Eight lessons from the first climate tech boom and bust

On the brink of a new technology movement to build a climate-conscious and more sustainable world, we reflect on the lessons and insights from CleanTech 1.0.

If it’s not already clear, climate change is the defining issue of our current era. Human emissions of greenhouse gasses have already warmed the earth by 2 degrees Fahrenheit since pre-industrial times and its effects are palpable. Among a long list of other first and second order effects, the sea level has risen by about eight inches and is predicted to rise eight more feet at our current rate of emissions. In addition, heat waves and forest fires are becoming more extreme, and the Arctic will likely become ice free by mid-century if current emissions hold.

Beyond global warming, the current European energy crisis has made it abundantly clear that the need for cheaper and more clean energy is of geopolitical concern. Due to European dependence on Russian oil and gas, energy prices are soaring, and as winter settles in, European countries are capping energy bills and providing multi-billion dollar aid packages to struggling utilities. Society-at-large severely needs the next generation of climate technologies, and getting there will require massive investment from governments, corporations, and investors alike.

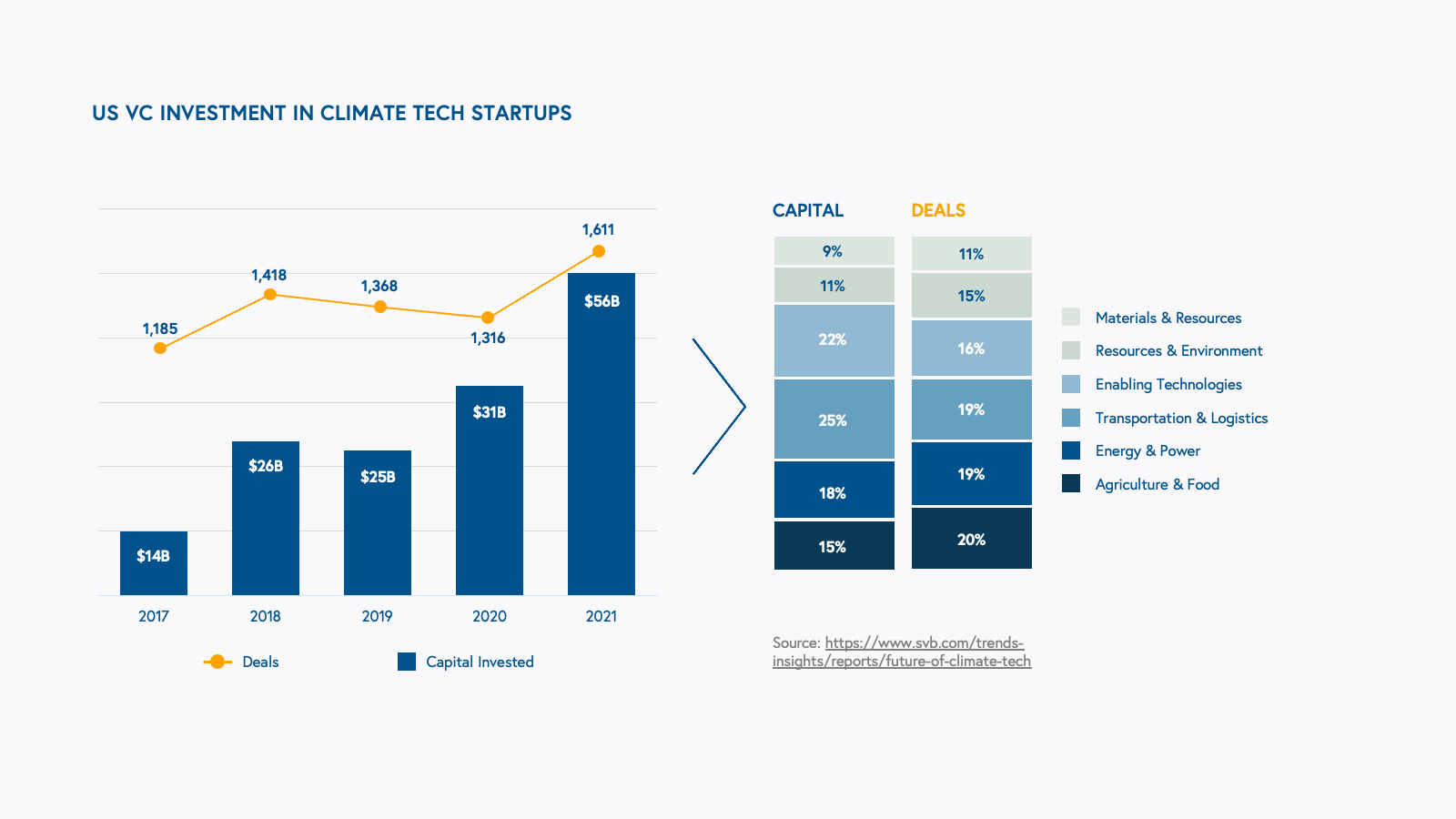

Over the past few years, we’ve seen a surge of venture capital funding into climate tech. In the last three years alone, almost $100 billion has been invested across sectors such as renewables, energy storage, mobility, agriculture, the circular economy, among others. This funding is momentous, both for the industry and for the future of humanity.

The recent injection of capital into the climate sector, however, might trigger flashbacks to the highly-publicized CleanTech 1.0 boom and bust from 2006-2011. According to a well-known post-mortem study, of the $25 billion that VC investors poured into CleanTech 1.0 from 2006-2011, more than 50% was lost by 2015. For instance, solar-panel developer Solyndra attracted over $1 billion in private and government funding, only to go bankrupt in 2015. Biofuel manufacturer KiOR was once valued at $1.6 billion but had burned through over $600 million of capital and went bankrupt in 2014.

Of course, it’s easy to say “that was then, and this is now.” Indeed, we’ve made this argument, as we believe the market and macro conditions are ripe today for outsized climate investing returns and impact. We also believe that ClimateTech today encompasses more than CleanTech did in the 2010s—where CleanTech 1.0 focused primarily on energy innovation in categories like solar and biofuels, ClimateTech 2.0 builds on top of the advancements in clean energy made over the last decade, encompassing solutions that support sectors as diverse as consumer, agriculture, manufacturing, maritime shipping, transportation, and construction.

Despite our excitement about the space, we believe it’s still important to temper enthusiasm with realism: climate tech investing is important, but we need to assess whether and when VC is the right asset class for funding a climate endeavor. Generalist VC funds have limited time horizons and specific return profiles, and not all climate companies are able to meet that bar. At the same time, we don’t think it’s wise to categorically reject climate companies simply because we have battle scars from 15 years ago.

With this in mind, we took a long, hard look at some of the successes and failures from CleanTech 1.0 and spoke to entrepreneurs and investors from that era to pick their brains on the lessons they learned. We hope that this wisdom can be applied today by entrepreneurs and VCs alike to make the next wave of climate technologies more effective. For each of these lessons, we highlight a mini-case study of a CleanTech 1.0 industry or company and a ClimateTech 2.0 example to illustrate where we’ve been and where we’re headed. Some of these case studies highlight the success stories from CleanTech 1.0 while others are cautionary tales. Of course, we hope not to fall into the trap of cherry-picking evidence, especially because the CleanTech 1.0 era was driven by a kaleidoscope of complex factors that can hardly be reduced to a set of core principles. Nonetheless, we hope these lessons shine light on how we think about climate companies today.

1. Avoid relying exclusively on altruism to scale

Consumers and shareholders alike are demanding that companies and industries reduce their reliance on fossil fuels and move towards net zero. The best climate technology companies of the coming decades, however, will not scale on altruism and corporate promises alone. Instead, they’ll find ways to provide alternative solutions in energy, agriculture, building electrification, and industrials (among others), that are both greener and deliver economic ROI to customers.

One way to do this is to offer green products at price parity with existing solutions. However, if you aren’t able to offer a product at price parity or low- or no-cost, another way is to offer green products that have secondary or tertiary value propositions, unrelated to climate change. These additional value propositions should be important enough to customers that they’d be willing to purchase at a premium.

Given the importance of this lesson, we provide two case studies for each of the CleanTech 1.0 and ClimateTech 2.0 eras.

CleanTech 1.0 case study: Fracking

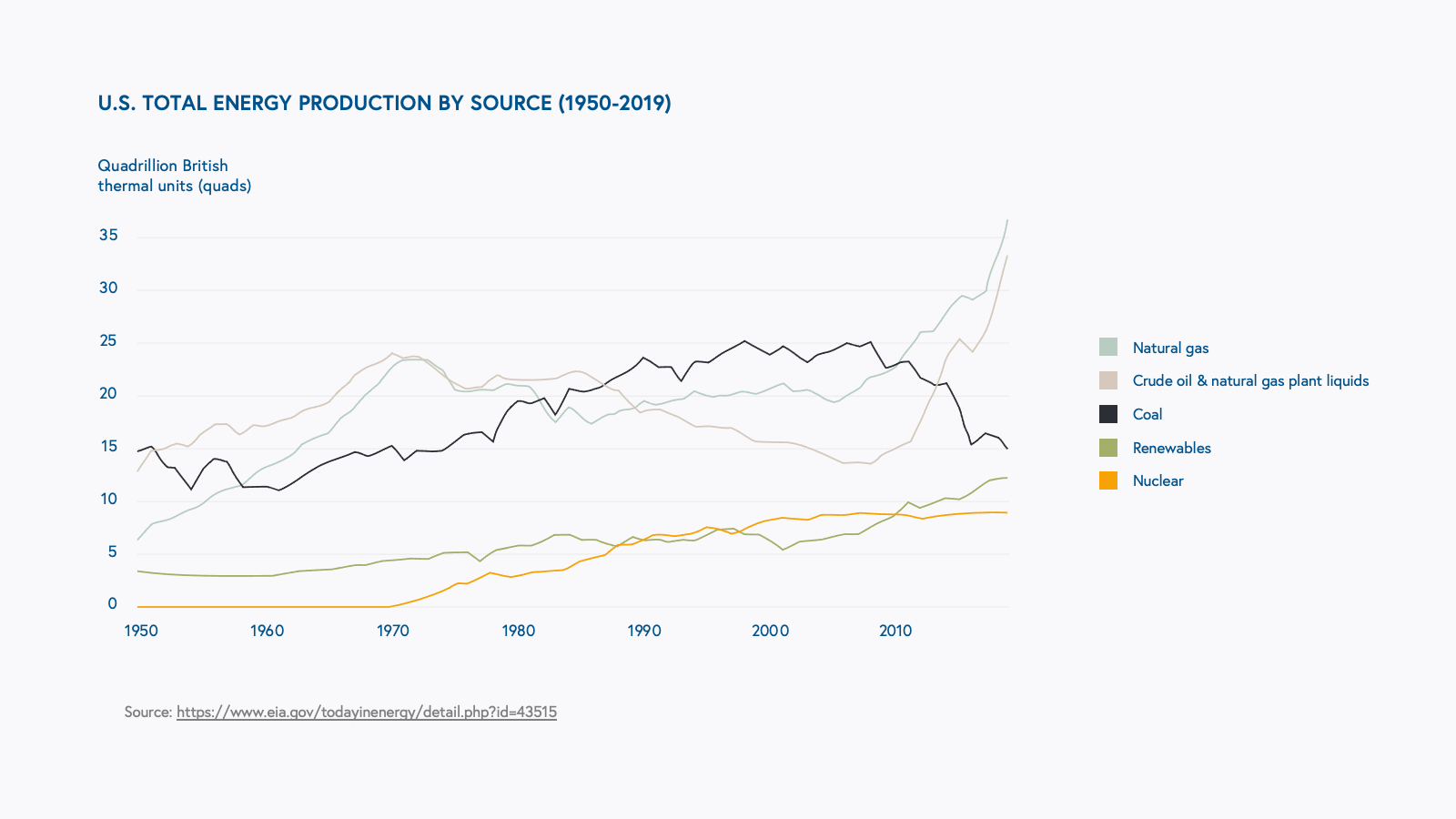

In CleanTech 1.0, climate founders and investors learned the hard way that electricity is the ultimate commodity. While a number of startups offered new methods for producing renewable energy, ultimately, it did not matter to consumers and businesses how their electricity was generated––the only thing that mattered was price.

For example, amidst a proliferation of clean technologies, the broad commercialization in the mid-2000s of fracking resulted in the widespread adoption of natural gas as a source of energy significantly cheaper than oil and coal. This made it even more challenging for clean energy to reach price parity, deteriorating prospects for innovative technology companies in solar, wind, hydropower, and nuclear. Despite harmful environmental impacts, fracking provided a source of natural gas at a price that blew renewables out of the water, so we flocked to it anyways. Without price parity or regulatory requirements and incentives, companies found themselves struggling to scale off of consumer and corporate altruism alone.

CleanTech 1.0 case study: Biofuels

During the CleanTech 1.0 era, companies like Amyris, Gevo, Enerkem, and Neste rushed to develop biofuels as an alternative to diesel. Biofuels are any kind of plant mass converted into a liquid fuel for transportation needs. The enabler for biofuels in the early 2000s was the use of genetic engineering to supercharge the feedstock (e.g., sugarcane, corn, etc.) involved in fuel production. The difficulty, however, was that these companies weren’t able to make their genetically-engineered biofuels cost-competitive with something as cheap as oil. As a result, companies routinely over-promised and under-delivered their production amounts, and many biofuel companies were unable to survive.

The successful biofuel companies realized that their genetic engineering platform could be used to develop clean products for other, high-margin industries. These companies began building products like rubber, plastic, nutritional supplements, chemicals, and beauty products. By using the same technology to go beyond pure biofuels and to concurrently produce much higher-margin products, these companies supplemented their value proposition beyond just climate.

ClimateTech 2.0 case study: Expensive carbon credits

The success and longevity of tomorrow’s climate tech startups will depend on building solutions that can reach scale through more concrete means, such as through price parity against competitive, non-green solutions. For example, big tech and corporations will play a role in the carbon capture markets, but it would be tough to rely solely on altruistic corporate investment alone to scale this market. One such example of a large corporate investment is =Frontier—a fund committed to jumpstarting the carbon removal market by providing an advanced commitment of almost $1 billion towards the purchase of carbon removal services. However, among the projects selected for investment by the Frontier fund, the cost to sequester a ton of carbon ranges between $500 and $1,800. In order to remove the 1.5 to 3.1 gigatons of carbon to reach net zero, we’d need to spend $3 trillion annually on carbon sequestration at these price points!

Advanced market commitments from large corporations like the backers of Frontier Fund will certainly help to scale carbon capture over the next decade, but it is highly unlikely that businesses beyond massive corporations with exceedingly deep pockets will make investments like this one at the scale necessary for a meaningful outcome. Therefore, we’re particularly excited by carbon capture and sequestration solutions that either have a clear pathway to widely accessible price points or provide additional, non-climate benefits that would justify a higher price.

ClimateTech 2.0 case study: Soil carbon sequestration

Today, many climate companies are pursuing strategies that offer co-benefits in addition to mitigating climate change. One of the clearest examples is in soil carbon sequestration. The pure climate angle for these companies is that they are able to capture and sequester carbon from the atmosphere directly in the soils. However, in addition to offering climate benefits, these companies also improve soil health and increase crop yields, which directly impact the bottom line for their customers (i.e., farmers). These co-benefits enable faster customer uptake and adoption.

2. Innovate on business model to tackle challenging sales motions

One impediment creating friction among ClimateTech companies is that they often sell to slow-moving legacy industries, making the sales motion for climate companies particularly difficult. One way climate startups can grease the wheels for the sales motion is by innovating on their business models to make it a no-brainer for customers to purchase or use the product. That is, companies often develop unique business models that enable them to provide concrete value to customers at low cost while still making a profit.

CleanTech 1.0 case study: Solar

During the CleanTech 1.0 era, residential rooftop solar providers like Sunrun succeeded thanks to business model innovations that enabled customers to install solar panels at zero cost to them. Sunrun recognized two things in particular. First, Sunrun entered into power purchase agreements (PPAs) with its customers, whereby customers purchased power at a fixed rate from Sunrun. This fixed rate was usually lower than the rate charged by utilities, so consumers had a clear incentive to switch from their utilities to solar. Sunrun would then turn around and sell any excess energy to utilities. Second, Sunrun acquired debt from banks who were willing to front the money for solar panel installations, which meant that Sunrun’s customers didn’t need to pay a cent for installation. The banks would retain a security interest over the solar panels, and Sunrun would pay the banks back through some of the cash made by selling electricity back to utilities.

ClimateTech 2.0 case study: Soil and food

For emerging technologies in sectors that have yet to become the norm (e.g., ClimateTech), there needs to be win-win business incentives for prospective customers as they take on edgy technology. For example, in the soil carbon sequestration space, companies like Loam Bio are trying to help farmers implement new technology for their crops to sequester additional carbon in the soil. Through revenue sharing agreements whereby these companies split the carbon credits with the farmer, companies are often able to provide these technologies to farmers at no cost. Some companies are even paying farmers to implement such technologies.

Another example is Neutral Foods, which helps farmers measure and reduce their carbon emissions, first starting with milk production. Up front, Neutral enters into advance purchase agreements with farmers to purchase the carbon-neutral milk at prices the farmers typically would command from its distributors and grocery stores, allowing farmers to capture revenue faster. Once the milk is produced, Neutral turns around and executes on a consumer packaged goods (CPG) strategy, selling this milk to climate-forward consumers, who are willing to pay a premium at grocery stores.

3. Leverage the regulatory environment as an advantageous tailwind

Across the board, government policies have and will continue to play a central role in the success of climate startups. Monetary policy levers like direct funding and tax credits or non-monetary levers like restrictions on carbon emissions can strengthen customer demand for a startup’s products, or serve as a bridge for companies to reach attractive unit economics.

While climate legislation spurred excitement among investors during CleanTech 1.0, the energy policies passed in the 2000s are dwarfed by the recently passed Inflation Reduction Act. This sweeping national policy is part of a grand strategy to transition the economy away from fossil fuels, leaving hardly any sector untouched. Climate startups certainly should use the IRA to fuel their growth. That said, we believe the companies that will ultimately win will figure out how to achieve attractive unit economics at scale without the permanent aid of government funding.

CleanTech 1.0 case study: ARPA-E and early climate legislation

In the 2000s, there was optimism that climate legislation would generate demand for cleantech products and services. The Energy Policy Act of 2005 enacted tax credits for consumers, home builders, and vehicles utilizing renewable energy sources and later, the 2009 American Recovery and Reinvestment Act offered $90 billion to support clean energy generation. $400 million was also earmarked to launch the Advanced Research Projects Agency for Energy (ARPA-E), which would incubate new green technologies.

ARPA-E demonstrated success in catalyzing an initial wave of energy startups; given its independent structure and focus on commercialization, its 1,200 projects later attracted $5.4 billion of private-sector funding. It filled a gap in energy startup funding by focusing on “technology visioning” and backing high-risk technologies that had the potential for sector-wide transformation in overlooked research areas. However, ARPA-E funding was part of an early and limited approach to help commercialize specific technologies––not a widespread, national climate strategy. Indeed, the legislation in 2005 and 2009 were important steps in the right direction towards reducing emissions but were more limited in scope than the recently-passed IRA. In later years, government funding for energy startups faced backlash when Solyndra, a high-profile government-funded company that later went bankrupt, became a cautionary tale of “wasteful government spending” despite overlooked examples of government catalyzing important early R&D for many energy startups.

Climate tech 2.0 case study: The IRA, ETS, and SEC regulation

The recent passage of the Inflation Reduction Act has spurred optimism for climate tech founders. Its $370 billion investment across a broad range of industries working towards decarbonization represents the single largest investment in climate in US history. The IRA provides not only incentives to lower the production cost of clean energy, but also tax incentives that will drive consumer adoption of clean technologies. Crucially, the IRA is part of an integrated structure that focuses on decarbonization across a myriad of sectors, including electricity production, transportation, industrial manufacturing, buildings, and agriculture, indicating a commitment to dramatically changing the U.S. energy landscape. In addition, the government has continued to build out the ARPA-E program, as well as other grant and fellowship programs to bridge highly technical energy startups moving from lab to market. While we are excited about these tailwinds, given the complexities associated with securing funding from appropriations committees and government programs, we hope that startups view public funding as a temporary bridge to mass adoption and strong unit economics, rather than as permanent aid.

In addition to sweeping monetary levers, we’re tracking a number of regulatory unlocks that we believe will provide structural advantages for climate technology startups. For example, to move towards low- and no-emissions fuels in maritime shipping, the EU’s “Fit for 55” climate package aims to involve maritime shipping in the EU’s emissions trading system and implement a directive on energy taxation that would incentivize alternative fuels at the expense of conventional maritime fuels, among other initiatives. The successful passage and implementation of such initiatives will spur startups producing low-carbon and no-carbon fuel technologies. In the US, a recent SEC proposal would require companies to include climate-related disclosures and risks in their registration statements and periodic reports. This, in turn, will inevitably create a wave of startups that help companies collect and analyze such data (see point #9). The question, though, is exactly when this rule will be implemented and in what form. Rules often slowly make their way through agencies and deliberative bodies, so in the interim, startups should proceed with caution when anticipating the implementation of such rules.

4. Beware of supply chain shocks

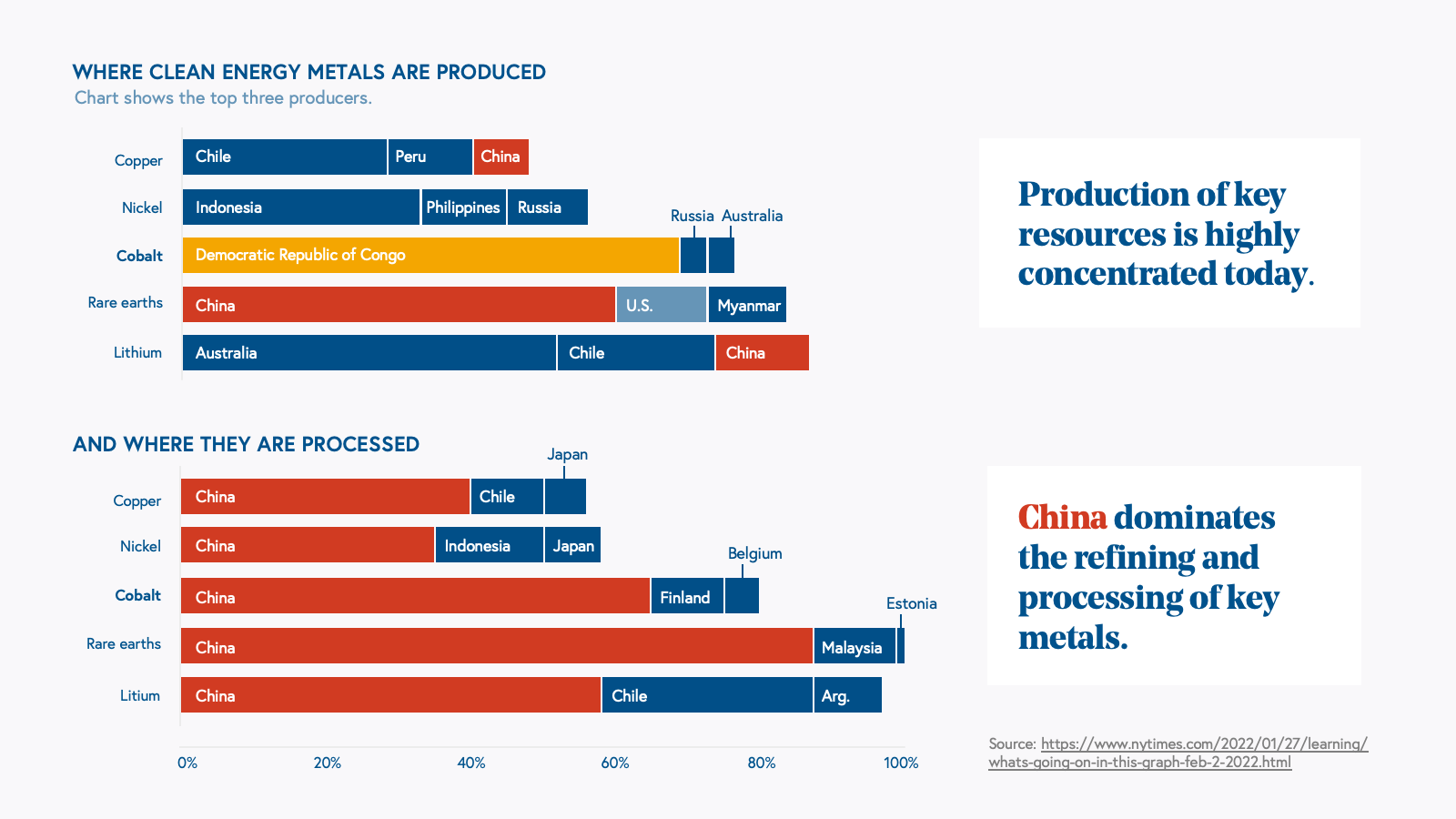

Given the global scope of supply chains for renewable energy assets, climate companies are particularly sensitive to exogenous events or actors that fundamentally change the nature of the supply chain. If a supply input (such as silicon or cobalt) lies in a region impacted by a dramatic external change, downstream climate technologies will face repercussions as they did in CleanTech 1.0.

CleanTech 1.0 case study: Solyndra and cheap Chinese solar panels

The failure of numerous solar panel innovators in the mid-2000s was due in part to cheap Chinese solar panels that flooded the market. The most well-documented of these bankruptcies was Solyndra, which offered a revolutionary method for building solar modules that was both more efficient and did not include silicon. Solyndra’s idea was to develop solar panels using copper, indium, gallium and selenium (CIGS), rather than silicon, which had been climbing to unsustainable prices. In short, Solyndra bet the company on the decreasing supply and increasing price of silicon.

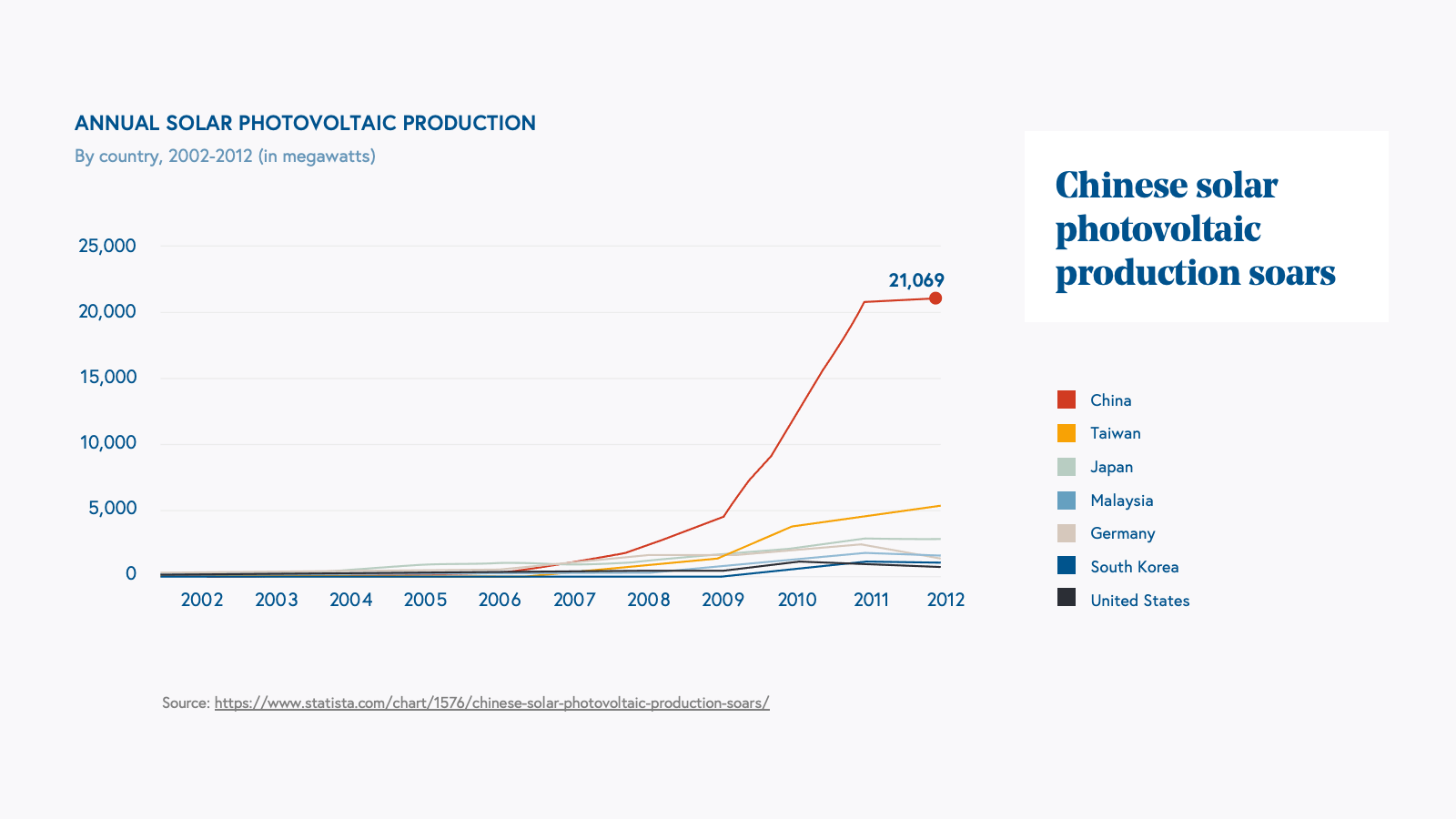

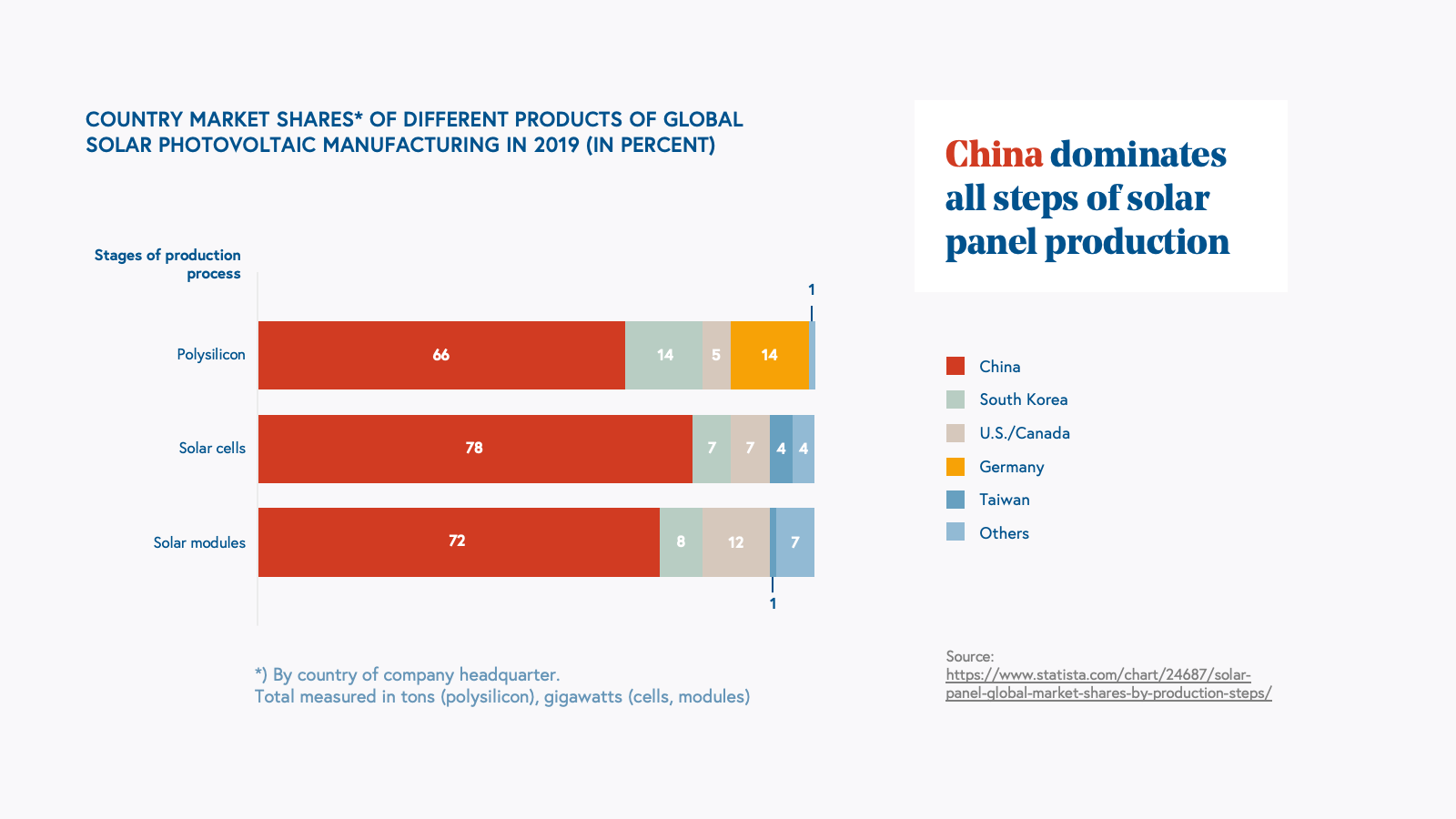

By 2011, Solyndra had raised $1.1 billion of VC money, and $535 million of government loans. However, around this time, China began heavily investing in domestic solar panel production. In the span of ten years, China went from manufacturing just 6% of the world’s solar panels in 2006, to more than 50% by 2011, and the panels produced were 20% cheaper than the US alternative. Combined with a subsequent decline in the price of silicon, there was no way for Solyndra and other solar innovators to compete. Traditional silicon panels produced in China had won. Ultimately, this would drive down the price of solar and spur the more widespread adoption that we see today, but it also contributed to Solyndra’s widely publicized bankruptcy and serious battle scars for both the US government and Solyndra’s investors.

ClimateTech 2.0 case study: Rare earth metals

Today, we still need to be wary of companies betting their lifeblood on either the continuation (or disruption!) of supply chain trends, given the degree to which these trends are outside of a company’s control. For example, China today dominates the supply chain for rare earth metals, which are a crucial input to climate technologies like batteries. Cobalt, in particular, is essential to improving the stability of lithium ion batteries, but about 85% of the world’s cobalt supply used in batteries has been processed in Chinese refineries.

Some battery and electric vehicle manufacturers have tried to reduce their dependence on Chinese cobalt by turning to nickel. But Chinese companies that dominate the cobalt market have now begun to invest heavily in nickel extraction. Despite increasing investment in mineral extraction by the US and Europe, China has continued to dominate the market given its headstart and ability to undercut other markets on price.

Companies should not throw their hands up in frustration and refuse to enter or build out complex, international supply chains. However, they should have contingency plans, especially in the absence of internal or domestic production capabilities. A number of companies like Lilac and KoBold Metals are helping to bolster discovery of lithium and other critical materials by leveraging software. After using predictive models on their corpus of data, they are able to find and partner with mine owners, exploration companies, and mineral resource businesses to extract critical resources necessary for the energy transition.

5. Invest in engineering problems, not science experiments

One primary difficulty with venture investing in climate tech is that we need to invest in companies building products that actually work, both from a technological standpoint and an economic standpoint.

When we’re evaluating new climate tech deals, we always ask ourselves the following set of questions:

- Does the underlying science already work, or is the technology dependent on some experimental breakthrough?

- What things need to be true in order for the technology to work economically at scale?

- Are those things in the company’s control (e.g., engineering) or are they external?

- Is there a plausible path for the economics to make sense within the next seven years?

If a product doesn’t work technologically, then the scientific research required to make it work should be funded by government grants (e.g., SBIRs and ARPA-E grants) and research institutions, not by venture capitalists. More robust ties between universities, national labs, and corporations can also bridge the gap between innovative technologies and business needs, preparing the path for venture capital and other financing to support commercialization. For those technologies that struggle to prove out unit economics, it may be worth investing in upstream technologies (e.g., materials or manufacturing) that will enable downstream technologies to work economically.

CleanTech 1.0 case study: Tesla

Rather than designing a new battery chemistry from scratch, Tesla in 2009 signed an agreement with Panasonic for the latter to supply lithium-ion battery cells to the former. However, these NCR 18650 battery cells were the size of AA batteries, and one battery alone was obviously not enough to power an entire 2.5-ton car. Tesla’s ingenuity was stringing 7,000 of these batteries in series and developing a way to compartmentalize battery failure such that the failure of one cell wouldn’t affect the entire battery pack. The crucial point here is that from day one, these individual batteries worked, and Tesla’s challenge was one of engineering, not of fundamental science.

ClimateTech 2.0 case study: Nuclear

The science for nuclear fission has been around for 50 years already. Even Generation IV reactor fuel cycles (e.g., high-temperature gas reactors) have been implemented in the past (e.g., the Fort St. Vraine and Peachbottom reactors). One main challenge with Generation IV startups has been engineering: How do we shrink these reactors down in size? For example, nuclear startups like Radiant Nuclear and Oklo are shrinking their reactors to the size of cargo that can be carried by commercial airplanes. These micro-reactors are quickly deployable and can deliver energy to remote areas that can’t be served by renewable energy. Of course, these startups also face risks like regulations and supply chain, but outside of political risk, these are engineering problems that can be solved through R&D rather than experimental breakthroughs.

6. Be wary of long investment horizons and financing risk at each stage of the company’s lifecycle

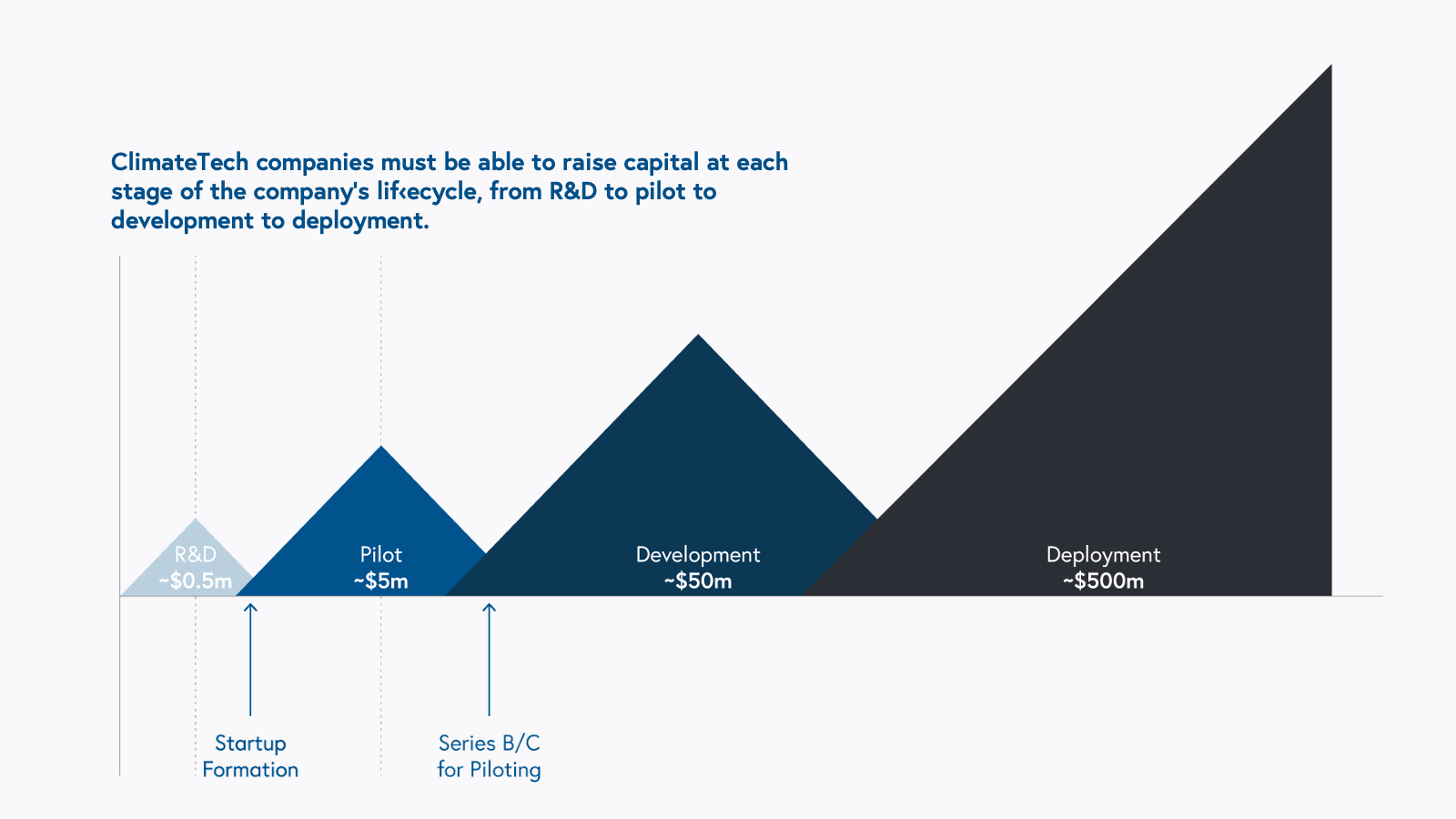

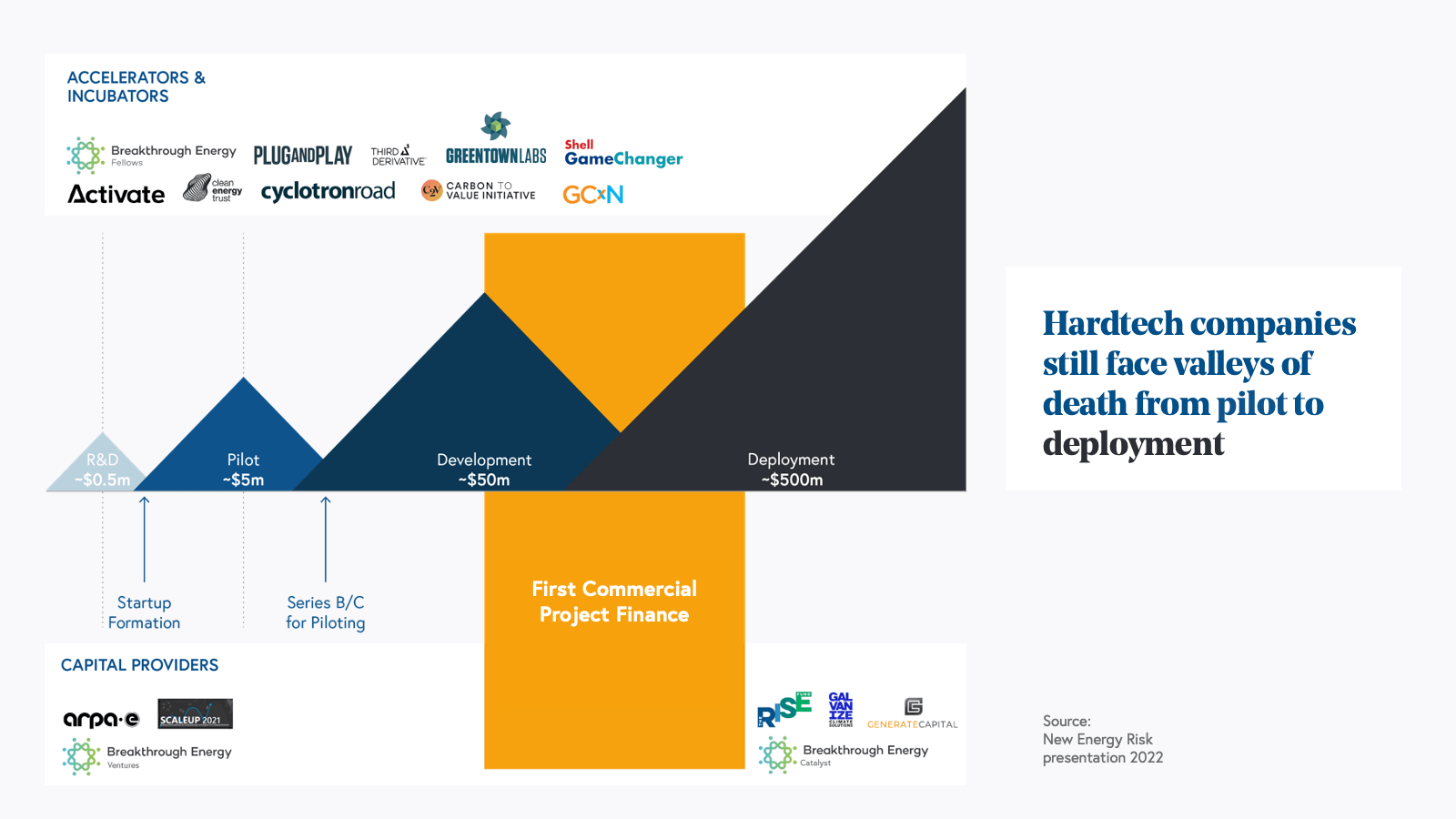

Many deep climate technologies have longer return profiles than traditional VC-backed companies. These climate companies therefore face significant financing risk and must be able to raise capital at each stage of the company’s lifecycle, from R&D to pilot to development to deployment. In the R&D phase, a company is just transitioning from the lab setting to the commercial world. In the pilot phase, a company is building its first working prototype or in trials with a few demo customers. In the development phase, a company is fully-operational in a real-world environment. Finally, in the deployment phase, a company has found a repeatable GTM motion that is being replicated at scale.

CleanTech 1.0 case study

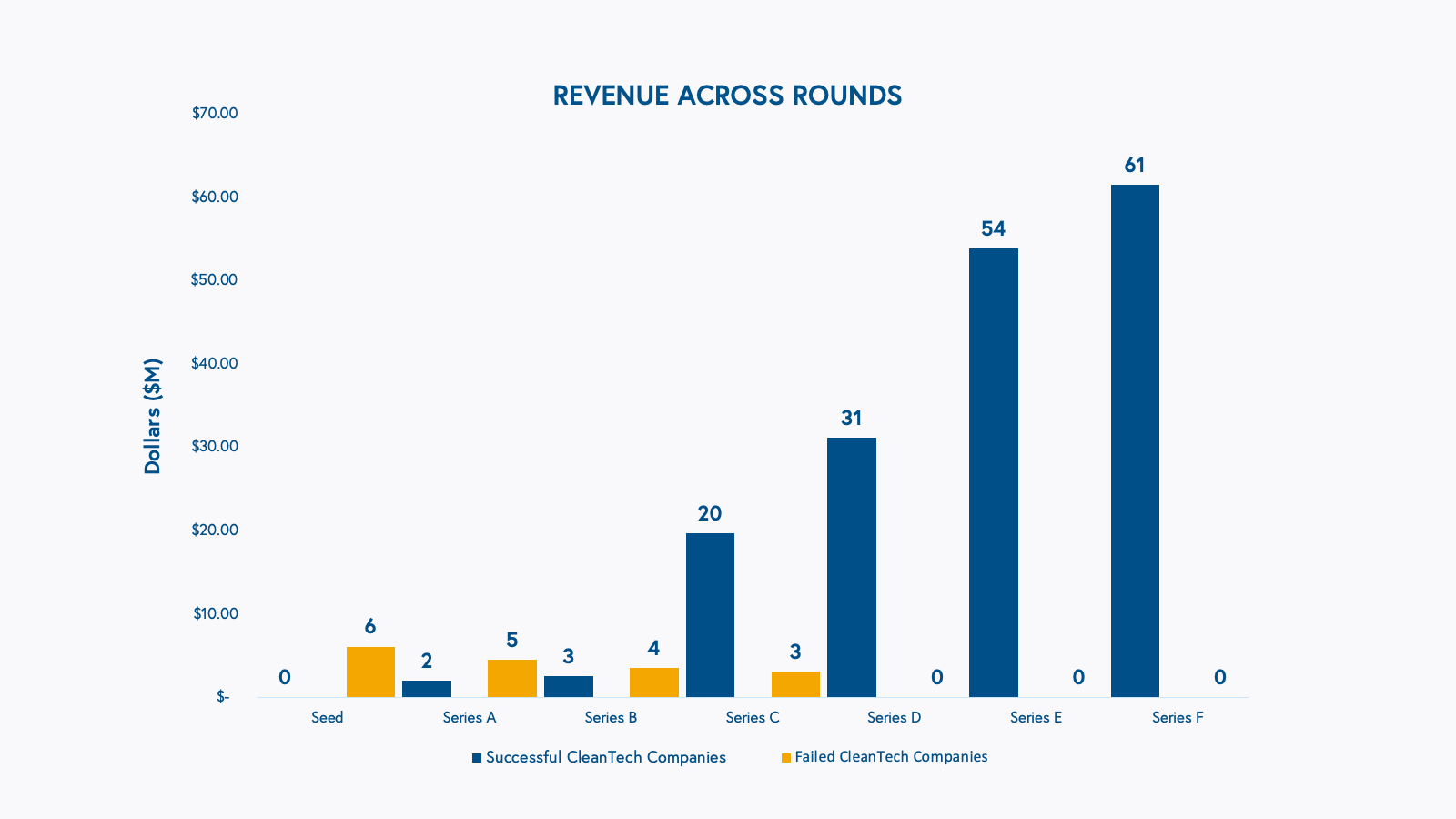

Rather than providing a case study of a single industry or company during the CleanTech 1.0 era, we did an empirical analysis of all CleanTech companies (394 companies, according to Pitchbook) that were funded between 2006-2011. We pulled data on investments into companies that today have already exited and compared that with data on investments into companies that today are no longer in business.

Our analysis shows that failed CleanTech 1.0 companies were never able to transition successfully from the pilot phase to the development phase. While all junctions in the climate company life cycle are important, the transition from pilot to development is particularly difficult and is the gating function for the injection of growth capital.

Successful CleanTech 1.0 companies, on the other hand, were able to raise additional rounds of financing as they moved from R&D to pilot to development to deployment. While revenues surged between the Series B and C stages (i.e., from pilot to development), they afterwards didn’t see the explosive growth that one might expect from a traditional venture industry like software.

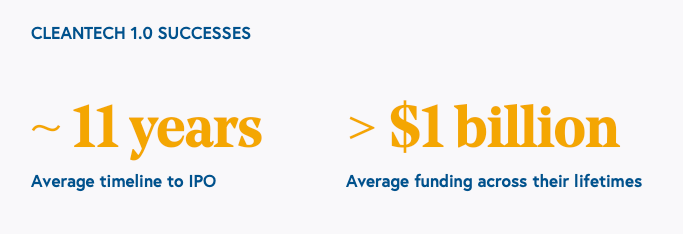

Finally, successful CleanTech 1.0 successes took an average of ~11 years to IPO, slightly above the typical time horizon of ~10 years for a traditional venture fund. Furthermore, successful companies on average needed > $1B in funding (including debt and equity) across their lifetimes.

Zooming out, investing in climate requires both an abundance of patient capital and a clear path to exit. Indeed, one reason why the CleanTech 1.0 bubble burst was because late-stage equity financing became unwilling to fund companies to exit. Successful CleanTech 1.0 companies like SunRun instead utilized other forms of financing like debt (see section #3 above) in order to survive. Exiting, too, was difficult. There were few corporate acquirers willing to purchase CleanTech startups at any point in company development. Contrast this with biotech, a sector in which despite similarly long developmental timelines, a number of corporate acquirers exist that purchase startups that have demonstrated certain technological, regulatory, or commercial milestones (e.g. FDA clearance).

ClimateTech 2.0 case study: More capital available

Today, the financing risk for climate companies is not as pronounced as it was 15 years ago. Deep climate tech startups were able to leverage the special-purpose acquisition company (SPAC) boom of 2020-2021 to go public although time will tell which of these companies are mature enough to withstand public scrutiny for the long-haul. New funds like Breakthrough Energy Ventures have explicitly lengthened their investment return horizons and are more willing to back climate companies with long return profiles. Investors have also raised dedicated growth capital to deploy into climate companies.

Climate companies must still work to identify the type of capital that fits their growth needs, but luckily, there is a growing abundance of options for entrepreneurs building energy startups. Initial options include non-dilutive government and philanthropic grants targeted on specific research areas as well as early equity from angel investors. Accelerator and incubator programs can also help companies to test early commercial appetite for technical solutions and often provide funding to run these experiments. Companies building high margin, fast growing, capital efficient businesses are good fits for venture capital, as are those that have demonstrated some early scale through pilots or traction.

Conversely, those companies looking to build first of a kind projects should access alternative financing with structured credit terms for initial pilots. Other types of financing include project finance for larger-scale infrastructure projects and loans, both public and private, for later-stage companies that have assets or cash flow against which debt can be raised. Climate companies should think critically about what sort of capital is necessary for different stages of their development.

The current path to exit is bolstered by greater involvement of strategics in climate startup investing. While a community of biotech-like corporations involved in buying up startups at various stages of development has not yet materialized, legacy materials, energy, and transportation companies have been making strategic investments in climate startups that could help them meet their own decarbonization goals. These initial bets might evolve into acquisitions as this new wave of climate startups mature.

7. Opportunities for better data as IoT and robotic technologies move down the cost curve

As companies work towards decarbonization, better data will be essential in meeting environmental, social, and governance (ESG) goals, improving automation and efficiency, and generating new revenue streams. In particular, we’re excited about climate startups that help emitting industries acquire novel data streams in pursuit of efficiency and sustainability gains. In order to build an effective data moat, many of these startups will need to leverage combined hardware-software models to effectively collect and monetize new data sources. While many hardware intensive companies fizzled during CleanTech 1.0, we believe that ClimateTech 2.0 offers new opportunities for companies that can effectively leverage cheap IoT sensors, robotics hardware and applications of AI/ML in the pursuit of simultaneous decarbonization and industrial process automation and efficiency.

CleanTech 1.0 case study: Early innings of IoT application

In 2011, Gartner added the “Internet of Things” (IoT) to its well-known “hype cycle of emerging technologies” list. IoT refers to objects that can connect to networks without human intervention. By 2013, IoT devices began incorporating sensors, giving rise to use cases like smart thermostats and motion detected lighting. For example, one of CleanTech 1.0’s biggest wins was Nest, a smart thermostat that transformed run-of-the-mill thermostats into something programmable and cool. Nest was able to initially capture an early share of the emerging smart home technology market by providing a modern and sleek consumer experience. More importantly, though, Nest made it easier to control energy consumption within homes by collecting home energy data and allowing for remote and automated programming of home temperatures. Around the same time, Prologis, a global leader in urban logistics, pioneered the use of motion sensing LED lighting fixtures, reducing operation energy use and costs by 82% as compared with static lighting. While IoT sensor technologies were too cost prohibitive for industrial application in CleanTech 1.0, today we see opportunities for companies to leverage this technology across a variety of sectors, including oil and gas, recycling, manufacturing and more.

ClimateTech 2.0: Maturation of IoT and robotics technologies unlocks opportunities for decarbonization across industrial verticals

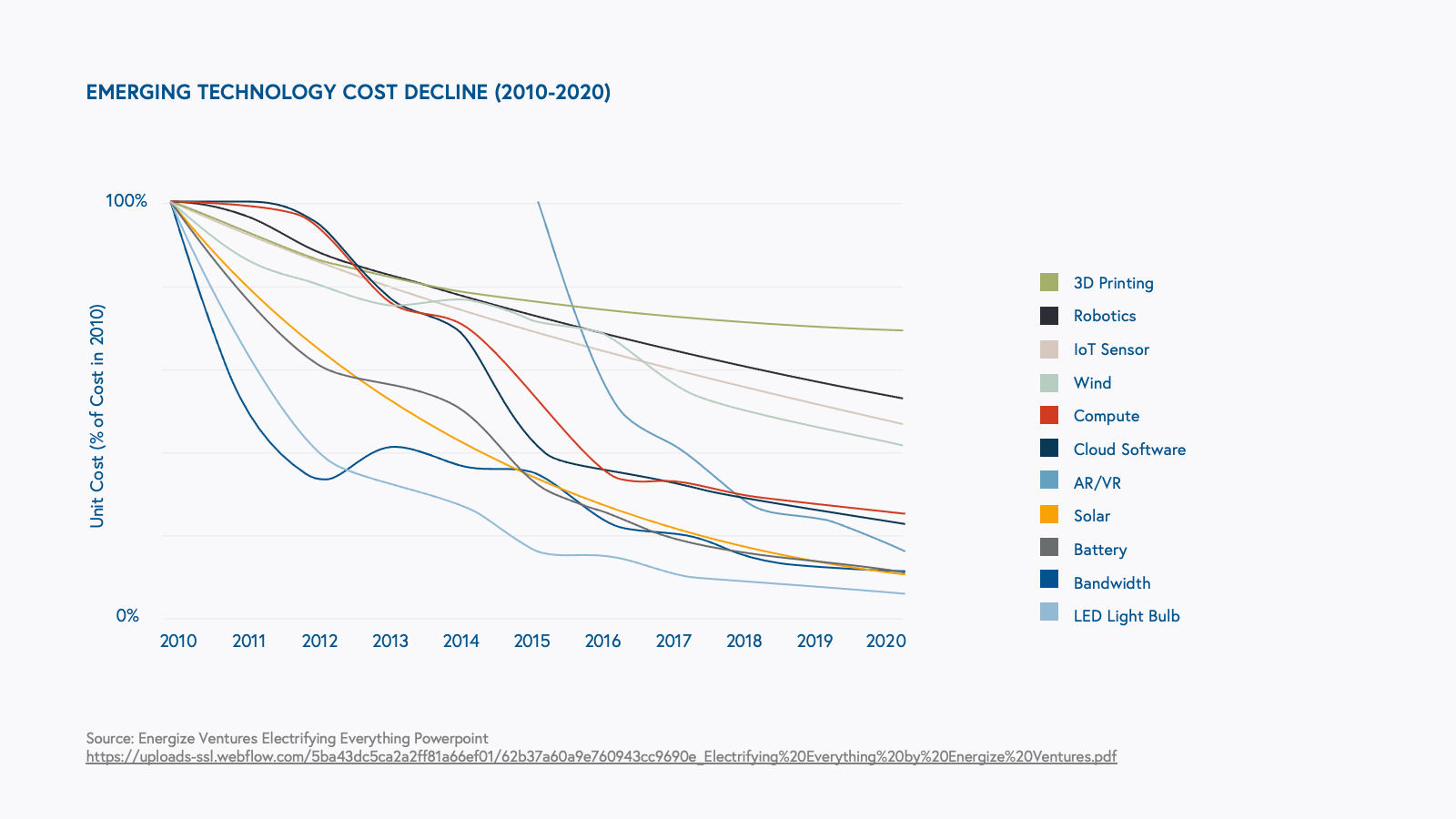

Today, prices have plummeted for robotics equipment and sensors, and barriers to manufacturing have decreased dramatically across the board, making it less cost prohibitive to manufacture hardware.

Just as importantly, industrial IoT companies have tapped into the success of SaaS business models (see section #3). Offering their platforms as hardware-as-a-service with data monetization revenue streams, they can transform capital expenditures to operating expenditures, and as these hardware-enabled companies scale, many can reach margins upwards of 50% with highly sustainable and recurring revenue streams.

Companies like AMP Robotics, TouchLab, Senorics and Toggle leverage IoT enabled hardware and AI/ML to generate new data streams and improve process efficiency within verticals like recycling, food processing, textile manufacturing and construction. In a similar vein, we are closely following climate solutions for high-emitting assets like industrial and manufacturing plants, especially those that are providing new insights and actionable steps to lowering emissions. Startups like Kuva Systems are actively working to address methane emissions monitoring and facilitating methane reduction while simultaneously optimizing operational processes.

8. Drive value through software that facilitates the deployment and operations of renewable energy assets

CleanTech 1.0 saw the development and early commercialization of critical technologies in the energy generation, storage, and efficiency space. While many of these technologies were hardware-focused, some of the most successful companies built during this time took a software-forward approach—providing insights and influencing corporate and consumer actions to be more climate-conscious. ClimateTech 2.0 has seen an explosion in software applications for climate problems as the number of renewable energy infrastructure assets grows and data becomes key in mitigating emissions, a trend we expect to continue.

CleanTech 1.0 case study: Opower

During CleanTech 1.0, 90% of companies failed to return capital to investors. A key reason for these poor returns, in addition to those discussed previously in this piece, is the focus on investing in advanced materials and hardware-only businesses with long developmental horizons, risk of commoditization, and difficult go-to-market approaches. While there is a key need for these technologies, many such solutions had high risk and low return profiles incongruent with the needs of venture capital, but lacking in alternative financing options. The poor returns, combined with the lack of capital stack diversity, left many companies unable to find additional financing to cross the valleys of death between research, development, pilot, and deployment—ultimately leading to venture capital pullback from the sector.

The companies that did meet venture return requirements were few, but often had a software component. One such example is Opower, which offered a suite of energy efficiency products. Founded in 2007, the company went public in 2014 and was acquired by Oracle in 2016 for $532 million. The company’s software solution helped utilities make sense of energy use data, utilizing AI and behavioral science to incentivize energy-saving actions by end customers, delivering energy efficiencies and reducing customer energy bills. While selling to utilities was a long process, Opower was able to meet demand by creating a novel way of delivering insights and driving behavior, creating a path to scale.

ClimateTech 2.0 case study: A climate software startup boom

While deep climate technologies will continue to be a key area of focus for us in ClimateTech 2.0, we’re equally excited about opportunities for software to measure and mitigate emissions, facilitate carbon trading, and manage the growing array of renewable energy assets, a topic we’ve written about before. Companies like Watershed, a carbon accounting startup, and NCX, a marketplace for forest management carbon credits, have built on the demand to understand and address emissions bolstered by customer demand and government regulation. We believe that the next wave of software companies will find success in concentrating on a sectoral basis, tackling hard-to-measure and hard-to-decarbonize sectors, such as industrials and transportation. Just as vertical software companies flourished by bringing expertise and targeted solutions to specific sectors, vertical climate software companies will be able to draw on industry knowledge, sector-specific data moats, and product layering to build full-stack solutions for the unique emissions and energy issues impacting different industries.

As the price of renewable energy assets continues to decrease, driving a boom in construction of electrical vehicles (EVs), solar farms, and wind farms, we envision a rise in software used to help build, operate, and maintain these assets. An example of such a company is Aurora Solar, a cloud-based solution that enables solar photovoltaic (PV) engineering design and provides workflow management functionality for the growing number of residential and commercial solar installation businesses across the US. We are also excited about companies that are building out the data infrastructure layer that analyzes the data associated with these assets. For example, in categories like EVs and batteries, we’ve seen a number of exciting platforms that create connectivity layers to help customers manage and develop applications on top of energy data.

Applying the hard-won lessons of CleanTech 1.0 to ClimateTech 2.0

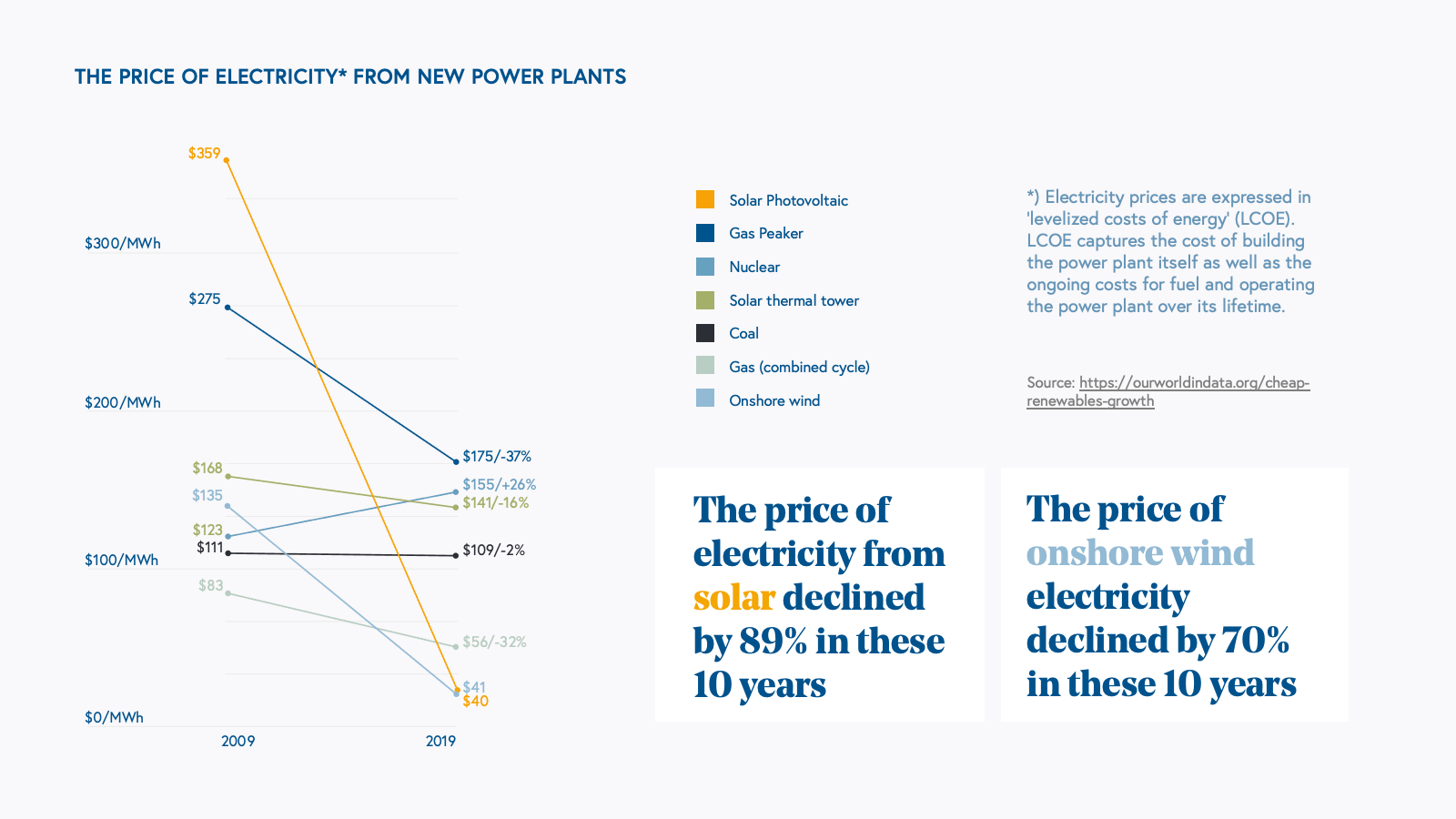

We believe that industry-wide investment bubbles and bursts, while painful in the short term, lay the foundation for long-term innovation. During the CleanTech 1.0 era from 2006-2011, billions of dollars in capital were plowed into climate startups, but many of those investments failed to pan out in the near term. Today, however, we’re reaping the benefits in unexpected ways. The price of solar and wind energy has plummeted and is a key driver of many new technologies today—like hydrogen production and batteries—that rely on cheap, renewable forms of energy.

Just as important, the CleanTech 1.0 era has shown us what to expect in a successful climate business and how to avoid or mitigate some of the difficulties in climate technology. We hope that these lessons will prove useful to entrepreneurs and investors alike as we build our Net Zero future. If any of these ideas resonate, or if you’re building a climate tech company we’d love to hear from you—email us at climate@bvp.com.