The four ironclad laws of B2B SaaS pricing that can boost your revenue up to 32%

Why pricing is the most common untapped growth lever and what leaders need to do about it.

Let’s face it—pricing makes a lot of founders squeamish. Many are technologists at heart who are obsessed with creating delightful, world-changing products. This often leads to an unconscious avoidance of pricing. Even the industry's sharpest minds balk at its dizzying complexity. Stripe took nearly a decade to hire their first dedicated pricing leader.

However, there are consequences to evading the pricing conundrum. If you don’t regularly revisit and optimize pricing, it can stunt your company’s growth. You’ll leave money on the table, keep underserved customer segments in the dark, and ultimately not generate revenue as efficiently as you could.

In this article, we’ll briefly explore why pricing is such an underutilized tool, then share the four ironclad laws of pricing that will help you seize your business’ most important growth opportunity.

The largest untapped growth lever of the modern CEO

“When compared to all the other choices in front of us, pricing was by far the highest ROI lever we could pull while also the one we ended up waiting much too long to tackle.” — Chief Product Officer at a top Bessemer portfolio company

If you look at the companies that have recently ramped ARR past $100M and achieved unicorn status, they are often focused on several traditional levers for growth. These are certainly integral parts of building a sustainable business—including improving products, closing new logos, securing renewals, generating demand, and forming partnerships. But these methods of growth are time-consuming and extremely expensive.

Pricing, on the other hand, is comparatively cheap. And since it’s a cross-functional initiative, it doesn’t preclude those other growth levers. In fact, it often bolsters them. For example, renewal rates are stronger when there’s a better congruence between value delivered and willingness to pay, and demand generation efforts are stronger with more attractive introductory tiers.

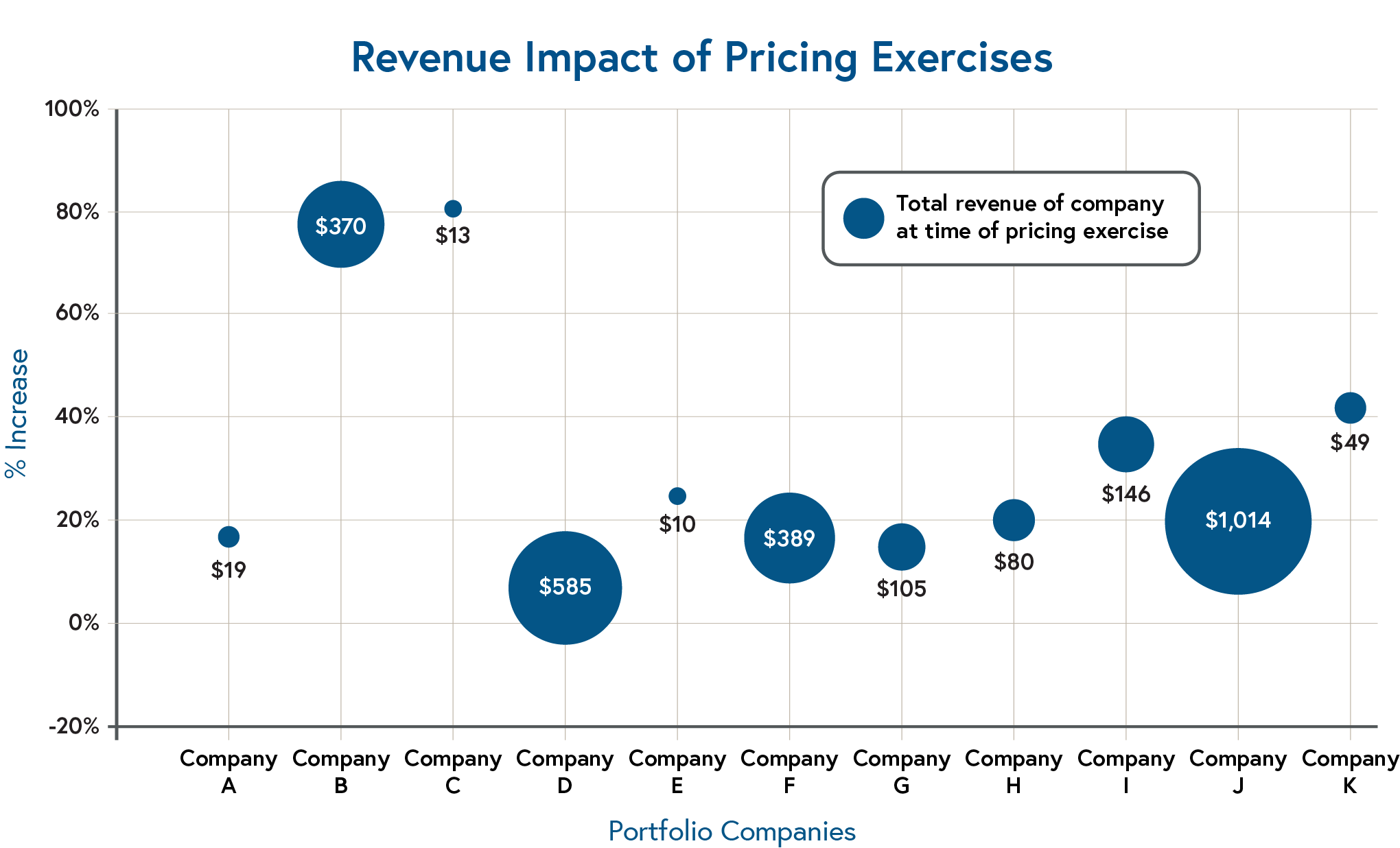

Top pricing consultancy firm Simon-Kucher & Partners has seen pricing work wonders time and time again. Across their client base, they saw an average lift in revenue of 32% when teams tackled pricing.

Take Company A, for example (from the chart above). They built a freemium product in 2012 and didn’t touch pricing much for the next six years. After all, they were occupied with the taxing demands of building a hypergrowth software business. But they eventually woke up to the need to optimize pricing. After implementing a “Good-Better-Best” packaging lineup, they were able to boost the price on their most popular offering by 30% without negatively impacting conversion metrics.

What’s more, the pricing changes they made helped to inform other initiatives such as creating better products, strengthening renewals, and supporting demand generation with a new product and pricing scheme that met more customer needs.

While Company A’s success is inspiring, it doesn’t mean your startup pricing journey is going to be easy. Pricing will always be a thorny and multifaceted issue. You need to corral busy stakeholders from every corner of the business. You likely don’t have robust customer data to inform the decision. And you must parse through myriad interrelated factors to arrive at an optimal decision for the business.

But the reward for your hard work and determination will be lucrative. Along with the team from Simon-Kucher & Partners, we’ve developed four ironclad laws that have been instrumental in their clients’ pricing triumphs.

The four ironclad laws of pricing

1. Pricing is never done.

You must revisit it regularly. Twice a year is a good rule of thumb. Much like in product development, constant iteration and testing are essential for achieving excellence. Too many companies treat pricing as a point-in-time exercise. They devise pricing strategies once and leave it untouched for years. But this is a major mistake.

Here’s why: A customer’s willingness to pay (WTP) should be the North Star for all pricing decisions. But WTP is dynamic. It often increases as a market matures and your product offerings get more sophisticated, and it can change based on any number of externalities. Since WTP is a moving target, your pricing strategy needs constant revision. The faster early-stage companies create an iterative and collaborative culture around pricing, the better.

2. Data-light does not equal data-free.

While initial pricing is usually light on data, it still shouldn’t be a total shot in the dark. Even if you don’t have any direct competitors, there are almost always roughly comparable products you can use to make an educated estimate. Since price is relative to your customers’ expectations, you can compare your product to others they buy for their tech stack. Or you can look for parallels in comparable markets.

When new products are released or new categories are created, it is tempting to assume that it’s impossible to use data to inform this decision since there are no customers (yet) and there are no true comparable offerings. But this assumption will only hold you back from achieving the next best thing.

3. Interdisciplinary input is critical.

Create a feedback loop throughout your organization to source ongoing input. Optimal pricing is a delicate balancing act between stakeholders’ sometimes opposing needs, so it is essential to regularly collect insights from all parties including sales, marketing, product, and customer success.

Unlike many strategic initiatives that fit tightly within one silo of one senior leader, pricing demands input from all corners of the company. From sales to product to finance to customer success to marketing, a lot of folks get a say. Since it’s harder for a CEO to delegate to a single team member, these pricing projects often get delayed. But this will quickly inhibit your growth. Give all teams the opportunity to come together and speak up, whether that’s a biannual workshop or through ongoing conversations. And make sure to appoint a project owner who can coordinate across functions and collect relevant data points.

4. Money is only the tip of the pricing iceberg.

Pricing is more than just dollars and cents. Savvy leaders need to recognize that you have many other tools at your disposal such as packaging, positioning, customer segmentation, and customer communication.

For venture-backed companies where growth is objective #1, churn is often seen as something to be avoided at all costs. Many founders fear that changing or raising prices will inhibit sales and adoption of their products. While this is a valid concern, avoiding pricing for this reason is short-sighted.

For one, pricing doesn’t always mean raising costs. It can also mean revisiting your model to more closely align what you charge with the value you deliver each account. Or fine-tuning your positioning or packaging. While you do need to mitigate the risk of a change in price causing churn, remember that it can also be one of your most powerful accelerators of revenue.

Finally, effective price and packaging can actually help reduce churn (for example, by creating a lower price offer that effectively differentiates willingness to pay between customers.)

Ready to get smarter about pricing?

This is the first article in a 7-part course where we share insights, case studies, and revenue-generating frameworks to optimize your pricing strategy. If you prefer to get bite-sized lessons delivered right to your inbox each week, sign up for the course below.

Dive into the rest of the series:

- Gnome or Godzilla? B2B SaaS archetypes to help you pick the right price model

- ‘One-size-fits-all’ is really ‘one-size-fits-none’: How to segment your customer base for more precise pricing & packaging

- Upsell & cross-sell caveats—plus how one B2B SaaS company revamped pricing for an ultra-successful land-and-expand play

- Why pricing deserves as much iteration as product development—and how one multibillion-dollar public tech company does it

- Five pros and four cons of usage-based pricing—and why it was a no-brainer for Courier’s CEO