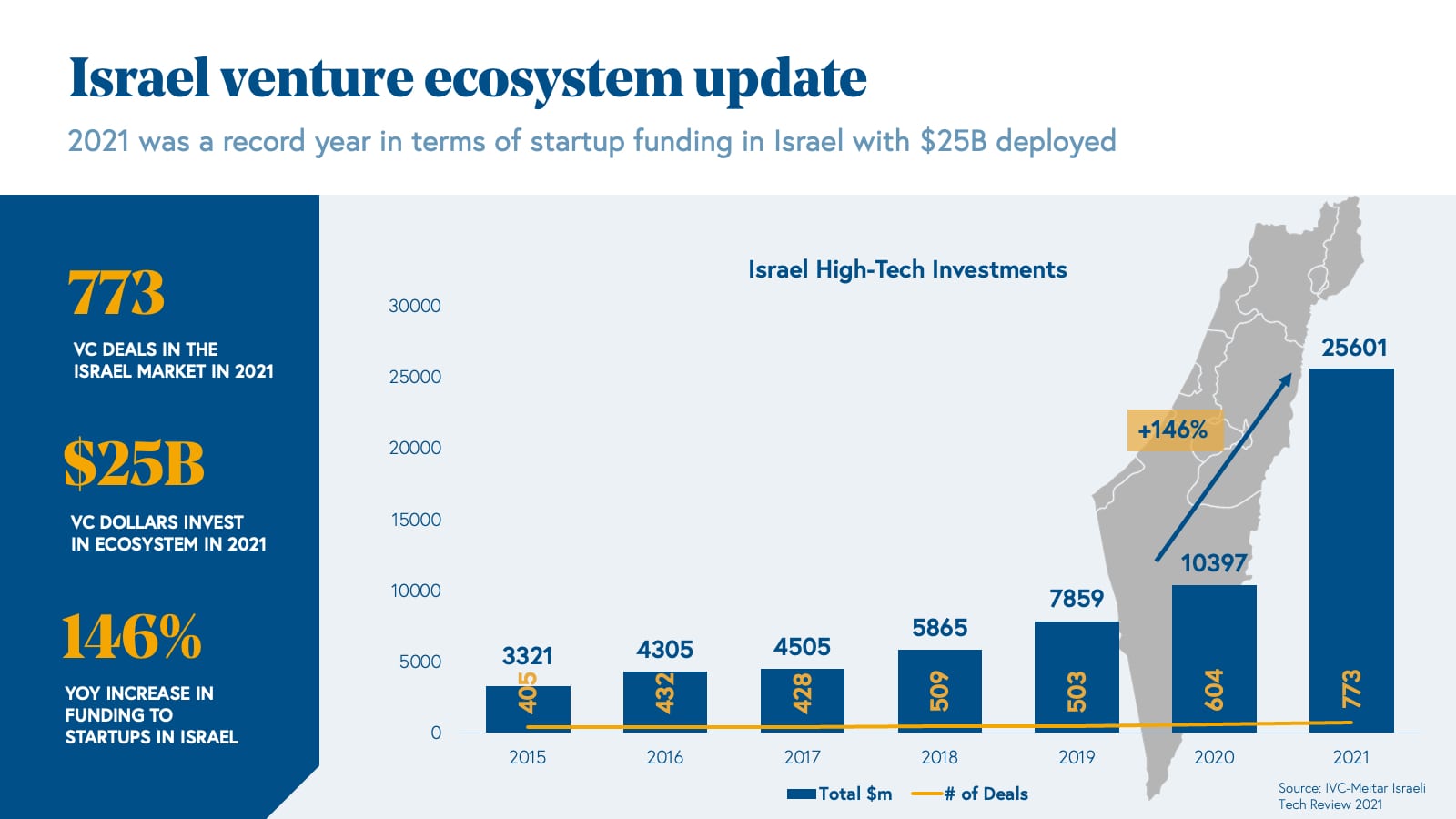

Israel SaaS

2021 was a banner year for the startup ecosystem in Israel as venture deployed more than $25.6 billion across 773 deals—a 146% increase from the amount raised last year and 28% more deals. A large majority of this capital within the region has been earmarked for SaaS investing.

Tracking closely with the trends we see on The Cloud 100, the three top categories that drove the most investments in Israel were in fintech, data infrastructure, and cybersecurity, making up 65% of the total funds raised.

Today, we see three driving factors contributing to the evolution of Israel’s startup ecosystem: First, Israeli entrepreneurs are finally building businesses, not just developing technologies. Second, unparalleled access to capital has allowed these businesses to invest heavily in product and people, ensuring an enduring independence at the company level. Lastly, a new and growing category of independent growth businesses has created a local Israeli market of customers for new Israeli startups to access and leverage.

The evidence of the thriving startup ecosystem in Israel, especially for cloud founders, is mounting. For example:

- In 2021, we saw 14 Israeli companies on the 2021 Cloud 100 list: Gong, Snyk, Forter, Yotpo, Cloudinary, Rapyd, TripActions, Riskified, Sisense, BigID, OwnBackup, Papaya Global, and Axonius. In other words, about one out of eight top cloud companies in the world comes from Israel.

- From our research, we’ve also identified ~25 notable cloud players in Israel that have surpassed the $100 million ARR mark, across a number of categories. Select names include:

- Cyber: Cybereason, Snyk, Transmit.

- Fintech: Fundbox, Rapyd.

- Horizontal & Vertical SaaS: AppsFlyer, Cloudinary, Gong, Redis, Sisense, and Yotpo.

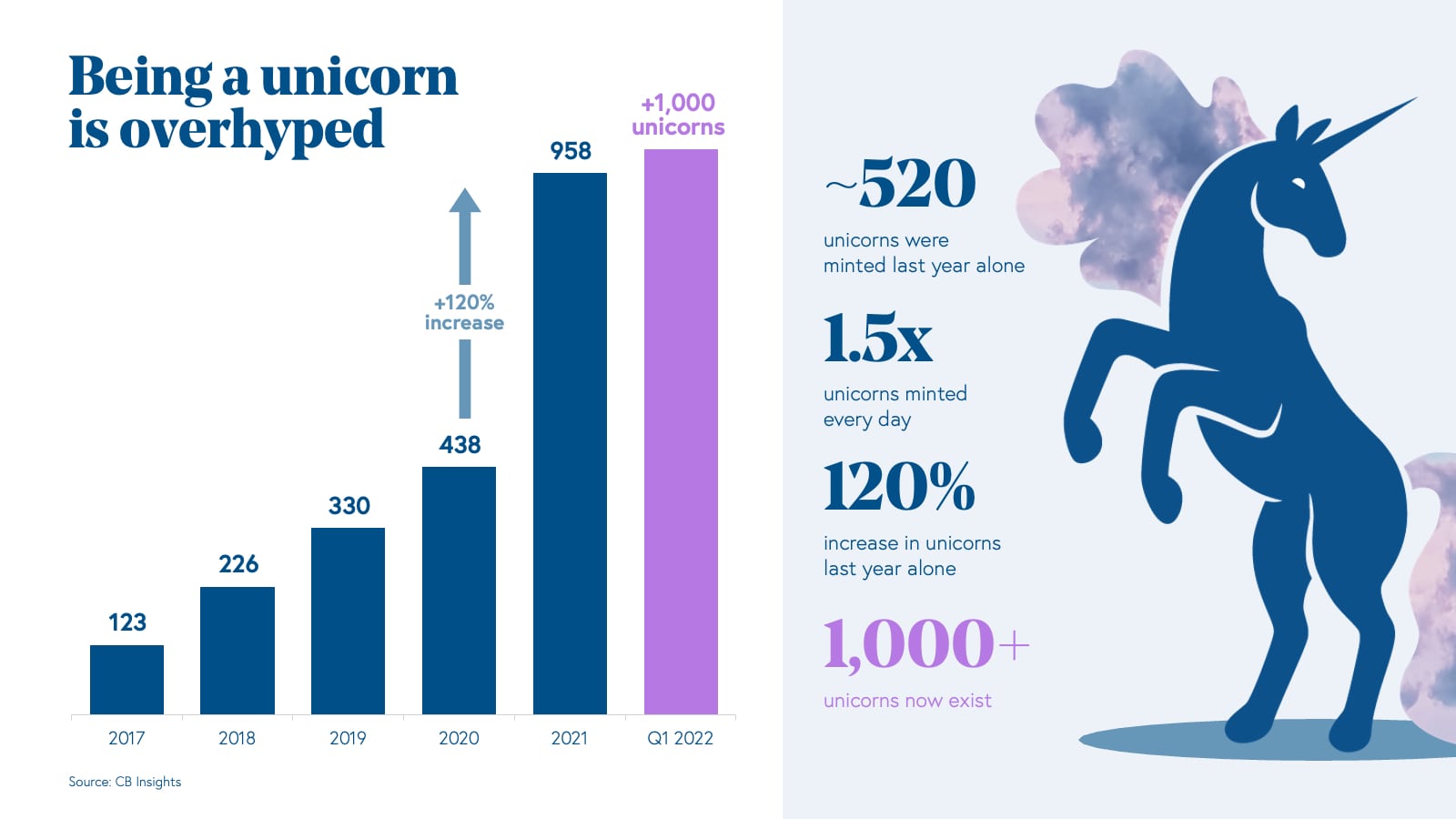

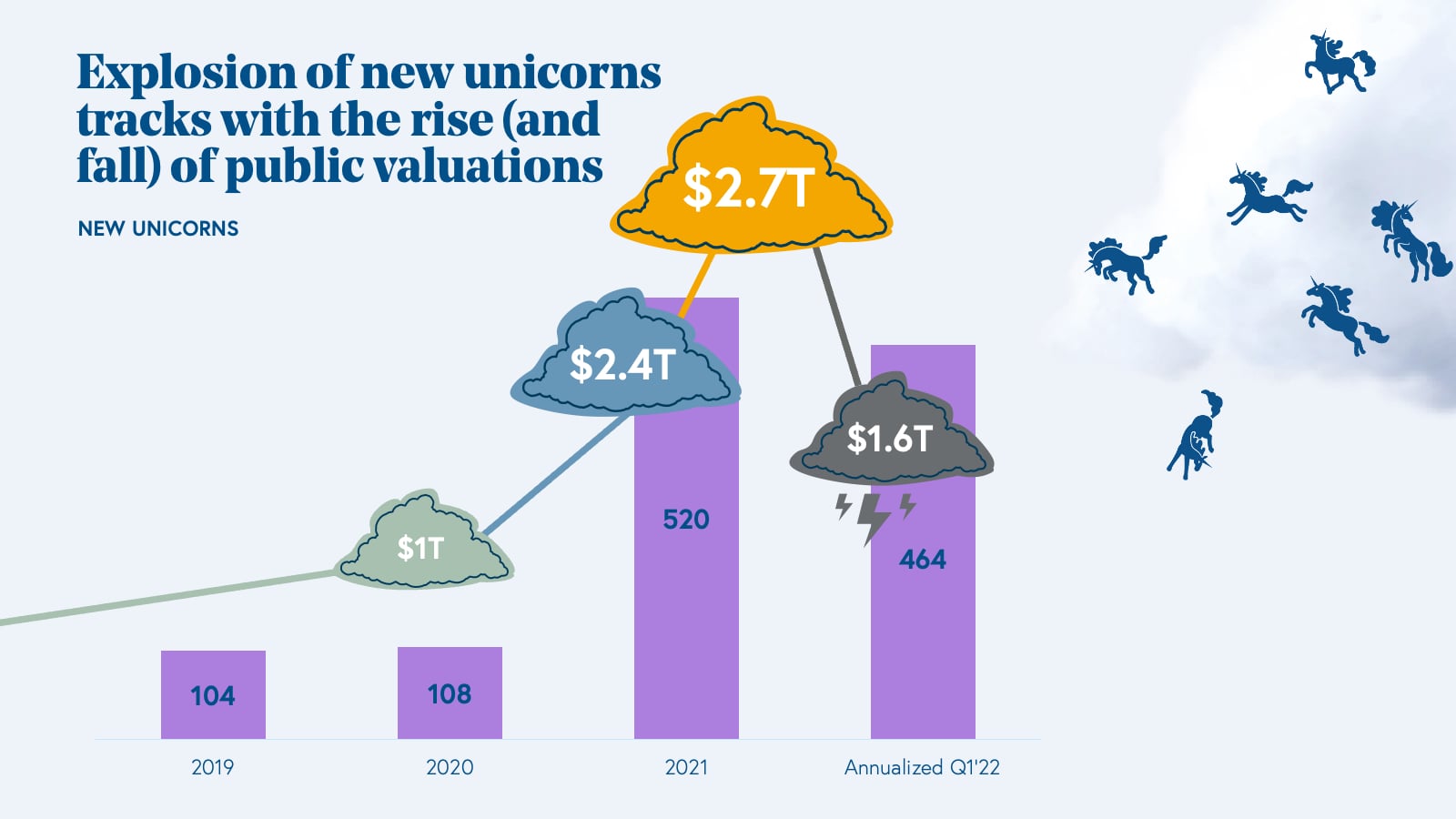

The state of unicorns—why ARR is the new valuation

Valuations have historically been a primary measure of success in the private cloud markets. But the stampede trying to earn a unicorn valuation is getting out of hand. Almost a decade ago when Aileen Lee coined the term, unicorns were an elite group of billion dollar companies with meaningful revenue leaving an undeniable imprint on the global economy.

Today, that’s not quite the case, as there are more than a thousand unicorns in the world—many of them with less than a million dollars of revenue. From 2020 to 2021 we saw a 120% increase in unicorns. One and a half new unicorns are minted every day.

The abundance of capital has created an environment where valuations have somewhat lost their meaning. The only thing we can truly conclude about a unicorn today is their ability to attract investor interest. In addition, we’ve seen how the unicorn birth rate has correlated to the rise and fall of public valuations.

The unicorn-or-bust mentality has unfortunately driven many startups and investors to focus on valuation as their primary goal, instead of building a great business. Given these conditions, and the market correction, at Bessemer we know the VC and founder community are in need of a new milestone to strive for—one rooted in evidence, cloud fundamentals, and dare we say a milestone based on…revenue?

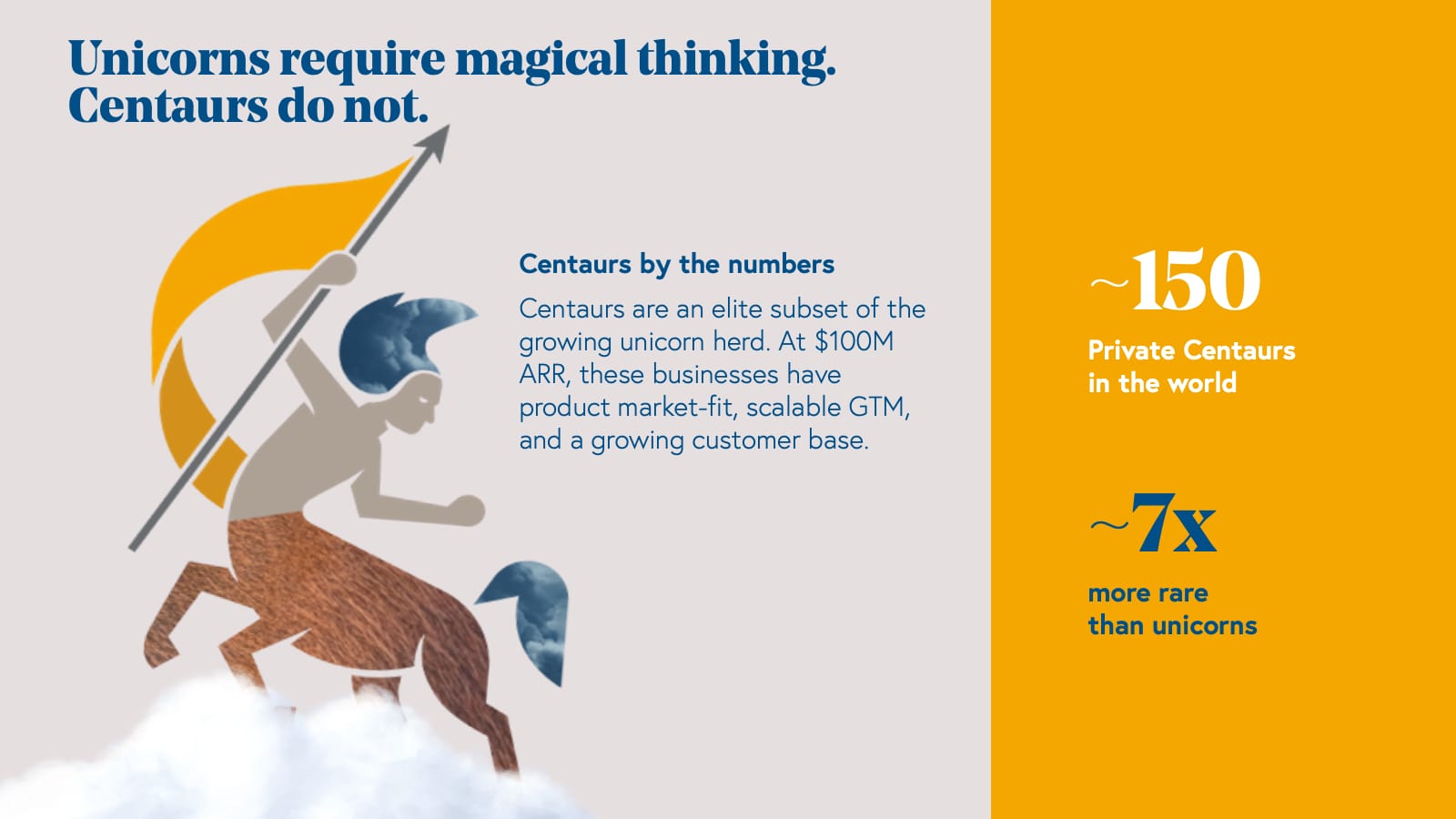

Prediction 5: 2022 will be the year of the Centaur

At Bessemer, we believe a new milestone (and mythical creature) is the true mark of an exceptional SaaS startup. The Centaur is a business that reaches $100 million of annual recurring revenue (ARR)—a rare breed of cloud business, part of an elite subset of the growing unicorn herd. At $100 million ARR, Centaur businesses have product-market fit, scalable go-to-market strategy, and a growing customer base.

While 520 unicorns were born in 2021, ~60 private cloud businesses reached Centaurs status in that same year, including names such as Pendo, Salesloft, Cloudinary, Iterable, InVision, 6Sense, Yotpo, and Dataiku.

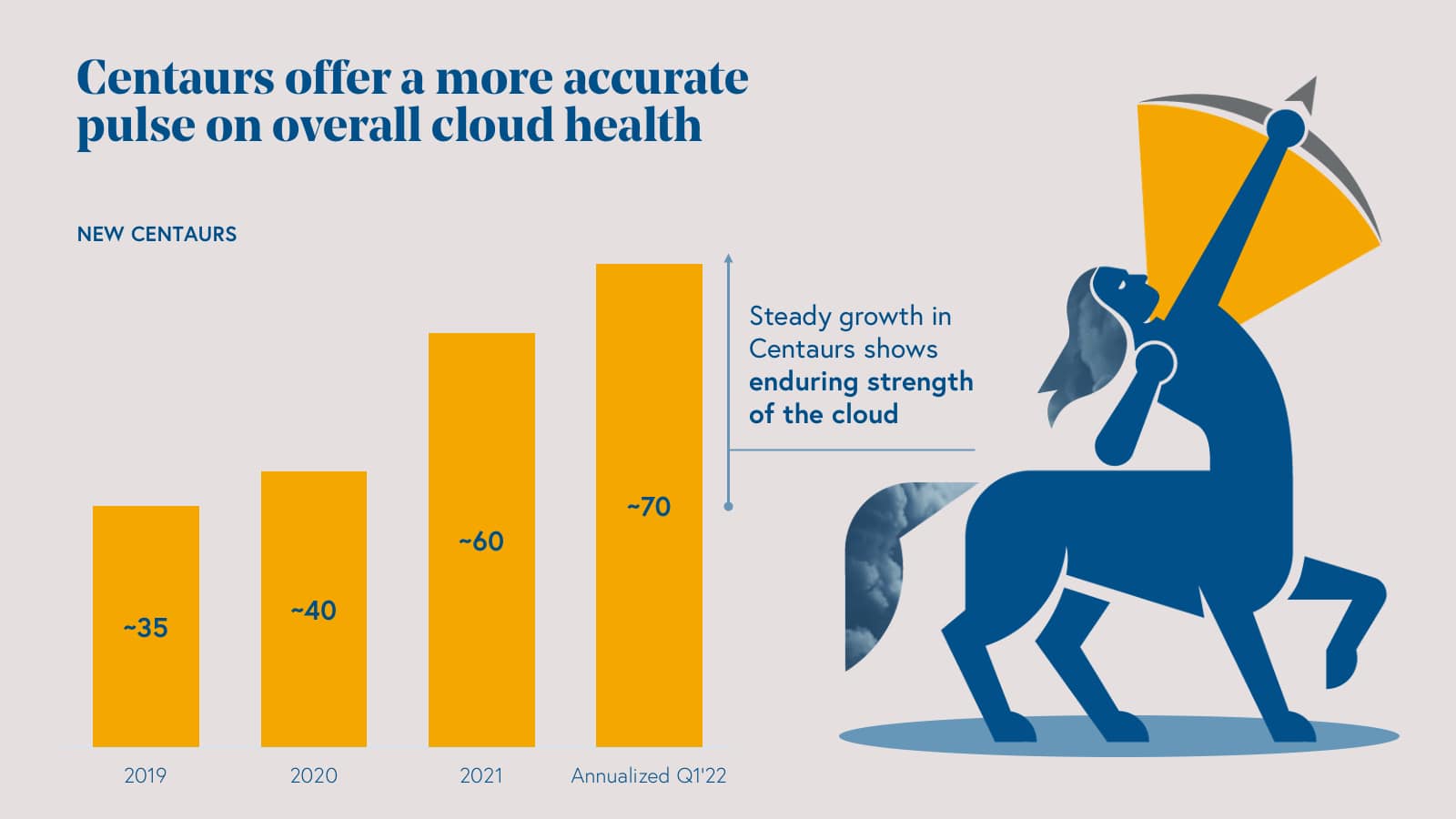

In our research, we’ve identified at least 150 private Centaurs, making this category of cloud company 7x more rare than unicorns. Over the past four years, we’ve seen a steady increase in new Centaur being born each year. In 2019, we identified at least 35 private cloud Centaurs were born and today we project 70 new businesses will reach Centaur status in 2022. Whereas new unicorn births have been more volatile, Centaur creation has followed a steady uphill climb. We believe tracking Centaur growth offers a more accurate pulse on the overall health of the cloud ecosystem. This elite cohort measures what matters—tangible growth in businesses hitting recurring revenue milestones vs. companies reaching valuations based on magical thinking.

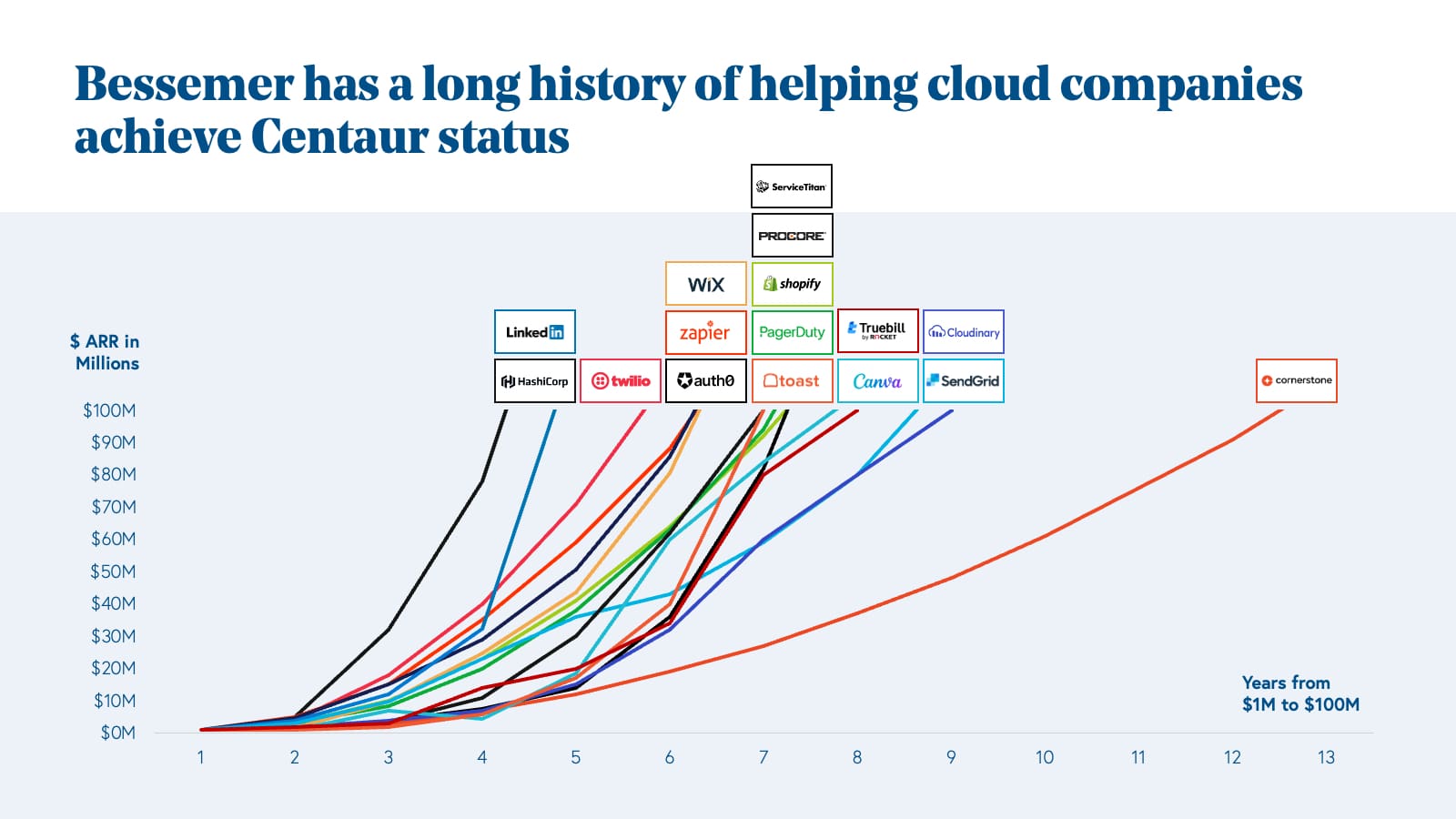

So how does a business become a centaur exactly? The good news is that there isn’t one way to do it (and we do have benchmarks to help you along your company’s growth trajectory).

We’ve seen enduring companies take a variety of paths to Centaur status over the years ranging from a few years to over ten to scale from $1 million to $100 million ARR.

Bessemer's $1 million to $100 million ARR chart

So where does this leave us? With volatility likely to continue in at least the public markets, many over-hyped unicorns may feel the headwinds and challenges of today’s environment. But here’s the silver lining: we expect the VC and founder community will begin to turn their attention back to SaaS fundamentals where great products drive loyal engaged customers and efficient growth of good old-fashioned revenue.

For more resources to help your business achieve centaur status, go to bvp.com/centaur.