Close Info Window

AlgoX2

AlgoX2 is a data infrastructure company building a next-generation data streaming platform.

Elliott Robinson is based in the NYC office and a partner of the growth investment practice at Bessemer, where he focuses primarily on Cloud software investments. He co-authors Bessemer’s iconic 10 Laws of Cloud Computing and the annual State of the Cloud Report. He looks to partner with companies and management teams that are defining their market category while also maintaining a set of core values that will allow them to expand and solidify their leadership position. Elliott is currently a board member for Coactive AI, Databook, Hinge Health, Hyperscience, Imply Data, Netlify and Render. Additionally, he has led Bessemer’s investments in Forter, Statespace, and Canva.

Prior to joining Bessemer, Elliott was a partner with M12, leading investments in companies such as Livongo (IPO: LVGO), BlueVine, Trusona, and Cooler Screens. Elliott started his career with Syncom Venture Partners, investing in both early and growth stage enterprise software and frontier tech companies such as CLEAR and Iridium Communications (IPO: IRDM). After six years with Syncom, he joined Georgian Partners, investing in a number of successful growth stage software companies such as TurnItIn (acquired by Advance), Kinnser (acquired by Mediware), and eSentire.

Elliott earned his M.B.A from Columbia Business School and a Bachelor of Science in mathematics from Morehouse College. He is a board director of Venture Forward, BLCK VC, and a member of the Kauffman Fellows Class 22.

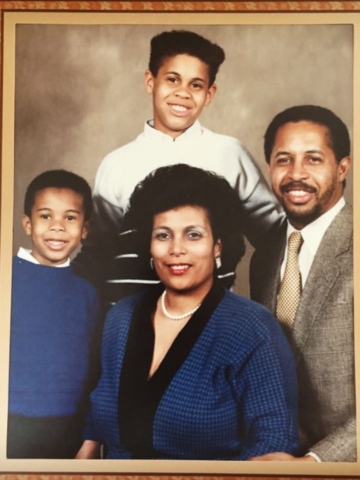

Some of the most defining moments in Elliott’s life happened while working at his dad’s enterprise software startup. At the office, he spent time in the “computer room,” learning to code and developing a love for computer games. More importantly, he gained a deep level of empathy for entrepreneurs by witnessing the challenges his dad faced and the emotional toll of being on the brink of bankruptcy (twice!). This experience has shaped how Elliott connects with founders, allowing him to understand not only the professional and financial challenges of company-building but also the personal sacrifices they have to make and the impact of these sacrifices on their families.

In college, Elliott pursued his dream of becoming an entrepreneur. He conducted research on stock market data using radial neural networks with the goal of building the next generation of financial services software. His work earned him a research award and caught the attention of a college board member who ran a venture capital fund and who offered Elliott a summer internship at the firm. There, Elliott fell in love with venture capital and has dedicated his career to investing and supporting entrepreneurs ever since.

Prior to joining Bessemer, Elliott had the opportunity to partner with the digital health company Livongo. Although health tech was not Elliott’s focus area, he noticed strong signals of product-market fit and clear founder-market fit with Glen Tullman at the helm— an entrepreneur with a personal passion for the company’s mission and deep healthcare industry experience. When Elliott invested in Livongo’s Series C, the company’s revenue run rate was under $10 million. Just three years later, Livongo went public and was ultimately acquired by Teladoc for $18 billion.

Elliott co-leads the growth investment practice at Bessemer, partnering with companies at the Series B stage and later. His goal is to help these businesses scale from generating five to ten million dollars in annual recurring (ARR) revenue to becoming what Bessemer calls “Centaurs” — companies that reach $100 million in ARR). As they’re building and growing, Elliott encourages his teams to hire and bring together a group of people with diverse perspectives, experiences, and work styles in order to create more effective organizations. Based on his own experiences and those of his network, Elliott believes embracing diversity and honoring people’s individuality leads to better business outcomes and creates a more fulfilling (and fun!) work environment for everyone involved.

As a venture growth investor, Elliott brings a fun-loving energy to the startup journey, always celebrating big and small wins. He’s also direct and honest, and prefers tackling challenges head-on so that he and the founders he works with can focus on the company’s long-term vision and strategy. Recognizing how hard entrepreneurship can be based on his dad’s experience, Elliott really understands that a startup is often a founder’s life work and impacts every corner of their lives. He understands the importance of helping founders step back, see the big picture, and understand how their company fits into their larger life story and values.

Music is one of Elliott’s great passions. He loves to DJ at home on Saturday mornings before his family wakes up. This is his happy place — putting on headphones, discovering new music, and blending it with songs that he grew up with. Although he loves 90s hip hop and EDM, particularly deep house, Elliott considers Sade to be the greatest musical artist of all time. Her music never fails to put him in a good mood.

LinkedIn: VC Wednesdays

Upfront Summit 2022: Elliott Robinson on Bessemer’s Growth Investment Strategy