Investing in a world powered by nuclear fission

Why nuclear fission could decarbonize the future and re-emerge as a leading energy source.

As geopolitical tensions in Ukraine continue to destabilize the global economy, Western countries have begun to revisit their stance on nuclear power as a way to cut ties with Russian oil. For instance, Belgium, which had previously vowed to close all its nuclear plants, is now keeping them running for a while longer. Elon Musk himself issued a call for governments to restart dormant nuclear power plants, even offering to eat food grown locally at nuclear power plant locations just to prove that there would be no radiation risk. More recently, European Union lawmakers voted in favor to label nuclear power a “green” source of energy, and France decided to nationalize one of its nuclear power plants to assist in the global energy crisis.

But the momentum for nuclear power goes beyond what’s happening in Ukraine. The U.S. Energy Information Administration (EIA) predicts that global energy consumption in 2050 will increase by 50%, but we absolutely can’t afford to meet this incredible level of energy consumption with our current greenhouse gas-laden methods for energy generation: The consequences to our environment would be dire. As a result, countries around the world have banded together to decarbonize the energy grid. Japan, Canada, and the EU have already passed legally binding net zero commitments, and more than 130 countries have now set or are considering a policy target of reducing emissions to net zero, including China (by 2060) and the U.S. (by 2030).

Experts predict that solar and wind can meet ~70% of the world’s energy demands, but what energy sources will take up which shares of the remaining pie? The remaining must be covered by some combination of other low-carbon sources like hydro, biomass, geothermal, gas/oil with carbon sequestration, and, of course, nuclear.

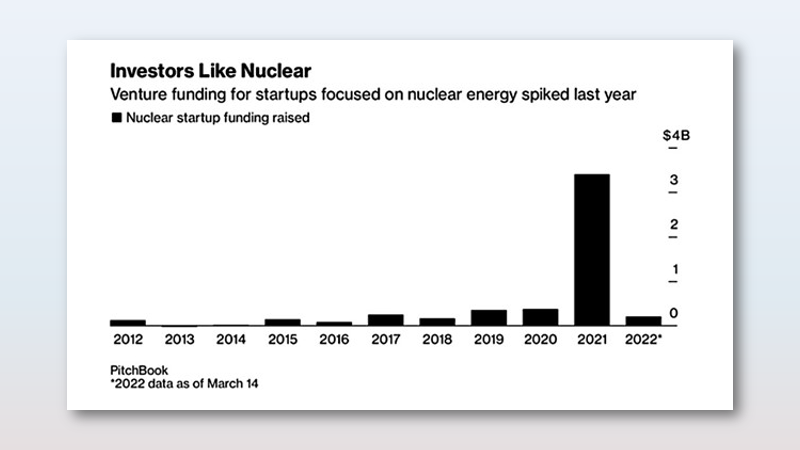

Over the past few months, venture activity in nuclear has converged upon nuclear fusion. Look no further than the flurry of funding that capped off 2021, as fusion startups Commonwealth Fusion Systems, Helion Energy, and General Fusion cumulatively raised about $2.5 billion.

Nuclear fusion has been garnering a significant amount of attention—perhaps at the neglect of its older sibling, nuclear fission. While the technology and progress of nuclear fusion is astonishing, we think the future of nuclear fission holds equal potential to support society in the coming decades. As the scientific community along with hopeful investors and entrepreneurs rally around the advancements in nuclear fission, we see it as a promising avenue for decarbonizing the future while meeting the world’s energy needs.

How nuclear fission works

Fission occurs when a neutron comes in contact with a larger nucleus (say, Uranium-235). After absorbing the neutron, U-235 turns into the violently unstable U-236 and immediately splits into two smaller nuclei, releasing a tremendous amount of energy. Additional neutrons are also released from the fission reaction, subsequently striking other U-235 and releasing more energy in a chain reaction. However, the likelihood of subsequent fission occurring on its own is low because these additional neutrons from the fission reaction are moving so fast. That’s why traditional nuclear reactors, which are known as Generations I, II, and III “light water reactors,” use a moderator (typically water) to decrease neutron velocity and keep the reaction going.

The heat released by fission in nuclear reactors must be captured and transferred for use in electricity generation. To this end, reactors use coolants (e.g., water) that remove heat from the core where the fuel is processed and carry it to electrical generators. Coolants also serve to maintain manageable pressures within the core.

Fission headwinds

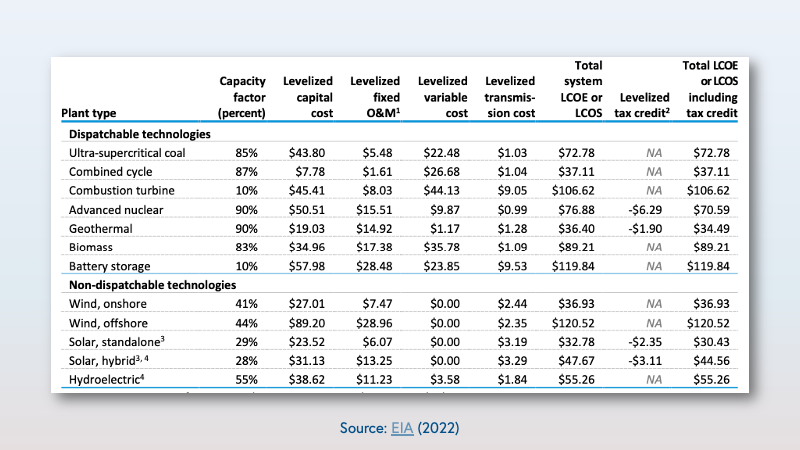

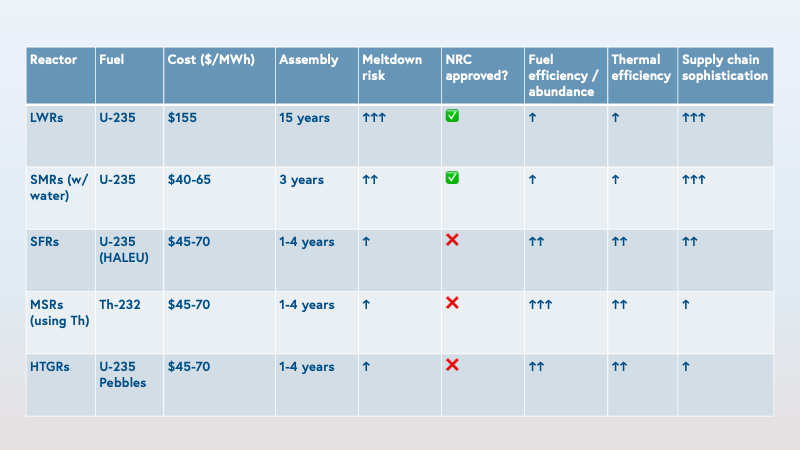

One of the biggest challenges for nuclear fission is economic: New plants take years to build and cost billions of dollars. One metric that environmentalists use to compare costs across energy sources is the levelized cost of energy (LCOE), defined as the sum of all the money it takes to build the power plant and operate it for its entire life, divided by the amount of electricity it produces over those years. The table below shows various LCOEs of alternative energies (units are in $/MWh).

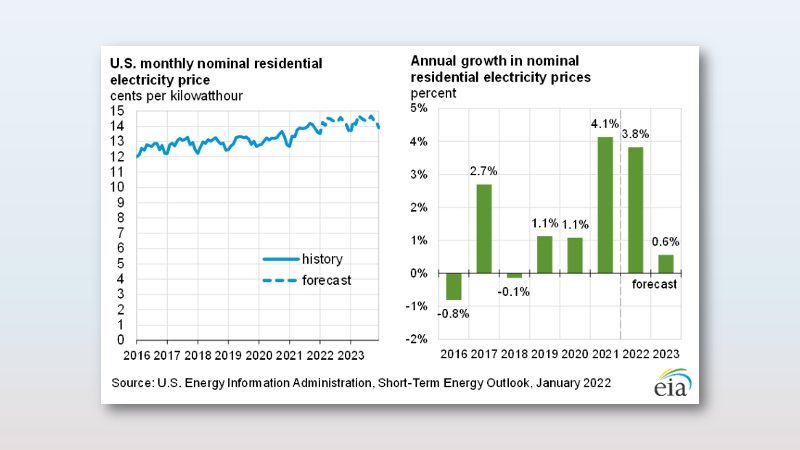

To evaluate the attractiveness of nuclear fission economics, we can ask whether a fission reactor can reach “grid parity,” where its LCOE meets the prevailing market price of energy. In 2021, wholesale electricity prices throughout the country ranged from ~$72/MWh for the industrial sector to ~$137/MWh for the residential sector (see graphs below). However, even grid parity alone probably isn’t enough. Nuclear companies will sell energy to utilities, who then turn around and sell electricity to end customers. Utility companies, which typically also produce energy by owning/operating their own coal plants, have a gross margin of ~50%, so we’d need to see nuclear come down to $50/MWh for the economics to make sense.

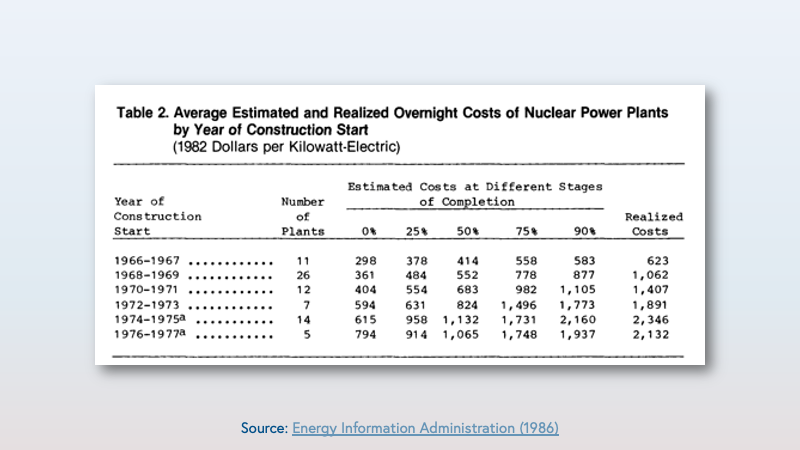

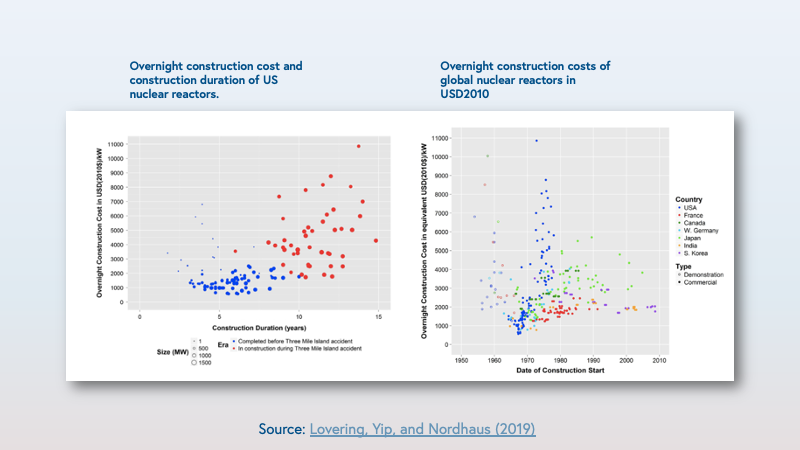

A number of factors contribute to nuclear fission’s economic challenges, which have only increased over the past few decades. In addition to the obvious capital costs, onerous regulations stretch out the development times for nuclear power plants. To go to market in the U.S., nuclear plants need to budget 7-10 years and possibly hundreds of millions of dollars to pass through the Nuclear Regulatory Commission’s (NRC) design certification process. Different states also have different safety requirements (not to mention different views on the viability and desirability of nuclear), which inhibits any company's ability to standardize design.

Additionally, the heat engines that fission power plants use to convert fission energy into electricity (i.e., heat produces steam which turns a turbine) are incredibly inefficient. According to thermodynamics, you can increase the efficiency of heat engines by increasing the temperature of the emitted heat. However, temperatures in traditional water reactors can’t be too high (< 400 degrees C); otherwise, you run the risk of meltdown. Therefore, the efficiency of fission reactors have traditionally been around 30%.

Water reactors also need to constantly replenish their supply of U-235, but the U-235 isotope makes up only 0.7% of the Earth’s naturally occurring supply of uranium. The supply isn’t unlimited, and indeed, the price of uranium has slowly been creeping up over the last year. Furthermore, once the U-235 in a reactor core is spent, the nuclear waste products must be securely disposed of, which increases operational costs.

Another challenge for nuclear fission is optics and government backing. Demand for nuclear power has been heavily impacted by nuclear accidents. In 2011, following the Fukushima nuclear disaster, the Japanese government responded by closing the country’s 50 nuclear reactors, imperiling the national economy, as the country became reliant upon much more expensive sources of electricity. This had a ripple effect on other countries like Germany, Switzerland, and Belgium, which also pushed forward their commitment to phase out their nuclear power plants. Today, nuclear power has become a highly polarized topic in our most advanced economies due to such safety concerns.

While Western nations have trended towards phasing out nuclear, other countries have been undeterred. Russia and China in particular have state-owned and sponsored nuclear suppliers, meaning they can provide competitive financing and other support that U.S. nuclear suppliers have not been able to match. These state-owned nuclear companies therefore have taken the lead in offering nuclear power plants to emerging countries, usually with financing, fuel services, reactor designs, recycling, and disposal. Latin America, Africa, the Middle East, South Asia, and South East Asia are all also expected to show substantial growth in nuclear power generation by 2050.

Generation IV nuclear reactors

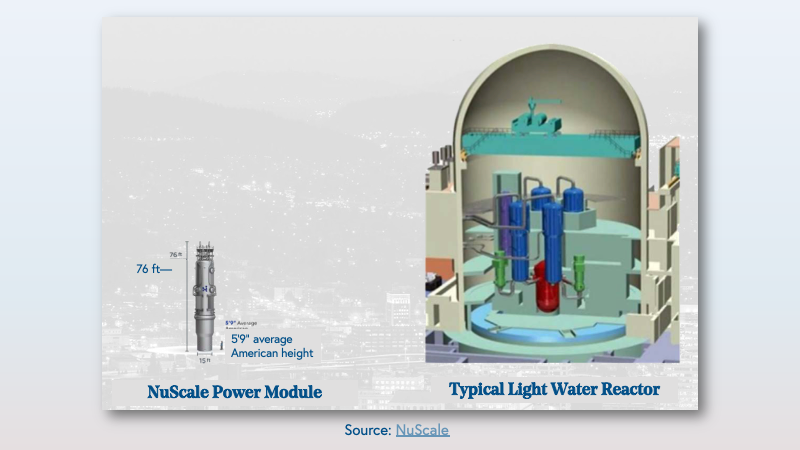

The next generation of nuclear fission reactors will shed the inefficiencies that have plagued the previous generations of light water reactors. One unifying characteristic of many Generation IV reactors is that many are small, modular reactors (SMRs). Unlike traditional large, fixed nuclear power plants, SMRs are small, manufactured off-site, and then delivered to location for final assembly. By design, SMRs need fewer staff for location assembly, maintenance, and operation. Their modularity enables flexible, incremental power generation as energy demands increase.

NuScale is a leading SMR company (incidentally, NuScale also recently announced a special purpose acquisition company, or SPAC). NuScale was the first SMR design to be approved by the American NRC and NuScale is already licensing its design to regional utilities. For reference, each of NuScale’s modules can be constructed in less than three years, and NuScale estimates it can deliver energy at approximately $40-65/MWh.

Startups like Oklo and Radiant Nuclear are also building microreactors, which are even smaller than SMRs. Indeed, microreactors only generate 1-20 MW of energy (compare this to the hundreds of MW for SMRs and thousands of MW for traditional nuclear power plants). The benefit to microreactors is their rapid deployability, especially for remote locations with limited access to power.

The U.S. government is pushing hard to fund the development of fourth-generation SMRs and microreactors. The Department of Energy’s (DOE) Advanced Reactor Demonstration Program (ARDP) has allocated billions of dollars to startups, including $1.2 billion to X-Energy and $2 billion to TerraPower. Similarly, the Pentagon recently selected BWXT to develop a microreactor for three years of power generation at a contract value of approximately $300 million.

Within the broad umbrella of SMRs and microreactors, though, there are a number of additional innovations.

New reactor designs

Molten Salt Reactors (MSRs): In MSRs, molten salt (e.g., fluoride, chloride) contains the nuclear fuel (i.e., uranium). The molten salt also acts as the coolant, and graphite rods act as the moderator. Replacing water as the coolant removes the possibility of steam explosions and the generation of flammable hydrogen gas. The nuclear reactions in MSRs are also easier to control because molten salt expands, so in an unanticipated rise in temperature, the expansion automatically shuts down the reaction.

Molten salts also have elevated boiling points that allow high operating temperatures at atmospheric pressure, thus improving thermal efficiency (up to 40%). With these higher temperatures, MSRs (and SFRs and HGTRs, below) can supply heat directly for industrial customers—rather than needing to convert heat to electricity for utility customers—for processes like ethylene cracking and hydrogen production. The main downside of MSRs is that molten salt is corrosive and may increase the complexity of plant operations and maintenance. Furthermore, with so many atoms decaying and neutrons flying around in the molten salt, you have a soup of chemical elements that may react in unanticipated ways.

Example: Terrestrial Energy

Sodium fast reactors (SFR): In SFRs, liquid sodium acts as the coolant instead of water. Liquid sodium, compared to water, can handle higher temperatures at lower pressures, which improves the efficiency and safety of the reactor.

The “fast” in the SFR means that the reactor doesn’t use moderators to slow down the neutrons. To keep the rate of fission high, fast reactors use high-assay low-enriched uranium (HALEU), which is a uranium fuel that contains ~20% U-235, compared to the low-enriched ~5% U-235 of water reactors. One of the main benefits of fast reactors is that HALEU enables reactors to recycle and reuse spent fuel.

Example: TerraPower

High-temperature gas reactors (HTGRs): In HTGRs, gasses (typically helium) act as the coolant that is fed directly into the turbine to produce energy. Helium is an inert gas, so it generally won’t chemically react with any material, and exposing helium to neutron radiation won’t make it radioactive. Helium can therefore be heated to higher temperatures, increasing thermal efficiency.

HTGRs may face less regulatory skepticism because a couple third-generation reactors used gasses as their coolants. Furthermore, last year, the UK government announced that HTGRs are its preferred Generation IV technology to reach its 2050 Net Zero target, since it was already familiar with the design. However, HTGRs require a robust sealing system to keep helium in and other materials out, increasing the complexity and cost of the reactor.

Examples: Ultra Safe Nuclear, X-Energy, Boston Atomics

New fuels

High-assay low-enriched uranium (HALEU): HALEU is a uranium fuel that contains ~20% U-235. However, there is no developed supply chain for HALEU yet, and the higher concentration of fissile material has generated political resistance due to fear of military applications and nuclear proliferation. In fact, one of the few HALEU suppliers in the world is Tenex, a Russian state-owned subsidiary. However, in late 2021, the Department of Energy issued a Request for Information on how the government can fund and build out a domestic HALEU supply chain. Based on the demand by SMRs and microreactors for HALEU, we’ll need capabilities to develop dozens of metric tons of HALEU uranium in the next decade.

Pebble fuel: Typically used for HTGRs, fuel pebbles are meltdown-resistant small, solid pellets that encase uranium fuel (typically HALEU). The pellets retain fission products under all reactor conditions and are structurally more resistant to neutron irradiation, corrosion, and high temperatures than are traditional reactor fuels. TRISO (TRi-structural ISOtropic particle fuel) is a leading form of HALEU pebble, but fabrication facilities have yet to be built. Fourth-generation fission companies like X-Energy are working to build TRISO in-house.

Examples: Radiant Nuclear, Kairos Power

Thorium fuel: Like HALEU for fast reactors, thorium fuel is also more efficient, as the thorium can be fully consumed and then recycled, without needing continuous replenishment of fuel. However, irradiated thorium can produce U-232, which gives off dangerous gamma ray emissions that can be harmful to human health, and the sophistication of the thorium supply chain is unclear. Thorium today is only beginning to be incorporated into nuclear reactors in countries like India, where thorium supply is abundant.

Examples: Transmutex, Flibe Energy

The future of fission

It’s not just the current political climate leading to a renewed interest in nuclear power. The story of nuclear fission is one of decreasing physical size, increasing safety, and increasing efficiency. In spite of this progress, though, nuclear fission still faces regulatory headwinds: Because the history of nuclear fission power plants has revolved around water reactors and uranium fuel, regulatory bodies have yet to approve many new reactor designs with new fuels. Even NuScale, the only SMR design to have been approved by the NRC to-date, doesn’t anticipate deploying its reactors until the end of the decade. However, this hasn’t deterred Generation IV fission startups from innovating and forging onwards. As the world increasingly looks to nuclear to achieve its net zero targets, we’re excited to partner with these companies to power our carbon-free future.