The Cloud 100 Benchmarks Report 2023

Bessemer reveals insights into the 2022 Cloud 100 cohort—valuation marks aren’t always a true indicator of fundamental performance and Centaurs are dominating the private cloud market.

Today Bessemer Venture Partners, Forbes, and Salesforce Ventures announced the 2023 Cloud 100 List, the definitive ranking of the top 100 private cloud companies. And this year’s list feels different – is different – for two core reasons.

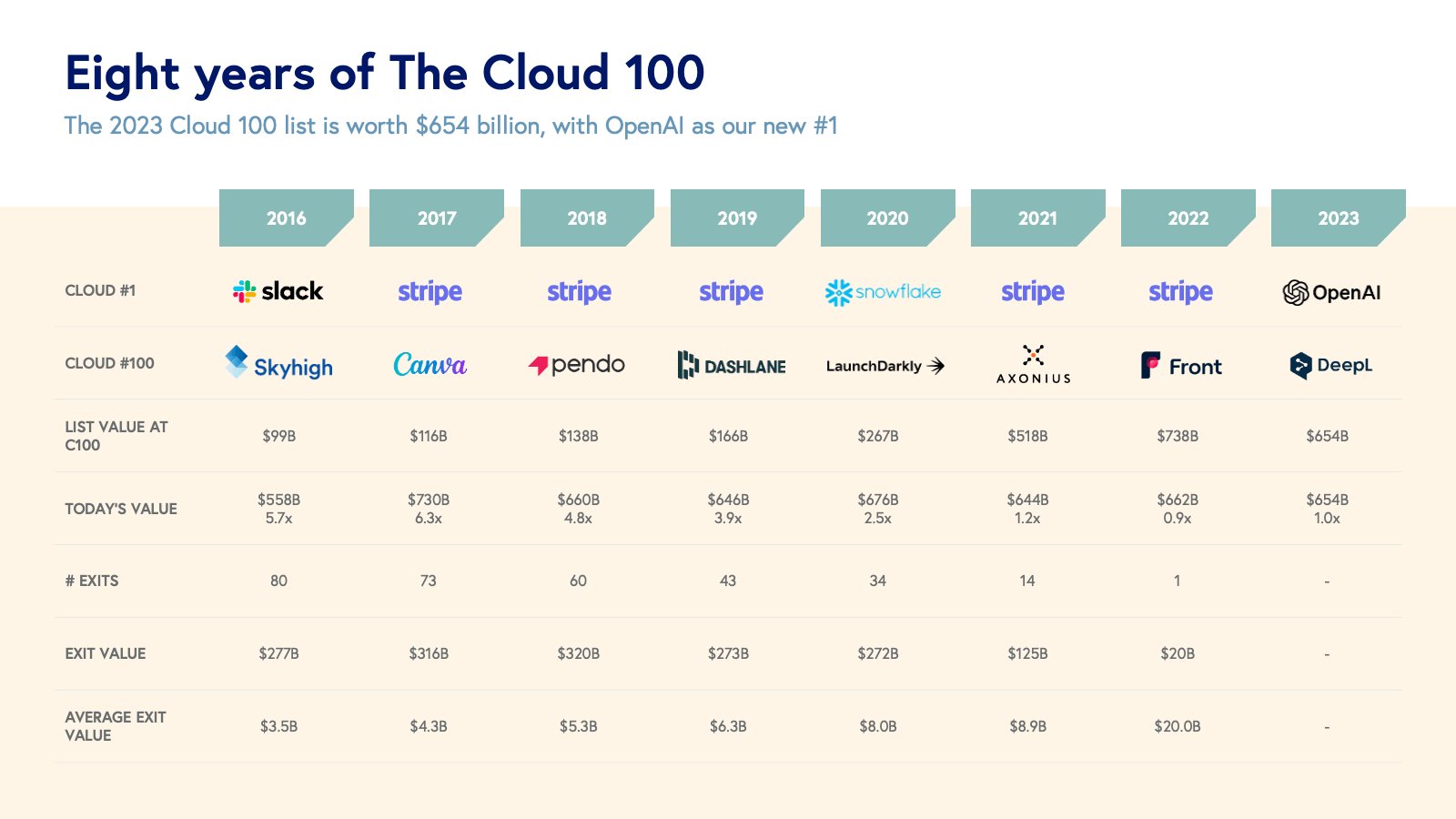

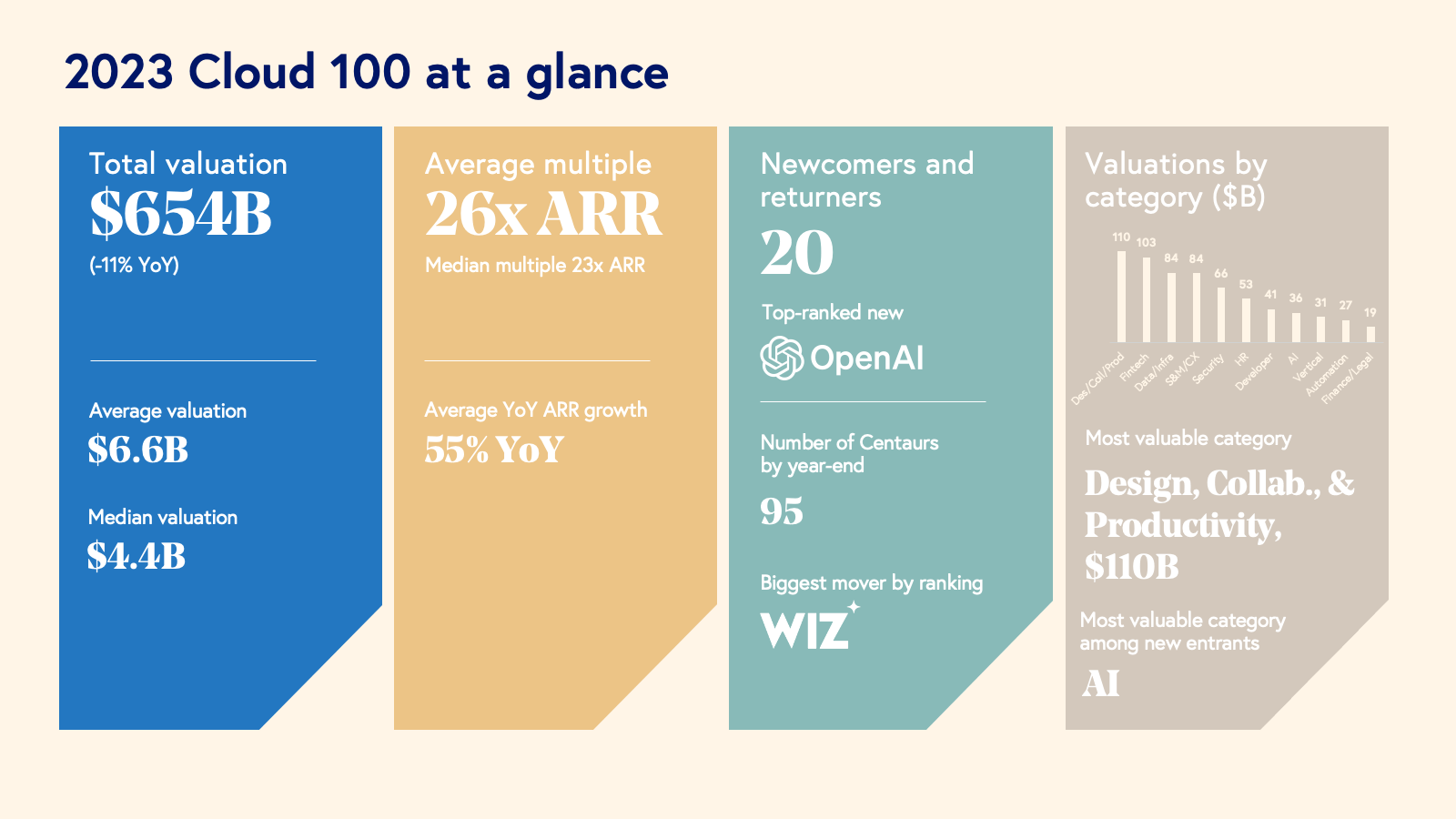

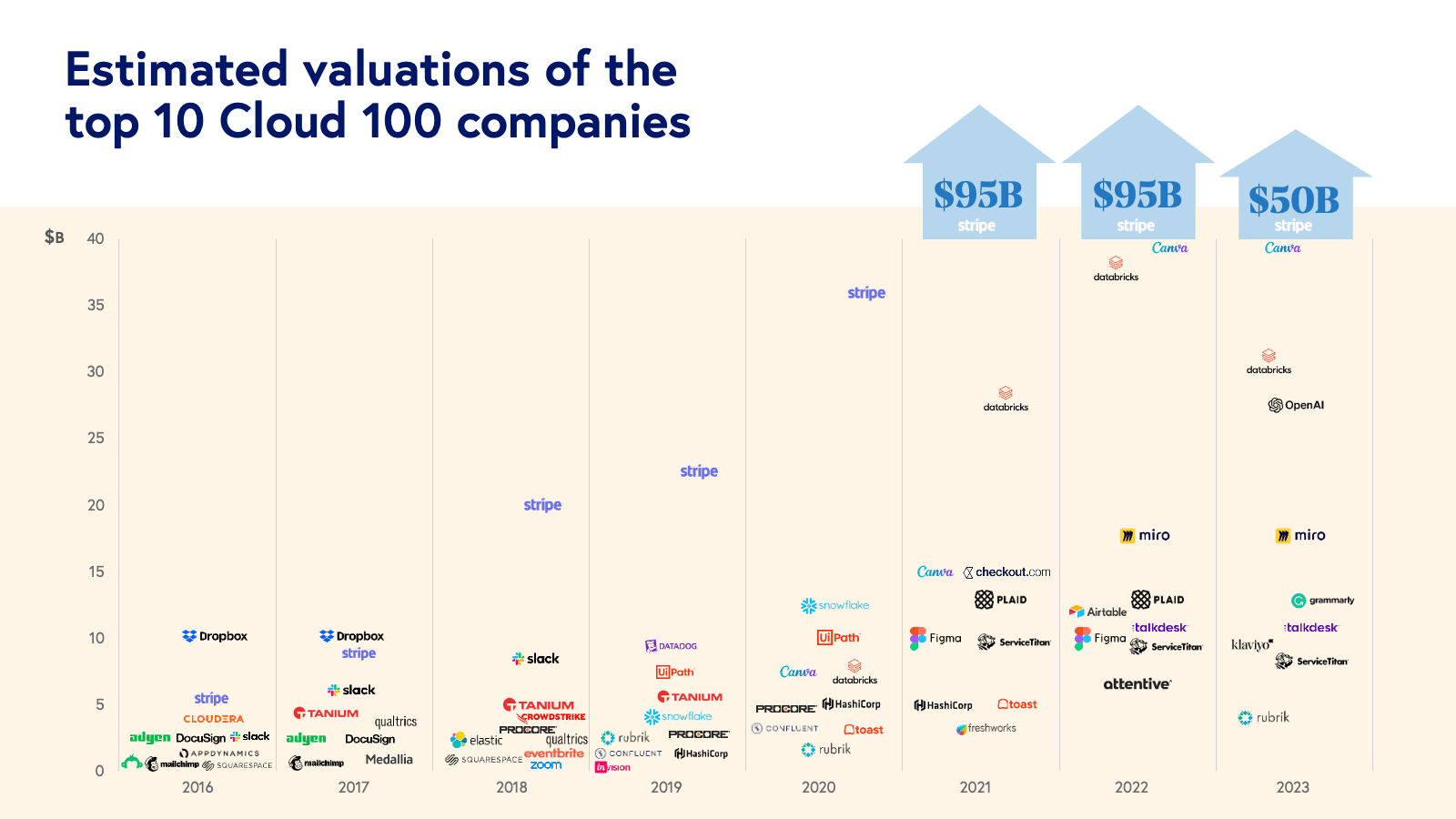

First, for the first time ever, the aggregate Cloud 100 list value actually contracted in value year-over-year. Last year, the bar for inclusion in the Cloud 100 was incredibly high: not only did all the 2022 Cloud 100 honorees reach the $1 billion valuation milestone, but also the average Cloud 100 valuation skyrocketed to $7.4 billion. However, 2022 was one of the most challenging years in recent history for the cloud economy as companies dealt with macroeconomic uncertainty, tightened IT budgets, elongated sales cycles, layoffs, and valuation multiple compression. These headwinds combined and made 2023 the first year in which the aggregate value of the Cloud 100 contracted year-over-year to $654 billion, down 11% versus the 2022 list value.

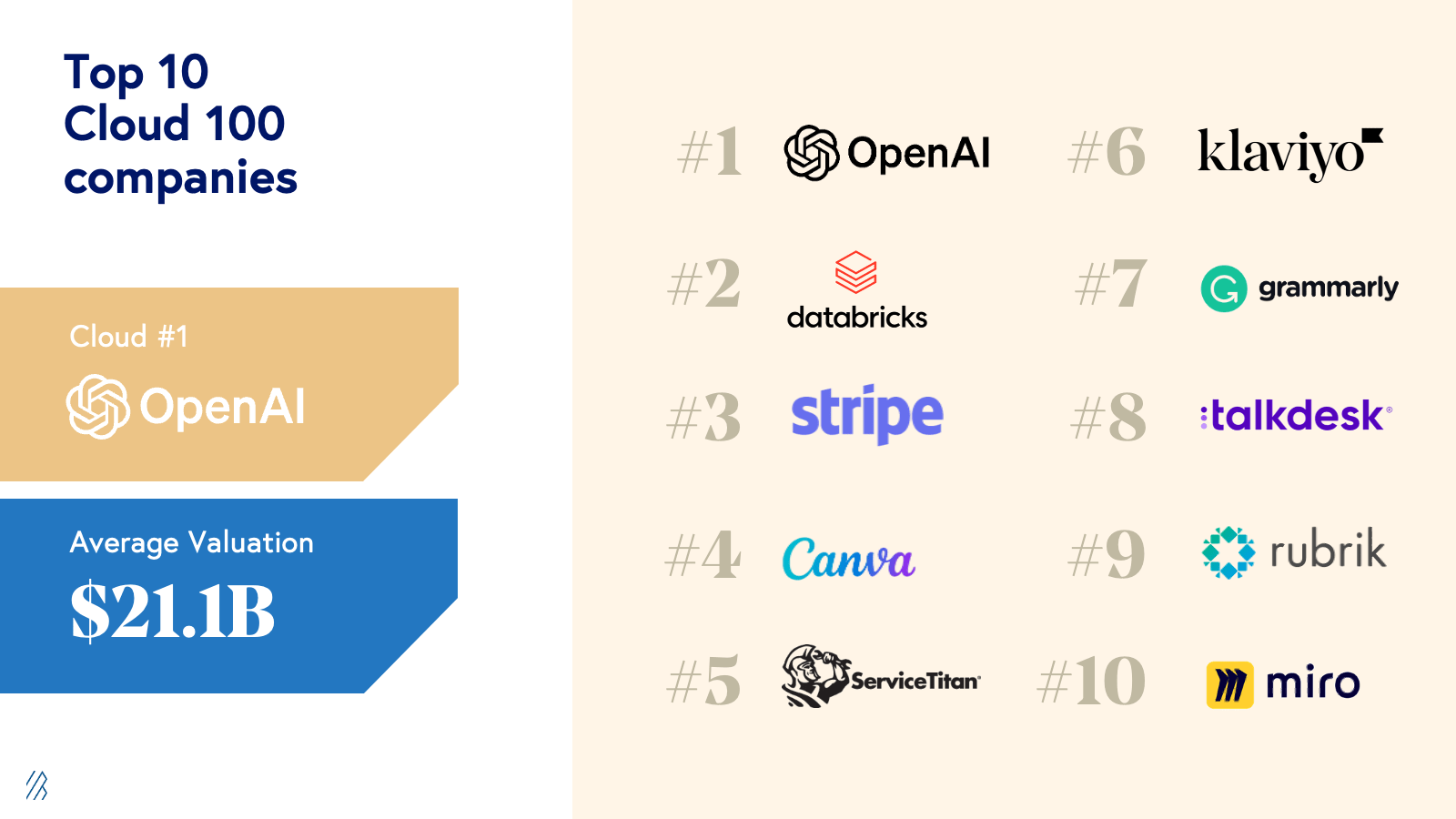

Second, despite this bleak backdrop, AI emerged as a shining light for the cloud ecosystem. The AI revolution propelled many of the movers and shakers on the 2023 Cloud 100 list. OpenAI not only made the list for the first time, but it also replaced Stripe in earning the top spot as #1 on the list. Databricks, another company making big investments into AI, also moved to the #2 spot. Embedded AI catalyzed growth in the highest-valued cloud category, “Design, Collaboration, and Productivity”, and AI-Native was by far the most highly valued category of new entrants to the list. These shake-ups make this year’s Cloud 100 list one of the most dynamic in history, and we believe the cloud economy will continue evolving as we enter the Age of AI.

With eight years of Cloud 100 data behind us, in this year’s Benchmarks Report we reveal Bessemer’s analysis and insights into the 2023 Cloud 100 cohort and what it tells us about the exciting future ahead for the cloud economy.

Top highlights:

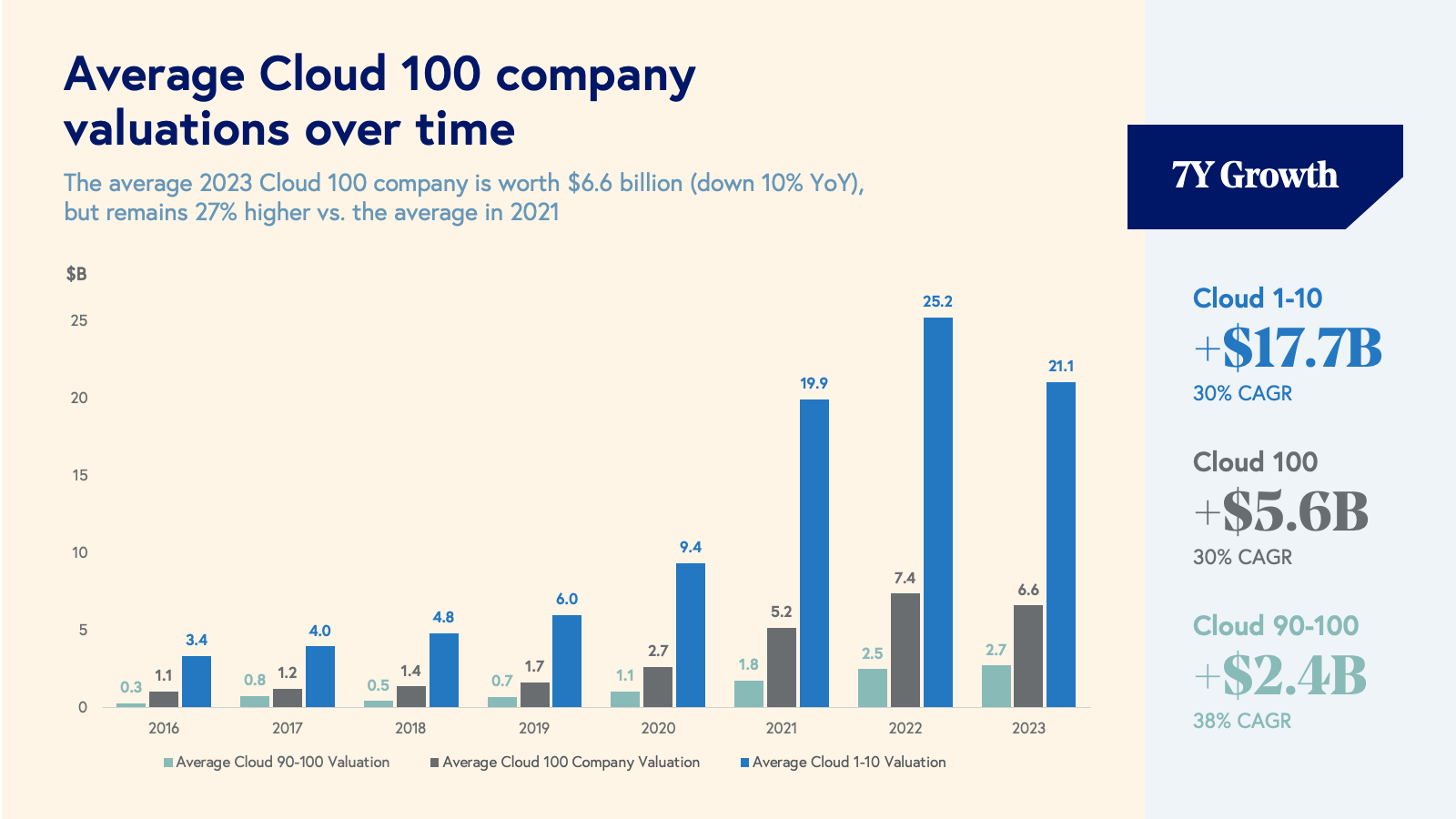

- The 2023 Cloud 100 is worth an aggregate $654 billion vs. $738 billion in 2022, representing an 11% decrease year-over-year. Nonetheless, the top 10 Cloud 100 companies still represent an astounding $211 billion of equity value (32% of list value) and the average Cloud 100 company is worth $6.6 billion.

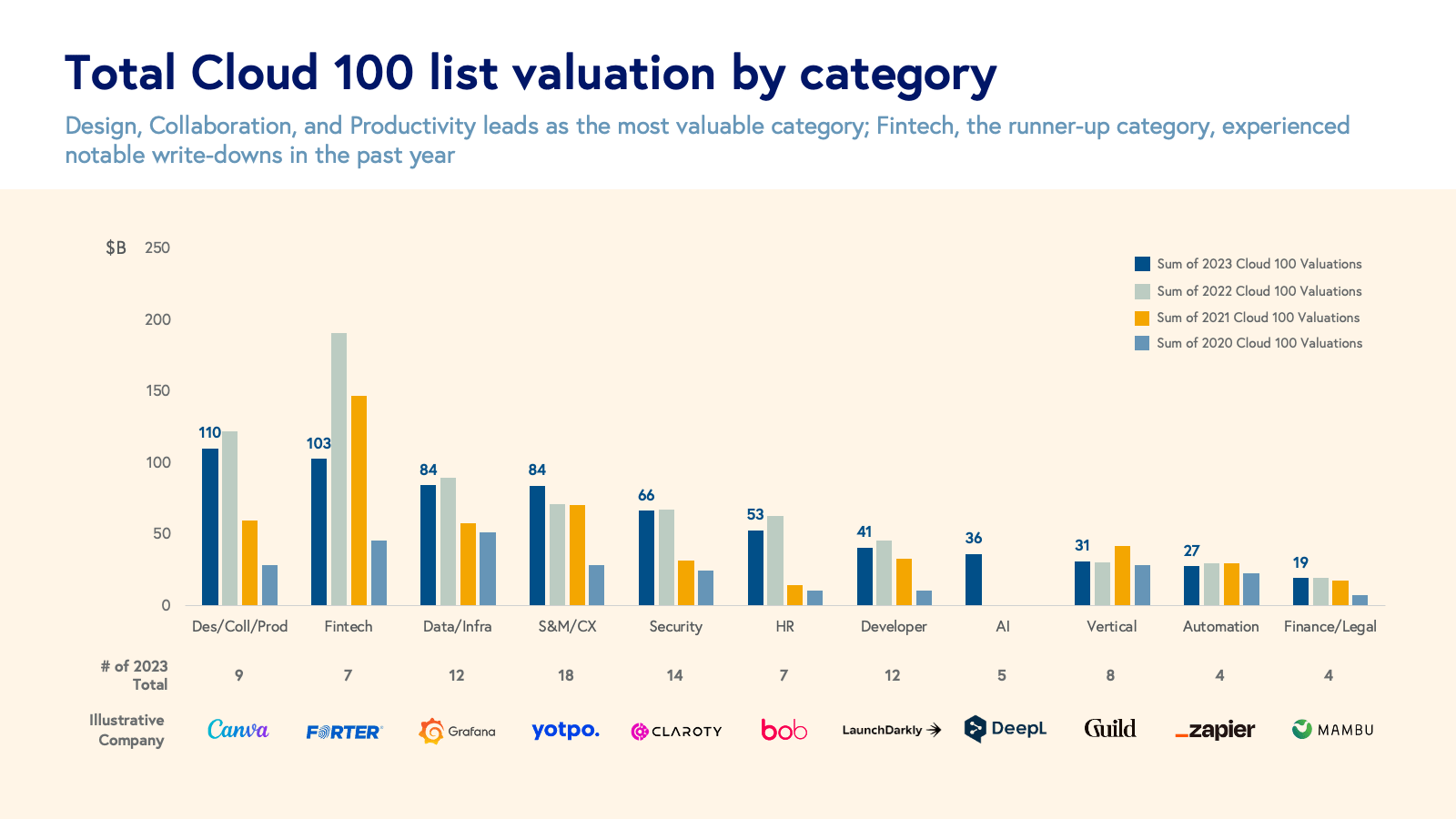

- This year, Design, Collaboration, and Productivity is the highest valued category at $110 billion (17% of list value), followed by Fintech at $103 billion (16% of list value), the highest category last year. (We evaluate Cloud 100 entrants in 12 different categories of cloud computing: AI; Data and Infrastructure; Fintech; Design, Collaboration, and Productivity; Sales, Marketing, and CX; Security; Finance and Legal; Automation; HR; Developer; and Vertical Software.)

- We introduced AI as a new standalone category this year, with all 5 AI-native companies in the category making their debut on the Cloud 100 list this year. While the core AI category represents $36 billion in total equity value, we’ve seen the impacts of AI across almost every category; in particular, nearly every company in this year’s leading Design, Collaboration, and Productivity category has openly embraced integrating AI into their product capabilities.

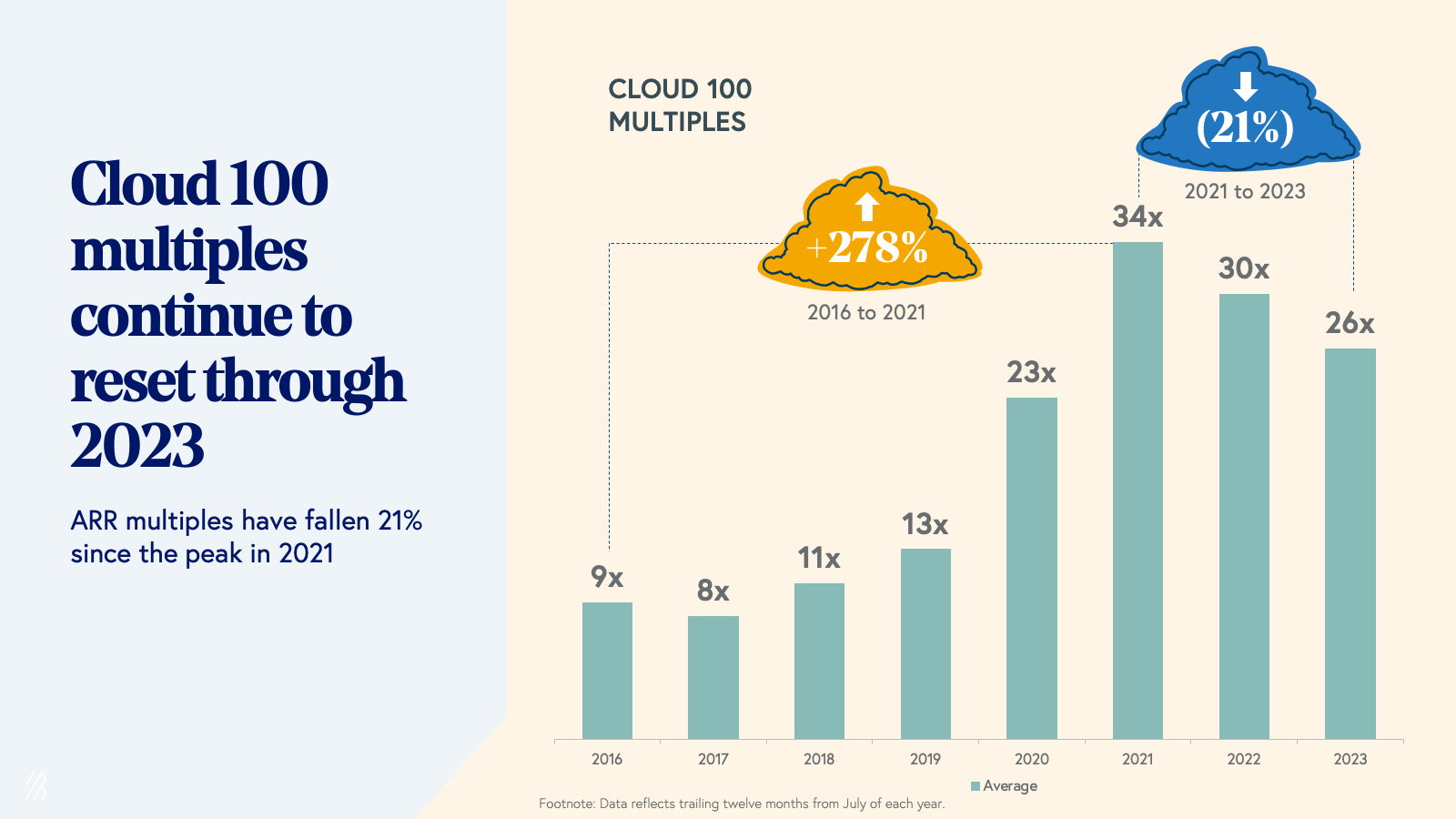

- Private cloud multiples are now reflecting the impact of the public market reset that began at the start of 2022. The average Cloud 100 multiple decreased for the second year in a row, down to 26x from 30x last year, representing a 21% decline since the 2021 peak of 34x.

- Last year, we introduced the “Centaur,” a $100 million+ ARR business. In 2022, ~80% of companies on the Cloud 100 list were forecasted to become Centaurs by the end of the year; this year’s list of honorees has raised the bar, with ~95% of honorees forecasted to reach $100 million of ARR by the end of the year.

The 2023 Cloud 100 at a glance: a year with major changes and shake-ups

The 2023 Cloud 100 list represents an astonishing $654 billion of equity value, with an average company valuation of $6.6 billion. Still, this is the first year in which the cumulative Cloud 100 list value contracted year-over-year, largely due to down rounds. (Note that the total list value of The Cloud 100 excludes Midjourney's valuation, as it has not conducted a publicly reported financing.)

Despite this backdrop, 2023 was one of the most competitive years in history for honorees to make the Cloud 100 list, since there was only one graduate off of the 2022 list, design software company Figma. Adobe announced its $20 billion acquisition of Figma in September 2022, though the acquisition is still in process. Adobe’s proposed price valued the company at 50x current ARR, representing one of the highest acquisition multiples in history. While the deal has not yet closed, it exemplifies that best-in-class cloud companies can command a valuation premium even in tough economic conditions.

20 newcomers and returners nonetheless earned their spots on the 2023 Cloud 100 list, largely fueled by the AI revolution. In a testament to the rise of AI, the highest-ranked new entrant was OpenAI, which earned the #1 spot on this year’s list. Stripe has had a stronghold on the top spot for four of the last five years, having briefly been replaced by Snowflake until its IPO in 2020. Alongside OpenAI, other newcomers and returners include Dialpad (#25), Appsflyer (#27), Zoho (#41), Druva (#49), Komodo Health (#56), Browserstack (#58), Retool (#64), ContentSquare (#66), Anthropic (#73), Abnormal (#80), Vanta (#82), Midjourney (#85), Brightwheel (#86), Tekion (#87), Moveworks (#92), Orca Security (#95), Cribl (#96), Hugging Face (#98), and DeepL (#100).

The biggest mover title for 2023 went to cloud security company Wiz, which moved up +67 spots to #15 on the Cloud 100 list. Wiz closed its latest $300 million financing in February 2023, valuing the company at $10 billion. The strength of this financing is notable given the overall decline in list value as well as the backdrop of muted VC fundraising activity, especially at the growth stage. Months before that, Wiz announced that it had reached Centaur status—$100 million of ARR—in a record-breaking speed of just 18 months!

The top 10 Cloud 100 companies represent $211 billion of equity value alone, accounting for 32% of the list’s aggregate value. New entrant OpenAI earned the #1 spot with its multi-billion megaround led by Microsoft earlier this year at a $29 billion valuation. Another big move within the Top 10 was Databricks, which moved ahead of Stripe, last year’s #1. Databricks is another company that has embraced AI over the last year, having recently announced its acquisition of MosaicML, its launch of its own large language model (Dolly 2.0), and its launch of the Lakehouse AI platform. Last year’s #1, Stripe, rounds out the Top 3. Joining them in the top ten are Canva, ServiceTitan, Klaviyo, Grammarly, Talkdesk, Rubrik, and Miro. The top 10 average a $21 billion valuation individually, up +$18 billion from the inaugural 2016 list.

While the IPO window has been frozen over the last year-and-a-half, there are signs of life. Companies are beginning to test the waters—non-cloud companies like restaurant chain Cava have gone public over the last two months, and there are indications that shoemaker Birkenstock and chip maker Arm will go public as early as September. Combined with slowing inflation and the market’s indication that it has priced in the impact of recent interest rate hikes, the capital markets have become more predictable. We anticipate that this will lead to many Top 10 Cloud 100 companies soon making public exits and paving the way for others. It has been reported that companies such as Stripe, Klaviyo, Talkdesk, and Rubrik, have been ramping up IPO discussions and preparations.

At $110 billion of aggregate value, the Design, Collaboration, and Productivity category has now overtaken Fintech as the most valuable Cloud 100 category, largely because these companies have recently supercharged their business models and revenues by leveraging AI. As brief examples, Canva released a suite of AI-powered image design and text capabilities, Grammarly launched GrammarlyGO, its enterprise-grade AI text generator and editor, and ClickUp released an AI-powered productivity assistant. Fintech, last year’s leading category, was the second most valuable category this year at $103 billion. It felt downwards pressure from high-profile write-downs from companies—for instance, Stripe’s March 2023 Series I funding round valued the company at $50 billion (down from its prior Series H valuation of $95 billion), and Checkout.com reportedly lowered its internal valuation from $40 billion to $11 billion in December 2022.

Sales, Marketing, and Customer Experience software continues to be the category with the most Cloud 100 companies, at an impressive 18. This category includes the likes of Yotpo, Attentive, and Intercom. The most represented category for newcomers to the Cloud 100 was AI, including OpenAI, Anthropic, Midjourney, Hugging Face, and DeepL, with an estimated combined valuation of $36 billion.

AI takes center stage

The impact of AI on the 2023 Cloud 100 list cannot be understated: 55 Cloud 100 honorees have announced a generative AI product or feature in the last eight months, and 70 are using AI or ML (generative and otherwise) in their products today. Of the 70 companies using AI or ML, 65 honorees have embedded AI, meaning they have added AI tooling and capabilities to enhance their core applications, while five are AI-native, meaning they were designed from the ground up to incorporate generative AI as a core component of their product architecture.

Many of this year’s honorees have embedded generative AI to enhance and streamline workflows in their flagship applications, improving both user productivity and experience. Some have taken the “AI assistant” product approach, using large language models (LLMs) to auto-generate everything from email and SMS content to marketing copy to code suggestions. Others are launching entirely new product lines built from generative AI, like Intercom’s Fin, a GPT-4 powered chatbot, and Zapier’s AI-powered natural language actions API, which allows customers to use natural language prompts to link information and build workflows between applications.

Embedding AI isn’t the only way to capture value—companies are also acquiring these capabilities via M&A, and others are building AI-native apps from the ground up. Cloud 100 honorees like OpenAI, Anthropic, Midjourney, Hugging Face, and DeepL have built their products with a generative AI-first architecture and rely on AI-driven products and research to drive their business strategy.

In this deep dive section, we look at how Cloud 100 honorees Cloudinary, Databricks, and DeepL have taken embedded AI, acquired AI, and AI-native approaches, respectively, to enhance their product offerings and deliver more value to their customers.

Case Study: How Cloudinary is embedding generative AI

Founded in 2012, Cloudinary (#81 on the 2023 Cloud 100) is a cloud solution for managing digital media assets — whether a furniture brand wants to offer a 360° view of its latest sofa, or a large corporation wants to optimize its high-quality images for faster website load speeds on smartphones, the Cloudinary platform helps businesses improve their visual media experiences and workflows.

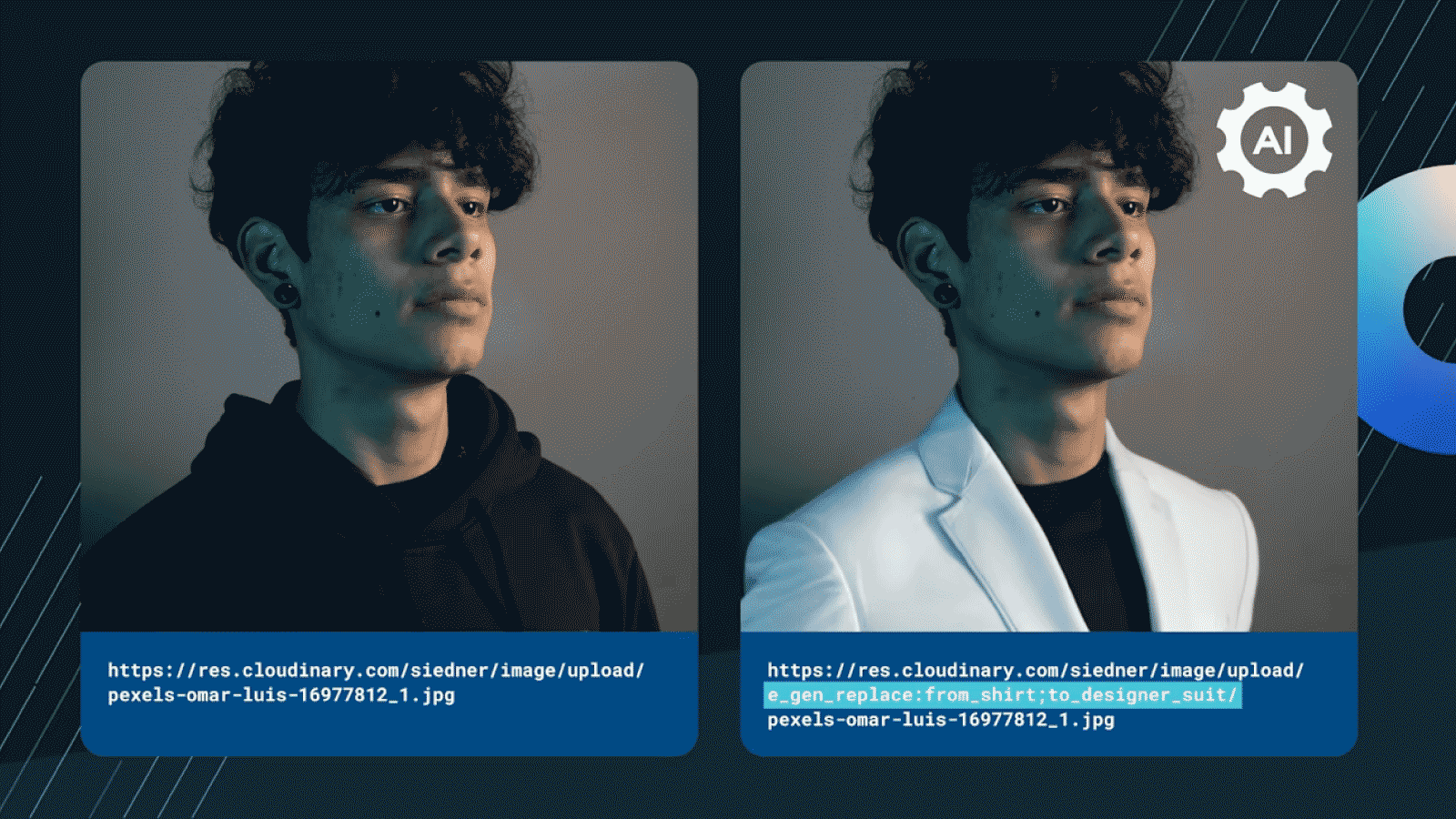

With the help of generative AI and LLMs, Cloudinary recently introduced new generative AI features that enhance the capabilities of its Programmable Media image and video APIs. Generative Fill, for instance, makes it possible for users to expand images with matching content, and Generative Remove and Replace features enable users to remove and replace unwanted objects from images without the need for reshooting. New natural language features, like AI-Powered Image Captioning and Conversational Transformation Builder, help technical and non-technical users quickly caption images and make transformations via ChatGPT—for example, instead of coding, users can type conversational language commands, like “remove the dog using AI,” to prompt Cloudinary to remove a dog from an image without disturbing the existing background.

The above image depicts Cloudinary’s new Generative Replace feature, which uses natural language prompts to detect and replace objects in photos. In this case, AI identifies and transforms the subject’s black sweatshirt to a white designer suit using the following prompt: “gen_replace:from-shirt;to_designer_suit.”

These AI-embedded features not only facilitate productivity gains for users, but also expand Cloudinary’s total addressable market (TAM) and drive customer growth. By making it possible for non-technical professionals to make what used to be developer-grade media modifications, and by hastening the creative process, Cloudinary’s AI strategy will help the company reach new user personas, like marketers. And selling additional seats to adjacent customers will enable Cloudinary to increase the account value of its customers, a move that increases net dollar retention and revenue growth over time.

Case Study: How Databricks is cementing its AI leadership through acquisitions

In the AI era when moving fast is rewarded, acquiring capabilities is another way that Cloud 100 winners are maintaining an edge. Databricks (#2 on the 2023 Cloud 100) acquired MosaicML, a pioneer in large language model operations (LLMOps), for $1.3 billion, adding to its strong, internally-developed AI capabilities.

Founded in 2013, Databricks makes software that helps organizations store and transform massive datasets, while MosaicML enables companies to train and deploy their own generative AI models. Concurrent with the MosaicML acquisition, Databricks unveiled Lakehouse AI, a suite of tools for building and governing generative AI models, including LLMs within the Databricks platform. Earlier in the year, Databricks had released Dolly, an LLM trained for less than $30 to exhibit ChatGPT-like human interactivity (aka instruction-following), as well as Dolly 2.0 which it touted as “the World's First Truly Open Instruction-Tuned LLM. ”

Now with MosaicML onboard, Databricks customers have access to a cost-effective, unified platform to manage and analyze their data at scale. By making it simpler than ever for companies to deploy proprietary machine learning models—helping them with everything from fraud detection and drug discovery to modernizing their business intelligence processes—Databricks’ acquisition of MosaicML expands the capabilities of their infrastructure offers, enhancing current customers and bringing on new businesses that are hindered by their existing data architecture setup and costs.

Case Study: How AI-native DeepL is breaking language barriers

Lastly, DeepL (#100 on the 2023 Cloud 100) is transforming the $60 billion language services provider market with its AI-native architecture. DeepL generates real-time language translations that capture cultural context and resonate with native speakers. Unlike traditional translation options that often fall short in providing accurate and culturally aware results, DeepL uses neural machine translation (NMT) and deep learning to provide high-quality translations. By utilizing NMT models, DeepL captures context and nuances of language more accurately, making it the platform of choice particularly for business users who are seeking to translate contracts, corporate communications, and other key business documents in which translation errors might be deleterious.

Deep learning is a way to train computers to process new information just like the human brain does. At DeepL, this approach ensures that the company’s models learn complex language patterns, making them adaptable to linguistic nuances and continuously improving over time. Deep learning with NMT is helping DeepL sell to different markets and use cases, ranging from consumers and small teams to full API access plans. DeepL’s Translator product helps enterprise customers sharpen their customer support chatbots, communicate internally across geographies, and securely translate sensitive information. And translation is only the beginning for DeepL— the team recently introduced DeepL Write, a generative AI writing assistant that’s built on neural network technology, just like DeepL Translator. Now with a multi-product suite of solutions, DeepL serves a broader customer base of creators, professionals, and teams with writing-heavy workloads. With each new solution, DeepL is set up to cross-sell to a new segment or team, deepening engagement and retention with customers and driving more value for the business.

Cloudinary, Databricks, and DeepL exemplify AI’s transformative capacity to increase productivity, expand product use cases, and strengthen cloud software business models. Whether embedded, acquired, or built natively, AI has expanded the product capabilities and improved user experience for customers in a way we’ve never seen before. It enabled our spotlight companies to democratize creative content generation for non-technical users through embedded AI (Cloudinary), empower customers to develop their own proprietary models through acquisitions like MosaicML (Databricks), and deliver higher fidelity translations via AI-native architecture (DeepL). The impact of generative AI on our Cloud 100 honorees list is undeniable, and we expect that it will continue to drive innovation and enhance user experience across software more broadly.

Cloud fundamentals check in: Centaurs, multiples, and efficiency

The average 2023 Cloud 100 company valuation is $6.6 billion—down 10% year-over-year, but still 27% higher than the 2021 average valuation, even as the macro environment has deteriorated over the last 18 months. As we noted last year, however, valuations are not always reflective of a company’s fundamental value, especially when capital is easily accessible and markets are frothy. This golden truth is even more pertinent in today’s challenging environment where the already significant gap between fundamentals and valuations is growing even wider.

This is why we introduced the concept of the Centaur, a $100 million ARR business as a more reflective milestone of performance. Last year, we expected 80% of the 2022 Cloud 100 honorees to reach the Centaur milestone by the end of the year. For the 2023 Cloud 100 cohort, we expect to reach ~95% by the end of the year, strengthening our conviction that the cloud market has a bright future ahead despite all the doom and gloom of the last year. That’s right – ~95% of the Cloud 100 will have $100 million or more of ARR by the end of 2023. This includes companies like Zapier, Canva, Cohesity, and Wiz, which has announced reaching $100 million ARR faster than ever.

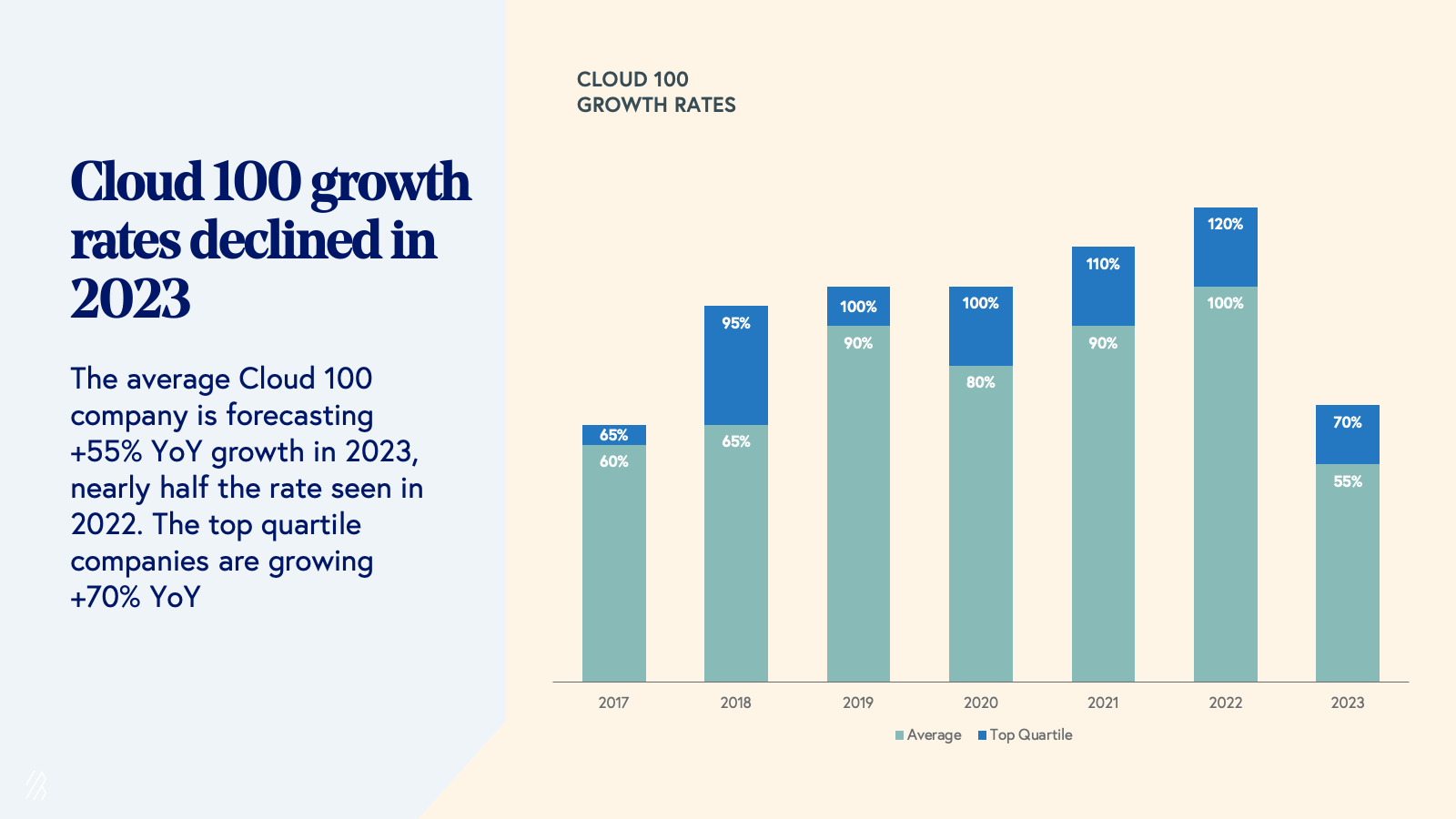

The macro background has nonetheless hurt the average Cloud 100 company. For years we saw growth rates increase, but in 2023, the average growth rate for a Cloud 100 company – the 100 best private companies in the world – has been nearly halved. After years of defying gravity and reaching record highs, headwinds eventually caught up with Cloud 100 fundamentals. The average Cloud 100 revenue growth rate fell significantly to 55% within the year, with the growth rate of the top quartile companies falling to 70%, once again reinforcing the extremely challenging year that the world’s best cloud companies had to deal with.

The private financing markets have responded in turn. For the second year in a row, the average Cloud 100 multiple has decreased, from 30x in 2022 to 26x. Considering that the average public BVP Cloud Index company is trading under 10x, we expect that reported private multiples will continue to compress.

Cloud 100’s year of efficiency

As 2022 saw more tightening in capital markets, IT budgets, and consumer spend, founders faced new challenges in reducing burn and driving efficient growth. 2023 became the year of efficiency in cloud, and profitable growth became more valuable than growth-at-all-costs. At Bessemer, we’ve always been big advocates of growth at optimal costs as a core guiding principle, and this is Law #2 in our 10 Laws of Cloud.

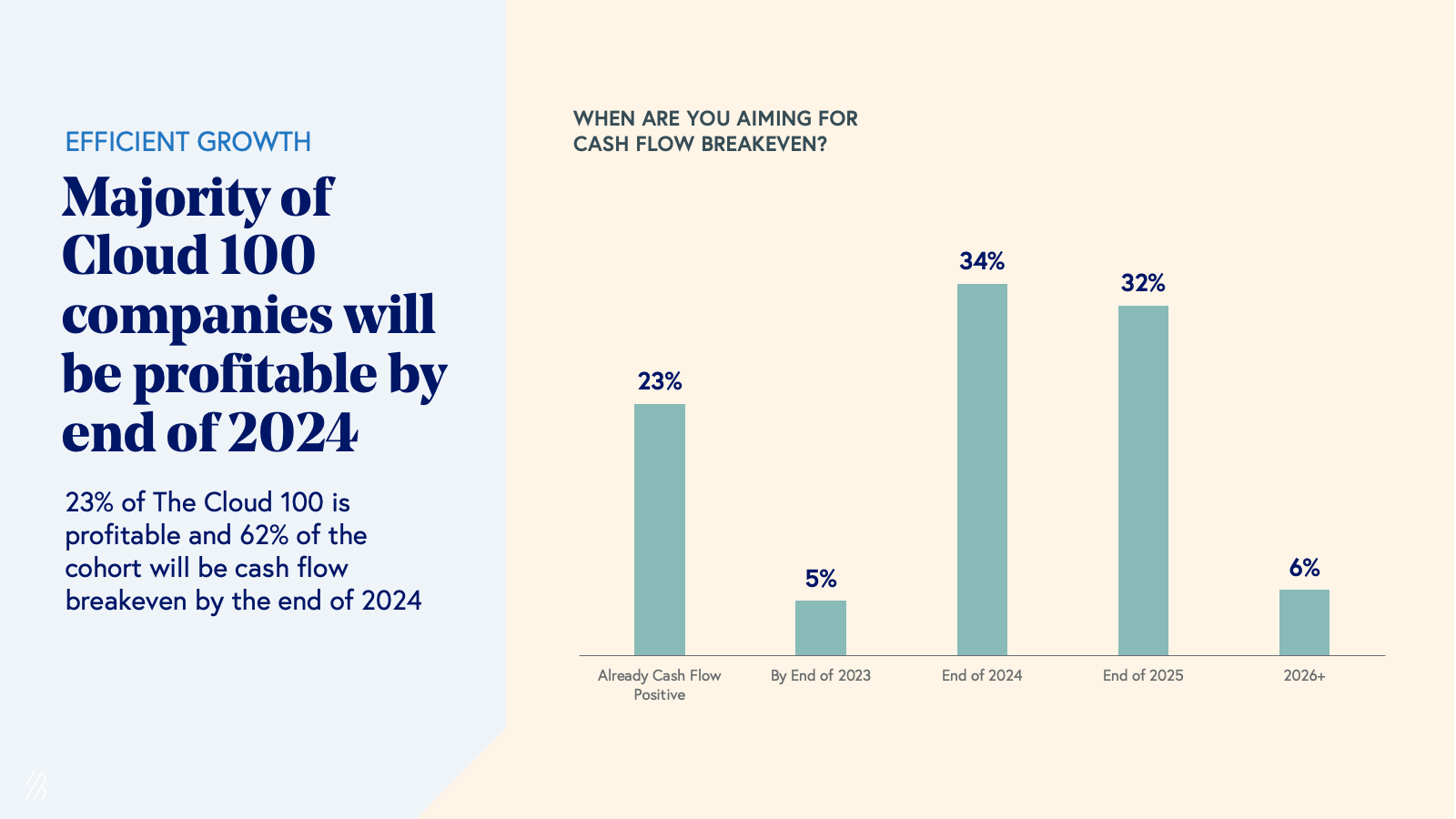

Internalizing this mantra of efficient growth, this year’s Cloud 100 honorees displayed remarkable resilience and adaptability proving the power of the cloud business model. Nearly 25% of Cloud 100 members are already cash flow positive today, and nearly two-thirds of the 2023 Cloud 100 will be cash flow breakeven or profitable by the end of 2024. 94% of Cloud 100 companies will be profitable by the end of 2025.

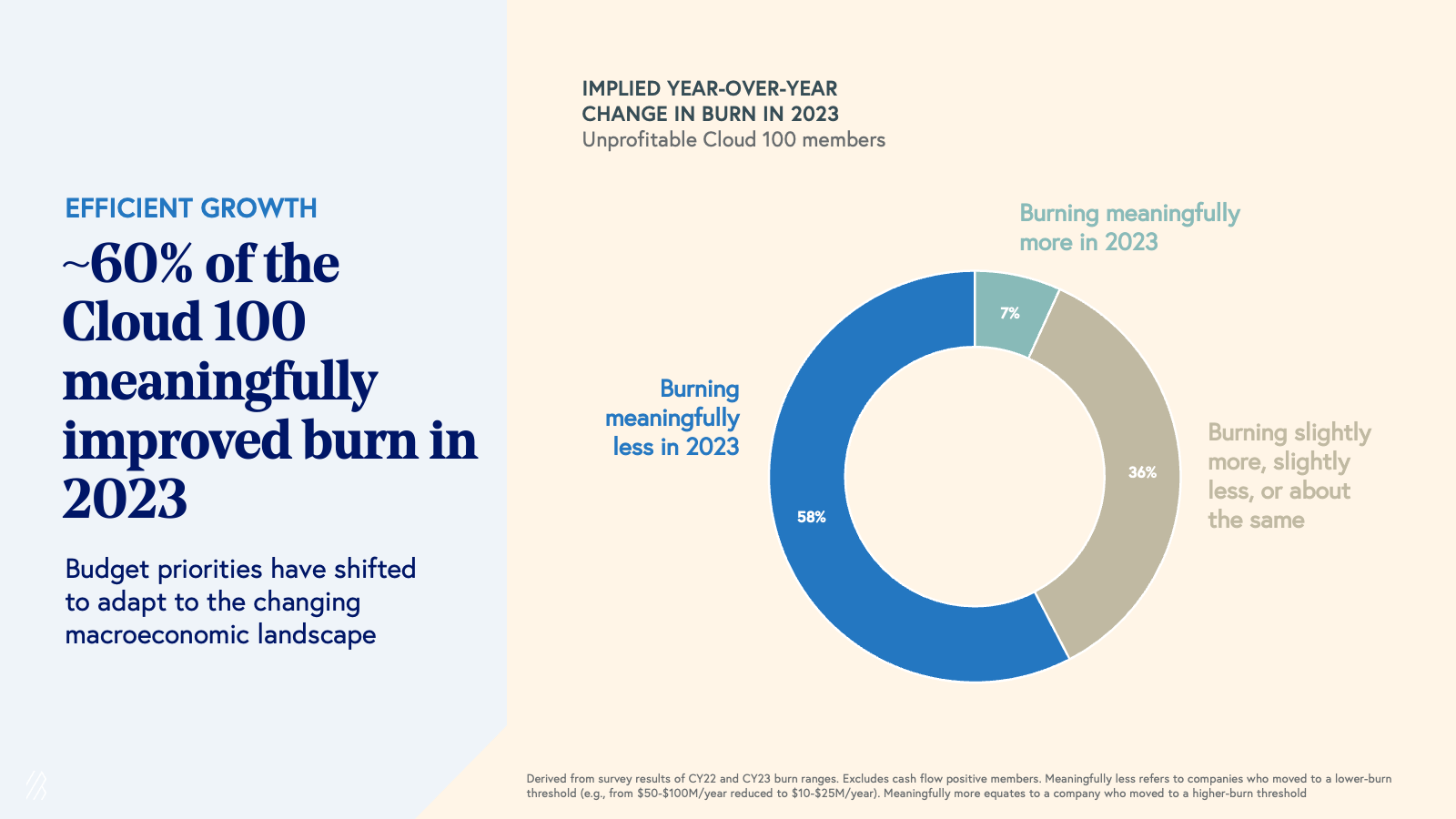

Further improving on this strong trajectory of efficient growth, over half of 2023’s currently unprofitable Cloud 100 honorees (58%) are meaningfully reducing their burn rate this year. Only a very small portion (7%) of the Cloud 100 intends to accelerate burn in 2023.

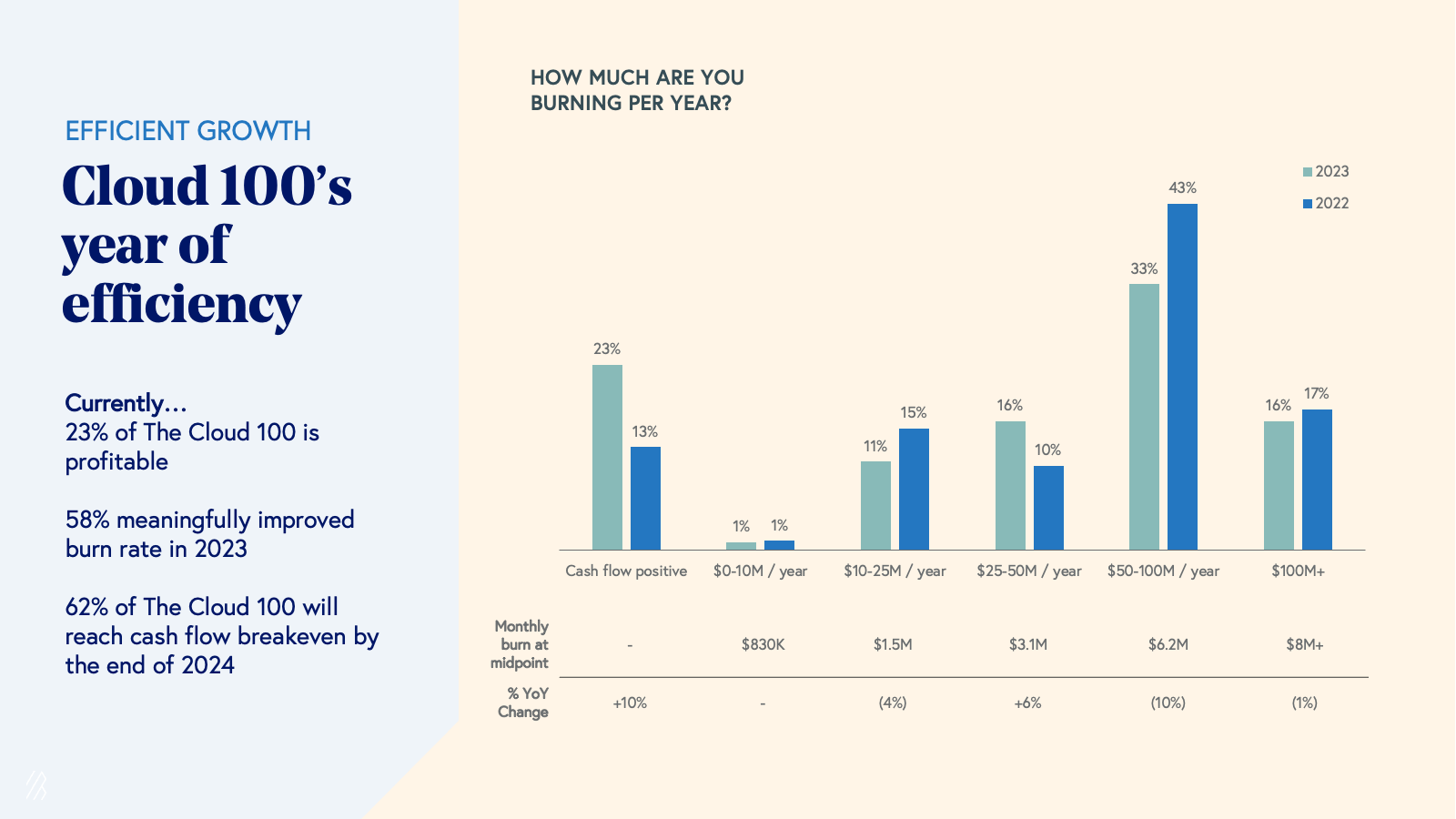

Observing the trends in absolute burn numbers also validates the commitment of the Cloud 100 cohort towards cash flow positivity and how these companies took swift action within a short period of time. On an absolute basis, 2023’s Cloud 100 cohort showed meaningful improvement in total burn when comparing their burn numbers from 2022 to 2023.

As the Cloud 100 cohort has shown, efficiency is a core imperative for cloud companies in 2023, especially since balancing the trade offs between growth and profitability not only has a tangible impact on business performance, but also on valuations. At Bessemer, we have seen the tactical steps great cloud companies have taken across our portfolio and compiled them here as a guide for SaaS leaders to drive profitable growth.

The future of the cloud economy will be efficient, and will be AI-driven

In the midst of a highly uncertain and volatile year, we commend all of the 2023 Cloud 100 honorees for demonstrating resilience and executing on efficient growth despite the doom-and-gloom that has impacted cloud fundamentals and valuations. We applaud that ~95% of the Cloud 100 will reach Centaur status by the end of 2023—the highest percentage ever in Cloud 100’s history—with companies hitting this milestone at record-breaking speed and strong efficiency despite the bleak backdrop.

Looking ahead to a brighter future, we recognize that we are in the midst of a defining paradigm shift as AI advancements will no doubt shape our lives and work for generations. We are excited to see so many Cloud 100 honorees at the forefront of this movement and look forward to seeing how the AI revolution will continue to define and transform the cloud industry in the years to come.

See you for the 2024 Cloud 100!

Benchmarks archive

2022 Cloud 100 Benchmarks

Today Bessemer Venture Partners, Forbes, and Salesforce Ventures announced the 2022 Cloud 100 List, the definitive ranking of the top 100 private cloud companies. Last year, the estimated valuation required to make the Cloud 100 list was over $1 billion, and the median was $3 billion. This was a record-high threshold for which—for the first time in history—each honoree had to achieve the unicorn milestone to be on the list.

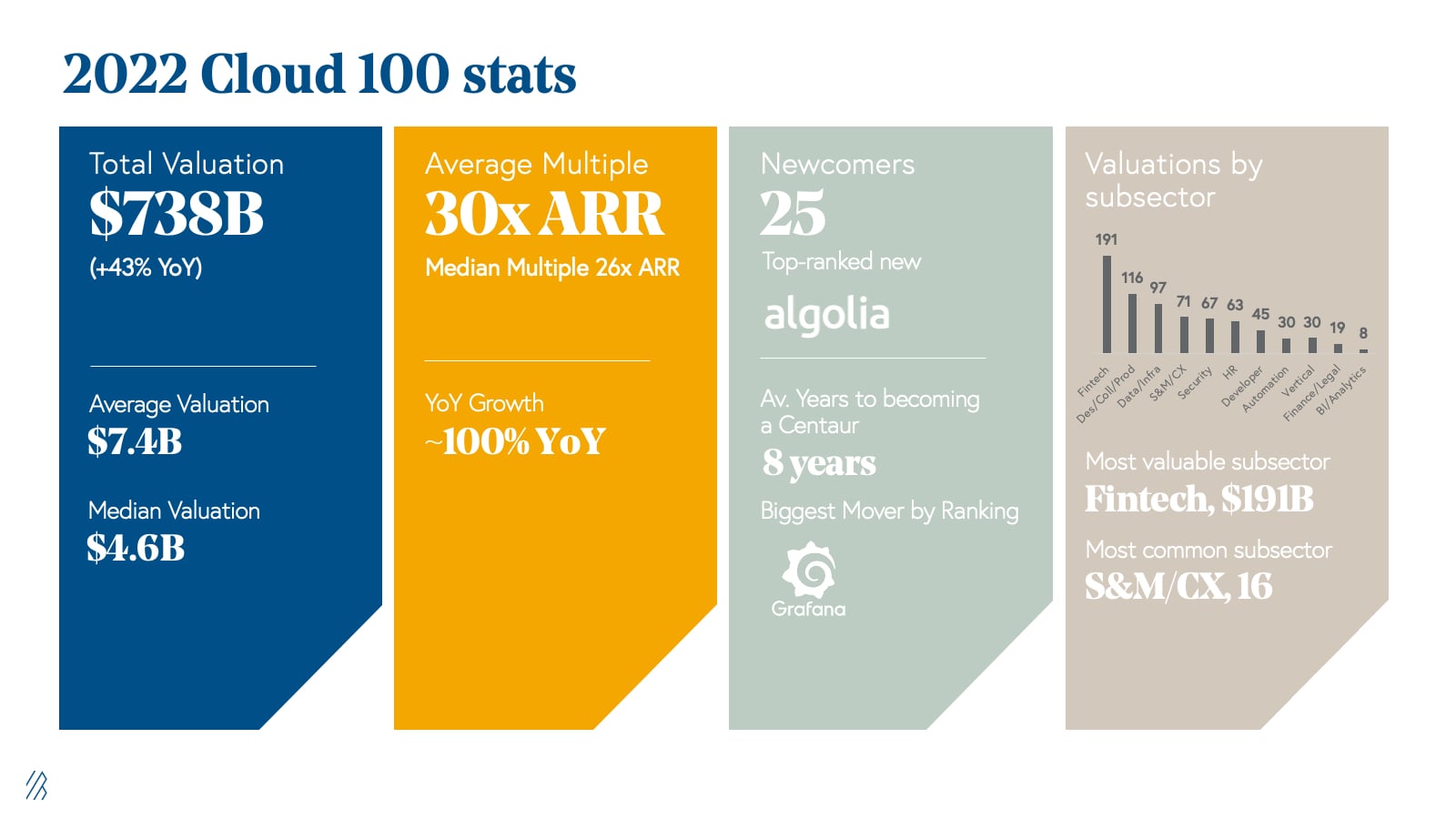

This year, the bar has been set even higher. Not only have all of the 2022 Cloud 100 honorees again reached at least the $1 billion valuation milestone, but also the average Cloud 100 valuation has skyrocketed to $7.4 billion. The median is an impressive $4.6 billion.

But wait, aren’t the public markets in turmoil? With rising inflation, decreased stock prices, and the fears of recession looming, why did private cloud valuations continue to get bigger? We note that all of the 2022 Cloud 100 honorees raised their last private round between 2020 to early 2022, when the cloud market was far more exuberant than it is today. All of the companies on this years’ list raised before the downturn and are still holding on to these high private marks.

Given the ebullient market backdrop of 2020 and 2021, we recently wrote about the need to return to business metrics outside of valuation that cannot be so easily gamed, and we looked for a milestone rooted in business fundamentals. And the milestone that we celebrate now is reaching $100 million of ARR, which we call becoming a Centaur.

Based on this year’s data, over 70% of 2022 Cloud 100 companies are currently Centaurs, with an additional about 10% expected to hit this milestone by the end of the year—marking over 80% of 2022 Cloud 100 honorees as Centaurs! This is a primary reason why we have conviction that this year's honorees truly represent the best cloud companies globally.

To learn more about the strategies that help cloud leaders gain Centaur status, read the full report.

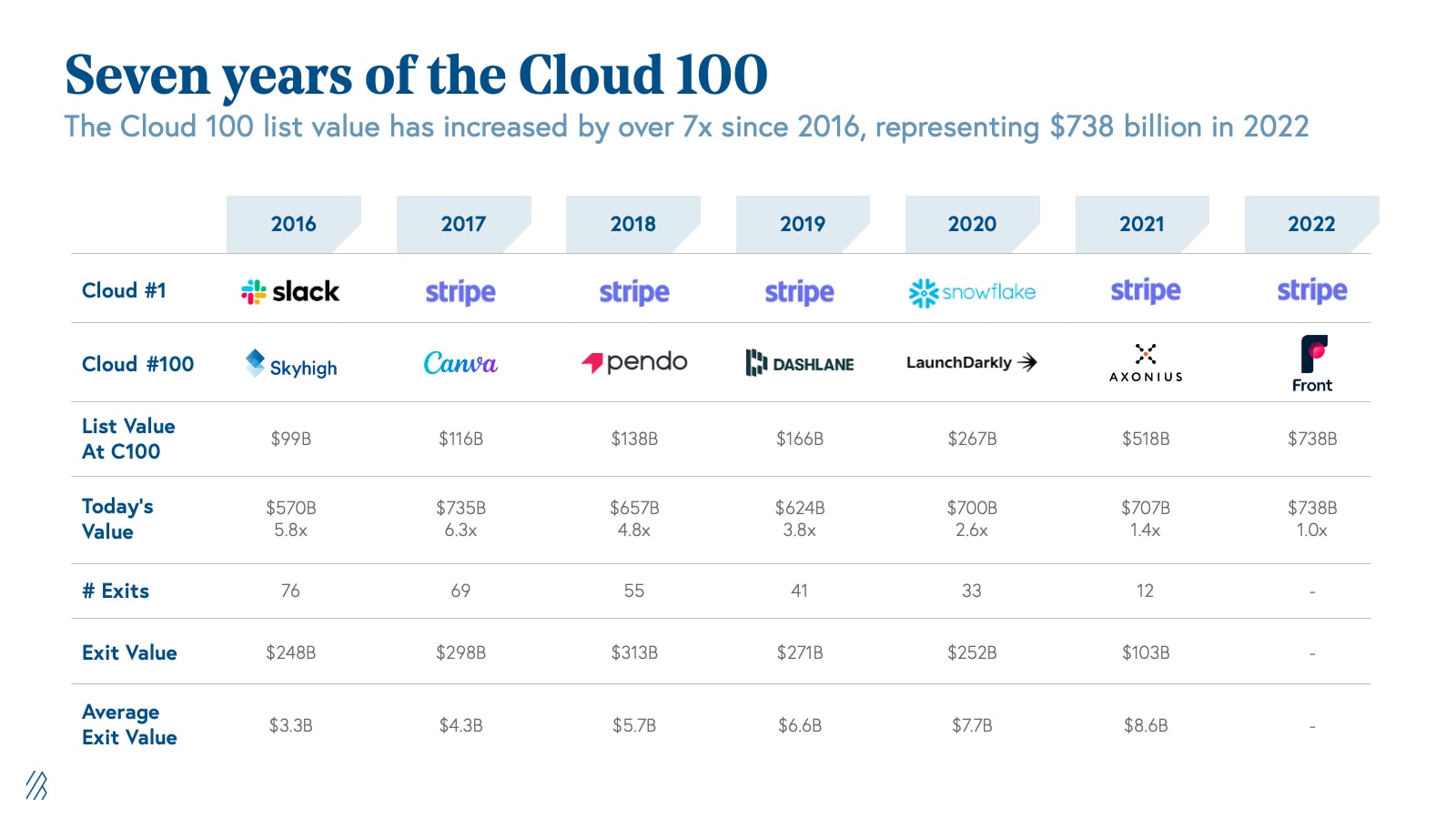

With seven years of Cloud 100 data behind us, in this year’s Benchmarks Report we reveal Bessemer’s analysis and insights into the 2022 Cloud 100 cohort and what it tells us about the Cloud Centaurs in the private cloud market today.

Top highlights:

- Private cloud valuations continue to get bigger. The Cloud 100 2022 is worth an aggregate of $738 billion in 2022 vs. $518 billion in 2021, which is a 43% increase year-over-year and 7.5x increase since 2016. The top 10 Cloud 100 companies alone contribute $252 billion of equity value (34% of list value).

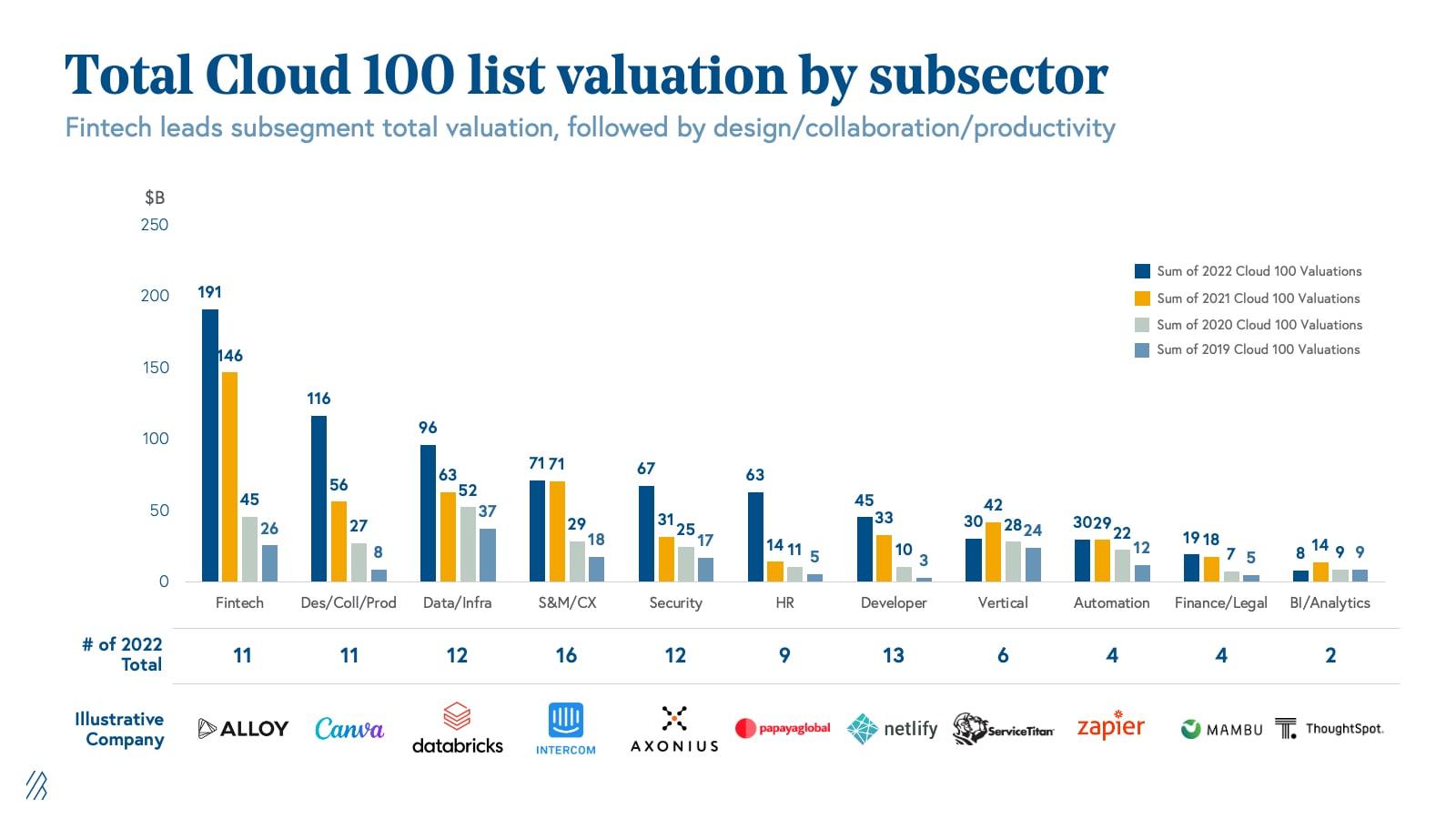

- Similar to last year’s trend, Fintech represents the highest value subsector at $191 billion (26% of list value), anchored by Stripe that contributes $95 billion of market cap alone per its last private financing. This is followed by Design/Collaboration/Productivity at $116 billion (16% of list value), and data/infrastructure at $96 billion (13% of list value).

- The threshold to make the Cloud 100 continues to get higher: similar to last year, every company on the list has at least hit the $1 billion+ valuation milestone. In addition, the average cloud company valuation was $7.4 billion, an increase of $2.2 billion year-over-year. Note, however, that all 2022 Cloud 100 companies raised prior to early 2022, keeping their high marks they earned pre-downturn.

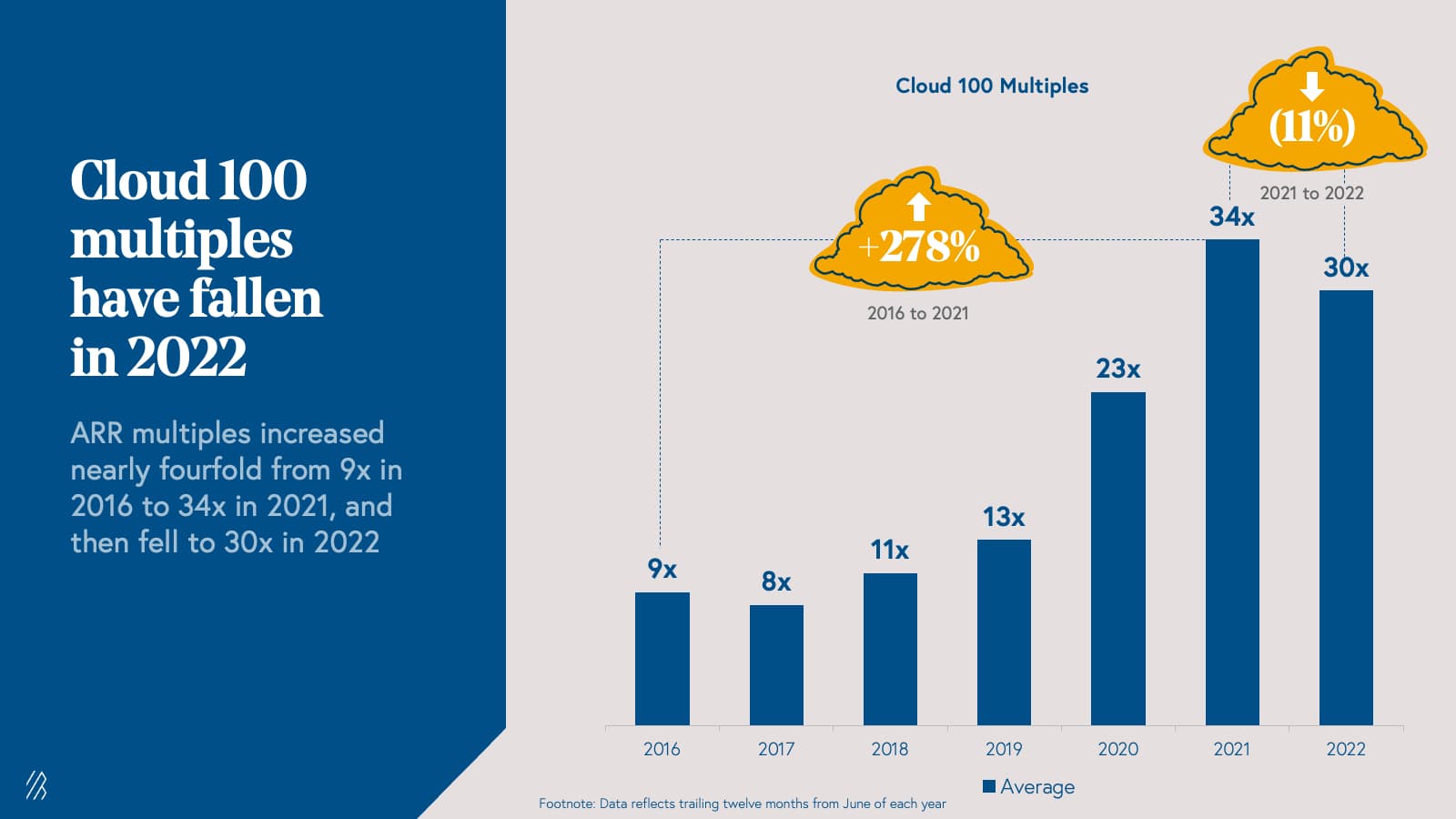

- Something notable this year is that as the public markets began to cool, the average Cloud 100 multiple has decreased slightly from 34x in 2021 to 30x ARR, though the average growth rate actually increased to 100% year-over-year.

- Given the fact that valuation can be an illusion, at Bessemer we choose to use a more reflective metric: the Centaur milestone of achieving $100 million of ARR. We are proud to observe that over 70% of 2022 Cloud 100 Honorees are currently Centaurs, with an additional about 10% expected to hit this milestone by the end of the year—marking over 80% of 2022 Cloud 100 honorees being Centaurs. Impressively, it took an average of eight years from their founding for Cloud 100 Centaurs to hit this milestone.

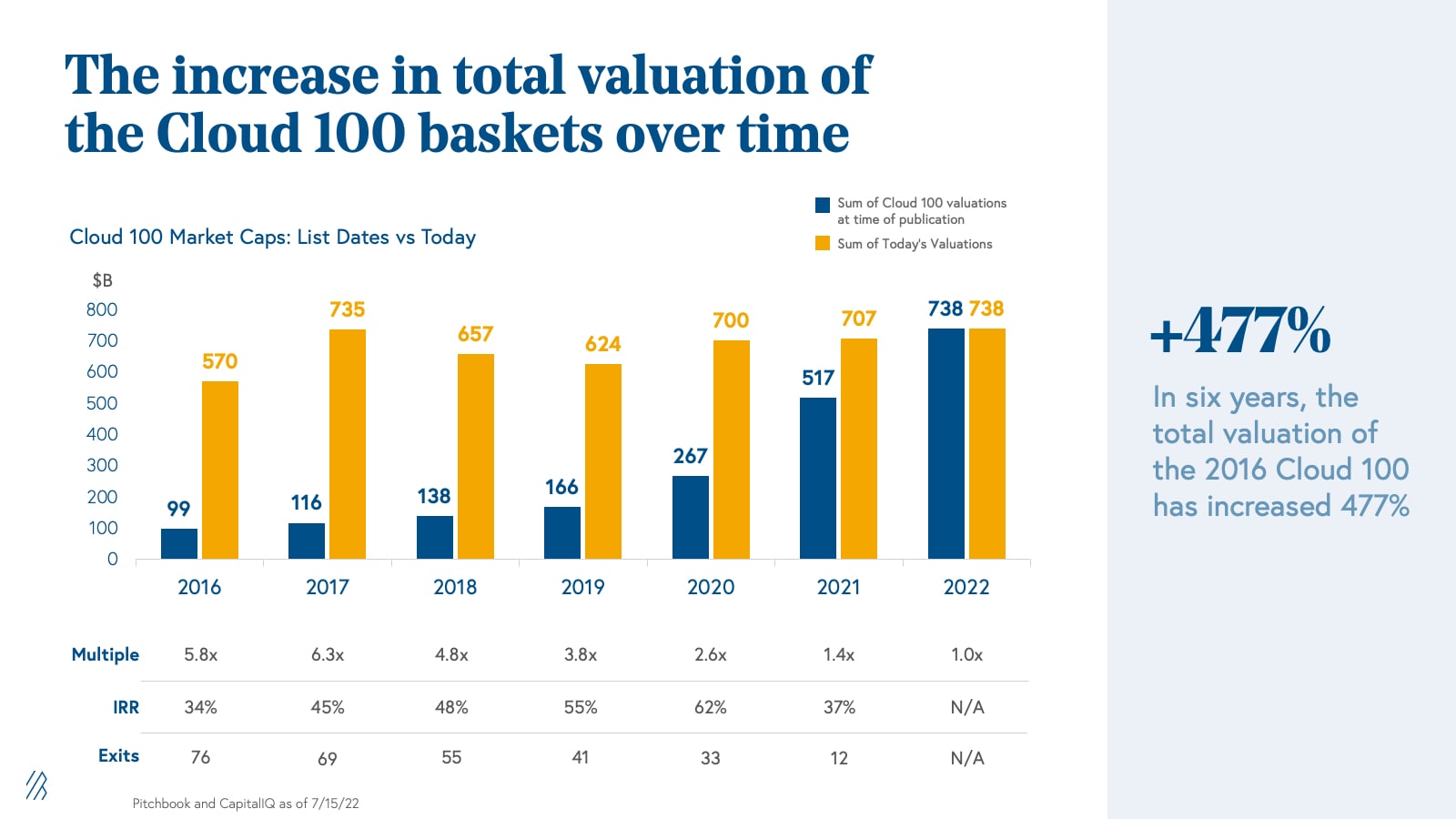

- It is no surprise that since these are the best-in-class companies as defined by fundamental performance rather than arbitrary valuation marks, the Cloud 100 list continues to produce strong returns. In seven years, the total valuation of the 2016 Cloud 100 list has increased by more than $469 billion, delivering a 5.8x and 34% IRR in that time. The 2017 Cloud 100 basket has delivered an 6.3x and 45% IRR as its aggregate value nears $735 billion; the 2018 basket a 4.8x and 48% IRR; the 2019 basket a 3.8x and 55% IRR; the 2020 basket a 2.6x and 62% IRR, and the 2021 basket a 1.4x and 37% IRR in just one year alone.

The 2022 Cloud 100 at a glance: $738 billion of equity value

The 2022 Cloud 100 list represents an astonishing $738 billion of equity value, with an average $7.4 billion valuation per company. The cumulative value of the Cloud 100 list is up a staggering +43% from the 2021 list’s aggregate value of $518 billion, in just one year.

This valuation growth was catalyzed in part by both a high-priced multiple environment and the sheer volume of capital that went into cloud businesses: $129 billion in 2021 per Pitchbook. In many ways, it may have been wise of these companies to take advantage of market conditions to reduce dilution and buffer their cash runway in anticipation of more challenging times ahead.

This year we welcomed 25 new companies to the Cloud 100 list. The highest-ranked new entrant was Algolia, which graced the Cloud 100 list in 2018 and returns in 2022. Other newcomers include Clickup and Dataiku, alongside Bessemer portfolio companies HiBob, the modern HR platform; Alloy, the identity decisioning engine for financial services; and Netlify, the web development and deployment platform.

This year’s biggest mover title goes to Grafana Labs, the performance monitoring platform, which moved up +43 spots to #37 on the Cloud 100 list and announced its Series D raise at a $6 billion valuation in April.

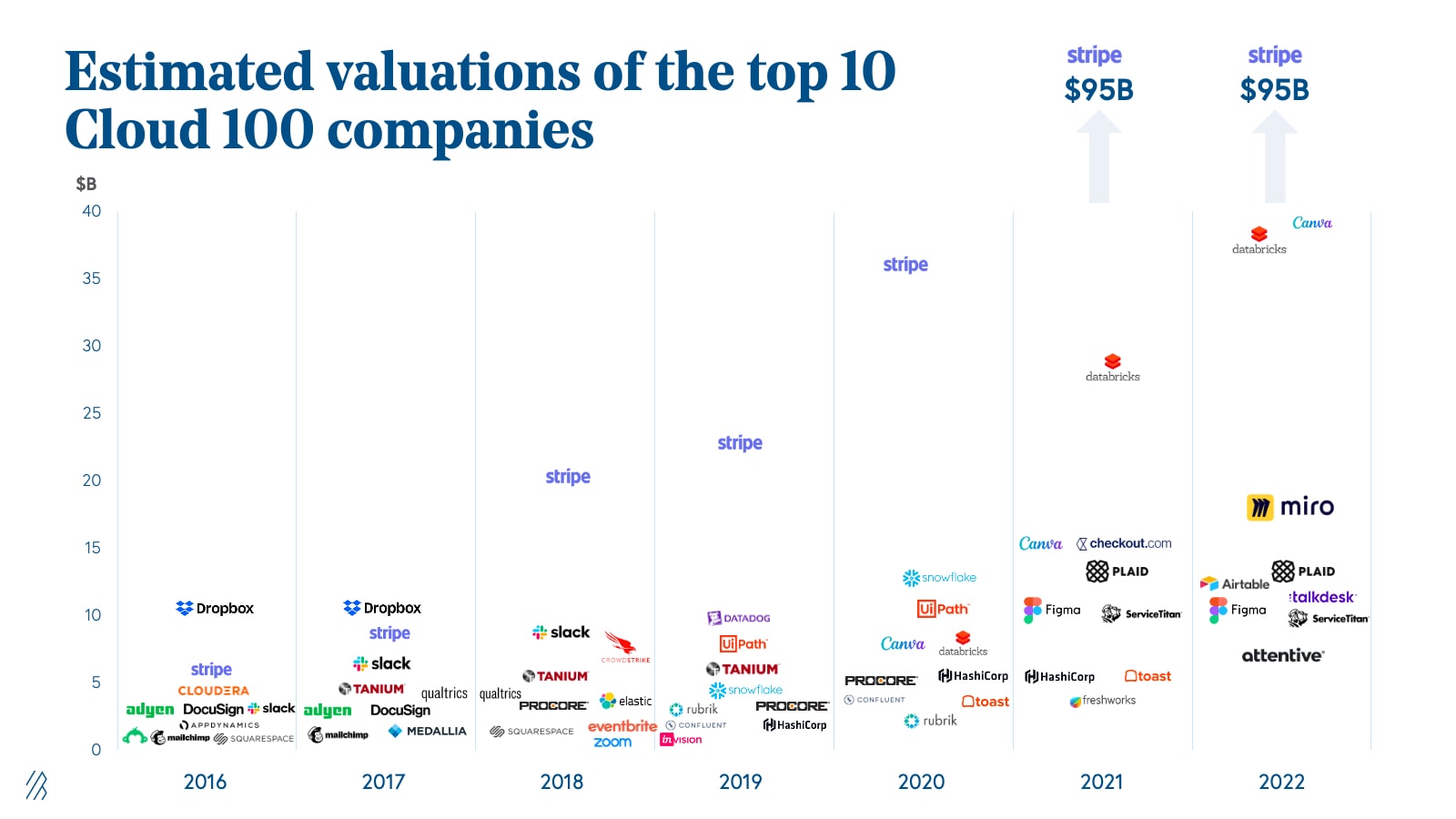

The Top 10 Cloud Companies represent over $252 billion of equity value alone. Stripe retains the #1 spot on the Cloud 100 for the second year in a row (and fifth year overall) with its last private financing at a $95 billion valuation. Joining Stripe in the top ten are Databricks (#2), Canva (#3), Miro (#4), Figma (#5), Airtable (#6), ServiceTitan (#7), TalkDesk (#8), Plaid (#9), and Attentive (#10). At #4, Miro had the largest jump of any Top 10 company, increasing +32 spots from its #36 position on the 2021 list.

Representing $252 billion as a group, the Top 10 Cloud 100 companies individually average a valuation of $25.2 billion, which is up +$5 billion from 2021 and +$22 billion from the inaugural 2016 list. Some notable financings in this group include Canva’s September 2021 round at $40 billion and Miro’s December 2021 round at $17.5 billion. The strength of the Top 10 companies cannot be overstated; from the 2021 list Toast, HashiCorp, and Freshworks all successfully went public in the second half of 2021. We anticipate that the most anticipated cloud IPOs in the future (when the IPO window opens!) will be from this Top 10 list.

Digging into sub-sectors, Fintech continues to represent the most valuable Cloud 100 category at $191 billion (and 26% of total list value), though that market cap is anchored by Stripe’s $95 billion valuation in the last round. The next most valuable category is Design/Collaboration/Productivity, which contributes 16% of list value with $116 billion of market cap. Cloud 100 winners from this category include Figma, Airtable, and Notion. Data/Infrastructure rounds out the top three with $96 billion of market cap and 13% of list value, inclusive of companies like Databricks, Scale AI, and Fivetran.

While Fintech is the most valuable category by market cap, the highest number Cloud 100 honorees come from the Sales, Marketing, and Customer Success category. With 16 companies represented including Attentive, Klaviyo, Yotpo, and Intercom, it retains its top spot on having the most number of Cloud 100 honorees year-over-year.

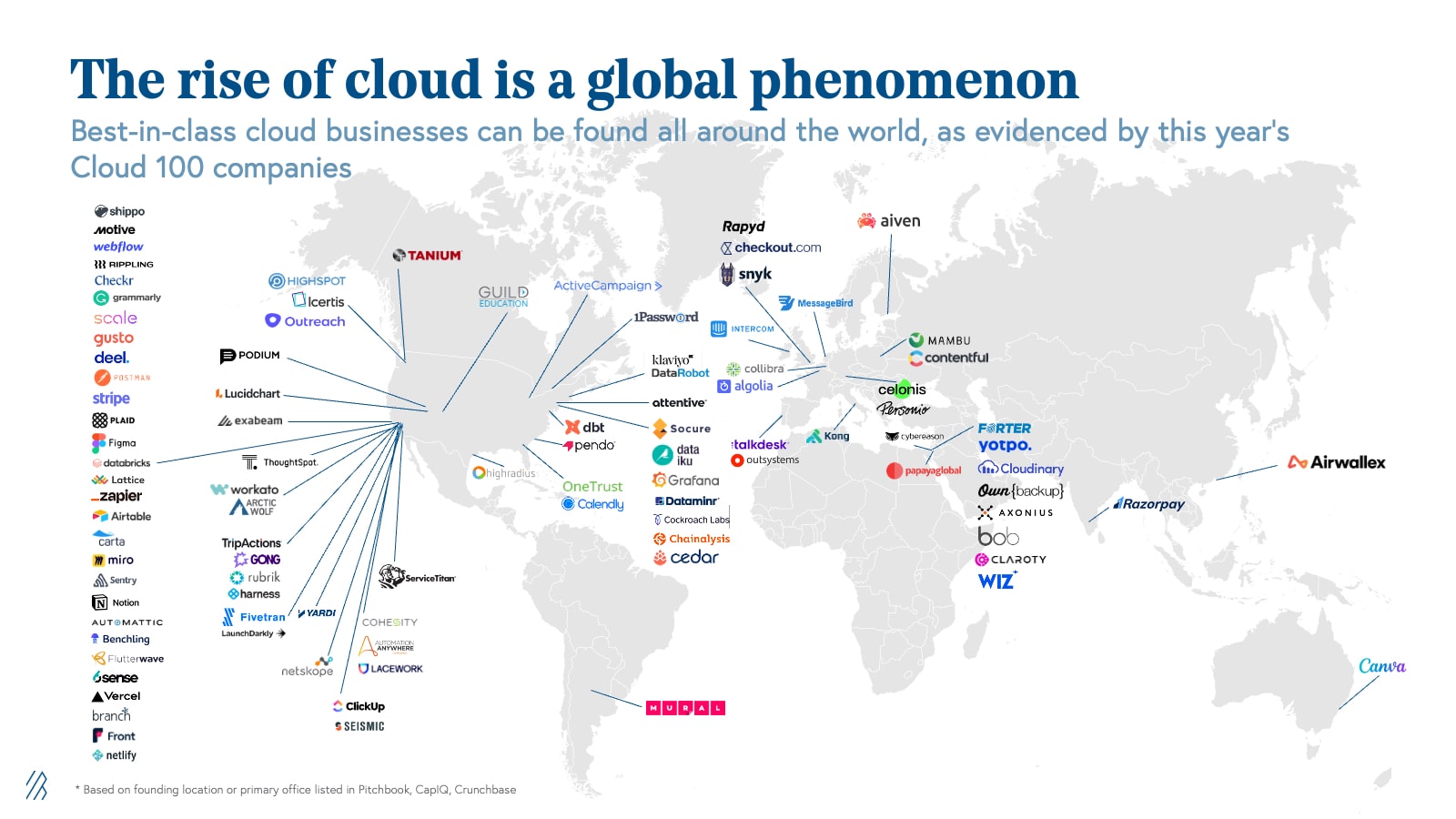

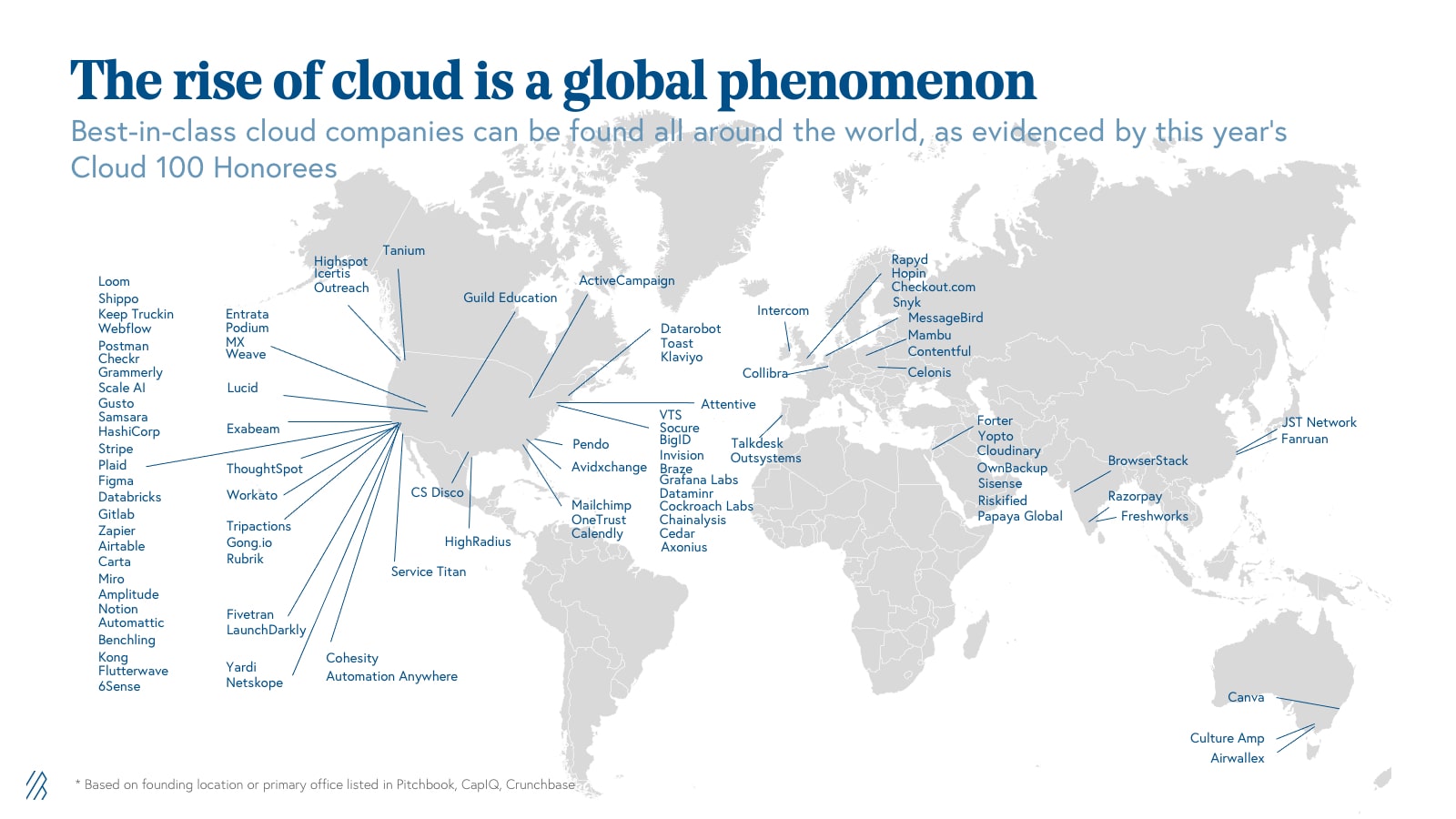

We noted last year that as entrepreneurs, operators, and investors all around the world increasingly recognize the power of the cloud, we’re seeing cloud startups bloom in technology hubs globally. Building on our prediction from last year, international representation on the 2022 Cloud 100 list has now surpassed 30%. In State of the Cloud 2022, we noted that public cloud spend is only 10% of the total $4 trillion total IT spend across the globe, with lots of untapped potential in regions such as Europe, Latin America, and Asia-Pacific. Using public cloud spend as a leading indicator of spend on all SaaS, we expect the Cloud 100 to become more and more geographically diverse in the coming years, as the globalization of cloud continues.

Valuations can be misleading, but Centaur status is a clear measure of traction

As we discussed above, the 2022 Cloud 100 list is worth an aggregate of $738 billion, an impressive +43% year-over-year growth over the $518 billion value of the 2021 list, increasing the average Cloud 100 winner’s valuation up to a massive $7.4 billion year-over-year ($6.5 billion if you remove Stripe). This must be surprising given the backdrop of deteriorating public markets, but as we noted, all of the 2022 Cloud 100 honorees raised their latest round in peak conditions before the downturn, and are still holding on to these high private marks.

However, we observe this year that as the market begins to cool, the average Cloud 100 multiple has decreased slightly from 34x in 2021 to 30x, reinforcing the frenzy of 2021 in the private cloud markets. Considering that the average public BVP Cloud Index company is trading under 10x, we expect that private multiples will continue to compress, though it may take several more quarters.

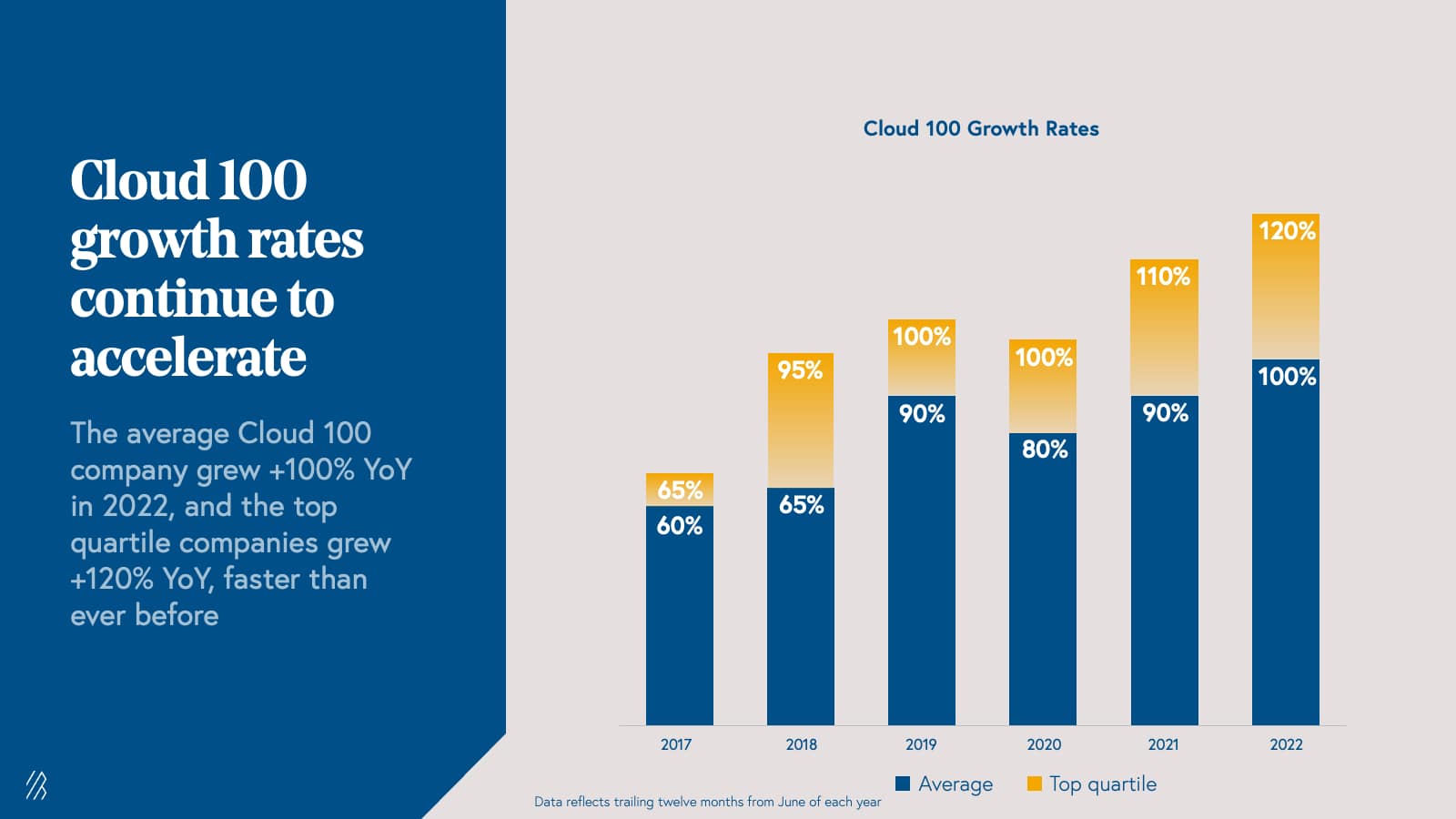

But while fears of recession, decreased purchasing power, and forecasted longer sales cycles are being often talked about in cloud company board rooms, thus far the performance of Cloud 100 companies continues to defy gravity. Even with these widespread macro concerns, the average Cloud 100 revenue growth rate actually increased to 100% year-over-year, with some companies forecasting even 200% or 300% growth for 2022. Taken in combination with the decreased multiples, growth-adjusted multiples improved year-over-year and returned to 2020 levels.

While we continue to celebrate the fundraising milestones of Cloud 100 companies, and the minimum threshold for this year’s list was $1 billion, we note that valuations are not always reflective of a company’s fundamental value when capital is easily accessible and markets are frothy. A decade ago, reaching the $1 billion valuation milestone was an exceptional accomplishment and a genuine proxy for success that signaled to customers, partners, employees and the media that a company should be taken seriously because it would likely endure. At that time, only 14 private startups were valued at $1 billion or more at the time, and only four unicorns were added to the herd yearly. However, as multiples increased and many cloud companies saw successful IPOs in a strong macro backdrop, capital flooded the cloud software startup ecosystem, driving the number of cloud unicorns to over 400+.

At Bessemer, this is why we choose to orient our companies, the broader VC community, and even ourselves, towards the more reflective company milestone of becoming a Centaur, a $100 million ARR business.

We are exceptionally proud to observe that over 70% of 2022 Cloud 100 Honorees are currently Centaurs, with an additional about 10% expected to hit this milestone by the end of the year—marking over 80% of 2022 Cloud 100 honorees as Centaurs! This year’s honorees possess an incredible ability to grow quickly at $100 million+ ARR scale, strengthening our conviction that this list truly represents the best cloud companies globally.

Impressively, it only took an average of eight years from the founding for Cloud 100 Centaurs to hit this milestone. On a category basis, the Sales/Marketing/CX category has the most Centaurs.

We congratulate every Cloud 100 company that has reached this exceptional milestone, including a very special Bessemer portfolio company that is proud to announce its Centaur status today—LaunchDarkly!

Cloud 100 returns: +477% increase in valuation since 2016

As highlighted by the high representation of Cloud Centaurs in the Cloud 100, these are best-in-class cloud companies as defined by fundamental performance rather than arbitrary valuation marks. It is thus no surprise that the Cloud 100 list continues to produce strong returns. In seven years, the total valuation of the 2016 Cloud 100 list has increased by more than $469 billion, delivering a 5.8x and 34% IRR in that time. The 2017 Cloud 100 basket has delivered an 6.3x and 45% IRR as its aggregate value nears $735 billion; the 2018 basket a 4.8x and 48% IRR; the 2019 basket a 3.8x and 55% IRR; the 2020 basket a 2.6x and 62% IRR, and the 2021 basket a 1.4x and 37% IRR in just one year alone.

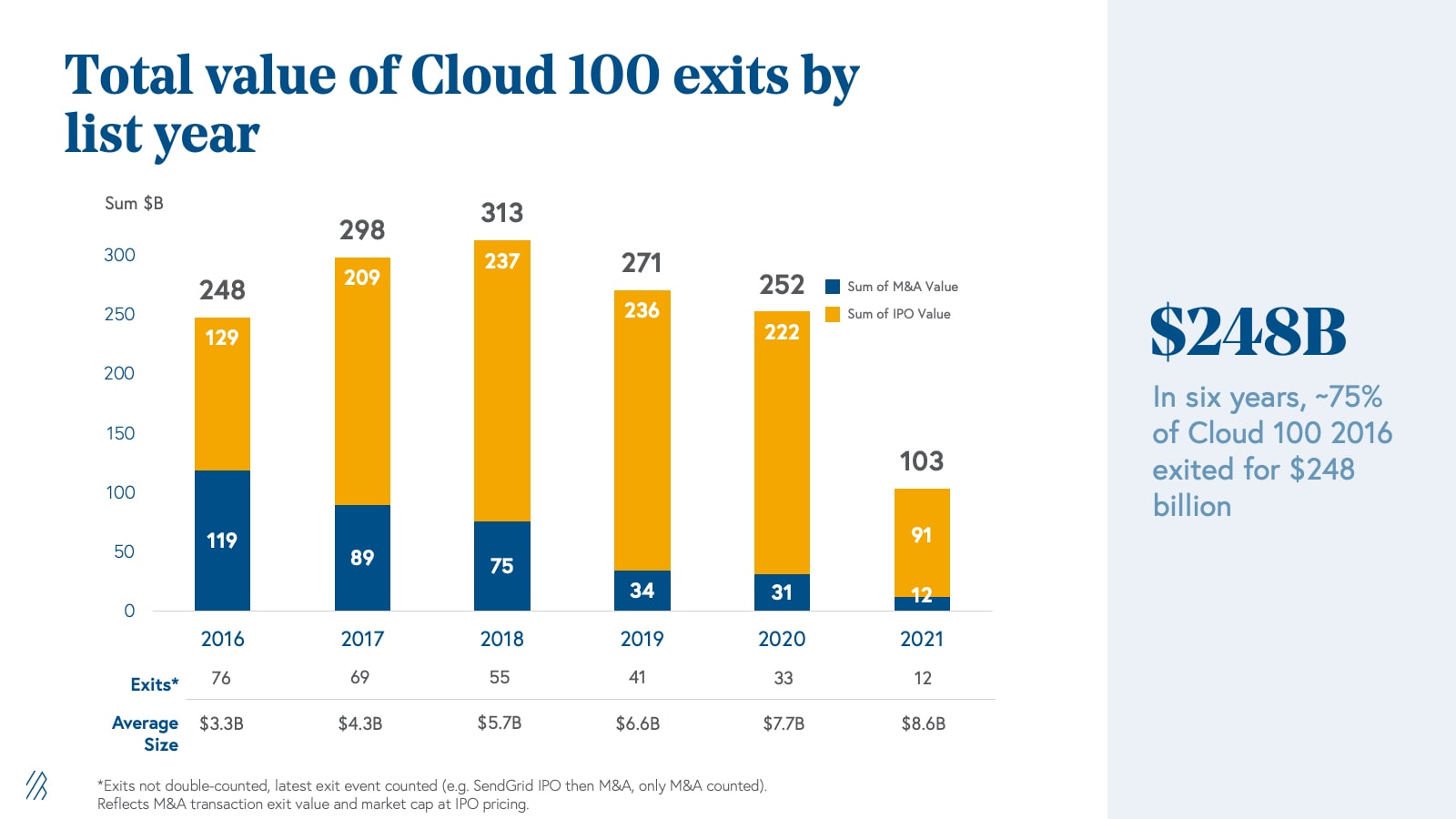

While there were 11 IPOs/direct listings from the 2021 Cloud 100 members, the IPO window remained shut in 2022 given the market turning for the worse. In fact, several honorees had to postpone IPO plans for this year. Despite this, we still have conviction that Cloud 100 honorees are going to be the strongest IPO candidates when the window opens and perhaps targets of strategic M&A.

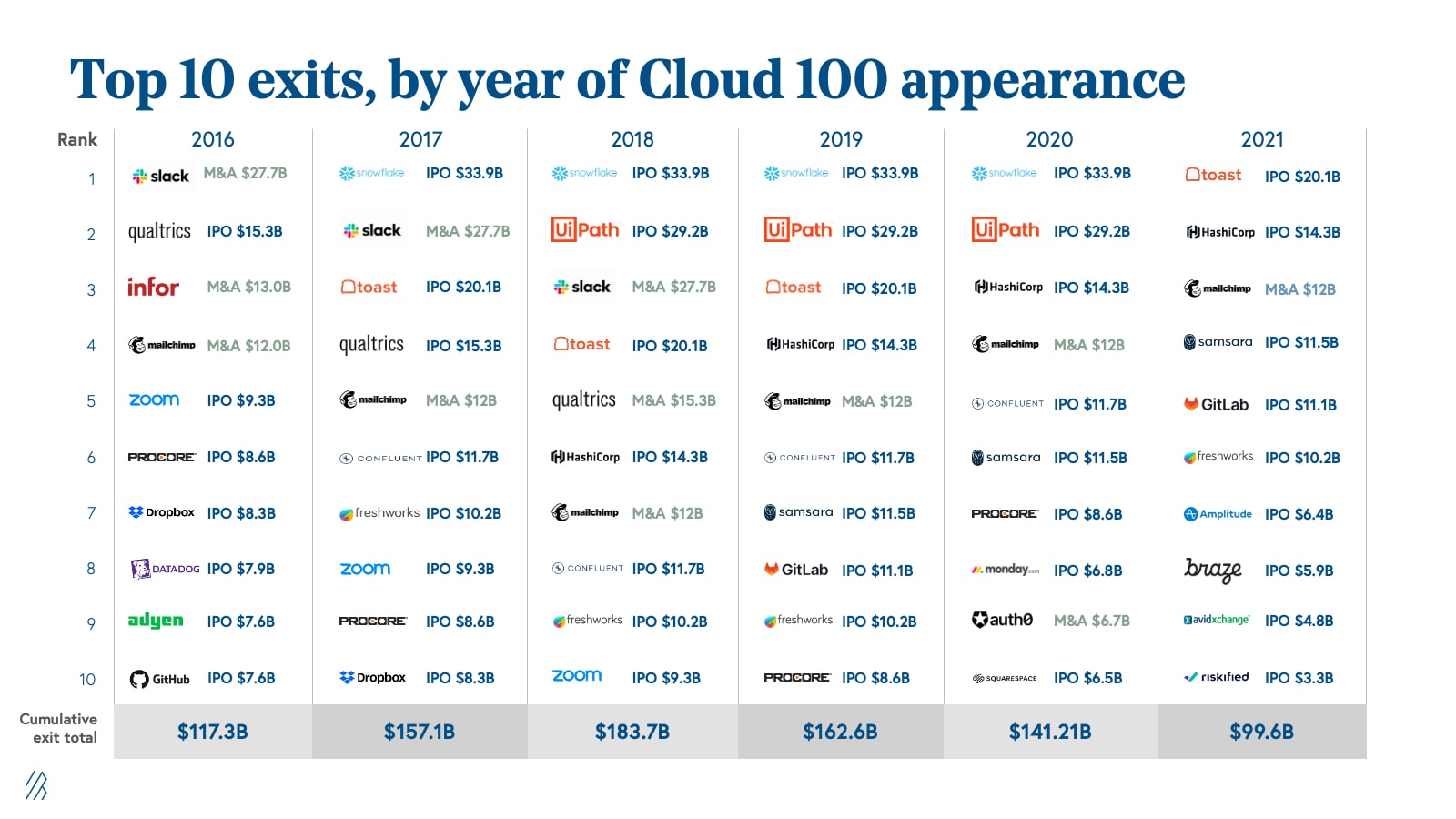

To highlight this potential, we reviewed exits per list year and found that the average exit size of Cloud 100 companies has been increasing over time, from an average of $3.3 billion in 2016 to $8.6 billion from realized exits in 2021. Historically, a majority of the exit value has been generated from IPOs, signaling how Cloud 100 members can grow into strong, standalone companies.

To illustrate this point, we note that iconic companies have IPOed from the Cloud 100 list, including the likes of Snowflake, UiPath, and Toast with their mega IPOs.

Focusing on strong business fundamentals

As we celebrate the 2022 Cloud 100 season, we want to remind entrepreneurs and investors that despite compressing multiples and what feels like doom-and-gloom in the markets, cloud businesses today are still displaying strong fundamentals.

As previous Cloud 100 graduates have demonstrated, the best cloud leaders are not only able to survive, but also thrive, through challenging times. These businesses are riding multi-decade tailwinds, and here at Bessemer we’re long-term oriented and long-term bullish on these companies. From the high percentage of Centaur representation in the 2022 Cloud 100 cohort, these honorees have already proven that they are companies with strong, durable fundamentals which gives us great conviction that the world’s best cloud companies will be able to weather the storm.

See you for the 2023 Cloud 100!

Read more Centaur Studies from ServiceTitan, Calendly, and LaunchDarkly in The Centaur Report.

2021 Cloud 100 Benchmarks

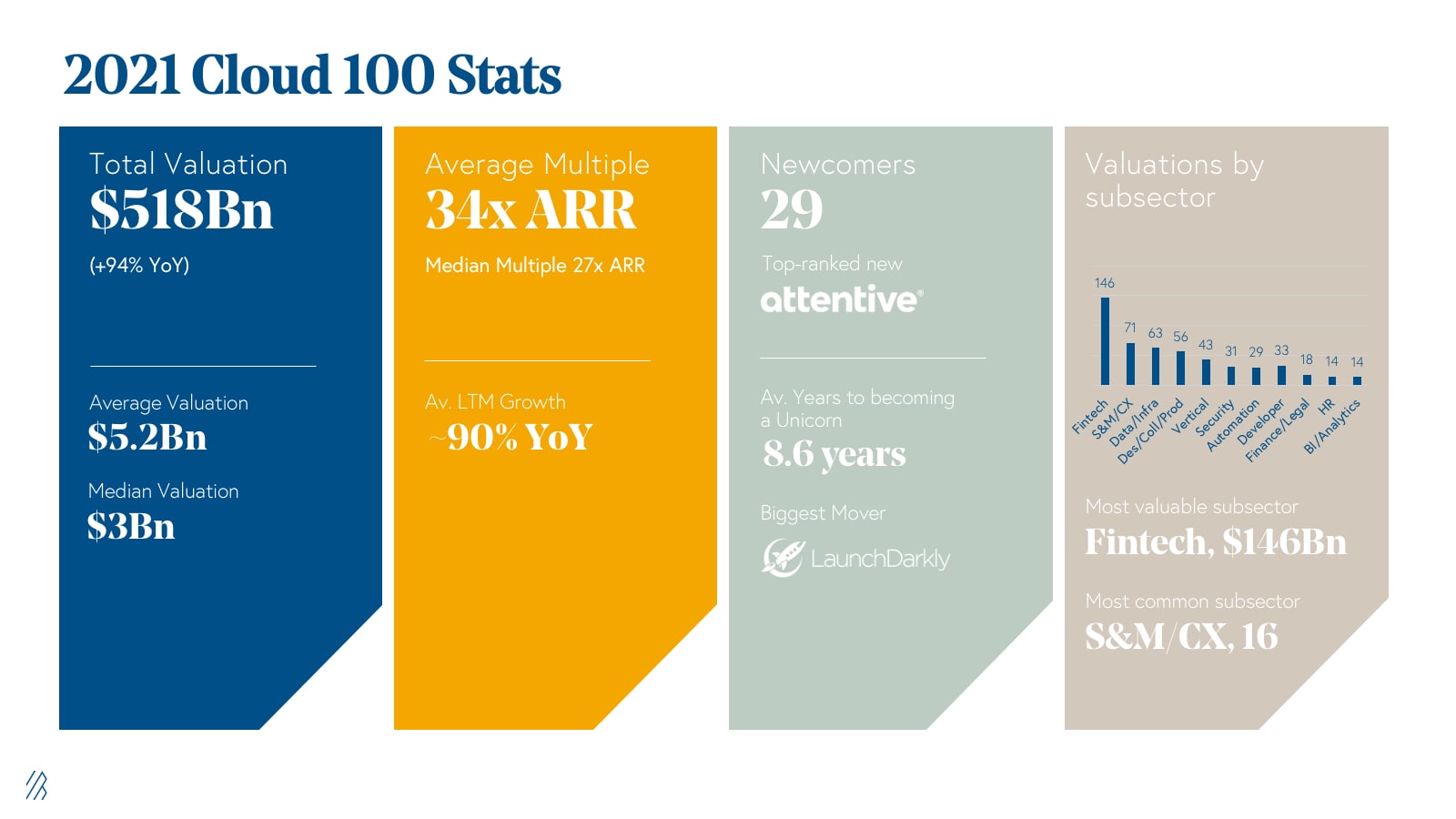

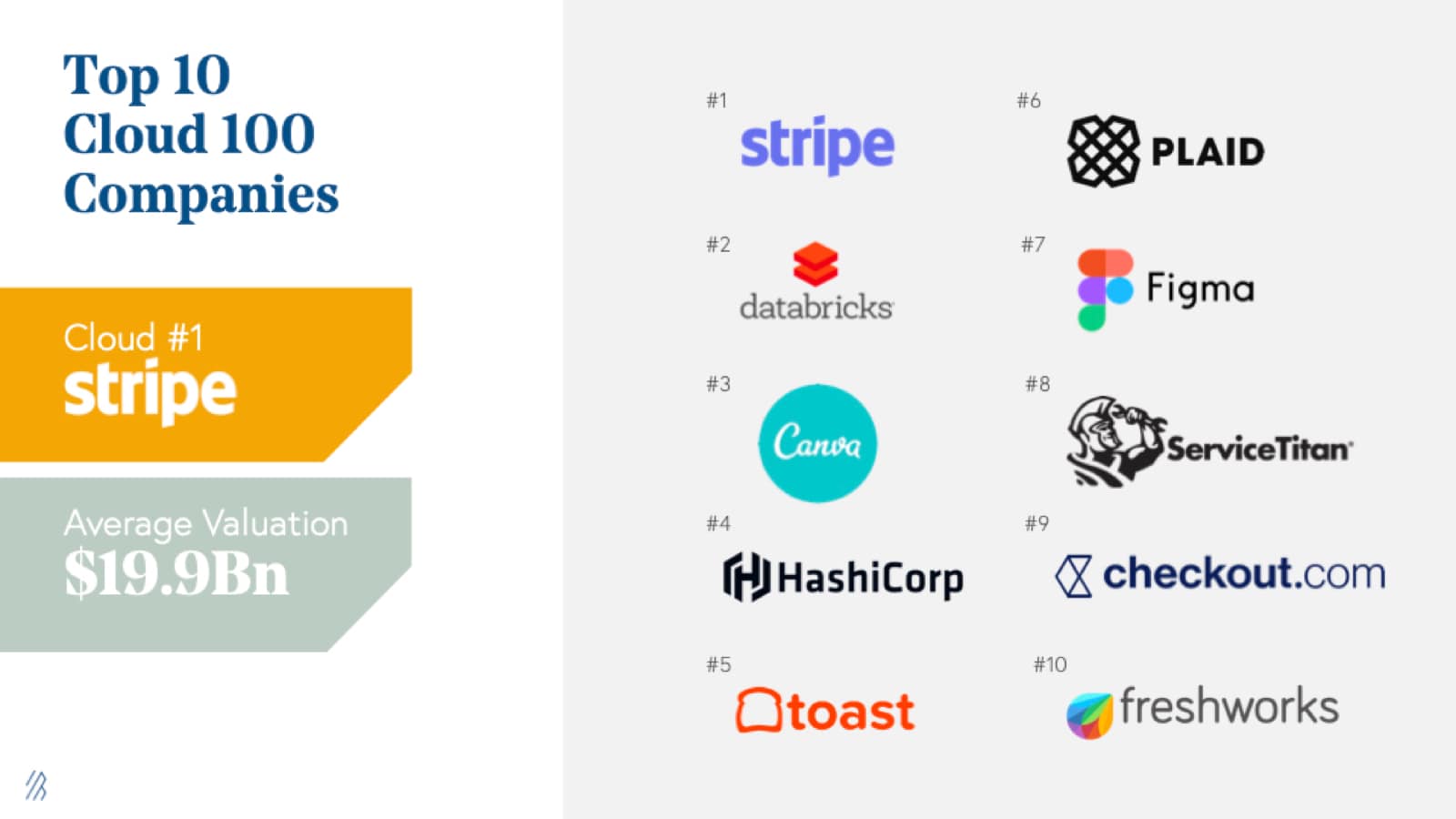

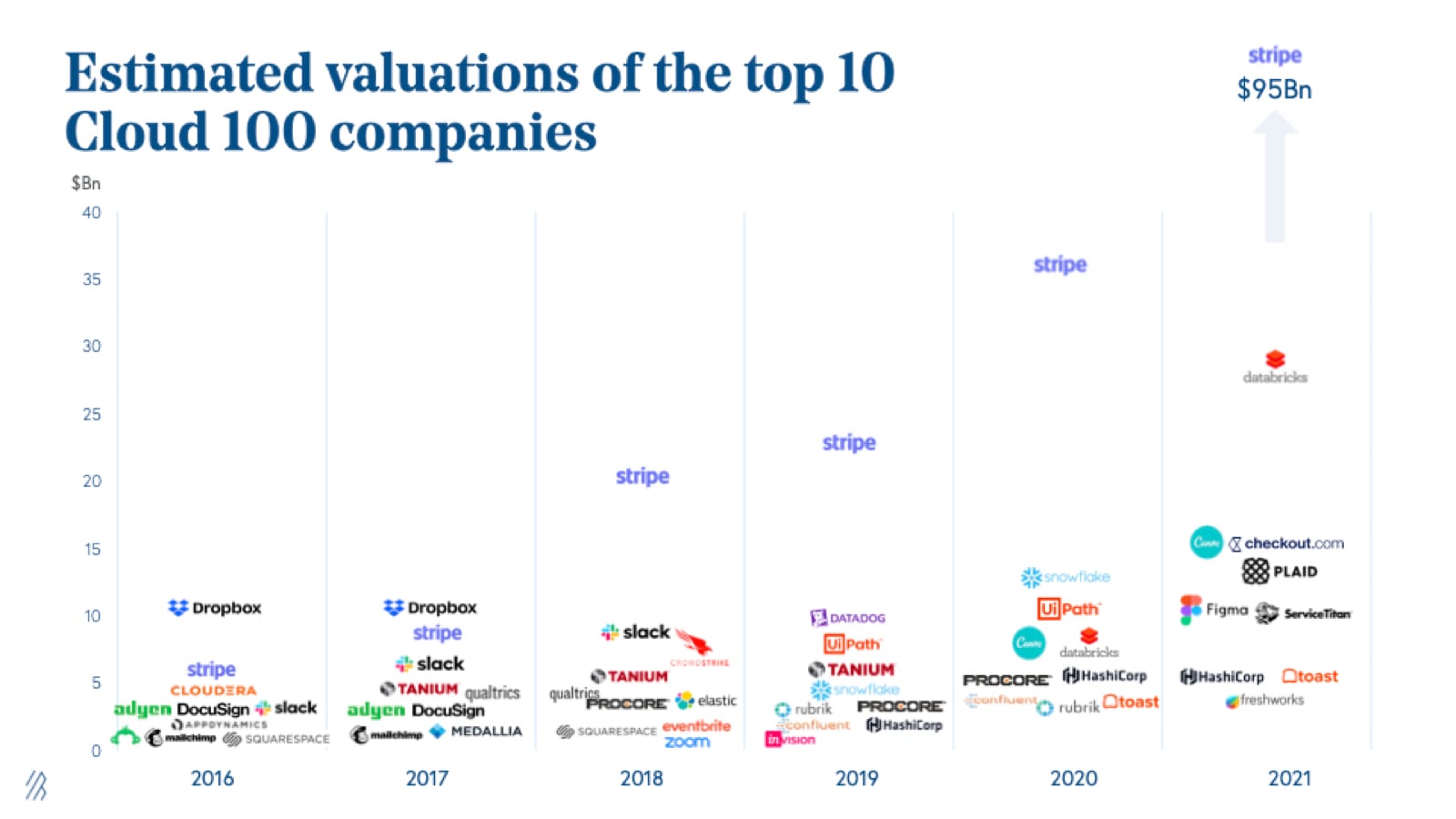

Today Bessemer Venture Partners, Forbes, and Salesforce Ventures announced the [2021 Cloud 100 List](https://forbes.com/cloud100), the definitive ranking of the top 100 private cloud companies. And — keeping consistent with previous years’ trends — the 2021 list was even stronger than the last. This year features bigger companies, higher valuations, and more market tailwinds than ever before — so much so, in fact, that the estimated valuation required to make the list was over $1 billion*. That’s right. The bar for this year’s list was so high that each honoree achieved the unicorn milestone. Between Stripe at $95 billion, Databricks at $28 billion, and Checkout at $15 billion, to get on the 2021 Cloud 100 list was a fight among giants. These honorees truly represent the best cloud companies globally.

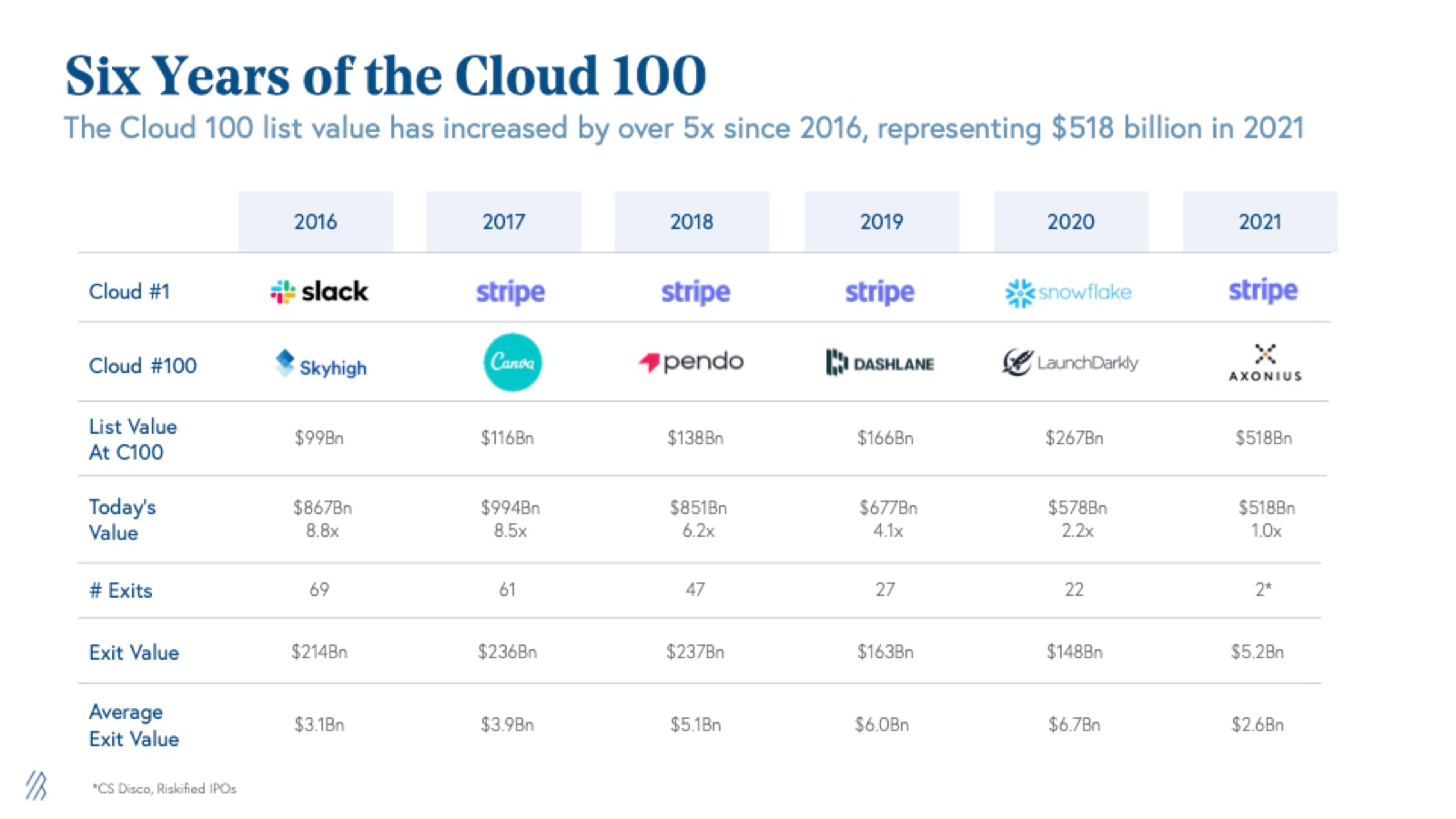

With six years of Cloud 100 data behind us, in this year’s Benchmarks Report we reveal Bessemer’s analysis and insights into the 2021 Cloud 100 cohort and what it tells us about the state of the private cloud market today.

Top highlights:

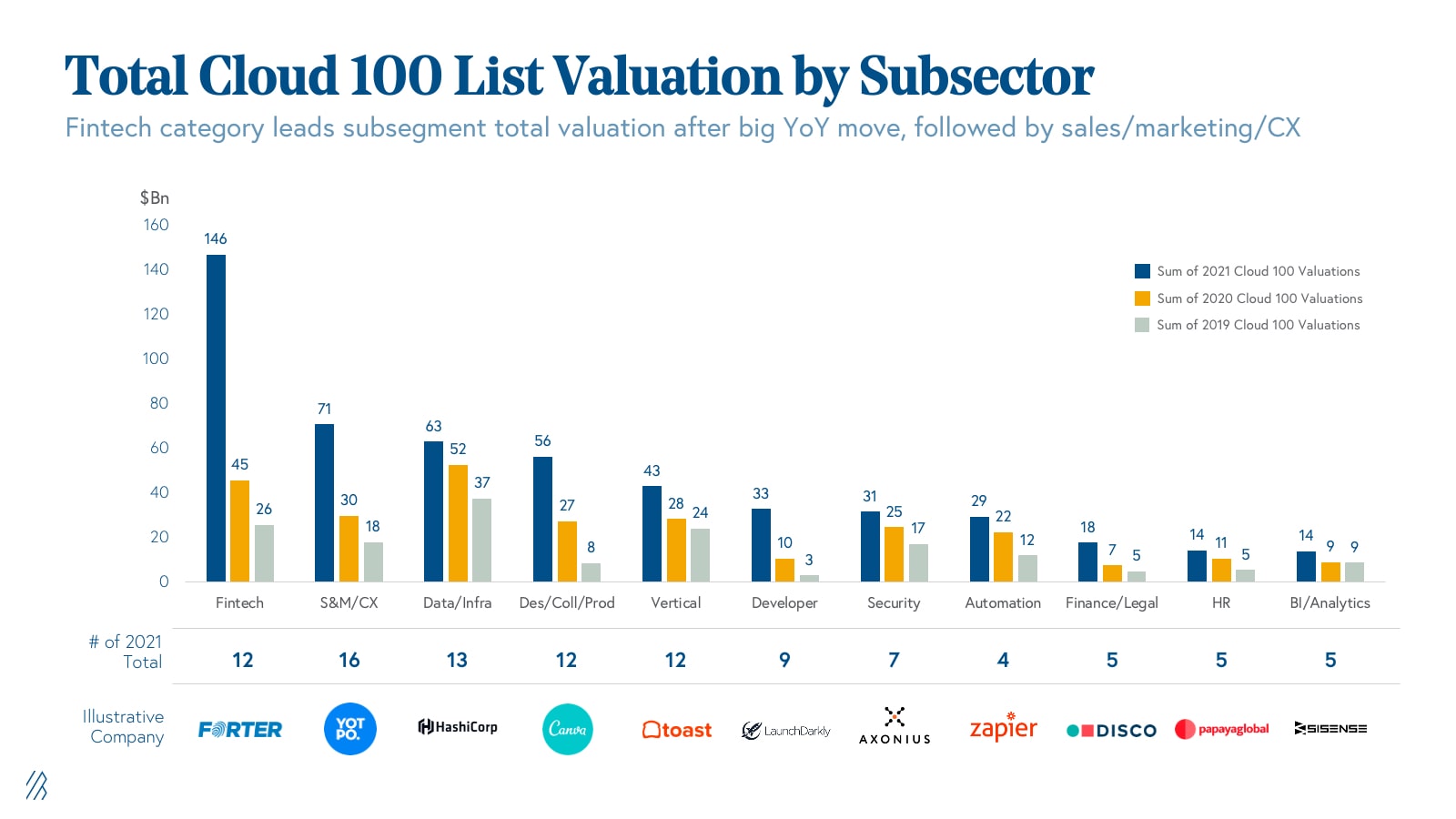

- Private cloud valuations continue to get bigger. The Cloud 100 2021 is worth an aggregate of $518 billion in 2021 vs. $267 billion in 2020, which is a 94% increase year-over-year (YoY). The top 10 Cloud 100 companies alone contribute $200 billion of equity value (38% of list value), and fintech represents the highest value subsector at $146 billion (28% of list value).

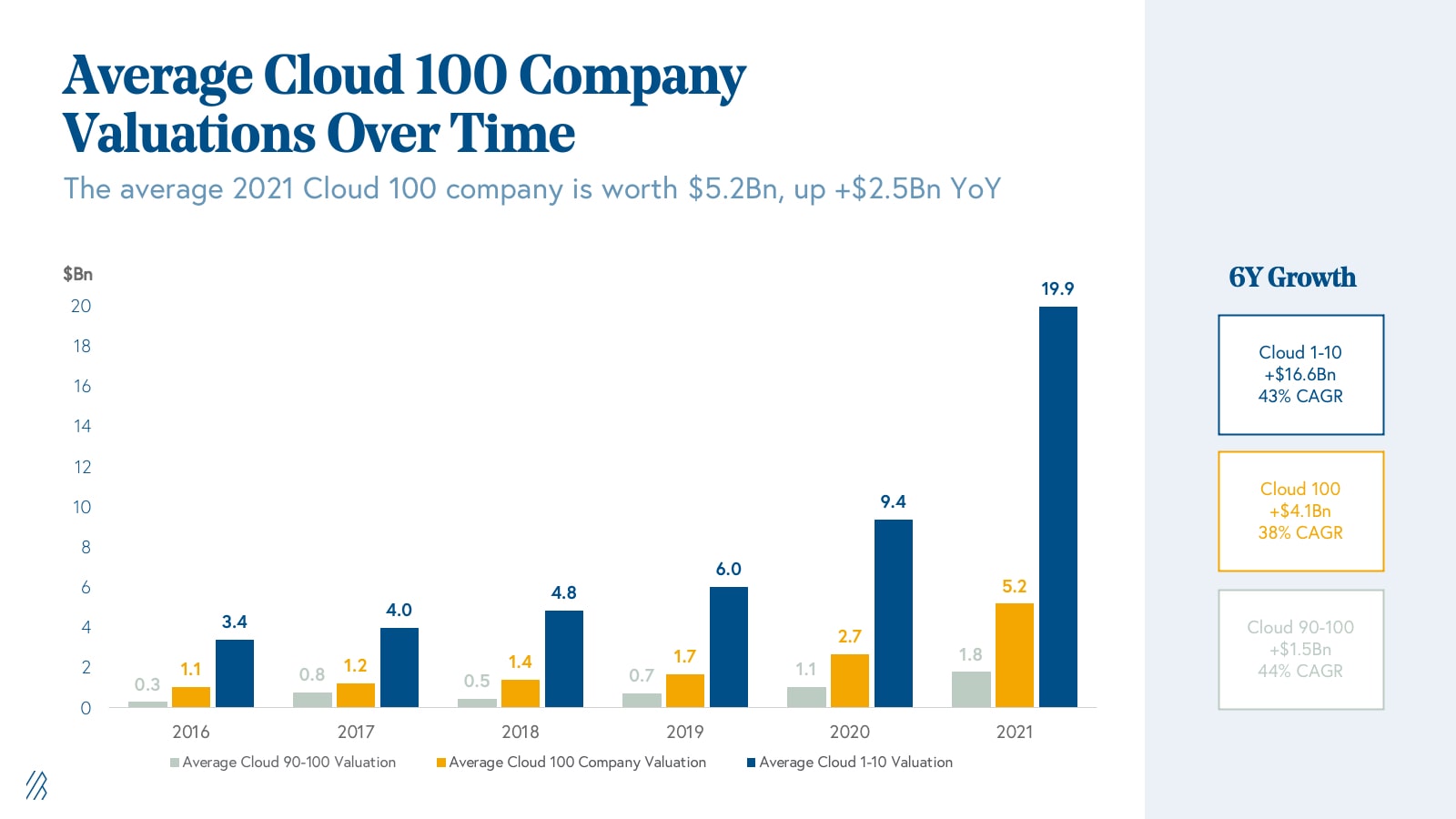

- The threshold to make the Cloud 100 continues to get higher: this year, every company on the list has at least hit the unicorn milestone. In addition, the average cloud company valuation was $5.2 billion, an increase of $2.5 billion YoY.

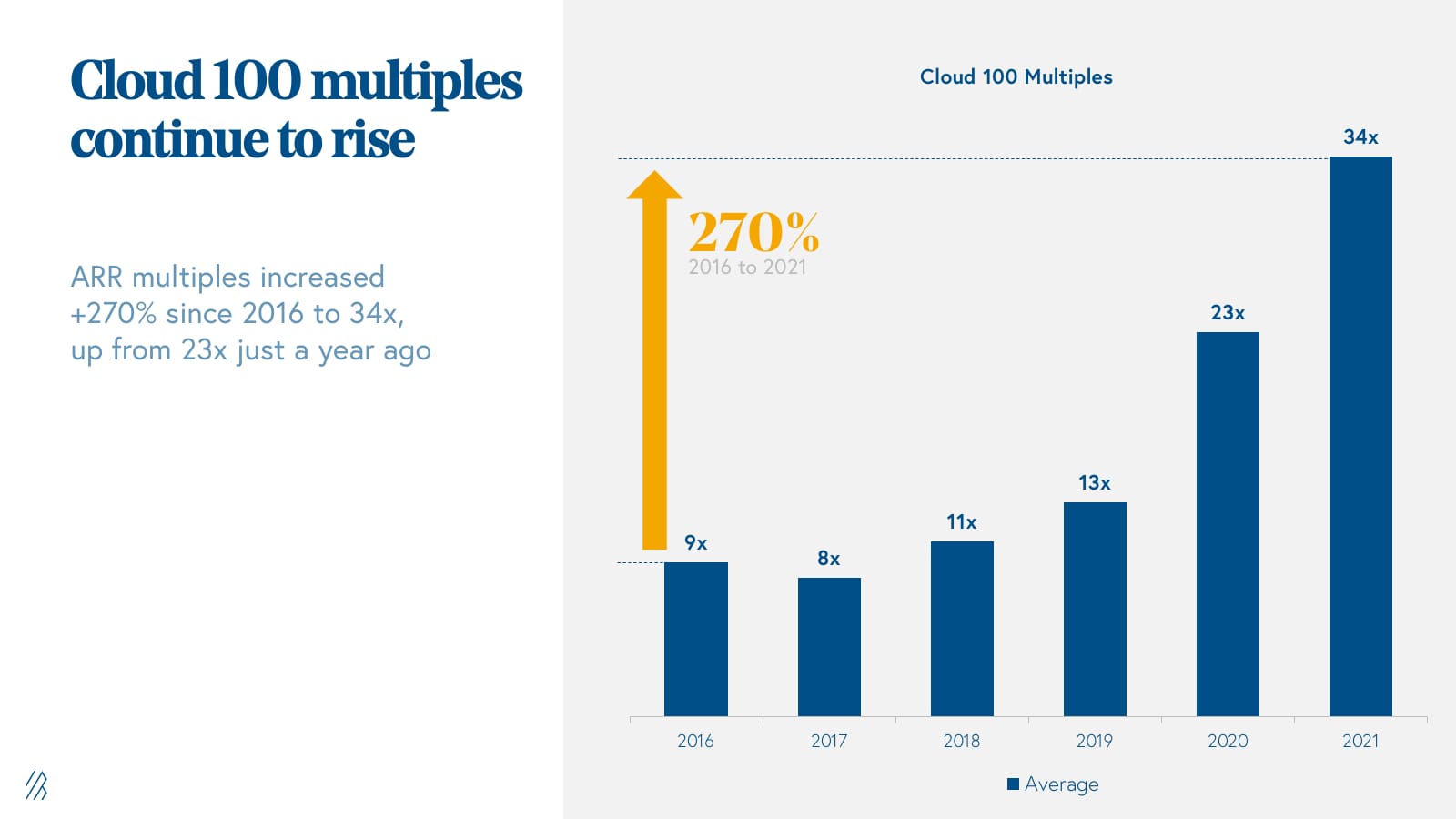

- The growth in valuations comes from both increased growth rates for Cloud 100 businesses and higher multiples being paid. The average Cloud 100 valuation multiple increased by approximately 270% in the last six years, from 9x ARR in 2016 to 34x in 2021, while the average Cloud 100 company revenue growth rate increased to 90% YoY.

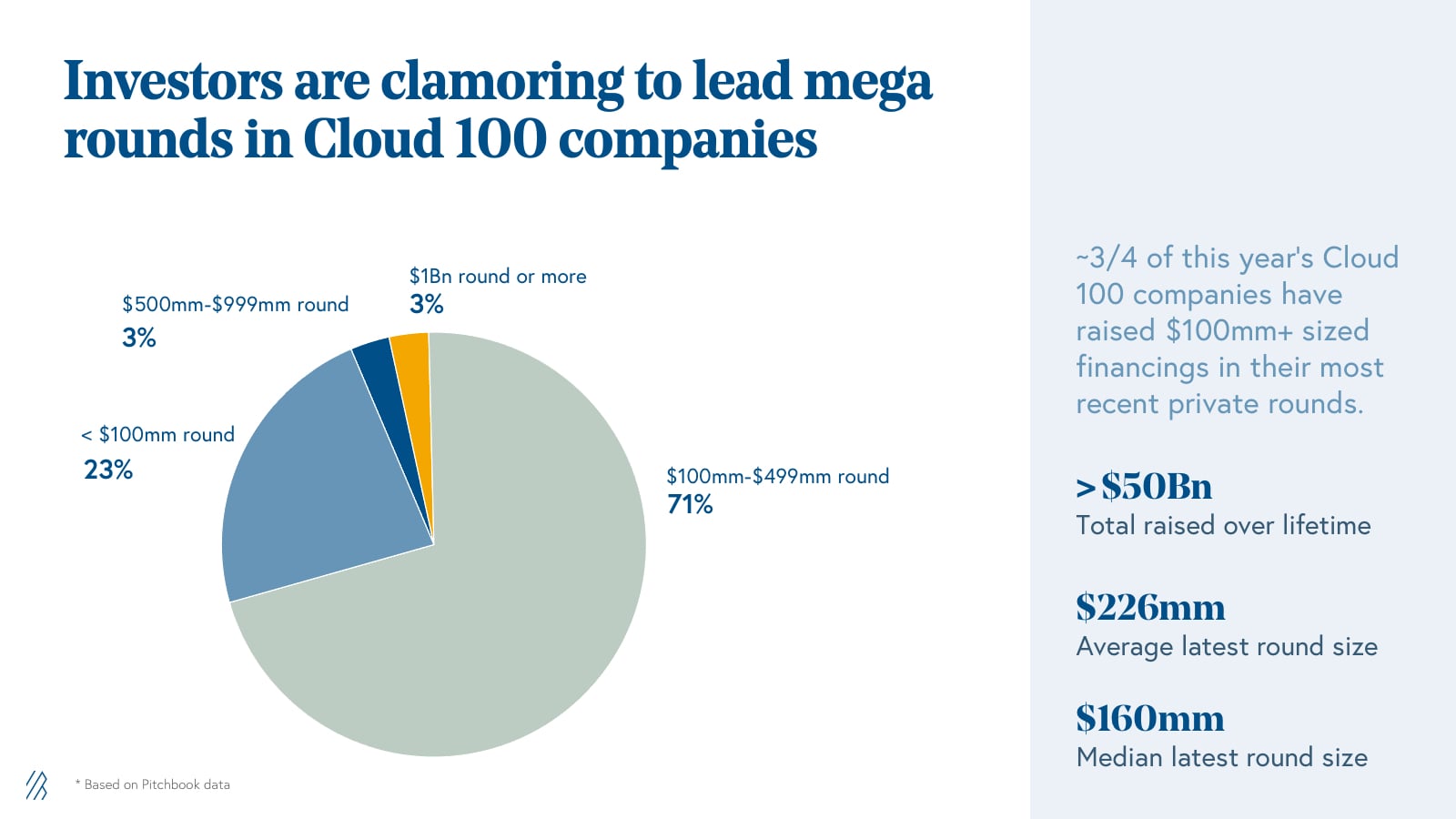

- Cloud 100 companies are reaching the unicorn milestone faster than ever before. When we look at the 2021 basket, it took the average Cloud 100 honoree 8.6 years from founding to grow into a unicorn, as compared to 12.1 years in 2016. Cumulatively, the Cloud 100 2021 basket has raised more than $50 billion over its lifetime.

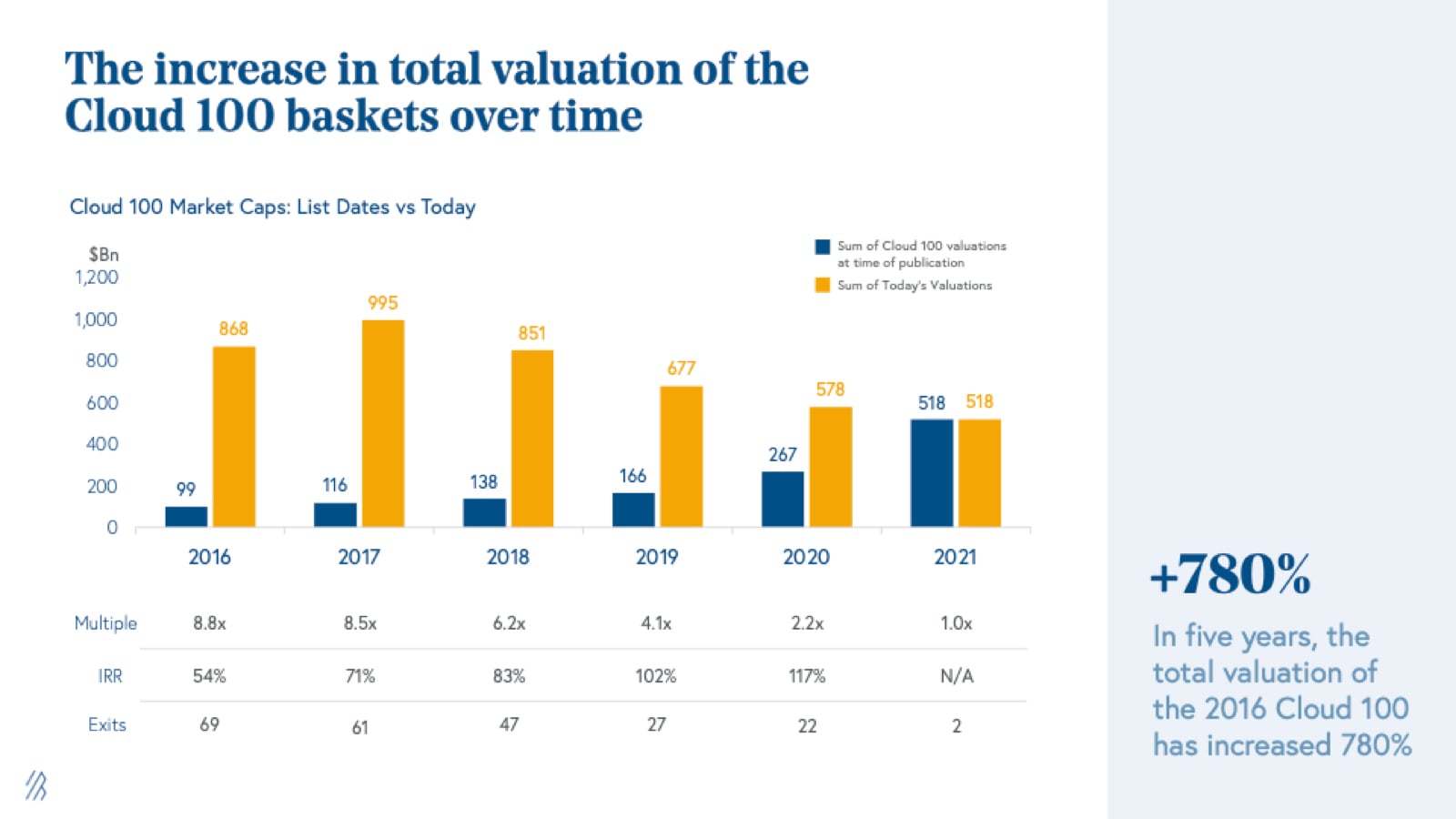

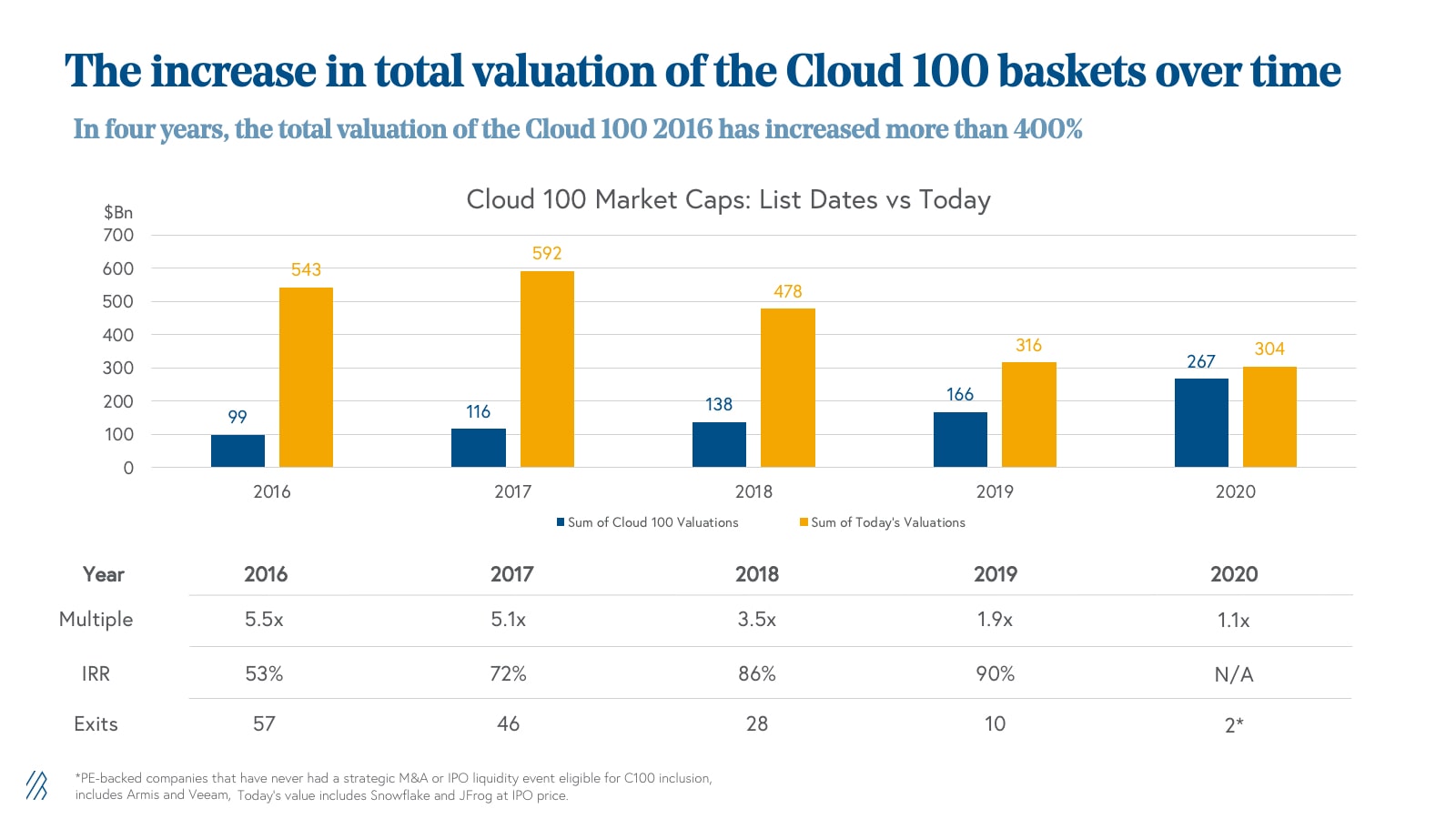

- The Cloud 100 list continues to produce strong returns. In five years, the total valuation of the 2016 Cloud 100 list has increased by more than 780%, delivering an 8.8x and 54% IRR in that time. The 2017 Cloud 100 basket has delivered an 8.5x and 71% IRR as its aggregate value nears $1 trillion; the 2018 basket a 6.2x and 83% IRR; the 2019 basket a 4.1x and 102% IRR; and the 2020 basket a 2.2x and 117% IRR in just one year alone.

Let’s dig in!

The Cloud 100 2021 at a glance: $518 billion of equity value

The 2021 Cloud 100 list represents an astonishing $518 billion of equity value, with an average $5.2 billion valuation per company. The cumulative value of the Cloud 100 list is up a staggering +94% from the 2020 list’s aggregate value of $267 billion, in just one year.

The Top 10 Cloud Companies represent almost $200 billion of equity value alone. Stripe, which was unseated by Snowflake in 2020, secured its number one spot once again and is the top-ranked cloud company, valued at $95 billion. Joining Stripe on the top ten list includes Databricks (#2), Canva (#3), HashiCorp (#4), Toast (#5), Plaid (#6), Figma (#7), ServiceTitan (#8), Checkout.com (#9), and Freshworks (#10). Representing $200 billion of equity value as a group, these companies individually average a valuation of almost $20 billion, $10.5 billion more than in 2020 and an incredible $16.6 billion more than in the 2016 iteration of the Cloud 100. Some notable financings in this group include [ServiceTitan’s $500 million round](https://www.servicetitan.com/press/500-million-investment) in March 2021, which put its valuation at $8.3 billion and [Canva’s April 2021 round at $15 billion](https://www.forbes.com/sites/alexkonrad/2021/04/06/canva-reaches-15-billion-valuation-making-cofounders-melanie-perkins-and-cliff-obrecht-billionaires/?sh=2c4a3dfc63c1).

Fintech surpassed data infrastructure as the most valuable Cloud 100 category, though sales, marketing, and customer success software continues to have the plurality of companies on the list. With 16 companies, the Sales/Marketing/CX category was the largest category represented on the 2021 Cloud 100 list by company count, including such notable names as Attentive, Yotpo, and Intercom, and it was the second most valuable subsector with $71 billion of value. However, the data changes when looking at aggregate valuation by subsector. With only 12 fintech companies on the list, this subsector holds 28% of the list’s equity value at $146 billion and is the highest valued subsector, anchored by Stripe (18% of the list’s value alone).

There were 29 newcomers to this year’s Cloud 100 list. The highest-ranked new entrant was Attentive, appearing on the list as #12. Other newcomers include Loom and Calendly alongside Bessemer portfolio companies Forter, the leader in fraud prevention software, and PapayaGlobal, an international payroll solution. The biggest mover title goes to world’s leading feature management platform, LaunchDarkly, which announced its Series D today at over a $3 billion valuation.

The globalization of cloud continues. As entrepreneurs, operators, and investors all around the world increasingly recognize the power of the cloud, we’re seeing cloud startups bloom in technology hubs globally. The Cloud serves as the backbone for emerging tech communities across the globe as startup teams have more flexibility and agency than ever before. In the Work from Anywhere movement, we’ve found that remote-first and distributed cloud teams across North and South America, EMEA, and APAC experienced more efficiency, increased scalability, and higher access to diverse pools of talent from all around the world. International representation on the Cloud 100 list reached almost 30% this year, and we expect this trend to continue for many more years to come, making the Cloud 100 more and more geographically diverse. We believe entrepreneurship is borderless, and we’re excited to continue to back cloud entrepreneurs around the world, from Canva in Australia to Mambu in Germany!

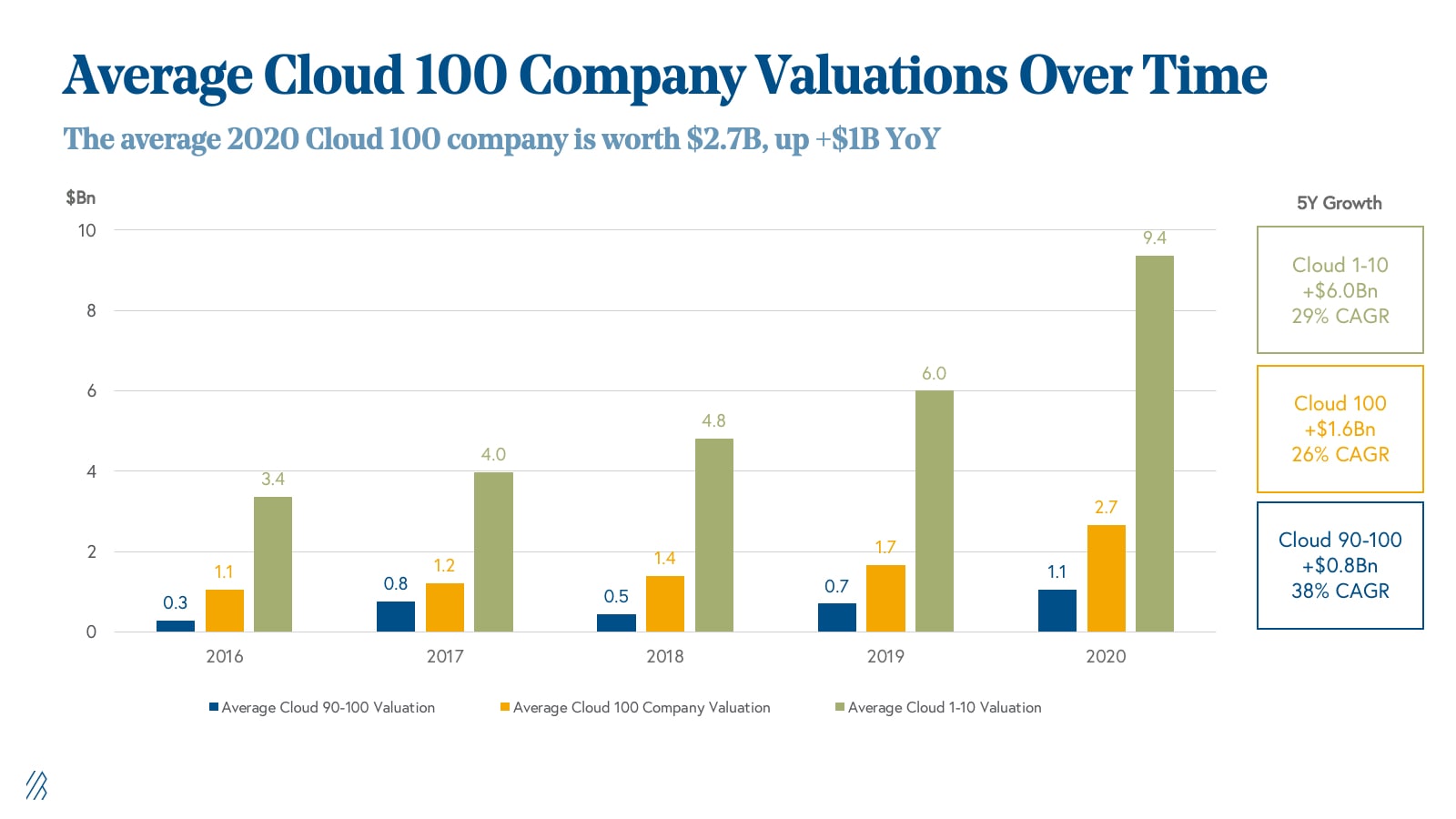

Cloud 100 new norms: 34x+ ARR multiples and +90% YoY growth

As we discussed above, the Cloud 100 2021 list is worth an aggregate of $518 billion, an impressive +94% YoY growth over the $267 billion value of the 2020 list, increasing the average Cloud 100 winner’s valuation up a massive $2.5 billion YoY ($1.6 billion if you remove Stripe). Combining all years of the Cloud 100, the growth is even more phenomenal. In six years, the average Cloud 100 valuation has grown by $4.1 billion and a +38% CAGR, from $1.1 billion in 2016 to $5.2 billion today.

As investors in cloud companies and as students of the market today, we find these statistics incredible; they are a credit to the tailwinds behind cloud adoption combined with investors’ understanding of the superiority of the cloud business model broadly. And as we explored in the [State of the Cloud 2021](https://www.bvp.com/atlas/state-of-the-cloud-2021#Private-cloud-market-analysis), we can attribute much of the growth in valuations to the combination of cloud company revenue growth and the multiples on that revenue expanding.

Across all the companies for which pricing data was disclosed, the 2021 Cloud 100 honorees commanded an average 34x ARR multiple in the most recent round of financing. This average Cloud 100 multiple has increased approximately 270% in the last six years from 9x ARR in 2016. The markets don’t look to be cooling off any time soon, with the average ARR multiple growing 47% in just a year, up from 23x in 2020.

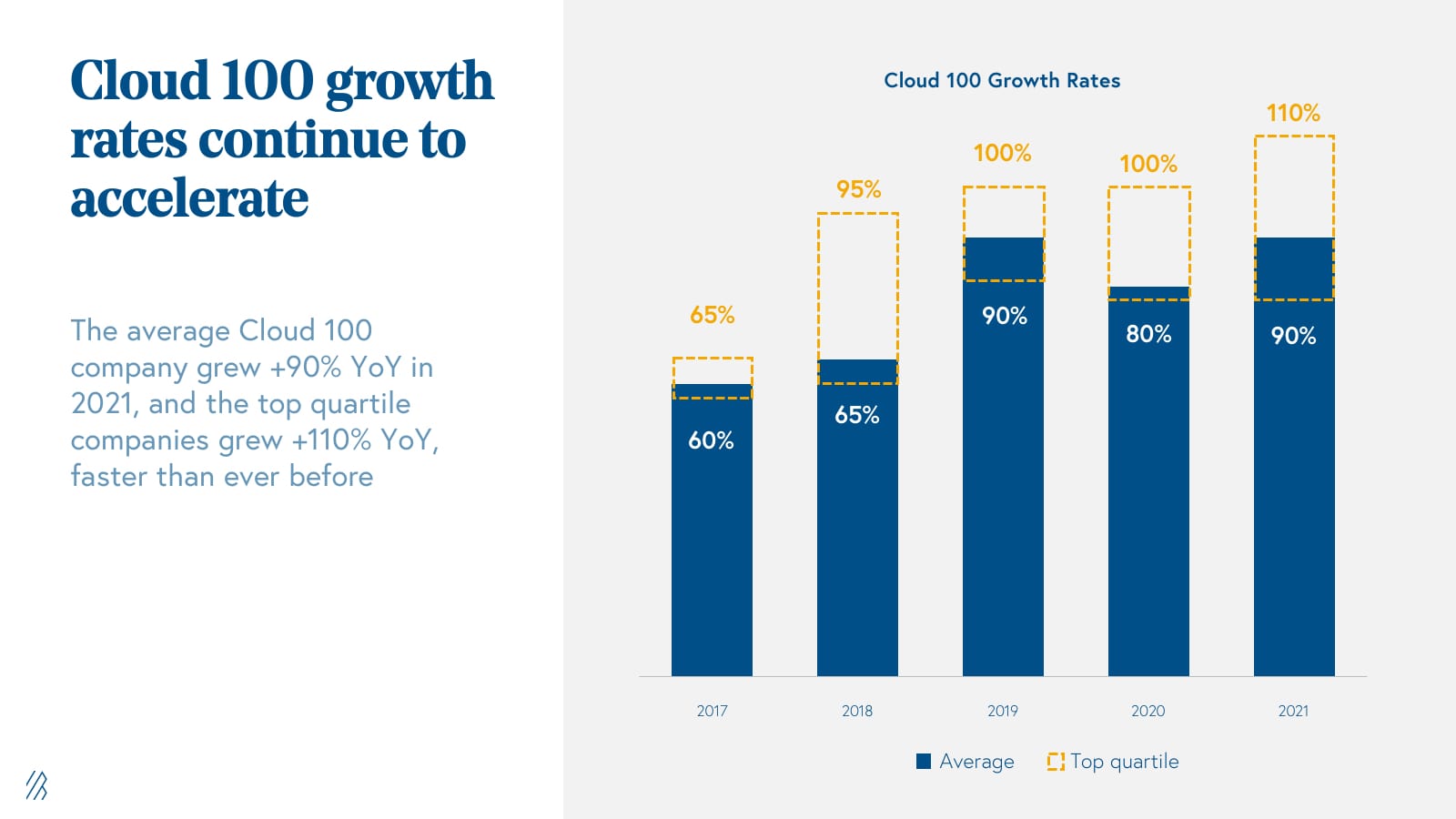

The average Cloud 100 growth rate also continues to accelerate, and top quartile companies are growing faster than ever before. Average growth rate increased from 60% in 2017 to 90% in 2019 given tailwinds for cloud adoption, though it dipped to 80% in 2020, which we largely attributed to COVID headwinds in certain industries. Today, average Cloud 100 growth rates have recovered and are back at 90% as more companies recognize the importance of moving to the cloud during the new normal.

It is also important to note that the top quartile cloud companies continue to pull away from the pack. Since 2017, the growth rates of the top quartile private cloud companies have increased 70%, from 65% in 2017 to 110% in 2021, including a 10% acceleration in the past year alone. We note that many of the fastest-growing companies have been beneficiaries of COVID tailwinds and include companies that facilitate distributed work and collaboration.

Cloud 100 data, however, points to the fact that in the private markets, multiples are expanding even on a growth-adjusted basis. From 2017 to 2021, the average growth-adjusted multiple for Cloud 100 companies increased by 180%, meaning that investors are willing to pay higher prices for the same growth rates; they are not both increasing in lock-step. We believe that this dynamic stems from high investor appetite for strong cloud businesses and the willingness to pay premium valuations for access to these special companies.

For founders, the takeaway is that building a cloud business today is as valuable as it has ever been before. The combination of unprecedented growth rates and increased investor demand have led to a proliferation of Cloud 100 unicorns.

This can be observed in the data. Best-in-class cloud companies are reaching the unicorn milestone faster than ever before. When we look at the 2021 basket, it took the average Cloud 100 Honoree 8.6 years from founding to become a unicorn, as compared to 12.1 years in 2016. The two companies that were fastest to achieve the unicorn milestone on this year’s list were Hopin and Axonius, which have both experienced explosive growth at record-breaking speed. Founded in 2019, Hopin reached unicorn status by the end of 2020, propelled by unprecedented demand for its event technology platform. Axonious was not far behind — founded in 2017 with Bessemer leading its Series A in 2019, the cybersecurity leader entered the unicorn herd in early 2021.

Investor excitement for strong cloud businesses has led to the growth in mega-rounds in Cloud 100 companies. Three-quarters of this year’s Cloud 100 companies have raised $100 million or more in their most recent financing rounds, with the average latest round size of a Cloud 100 company exceeding $225 million. Cumulatively, the Cloud 100 2021 basket has raised more than $50 billion over its lifetime!

Cloud 100 returns: +780% increase in valuation since 2016

The Cloud 100 is the definitive list of the world’s best cloud companies, and that legacy bears out in the returns it produces. In five years, the total valuation of the 2016 Cloud 100 list has increased by more than 780%, delivering an 8.8x and 54% IRR in that time. The 2017 Cloud 100 basket has delivered an 8.5x and 71% IRR as its aggregate value nears $1 trillion; the 2018 basket a 6.2x and 83% IRR; the 2019 basket a 4.1x and 102% IRR; and the 2020 basket a 2.2x and 117% IRR in just one year alone.

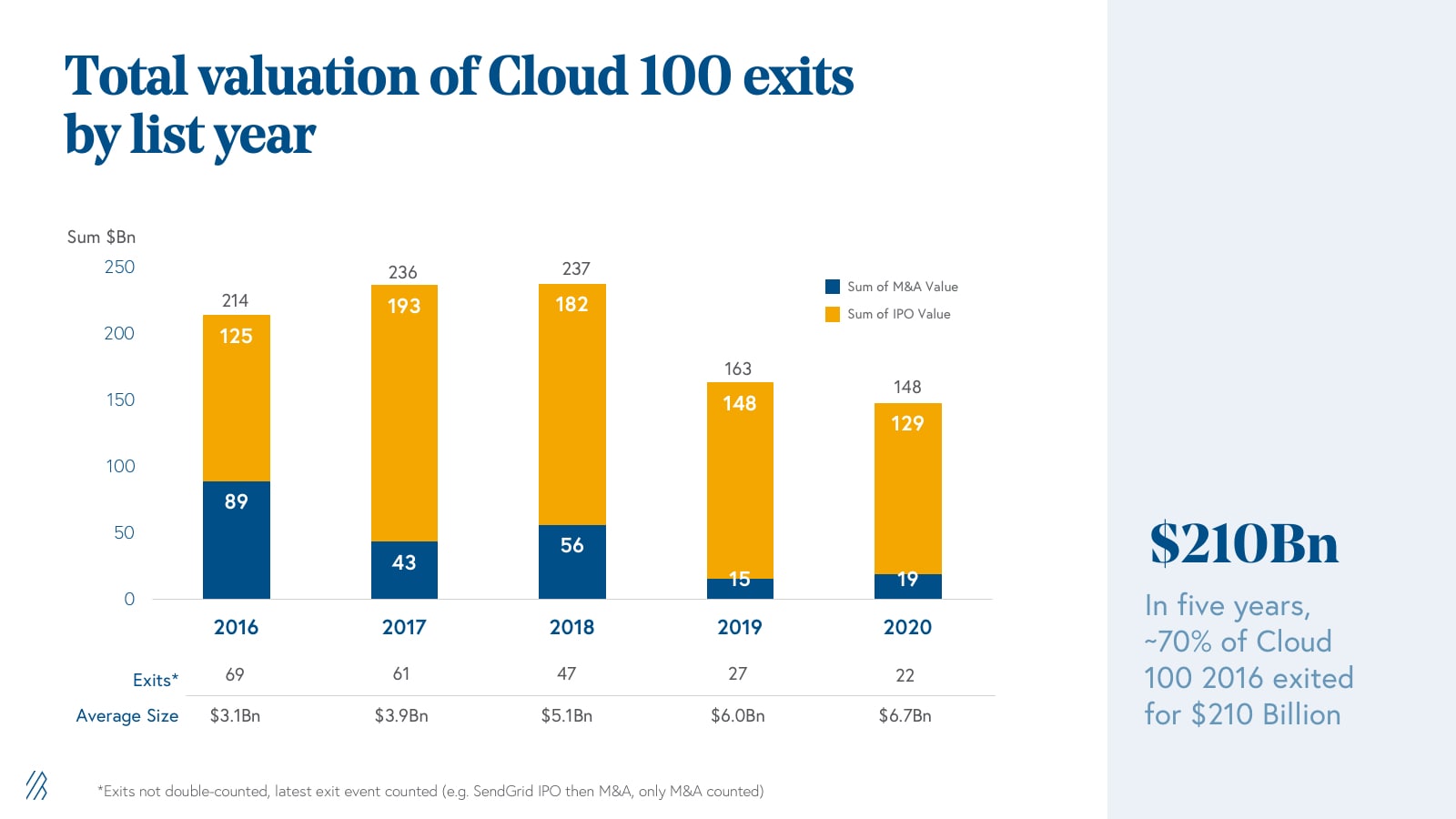

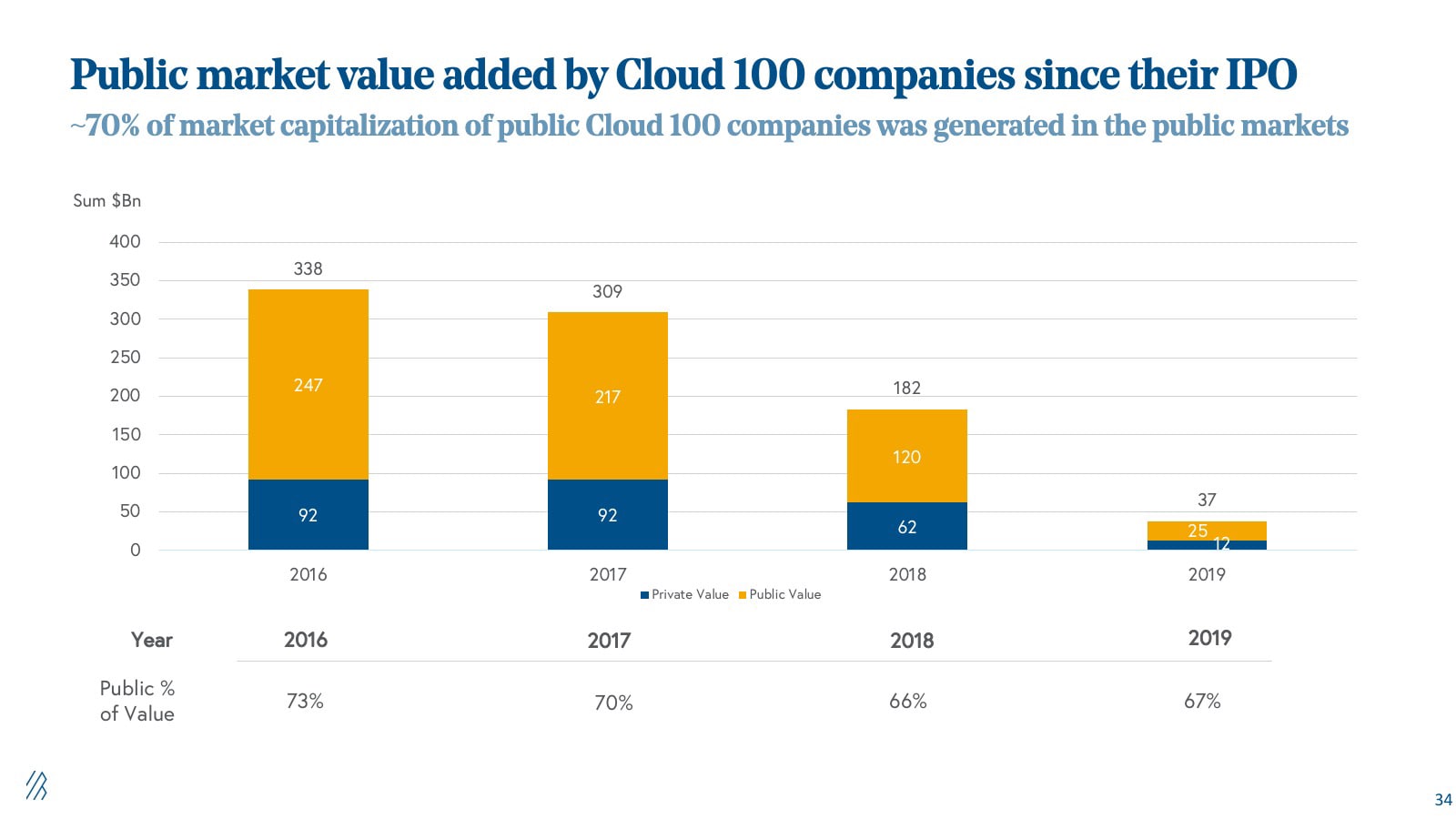

Much of the strong Cloud 100 returns — especially in the last year — have been driven by today’s strong market and exit environment for cloud companies. Almost 70% of the Cloud 100 2016 has exited, for an aggregate of $210 billion, while the average exit value has increased from $3Bn then to over $6.7Bn in 2020. Across the entire universe of 234 companies that have ever been on a Cloud 100 list, 86 companies (or 37%) have exited for a total of over $300 billion.

In 2021 alone we have seen over $100 billion of IPO exit value coming from past Cloud 100 winners, including Procore in its $9 billion IPO, UiPath in its $29 billion IPO, and Confluent in its $9 billion IPO. We also saw a direct listing from Squarespace and even a SPAC from DigitalOcean. All of this public market activity is happening against the backdrop of an average 22x multiple for [BVP Nasdaq Emerging Cloud Index](https://www.bvp.com/cloudindex) (^EMCLOUD) companies today.

The Cloud 100 has also delivered a meaningful portion of the public cloud software market capitalization, as measured by the BVP Nasdaq Emerging Cloud Index (^EMCLOUD). Twenty-six of the current ^EMCLOUD component companies are Cloud 100 graduates, contributing over $590 billion of public cloud market capitalization.

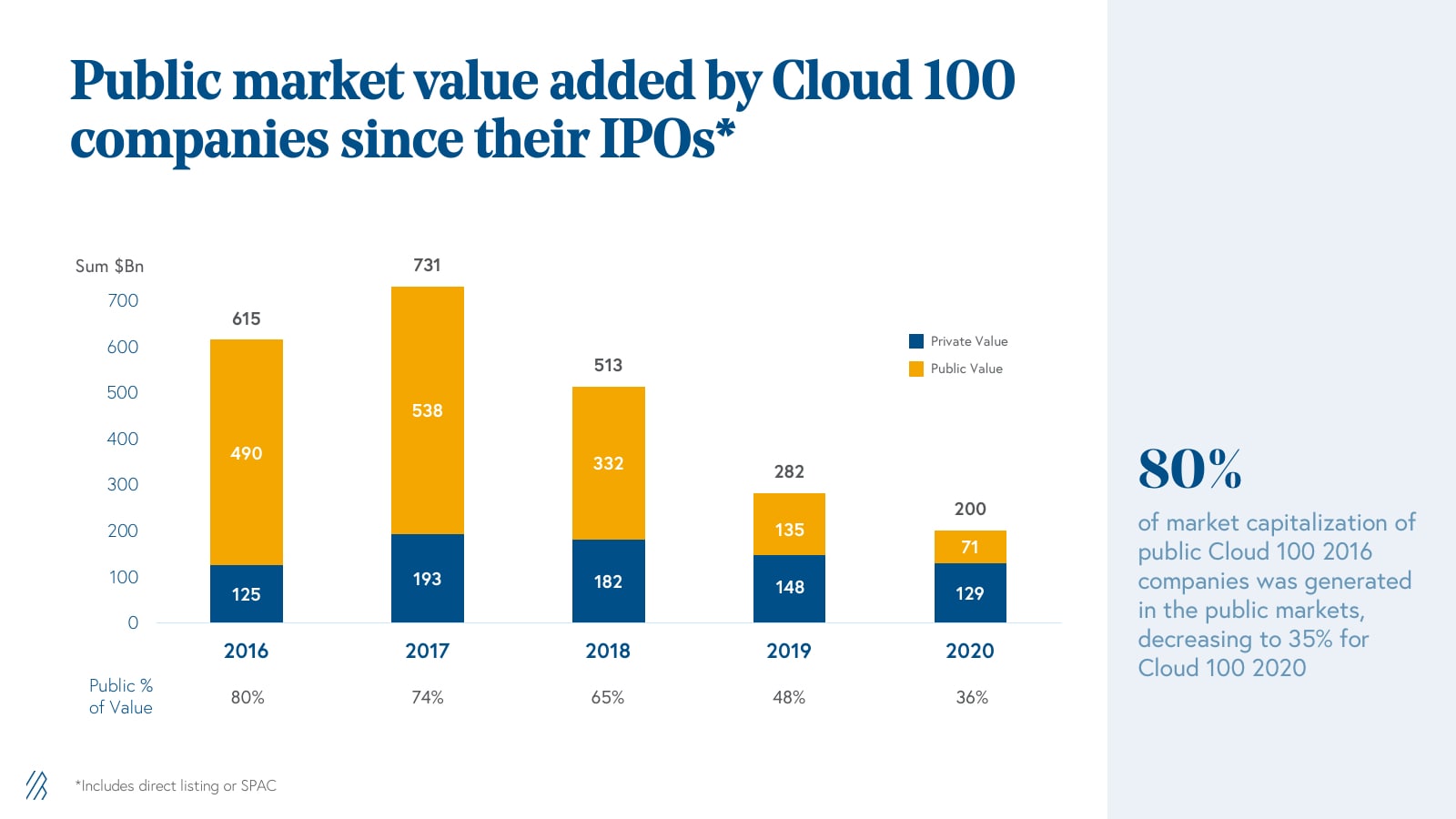

Looking into the value creation of public Cloud 100 companies from 2016, ~80% was generated in the public markets, with ~70% for 2017-2018; however, it is noteworthy that the 2019 and 2020 lists have materially less public contribution. Naturally more value will be captured in the public markets as these companies grow in revenue and in their valuations, but given the dynamic of increased multiples in the private markets, there is an argument to be made that companies are now capturing value in the private markets that historically was only reserved for the public markets.

What’s ahead

The Cloud 100 2021 companies have successfully captured industry tailwinds and combined it with strong execution and customer love to create equity value for themselves and value for the world. Most impressively, these companies have achieved such remarkable milestones during a period of unprecedented complexity and challenges, amidst the backdrop of the global pandemic. As this benchmark report has demonstrated, the 2021 Cloud 100 cohort has grown faster than ever before, doing so in a market that craves more supply. We expect that this trend will only continue throughout the rest of 2021 and beyond, and are excited to see what else lies ahead for the world’s best cloud companies.

See you for Cloud 100 2022!

*Note that not all companies’ last disclosed round valuations exceeded $1Bn, but this reflects valuation estimates determined by the combination of Bessemer, Salesforce, Forbes, and the judges.

2020 Benchmarks

Today, Bessemer Venture Partners, Forbes, and Salesforce Ventures announced the [2020 Cloud 100 List](https://www.forbes.com/cloud100/#5446b68e5f94), the definitive ranking of the top 100 private cloud companies. With five years of Cloud 100 data, we reveal Bessemer’s analysis and the top insights of this high-performing cohort and discuss why it’s such a significant achievement for a private cloud company to make the list.

The Cloud 100 serves as the industry benchmark of operating success and helps to measure the strength of the private cloud market.

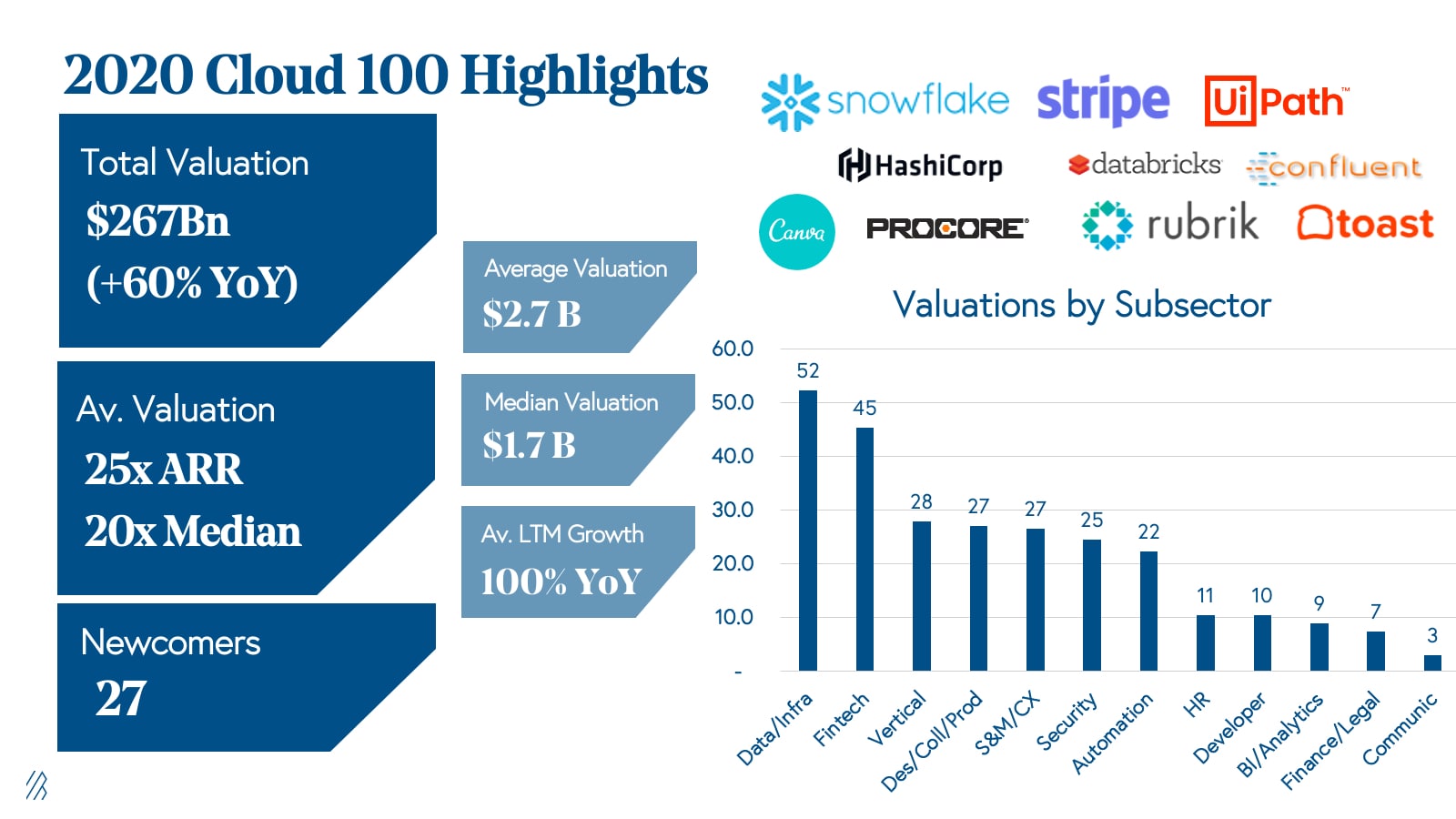

Top highlights:

- Private cloud valuations continue to get bigger – the Cloud 100 2020 is worth an aggregate $267 billion in 2020 vs. $166 billion in 2019, which is a 60% increase year-over-year (YoY). In addition, the average cloud company valuation increased by over $1 billion YoY.

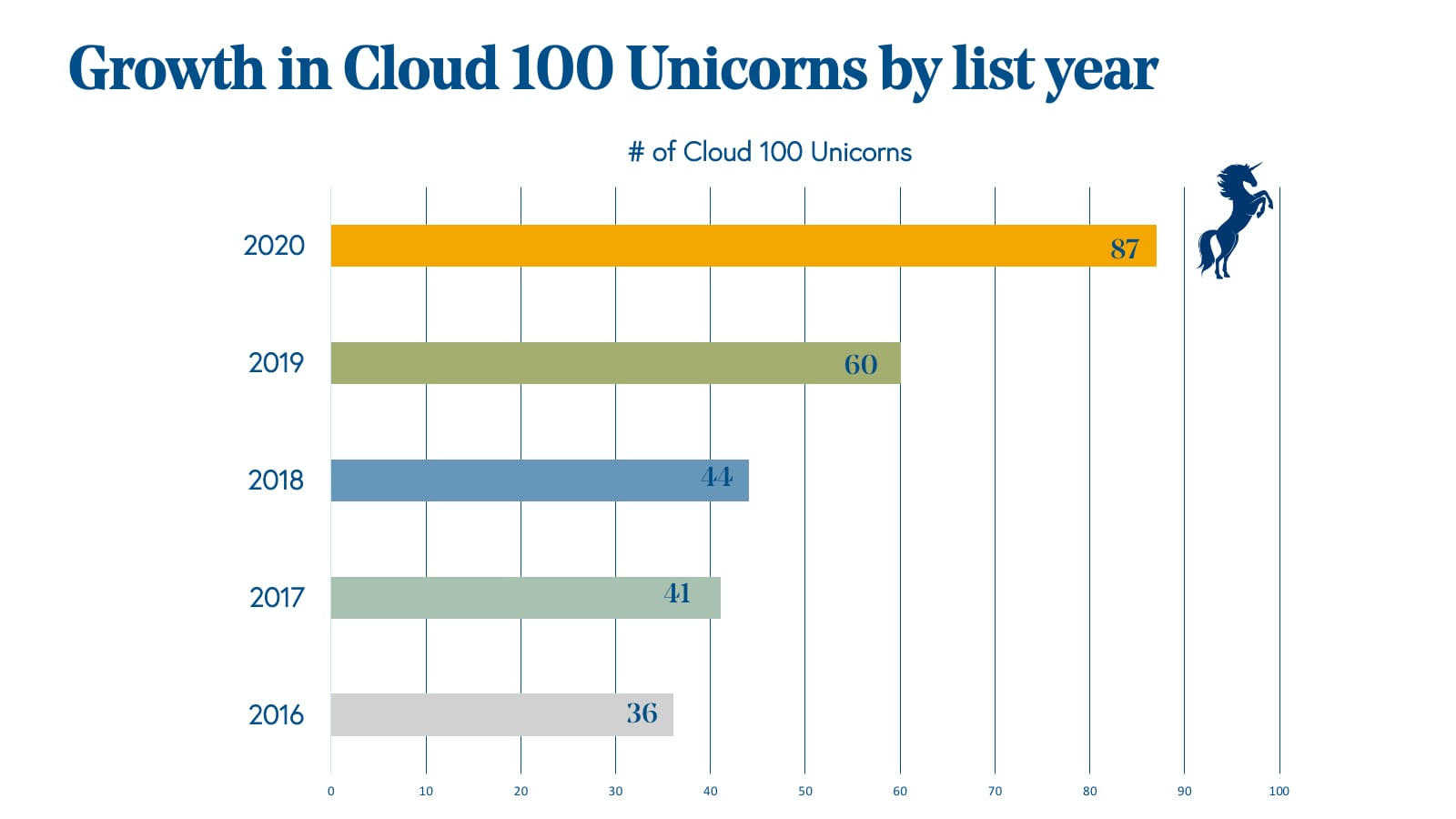

- The threshold to make the Cloud 100 continues to get higher – the median Cloud 100 company is a unicorn, and the average valuation of the Cloud 90-100 is above one billion dollars. This year there are 87 unicorns on the 2020 Cloud 100.

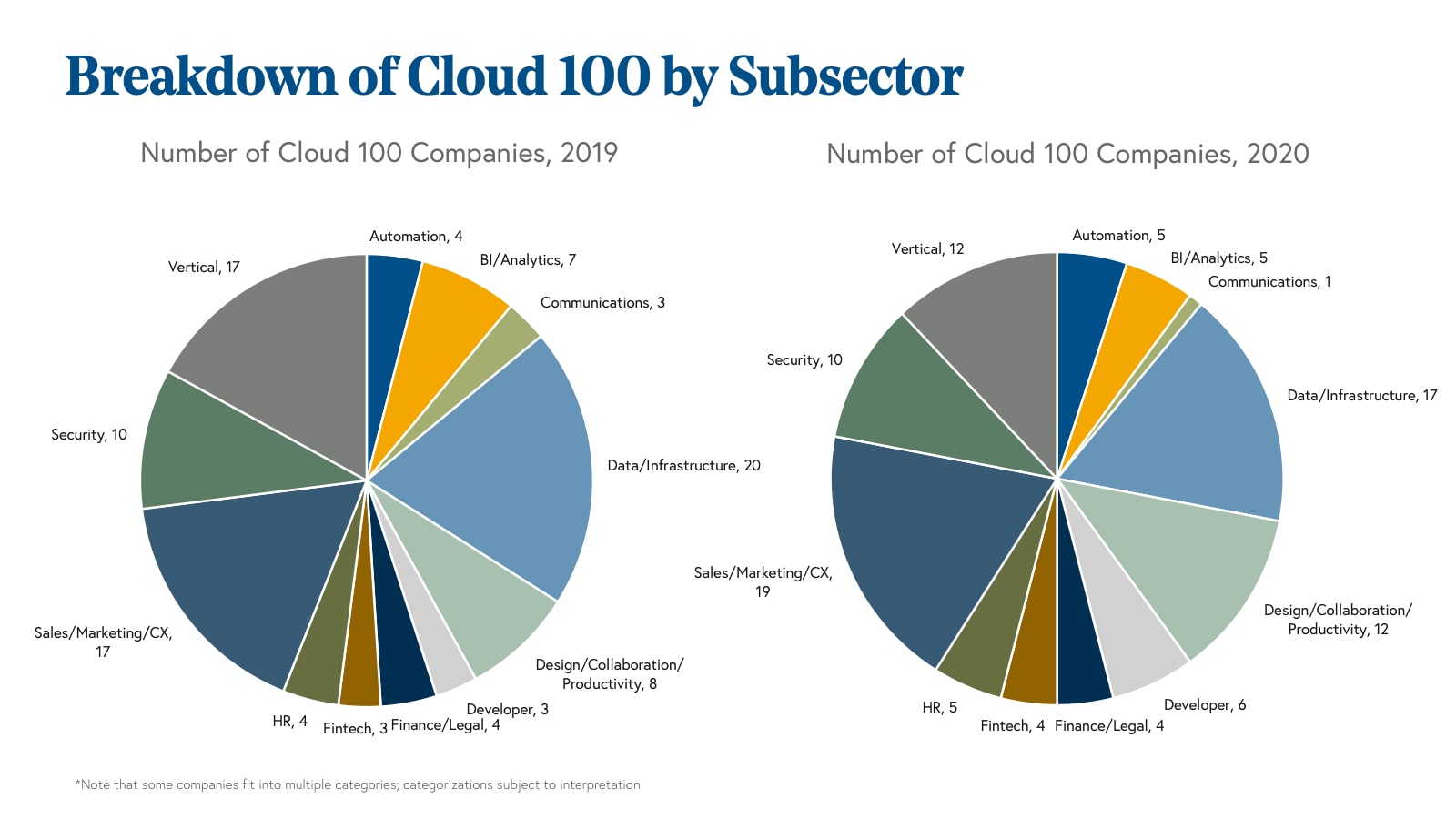

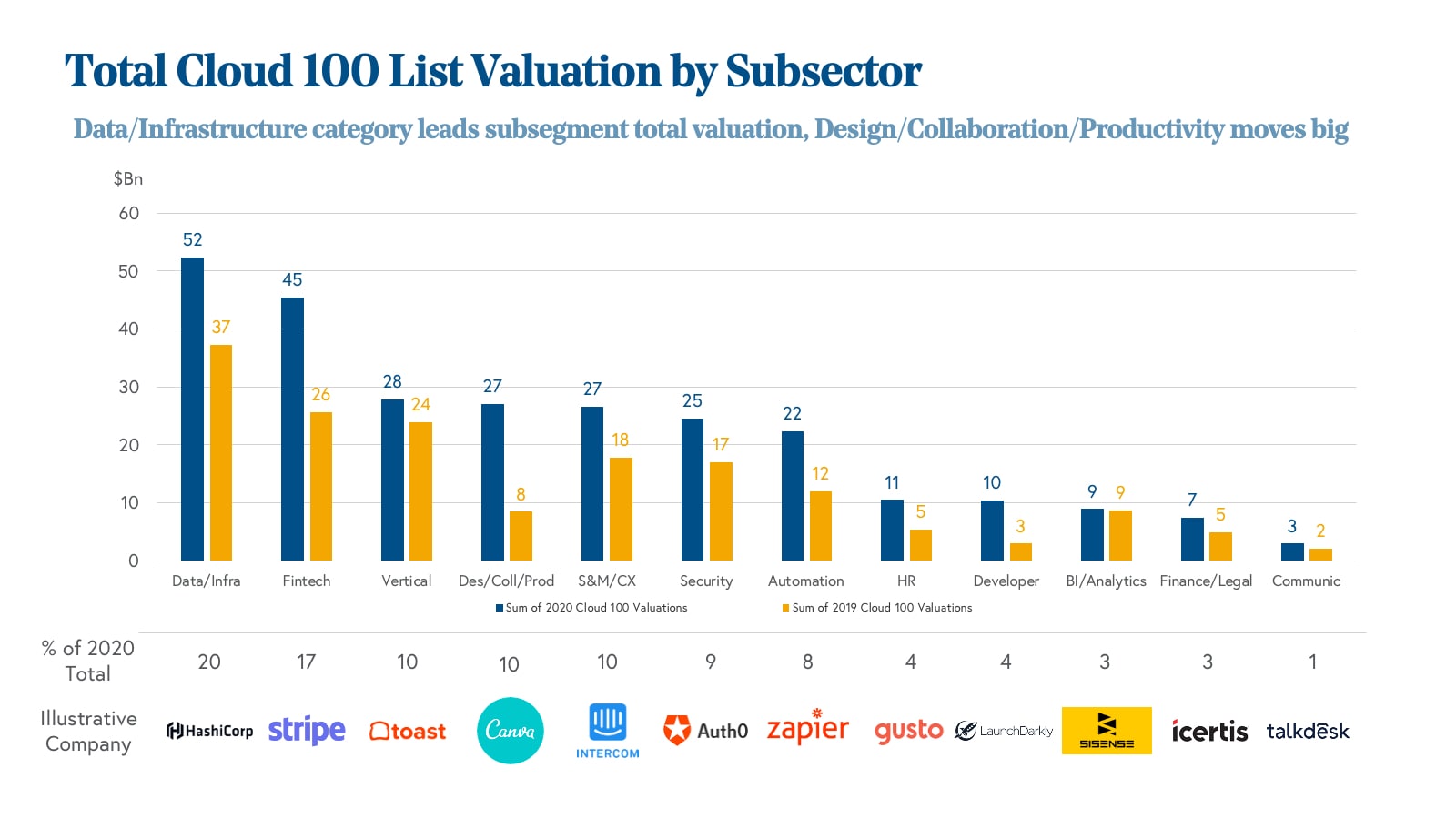

- The most featured cloud software subsector was sales/marketing/CX software with 19 companies represented. The data/infrastructure subsector is the most valuable with $52 billion of aggregate value, representing 20% of the Cloud 100 list value and 5 of the top 10 ranked companies

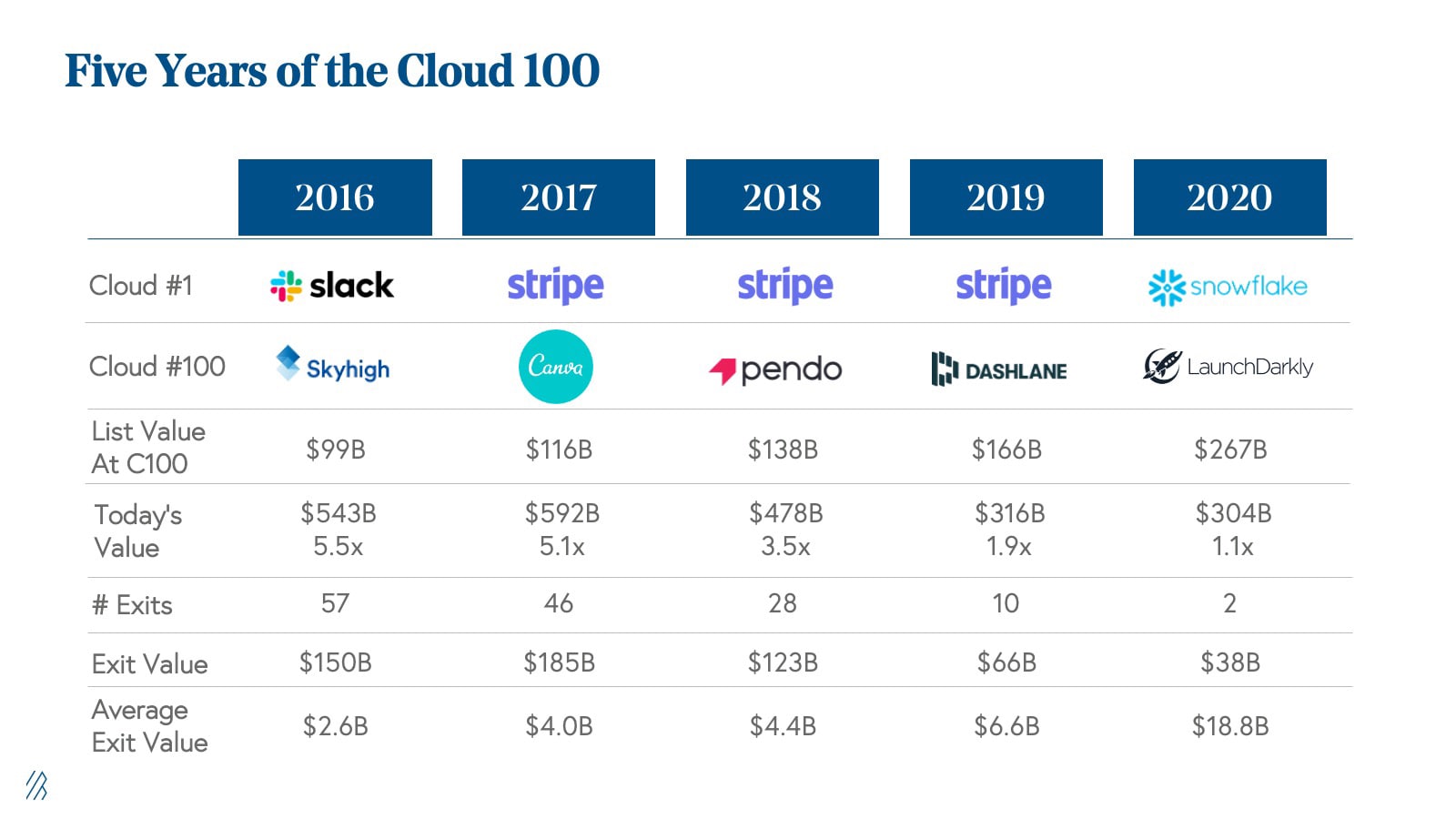

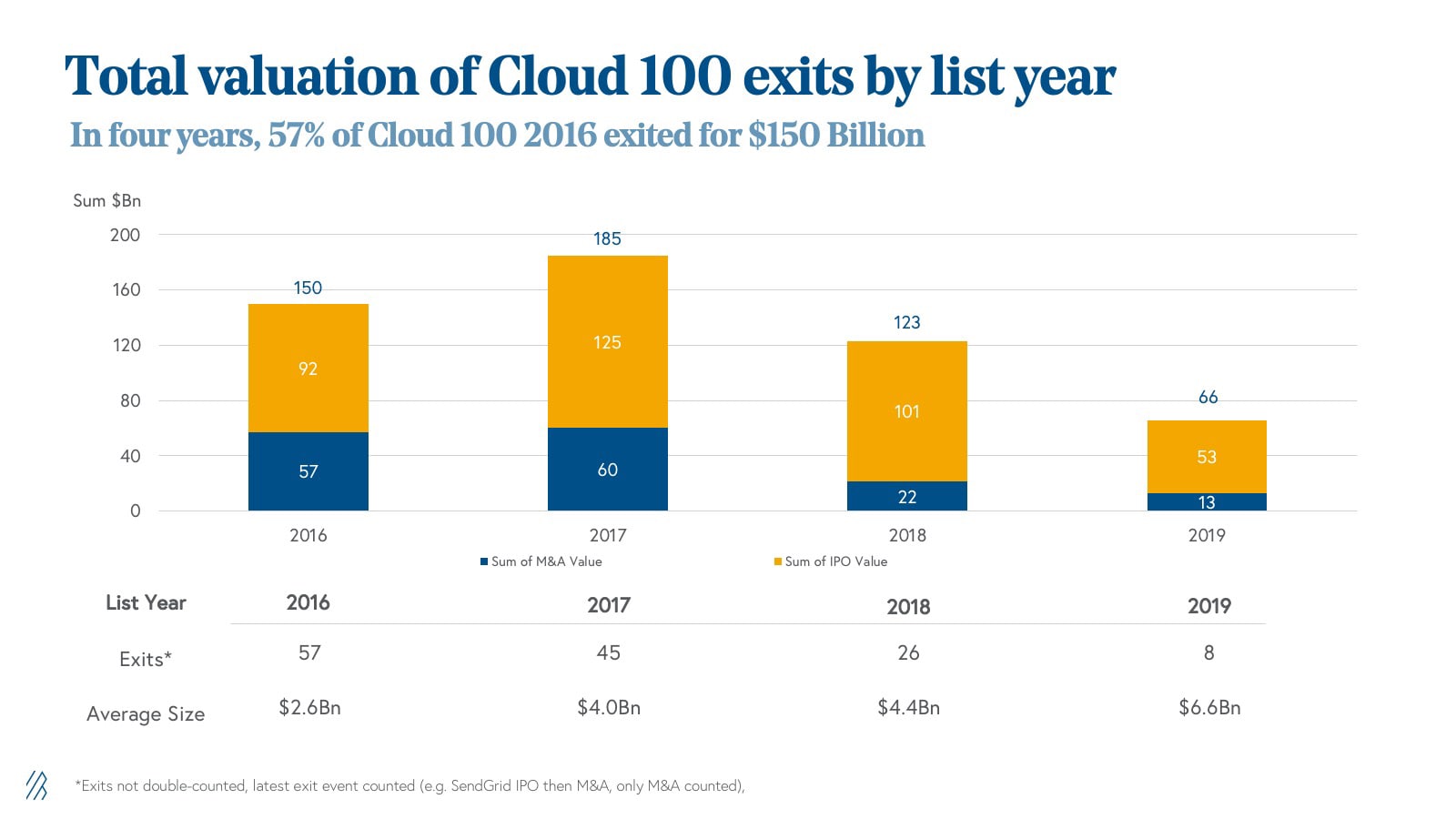

- The Cloud 100 continues to drive massive returns – if you were to have invested in the 2016 basket of Cloud 100 companies, you would have generated a 5.5x gross multiple of invested capital (MOIC) and a 53% internal rate of return (IRR). Fifty-seven percent of the Cloud 100 list from 2016 has exited for $150 billion of value.

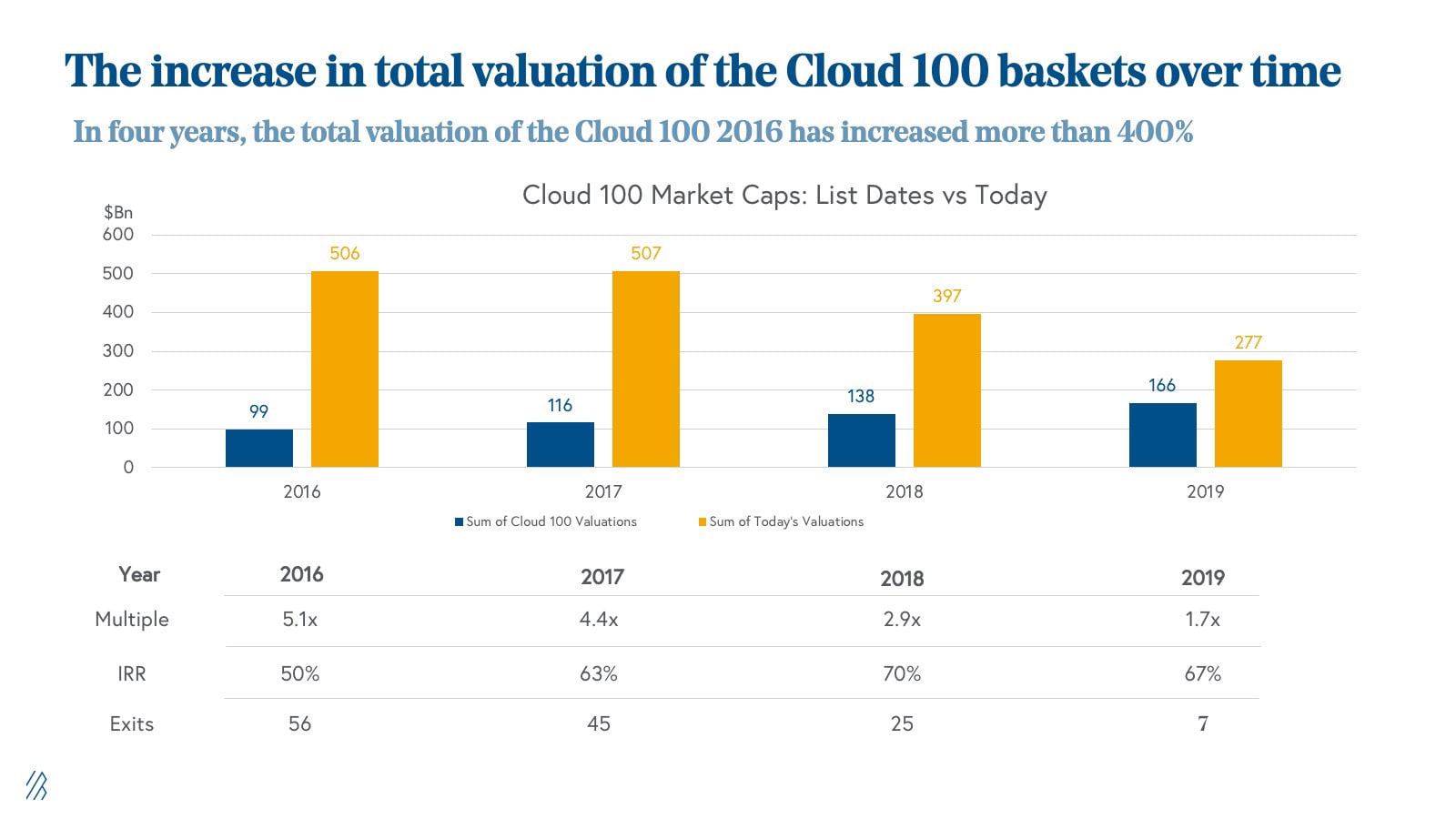

Over the past four years, the Cloud 100 has driven outsized returns. If you were to have invested in the Cloud 100 basket in 2016, your investment would have quintupled in the past four years, generating a 53% IRR and an incredible $444 billion of additional equity value.

The 2017 Cloud 100 basket has delivered a 5.1x and 72% IRR; the 2018 basket a 3.5x and 86% IRR; and the 2019 basket has delivered a 1.9x and 90% IRR in just one year. These are the 100 best cloud companies in the world every year. Let’s dig into the top insights from our 2020 benchmarks.

The Cloud 100 2020 List represents $267 billion of equity value

The 2020 Cloud 100 list represents an astonishing $267 billion of equity value, with an average $2.7 billion private valuation per company. This is up a dramatic 60% from the 2019 list’s aggregate value of $166 billion, in just one year.

The 2020 Cloud 100 list represents an astonishing $267 billion of equity value.

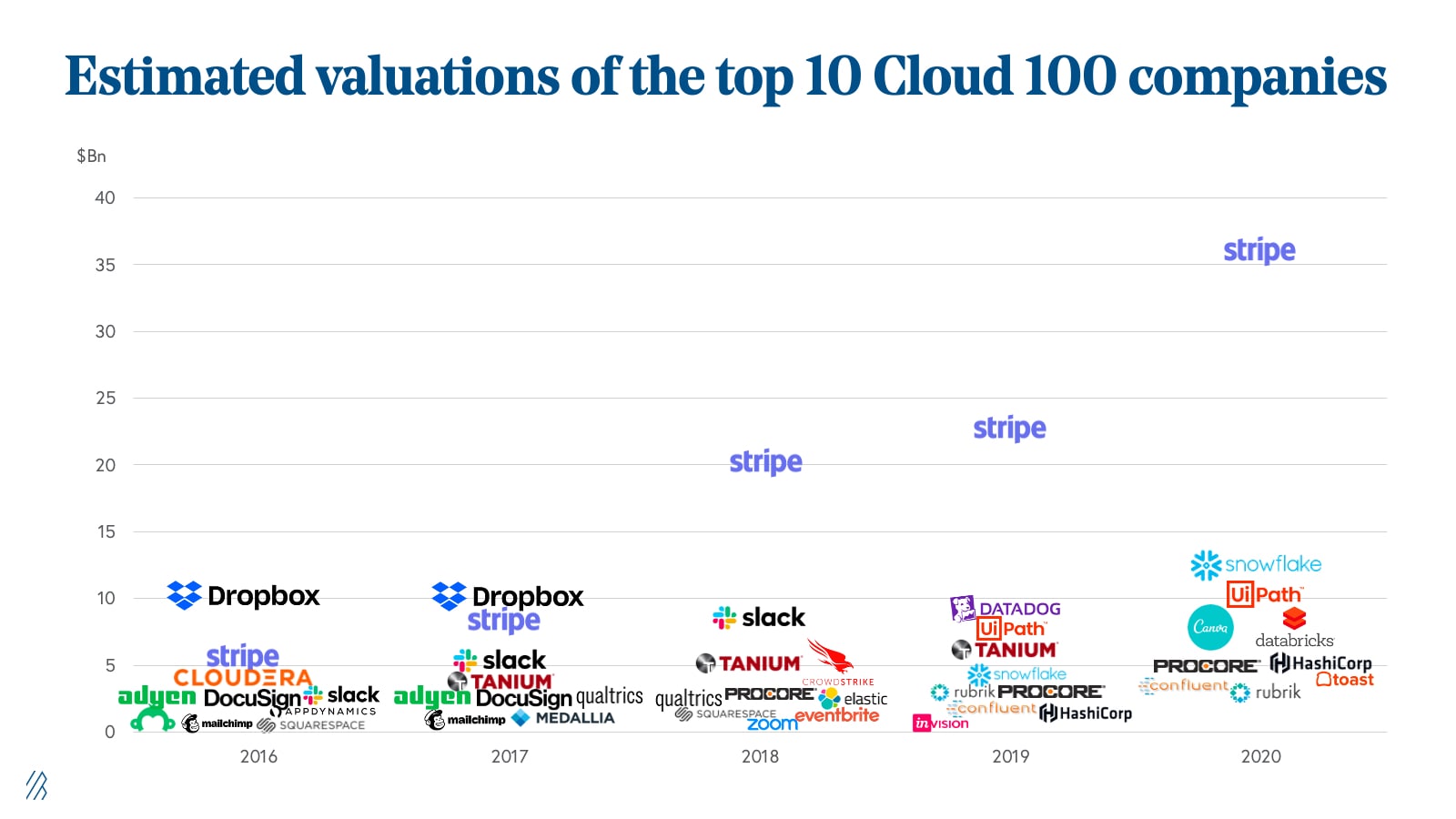

Snowflake became the number one ranked cloud company, just in time for it to enjoy the rank before its IPO! After Stripe enjoyed three consecutive years in the top spot, Snowflake supplanted Stripe as the number one ranked private cloud company in the world. Stripe moved down to the second-best private cloud company in the world, while Canva, Databricks, and Toast all joined the top ten for the first time.

In addition, there were 27 newcomers to the list. The highest-ranked new entrant was Checkout.com, appearing on the list as #15 after its June 2020 fundraise valuing the company at $5.5 billion. Other newcomers include some of the graduates from previous Rising Stars lists: LaunchDarkly, Gong, Benchling, and Notion. Keeping consistent with the themes in the broader subsegments of the list, we saw the most newcomers from the design, collaboration, and productivity segment, which includes Notion, Figma, and Miro.

There were some big movers on the list, too. The biggest increase was from Samsara, which moved from #67 in 2019 to #25 in 2020, after another year of growth and a new round of financing that valued it at $5.4 billion. Guild Education enjoyed tailwinds around online education and reskilling that propelled it up 40 spots to #36, and Pendo shot up 41 spots to #53 with its ongoing success in the product management category.

Cloud 100 new norms: 20-25x+ ARR valuation multiples and 100% YoY growth

Across all the companies for which pricing data was disclosed, the average Cloud 100 valuation was ~25x ARR in its most recent round of financing. The median ARR multiple is lower at ~20x, the average anchored higher by some transactions at 50-70x ARR. This represents a premium to the valuations in the public cloud markets, in which the average approximate ARR multiple is 17x; however, whereas the average public cloud company is growing at 35% YoY, the average Cloud 100 company is growing 100% YoY. While the private markets are ascribing nominally larger multiples, on a growth-adjusted basis the best-in-class private cloud companies are actually being valued lower than are public companies. Investors are willing to pay premium prices for premium assets in cloud.

The average Cloud 100 valuation grew by $1 billion year-over-year

Over the past five years, the average Cloud 100 valuation has grown by a tremendous 2.5x, from $1 billion in 2016 to $2.7 billion in 2020. Inspecting the numbers more closely, though, we see that the nominal growth year-over-year from 2016 to 2019 was between $170M-270M. In 2020 that number shoots up dramatically by $1 billion. Put another way, the year-over-year growth ranged from 14-19% from 2016-2019, and in 2020 the average Cloud 100 valuation grew an incredible 60%.

We attribute the growth in valuation to cloud company revenue growth and the multiples on that revenue expanding.

During COVID we have seen the public cloud software markets hit all-time highs, and these multiples have trickled down to the private markets, with investors willing to pay high prices for best-in-class assets. The global pandemic has also unlocked digital transformation initiatives that have expanded cloud companies’ total addressable markets and highlighted them as relatively safe havens for investment.

Cloud software can be remotely distributed, does not require on-premises installation, and tends to have lower exposure to high COVID-exposed industries like travel, retail, and dining. As a result, investor demand is high for high-quality cloud companies, which are in relatively short supply.

The average Cloud 90-100 company is a unicorn

The competition to be one of the 100 best private cloud companies has intensified dramatically over the last five years. To make the list in 2016, companies generally had a $300 million valuation; this year, 87% of the list-makers had a valuation above one billion. While some have been minted as unicorns for years, such as Stripe and Canva, some have achieved the title more recently, such as FiveTran and Blend.

The Top 10 Cloud Companies represent almost $100 billion of equity value

The best cloud companies, which rank #1 to #10 on the list, represent almost $100 billion of equity value alone, and they have grown their average valuation 56% YoY, close to the 60% average. However, the scale is larger: the average Cloud 1-10 company is worth $3.4 billion more than it was in 2019, and an incredible $6 billion more than it was five years ago.

For example, Stripe was last privately valued at $36 billion and UiPath at $10 billion. To put that scale into perspective, if these companies were to go public, they would be larger than 50% of the BVP Nasdaq Emerging Cloud Index (^EMCLOUD) component companies; these cloud companies would individually be larger than Dropbox, Smartsheet, Elastic, and Fastly.

Top subcategories by list count and equity value

With 19 companies, the Sales/Marketing/CX category was the largest category represented on the 2020 Cloud 100 list, including such notable names as Intercom, Pipedrive, and Yotpo. This category grew by two net new companies year-over-year.

The Data/Infrastructure category followed with 17 companies, down net three companies from the 2019 list. This decrease was mainly due to exits, including Datadog, Cloudflare, and Acquia, though it nonetheless had a very strong showing including newcomer BigID. Notably, Data/Infrastructure makes up the plurality of the top 10 cloud companies with Snowflake, HashiCorp, Databricks, Confluent, and Rubrik. While challenging to build, data/infrastructure companies operate in massive TAMs that can support huge businesses.

Where we saw the greatest growth is in the Design/Collaboration/Productivity segment, adding four net new companies to the category in 2020. With COVID tailwinds, companies like Canva and Figma have seen tremendous growth in 2020, reflected by their category’s prominent feature on this year’s list, and we expect even more to be featured on the Cloud 100 list in 2021.

Interestingly, vertical software is the category that decreased in count the most, in part due to exits, such as nCino’s IPO, Vlocity’s sale to Salesforce, as well as a deceleration in some COVID-affected industries.

The data changes when looking at aggregate valuation by subsector. The Data/Infrastructure category represents 20% of the total value of the 2020 Cloud 100 list, the most of any category with $52 billion of equity value. The Fintech category is second with a total value of $45 billion, though $36 billion of that is taken by Stripe alone. Without Stripe, Fintech would drop from second place to the ninth most valuable category. Vertical software rounds out the top three with $28 billion of aggregate value, the largest of which is the top-10 company Procore at $5Bn of equity value.

It is worthwhile to note where the big movers were and where they were not. The two categories that had the largest changes in percentage of aggregate valuation were Developer software and Design/Collaboration/Productivity software, both of which increased total valuation by more than 200% YoY.

We have noted the rise of the developer at Bessemer, underpinning much of the trend towards [developer tooling](https://www.bvp.com/atlas/developer-laws-2019/?from=feature), and [remote work trends](https://www.bvp.com/atlas/remote-work) from COVID have actively contributed to investment and interest in collaboration tools.

Cloud 100 Exits

The exit path for Cloud 100 companies continues to validate the list’s quality. Fifty-seven percent of the Cloud 100 from 2016 has exited for an average of $2.6 billion and total of $150 billion, including some household names like Slack, Dropbox, Okta, and Eventbrite.

Almost half of the 2017 list has already exited, a quarter of the 2018 list, and a tenth of the 2019 list, while the average exit value has increased by $4 billion in that time. The average exit off of the 2016 list was $2.6 billion, and from the 2019 list was $6.6 billion.

The Cloud 100 has also delivered a meaningful portion of the public cloud software market capitalization, as measured by the BVP Nasdaq Emerging Cloud Index.

Twenty-two of the 54 ^EMCLOUD component companies are Cloud 100 graduates, contributing over $350 billion of market capitalization of the total $1.6 trillion. As we discussed in the 2019 version of the Cloud 100 benchmarks report, public market demand has led to record high multiples – and therefore valuations – for cloud software companies, which continues to grow. Given this demand, we find that Cloud 100 companies accrete 65% of their value in the public markets.

We added 27 new names to the Cloud 100 basket in 2020, bringing the total number of cloud companies that have ever been on the Cloud 100 lists to 204. Of those 204, an incredible 34% have exited in either strategic or financial M&A or public listings, whether IPO or direct listing. These 70 companies have delivered an aggregate of $193 billion of exit value at the time of their exit.

In 2020 alone there have been 10 exits for Cloud 100 companies, including the recent $5 billion IPO from JFrog and $33 billion IPO from Snowflake. Earlier this year we saw nCino’s $3 billion IPO (that has since traded up to $7 billion+) and Plaid’s $5 billion sale to Visa, for an aggregate of $58 billion of exit value. With the robust cloud IPO backlog including Asana and Sumo Logic, we anticipate more IPOs to come in 2020. The average 2020 exit has been for $5.8 billion, up from the $1 billion average in 2016, reflecting today’s outsized demand for cloud.

What’s ahead

The move to the cloud is the most transformative technology shift since the move to the internet. The Cloud 100 companies are the companies that are best leveraging that trend, creating not only massive equity value for themselves but also value for the world and the people who use their services every day. And as the data proves, they are doing so at the largest scale that they ever have before. We expect that this will only grow in 2021.

See you next year for Cloud 100 2021!

2016-2019 Benchmarks

Cloud 100 is the definitive ranking of the top 100 private cloud companies in the world; these businesses also serve as an industry benchmark and measure the strength of the private cloud market. We are now taking [nominations for the fifth class](https://thecloud100.com/) of Cloud 100 companies, with one week left to submit nominations.

While we’ve analyzed these top companies for over four years (2016-2019), for the first time, we’re openly sharing the key insights we’ve gleaned from the performance metrics and trends in order to reveal what underpins the Cloud 100’s yearly rankings.

A few top highlights:

- Private cloud valuations are getting bigger and the market’s appetite for cloud continues to grow. There were 36 unicorns on the Cloud 100 list in 2016, growing to 60 on the 2019 list.

- The average Cloud 100 company exit value is nearly $3 billion, delivering powerful returns across both IPOs and M&A. Of the Cloud 100 exits, approximately 70% of them have exited for $1 billion or more, with additional value accretion in the public markets.

- Each basket of Cloud 100 lists, from 2016 to 2019, has delivered an effective 50-70% internal rate of return (IRR) based on current valuations.

If you were to have invested in the Cloud 100 basket in 2016, your investment would have quintupled in the past four years, generating a 50% IRR and an incredible ~$400 billion of additional equity value. The 2017 Cloud 100 basket has delivered a 4.4x and 63% IRR; the 2018 basket a 2.9x and 70% IRR; and the 2019 basket has delivered a 1.7x and 67% IRR in just one year.

In our very first Cloud 100 Benchmarks Report, we share the insights and observations that not only highlight why getting onto this list is an accomplishment for cloud founders and executives but also help explain the fundamentals of private cloud companies to today’s company leaders.

Private cloud valuations have gotten bigger.

As cloud companies have continued to prove their potential – both with their product leadership and financial performance in the public markets – their valuations in the private market have grown materially.

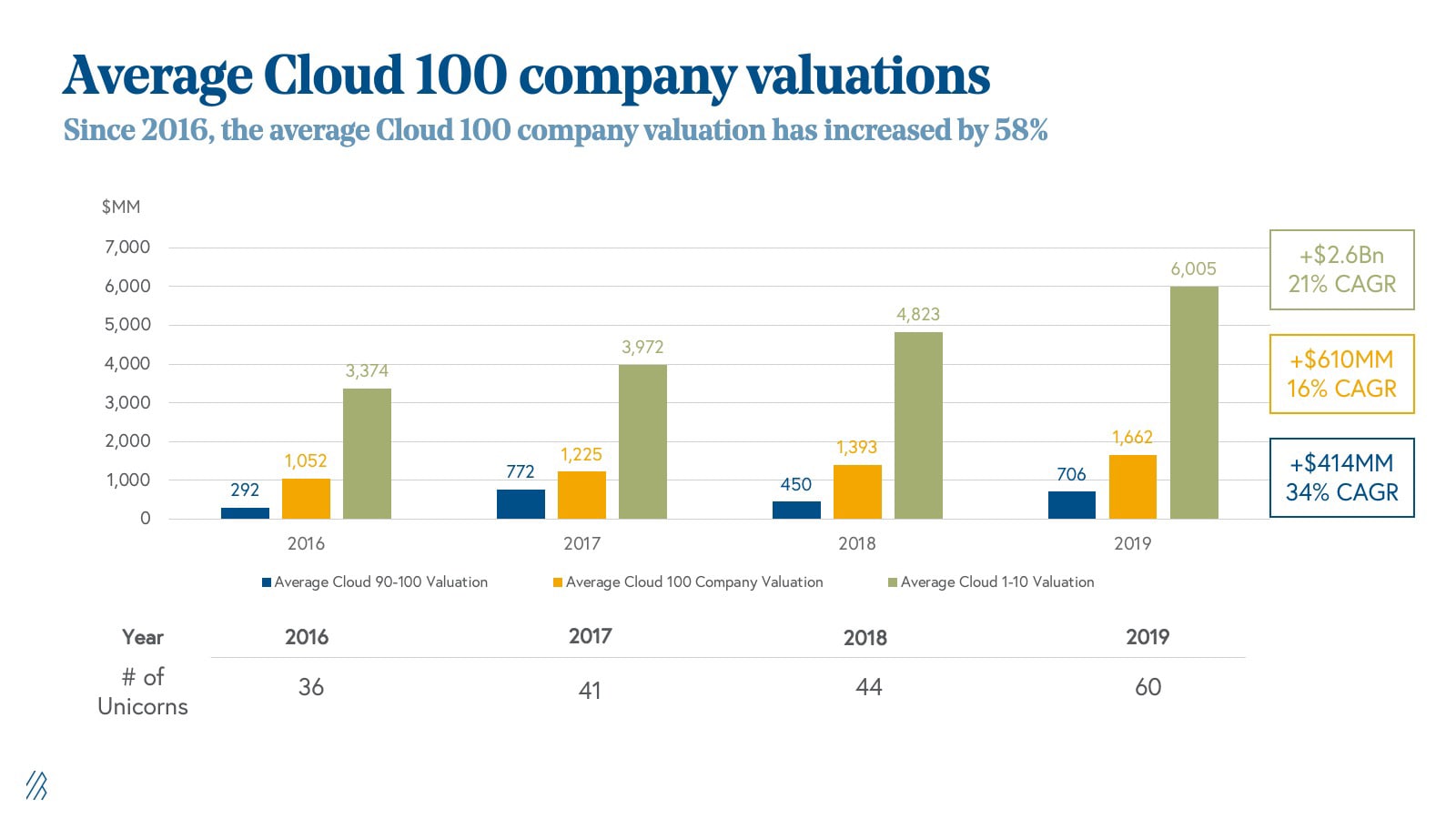

According to the Cloud 100 data, we’ve seen a staggering 58% increase in average valuation over these four years. In 2016, the average Cloud 100 company valuation was $1.1 billion, but only four years later, the average Cloud 100 company was worth $1.7 billion.

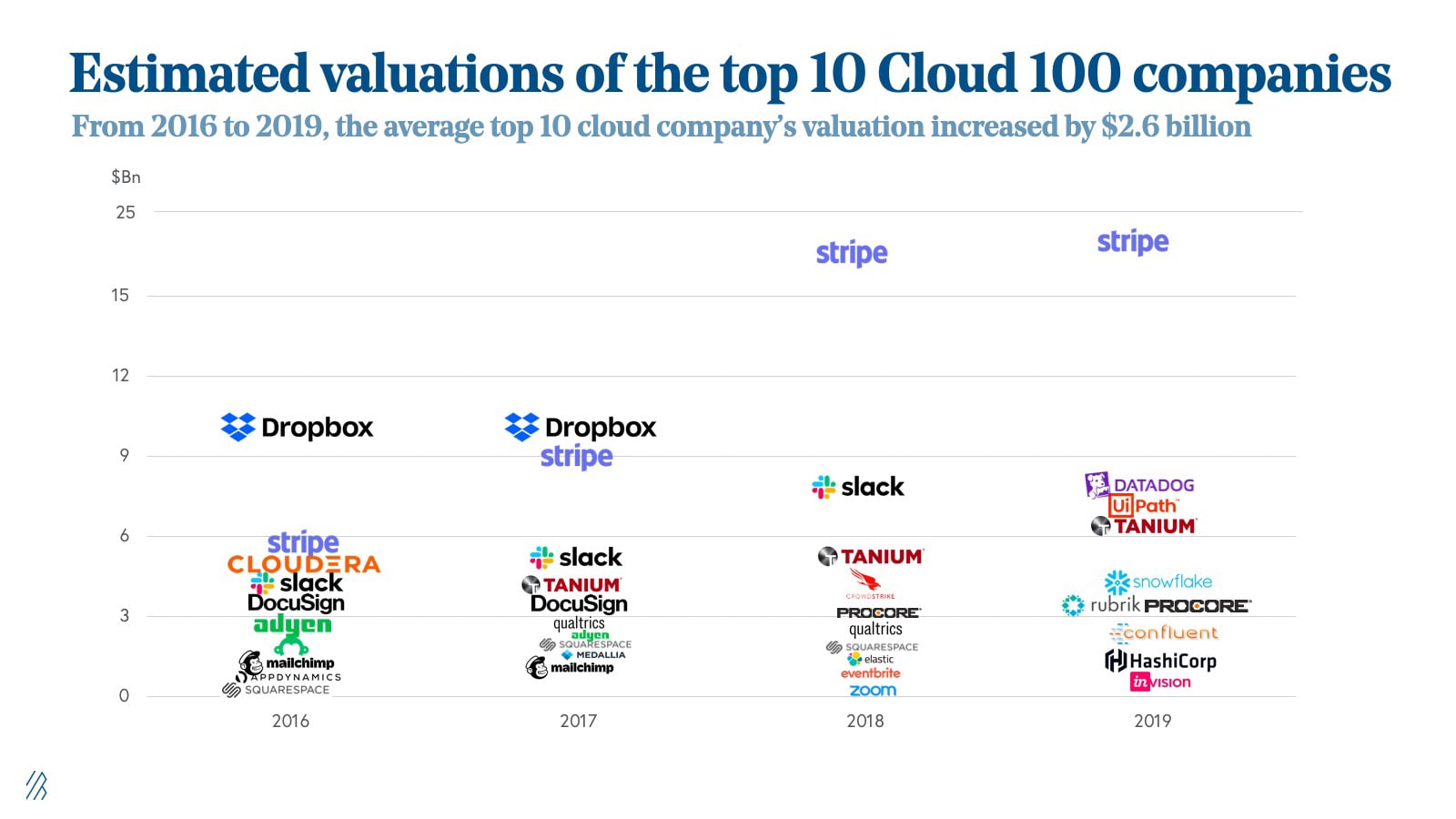

Interestingly, the growth in the best cloud companies, which rank #1 to #10 on the list, has been even steeper at 78% over the same four-year period. The average top 10 cloud company on the 2016 list was worth $3.4 billion at the time of publication, and by 2019 the average top 10 cloud company was worth a massive $6 billion.

Where the data changes significantly is in the average valuation of the companies that rank #90 to #100 on the list every year. The average “bottom” ten cloud company on the list was worth approximately $290 million in 2016 and approximately $700 million in 2019, which is a 142% increase. This growth in valuation is likely due to cloud companies winning new business, both gaining net new customers and expanding retained customers, at increasing rates relative to legacy software companies. (For reference, in [State of the Cloud 2020](https://www.bvp.com/atlas/state-of-the-cloud-2020), we showed the upward trajectory of cloud consuming legacy software solutions.)

Cloud company valuations are increasing because both revenue and the multiples on that revenue are going up. Cloud companies are in high demand as both the private and public markets have started to better understand and more highly value cloud’s predictable growth and high margin structures.

As a microcosm of the broader cloud software environment, the Cloud 100 data set illustrates the overall growth of the cloud category – which we believe will continue to expand from here.

The implication for 2020 Cloud 100 hopefuls is that the minimum valuation to make the list will likely increase again: only unicorns might make the 2020 list. We had 60 unicorns on the 2019 list, and we expect to see even more in 2020.

The average Cloud 100 company exit value is nearly $3 billion and is increasing over time, delivering large cloud returns.

Cloud company exits have gotten bigger, and more frequent, than ever before in the industry’s history.

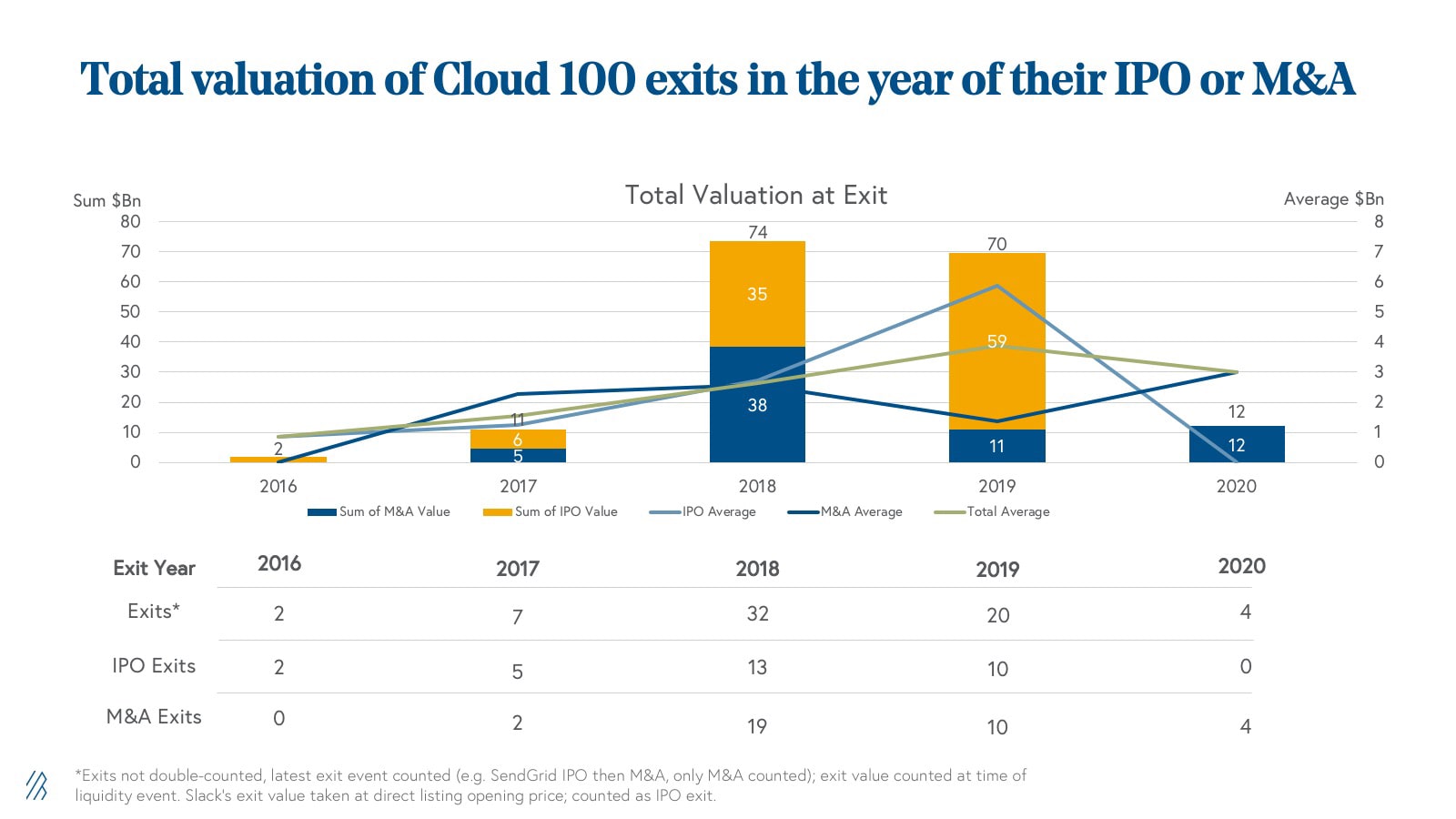

Of the 178 companies that have appeared on Cloud 100 lists, 65 of them, or 37%, have exited through an initial public offering or M&A, which speaks to the incredible quality of the cohort. What is even more impressive is their exit value. At the time of liquidity (either M&A or IPO), these 65 companies were worth a combined $168 billion. The average exit value was $2.8 billion across the four-year period but has changed substantially over time, going from $1 billion in 2016 to $3.9 billion in 2019 across 20 transactions.

On the M&A front, cloud assets are highly prized and are being actively pursued for strategic acquisitions. The largest recent M&A exits in software (and in technology) have come from cloud, including Salesforce’s $1.3 billion acquisition of Vlocity and Visa’s $5.3 billion acquisition of Plaid in 2020.

The Cloud 100 lists have doubled as “shopping lists” for strategic and financial acquirers, which have taken out 35 total Cloud 100 companies to date.

On the IPO front, cloud companies are seeing record high valuations in the public markets, with the [Bessemer Nasdaq Emerging Cloud Index](https://cloudindex.bvp.com/) trading at a ~14x run rate revenue multiple. The public cloud market cap currently stands at approximately $1.4 trillion, and the index has seen ~50% gains in 2020 YTD, far outpacing the returns of other major indices.

Recent, large cloud IPO exits include Zoom’s $9 billion IPO, Datadog’s $8 billion IPO, and Slack’s $19 billion direct listing.

Closer inspection of the average exit value for Cloud 100 companies shows that the average IPO value has carried the blended average up: as the average M&A value fell from ~$2.5 billion in 2017 and 2018 to ~$1.4 billion in 2019, the average IPO value more than doubled from $2.7 billion in 2018 to $5.9 billion in 2019.

The possibility for value accretion in the cloud public markets cannot be understated. Double clicking on the returns for Cloud 100 companies reveals that the public markets account for much of their value creation. For companies that exited via IPO, only ~30% of their market cap was captured by the private markets – the rest was created while public.

Whether a cloud company pursues an M&A or IPO exit tends to be a reflection of the cloud valuation environment. The average Bessemer Nasdaq Emerging Cloud Index run rate multiple was ~6-7x in 2017, increasing to ~9-11x in 2018, and increasing again to ~12-14x in 2019. In lower multiple environments, M&A tends to thrive as buyers can acquire financial or strategic assets for lower valuations. In higher multiple environments, those potential targets would tend towards IPOs as the public markets allow them to capture more upside than cash M&A. In high multiple environments, cloud companies can consider doing stock deals in order to capture some upside that cash deals may leave on the table.

2020 expectations

So far in 2020, we have seen Plaid, Vlocity, Veeam, and Blue Jeans from the previous Cloud 100 lists exit, all via M&A. However, given the h[igh cloud multiple environment and cloud’s resiliency](https://techcrunch.com/2020/05/14/why-were-doubling-down-on-cloud-investments-right-now), we should expect to see some large cloud IPOs in the second half of the year. As the trajectory of ^EMCLOUD demonstrates, the IPO window for public markets closed in early March with COVID-19 but has begun to reopen slowly. For example, Bessemer’s portfolio company [nCino has recently filed its S-1](https://www.forbes.com/sites/davidjeans/2020/06/22/ncino-cloud-based-ipo/#53029cd96068), and its IPO is expected to happen later this year.

Now that the cloud IPO window has re-opened, we expect to see similar exit activity from previous Cloud 100 lists. Of the top private cloud companies in any given list year, almost an equal number go public as get acquired.

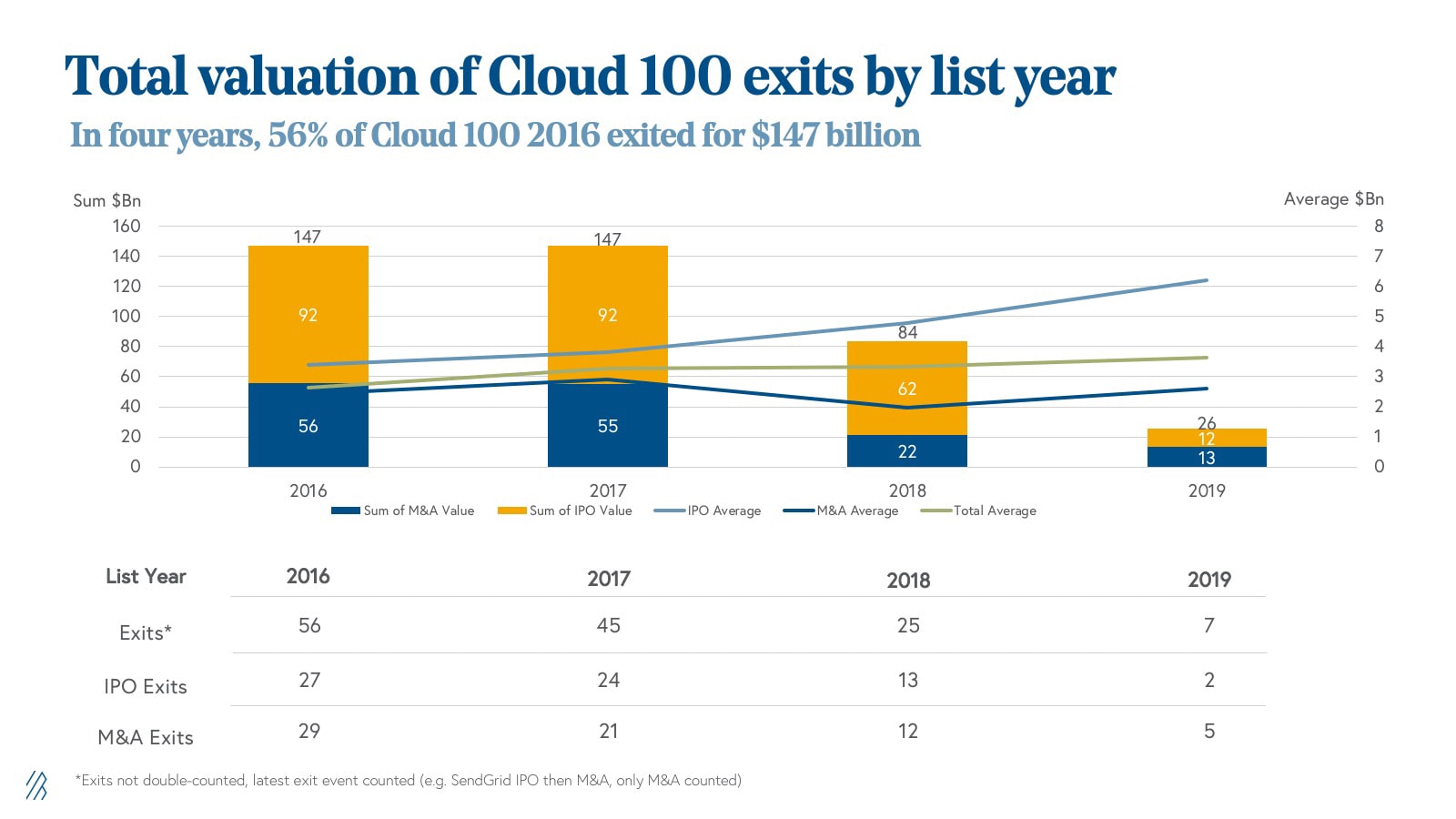

In only four years, 56% of the 2016 Cloud 100 list has exited for a combined $147 billion of value, half via IPO and half via M&A. Forty-five percent of the 2017 Cloud 100 list, and 25% and 7% of 2018 and 2019 lists, respectively, have exited.

Cloud companies have proven to generate massive returns for shareholders and for employees, in both the acquisition and public markets. For Cloud 100 hopefuls, the data set on total company exits speaks to the caliber of the cohort: of the 65 Cloud 100 companies that have exited from all of the Cloud 100 baskets from 2016 to 2019, 44 of them (or 68%) had a billion-dollar exit or more. Being on this list puts you in great company.