Roadmap: Reinventing IT services in the age of AI

As one of the largest exporters of IT services globally, India’s largest incumbents face a once-in-a-generation disruption from the rise of LLMs.

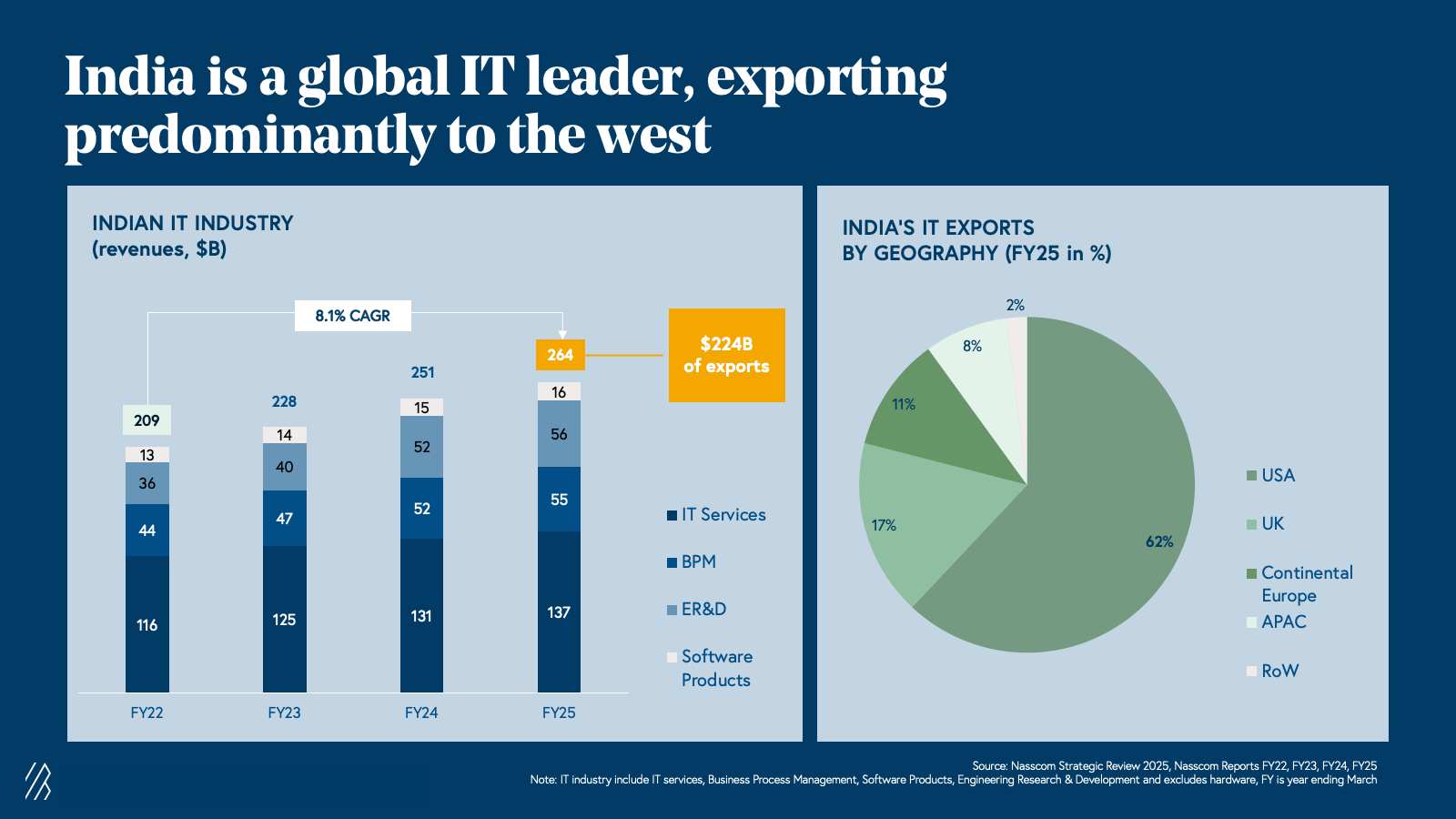

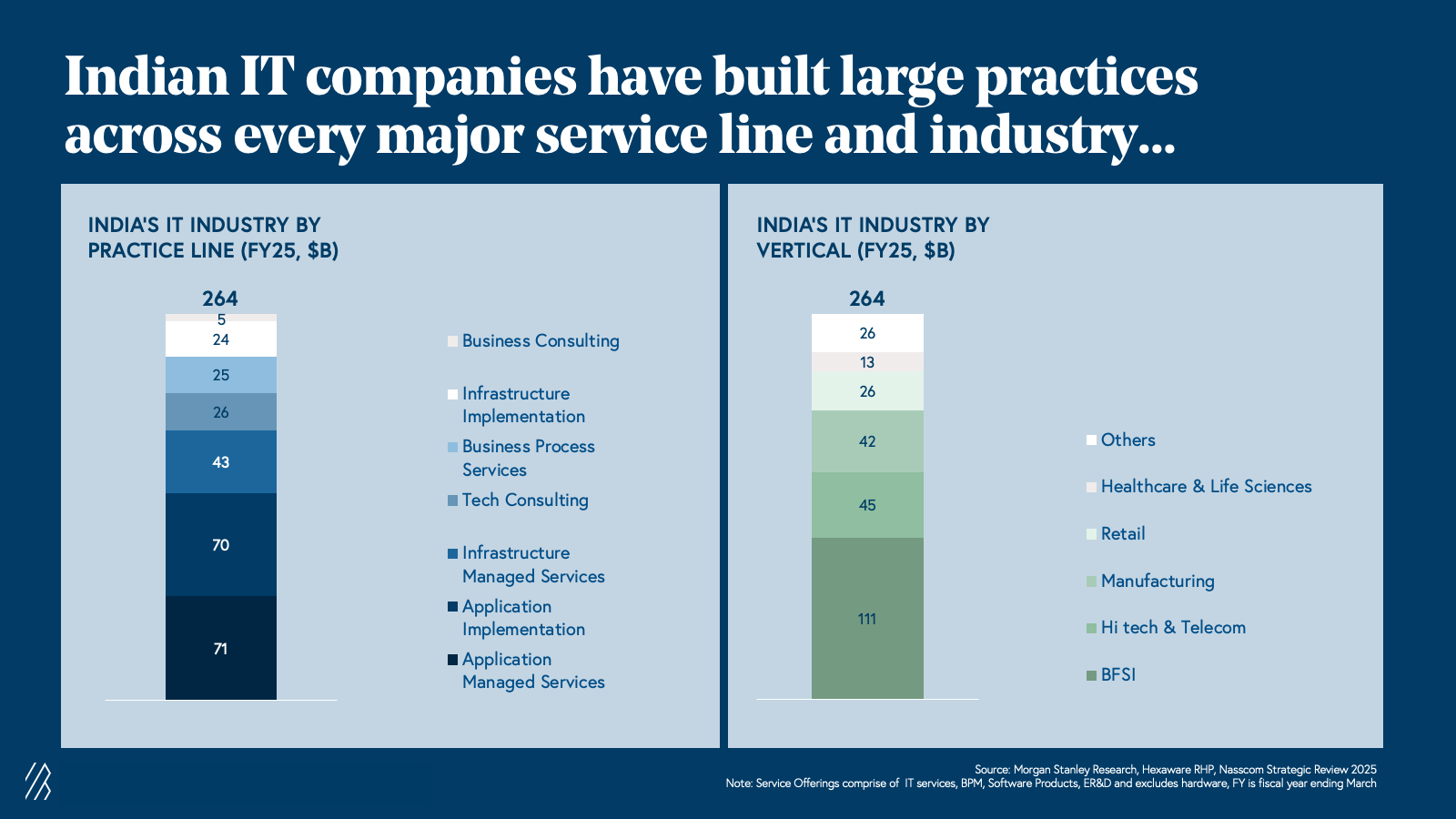

India’s $264 billion IT sector has long been the world’s technology backbone, powering enterprises across the US, Europe, and beyond. The industry’s success was built on scale, skilled talent, and cost efficiency, reinforced by decades of experience serving Fortune 500 clients.

The rise of LLMs and AI marks a once-in-a-generation inflection point. The people- and process-driven model that defined traditional outsourcing is being rewritten by automation, intelligence, and data-native workflows. This disruption is generating a new wave of AI-first challengers — nimble startups reimagining legacy services with smarter, faster, and more adaptive solutions.

This roadmap explores how AI is reshaping the foundation of India’s IT industry. Specifically, where incumbents must evolve, how new business models are emerging, and why this transformation could redefine the global outsourcing playbook for the decade ahead.

Key insights on reinventing IT services in the age of AI

- India has an enduring edge in IT services. This is anchored in talent, global client trust, and cost efficiency. However, AI makes deep strategic pivots crucial to stay competitive.

- AI is automating what people once powered, disrupting the billable-hour model that defines traditional IT services.

- Incumbents are adapting, but not as quickly as AI upstarts. Legacy structures and limited R&D leave room for agile, AI-native challengers to seize market share.

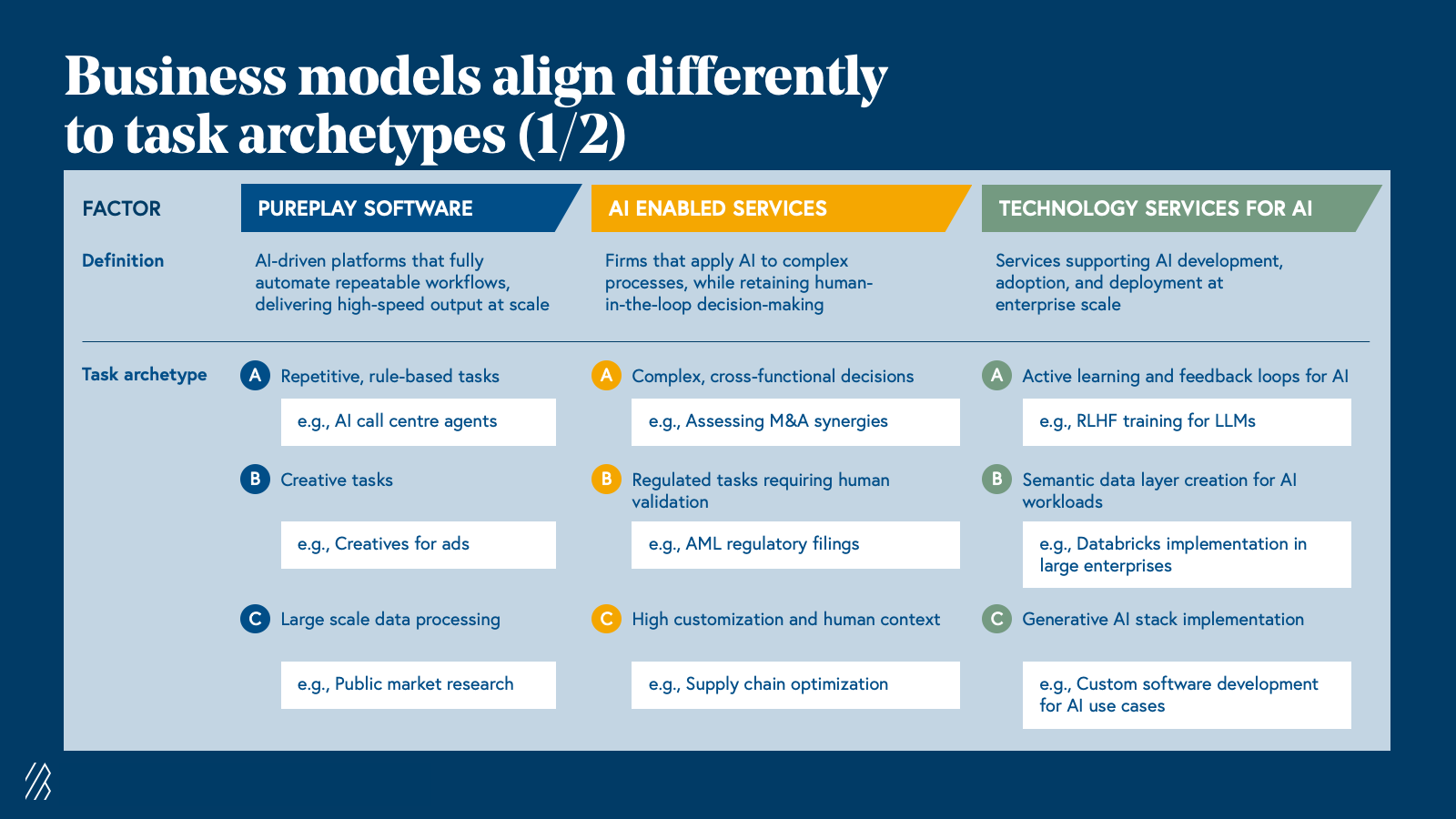

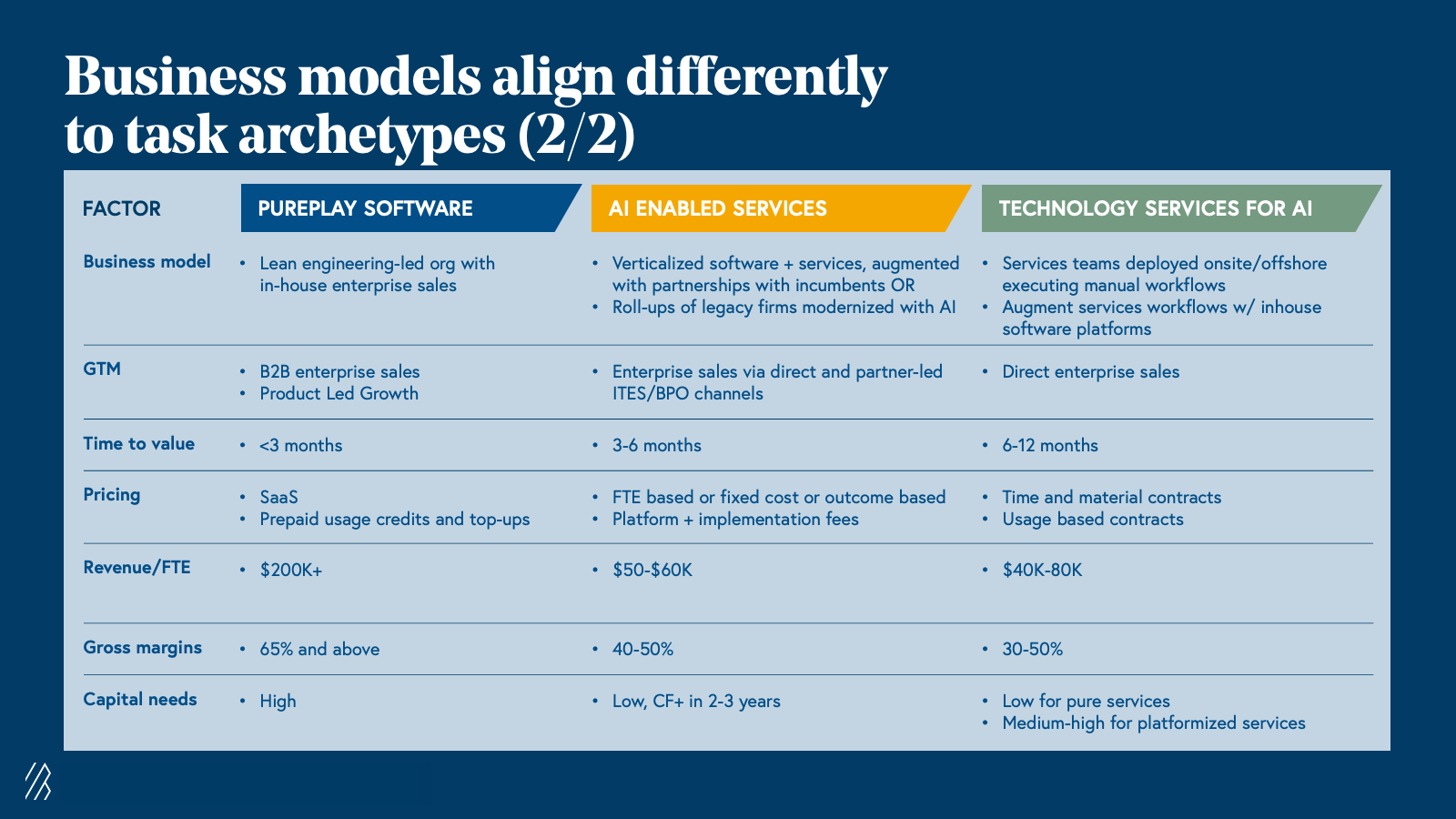

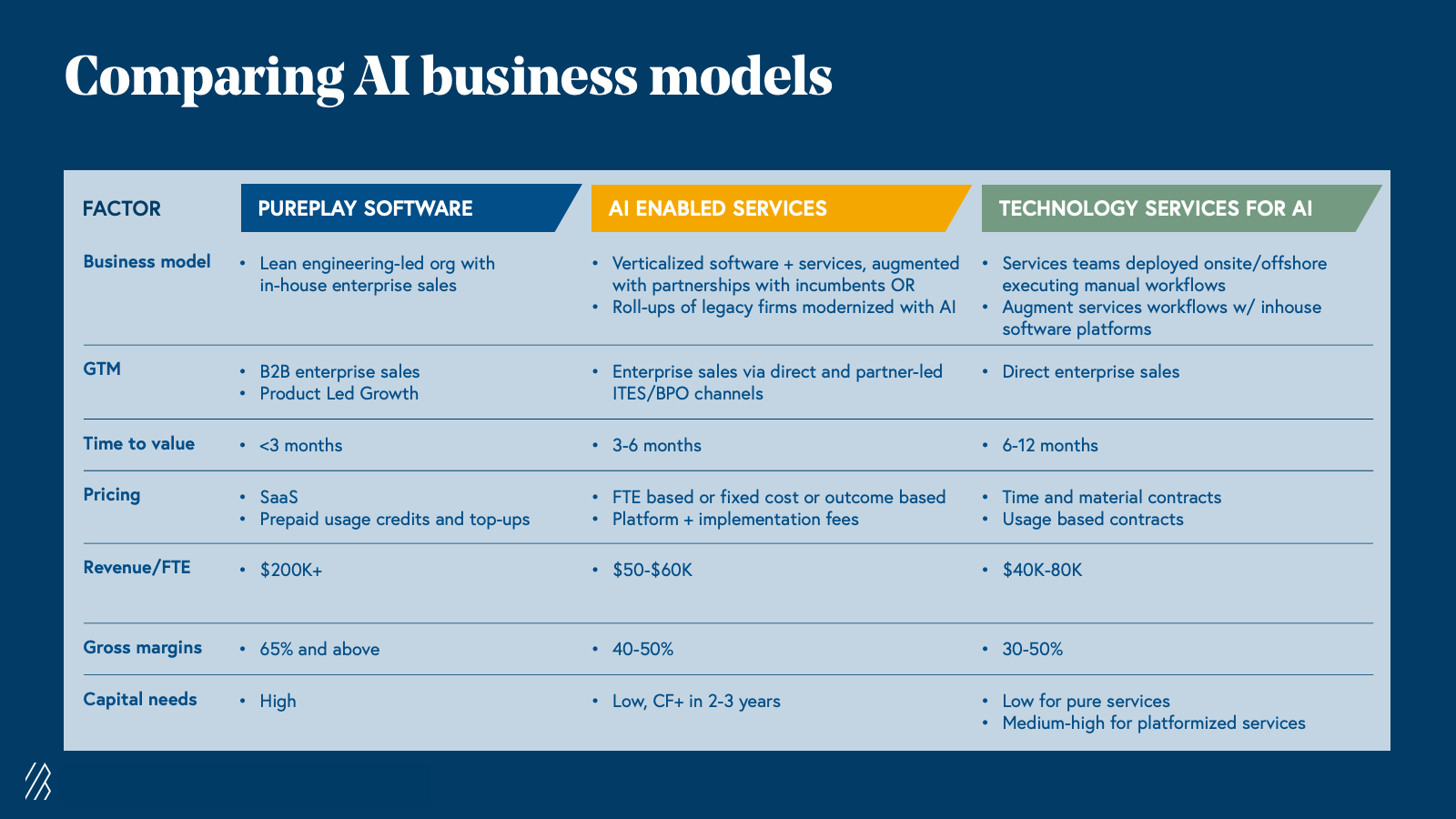

- Three new business models are emerging: AI-enabled services, services built for AI, and pure software-led platforms.

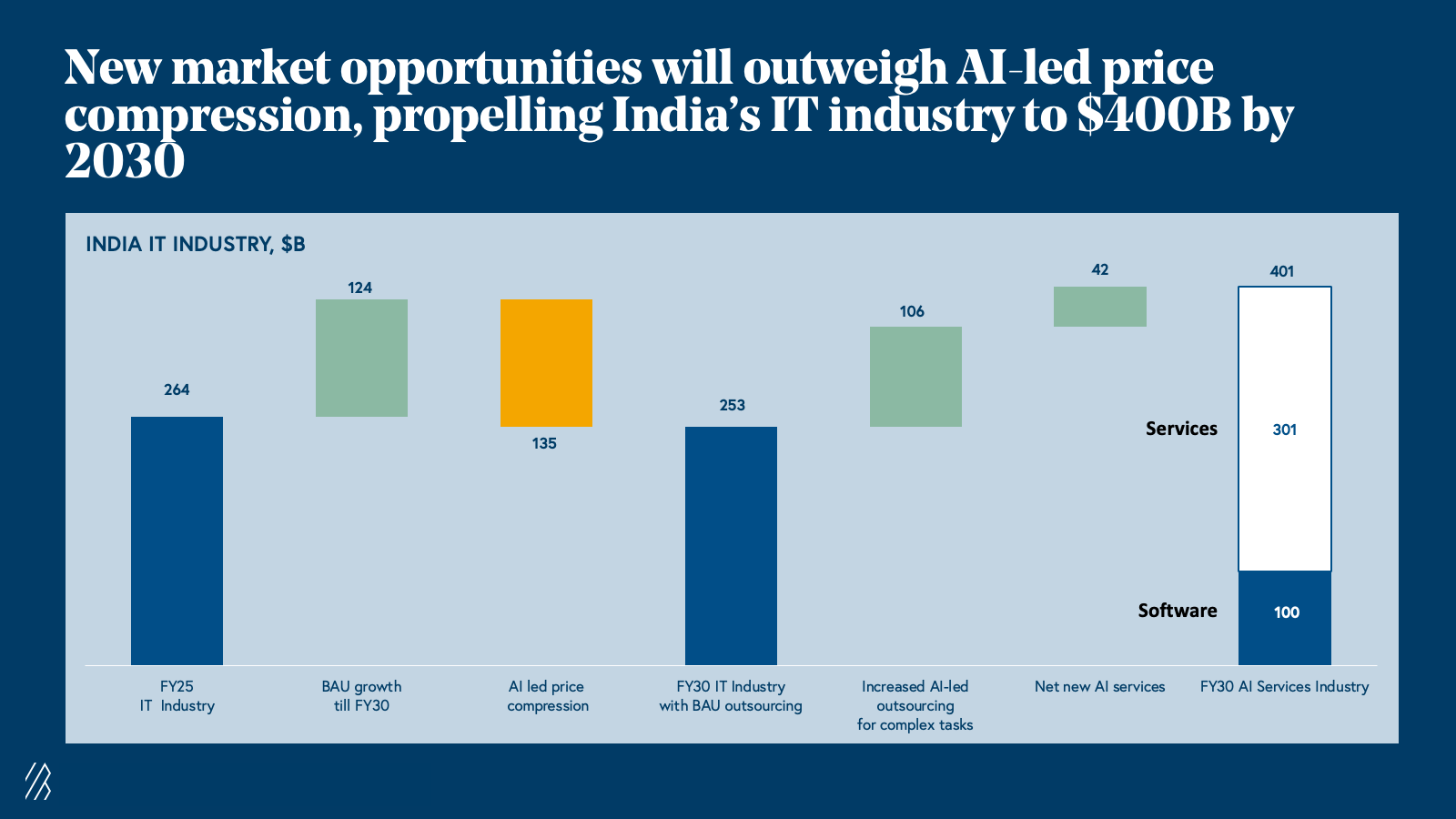

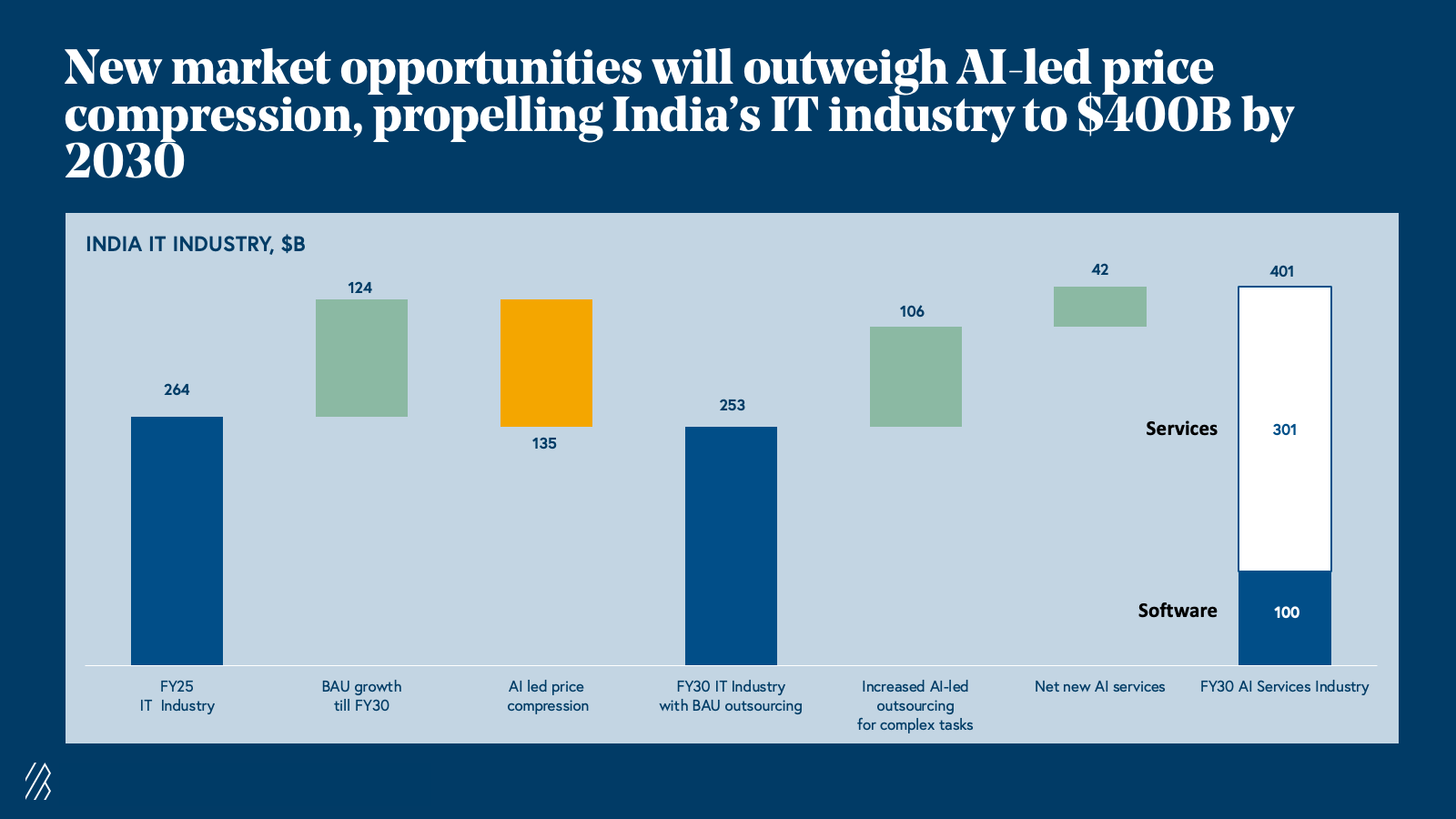

- Despite short-term price compression, AI is expanding the total outsourcing opportunity. With global demand for AI-driven solutions accelerating, we expect India’s IT sector to reach $400B by 2030, led by firms delivering domain-specific automation that outperforms traditional service models on speed, quality, and cost.

Full slide deck

How is AI disrupting the Indian IT industry?

Before the current wave of AI-native disruption, India’s IT services giants had perfected a powerful operating playbook built on three pillars:

1. A vast and skilled talent pool

2. Strong cost arbitrage

3. The ‘follow-the-sun delivery’ model

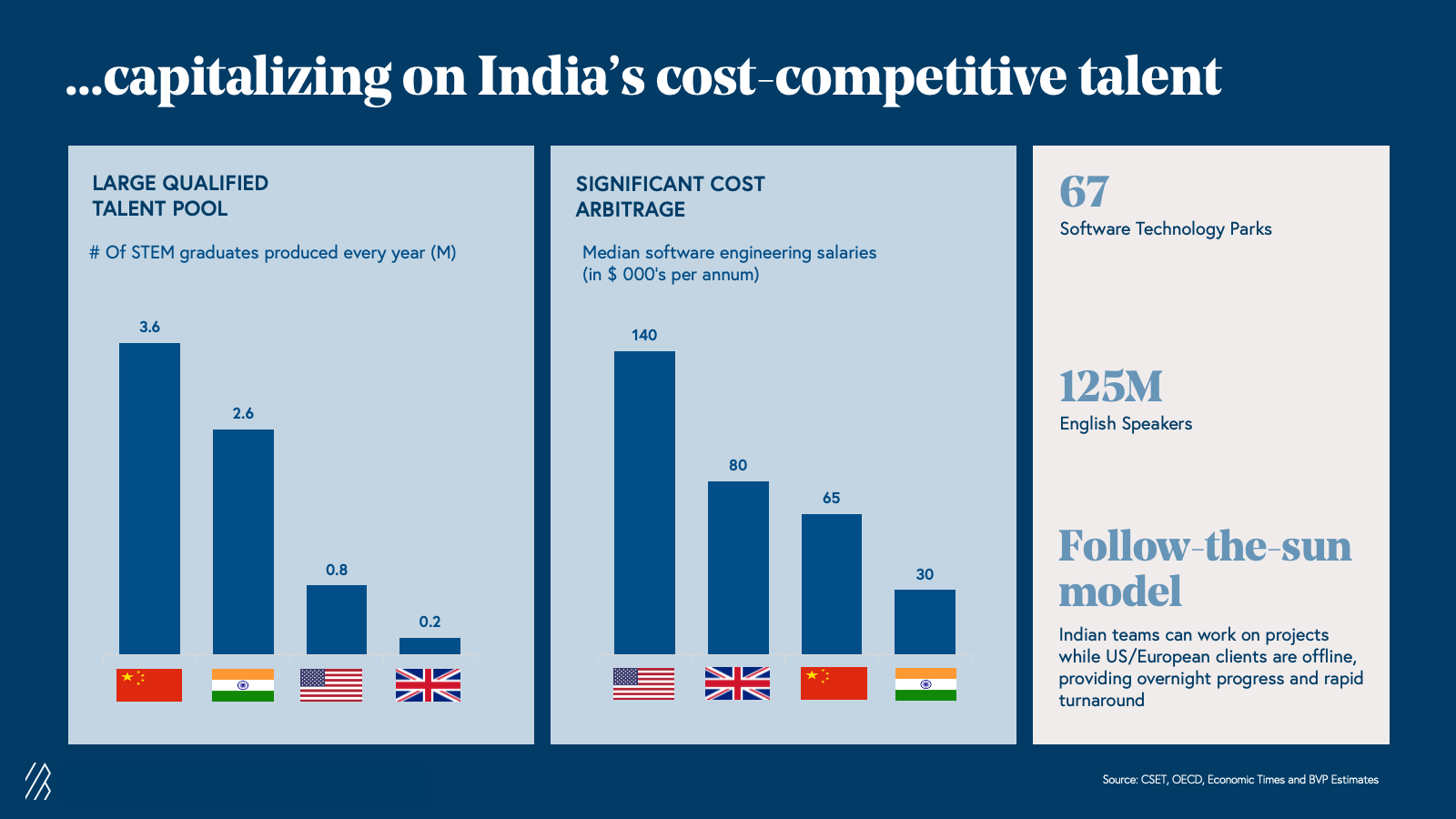

This model draws its strength from India’s advantage in cultivating a highly skilled and diverse talent ecosystem. The country produces roughly 2.6 million STEM graduates every year, more than triple the number of people in other leading nations, forming a deep bench of engineering experts who are fluent in English, coding, and quantitative reasoning. In addition, there’s a cost advantage to working with people in India, considering the median engineering salaries are well below those in other leading economies.

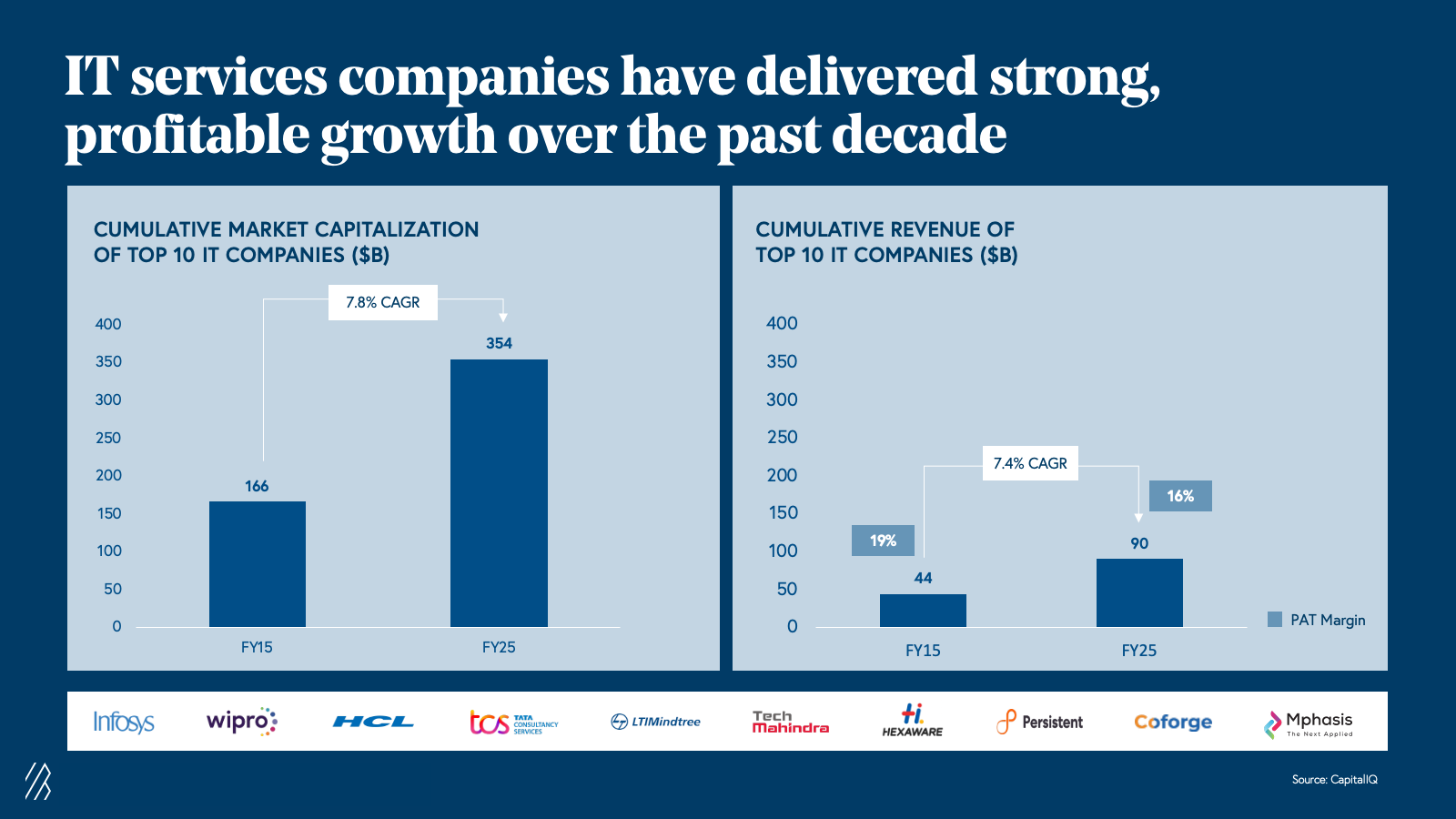

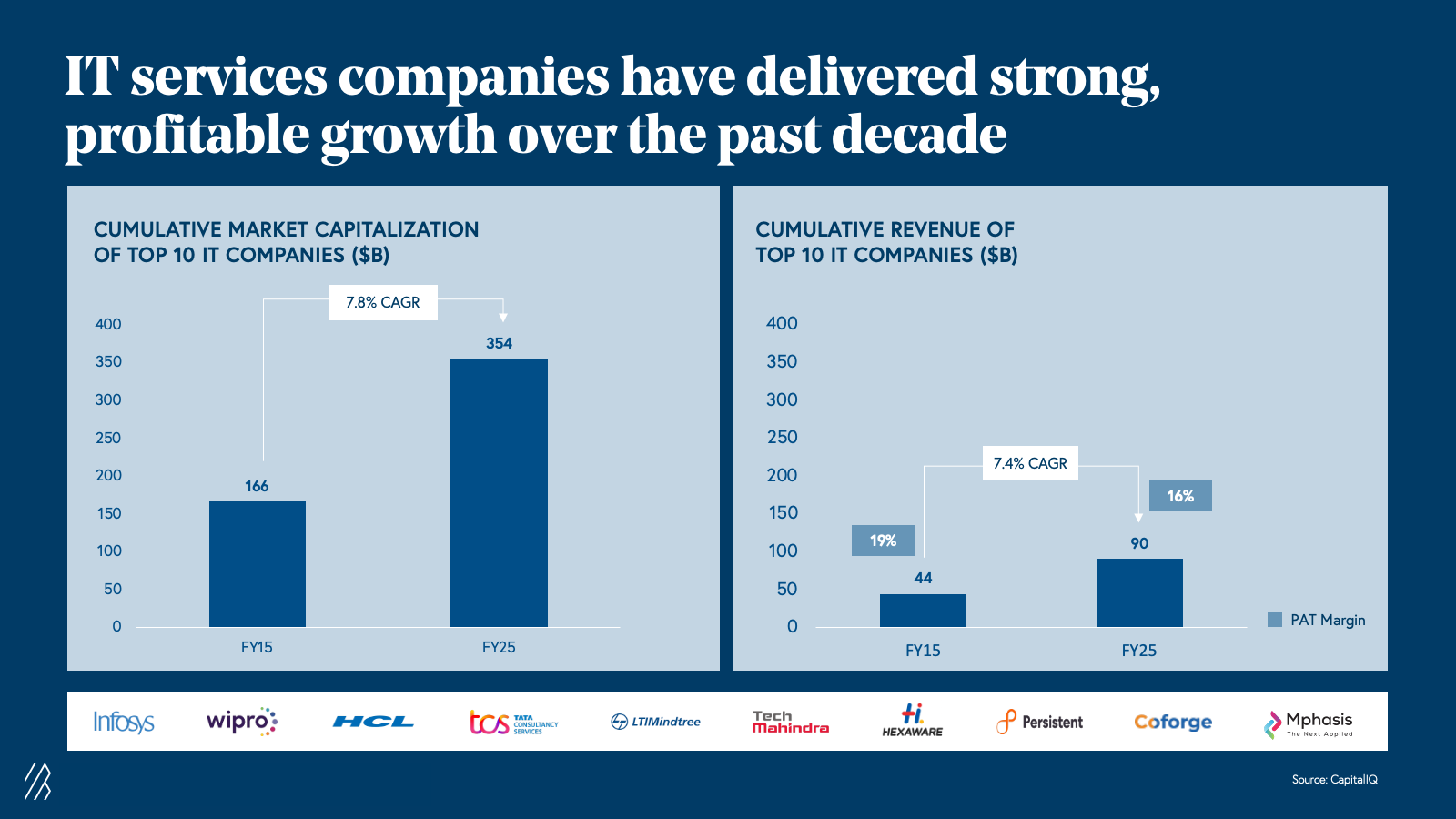

These levers have fueled sustained growth. Over the past decade, the combined market capitalization of India’s top ten IT services firms has more than doubled from $166 billion to $354 billion-underpinned by more than 7% annual revenue growth to nearly $90 billion.1

1. Data in this report has been generated through BVP research based on figures from company and industry reports

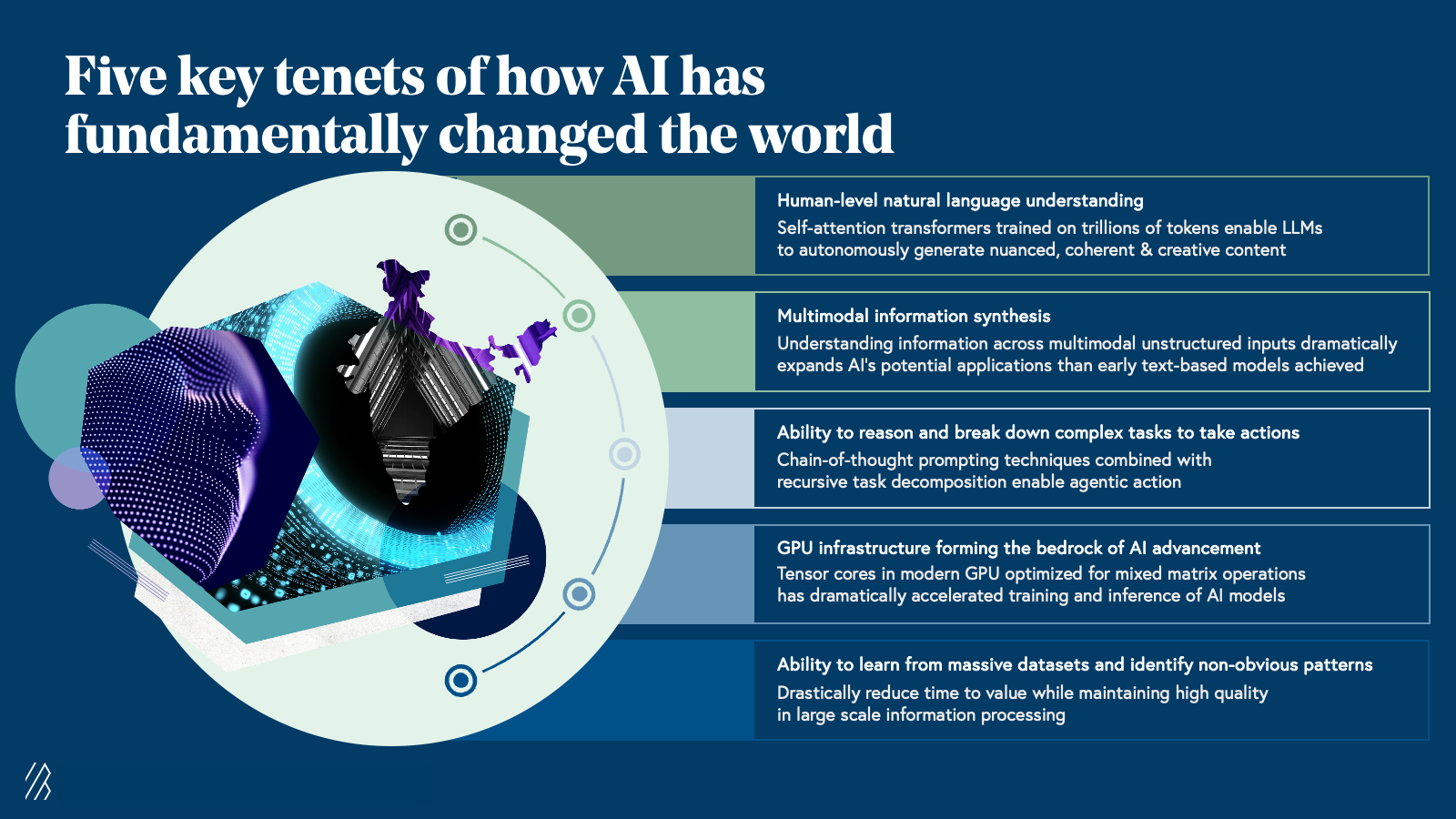

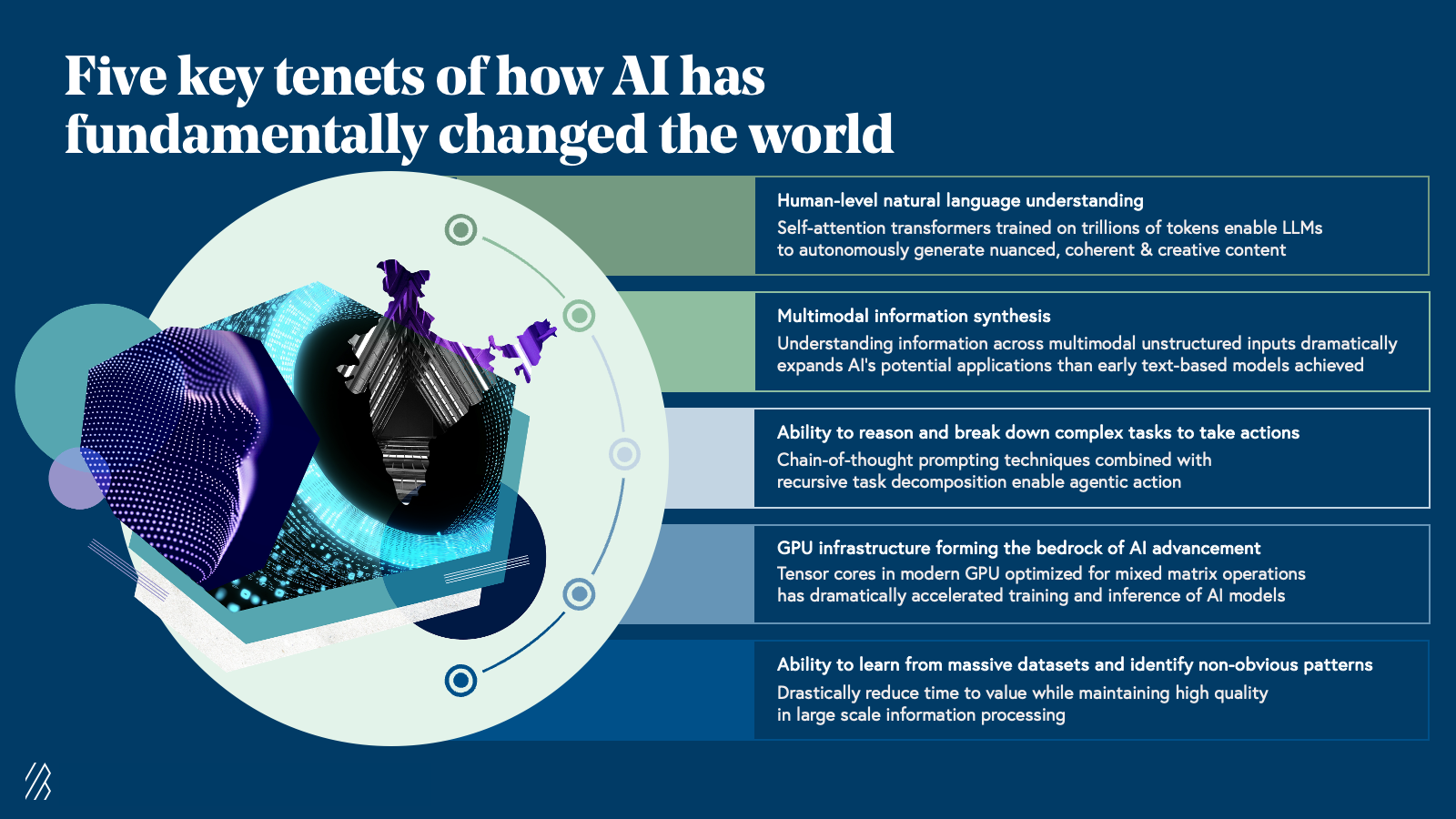

But AI is now rewriting the rules. Technologies such as transformer architectures and large language models (LLMs) are fundamentally changing how information is processed, tasks are executed, and value is delivered. What was once a people-centric delivery model is giving way to automation-driven intelligence. Cloud-hosted and open-source AI models are further lowering the cost and barriers to deploying sophisticated capabilities, reducing the need for massive, pyramid-shaped workforces.

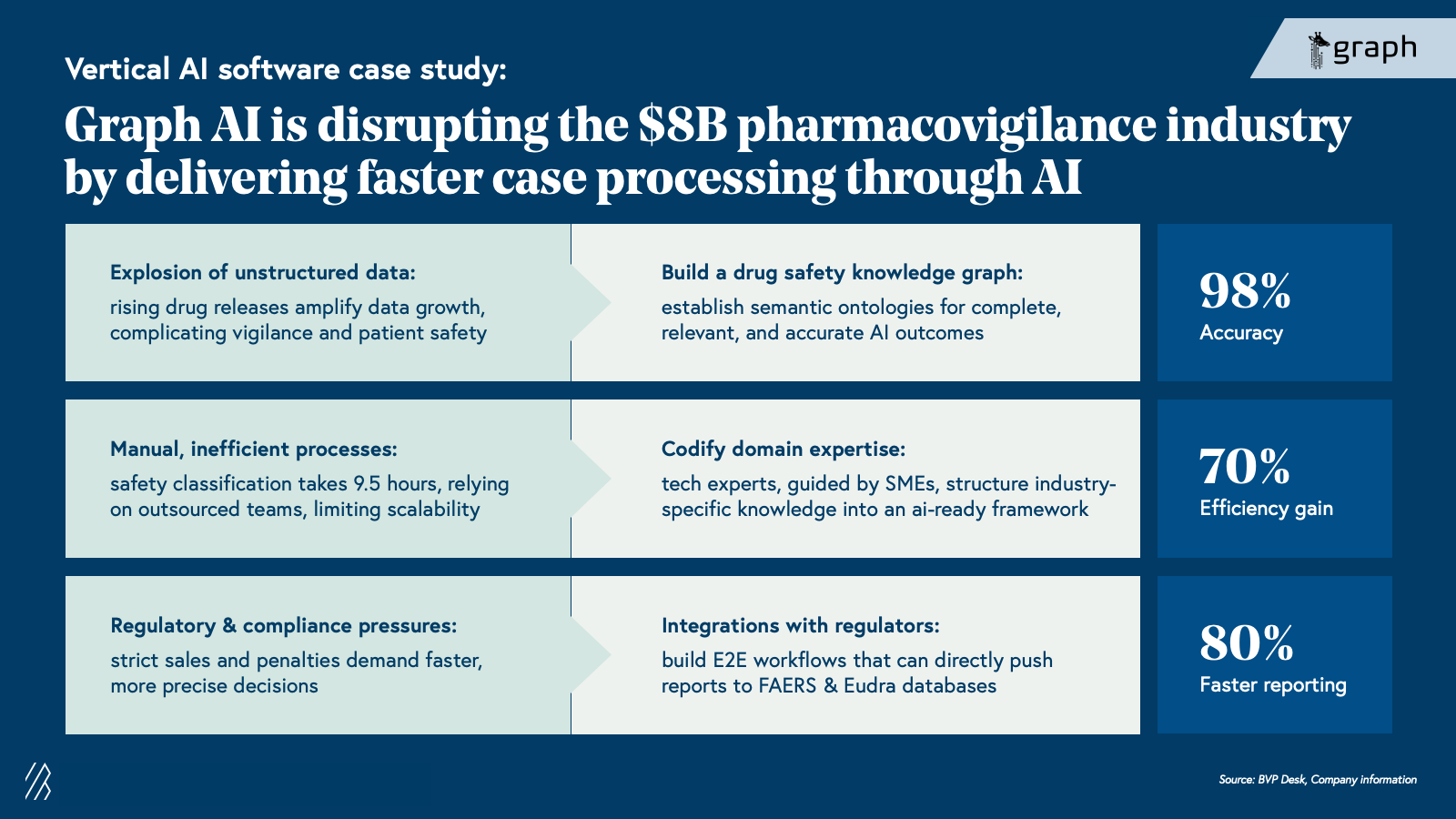

AI’s ability to process vast datasets, extract hidden insights, and accelerate time-to-value is reshaping client expectations and compressing delivery cycles. Firms like Graph AI illustrate this shift, for instance, by automating complex pharmacovigilance workflows by parsing hundreds of thousands of adverse drug event reports, evaluating causal links between drugs and patient symptoms, recommending remediation actions for human medical reviewers, and generating compliance-ready submissions for regulators.

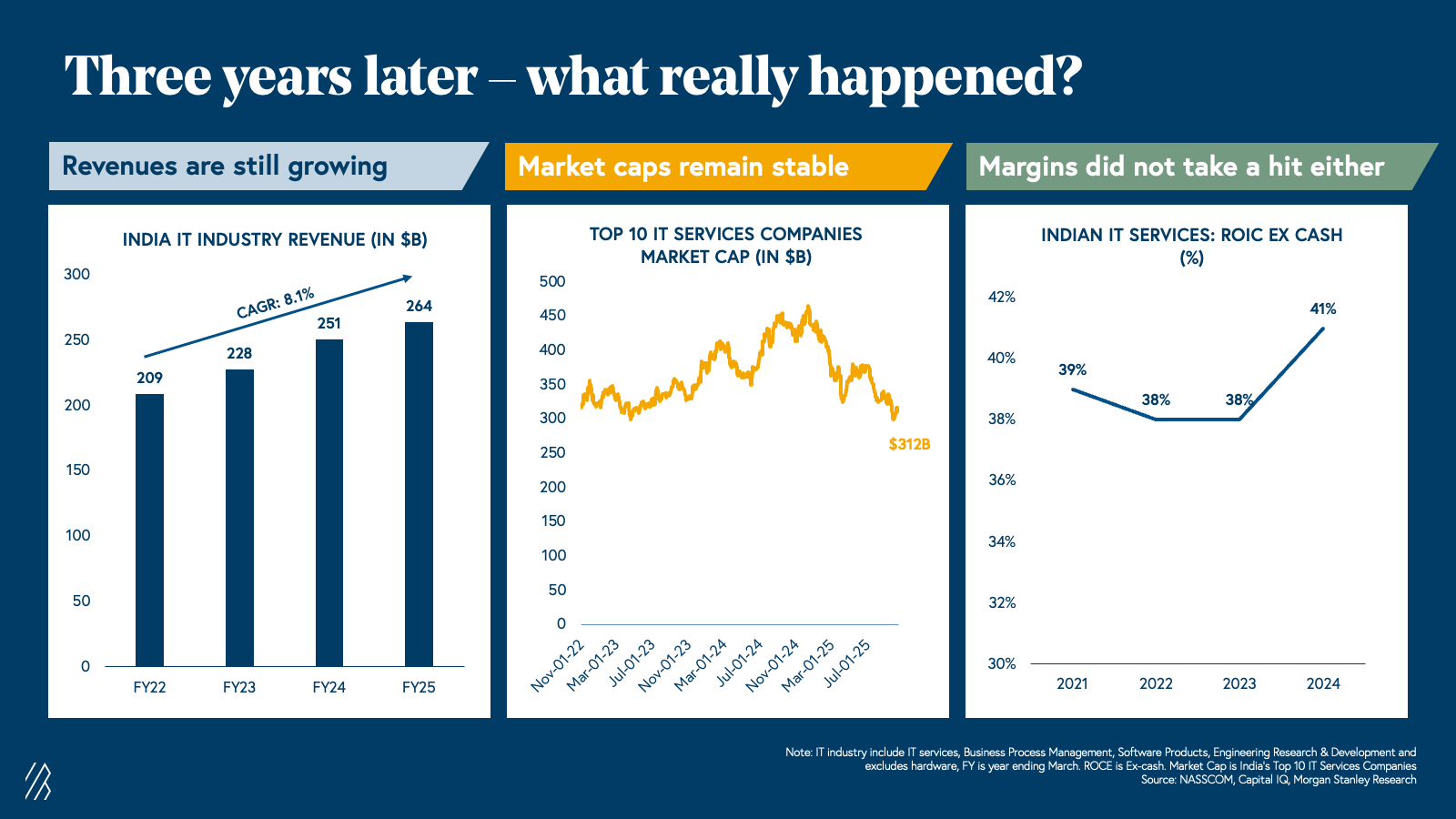

AI doesn’t just improve traditional IT services — it redefines them. When ChatGPT and other LLMs burst onto the scene, many feared an existential threat to India’s IT sector. The reality, however, is more nuanced: the industry isn’t dying; it’s going through a metamorphosis.

Why do enterprises still rely on IT services in the AI era?

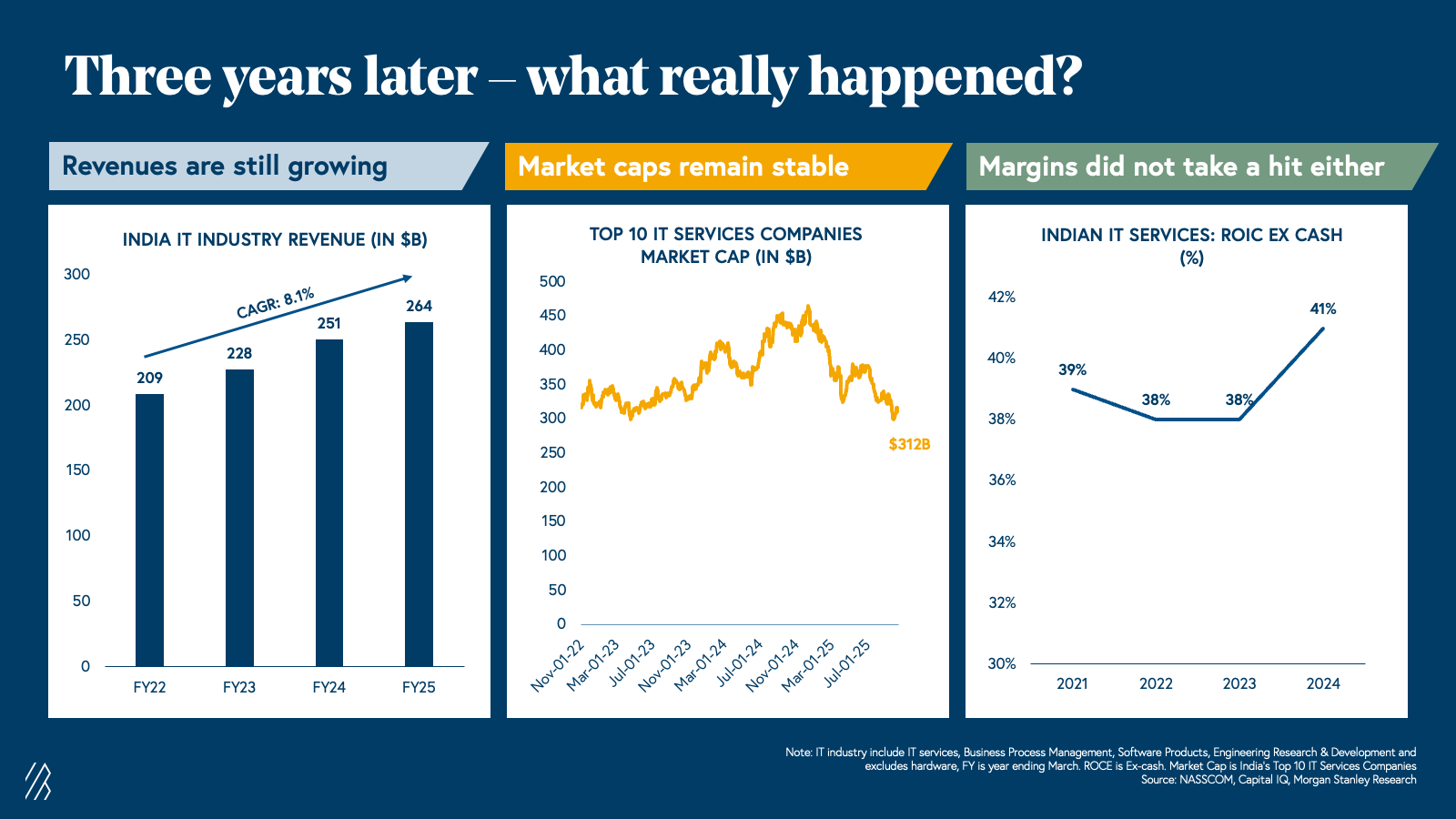

Three years after the launch of ChatGPT, India’s IT revenues continue to climb, and margins remain surprisingly resilient.

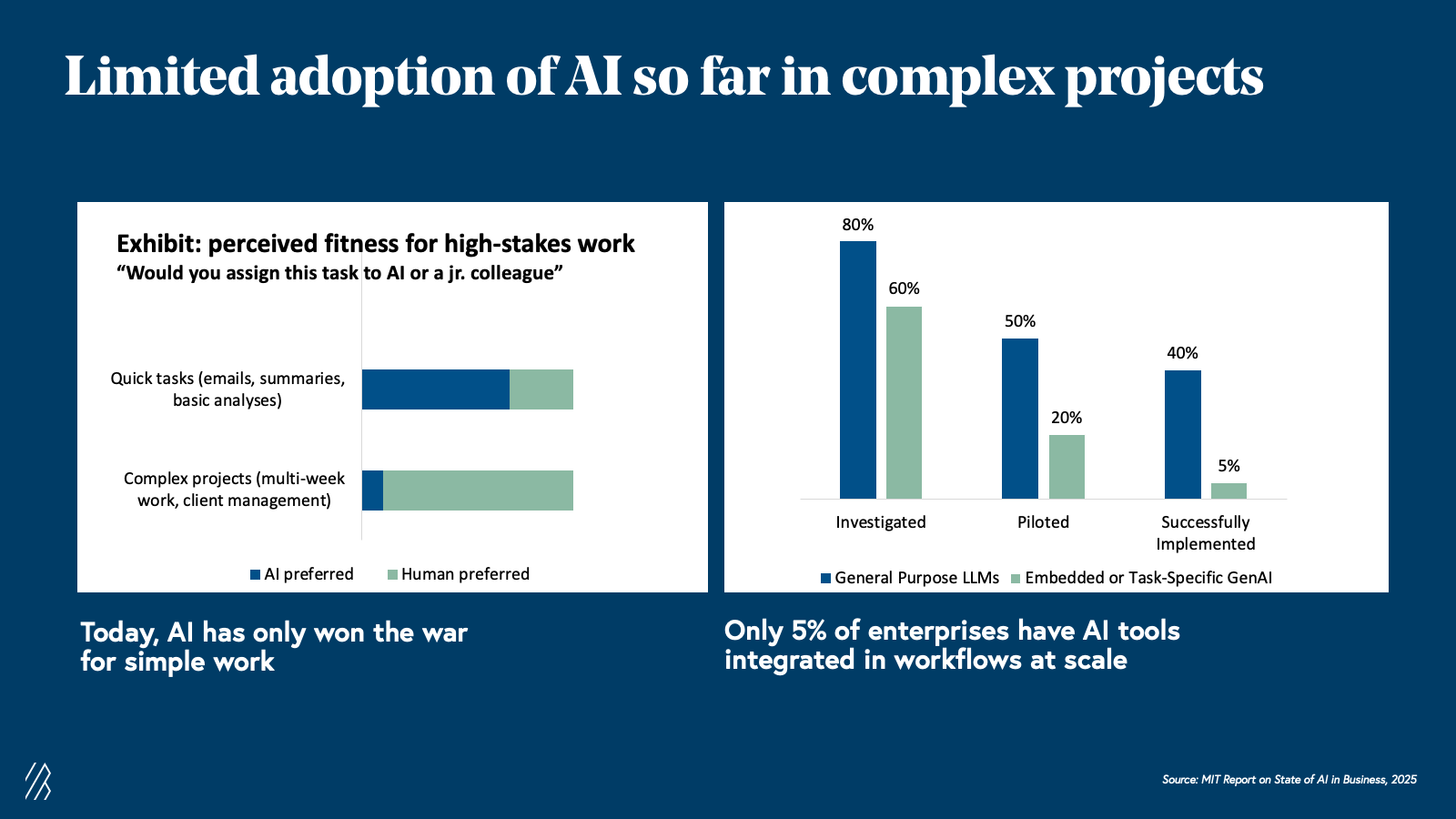

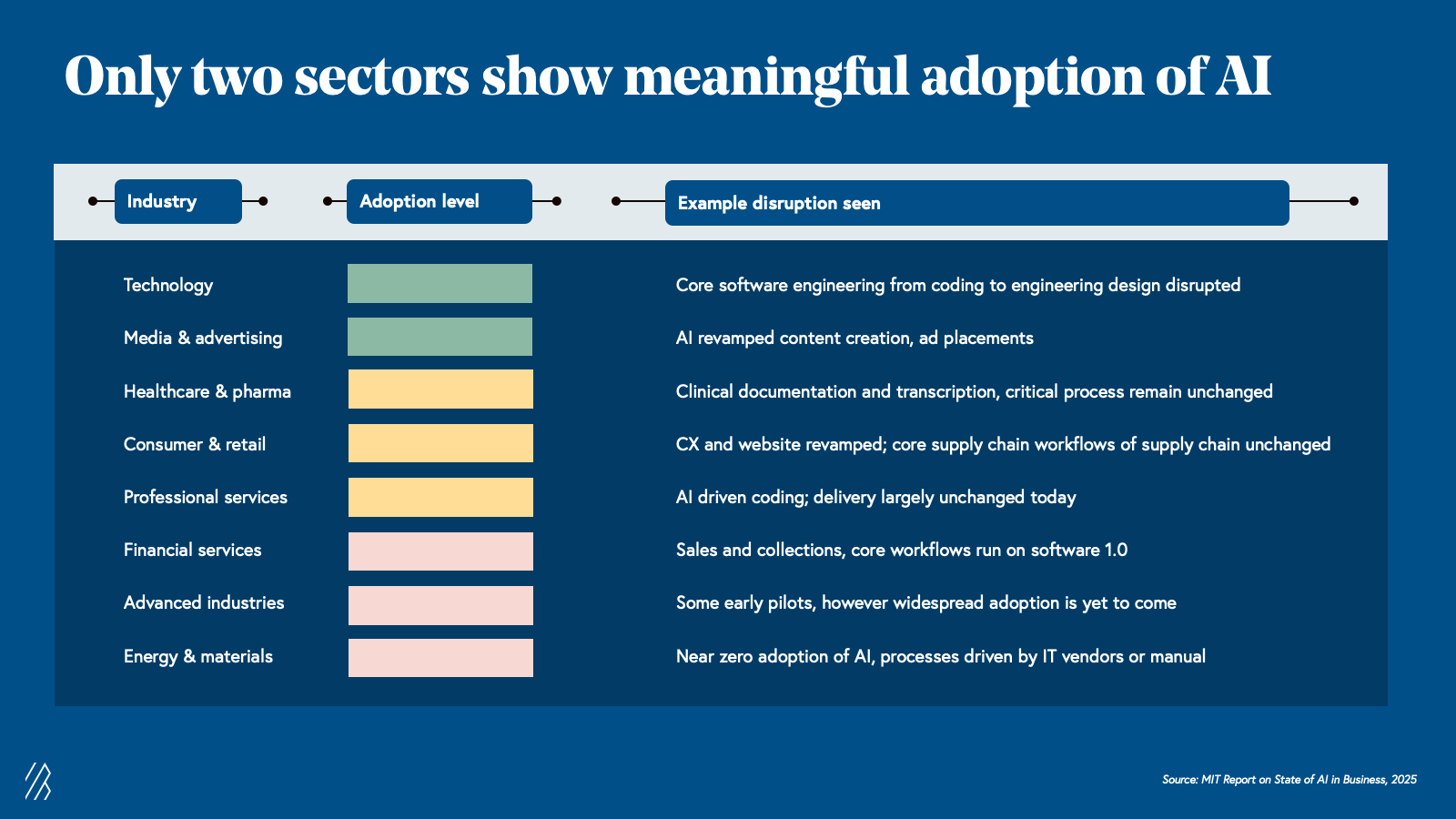

Research from MIT helps explain why. While general-purpose LLMs are now embedded in everyday workflows, from drafting emails to summarizing text, enterprise-grade AI adoption remains limited. So far, meaningful uptake has been concentrated in just two sectors: technology and media/advertising.

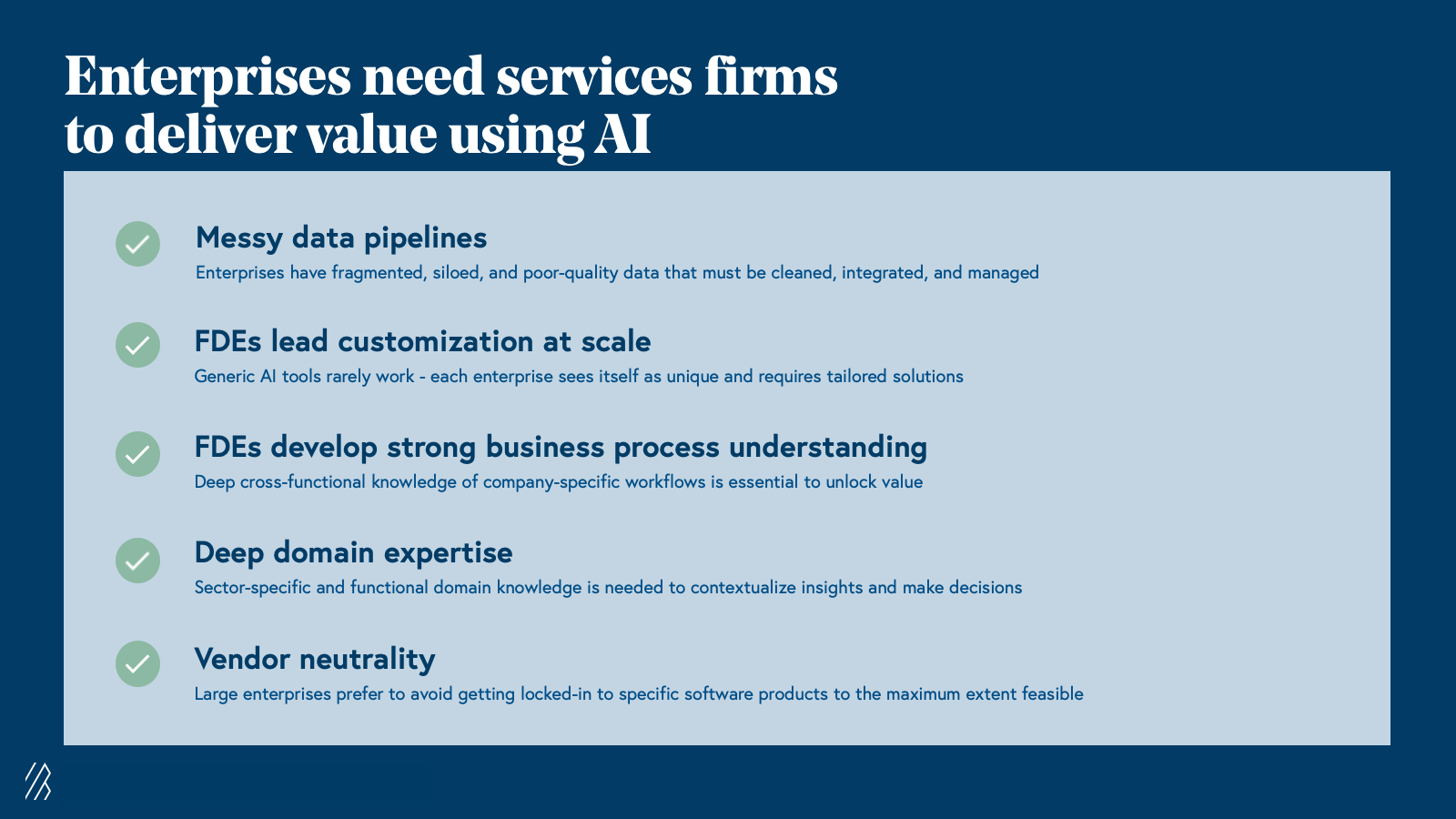

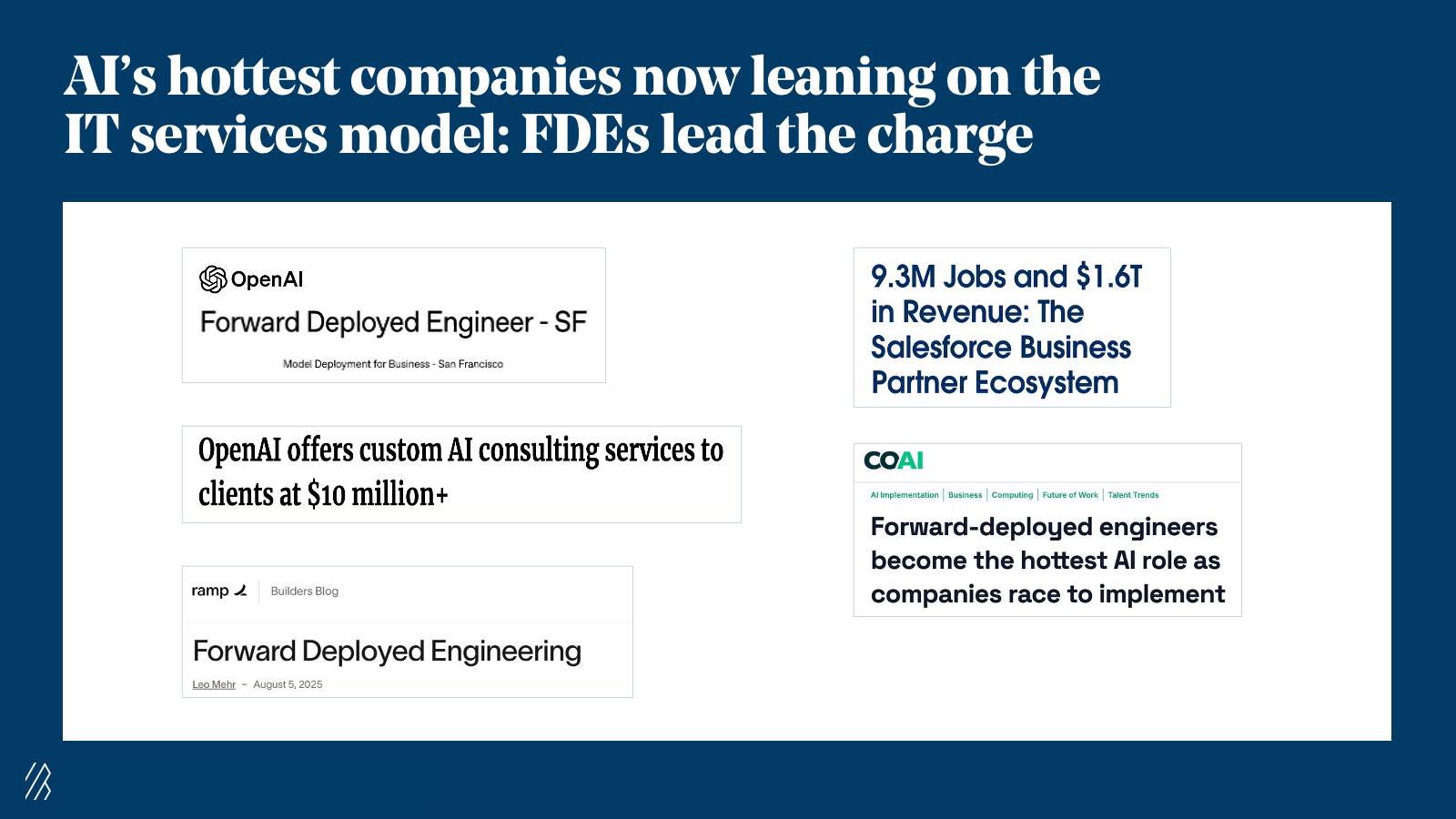

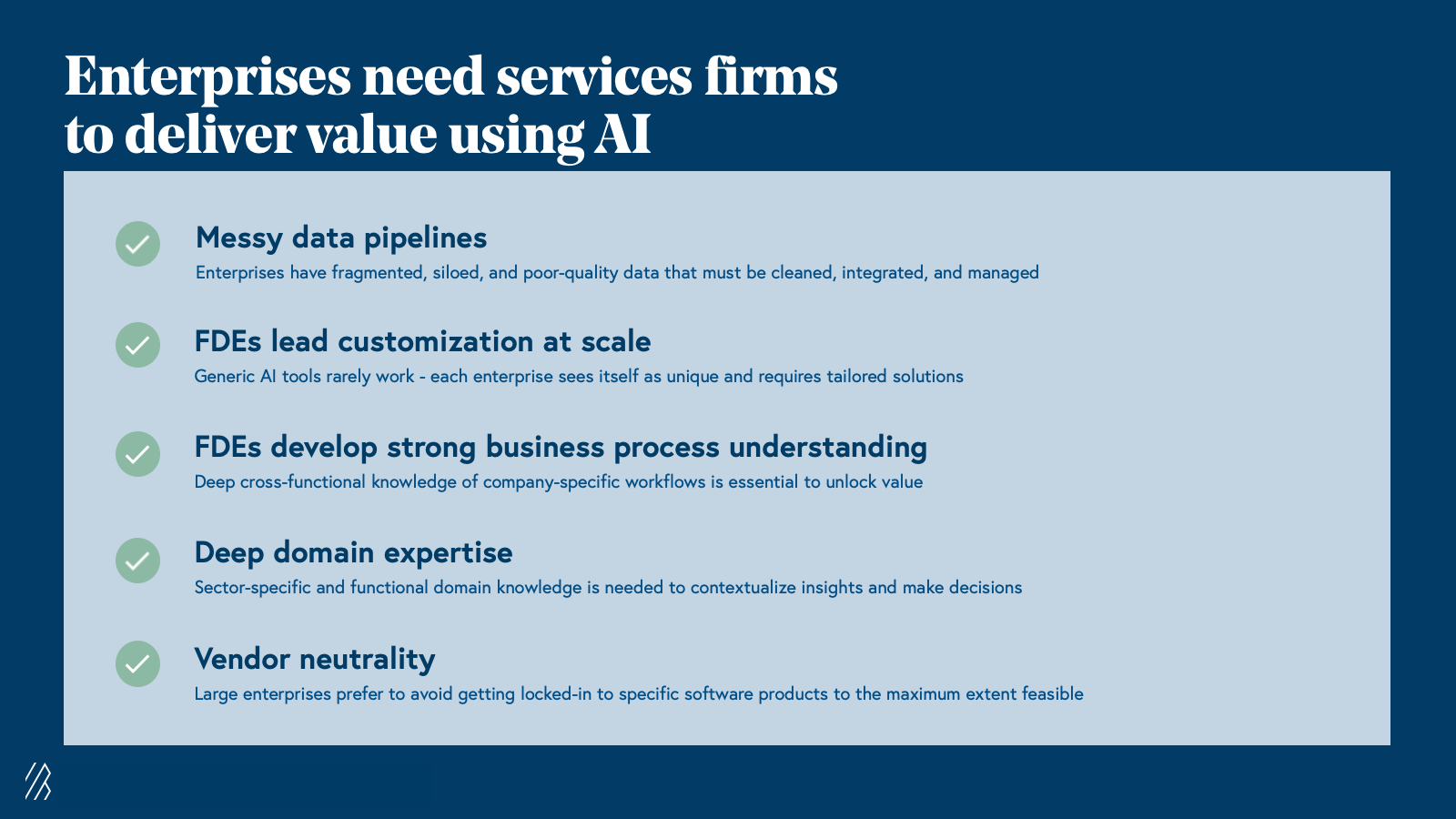

Our conversations with large enterprise clients and IT services executives reinforce this pattern. Incumbent IT firms continue to play a crucial role in solving complex business problems that are nuanced rather than providing one-size-fits-all SaaS deployments. The “forward-deployed engineer” (FDE) model — now adopted even by leading AI companies like OpenAI — was pioneered by IT services firms precisely for this reason. By embedding engineers directly within client organizations, these firms gain the deep business context needed to design tailored, scalable workflows that deliver measurable outcomes.

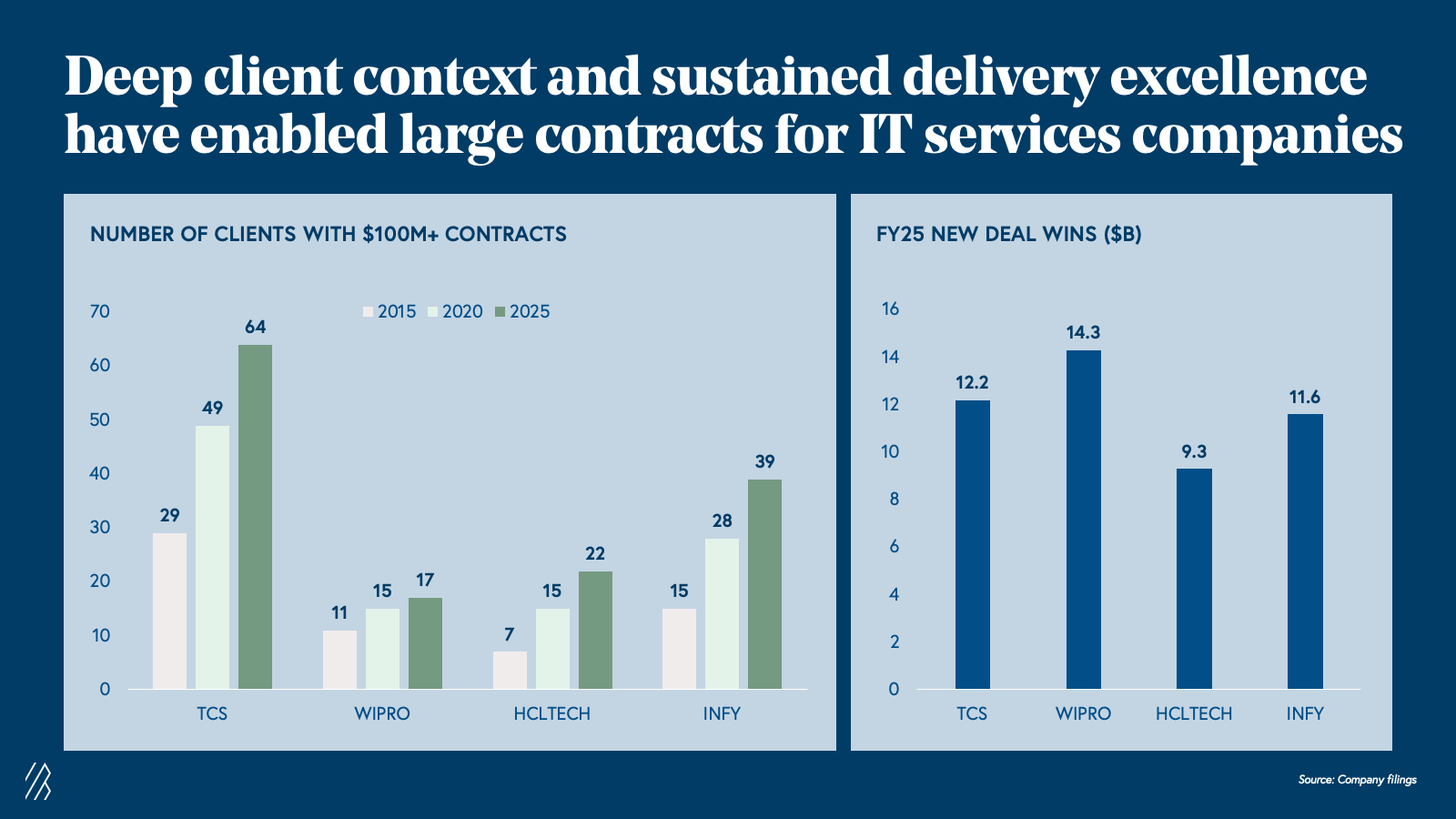

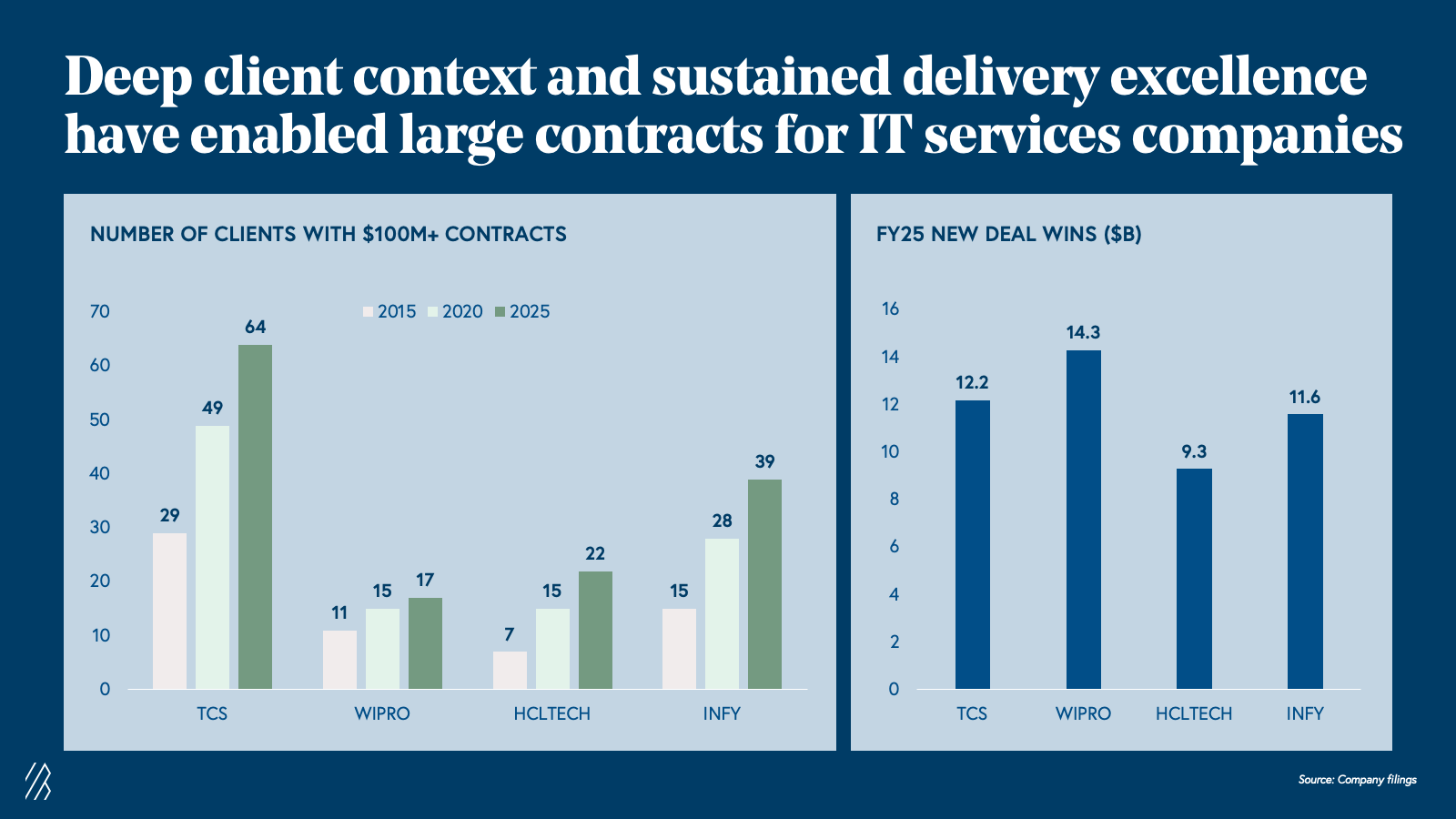

The strong balance sheets of these companies further strengthen client confidence. Fortune 500 companies trust that IT services vendors can manage multi-year projects, absorb macro shocks, and deliver consistent execution. Deep client relationships and delivery excellence have made large contract wins routine — the top four Indian IT services companies now count over 140 clients generating $100M+ in total value per annum.

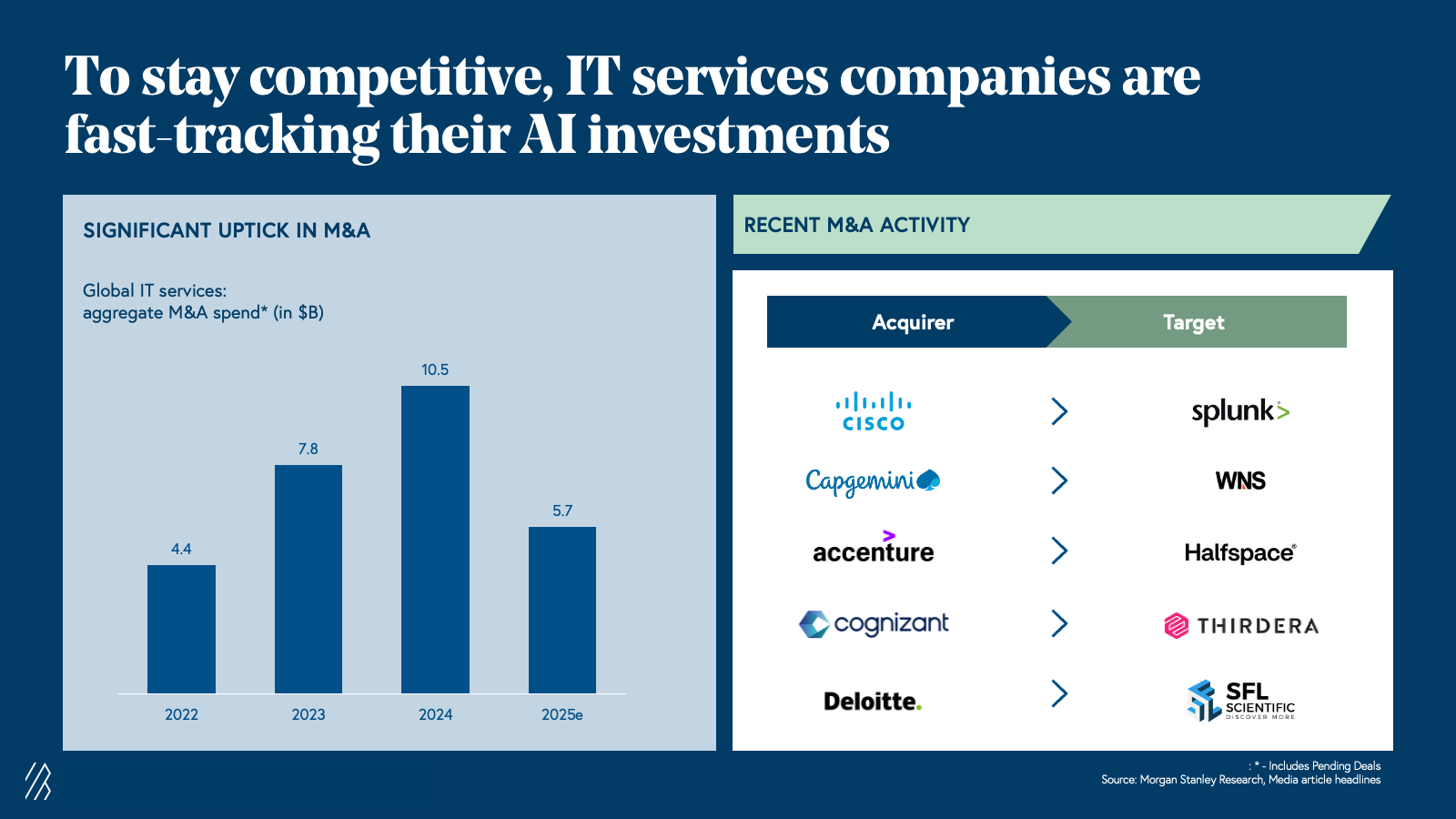

In this AI-first world, these behemoth companies are slowly retooling their playbooks to stay relevant. All major players have announced significant AI initiatives, from large-scale workforce upskilling to new acquisitions. Wipro’s ai360 program, for example, was launched in 2023 alongside a $1 billion AI investment commitment.

Yet, while these moves signal intent, the structural realities of their business models pose formidable challenges to meaningful transformation — creating an opening for agile, new disruptors.

What structural constraints hinder traditional IT players from becoming fully AI-native?

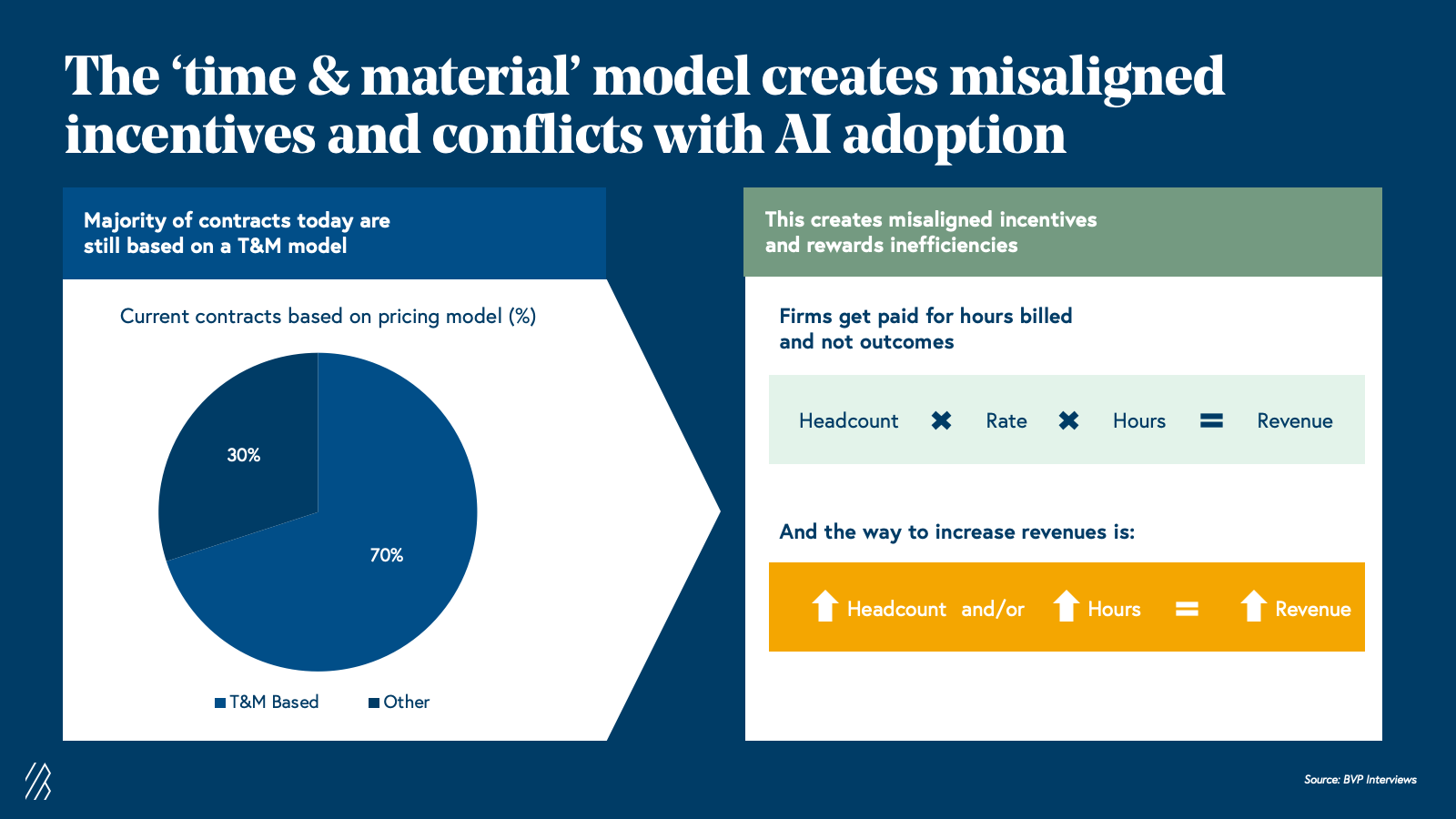

Despite their financial strength, most Indian IT firms remain trapped in legacy economics. The time-and-material (T&M) model, where revenue is tied to billable hours, creates an inherent misalignment in the AI era. Vendors are paid for time spent, not for outcomes delivered, reducing the incentive to automate, innovate, or improve efficiency.

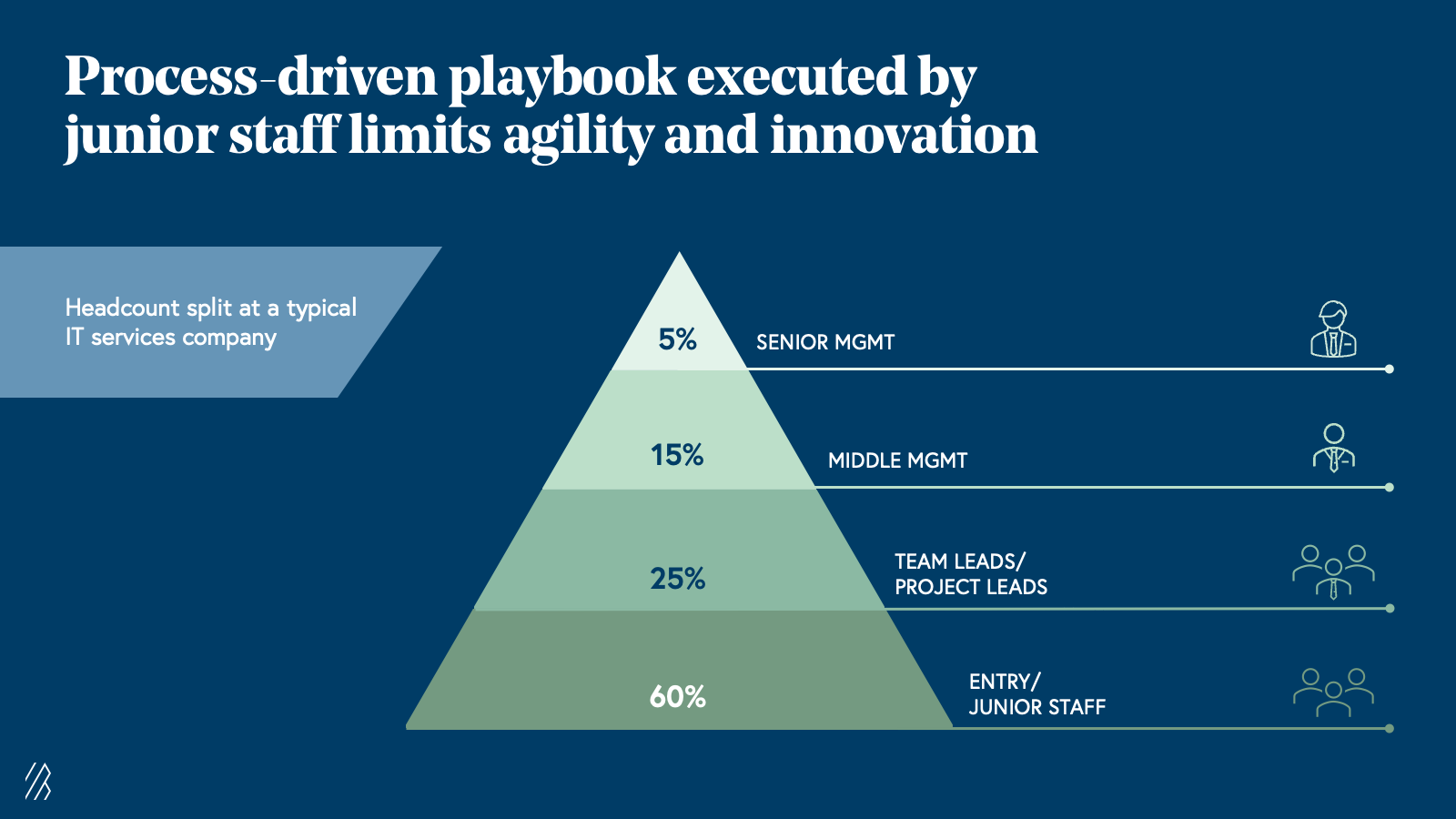

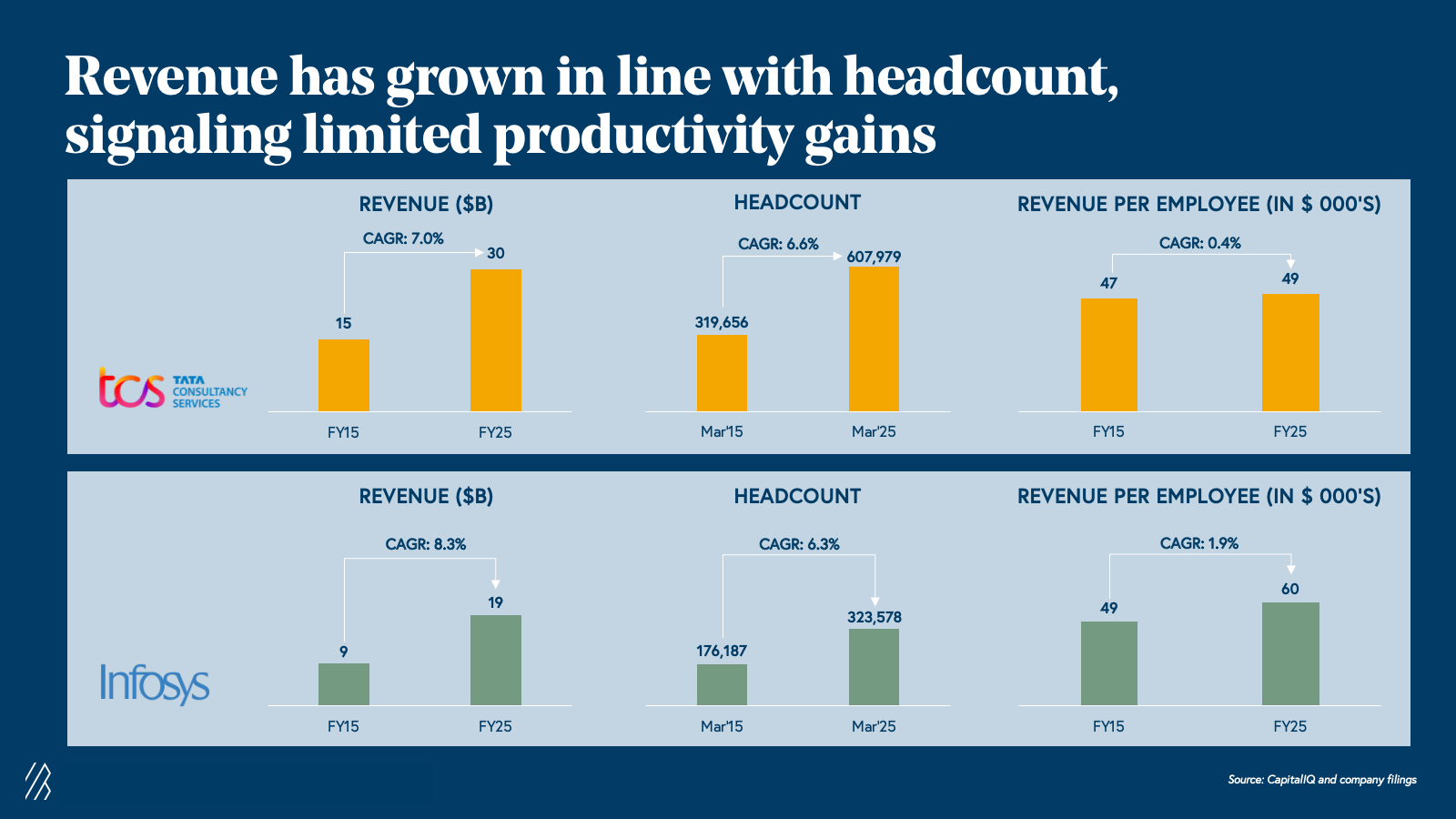

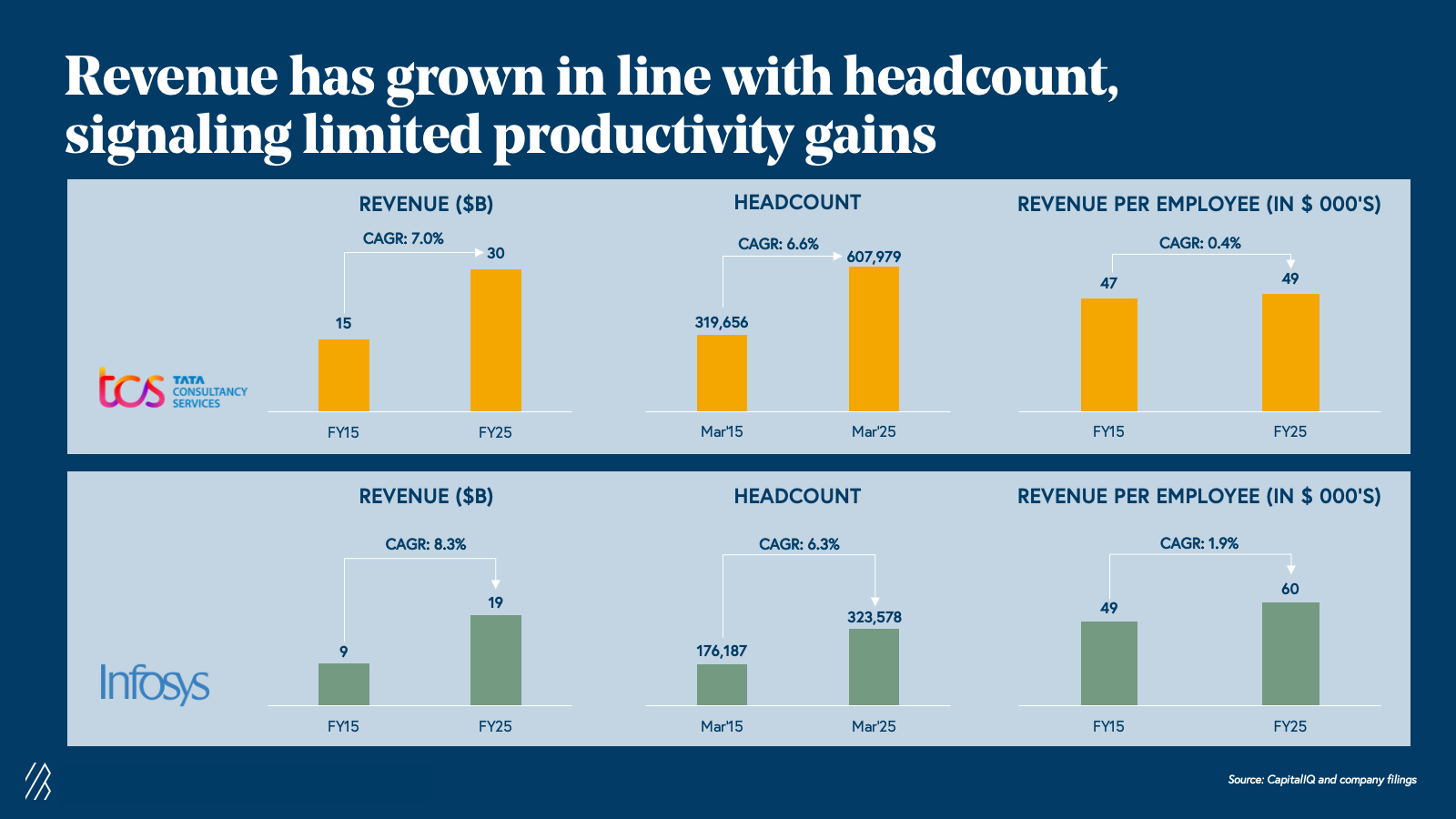

With over 60% of employees in entry-level roles, work is standardized, and success is measured by adherence to process rather than creativity or problem-solving. Productivity gains have been minimal: at TCS, revenues doubled from $15B to $30B over the past decade, but headcount nearly doubled too — from 320,000 to 608,000 — leaving revenue per employee flat at ~$49,000. Growth still depends on adding more people, not doing more with the same or fewer resources.

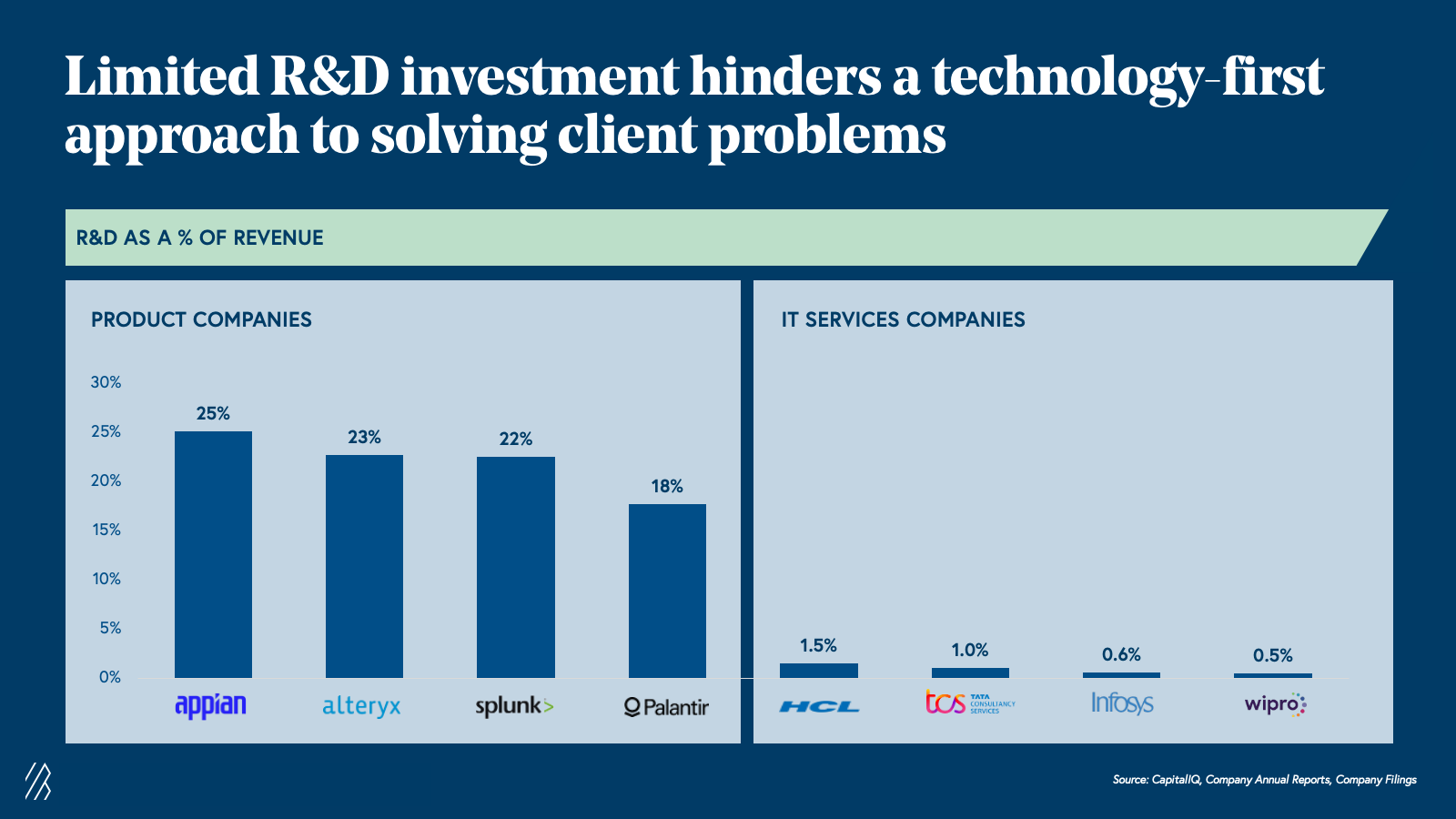

R&D investment remains another hurdle. While global product companies routinely allocate 20%+ of revenues to innovation, Indian IT firms spend less than 2% on IP creation, leaving them heavily reliant on labor-based delivery.

To remain competitive, legacy players will need to disrupt their own business model and undergo meaningful transformation — the classic Innovator’s Dilemma. While some may achieve this, we think this opens an opportunity for AI-native challengers to emerge with faster, leaner, and more cost-efficient business models built for a new era of intelligence outsourcing.

Three types of fast-moving AI-first challengers that will disrupt existing models

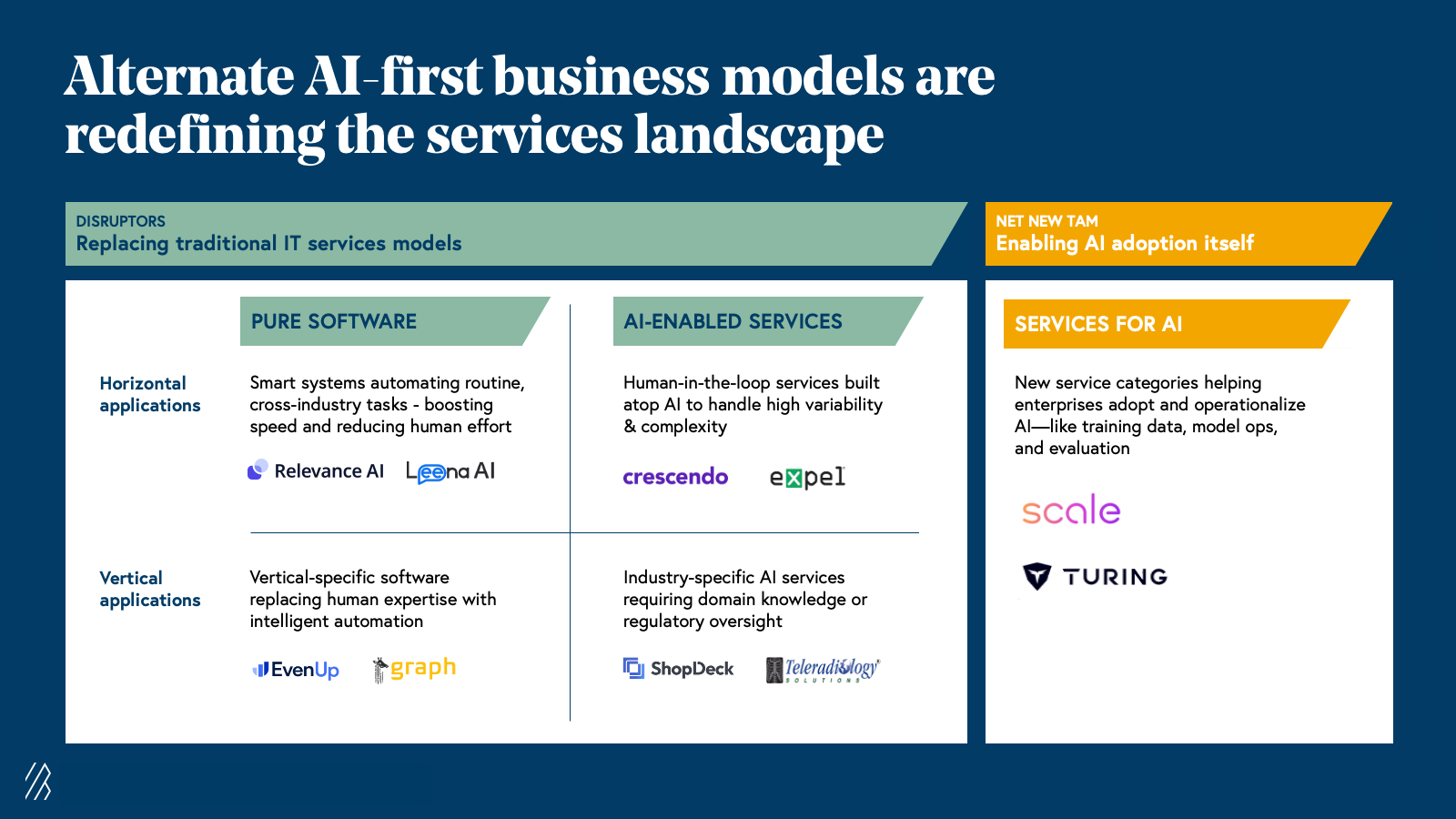

At Bessemer, we see three broad categories of AI-first business models that are poised to disrupt traditional IT services:

AI‑enabled services

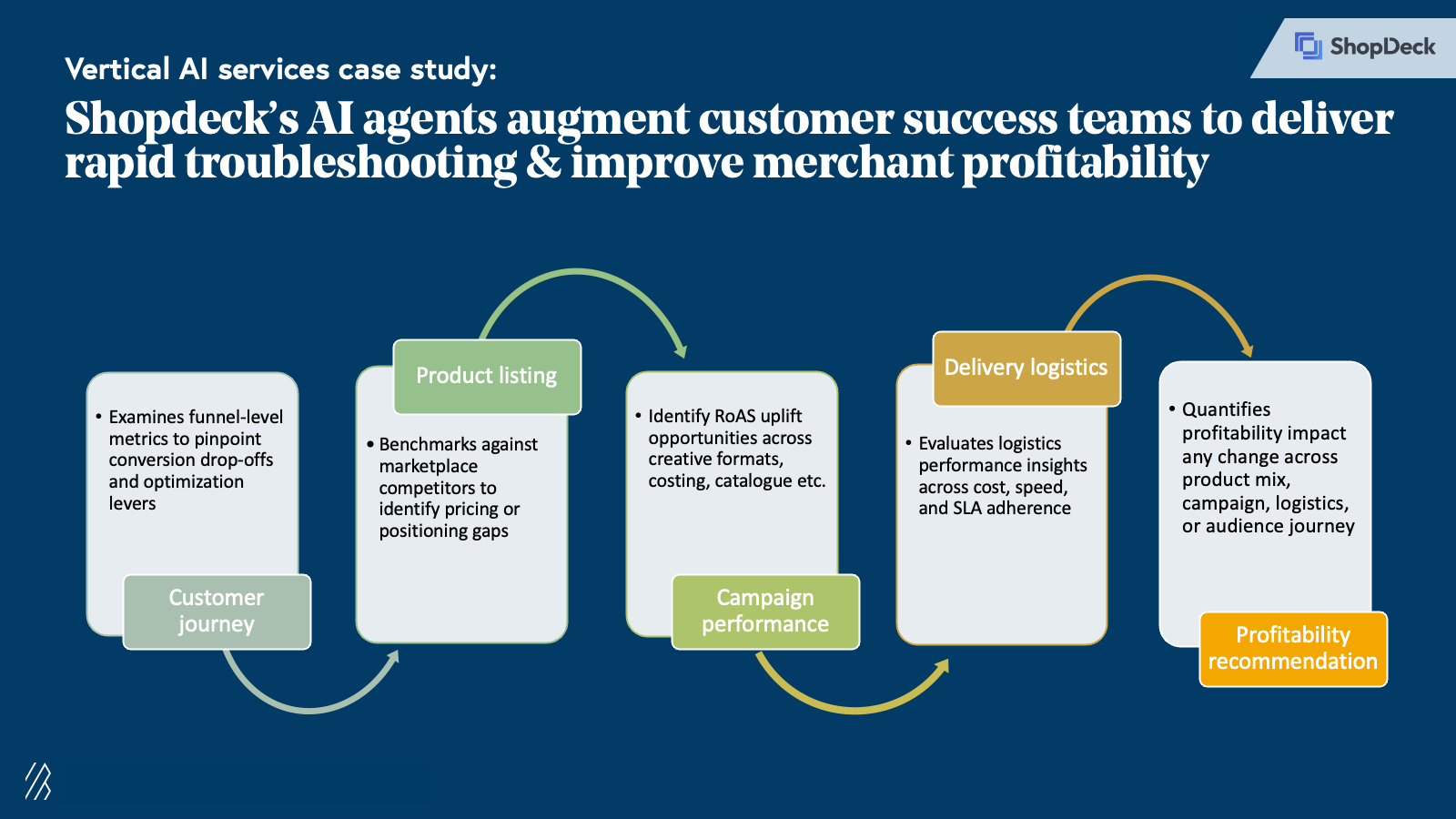

These hybrid models blend AI automation with human‑in‑the‑loop (HITL) partnership. Shopdeck uses AI agents to augment customer success teams and to guide merchants on techniques to drive sales and margins. At Teleradiology Solutions, AI-assisted pre-reading enables human radiologists to provide accelerated breast cancer diagnoses.

Technology services for AI

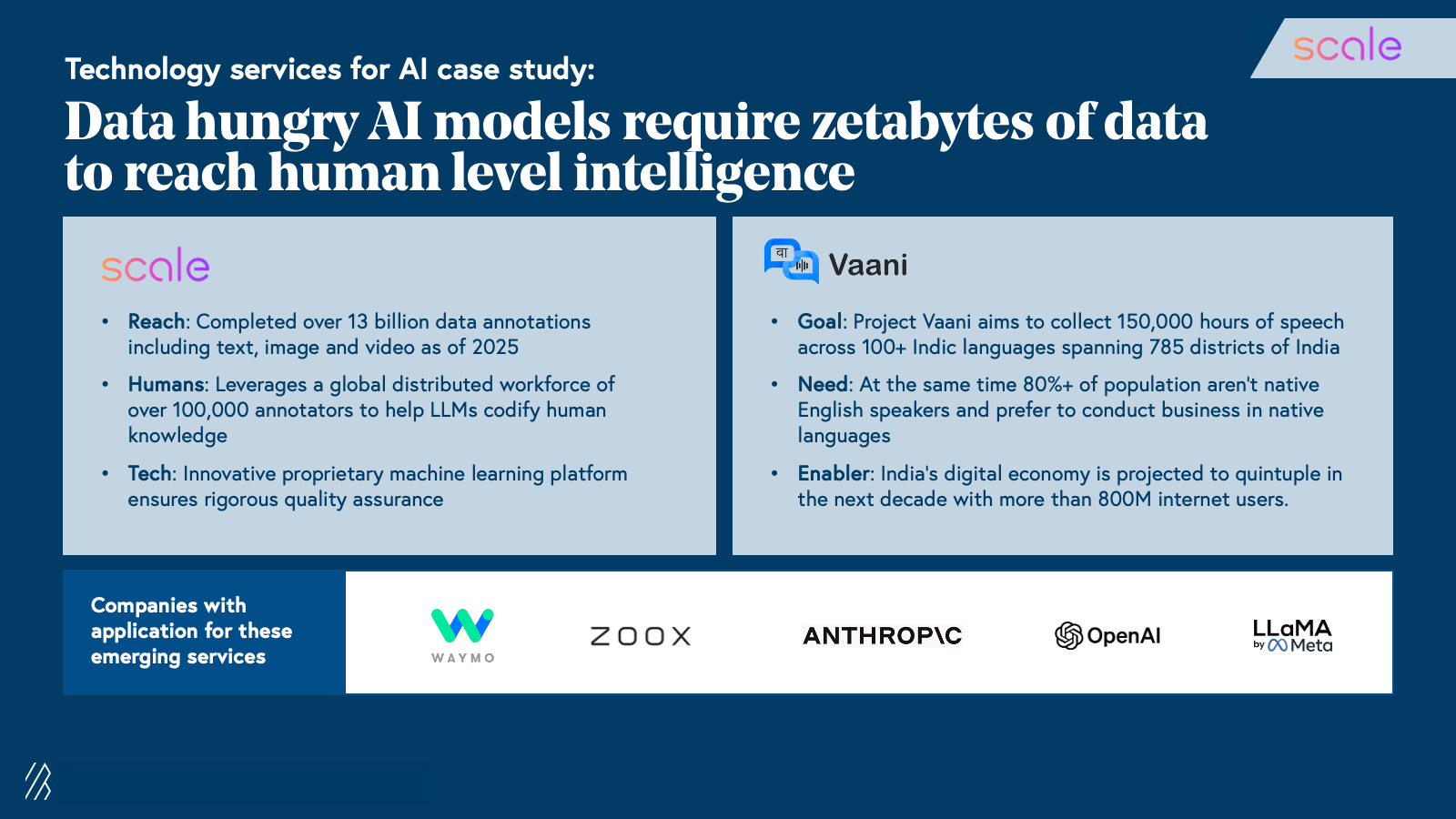

These firms build the data infrastructure, LLM-Ops, and evaluation capabilities needed to build net new AI solutions. For instance, companies like Scale AI have created massive markets around supporting foundational model development-completing 13 billion+ annotations across text, image, and video through networks of over 100,000 annotators. Together, these players form the scaffolding for the next generation of AI solutions.

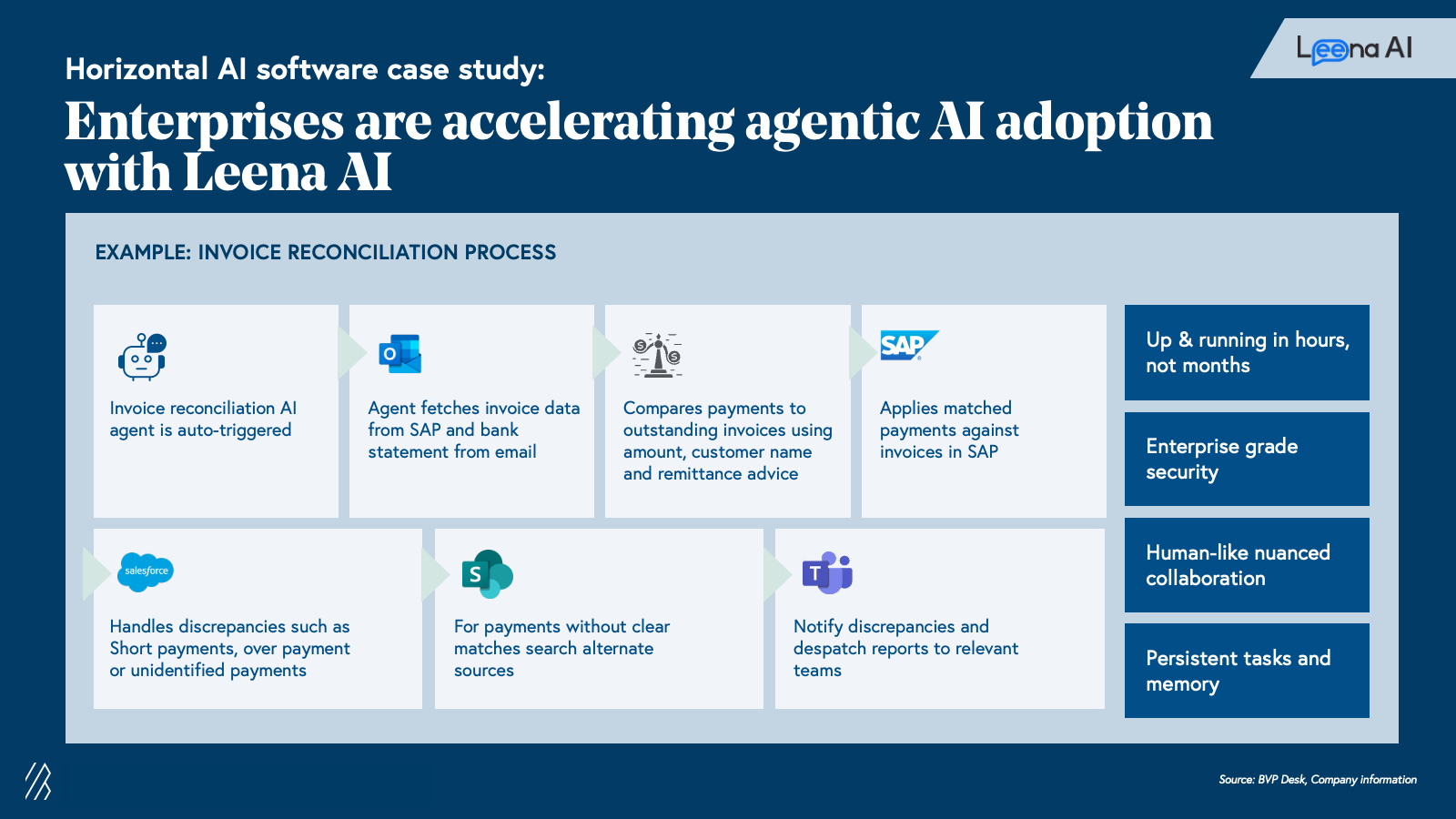

Pure software

These challengers are intelligent platforms that fully automate tasks end-to-end, delivering high-speed, scalable outputs with minimal human input. Horizontal platforms such as Leena AI and Relevance AI power cross-industry automation in areas like customer support and data labeling. Vertical specialists like Elise AI, EvenUp, and Graph AI go further, replacing human experts with domain-specific software-automating everything from legal demand package creation to real-estate leasing decisions.

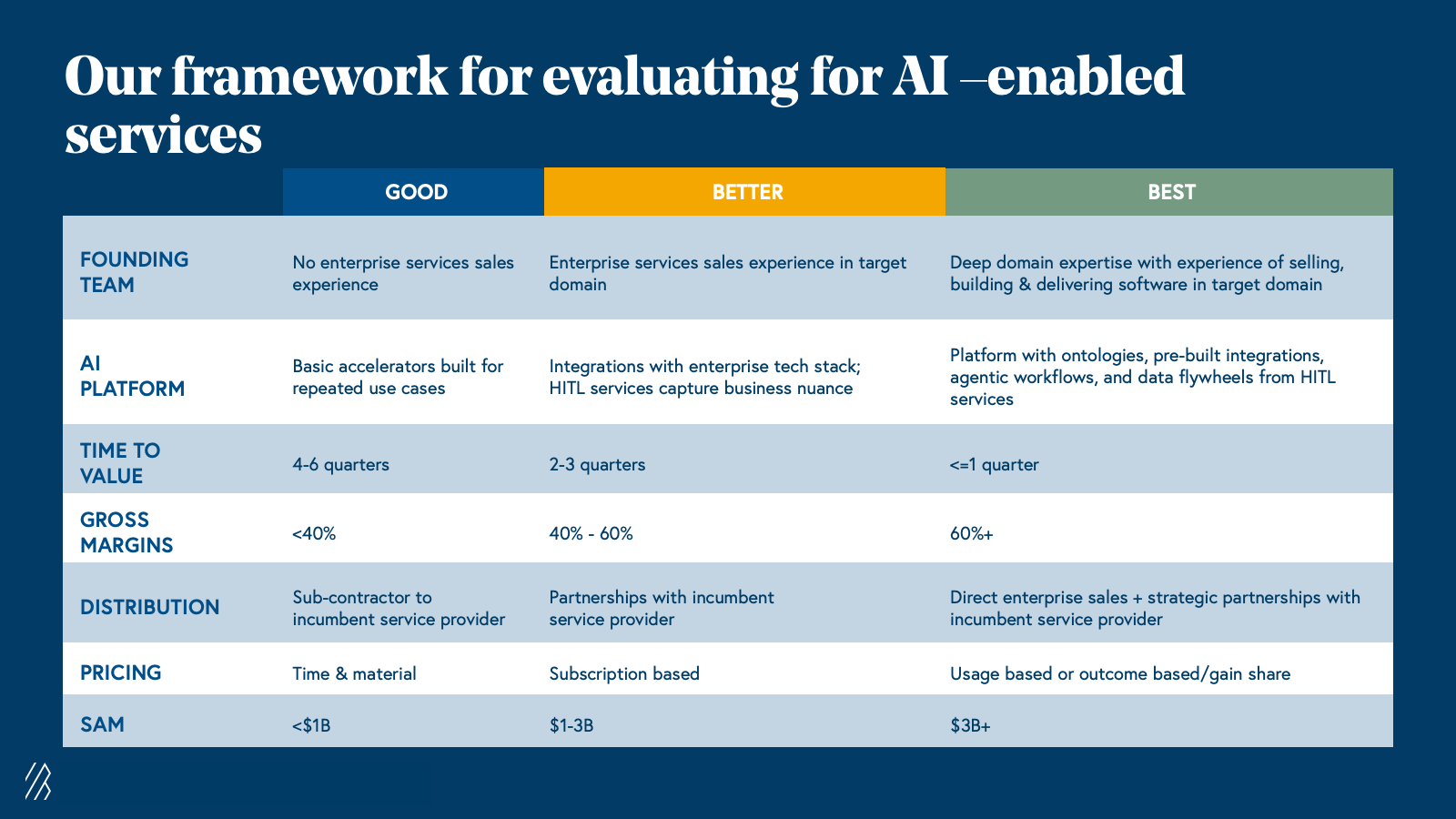

To truly disrupt the incumbents, an AI-first challenger must:

- Assemble an exceptional founding team that combines deep domain expertise with enterprise sales and product-led execution strength.

- Build AI-driven platforms that seamlessly integrate client infrastructure and deliver out-of-the-box customizable solutions, while actively learning from the FDE feedback loop to drive core platform improvements.

- Deliver superior outcomes, faster time-to-value, lower costs, and measurable ROI — all while maintaining strong gross margins and distribution.

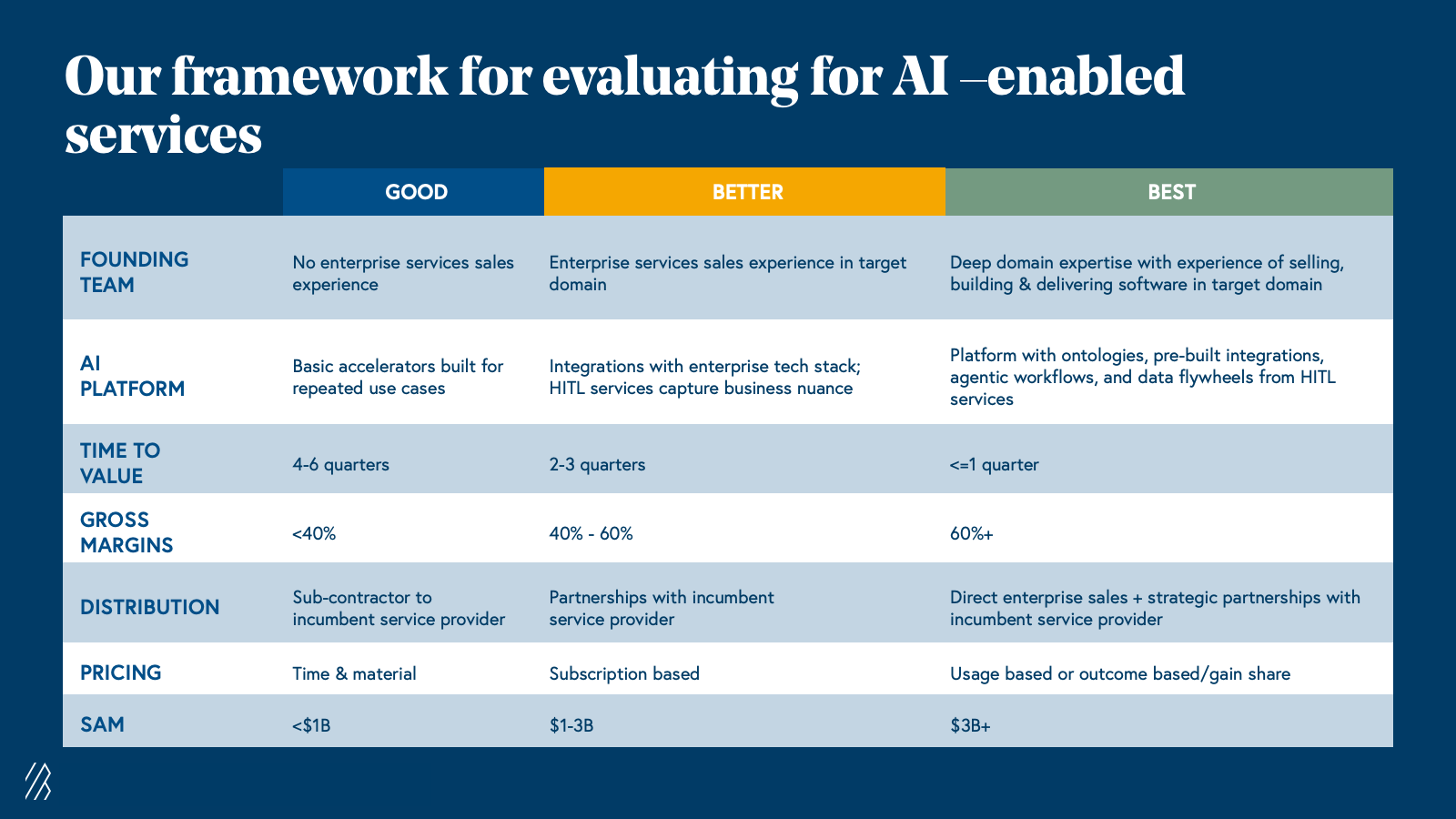

At Bessemer, our framework for assessing AI-native companies focuses on seven key factors: team quality, platform stickiness, time-to-value, margins, distribution, pricing strategy, and serviceable addressable market (SAM).

The most disruptive AI-first companies will combine deep domain expertise with entrenched workflows, demonstrate tangible business impact within a quarter, and sell directly to enterprises on outcome-based pricing models.

The future of AI-enabled IT — and what this means for founders

Our analysis suggests that AI will bring about significant efficiency gains in the way outsourcing teams function. While this will lead to price compression in the short term, we believe that the IT services market will continue to grow on account of:

- A new wave of outsourcing: As enterprises race to capture the productivity upside of AI, previously in-house complex workflows are becoming candidates for outsourcing — especially those requiring deep client context or cross-functional coordination. Boards and investors are pressing management teams to demonstrate AI-driven ROI, prompting enterprises to pilot projects with AI-first service providers. Once proven, these pilots will scale into long-term programs, creating entirely new categories.

- A new market for AI services: Beyond optimizing existing operations, AI itself has created a new market for services that enable its development, deployment, and governance at scale. From data curation and model tuning for AI infrastructure and evaluation pipelines, these “technology services for AI” players are powering the foundation of the new-age AI stack.

We predict that the Indian IT industry will grow to $400B by 2030, anchored in significant transformation. Companies that will ride this AI wave while delivering superior outcomes to enterprises in an AI-first approach will emerge as the next generation of behemoths and capture a meaningful slice of this opportunity.

Our investment thesis on AI services in India

1. The IT services industry will grow with margins intact: Enterprises will continue to need high-quality services partners who can operate on top of messy, unstructured data locked within legacy systems, and deliver actionable business outcomes

2. Legacy players have moats, but will struggle to adapt: Incumbents are entrenched in enterprise workflows and understand business nuances a lot better than challenger firms, but a difficult task to AI-upskill 100K+ FDEs & disrupt decades-long T&M pricing models

3. Challenger firms have a rare window to break in: Nimble AI-first services firms can differentiate with superior AI-first offerings

4. AI will not kill IT services — it will reshape them: Service delivery can be better, faster, cheaper with a platformized approach to services with skilled FDEs leading the way

New entrants combining AI automation with domain expertise are already proving that they can deliver outcomes that are better, faster, and cheaper than traditional services. For founders, the time is now to build AI‑first companies that leverage data, domain knowledge, and cutting‑edge models to capture this expanding opportunity.

If you’re building in this space, we would love to hear from you. Reach out to us at india_ai@bvp.com