Developer platforms in India

As one of the world’s epicenters for engineering talent, India’s startup ecosystem is now contributing to the global evolving developer tech stack.

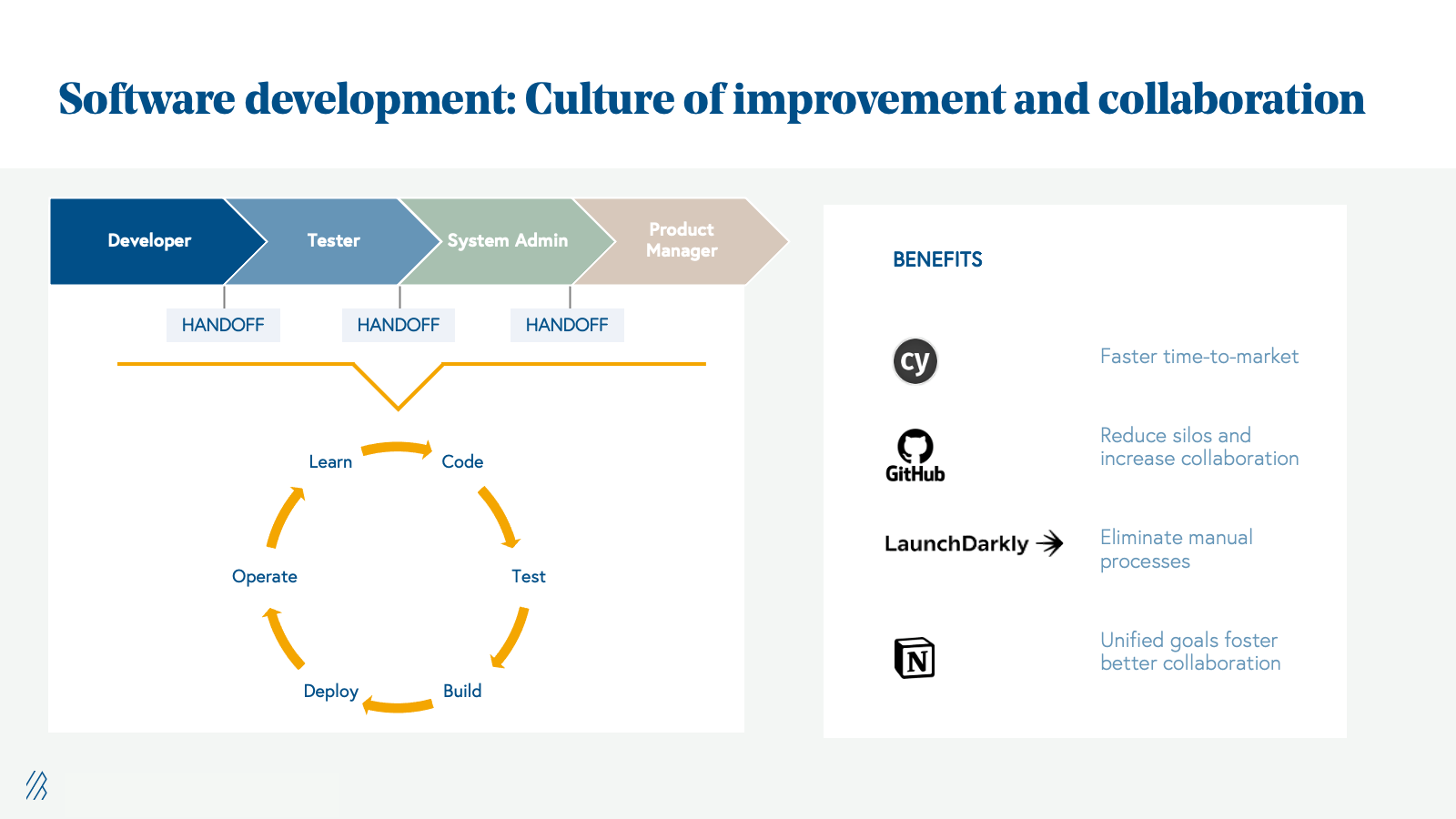

Gone are the days where software development organizations defined and siloed their engineering teams into roles such as developer, tester, and system admins—and gone are the days where teams only launched product enhancements once a quarter. In fact, the majority of today’s high-performing software teams embrace the philosophy of continuous improvement, a practice that leads to 973x more frequent code deployments, 3x lower change failure rate, and a 6570x faster time to recover from incidents, according to Google’s State of DevOps 2021 report.

DevOps—a portmanteau of “developer” and “operations”—is shorthand for tools and processes that enable this process of continuous development. In actuality, DevOps characterizes a cultural shift from the siloed teams of legacy product development to one in which teams own the entire product lifecycle, relying on multidisciplinary collaboration and streamlined workflows. The DevOps approach focuses on efficacy at the systems-level, rather than within a single function. This shift within teams impacts the fundamentals of the software development lifecycle from hiring, structuring teams, developing and delivering products, including post-deployment maintenance. This approach also fosters better collaboration, trust, and transparency among team members, as well as aligns work around shared goals, such as developing great products and operating them sustainably at-scale.

When these principles and practices are combined with the philosophy of continuous improvement, teams deploy code faster, reduce mean time to remediate (MTTR) issues, and better manage unplanned work. However, continuous improvement requires a change in not only culture and processes, but also the technology stack.

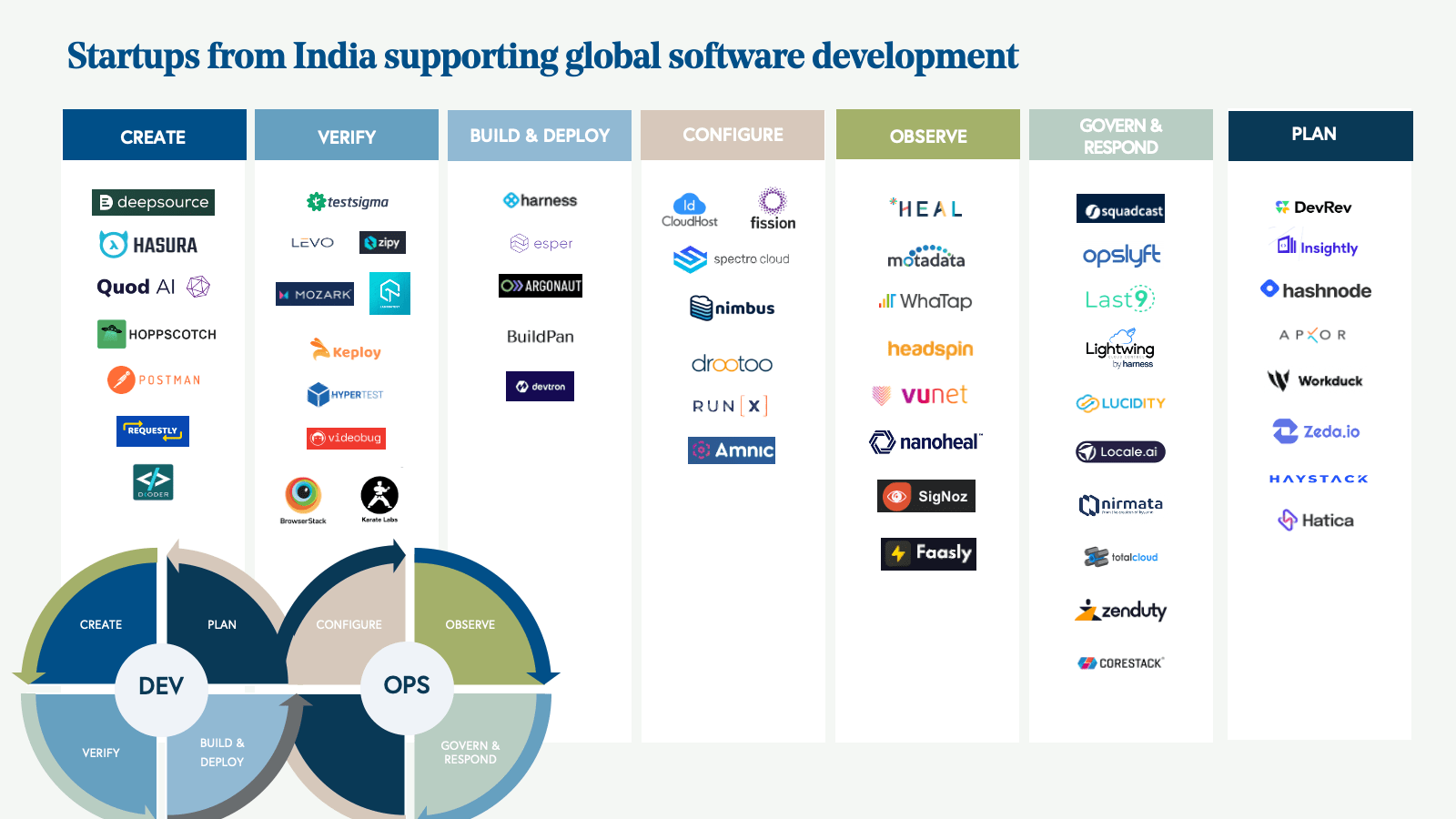

In order for teams to be as efficient as possible, they prioritize engineering resources to build a product’s competitive differentiation, and automate the rest. This has given rise to solutions across developer platforms for collaboration, real-time monitoring, automation, project management, security, and more.

While the shift toward building for developer tooling isn’t new, the opportunity to build for this massive market is growing and in demand in new geographies, such as India and Southeast Asia.

Today the global market size for developer platforms and data infrastructure products is estimated to be at least $150 billion. As India’s SaaS market continues to grow, startups are seizing this opportunity as both producers and consumers of developer platforms. In addition to adopting the continuous improvement mindset in India, companies are building platforms and tools that serve the developer economy, serving both a regional and global customer base. India, a growing epicenter for IT and engineering talent, is now on the cusp of transformation to meet this market need.

Why now? Factors driving change in India’s enterprise developer stack

Similar to the broader India SaaS landscape, growth in developer platforms in India is being driven by three key factors:

1. Abundance of high quality engineering talent

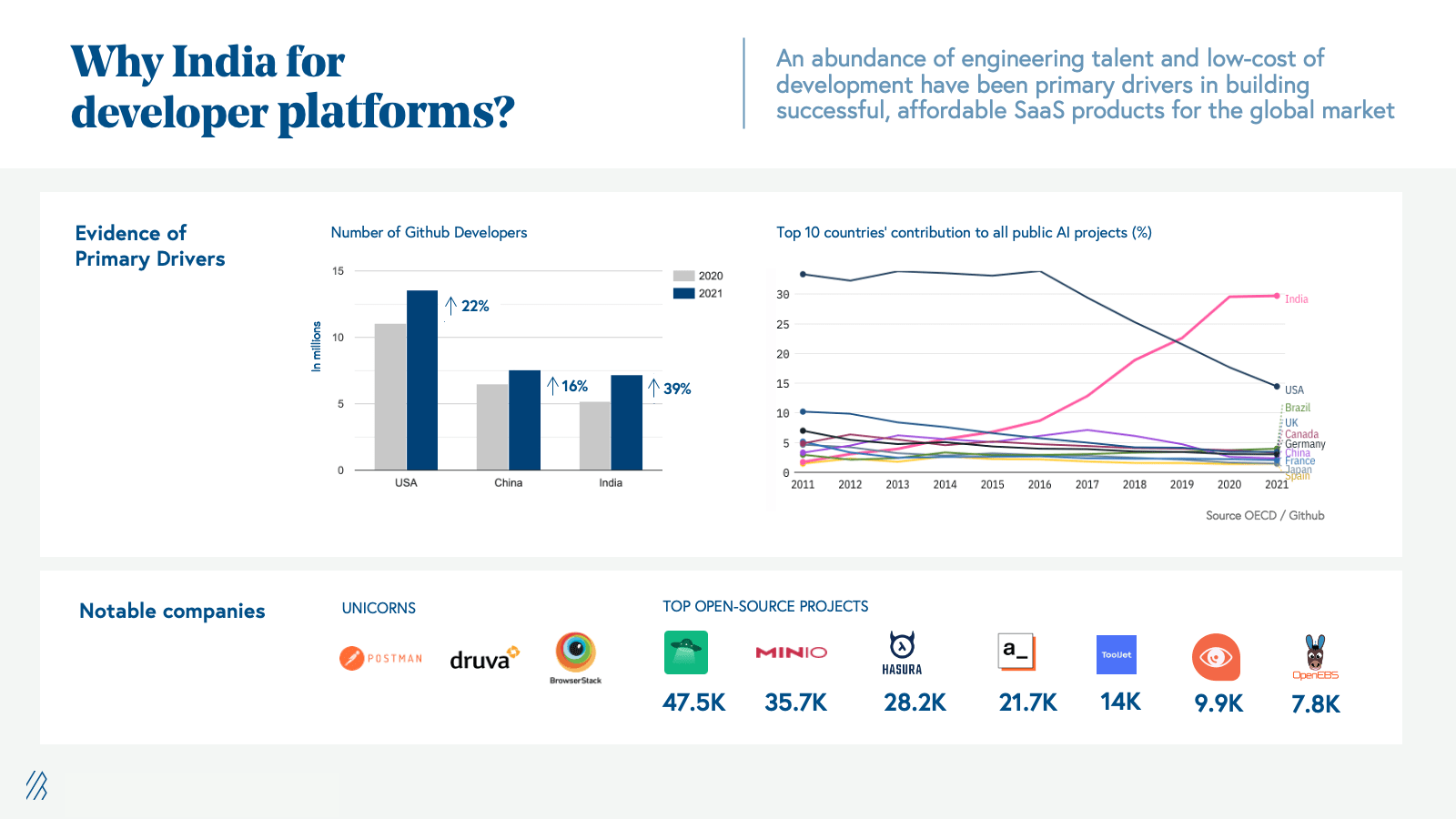

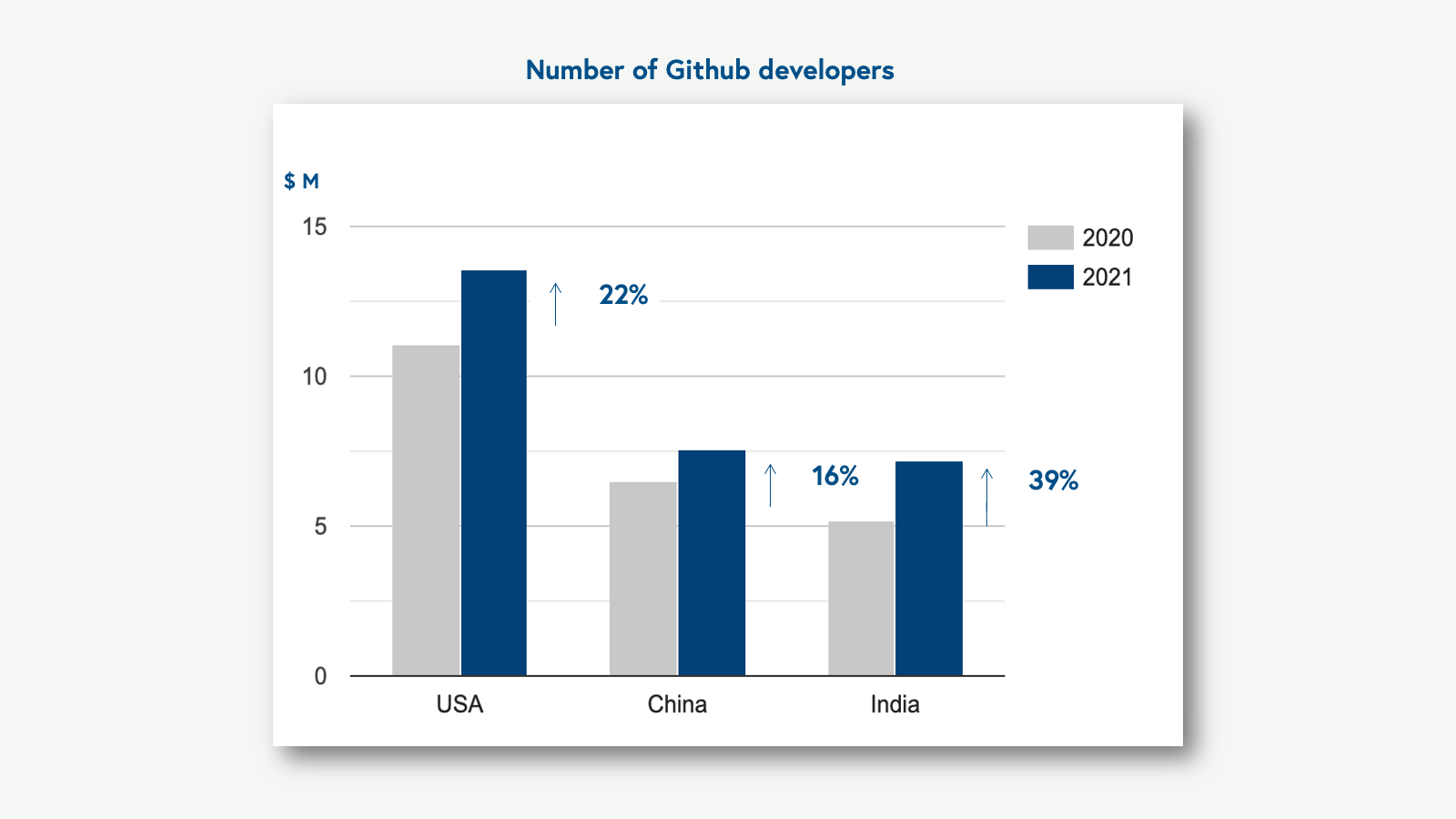

As the developer base grows in India, so does the DevOps market opportunity. Data from GitHub indicates that the US, China, and India have the greatest number of GitHub contributors, with India having the highest amount of year-over-year growth from 2020 to 2021. The Indian Github community is now 7.8 million strong, with 1.8 million joining just last year. Github has forecasted that ten million developers from India will join Github by 2023.

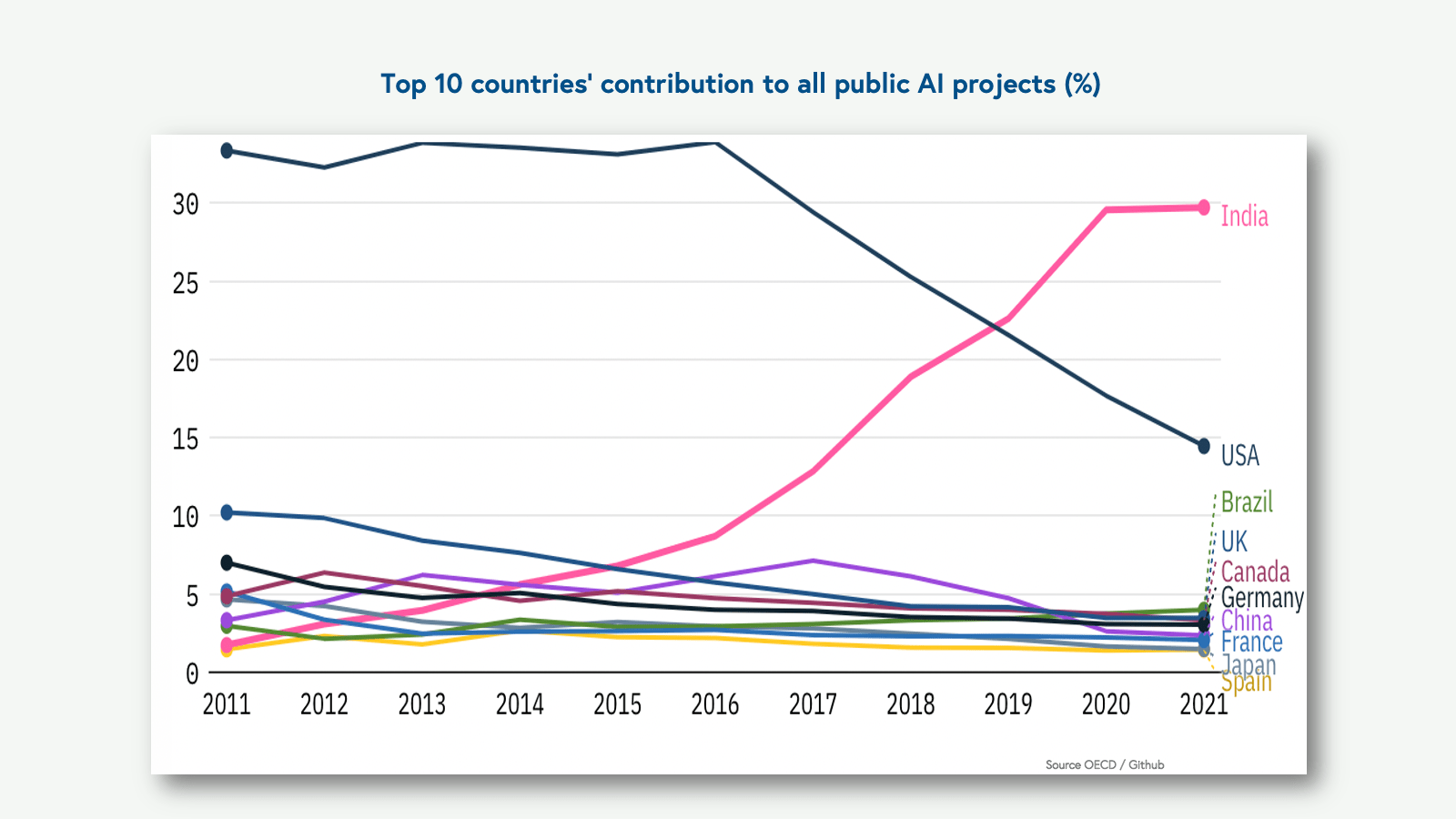

We are also seeing an increase in the quality of engineering talent. As a proxy metric, artificial intelligence contributions made by developers in India indicate that this region is a leading contributor to some of the most cutting-edge projects in development. The Indian contribution to AI code has been increasing steadily from 2016 to 2020. And for the last two years, Indian developers have been the top contributor to global AI-related Github repositories, overtaking even the US and China. This increase in developer quantity and quality expands both the capacity for DevOps and developer platform product development and consumption.

2. Capital efficiency

Innovation moves quickly—for scaling venture backed startups, velocity of growth determines market leaders, and achieving that speed requires constant experimentation. As mentioned in our Rise of India SaaS report, Indian SaaS companies have the potential to be much more capital efficient than their global counterparts. Many India SaaS companies like Perfios, Lentra, Browserstack got to profitability around the $10 million ARR mark and only needed to take on outside capital to reach hypergrowth (i.e., $100 million ARR). Companies have scaled with less capital by eschewing minimum viable products. Rather, they go to market with near-final versions of their products, giving them a strong competitive edge. In addition, they build multiple products earlier in their journey which allows for more cross sell/upsell and higher Net Revenue Retention (NRR). This approach also allows their capital from seed and Series A rounds to go further. Their efficiency pays off, with Indian SaaS startups approaching $100 million ARR with 80-100% sales efficiency (compared to the 30-40% seen in the global SaaS market at similar revenue numbers).

3. Thriving entrepreneurial ecosystem

In the past five years, we’ve seen a 5.4x increase in venture capital deployed in India, with a 3x increase in the 2021 alone. India’s SaaS market has reached a critical inflection point as venture dollars deployed in the region reached $4.8 billion in 2021. This influx of funding is attributed to the economic growth in India’s economy-at-large. Combined with the rising quantity and quality of engineering talent, this capital infusion has catalyzed net new startup creation. In the last three and a half years, the number of SaaS Unicorns in India grew from two businesses to twenty. Last year alone, 44 businesses achieved unicorn status across different industries.

With the track record of success in the India SaaS market, there are now playbooks that can be applied for scaling large developer and data infrastructure companies. Engineers and product managers from companies (like Browserstack, Freshworks, Postman) are starting new developer focused companies, incorporating the learnings from their experience. Moreover, the community of these entrepreneurs is now paying it forward to catalyze the growth of the next generation of entrepreneurs.

The developer landscape in India

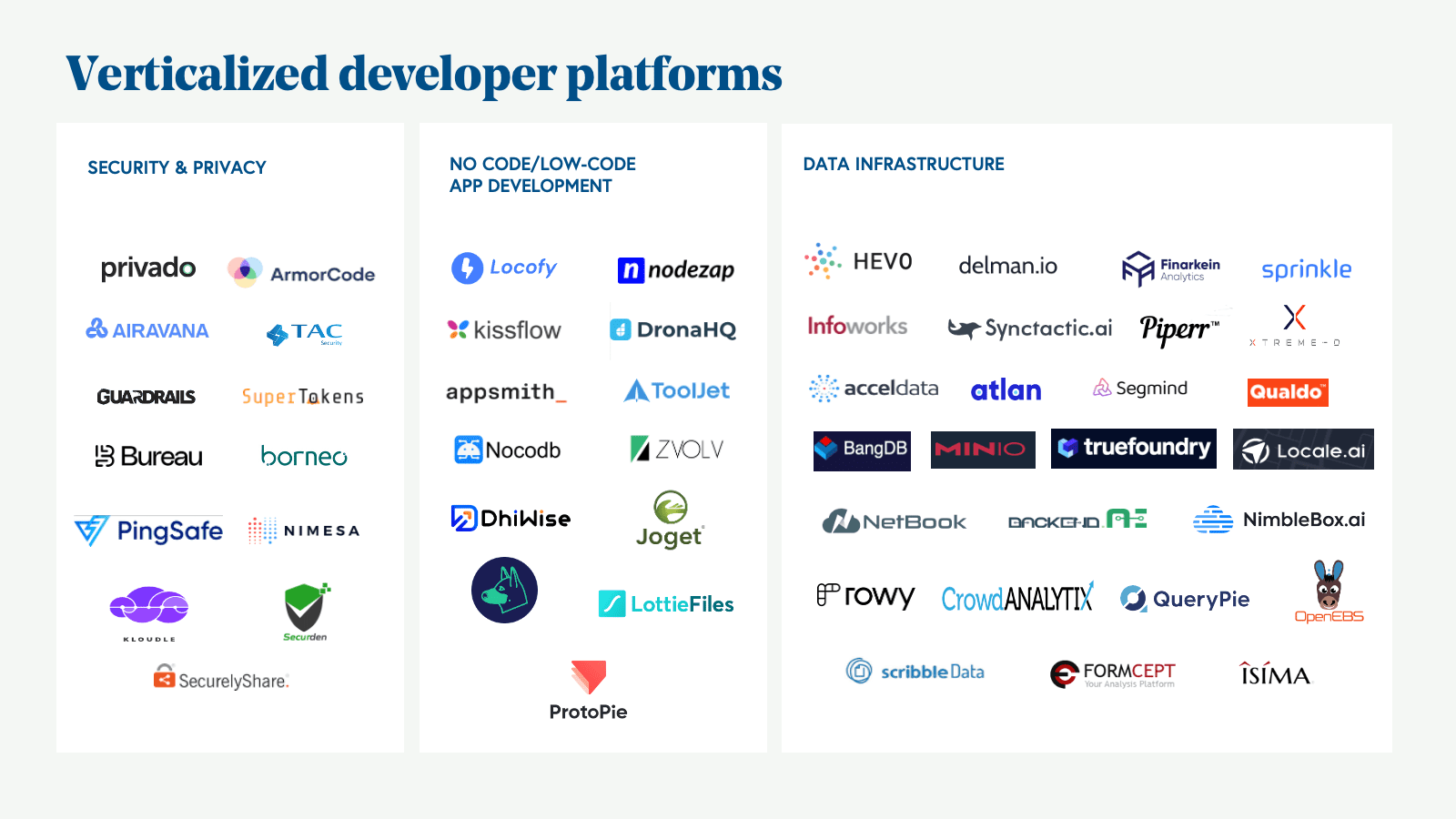

With macro tailwinds in the region as well as the large market opportunity of developer platforms and data infrastructure—projected to be upwards of $150+ billion—we’re seeing a fast growing entrepreneurial landscape in India and Southeast Asia. Given the adjacent nature of developer platforms and data infrastructure products, we’ve listed them both in the market landscapes here. (We’ve also previously published our investing framework for data infrastructure and developer laws.)

Developer platforms have the potential to capture global markets given the truly industry and geo agnostic nature of the products and its users. (People code in similar ways all around the world.) This convergence on how people build software was brought about by a combination of factors: the ubiquity of software products and the universal development processes (e.g., continuous improvement, the DevOps mindset), including the widespread adoption of the Agile Methodology and the globalization of Big Tech, such as Amazon and Google.

10% of Github developers are in India

With the standardization of the way development teams collaborate and work, good products created for development teams anywhere in the world tend to have a global appeal, regardless of what the dev teams are building. Thus, the developer economy's total addressable market transcends borders. With nearly 10% of Github developers being from India and the recent success of several developer/data oriented products (see chart here), we expect to see a surge in new innovation from the Indian and Southeast Asian ecosystem in the coming few years.

Our early insights in India’s developer ecosystem

Since the early ‘00s, when developers finally secured the pursestrings to purchase technology, we’ve seen an explosion of platforms and tools serving engineers across the tech stack. Ten years later, Bessemer’s Developer Laws, which detail the practices and principles on how SaaS businesses could successfully serve this category of customer, still hold to be true, with some amendments.

But how do these laws relate to what’s happening in India? As an emerging hub of innovation for developer-centric tools, India SaaS investors, like us, are noticing four key trends that are evolving in unique ways. Here, we share what’s driving our investments, and why we think it’s interesting to note.

Developer evangelism gaining traction

As our partner Ethan Kurzweil shared in Bessemer Developer Laws, users are the first and best marketing channel—their authentic evangelism drives adoption and sales. Companies with a bottom-up GTM strategy are propelling their market presence by completely or partially open sourcing their product or by offering freemium product tiers which allow developers to try the product before team purchase.

85% of India's internet runs on free or open source softwares

With 85% of India’s internet running on free or open source software, India has demonstrated an appetite to consume open source products. While the number of open source Github repositories with 50+ contributors or 10K+ Github stars is lower than the US, we think the budding ecosystem is making strides with projects such as Hoppscotch (47.5K Github stars), MinIO (35.7K Github stars), Hasura (28.2K Github stars), Appsmith (21.7K Github stars), Tooljet (14K Github stars), OpenEBS, among others. Although not open source, LottieFiles, a Malaysia-based software company, has democratized motion design creation with 3 million users and over 135,000 companies onboard.

Democratization of application creation

In 2021, Gartner reported that the global market for low-code development technologies has hit $13.8 billion in revenue with growth of 22.6% over 2020. With developer time becoming a scarce resource and the increasing demand for personalization of applications/workflows, we’re seeing a rise in adoption of tools that democratize code creation. No-code tools that enable developers to automate frequent workflows/tasks (Appsmith, Retool, DhiWise) or empower non-developer personas to create mini-applications (Kissflow, Joget) are currently at the forefront of this movement. While we do see the value of these applications in automating non-core projects and expanding the demographic that can build software applications, we don’t envision these products being used for creating large and complex enterprise products, and thus would not take away from existing/traditional code development products.

Embedding intelligence into developer products

Over the past decade, the industry has created more sophisticated tools to store, transform, and extract insights from large datasets. With the power of these products behind them, developers and data scientists are employing machine learning algorithms at scale to deliver predictions and recommendations from these datasets. Companies, especially with developer products, are embedding intelligence into products from day one as a strategic way to increase the stickiness and value of a single product. Across the development lifecycle, intelligence and automation are driving better results, from driving better code practices and code reviews (e.g., Builder.ai, DeepSource), code search (e.g., Quod AI), and intelligent testing (e.g., Karate Labs, TestSigma) to intelligent root cause analysis (e.g., Zipy.ai, Last9) and AI-driven application performance monitoring (e.g., Heal, Signoz). With the upsurge in industry-wide ML applications, the developer tools that drive such innovation are bound to embed intelligence within themselves. We believe this movement of creating more intelligent tools is here to stay and will grow over time.

Unified platforms simplifying software development

Unified development platforms provide a fully-managed production environment for one or many phases of the development lifecycle. These products aim to eliminate the need of managing servers, setting up dev environments, preventing software lock-in while ensuring security, and compliance and hybrid cloud compatibility. Across all functions—data engineering, data science, software development, testing, SRE, software infrastructure management—opportunities exist to create unified platforms to empower teams with more powerful tools that require less setup and conserve more dev time. Some companies have taken the opportunity to build unified platforms that enable (1) building, testing, and deploying code (e.g., Harness, Buildpan, Devtron) and ML models (e.g., Nimblebox), (2) extracting, ingesting, and storing data (e.g., Hevo Data, Piperr), (3) bringing transparency to cloud costs and compliance (e.g., CoreStack, economize.cloud) and (4) on-demand cloud dev environments (e.g., Nimbus, Amnic).

Successful products can garner global appeal

The industry and geo agnostic nature of most developer products deliver value to developers all over the world. We’ve seen this to be true as successful global developer platforms hail from Israel (e.g., Firebolt, Wix, Legit Security), Europe (e.g., Snyk, Dataiku, Collibra), Australia (e.g., Atlassian), U.S. (e.g., Cypress, LaunchDarkly, Prefect), and still gain international appeal. In India, we've seen recent success stories in Postman, BrowserStack, Hasura, LambdaTest, Esper, Accel Data, MinIO, Atlan and Druva, among others, as they’ve targeted the global market from day one and continue to grow overseas. The successful products in this category are viewed as great products with a global appeal rather than ones developed for India or any specific geography. India is the next great epicenter for innovation in developer platforms, and we look forward to working with teams in India building novel solutions across the umbrella of developer tools, data infrastructure, data security and privacy.

If you are a company embarking on this journey, please get in touch with us at IndiaSaaS@bvp.com.