Roadmap: Supply Chain Software

We are at a tipping point in supply chain digitization, enabling a new wave of data infrastructure, workflow automation, and collaboration platforms.

Most people don’t think about supply chains in their day-to-day lives, but they feel their impact when systems go awry. Whether these problems manifest in furniture delivery delays, toilet paper shortages, or higher prices for used cars, supply chains are foundational to everyday life and critical to how global industries and governments operate. Yet, by and large, supply chain management remains inefficient, with very little in the way of innovative and modern software.

At Bessemer, we’ve been thinking deeply about innovation in supply chains since 2017, when we made our first investment in Shippo, the leading provider of multi-carrier shipping rates for e-commerce vendors. As we developed our B2B marketplaces roadmap in 2020, we found opportunities for disruption in high-friction markets, including logistics and freight, which ultimately inspired us to back Cargo.one, a digital bookings platform for the air freight industry. Amid mounting supply chain concerns over the past year, we realized that these solutions were only the tip of an iceberg, which prompted our deeper exploration of the industry.

We have seen massive new software categories created as other legacy industries like financial services and healthcare underwent digital transformations. In the same way, the digitization of supply chains will lead to similar opportunities for startups and will go on to change the global economy for decades to come. The world will be more efficient, resilient, and sustainable because of the operational efficiencies gained with the rise of modern supply chain software companies. This roadmap discusses the multi-trillion-dollar opportunity ahead and highlights the gains and innovators that will forever impact supply chains by shifting B2B commerce online.

In short, we couldn't agree more with Shippo Co-founder and CEO Laura Behrens Wu. We are in the early innings of what will become one of the next great frontiers in cloud software, and we are eager to be backing the entrepreneurs leading this charge.

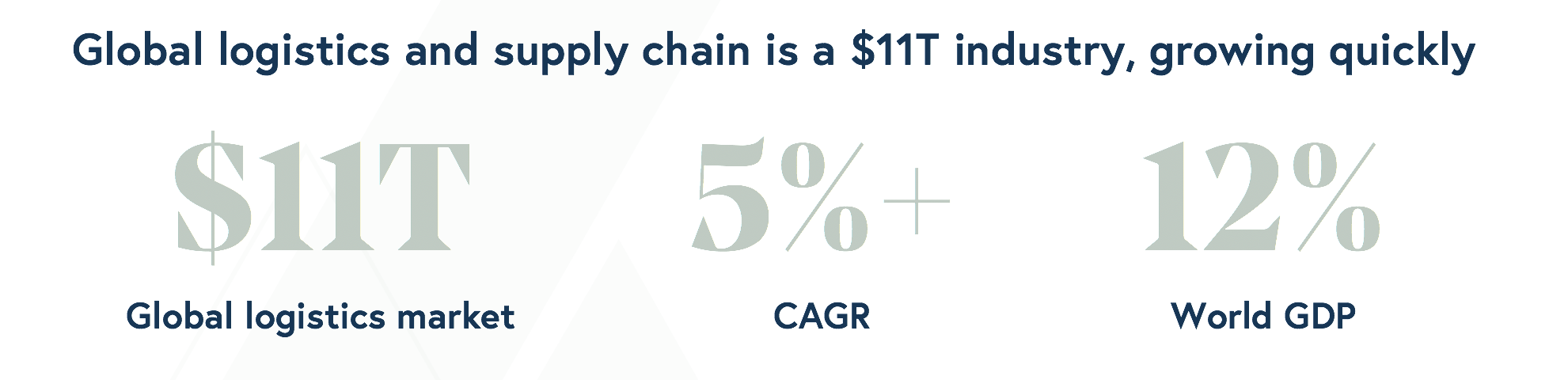

How big is this market

Supply chain and logistics is a massive industry—a nearly $10 trillion market representing more than 10% of the global GDP today. Even more impressive, this industry continues to grow rapidly, adding roughly ~$500 billion of market value each year.

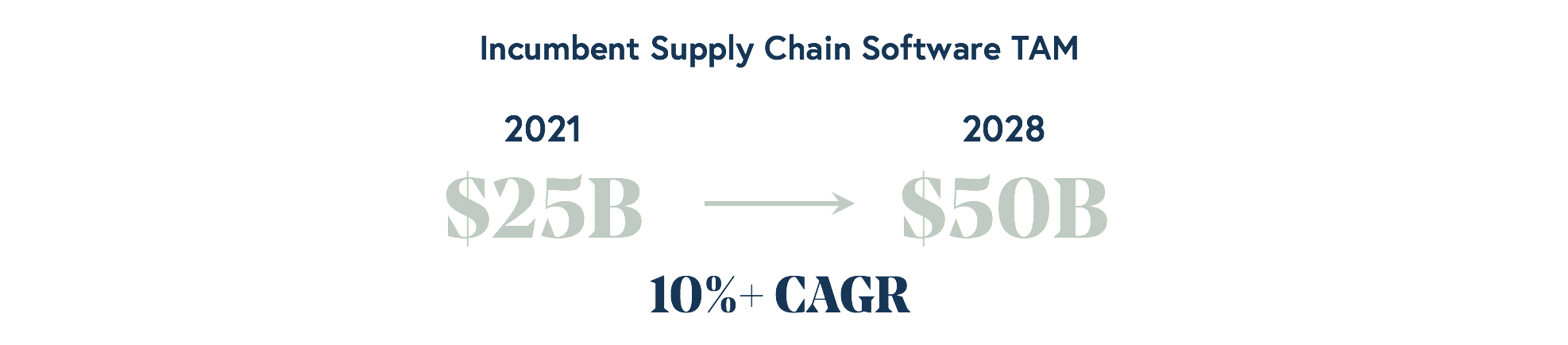

It goes without saying that the supply chain industry is extremely complex and has largely remained offline. Traditionally, most enterprise spend on supply chain software was focused on on-premise, ERP-like systems, like transportation management and warehouse management systems. If we look at the current addressable market for these core supply chain software categories, it represents about a $25 billion market today.

Over the next half-decade, incumbent enterprise supply chain software modules are expected to see over 10% annualized growth, which is impressive for these mature and established software categories. However, most of these legacy products are really systems of record, not systems of engagement, as is evident from the fact that 50% of the largest enterprise shippers in the U.S. still rely on some combination of email and spreadsheets to actually manage supply chains day-to-day. We are most excited about opportunities for entirely new software categories to emerge that can help to address the unmet needs in this industry, and by doing so, grow this market dramatically larger.

50% of the US’ largest importers still rely on spreadsheets to manage supply chains

Just as we’ve seen the rise of vertical software giants, such as Toast, Procore, ServiceTitan, etc. revolutionize other industries with cloud-enabled solutions, the supply chain and logistics sector is entering an auspicious time where entirely new categories of software will come to market.

Drivers of new opportunities for software in supply chains

We are seeing two trends drive tremendous opportunities for supply chain software companies:

1. Massive shocks to the system

Over the past half-decade we’ve witnessed repeated and massive shocks to global supply chains. This trend stretches back even before the global pandemic and the associated boom in e-commerce and includes geopolitical frictions such as Brexit, which spurred huge supply chain issues in Europe, as well as the US-China trade tensions, forcing many importers to start thinking about diversifying supply chains well before the pandemic started.

The recent shocks to the system have had the result of making supply chain resilience a top priority for all large companies. According to a McKinsey survey of enterprise supply chain leaders, 93% cite plans to increase resilience. And surprisingly only 11% of leaders cited budget constraints as a blocker to supply chain transformation. Now that supply chain resilience is such a high priority for many executive teams, we expect to see a substantial step up in supply chain technology investment from large enterprises, similar to the way that other categories like cybersecurity became C-suite priorities and garnered larger budgets after major security breaches.

2. Increased digitization

Supply chains are slowly becoming more digitized and modern, both in terms of how data is being generated and where it is stored. Years of investment in the deployment of hardware sensors, cameras, and IoT devices have helped to digitize the physical movement of goods and dramatically increased the volumes of data being created throughout supply chains.

In addition, while supply chain data had traditionally been stored in on-premise systems that were difficult to access or integrate with, over the past few years we have seen the emergence of cloud-based systems of record like Cargowise, and data aggregators like Project44 and FourKites, which are making it easier than ever before to build modern software applications that leverage this data. As a result, we see the opportunity for new categories of intelligence and application-layer SaaS companies to be built on top of these digital middleware layers.

We like to draw a loose analogy to the evolution of the fintech ecosystem, where middleware infrastructure providers like Plaid made it much easier to build modern application-layer software on top of legacy banking systems. We’re at a similar inflection point in the digitization of the supply chain industry and expect to see a proliferation of supply chain SaaS companies emerge over the next decade as a result.

Our thesis for supply chain SaaS

Over the past decade, we have seen dozens of innovative companies that have combined technology and strong operational expertise to transform parts of the supply chain industry. Companies like Flexport and Convoy laid the groundwork for integrating technology into traditionally manual businesses like freight forwarding and truck brokerage. At the same time, companies like Stord and Flexe have combined modern technology and innovative business models to revolutionize the way shippers distribute their goods through more agile warehousing networks.

We have reached a tipping point in supply chain digitization. This digital transformation, coupled with strong macro tailwinds, will drive a new wave of data infrastructure, workflow automation, and collaboration platforms that will ultimately create multiple billion-dollar software categories within the supply chain industry.

Over the next ten years, we estimate that the supply chain software market can expand to north of $100 billion of SaaS revenue, primarily driven by the emergence of entirely new software categories and products that address the unmet needs of supply chain professionals.

As we evaluate new SaaS businesses in the supply chain industry, we still rely on the same benchmarks and criteria that we have typically used to assess best-in-class vertical SaaS companies over the past decade. However, we have certainly tailored much of our guidelines to the industry. In particular, we have focused on understanding where the budget will come from for a given product and what is required to implement the product, as we think both of these criteria will influence how challenging it may be to build a hyper-growth software startup in this market.

- Budget: Traditional wisdom in the industry said software providers needed to sell to large enterprise shippers to access any substantial software budget. While shippers still hold most of the purse strings, some companies are bucking this trend and going directly to service providers, or even carriers as their beachhead market, despite these players often having much smaller IT budgets. Either model can work, but selling to carriers or brokers requires a special product that can demonstrate value on day one, and justify its cost by offsetting operating expenses within these organizations, thus turning opex budget into IT budget.

- Implementation: Supply chain software implementations have traditionally looked a lot like ERP implementations, requiring long integration phases, often aided by teams of consultants to install and operate the product. We are specifically looking for products that can be implemented very quickly, such that they can demonstrate value in a matter of days and be live in weeks, not months. This aspect not only enables a much more seamless onboarding process but can also completely change the speed and efficiency of a company’s go-to-market strategy. Companies that have figured out innovative ways to streamline implementation can lead their sales process with strong hooks like risk-free POCs or lightweight cost savings assessments that prove their value upfront. This is certainly easier said than done, but we believe that the next phase of supply chain SaaS companies will leverage clever integration hacks to get up and running quickly and design their interfaces to be easily used by industry veterans, not specialist consultants.

In general, we are looking to partner with founders and back opportunities that possess these unique qualities:

- Digital infrastructure that connects siloed data sources and SaaS applications that streamline workflows and optimize supply chain operations

- Software that can embrace and extend legacy systems of record with seamless implementation and onboarding

- Products that can tap into large shipper budgets or help incumbent service providers drive net margin improvement

- Products that offer sticky long-term value, extending beyond short term cost savings

- Teams with substantial industry experience and empathy

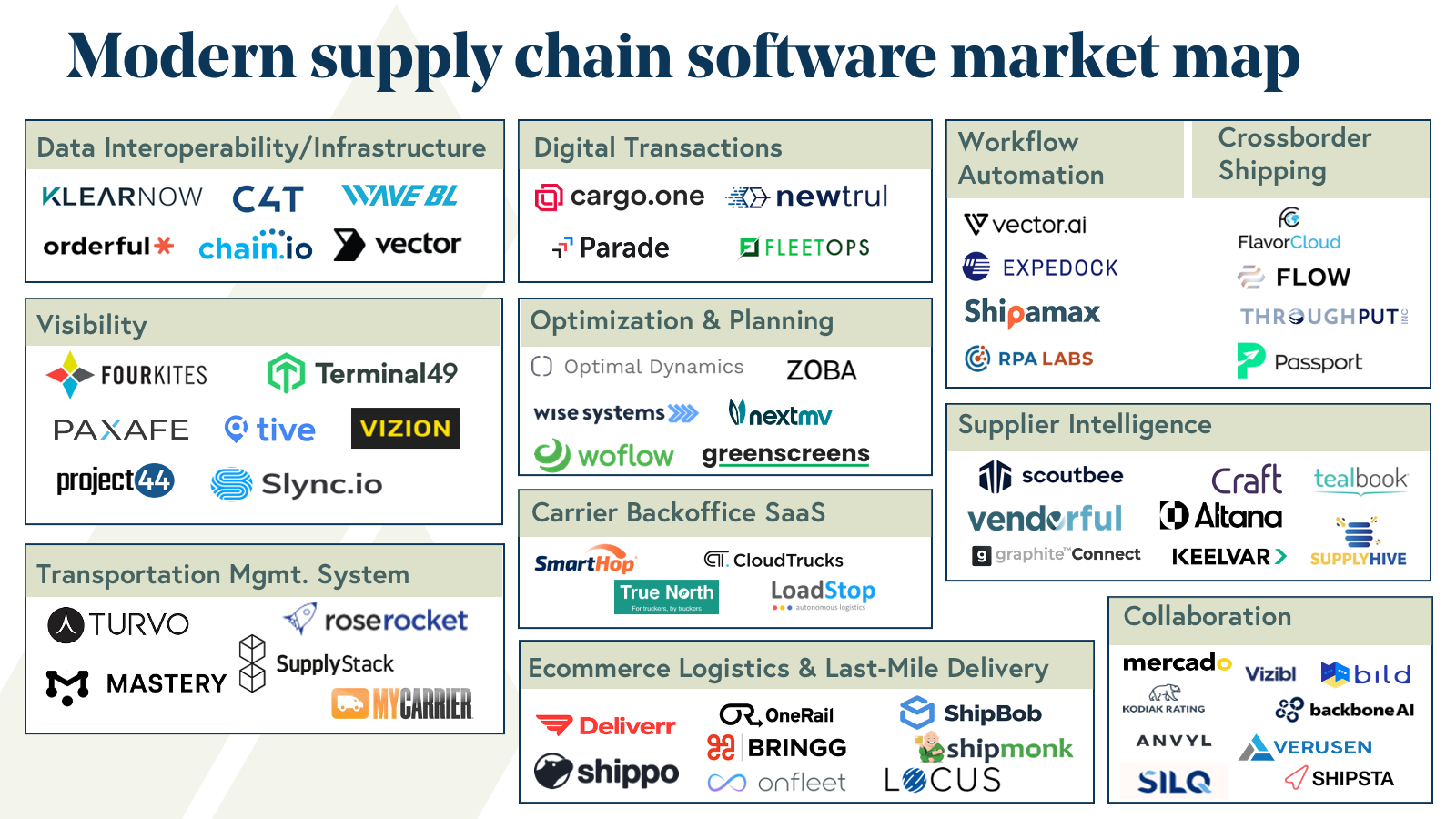

Mapping the market

Here’s the market map of the supply chain software categories we have been tracking closely. We have tried to focus largely on SaaS solutions, which is why you don’t see some tech-enabled service providers on the map, or some of the more capital-intensive and asset-heavy categories, like autonomous vehicles and warehousing solutions.

In particular, there are a few categories we have been more dialed into, which include workflow automation and optimization, digital bookings platforms, and supply chain intelligence & collaboration. Plus, we also have an emerging thesis around the demand for developer tools devoted specifically to the needs of supply chain and logistics companies.

Here’s what we find most interesting in these subcategories so far:

Digital infrastructure

Supply chains have come a long way in terms of digitization. However, limited connectivity and interoperability between data silos are still some of the most significant barriers to faster innovation in this market. The logistics industry has always needed to accommodate the lowest common denominator medium for communicating information anywhere in the world, which in many cases is still paper documentation, phone, and email. A tremendous amount of data remains stuck in analog formats, and digitized data is often locked up in legacy systems. We are interested in two emerging trends around supply chain data infrastructure, characterized as 1) increased digital interoperability and 2) transactional pipes for digital bookings.

— Digital interoperability: If enterprises were redesigning their supply chain management software from the ground up today, it would be much more open and accessible via standardized APIs than the legacy systems that exist in most enterprises. Supply chain data is still challenging to access and share across companies or even across different systems within an organization. Over the past decade, companies like Project44 and FourKites have demonstrated what more open platforms can look like within the realm of visibility data. These companies have expanded from pure track-and-trace visibility layers to a broad suite of API-based services that help to provide data connectivity across supply chain stakeholders. However, we are still just in the earliest innings of this transition to digital supply chain infrastructure. Despite the gains in visibility, data connectivity remains one of the top needs among enterprise shippers. In particular, we are seeing demands for better data at common bottlenecks and pain points within supply chain operations, such as procurement, first mile, drayage, customs clearance, and last mile.

Supply chain data infrastructure solutions will need to harness data wherever it lives, whether that be integrating with legacy electronic data interchange (EDI) protocols dating back to the 1980s, scraping data from email feeds, extracting critical information from scanned documents, or simply harmonizing data across multiple APIs. We have started to see some of the most forward-thinking enterprise shippers build out custom cloud data warehouses for their supply chain teams, where they can pipe all of this data and then run analytics on top of it. But we expect this to be the exception rather than the rule for most supply chain organizations.

From our perspective, the biggest opportunities in this industry will come from cloud-based systems that can tap into existing data wherever it resides, harmonize it, and make it accessible across teams. This foundational level of digital infrastructure is a prerequisite for the exciting, intelligent supply chain planning and optimization solutions that the industry has long been striving for.

— Digital execution networks: Logistics procurement is another area where technology can provide more efficiency to the industry. Booking freight is still a highly manual process, in most cases. Considering this, we’re excited about platforms that can integrate with both carriers and existing service providers, like freight forwarders and brokers, to provide the pipes for instantly bookable freight, without eliminating the value-added services that these providers offer. Our portfolio company Cargo.one, is building out a digital execution layer in air cargo, providing real-time access to one-click bookable freight between air carriers and freight forwarders, saving both sides countless hours and enabling them to focus on high-value tasks like growing their businesses and better serving customers. These systems require robust integrations into large networks of carriers, which can take time to build, but at scale, we think they have the potential to be extremely powerful. We are also starting to see similar platforms emerge across other modalities like trucking. We believe that this movement will take years to play out, but we expect to see many more digital execution networks emerge in the future.

Workflow automation and optimization tools

The supply chain industry is full of inefficient workflows that cause specialized workers to waste their time on low-value tasks, like data entry. Thanks to recent advancements in computer vision and machine learning, there are many opportunities for software to automate common workflows like data entry and invoice processing, with limited oversight from humans. These technologies have the potential to dramatically increase the productivity of supply chain professionals and free them up to spend their time on higher-value tasks. Our portfolio company Vector.ai is one such example, providing valuable automation for freight forwarders, enabling them to spend less time processing documents and more time serving customers. Longer-term, we expect these automation platforms to expand across more workflows within logistics and eventually become the operating system that helps orchestrate and streamline the complex operations in any supply chain business.

Similarly, supply chain operators tend to make many crucial decisions based on outdated information, or on gut intuition. Given how small the margin for error is in the industry, these types of decisions can have huge impacts. We believe there are many opportunities for real-time data and machine learning to help operators make much better decisions that can dramatically improve their ability to hit key service level targets or lift operating margins. Our company, Optimal Dynamics, for example, has built an industry-leading decision optimization engine based on decades of research in stochastic optimization under uncertainty for logistics. Optimal Dynamics helps trucking carriers and enterprise shippers make better decisions in real-time regarding both strategic issues like network planning and tactical issues like which loads should be carried by which assets to help them improve their fleet utilization and optimize for target service metrics.

We are most interested in products that leverage automation or optimization as a wedge to provide immediate ROI to customers and thus get in the door quickly. Longer-term we think that these systems will have opportunities to expand further throughout their customers’ use cases and take on higher-value tasks over time.

Supplier intelligence

Historically, enterprises built out custom processes and portals to manage their upstream supply chains or adopted legacy solutions that provided little in the way of real-time intelligence. For example, many companies rely on static surveys and rigid procurement portals to manage audits, compliance, and performance reviews.

These manual processes deteriorate however when companies face unforeseen challenges with environmental disasters, global political trade tensions, and growing consumer demand for responsible sourcing and procurement. Questions like “where is my stuff” and “where did it come from” can no longer be easily answered with a phone call. The past few years of mounting pressure and global crises have made company executives painfully aware of the costly impacts of supply chain disruptions. This has unlocked larger budgets for software solutions that can provide enterprises with better visibility, risk management, and communication across their upstream suppliers.

A new generation of software tools will help companies solve these issues, especially considering the rise of cloud-first supplier relationship management platforms that enable accurate and automated communication, more dynamic supplier monitoring tools with increased visibility and data granularity, and real-time collaboration software to streamline work between OEMs and their upstream suppliers.

Early on in the ecosystem’s development, companies will likely leverage the natural network effects between suppliers and buyers to drive strong organic growth. At scale, eventually, these companies will unlock immense value by aggregating and mapping supplier data to provide enterprises with a dramatically better view of their supply chain risks and dependencies and give them the tools to proactively address potential threats.

Developer platforms

As we expect digital infrastructure to grow with supply chains, so too do we expect to see increasing demands for developer platforms devoted specifically to the needs of supply chain companies. We have seen similar trends in other industries like healthcare and financial services where vertical specific developer platforms and API-based services followed closely behind the underlying digitization of these industries. These solutions will help to abstract away the complexity of building software services that are generally needed across the industry, such as routing, tracking, logistics procurement, insurance, and pricing optimization. We’re still in the earliest days of this movement, but already we have started to see the emergence of some vertical-specific platforms, like Zoba, an embedded service focused on optimization for urban mobility fleets. We are eager to learn more about where the biggest developer pain points are within this industry, and we are keeping our eyes open for more developer tools and API-based services that can be embedded into other software products to help further power the digital transformation of supply chains.

Looking ahead

As many industries shifted quickly to the cloud during the pandemic, the supply chain industry has trailed behind, in part due to the lagging state of digitization across this complex industry. Supply chain issues have since compounded, driven by a combination of labor shortages, bottlenecks at key ports, lack of visibility, and a general misalignment between where logistics capacity is needed and where it is available. These mounting issues have already had a huge impact on consumers while also constraining productivity, which, over time, will hinder economic recovery. According to the Kiel Institute for the World Economy, global industrial output has stagnated since early 2021 due to supply chain issues.

While software can’t solve all geo-political, supply chain infrastructure, and trade issues, we do believe that the rise of new digital solutions in this legacy, paper-based industry will go a long way towards streamlining workflows and optimizing operations. Ultimately, software is the key to building and managing more resilient supply chains that will help society better cope with massive shocks in the future.

We’re actively investing, and frankly, still learning about the emerging opportunities in this massive market. We want to meet supply chain entrepreneurs that understand the challenges their customers face and are passionate about taking on the huge challenges that still remain to be solved. If you’re building a Supply Chain SaaS company, please reach out to Mike Droesch (mdroesch@bvp.com) and Alice Deng (adeng@bvp.com).

*All our market numbers are estimations made by Bessemer, backed by research and data.