How one B2B SaaS company revamped pricing for an ultra-successful land-and-expand play

Plus important caveats to note when beefing up upsell and cross-selling motions.

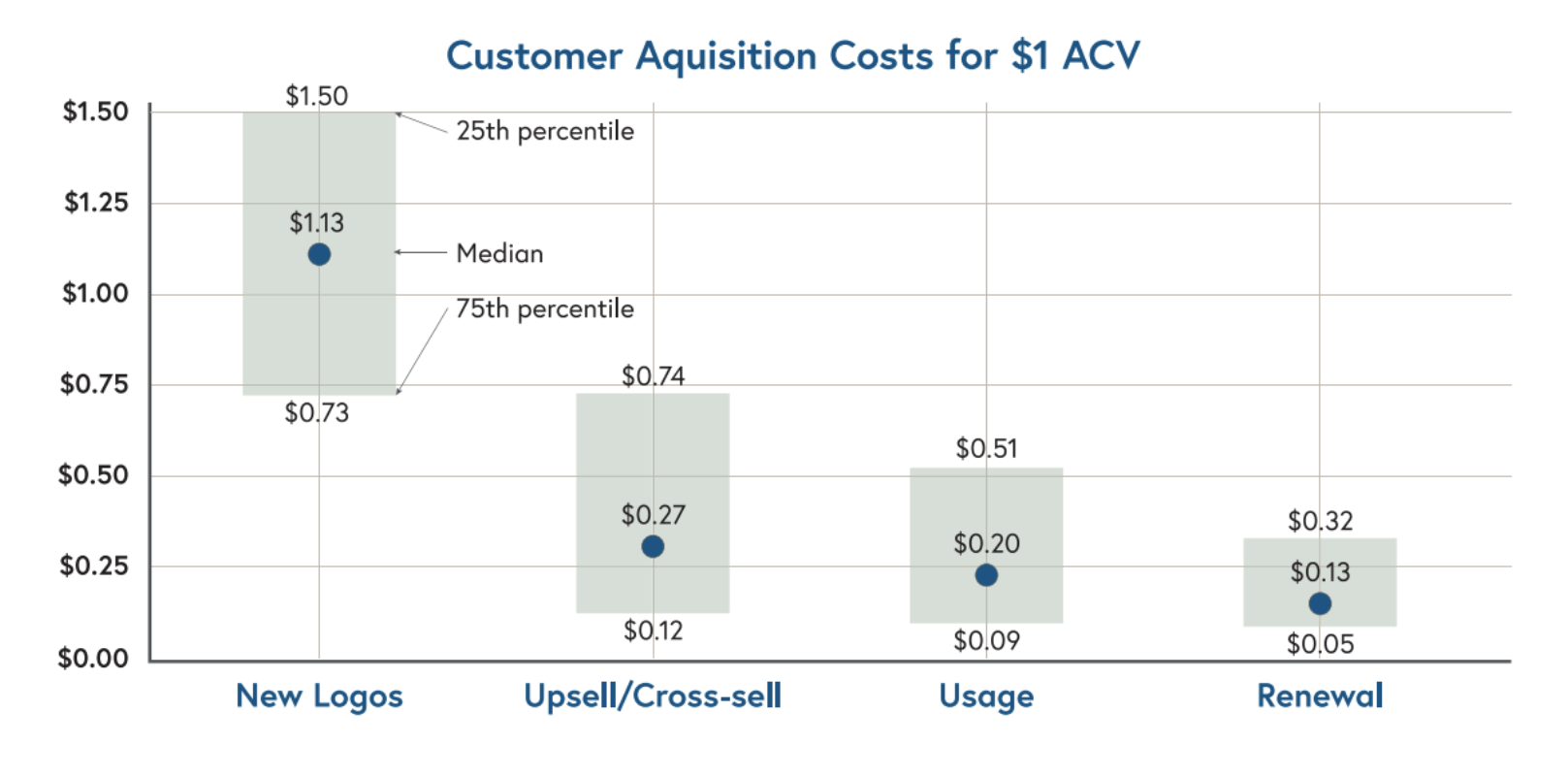

Coffee is for closers? Forget it, coffee should be for upsells and cross-sellers. After all, new logo acquisition is the most expensive way for most companies to generate revenue. It devours an average of $1.13 in customer acquisition costs for every dollar of revenue generated. Upselling and cross-selling, on the other hand, costs an average of 27 cents, according to a study of 174 SaaS companies.

Upsell and cross-sells are also the reason why the most efficient SaaS companies have net retention scores over 100%. In fact, the top 20% have net retention scores of over 120%. So what does it take to make your (profitability) cup runneth over?

In this article, we’ll talk about the trade-offs inherent in a land-and-expand strategy, then share how one B2B tech company drastically improved its revenue efficiency with a concerted cross-sell and upsell effort.

The tricky thing about land-and-expand

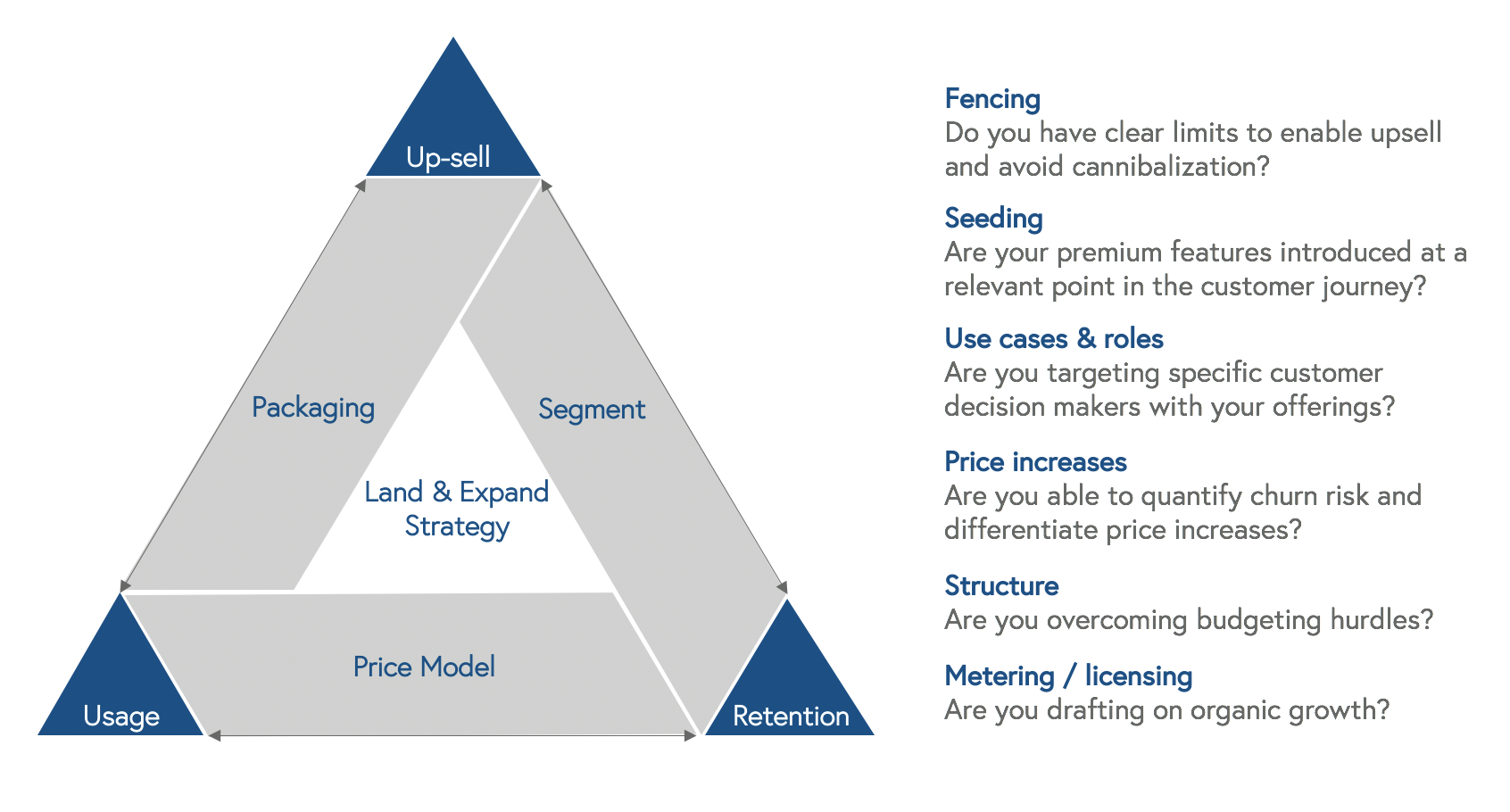

Land-and-expand refers to a SaaS strategy where you sell into a company with a small deal, and then increase your footprint over time through upselling and cross-selling. This strategy is the hallmark of high net retention scores, and it involves three independent but interrelated goals: upsell, usage, and retention.

But here’s the hard part: These three goals can often be trade-offs with one another. The packaging, segmentation, and price models that boost one goal may impede the others. For example, pricing that is designed to drive retention can make it difficult to increase usage or push for upsells.

In the diagram below, we’ve laid out the goals that can sometimes be in a bit of a tug-of-war with each other—as well as the levers in between each that you can use to navigate the tension and mitigate cannibalization.

Case Study: How a Series C company took their pricing model from chaos to cohesion

Company C, a popular Customer Success platform, enjoyed breakout success early on. But after some initial waves of success subsided, leaders realized that they’d failed to go after pricing with the same gusto they’d gone after feature delivery and sales execution.

As a result, the pricing model had grown overly complicated with hundreds of SKUs and seemingly a new model for each new segment. Being a fairly product-led organization, engineering would take initiative to build cool new features. But they were often priced individually, and it was challenging for customers to understand the value of such fragmented features.

The team was missing a robust product marketing layer to explain the value of the features to customers, as well as how to position and price them so sellers could sell them effectively. Without a dedicated pricing lead, anecdotal sales suggestions had created a confusing and overly complex pricing model.

The truth was that Company C was still trying to sell the whole platform to all customers without any levers to drive usage, upsell, or retention. The problem was twofold—price- sensitive SMBs needed more optionality to fit into their budget, and enterprise customers had more willingness to pay which went unrealized.

After identifying the pricing problems, the newly formed Product Marketing team undertook a robust examination of customer use cases and competitive analyses over the course of four months. They delivered a new pricing model that worked for SMBs and enterprise customers by creating multiple levers and a coordinated discount schedule.

They combined fragmented product SKUs into cohesive packages designed to serve customers’ needs. By bundling features in some areas of the product, and breaking apart huge feature sets in other parts of the product, the team was able to better align their product packages with the needs of distinct customer segments.

After the new pricing rollout, the team increased their cross-sell, upsell, and expansion opportunities drastically—leading to a spike in their net retention. Upfront sales also became easier and quicker with more logical packages and less confusion for sales to explain away. They also boosted their ACV with fewer individual SKUs.

After their successful new pricing rollout, Company C acquired a company to expand their product suite to a number of new user personas. The team took a two-phased approach to adapt their previous pricing plan to this new offering. In order to quickly go to market with an expanded offering, Phase 1 simply took their existing model and used that as a template to create stand-alone pricing and packaging for these new complementary products. With sales happening, Phase 2 then aimed to go back to core principles and start from scratch by eliminating the current model and building a more integrated solution.

It’s unlikely that version 1.0 of any rollout of a land-and-expand strategy will hit the mark completely. It’s important to take a long-term perspective on putting these building blocks in place and rely on an iterative approach to eventually find the optimal combination that unlocks more upsell and cross-sell.

Three lessons from the transformation of Company C

1. Prioritize research to achieve a reasonably close version 1.0

Effective cross-selling comes from creating the best new product types and configurations for use cases. You can guarantee your success by investing heavily in upfront research to determine buyer and persona types whenever new markets or industries are unlocked. There are three main ways you can research this:

- Conduct internal research. Identify and examine your best-fit customers—the 20% of your customers who generate 80% of your revenue. Then ask yourself: How do you win more companies like that? It relies on accurate data which you may or may not have, so you might have to buy data or enrich your list to figure out, say, how many business units IBM has and what their buying power is.

- Interviews with your top customers. Conduct a panel of interviews with top clients to get a sense of how they think about their budget, what's fair, what else they're paying for that this can supplant, to arrive at optimal pricing.

- Gut check it with your sales or service team. Before rolling something out, put it in front of a few perceptive reps and managers and have them walk through how this would affect them, perhaps prospect by prospect.

2. Build in sales specialization to sell more efficiently

Sales specialization helps you sell efficiently by creating experts in various selling motions designed for verticals. If you can assign each sales rep to a specific vertical, region, use case, or company size, they’ll get to be an expert in selling to their needs.

They’ll waste less time context-switching, and learning enormous amounts of information that they only use occasionally. Specialization allows them to go deep instead of wide. You can also achieve specialization with sales overlays—solutions consultants who specialize in a particular thing, and who more generalist sales reps can bring in to talk about particular topics.

3. Invest in product marketing as early as possible

Investing more in product marketing earlier on pays dividends down the road. Product marketing first arose to prominence in B2B because of the divide between engineering and marketing. Marketing promises can tend to creep into hyperbole, causing CSMs to apologize and the company to appear fragmented. Product marketing unites sales, marketing, and product teams so there's one source of truth for messaging so everyone stays keyed into customers and how they think and what they buy.

A final word of caution—resist the temptation to oversell

While upselling and cross-selling are the holy grail of efficient revenue, we must end with a word of caution: Overselling will only come back to haunt you. If you let talented albeit overzealous sales reps push the limits and sell too much to customers, you’ll have a churn problem to deal with down the line. What’s more, overselling can cause customers to cancel their entire subscription instead of downgrading to a more appropriate package. Customers resent having purchased “shelfware,” that sits on the proverbial shelf of their tech stack without adding value. Ultimately, nothing is worth more than customer trust—so act accordingly.

Ready to get smarter about pricing?

This is the fourth article in a 7-part course where we share insights, case studies, and revenue-generating frameworks to optimize your pricing strategy. If you prefer to get bite-sized lessons delivered right to your inbox each week, sign up for the course below.

Read the rest of the series here:

- The four ironclad laws of B2B SaaS pricing that can boost your revenue up to 32%

- Gnome or Godzilla? B2B SaaS archetypes to help you pick the right price model

- ‘One-size-fits-all’ is really ‘one-size-fits-none’: How to segment your customer base for more precise pricing & packaging

- Why pricing deserves as much iteration as product development—and how one multibillion-dollar public tech company does it

- Five pros and four cons of usage-based pricing—and why it was a no-brainer for Courier’s CEO