Direct-to-clinician—How product-led growth is changing healthcare and life sciences

A new DTC model (direct-to-clinician) is on the rise. Here’s how healthcare and life science tech companies are evolving go-to-market strategies for the next generation of workers.

As a life-long student of computing turned healthcare and life sciences investor, medical training has felt like a nostalgic trip to the technology of 20 years ago. Most healthcare industry insiders can recite the stats in their sleep: 90% of clinicians still use fax and 40% use a pager. However, in the grand scheme of this field, as old as humankind, healthcare has come a long way since Ancient Greeks blew horns to signal plagues, and more recently, hospitals exchanged paper medical records for electronic.

We’re on the cusp of a major shift in how healthcare and life sciences software is built and sold. Increasingly, individual workers such as clinicians and scientists are adopting consumer-grade technology through bottoms-up motions. Healthcare and life sciences tech companies are leveraging product-led growth strategies first pioneered by cloud giants.

Over the years, selling technology to incumbent healthcare providers, payers, and pharma companies has been a mere act of survival for startups. Early stage financings typically unlock 18-24 months of runway, yet the enterprise sales cycle in healthcare and life sciences can take just as long. Attempts to keep burn low are often thwarted once a company hires a seasoned sales executive (with a deep Rolodex of contacts) tasked with driving large enterprise deals for the business.

Still, many healthcare technology companies pursue this path because it aligns with the primary way these organizations procure technology. Enterprise deals in healthcare and life sciences tend to be sticky, and so dollars burned on sales and marketing can be recovered over many years as deals appreciate like annuities due to high lifetime values.

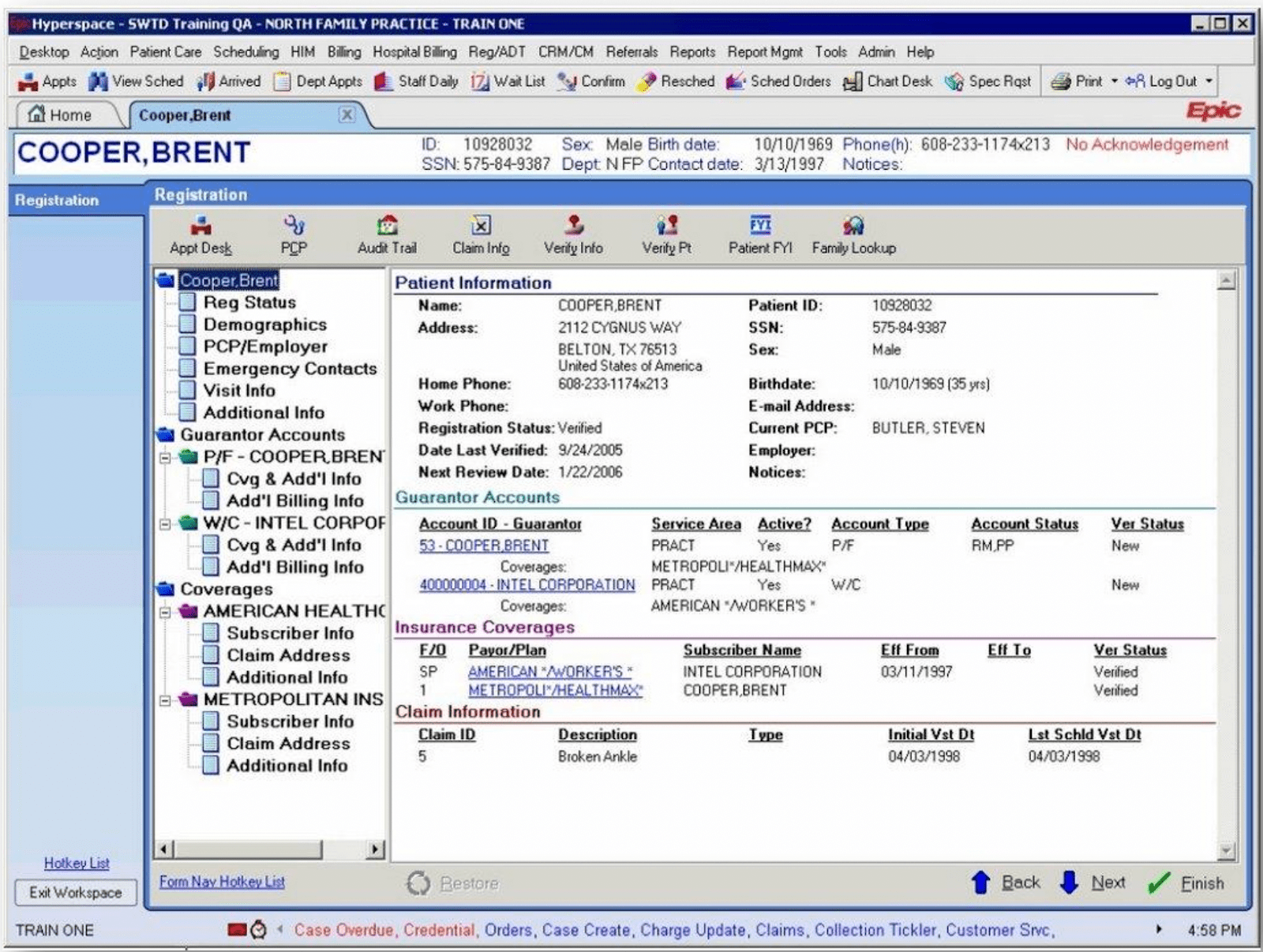

Traditionally, once contracted, enterprise technology is pushed down onto workers in healthcare and life sciences–an implementation strategy that has proved to be extremely challenging and can require regulatory support. After the HITECH Act in 2009, when electronic health record adoption began on a national scale, the US government subsidized $30 billion of incentive payments to support utilization. Later, penalties were created for those who failed to do so. More recently, the Interoperability and Patient Access Ruling reinforces the role of regulation in driving product innovation in healthcare.

The few companies that have been successful at breaking through the tough top-down go-to-market strategy in healthcare have built walled gardens that lack sufficient, open APIs. (There’s been little incentive to do otherwise.) Incumbency and high retention also decrease incentives to iterate quickly on new product features or cultivate communities that spawn product evangelism. Many of these enterprise platforms have failed to “spark joy” among users, and in some cases, are making day-to-day tasks more difficult for healthcare and life sciences workers. (Did I also mention this sales approach makes it challenging to show true product market fit?)

There's a clear shift in how healthcare and life sciences workers—namely clinicians—but also scientists, pharmacists, medical billers, call center representatives, counselors, caregivers, and more, are procuring and using technology. In our latest healthcare roadmap, we uncover four key market trends that are driving bottoms-up adoption of technology solutions in healthcare and life sciences. In addition, we explore the size of these individual markets and the promising areas of innovation underpinning our investment thesis.

Undeniable market trends transforming technology adoption in healthcare and life sciences

1. Increased demand and low supply of workers

Demand for healthcare labor has reached a peak that is driving profound supply and demand discontinuity in the industry, in large part due to:

- Longer life expectancies—a wonderful byproduct of advancements in modern medicine—are translating to “less churn” in the demand for healthcare services. This dynamic poses structural issues when the industry’s current staffing and hiring practices don’t meet the latest demands. The growth of the field of adult congenital cardiology is a great example of a specialty that has blossomed as patients with congenital heart defects live longer lives due to improved treatment.

- Aging patient populations, attributable to demographic shifts in the U.S., are increasing demand for and consumption of healthcare services.

- An aging provider base, evidenced by the fact that the average age of a primary care physician in the U.S. is 58 years old. Roughly a quarter of all healthcare workers are older than 55 and the average age across all physicians in the U.S. is 52. An aging patient population also means an aging healthcare workforce and many healthcare workers are poised to retire over the next decade.

- The Great Resignation, a massive voluntary resignation of 20% of the healthcare workforce left over the last two years, including 30% of our nation’s nurses.

To keep pace with the burgeoning demand for healthcare, we’d need to hire over 124,000 physicians by 2033 and add 200,000 nurses per year.

It’s clear that linear strategies (i.e., hiring more clinicians) are no match for these nonlinear problems (e.g. increasing life expectancies, aging providers and patients, burnout), but will be a part of the solution. There is an immense opportunity to deploy software more effectively to re-architecture the roles and responsibilities of various healthcare worker types and drive efficiencies in the system.

2. Antiquated technology is pushing workers out

We talked about the Great Resignation and the breaking point many healthcare workers have reached driven by unprecedented burnout and a clinician mental health crisis.

Administrative burden is the number one reason healthcare workers are leaving their jobs as part of this trend, with half citing that electronic health records and other IT tools are hurting efficiency, and one-third citing that tools are inhibiting their ability to deliver quality care. Because healthcare workers lack access to delightful and empowering technology, we’ve failed to automate tasks that would alleviate administrative burden at scale and instead have amassed a patchwork of institution-specific, tailor-made band-aid solutions that don’t scale.

3. Adaptation—the meteoric rise of ad hoc platforms

The juxtaposition of the digital tools we use personally for entertainment and social networking with the archaic architecture of healthcare systems and pharmaceutical companies makes the opportunity clear. As digital-first workers—notably, millennials and Gen-Z—represent nearly one-third of the healthcare workforce (and growing!), interest in adopting newer tools is palpable.

How do we know this? Healthcare and life sciences workers are adapting contemporary platforms such as social media to meet their needs while building flourishing online communities around them.

On Instagram, physicians are building storefronts that drive awareness to their practices (check out how Dallas-based plastic surgeon, Dr. Rod Rohrich, leverages Instagram to share his surgical work). Others are taking to Twitter to flex medical knowledge via #tweetorials on #medtwitter. And, during the heyday of Clubhouse, audio-first virtual grand rounds (akin to a standup meeting for clinicians) took the app by storm as a natural extension of existing hospital workflows—except now on a global scale.

While some clinicians are leveraging social media to enhance their clinical practice, others have become creators and influencers, spending more time generating healthcare and wellness content than practicing medicine. There’s a fine line to walk in terms of not providing medical advice online. However, clinician influencers meeting patients where they are (i.e., on social media) with relatable and accessible information is an evolution of patient education, building upon the foundational work of first generation health education platforms like WebMD.

During the pandemic, many clinicians and scientist influencers on TikTok created content to combat misinformation (SciTimeWithTracy rocks!). Also intriguing is clinician influencer Hospice Nurse Julie, who offers real perspectives and answers questions about what it’s like for patients on hospice, providing invaluable resources for caregivers navigating this transition with a loved one. We’ve also seen clinician influencers serving other clinicians, like Dr. Glaucomflecken, the famed comedian-ophthalmologist with a highly engaged >630k following.

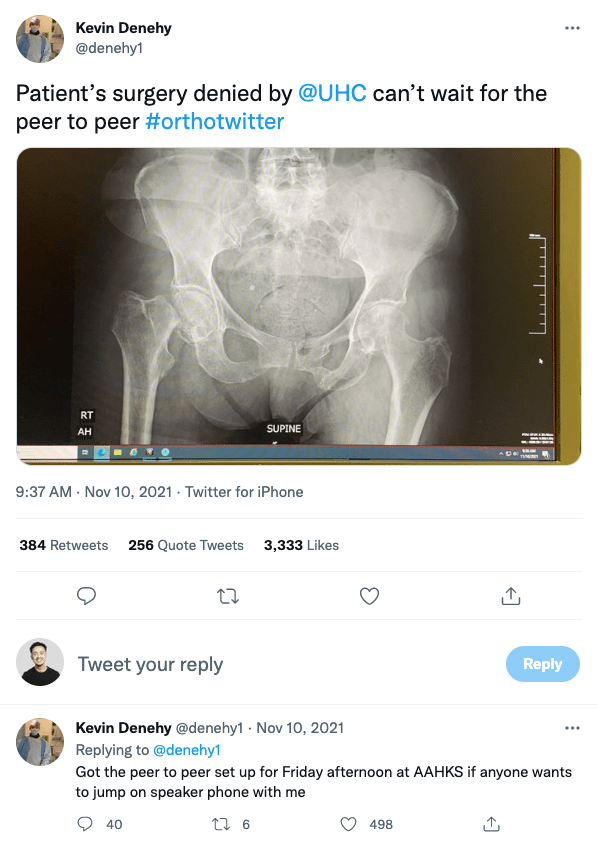

Of the platforms discussed thus far, Twitter is among the most interesting today given the high activity and engagement among healthcare and life sciences workers. Did you know that clinicians can actually earn Continuing Medical Education credit directly on Twitter? Specific hashtags like #OrthoTwitter, #TherapistTwitter, and #ImmunoTwitter are creating segmented spaces for clinicians and scientists of specific experiences to gather, and accounts like CPSolvers are facilitating cross-institution collaboration across specialties. Increasingly, Twitter is serving as a forum for disseminating science–from public health PSAs to new Nature articles–and in some cases, an open platform for debate, particularly during the pandemic. We’ve even seen healthcare have its own “WallStreetBets” moment as providers took to Twitter to resolve issues with health plans pertaining to prior authorization.

Interestingly, the healthcare enterprise is responding. Rivaling the consumer behavior of complaining to an airline after a delayed flight, physicians taking prior auth complaints online have been met with responsive approaches from the health plan enterprise.

Pharmaceutical and medical device companies have also noticed and are equipping medical science liaisons with tools to disseminate provider education on social channels, deploying social listening technologies to inform detailing strategies online—not only for patients, but now, healthcare providers.

As meme culture is often a signal of the strength of an online community, healthcare is highly engaged! Check out a few of our favorite Instagram pages like @codebluememes, @internalmemecine, or @emr.poetry.

These anecdotes provide proof of concept that healthcare and life sciences professionals want to use next-generation tools, and in lieu of having access to specific and built-for-purpose platforms, will make do with what’s available.

4. Structural changes in how and where healthcare workers work

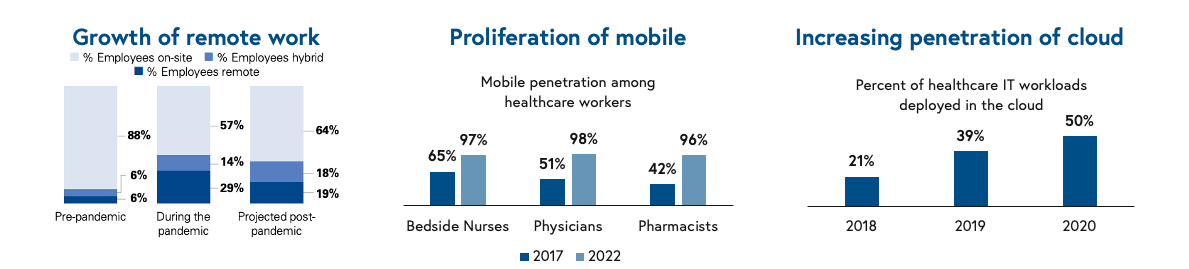

We often say healthcare is about 20 years behind the tech sector, and cloud penetration certainly reflects this. For the first time ever, the percentage of healthcare IT workloads deployed in the cloud has eclipsed 50%, signaling greater comfort and adoption of cloud technology in the healthcare enterprise.

Furthermore, pandemic-fueled expansion of telemedicine, the sheer opportunity for healthcare workers to work from home has evolved, unlocking new product categories for remote professionals deployed on the cloud. Mobile penetration among healthcare workers has achieved near-ubiquity, with greater than 96-98% of clinicians leveraging mobile technology, unlocking vast new surface area for technology products.

Why the product-led growth go-to-market model works in healthcare

We’ve actually seen this story unfold before as product-led growth companies have empowered other workforces in the general cloud ecosystem. One of our favorite examples is the Developer Economy, an ecosystem of tools and companies built for software developers and sold via bottoms-up approaches, which proliferated in the 2010s based on strikingly similar benefits and opportunities.

- Healthcare workers do adopt tools that make their jobs easier: If a service solves a non-core problem well, many healthcare workers are happy to outsource. Most clinicians pursued exorbitant amounts of training to practice medicine, not billing. Lifelong learning is a key tenet of the biomedical field, and most healthcare and life sciences workers understand what it means to update priors and try something new—a motion pervasive in clinical care that we can extrapolate to tech enablement and adoption. As naturally competitive and hard-working professionals, new tools that improve care, safety, and quality or alleviate burden are certain to get attention, as are companies that are building consumer-grade technologies for an industry characterized at times by a single digit NPS.

- Collaboration-based workflows drive network effects: Healthcare is a collaborative industry driven by team-based workflows such as rounding and consults, which create natural opportunities to introduce others to new tools (extending the analogy, this is not too dissimilar from the developer scrum). Being at a hospital or in a lab is akin to being on a college campus (sometimes it is!), and information travels quickly. If someone pulls up a new app on a desktop or on a phone during a meeting, odds are others will ask about it.

- Healthcare workers don’t like being sold to: Whether you’re a pharma rep or a hospital executive, most healthcare workers are healthy skeptics of salesy or pushy tactics. Community-focused products and exceptional consumer-grade experiences are a welcome replacement for traditional top-down sales and implementation.

- Clear paths to revenue expansion: Sub-segmentation within teams or departments that may have budget unlock opportunity to land an account without escalating to senior leadership. In some cases, software can spread through an organization organically without the C-suite being involved depending on the data managed in the application, compliance considerations, and cost. There is often a tipping point where integration is required (either to access data, unlock enterprise features, or for compliance), and in these scenarios, the strong influence of clinicians can move the needle. If a non-trivial percentage of clinicians are using an application and finding value, that product will likely be escalated to the C-suite, and a similar dynamic is true for researchers and scientists. Certainly, to capture the full potential of the platform, an enterprise contract is required; however, the bottoms-up motion offers a compelling Trojan horse for going to market more quickly.

- Vibrant community underpins engagement: Healthcare and life sciences workers are often highly subspecialized, and this subspecialization deepens community affinity via shared experiences. As a result, these professions can be coupled with identity (e.g., I’m a physician, I’m clinical, I’m a scientist). Leaning into these dynamics, no matter how niche, allows companies serving these professions to accelerate trust and community-building around a product/service.

So how big are these markets?

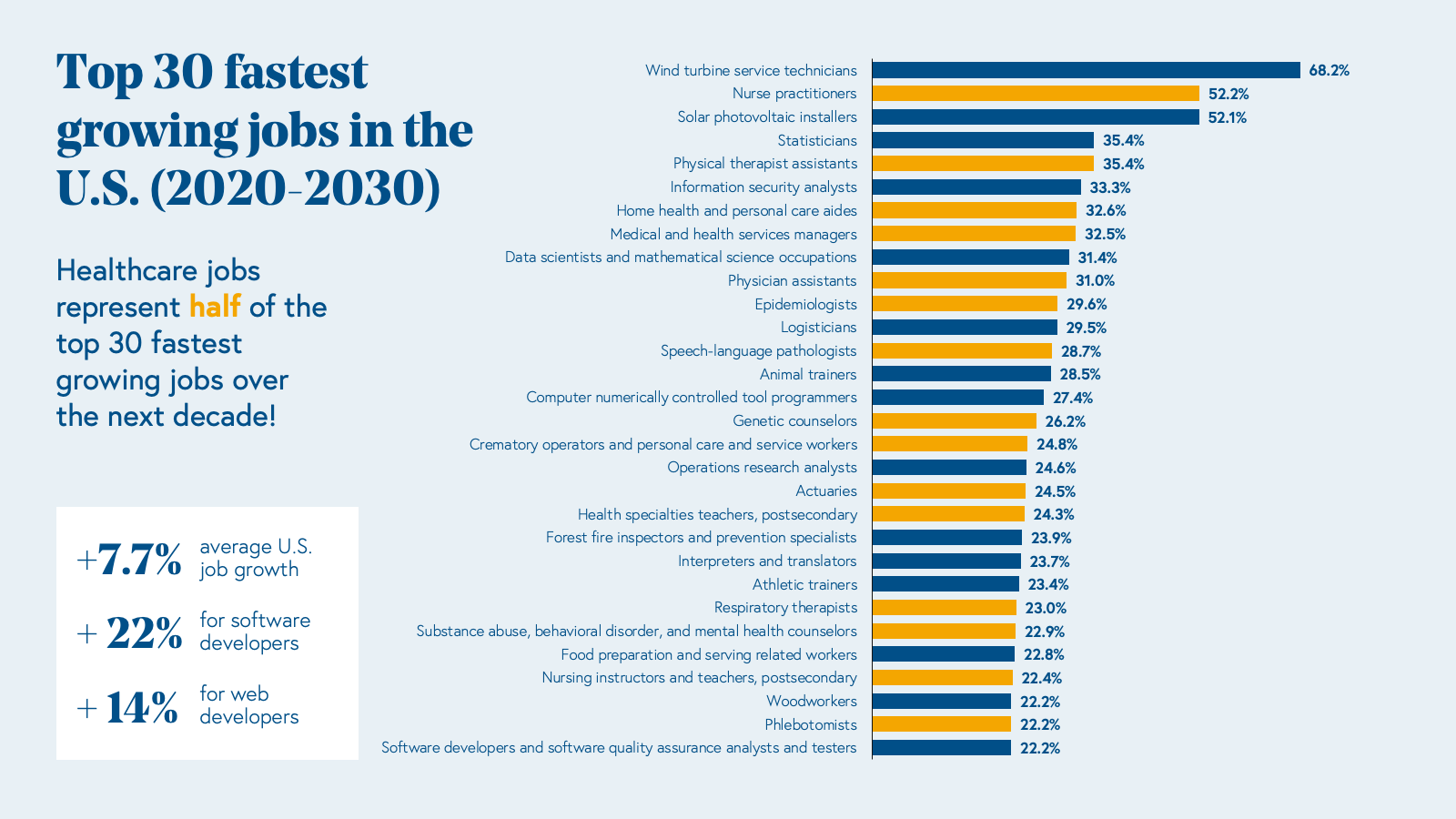

Selling bottoms-up to healthcare and life sciences represents a massive total addressable market (TAM). A whopping 14% of the US workforce works in healthcare: 1 in 7 American workers, or 22 million people, and healthcare jobs represent half of the top 30 fastest growing jobs in the US over the next decade.

Over half of these workers are involved in care delivery (clinicians or “white coats”), while the other half work in operations or administration (“suit coats”), and collectively, they earn over a trillion of annual payroll. Moreover, the industry is growing rapidly and will add 2.6 million new jobs by 2030.

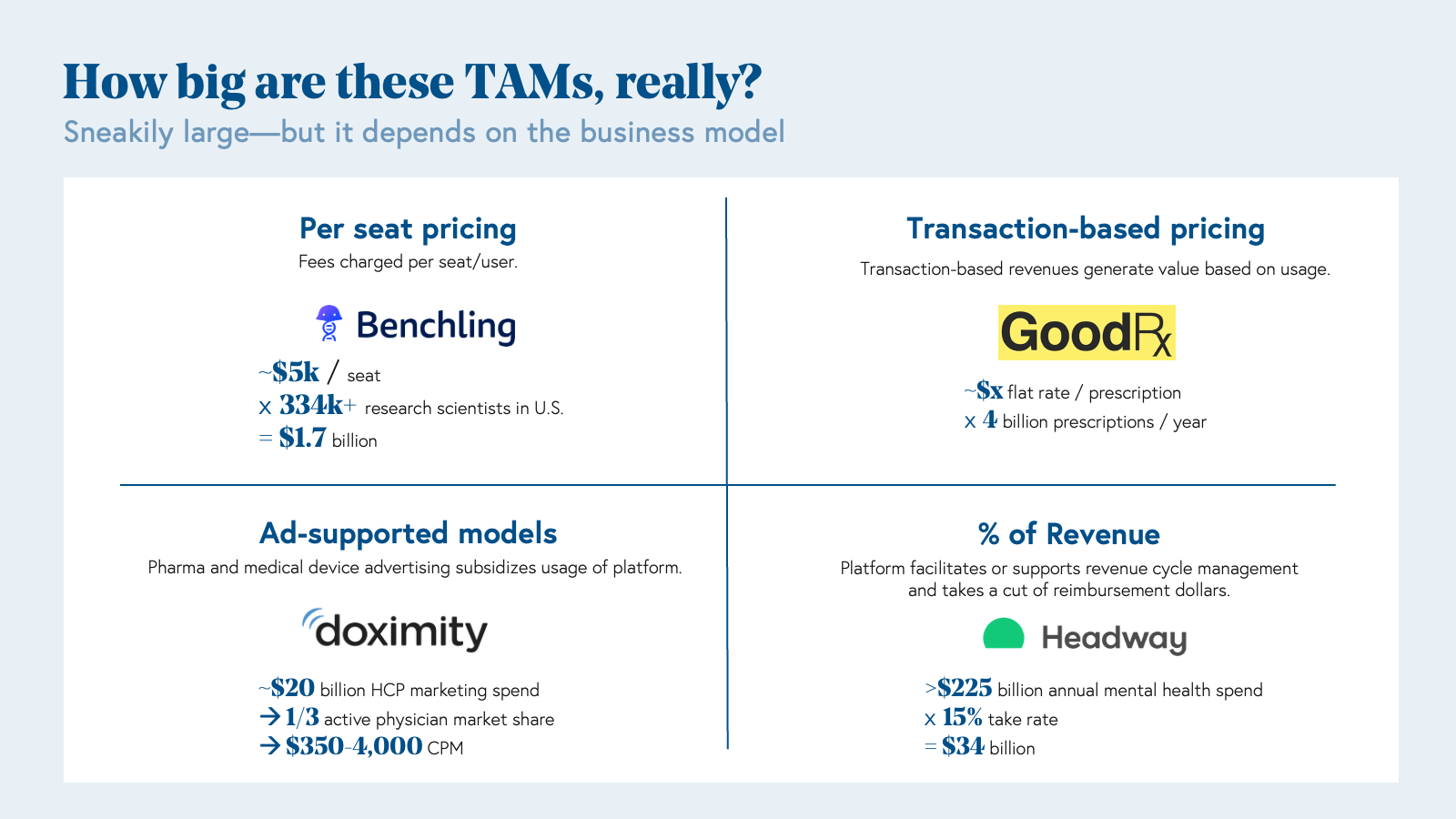

Impressive at a glance, the true TAMs for product-led health tech and life sciences companies are actually quite sub segmented, unlocked by business model innovation rather than the sheer numbers of addressable users.

For example, there are about 1 million physicians in the United States, about 4.4 million nurses, roughly 1.2 million medical assistants, and 530,000 biopharma scientists. On face value, selling software bottoms-up to each of these professional types would require a high average revenue per user (ARPU) to produce a deca-billion dollar company. Business model innovation allows product-led companies to capture the full value of serving these professionals while creating proper incentive structures for appropriate use and expansion. Let’s walk through a few case studies:

Per seat pricing: Charging an annual fee per user of software has created large outcomes when selling to stakeholders with deep pockets for software spend (e.g., Benchling selling to pharmaceutical companies for four-figure seat prices); however, this motion is less likely to yield outsized outcomes in the provider and payer worlds. Among providers in particular, institutions have already made their largest software investment yet: the electronic health record (EHR), and therefore, the spend for additional software products will likely be capped relative to the EHR. Per seat pricing can be a great way to get in the door and unlock additional business models over time.

Transaction-based pricing: Transaction-based pricing generates revenue based on usage, such as an API call or in GoodRx’s case, per prescription. GoodRx is a great example of a company that went to market via a direct-to-clinician motion by providing a drug reference tool. Clinicians using GoodRx onboarded patients to the consumer platform, which created powerful acquisition loops and network effects. GoodRx leverages a multi-faceted business model, and instead of monetizing per physician or per patient alone, one revenue stream comes from per prescription fees paid by pharmaceutical companies.

Ad-supported models: Companies leveraging ads based models in healthcare and life sciences are not too dissimilar from generalized consumer platforms. These companies capitalize on high engagement with valuable demographics, such as physicians. In Doximity’s case, the company went to market as a social media platform for doctors, but on the inside, is actually a product-led company that offers a simple but powerful tool: a dialer that allows doctors to call patients from private numbers and/or call directly to voicemail to leave a message, similar to a voice note. Instead of charging per physician user, Doximity generates revenue from pharmaceutical advertising on its platform, and in return, has demonstrated return on investment for pharma clients by increasing prescription volumes. Therefore, Doximity’s TAM is not defined by a per seat fee x the number of physicians. Rather, Doximity’s TAM is based on the $20 billion marketing and advertising spend of biopharma healthcare providers on the platform.

Take rate: These companies typically take a cut of reimbursement dollars by facilitating or supporting aspects of revenue cycle management. Over the last five years, we’ve noted an explosion of companies serving mental health providers such as therapists and psychiatrists (Headway, Sondermind, Alma, Grow Therapy), maternal health practitioners (Zaya Care), and more recently dieticians by assisting with insurance billing and reimbursement. On a surface level, selling to psychiatrists or psychologists alone would not be a large market on a per seat basis as there are approximately 25k and 180k in the U.S., respectively; however, taking a percentage of the $225 billion dollar mental health spend is massive.

Business model selection is key for product-led companies “flipping the switch”—that is, transitioning from a focus on user acquisition and engagement to monetization within the enterprise. While strong user engagement and utilization might spark a meeting with an enterprise decision-maker, selecting the right business model that aligns incentives properly drives long term enterprise value. Some companies are solving a pain point that is sufficiently acute that healthchttps://www.epocrates.com/are workers will pay out of pocket either personally, or in rare cases, will pay then seek reimbursement from their employers. One benefit, however, of selling to clinicians and scientists is that those mature in their careers have more disposable income to buy and try new products. For those that do not yet have income stability, notably trainees pursuing MDs, PhDs, and NPs, there’s a unique window during training to establish trust, brand, and community within these populations. FIGS, a leading medical apparel company akin to “Patagonia for scrubs,” has done a great job doing just this.

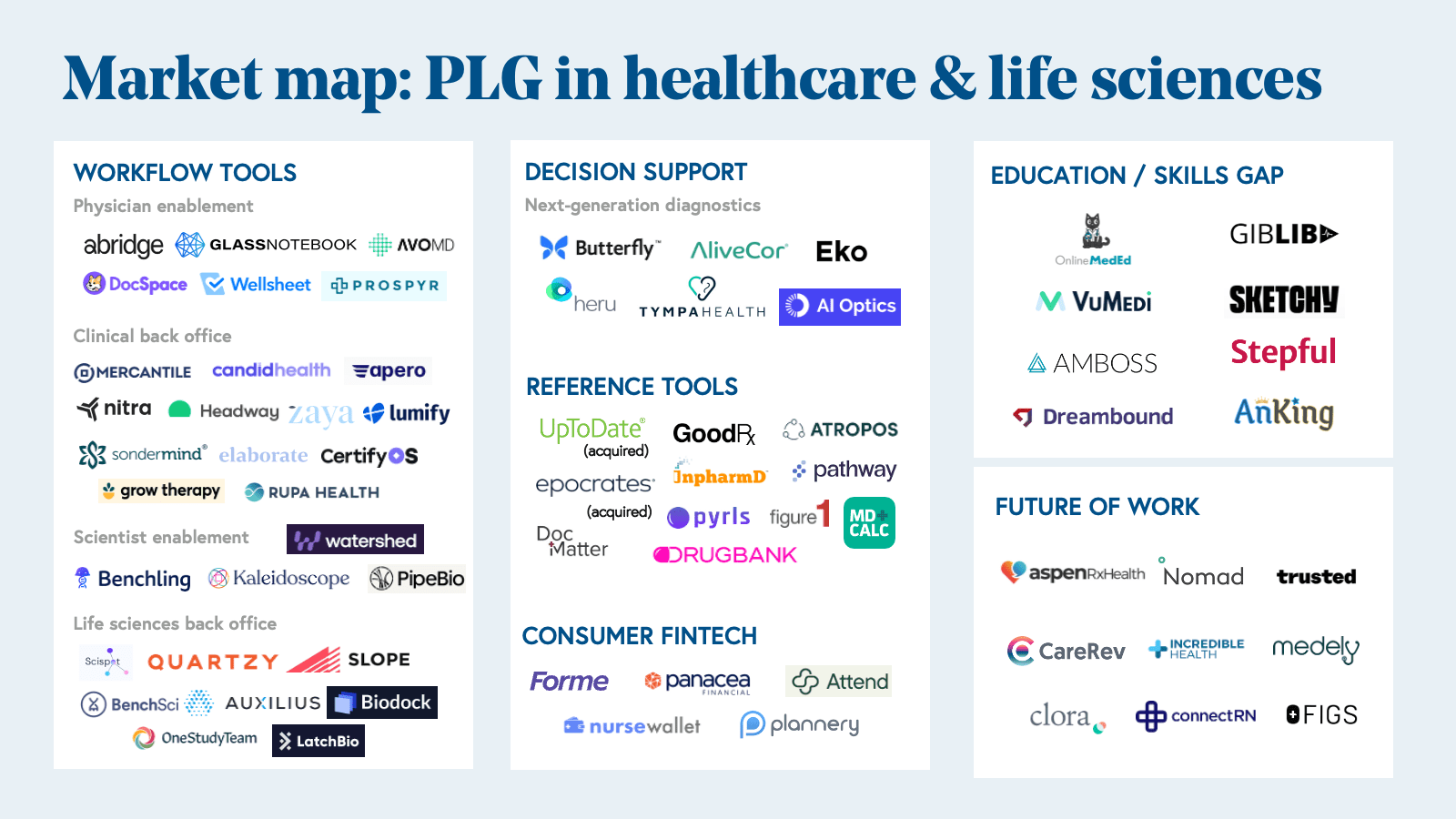

Emerging categories of innovation in PLG healthcare

We’re seeing more companies lean into the direct-to-clinician sales motion—selling directly to clinicians with the hope that these tools will eventually be adopted by their entire organizations (whether those are hospitals, clinics, research labs, or pharma companies.) Here are five categories of innovation that will only grow over the coming decade. In this section, we include companies that are both truly product-led (i.e., user can access the product online without having to speak to an employee of the company) and sales-touched (i.e., user may need to request a demo before onboarding). The cohort of companies in healthcare and life sciences that are truly product-led remains nascent but growing, and we’re seeing signs that more sales-led companies are exploring how to architect freemium models that allow users to get started without requiring deep integration or compliance conversations before delivering value.

1. Workflow

This new class of tools is designed to streamline the workflows of healthcare and life sciences workers with consumer-grade applications. In the 10 Laws of Healthcare, we note there are both front office and back office workflow automation opportunities. Front office platforms might support care delivery or patient-facing clinical trial workflows, such as audio-first documentation companies going direct-to-clinician like Abridge, whereas back office are focused on the operations of care, trials, and experiments, including companies like Slope, a clinical trial supply chain management company that sells bottoms-up to trial site coordinators. Also included in back office workflow tools are revenue cycle management (RCM) managed services organizations (MSOs) like Headway, Sondermind, Alma, and Grow Therapy, which take a bottoms-up approach to powering behavioral health billing and collections.

2. Decision support

As our current corpus of medical knowledge doubles every 73 days, it’s not feasible for practitioners to retain every detail. Software and AI are well-suited to supercharge clinical workforces via next-generation clinical decision support (CDS) tools and computational diagnostics.

For decades, the darling of CDS has been UpToDate, a platform akin to a “curated StackOverflow for medical knowledge,” which was started by an enterprising nephrologist who sought to digitize his medical texts so that he could update them frequently in between new editions. The company, which began as software passed among physicians on floppy disks, is now a global leading medical information resource serving 25 specialties, all supported by a worldwide community of 6,000+ authors and editors.

Building upon foundational resources like UpToDate and Epocrates, next-generation CDS tools are personalized and leverage advanced computational methods to inform clinical decisions. For example, Atropos Health, a physician consultation service powered by publication-grade real-world evidence studies called “prognostograms,” leverages millions of anonymized patient records, coupled with a powerful querying language, to empower physicians to answer highly specific questions pertaining to patients under their care. (You can order a prognostogram here!)

Glass Health is another company that is reimagining medical knowledge management for healthcare professionals akin to what Notion has done for technology workers. Medicine-specific features, online community, and proprietary content differentiate Glass from generic notes apps and tools.

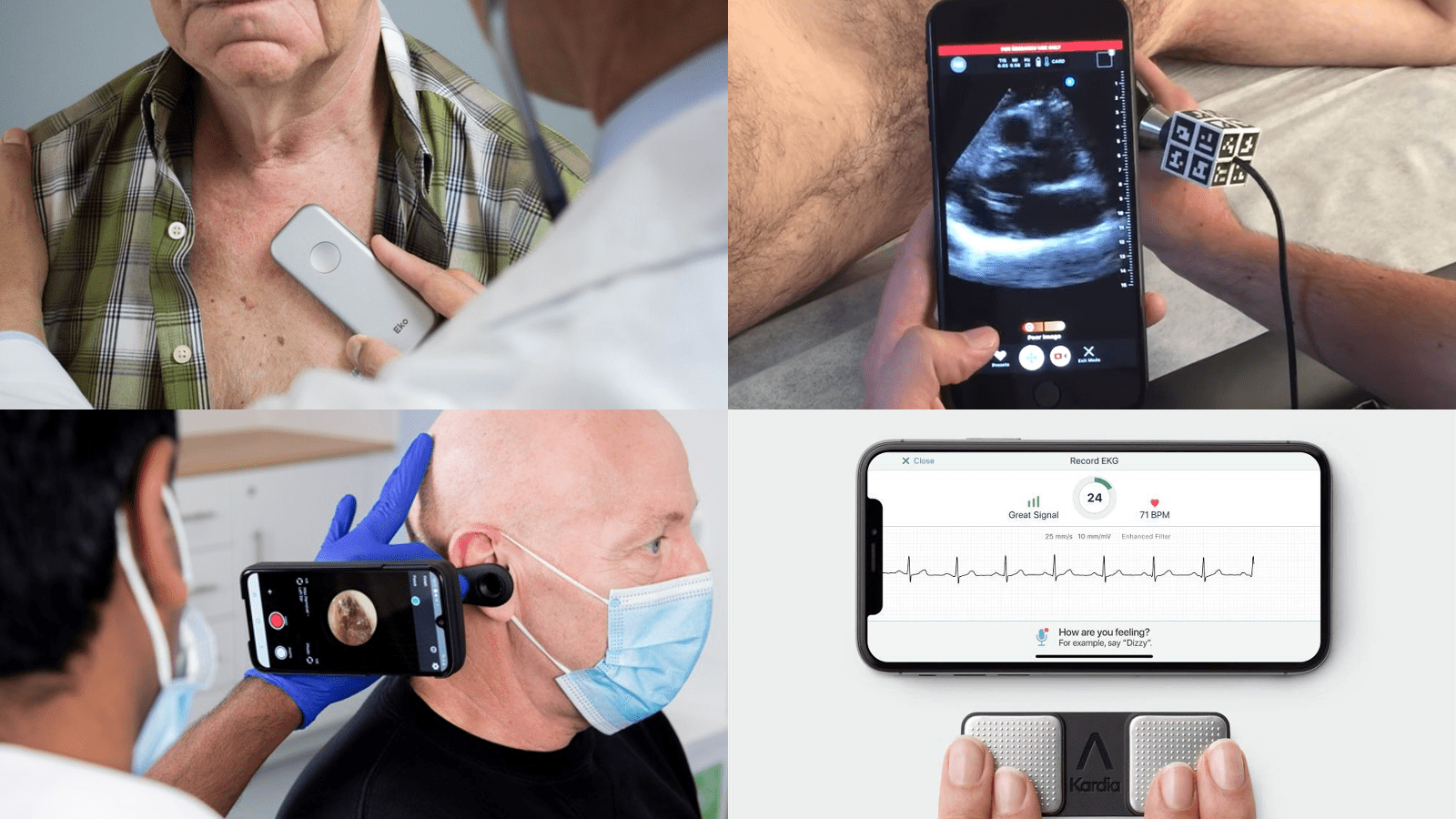

In addition to next-generation CDS, a new class of computational diagnostic tools are also emerging and going to market via bottoms-up motions that target clinicians as consumers. Many of these consumer-grade diagnostics can run on iPhones, such as:

- Butterfly, a portable ultrasound that clinicians can bring to homecare sites or in a hospital setting;

- AliveCor, a digital EKG that clinicians can hook up to the back of their smartphone;

- Eko, an AI-powered stethoscope that rivals the coveted Littmann procured by first-year medical students just in time for their white coat ceremonies;

- Tympa Health, a hearing health screening platform.

The success of this burgeoning category of computational diagnostics has hinged on two factors: 1) direct-to-clinician go-to-market models, and 2) powerful mobile-first experiences. Each time a new smartphone is released, ask yourself – with these hardware advancements, what new tools might be possible (e.g., diagnostic, clinical, scientific, etc.)?

3. Education / skills gap

With a deficit of qualified workers (white coats and suit coats) to meet our growing demand for healthcare services, only exacerbated by the massive expense of training for these roles, there’s an opportunity to adopt novel edtech models to recruit new and upskill existing healthcare workers. Principles from massive online open courses (MOOCs) like Udemy and Coursera, and new cohort-based learning models like Studio and Maven, could be applied to healthcare certifications, continuing medical education requirements, and pharma/medical device healthcare provider education.

There are companies bringing these approaches to life. Stepful, a company leveraging cohort-based learning for healthcare certifications, enables students to pursue training for roles such as medical assistant, phlebotomist, and EKG technician via virtual-first and hybrid virtual and in-person curricula–all with the goal of increasing our supply of allied health workers. Mobile-first medical education company, Amboss, has emerged as a leading consumer platform for medical trainees.

4. Consumer fintech

Due to the education and training requirements of working in healthcare and life sciences, many MDs, PhDs, NPs, and other specialists often exhibit a very specific financial trajectory that differs from other professions but benefits from remarkable stability after completing training. Companies tapping into the specific financial needs of medical and scientific trainees such as Forme Financial, Plannery, Panacea Financial, and Nurse Wallet are well-positioned to capture and build trust with this high earning demographic early in their careers, creating long-term relationships and opportunities to upsell financial products and services over time. I’d be remiss not to mention that many of these companies are building on the foundations laid by The White Coat Investor, an online platform focused on financial wellness built by physicians for physicians in 2011.

5. Future of work

We've seen gig economy models take shape in many workforces, and healthcare is no exception. Following rapid expansion of telemedicine during the pandemic, working from home has become a sustainable option for many healthcare workers, and for the first time, clinicians don’t have to choose between maximizing earnings potential vs. working virtually thanks to telemedicine reimbursement parity. New infrastructure is needed to support virtual-first clinicians (and other healthcare and life sciences workers such as scientists) and those working as part of gig economy platforms.

We’re also excited about companies tapping into how clinically and scientifically trained workers can contribute knowledge outside of direct service delivery, and companies such as Clora, a next-generation expert network for life sciences, are creating alternative revenue streams and career opportunities for these highly skilled professionals.

Across all of these areas of innovation, keep an eye on mobile as critical and largely untapped real estate for healthcare and life sciences worker technology.

Technology reimagines what healthcare and life sciences workers can achieve

Ultimately, there has never been a more important time than now to empower healthcare and life science workers to do their best, most efficient work. Luckily, there’s a new wave of innovators who are building the tools to unlock unprecedented advances in the healthcare and life sciences field.

If you’re a founder building in this space, we want to hear from you. If you own or operate a medical or scientific website and want to chat about how you might be able to scale up, drop us a note. Email morgan@bvp.com, and let’s continue this conversation on Twitter @morgancheatham!