The five accounting metrics for cloud companies

How cloud companies play moneyball with these critical five business metrics

Internet giants like Google and Amazon were built on deep consumer data and analytics. Complex manufacturing businesses like Intel measure production inefficiencies down to the particle level. Elite athletes and sports teams measure performance in excruciating detail to try to highlight areas for improvement and competitive advantage. As we know from other industries and fields, a company has to decide what performance metrics are valuable and indicate success before a team can track them, and predictably improve upon them.

In the past, enterprise software companies organized themselves around a clear set of business metrics, including bookings, maintenance and support fees, and revenue; today, software-as-a-service (SaaS) companies run on a consistent set of metrics, no matter if the business serves horizontal or vertical industries.

After surveying hundreds of leading public and private cloud companies, five key metrics, which you can easily remember since they start with the letter C, now rise above the others as essential top level performance indicators. Bessemer recommends that every cloud business tracks and reports the following financial metrics, as a starting point, when a business is trying to develop its high-level business dashboard:

- Committed monthly recurring revenue (CMRR)

- Cash flow

- Customer acquisition cost payback period (CAC)

- Customer lifetime value (CLTV)

- Churn

In this article, we go into further detail to explain each metric, how to calculate them, and key insights cloud founders need to know when improving these metrics over time.

1. Committed monthly recurring revenue (CMRR)

CMRR is the single metric that gives you the purest forward view of the “steady state” revenue of the business based on all the known information to date.

Many first generation cloud businesses turned to total contract value (TCV) or annual contract value (ACV) as their top level metric as a carry-over from the legacy software world of tracking bookings. For cloud companies, these metrics can be easily manipulated and are often misleading, and therefore we recommend more focused metrics around the recurring revenue in a normalized time period. TCV and ACV are flawed for many reasons, most notably with regard to duration and services.

If your renewal rates are strong, then contract duration isn’t a major variable. However, when cash collection and the size of the monthly subscription will massively impact your business (see points on cash flow and churn below), then contract duration is a variable to pay close attention to and try to control.

CMRR is the single most important metric for a cloud business to monitor.

A focus on total contract value has a tendency to encourage sales professionals to focus on longer term (often multi-year) deals to push up the total value versus pushing on the more important elements of monthly subscription value and cash pre-payments.

Annual contract value does help to reduce this over-emphasis on duration by just focusing on the first year of the deal, but it shares the second major flaw that total contract value is also burdened with, which is an over-emphasis on services revenue as part of the contract value.

I’ll be very blunt: professional services revenue is bad for cloud businesses in most cases. It’s low gross margin revenue that slows down your implementations and can only scale in proportion to your services headcount. For these and many other reasons, Wall Street investors and your customers hate to see a large mix of services revenue in cloud businesses.

Instead, a company should focus its product development, sales, and customer success teams on eliminating the friction during implementation, and reduce the time and cost toward implementation as much as possible.

In most cases, a company shouldn’t reward a sales team on contract value by giving them quota relief and commissions against services revenue. To address these concerns, many cloud businesses now focus on monthly recurring revenue (MRR), which represent the combined value of all of the recognized recurring subscription revenue on a monthly basis.

MRR is a great base metric, but CMRR is more insightful because it includes all MRR, plus signed contracts currently committed and going into production, and minus churn, which is the MRR that is no longer committed from customers that have turned off the service, or are anticipated to do so in the future.

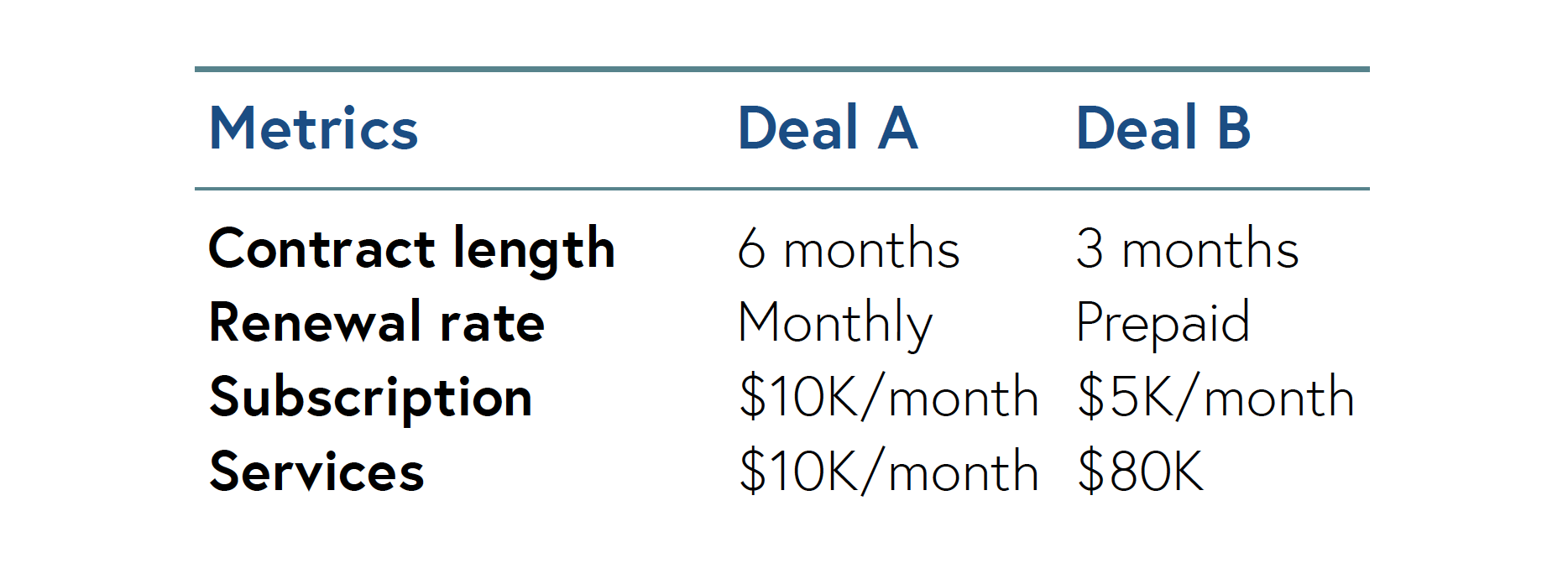

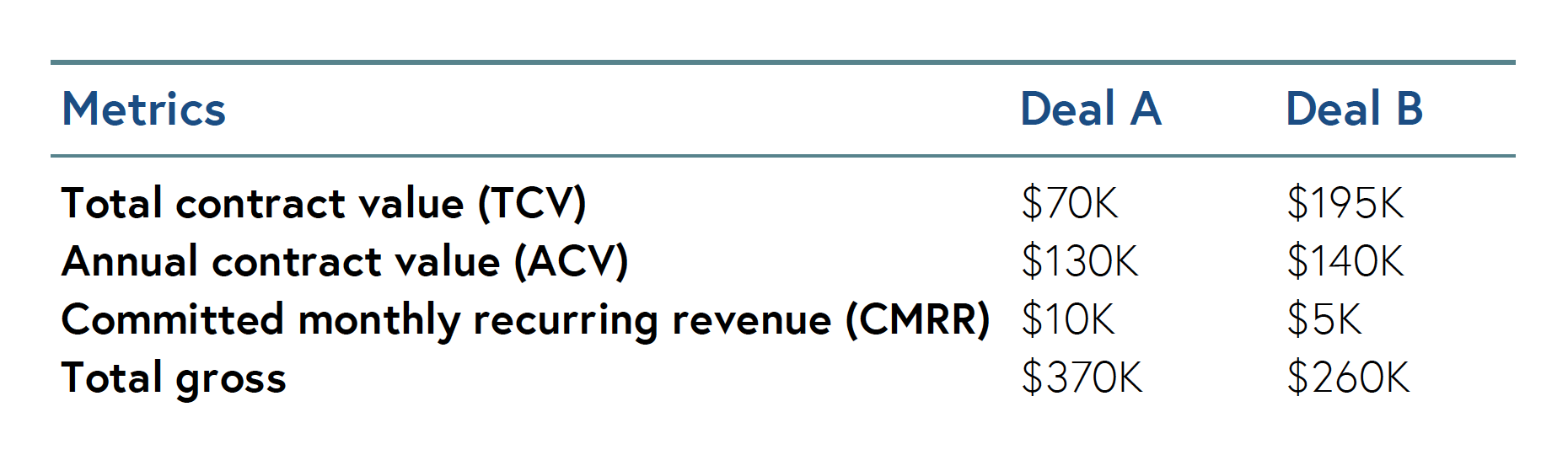

Here’s an exercise: Below are two deals, which one should you pick?

Deal A: Six month prepaid contract; renews monthly; $10K monthly subscription; $10K services.

- TCV: $70K

- ACV: $130K

- CMRR: $10K

Deal B: Three year contract; three months prepaid; $5K monthly subscription; $80K services.

- TCV: $195K

- ACV: $140K

- CMRR: $5K

Answer: Despite lower TCV and ACV, Cloudonomics writes you should pick Deal A every time.

Deal A will gross approximately $370K of revenue over three years, whereas Deal B will only gross approximately $260K. Deal A will also likely be much higher in gross margin given the lower services ratio.

In fact, there are only two reasons to even consider Deal B and those relate to churn risk and cash flow, but we also attempt to correct those misconceptions later. In almost every case, CMRR is the single most effective metric.

For businesses that don’t operate with long term contracts, such as PaaS businesses with monthly or consumption based contract terms, “committed” is the calculated MRR at that instant (as committed to by the CFO, Vice President of Sales, and CEO combined) based on the current customers in production with their existing consumption levels adjusted for seasonality or known usage trends.

This is meant to be the truest baseline number of expected product, subscription, or usage revenue for the month, without adding any new customers, upselling any new products, or expanding usage beyond the current footprint, and subtracting all known churn.

CMRR is the single metric that gives you the purest forward view of the “steady state” revenue of the business based on all the known information today.

The monthly focus also tends to drive many positive behavioral changes within a team including a monthly sales and development cadence, better sales compensation plan and cash flow alignment, reduced customer price sensitivity, and heightened awareness around small MRR changes.

Many leading cloud companies therefore use CMRR as the basis for everything from the financial model to the sales commission plan. This is the single most important metric for a cloud business to monitor, as the change in CMRR provides the clearest visibility into the health of any cloud business.

For external purposes, you will likely want to highlight slightly different versions of these metrics: the annual recurring revenue (ARR) and annual run rate revenue (ARRR).

ARR is simply the currently recognized portion of this monthly revenue, multiplied by twelve. ARRR is the ARR, plus any non-recurring revenue related to items such as professional services, transactions, and implementations.

These external “vanity” metrics can help drive home the run rate scale of your business, especially when used to describe the forward business model.

Your current CMRR may be $1.75 million and projected to grow to $2.17 million at year end, so for external audiences you may get maximum impact by summarizing the business plan by saying: “As we exit this year our annual run rate revenue (ARRR) should cross $30 million, which includes $26 million of annual recurring revenue (ARR).”

2. Cash flow

As any scrappy entrepreneur will tell you, a business will live or die based on its cash management in the early days, and therefore detailed cash metrics are also needed.

Cash flow is calculated by tracking gross burn rate and net burn rate, then hopefully, it turns to free cash flow over time. CMRR gives you a great sense for the revenue health of the business, but can very often be disconnected from the “cash health” of the business.

Gross and net burn rate (cash flow) metrics are critical for cloud businesses because the working capital requirements are higher and the payment terms are often backend weighted.

Gross burn rate is all of the expenses paid for in the month including debt and finance charges. Net burn rate is simply all cash received during the month minus all the expenses, which nets out to the cash burned in the month.

These numbers are obviously lumpy based on the timing of collections and payables, so many companies further refine this by adding a “rolling three month average” burn rate set of metrics.

In the early stages, a business lives or dies based on its cash management.

Cloud businesses typically show significant positive free cash flow (FCF) long before the company turns GAAP EBIT positive. As a company grows, the goal is to flip your burn rate metric (negative cash flow) into a positive one and then start tracking free cash flow instead.

By tracking CMRR and burn rate a company has a very good sense for the steady-state health of the business. At any point, a company can divide its monthly net burn rate into a cash balance to understand its number of months of runway, which many CEOs monitor routinely.

One should always have a variety of insurance plans, which we strongly recommend a CEO discusses with its board and keeps updated. These changes could include cuts in the business to quickly reach cash flow breakeven.

One of the best benefits of cloud businesses is the recurring nature of the revenue streams; a company can model and predict the steps needed to instantly bring the gross burn rate of the business inline with the CMRR. That way, a business can glide into a net burn rate of zero as your working capital catches up.

Many from our portfolio with extremely aggressive growth plans and high burn rates speak openly about their insurance or “ripcord” plans. Decision makers freeze hiring, slow marketing spend, or make targeted cuts if their costs of capital spikes or their sales metrics deteriorate, and the company still has to work to breakeven.

3. The relationship between CAC and CLTV

A profitable business rests on the shoulders of profitable customers. Here are the definitions for two critical customer-centric metrics:

-

Customer acquisition cost payback period (CAC)

The CAC payback period is a statement in months, of the time to fully payback your sales and marketing investment.

-

Customer lifetime value (CLTV)

Understanding your customer lifetime value (CLTV) is critical for a company’s profitability. CLTV is the net present value of the recurring profit streams of a given customer less the acquisition cost.

One of the many attractive qualities of a cloud business model is that once a company has repaid the initial customer acquisition costs (CAC), the cash flow and profit streams from customers can be quite lucrative.

CAC payback period is the number of months required to pay back the upfront customer acquisition costs after accounting for the variable expenses to service that customer. While this metric indicates the number of months it takes to get a return on your incremental sales and marketing costs on each customer, it still doesn’t tell you if these customers are highly profitable over time. To measure if your customers will be highly profitable over time, many companies have modified the consumer internet concept of lifetime value, into a similar cloud CLTV metric.

We’ll use this calculation to better illustrate the relationship between CAC & CLTV:

Assume that a customer generates $10K of annual recurring revenue for a company with a CAC payback of 12 months, a 70 percent gross margin and 10 percent each of R&D and G&A costs.

The $10K of revenue will generate $7K of gross margin and $5K of profit each year ($7K less $1K of R&D and $1K of G&A costs).

Over 5 years, this customer will generate $25K of profit (5 years x $5K/year).

A CAC period of 12 months means a $7K upfront acquisition cost, making the CLTV equal to $25K minus $7K equaling $18K.

Obviously if the retention period is longer, and a company benefits from net positive CMRR renewal rates that actually grow your average customer relationship over time, these numbers can be much larger.

For those who want to get more analytical, this is equivalent to ($18K/5) = $3,600 of annualized profit or 36 percent profit margin.

The calculation can be refined with a better allocation of the sales and marketing costs (the parts used to support current customers) and by discounting the profit streams (in this example, a 15 percent discount rate would reduce the CLTV to $12.3K or 25 percent annualized profit margin).

It’s also worth noting that for younger companies, it may be more of an art than a science to estimate the lifetime of the customer as your churn data is still limited. A conservative estimate would take three to four years for SMB customers, and five to seven for enterprise customers.

4. Measuring the impact of churn and renewal rates

These metrics also include logo churn, CMRR churn, and CMRR renewed.

It’s very difficult and expensive to grow subscription businesses if you have moderate customer churn, and prohibitive if your churn is high.

As detailed financial models of CLTV and free cash flow demonstrate, the single biggest driver of long term profitability for your cloud business, and thus valuation, is the renewal rate of your customers.

Whereas the largest legacy enterprise software companies made tens of billions of dollars over the last decade with “shelf-ware” projects that never got fully implemented, project failure is not an option for cloud businesses or the customer will simply turn you off, regardless of the contract terms.

This is another reason not to overly focus your team on long term contracts, because it creates a false sense of customer lock-in regarding your unhappy customers, and may leave money on the table from lost upsell opportunities with your happiest customers.

Over time when you have successfully realized most of the upsell potential of your accounts and have built in deep ties to the account, you may want to push for longer term contracts for predictability (which Wall Street does still value), but this shouldn’t come at the expense of CMRR.

Cloud executives need to track renewal rates in detail to capture “logos lost” (lost customers) as well as the percentages of CMRR renewed and lost.

The standard approach is to track three key sub-metrics related to renewal rate:

Logo churn percentage

This is a percentage calculation of all your customer names (“logos”) that have churned over the measured time period.

If you started the year with 500 customers and 460 of them were still paying customers at some level at the end of the year, then you have churn of 40 customers and your annual logo churn is 8 percent (40/500).

As with all renewal metrics, you exclude all new customers signed during the time period. They’ll be captured in your next renewal report.

CMRR churn percentage

This is a percentage calculation of all your customer CMRR that has been lost over the measured time period.

If you started the year with $500k of CMRR for your same 500 customers, and the 40 customers that churned represented $30k of CMRR at the start of the year, then your base CMRR churn rate is 6% annually ($30k of starting CMRR churned/$500k of starting CMRR).

CMRR renewal percentage

This is a percentage calculation of the total CMRR of your renewed customers at the end of the year, divided by the total CMRR of your existing customers at the beginning of the year.

Of your 460 renewed customers, if they have been upsold on new products and grown in their usage of the product during the year to the point where their CMRR equals $550K in total, then your total CMRR renewal rate is 110 percent ($550K end of year CMRR just from customers who were on board at the start of the year/$500K CMRR of all customers at start of year).

The top performing cloud companies benefit from annual logo churn rates below 7 percent and CMRR churn rates below 5 percent.

Seven percent of the logo churn rate should be due to bankruptcies or acquisitions, whereas CMRR renewal rates well above 110 percent should be due to upsells into its original customer base.

A specific business is likely to have additional key metrics that are worthy of showcasing on the top level executive dashboard, but Bessemer has found these five to be pretty universal across the vast majority of cloud businesses.

A cloud executive will find him or herself reviewing these metrics at different frequencies:

CMRR, cash flow, and churn tend to be highly dynamic and thus should be checked daily or weekly, whereas CAC and CLTV are more strategic and thus longer term in their nature.

Many of our top performing cloud CEOs have also modeled their executive team objectives and bonus plans around a subset of these metrics exclusively (typically CMRR growth, churn, and cash flow).

As a founder or CEO approaches IPO, they will likely choose to keep these metrics private and will only be public with a select number of “street metrics” including GAAP revenue, gross margin, and earnings before interest, taxes, depreciation and amortization (EBITDA).

Finally, with these metrics in place, a cloud executive can use them to drive their rolling financial budgets and forecasts. While most leaders would likely want to keep their annual “Board Plan” of record locked down for the year, one should get in the habit of revising and sharing business forecasts monthly or quarterly.

Some executives may come to a Q3 meeting and simply publish their second half board plan as their forecast, but that suggests the company hasn’t learned anything in the six to nine months since that budget was originally drafted.

There may only be slight variations in expenses, CMRR, or cash flows, however it’s important to get in the habit early of revising forecasts and using these revisions as an exercise to share the positive and negative trends within the business.

In return, a collaborative board of directors should view the forecasts as rough projections and not overreact to information shared.

You don’t want to practice your first forecasting attempts when you’re getting ready for your IPO roadshow.