Roadmap: Climate and energy software

On the precipice of a global energy transition, entrepreneurs are building innovative software solutions to usher in the green energy revolution.

From intermittent blackouts in California to the energy security emergency in Europe, the energy crisis around the world is becoming increasingly volatile and presenting an existential threat to humanity. Addressing this crisis and mitigating its impact will require significant intervention. As governments work to pass legislation to decarbonize the economy, entrepreneurs are building new tools and technologies to accelerate the transition to more sustainable sources of energy.

We are in the midst of one of the most consequential energy transitions of our lifetime. Clean energy is one of the cheapest forms of energy we have at our disposal and is becoming increasingly more affordable to generate and store. The increasing availability of clean electrons has motivated consumers and businesses to transition away from fossil fuels and adopt more sustainable forms of energy production and consumption.

Looking back, there have been two major energy transitions in the past 200 years; first, during the Industrial Revolution in the 19th century as coal replaced biomass-based energy, and then in the mid-20th century as oil and natural gas eclipsed coal. The businesses that both ushered in and emerged out of these energy transitions, including Carnegie Steel, went on to become some of the most influential businesses in history. (In fact, Bessemer Venture Partners, which spun out of the family office of Carnegie Steel co-founder Henry Phipps, owes its origins to this energy transition.)

This 21st century story is not one of atoms vs. bits but rather of bits enabling atoms.

We believe the businesses that come from today’s renewable energy transition will grow into enduring enterprises as they help the world access cheaper and cleaner sources of energy. This 21st century story is not one of atoms vs. bits but rather of bits enabling atoms. While solar panels, heat pumps, and EVs will be critical to address the energy challenges ahead of us, software will play a significant role in how people build new systems and processes for the clean energy industry; much of the green transition will rely on how software optimizes the value chain and makes use of these physical energy assets. As the energy ecosystem continues to evolve and electrify our homes, offices, and industries, we at Bessemer are excited to back software businesses enabling this transition.

How big is this market?

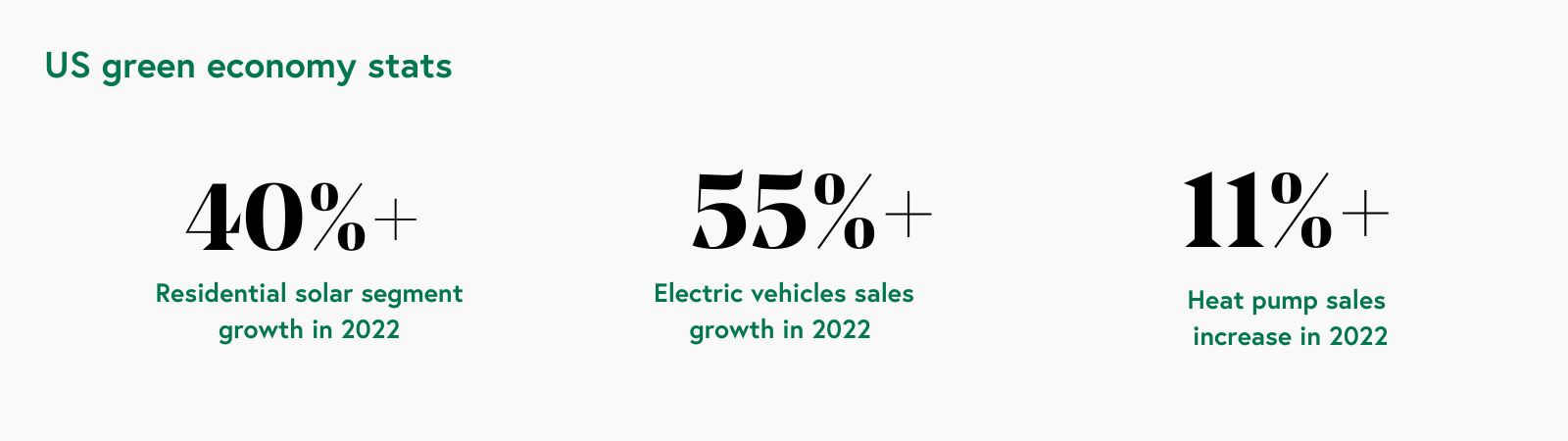

The market for clean energy production and consumption has been rapidly expanding as we transition to a decarbonized energy system. The market includes renewable energy sources such as solar, wind, hydropower, and geothermal, as well as energy-efficient technologies such as electric vehicles (“EVs”) and heat pumps.

Renewables’ share of the power generation mix worldwide is set to rise to 35% by 2025, with solar and wind driving most of its growth. At this rate, there will be as much renewable power added in the next five years as there was in the past 20. Simultaneously, demand for technologies like EVs and heat pumps has never been higher. EV sales are projected to comprise 60% of new car sales by 2030, while global heat pump sales are expected to meet 20% of global heating needs by 2030.

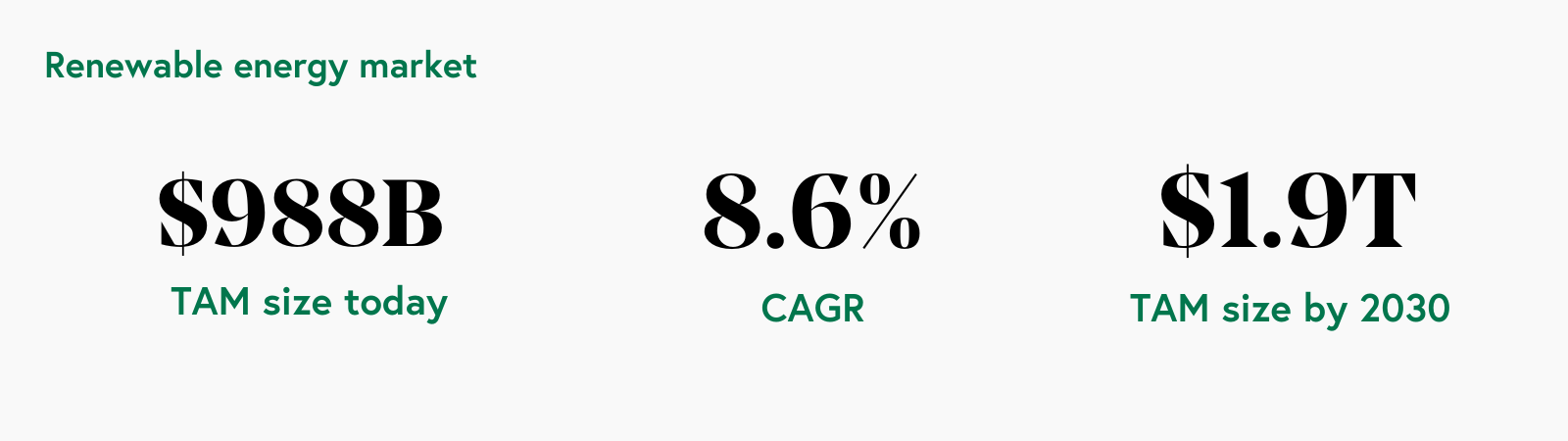

The renewable energy market size is $988.26B in 2022, growing at a CAGR of 8.6%, and expecting to scale to $1,912.12B by 2030. The transition from fossil fuels to clean energy generation and electrification will be one of the largest wealth transitions of our lifetime, and capturing even a sliver of this market with enabling software represents a massive TAM opportunity with room for rapid growth as the industry matures.

What is driving the clean energy transition?

1. Rapid decline in the cost of solar and wind energy

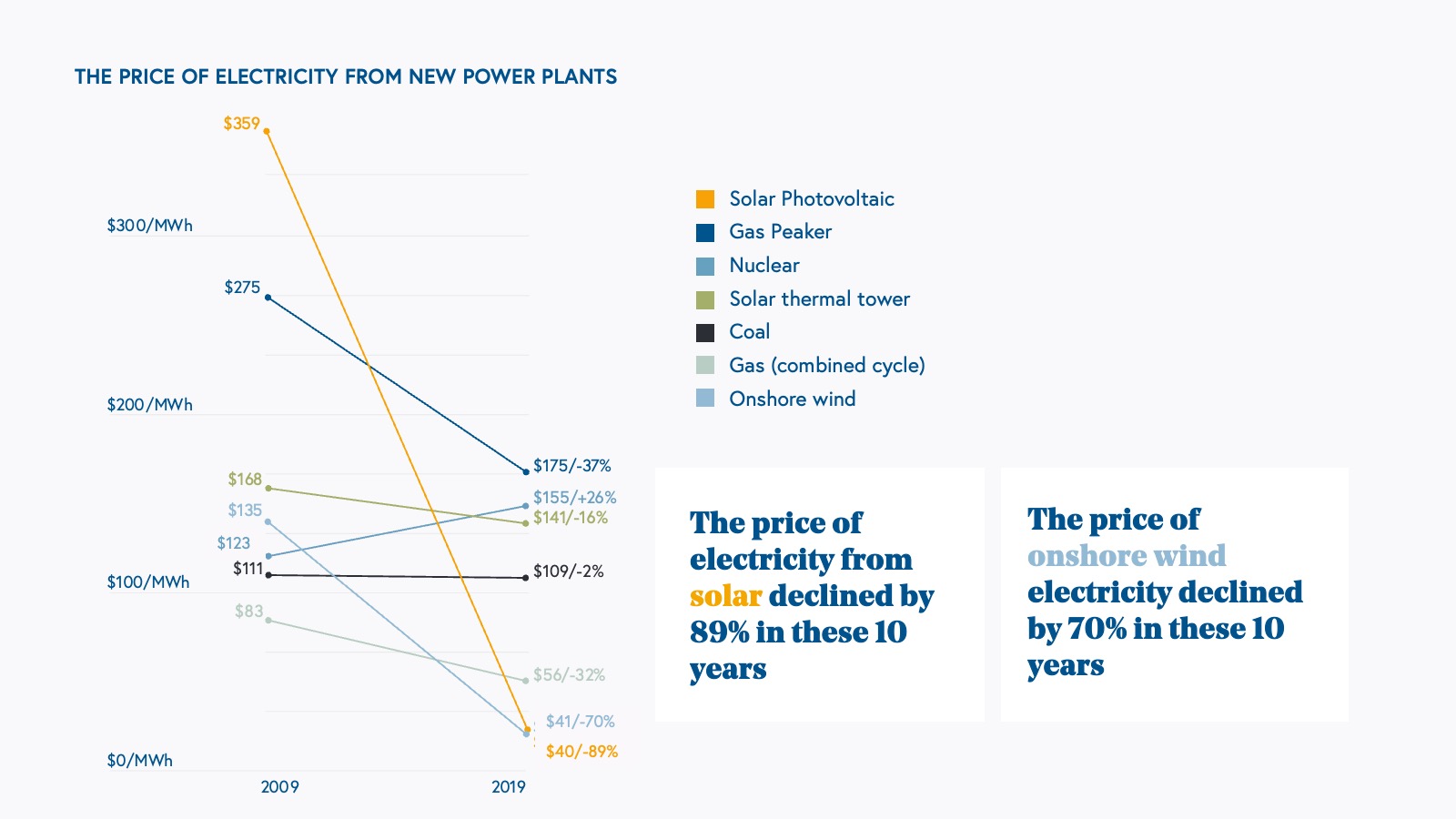

From 2009 to 2019, the price of electricity from solar dropped 89% while the price of electricity from onshore wind dropped 70%, bringing the cost of solar and wind below that of fossil fuels. This is thanks in large part to increased capacity coming from advances in solar panel and wind turbine technologies that have led to higher efficiency at lower prices. The levelized cost of energy* of solar and wind is less than half that of coal and below that of natural gas. Renewables aren’t just greener – they’re cheaper.

*Electricity prices are expressed in levelized costs of energy (“LCOE”). LCOE captures the cost of building the power plant itself as well as the ongoing costs for fuel and operating the power plant over its lifetime. Graph source.

2. Alignment of business and investment models with commercial drivers

As renewable energy technologies become cheaper and the environmental and social costs of using fossil fuels become more apparent, business models are evolving to facilitate the procurement of renewable energy and deployment of distributed energy resources (“DERs”) for corporate and residential customers. Given the high upfront cost of heat pumps and solar panels, startups are providing the installation and use of renewable energy devices at zero upfront cost to the consumer with low monthly subscription payments to smooth the transition to renewables for customers. In addition, power purchase agreements (“PPAs”) and renewable energy certificates are evolving to define market mechanisms for renewable energy exchange and access, enabling corporations to diversify their energy mix and meet their sustainability goals. Bolstering these business model evolutions are a variety of investment models — including venture capital, project finance, green bonds, government grants, and others — that can precisely align the risk profile of energy technologies to their expected return.

3. Increasing digitization enabling new energy applications

Advancements in technologies such as IoT sensors, robotics hardware, and applications of AI/ML have enabled access to deeper sets of data and creation of new approaches to help meet climate and sustainability goals. These advancements have ushered in new technologies that can optimize wind farm operations and increase asset life, facilitate automated solar panel design proposals through enhanced visualization, and create API infrastructure layers across distributed energy resources to facilitate energy trading and demand-response programs. As the underlying hardware and automation technologies keep improving, we envision the emergence of additional energy applications that will accelerate the clean energy transition.

4. Legislation in the United States and Europe

In August of 2022, the United States passed the Inflation Reduction Act, the largest single investment in climate and energy in American history. The IRA allocates $393 billion in new federal spending targeted at climate efforts over the next ten years and includes provisions to cut Americans’ energy costs, create good jobs, increase energy security, and transform American industry to address the climate crisis. The European Union has already passed numerous similar laws as part of its Fit for 55 package aimed at increasing renewable energy share, increasing energy efficiency, and lowering greenhouse gas targets. Russia’s invasion of Ukraine highlighted the urgency of ensuring energy independence through reducing reliance on Russian oil and gas and diversifying the energy mix.

Our theses on the energy transition software ecosystem

The technology to decarbonize and electrify our world already exists and is largely cost competitive today. With regulatory tailwinds accelerating the industry, governments, founders, and investors are well equipped with resources to usher in a cleaner and greener future by decarbonizing the grid and electrifying properties and vehicles. At Bessemer, we’re looking to back software entrepreneurs that are enabling the deployment of residential, commercial, and utility scale electrification and decarbonization.

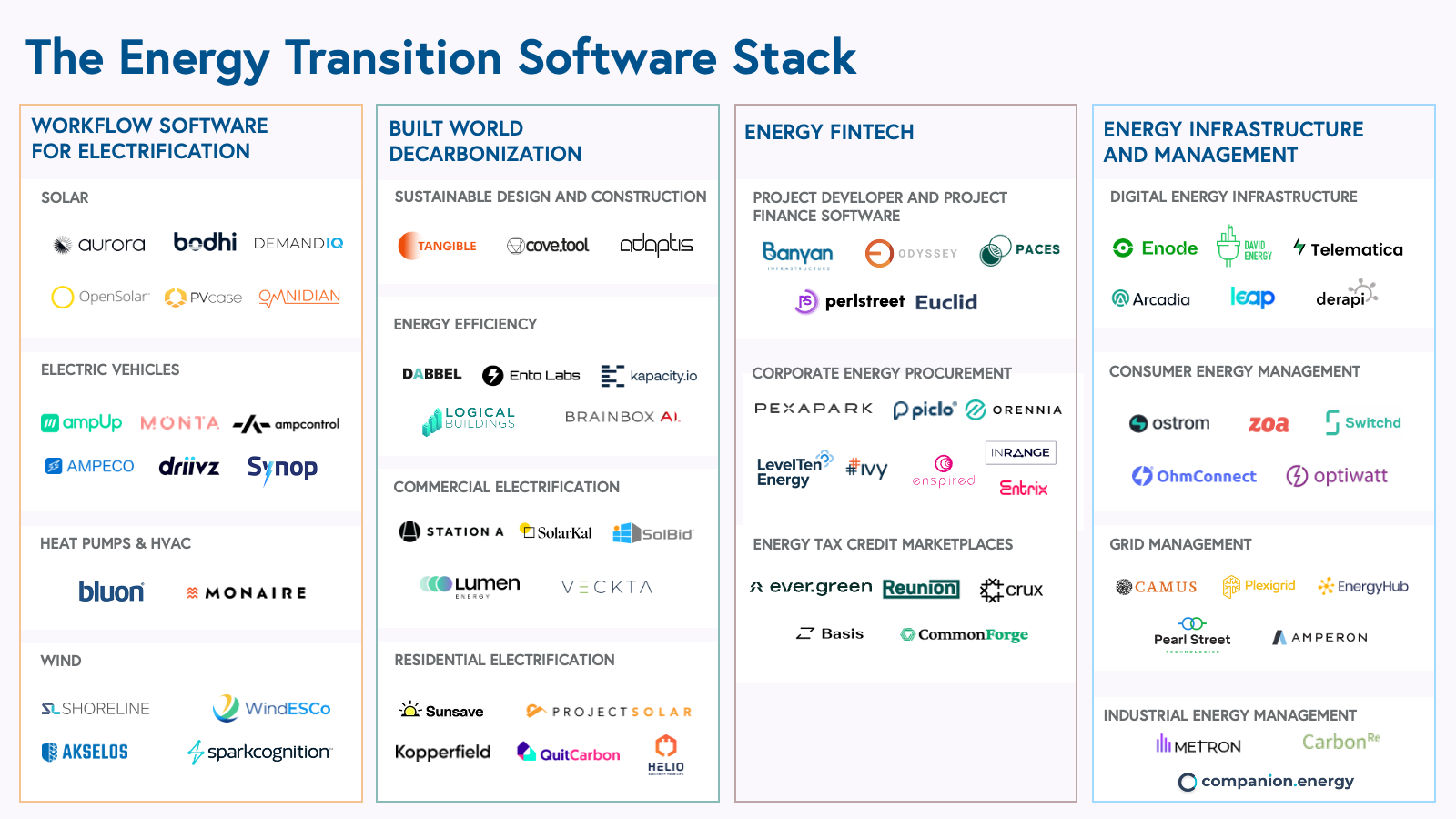

Workflow software for electrification

As consumers and businesses look for electric energy alternatives, a new wave of B2B workflow software is emerging to help everyone from installers to asset managers. We envision that these sector-specific solutions will emerge across the energy landscape, facilitating everything from fleet electrification to renewable energy project management. We are especially excited about vertical software approaches in a few key sectors, including solar, electric vehicles, and heat pumps.

Solar Software: The solar market continues to scale rapidly. Global capacity hit 1TW in April 2022, and is expected to more than double to 2.3TW by 2025. There are many tailwinds to be excited about in this market: solar software is a fast-growing category with few IT stack incumbents, commercial and residential customers are served by a fragmented base of largely mom-and-pop solar installers, and the multiple steps in the solar installation value chain present numerous opportunities for optimization. Given the complexity of the solar installation process, a host of software solutions are emerging to digitize the solar lifecycle from site selection to ongoing maintenance. These solutions are removing inefficiencies in the solar installation market, clearing the path for consumers and businesses to install and leverage electric solutions.

Solar contractors and developers must manage multiple parts of the pre- and post-installation process, including design and sales, project management, and panel procurement and maintenance. Aurora Solar has helped installers cut down the time it takes to physically visit homes and assess them for solar panel installation, creating customer-ready designs and proposals to speed up sales. There are also platforms that offer panel procurement and project management solutions for field operations that significantly reduce the time it takes to execute and facilitate collaboration across stakeholders. Further down the value chain, Omnidian facilitates tracking, evaluation, and reporting on solar assets to maximize performance and enhance asset life. As solar adoption continues to swell, we see a variety of workflow software solutions emerging to enable the solar ecosystem.

Electric Vehicles: As EV costs continue to decline and consumer preferences adapt, EVs are projected to represent the majority of new car sales by the end of the decade. With this boom, software is touching every aspect of the EV value chain, from battery analytics, to charging, to fleet electrification. We’re particularly excited by EV and charger operating systems that provide off-the-shelf software to charging station owners, businesses, fleets, and OEMs to manage the EV transition. As businesses install charging stations, software solutions like Monta can help them manage access to charging stations, provide analytics around charging, and optimize vehicle charging to achieve energy savings for fleets. As with some of our most successful vertical SaaS investments, we believe there are opportunities to build on top of pure charging offerings by providing billing and payments solutions while expanding the network of partners — from installers to charging station operators — that strengthen the ecosystem and provide additional value.

Heat Pumps: Heat pumps are an electric alternative to AC units and furnaces. While the technology has been around for some time, it’s been gaining popularity as heat pump sales surpassed gas furnace sales in the United States for the first time in 2022. Amidst rapid industry growth, the process of designing and installing heat pumps remains a time consuming and complex challenge for contractors. We are excited by software that facilitates heat pump design, proposal creation, and installation and can shorten the time it takes for contractors to assess a home’s readiness for heat pumps and enable the tracking and coordination of system installation. We think there is a massive opportunity for installer-facing solutions that offer a lightweight and high-margin approach to installation, providing clear installer ROI via leads, increased productivity, and sticky workflow tooling. Such solutions can provide both lower energy bills for homeowners while driving jobs and ticket sizes for contractors.

Built world decarbonization

With the built world contributing to 40% of CO2 emissions, decarbonization has become a prime focus for property owners and developers. Beyond the energy efficiency savings businesses and consumers can realize by electrifying commercial and residential buildings, legislation like New York’s Local Law 97 will levy penalties for buildings that fail to reduce their emissions.

A new wave of companies have emerged that help commercial property owners take the next step in decarbonization through sustainable design and building electrification that can drive down energy costs and even increase property value. As compliance requirements tighten, companies like CoveTool provide automated building design and analysis solutions that help architects and engineers optimize energy efficiency. In addition, new technologies are emerging to help architects and developers procure sustainable and low-carbon materials. We’ve been particularly excited to see the application of automation and generative AI to building design that facilitates energy efficiency and management of energy compliance requirements across jurisdictions.

For existing buildings, solutions have emerged to facilitate building electrification by connecting commercial installers to property owners to install solar panels, heat pumps, and other DERs. These solutions evaluate buildings to identify the most lucrative and impactful electrification project opportunities for owners, drive leads to commercial installers, and provide project financing opportunities for investors. For example, Station A digitizes a time-consuming and opaque electrification process by streamlining and shortening the commercial electrification RFP process, giving building owners continued insights into additional projects that can drive IRR, and facilitating the origination and completion of commercial-scale decarbonization projects.

A similar model exists for consumer-facing residential electrification that helps consumers navigate the opaque process of choosing renewable projects and selecting the best installer to meet their needs at a low or no upfront cost. Solutions like Project Solar help facilitate residential solar panel installation by connecting consumers with vetted installers and financing providers while providing qualified leads to installers. The best solutions in this category will have found a low-cost way to acquire consumers while building a sticky relationship with customers for future electrification and energy management journeys.

Energy fintech

As the amount of renewable energy infrastructure grows, the workflows of energy developers, project financiers, and energy traders are changing. As energy buyers, investors, lenders, and developers deal with a new energy paradigm, they need new solutions to execute workflows and manage energy pricing, trading, and risk.

Much existing energy project development and finance management runs on clunky and decades-old software. Stakeholder communication is siloed and executed via email while project financing risk is difficult to assess and monitor. The fundamental issue is that many existing tools for financing and developing energy projects have been built for large, predictable assets like coal plants and oil rigs — not dynamic and variable assets like solar plants and wind farms. A new wave of software is required to digitize workflows, automate contracts and compliance, and facilitate transparency between lenders and borrowers to finance and develop renewable energy infrastructure. Companies like Banyan Infrastructure provide origination and portfolio management solutions to banks and investors financing sustainable infrastructure development while offering core, sticky workflow capabilities. Others, like Odyssey Energy Solutions, offer a suite of solutions including equipment procurement and renewable asset operations management in addition to financing for renewable energy companies.

At the same time, energy market participants are undergoing a paradigm shift in pricing and trading energy. Corporate buyers have traditionally procured energy from utilities but suffered from energy cost volatility due to fossil fuel price swings. To mitigate this price uncertainty, large corporate buyers, industrial companies, and energy suppliers would purchase PPAs that allow them to buy renewable energy from a developer in advance to lock in a price and guarantee energy provision for a period of 10-20 years. Even so, PPA pricing and structuring is not simple; we can’t easily predict when the sun will shine and the wind will blow, which makes accurately pricing volume and profile risk challenging. New energy software solutions like LevelTen Energy and Pexapark allow energy developers, energy advisors, and investors to price PPAs and optimize energy trading. These solutions range from integrations with renewable energy assets that offer point-source data capture to portfolio-level pricing, PPA structuring, renewable energy certification, and risk management for renewable projects.

Additionally, increasing numbers of property owners and businesses are looking for support in setting up and maintaining renewable energy procurement programs that buy energy when it’s cheapest, sell excess energy, and manage complex billing processes. The goals of these programs vary across corporate energy buyers as they may seek some combination of optimizing cost savings, meeting net zero goals, increasing renewable energy consumption targets, or maximizing energy purchase optionality. A new wave of startups is emerging to fulfill this demand by allowing corporate energy buyers to access a digital energy broker and “choose their own adventure” when it comes to meeting their energy procurement goals while optimizing for the lowest possible electricity costs. For large properties transitioning to onsite energy generation, software solutions can help property owners manage the billing process for renewables by setting up the right pricing and incentive structures, accurately ascribe bills to tenants, and optimize property value from electrification.

Energy infrastructure and management

With the explosion of solar inverters, heat pumps, EV chargers, and other renewable energy devices, energy is becoming increasingly decentralized and decarbonized. Given the changing energy ecosystems, stakeholders from energy retailers to DER asset operators are looking for novel ways of accessing and utilizing energy data and distributed devices. However, accessing these data and devices often involve manual and time-consuming processes of building relationships with data providers and setting up agreements to ensure access.

We see an opportunity to do for energy data what Zapier and Twilio did for app automation and communications data. Currently, DER service providers like energy retailers, microgrids, and energy management solutions must build individual links to DERs, sifting through disparate API types and security protocols to establish connectivity. Whether energy retailers or startups looking to build energy apps, users must invest significant resources into developer resources to build these individual connections, hobbling their ability to offer renewable energy services.

Companies like Enode have built a connected infrastructure layer to eliminate the time it takes to build these individual connections. Its platform allows their customers to use one API integration to directly connect to a variety of DERs at a fraction of the cost and time it would take to build individual device connections themselves. By building the infrastructure layer, these DER connectors reduce the time and development costs for device integrations while allowing end users to easily build tools for use cases as diverse as wholesale trading, demand-response, asset maintenance, and virtual power plants, among others, while taking on the burden of API connection security and maintenance.

As energy data from DERs becomes more accessible, energy management solutions will become more precise and amplify the benefits customers derive from renewable energy. Consumer-oriented solutions like Ostrom streamline the complexity of renewable energy contracts by issuing simplified energy invoices and tariffs, allowing users to access energy at low prices as they switch to renewables and use energy from multiple sources. The market is expanding for solutions that help consumers save on energy costs, whether by procuring energy from the cheapest supplier or facilitating energy use when rates are cheapest. We believe that the best solutions will enable customers to put their energy consumption on autopilot while generating savings through a refined energy usage and procurement backend.

Principles for building a climate software business

The technologies needed to address our energy challenges will take many forms across hardware and software, including solutions such as utility-scale wind farms, EV charging stations, and collaboration software for electricians. The capital intensity and monetization trajectory of these businesses are just some of the factors that will determine which business models and financing vehicles they will use to grow.

Our Bessemer Climate team is particularly excited about investing in asset-light, capital-efficient businesses. We have already seen the rise of successful climate software companies in the past decade — from Palmetto facilitating consumer-oriented solar panel installation to Arcadia facilitating access to utility data. The proliferation of climate deep tech and energy infrastructure businesses has led to a need for software to both optimize physical asset performance and catalyze the supporting energy ecosystem. For example, Bessemer’s portfolio company Sila Nanotechnologies developed a next-generation silicon anode battery technology around which battery management systems like Zitara are measuring and optimizing battery performance. Additionally, software solutions are emerging to facilitate everything from panel procurement to permit applications for energy developers to speed up renewable energy infrastructure construction.

To evaluate software businesses in this category, we use traditional software benchmarks to assess vertical SaaS companies looking to become market leaders in their categories. Due to the unique dynamics in the climate and energy space, we also use the following principles to assess companies:

1. Rely on commercial rather than regulatory drivers

Business should provide strong commercially-driven revenue-unlocking or cost-cutting ROI independent of regulatory tailwinds. Compliance or regulation might boost support for a solution or serve as a wedge to build a relationship with a customer, but should not be required for the business to scale. We recommend leaders avoid exclusively relying on regulation or government incentives programs to drive your business due to limited upsell possibilities and potential for regulatory rollback.

2. Build a layer cake to expand emerging TAMs

Given the number of emerging categories within climate, current TAMs for software-only solutions may seem limited. Founders should demonstrate that there is a reasonable path to at least a several billion dollar TAM upon exit. Beyond relying on market forces to expand TAMs, founders should consider baking a product and revenue layer cake, expanding upon a core offering with symbiotic solutions. For example, EV charging management solutions may utilize per charging station pricing, monetizing on a core software product and growing with expanding charging stations owned by customers. By facilitating payments, these solutions can provide a natural and value additive expansion product for customers while growing TAM by taking a fee each time a charging station is used.

3. Invest in partnerships to strengthen GTM and win over stakeholders

Partnerships in the climate and energy space can play a key role in speeding up GTM and ensuring access to data for product development. Many emerging climate software companies may struggle to win customers with direct sales given the need to first get buy-in from multiple stakeholders, integrate with physical solutions, and engender trust. EV charge management company Monta built partnerships with hardware providers like ABB and Zaptec to allow them to offer fully-integrated charging solutions to their end customers. On the consumer side, we’ve seen some companies develop unique distribution channels to access end users, such as building partnerships with dealerships or financing providers to turbocharge their device installation GTM. In addition, for companies whose business models are dependent on access to sensitive data from utilities, HVAC systems, or EVs, to “move fast and break things” can backfire as data providers close off access to critical inputs. While slower, a more sustainable approach is to build partnerships with DERs, utilities, and other data providers to give end customers confidence that a product will be able to continue providing services.

4. Commit to a novel approach to serve and sell to your ideal customer profile (ICP)

Assess if the opportunity has changed to address the needs of customers and categories that have traditionally been difficult to build fast-growing software businesses in. For example, venture investors have traditionally shied away from businesses selling into enterprise energy providers due to long sales cycles, dominance of legacy systems, and high customer service needs. However, new market dynamics and emerging technologies are providing an opportunity to address previously unmet needs. For example, in order to remain competitive in newly deregulated energy markets, energy suppliers are more motivated to adopt new software solutions like Zoa Energy’s energy supplier-oriented consumer experience platform to enhance their value proposition to energy consumers. Additionally, some professional services provision may be unavoidable for larger customers that need support managing their electrification and energy transition journeys. In these cases, software companies should consider structuring contracts to transition any initial (and preferably minimal) professional services revenue into higher-value and multi-year recurring revenue while providing ample opportunity for software upsells, or leveraging partnerships to outsource high-touch implementation and support.

5. Access the OpEx budget

The holy grail of climate software sales is to integrate into a buyer’s OpEx budget. Companies should avoid being pigeonholed into customers’ limited sustainability budgets or fluctuating and experimental innovation budgets. By replacing existing OpEx spend — especially when a solution simplifies workflows and drives revenue via increasing sales — businesses can achieve both a faster sales cycle given demonstrated ROI and achieve stronger retention through enhanced stickiness.

Looking toward a greener future

Picture the world in 2040: homes fueled by solar, EVs on the streets, grids powered by wind, and infrastructure that can handle the electrification on the horizon. While the particulars of the transition to a clean energy future will be dependent on a mix of political, economic, and technological factors, we’re excited to imagine what a world in which clean energy costs continue to drop precipitously might look like. In this greener future, energy-intensive sectors, including manufacturing, industrials, and transportation, would experience reduced production costs, making goods and services more affordable. Innovations like distribution and battery storage technologies would be prioritized to address the intermittent nature of renewable energy management. With these contributing factors, cheaper and consistent electricity would become more accessible, regardless of geography or socioeconomic status. We could finally live in a world where we are no longer dependent on fossil fuel resources, ensuring greater energy security for nations and achievement of net-zero goals.

Building toward this vision will require a new generation of software businesses that will define the net-zero era. These are the entrepreneurs and leaders that will help usher in the clean energy transition. Are you already building this future? Please reach out to Aia Sarycheva (asarycheva@bvp.com) and Madeline Shue (mshue@bvp.com).