Roadmap: B2B Marketplaces

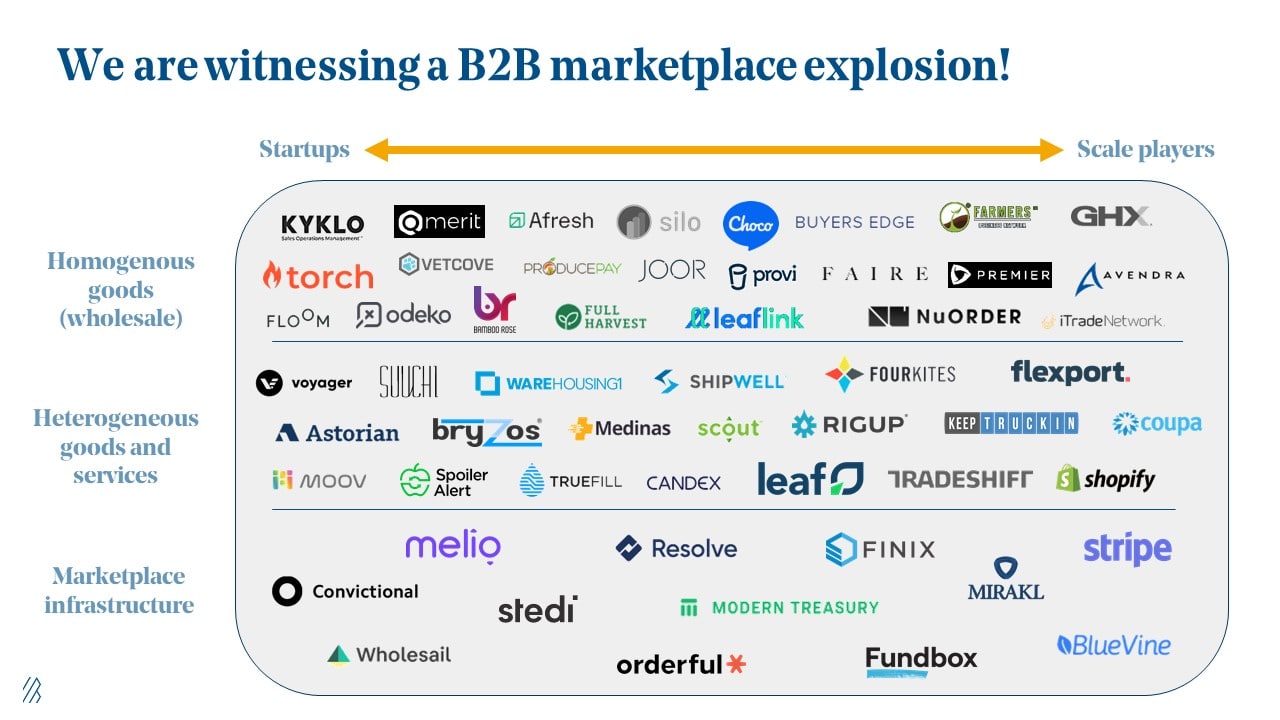

We’re at the dawn of a renaissance in B2B commerce. We’re seeing a new generation of founders who are using new technologies and business models to bring B2B spend online.

As consumers we can buy basically anything online: car washes, deodorant, home renovations, even Albino Pac-Man Frogs. So why do restaurants have to order their most basic supplies over the phone? Why don’t dentists have an easy way to compare latex glove prices from different vendors? And why do most gas stations manage their fuel purchases in email and Excel?

Historically, digitally-savvy entrepreneurs have given more attention to B2C commerce than to B2B commerce—and we don’t blame them! B2C spend is more top-of-mind, and as consumers we benefit from companies like Amazon, Shopify, and Stripe every day.

But B2B markets are many times bigger than B2C markets (annual global B2B spend is more than $100 trillion), and they’re much more offline. Indeed, massive B2B markets like wholesale and logistics remain opaque and intermediary-driven, with orders and payments flowing via email, SMS, fax, and paper check.

(Above: Partner Kent Bennett presents Bessemer's B2B Marketplaces Roadmap to a room of industry leaders.)

In February, we hosted more than 50 founders at our B2B Marketplace Summit to discuss emerging trends in B2B commerce and payments, and we walked away convinced we’re on the cusp of a B2B purchasing renaissance that will spawn dozens of $1 billion+ companies with winner-take most dynamics. We’re seeing a new generation of founders who are using new technologies and business models to digitize B2B spend; most of these founders come from large, antiquated industries where they discovered offline purchasing workflows firsthand.

In this roadmap, we outline our learnings from the conference and reasons we’re so excited about B2B marketplaces as an emerging software category.

Why is this happening now?

Digital procurement is not a new idea. There are numerous pre-2010 “e-procurement” success stories including procure-to-pay applications like Ariba and Coupa, vertically-focused applications like iTrade (grocery), Grainger (MRO supplies), and GHX (healthcare), and infrastructure providers like SPS (EDI) and Sabre (travel middleware).

These companies were successful in certain categories, but the vast majority of B2B spend remains offline. Why aren’t these legacy vendors used more broadly?

- They are (mostly) horizontal: Procure-to-pay vendors like Ariba and Coupa built horizontal solutions handling indirect spend for enterprise procurement departments. These solutions didn’t address vertical specific workflows and thus never really captured direct spend

- They are expensive and hard-to-use: Most e-procurement 1.0 vendors monetize via direct SaaS or transaction fees, and most require lengthy set-up, integration and onboarding. As a result, hardly any SMBs use them!

- They lack integrated payments and lending: Even when B2B orders are automated or placed digitally, the associated payment is rarely triggered automatically

- They do little to facilitate trust: Many e-procurement 1.0 platforms were primarily focused on digitizing existing buyer/seller relationships vs facilitating new connections

What’s changed?

Some big startup trends happen overnight (remember when Apple opened its app store to third party developers?), while others, like B2B marketplaces, are a slower burn. We believe there are multiple underlying drivers creating new opportunity for B2B marketplaces:

- Millennials are taking the reins in legacy industries and hate clunky, offline workflows. The most frustrated millennials leave their industries to start software companies

- Integrated payments and lending are unlocking new business models for software companies and vastly improving the user experience. B2B marketplaces with “indirect” business models like invoice factoring can offer core workflow and ordering applications for free to drive adoption

- API-driven architecture is maturing as a paradigm and enabling more communication between applications across value chains. Open architectures allow B2B marketplaces to build real-time multi-vendor product catalogs with accurate SKU and pricing information

- Software development is getting easier, cheaper, and faster in general, enabling a wider set of founders to bring their ideas to life

The 2.0 playbook for B2B Marketplaces

The confluence of these “why now” factors is creating a new playbook for the next generation of B2B marketplaces. We’re seeing that 2.0 marketplaces possess the following qualities:

- They’re free, provide a freemium model, or are mind-blowingly cheap: 2.0 marketplaces offer a “no-brainer” economic value proposition to at least one value chain stakeholder, driving early liquidity. Often these 2.0 players monetize indirectly via payments and lending, ads, data, or volume-based discounts.

- They’re often vertical-specific: One size doesn’t fit all. Different verticals require different buyer and seller workflows and monetization schemes.

- They focus on “day 1” value: Newer B2B marketplaces often have a low barrier to adoption enabling users to transact without lengthy on-boarding or integration processes.

- They keep intermediaries reasonably happy: In the early days, B2B marketplaces are better off keeping the existing value chain happy to build liquidity and scale.

- They instill trust: In markets where supplier/product quality can vary, 2.0 marketplaces manage and vet the quality of suppliers in the network and maintain reputation systems to establish trust and facilitate new buyer/seller relationships.

Where we’re seeing opportunity

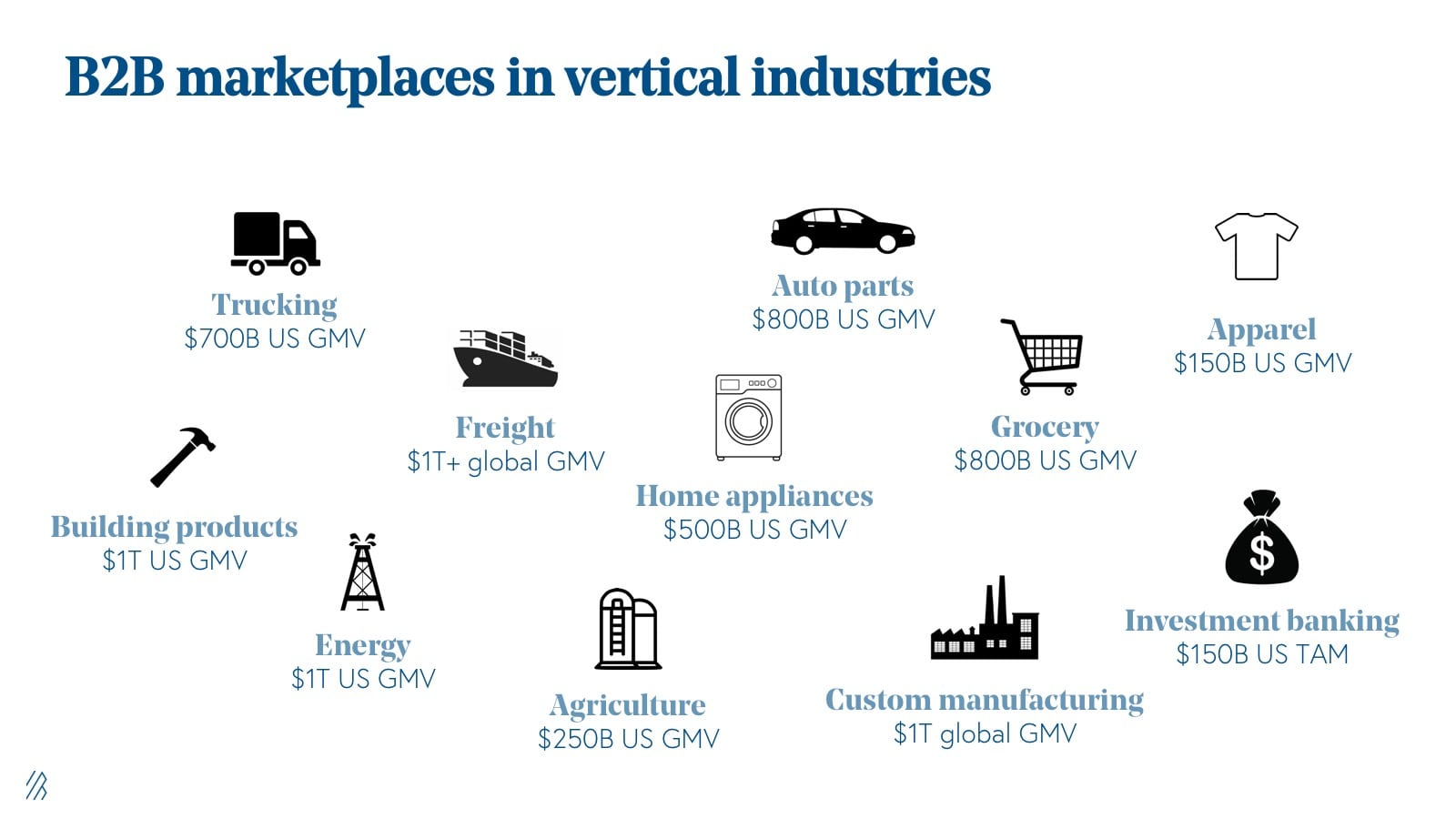

One obvious way to segment opportunities for B2B marketplace founders is by industry vertical. Here’s the good news: these are massive pools of offline B2B spend!

(For the nerds out there, check out these NAICS datasets from the US Census and explore the wonderful world of wholesale.)

But one size does not fit all. While all of the industries in the graphic above are massive and largely offline, they have very different value chain dynamics and thus require very different approaches. At our summit, for example, we unpacked why Flexport (freight forwarding) and Provi (wholesale alcohol) have very different go-to-market and monetization strategies.

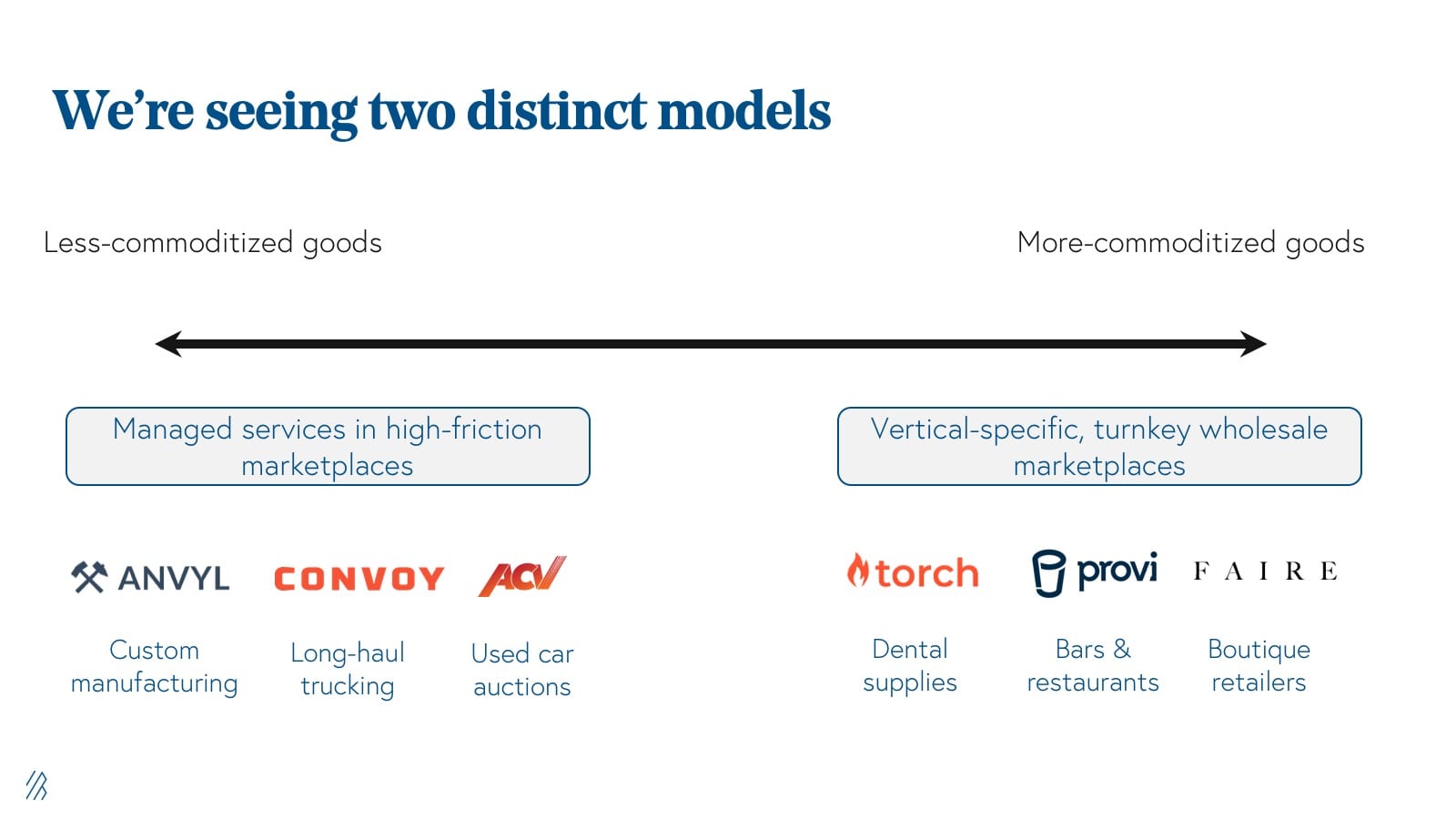

At Bessemer, we’re seeing three types of opportunities within B2B purchasing. First we differentiate between (1) wholesale marketplaces which facilitate smaller, more frequent B2B transactions of relatively standard and commoditized goods (e.g., apparel, restaurant supplies, boutique goods) and (2) high-friction marketplaces which facilitate larger, less frequent transactions of non-standard goods or services (e.g., logistics services, manufacturing, used cars) which today flow through brokers or lengthy RFP/RFQ processes. Both wholesale and high-friction marketplaces rely on (3) infrastructure providers to facilitate payments/lending and connect various supply chain applications.

Wholesale marketplaces

Wholesale marketplaces facilitate B2B transactions where SKUs are relatively standard, commoditized and easily comparable across vendors, typically connecting some combination of retailers, distributors, and manufacturers.

Wholesale marketplaces bring several benefits to buyers and sellers. In more open markets where buyers aren’t loyal to particular sellers, wholesale marketplaces enable price and vendor comparison. Even in less open markets, wholesale marketplaces can generate value by streamlining manual and offline ordering and accounts receivable/accounts payable (AR/AP) workflows, saving buyers and sellers time. In markets where demand is fragmented, wholesale marketplaces enable smaller buyers to aggregate purchasing power and negotiate volume discounts from sellers.

Few wholesale marketplaces we’ve seen monetize directly by charging buyers or sellers transaction fees or SaaS fees. Instead, most offer a core workflow product for free and monetize indirectly by selling ads or data, facilitating payments/lending, or by leveraging scale to negotiate volume discounts from suppliers.

High-friction marketplaces

In high-friction B2B markets, SKUs are less standard and comparable across vendors; examples include used cars, investment banking, bulk commodities, freight, and logistics. In these markets, buyers must specify the goods or services they need, and suppliers respond with quotes. Buyers often rely on opaque brokers and/or lengthy RFP/RFQ processes to vet sellers and compare pricing.

Because these transactions are complex and require buyer/seller trust, high-friction marketplaces typically have:

- Robust workflow tools for buyers and sellers to manage multi-step, multi-stakeholder transactions;

- Highly managed and vetted supply along with reputation systems to instill trust.

Some high-friction marketplaces go even further than reputation systems and provide financial guarantees to protect buyers from bad actors.

We’ve seen two distinct approaches to building liquidity in a high-friction B2B market. The first approach is to work with existing intermediaries and brokers, offering software to aggregate data with the eventual goal of disintermediation. In other industries, high-friction marketplaces can provide a tech-enabled service to replace brokers on day one.

In both cases, high-friction B2B marketplaces can typically charge relatively substantial direct transaction fees, though they can also monetize via indirect business models like payments/lending, ads, and data sales.

Infrastructure providers

Both wholesale and high-friction marketplaces rely on infrastructure providers to handle complex jobs like payments facilitation, invoice factoring, insurance, logistics and delivery, and reading from/writing to buyer/seller ERP systems, often via API.

(This is a work in progress! If we missed you, please reach out.)

How we evaluate B2B marketplace businesses

We’re eager to partner with B2B marketplaces that have a capital-efficient path to hundreds of millions of net revenue, and we evaluate early B2B marketplaces on three dimensions:

- GMV TAM: How much B2B spend could the marketplace facilitate at scale?

- Effective take rate: What percentage of GMV can the marketplace capture as net revenue? (Often the effective take rate will be a combination of multiple business lines.)

- GTM efficiency: How efficiently can the marketplace grow? How much does the marketplace spend to acquire and onboard a new buyer or seller?

At Bessemer, we believe that we’re on the cusp of a B2B purchasing renaissance, and we’re incredibly eager to support entrepreneurs building a new generation of B2B commerce applications and infrastructure. If this sounds like you, give us a shout by emailing Kent Bennett at kent@bvp.com.