State of the Cloud 2023

The cloud economy has entered the multiverse—we share insights for SaaS founders as they navigate today’s difficult financing climate and welcome the dawn of the AI era.

If we thought the pandemic years were an era of dramatic cultural and digital transformation, think again. 2023 is the year of the “multiverse,” where technological and macro changes continue accelerating at stunning rates leaving SaaS builders, founders, and investors breathless.

On one side of the cloud economy, founders and CEOs are weathering some of the most challenging storms since 2000 and the ‘08 Recession. Rising interest rates have evaporated the cheap equity of recent years forcing startups to reduce burn and drive towards efficient growth. The Silicon Valley Bank crisis drove even more uncertainty into an already fragile environment. But amidst the anxiety and turmoil, the tech ecosystem has witnessed something potentially as world-changing as electricity: a string of AI advancements that may prove to define technology and society for generations to come.

The Large Language Model revolution is one of the most significant developments in computing history. We believe artificial intelligence will not only multiply software and human capabilities, but also completely transform and expand the cloud economy in the process.

In The State of the Cloud, Bessemer provides a founder’s guide on navigating the financing ecosystem for what will likely be the next 18-24 months. We also explore Bessemer’s view on the cloud economy and the AI imperatives that SaaS leaders must enact today or else be left behind.

Exploring the cloud multiverse:

- The cloud market landscape

- Fundability benchmarks

- Efficiency insights for founders

- The dawn of the AI era

- Four steps to AI adoption for SaaS leaders

Navigating the cloud market landscape

As venture investors, we learn from historical cycles and the laws of the universe—what goes up must eventually come down. Over the past two years, the pandemic served as a tailwind to pull forward cloud adoption, and a low interest rate environment fueled an investment frenzy in both public and private cloud markets. But normalization came quickly in the form of mean regression.

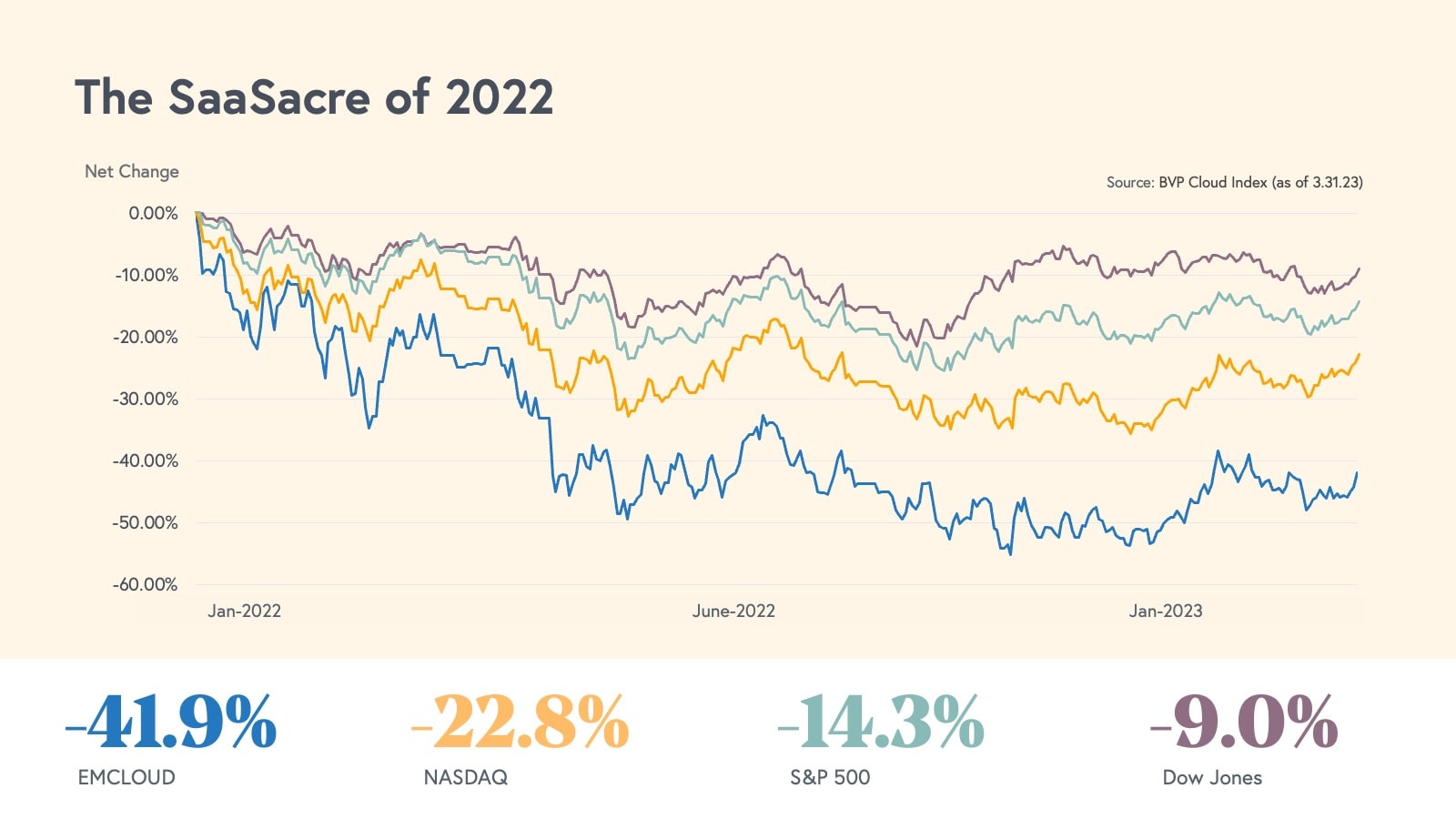

November 2021 marked the height of the bull market as public cloud market capitalization reached its peak of $2.7 trillion. Since then, cloud markets tumbled in 2022’s SaaSacre and declined disproportionately compared to other broad market indices.

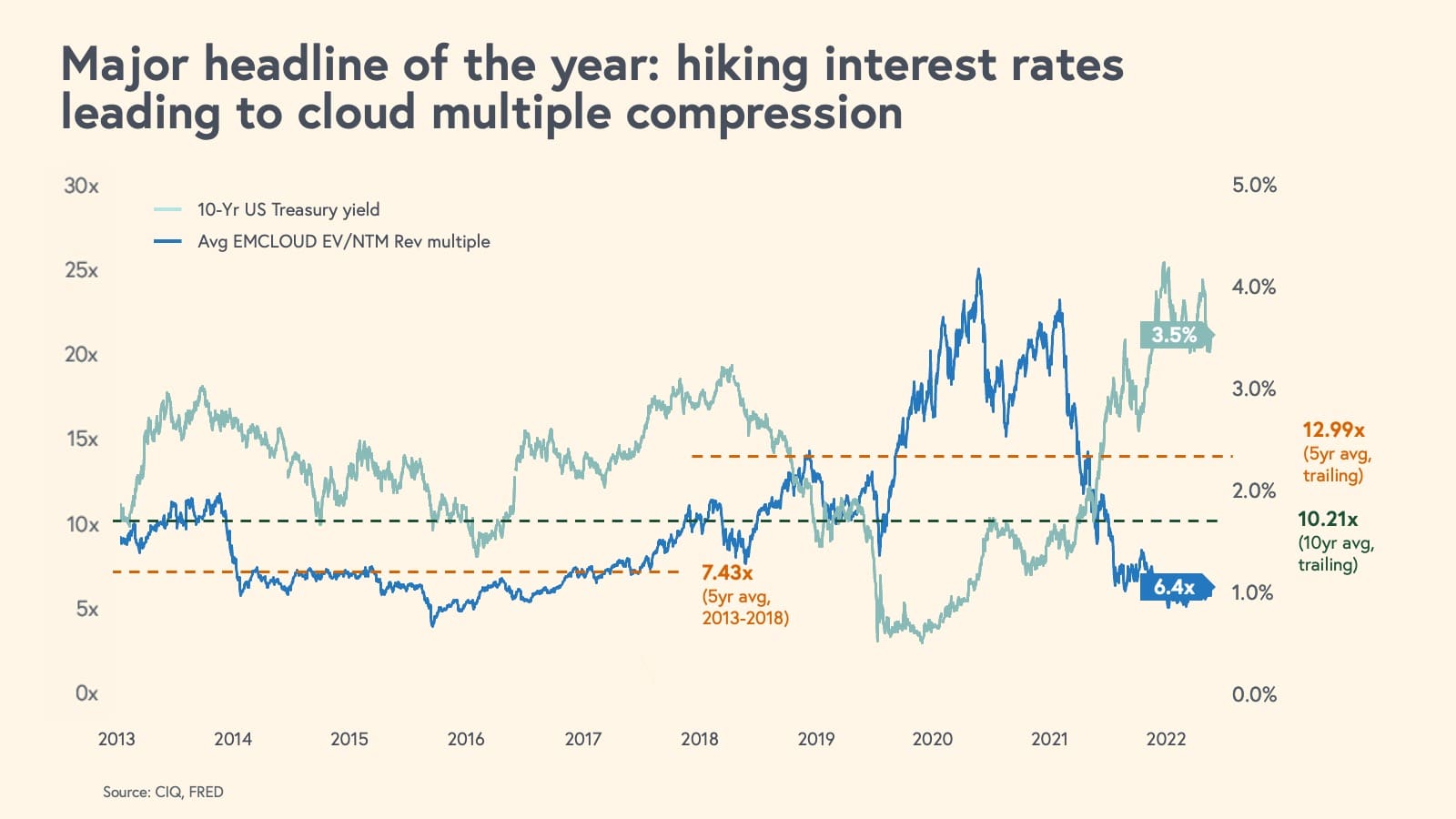

The major story of 2022 was around the external shock of hiking interest rates. Within the year, we moved out of a near zero interest environment at record breaking speed, leading to multiple compression and a significant amount of macro uncertainty. The record high multiples of prior years inflated by hyper low interest rates and stimulatory environment have not just regressed to the mean—they are currently reset below normalized, historical long-term averages.

Additionally, this macro instability had a double squeeze on cloud companies since recession fears led to headwinds such as lengthening sales cycles and tighter customer budgets, which impacted core business fundamentals such as growth.

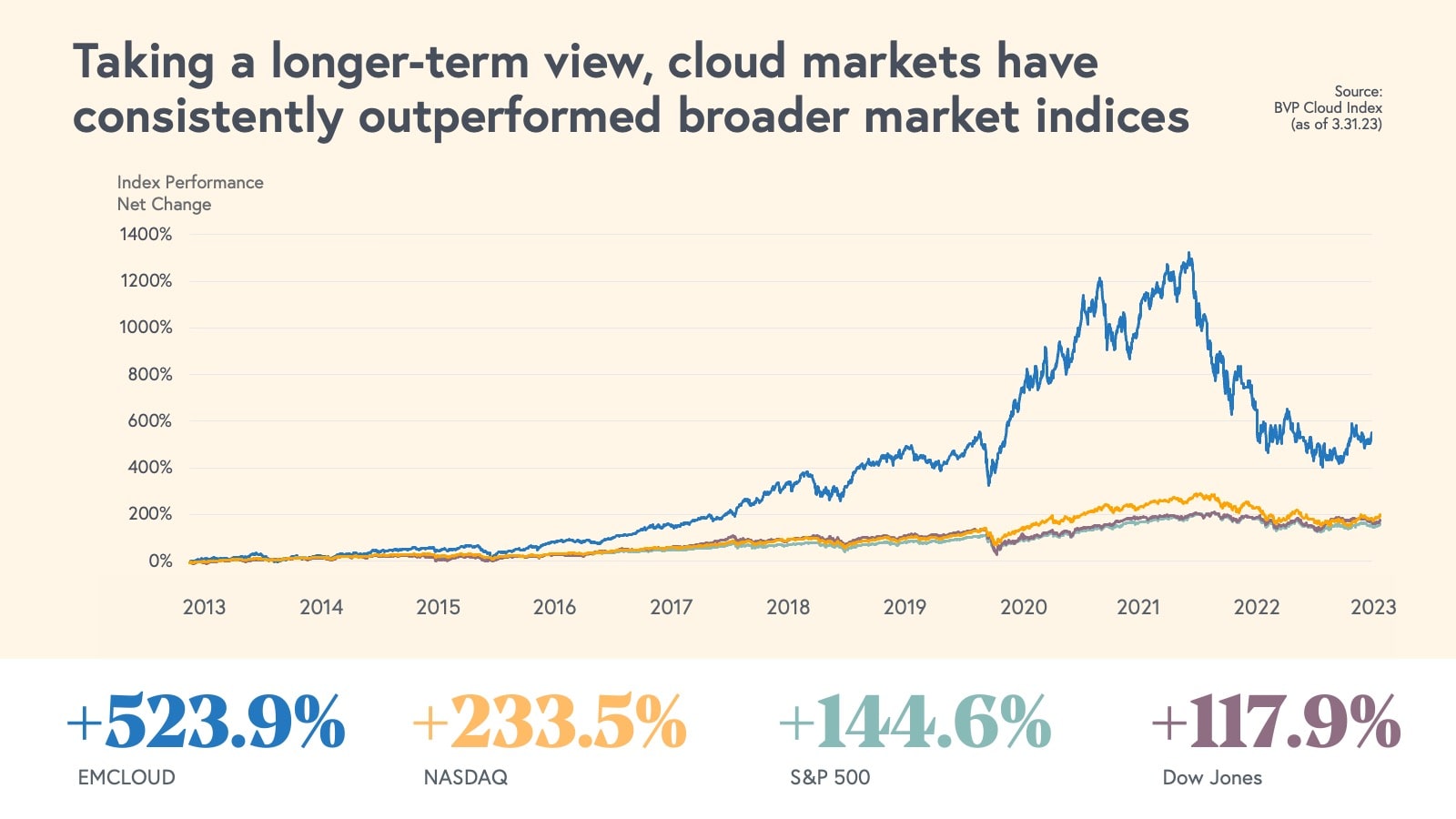

Despite the challenges in the cloud economy, there are many silver linings. Taking a long-term perspective, cloud markets have consistently outperformed other broader market indices. This is a testament to the power of the cloud model—one of the most attractive business models to ever be invented. Even in the last 12 months, with seemingly never-ending challenges, the average BVP Nasdaq Emerging Cloud Index growth rate was still more than twice the average S&P 500 company growth rate. In just ten years (2013-2023), the total public cloud market capitalization has grown from $283 billion in March of 2013 to $1.3 trillion in March of 2023. Today the public cloud market is still above pre-pandemic levels.

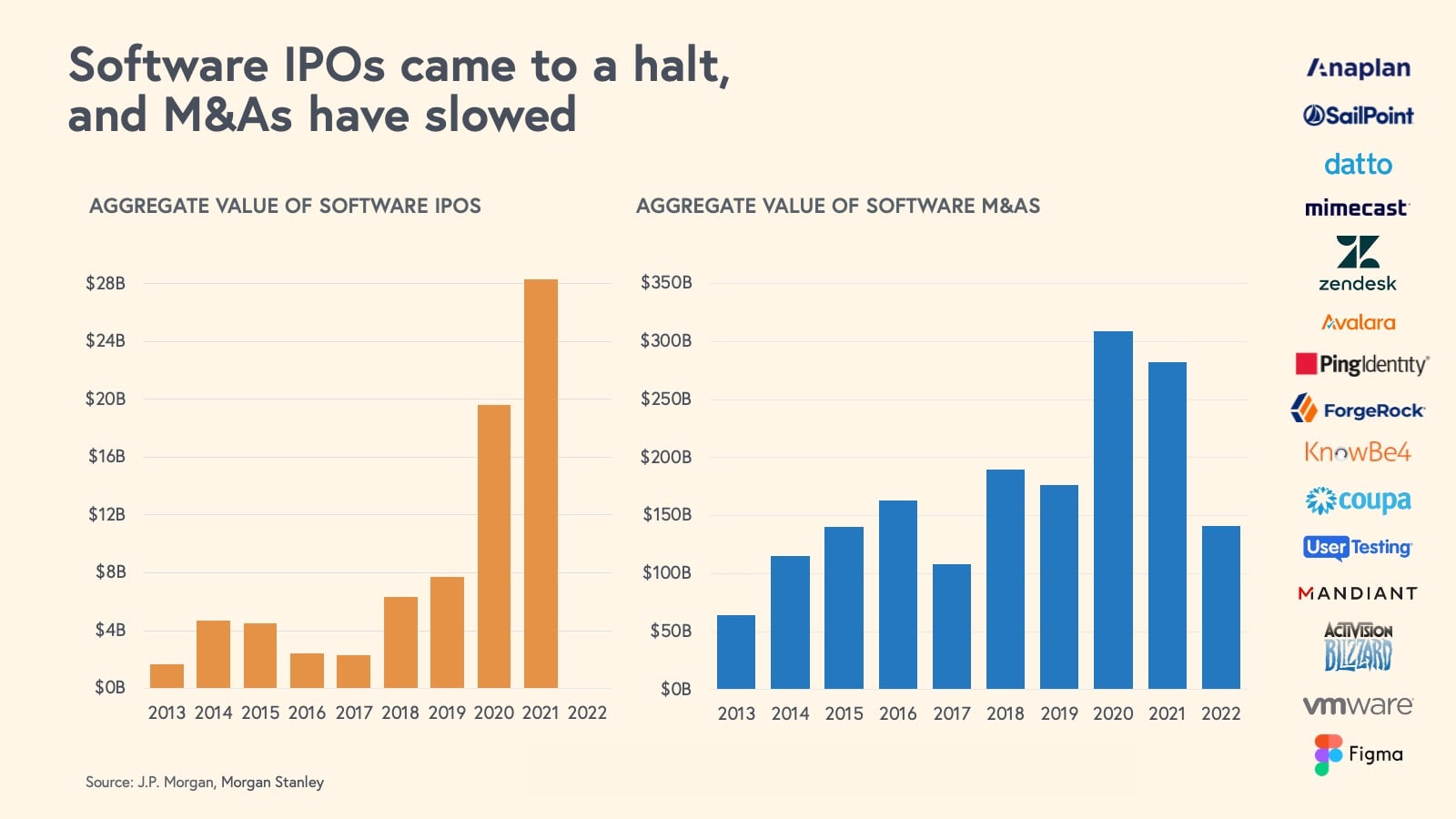

SaaS M&A and IPO slowed to a halt

In a stark juxtaposition to 2021's IPO frenzy, SaaS IPOs came to a screeching halt in 2022. SaaS M&A activity also slowed but remained slightly more robust and was notable for several reasons:

- It was a record year for private equity backed deals, especially “take-privates”, as financial sponsors sought to capitalize on the lowered multiple setting. Cloud businesses such as Anaplan, Sailpoint, Mimecast, Zendesk, Avalara, Ping Identity, KnowBe4, ForgeRock, Coupa, UserTesting, and others were taken private this past year by private equity sponsors in part due to their solid business models and cloud fundamentals. This trend continued into 2023 with the acquisitions of companies such as Duck Creek and Qualtrics amongst others. The accelerated rate of private equity M&A set the new "floor" for cloud software businesses.

- On the strategic M&A side, there were several blockbuster strategic acquisitions, including Adobe's announcement of its intent to acquire Figma for $20 billion, which represented the highest acquisition multiple offered for any software company of scale. While this deal has not yet closed, this example reinforces that best-in-class cloud companies can command a valuation premium even in tough economic conditions.

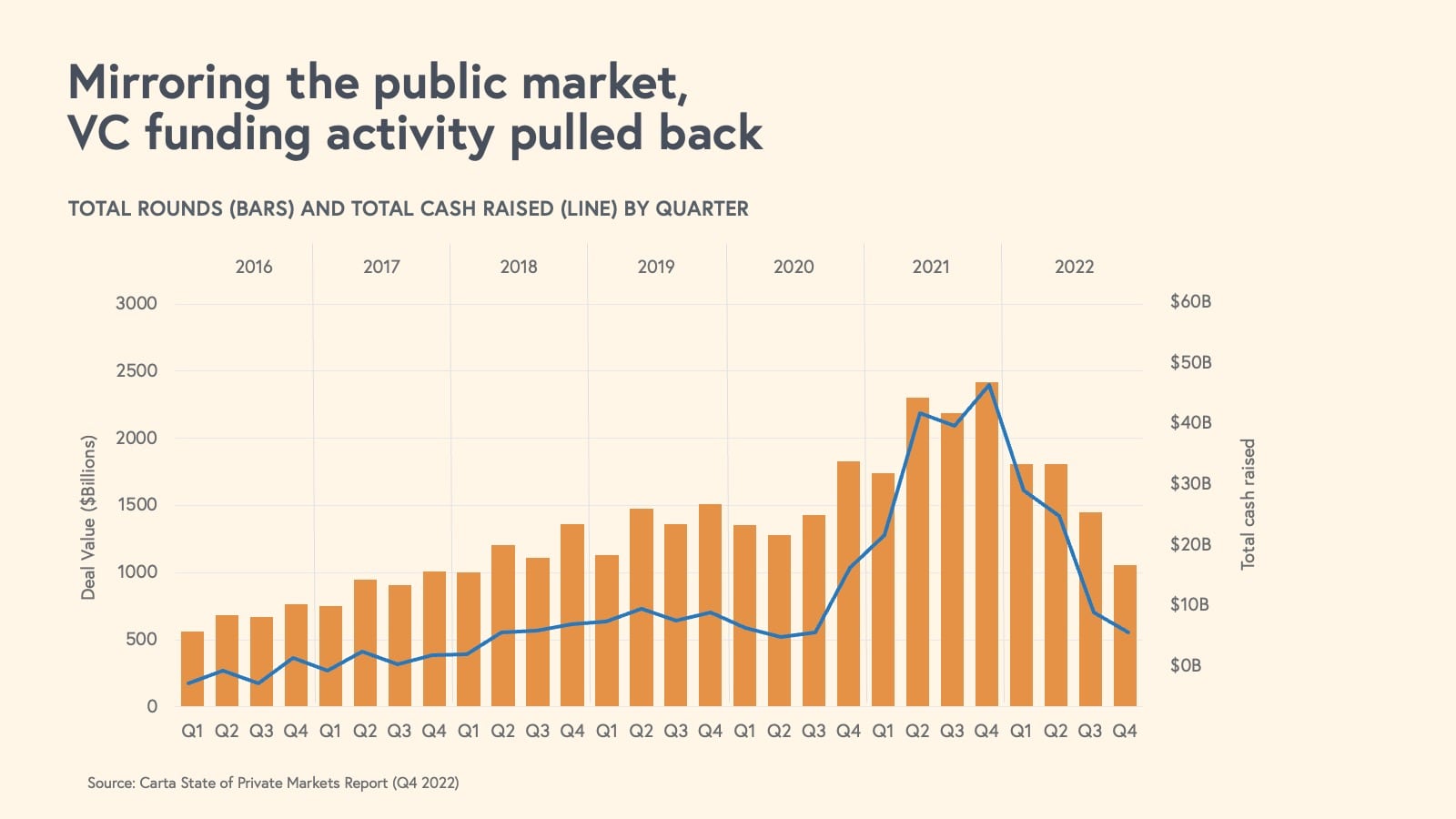

Mirroring the public markets, VC funding pulled back, with Q4 2022 being the weakest quarter of VC funding since 2018. Just as efficiency took center stage in the public market discourse, efficient growth was the new zeitgeist in the private markets. VCs advocated for capital efficiency not just to remain "alive" but also to remain fundable.

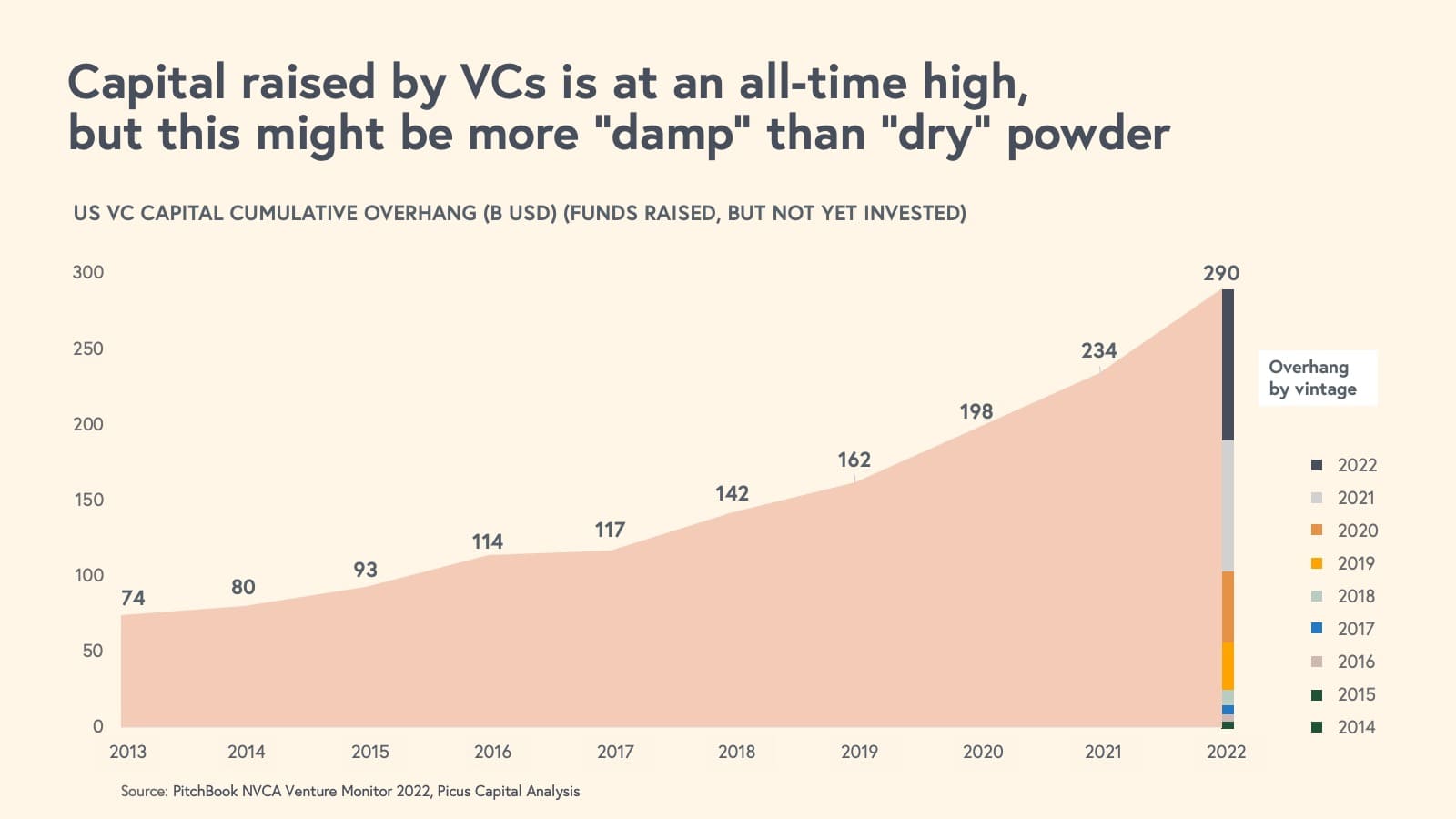

At the same time, venture dollars raised have reached an all-time high; however, despite the ecosystem having a lot of “dry” powder available, some of these are more "damp" dollars that are earmarked as reserves to support existing portfolio companies.

With the Silicon Valley Bank crisis, the startup ecosystem lost a trusted partner serving founders across the globe. These compounding factors make the economic environment more challenging than ever for founders.

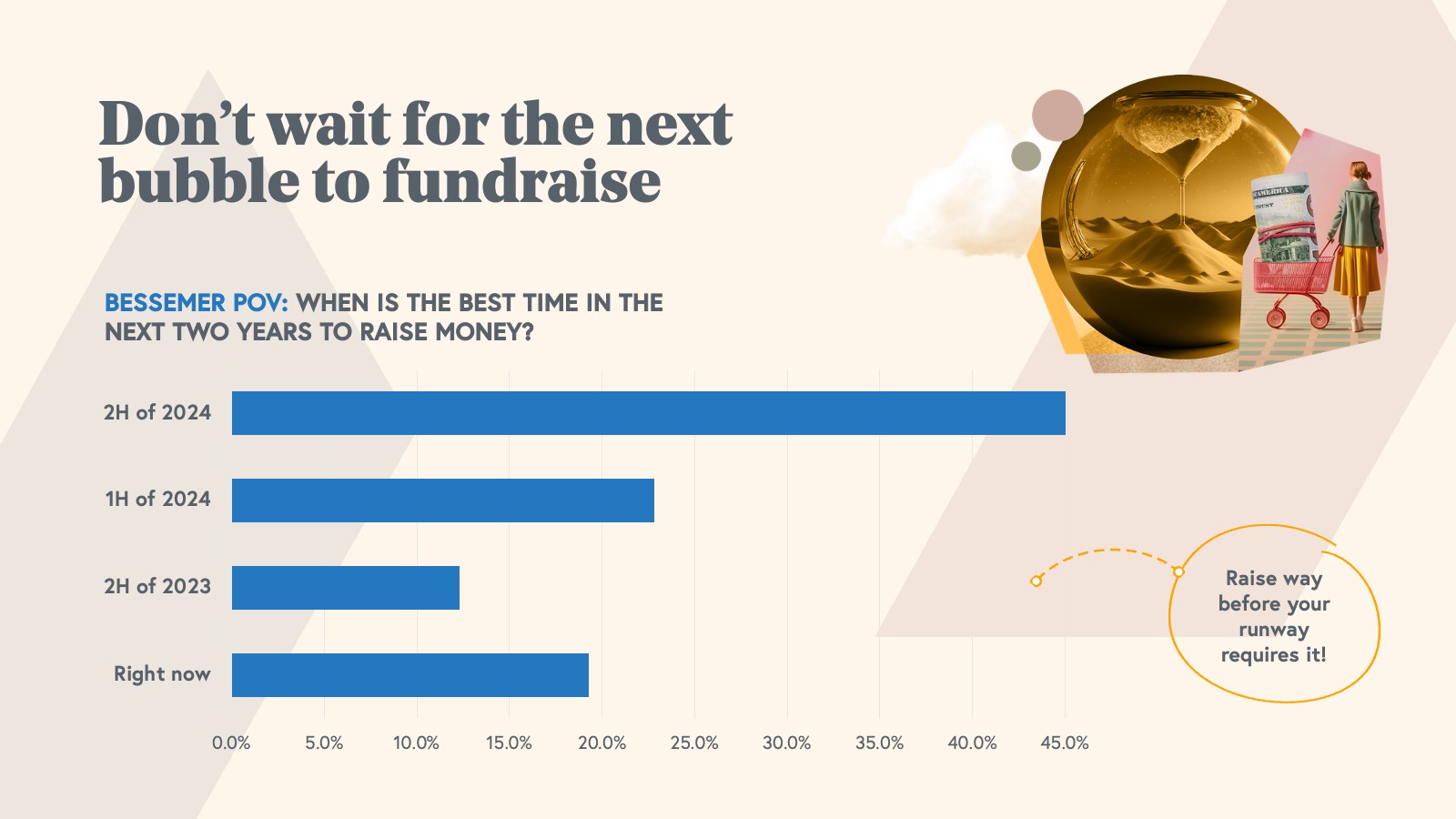

Don’t wait for the next bubble to fundraise.

The days of “easy money” are over and there is no “perfect” time to fundraise. While public market valuations have adjusted in the past several months, private valuations have yet to normalize from the highs of 2021. The topic on every founder's mind currently is when to fundraise and how to time the markets. We recommend not to try to time the market and instead fundraise when the capital is available to you. As we often say, the best time to fundraise is when you do not need the money.

Opinions on the recommended timeframe vary widely across our 60 person investment team at Bessemer Venture Partners.

Bessemer POV: When is the best time to raise money?

- 19% say ASAP

- 12% say 2H ‘23

- 22% say 1H ‘24

- 45% say 2H ‘24

Focusing on fundability benchmarks

The goal for venture-backed businesses has never been slow, profitable growth. After all, founders raise venture capital to aggressively tackle a compelling market opportunity, and that reality hasn’t changed. VCs still have the capital, and the day job, to find and invest in the most innovative, category-creating businesses. But as wallets tighten and criteria narrows, founders have to tell a different story. A story that doesn’t rely on TAM, vision and market dominance, but one that presents a compelling and level-headed opportunity for potential investors.

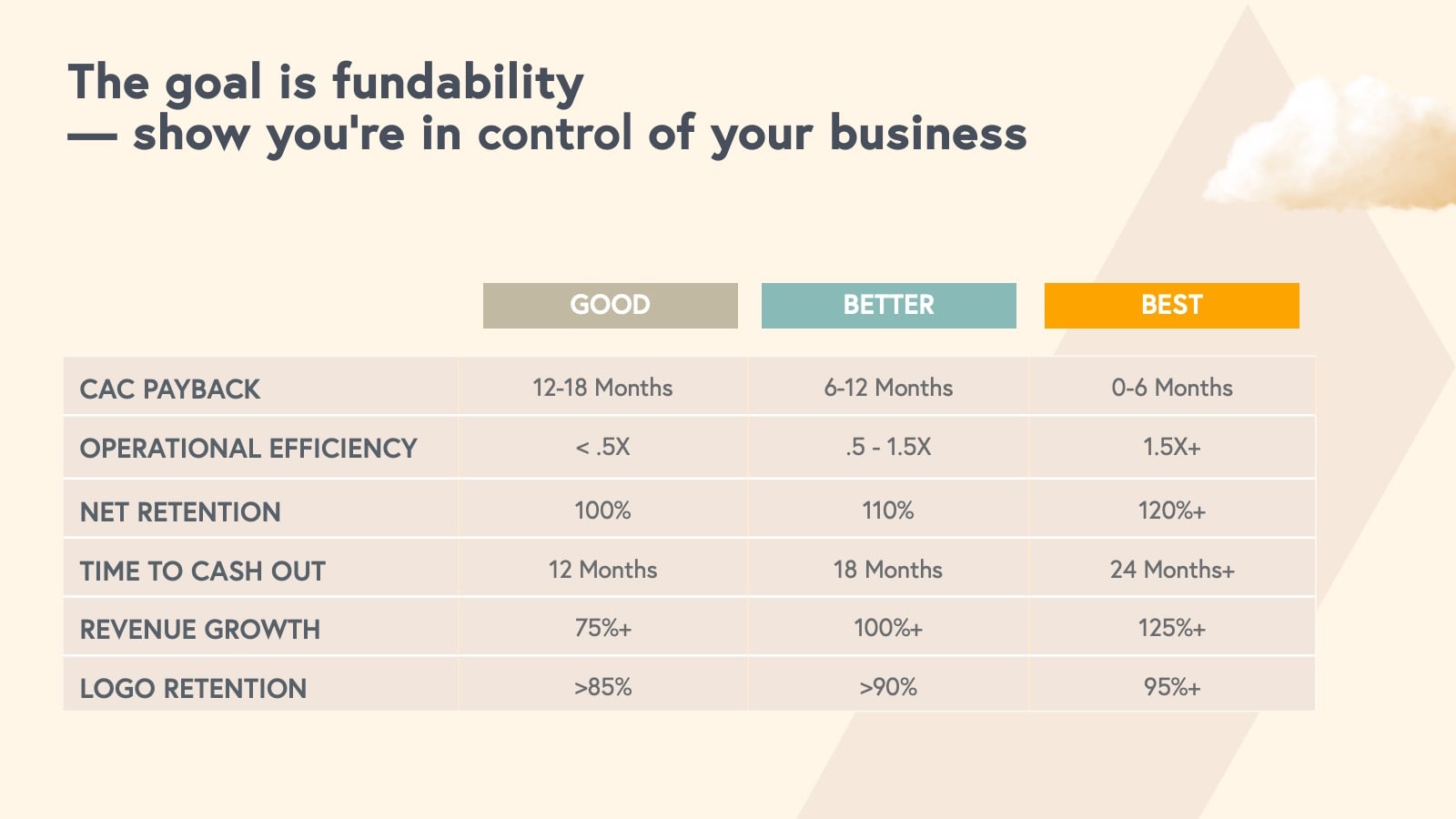

As a founder, you should be looking at your business in terms of what we call “fundability,” and in the new cloud environment, fundability comes down to whether or not you are in control of the core levers of your business.

Consider the following:

- What is your company’s burn profile? The more absolute dollars you’re burning, the larger your next fundraise needs to be. If you’re burning $40 million/year, you’ll have to present enough strong fundamentals to successfully raise the $80 million+ from an increasingly narrow pool of relevant investors.

- On the other extreme, if you’ve successfully flipped to cash-flow break-even, do you still have the revenue growth and tailwinds to drive a potential venture return for your investors?

- Beyond the top and bottom line, core SaaS metrics continue to reign. Unit economics are finally more in vogue, while the compelling fundamentals of SaaS businesses, namely the net expansion dynamics and potential for significant opex leverage, remain more critical than ever. Is your sales and marketing spend filling a leaky bucket? How quickly are you paying back your CAC? In other words, how quickly are you reinvesting back into growth?

To maintain control of your financing destiny, we recommend every SaaS founder guide their business toward the following Good, Better, Best Benchmarks:

- CaC Payback: 12-18 months (good), 6-12 months (better), 0-6 months (best)

- Operational efficiency: <.5X (good), .5-1.5X (better), 1.5X+ (best). The Bessemer Efficiency Score metric (Net New ARR / Net Burn) accounts for the leverage your business is getting from both its operational overhead as well as the gross margin profile.

- Net revenue retention: 100% (good), 110% (better), 120+% (best)

- Time to cash out: Runway of 12 months (good), 18 months (better), 24+ months (best)

- Revenue growth: 75%+ (good), 100%+ (better), 125%+ (best)

- Logo retention: >85% (good), >90% (better), 95%+ (best)

Of course, these benchmarks may shift up or down depending on the stage of your business, as well as according to the different dynamics of SMB, Mid-Market, and Enterprise audiences. For the typical Series B or C enterprise software company, these targets should be top of mind to successfully navigate the fundraising landscape of the next 24 months.

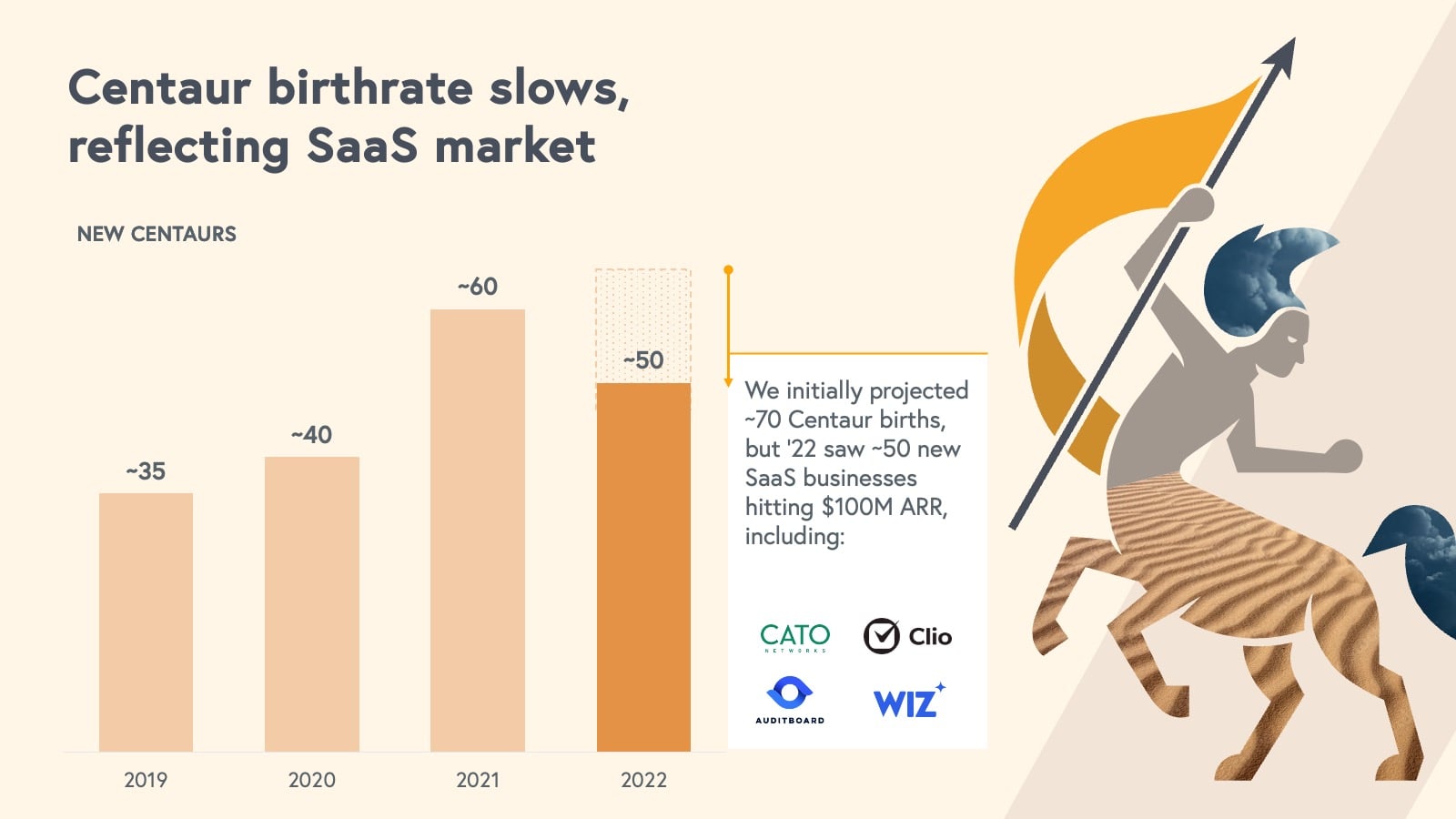

So what does this mean for the global Centaur count (SaaS businesses with $100M ARR)?

Last year, we introduced the Centaur, a coveted milestone for SaaS businesses and a rare breed of cloud business, part of an elite subset of the growing unicorn herd. Centaur creation has steadily climbed since 2019, providing a more accurate measure of cloud ecosystem health based on tangible growth. At $100 million ARR, Centaur businesses have product-market fit, scalable go-to-market strategy, and a growing customer base.

With 35 identified Centaurs in 2019, the birth rate increased year over year, with ~40 in 2020 and ~60 in 2021. We predicted there would be ~70 new Centaurs born in 2022, but as the market slowed, so did the Centaur growth. Last year's Centaur birth rate came to approximately 50, with new additions of great companies such as Clio, Cato, Wiz, and Auditboard.

The slower pace was unsurprising given the macro environment; 2022 has taught us that even Centaurs are not immune to the markets. However, we believe 2023 will separate the wheat from the chaff—those companies that reach Centaur status this year will continue to be enduring businesses.

Efficiency insights for cloud founders

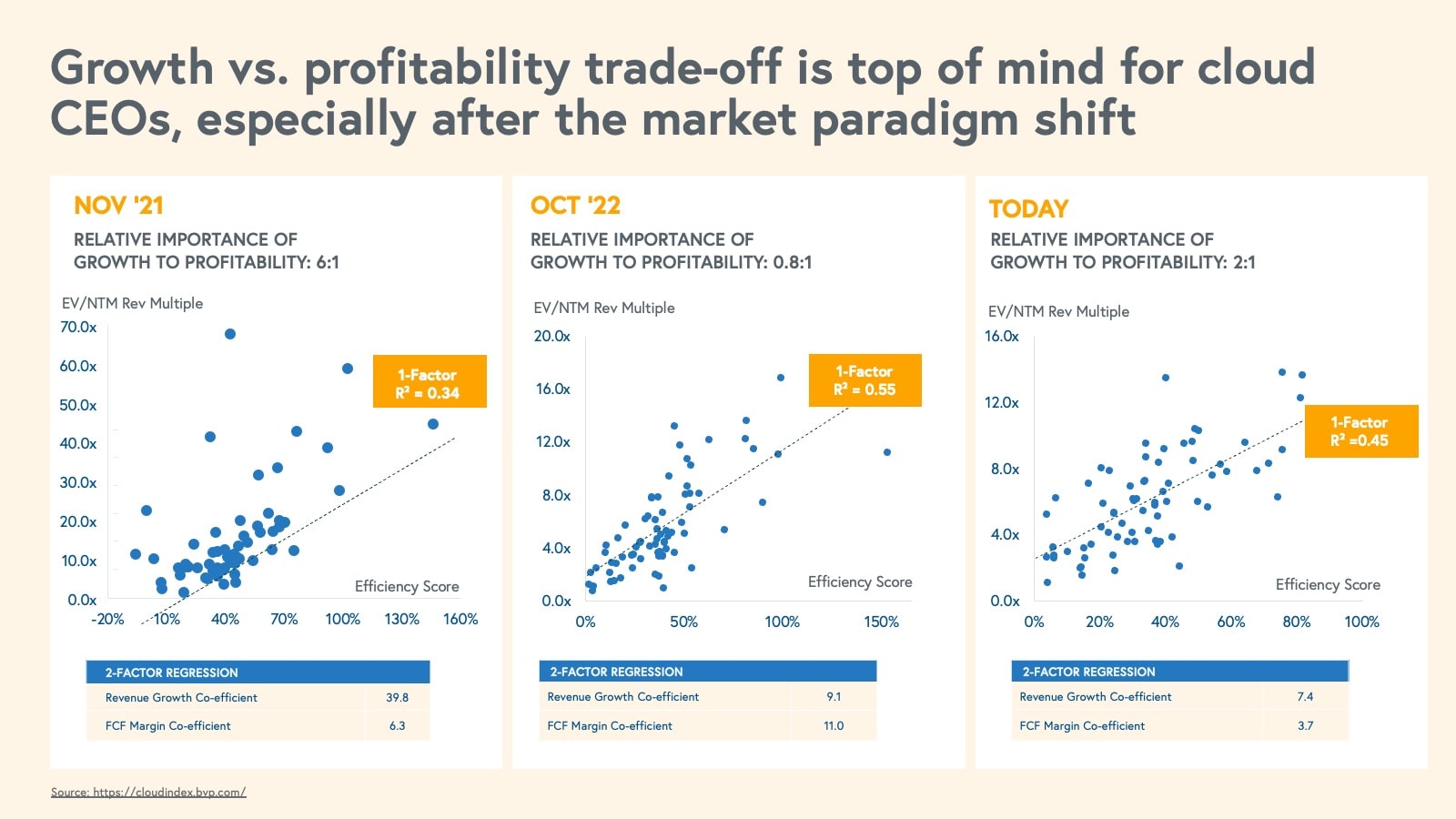

The market pullback ushers in a paradigm shift from the age of growth-at-all-costs to the age of efficiency. Valuations for cloud companies are currently more tightly coupled with efficiency scores than absolute growth. We observe that this efficiency premium on valuation is material with “Rule of 40+” BVP Cloud Index companies trading ~1.7x higher than less efficient peers.

Balancing the trade offs between growth and profitability in order to drive efficient growth is now top of mind for many cloud leaders. Let’s put this trade-off into a heuristic mapped to public market conditions: At the height of bull market exuberance in 2021, a ~1% improvement in revenue growth had the same impact on public cloud valuations as a ~6% improvement in Free-Cash-Flow (FCF) margin. Then the tide turned. In late 2022, this ratio moved closer to ~1:1 and even tipped slightly in favor of profitability. Today, with more macro stabilization, the ratio stands at 2:1 in favor of growth, where a ~1% improvement in revenue growth has the same valuation impact as ~2% increase in profitability.

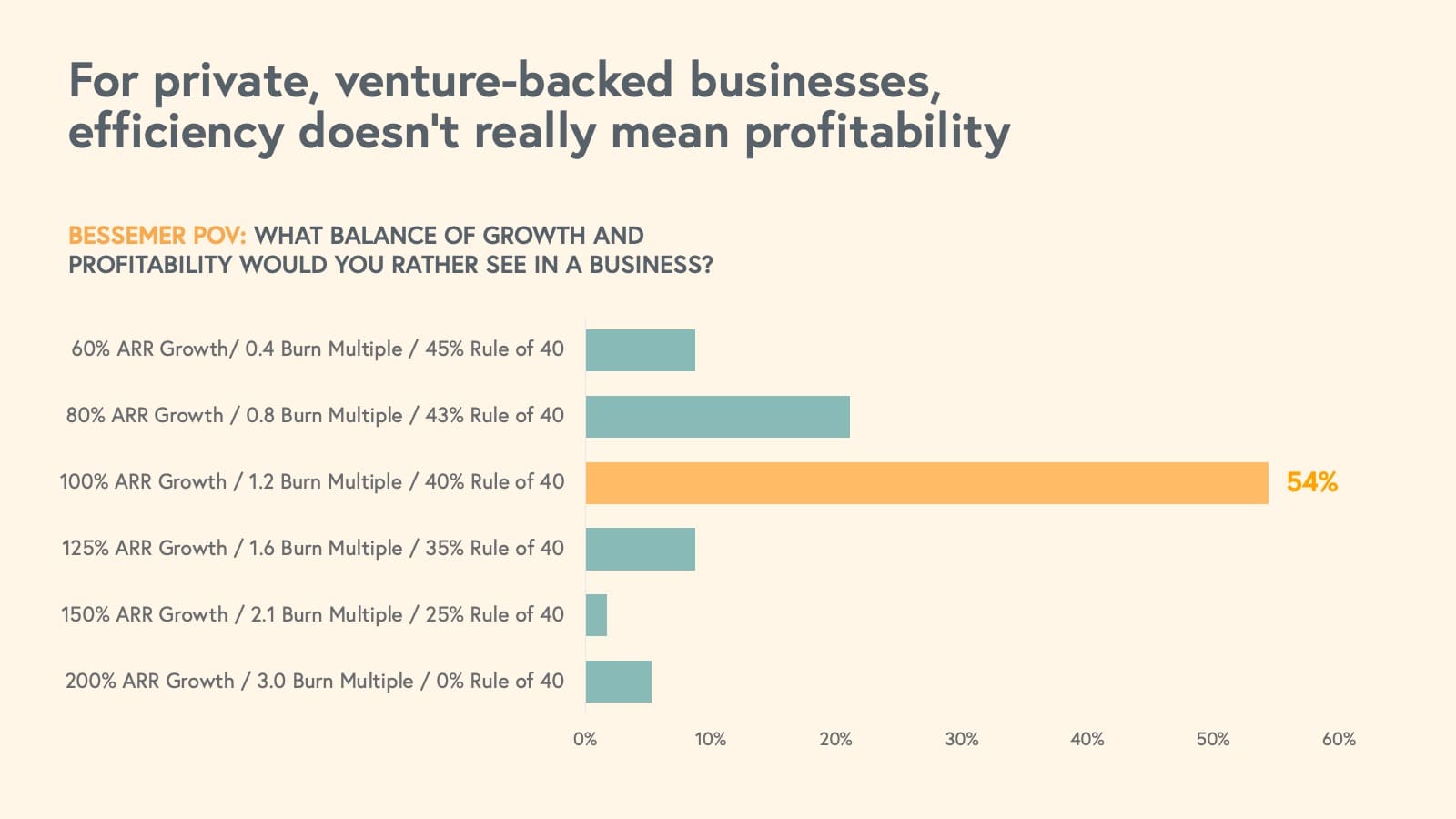

What about private market sentiment? To answer this, we surveyed the Bessemer investment team to understand what should be the “ideal profile” of growth vs profitability for startups. Triple digit growth is still the resounding aspirational goal, but now layering on the Rule of 40 benchmark as a north star. The ideal growth profile for SaaS businesses looks like 100% Revenue Growth and a 1.2X Burn multiple. What this means is that startups do not need to solve for cash flow break-even right away as they should still be investing in growth, but this growth should be at optimal costs, not growth-at-all-costs.

The rising imperative of efficient growth brings us to one of our predictions for 2023. We anticipate a surge in adoption of SaaS solutions that help reduce inefficiency and optimize spending and procurement.

Prediction 1: SaaS fights inefficiency and sprawl

A frothy market is a tide that lifts all startup ships, where SaaS buyers and business users have less discipline in their willingness to pay or spend resources. In downturns, customers become more price sensitive and begin to re-evaluate their software stack, consolidate vendors, and rationalize spend.

There are many key areas where cloud leaders can leverage software to drive efficiency and reduce excess, including SaaS purchasing solutions to help with vendor negotiation and procurement, Cloud FinOps and cost management platforms to optimize cloud costs, and engineering productivity tools to improve developer workflows and benchmark OKRs.

At Bessemer, we consolidated 40 strategies and tactics that SaaS leaders can apply across the organization to drive profitable growth and highlighted many companies that are contributing to this prediction.

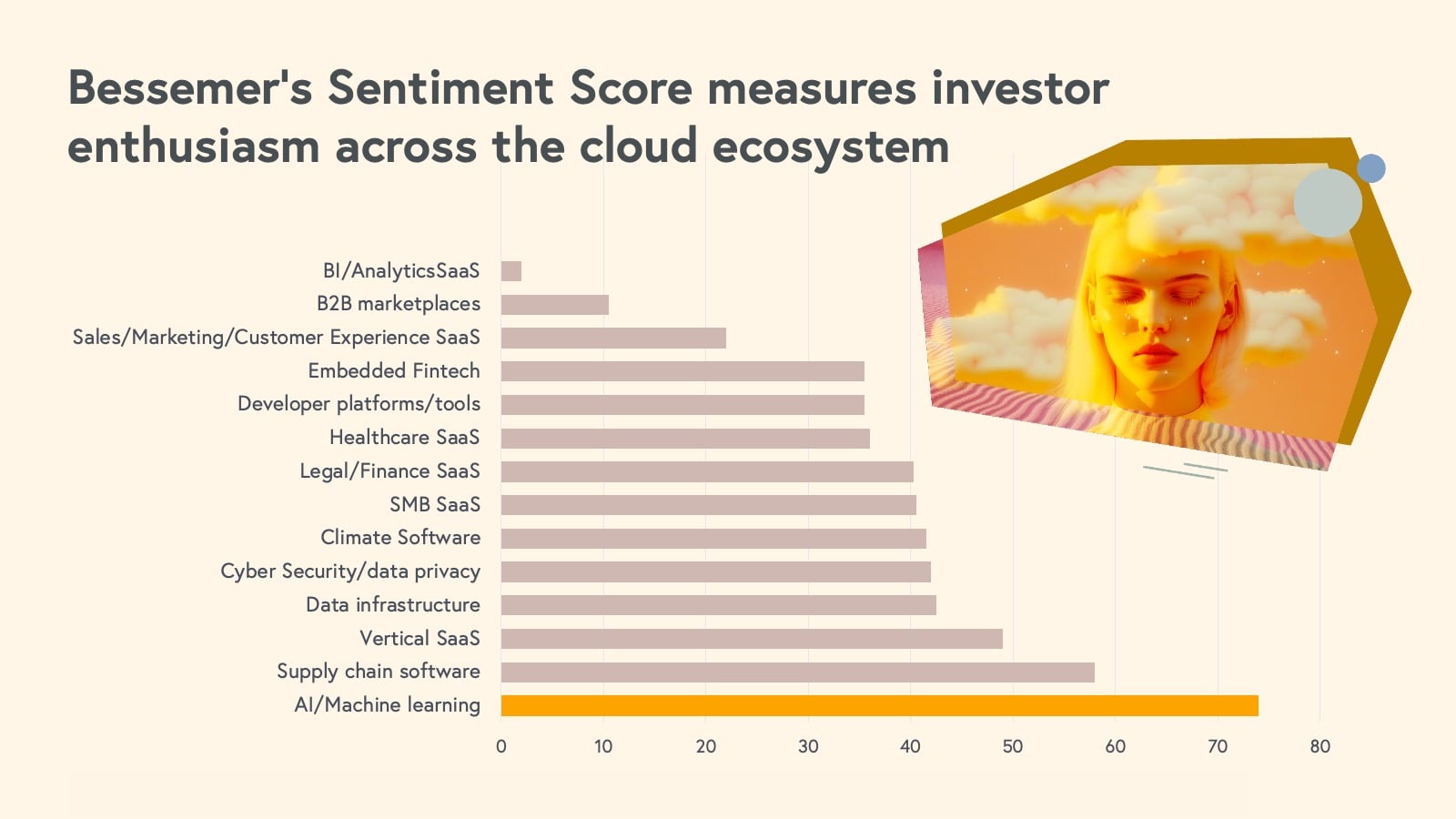

So what are cloud investors enthusiastic about in 2023?

Despite the headwinds in the financial markets, we at Bessemer are as optimistic as ever to back the evolving cloud economy. Today’s entrepreneurs are more focused on fundamentals and advancing innovation with the rise of major shifts in technology, leading to the creation of new markets and opportunities.

We surveyed all 60 investors at the firm to see which cloud economy sectors they were most enthusiastic about. Top-ranking categories included tools and platforms for organizational efficiencies within Sales, HR, Legal, Infrastructure, and more. Similarly, enthusiasm for supply chain software highlights the global need for optimization at the macro level for trade, commerce, and global logistics.

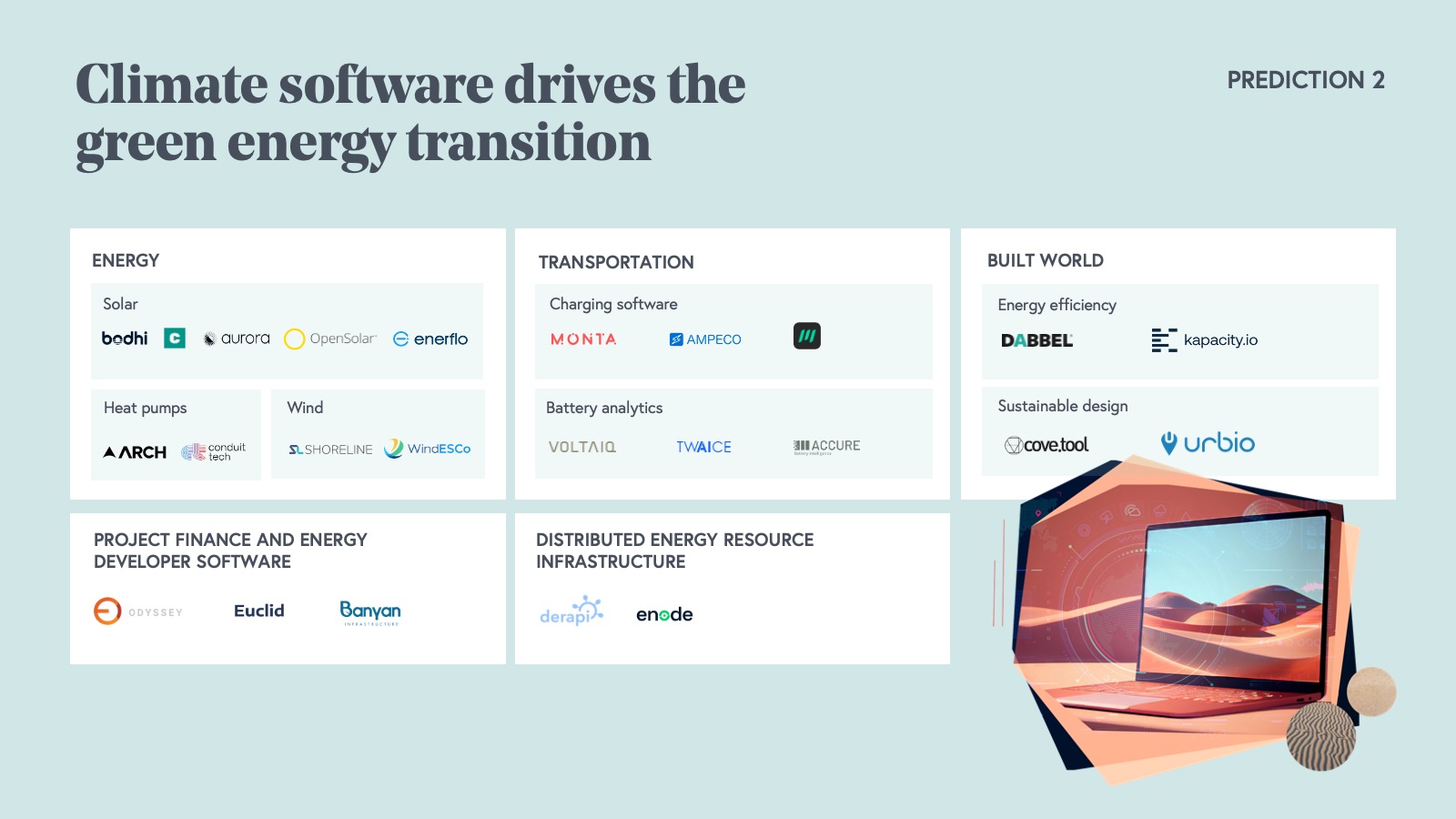

One key area of focus is climate software, a burgeoning sector within the cloud economy as the climate crisis continues to compound as an existential threat. In 2022, the U.S. passed one of the most critical pieces of legislation for the green economy: The Inflation Reduction Act.

Prediction 2: Climate software drives the green energy transition

The falling price of renewables, legislation supporting investment into the green economy, and consumer activism make us optimistic about our climate future. With significant resources being dedicated to scientific research and innovation in the energy sector, we are witnessing the rise of entrepreneurs building green energy technologies and an emerging ecosystem of renewable energy players—including installers, developers, and consumers—supporting the climate ecosystem. To support this growing green economy, we predict the emergence of new cloud software tailor-made to power the energy transition.

There are several areas we are excited about, including:

- Vertical Software for Solar/EVs/Heat Pumps: Aurora Solar, OpenSolar, Monta, Ampeco

- Distributed Energy Resource Infrastructure: Enode, Derapi

- Project Finance and Energy Developer Software: Odyssey Energy Solutions, Banyan Infrastructure

- Built World: Dabbel and Kapacity.io (Energy efficiency) and CoveTool and Urbio (Sustainable design)

But there was one area of the cloud economy our investors were the most enthusiastic about: artificial intelligence and machine learning. In a survey of our entire Bessemer investment team, 96% of our investors see portfolio companies with AI-driven features on the roadmap.

As the world continues to run on the cloud, we’re also on the brink of the next platform shift that’ll accelerate generations of innovation and value creation. The knowledge and information economy will be defined by artificial intelligence—both for AI native businesses and SaaS applications. More on our AI predictions below.

The dawn of the AI era

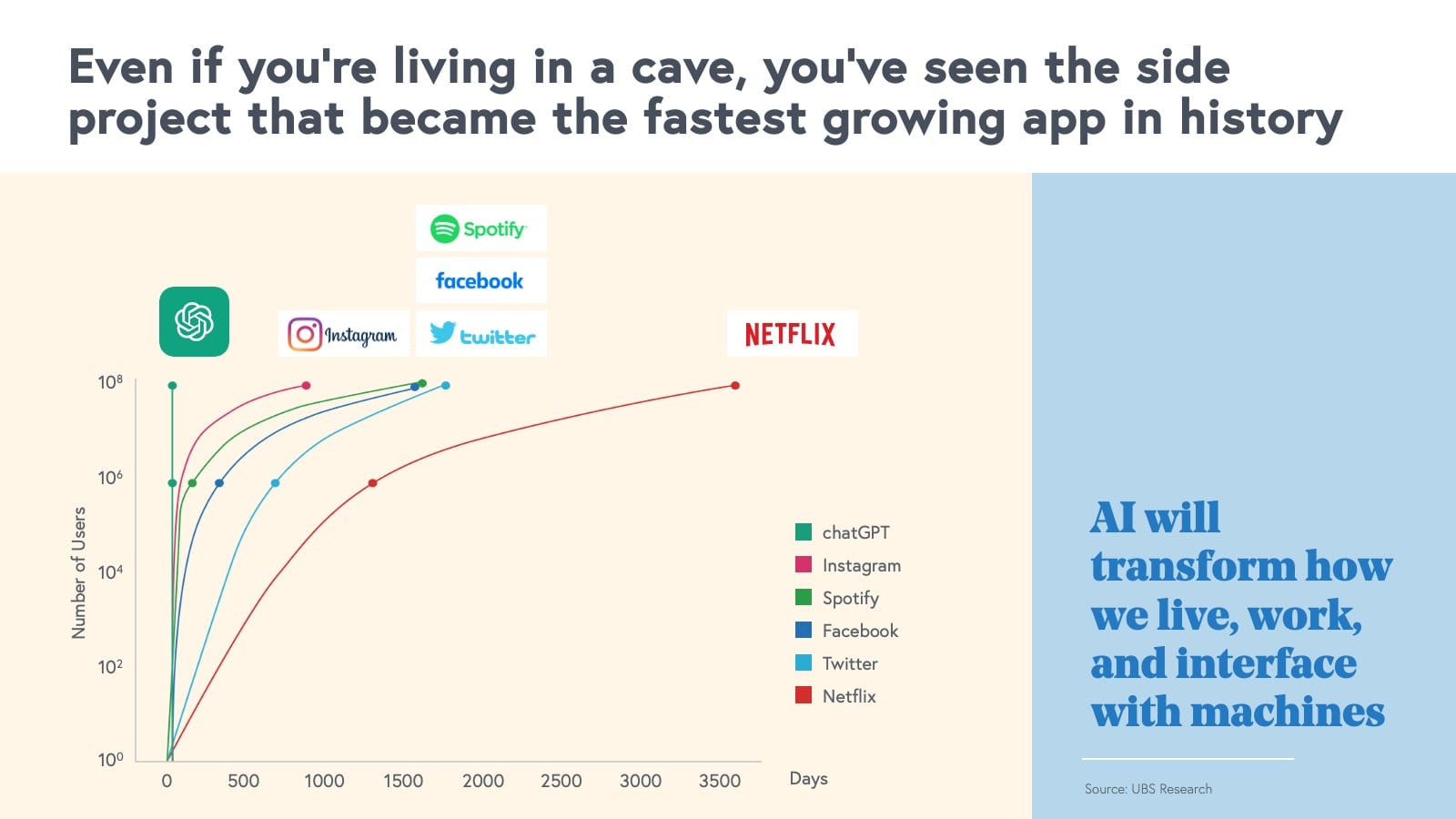

In January 2023, OpenAI's ChatGPT, powered by GPT-3 and its successors, including GPT 3.5 and GPT-4, achieved a remarkable feat by amassing 100 million monthly active users just two months after launch. This historic moment makes ChatGPT the fastest-growing consumer application in history, highlighting the growing demand for AI-powered applications that can interact with users naturally and intuitively.

Prediction 3: The majority of the value produced by AI will flow to the end users

Artificial intelligence is creating unprecedented consumer surplus. In other words, the value of the efficiency gains and experiences that AI enables far exceeds its market price. AI is becoming increasingly available and accessible. The open source ecosystem is thriving, making AI even more affordable, and prices are plummeting as performance improves. OpenAI dropped prices by 10x in just the last six months! While AI is driving massive productivity gains—given these dynamics—end users, consumers, and the developers building with AI are capturing outsized value.

As the ecosystem explodes, entirely new categories of products and services are emerging around AI capabilities. AI-native businesses are being built and designed from the ground up with AI at the core of the product offering. And we’re seeing new leaders rise in consumer and enterprise categories, as well as the emergence of a new layer of developer tools and enablers that make it easier to build and leverage AI. For example, Jasper defined a new model for content creation, pioneering the market for AI generated copywriting. Likewise, Perplexity is reinventing search, creating a new paradigm around knowledge discovery and information access.

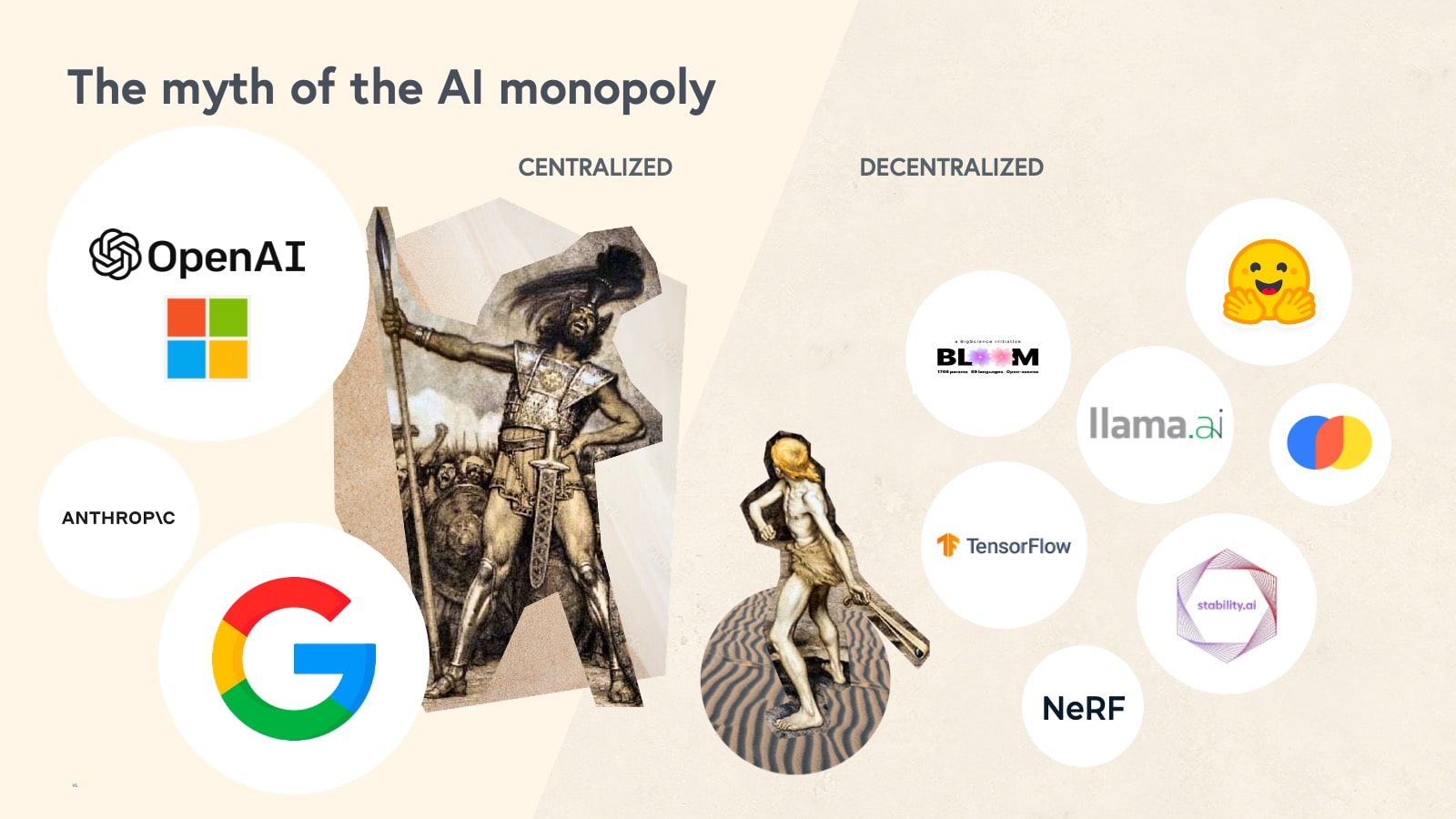

The AI market: centralized vs. decentralized systems

A David and Goliath story is shaping the core of the AI market. To many it appears an oligopoly of a few key players, including OpenAI, Google, Microsoft, and Anthropic, is solidifying to capture the bulk of the developer activity generated by this AI wave. But the long tail of AI models and enablers is blooming, in part driven by the open-source community. Some open source models like stable diffusion and whisper are at times outperforming centralized players, particularly in areas like speech-to-text and image. Training AI models is also getting cheaper, leading to the emergence of a fragmented ecosystem of low-cost, smaller, or verticalized models.

The good news is that the competition between centralized and decentralized AI systems is leading to continued innovation and progress. This means better technology and lower prices.

Prediction 4: The Large Language Model Revolution will transform the SaaS application layer

For incumbent cloud leaders, the way they run their business and products must fundamentally change. We are already seeing big names in the cloud, such as Intercom, Canva, and Zapier, among others, launching stellar products with OpenAI’s GPT-4 API. Countless opportunities now exist for new founders to pursue in software.

It’s important to note that oftentimes incumbents don’t move quickly on new technological trends, however, as we’ve seen with Microsoft, Google, Adobe, and others, many of the established big tech companies have quickly integrated language models into their products.

This is making it all the more important for cloud category leaders to continue moving quickly, spurring the cloud economy into the age of AI.

AI is now table stakes—those that don’t get on board will be left behind

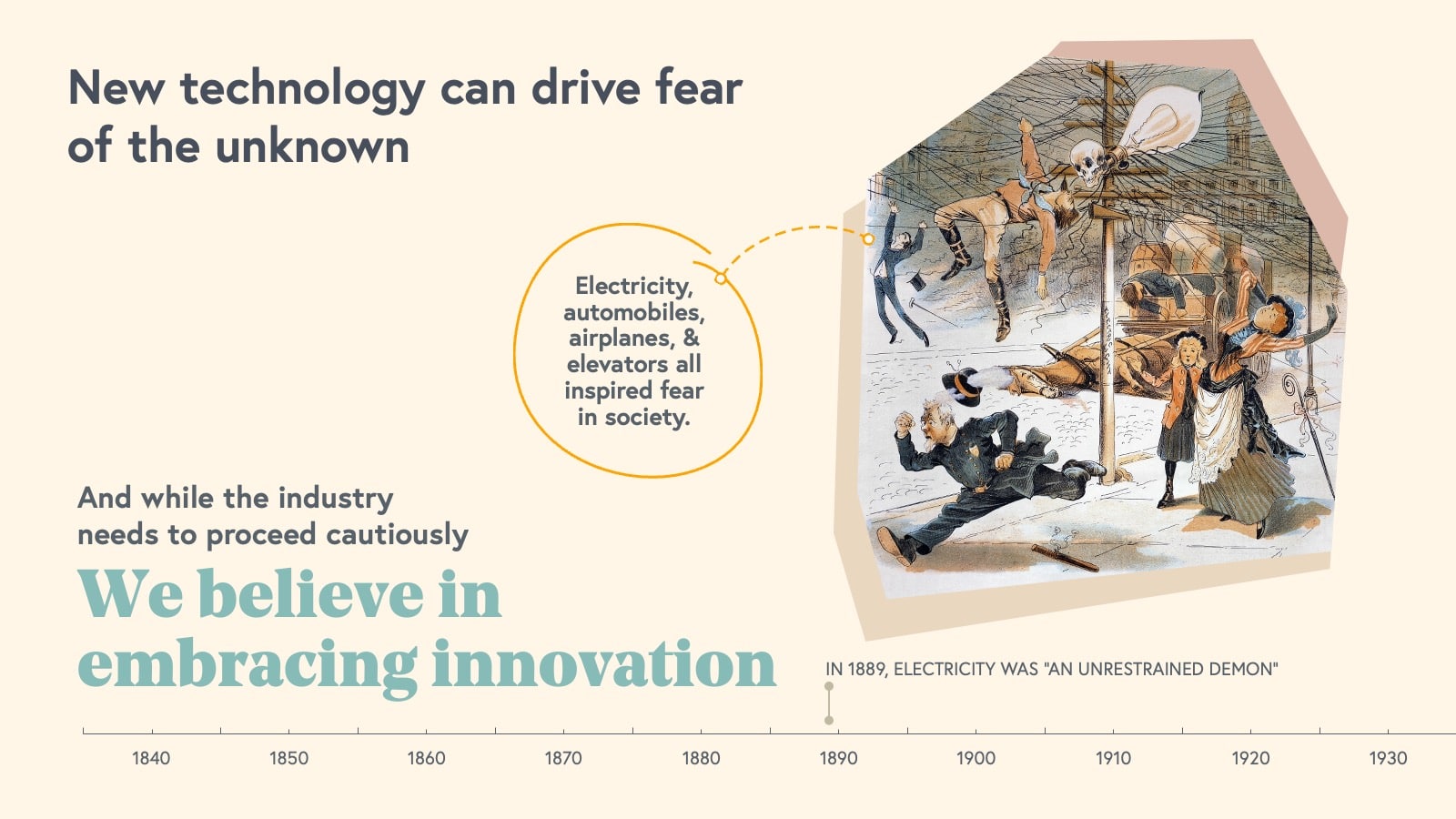

Every major technological shift has driven fear of the unknown. Electricity, automobiles, airplanes, and elevators all inspired fear within society. In 1889, electricity was deemed “an unrestrained demon” and yet the electrical grid is essential to modern society and drove millions of inventions powering the world today.

While innovation comes with a degree of risk, builders of today have the power to determine AI's ethics along with its beneficial applications. As business leaders, you can be part of shaping a net-positive future.

But to all the SaaS founders, we know your legal team is already nervous. These breakthrough models are as astonishing and powerful as they are nascent. Technology is accelerating at rates we have never seen before, and businesses and society-at-large will be playing catch-up for some time. There are real legal and ethical concerns around IP, biases, accuracy (i.e., hallucinations), and regulation. Over the coming months, fear will build as we enter the trough of disillusionment. Companies will continue to ban employees from using AI at work, regulators will raise more questions, and AI-powered apps will make real mistakes. It is important for companies to work closely with their legal teams and take appropriate measures to mitigate these risks when implementing AI-powered tools.

However, if you're a CEO of a cloud company, opting for no AI strategy is equivalent to signing the business's death warrant.

What exactly are LLMs capable of?

Many SaaS founders have been following AI closely, but for those too busy with their day jobs, here is a quick primer on the promise of LLMs for SaaS applications.

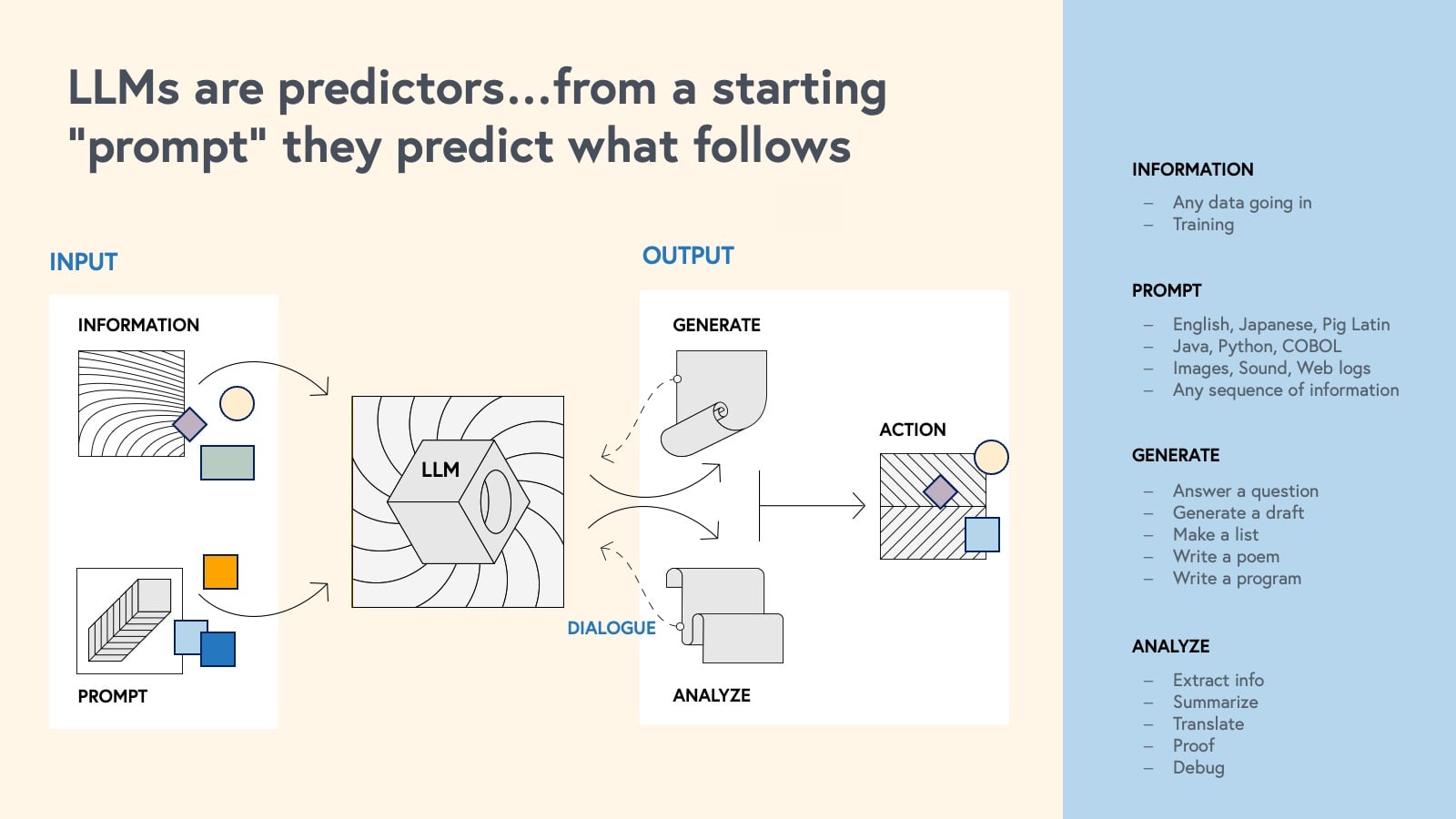

An LLM is a giant predictive machine—trained on massive sets of information (text languages, coding languages, images with descriptions, weblogs, other datasets) and optimized to predict the information most likely to follow a starting prompt.

The nature of the prompt controls the nature of the output. The early jaw-dropping demos of these LLMs often leveraged prompts that “generate” output—asking models to write blog posts, or even poetry from a starting prompt. But while these generative prompts make for mind-blowing and entertaining demos they may as a class offer less utility than prompts that ask the model to simply analyze a string of information. This analytical capability means the models can synthesize, interpret, translate, or extract key data from a starting prompt—and as these models are given API access, this analytical ability means that a prompt could be used to initiate action using any application with an available API. Thus language can be used to control any software application or even multiple software applications simultaneously. And the generative ability of these models means the models could interpret and act on a starting command and then suggest a subsequent request that is likely to follow. For example, in the future we may hear computers say: “I’ve booked your flight for tomorrow, would you like me to look for a hotel?"

The potential applications of LLMs are truly unlimited.

While it’s easy to build an intuition on the generative, analytical, and active capabilities these models have with human language, it’s important to remember that human language is just one type of information string, and that the same capabilities apply to any string of information including weblogs, computer languages, machine data, images, sound waves, and so on.

The potential applications of this technology are truly unlimited and will certainly impact every single category of software.

Four mission critical steps to AI adoption for SaaS leaders

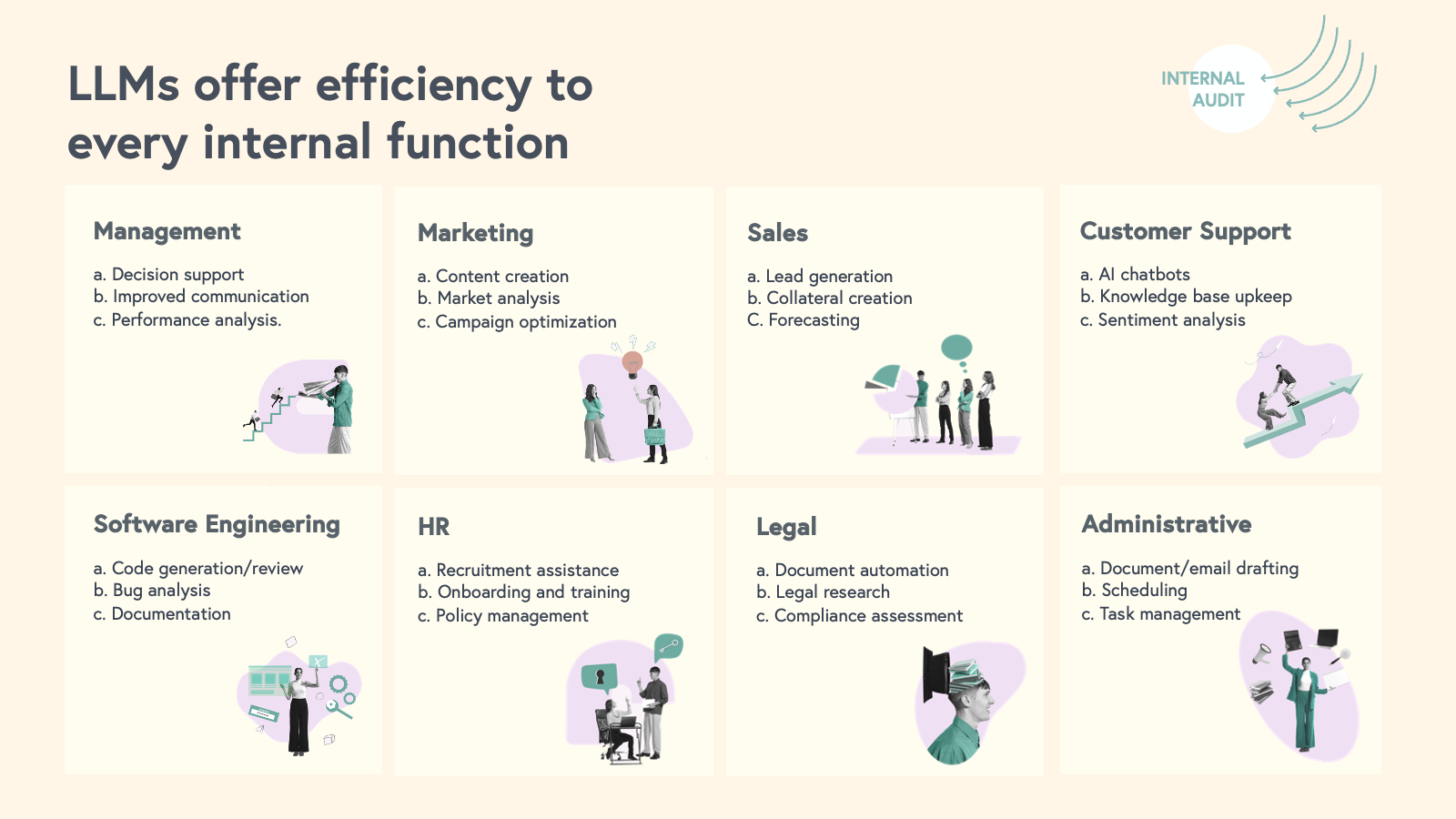

1. Assess the AI opportunities by conducting an internal audit.

LLMs can help to accelerate human workflows and within every department in your company. Similar to how we leveraged ChatGPT for some research aspects of this report, teams can leverage LLMs to brainstorm and explore possible areas to leverage the power of AI.

From Administration, Customer Support, and HR, to Legal, Marketing, and Engineering, AI is an ability multiplier. As individuals, teams, and organizations leverage these models for knowledge work, there will be accelerated productivity and step function changes in teams taking on more strategic work.

2. Reimagine your product roadmap.

Reimagine your product roadmap from a first principles perspective. If you were to build your product today from the ground up, how would you leverage AI to best address your customers’ core needs?

There are three critical levels where product roadmaps can be transformed:

- Within the application: Identify where your SaaS application "analyzes'' and "generates." Assess where there are language interfaces within your current product and identify opportunities to superpower them with LLMs.

- Within the product workflow: Identify predictable and repeatable sequences of workflows within your products, these are potential opportunities to consolidate manual workflows with AI.

- Within the ecosystem and across product workflows: Look beyond the boundaries of your product to identify predictable sequences where your users interact with other products immediately before or after using your product. This could involve sending emails, generating reports, or pulling unstructured data from other systems into your product. All of these should represent potential opportunities to automate cross-product workflows with AI.

Integrating AI and LLMs into a SaaS product roadmap requires a strategic approach and collaboration between multiple teams, including product, engineering, data science, and legal/compliance. Define clear goals, identify use cases, and prioritize features to successfully integrate LLMs into your product offerings and drive innovation in your industry.

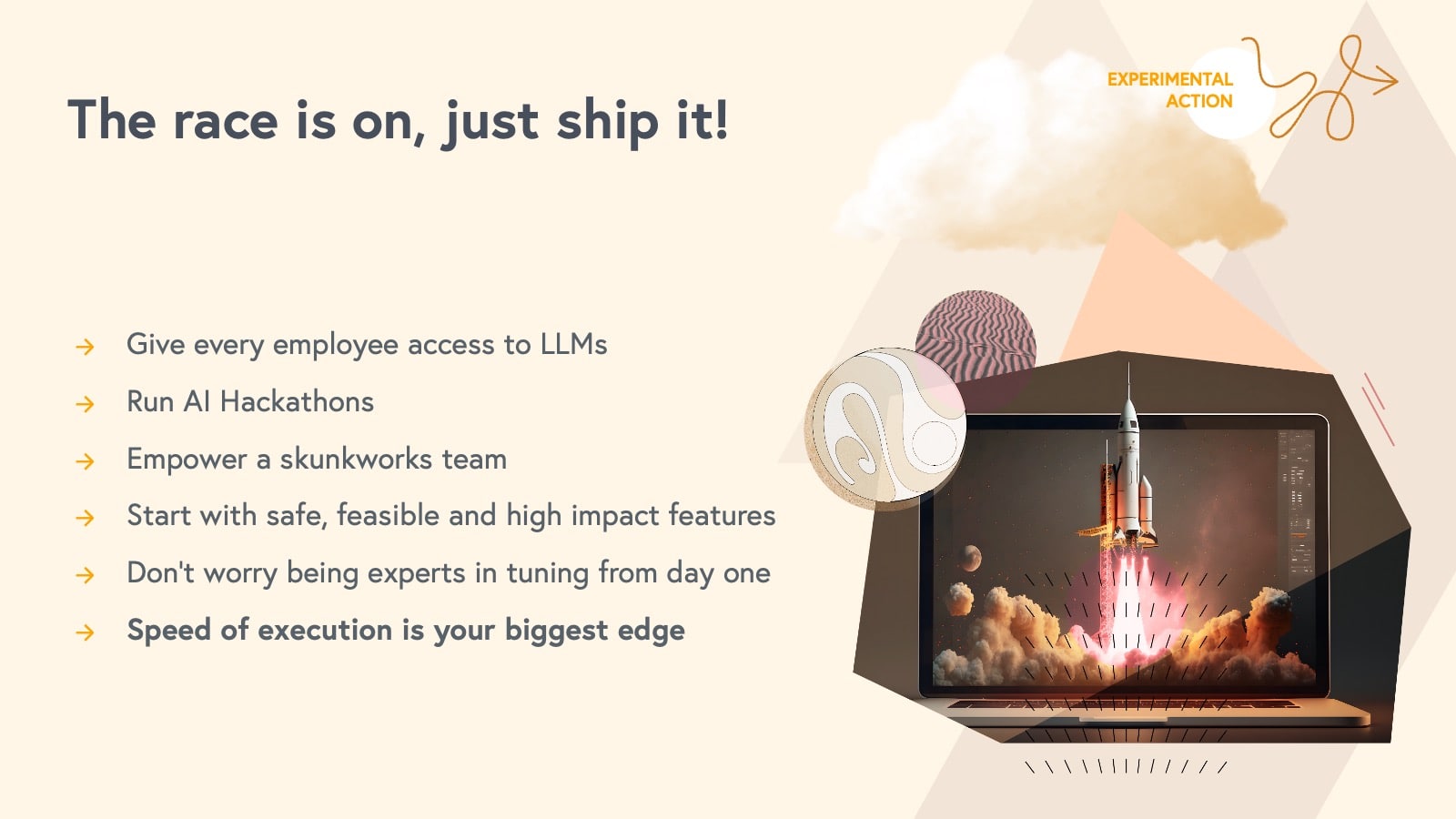

3. Take action and start shipping.

It's time to start shipping product. In previous technology shifts, incumbents were slow to react and startups had the advantage of speed. But this may not be the case anymore. Major cloud giants, including Google, Microsoft, and Adobe, are already incorporating AI into their offerings and benefiting from their massive scale. And new players are entering the market at an astonishing pace. So it is even more important than ever that today’s cloud companies remain agile and move quickly to start incorporating these technologies into their products.

Here are some immediate tactics you can take to start integrating AI and LLMs into your business:

- Give every employee access to LLMs and share best practices for using them effectively.

- Host AI hackathons to encourage experimentation and creativity.

- Start reimagining features that can benefit from AI, focusing on those that are safe, feasible, and high-impact.

Remember, in the short term, speed of execution is the most important factor. Don't worry about cost or long-term differentiation. Start with off-the-shelf tools until you can prove out differentiating use cases, and then assess where you need dedicated ML talent. Being agile is essential for survival in this rapidly-evolving landscape.

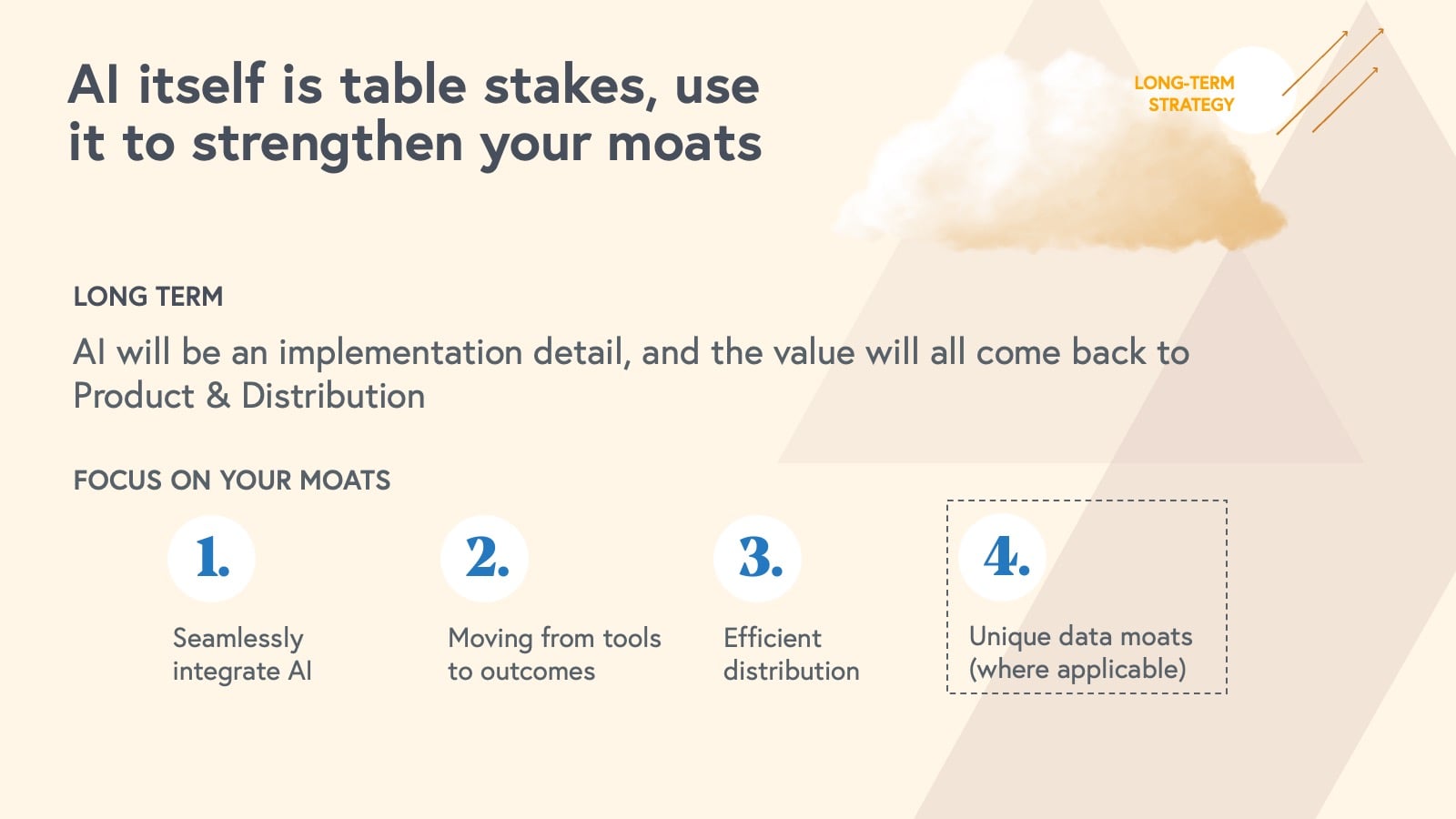

4. Start your AI strategy today and once to market, focus on long-term defensibility

In the short term, the key for SaaS leaders is to continue moving quickly and not get left behind.

Over the next three to six months, cloud founders should prioritize finding product-market fit with new AI-powered features, maintaining a modular and API-driven product for flexibility, and avoiding over-optimization for perfection. It's important to focus on rapid iteration to quickly test and adapt to feedback from users and the market, rather than getting bogged down in lengthy development cycles.

Longer term, AI will be an implementation detail, and the value will all come back to product and distribution. At this stage, SaaS founders will want to focus their product on solving their customers core “job to be done,” moving from being a user tool to an outcomes machine, and reinventing the UI for users to become supervisors vs. workers.

Defensibility for most SaaS companies will ultimately come back to product, execution, and distribution. AI will be the enabling infrastructure to drive increased value and outcomes across all categories of software.

Accelerating value creation in the cloud economy

Today the drivers of innovation and value creation in cloud computing stem from the advancements in AI and LLMs. Two decades ago, it was considered edgy for a software founder to build and deploy in the cloud. Now nearly every digital or software business operates in a cloud-first world. We anticipate that in a few short years every sector of software will be transformed by the intelligent future—and it will happen faster than anticipated.

The businesses that endure and succeed 10 years from now will be the ones that have already become AI-focused or will in the next few months.

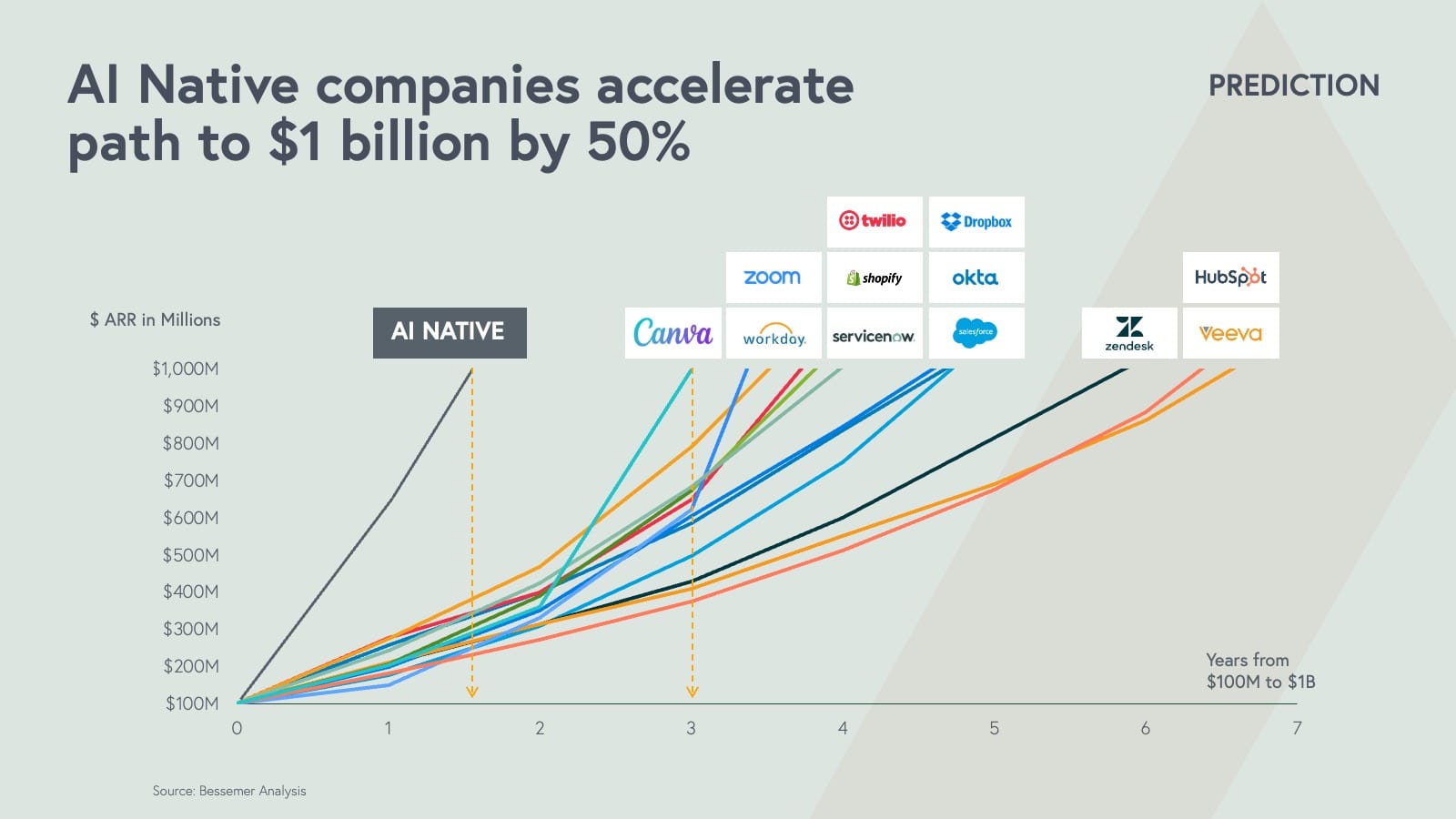

Prediction 5: AI Native companies will accelerate path to $1 billion by 50%

As business models change, people will acquire new skills with the power of AI solutions, and technologies will accelerate faster than ever before due to the compounding powers of these foundational models. Revenue generation will also accelerate in the age of AI.

The path from $100 million ARR to $1 billion ARR looks different for many Cloud Giants. Canva achieved it in three years, Zoom in 3.5 years, and Twilio in four years. Emergent leaders such as OpenAI and Anthropic are well on their way to reaching not only Centaur status ($100M ARR), but becoming some of the fastest growing technology businesses in recent history. We estimate that AI-native companies will reach $1 billion ARR 50% faster than their cloud counterparts.

To read more venture insights on SaaS and artificial intelligence, subscribe to Atlas.

![]()