Fintech for all in India

Incumbent leaders in financial services are undergoing massive transformation. From credit to insurance, financial products in India are leveraging the powers of data and cloud software.

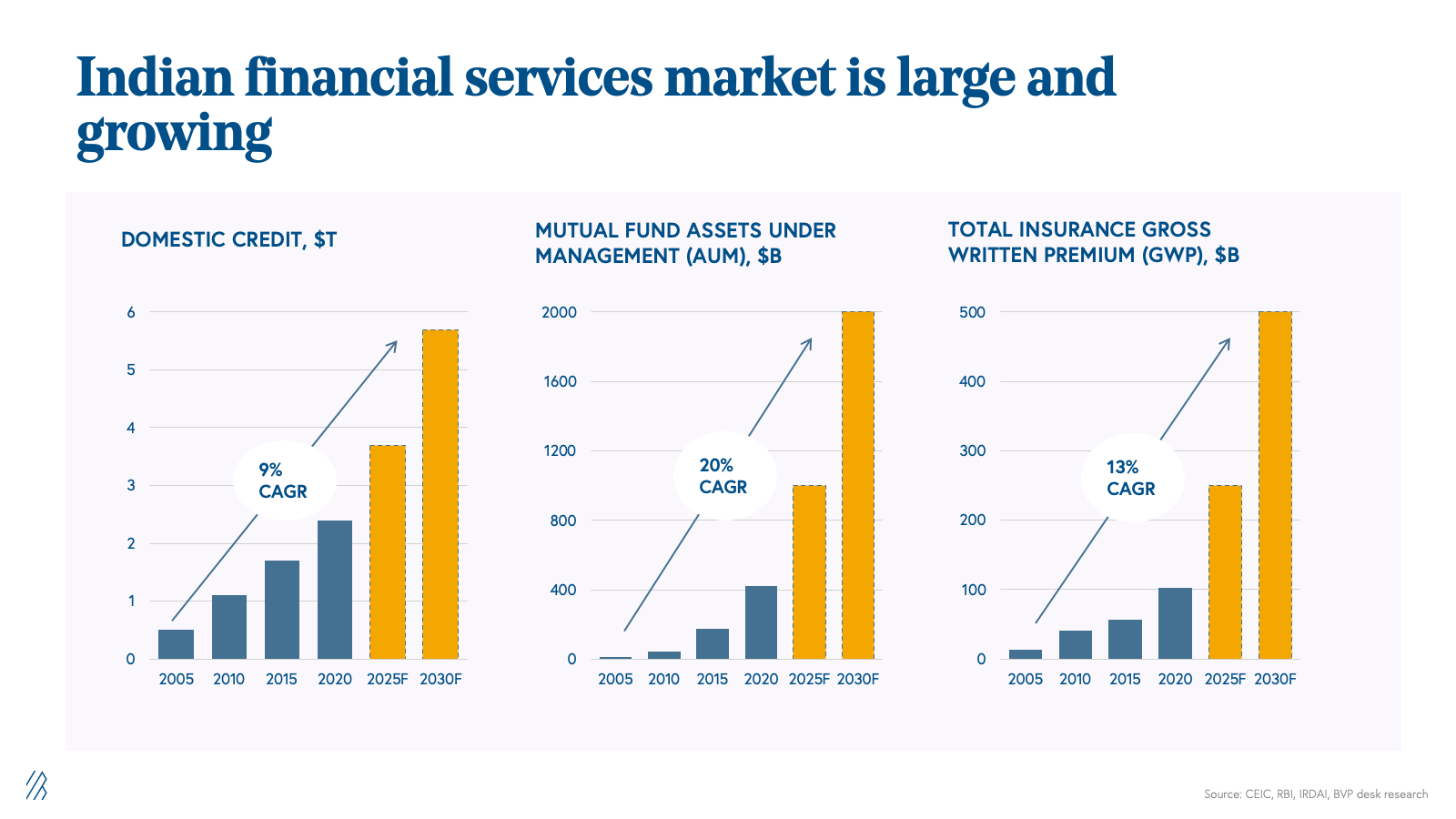

Financial services is the largest sector in the world at around 20-25% of the global economy. India is no different, with financial services constituting over 24% of the country’s market capitalization. Despite the sector’s might and scale, there still is massive scope for rapid growth across all dimensions of financial services, including credit, investments, and insurance, with the potential for billions of dollars in market capitalization to be created in each of these sub-sectors. We estimate that by 2030, domestic credit will double and become a $5.5 trillion market; mutual fund assets under management (AUM) will grow 5x from $400 billion to $2 trillion; and insurance will grow from $100 billion to $500 billion. Even then, the industry will have just scratched the surface with each of these sectors.

While we expect the sector to grow as a whole, certain types of businesses will fare better than others. Since India’s financial ecosystem infrastructure began to digitize in 2012, we have seen how financial services organizations from fintech startups to incumbent banks have capitalized on these changes, with incumbents having the clear upper hand. Here’s what we learned from our legacy financial services roadmap, and how our investment strategy has evolved as a result.

Lessons from our financial services roadmap in India

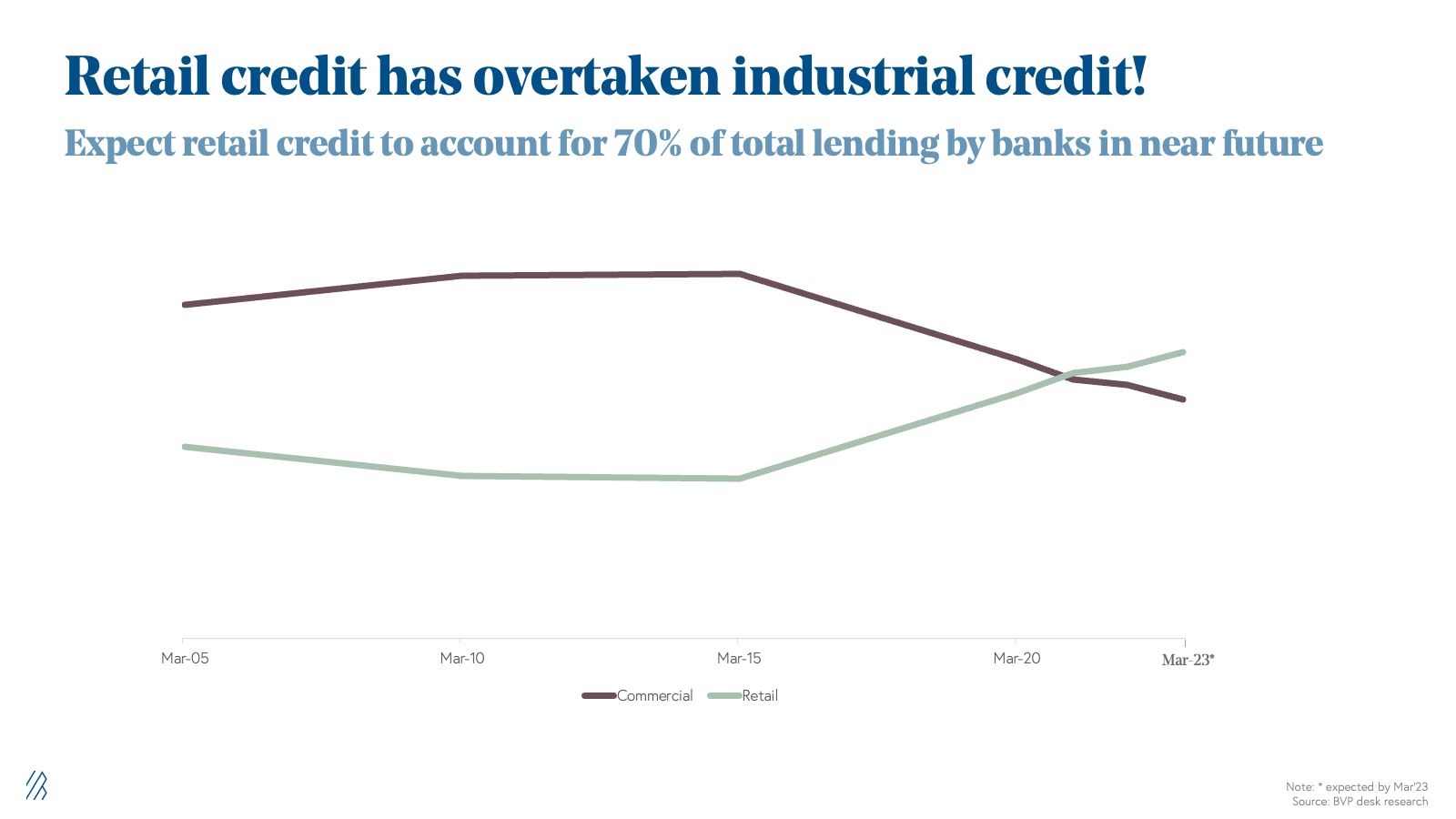

As of March 2005, banks in India had $50 billion in total outstanding retail loans, representing 7% of the country’s gross domestic product (GDP). By December 2022, the same figure had grown to $480 billion, or 15% of the GDP. For the last two decades, corporate loans represented the majority of loans in India, which peaked in 2013. Since then, retail lending has overtaken corporate lending. We believe retail loans will occupy 70% of India’s overall bank loan market in the near future.

India has a triple engine of retail credit: by increasing GDP, lending as a percentage of GDP, and retail lending as part of all lending activity in the country, India will drive its retail credit 3x over the next seven years.

Indian lenders, including banks and non-banking financial companies (NBFCs), will benefit disproportionately from these tailwinds compared to fintech lenders, given that they have the advantages of supportive regulations, stronger brands and distribution, and a lower cost of capital over the long term.

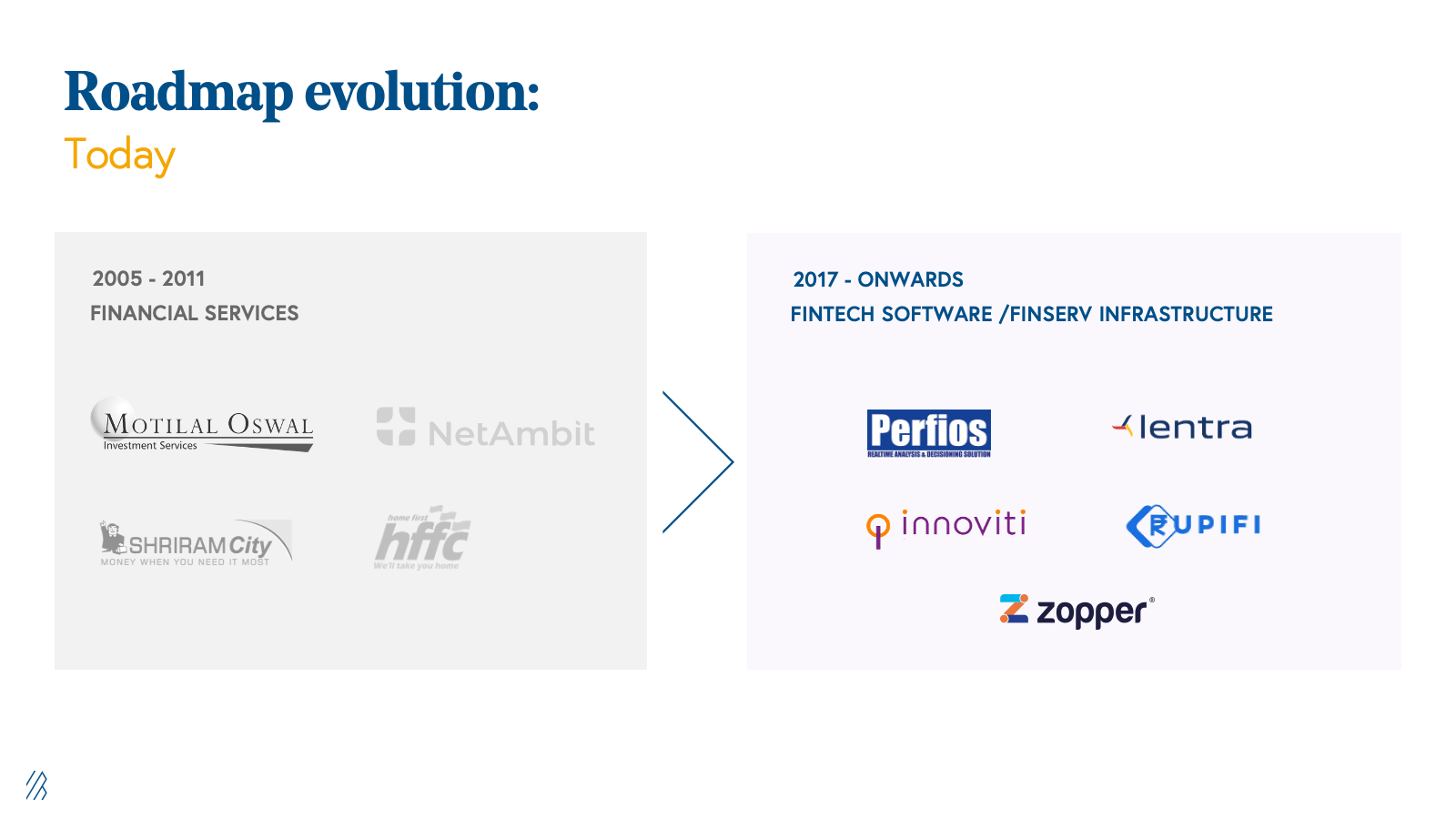

Between 2006 and 2011, when we started investing in India and looked at the large market opportunity, we backed sector leaders across brokerage, lending, and insurance. We were the first institutional investors in Motilal Oswal, which was then the largest retail brokerage. The company went public within two years of our investment. On the lending side, we invested in two companies. The first one was non-bank retail lender Shriram City Union Finance, now called Shriram Finance, where we led an investment and saw the company scale its AUM by ten times. The second was Home First Finance Company , an affordable mortgage lender that was a proprietary incubation effort alongside three seasoned retail bankers from Citibank—the company went public in 2021, and we continue to be shareholders given the compounding potential in home loans.

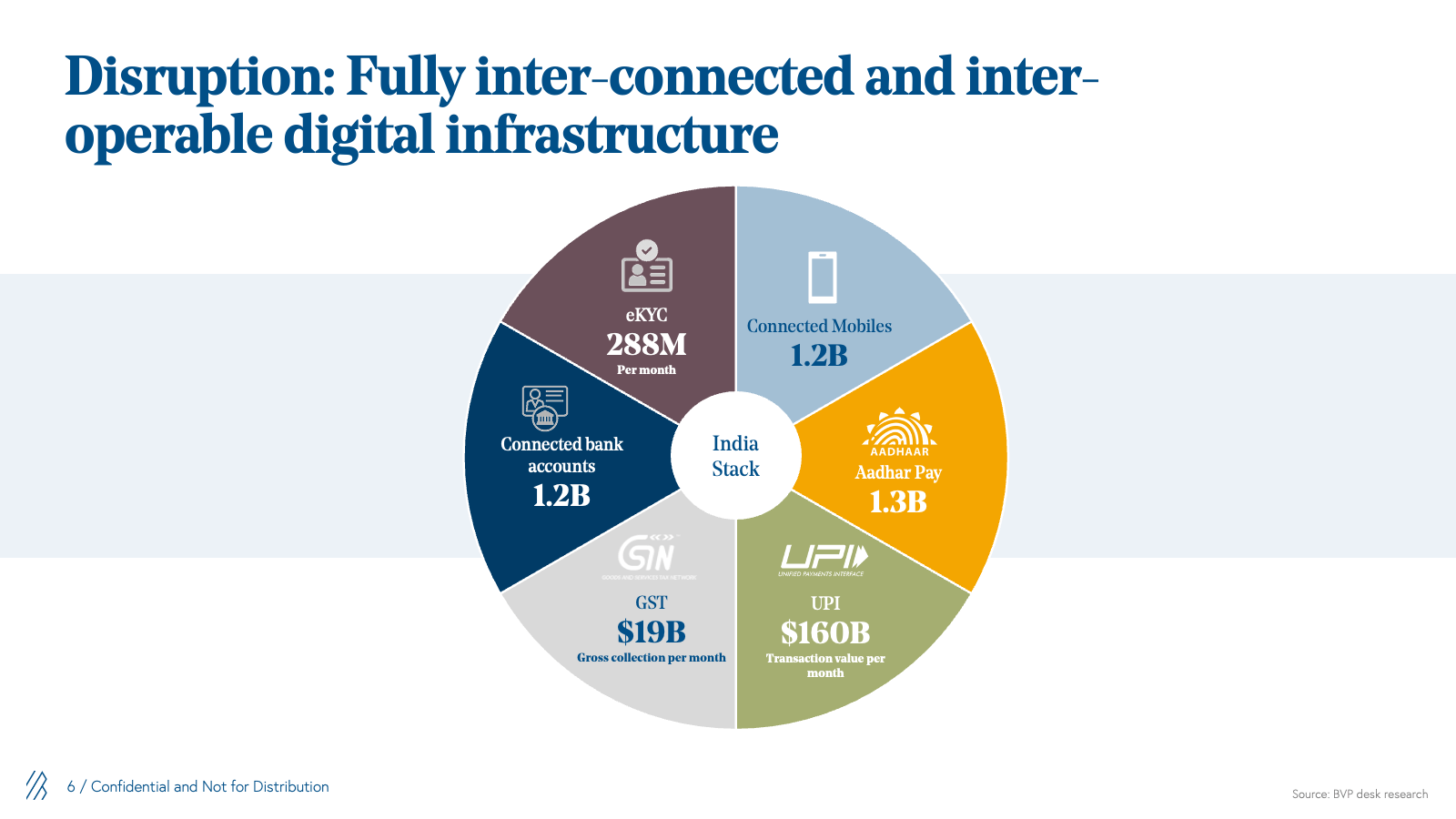

At the same time, the Indian government helped initiate a new wave of technology initiatives through the country’s financial services ecosystem from 2012 onwards. The first was Aadhaar, which enabled a biometric, social security number-like digital identity for every individual. With over 1 billion enrolled members, Aadhaar is the world’s largest biometric identification (ID) system. The unique Aadhaar formed the basis of a digitally enabled bank account, called Jan Dhan Yojana, as well as instant mobile payments and money transfers via Unified Payments Interface (UPI). In addition, several other enabling technologies have been created, including Aadhar-led know your customer (KYC), a DocuSign-like protocol called eSign, a Dropbox-like secure repository called DigiLocker, an Account Aggregator (AA) framework, and OCEN (Open Credit Enablement Network). All these initiatives have led to the creation of uniform, standardized digital rails for financial services in India.

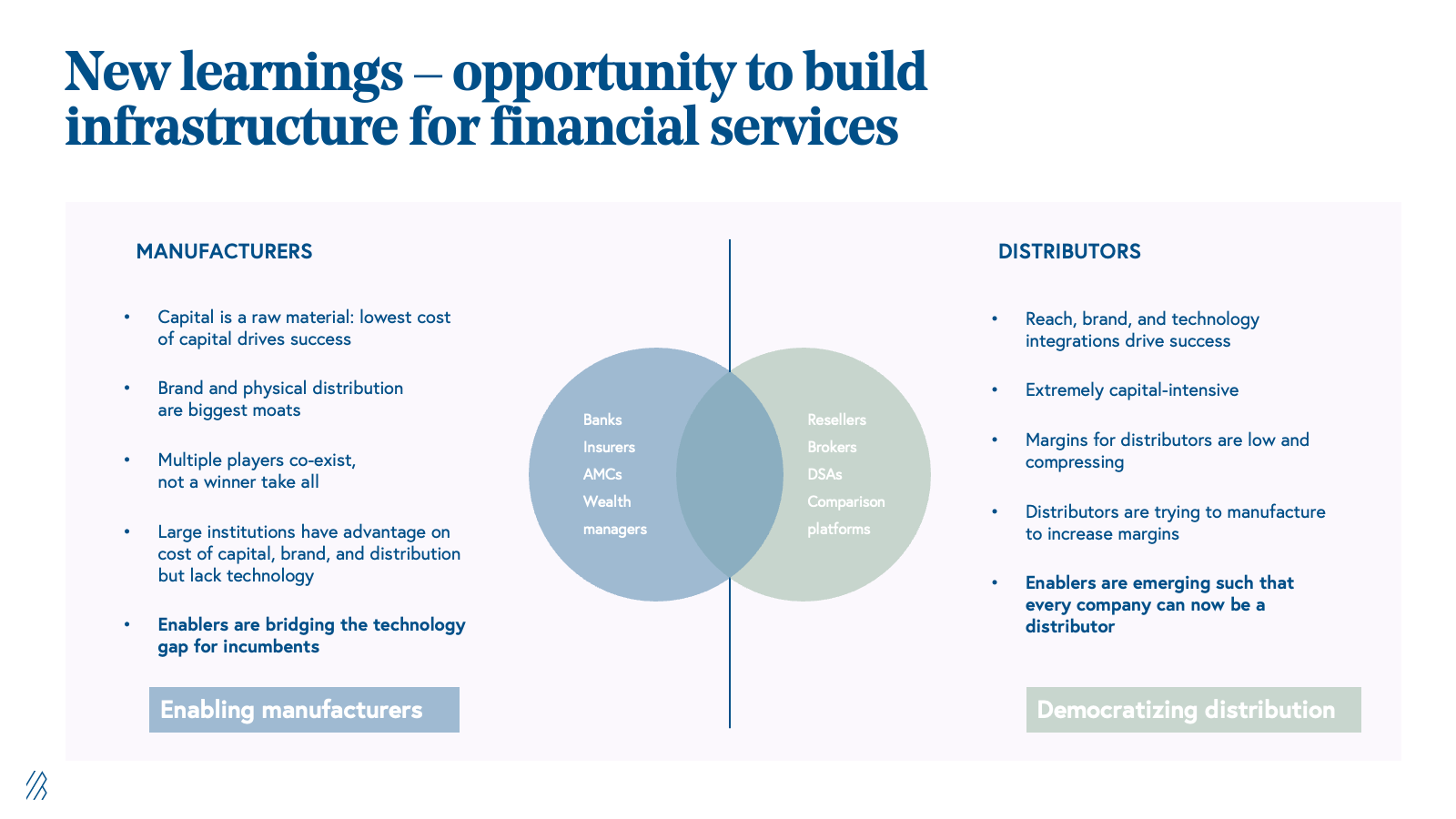

While we had a lot of success in our legacy financial services roadmap, we also came away with some key learnings which gave us pause on pursuing the same strategy any further. One learning was that existing manufacturers in the financial services industry, i.e. banks, insurers, and asset management companies (AMCs), have a sustainable advantage on cost of capital, brand, and distribution that allows them to have a long-term edge over new tech-enabled providers.

The other learning was that on the distribution side, margins are extremely low and continuously compressing due to regulatory pressures—all distributors eventually want to become manufacturers to increase margins. Moreover, in both segments, multiple players coexist without any winner-take-all dynamic. All these learnings discouraged us from leaning further into this legacy roadmap.

We think investing in fintech infrastructure at this moment is a once-in-a-lifetime opportunity, given a unique confluence of events: the adoption of cloud; new players offering more flexible and customer-friendly products; banks being unable to launch new products on the go, because legacy software hampered flexibility; and COVID-19 accelerating the process of digital lending. The pressure from new players, the accelerated adoption of digital lending, and widespread cloud usage has meant that banks and non-bank lenders have started embracing cloud based SaaS platforms across different use cases: underwriting, fraud, collection, KYC, wealth management, loan origination systems (LOS), loan management systems (LMS), customer engagement, etc.

Since 2017, we have been investing in the evolved roadmap based on our learnings. We want to continue to find software opportunities in different parts of the banking and insurance lifecycle including credit, underwriting, fraud, collection, KYC, wealth management, claims, and straight-through processing (STP). We are among the few funds who have experience on both the actual lending side as well as the software enablement side and understand the nuances of both. We also benefit from our experience of investing in companies such as Perfios, Lentra, Mambu, nCino, Zopa, Bankjoy, Zopper, and Shyft, among others.

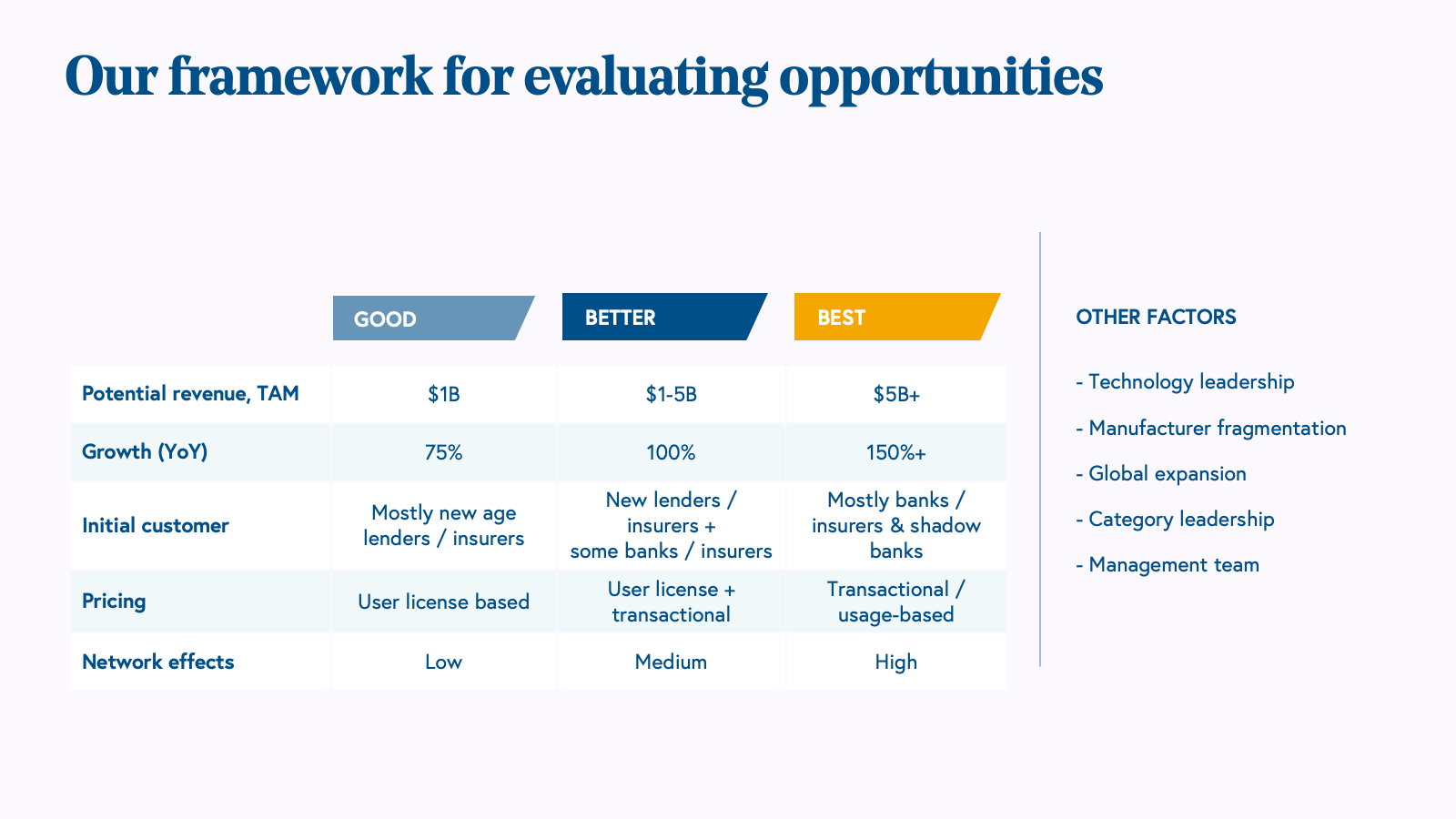

We want to give you a sense of how we source, evaluate, and pick winners using our framework. Today, the fintech companies best poised for success are those building data, cloud, and software layers atop legacy financial institutions. We think legacy financial institutions’ vast distribution combined with cutting-edge technology puts businesses ahead of newer entrants to the market who have to build their reach from day one.

We take a close look at the customer profile and pricing strategy when we're evaluating fintech software investment opportunities.

On customers, we like companies that build enterprise grid software for large banks, shadow banks, and insurers, as opposed to building software just for new age fintechs. We understand that this has its own drawback—a longer sales cycle—but companies that crack this code build very large businesses around enterprise grid, integration, and network effects.

On pricing, it is important to start with usage-based pricing early because that allows for revenue scale as customers grow. Again, while this monetization approach is more challenging to pull off early, it enables companies to grow rapidly and show significant net negative churn on revenue. We believe pricing models are extremely hard to change, unless the company focuses on this from day one.

Evaluating fintech opportunities in India

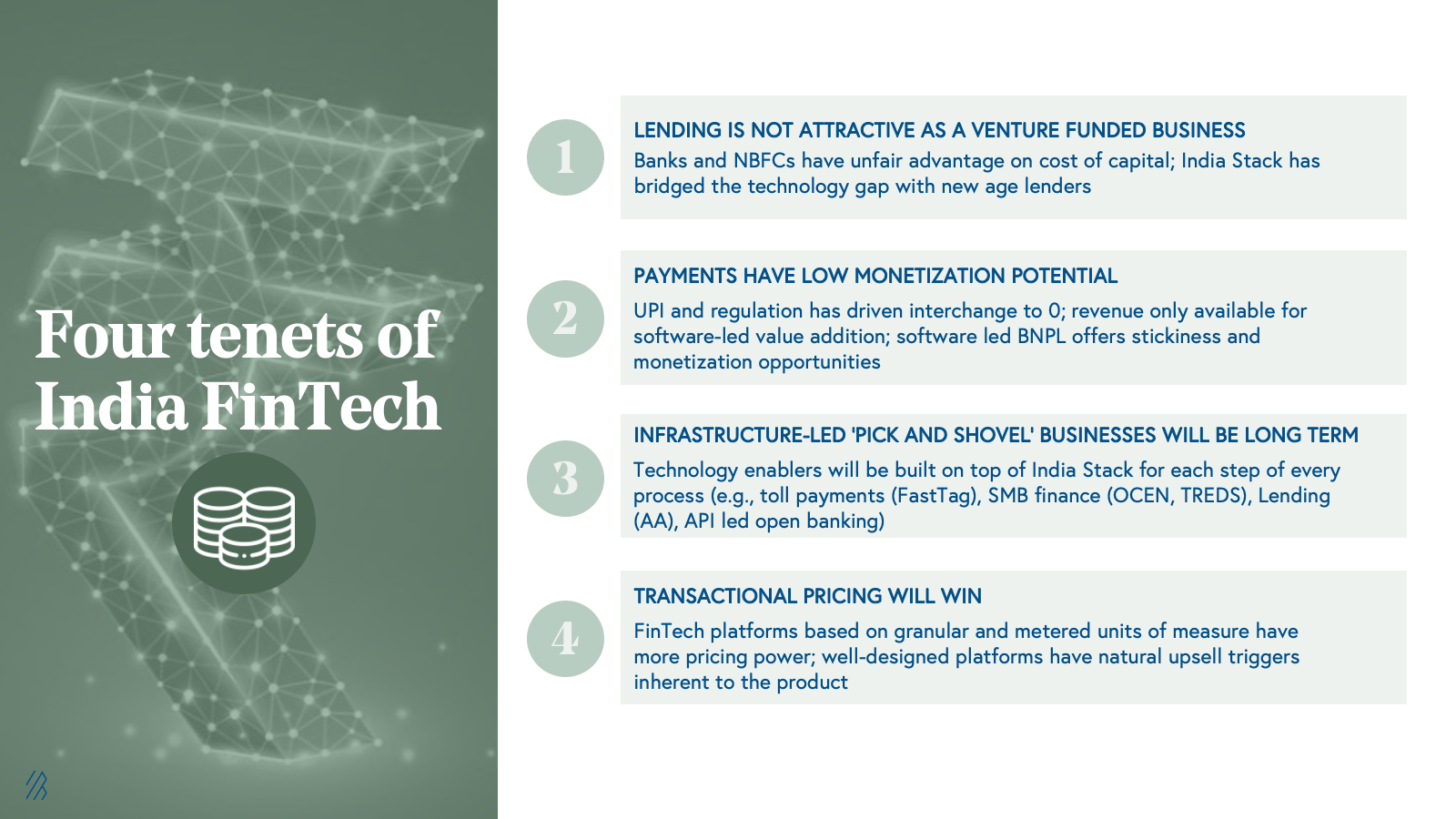

When we updated our roadmap, we landed on four tenets to guide our fintech investing strategy. Some of these are distillations of our learnings from both the legacy roadmap and the newer software roadmap; others are our hypotheses based on trends we are seeing in the market landscape today.

The four tenets that inform our investing strategy in the market

- Lending is not attractive to venture-funded businesses. We came to this conclusion in the first phase of our roadmap—we made money investing in lending businesses, but later realized that they are compounding businesses with capital as a raw material.

- Payments have low monetization potential. Due to government-led UPI and regulation, interchange rates are nonexistent. In order to make money from payments, software needs an additional value-add. An example of this is a “buy now, pay later” (BNPL) product, which monetizes payments.

- Infrastructure-led 'pick and shovel' businesses will be long-term. We realized that the cost of capital and regulations would eventually favor large banks, NBFCs, and insurers. Software businesses must have an ability to play across all banks, non-banks, new age lenders, and insurers via a pick-and-shovel play and a strong winner-take-all dynamic, which can lead to outsized outcomes. We’re also expecting infrastructure innovation to catalyze growth, with technology enabling every financial process. While the government led most of the current financial stack efforts, in the coming years we envision more private sector leadership in building newer API-led infrastructure and data platforms on top of current rails, driving more adoption and improving ease -of -use across different segments of the financial services industry.

- Transactional pricing will win. The fintech products that are best equipped for success will have inherent upsell triggers and pricing power based on granular and metered units of measure.

What’s on the horizon for India’s fintech revolution?

At Bessemer, we believe we are still in the early days of a revolution in the fintech software ecosystem and we’re incredibly eager to support entrepreneurs looking to change the status quo.

We believe that every lending decision, every customer interaction, and every single insurance underwriting and claim is going to be connected to cloud and data, and that all of this will be mediated by software.

If you’re an entrepreneur building the next great fintech software business in India, we want to hear from you. Reach out to our team at IndiaFintech@bvp.com.