The Analyst Program

At Bessemer, we believe venture capital thrives in an apprenticeship model. For almost twenty years, we’ve been fortunate enough to bring on three to four bright, ambitious, and aspiring investors each year to join the program as a foray into their careers.

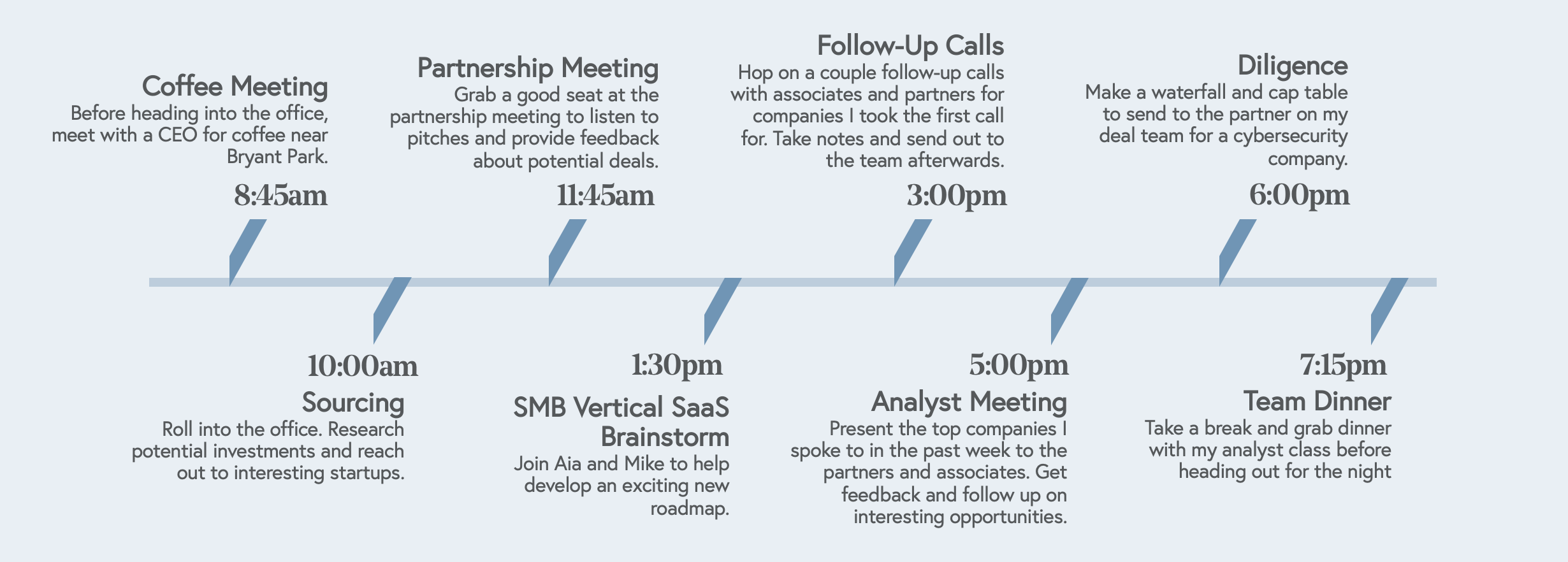

While there are skills and lessons you can learn in school, many elements of venture capital, such as developing investment judgment, sourcing emerging new startups, and refining roadmaps for the future, are uniquely learned on the job by engaging with entrepreneurs and experienced investors.

Analysts typically join our selective, two-year program directly from their undergraduate studies or soon after. The program is based in our New York office, but analysts will collaborate on projects with Bessemer partners across the globe and work with emerging founders and exceptional operators.

Our partners and the broader investing team provide hands-on training to gain the foundational skills for your investing career, mentorship on the art of the industry, and invaluable experience. Our analysts are critical, valuable members of the team; they participate in our weekly partnership meetings and make a tremendous impact on the firm.