The emergence of B2B marketplaces in India

Consumers were the first beneficiaries of India’s rapid digitization wave—businesses are up next.

Over the past decade, India has undergone a remarkable journey of consumer digitization. In 2010, the number of users engaging in online transactions was less than a million. Fast forward to 2022, and that number has skyrocketed to over 100 million. This phenomenal growth has primarily been driven by the emergence of various B2C marketplaces in the country, such as Flipkart (Multi-category), Zomato (Food Delivery), Swiggy (Food Delivery), Ola (Transport), Big Basket (Online Grocery), Pharmeasy (Pharmacy), Urban Company (Home Services), Livspace (Furniture), Myntra (Apparel and Accessories). These companies have harnessed macro enablers like the decreasing costs of data, the increasing penetration of smartphones, and the adoption of the India Stack initiative's open APIs, among others. Bessemer has been fortunate to partner with some of these pioneering companies.

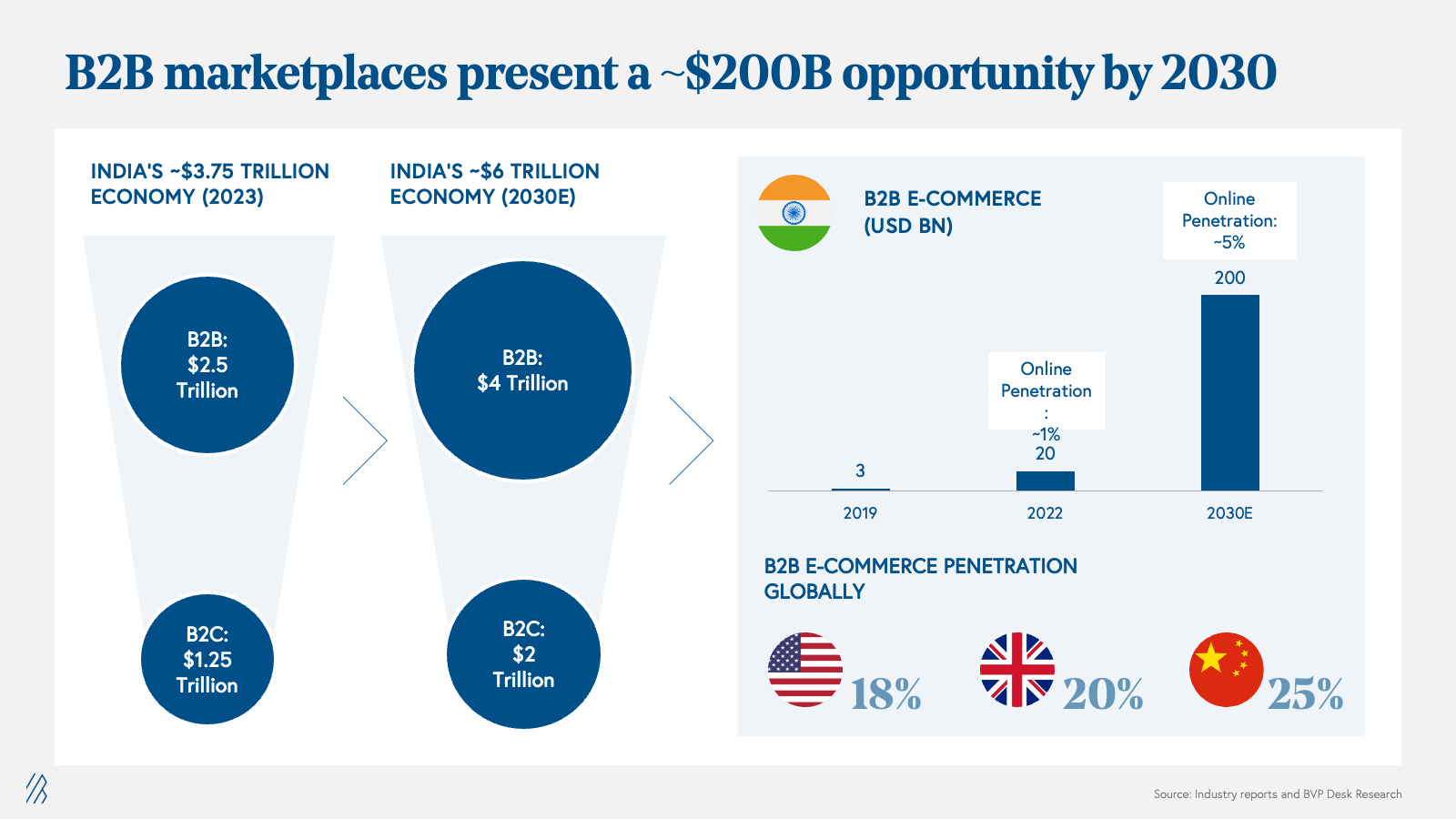

Today's massive shift to online transactions is just the beginning. As India’s $3.75 trillion economy grows to $6 trillion within the next decade, we anticipate a significant portion of this growth will be driven by the digital economy, which we estimate will grow from its current ~$100 billion to $1 trillion. While most of the first $100 billion of India’s digital economy has come from consumer digitization, we believe a large portion of the digital economy’s next 10X will come from business digitization and online transactions, or what we broadly call business-to-business (B2B) online marketplaces.

B2B marketplaces in India hold immense potential, driven by the sheer size of the country's predominantly unorganized B2B economy and fragmented supply chain. In 2022, B2B e-commerce accounted for a mere 1% of the overall B2B market in India, a stark contrast to its negligible presence in 2019. However, the trajectory of B2B e-commerce adoption indicates a significant upswing, with projections indicating its share will rise to just under 5% of the overall market by 2030.

By 2030, we anticipate that online-first, tech enabled B2B marketplaces will represent a remarkable $200 billion market opportunity. It's important to note that even with such substantial growth, online B2B gross merchandise value (GMV) would still account for only ~5% of overall B2B business in India, which is significantly lower than the penetration in other countries.

Why now?

We believe that four different factors—increased digital adoption, mature digital infrastructure, favorable regulatory policies, and a conducive cross-border environment—have led to a unique inflection point for B2B marketplaces in India.

Businesses are coming online

Business digitization has been a major driver of B2B marketplace growth in India. Tech adoption in the country has its roots in consumer internet adoption: as over 750 million people in India have gone online, micro, small, and medium enterprises (MSMEs) have benefited from discovery, price, convenience, and assortment. As of 2022, India has over 60 million MSMEs, and two out of three MSMEs have adopted tech in some form. Out of these, while only 10% of MSMEs (six million) currently engage in buying and selling online, 25% (15 million) are expected to transact on online marketplaces over the next four years.

Digital infrastructure is coming of age

1. Digital payment services – Developed payment infrastructure has transformed B2B transactions in India, offering businesses a fast, secure, and convenient way to transact with suppliers and customers. This shift has streamlined operations, reduced reliance on cash transactions and manual processes, and expanded business reach across geographical boundaries. India has witnessed substantial growth in online payment transaction value, projected to reach $208 billion by 2025, with companies like Razorpay, Juspay, and Rupifi playing a key role. Among these advancements, India’s Unified Payments Interface (UPI) has revolutionized B2B payments in India. It enables instant fund transfers, eliminating the need for time-consuming cheques or NEFT transfers. UPI's low transaction fees make it ideal for frequent small-value transactions, enhancing cash flow management. We think UPI represents one of several payment infrastructure tailwinds for efficient, secure, and hassle-free B2B transactions.

2. Open Network for Digital Commerce (ONDC) - ONDC is a significant development that will aid B2B marketplaces in India by facilitating secure data exchange and streamlining operations. It is a technology infrastructure that enables seamless integration and interoperability among different participants in the digital commerce ecosystem. It offers standardized integration through APIs, enabling seamless connections with logistics providers, payment gateways, and financial institutions. B2B marketplaces can benefit from a wider network, improved operational efficiency, enhanced trust, and regulatory compliance.

3. Open Credit Enablement Network (OCEN) - OCEN can play a vital role in empowering B2B marketplaces by streamlining credit access, fostering trust and transparency, enabling personalized loan products, and enhancing efficiency. By facilitating the exchange of credit-related information, OCEN can support the growth and development of the B2B lending ecosystem, benefiting both lenders and businesses seeking credit.

Favorable regulatory changes are facilitating growth

Several favorable public policy changes have provided a strong tailwind to B2B marketplaces in India.

1. Goods and Services Tax (GST): The implementation of the Goods and Services Tax (GST) in India has had a positive impact on the adoption of B2B marketplaces in the country. One of the major advantages of GST for B2B marketplaces is that it eliminates the need for multiple tax registrations and compliance with different tax laws in different states. This makes it easier for businesses to operate across different states and reduces the associated administrative and compliance costs. GST also makes it easier for businesses to claim input tax credit, which is the credit they can claim on the tax paid on their inputs (raw materials and services) while paying GST on their output (goods or services), while also creating a level playing field for MSMEs by eliminating the tax advantage that larger businesses had earlier.

2. eWay Bill: The eWay Bill is an electronic document generated online for the movement of goods from one place to another in India. It is mandatory for inter-state transportation of goods and has been made optional for intra-state movement by several states in the country. One of the significant challenges faced by B2B marketplaces was the lack of a streamlined system for the movement of goods. With the introduction of the eWay Bill, B2B marketplaces can now easily track the movement of goods from the seller's warehouse to the buyer's location. This has resulted in a reduction in delivery time and improved efficiency, leading to increased participation from sellers and buyers on these marketplaces. Companies like Shiprocket, Delhivery, Shadowfax, Freight Tiger, among others have been at the forefront of this revolution, making logistics more efficient and cost-effective.

3. Trade receivables discounting system (TREDS): TREDS is an online invoice discounting platform introduced by the Reserve Bank of India (RBI) in 2017, which has played a crucial role in promoting the adoption of B2B marketplaces in India. The platform has provided MSMEs with an efficient and transparent system for raising finance against their receivables, which was previously a challenging and time-consuming process. With TREDS, MSMEs can raise funds in a short period, reducing the need for them to hold on to their receivables and improving their cash flow management.

TREDS has also helped increase trust between buyers and sellers on B2B marketplaces. The availability of an efficient and transparent invoice discounting system has reduced the risk of defaults and delayed payments, leading to more significant participation from MSMEs on these platforms.

4. Production Linked Incentives (PLI): PLI schemes indirectly benefit B2B marketplaces by expanding the supplier base, improving product quality and competitiveness, lowering costs, strengthening the supply chain, and creating collaboration opportunities. It creates a favorable environment for the growth and development of B2B marketplaces, enabling them to offer enhanced value and contribute to the overall expansion of domestic manufacturing in India. Additionally, government initiatives such as Make in India, Digital India and Start-up India are also promoting the growth of B2B marketplaces in India by encouraging MSMEs to adopt digital technologies and platforms to boost their competitiveness and efficiency.

Conducive cross-border environment

Encompassing both manufacturing and services, India is poised to become an export hub. As businesses worldwide seek to mitigate supply chain risks and adopt a China+1 strategy, a significant portion of demand, estimated at 15%, is expected to shift towards India. This shift can be attributed to India's abundant natural resources, cost-effective labor, and transparent regulatory environment. Additionally, India is actively engaging in free trade agreements with multiple nations to bolster its economy and achieve its ambitious $2 trillion export target by 2030. On the services front, India's exponential growth in the tech talent pool presents an opportunity to export high-value Software-as-a-Service (SaaS) products and services, transcending the traditional realm of IT services. This transition allows India to capitalize on its expertise and cater to the evolving global demand for innovative technological solutions.

Moreover, the next generation, well-versed in the ways of the internet, is poised to take the reins of MSMEs. Having grown accustomed to transacting online through D2C marketplaces, this tech-savvy generation recognizes the potential of B2B marketplaces in fueling the growth and scalability of their businesses. We envision these marketplaces becoming the driving force behind the journey towards a $1 trillion digital economy, ushering in a new era of growth and opportunities.

Key opportunities in B2B marketplaces

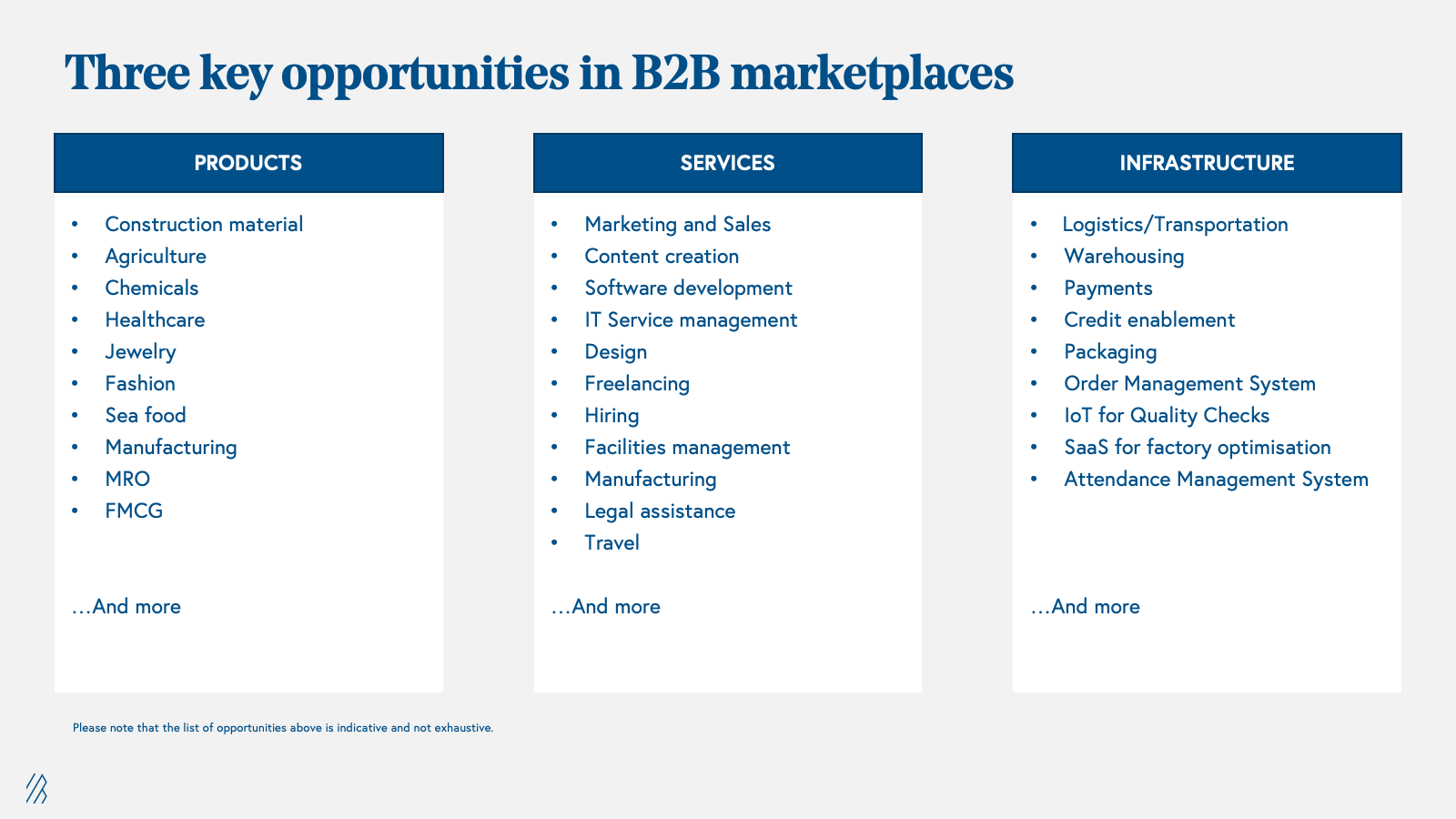

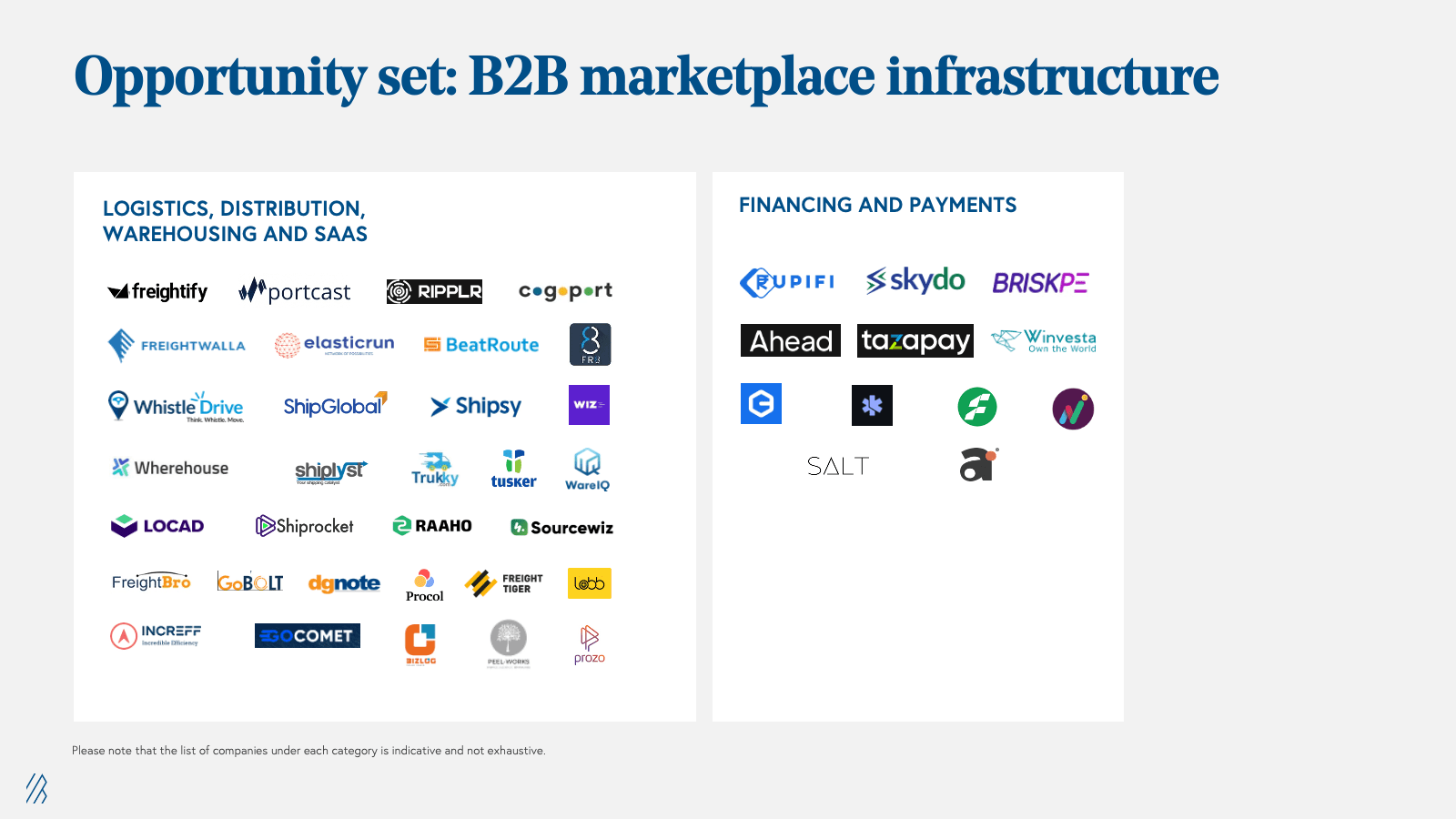

We believe there are three kinds of opportunities emerging in the B2B marketplaces domain: (1) product marketplaces, (2) service marketplaces, and (3) marketplace infrastructure startups.

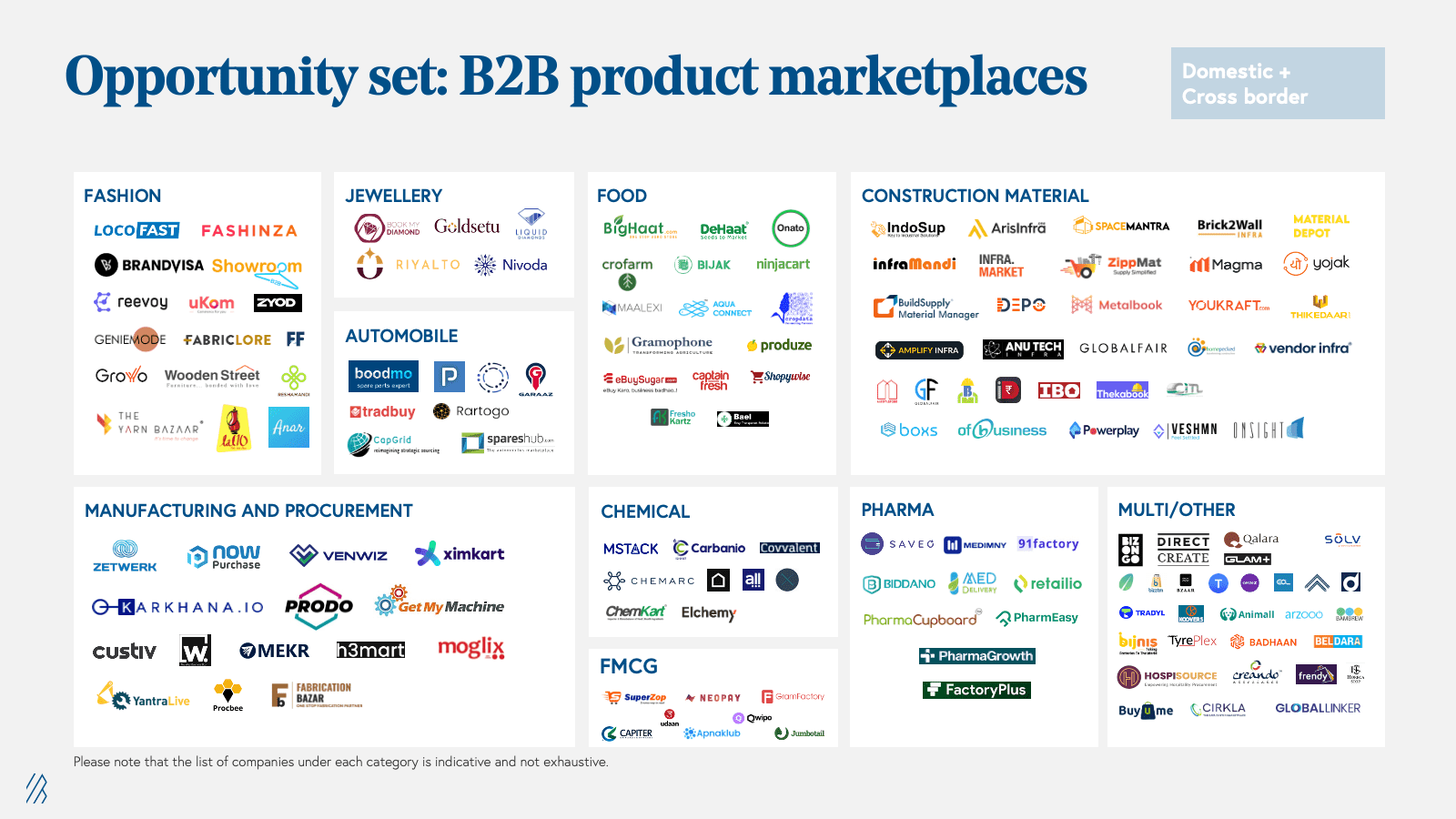

1. B2B product marketplaces: These are full-stack online marketplaces that not only connect buyers and sellers of physical goods, but also manage the entire transaction by providing relevant services, such as assortment, quality assurance, and logistics. They are often vertical-specific in sectors such as construction material, agriculture, chemicals, fashion, consumer electronics, jewelry, among others, and can be domestic and/or export-oriented.

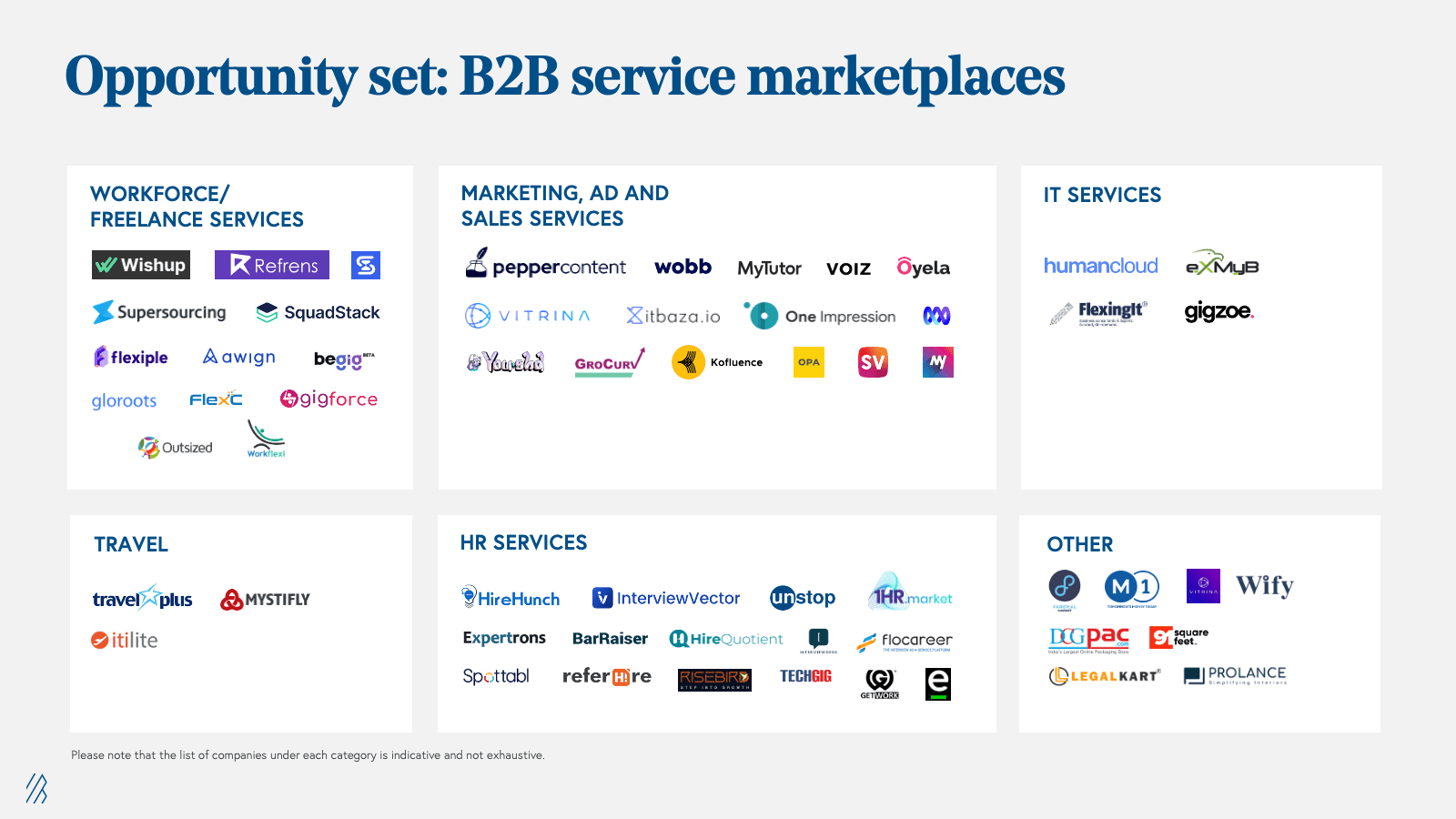

2. B2B services marketplaces: These are full-stack online marketplaces (like product marketplaces), but instead of physical products, they connect businesses with service providers such as freelancers, consultants, and agencies, and operate in verticals like marketing and sales, IT, recruitment and HR, industrial, among others.

3. B2B marketplace infrastructure: These are technology platforms and tools in payments, logistics, warehousing, etc. that enable companies to build, assist and/or operate B2B marketplaces. Some companies overlap in having both a marketplace and infrastructure—for instance, a B2B startup could begin with a B2B marketplace and either build its own SaaS product for its customers or plug in a SaaS player, while other companies start with a SaaS product and build a B2B marketplace on top of it.

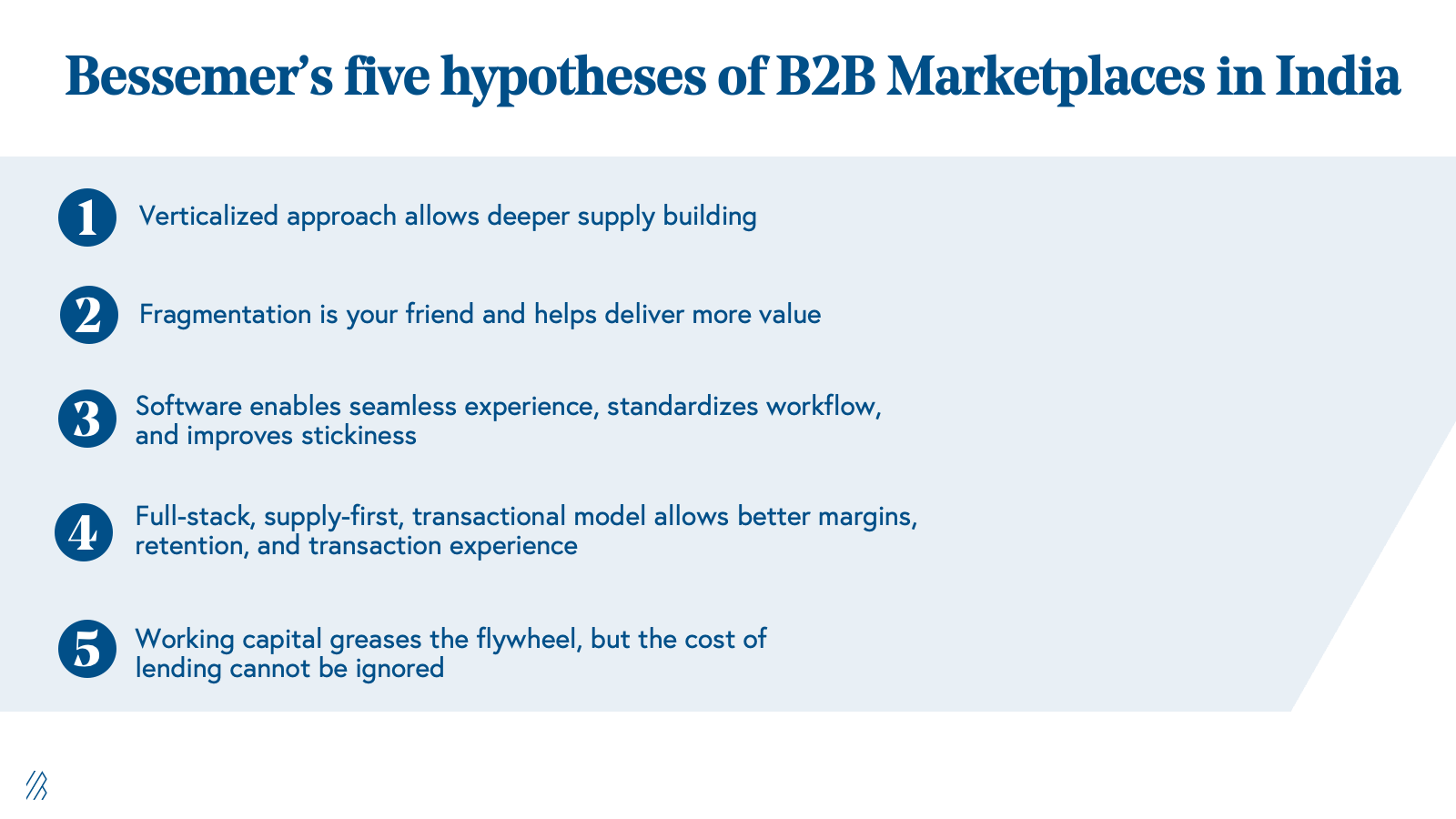

Bessemer’s five hypotheses of B2B marketplaces in India

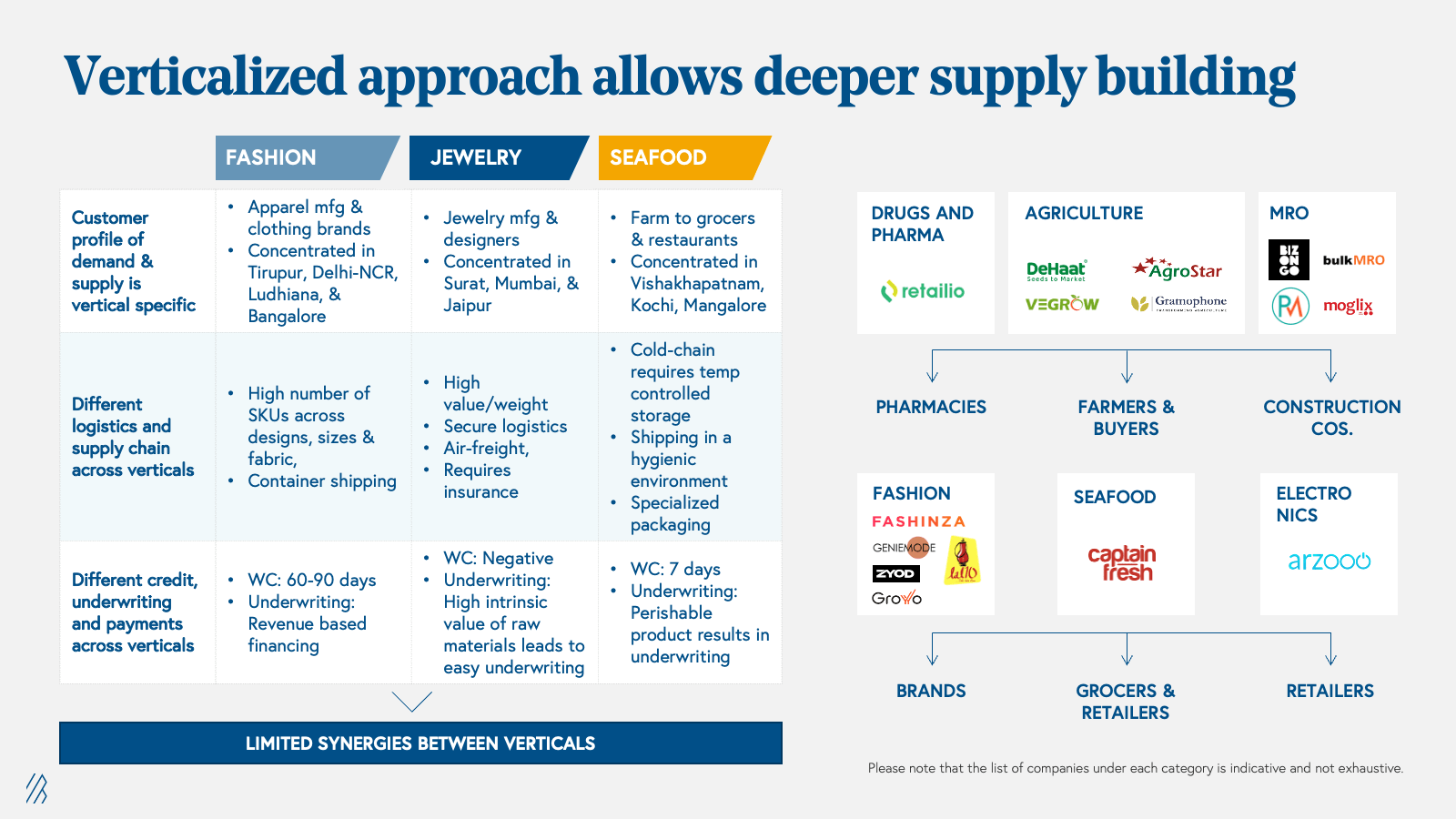

1. Verticalized approach allows deeper supply building: The supply-side in India is highly unstandardized and fragmented, necessitating that marketplaces manage entire transactions through a full-stack approach. This stronger control over supply leads to improved customer experience, strong customer retention, and the ability to build a long-term sustainable business and gain market leadership. This is our thesis for all marketplaces, and we highlighted it in our last piece on Internet Marketplaces in India.

In the B2B supply chain, factors like buyer and supplier personas, working capital requirements, logistics, payments, and underwriting vary significantly across verticals. These disparities are better solved by the power of vertical marketplaces. Due to the distinctive nature of each industry's supply chain, there are limited synergies between verticals. Therefore, B2B marketplaces thrive by specializing in a specific vertical rather than attempting to cater to a wide range of industries. After establishing a strong presence and capturing a significant market share within a vertical, marketplaces can subsequently explore adjacent verticals or expand their reach within the existing vertical's supply chain. For instance, a B2B marketplace operating in the manufacturing sector can expand its services by venturing into distribution for buyers or engaging in raw material sourcing for suppliers, thus extending its value chain coverage.

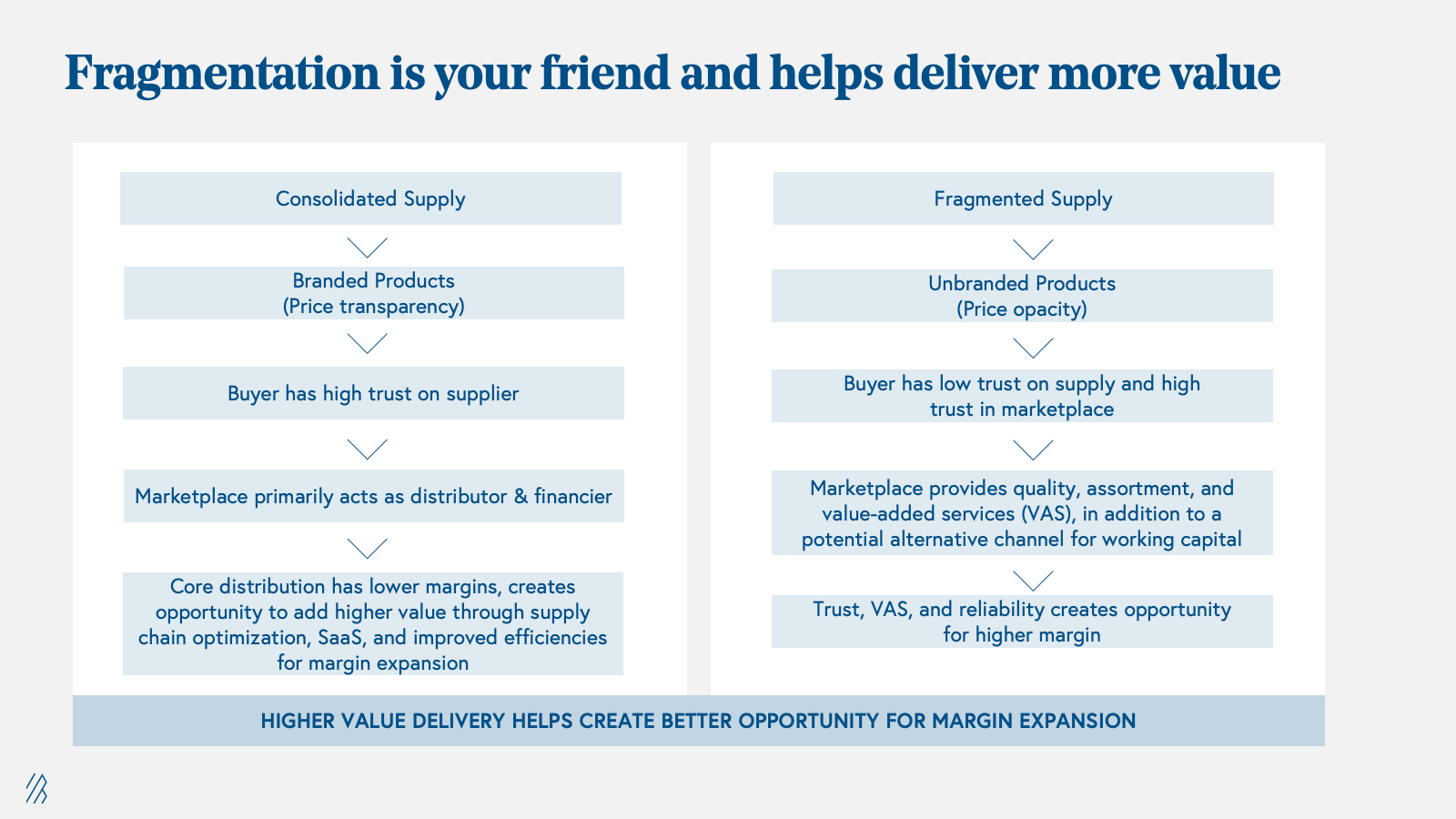

2. Fragmentation helps create and deliver more value: B2B Marketplaces thrive in fragmented industries. When the supply side of an industry is dominated by a few players, retailers already have knowledge of these players, trust their brands or reputation, and face no challenges in price discovery. In such cases, retailers can directly purchase from their preferred suppliers instead of relying on a B2B marketplace. Traditional middlemen often serve as distributors and financiers in these consolidated markets. To create a profitable business in this scenario, a B2B marketplace must deliver value through improved efficiencies, such as faster turnaround times, higher service levels, or a SaaS offering.

On the other hand, in fragmented markets on both the buyer and supplier sides, it becomes challenging for buyers to discover, vet, and work with multiple suppliers, and vice versa. This is where a full-stack, software-enabled B2B marketplace excels. For instance, Retailio (a Bessemer portfolio company) addresses this challenge in the pharma industry. With hundreds of pharma brands and thousands of pharmacies, Retailio offers discovery, better pricing, a wider assortment, and a SaaS product to enhance pharmacy productivity.

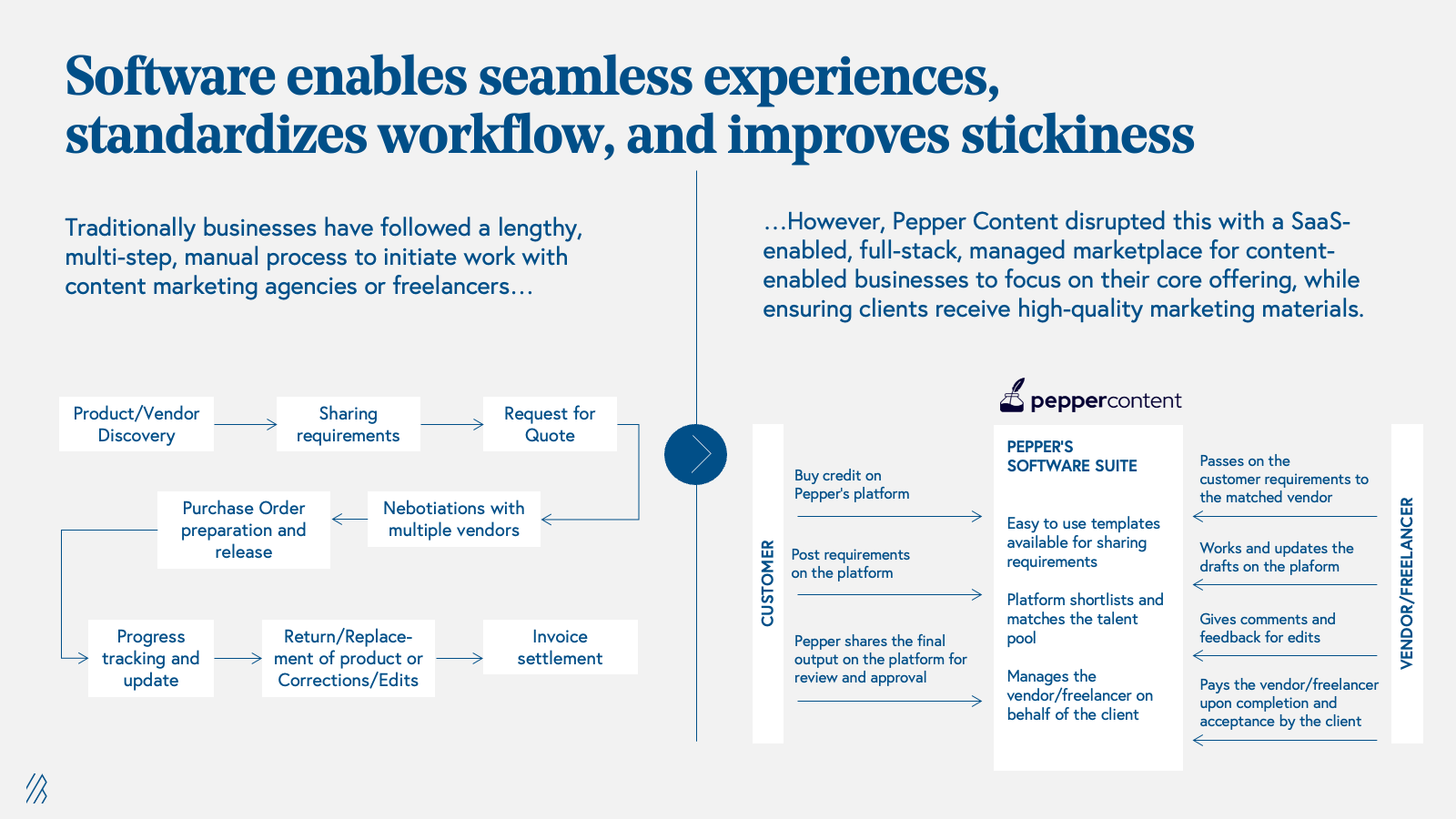

3. Software enables seamless experiences, standardizes workflows, and improves stickiness: The conventional process businesses undergo to procure products or services is often lengthy and complex. This inherent inefficiency calls for a software solution that can transparently and cost-effectively address these challenges. By implementing a software solution, businesses can eliminate inefficiencies, streamline workflows, and enhance transparency in a cost-effective manner. Without such a solution, B2B marketplaces risk being limited to the role of a distributor, which lacks long-term profitability and sustainability.

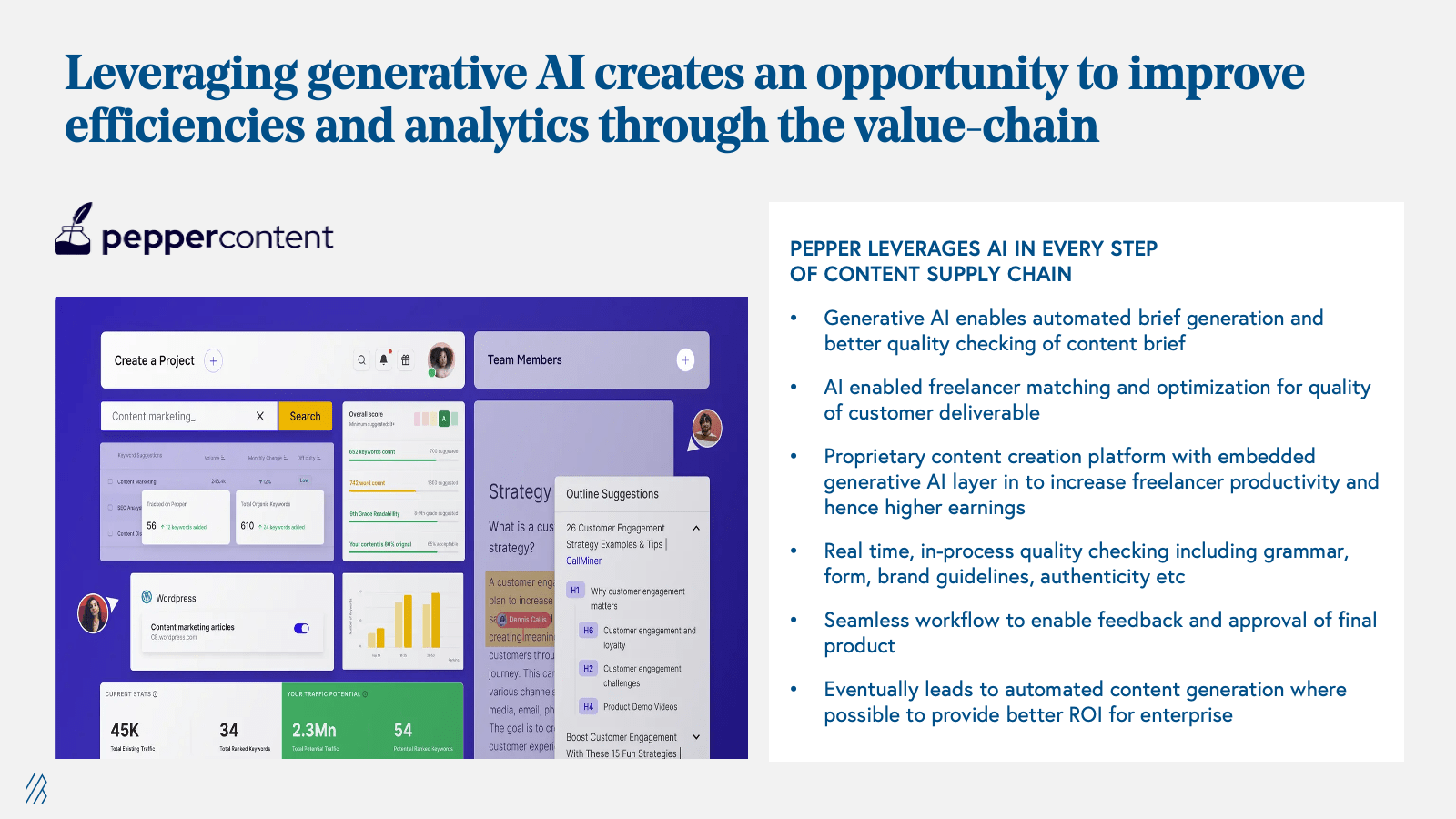

Leveraging generative AI: Our portfolio company Pepper Content, a SaaS-enabled full-stack managed B2B services marketplace for content marketing, exemplifies this. Pepper Content connects businesses with a network of freelance writers, editors, and designers, who can create high-quality content for a wide range of industries. The platform uses software to automate many of the processes involved in connecting businesses with content creators, including project management, payment, and delivery. This helps businesses save time and money on content creation, as they can find high-quality writers and designers at a standardized cost without the hassles of negotiating with individual freelancers, hiring full-time employees, or finding freelancers every time the organization has new content needs. For freelancers, Pepper Content provides them with consistent business and gives them visibility into their earning while also providing them with AI-driven tools to help ease their work. This increase in efficiency and cost-effectiveness on both sides of the marketplace is the main reason why software enabled B2B marketplaces like Pepper Content will thrive in today's market.

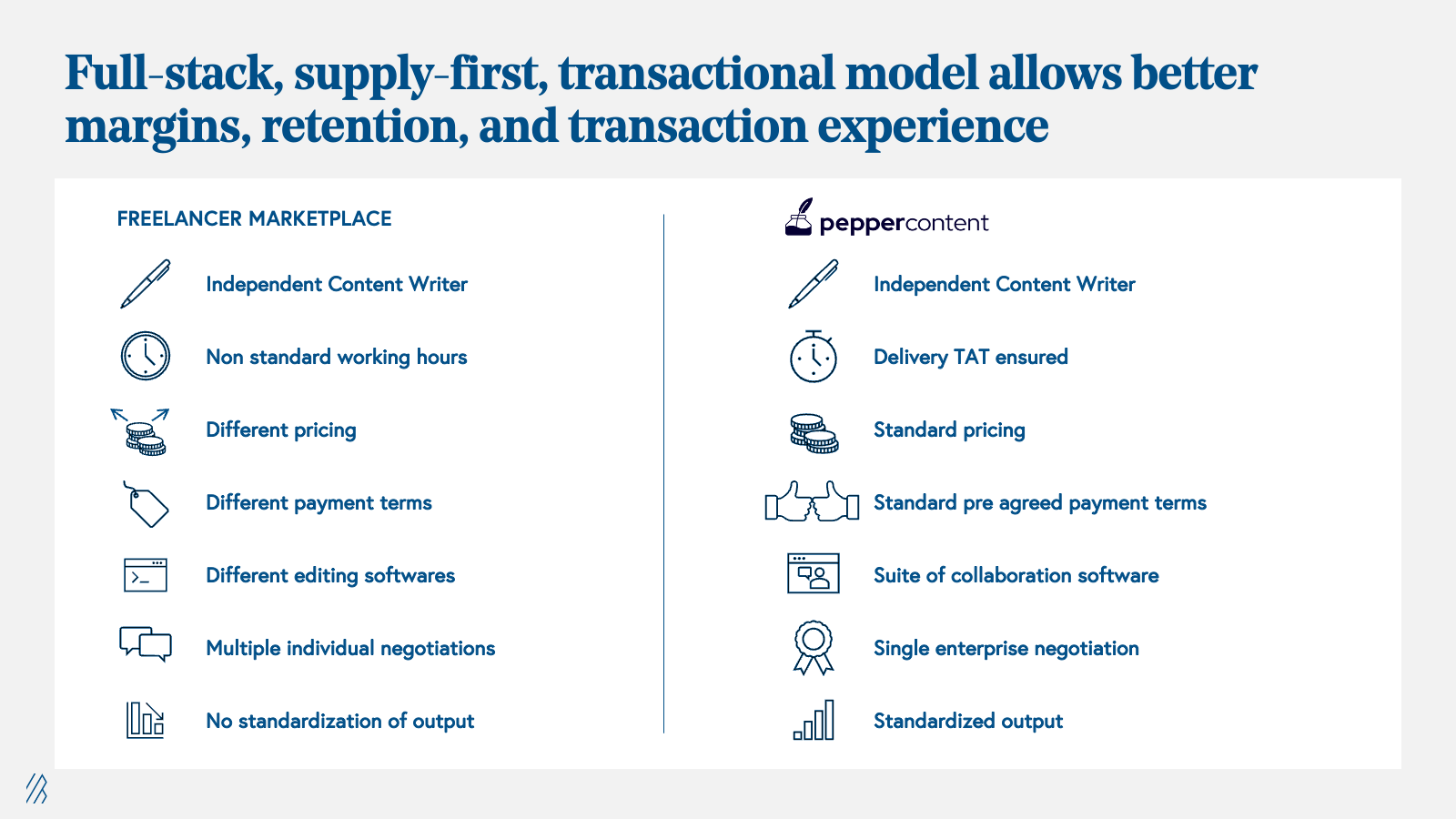

4. Full-stack, supply-first, transactional model allows better margins, retention, and transaction experience: “Full-stack” means complete, end-to-end control over the supply chain. A “full-stack” model ensures better customer experience at the lowest cost while ensuring the highest margins. For example, in Swiggy’s delivery service, “full-stack” means controlling the delivery fleet for food delivery such that the consumer has full transparency as to where their order is. This doesn’t change between B2C and B2B marketplaces and we have covered this in more detail in our article on Internet Marketplaces in India.

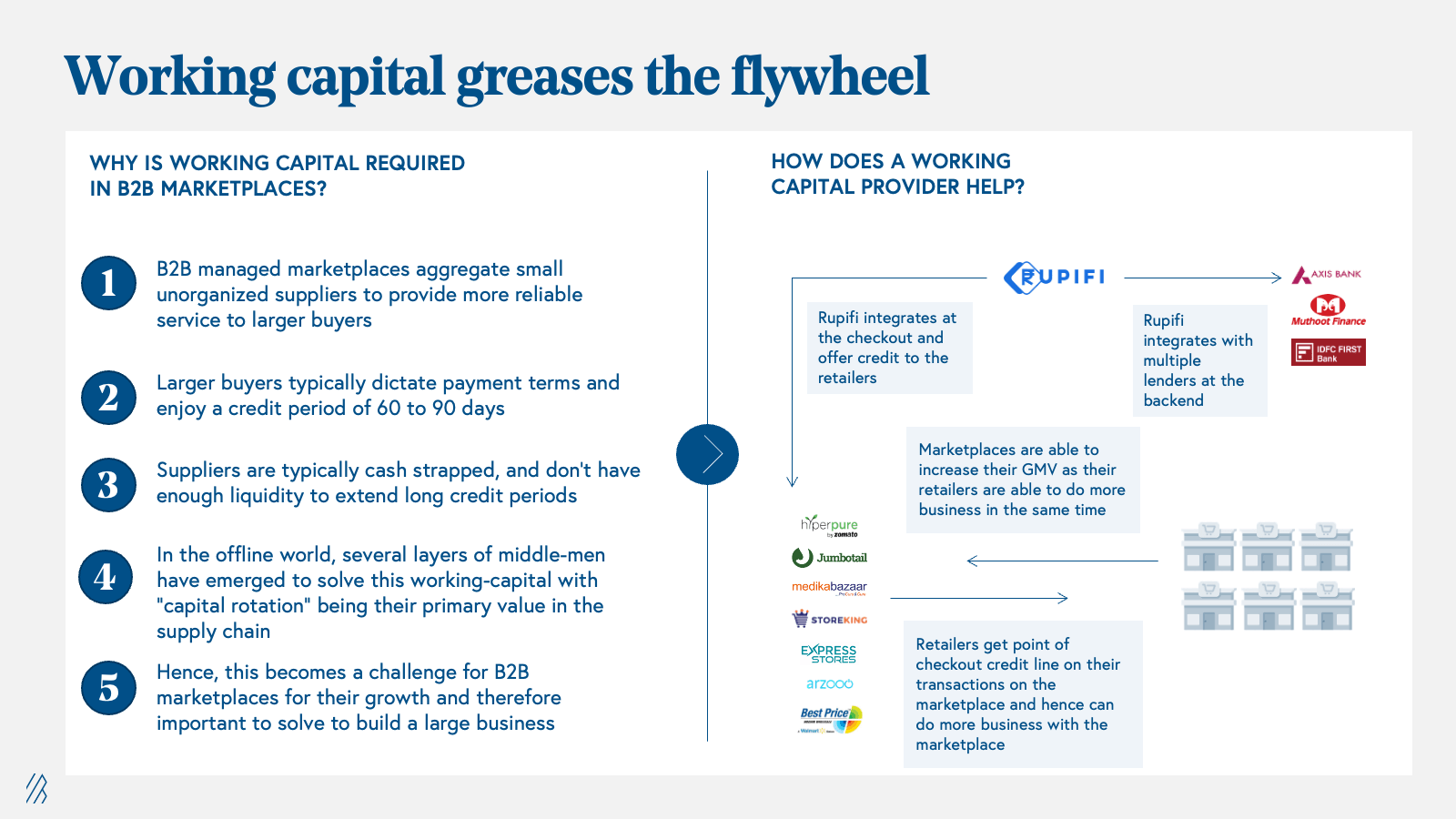

5. Working capital greases the fly-wheel – B2B businesses often require working capital, typically with credit periods ranging from 30 to 90 days. To achieve scalability, it is crucial for B2B marketplaces to address this financing need. However, when marketplaces lend from their own balance sheets, they assume credit risk, which can erode their margins, given historical default rates for MSMEs of 8-10%. Moreover, scaling the loan book becomes capital-intensive, making balance sheet lending an unfavorable solution.

Our portfolio company Rupifi offers a working capital solution tailored for B2B marketplaces. It provides businesses with the necessary funding to purchase goods from other marketplace participants, enabling their growth while relieving marketplaces from the burden of lending on their own books. Rupifi seamlessly integrates with B2B marketplaces, offering customers a credit line that can be utilized as needed and repaid over the loan cycle. The Rupifi platform enhances underwriting decisions by leveraging transaction data and analyzing buyer and supplier behavior. This integration empowers more businesses to access the funding required for purchasing goods while maintaining a digital record of their transactions and repayments, contributing to the wider adoption of B2B marketplaces.

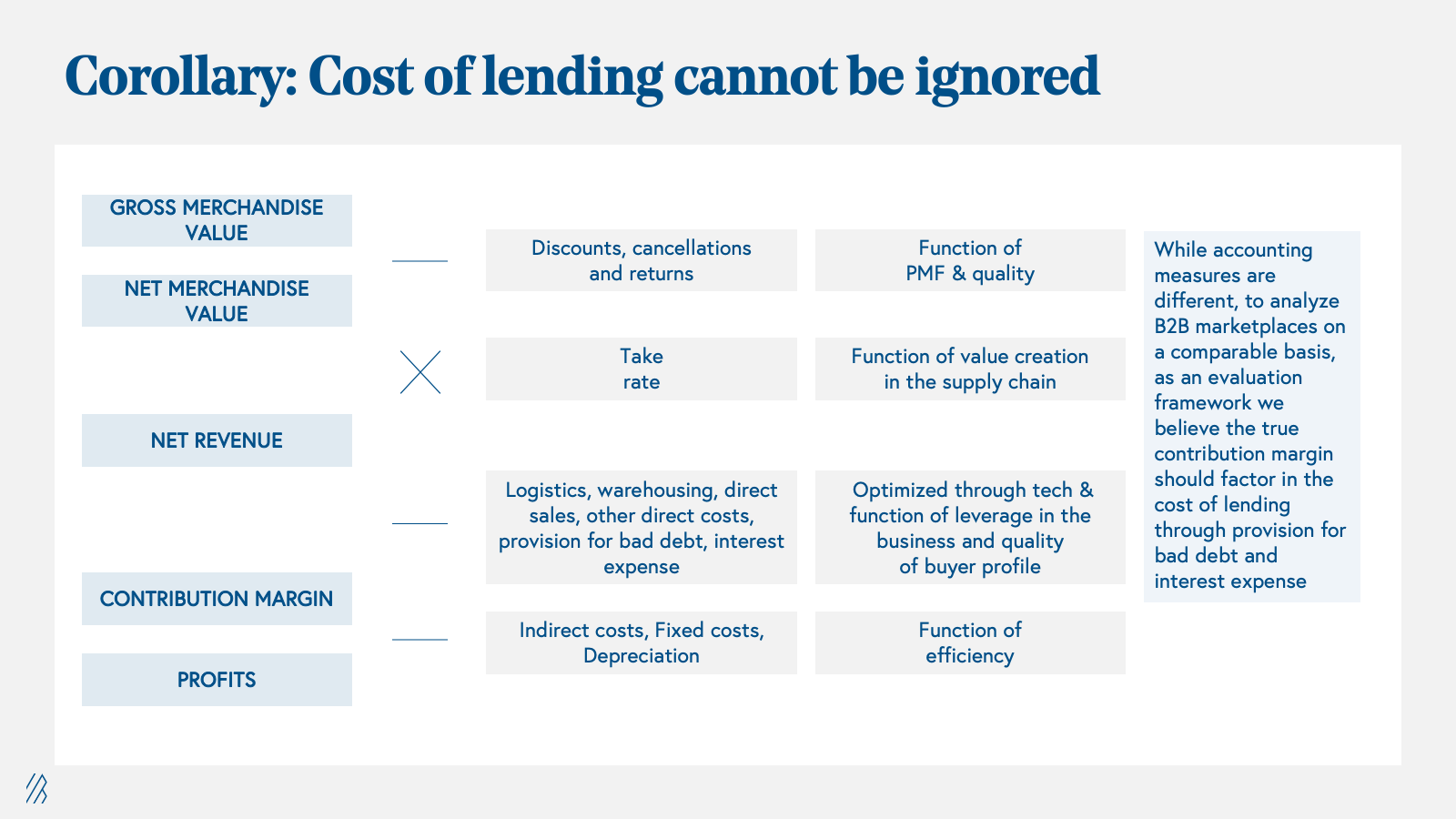

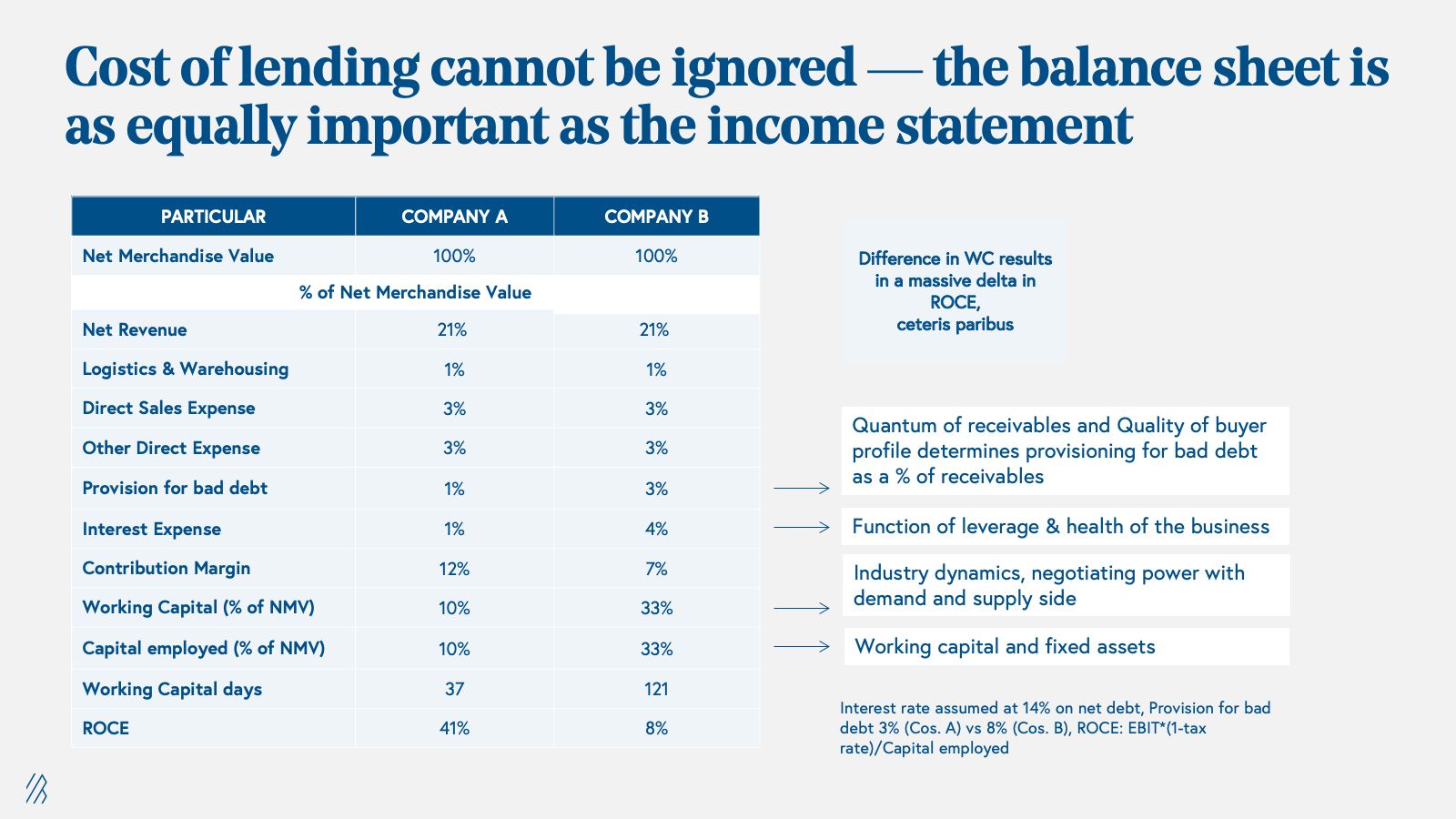

But the cost of lending cannot be ignored: While working capital enablement is an important part of any B2B business, the costs of lending cannot be ignored. Analyzing the costs associated with working capital is crucial in the context of B2B businesses. The working capital needs vary depending on factors such as the operating model of the marketplace, the market dynamics of the particular vertical, and the wallet share between suppliers and buyers. It's worth noting that as the B2B marketplace scales and gains more negotiating power with suppliers, the dynamics of working capital can change. Whether the working capital is sourced from equity, on-balance sheet debt, factoring, or through partnering with a B2B BNPL (Buy Now Pay Later) player, the costs involved manifest as bad debt, interest expenses, and/or potential compression of take rates on the P&L of the B2B marketplace. The illustration above demonstrates how these costs can significantly impact the true contribution margin of the business and must be carefully considered.

Furthermore, most B2B marketplaces operate under the assumption of being capital efficient, aiming for a return on capital employed (ROCE) of greater than 15%. However, longer working capital cycles introduce greater capital intensity, which can significantly impact ROCE of the marketplace. (See our illustration above.)

How we evaluate B2B marketplace opportunities in India

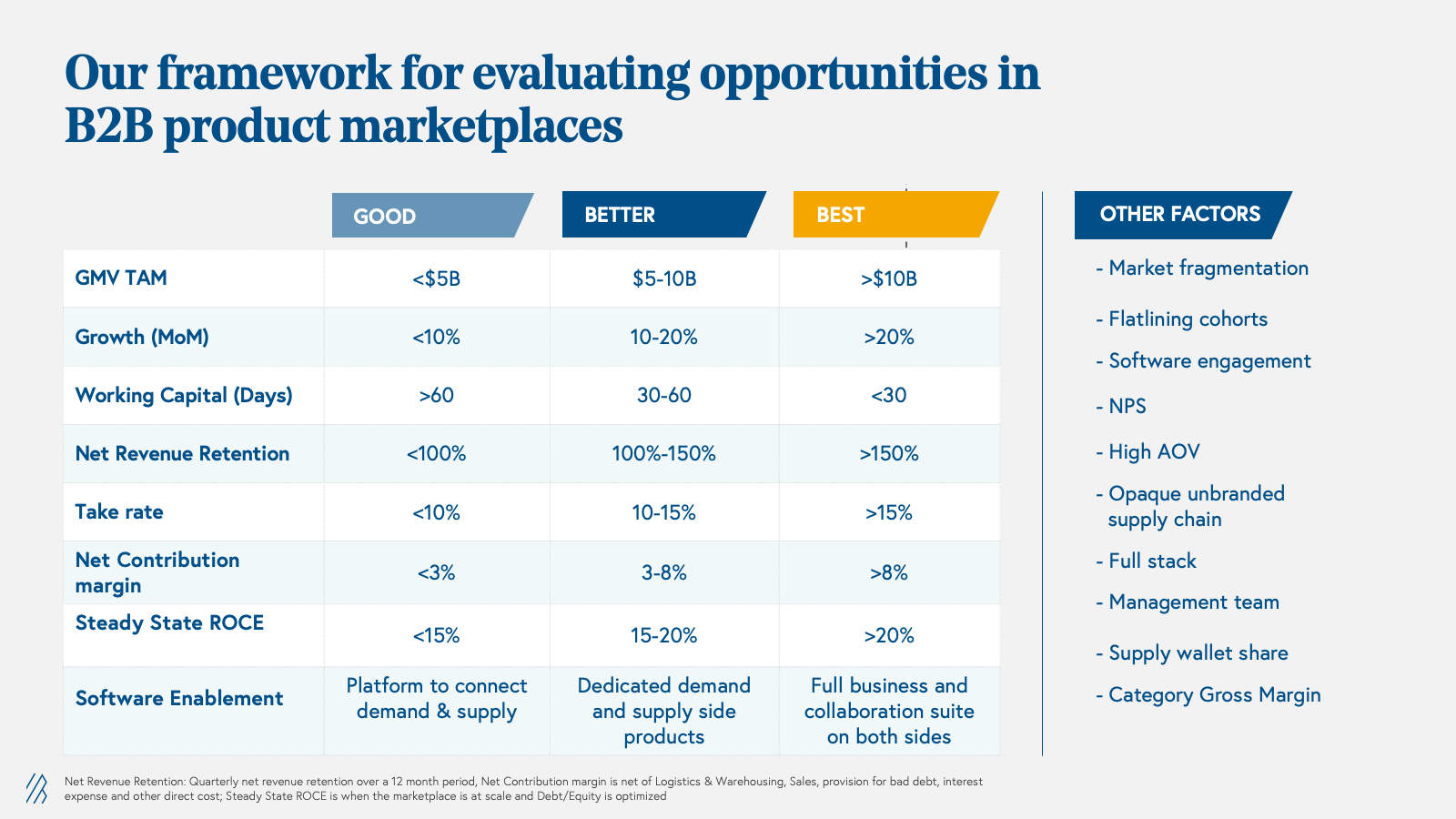

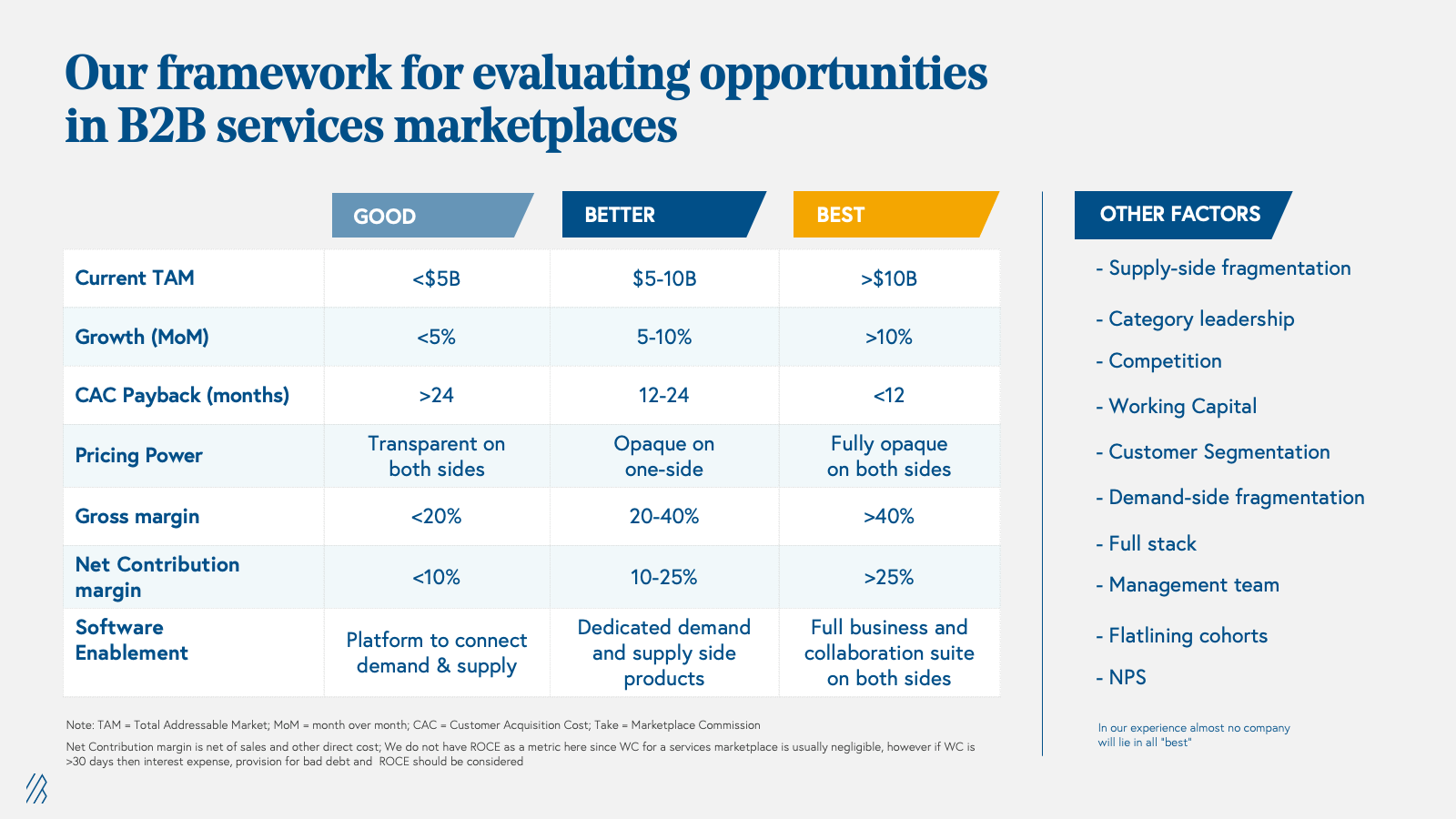

These five tenets have helped us build several evaluation frameworks for different internet B2B marketplace models within India. While the broad metrics remain the same for product (both domestic and cross-border) and services B2B marketplaces anywhere in the world, the benchmarks are different depending on the business model and vertical. The frameworks below are indicative of how we evaluate Products and Services B2B Marketplaces in India. In our experience, almost no business has every metric in green and specific benchmarks could vary slightly with scale and specific sector.

Product marketplaces

Services marketplaces

The decade of B2B marketplaces

We believe that the next ten years of India’s internet economy represent the country’s decade of B2B marketplaces. With robust e-commerce infrastructure already in place, encompassing logistics, payment systems like UPI (Unified Payments Interface), ONDC (Open Network for Digital Commerce), Account Aggregators, and OCEN (Open Credit Enablement Network), coupled with favorable regulatory changes surrounding GST (Goods and Services Tax), TREDS (Trade Receivables Discounting System), and PLI (Production Linked Incentive) for manufacturing, the stage is set for the ascent of B2B marketplaces.

If you are a founder, building a B2B marketplace business in India, please write to us at IndiaB2BMarketplaces@bvp.com.