ACV Auctions: The value of bringing trust to used cars sales

Today ACV Auctions celebrates a momentous milestone with their IPO. As we congratulate the team on this achievement, we also wanted to take a moment to reflect on their impressive journey to get here.

On the face of it, ACV seemed far from the prototypical VC-backed tech startup in the early days. For starters, the company is based in Buffalo NY, they deal in a notoriously messy industry, and if they somehow got their marketplace to work in their home market, they would need to repeat that feat across 150 territories nationwide, while hiring hundreds of vehicle inspectors, and physically moving tens of thousands of cars and vehicle titles. To top it all off, they were setting out to change user behavior in an industry that hadn’t changed in decades.

At the same time, the scale, fragmentation and inefficiency of the wholesale used car market made it ripe for disruption. Unlike new vehicles, every used car is a unique snowflake, and there is an inherent lack of trust between buyers and sellers given the information asymmetry between them. All of these traits made this market ideal for what we have termed a high-friction B2B marketplace, to come in and streamline transactions by serving as a trusted intermediary. (Solving the trust problem was the No. 1 challenge for ACV.)

The idea of moving used car sales online was far from a novel concept in itself. There had even been numerous companies that tried to digitize the wholesale used car market before ACV, with limited success. ACV’s magic ingredient was having a combination of founders like Joe Neiman and Dan Magnuszewski who understood the nuances of wholesale used car buyers intimately, and an excellent team of technologists and operators, led by CEO George Chamoun that have executed flawlessly on their plan.

ACV is a classic example of what our partner Adam Fisher would consider a “smart” business, in that it does not rely on any sort of breakthrough technology or new consumer behavior, instead they have realized a clever new model, enabled by technology, to address an unmet need in the market. As Adam describes ‘smart’ companies “the founders of these companies usually possess a strong understanding of the target market, including the economics, psychology and politics that drive it. The risk around these companies is largely execution, but when done properly these companies can quickly disrupt an existing market or create a new one with a surprisingly simple, yet smart approach.”

ACV’s big innovation was taking the process a step further than just listing cars online. They invested heavily in the technology, people, and processes required to thoroughly evaluate vehicles, provide a comprehensive assessment of quality, and ultimately stand behind the cars on the platform as a trusted intermediary. This was crucial in giving wholesale used car buyers - who pride themselves on their ability to assess a car’s value by seeing, touching,and even smelling cars - the comfort to buy a vehicle from someone they had never met, entirely online. In addition, they offered sellers an opportunity to onboard supply with virtually zero risk, i.e “try our virtual auction for free, if it doesn't sell, no sweat, you can still take it to the physical auction”.

By digitizing this industry, ACV Auctions unlocked a much more efficient marketplace, in which buyers and sellers could transact with a much broader market, all without physically shipping their cars to an auction. At scale, this has made ACV the best place for sellers to reach more buyers and vice versa. All while providing a dramatically better user experience for both buyers and sellers, which has led to a virtuous marketplace flywheel.

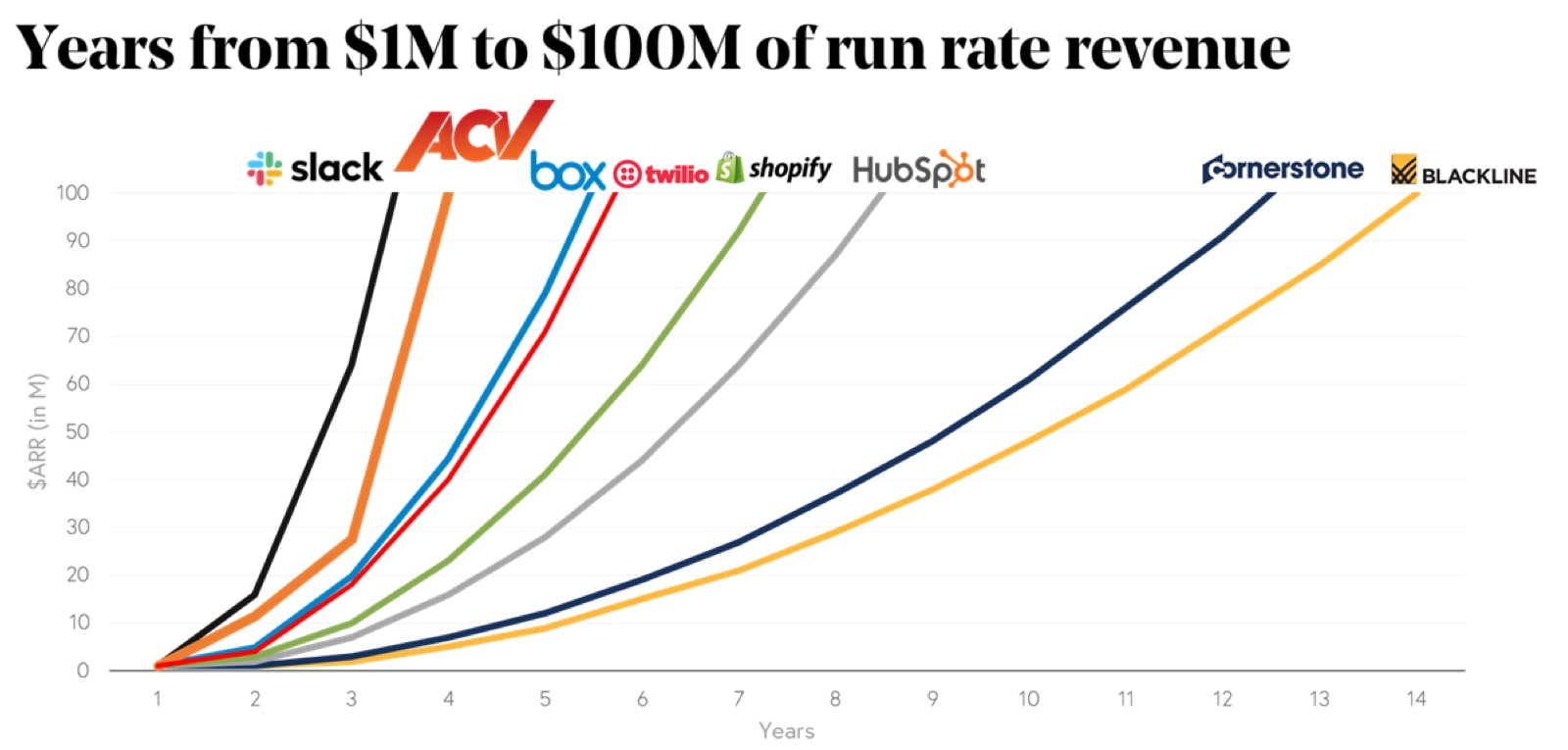

In the early days, the team was relentlessly focused on getting the product and user experience right in their initial markets around western New York state. After proving out repeatable market-level economics, the team doubled down aggressively on expansion. Perhaps what is most impressive about ACV’s story is just how quickly and efficiently the team was able to scale up the business. Despite the challenges of building a marketplace that needs to move physical products and manage vast teams of inspectors, ACV was still one of the fastest growing software companies we have ever seen. When we compare them to hyper growth SaaS companies, they rank best-in-class in terms of the time it took them to get from $1M to $100M of run rate revenue.

We have long focused on B2B marketplaces as one of our core roadmaps at Bessemer. In particular we believe that high-friction marketplaces offer tremendous potential to bring more efficiency and transparency to the $100 trillion of global B2B spend that largely flows through offline channels today. ACV Auctions is one of a small handful of successful high-friction B2B marketplaces that have reached real scale, and they have informed much of our thesis on what it takes to succeed with this model. While it is often very challenging to change behavior in these industries, when they work, B2B marketplaces can deliver a radically better experience to both buyers and sellers and have the power to grow incredibly quickly as ACV has proven.

We want to say a huge congratulations to the entire ACV team, on a tremendous accomplishment. We are grateful for the opportunity to be a small part of this journey and have no doubts that this company is still just getting started!