How to segment your customer base for more precise pricing and packaging

Why ‘one-size-fits-all’ is really ‘one-size-fits-none.’

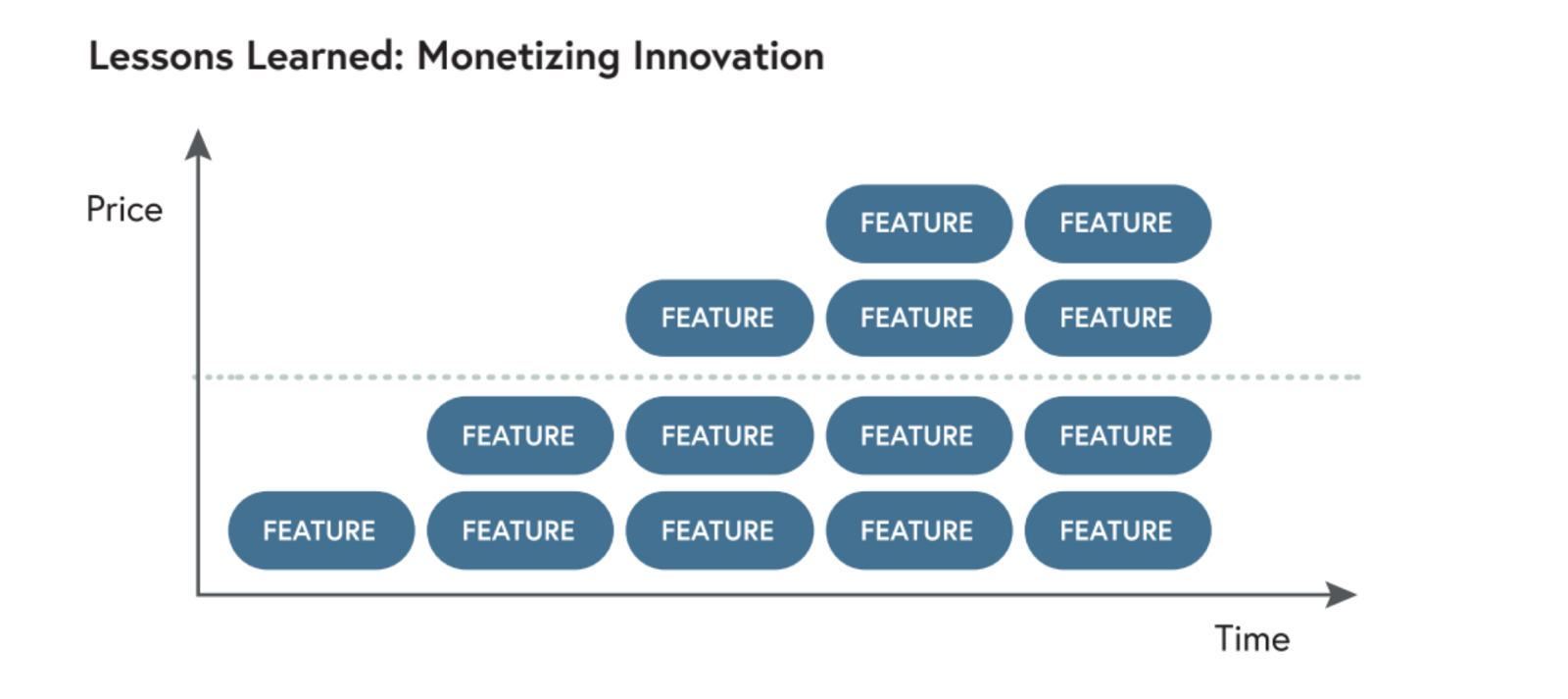

Amongst early-stage startups, the “fake it ‘til you make it” approach is ubiquitous. That is, companies set a price and then rush to build enough features to justify that price to the market. But over time, this relentless pursuit of customer delight means feature after feature gets shipped. Eventually, the value you’re delivering to customers starts to outstrip your original price point.

Inevitably there comes a point when you get a nagging feeling that all of this surplus innovation needs to be monetized. Fortunately, customer segmentation and packaging is the quickest way to monetize it without alienating the smaller tiers of your customer base.

In this article, we’ll explain the warning signs that it’s time to segment your customer base, and cover the key strategic factors you need to consider to capture the most value from each segment.

Tell-tale signs that you need to segment your customer base

In the early stages of building a startup, your customer base may be fairly homogenous. Or it might be so varied that you don’t even know what the repeatable use cases are. Either way, it’s too soon to definitively group your customers into discrete segments. How do you know when the time is right to start dividing your customers into segments?

When any of the following happen, you can be confident you’ve reached a crossroads:

- Your original one-size-fits-all product is splintering into distinct offerings for different firmographics or demographics.

- You’re leaving money on the table because larger customers are paying less than they’d be willing to.

- You’re losing smaller customers who would subscribe to a more accessible tier if it were available.

- Requests for pricing adjustments from your sales team are trending up.

- Legal and finance are spending an unreasonable amount of time modifying contracts.

Picking the best way to divide up segments

Here’s what people often get wrong about segmentation: They think the pricing variety is the same as the marketing and advertising variety. Marketers commonly divide their market into subsets based on demographics, common interests, and other behavioral criteria. This helps them effectively target each segment with different campaigns and messaging.

However, this form of segmentation may not be actionable for pricing. Pricing segmentation is largely driven by identifying the willingness to pay (WTP) of customer cohorts. The ultimate goal is to enable the company to serve customers with different WTP with different permutations of the product.

Companies need to segment their customer base in ways that directly apply to the product offering. For example, are there groups of customers who are buying the same things repeatedly? It’s important to focus on the commonalities of customers as they pertain to purchasing habits. These may commonly correspond to broad firmographics like company size. Certain segments may also use more or less of the product and it’s important to understand why.

Common ways to segment your customer base include:

- Number of employees (e.g. commercial is 1-500, mid-market is 501-1000, enterprise is 1000+)

- Revenue (e.g. $0-1M, $1.1-10M, $10.1M+)

- Enterprise only: Fortune 500, Fortune 1000

Serving each segment and capturing value from each

Identifying customer segments is only half the battle. Once you’ve decided on an appropriate way to group your customers, you need to decide how to respond to those differences via a packaging plan. It takes careful consideration, as well as a product that enables gated features.

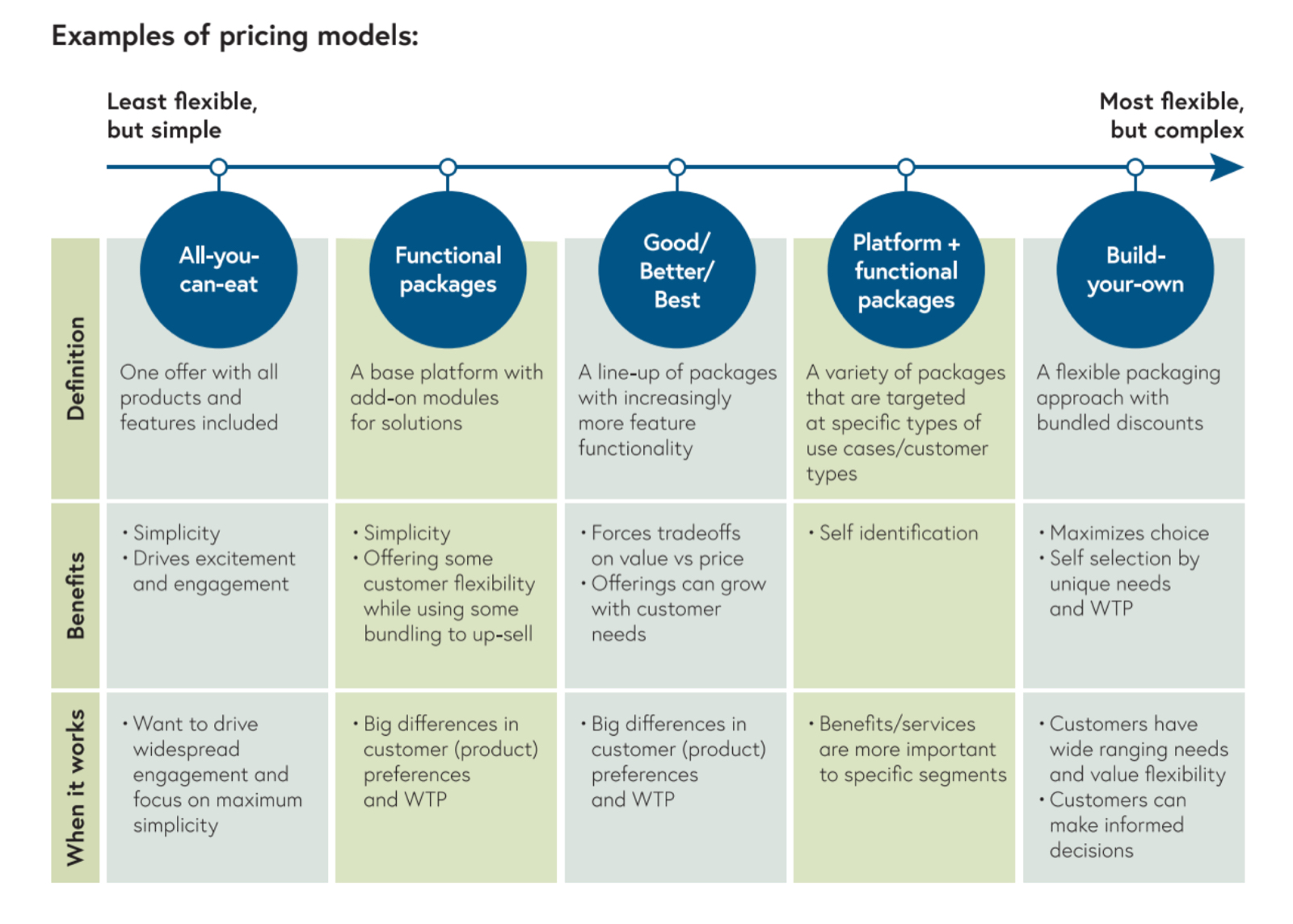

While there isn’t a 1:1 relationship between segments and packaging models, they do need to be aligned. You need to understand the different groups of customers that exist and their unique needs, then decide which pricing model helps serve each group best.

For example, you may go for a platform play, with individual add-ons available if there's a core piece of functionality everyone needs, but additional functionality that differs greatly by customer segment. Or maybe you divided segments by company size and it's clear that different groups of people need increasing amounts of functionality—this would be where a “Good-Better-Best” model works perfectly.

Here are some pricing models you can consider. An “all-you-can-eat” model is the most common in early-stage startups, and “Good-Better-Best” becomes more popular for mid-stage startups. However, each model has its merits and the best choice is different for every business. The most important thing is for it to align to your business model.

Three common segmentation mistakes to avoid

1. Excessively large customers on an all-you-can-eat pricing model

Without product tiering, it’s difficult to capture value from the higher end of the market without causing the lower end of the market to churn. Upselling opportunities are also difficult because there aren’t additional features available for clients who need more sophisticated functionality and have a higher willingness to pay.

2. A bloated product

When building a product to delight all customers, eventually a single product can become too complicated and no longer delivers equal value to all customers. This doesn’t allow the company to capture revenue from all customer types. It’s time to splinter your product into different offerings for different segments.

3. Complicated selling motion

Rolling out feature on top of feature often leads to a realization that one day smacks you in the face: Things have become overly complicated. This can cause your sales velocity to slow down because each sales rep has to work harder to explain a very confusing product. A product marketing team can help streamline packaging to combat this, and enable sellers to work efficiently.

Don’t try to sell a mountain bike to city cyclists

Imagine you’re selling bicycles, and you’re trying to serve both mountain bikers and city cyclists. The bike you're going to build needs to have both skinny lightweight tires, but tread to be able to scale mountains. But when you try to mash both of those features together, it makes something that neither customer segment can use effectively.

The bottom line is that if you don’t segment effectively, you’re leaving revenue on the table—both from large customers willing to pay more and smaller customers who need a tier that’s accessible to them. And without proper packaging, you won’t be able to upsell or increase the size of accounts for larger customers because you’ve sold everything to them already.

Segmentation is important because your customers have differing needs and willingness to pay. If you lump everyone into one category, you'll end up building a solution that either over-indexes on fringe needs, or is a lukewarm one-size-fits-all. The old adage is true: “If you try to be everything to everyone, you’ll end up being nothing to anyone.” And for pricing: When you try to build a one-size-fits-all, you usually end up with a one-size-fits-none.

Ready to get smarter about pricing?

This is the third article in a 7-part course where we share insights, case studies, and revenue-generating frameworks to optimize your pricing strategy. If you prefer to get bite-sized lessons delivered right to your inbox each week, sign up for the course below.

Dive into the rest of the course:

- The four ironclad laws of B2B SaaS pricing that can boost your revenue up to 32%

- Gnome or Godzilla? B2B SaaS archetypes to help you pick the right price model

- Upsell & cross-sell caveats—plus how one B2B SaaS company revamped pricing for an ultra-successful land-and-expand play

- Why pricing deserves as much iteration as product development—and how one multibillion-dollar public tech company does it

- Five pros and four cons of usage-based pricing—and why it was a no-brainer for Courier’s CEO